4. Maintaining System Parameters

In Oracle FLEXCUBE Investor Servicing, you can maintain static parameter data such as additional information heads, fee categories for investors, and codes for additional parameters. You can also map these maintained parameters to be applicable for certain entities such as unit holders and brokers. The additional parameters enable you to capture information relating to entities such as unit holders and brokers that are not otherwise captured in the system.

This chapter describes the definition and maintenance of these parameters in the system. It also includes the definition and maintenance of basic system default data. Default data is information that will be used as defaulted in any maintenance operation such as setting up investor accounts, setting up entities, setting up brokers and so on.

All the menu options pertaining to the maintenance of system parameters and default information can be accessed through the System Parameters menu item in the Maintenance menu category of the Agency Branch main menu. The following screens can be accessed through this menu item:

- Defaults Setup: Use this option to access the Defaults Maintenance screen, where you can set up the system default information.

- Parameters Setup: Use this option to access the System Parameter Codes Maintenance screen, where you can view defined codes for parameters that will be used in the maintenance of entities as well as other data in the system, and add any applicable valid values.

- Entity Mapping: Use this option to access the Entity Additional Information Mapping screen, where you can map any additional information heads to be applicable for the maintenance of entities such as unit holders and brokers.

- Addl Info Maint: Use this option to access the Additional Information Maintenance screen, where you can define any additional information heads.

- Fee Category Setup: Use this option to access the Fee Category Codes Maintenance screen, where you can view any specific defined fee category (and sub category) that is applicable to different investor types. You can also add new fee sub-categories.

- Data Maintenance: Use this option to access the FCIS Data Mapping Codes Maintenance screen, where you can define data mapping between an external system and FCIS.

This chapter contains the following sections:

- Section 4.1, "System Default Information"

- Section 4.2, "System Parameters"

- Section 4.3, "Additional Information Heads"

- Section 4.4, "Entity Additional Information Mapping"

- Section 4.5, "Fee Categories and Sub-categories"

- Section 4.6, "Data Mapping"

- Section 4.7, "User Event Mapping"

- Section 4.8, "Dividend Component Details"

- Section 4.9, "RDR Parameters"

4.1 System Default Information

This section contains the following topics:

4.1.1 Maintaining System Default Information

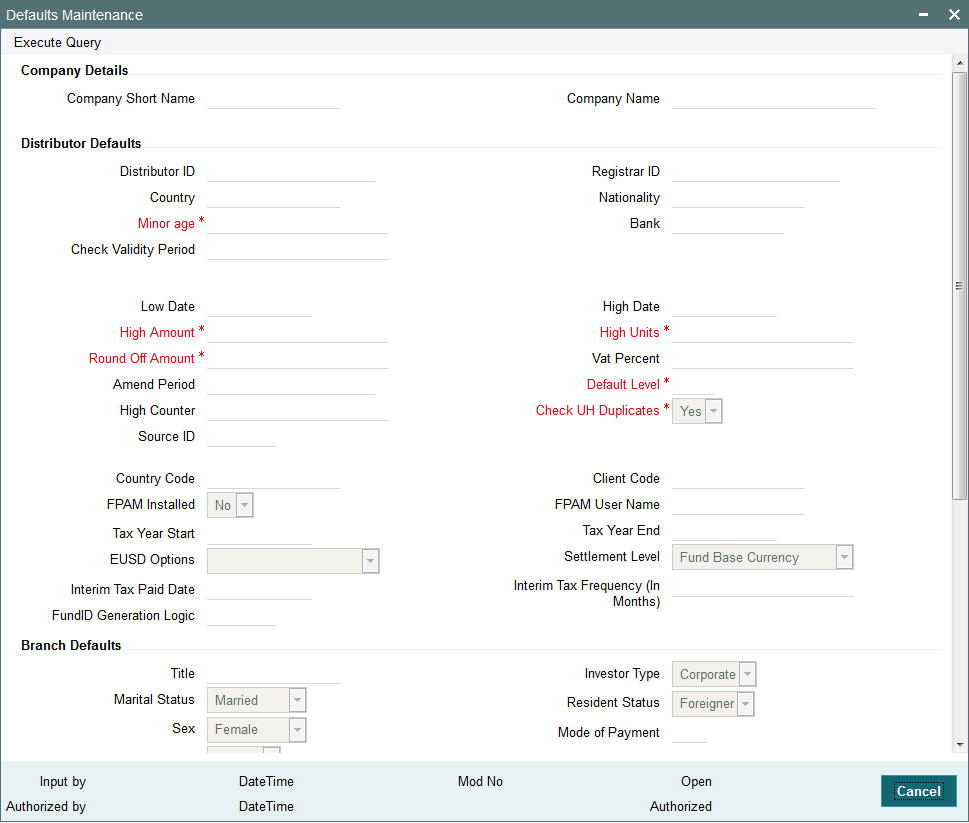

To set up system default information, use the ‘Defaults Maintenance’ screen. You can invoke this screen by typing ‘UTDDEFMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

In this screen press F7/F8 to query the data. You need to unlock and then modify the data if required.

Company Details Section

Company Name

60 Character Maximum, Alphanumeric, Mandatory

Enter the full name of the Company that is using Oracle FLEXCUBE Investor Servicing. The system will print this as the company name in all the reports.

Company Short Name

10 Character Maximum, Alphanumeric, Mandatory

Enter the short name of the Company that is using Oracle FLEXCUBE Investor Servicing.

Distributor Defaults Section

In this section, define the default information applicable for the AMC, in any maintenance operation in the system.

Distributor ID

6 Character Maximum, Alphanumeric, Mandatory

Enter the ID of the default distributor for the installation.

Registrar ID

6 Character Maximum, Alphanumeric, Mandatory

Enter the ID of the default Registrar for the installation.

Nationality

15 Character Maximum, Alphanumeric, Mandatory

Enter the default Nationality of the unit holder.

Country

20 Character Maximum, Alphanumeric, Mandatory

Enter the default Country of the unit holder.

Minor Age

Numeric, Mandatory

Enter the default age limit for the Minors.

Bank

Numeric, Mandatory

Enter the code of the default Bank for the system.

Check Validity Period

Numeric, Mandatory

Enter the number of days for which a Check is valid, by default during transactions.

Low Date

Date, Mandatory

Enter the default Low date value for the system.

High Date

Date, Mandatory

Enter the default High Date Value for the system.

High Amount

Currency, Mandatory

Enter the default high amount value.

High Units

Numeric, Mandatory

Enter the default high unit value.

Round Off Amount

Currency, Mandatory

Enter the default value for round off amount.

VAT Percent

20 Character Maximum, Alphanumeric, Mandatory

Displays the default value of Value Added Tax (VAT) Percentage.

Amend Period

Numeric, Mandatory

Enter the default Amendment period for the Fund Rule/Transactions.

Default Level

2 Characters Maximum, Numeric, Display

This displays the hierarchy default number in the fund. For example, if the existing fund has a parent fund, then the default level will be ‘2’.

High Counter

Numeric, Mandatory

Enter the default high counter value.

Check UH Duplicates

1 Character Maximum, Boolean, Mandatory

Select Yes or No to check for unit holder Duplicates.

Source ID

Alphanumeric, Mandatory

From the list, select the default exchange rate source for the AMC.

Country Code

15 Characters Maximum, Alphanumeric, Optional

Displays the code given to the country where the client site is located.

