3. Generating Reports

Oracle FLEXCUBE Investor Servicing provides an extensive reporting facility. You can query the database to obtain pre-defined reports relating to any aspect of fund management, entity management, transaction processing or security.

The reports are grouped into the following categories:

- Activity Reports

- Broker Reports

- Certificate Printing

- Confirmation Reports

- Inquiry

- LEP Reports

- Other Reports

- Print Reports

- Queries

- Reinvestment Report

- SI Reports

- Threshold Balance

- Transfer Register

- Transaction Reports

- UH Info Reports

- Unit Holder Reports

This chapter contains the following sections:

- Section 3.1, "Activity Reports"

- Section 3.2, "Broker Reports"

- Section 3.3, "Confirmation Reports"

- Section 3.4, "Other Reports"

- Section 3.6, "SI Reports"

- Section 3.7, "Transaction Reports"

- Section 3.8, "UH Info Reports"

- Section 3.9, "Unit Holder Reports"

- Section 3.10, "Reinvestment Report"

- Section 3.11, "Certificate Inquiry"

- Section 3.12, "Certificate Printing"

- Section 3.13, "Threshold Balance Report"

- Section 3.14, "Transfer Register Report"

- Section 3.15, "Tax Statements Reports"

- Section 3.16, "Investment Simulator"

- Section 3.17, "Multi Transaction Error Log Report"

- Section 3.18, "Tax Credit Report"

3.1 Activity Reports

This section contains the following topics:

- Section 3.1.1, "Activity Report Details"

- Section 3.1.2, "Generating the Fund Activity Report"

- Section 3.1.3, "Generating Inactive Users Report"

- Section 3.1.4, "Generating the User Profile Info Report"

- Section 3.1.5, "Generating SMS Event Log Report"

3.1.1 Activity Report Details

The reports in this section display data regarding the logging of activities performed by the users that access the Oracle FLEXCUBE system. These are mainly security management related reports.

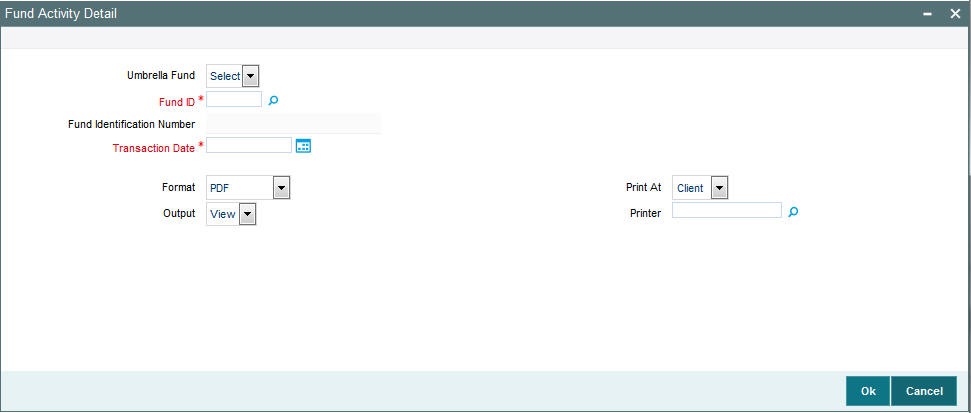

3.1.2 Generating the Fund Activity Report

This report will print the Activity Summary or Super Sheet of the fund for the day. It is printed on request. You can invoke the ‘Fund Activity Detail’ screen by typing ‘UTR00033’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Enter the search criteria and click ‘Ok’ button to generate the report.

3.1.2.1 Contents of the Fund Activity Report

Subscription

The sum of the total subscription, in units and amounts that have been made.

Switch To

The sum of the total Switch transactions, in units and amounts that have been made to this fund.

Total Subscriptions

The sum of the total Subscription, in units and amounts that have been made. This includes Subscriptions and Switch To this fund.

Redemption

The sum of the total redemption, in units and amounts that have been made.

Switch From

The sum of the total Switches, in units and amounts that have been made from this fund.

Dividends

The sum of the total Dividends, in units and amounts that have been declared.

Total Redemption

The sum of the total Redemption, in units and amounts that have been made. This includes redemption, switch from this fund, dividends.

Net

This is the Total Subscriptions minus the Total Redemption made.

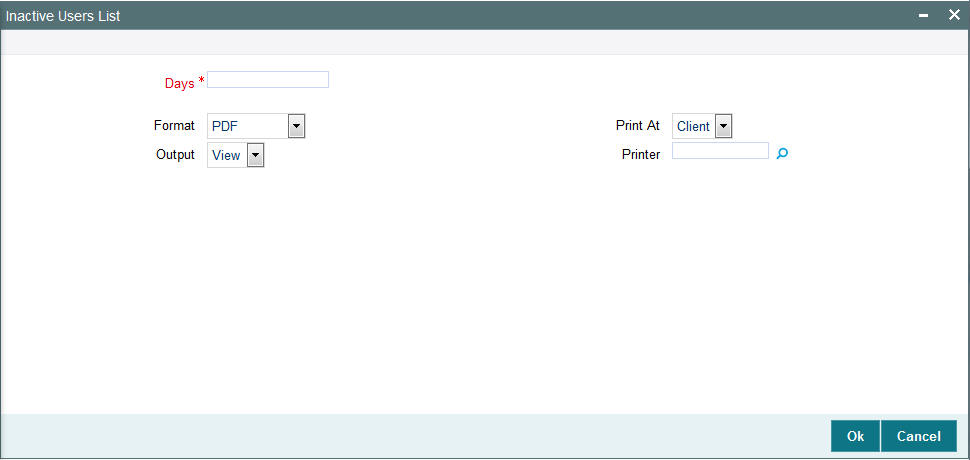

3.1.3 Generating Inactive Users Report

This report is generated to view the details of the inactive users.

The ‘Inactive Users Report’ screen is as shown below. You can invoke the ‘Inactive Users List’ screen by typing ‘UTR00193’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Enter the search criteria and click ‘Ok’ button to generate the report.

In this screen, the following are the parameters for the generation of the report:

- The number of days from the application date since when the user’s status has been inactive.

- The language in which the report must appear.

- The mandatory box needs to be checked against the fields which are mandatory for the generation of the report.

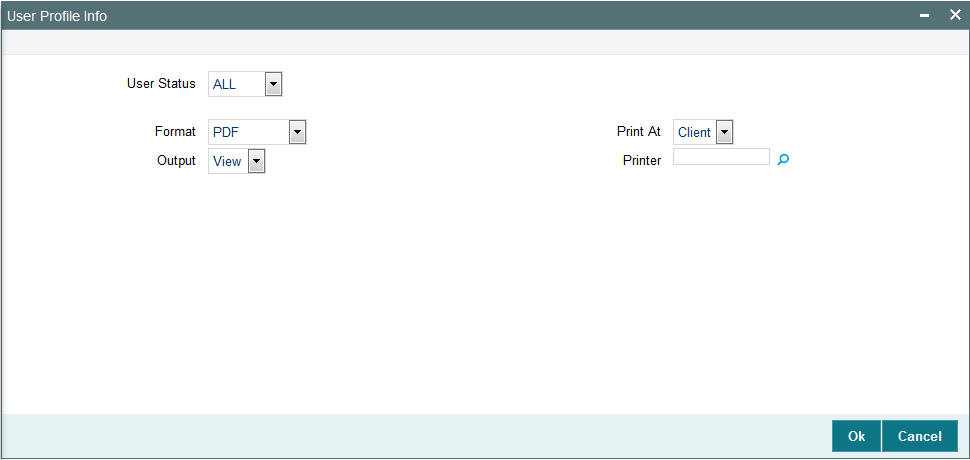

3.1.4 Generating the User Profile Info Report

This report is generated to view the details of the inactive users. You can invoke the ‘User Profile Info’ screen by typing ‘UTR00192’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Enter the search criteria and click ‘Ok’ button to generate the report.

3.1.4.1 Contents of the User Profile Info Report

In this screen, the following are the parameters for the generation of the report:

- The user’s status the options being

- Disable

- Enable

- All

- The language in which the report must appear.

- The mandatory box needs to be checked against the fields which are mandatory for the generation of the report.

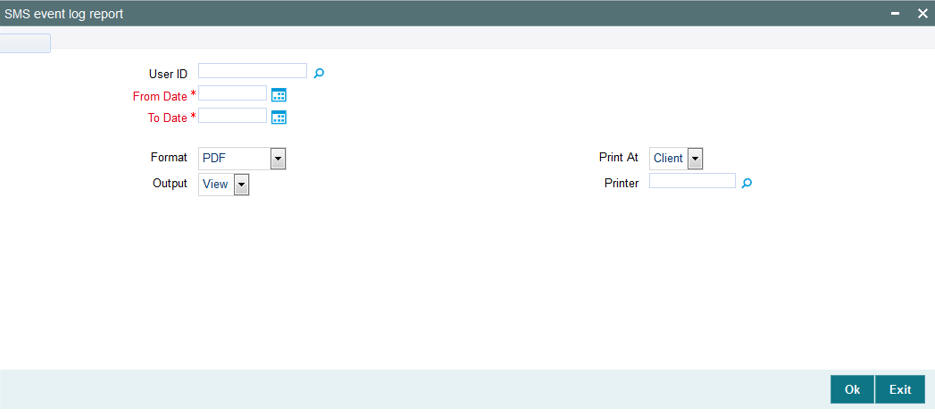

3.1.5 Generating SMS Event Log Report

This report is generated to view the details of the events logged by the user. You can invoke the ‘SMS event log report’ screen by typing ‘UTRPEVLG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details:

User ID

Optional

Select the user ID from the list of values. The list consists of all user IDs maintained in the system.

From Date

Date Format; Mandatory

Select From date from the adjoining calendar.

To Date

Date Format; Mandatory

Select To date from the adjoining calendar.

Format

Optional

Select the format from the drop-down list. The list displays the following values:

- HTML

- Excel

- Excel (.xlsx)

- RTF

Output

Optional

Select the output from the drop-down list. The list displays the following values:

- View

- Spool

Print At

Optional

Select the printing location from the drop-down list. The list displays the following values:

- Client

- Server

Printer

Alphanumeric; 15 Characters; Optional

Specify the printer details from adjoining option list.

Enter the search criteria and click ‘OK’ button to generate the report.

3.2 Broker Reports

This section contains the following topics:

- Section 3.2.1, "Broker Reports Details"

- Section 3.2.2, "Broker Communique Report"

- Section 3.2.3, "Broker Details Report Description"

- Section 3.2.4, "Generating Reporting Structure for Brokers Report"

- Section 3.2.5, "Broker Commission Payment Report Description"

3.2.1 Broker Reports Details

Any information related to brokers in the system can be displayed by generating the reports in the reports in this section.

3.2.2 Broker Communique Report

This report shows you the commission details for a broker, over a period, with summaries as well as fund-wise and transaction-wise groupings.

Also, this report shows you the value of the broker’s holdings in each fund, along with the CASA account balances.

The following details are displayed in the report:

3.2.2.1 Broker Details

In this section of the report, the Name, Code, Telephone and Facsimile Numbers, Mobile Number, Email Address and Postal Address of the concerned broker are displayed.

Also, the Last Paid On Date, which refers to the last commission payment date and the Next Payment On Date are displayed.

The VAT Registration Number is also displayed.

3.2.2.2 Summary of Commission Details

Here, the summary details of commissions that have accrued to this broker over the given time period are displayed. This includes the following information:

- The Payment Dates of the Commissions

- The Opening Balance

- The Commission Accrued, Earned, Paid and Reinvested

Here, the commission accrued will include the commission that has accrued from transactions for which the payment instruments have not been cleared, too. This portion of the commission is not paid out till the payment instruments are cleared.

3.2.2.3 Payment Details

The details of each commission payment are displayed here. Both Check as well as Transfer payments are displayed under the appropriate head.

For Check Payments, the following details are available for view:

- The Payment Reference Number and Payment Date

- The Check Amount, the Check Number, the Clearing Date and the Clearing Status.

For Transfer Payments, the following details are available for view:

- The Payment Date

- The Transfer Amount, Transfer Bank Name and Branch Name

- The Transfer Account Type and Account Number.

The commission paid out will not include the commission that has accrued from transactions for which the payment instruments have not been cleared. This portion of the commission is not paid out till the payment instruments are cleared.

3.2.2.4 Commission Details Grouped by Transaction and Fund

In this section, the details of commission in each fund, grouped according to transactions, are displayed. For each transaction that has resulted in a commission payment, the following details are displayed:

- Client Details such as the Unit Holder that has entered into the transaction and the Unit Holder Number.

- Transaction Details such as the Transaction Date and Type, the Number of Units involved in the transaction, the Buy Price and the Amount in fund base currency.

- Commission Details, such as the Commission Earned

If the payment instrument for the transaction is not cleared, the commission as a result of the transaction is processed and accrued, but it is not paid out till the payment instrument is cleared.

3.2.2.5 Unit holder Balances across Funds and CASA Account Balances

In the final section of this report, the fund-wise balances held by each unit holder whose introducer broker is the broker for whom the report is being printed, are displayed. For each unit holder, the following details are displayed fund-wise:

- The Unit Balance in each of the funds, with Provisional Units and Blocked Units. The Value of Fund Holdings is also displayed, in unit holder currency.

- The Total Value of Holdings of the unit holder across funds is also summed up and displayed in fund base currency.

- The CASA Account Balance for the unit holder is also displayed.

- The Total Blocked Amount, across funds, is also displayed.

The Grand Total of Holdings is the sum of all the total values of holdings for all unit holders across funds. This is also displayed in the report.

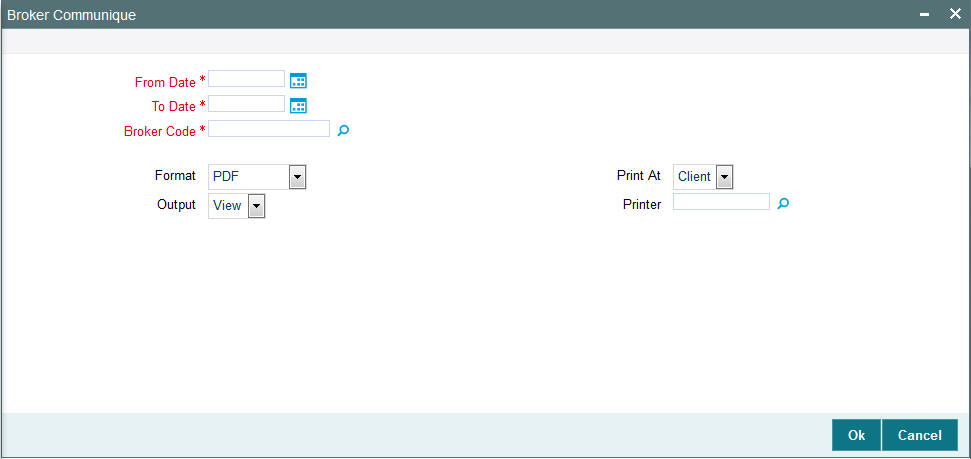

3.2.2.6 Generating Broker Communique Report

The ‘Broker Communique’ Report generation screen is as shown below. You can invoke the ‘Broker Communique’ screen by typing ‘UTR00107’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The dates that specify the period between which you want to view the broker details, in the From Date and To Date fields.

- The code of the broker for whom you want to view the details between the specified dates, in the Broker Code field. (This specification is not mandatory. If not specified, the details for all brokers between the two specified dates will be displayed)

- The language in which the report must appear, in the Report Language field.

After making your specifications, click ‘Ok’ button.

3.2.3 Broker Details Report Description

This report displays all information regarding the Broker that you have entered in the broker's record, in the ‘Broker Maintenance’ screen. The information is logically grouped under the following heads:

- Broker Details such as the Broker Name and the Parent Broker Name.

- Contact Details

- Commission Details

- Bank Details

- Income Distribution Set-up Details

- Reinvestment Setup Details

3.2.3.1 Broker Details

In this portion of the report, the following details are displayed:

- The Broker's Name

- The Broker's Code (i.e., the broker's identification within the system)

- The name of the Parent Broker to whom this broker reports.

- The Broker Code of this Parent Broker

3.2.3.2 Contact Details

In this portion of the report, the following details are displayed:

- The Broker's complete address, with the City, State and Zip Code.

- The Broker's telephone, fax and cell-phone numbers.

- The name of the Contact Person for this broker.

3.2.3.3 Commission Details

In this portion of the report, the following details are displayed:

- The VAT details of the broker (i.e, whether the broker is a VAT Registered Broker or not, and if so, his VAT Registration Number)

- The hierarchical commission percentage that is payable to this Broker.

- The Commission Payment Frequency, with the Next Payment Date, Last Payment Date, Last Payment Number and Last Processed Date.

- The Commission that has been carried forward.

3.2.3.4 Bank Details

In this portion of the report, the following details are displayed:

- The name and branch name of the Bank where the Broker has an account.

- The ID of the account in the concerned Bank which must be used to make or receive payments regarding this broker, and the name of the Account Holder. If this is the default account for this broker, this will also be mentioned.

3.2.3.5 Income Distribution Set-up Details

In this portion of the report, all details that pertain to the income distribution set-up for this broker are displayed, as follows:

- The Income Distribution Mode, the Payment Split Percentage and the Check or Transfer Payment Split Percentage.

- The Transfer Details such as the Account Type, Number, Bank Name and Branch Name.

3.2.3.6 Reinvestment Setup Details

In this portion of the report, all details that pertain to the Reinvestment Options set up for this Broker are displayed, such as the Reinvestment Unit Holder ID, the Reinvestment Fund ID and the Split Percentage.

