6. Adjustment and Amount Block Transactions

The system provides a facility to capture transactions for which a specific price, other than the prevalent transaction base price at the time of entry, is applicable. These transactions are typically representative of holdings of an investor in any external agency of any kind, which need to be reflected in the system. They are known as adjustment transactions.

Typically, for such transactions, no processing is done in the system with respect to computation of charges or fund prices. All these computations are done externally and the information is only captured as data in the FC-IS system.

This chapter contains the following section:

- Section 6.1, "Adjustment Redemption Transaction Detail Screen"

- Section 6.2, "Adjustment Subscription Transaction Summary"

- Section 6.3, "Block or Unblock Transactions by Amounts"

- Section 6.4, "Redeeming Units for Unblocked Amounts"

6.1 Adjustment Redemption Transaction Detail Screen

This section contains the following topics:

- Section 6.1.1, "Invoking Adjustment Redemption Transaction Detail Screens"

- Section 6.1.2, "Transaction Intermediary Button"

- Section 6.1.3, "Add Info Button"

- Section 6.1.4, "Load Details Button"

- Section 6.1.5, "Payment Details Button"

- Section 6.1.6, "Document Details Button"

6.1.1 Invoking Adjustment Redemption Transaction Detail Screens

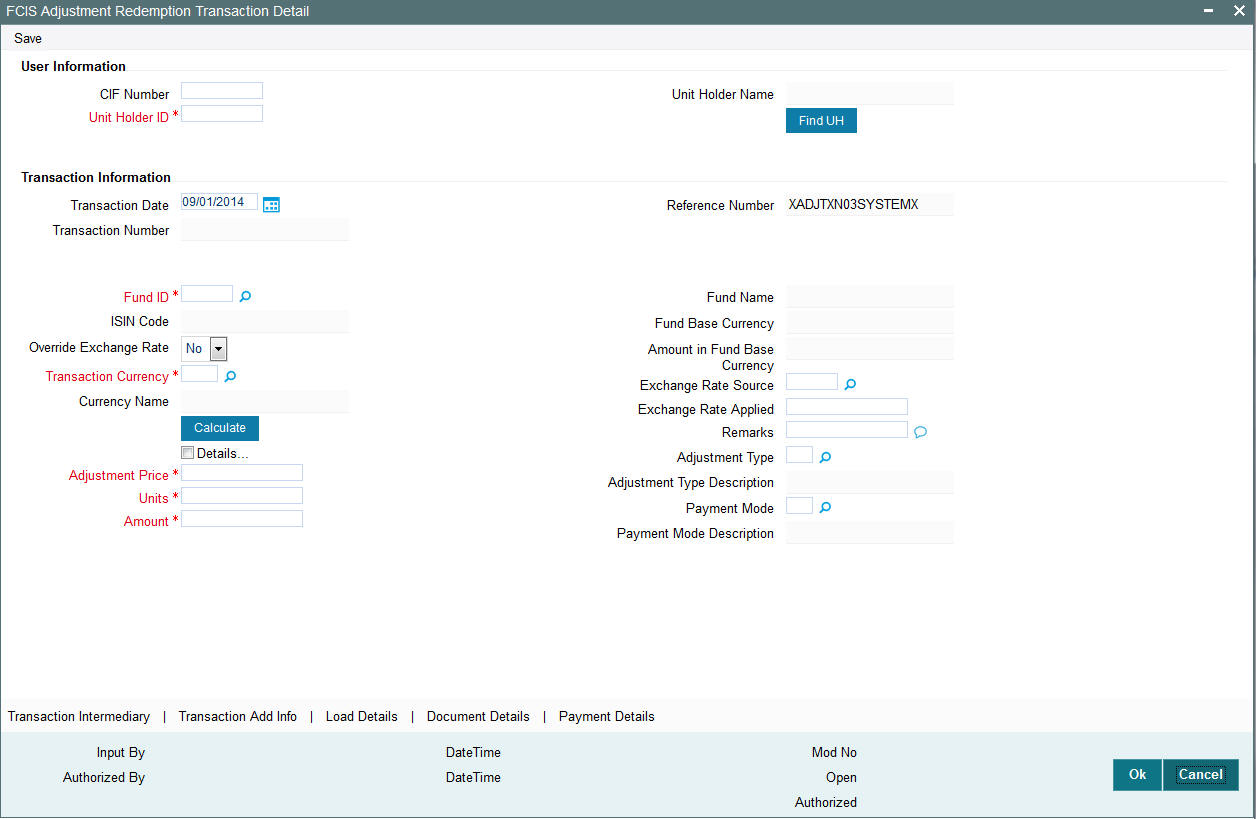

You can capture new adjustment transactions through the Adjustment Subscription (for subscriptions into the fund) and the Adjustment Redemption screens (for redemption from the fund). You can invoke the ‘FCIS Adjustment Redemption Transaction Detail’ screen by typing ‘UTDADJ03’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select 'New' from the Actions menu in the Application tool bar or click new icon to enter the details of the Adjustment transactions. Click on new record button, to enter details of a new record.

To enter an adjustment transaction in the adjustment transaction detail screens,

- Specify the CIF unit holder for whom this adjustment transaction is being captured, in the Unit Holder field. When you do this, the following information is retrieved from the unit holder’s account details and displayed in this screen. This information will be reckoned as default, unless you change any of it when you enter the transaction:

Transaction Intermediary: The unit holder’s default broker or transaction intermediary is displayed here, and you can change the broker.

Transaction Currency: The unit holder’s preferred currency is displayed here, and will be deemed as the default currency for the adjustment transaction. You can change it when you enter the transaction.

- In the Transaction Information section, specify the following :

Select the fund, from the option list in the Funds Field. When you do this, the fund base currency is displayed in the Fund Currency field. Also, all the loads mapped to this fund that have a processing frequency that is different from transaction time loads and allocation time loads, are displayed. You can also specify the ISIN Code of the fund.

Specify the number of units in the Units field.

The specific price for the transaction, in the Adjustment Price field. When you specify the price, on clicking the Calculate button, the system calculates the transaction amount and displays it in the Transaction amount field. If you specify the amount, it must be a multiple of the units and price that you have specified.

The system obtains the exchange rate applicable and it is displayed in the Exchange Rate Applied field. It also calculates the transaction amount in fund base currency and displays it in the Amount (Fund Currency) field. You can override the exchange rate.

The type of adjustment transaction, in the Adjustment Type field.

Select the preferred mode of payment, in the Payment Mode Description field from the drop down list.

In the Load Details section, specify the Load Description and the Load Amount, for each load that is applicable for the transaction. If you do not specify the value of any or all of the loads, then the value is deemed as zero (or nil) in the system.

Specify the payment details, according to the selected mode of payment, in the Payment Details section. The Payment details screen is available on selection of Payment Mode

In the Document Details section, specify the document id of the unit holder. You can either enter the document id or choose the same from the option list provided. This section will be enabled only if your installation is integrated with DMS.

Save the transaction by clicking ‘Ok’ button.

6.1.1.1 User Information Section

In this section, specify the details of the CIF customer or the investor that has requested for the transaction.

Note

- To retrieve a CIF customer number or a unit holder number, click Find UH.

- To enter a transaction for an investor that is attached to a CIF customer, first specify the number of the CIF customer in the CIF Number field, and then select the number of the required unit holder in the Unit Holders for CIF field.

- To enter a transaction for an investor that is not attached to a CIF customer, specify the number of the required unit holder in the Unit Holder field.