Client Code

15 Characters Maximum, Alphanumeric, Optional

Displays the code given to the client where Oracle FLEXCUBE Investor Servicing has been installed.

FPAM Installed

Alphanumeric, Optional

If Oracle FLEXCUBE Asset Management has been installed at the client site, it is indicated here.

FPAM User Name

15 Characters Maximum, Alphanumeric, Optional

The name of the user where Oracle FLEXCUBE Asset Management has been installed is displayed here.

Tax Year Start

Date Format, Optional

Specify the start date from which the tax payment should be considered.

Tax Year End

Date Format, Optional

Specify the date till which the tax payment should be considered.

EUSD Option

Alphanumeric, Optional

Select the default EUSD (European Union Savings Directive) option for the segment. The options available are:

- WithHolding Tax (WHT) : EUSD tax is computed and deducted

- Exchange of Information (EOI) : EUSD tax is computed but not deducted

- Tax Exemption Certificate (TEC) : EUSD tax is computed but not deducted

By default, the option is left unchecked. If you do not indicate any EUSD option, then EUSD option will not be applicable for the segment.

Note

This functionality is applicable only for the Fund Manager module.

Settlement Level

Mandatory

Indicate whether the payment amount must be compared with the fund base currency amount or the transaction currency amount while processing transaction settlements.

Interim Tax Paid Date

Date, Format (DD/MM/YYYY)

Specify the tax payment date here. This is only applicable for non-pensions funds.

Note

It is mandatory to specify the interim tax for funds where IOF/IRRF is applicable.

Interim Tax Frequency

Numeric

Specify the tax payment frequency here. This is only applicable for non-pensions funds.

Note

It is mandatory to specify the interim tax frequency for funds where IOF/IRRF is applicable.

Fund ID Generation Logic

6 Characters Maximum, Optional

Indicate the pattern using which the fund ID needs to be generated, where the first two characters represent the ISO Country Code (except for any jurisdiction with distributor schemas where the 2nd character will designate whether it is "R"egistrar-world or "D"istributor-world) and the following four characters are auto generated numerals.

Branch Defaults Section

In this section, define the default information applicable for any branch of the AMC, in any maintenance operation in the system.

Title

15 Character Maximum, Alphanumeric, Mandatory

Enter the Title to default during unit holder Data Entry. You can make a blank specification so that a blank entry may be accepted as a title by the system.

Investor Type

1 Character Maximum, Alphanumeric, Mandatory

Enter the default Investor Type, whether Individual or Corporate, during unit holder data entry.

Marital Status

1 Character Maximum, Alphanumeric, Mandatory

Enter Single or Married as the Marital Status to default during unit holder data entry.

Resident Status

1 Character Maximum, Alphanumeric, Mandatory

Enter Resident or Non-Resident as the Resident Status to default during unit holder data entry.

Sex

1 Character Maximum, Alphanumeric, Mandatory

Enter Male or Female as the Sex to default during unit holder Data Entry.

Mode of Payment

1 Character Maximum, Alphanumeric, Mandatory

Enter Cash, Check or Transfer as the Payment Mode to default during Transaction data entry.

Redemption Mode

1 Character Maximum, Alphanumeric, Mandatory

Enter Amount or Units as the Redemption Mode to default during transaction acceptance.

Account Type

1 Character Maximum, Alphanumeric, Mandatory

Enter Current, Savings or Fixed as the Payment Mode to default during Transaction data entry.

Language

1 Character Maximum, Alphanumeric, Mandatory

Enter English or Non-English as the default language in which the system should display messages.

Password Valid For (in days)

Numeric, Mandatory

Enter the minimum number of days after which the Users will have to change the Password. At the end of this retention period, the system will automatically prompt the User at login time to change the password.

System General Reference Number

1 Character Maximum, Boolean, Mandatory

Enter the option of using a System General Reference Number. If yes, then the Reference Number for all the transactions will also be generated by the system. If not, the Reference Number must be specified at the time of entering the transaction.

Error Level

Numeric, Mandatory

Enter the Error Messages Level.

- Enter 1 if you want the system to display an Error Message and not log it.

- Enter 2 if you want the system not to display an Error Message but to log it.

- Enter 3 if you want the system to display an Error Message and Log it.

- If any other level is indicated, the system will display Error Messages and Log it.

Online

Display

The online status of the branch, at the time of viewing this record, is displayed here.

Default Time Zone

Optional

Select the default time zone from the values available. All time zones you have maintained through the Time Zone Maintenance screen are displayed in the option list.

Auto Clear Provisional Balance

1 Character Maximum, Alphanumeric, Mandatory

Indicate whether 100% outflow transactions include provisionally allotted units. You can specify any of the following options:

- Option not allowed: Provisionally allotted units should not be considered while processing 100% outflow transactions.

- Allowed – Default checked: Provisionally allotted units should be considered while processing 100% outflow transactions by default.

- Allowed – Default unchecked: Provisionally allotted units will not be considered while processing 100% outflow transactions by default. However, you can check this option while performing transactions.

Auto Clear Reinvestments

1 Character Maximum, Alphanumeric, Mandatory

Indicate whether 100% outflow transactions include freeze held and reinvestment units.

You can specify any of the following options:

- Option not allowed: Freeze held/reinvestment units should not be considered while processing 100% outflow transactions.

- Allowed – Default checked: Freeze held/reinvestment units should be considered while processing 100% outflow transactions by default.

- Allowed – Default unchecked: Freeze held/reinvestment units will not be considered while processing 100% outflow transactions by default. However, you can check this option while performing transactions.

Other Defaults Section

In this section, define the other default information applicable for the AMC, in any maintenance operation in the system.

Database

15 Character Maximum, Alphanumeric, Mandatory

Enter the name of database that contains all the objects (tables, stored procedures, etc.) used by the system. This will be displayed at the footer of all the screens at run time. This field cannot be edited after it has been entered for the first time.

When you are in Edit mode, this is a Display Only field.

Agent

Numeric, Mandatory

Enter the code of the default Agent for the system.

Branch

Numeric, Mandatory

Enter the code of the default Agency Branch for the system.

When you are in Edit mode, the Agent and Branch fields are Display Only fields.

Component

20 Character Maximum, Alphanumeric, Mandatory

Enter the default Component of the system for the installation.

4.2 System Parameters

This section contains the following topics:

- Section 4.2.1, "Maintaining System Parameters"

- Section 4.2.2, "System Parameter Codes Maintenance Screen"

- Section 4.2.3, "System Params Value Maintenance Screen"

4.2.1 Maintaining System Parameters

At the time of installation of Oracle FLEXCUBE Investor Servicing, the implementers set up codes for parameters that will be used in any maintenance operation in the system, involving both static tables and processing. They also set up a list of values that would be considered valid for each parameter code. In any drop down list in a maintenance screen where the parameter code is used, the valid values list will appear.

The implementers set up these codes and values based on the requirements at each installation. Through the System Parameter maintenance, static information such as the following master lists can be maintained:

- Bank account types

- Countries

- Corporation types

- Identification types

- Occupation types

- Dividend component types

- Investor category types

- Investment Component types

You as a user will be able to add to a list of valid values for a parameter code, if so designated by the implementers at the time of installation.

The valid value lists that you set up will be displayed in the option lists in the user interface, in whatever operation a system parameter value is required to be picked up.