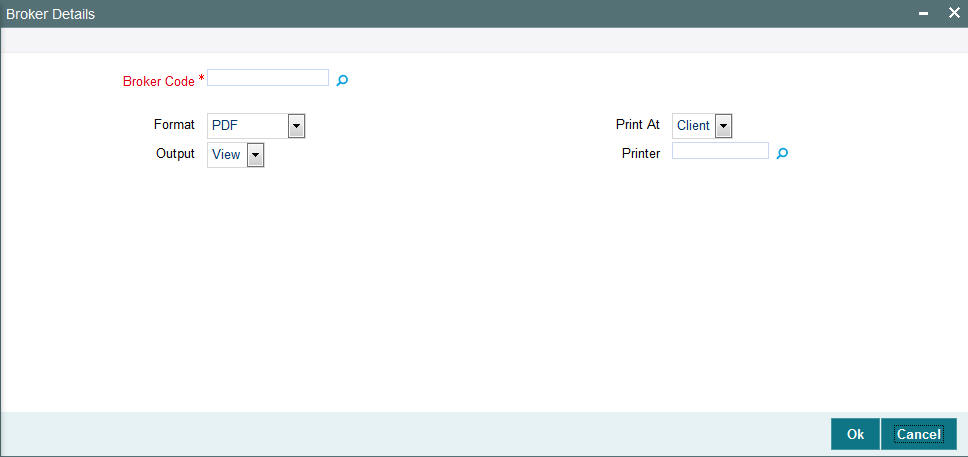

3.2.3.7 Generating Broker Details Report

The Broker Details Report generation screen is as shown below. You can invoke the ‘Broker Details’ screen by typing ‘UTR00048’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the code of the broker whose details you want to view, in the Broker Code field. as mandatory sorting parameters for the generation of the report. After making your specifications, click ‘Ok’ button.

3.2.4 Generating Reporting Structure for Brokers Report

This report may also be termed as the Broker Hierarchy Report. You can use it to view the details and the framework of the reporting structure in a given Hierarchy Structure, for a given Parent Broker. The following details are displayed at each Reporting Hierarchy Level:

- The Broker Code, Name and Address details, the Telephone, Cell Phone, Fax Numbers and the E-Mail Address.

- The Code of the Broker to whom the concerned Broker reports

- Commission Percentage payable by the broker to the immediate Parent Broker in the hierarchy

- The Commission Payment Frequency

- The Last Paid On and Next Payment On dates

- The carried forward Commission

- The VAT Registration Number

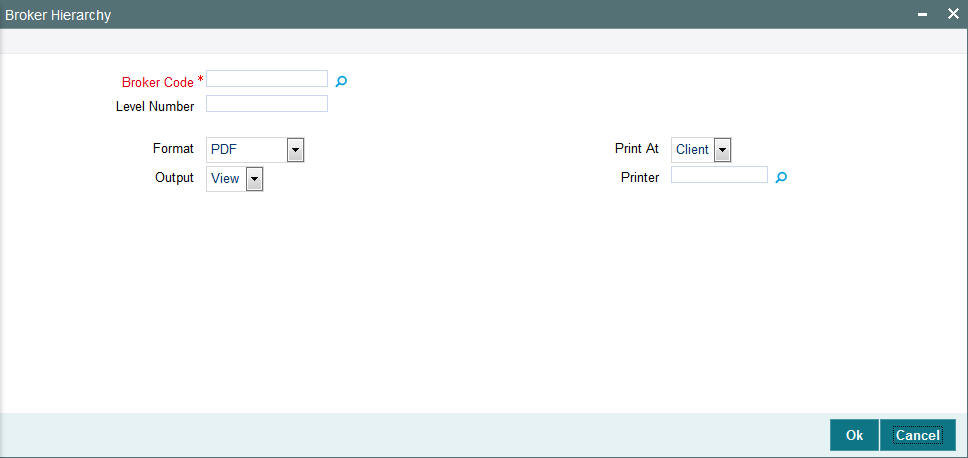

The Broker Hierarchy Report generation screen is as shown below. You can invoke the ‘Broker Hierarchy’ screen by typing ‘UTR00046’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

3.2.4.1 Contents of the Broker Hierarchy Report

In this screen, you must specify the following as sorting parameters for the generation of the report:

- The code of the broker whose hierarchy structure details are to be displayed, in the Broker Code field.

- The level number of the selected broker in the hierarchy. Specify this in the level number field.

Note

None of these details are mandatory.

After making your specifications, click ‘Ok’ button. The report details are displayed.

3.2.5 Broker Commission Payment Report Description

You can use this report to view the details of commission payment and commission reinvestment processing for a broker.

The information that is displayed is grouped under the following heads:

- Broker Details

- Commission Details

- Payment Details

- Reinvestment Details

- Broker Journal Details

3.2.5.1 Broker Details

In this section of the report, the Name, Code, Telephone Number and Postal Address of the concerned broker are displayed.

3.2.5.2 Commission Details

Here, the details of commissions that have accrued to this broker over the given time period are displayed. This includes the following information:

- The Payment Dates of the Commissions

- The Opening Balance

- The Commission Accrued, Paid and Reinvested

Here, the commission accrued will include the commission that has accrued from transactions for which the payment instruments have not been cleared, too. This portion of the commission is not paid out till the payment instruments are cleared.

- The VAT Amount

- The VAT Registration Number

- Whether VAT Amount has been paid or not.

3.2.5.3 Payment Details

The details of each commission payment are displayed here. Both Check as well as Transfer payments are displayed under the appropriate head.

For Check Payments, the following details are available for view:

- The Payment Reference Number and Payment Date

- The Check Amount, the Check Number, the Clearing Date and the Clearing Status.

For Transfer Payments, the following details are available for view:

- The Payment Date

- The Transfer Amount, Transfer Bank Name and Branch Name

- The Transfer Account Type and Account Number.

The commission paid out will not include the commission that has accrued from transactions for which the payment instruments have not been cleared. This portion of the commission is not paid out till the payment instruments are cleared.

3.2.5.4 Reinvestment Details

The details of the reinvestment options that are set up for this broker are displayed here. These details include the Payment Date corresponding to the commission which is being reinvested in part or full, the Reinvestment Unit Holder ID, Reinvestment Fund ID and the Reinvestment Amount.

3.2.5.5 Broker Journal Details

The details of the journal of commission payment for this broker are displayed here. This includes transaction number corresponding to the journal entry, Adjustment of payments of commissions, Payables and Receivables for the broker resulting from the transaction and the Remarks, if any.

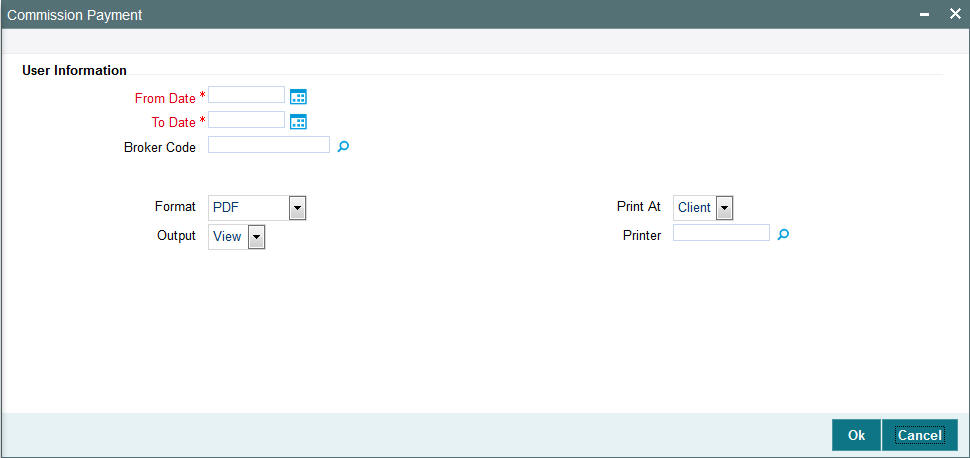

3.2.5.6 Generating Broker Commission Payment Report

The Broker Commission Payment Report generation screen is as shown below. You can invoke the ‘Commission Payment’ screen by typing ‘UTR00083’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The dates that specify the period between which you want to view the commission payment details, in the From Date and To Date fields.

- The code of the broker for whom you want to view the commission details between the specified dates, in the Broker Code field.

After making your specifications, click ‘Ok’ button. The report details are displayed.

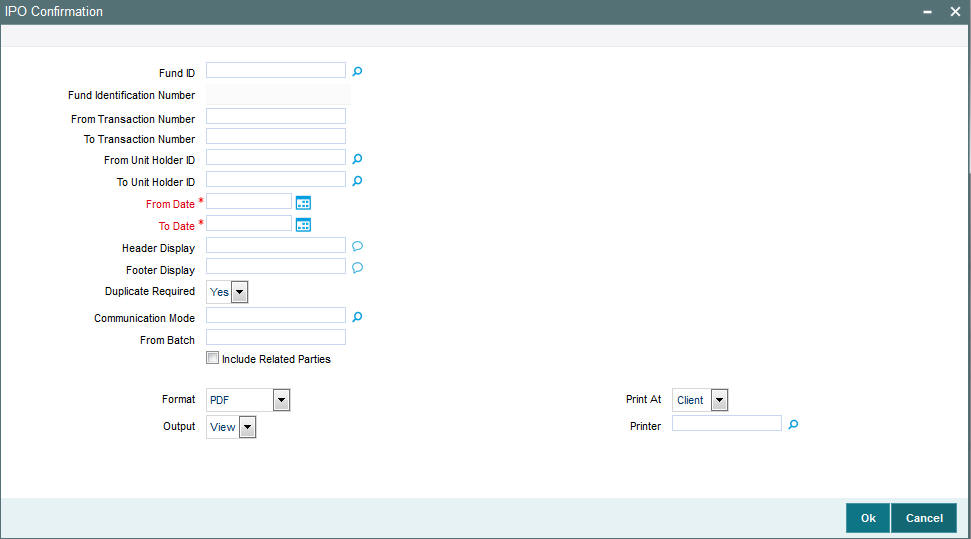

3.3 Confirmation Reports

This section contains the following topics:

3.3.1 Generating Confirmation Reports

The Oracle FLEXCUBE Investor Servicing (FC-IS) system provides the facility of printing confirmation reports for all allocated transactions that have been confirmed on a given business day.

The transaction type confirmation report generation screen is as shown below.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The ID of the fund, for which you want to view the confirmed transactions on a given business day (or range of dates).

- The language in which the report must appear, in the Report Language field.

You could also print or view it as required by the user, by making appropriate specifications in the remaining fields of the generation screen, as follows:

- To reflect all allocated and confirmed transactions of any transaction type or a particular transaction type, between any two dates.

- To reflect all allocated and confirmed transactions from a given transaction number to a given transaction number, between any two dates.

- To reflect all allocated and confirmed transactions requested by a range of unit holders, between any two dates.

- To reflect all allocated and confirmed transactions requested by a particular unit holder, between any two dates.

- To reflect all allocated and confirmed transactions, for a range of unit holders or all unit holders, between a range of dates bounded by a From and To Date.

- To reflect all allocated and confirmed transactions, for a range of unit holders or all unit holder, on a given date.

After making your specifications, click ‘Ok’ button. The report details are displayed.

3.3.2 Details in Confirmation Reports

The following details are printed in the report:

- The ID, name and the address details of the unit holder that has requested the transaction.

- The transaction date.

- The fund in which the unit holder has requested the transaction.

- The market value of the total investments held by the unit holder in the AMC as on the dates of printing the confirmation report.

- The opening and closing balance for the unit holder in the fund as a result of the transaction.

- The volume of the transaction in number of units.

- The payment details for the transaction.

- The transaction number.

- The fees break-up for the transaction.

In the case of switch transaction, confirmation notes are printed for both the legs of the transaction. For transfer transactions, separate confirmation notes are printed for both the transferor and the transferee.

3.4 Other Reports

This section contains the following topics:

- Section 3.4.1, "Other Reports Details"

- Section 3.4.2, "Generating the Allocation Error Report"

- Section 3.4.3, "Generating the Derived Load Report"

- Section 3.4.4, "Generating the Entity Details Report"

- Section 3.4.5, "Generating the Exchange Override Report"

- Section 3.4.6, "Generating Fund Price Report"

- Section 3.4.7, "Generating IDS Summary Report"

- Section 3.4.8, "Generating Income Advice Report"

- Section 3.4.9, "Generating LOI Non Fulfilment Report"

- Section 3.4.10, "Generating Transaction Load Override Report"

- Section 3.4.11, "Generating Load Override Report"

- Section 3.4.12, "Generating Trailing Commission Report"

- Section 3.4.13, "Generating Transaction Summary Report"

- Section 3.4.14, "Generating Transaction Summary Report"

3.4.1 Other Reports Details

Some other types of reports are discussed here.

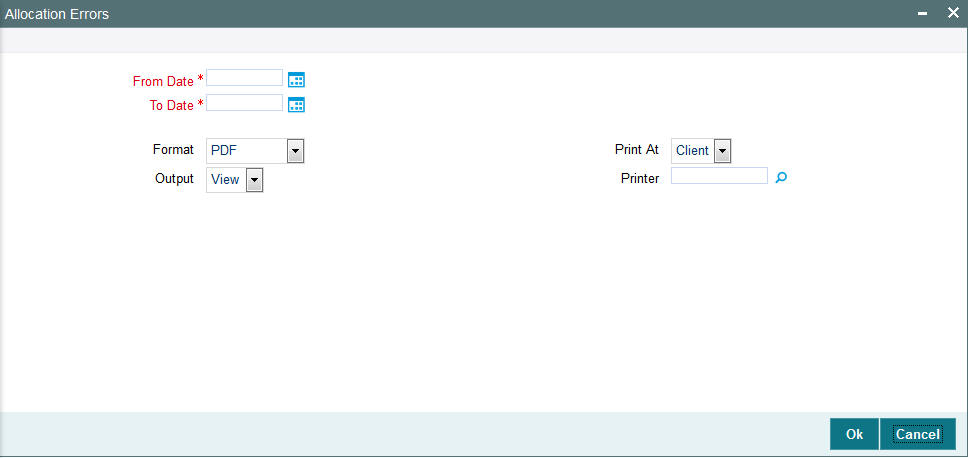

3.4.2 Generating the Allocation Error Report

This report displays the errors logged by the allocation process between any two dates.

The FMG Allocation Error Report screen is as shown. You can invoke the ‘Allocation Errors’ screen by typing ‘UTR00066’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The dates that enclose the period during which you want to view the corresponding allocation error data, in the From Date and To Date fields.

- The language in which the report must appear, in the Report Language field.

After making your specifications, click ‘Ok’ button. The report details are displayed.

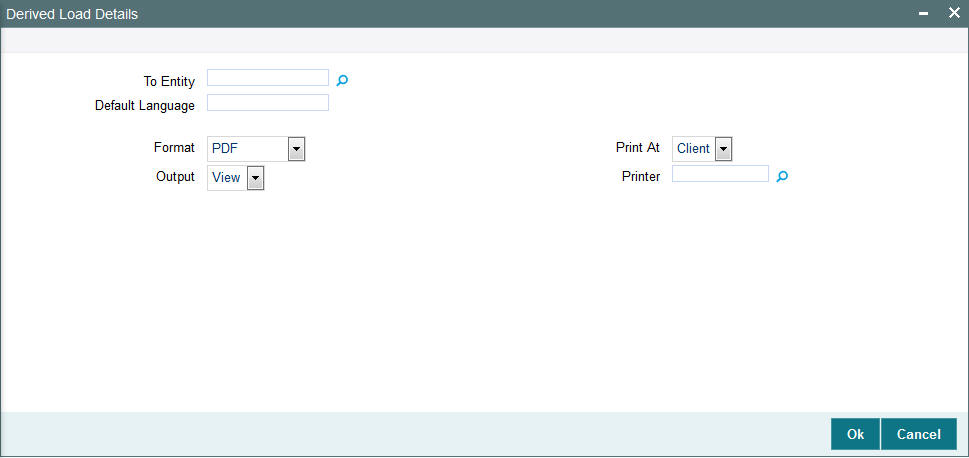

3.4.3 Generating the Derived Load Report

This report can be used to obtain a list of all the authorized loads that have been set up in the system and the loads that are dependent on the same. There are no parameters for the report. It will list the following details, grouped by the information item, Parent Load.

- The ID of the derived Load

- The description of the derived load

- The Parent Load that the specified load is mapped to

- The Load Percentage

- The Type of the receiving Entity( or the To Entity)

- The ID of the receiving Entity( or the To Entity)

- The Criteria for this derived load

- Mandatory / Optional Option

- The Priority for the derived load

- The Rule Effective Date of the derived load

The Derived Load Report generation screen is as shown below. You can invoke the ‘Derived Load Details’ screen by typing ‘UTR00063’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The entity that is the recipient for the proceeds of the derived load, in the To Entity field. (This specification is not mandatory)

- The language in which the report must appear, in the Report Language field.

After making your specifications, click ‘Ok’ button. The report details are displayed.

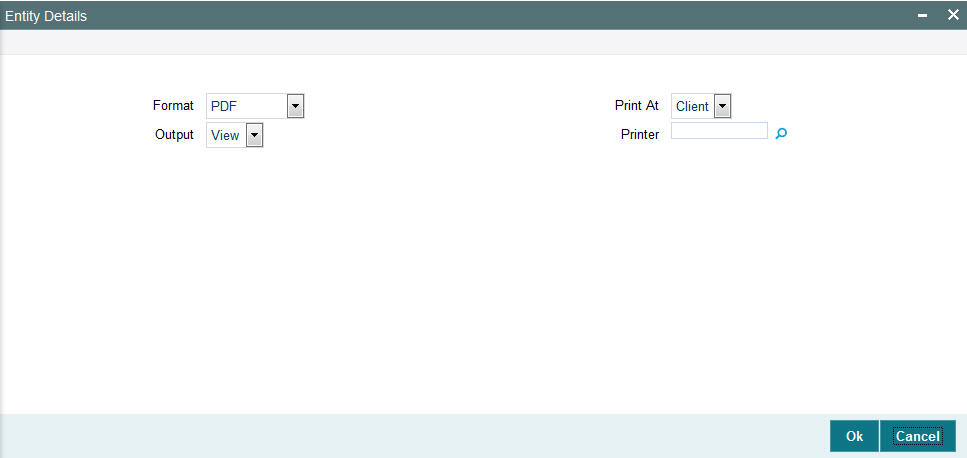

3.4.4 Generating the Entity Details Report

This report displays all the entities present in the system - all the AMC, Registrars and Trustees.