CIF Number

Alphanumeric, Optional

If the unit holder that has requested for the transaction is attached to a CIF Customer, specify the number of the CIF customer in this field. The system retrieves the name of the CIF customer and displays it alongside this field.

Unit Holders for CIF

12 Characters Maximum, Alphanumeric, Optional. This information is mandatory if you have

specified a CIF number.

Select the unit holder for whom the transaction request is being entered.

When you specify the CIF Number, all the unit holders that fall under the CIF are displayed in the drop down list in this field. You can make your choice from this list.

If you have selected a unit holder for the selected CIF using the Find link, the name and number of the selected unit holder is displayed here.

Unit Holder ID

12 Characters Maximum, Alphanumeric, Mandatory

If the transaction is being entered for a unit holder that is not under a CIF Number, specify the same in this field.

If you have selected a unit holder using the Find link, the number of the selected unit holder is displayed here.

If you have specified a CIF Number and selected a unit holder for the CIF, then the selected unit holder number is displayed here. It cannot be changed.

The unit holder specified here must belong to the same agency branch from where the adjustment transaction is being entered, if cross branching is not allowed for the agency branch.

Unitholder Name

The system displays the name of the unit holder along the Unit Holder ID field.

Transaction Information Section

Reference Number

System generated information, display only.

For all adjustment transactions, the system affixes the following alphanumeric value as the reference number:

XADJTXN02SYSTEMX (For subscription adjustment transactions)

XADJTXN03SYSTEMX (For redemption adjustment transactions)

The reference number will be used to identify the adjustment transaction uniquely in the system.

Transaction Date

Date, Mandatory

Specify the date on which the adjustment transaction is accepted in the system. By default, the application date is displayed here.

If backdating is allowed for the fund, then the user can enter a date that is between the application date and the backdating limit specified for the Fund in the Transaction Processing Rules setup for this transaction type. Further, if the back dating period is specified for the fund, then this limit will override the limit specified for the fund.

Fund ID

6 Character Maximum, Alphanumeric, Mandatory

Select the name of the fund in which the specified unit holder wishes to subscribe, from the list provided. The drop down list is populated based on the unit holder specified, in the following manner:

The nationality of the specified unit holder is reckoned from the information provided in the unit holder’s account profile. Only those funds that contain the country of domicile of the unit holder in their Fund Residency list are populated here.

Only funds that belong to the AMC of the specified unit holder are populated here.

Fund Name

When you specify the name of the fund, the Name of the fund is displayed in the Fund Name field.

ISIN Code

Fund Identification Number

12 Characters Maximum; Alphanumeric; Mandatory

Select the Fund Identification Code of the selected fund. If you specify the Code of a fund, the name of the fund is displayed in the Fund field.

Fund Base Currency

Display Only

The base currency of the specified fund is displayed here.

Transaction Currency

Alphanumeric, Mandatory

Select the currency in which the payments for the adjustment transaction will be made or accepted. The drop down list contains currencies that are valid as transaction currencies for the fund, from the Fund Transaction Currency list.

If the specified unit holder’s currency is a valid transaction currency for the fund, it is displayed here by default. If not, the Fund Base Currency is displayed here by default. In either case, the unit holder can alter the currency and specify any currency from the list.

Currency Name

Display only

Once you have specified the Transaction currency applicable for the adjustment transaction, the name of the currency is displayed in this field.

Units

Numeric, Mandatory

Specify the number of units applied for by the unit holder in the adjustment transaction.

Price Details

Numeric, Mandatory

Specify the details of the price to be applied for this adjustment transaction. It will be reckoned to be in the Fund Base Currency.

Amount

Numeric, Optional

When you specify the units applied and the adjustment price, the system computes the adjustment transaction amount and displays it in this field.

Amount in Fund Base Currency

Display Only

When you specify an amount as the transaction value, the system computes the equivalent of the same in the base currency of the selected fund and displays it here.

Exchange Rate Source

Alphanumeric, Mandatory

Select the exchange rate source from which the exchange rates are to be derived for the adjustment transaction. The default source for the AMC is displayed here, from the Defaults Maintenance.

Override Exchange Rate?

1 Character Maximum, Boolean, Mandatory

Select ‘Yes’, if you want to override the computed exchange rate.

Calculate link for Exchange Rate Calculation

To compute the exchange rate that will be applied for the adjustment transaction, click ‘Calculate’ button. The system computes the exchange rate and displays it in the Exchange Rate Applied field.

Exchange Rate Applied

Numeric, Mandatory

The actual exchange rate applied is computed by the system using the transaction currency, fund base currency and the value of the adjustment transaction, and displayed here. This rate can be overridden if the Override Exchange Rate box is checked.

If this applied exchange rate is overridden, the overridden value must fall within the fluctuation range allowed for the transaction currency - fund base currency pair, in the Currency Pair Setup records.

Adjustment Type

Alphanumeric, Mandatory

Select the mode in which the units have resulted (or the origin of the units) in the Adjustment Type field. You can choose any of the following:

- Adjustment Transaction

- Bearer Shares

- Insurance Units

Payment Mode Description

Alphanumeric, Mandatory

Select the mode in which the payment must be made or received, from the drop down list. If the adjustment transaction currency is EURO, then the mode chosen cannot be Cash.

If the mode of payment chosen here is cash, all the bank details fields and the check or credit card related fields will be disabled.

Remarks

255 Characters Maximum, Alphanumeric, Optional

Enter any text explaining or relating to the adjustment transaction.

Tick the Details check box to activate the following tabs : Add Info / Document Details / Load Details / Broker Details.

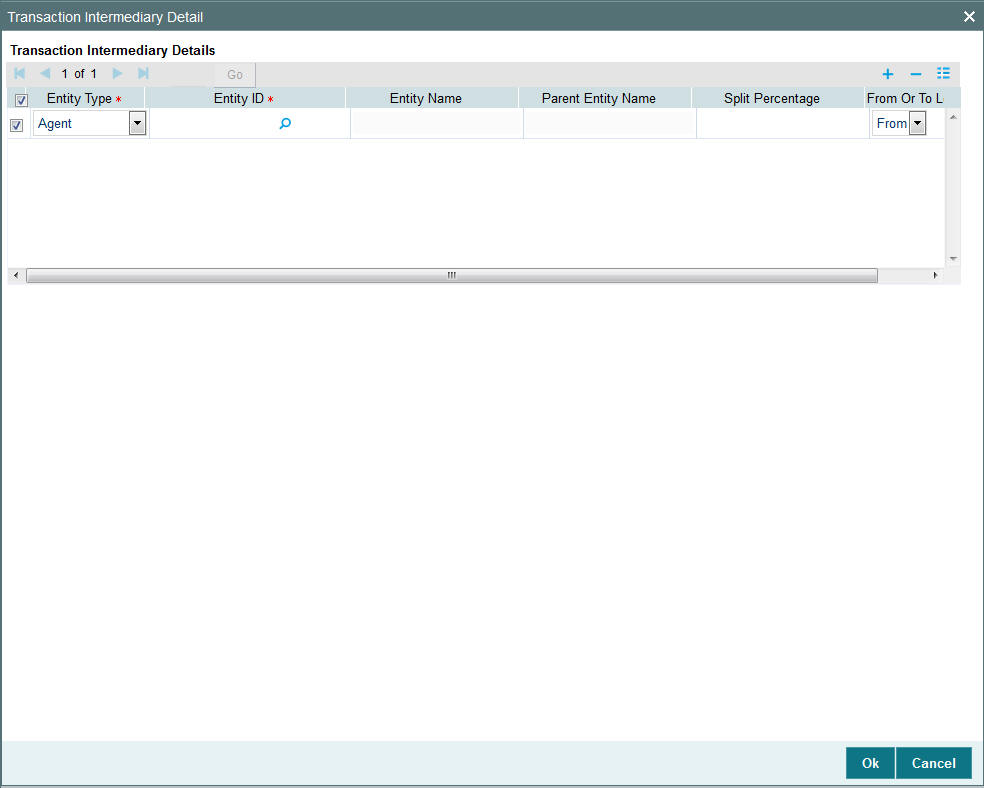

6.1.2 Transaction Intermediary Button

Click on ‘Transaction Intermediary’ button to specify transaction intermediary details.