For instance, when bank account types are maintained as a system parameter, a value list containing the different account types is maintained as part of the System Parameter maintenance. In the system, in any screen that requires an account type as input information, the value list will be displayed to the user to select the required account type.

You must define the various components required for validating Prudential Investment Guidelines/Foreign Exchange Compliance under the parameter code “INVESTMENTCOMP”. This is a necessary maintenance required if you have selected Prudential Investment Guidelines as part of the Fund Product categories. The procedure for specifying the investment component code is the same for any other Parameter value to be maintained.

4.2.2 System Parameter Codes Maintenance Screen

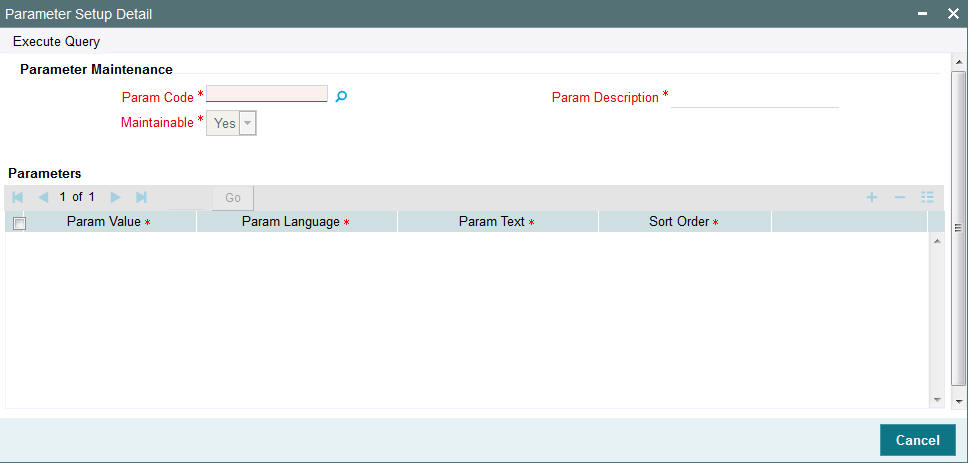

To view the system parameters codes and add to valid value lists for the same, use the System ‘Parameter Setup Detail’ screen. You can invoke this screen by typing ‘UTDPARAM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details.

All maintained codes are displayed in the grid portion of the screen, as a list. The following information is displayed for each parameter:

- The code and description for each parameter, in the Parameter Code and Parameter Description fields.

- The maximum applicable length of any specification (or valid value) for the parameter, in any maintenance screen or operation in the system. This is displayed in the Maximum Length field.

- Whether the valid value list maintained for the parameter code is editable, as designated by the implementers, in the Editable field. If the list is not editable, then you cannot add any valid acceptable values to the list in this screen.

- A list of valid values defined by the implementers as acceptable specifications for the parameter code. To view a list of these, click the Valid Values button.

4.2.3 System Params Value Maintenance Screen

When you click the Valid Values button for a selected parameter code in the System Parameter Setup Detail screen, the System Params Value Maintenance screen is opened.

If the parameter value list is not editable, then an error message, “Values cannot be maintained” is displayed, and when you click ‘Ok’ button in the message window, the System Params Value Maintenance screen is opened in view mode.

The selected parameter code and description is shown in the header portion of the screen.

Any maintained values are listed in the lower grid portion of the screen. The information maintained for each value is as follows:

- The identification for the parameter value in the Param Value field

- The text (or label) representing the parameter value in the Param Text field. For a given Param Value, the system allows you to enter different descriptions for different languages i.e. you can describe the same Param Value differently in various languages.

- The serial number representing the sorting order of the parameter value, in the Sort Order field

Parameter values may be stored in languages other than the default language. Click on the ‘Details’ link under the column Param Language to view the list of languages in which the parameter value is stored in the system.

Adding a value to the list

If the list is editable, then the Param Text and Sort Order fields are enabled for editing, and the Add link is available at the bottom of the list, to enable any additions to the list. The default language in which the codes are stored is also displayed in the grid. To add a value, click the Add link. A new row is inserted at the bottom of the list.

For each value you add in this manner, you must specify the following information as mandatory:

- A unique identifier for the value in the Param Value field

- The text (or label) representing the parameter value in the Param Text field. For a given Param Value, the system allows you to enter different descriptions for different languages i.e. you can describe the same Param Value differently in various languages.

- The serial number representing the sorting order of the parameter value, in the Sort Order field

If you wish to record the parameter value in the other languages supported by the system, click on the ‘Details’ link under the Multi Language column and enter the A unique identifier for the value in the Param Text field.

Click ‘Ok’ button. Your changes are saved, the System Params Value Maintenance screen is closed, and you are returned to the main System Parameter Codes Maintenance screen.

If the existing value list is not editable, all fields are in display only mode, and the Add link is not available.

Note

The system makes available the Param Codes to a user based on the language (if they have been maintained in that language) which has been specified in the SMS screen for the user. If you amend the language for a user, the system accordingly displays Param text in the latest language.

For example, if the language for User1 is initially German, the system makes available all the param codes in German. Later, if the language for User1 is changed to French, the param codes will be available in French.

4.2.3.1 Setting up Value Lists for Static Data

For the purpose of setting up value lists for static information such as the following, proceed in the manner described in the section, Adding a list of values, found earlier in this chapter.

- Bank account types

- Countries

- Corporation types

- Identification types

- Occupation types

- Dividend component types

- Investor category types

4.3 Additional Information Heads

This section contains the following topics:

- Section 4.3.1, "Maintaining Additional Information Heads"

- Section 4.3.2, "Adding New Information Head"

- Section 4.3.3, "List of Values Screen"

4.3.1 Maintaining Additional Information Heads

The Oracle FLEXCUBE Investor Servicing system gives you the facility of defining heads under which you can capture any additional information pertaining to any entities that you set up in the system, especially unit holders and brokers.

You can also set up a list of acceptable, valid values for each information head.

