7. Foreign Account Tax Compliance Act (FATCA)

FATCA is the acronym for Foreign Account Tax Compliance Act enacted by the US Government as part of the Hiring Incentives to Restore Employment (HIRE) Act, in 2010.The purpose of FATCA is to help Internal Revenue Service (IRS) to identify and collect tax from US Persons (USP) holding financial assets outside US.

This chapter deals with Foreign Account Tax Compliance regulation. It includes the description about functions that would help FCIS to support FATCA.

This chapter contains the following sections:

- Section 7.1, "FATCA Classification Process"

- Section 7.2, "System Parameters"

- Section 7.3, "FATCA Documents"

- Section 7.4, "FATCA Document Maintenance"

- Section 7.5, "Entity FATCA Classification"

- Section 7.6, "Entity FATCA Classification Maintenance"

7.1 FATCA Classification Process

7.2 System Parameters

The below mentioned table describe the system parameters for the related fields:

Field |

System Parameter |

Maximum Length |

FATCA Classification –Individual |

FATCACATIND |

10 |

FATCA Classification –Corporate |

FATCACATCOR |

10 |

FATCA Classification Reasons |

FATCACATREASON |

10 |

FATCA Effective Date |

FATCAEFFDATE |

10 |

FATCA Individual UH Reporting |

FATCAINDUHLIMIT |

10 |

FATCA Corporate UH Reporting |

FATCACORPUHLIMIT |

10 |

FATCA Verification Time Limit in days |

FATCAVERTMLIMIT |

4 |

FATCA Due Diligence Date |

FATCADUEDELIGENCEDATE |

10 |

FATCA Country Code |

FATCACNTRYCD |

3 |

FATCA Amount Limit |

FATCAAMOUNTLIMIT |

10 |

FATCA WHT Applicable |

FATCAWHTAPPLICABLE |

3 |

FATCA WHT Effective Date |

FATCAWHTEFFDT |

10 |

FATCA WHT Percentage |

FATCAWHTPERCENTAGE |

3 |

Document for individuals |

MASTERDOCIND |

Max |

Document for corporate |

MASTERDOCCORP |

Max |

Category of the documents |

MASTERDOCCAT |

3,2 |

Max % of holding for Corporate UH for the defined directors |

FATCAMINPCNTHLDG |

Max |

The international dialling country code |

INTDIALCODE |

|

7.3 FATCA Documents

This section contains the following topics:

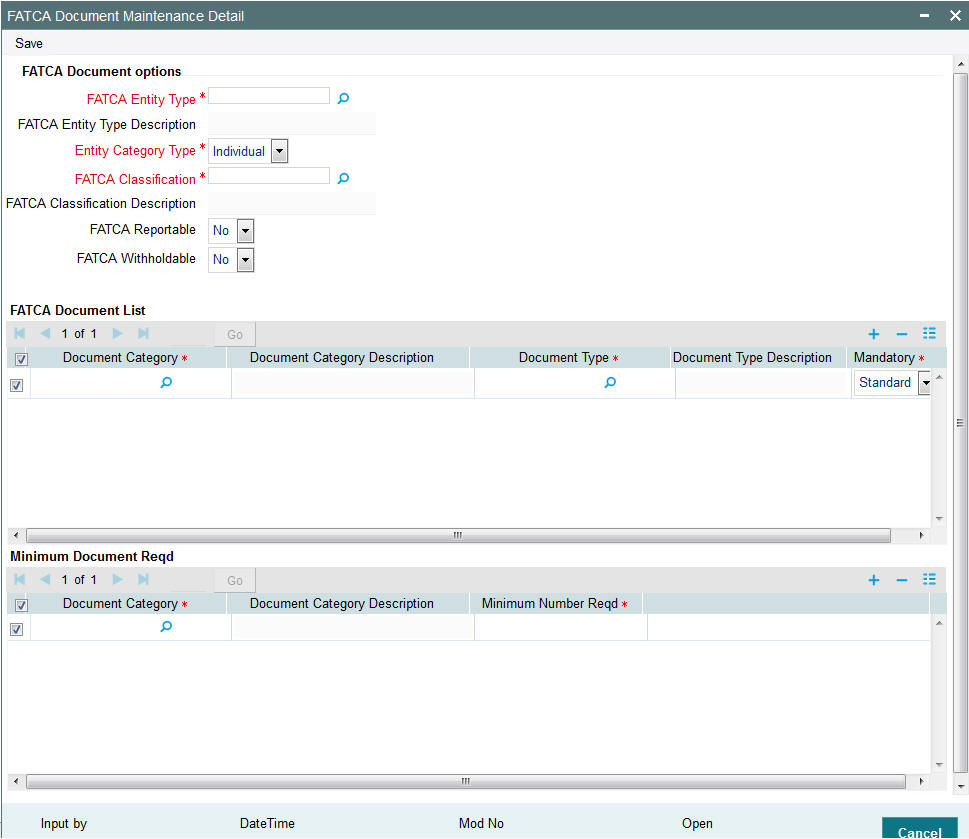

7.3.1 Maintaining FATCA Documents

You can maintain the list of FATCA Document details in the ‘FATCA Document Maintenance-Detail’ screen. To invoke this screen type ‘UTDFATDT’ in the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

You can capture the following in this screen:

FATCA Entity Type

Alphanumeric; Mandatory

Select the FATCA entity type from the adjoining option list.

Entity Category Type

Select the entity category type from the adjoining drop-down list. The options available are:

- Individual

- Corporate

FATCA Classification

Alphanumeric; Mandatory

Select the FATCA Classification from the adjoining option list.

FATCA Classification Description

Display

The system will display the description based on the selected FATCA Classification.

FATCA Reportable

Optional

FATCA Reportable gets defaulted from the FATCA document maintenance for the entity selected. You can change the value from ‘Yes’ to ‘No’, but vice versa is not allowed.

System defaults FATCA Reportable as ‘No’.

FATCA With holdable

Optional

FATCA With holdable gets defaulted from the FATCA document maintenance for the entity selected. You can change the value from ‘Yes’ to ‘No’, but vice versa is not allowed.

System defaults FATCA With holdable as ‘No’.

FATCA Document List

Document Category

Alphanumeric; Mandatory

Select the category of the document from the adjoining option list.

Document Category Description

Display

The system displays the document category description based on the selected document category.

Document Type

Alphanumeric; Mandatory

Select the type of document from the adjoining option list.

Document Type Description

Display

The system displays the document type based on the selected document type.

Mandatory

Alphanumeric; Mandatory

You need to indicate whether the document is mandatory or optional. The drop-down list displays the following options:

- Standard - This indicates that the document is mandatory

- Additional - This indicates that the document is optional

Select the appropriate option.

Minimum Document Reqd

Document Category

Alphanumeric; Mandatory

Select the document category from the adjoining option list.

Document Category Description

Display

The system displays the document category description based on the selected document category.

Minimum Number Reqd

Numeric; Mandatory

Specify the minimum number of the standard documents that is required.

7.4 FATCA Document Maintenance

This section contains the following topics:

- Section 7.4.1, "Viewing FATCA Document Maintenance"

- Section 7.4.2, "Deleting FATCA Document Maintenance Details"

- Section 7.4.3, "Modifying FATCA Document Maintenance Details"

- Section 7.4.4, "Authorizing FATCA Document Maintenance Details"