If a broker has been identified as an intermediary for the transaction, then you must identify the same in this section, along with the commission percentage split for the broker.

If brokers are designated as mandatory for the fund in which the transaction is being put through, then you must specify at least one broker as mandatory information in this section. If brokers are not mandatory for the fund, and you do not specify any broker in this section, then the system reckons the broker as DIRECT and designates the same as the default broker.

Entity Type

Mandatory

Select the entity type from the drop-down list. The list displays the following values:

- Agent

- Broker Code

- IFA

- Account Officer

- Broker

Entity ID

Alphanumeric, 12 Characters; Mandatory

Select the entity ID that has been identified as the intermediary for the transaction.

Entity Name

Display

The system displays the entity name for the selected Entity ID.

Parent Entity Name

Display

The system displays the parent entity name for the selected entity ID.

Split Percentage

Numeric; 5 Characters; Optional

Specify the percentage of total commission that is to accrue to the selected broker. The sum of all the percentages specified for any brokers identified for the transaction must equal one hundred percent.

From Or To Leg

Mandatory

Select From or To leg from the drop-down list. The list displays the following values:

- From

- To

To add a new row at the bottom of the grid in this section, click the Add link.

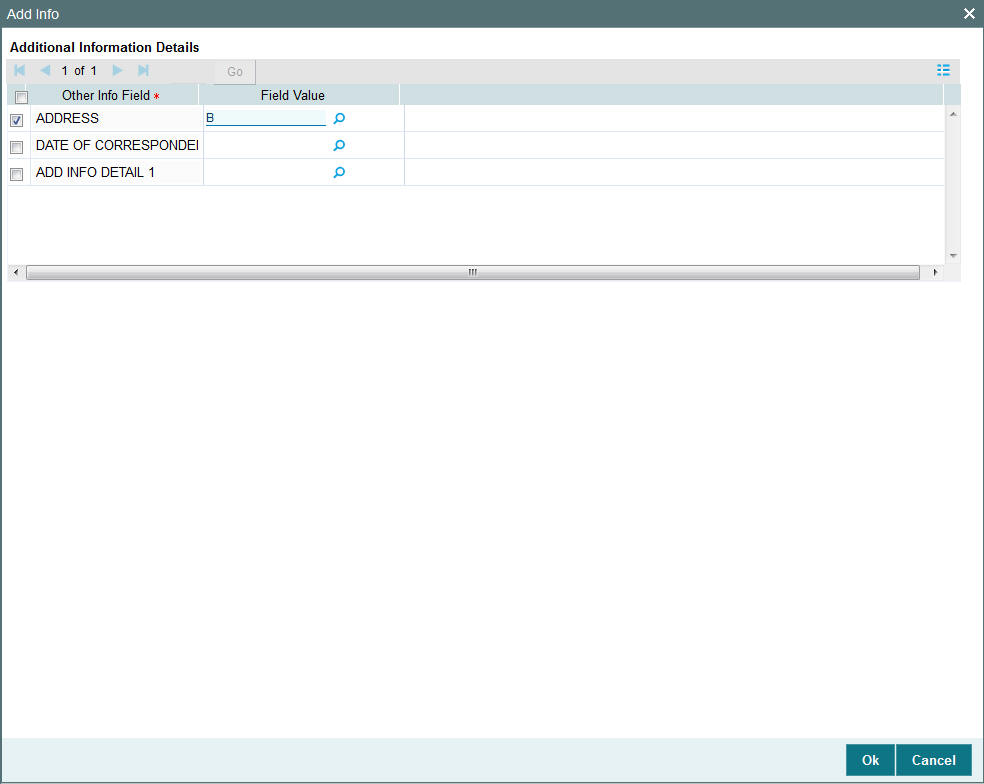

6.1.3 Add Info Button

Click ‘Add Info’ button to specify additional information.

Additional Information Details

Other Info Field

Display

the system displays the other information details.

Field Value

Alphanumeric; 60 Characters; Optional

Specify the field value.

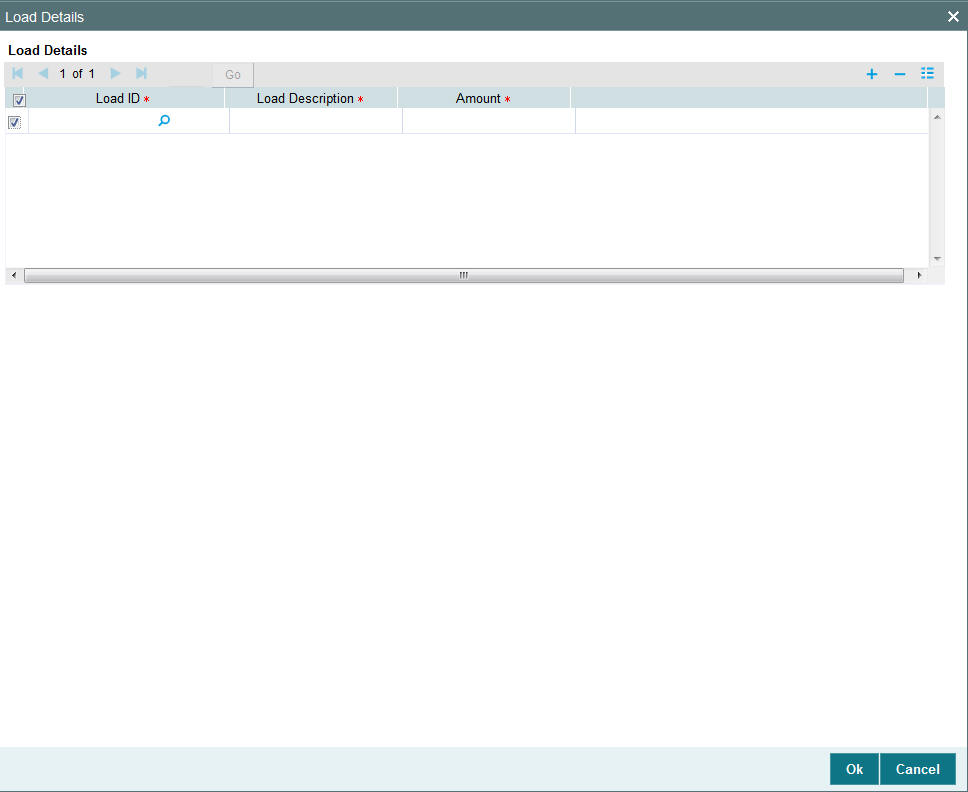

6.1.4 Load Details Button

Load ID

Alphanumeric; 5 Characters; Mandatory

Specify the load ID. Alternatively, you can select load ID from the option list. The list displays all valid load ID maintained in the system.