It is printed on request, and the details are ordered according to Entity Type and Entity ID. All the static data that is available for the entities is displayed, such as the entity type, name, address, contact person, authorized signatory, phone number, fax number, etc.

The ‘Entity Report generation’ screen is as shown below. You can invoke the ‘Entity Details’ screen by typing ‘UTR00062’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Enter the following details:

- Output: Select any one of the following output:

- View

- Spool

- Format :Select any one of the following format:

- HTML

- RTF

Enter the printing options and Click ‘Ok’ button to print.

3.4.5 Generating the Exchange Override Report

This report displays details of overridden exchange rates for a fund on a given date. The details are displayed grouped by each Agent Code.

The following details are displayed:

- Transaction Number

- Applied Exchange Rate

- Overridden Exchange Rate

- The Variance percentage

- The Source ID of the Source from which the applied exchange rate was derived.

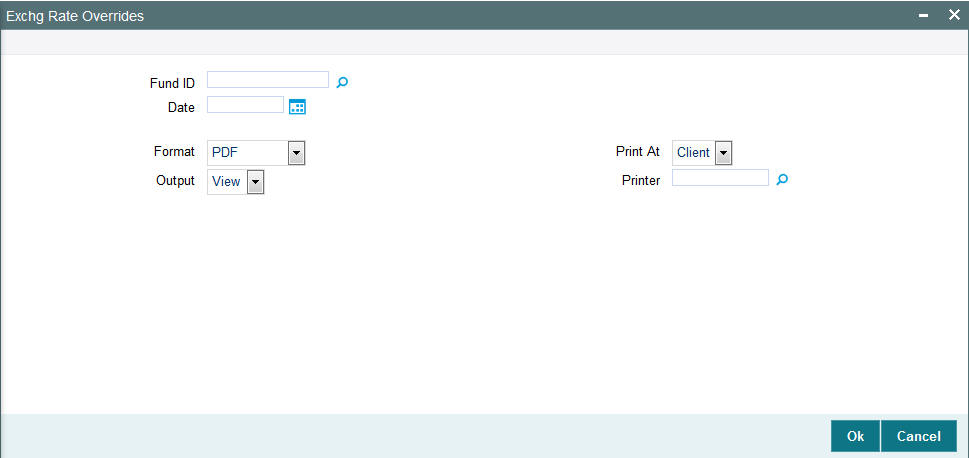

The ‘Exchange Rate Override Report generation’ screen is as shown below. You can invoke the ‘Exchange Rate Overrides’ screen by typing ‘UTR00065’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The ID of the fund, for which the exchange rate override was performed, in the Fund ID field.

- The date on which the exchange rate was overridden, in the Date field.

- The language in which the report must appear, in the Report Language field.

After making your specifications, click ‘Ok’ button. The report details are displayed.

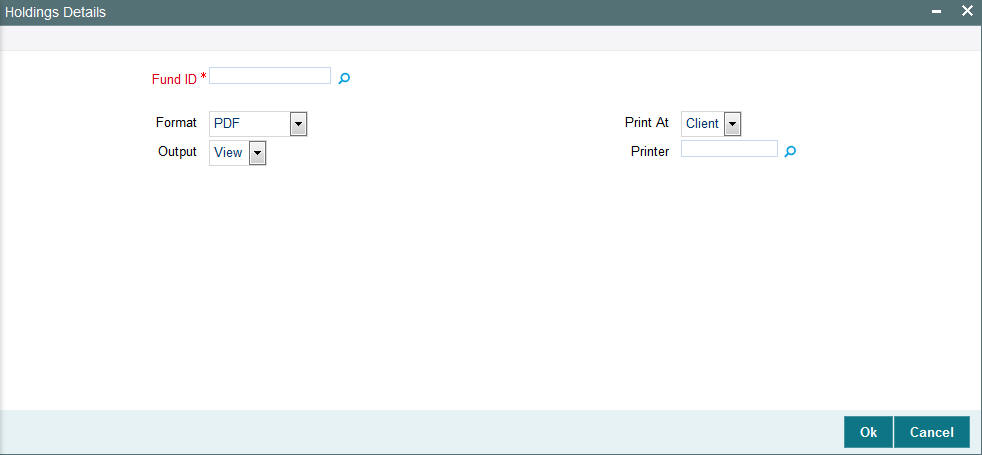

3.4.6 Generating Fund Price Report

This report will contain all the data with respect to the Fund Price maintenance. It will contain details of the Real NAV per unit, Declared NAV, Total assets, Outstanding Units, Total Foreign Investors Outstanding Units, Total number of Unit Holders. It also has details of the base prices of the all the transactions that are operational with the fund as of that particular date.

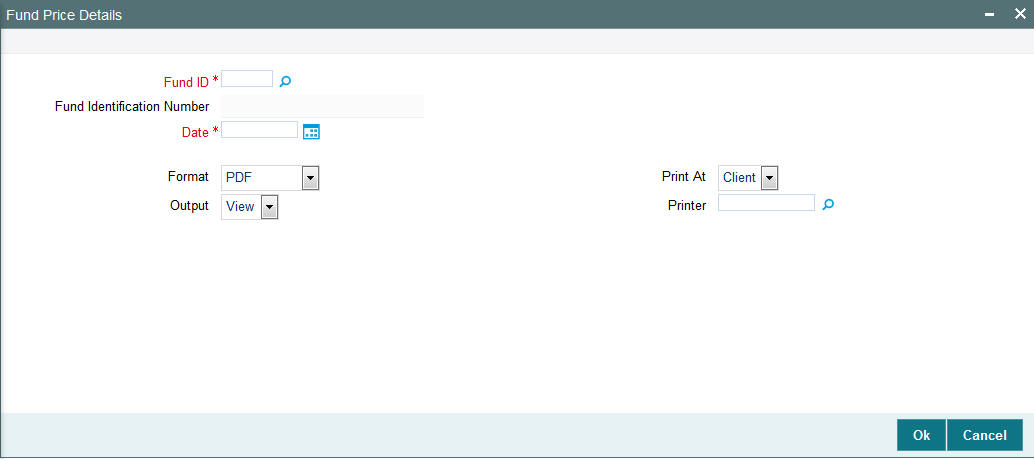

The ‘Fund Price Report generation’ screen is as shown below. You can invoke the ‘Fund Price Details’ screen by typing ‘UTR00040’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The ID of the fund, for which you want to view the price details, in the Fund ID field. (this is not a mandatory specification)

- The date on which you want to view the price details, in the Date field.

- The language in which the report must appear, in the Report Language field.

After making your specifications, click ‘Ok’ button. The report details are displayed.

3.4.7 Generating IDS Summary Report

To obtain a summary of income distribution payments made for a fund, you can use this report.

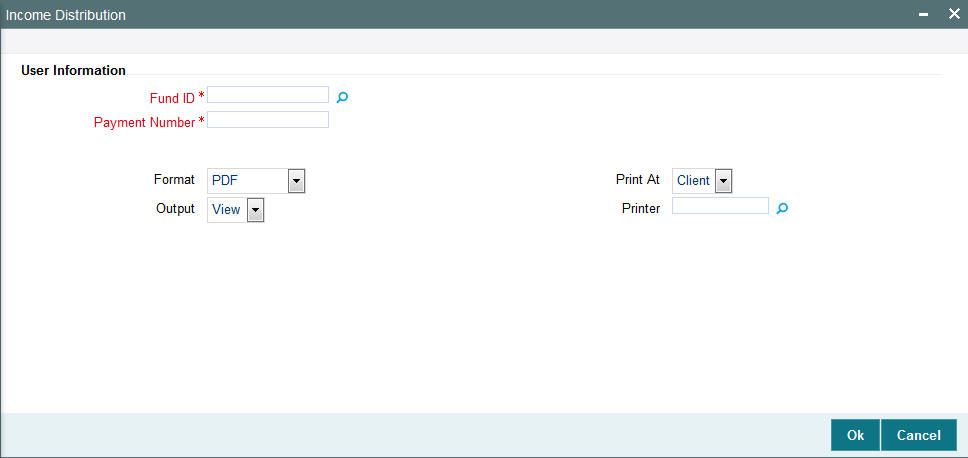

The ‘Income Distribution Summary Report generation’ screen is as shown below. You can invoke the ‘Income Distribution’ screen by typing ‘UTR00115’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The ID of the fund, for which you want to view the price details, in the Fund ID field.

- The number of the payment made as a result of the income distribution cycle, in the Payment Number field.

- The language in which the report must appear, in the Report Language field.

After making your specifications, click ‘Ok’ button. The report details are displayed.

3.4.8 Generating Income Advice Report

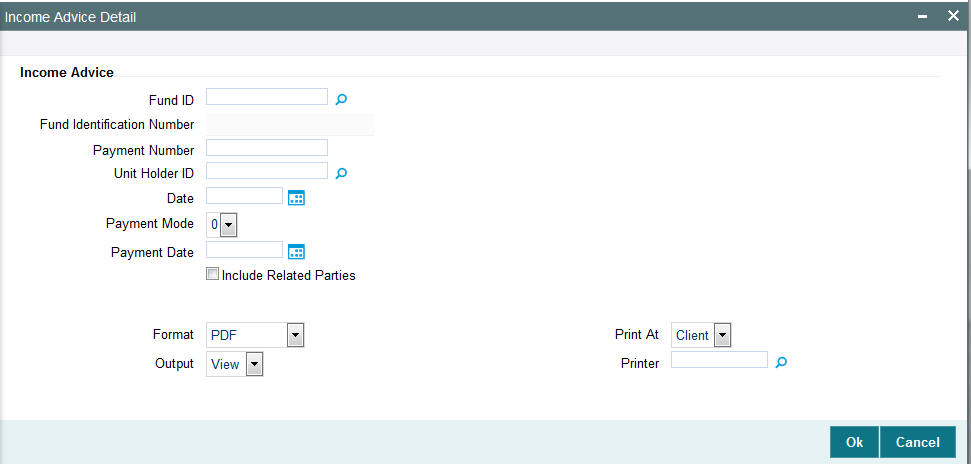

The Income Advice Report generation screen is as shown below. You can invoke the ‘Income Advice Detail’ screen by typing ‘UTR00110’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The ID of the fund for which the income payment was made, in the Fund ID field.

- The number of the payment made as a result of the income distribution cycle, in the Payment Number field.

You can also specify any of the following to fine tune your search:

- The ID of the unit holder for whom the income payment was made, in the Unit Holder field.

- The details of the payment, such as the Payment Mode and the Payment Date.

After making your specifications, click ‘Ok’ button. The report details are displayed.

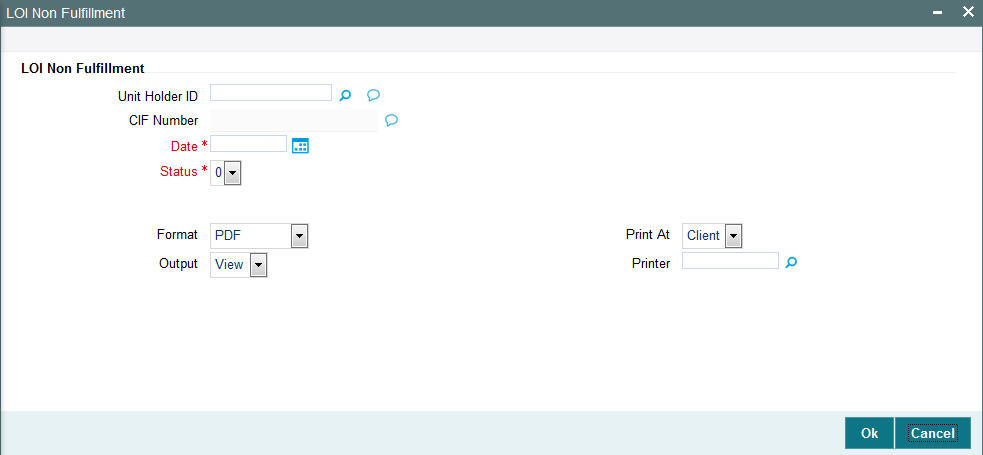

3.4.9 Generating LOI Non Fulfilment Report

This report displays details of Letter of Intent indemnifications by unit holders that have nor been fulfilled in the LOI Period.

The ‘LOI Non Fulfillment Report generation’ screen is as shown below. You can invoke the ‘LOI Non Fulfillment’ screen by typing ‘UTR00104’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify any of the following as sorting parameters for the generation of the report:

- The ID of the unit holder that has not fulfilled the LOI indemnification amount, in the Unit Holder field.

- The customer or CIF number under which the unit holder that has not fulfilled the LOI is placed, in the Customer field.

After making your specifications, click ‘Ok’ button. A screen with print options is displayed. Enter the printing options and Click ‘Ok’ button to print.

3.4.10 Generating Transaction Load Override Report

This report presents a list of all transactions that have overridden loads, and have been entered from the branch where it is being generated. The details of each override such as the original percentage/amount, override percentage/amount and the load calculation method are displayed.

The report may be generated based on the Transaction From Date and To Date.

3.4.10.1 Fields in Transaction Load Override Report screen

Transaction Number

Display Only

In this field, the transaction numbers of the transactions for which the load is applicable are displayed.

Transaction Date

Display Only

The dates of the concerned transactions are displayed here.

Unit Holder Number

Display Only

The ID of the unit holder who has made the transaction is displayed here.

Unit Holder Name

Display Only

The name of the unit holder who has made the transaction is displayed here.

Fund ID

Display Only

The Fund ID of the transaction, if any, is displayed here.

Broker Code

Display Only

The Code of the Broker that is involved in the transaction, if any, is displayed here.

Load ID

Display Only

The IDs of the loads that are applicable to the given transaction is displayed here.

Transaction Mode

Display Only

This shows whether the transaction is based on Units or Transaction Amount

Value Applied

Display Only

The transaction amount, upon which the load has been computed, is displayed here.

Original Load Percentage

Display Only

If the load is computed as a percentage, the original percentage that had been applicable before the override is displayed here.

Override Load Percentage

Display Only

If the load is computed as a percentage, the percentage became applicable after the override is displayed here.

Original Load Amount

Display Only

If the load is computed as an amount, the new amount that had been applicable before the override is displayed here.

Override Load Amount

Display Only

If the load is computed as an amount, the new amount that became applicable after the override is displayed here.

Date Allotted

Display Only

If the transaction has been allotted, the date on which the allotment took place is displayed here.

Units Allotted

Display Only

If the transaction has been allotted, the number of units that were allotted at the time of allotment is displayed here.

Maker ID

Display Only

The ID of the user who actually entered the override is displayed here.

Checker ID

Display Only

The ID of the user who actually authorized the override is displayed here.

Agent Code

Display Only

The Agent Code of the Agency from where the override was performed and entered into the system is displayed here.

Branch Code

Display Only

The Branch Code of the Agency from where the override was performed and entered into the system is displayed here.

Override Module

Display Only

The Module (FUNDMANAGER/AGENCY BRANCH) where the override was actually done is displayed here.

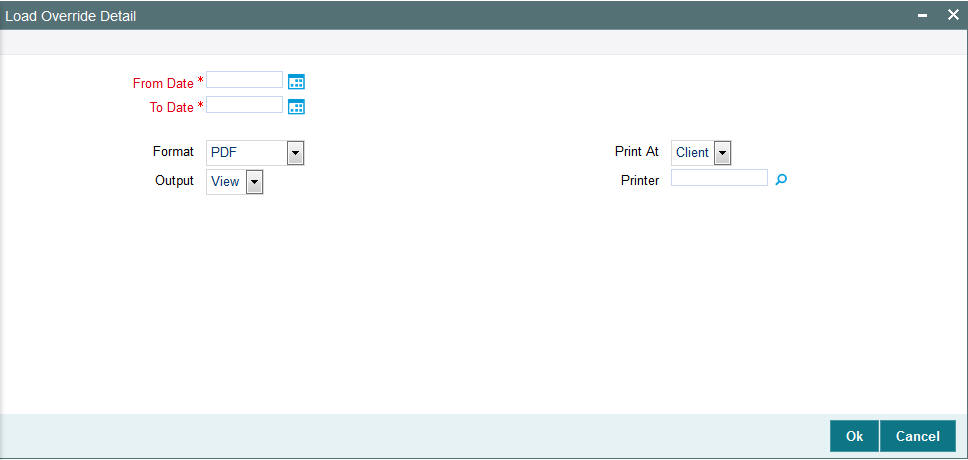

3.4.11 Generating Load Override Report

The Load Override Report generation screen is as shown below. You can invoke the ‘Load Override Detail’ screen by typing ‘UTR00094’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the the dates that enclose the period during which you want to view the details of load overrides that have been performed, in the From Date and To Date fields as sorting parameter for the generation of the report.

After making your specifications, click ‘Ok’ button. A screen with print options is displayed. Enter the printing options and Click ‘Ok’ button to print.

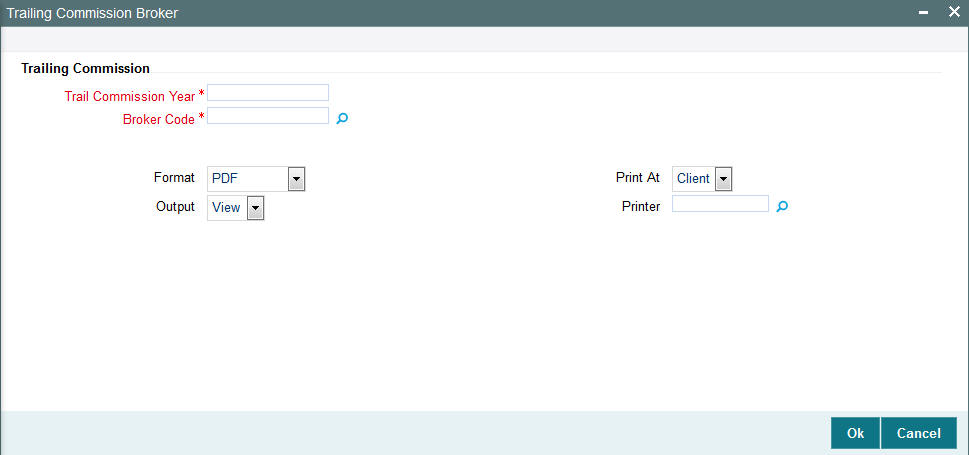

3.4.12 Generating Trailing Commission Report

This report displays details of the trailing commissions paid to brokers, across all funds, for a given period.