7.4.1 Viewing FATCA Document Maintenance

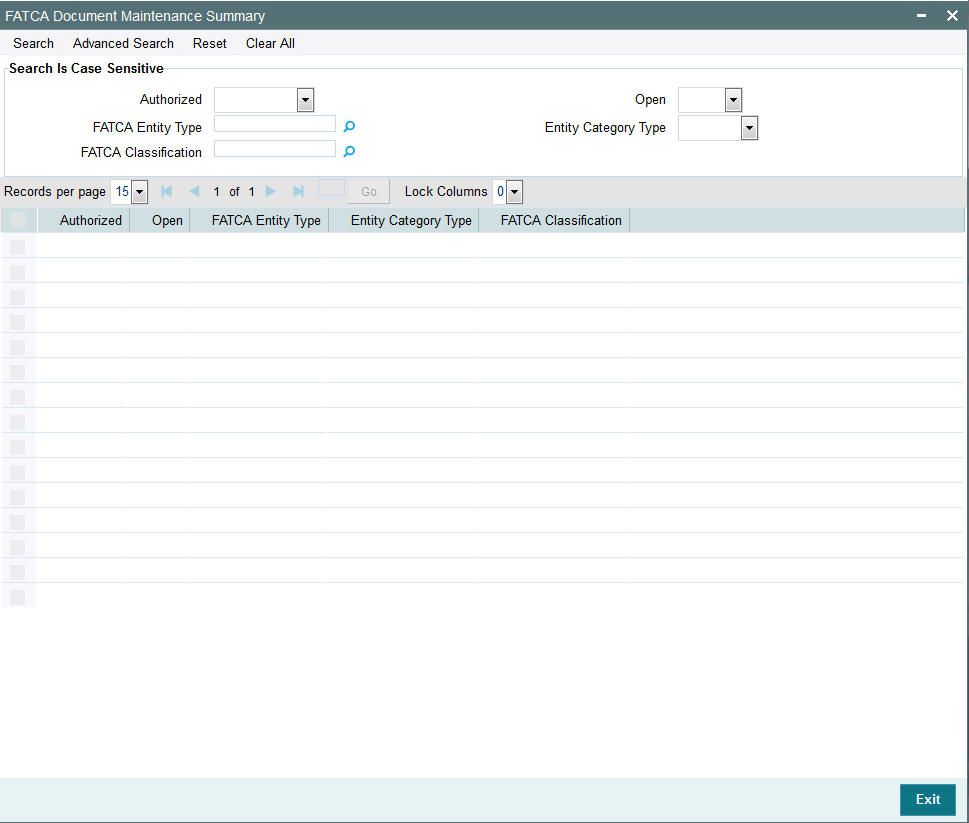

You can view FATCA Maintenance details in the ‘FATCA Document Maintenance Summary’ screen. You can invoke this screen by typing ‘UTSFATDT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can perform the following actions using this screen

You can view previously entered details of FATCA Maintenance in the ‘FATCA Maintenance Summary’ screen, as follows:

- Specify any or all of the following details in the ‘FATCA Maintenance

Summary’ screen:

- The status of the record in the Authorization Status field. If you choose the ‘Blank Space’ option, then all the records that involve the specified FATCA Maintenance are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all the records that involve the specified FATCA Maintenance are retrieved.

- Action

Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also search the record by using combination of % and alphanumeric value.

7.4.2 Deleting FATCA Document Maintenance Details

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the ‘FATCA Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete. The ‘FATCA Document Maintenance Detail’ screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

7.4.3 Modifying FATCA Document Maintenance Details

You can modify only unauthorized records in the system. To modify a record that you have previously entered:

- Invoke the ‘FATCA Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for modification.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify. The ‘FATCA Document Maintenance Detail’ screen is displayed.

- Select Edit operation from the Action list and modify the details. After modifying the details, click Save to save the modifications.

7.4.4 Authorizing FATCA Document Maintenance Details

You can authorize records in the system. To authorize a record that you have previously entered:

- Invoke the ‘FATCA Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for authorization.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to authorize. The ‘FATCA Document Maintenance Detail’ screen is displayed.

- Select authorize operation from the Action list. The system prompts you to confirm the authorization, and the record is authorized.