Load Description

Alphanumeric, Optional

Select the load that is applicable for the adjustment transaction. When you specify the fund in the Fund field, all loads mapped to the selected fund with processing frequency that is different from transaction time loads and allocation time loads (i.e., with processing frequency as ‘F’), are populated in this field.

Amount

Alphanumeric, Optional

Specify the load amount applicable for the selected load description, for the adjustment transaction. If you do not enter a load amount in this field, the system reckons the load to have a zero value. The load amounts that you specify here will not be processed at the time when the adjustment transaction record is inserted into the allocation tables

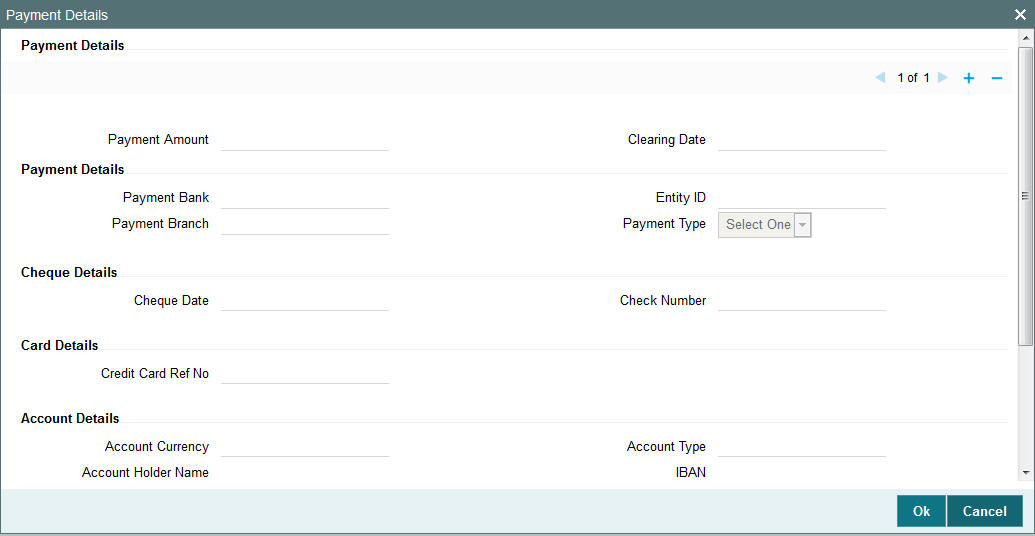

6.1.5 Payment Details Button

The payment details include the following:

The type of payment i.e., whether the payment is being made by the unit holder that has requested the transaction or by an external third party.

The details of the bank and branch of the bank for the payment

The details of any payment instruments such as checks, the number, date and the clearing date.

In the case of payment by account transfer, the details of the bank account to which /from which the payment is being made.

Payment Amount

Numeric; 30 Characters; Optional

Specify the payment amount.

Paid Date

Date Format; Optional

Select the paid date from the adjoining calendar.

Payment Details

Capture the following details if the mode of payment chosen is check, credit card or demand draft:

Payment Bank

Alphanumeric; 12 Characters; Optional

Specify the name of the bank where the payment instrument is drawn, if the mode of payment is Check, Credit Card or Demand Draft. Alternatively, you can select bank code from the option list. The list displays all valid bank code maintained in the system.

Payment Branch

Alphanumeric; 20 Characters; Optional

Specify the branch of the selected bank where the payment is drawn, if the mode of payment is Check or Demand Draft. Alternatively, you can select payment branch code from the option list. The list displays all valid payment branch code maintained in the system.

Entity ID

Alphanumeric; 12 Characters; Optional

Specify the entity ID.

Payment Type

Optional

Select the type of payment from the drop-down list. The list displays the following values:

- Self

- Third Party

- Broker

Cheque Details

Cheque Date

Date Format; Optional

Specify the date on which the cheque is drawn.

Cheque Number

Alphanumeric; 16 Characters; Optional

Specify the cheque number.

Card Details

Credit Card Ref No

Alphanumeric; 16 Characters; Optional

Specify the credit card reference number.

Account Details

Account Currency

Alphanumeric; 3 Characters; Optional

Specify the account currency. Alternatively, you can select account currency code from the option list. The list displays all valid account currency code maintained in the system.

Account Holder Name

Alphanumeric; 100 Characters; Optional

Specify the name of the account holder.

Account Number

Alphanumeric; 16 Characters; Optional

Specify the account number. Alternatively, you can select account number from the option list. The list displays all valid account number maintained in the system.

Note

Based on the account number selected, the system displays the account currency, account holder name, account type, and IBAN details.

Account Type

Alphanumeric; 1 Character; optional

Specify the type of account. Alternatively, you can select account type from the option list. The list displays all valid account type maintained in the system.

IBAN

Alphanumeric; 40 Characters; Optional

Specify the IBAN details.

Third Party Details

Third Party Address

Alphanumeric; 255 Characters; Optional

Specify the third party address details.

Third Party Reference

Alphanumeric; 255 Characters; Optional

Specify the third party reference details.

Third Party US State

Alphanumeric; 1 Character; Optional

Specify the third party US state code.

Third Party Zip Code

Alphanumeric; 255 Characters; Optional

Specify the third party zip code.

6.1.6 Document Details Button

Document Management System or DMS is used to scan and store documents like Account Opening form, Transaction form, Identity Proof etc. In this section, you can specify the document type for the unit holder. The document types can be maintained in the System Parameters Maintenance screen.

For further information refer to the chapter ‘Maintaining System Parameters’

Access this section through the Document Details section.

Document ID

Alphanumeric; 25 Characters; Mandatory

You can either enter the document ID in this field or choose the document ID from the option list.

Document Type

Alphanumeric; 4 Characters; Mandatory

Specify the document type.

Document Description

Alphanumeric; 255 Characters; Optional

Specify the document description.

Note

The Document Details Section will be enabled only if your installation is integrated with DMS.

6.2 Adjustment Subscription Transaction Summary

This section contains the following topics:

- Section 6.2.1, "Invoking Adjustment Subscription Transaction Summary Screen"

- Section 6.2.2, "Retrieving Transaction in Transaction Summary Screens"

- Section 6.2.3, "Editing Adjustment Transaction"

- Section 6.2.4, "Viewing Adjustment Transaction"

- Section 6.2.5, "Deleting Adjustment Transaction"

- Section 6.2.6, "Authorizing Adjustment Transactions"

- Section 6.2.7, "Amending Adjustment Transaction"