The following details are displayed:

- The Transaction Number

- Last Processed on Date

- The From and to Branches

- The Basis Amount

- The equivalent basis amount in Euro Currency

- The Load Amount

- The equivalent load amount in Euro Currency

- The Referral Entity

- The Load ID

- The To Entity Type and To Entity ID.

- The From Entity Type.

The Trailing Commission Details Report generation screen is as shown below. You can invoke the ‘Trailing Commission’ screen by typing ‘UTR00152’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The dates that enclose the period during which you want to view the details of trailing commission accruals, in the From Date and To Date fields.

- The entity that is the recipient for the proceeds of the trailing commission, in the To Entity field

- The language in which the report must appear, in the Report Language field.

You can also choose the ID of the fund for which you want to view the details of trailing commission accruals, in the Fund ID field.

After making your specifications, click ‘Ok’ button. The report details are displayed.

3.4.13 Generating Transaction Summary Report

This report displays all the transactions of any selected type received for a given date for which units have been allotted, between any two dates. It must typically be printed by the AMC at the end of the day after the unit price is allotted.

The details are ordered according to agent / branch / transaction numbers. The report is printed fund-wise.

Sub totals of total units subscribed, amount subscribed, total fee and consideration for each branch is also calculated and printed for the same.

Grand totals of total units subscribed, amount subscribed, total fee and consideration across all branches for the agent are also calculated and printed for the transactions.

3.4.13.1 Transaction Summary Report Information

For each transaction type, the following details are displayed:

Unit Holder ID

The IDs of the unit holders who have entered into transactions of the selected type for the day.

Unit Holder Name

The Full Name (Title, First Name, Last Name and Middle Name) of the unit holders who have entered into transactions of the selected type for the day.

Agent Code

The code of the Agent where transactions of the selected type were entered into the system.

Branch Code

The code of the Agency Branch where transactions of the selected type were entered into the system.

Broker

The code of the broker involved in the transaction.

Sub Broker

The code of the sub-broker involved in the transaction.

Amount or Units

Enter the mode of the transaction.

Transaction Value

Enter the value of the transaction, in amount, units or percentage of holdings, as applicable to the transaction mode and the transaction type.

Net Units Allotted

Enter the actual number of units that have been allotted for the transaction.

Total VAT %

The rate of VAT charged on the fee for the transaction.

Total Fee

Enter the sum of all the fees applicable for the transaction.

Total Incentive

Enter the sum of all the Incentives applicable for the transaction.

Gross Fee

Enter the total fee applicable for the transaction. It is the sum of the total fees and the total VAT % that is applicable for the transaction.

Net Consideration

Enter the net consideration for the transaction. It is the total amount applied (Transaction Amount) minus the gross fee.

Total Amount

Displays the total amount value of transactions for the transaction type made for the day.

Remarks

Enter the Remarks for the transaction.

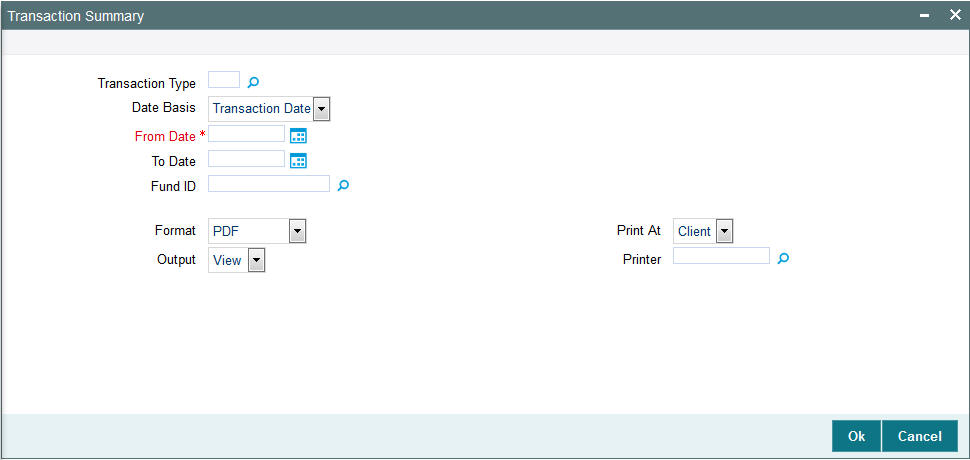

3.4.14 Generating Transaction Summary Report

The ‘Transaction Summary Report generation’ screen is as shown below. You can invoke the ‘Transaction Summary’ screen by typing ‘UTR00001’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

This report displays all the transactions of any selected type received for a given date for which units have been allotted, between any two dates. It must typically be printed by the AMC at the end of the day after the unit price is allotted.

The details are ordered according to agent / branch / transaction numbers. The report is printed fund-wise.

Sub totals of total units subscribed, amount subscribed, total fee and consideration for each branch is also calculated and printed for the same.

Grand totals of total units subscribed, amount subscribed, total fee and consideration across all branches for the agent are also calculated and printed for the transactions.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The basis for the dates that will form the period for which you want details of all allotted transactions. Specify this in the Date Basis field.

- The dates that enclose the period during which you want to view the details of transactions that have been allotted, in the From Date and To Date fields.

You can also obtain the details specific to a particular transaction type, or a fund, or both, by selecting the transaction type in the Transaction Type field, and / or the ID of the fund in the Fund ID field.

After making your specifications, click ‘Ok’ button. A screen with print options is displayed. Enter the printing options and Click ‘Ok’ button to print.

3.5 Queries

This section contains the following topics:

- Section 3.5.1, "Queries Reports Details"

- Section 3.5.2, "Generating Consolidated Inquiry"

- Section 3.5.3, "Retrieving Unitholder/ CIF Basic Details in Client Enquiry Screen"

- Section 3.5.4, "Viewing Details of Investor Fund Balances"

- Section 3.5.5, "Viewing Other Details"

- Section 3.5.6, "Generating Fund Price Inquiry"

- Section 3.5.7, "Generating Fund Rules Inquiry"

- Section 3.5.8, "View Jobs Scheduled"

3.5.1 Queries Reports Details

You can use this section of the Reports to query the database for any details regarding the following information:

- Unit holder accounts or CIF customer accounts

- Fund rules

- Fund prices

- Jobs that have been scheduled through the Scheduler Services

3.5.2 Generating Consolidated Inquiry

You can view any details related to any unit holder account or CIF customer account at any point of time using the Consolidated Inquiry query. The number of unit holders that you are able to access depends upon the agency branches you are mapped to and the groups of unit holders that you are restricted to.

Each time you query a UH in this screen, the system displays all details pertaining to the UH only if you are mapped to the following:

- The agency branch of the UH

- The group to which the default intermediary agent of the UH belongs

If you are mapped to all the groups, then you can view the information of all the unit holders with-in the mapped agency branches.

The details regarding the account that you can view include the following:

- Unit holder/ CIF information

- Investor fund balance

- Certificates

- Standing Instructions

- Income Distribution Setup

- Summaries of transactions entered into by the unit holder / CIF account customer

- G1 Holding of the investor for the given fund ID

- G2 holding of the investor for the given fund ID

- Equalization Income

- Gross income of the Unit holder and Fund ID.

- Payment Date

- Reinvestment Date

3.5.3 Retrieving Unitholder/ CIF Basic Details in Client Enquiry Screen

- To retrieve a CIF customer account, check the CIF No radio button in the Find For section.

- To retrieve a non-CIF unit holder account, check the Unit Holder ID radio button in the Find For section.

- Specify the search parameters for the unit holder or CIF customer, in the Find On section. You can specify a Client ID, First, Middle or Last Name, Reference Number or Identification Number. Specify the value for this parameter in the Search Value field and click the View Information button. The Client Enquiry Find Results screen is opened, with the results of your search displayed as a list.

- Click the Unit Holder ID of the account for which you want to view the details. The details are displayed in the main Client Enquiry screen, in the Unit Holder Basic Details section.

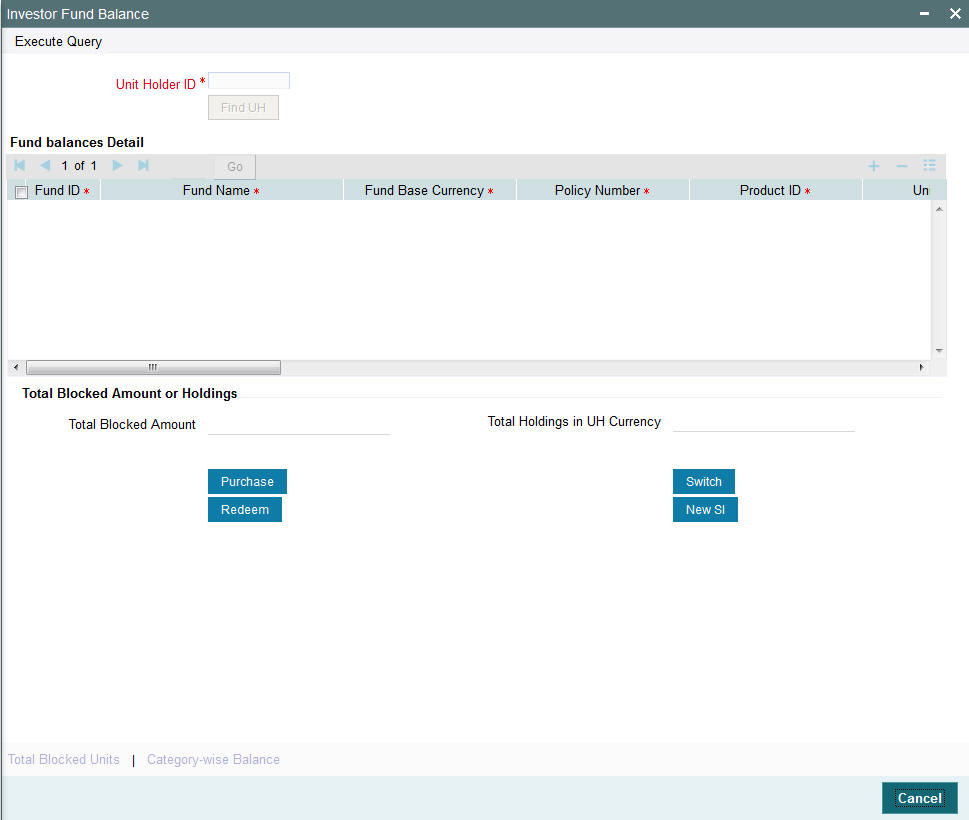

3.5.4 Viewing Details of Investor Fund Balances

After you have retrieved the details of the account so that it is displayed in the main Client Enquiry screen, click the Investor Fund Balances button to view the holdings balance of the investor in each of the funds of the AMC.

You can also invoke ’Investor Fund Balance Summary’ screen by typing ‘UTDFNBAL’ in the field at the top right corner of the Application tool bar and click the adjoining arrow. The screen is displayed below:

In addition to viewing the fund details of a unit holder, you can perform the following operations through the links in this screen:

- Purchase – On clicking this link, the ‘Subscription’ screen gets displayed for the selected unit holder and fund combination. You can then input the transaction amount, mode of payment and settlement date and then save the subscription transaction.

- Redeem – On clicking this link, the redemption screen gets displayed to capture a new redemption for the selected unit holder and fund combination. This process validates the zero balance in the fund. Here too you need to input minimal mandatory information to save the transaction.

- Switch – On clicking this link, the ‘Switch’ screen gets displayed to capture a switch transaction for that unit holder and fund combination. The selected fund is treated as a ‘From Fund’. This also validates the zero balance in the ‘From Fund’.

- New SI – Through this link you can invoke the ‘SI’ screen for the selected unit holder and fund combination. You can set up a new SI from here.

- Modify SI – This link opens the SI summary screen in ‘Amend’ mode and lets you amend an existing SI for the selected fund.

You can also view financier and fund-wise blocked units and total number of units blocked in the ‘Total Block Units’ screen. You can invoke this screen by clicking the ‘Total Blocked Units’ button in the ’Investor Fund Balance Summary’ screen.

During block transaction, if the financer name is not maintained, then all the records will be categorized and consolidated under financer as ‘others’.

Note

You will be able to open the subscription /redemption/switch/SI screens from the Client Enquiry Fund Balances screen provided you have the SMS rights to open and transact in those screens.

3.5.5 Viewing Other Details

After you have retrieved the details of the account so that it is displayed in the main Client Enquiry screen, fine tune your query as follows:

- To retrieve transaction information for the unit holder, check the Transactions radio button in the Information section.

- To retrieve information related to the account profile of the unit holder, check the Static radio button in the Information section

- To view a history of the data, which will show the details of changes made since the account was opened, check the History radio button in the Data section.

- To view data that is the latest for the account (the effective data present in the database as on the date of query) check the Live radio button in the Data section.

- To view data pertaining to the last month, check the Last Month radio button in the Time Basis section. For data in the last quarter, check the Last Month radio button.

- After you have made all these specifications, click the Show button.

- The following additional buttons appear at the bottom of the screen,

in the Transaction Information - Live section:

- Standing Instructions

- Certificates

- Help Desk

- Income Distribution Setup

- Transaction Summary

- Entity Note Pad Capture

- Entity Note Pad View

- To capture information about any entity involved in the transaction, click on the Entity Note Pad Capture button.

- Click on the appropriate button to view the required data.

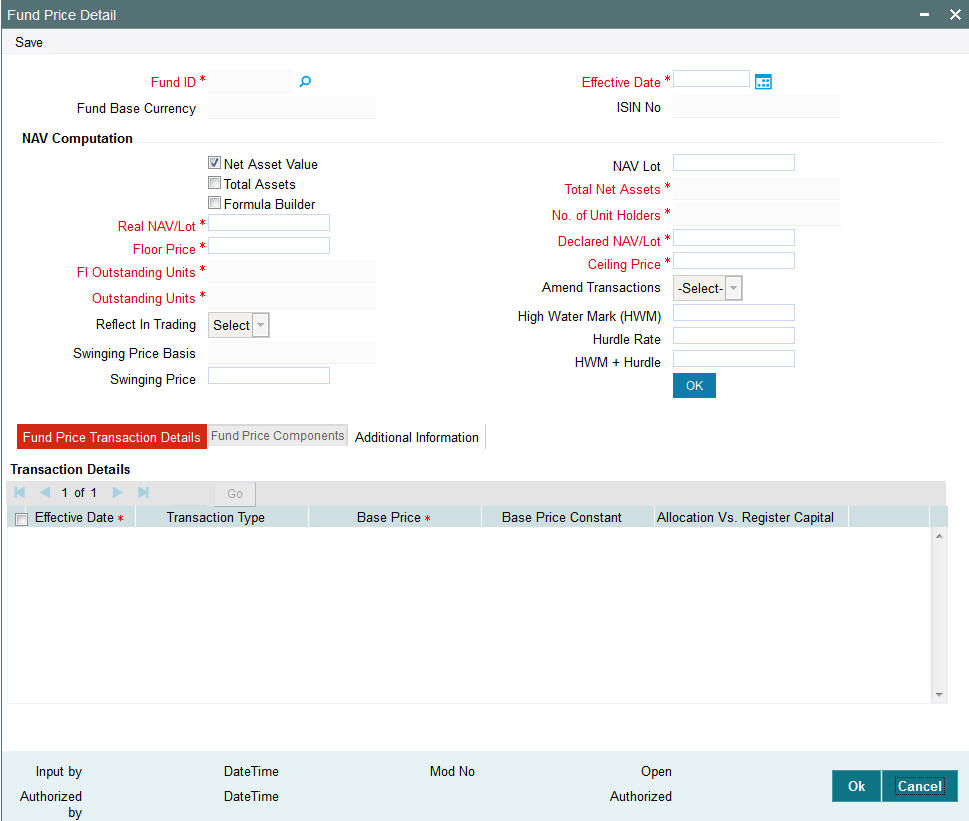

3.5.6 Generating Fund Price Inquiry

You can view all the details regarding the fund prices for any fund on a given business date, using this query. The View Fund Price screen is as shown below. You can also invoke ’Investor Fund Balance Summary’ screen by typing ‘UTDFPRIC’ in the field at the top right corner of the Application tool bar and click the adjoining arrow. The screen is displayed below:

Select the fund for which you want to view the fund prices, in the Select Fund From List field. Also specify the date for which you want to view details of the prevalent price as on that date, in the Effective Date field. Click the View button to trigger the query.

The details of the fund price prevalent for the selected fund on the specified date are displayed in the Fund Setup Details section and the Fund Price Transaction Details section.

In the Fund Setup Details section, the fund price record that would have been entered for the selected fund in the Fund Price screen in the Fund Manager component on the specified date is displayed. In the Fund Price Transaction Details section, the details for each transaction type are displayed.