7.5 Entity FATCA Classification

This section contains the following topics:

- Section 7.5.1, "Maintaining Entity FATCA Classification"

- Section 7.5.2, "Linked Entity Details Button"

7.5.1 Maintaining Entity FATCA Classification

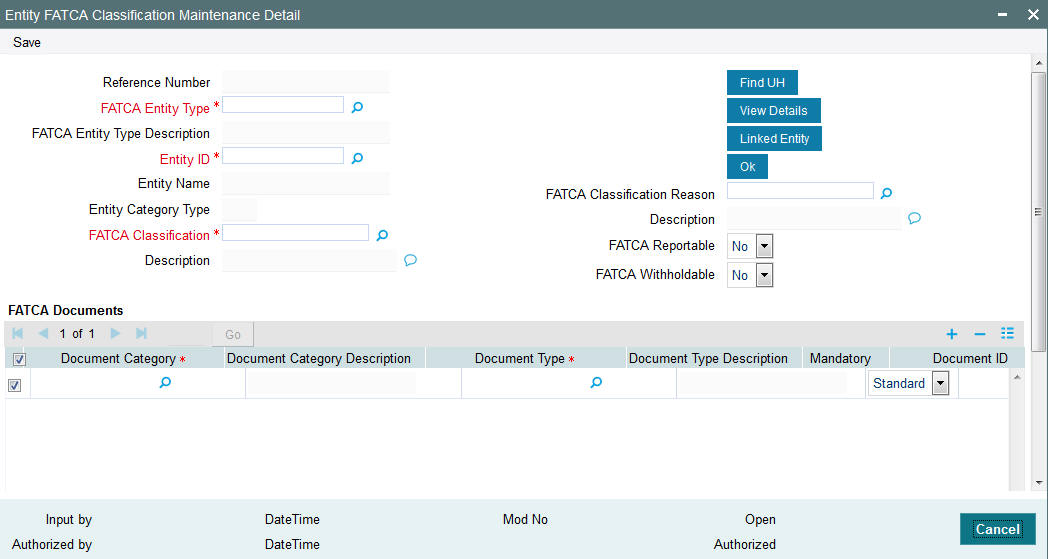

You can maintain FATCA Classification and record document details in the ‘Entity FATCA Classification Maintenance Detail’ screen. To invoke this screen type ‘UTDFATMT’ in the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

You can capture the following details in this screen:

Reference Number

Optional

Specify the reference number.

FATCA Entity Type

Alphanumeric; Mandatory

Select the FATCA entity type from the adjoining drop-down list. The options available are:

- Unit Holder

- Broker

- Single Entity

- Nominee

Entity ID

Alphanumeric; Mandatory

Select the Entity identification from the adjoining option list.

Entity Name

Display

The system defaults the entity name from the entity record.

Entity Category Type

Display

The system displays the entity category type.

FATCA Classification

Alphanumeric; Optional

Select the FATCA Classification from the adjoining option list.

Description

Alphanumeric; Optional

Give a brief description on FATCA classification.

FATCA Classification Reason

Alphanumeric; Mandatory

Select the reason for FATCA classification from the adjoining option list.

Description

Alphanumeric; Optional

Give a brief description on the FATCA classification reason.

FATCA Reportable

Optional

FATCA Reportable gets defaulted from the FATCA document maintenance for the entity selected. You can change the value from ‘Yes’ to ‘No’, but vice versa is not allowed.

System defaults FATCA Reportable as ‘No’.

FATCA With holdable

Optional

FATCA With holdable gets defaulted from the FATCA document maintenance for the entity selected. You can change the value from ‘Yes’ to ‘No’, but vice versa is not allowed.

System defaults FATCA With holdable as ‘No’.

FATCA Documents

Document Category

Alphanumeric; Mandatory

Select the document category from the adjoining option list.

Document Type

Alphanumeric; Mandatory

Select the type of the document from the adjoining option list.

Mandatory

Alphanumeric; Mandatory

You need to indicate whether the document is mandatory or optional. The drop-down list displays the following options:

- Standard - This indicates that the document is mandatory

- Additional - This indicates that the document is optional

Select the appropriate option.