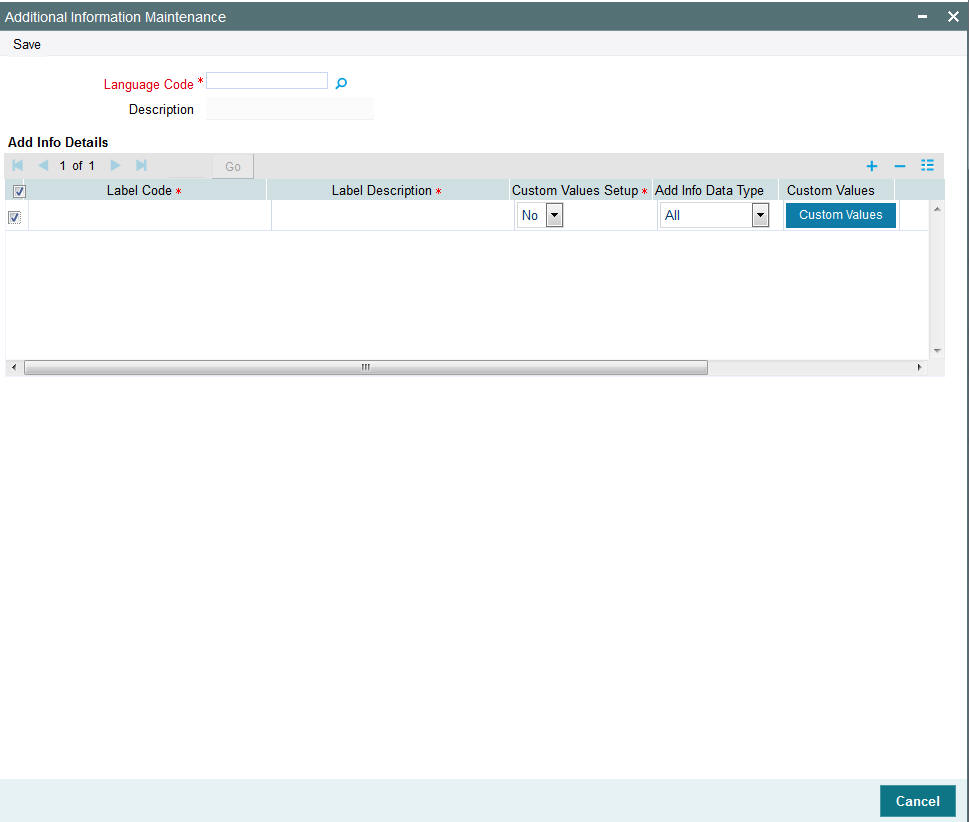

To define these additional information heads and their valid values, use the ‘Additional Information Maintenance’ screen. You can invoke this screen by typing ‘UTDADINF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details.

When you open the screen, choose the language for which you want to define the additional information heads, in the Language field.

All previously defined heads for the selected language are displayed in the grid portion of the screen, in the Label Details section, as a list. The following information is displayed for each information head:

- The code and description for each label, in the Label Code and Label Description fields.

- Whether the valid value list maintained for the information head is restricted, as designated by the implementers, in the Restriction field.

- A list of valid values defined by the implementers as acceptable specifications for the information head. To view a list of these, click the Valid Values button.

4.3.2 Adding New Information Head

To add a new information head, click the Add link in the Additional Information Maintenance screen. A new row is inserted at the bottom of the list.

For each information head you add in this manner, you must specify the following information as mandatory:

- A unique identifier for the value in the Label Code field.

- The descriptive text for the label representing the information head in the Label Description field.

- Indicate whether the information head is a restricted one, by choosing the appropriate option in the Restriction field. Once you have chosen to restrict an information head, you cannot make it unrestricted again.

To define a set of valid values, click the Valid Values button.

After you have defined the applicable valid values for the information head in the List of Values screen, click the Save button in the Additional Information Maintenance screen to save your changes.

You can also specify the following information for an additional information head:

Linking an additional information head to a system parameter

You can use the Link to Param field to indicate whether the additional information head that is being maintained is linked to a system parameter that has been maintained for the installation. Check this box to indicate such a linkage.

If a linkage is indicated, you must also enter the code of the specific system parameter to which the additional information head is linked. The values maintained for the linked parameter are also applicable for the additional information head. When you click on the Valid Values button, you can select the system parameter to which the additional information head must be linked.

You cannot maintain a restrictive list for an additional information head that is linked to a system parameter.

In the system, when the additional information field that is linked to a parameter code is displayed for data entry, a list of values button is provided for selection of the values defined for the linked parameter code.

Specifying the Param Code to which the Additional Information Head is linked

If the additional information head being maintained is to be linked to a system parameter that has been maintained for the installation, you must also enter the code of the specific system parameter to which the additional information head is linked. The values maintained for the linked parameter are also applicable for the additional information head. When you click on the Valid Values button, you can select the system parameter to which the additional information head must be linked.

Specifying the data type

Select the type of data that can be entered into the additional information field. This specification can be made only for those additional information heads that are not linked to a system parameter.

In the system, when a value is entered into the additional information field, the data type of the entered value is validated by the system.

4.3.3 List of Values Screen

When you click the Custom Values button for a selected information head in the Additional Information Maintenance screen, the List of Values screen is opened.

The selected Label Code and Label Description are shown in the header portion of the screen.

Any maintained values are listed in the lower grid portion of the screen, in the Valid Value Details section. When you are defining valid values for a new information head, this section is blank, and all the fields are enabled. The information maintained for each value is as follows:

- The identification for the valid value in the Valid Value Code field.

- The text (or label) representing the value in the Valid Value Description field.

- Whether the value is to be shown as default, in the drop down list for this information head, in any maintenance screen in the system. This is shown in the Default field.

Adding a value to the list

The Add link is available at the bottom of the list, to enable any additions to the list. To add a value, click the Add link. A new row is inserted at the bottom of the list.

For each value you add in this manner, you must specify the following information as mandatory:

- A unique identifier for the value in the Valid Value Code field.

- The text (or label) representing the value in the Valid Value Description field.

- Whether the value is to be shown as default, in the drop down list for this information head, in any maintenance screen in the system. This is shown in the Default field.

Click ‘Ok’ button. Your changes are saved, the List of Values screen is closed, and you are returned to the main Additional Information Maintenance screen.

4.3.3.1 Specifying RPO Code for Account Status as Additional Information Head

When you set up a unit holder account in the system, you can capture the RPO Code that would be used for tracking the status of the account. To enable this, the RPO Code is provided as an additional information head in the Additional Information Maintenance, with valid values such as Bankrupt, Deceased, Lien on Holdings, Return Mail and so on, as a pre-shipped maintenance.

Based on the RPO Code, specific transaction types could be allowed or disallowed, as follows:

RPO Code |

Processing Implications |

Normal/Active |

No associated RPO Code |

Bankrupt |

Redemptions, Transfer-In will be allowed. Subscription, Switch-Out, Switch-In, Transfer-Out transactions will not be allowed |

Deceased |

All transaction types disallowed |

Deceased Estate |

|

Frozen |

All transaction types disallowed |

Hold |

All transaction types allowed |

Blacklist |

All transaction types disallowed |

Suspicious |

All transaction types allowed |

Closed |

All transaction types disallowed |

The RPO code can be tracked separately for each installation; therefore, the same account could have the BLOCKED status in one installation and ACTIVE in another. To mark a status, an Information Change must be used.

To capture the effective date for the RPO status, an additional information head RPO Effective Date is provided, with the data type as ‘Date Type’. The format for the date is picked up from the Parameter Code ‘DATEFORMATFORADDINFO’, which is a pre-shipped maintenance.

These additional information heads are provided at your installation only if specifically requested for.

4.4 Entity Additional Information Mapping

This section contains the following topics:

- Section 4.4.1, "Invoking the Entity Additional Information Mapping Screen"

- Section 4.4.2, "Mapping Information Head to Entity"

4.4.1 Invoking the Entity Additional Information Mapping Screen

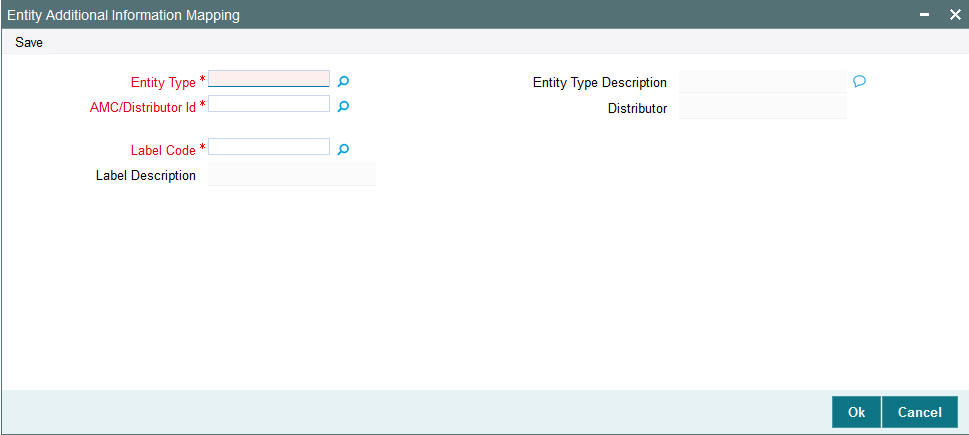

After you have defined the additional information heads with their valid values in the Additional Information Maintenance screen, you must map them to be applicable during the maintenance of entities.