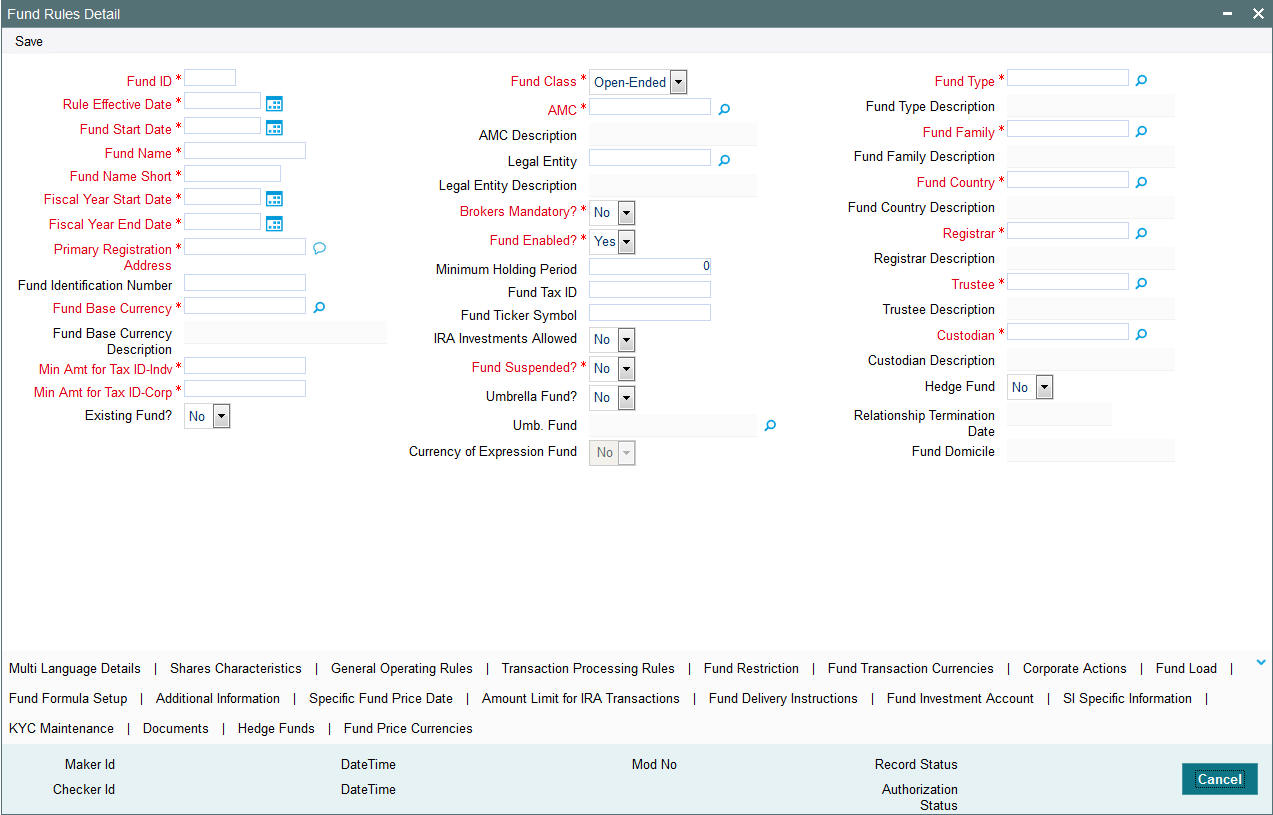

3.5.7 Generating Fund Rules Inquiry

You can view all the details regarding the authorized fund rules defined for any fund that are effective on the application date, using this query.

You can invoke ‘Fund Rule’ screen by typing ‘UTDFNDRL’ in the field at the top right corner of the Application tool bar and click the adjoining arrow. The screen is displayed below:

The View Fund Rule screen is opened.

Select the fund for which you want to view the fund rules, in the Select Fund From List field. Click the View button to trigger the query.

The details of all the fund rules that are effective for the selected fund on the specified date are displayed in the screen.

Click on any of the links to see the details for any of the fund rules for the fund.

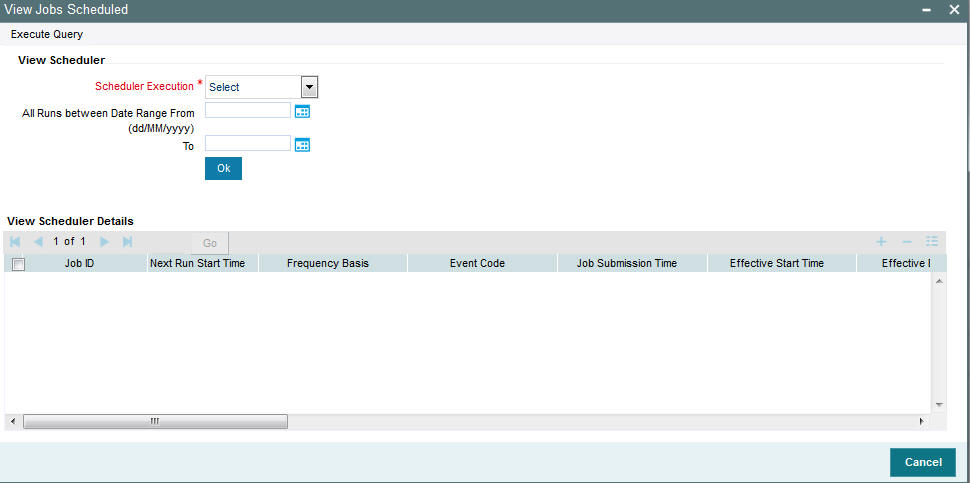

3.5.8 View Jobs Scheduled

You can view details regarding any scheduler activities, using this query. This includes details of jobs that are scheduled for execution as on the application date. You can invoke the ‘View Jobs Scheduled’ screen by typing ‘UTDJBVIW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select the fund for which you want to view the fund rules, in the Select Fund From List field. Also specify the date range for which you want to view details of the scheduler activity, in the All Runs between Date Range Between fields. Click ‘Ok’ button to trigger the query.

The details of all the scheduled jobs as on the application date are displayed in the screen.

Click the Show Future Runs button to see the details for any future scheduled executions of the jobs.

3.6 SI Reports

This section contains the following topics:

- Section 3.6.1, "SI Reports Details"

- Section 3.6.2, "Generating Standing Instructions Amendments"

- Section 3.6.3, "Generating Standing Instructions Escalations"

- Section 3.6.4, "Generating Standing Instructions Reminders"

- Section 3.6.5, "Generating Standing Instructions Transaction Details Report"

3.6.1 SI Reports Details

These reports display details of standing instructions maintained for investors.

3.6.2 Generating Standing Instructions Amendments

You can use this report to view details about amendments to standing instructions maintained for investors that were affected between any two dates.Section 3.6.1, "SI Reports Details"

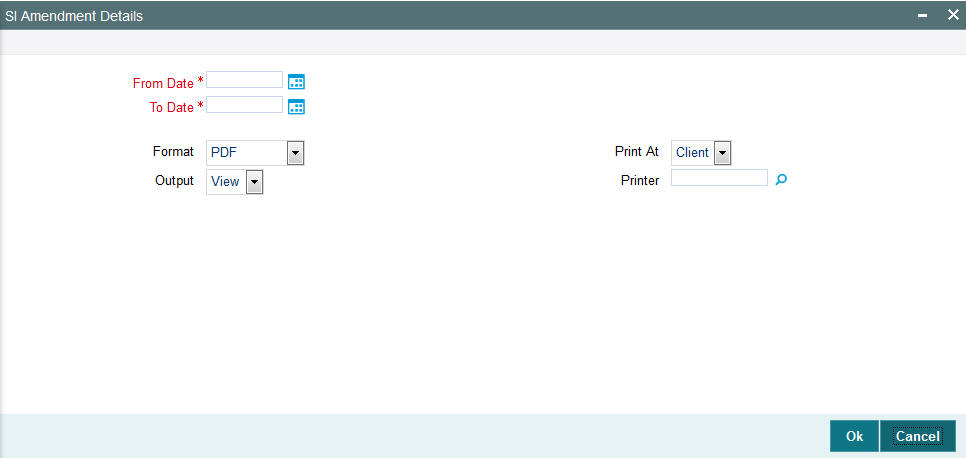

The SI Amendment Report generation screen is as shown below. You can invoke the ‘SI Amendment Details’ screen by typing ‘UTR00078’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the dates that enclose the period during which the amendments were made any standing instructions maintained for any investor, in the From Date and To Date fields as the sorting parameter for the generation of the report.

Click ‘Ok’ button after making your specifications. A screen with print options is displayed. Enter the printing options and click ‘Ok’ button to print.

3.6.3 Generating Standing Instructions Escalations

You can use this report to view details about escalations to standing instruction amounts for investors.

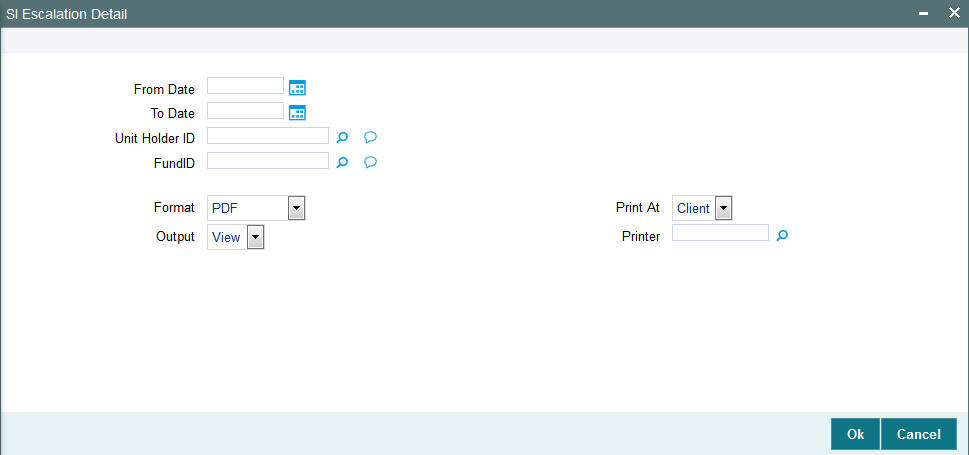

The SI Escalation Report generation screen is as shown below. You can invoke the ‘SI Escalation Detail’ screen by typing ‘UTR00073’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Click ‘Ok’ button to generate the report. A screen with print options is displayed. Enter the printing options and Click ‘Ok’ button to print.

3.6.4 Generating Standing Instructions Reminders

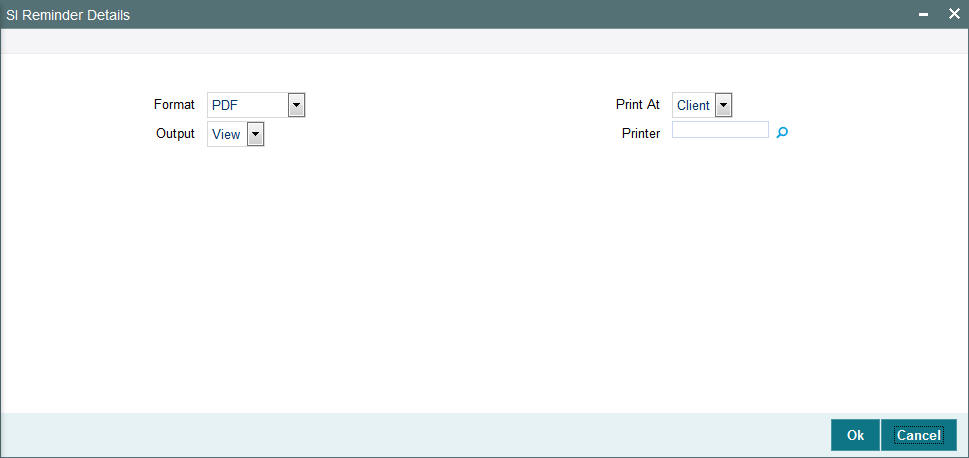

This report will print the reminders for any standing instructions for the given fund. It is generated based on the reminder action period. This is a word interface document with standard template. It will contain information telling that SI has been generated and needs to be processed.

The SI Reminder Report generation screen is as shown below. You can invoke the ‘SI Reminder Details’ screen by typing ‘UTR00079’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the language in which the report must appear, in the Report Language field for the generation of the report:

After making your specifications, click ‘Ok’ button . A screen with print options is displayed. Enter the printing options and Click ‘Ok’ button to print.

3.6.5 Generating Standing Instructions Transaction Details Report

This report will print all the standing instructions for the given fund as of that date. It will only print the details of those standing instructions that are effective as of that date. Details of elapsed standing instructions will not be printed.

This report is typically printed as a monthly or quarterly report.

Details of the transactions that have been generated for the standing instructions are also printed. The data is ordered according to the standing instructions ID.

Along with the transaction details, any applicable fees, details of check numbers and dates for post dated checks, provided this option is available. Escalation details and the unit holder contact address details are also displayed.

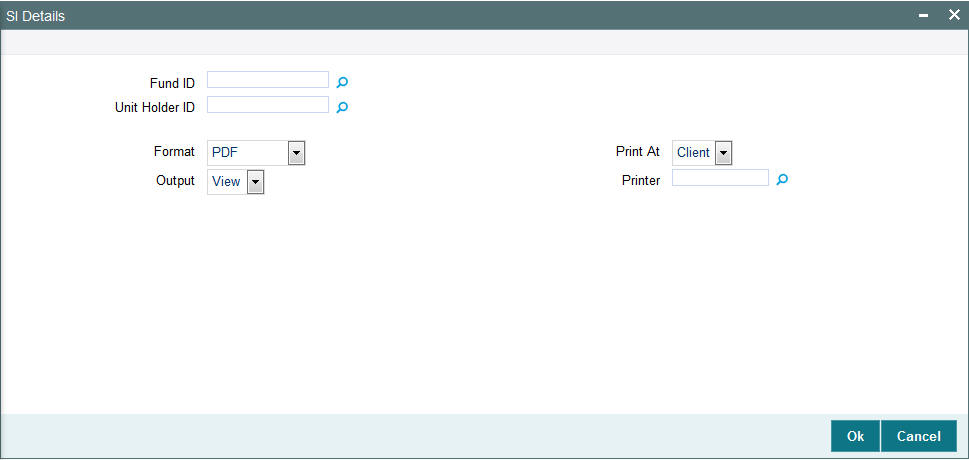

The SI Report generation screen is as shown below. You can invoke the ‘SI Details’ screen by typing ‘UTR00067’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can view any standing instructions maintained in any fund for any unit holder, by specifying the required fund in the Fund ID field and the ID of the unit holder in the Unit Holder ID field.

After making your specifications, click ‘Ok’ button. The report details are displayed.

3.7 Transaction Reports

This section contains the following topics:

- Section 3.7.1, "Generating Transaction Reports"

- Section 3.7.2, "Generating Transaction Enquiry Report"

- Section 3.7.3, "Generating Daily IPO Transactions"

- Section 3.7.4, "Generating Daily Subscription Transactions"

- Section 3.7.5, "Generating Daily Redemption Transactions"

- Section 3.7.6, "Generating Daily Switch Transactions"

- Section 3.7.7, "Generating Daily Transfer Transactions"

- Section 3.7.8, "Generating Daily Block Transactions"

- Section 3.7.9, "Generating Daily Unblock Transactions"

- Section 3.7.10, "Generating Daily Split Transactions"

- Section 3.7.11, "Generating Daily Consolidation Transactions"

- Section 3.7.12, "Generating Daily Reissue Transactions"

3.7.1 Generating Transaction Reports

The Transaction reports displays information about transactions of any type received from investors on any given business day.

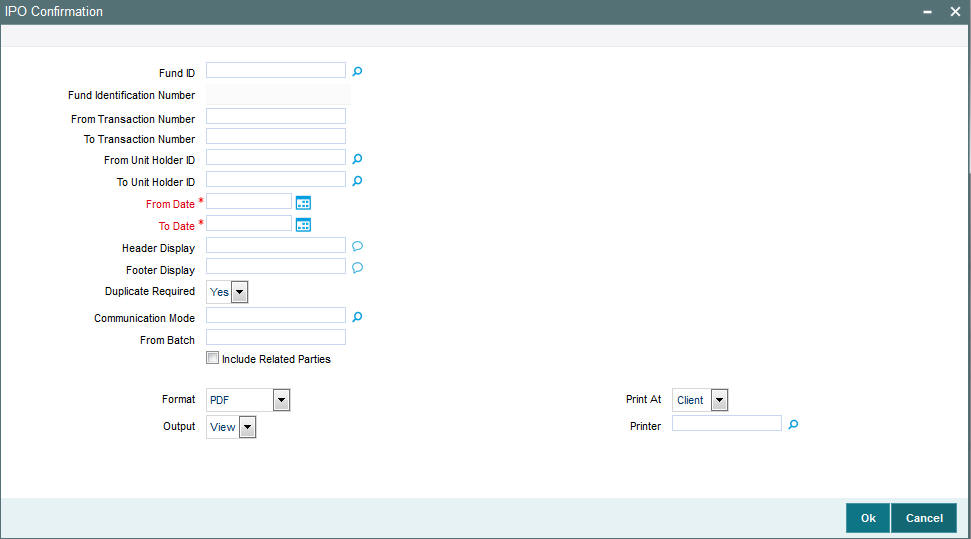

You can invoke ‘IPO Confirmation’ screen by typing ‘UTR00103’ in the field at the top right corner of the Application tool bar and click the adjoining arrow. The screen is displayed below:

The ‘transaction type confirmation report generation’ screen is as shown below.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The status of the transaction, whether authorized or unauthorized, in the Unauthorized / Authorized field.

- The dates that enclose the period during which the transactions were received, in the From Date and To Date fields. To indicate a business day, specify the same date in both fields.

You can also specify a unit holder to retrieve transactions received only for the unit holder on the business day.

After making your specifications, click ‘Ok’ button. A screen with print options is displayed. Enter the printing options and Click ‘Ok’ button to print.

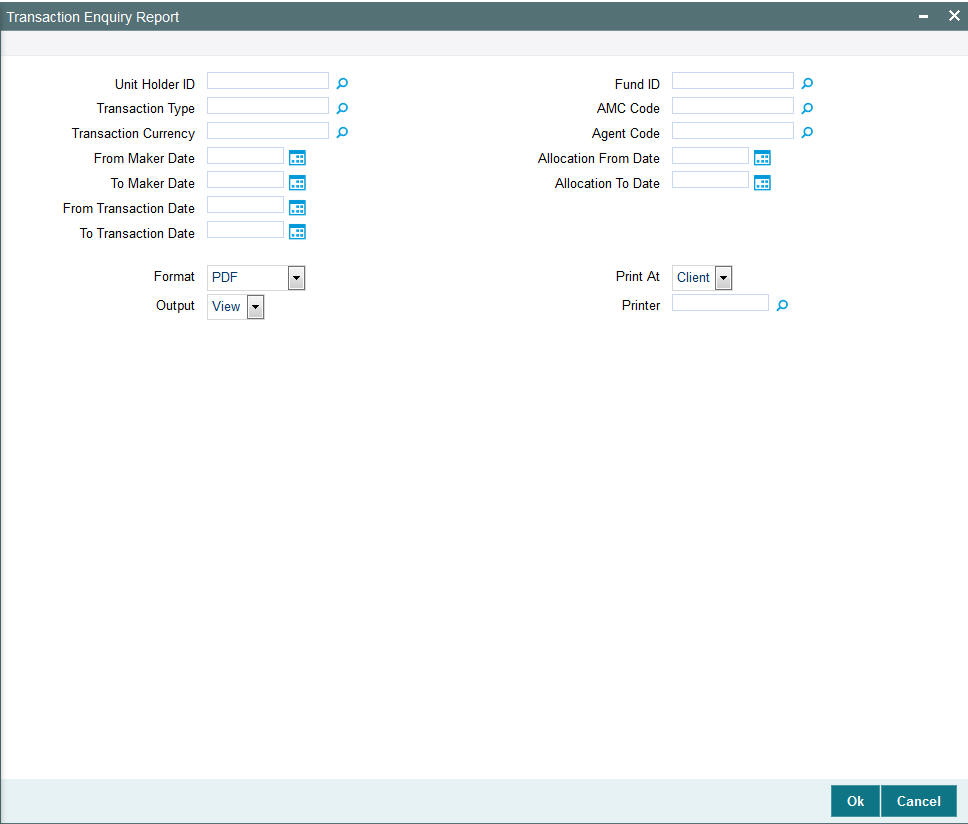

3.7.2 Generating Transaction Enquiry Report

The Transaction Enquiry report displays all the transactions details made by all the unit holders maintained in the system on a desired search criteria.