Document ID

Alphanumeric; Mandatory

Specify the document identification.

Issue Date

Date Format; Mandatory

Specify the issue date of the received document.

Expiry Date

Date Format; Optional

Specify the expiry date of the received document.

Copy Received

Alphanumeric; Mandatory

Check this box to indicate that the copy is received.

Original Received

Alphanumeric; Mandatory

Check this box to indicate that the original is received.

Received Date

Date Format; Optional

Specify the document received date.

Document Reference Number

Alphanumeric; Optional

Specify the document tracking reference number.

Remarks

Alphanumeric; Optional

Specify remarks, if any.

Chasing Date

Date Format; Optional

Specify the document chasing date.

Document Upload

Click this button to upload or view the documents.

FATCA Status

FATCA Compliant

Display

The system displays whether you are FATCA compliant.

Remarks

Alphanumeric; Optional

Specify remarks, if any.

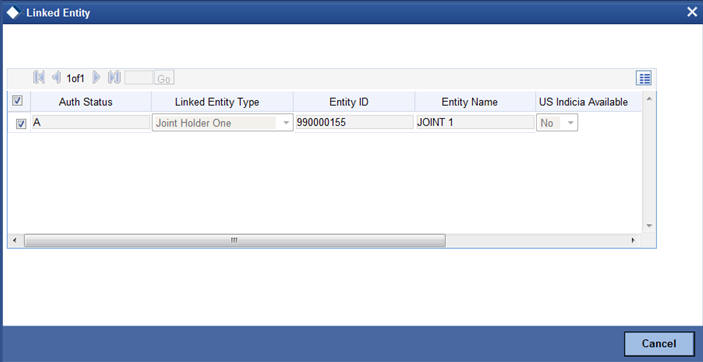

7.5.2 Linked Entity Details Button

Click on Linked Entity to maintain linked entity details.

You can maintain the following here:

Auth Status

Alphanumeric; Optional

Specify the Authorization status.

Linked Entity Type

Alphanumeric; Optional

Select the linked entity type from the adjoining option list.

Entity ID

Optional

Specify the entity identification.

Entity Name

Alphanumeric; Optional

Specify the entity name.

US Indicia Available

Display

The system defaults the US Indicia as Yes or No.

FATCA Classification

Display

The system displays the FATCA classification type.

FATCA Compliant

Display

The system defaults whether the linked entity is FATCA Complaint.

View

Click on ‘View’ to view the details of FATCA Maintenance of a linked entity.

Note

During UT Transaction capture for US Indicia Available Funds, if the FATCA Status of the unit holder or linked entity of a unit holder is:

- Pending, then the system displays a warning message as ‘Maintain FATCA Classification for UH/Linked entity’.

- Recalcitrant, then the system displays warning message as ‘Unit Holder or Linked entities mapped to the Unit Holder is FATCA is recalcitrant’.

During LEP Transaction capture for US Indicia Available Funds, if the FATCA Status of the unit holder or linked entity of a unit holder is:

- Pending, then the system displays a warning message as ‘Maintain FATCA Classification for UH/Linked entity.

- Recalcitrant, then the system displays warning message as ‘Unit Holder or Linked entities mapped to the Unit Holder is FATCA is recalcitrant’.

If the US Indicia is available for one of the customer during the CIF merge, then the customer account to which this account is being merged will also be US Indicia.