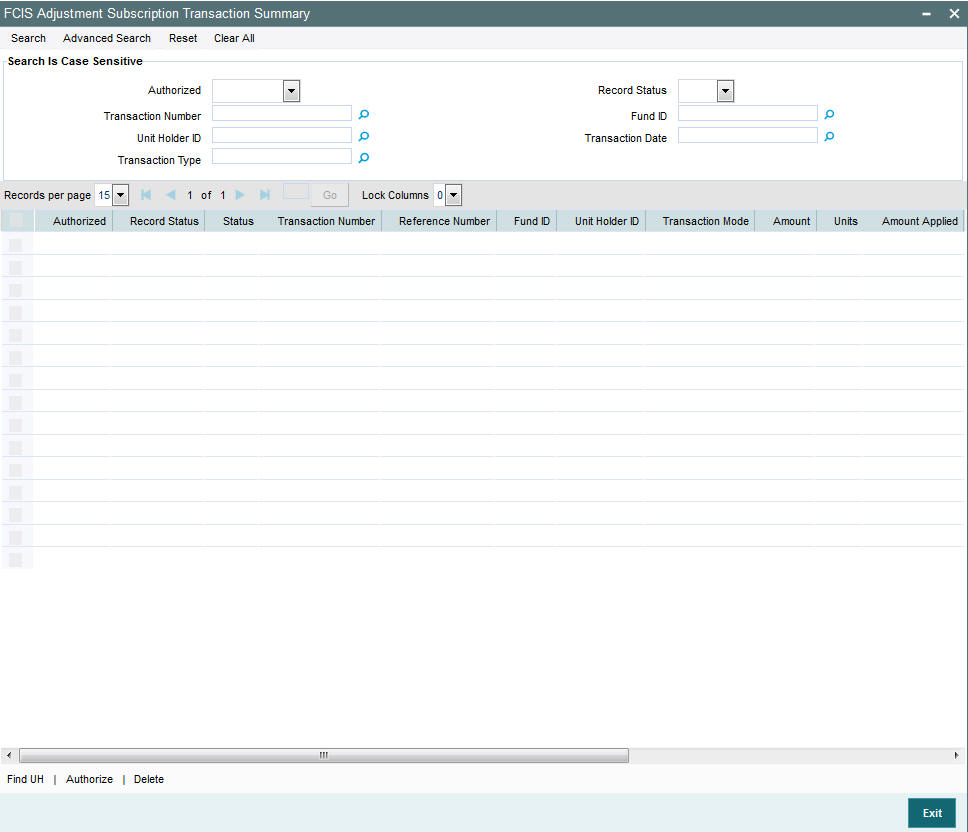

6.2.1 Invoking Adjustment Subscription Transaction Summary Screen

The adjustment screen also provides you with ability to perform actions on previously stored or incomplete transactions. You can perform the actions of editing, viewing, authorizing, the details of a transaction. You can also authorize a previously saved adjustment transaction and apply a modification to an authorized transaction. The summary screens can be accessed by logging into the Agency Branch module of the browser. You can invoke the ‘FCIS Adjustment Subscription Transaction Summary’ screen by typing ‘UTSADJ02’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

6.2.2 Retrieving Transaction in Transaction Summary Screens

You can perform all these operations through the Adjustment Transaction Summary screens. You can retrieve a previously entered adjustment transaction in the Summary screen, as follows:

In the browser, select the Adjustment Subscription Summary or the Adjustment Redemption Summary options, from the Transaction menu category of the Agency Branch module. Specify any or all of the following parameters:

- The status of the transaction in the Authorized field. If you choose the “Blank Space” option, then all the transactions are retrieved.

- The status of the Transaction in the Open field. If you choose the “Blank Space” option, then all the transactions are retrieved.

- The unit holder ID

- The number of the adjustment transaction, in the Adjustment Transaction Number field.

After adjustment transactions are entered into the system, you can perform any of the following operations:

- Edit or delete them, provided they are still unauthorized.

- Retrieve and view them.

- Have them authorized by another user.

6.2.3 Editing Adjustment Transaction

You can modify the details of an adjustment transaction that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- In the main menu, invoke the Transaction menu. Select Adjustment transaction type, choose the Summary option. The Transaction Summary screen is opened.

- In the Authorized field, select the status of the adjustment transaction that you want to retrieve for modification. You can only modify records of transactions that are unauthorized. Accordingly, choose the unauthorized option from the drop down list.

- To retrieve the adjustment transaction that is to be modified, specify any or all of the details of the transaction in the corresponding fields on the screen. All unauthorized transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Select the adjustment transaction type that you want to modify in the list of displayed transactions, in the lower portion of the screen

- The Adjustment Transaction Detail screen is opened by double clicking on the selected row, with the selected transaction displayed.

- To modify the record you can select the Unlock operation form the drop down Actions List

You can modify the required details for an unauthorized transaction:

- The date.

- The reference number

- The unit holder (including the To Client Information in the case of transfer transactions)

Accordingly, modify the necessary information, and click the Save button to save your changes.

The Transaction Detail screen is closed and the changes made are reflected in the Transaction Summary screen.

6.2.4 Viewing Adjustment Transaction

To view a transaction that you have previously entered, you must retrieve the same in the ‘Adjustment Transaction Summary’ screen, as follows:

- From the main menu, invoke the Transaction menu. Select adjustment transaction type, and choose the Summary option. The Adjustment Transaction Summary screen is opened.

- In the Authorized field, select the status of the adjustment transaction

that you want to retrieve for viewing. You can view records of transactions

that are:

- Unauthorized

- Authorized

- Allotted

- Un-allotted

- Amended after allocation

- Amended before allocation

- Rejected

- You can also view all transactions that are either unauthorized or authorized only, by choosing the Unauthorized / Authorized option.

- To retrieve the adjustment transaction that is to be viewed, specify any or all of the details of the transaction in the corresponding fields on the screen, and click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Select the adjustment transaction that you want to view in the list of displayed transactions, in the lower portion of the screen

- The Transaction Detail screen is opened by double clicking the selected transaction, with the selected transaction displayed in view mode

6.2.5 Deleting Adjustment Transaction

You can delete only unauthorized adjustment transactions in the system.

To delete an adjustment transaction that you have previously entered, you must retrieve the same in the ‘Transaction Summary’ screen, as follows:

- From the main menu, invoke the Transaction Input menu. Select Adjustment transaction type and choose the Summary option. The Transaction Summary screen is opened.

- In the Authorized field, select the status of the adjustment transaction that you want to retrieve for deletion. You can only delete records of transactions that are unauthorized. Accordingly, choose the Unauthorized option from the drop down list.

- To retrieve the adjustment transaction that is to be deleted, specify any or all of the details of the transaction in the corresponding fields on the screen, and click ‘Search’ button. All adjustment transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Select the transaction that you want to delete in the list of displayed transactions, in the lower portion of the screen.

- The Adjustment Transaction Detail screen is opened by double clicking on the selected row in view mode, with the selected transaction displayed

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

6.2.6 Authorizing Adjustment Transactions

When you authorize an adjustment transaction, it not only acquires the Authorized record status, but it also becomes an “allotted” transaction. The number of units applied is allotted, with no processing for the load amounts.

For instance, if an adjustment subscription transaction is entered for a unit holder in a fund as follows:

Units applied: 1000

Adjustment price: 20 USD

Transaction amount: 20000 USD

Load amounts: 15

When you authorize this transaction, it is allocated immediately as follows:

Units allocated: 1000

Units confirmed: 1000

Load amounts: 15.

No processing is done for the load amounts, and the prevalent transaction base price at the time of allocation is not used. The adjustment price is used.

- To authorize an adjustment transaction, you must first retrieve the

same in the Summary screen. You can retrieve a previously entered transaction

in the Summary screen, as follows:

- In the Operation field, select the Authorize option from the drop-down list. If you choose the “Blank Space” option, then all the adjustment transactions that involve the specified unit holder are retrieved.

- In the Status field, select the status of the transaction that you want to retrieve for authorization. Typically, choose the unauthorized option from the drop down list. If you choose the “Blank Space” option, then all the adjustment transactions that involve the specified unit holder are retrieved.