You can invoke the ‘Transaction Enquiry Report’ screen by typing ‘UTR00228’ in the field at the top right corner of the Application tool bar and click the adjoining arrow. The screen is displayed below:

Enter the search criteria and click ‘Ok’ button to generate the report.

Based on the selected criteria, the following details are displayed in the report:

- Transaction Number

- Old Transaction Number

- Reference Number

- Unit Holder

- Fund Name

- Transaction Type

- Transaction Date

- Transaction Currency

- Transaction Mode

- Transaction Value

- Current Transaction Status

- AMC ID

- Dealing Date

3.7.2.1 Fields in Transaction Enquiry Report Screen

Unit Holder ID

Enter the ID of the unit holder for whom the transaction report is being generated.

From Maker Date, To Maker Date

Enter the date range to generate a report displaying all the transactions created by all the unit holders maintained in the system.

From Transaction Date, To Transaction Date

Enter the date range to generate a report displaying all the transaction details made by all the unit holders maintained in the system.

From Allocation Date, To Allocation Date

Enter the date range to generate a report displaying all the allotted transactions made by all the unit holders in the system.

AMC

Select the AMC to generate a report displaying all the transactions made by all the unit holders in the selected AMC.

Distributor

Select the distributor to generate a report displaying all the transactions made by all the unit holders for a selected distributor.

Fund ID

Select the fund ID to generate a report displaying all the transactions made by all the unit holders for a selected fund ID.

Transaction Type

Select the type of transaction for which the transaction enquiry report is being generated.

Currency

Select the currency for which the transaction enquiry report is being generated.

3.7.3 Generating Daily IPO Transactions

This report will print all the IPO transactions (both authorized and unauthorized transactions) received on the current business day at the Agency Branch.

Typically, the Agency Branch prints this report at the end of the day.

3.7.3.1 By Fund

Click the IPO – By Fund option to group the transactions fund-wise.

Totals and sub totals will be shown at the following levels:

- Amount received for each type of payment for every fund.

- Total amount received for every fund.

- Total amount received for the day.

3.7.3.2 By Payment Mode

Click the IPO – By Payment option to group the transactions according to the mode of payment as well as fund-wise.

Totals and sub totals will be shown at the following levels:

- Amount received for each fund for that payment type.

- Total amount received for each payment type.

- Total amount received for the day.

3.7.4 Generating Daily Subscription Transactions

This report will print all the subscription transactions (both authorized and unauthorized transactions) received on the current business day at the Agency Branch.

Typically, the Agency Branch prints this report at the end of the day.

3.7.4.1 By Fund

Click the Purchases – By Fund option to group the transactions fund-wise.

Totals and sub totals will be shown at the following levels:

- Amount received for each type of payment for every fund.

- Total amount received for every fund.

- Total amount received for the day.

3.7.4.2 By Payment Type

Click the Purchases – By Payment option to group the transactions according to the mode of payment as well as fund-wise.

Totals and sub totals will be shown at the following levels:

- Amount received for each fund for that payment type.

- Total amount received for each payment type.

- Total amount received for the day.

3.7.5 Generating Daily Redemption Transactions

This report will print all the redemption transactions (both authorized and unauthorized transactions) received on the current business day at the Agency Branch.

Typically, the Agency Branch prints this report at the end of the day.

3.7.5.1 By Fund

Click the Sales – By Fund option to group the transactions fund-wise.

Totals and sub totals will be shown at the following levels:

- Amount received for each type of payment for every fund.

- Total amount received for every fund.

- Total amount received for the day.

3.7.5.2 By Payment Type

Click the Sales – By Payment option to group the transactions according to the mode of payment as well as fund-wise.

Totals and sub totals will be shown at the following levels:

- Amount received for each fund for that payment type.

- Total amount received for each payment type.

- Total amount received for the day.

3.7.6 Generating Daily Switch Transactions

This report will print all the switch transactions (both authorized and unauthorized transactions) received on the current business day at the Agency Branch.

Typically, the Agency Branch prints this report at the end of the day.

Totals and sub totals will be shown at the following levels:

- Units switched for every fund.

- Total units switched across all the funds.

3.7.7 Generating Daily Transfer Transactions

This report will print all the transfer transactions (both authorized and unauthorized transactions) received on the current business day at the Agency Branch.

Typically, the Agency Branch prints this report at the end of the day.

Totals and sub totals will be shown at the following levels:

- Units transferred for every fund.

- Total units transferred across all the funds.

3.7.8 Generating Daily Block Transactions

This report will print all the block transactions (both authorized and unauthorized transactions) received on the current business day at the Agency Branch.

Typically, the Agency Branch prints this report at the end of the day.

Totals and sub totals will be shown at the following levels:

- Units blocked for every fund.

- Total units blocked across all the funds.

3.7.9 Generating Daily Unblock Transactions

This report will print all the unblock transactions (both authorized and unauthorized transactions) received on the current business day at the Agency Branch.

Typically, the Agency Branch prints this report at the end of the day.

Totals and sub totals will be shown at the following levels:

- Units unblocked for every fund.

- Total units unblocked across all the funds.

3.7.10 Generating Daily Split Transactions

This report will print all the split transactions (both authorized and unauthorized transactions) received on the current business day at the Agency Branch. Typically, the Agency Branch prints this report at the end of the day.

Totals and sub totals will be shown at the following levels:

- Units split for every fund.

- Total units split across all the funds.

3.7.11 Generating Daily Consolidation Transactions

This report will print all the consolidation transactions (both authorized and unauthorized transactions) received on the current business day at the Agency Branch.

Typically, the Agency Branch prints this report at the end of the day.

Totals and sub totals will be shown at the following levels:

- Units consolidated for every fund.

- Total units consolidated across all the funds.

3.7.12 Generating Daily Reissue Transactions

This report will print all the transfer transactions (both authorized and unauthorized transactions) received on the current business day at the Agency Branch.

Typically, the Agency Branch prints this report at the end of the day.

Totals and sub totals will be shown at the following levels:

- Units reissued for every fund.

- Total units reissued across all the funds.

3.8 UH Info Reports

This section contains the following topics:

- Section 3.8.1, "UH Info Reports Details"

- Section 3.8.2, "Generating Unit Holder Acknowledgment"

- Section 3.8.3, "Generating Unit Holder Dividend Details Report"

- Section 3.8.4, "Generating Unit Holder Zero Balance Report"

3.8.1 UH Info Reports Details

These reports display information regarding unit holder / CIF accounts.

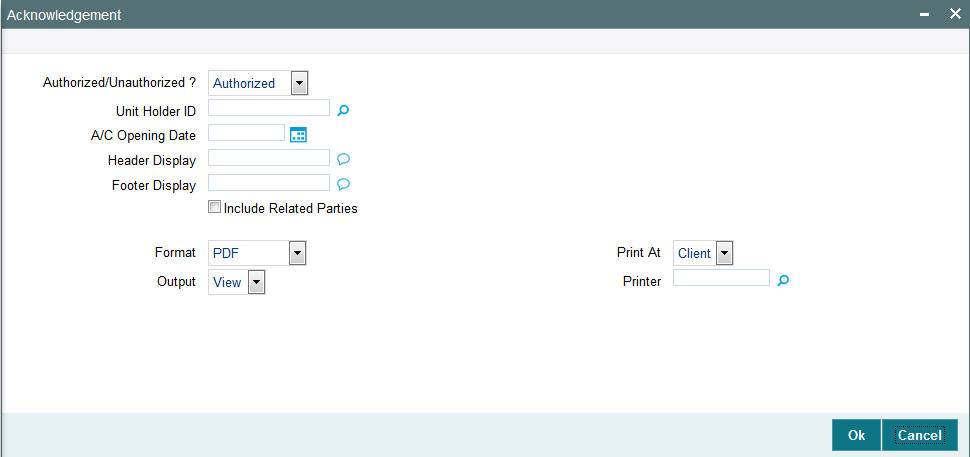

3.8.2 Generating Unit Holder Acknowledgment

Use this report to list the acknowledgement reports generated for new unit holder accounts.

The Unit Holder Acknowledgement Report generation screen is as shown below. You can invoke the ‘Acknowledgement’ screen by typing ‘UTR00095’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can generate a report specific to a unit holder account, or the authorization status of the accounts, or to any unit holder account opened on a certain date, by specifying:

- The date on which you want to view all the unit holder accounts opened, in the Account Opening Date field.

- The ID of the unit holder whose specific account you want to generate an acknowledgement for.

- The authorization status, in the Unauthorized / Authorized field.

After making your specifications, click ‘Ok’ button. A screen with print options is displayed. Enter the printing options and Click ‘Ok’ button to print.

3.8.3 Generating Unit Holder Dividend Details Report

This report may be generated to view previous dividend payments for a unit holder in a fund. The payment details are presented, along with the reinvestment details and EPU component breakups. The following information is presented:

- The name, address and ID of the unit holder whose dividend payment details are being displayed in this report.

- The name of the fund for which the dividend declaration and payment was made.

- The payment date for the payment cycle that is being viewed.

- The total dividend paid to the unit holder, the tax deducted and the net dividend paid out for the particular payment cycle. (This represents the dividend distributed for the payment cycle under view)

- The payment details as under the following:

- Total payment amount (i.e., the pay out component of the dividend)

- Amounts paid out by check and amounts paid out by transfer.

- The check details (Bank and branch of issue, date of issue and check number)

- The transfer details (Bank and branch name, account type and account number)

- The reinvestment details as under the following:

- The Reinvestment Unit Holder ID and Name

- The Reinvestment Fund ID and Name

- The amount reinvested in each Unit Holder ID/Fund combination

- The reinvestment transaction numbers

- The earnings by components as under:

- The ID and description of the component which the unit holder has derived a portion of his income from.

- The breakup of the earnings of the unit holder by component. Each figure in the breakup represents the summation of the product of the component value and the Freeze Holding Units for each declaration in the Payment Cycle.

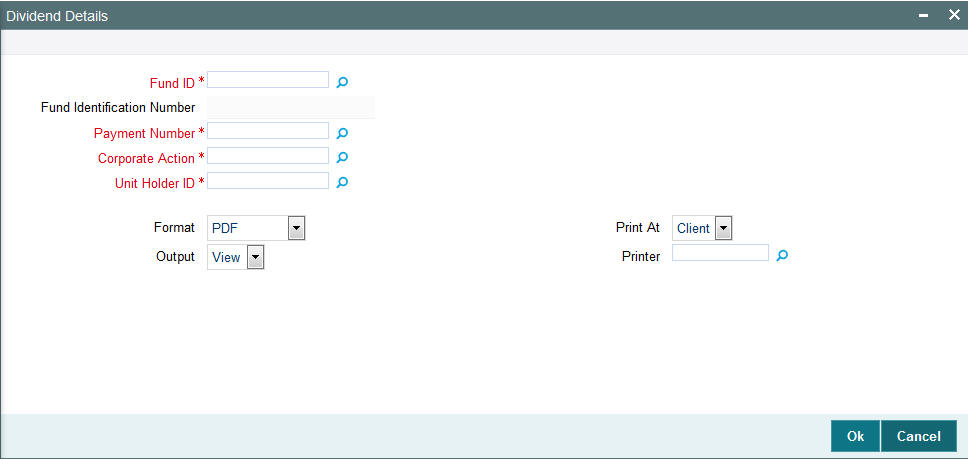

The Unit Holder Dividend Details Report generation screen is as shown below. You can invoke the ‘Dividend Details’ screen by typing ‘UTR00070’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The number of the dividend payment, in the Payment Number field.

- The fund for which the dividend was declared, that resulted in dividend payment to unit holders, in the Fund ID field.

You can also obtain this report specific to a unit holder by specifying the ID of the unit holder account in the Unit Holder ID field.

After making your specifications, click ‘Ok’ button. A screen with print options is displayed. Enter the printing options and Click ‘Ok’ button to print.

3.8.4 Generating Unit Holder Zero Balance Report

This report will print the summary of the list of unit holders whose balances have become zero for the given fund along with the date on which the balances touched zero.

3.8.4.1 Unit Holder Zero Balance Report Information

Unit Holder ID

12 Character Maximum, Alphanumeric, Display

This is the ID of the unit holder whose balance has become zero.

Unit Holder Name

12 Character Maximum, Alphanumeric, Display

This field displays the Name of the unit holder whose balance has become zero.

Date

Date, Display

This is the Date as of which the unit holder balance became zero.

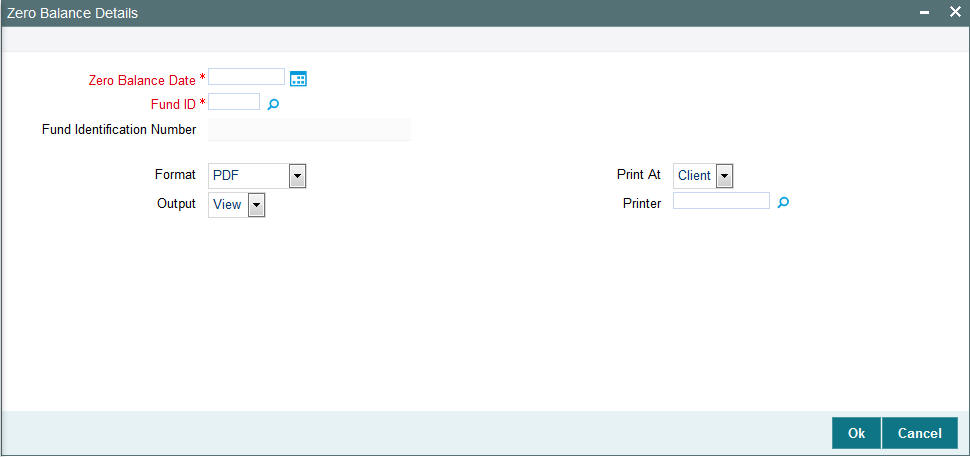

The Unit Holder Zero Balance Report generation screen is as shown below. You can invoke the ‘Zero Balance Details’ screen by typing ‘UTR00044’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must specify the following as mandatory sorting parameters for the generation of the report:

- The date on which the last transaction for the unit holder was accepted, in the Last Transaction field.

- The fund, in the Fund ID field.

After making your specifications, click ‘Ok’ button. A screen with print options is displayed. Enter the printing options and Click ‘Ok’ button to print.