To do so, use the ‘Entity Additional Information Mapping’ screen. You can invoke this screen by typing ‘UTDENMAP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details.

4.4.2 Mapping Information Head to Entity

In the Entity Additional Information Mapping screen,

- Choose the entity for which the information head must be mapped, in the Entity field.

- Choose the AMC for which the mapping is applicable, in the AMC ID field.

- All the defined additional information heads are displayed in the Label Details section, with the Label Code and Description representing each information head.

- After you have mapped all the desired information heads in this manner, click the Save button to save your changes.

4.5 Fee Categories and Sub-categories

This section contains the following topics:

- Section 4.5.1, "Setting up Fee Categories and Sub-categories"

- Section 4.5.2, "Fee Category Code Maintenance Screen"

4.5.1 Setting up Fee Categories and Sub-categories

At the time of installation of Oracle FLEXCUBE Investor Servicing, the implementers set up codes for fee categories that will be deemed applicable for specific investor categories. They also set up a list of fee sub-categories that would be considered valid for each fee category.

The implementers set up these codes and values based on the requirements at each installation.

You as a user will be able to add to a list of fee sub-categories for a fee category code. However, you cannot set up any new fee categories.

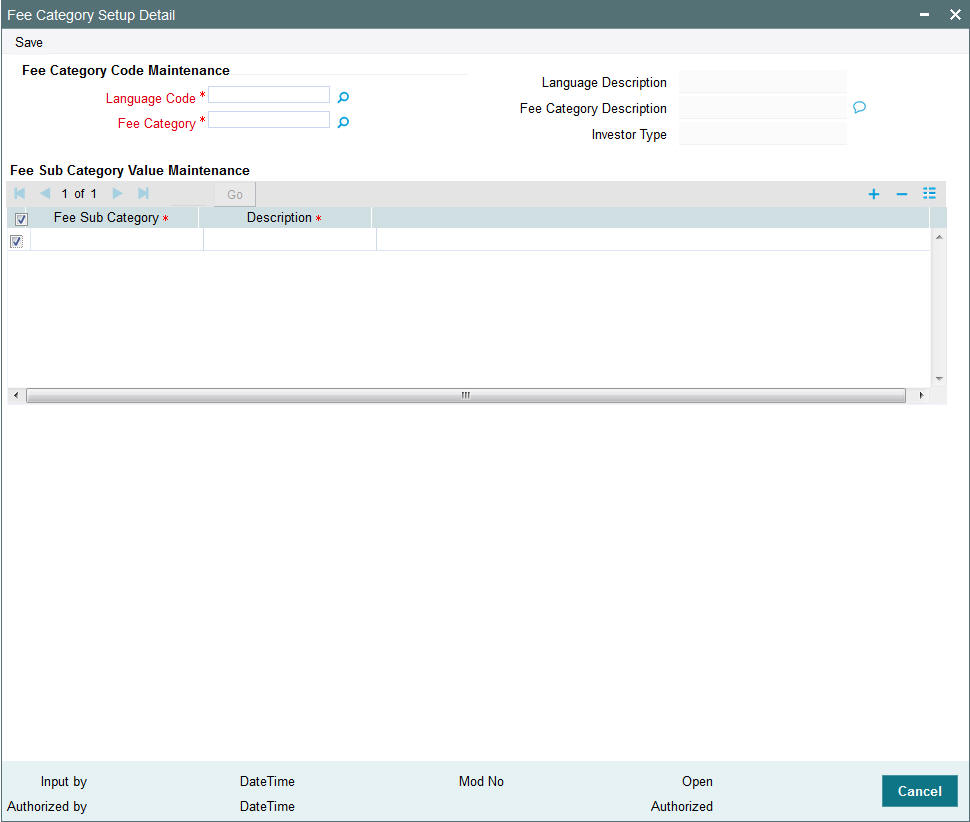

4.5.2 Fee Category Code Maintenance Screen

To view a list of defined fee category codes or add any new fee sub-categories, use the ‘Fee Category Setup Detail’ screen. You can invoke this screen by typing ‘UTDFEECA’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details.

When you open the screen, choose the language for which you want to view the defined fee category codes, in the Language field.

All defined fee categories for the selected language can be viewed on clicking the option list for the Fee Category Code. The following information is displayed on clicking:

- The code and description for each label, in the Fee Category Code and Fee Description fields.

- The investor category that the fee category is applicable for, in the Investor Type field.

The selected Fee Category Code and Fee Description are shown in the header portion of the screen.

Any maintained values for fee sub-category are listed in the lower grid portion of the screen. The information maintained for each fee sub-category is as follows:

- The identification for the fee sub-category in the Sub-category field

- The text (or label) representing the fee sub-category value in the Description field

Adding a new fee sub-category to the list

The Add link is available to enable any additions to the list. To add a fee sub-category, click the Add link. A new row is inserted at the bottom of the list.

4.5.2.1 Indicating Fee Sub Category Values

For each fee sub-category you add in this manner, you must specify the following information as mandatory:

- A unique identifier for the fee sub-category in the Sub-category field

- The text (or label) representing the fee sub-category in the Description field

Click ‘Ok’ button. The Fee Sub Category Value Maintenance screen is closed, and you are returned to the main Fee Category Code Maintenance screen. Here, click the Save button to save your changes.

4.6 Data Mapping

This section contains the following topics:

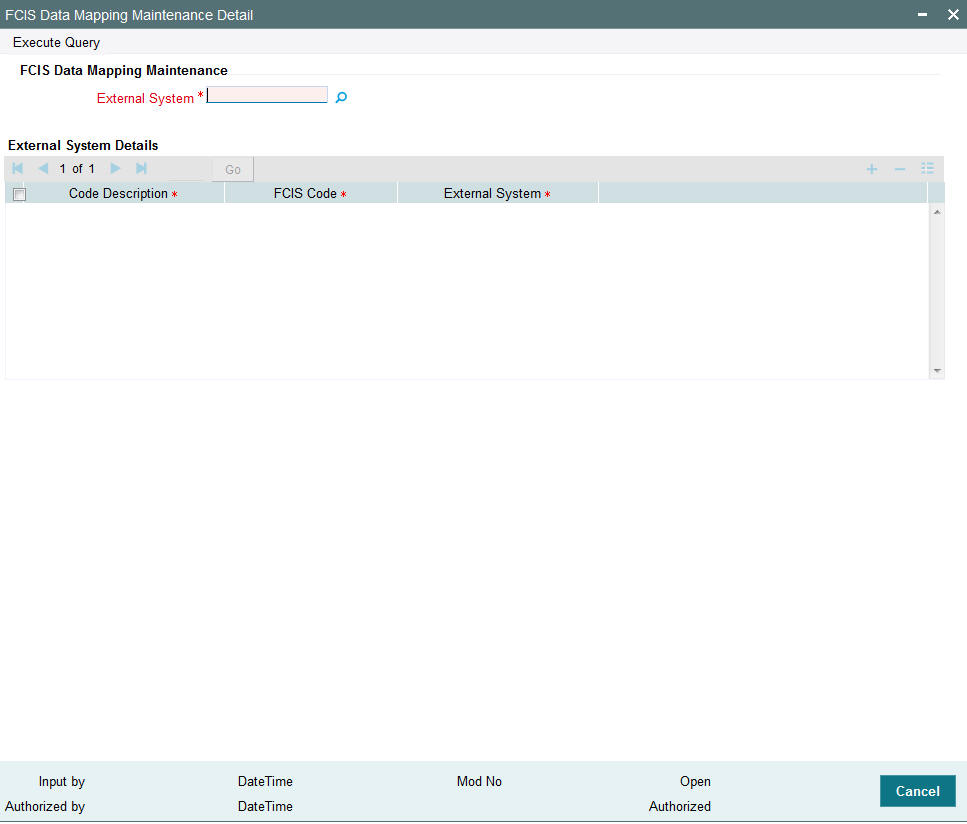

4.6.1 Maintaining Data Mapping

You can map data from external systems to FCIS using the ‘FCIS Data Mapping Maintenance Detail’ screen. You can invoke this screen by typing ‘UTDDMAP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

External System

2 Character Maximum, Mandatory

Select the external system from which the data needs to be mapped. The options being:

- CAMS

- TEMPLETON

- KARVY

- HSBC

- Oasis

External System Details Section

Code Description

Select the category of codes from factory shipped values available.

FCIS Code

Select the corresponding factory shipped value available in FCIS for the specified category code.

External System Code

2 Character Maximum, Mandatory

Specify the external system code here.

Note

If the code description selected from the available list is linked to any existing PARAMS, system would display all valid codes irrespective of the maintenance.

4.7 User Event Mapping

This section contains the following topics:

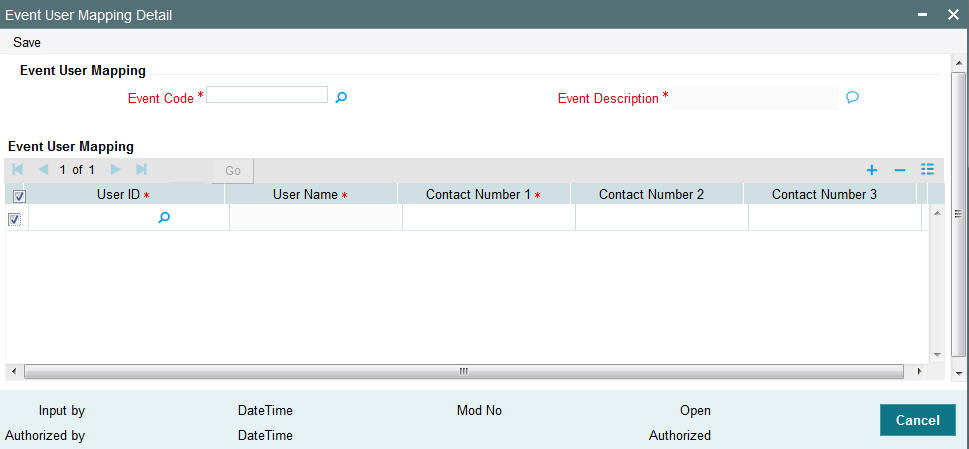

4.7.1 Invoking the User Event Mapping Screen

FCIS provides the facility to map the users responsible for each event that can be raised during the End of Day (EOD) process. You can also capture the user’s telephone numbers.

To map an EOD operator with an event, use the ‘Event User Mapping Detail’ screen. You can invoke this by typing ‘UTDEUMAP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details.

Event Code

Alphanumeric, Mandatory

Select the event for which you wish to map a user from the drop-down list. The list contains all the valid event codes maintained in the system.

Event Description

Display Only

On selecting the event code, the system displays the description of the event code.

Event User Mapping Section

User ID

Alphanumeric, Mandatory

Select the User Id of the person who is to be mapped to the chosen event. The list contains all the valid users maintained in the system.

Contact Numbers 1 – 3

Alphanumeric, Contact Number 1 is Mandatory

Enter the contact telephone numbers of the user. You can enter up to three contact numbers.

4.8 Dividend Component Details

This section contains the following topics:

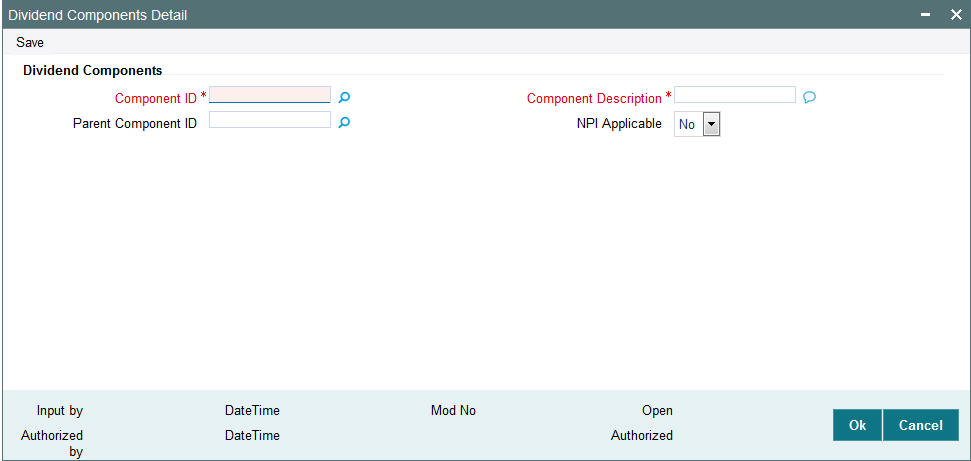

4.8.1 Maintaining Dividend Component Details

Earnings from a dividend can be classified as permissible or non permissible. As per Shariah laws, non permissible income cannot be reinvested into the fund.

You can maintain dividend component details in the ‘Dividend Components Detail’ screen. You can invoke this screen by typing ‘UTDDVCOM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details.

You can specify the following fields in this screen:

Component ID

2 Character Maximum, Alphanumeric, Mandatory

Enter a unique identifier for the dividend component that is to be classified as Non permissible income.

Component Description

Enter a description of the component.

NPI Applicable

Check this option to indicate that income from this component is non permissible.

Parent Component ID

Mandatory if the component is NPI Applicable

If the component has been classified as NPI Applicable then specify the parent dividend component. The parent component specified here will be used for reporting purposes. The option list contains the valid dividend component Ids maintained in the system.

4.9 RDR Parameters

This section contains the following topics:

- Section 4.9.1, "Maintaining RDR Parameters"

- Section 4.9.2, "Invoking RDR Parameter Maintenance Screen"

- Section 4.9.3, "Processing RDR Parameters"

- Section 4.9.4, "Front-end Fees and Trail Commission Payments"

4.9.1 Maintaining RDR Parameters

The Financial Services Authority (FSA) is an independent non-governmental regulatory body. FSA has proposed new regulations Retail Distribution Review (RDR) on Retail Advised portion of the Fund Market with effect from 1st January 2013.