- If you are a Fund Manager Component user, and you are authorizing transactions that have been amended, then only two options are available in this field – Amended before Allocation and Amended After Allocation. Choose the required option.

- To retrieve the transaction that is to be authorized, specify any or all of the details of the transaction in the corresponding fields on the screen, and click ‘Search’ button. All transactions with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- To authorize any single transaction that has been retrieved Click the Authorize option from the action list Records button to complete the authorization.

- To mark all retrieved records for authorization, click the Mark All for Authorize link. Then click the Authorize Marked Records button to complete the authorization.

6.2.7 Amending Adjustment Transaction

After a transaction is authorized, it cannot be modified using the Edit operation. To make changes to a transaction after authorization, you must invoke the Unlock operation, which is termed as the Amend operation.

You can amend an authorized transaction by:

- From the main menu select Agency Branch, invoke the Transaction menu. From Adjustment Transaction, choose the Summary option. The Adjustment Transaction Summary screen is opened.

- In the Authorized field, select the status of the adjustment transaction

that you want to retrieve for amendment. You can only amend records of

transactions that are authorized. Accordingly, choose any of the following

options from the drop down list:

- Authorized

- Allotted

- Un-allotted.

- To retrieve the transaction that is to be amended, specify any or all of the details of the adjustment transaction in the corresponding fields on the screen. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Select the transaction that you want to amend in the list of displayed transactions, in the lower portion of the screen, and double click the selected row. The adjustment transaction Screen is opened. Then click on the Unlock button in the Action List.

- The Adjustment Transaction Detail screen is opened in amendment mode, with the selected transaction displayed.

- You can amend the required details for a transaction provided the units in respect of the transaction have not been allocated:

- Accordingly, amend the necessary information. If required, you can specify the appropriate rejection code, if any, for the amendment, in the Reversal Code field. You can also specify any appropriate amendment remarks in the Remarks field.

- Click the Save button to save your changes.

6.3 Block or Unblock Transactions by Amounts

This section contains the following topics:

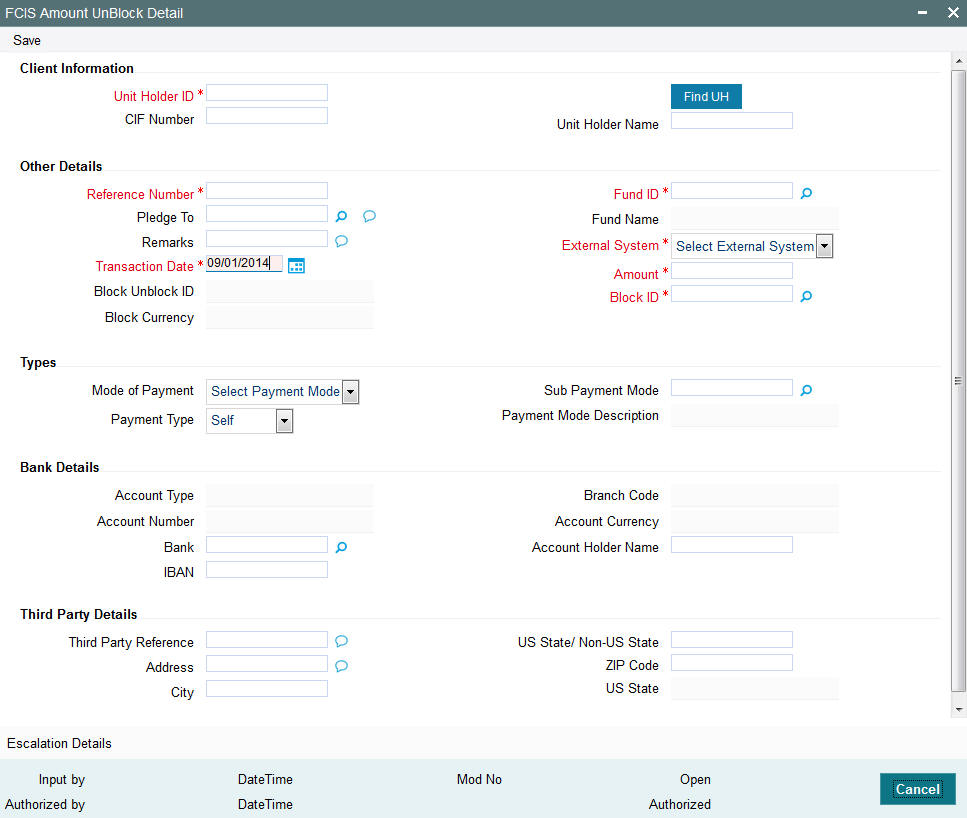

6.3.1 Invoking Amount Unblock Detail Screen

The FC-IS system provides the facility of accepting and processing block or unblock transactions that involve amounts across funds. It means that a specific amount portion of the investor’s holdings across funds can be blocked in the system.

You can also increase (i.e., escalate) the blocked amounts at a given frequency. Also, upon specific instructions from the investor, you can also reduce the blocked amounts for the purpose of unblocking. The unblocking could also be facilitated at any point of time and escalated at a designated frequency.

Note

For any investor, you can enter multiple transactions of the amount block type.

To enter and process such block transactions that involve blocking or unblocking of amounts across funds, use the ‘FCIS Amount Block Detail’ or ‘FCIS Amount UnBlock Detail’ screen. You can invoke the ‘FCIS Amount UnBlock Detail’ screen by typing ‘UTDAMT07’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select 'New' from the Actions menu in the Application tool bar or click new icon to enter the details of the amount block and unblock transactions.

To enter an amount block or unblock transaction in the Detail screen,

- Specify the CIF to which the unit holder for whom the transaction is being entered belongs. Then select the unit holder account.

- If you are unblocking against a previously blocked amount transaction, specify the date of the unblocking transaction.

- Specify a unique reference number for the transaction.

- If you are entering a block transaction, specify the pledgor, if any, to whom the amount is pledged.

- Specify the amount to be blocked or unblocked for the transaction.

- If you are unblocking against a previously blocked amount transaction, specify the fund from which the units may be redeemed.

- Specify any relevant details of escalation for the amounts, as well as any payment details (for the redemption of units due to unblocking)

- Click ‘Ok’ button to save the transaction.

6.3.1.1 Client Information Section

In this section, specify the details of the CIF customer or the investor that has requested for the amount block or unblock transaction.

Note

- To retrieve a CIF customer number or a unit holder number, click ’Find UH’ button.

- To enter a transaction for an investor that is attached to a CIF customer, first specify the number of the CIF customer in the CIF Number field, and then specify the identity number of the required unit holder in the Unit Holders ID field.

- To enter a transaction for an investor that is not attached to a CIF customer, specify the number of the required unit holder in the Unit Holder field.

CIF Number

Alphanumeric, Optional

If the unit holder that has requested for the transaction is attached to a CIF Customer, specify the number of the CIF customer in this field. The system retrieves the name of the CIF customer and displays it alongside this field.

Unit Holder ID

12 Characters Maximum, Alphanumeric, Optional. This information is mandatory if you have specified a CIF number.

Select the unit holder for whom the transaction request is being entered.

When you specify the CIF Number, all the unit holders that fall under the CIF are displayed in the drop down list in this field. You can make your choice from this list.

If you have selected a unit holder for the selected CIF using the Find link, the name and number of the selected unit holder is displayed here.

Unit Holder

12 Characters Maximum, Alphanumeric, Mandatory

If the transaction is being entered for a unit holder that is not under a CIF Number, specify the same in this field.