7.6 Entity FATCA Classification Maintenance

This section contains the following topics:

- Section 7.6.1, "Viewing Entity FATCA Classification Maintenance"

- Section 7.6.2, "Deleting Entity FATCA Classification Maintenance Details"

- Section 7.6.3, "Modifying FATCA Maintenance Details"

- Section 7.6.4, "Authorizing FATCA Maintenance Details"

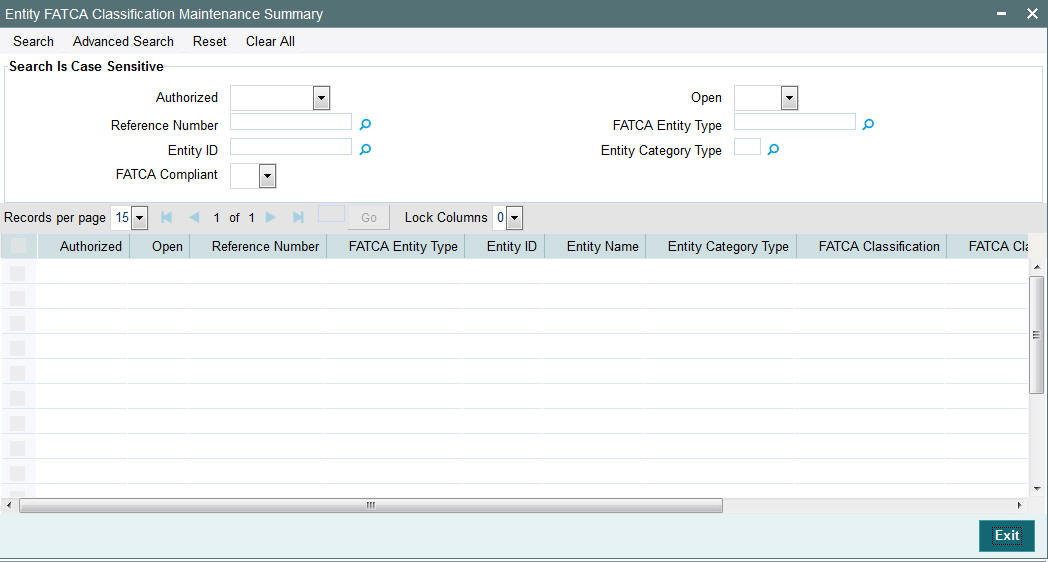

7.6.1 Viewing Entity FATCA Classification Maintenance

You can view, modify, delete and authorize Entity FATCA Classification Maintenance details in the ‘Entity FATCA Classification Maintenance Summary’ screen. You can invoke this screen by typing ‘UTSFATMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can perform the following actions using this screen

You can view previously entered details of Entity FATCA Classification Maintenance Detail in the ‘Entity FATCA Classification Maintenance Summary’ screen, as follows:

- Specify any or all of the following details in the ‘Entity

FATCA Classification Maintenance Summary’ screen:

- The status of the record in the Authorization Status field. If you choose the ‘Blank Space’ option, then all the records that involve the specified Entity FATCA Classification Maintenance Detail are retrieved.

- The status of the record in the Open field. If you choose the ‘Blank Space’ option, then all the records that involve the specified Entity FATCA Classification Maintenance Detail are retrieved.

- Entity FATCA Classification Maintenance Detail

Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also search the record by using combination of % and alphanumeric value.

7.6.2 Deleting Entity FATCA Classification Maintenance Details

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the ‘Entity FATCA Classification Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete. The ‘Entity FATCA Classification Maintenance Detail’ screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

7.6.3 Modifying FATCA Maintenance Details

You can modify only unauthorized records in the system. To modify a record that you have previously entered:

- Invoke the ‘Entity FATCA Classification Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for modification.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify. The ‘Entity FATCA Classification Maintenance Detail’ screen is displayed.

- Select Edit operation from the Action list and modify the details. After modifying the details, click Save to save the modifications.

7.6.4 Authorizing FATCA Maintenance Details

You can authorize records in the system. To authorize a record that you have previously entered:

- Invoke the ‘Entity FATCA Classification Maintenance Summary’ screen from the Browser.

- Select the status of the record that you want to retrieve for authorization.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to authorize. The ‘Entity FATCA Classification Maintenance Detail’ screen is displayed.

- Select authorize operation from the Action list. The system prompts you to confirm the authorization, and the record is authorized.