3.9 Unit Holder Reports

This section contains the following topics:

- Section 3.9.1, "Printing Account Statements"

- Section 3.9.2, "Generating Auto Investment Reminder Report"

- Section 3.9.3, "Generating Unit Holder Register Report "

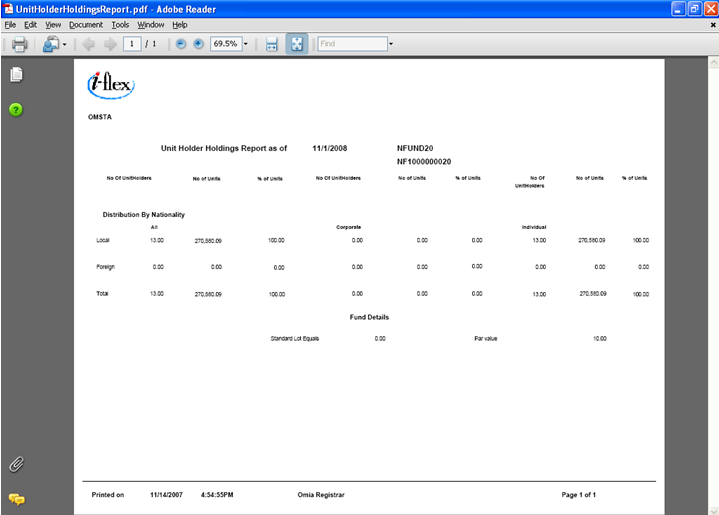

- Section 3.9.4, "Generating Unit Holder Holdings Summary Report"

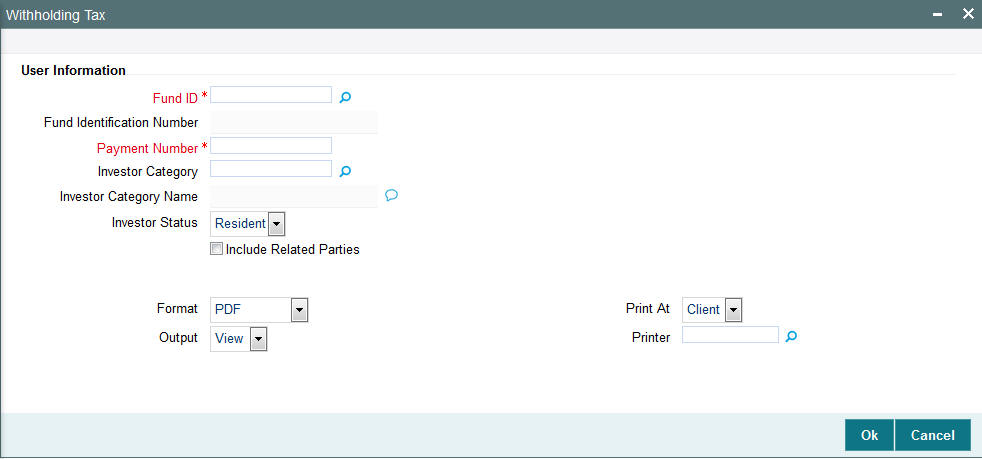

- Section 3.9.5, "Generating Unit Holder Withholding Tax Report"

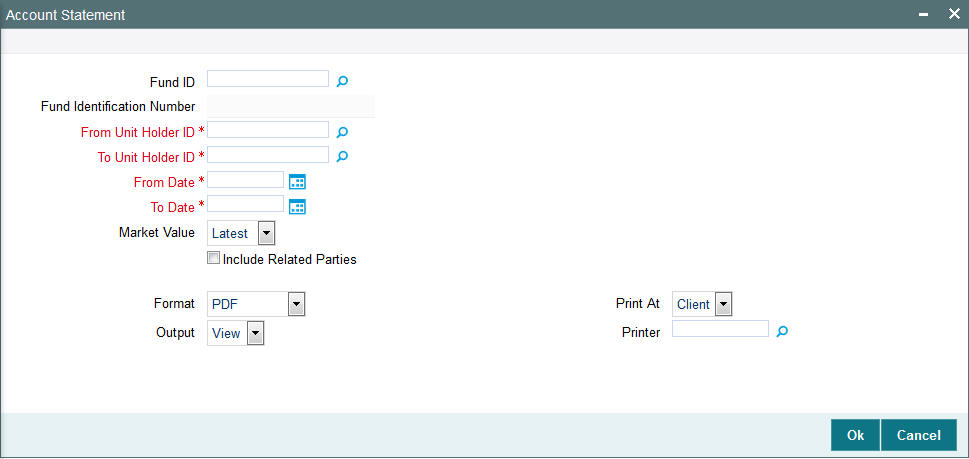

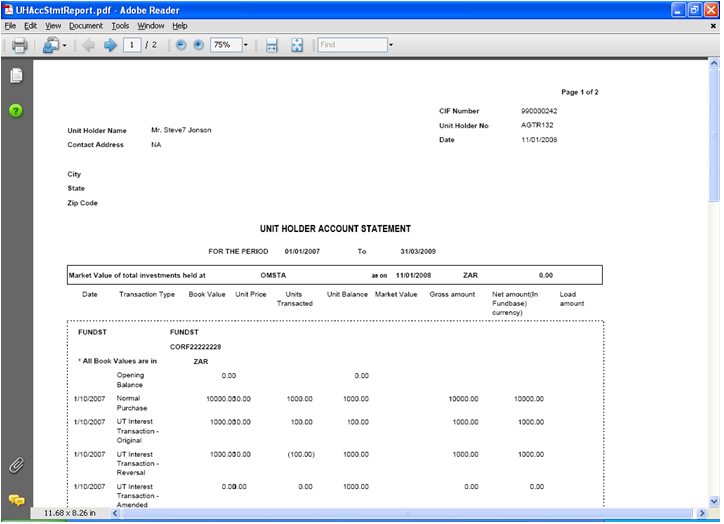

3.9.1 Printing Account Statements

For the given fund, the Account Statement of all the Unit Holders is printed. By availing of the Holdings Statement option, the Holdings Statement can be printed along with the Account Statement. It is printed as per the Account Statement Period. Account statements can either be printed as of the latest market value or as of the market value on the end date of the account statement period.

You must specify the Fund ID, unit holder ID range, date range and report language as mandatory information to generate the report. Also, indicate whether the market value of the investor’s holdings is ‘Latest’ or as of the report’s ‘To date’. You can invoke the ‘Acc. Statement’ screen by typing ‘UTR00137’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

3.9.1.1 Fields in Account Statement screens

AMC Name

40 Character Maximum, Alphanumeric, Display

The Name of the Asset Management Company to which the Fund belongs is displayed.

AMC Address

255 Character Maximum, Alphanumeric, Display

The Address of the Asset Management Company, to which the Fund belongs, is displayed.

Unit Holder ID

12 Character Maximum, Alphanumeric, Display

The ID of the Unit Holder, for whom the Account Statement is to be printed, is displayed.

Unit Holder Name

100 Character Maximum, Alphanumeric, Display

The Name of the Unit Holder, for whom the Account Statement is to be printed, is displayed.

Unit Holder Address

255 Character Maximum, Alphanumeric, Display

The Address of the Unit Holder, for whom the Account Statement is to be printed, is displayed.

Fund ID

Alphanumeric, Display

The ID of the Fund, for which the Account Statement is to be printed, is displayed.

Fund Name

Alphanumeric, Display

The Full Name of the Fund, for which the Account Statement is to be printed, is displayed.

Transaction Date

Display

Displays the date on which the transaction took place.

Transaction Type

25 Character Maximum, Alphanumeric, Display

The type of transaction that has affected the Unit Holder balance is displayed.

Units Transacted

Numeric, Display

The Number of Units transacted for the given transaction is displayed.

Transaction Number

Display

This displays the transaction number.

Price

Alphanumeric, Display

Displays the price at which the transaction was affected.

Unit Balance

Numeric, Display

The balance Number of Units at the end of the given transaction is displayed.

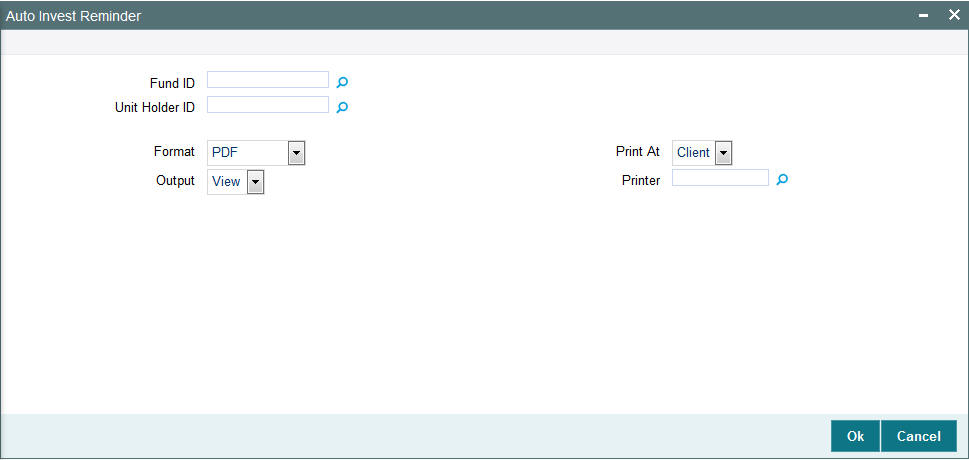

3.9.2 Generating Auto Investment Reminder Report

This report will print the details of redemption transaction for which payment is held back due to the unit holder being FICA non-compliant. The report also displays the Auto Investment date i.e. the date on which the redemption will be automatically invested back in the fund. You can invoke the ‘Auto Invest Reminder’ screen by typing ‘UTR00212’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You must specify the Fund ID, the unit holder, report language as mandatory information, and click ‘Ok’ button to generate the report. A screen with print options is displayed. Enter the printing options and Click ‘Ok’ button to print.

Fund ID

6 Character Maximum, Alphanumeric, Display

This field displays the Fund ID and the Name of the fund for which the report is to be printed.

Unit Holder

12 Character Maximum, Alphanumeric, Display

Display Only

The ID of the unit holder who has made the transaction is displayed here.

Transaction Number

Display Only

In this field, the transaction numbers of the transactions for which the unit holder is FICA non-compliant are displayed.

Transaction Date

Display Only

The dates of the concerned transactions are displayed here.

Allocation Date

Display Only

If the transaction has been allotted, the date on which the allotment took place is displayed here.

Investment Date

Display Only

This field displays the date on which the amount must be reinvested into the fund if the investor continues to be FICA non-compliant.

Reminder Date

Display Only

This field displays the date on which the reminder must be sent out to the FICA non-compliant investor.

3.9.3 Generating Unit Holder Register Report

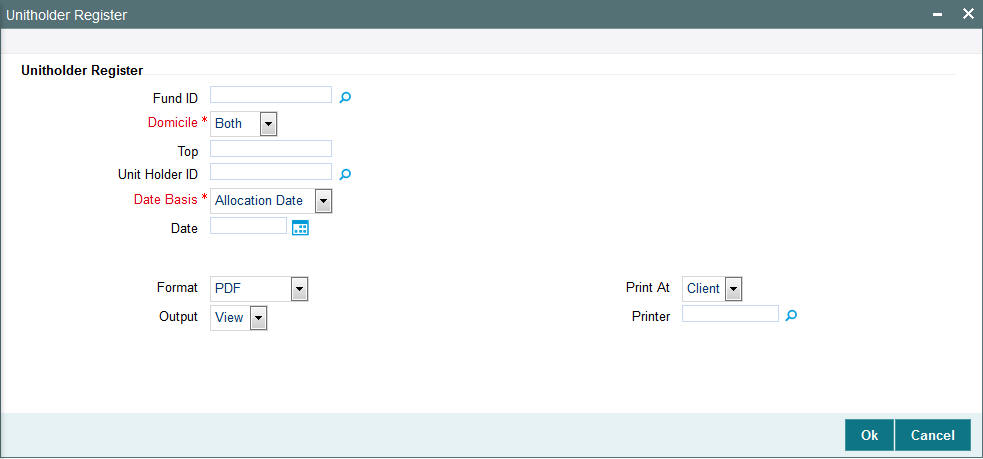

This report will print the details of Fund Holdings of the Unit holder. The mailing label of the selected Unit holders can also be printed. You can invoke the ‘Unitholder Register’ screen by typing ‘UTR00127’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can use this screen to:

- Generate Unit Holder Register Report.

- Print Unit Holder Register Report.

- Preview Unit Holder Register Report.

You can specify the Fund ID, Domicile of the unit holder and report language as mandatory information and the top number of records with sort parameters, to generate the report.

You can specify the date, as on which the details must be displayed in the report. You can opt for details as of:

- the Allocation Date, Transaction Date or Price Date (select the required option in the Date Basis field)

- a required date of your choosing (select the required date in the Date field)

The Report has Totals / subtotals for Number of Unit holders, Total of Holdings, Percentage of Holdings.

3.9.3.1 Fields in Unit Holder Register Report screen

Fund ID

6 Character Maximum, Alphanumeric, Display

This field displays the Fund ID and the Name of the fund for which the Unit holder holding details are to be printed.

Fund Name

20 Character Maximum, Alphanumeric, Display

Enter the Fund ID and the Name of the fund for which the Unit holder holding details are to be printed.

Date

Date, Display

This displays the Date on which the Report is printed.

Unit Holder ID

12 Character Maximum, Alphanumeric, Display

This displays the ID of the Unit holder for whom the Fund Holdings are being printed.

Unit Holder Name

85 Character Maximum, Alphanumeric, Display

This displays the Full Name (Title + First Name + Last Name) of the Unit holder for whom the Fund Holding details are being printed.

Type of Investor

1 Character Maximum, Alphanumeric, Display

This displays the type of the Unit holder, whether Individual or Corporate, for whom the Fund Holding details are being printed.

Corresponding Address

1 Character Maximum, Alphanumeric, Display

This displays the Address of the Unit holder for whom the Fund Holding details are is being printed. This could be the permanent or the secondary address of the Unit holder as per the Unit holder’s instructions as to where his correspondence is to be made.

Telephone Number

1 Character Maximum, Alphanumeric, Display

This displays the Telephone Number of the Unit holder for whom the Fund Holding details are being printed.