If you have selected a unit holder using the Find link, the number of the selected unit holder is displayed here.

If you have specified a CIF Number and selected a unit holder for the CIF, then the selected unit holder number is displayed here. It cannot be changed.

The unit holder specified here must belong to the same agency branch from where the adjustment transaction is being entered, if cross branching is not allowed for the agency branch.

The system displays the name of the unit holder alongside this field.

6.3.1.2 Other Details section

Block / Unblock ID

System Generated Information

Each amount block transaction that you enter is also given what is called a Block / Unblock ID, which is used to track any future amount unblock transactions that would be requested against this amount block transaction. At the time of transaction entry of an amount block transaction, it is the same as the Block ID, and is generated using the same logic as the Block ID.

For a single Block ID, multiple unblock transactions can be entered and processed.

At the time of entering an amount unblock transaction, the Block ID will be available for selection in the dropdown (Block ID) after selecting the external system and after the saving of Unblock Transaction, the Unblock ID is generated by the system.

Block ID

System Generated Information

This is a unique number automatically assigned to each amount block transaction by the system. It is internally generated upon successful entry of the transaction and after all validations have been made. Therefore, when you enter a new amount block transaction, this field is disabled.

The transaction number generated by the system is in the format TT-YYYY-JJJ-NNNNNNN

Where,

TT- Transaction type (“11” for amount block transactions, “12” for amount unblock transactions)

YYYY - Year of processing

JJJ - Julian date

NNNNNNN- Running sequence number for the day

If an agency branch goes offline during transaction entry, the validations cannot be made and the transaction number cannot be generated. In such a case, the reference number is the identification for the transaction till the system goes online and the validations can be made.

Note

For a single Block ID, multiple unblock transactions can be entered and processed. When you are entering an amount unblock transaction, the Block ID field is enabled and you can select the Block ID against which the unblock transaction is being entered, from the drop down list.

Block Currency

The currency of the amount that is allocated for the amount block

External System

Alphanumeric, Mandatory

The options are:

- SPB

- FCC

- ONLINE

The option list should be parameterized in the system parameters under 'Amount Block External System Code '.

Reference Number

16 Characters Alphanumeric, Mandatory

Specify a unique reference number that will be used to identify the amount block transaction in the system. Typically, this number is the number of the application that is used to enter this transaction. It will be the initial identification for the transaction, before the actual Block ID is generated by the system.

If the reference number is designated to be a system-generated number in the Defaults Maintenance, the system will internally generate and display this number when the transaction screen is opened, and this field is disabled.

Amount

Numeric, Mandatory

Specify the amount to be blocked against this amount block or unblock transaction. For amount block transactions, this is the amount that will be blocked across all the combination of fund and unit holder, in which the investor retains holdings. For amount unblock transactions, this is the amount that will be unblocked against the selected Block ID.

Transaction Date

Display only for amount block transactions, enabled and mandatory for amount unblock

transactions.

This is the date on which you enter the amount block transaction into the system. It is reckoned to be the application date, which is displayed here.

For amount unblock transactions, you can specify either the application date or a future date.

Pledged To

Alphanumeric, Optional

Specify the entity that the blocked amount is pledged to (i.e., the pledgor). This pledgor entity that you specify here must be the same for all amount block transactions that you enter for the unit holder that you have entered in the Unit Holder field. This means that for all amount block transactions entered into by a single unit holder, the pledgor entity specified must be the same.

On the first occasion that you enter an amount block transaction for a unit holder, the pledgor that you specify will be taken as the pledgor for the subsequent amount block transactions for the same unit holder, and will be displayed by default in this field.

When you are entering an amount unblock transaction, the pledgor details that you specified for the selected Block ID are displayed here, and cannot be changed.

Fund ID

Select the fund for which the amount needs to be blocked from the list which displays all the funds for which amount blocking is allowed.

Fund Name

Display

Explanation required from Dev/ Testing Team

ISIN Code

Specify the ISIN code for the fund where the amount needs to be blocked from the list which displays all the funds for which amount blocking is allowed..

Transaction Currency

Alphanumeric, Mandatory

When you specify the unit holder number in the Unit Holder field, the preferred currency of the unit holder is displayed here. This will be deemed as the transacting currency, by default. You can always change it when you are entering a new amount unblock transaction.

Fund ID

Alphanumeric, Optional

This field is only applicable for amount unblock transactions and is not visible in the case of amount block transactions.

Specify the fund from which units must be redeemed (if any) for the selected unit holder when you initiate the amount unblock transaction. You will be allowed to specify only one fund here.

You must specify a fund in which the unit holder will possess holdings to the extent of the unblocked amount, after the unblock transaction has been allocated. Refer the second example given at the beginning of this section for a detailed scenario

If you do not specify any fund in this field, then no redemption will take place in any fund, against the unblocked amount.

Refer to the section ‘Redeeming Units for Unblocked Amounts’ that is found later in this chapter, for a full discussion of the redemption process.

When you specify the fund, the ISIN Code of the fund is displayed in the ISIN Code field.

ISIN Code

12 Characters Maximum; Alphanumeric; Mandatory

Select the ISIN Code of the selected fund. If you specify the ISIN Code of a fund, the ID of the fund is displayed in the Fund field.

Agent

Display Only

The code of the Agent where the transaction is accepted is displayed here.

Branch

Display Only

The name of the Agency Branch where the transaction is accepted is displayed here.

Remarks

Specify if there are any remarks.

You can view the ‘Escalation Detail Section’ provided the client country parameter “SICREDSPECIFIC” is set to False for the installation in your bank.

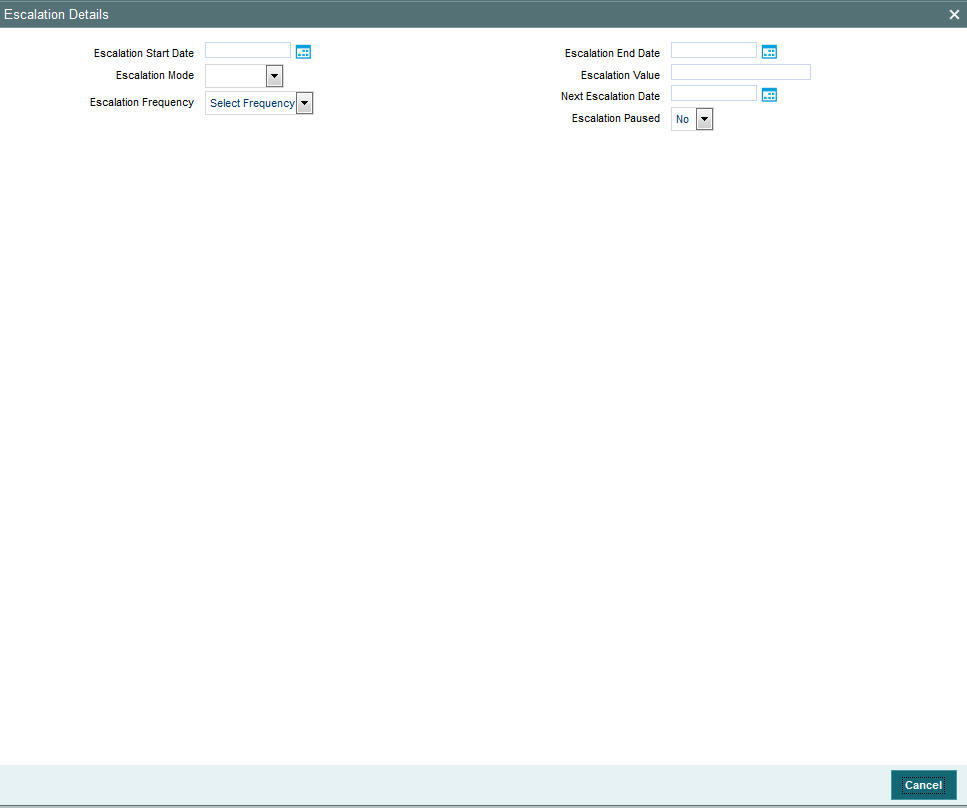

6.3.2 Escalation Details Button

Sometimes an investor may instruct the AMC to increase the blocked or unblocked amounts at pre-defined intervals. Such increase patterns are termed as escalation details.