The Retail Distribution Review regulations ban the payment of commission on retail advised retail business after 31st December 2012. Execution only Business can be defined as transactions by investor post-RDR without any advice from any advisor. While Advised Business can be defined as transactions done by investor post-RDR based on advice from advisor. Post RDR, neither front-end nor trail commission can be paid on advised new retail business. However, payment of commission (front-end/trail) can continue on New Business classified as ‘Execution only Business’. Commission payments can also continue to be paid on ‘Legacy Business’. Post RDR, the payment of commissions will depend on the classification of transactions (‘Legacy Business’, ‘Advised Business’, and ‘Execution Only Business’).

The RDR regulations will be applicable to UK domiciled advisor irrespective of whether they purchase UK funds or non-UK funds. The TAs for funds outside UK that are purchased as result of advice from a UK domiciled advisor will need to comply with RDR. It will be required to ascertain whether the advisor is domiciled in UK or not.

It is required to define the front-end commission and trail commission payable based on classification of transaction and domicile of advisor. It will be required to provide the audit trail for front-end commission and trail commission.

In the absence of commission payments on new advised business, investor will be required to pay fees to the advisor for the advice received. The advisor fee will be agreed upon by the investor and the advisor. The advisor will also be able to charge for ongoing services provided to investors. It will be required to provide audit trail for advisor fees. These fees are expected to be handled outside the system.

An investor may hold units in a fund and could have made investments based on advice received Pre-RDR and Post RDR. The payment of commission or fees will depend on the classification of transactions. It will be required to segregate an investors holding (Pre-RDR/Post-RDR) and classify them. Segregation of investor’s holdings will also be required to classify transactions resulting from reinvestment of dividends. It will be required to provide the audit trail for Pre-RDR and Post-RDR holdings.

Payment of commission on SI transactions will depend on whether the SI transaction is classified as “Legacy Business”, “Advised Business” or “Execution Only Business”. The escalation in SI transactions will also need to be classified similarly.

Re-registration of an investment from one platform to another will not be by default classified as an advised event and trail commission can continued to be paid. In case the re-registration is based on advised activity, then trail commission cannot be paid. It will be required to capture whether re-registration is based on advice or not.

Post RDR, in case there is a change in agent, the reason for the same will determine the eligibility for payment of commission. In case the change of agent is due to agent’s decision like old agent selling his business, the new agent will inherit the terms of holdings and receive trail commission. If the change of agent is due decision by investor, no trial commission is payable to the new agent. Trail commission can be paid to the investor and reinvested.

At present, from the management fee charged by the AMC, a portion is paid to advisor as trail commission, portion paid to platform providers and the balance is retained for fund management. The RDR regulations ban payment of trail commission on new retail advised business. In order to comply with the regulations, the AMC may introduce a new fund class for all the existing funds with lower management fees. The AMC may also retain the existing funds and modify the fee structure. Post RDR, AMCs may reduce the management fees or retain the old structure and pay rebate to either or both platform providers and investors. In case platform providers are continued to be paid from the management fees, the same will required to be disclosed to the investors. In the future, the FSA would like to enforce all platforms to receive fees from investors for services provided.

The actual fee charging will be driven by business rules by mapping appropriate load ref type.

4.9.2 Invoking RDR Parameter Maintenance Screen

You need to segregate into pre-RDR and post-RDR holdings while paying the commission. You need to classify the transactions for the purpose of commission payments. the front-end load and trail commission (management fees) will be mapped as loads with appropriate ref types.

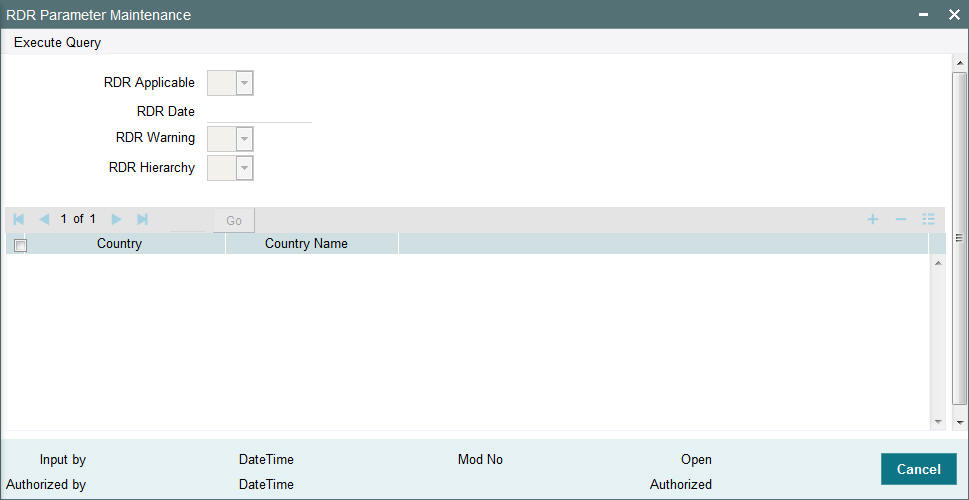

You can maintain RDR Parameters using ‘RDR Parameter Maintenance’ screen. You can invoke this screen by typing ‘UTDRDRPM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

RDR Applicable

Optional

Select if RDR is applicable or not from the adjoining drop-down list. Following are the options available:

- Yes

- No

RDR Date

Date Format; Optional

Specify RDR date.

RDR Warning

Optional

Select if RDR warning is applicable or not from the adjoining option list. Following are the options available:

- Yes

- No

RDR Hierarchy

Optional

Select if RDR hierarchy is applicable or not from the adjoining option list. Following are the options available:

- Yes

- No

Country

Alphanumeric; 8 Characters; Optional

Specify the country code. This adjoining option list displays all valid country code maintained in the system. You can choose the appropriate one.

Country Name

Display

The system displays the name of the country for the selected country code.

The system will determine the payment of commission by the classification of transactions, such as, IPO subscriptions, subscription, switch and transfer In, where transaction date is less than RDR Effective date and advisor is UK domiciled broker as ‘Legacy/Direct Business’.

Post RDR for UK domiciled advisor, the system will track the transactions, such as, IPO subscriptions, subscription, switch transfer In and Trail Commission reinvestment as new business. Based on the value of ‘Transaction Category’ field at the transaction level, the system will classify the transactions as either ‘Legacy/Direct Business’, ‘Advised Business’ or ‘Execution Only Business’.

For Non UK domiciled adviser, the system will default the Transaction category to ‘Legacy/Direct Business’. The defaulting of ‘Transaction Category’ field will happen on clicking the ‘Enrich Transaction’ button.

If you change the transaction category for non UK domiciled advisor to Advised/Execution Only Business, the system will display the following warning message:

Default Transaction Category has been overridden. Do you want to continue?

The above validation is also applicable, if you change the transaction category during edit/amend operation.

In case of agent hierarchy, if any entity in the hierarchy is domiciled in UK, you should tag the transaction as ‘Advised or Execution Business’. In such a case, if you choose the transaction category as Legacy Business, even if any one of the entity mapped in the Hierarchy is domiciled in UK, then the system will display the following warning message:

Default Transaction Category has been overridden. Do you want to continue?