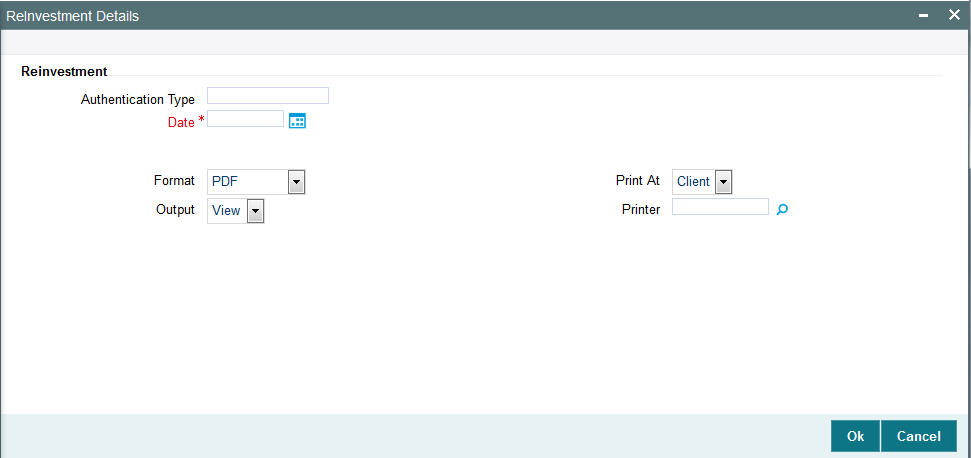

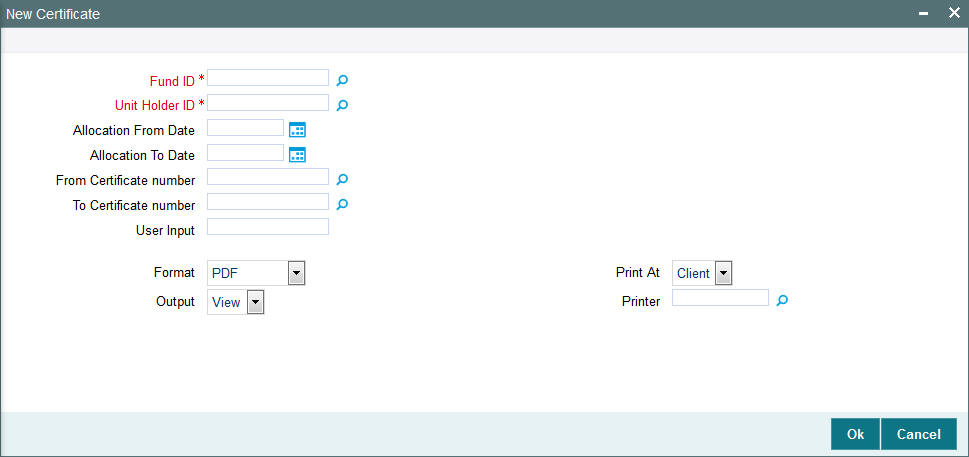

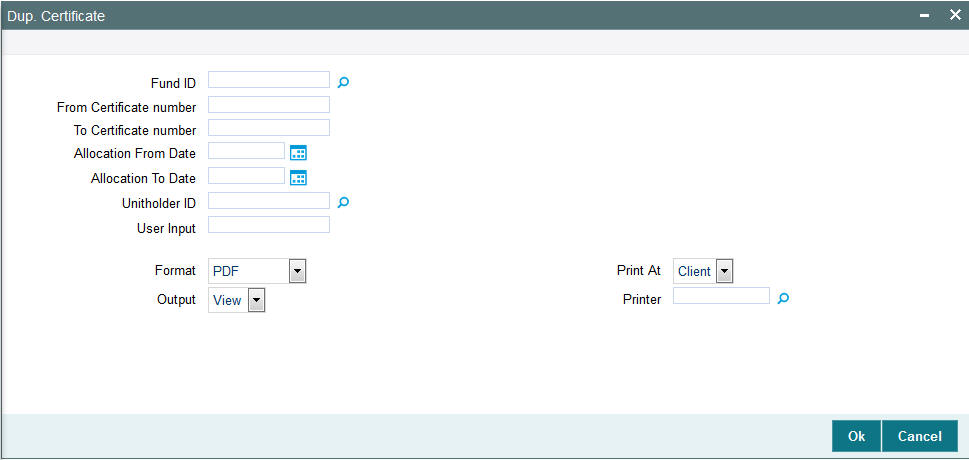

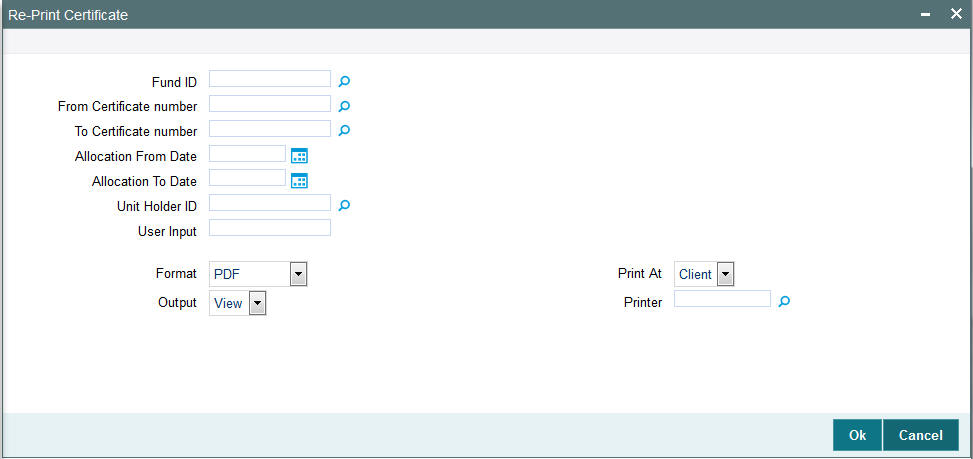

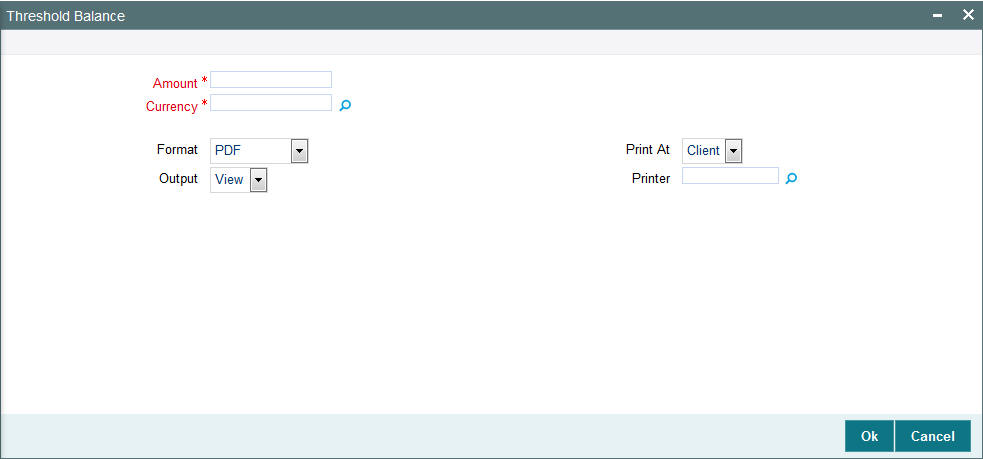

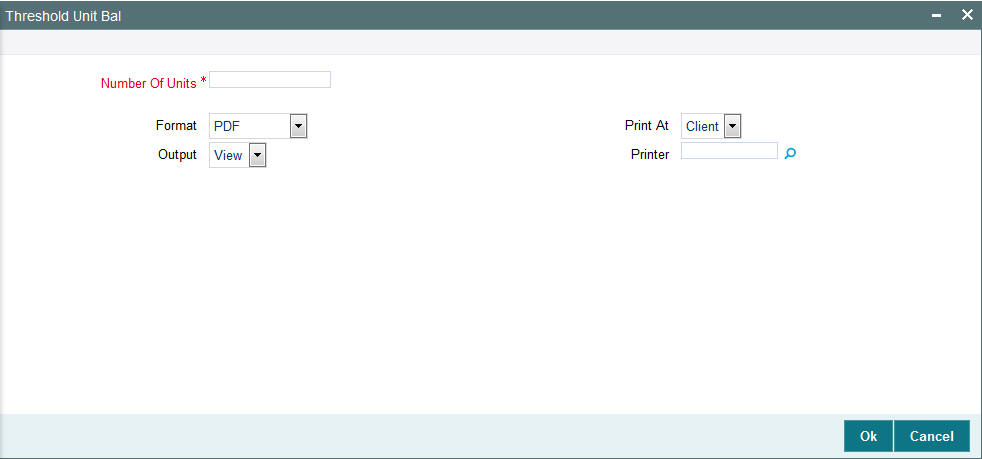

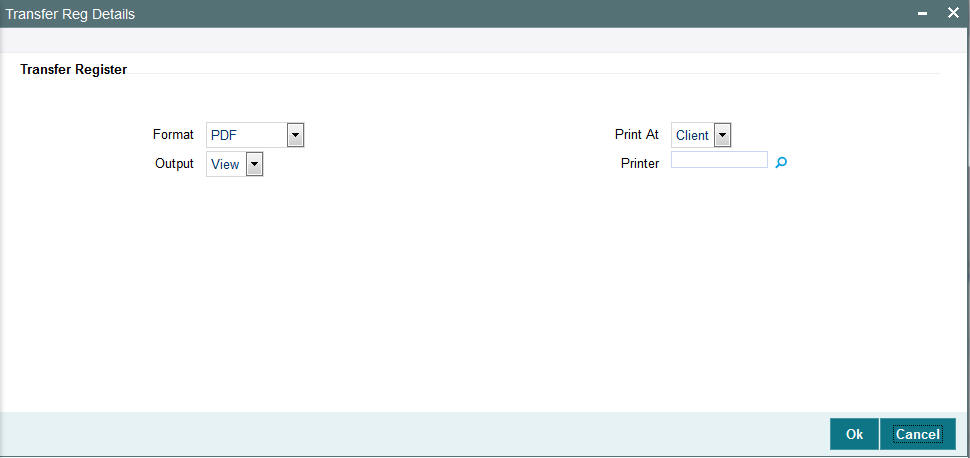

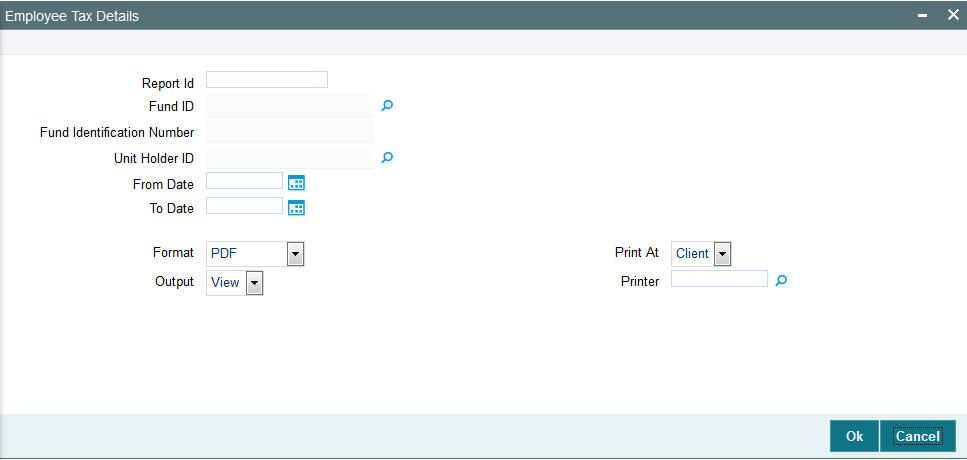

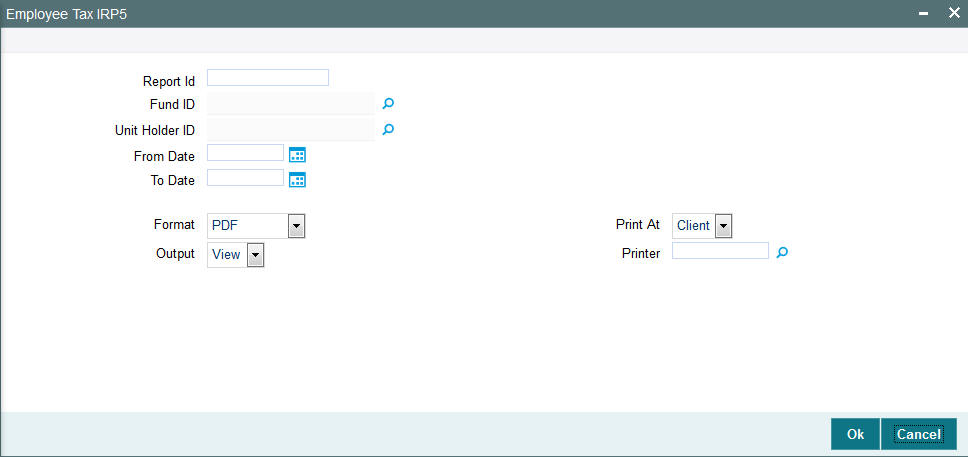

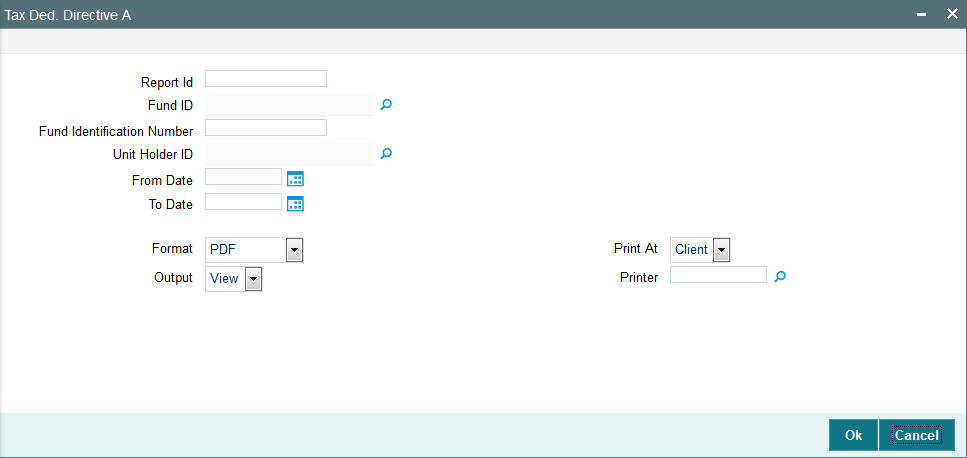

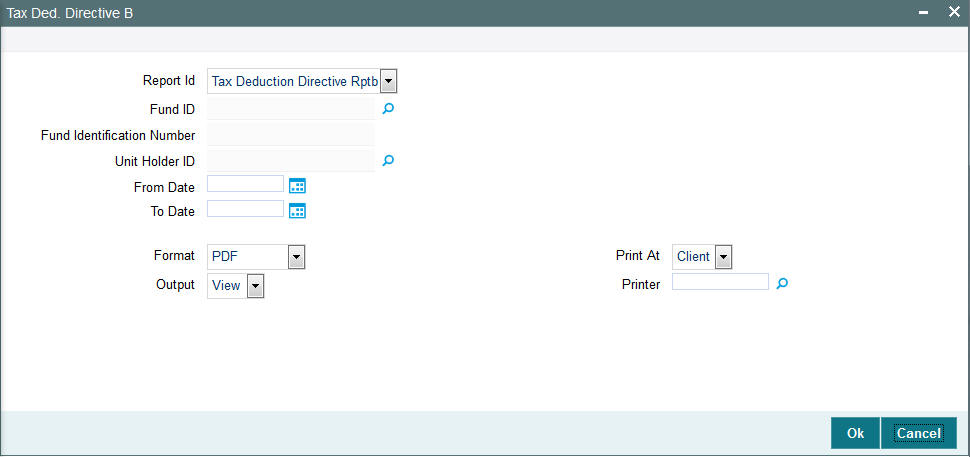

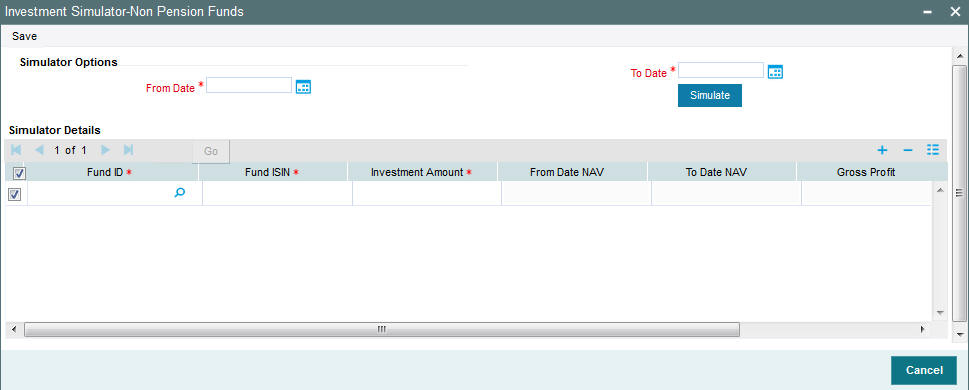

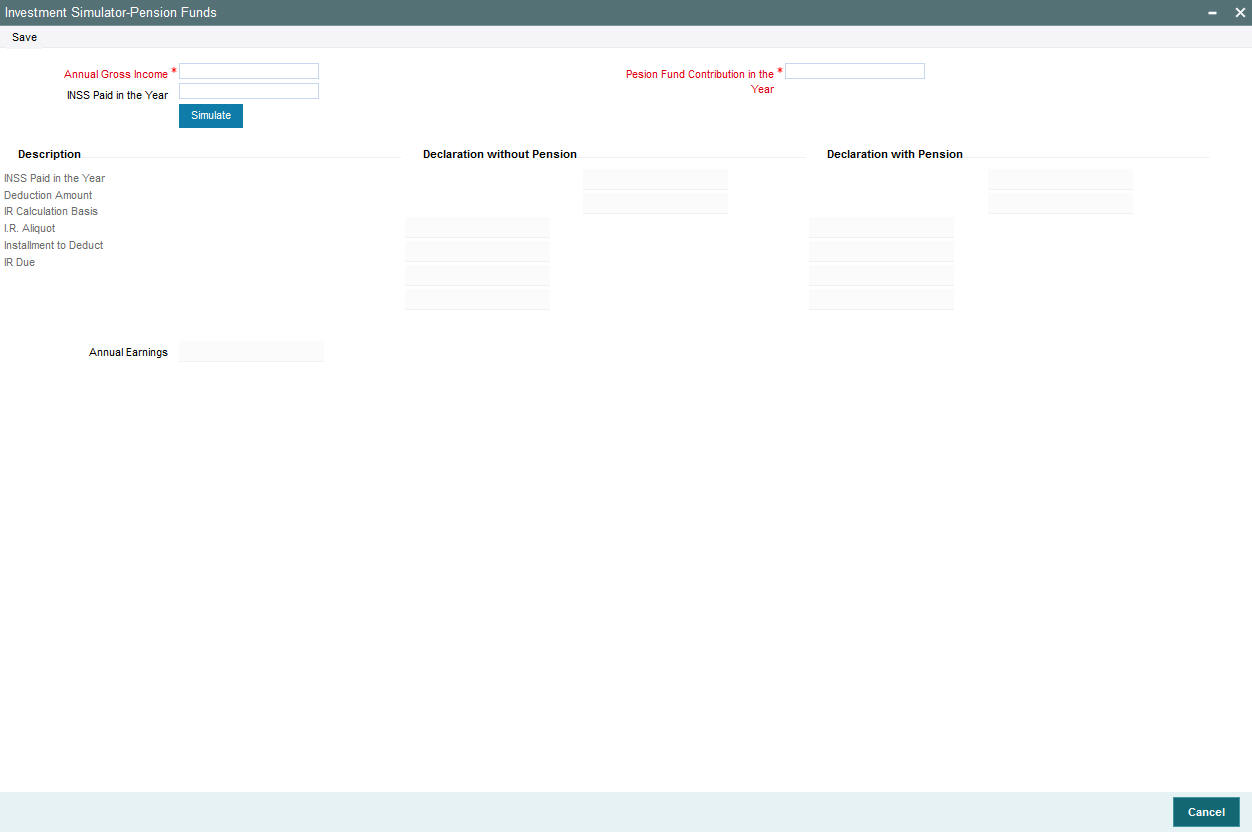

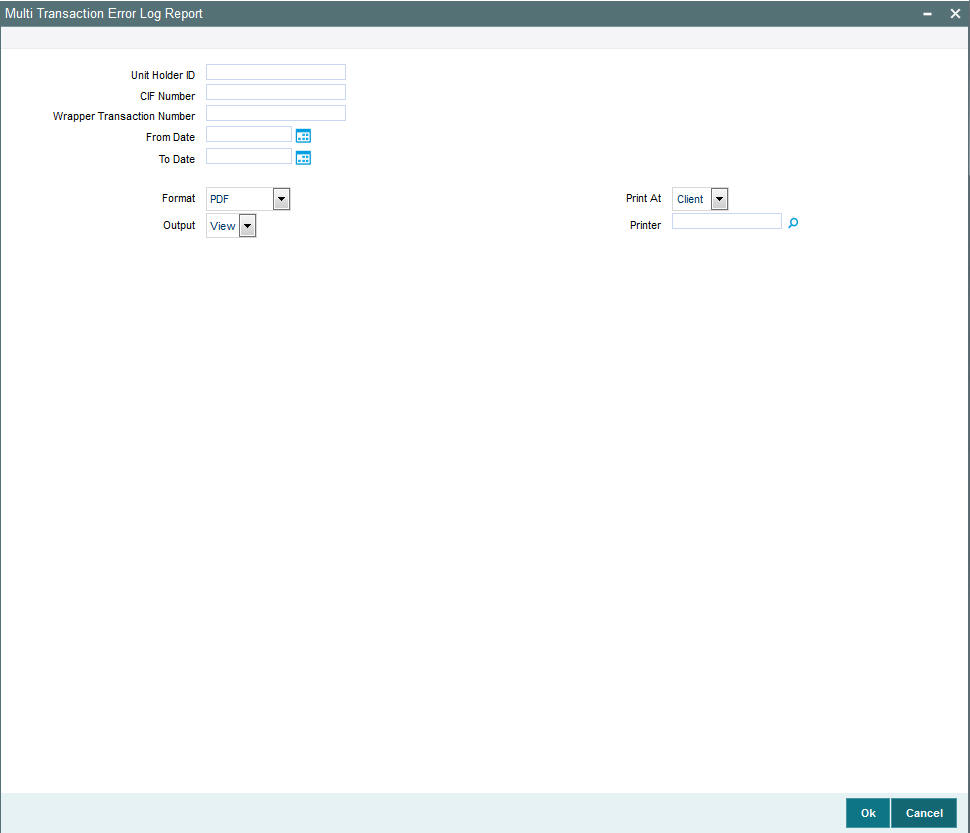

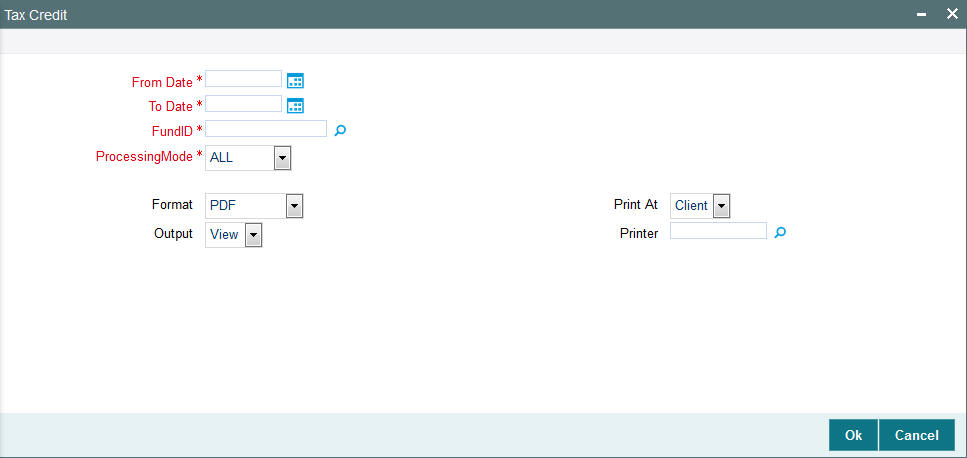

Country of Residence