The above validation is also applicable, if you change the transaction category during edit/amend operation.

The system will default the ‘Transaction Category’ field based on the country of Domicile of Advisor, RDR Applicable, RDR Date and the classification of broker at UH maintenance screen.

In case the transaction has broker which is not mapped at UH level and if the intermediary is UK domiciled, the system will default the transaction category to Execution. For non UK domiciled intermediary, the system will default the transaction category to Legacy/Direct Business.

The above validation is applicable if RDR Applicable is selected as ‘Yes’ and the transaction date is greater than or equal to RDR Date.

Post RDR, the holdings in a fund due to Share Class Conversion, Fund Merger, Fund Split, Dividend Reinvestment, Reverse split will be classified as ‘Legacy/Direct Business ‘, ‘Advised Business’ or ‘Execution Only Business’, based on the category of original holdings.

If a regular savings plan is in force at the RDR date, the system will continue the front end commission to be paid on each subsequent contribution. In addition, the system will tag the units/ shares allocated to the transaction as legacy/direct.

If for a existing or a new SI (post RDR Date), the SI is amended for escalation, then the system will display the following warning message:

SI is being escalated for UK domiciled broker transaction – Do you wish to continue?

If the transaction category is amended, the system will reflect the new category from next SI generation onwards.

For Non-UK domiciled advisor, all transactions including Switch/SI/escalations in SI will continue to be marked as Legacy/Direct Business irrespective of the trade date/SI registered Date.

4.9.3 Processing RDR Parameters

The system will charge front end fees, post RDR, based on the transaction category. The system will charge front end fees for transactions classified as ‘Legacy/Direct Business’ and ‘Execution Only Business’ done through a UK domiciled advisor.

For agent hierarchy, you need to map appropriate transaction category– depending on the business needs.

- Case1: If agent is domiciled in UK, then irrespective of the hierarchy, they may follow RDR rules

- Case 2: If agent is not domiciled in UK, then irrespective of the domicile of other entities in Hierarchy, they may not follow RDR rules.

Post RDR, the system will compute trail commission based on transaction category for the transactions, such as, ‘Legacy/Direct Business’ and ‘Execution Only Business’ done through a UK domiciled advisor. For ‘Advised Business’ done via a UK domiciled advisor, the system will not compute trail commission. You can maintain different rates of trail commission for the different transaction categories.

You can also set up configuration such that all trailer commission on legacy business get paid to the unitholder.

Post RDR, the AMC can maintain the same management fee for transactions done through a UK domiciled Advisor and give rebate to investor. The management fee (periodic load) with From entity as ‘AMC’ and To Entity as ‘Unit Holder’ to be given based on appropriate mapping.

In case of a Product periodic load, if at Unitholder level, and if Trailer commission preference at UH level is reinvestment, then the system will generate transaction into CMA fund for the UH on trailer commission payment date. If CMA fund is not maintained, then the system will generate reinvestment transaction into the preferred fund.If preferred fund is not maintained, then the system will generate reinvestment transaction for all funds available in the policy for which trailer fee has been computed.

The transaction category for this transaction will be legacy/execution depending on the advisor is UK domiciled or non UK domiciled. In case of reinvestment of trailer commissions, the transaction category will be updated as follows:

- Post RDR date, if default broker at UH level is UK domiciled and advise mode at UH level is Advised, then the transaction category will be Advised Business, else it will be Execution Business.

- Pre RDR Date, if default broker at UH level is UK domiciled, then the Transaction category will be Legacy/Direct business.

- If default broker is non UK domiciled, the generated transaction will have the transaction category as Legacy/Direct business.

The AMC can also decide to lower the management fee to be charged when the advisor is domiciled in UK. The new lower management fee with appropriate category for Advisor domiciled in UK will be mapped.

4.9.4 Front-end Fees and Trail Commission Payments

4.9.4.1 For legacy business

Front end fee:

Case 1:

Load |

From Entity |

To Entity |

L1 |

Unit Holder |

AMC |

L2 |

AMC |

Broker/Agent |

L3 |

Broker/Agent |

Unit Holder |

Case 2:

Load |

From Entity |

To Entity |

L1 |

Unit Holder |

Broker |

L2 |

Broker |

AMC |

Trailer Fee:

Case 1:

Load |

From Entity |

To Entity |

T1 |

AMC |

Broker/Agent |

Case 2:

Load |

From Entity |

To Entity |

T1 |

AMC |

Broker/Agent |

T2 |

Broker/Agent |

Unitholder |

Case 3:

Load |

From Entity |

To Entity |

T1 |

AMC |

Unit Holder |

Case 4:

Load |

From Entity |

To Entity |

T1 |

AMC |

Broker/Agent |

T2 |

AMC |

Unit Holder |

Case 5:

Load |

From Entity |

To Entity |

T1 |

Unit Holder |

Broker/Agent |

In cases, where To Entity is Unitholder, investor may receive trailer commission in the form of Cash or reinvestment (into same fund) – This is only applicable when from Entity is M.

4.9.4.2 For Execution business

Front end fee:

Case 1:

Load |

From Entity |

To Entity |

L1 |

Unit Holder |

AMC |

L2 |

AMC |

Broker/Agent |

Case 2:

Load |

From Entity |

To Entity |

L1 |

Unit Holder |

Broker |

L2 |

Broker |

AMC |

Trailer Fee:

Case 1:

Load |

From Entity |

To Entity |

T1 |

AMC |

Broker/Agent |

Case 2:

Load |

From Entity |

To Entity |

T1 |

AMC |

Broker/Agent |

T2 |

Broker/Agent |

Unit Holder |

Case 3:

Load |

From Entity |

To Entity |

T1 |

AMC |

Unit Holder |

Case 4:

Load |

From Entity |

To Entity |

T1 |

AMC |

Broker/Agent |

T2 |

AMC |

Unit Holder |

Case 5:

Load |

From Entity |

To Entity |

T1 |

Unit Holder |

Broker/Agent |

In this case Unitholder can mention his preferred fund, and fee can be paid by redeeming units from this fund.

4.9.4.3 For Advisor Business

Front end fee:

Case 1:

Load |

From Entity |

To Entity |

L1 |

Unit Holder |

AMC |

Trailer Fee

Case 1:

Load |

From Entity |

To Entity |

T1 |

AMC |

Unit Holder |

However the fee configurations are expected to be handled operationally by the business. Hence, for UK domiciled broker when the transaction category is Advised Business, you should not map any load which will have ‘To Entity’ as ‘Broker/Agent/Agency Branch/Account Officer/IFA’.

Appropriate transaction categories will be mapped to enable system to skip transactions where the transaction category is Advised business for trailer commissions when the To Entity is mapped as ‘Broker/Agent/Agency Branch/Account Officer/IFA’.

In case of Agent/Agency Branch /AO/IFA hierarchy, the system will compute Trailer commission based on the transaction category mapped for the hierarchy.

If the trailer commission computed for the hierarchy does not include ‘Advised Business’ transactions, then commission shared among other entities (in the hierarchy below the entity for which trailer commission has been computed) will also not include the commission eligible due to Advised Business.

Post RDR, the system will setup the payment of front-end fees based on load ref type.

In fund load mapping/group load mapping and product load mapping screen, you can map the appropriate load ref type for applying desired fee rate.