In this section, you can maintain the pattern of escalation for the amount block or unblock transaction.

Note

This section is an optional section, but if you make an entry in any field here, then all the other fields will be mandatory and you must then make your specifications in all the fields.

Start Date

Date, Optional

Specify the date on which the first increase or first escalation must occur. Beginning from this date, the blocked (or unblocked) amount will be increased as specified, at intervals determined by the pre-defined frequency that you specify in the Escalation Frequency field.

End Date

Date, Optional

Specify the date on which the last increase or escalation must occur.

The start date and end date taken together signify a period during which escalation of the blocked (or unblocked) amount will occur at the frequency that you define in the Escalation Frequency field.

Escalation Type

Alphanumeric, Optional

Specify whether the increase is an amount-based escalation or percentage escalation. Select the desired type from the drop down list.

Escalation Value

Optional

Enter the value by which the blocked (or unblocked) amount must be increased. At each instance when the escalation comes into effect, the blocked amount will be increased by this value.

Escalation Frequency

Alphanumeric, Optional

Specify the frequency at which the escalation must occur. You can select the desired frequency format from the drop down list.

Next Escalation Date

Display Only

This is the date on which the next escalation will take place. It is updated by the system based on the escalation start date and the escalation frequency in the case of a new amount block or unblock transaction. For records retrieved in the Amend mode, this date may be altered in the amend session.

Escalation Paused

Optional

If you want the escalation to be halted for a while or a hiatus to occur, then check this box. No more escalation will occur till this box is unchecked.

6.4 Redeeming Units for Unblocked Amounts

This section contains the following topics:

- Section 6.4.1, "Processing Redemption Transactions against Unblocked Amounts"

- Section 6.4.2, "Retrieving Amount Block/ Unblock Summary Screens"

- Section 6.4.3, "Editing Amount Block/ Unblock Transaction"

- Section 6.4.4, "Viewing Amount Block/ Unblock Transaction"

- Section 6.4.5, "Deleting Amount Block/ Unblock Transaction"

- Section 6.4.6, "Authorizing Amount Block/ Unblock Transactions"

- Section 6.4.7, "Amending Amount Block / Unblock Transactions"

- Section 6.4.8, "Authorizing Amended Amount Block/ Unblock Transactions"

6.4.1 Processing Redemption Transactions against Unblocked Amounts

FC-IS provides the facility of redeeming the resulting units for a unit holder when an unblock amount transaction is put through against a Block ID.

When you enter an unblock transaction for a unit holder against a Block ID, you can also specify the fund from which the units may be redeemed when the unblock transaction is authorized and allocated.

Note

In an amount unblock transaction, the amount unblocked could be unblocked against a Block ID, across all the funds in which the amount was blocked. The redemption against this unblock amount can only be initiated in a single specified fund.

To enable the redemption of units in this way,

When you enter the unblock transaction in the Adjustment Unblock Amount Transaction screen against a Block ID, specify the fund in which the redemption must occur for the unit holder.

Specify the details of payment for the redemption transaction, in the Payment Details section.

When the amount unblock transaction is authorized on the date of entry, a redemption transaction for the unblocked amount is initiated in the system for the specified unit holder, in the specified fund. The date of this redemption transaction is the date of authorization of the amount unblock transaction.

Note

If the amount unblock transaction is a future-dated transaction, the redemption transaction would be initiated by a Beginning of Day (BOD) process on the transaction date. The date for the redemption transaction would then be the transaction date of the amount unblock transaction.

The redemption transaction is allocated by the End of Day (EOD) process on the redemption transaction date. The NAV considered for the allocation is the prevalent NAV on the redemption transaction date.

When an unblock escalation occurs, a redemption transaction is inserted for the unblocked amount by the BOD process on the date of escalation, and allocated by the EOD process on the date of escalation. The NAV considered for the allocation is the prevalent NAV on the date of escalation.

6.4.2 Retrieving Amount Block/ Unblock Summary Screens

You can perform all these operations through the Amount Block/Unblock Transaction Summary screens. You can retrieve a previously entered adjustment transaction in the Summary screen, as follows:

- In the browser, select the Amount Block Summary or the Amount Unblock

Summary options, from the Transaction menu category of the Agency Branch

module:

- The status of the block/unblock transaction in the Authorization Status field. If you choose the “Blank Space” option, then all the transactions that involve the specified unit holder are retrieved.

- The status of the block/unblock Transaction in the Record Status field. If you choose the “Blank Space” option, then all the transactions that involve the specified unit holder are retrieved.

- The unit holder ID

- The reference number of the amount block/unblock transaction, in the Amount Block/Unblock Transaction Number field.

- The fund ID of the amount Block/Unblock transaction

- The transaction date of the Amount Block/Unblock transaction

- Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual transaction detail from the detail screen by doing query in the following manner:

- Press F7

- Input the unit holder ID.

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

Example

You can search the record for unit holder ID by using the combination of % and alphanumeric value as follows:-

- Search by A%: System will fetch all the records whose unit holder ID starts from Alphabet ‘A’. For Example: AGC17, AGVO6, AGC74 and so forth.

- Search by %7: System will fetch all the records whose unit holder ID ends by numeric value’ 7’. For Example: AGC17, GSD267, AGC77 and so forth.

- Search by %17%:- System will fetch all the records whose unit holder ID contains the numeric value 17. For Example: GSD217, GSD172, AGC17 and so forth.

6.4.3 Editing Amount Block/ Unblock Transaction

You can modify the details of transaction that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Transaction Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorization Status field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed transactions. The Amount Block/ Unblock screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click ‘Ok’ button to save your changes. Amount Block/ Unblock Detail screen is closed and the changes made are reflected in the Amount Block/ Unblock Summary screen.

6.4.4 Viewing Amount Block/ Unblock Transaction

To view an amount Block/Unblock transaction that you have previously entered, you must retrieve the same in the Amount Block/Unblock Transaction Summary screen, as follows:

- From the main menu, invoke the Transaction menu. Select Amount Block/ Unblock transaction type, and choose the Summary option. The Amount Block/Unblock Transaction Summary screen is opened.

- In the Authorization Status field, select the status of the block/unblock

transaction that you want to retrieve for viewing. You can view records

of transactions that are:

- Unauthorized

- Authorized

- To retrieve the block/unblock transaction that is to be viewed, specify any or all of the details of the transaction in the corresponding fields on the screen, and click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Select the block/unblock transaction that you want to view in the list of displayed transactions, in the lower portion of the screen.

- The Amount Block/Unblock Transaction Detail screen is opened by double clicking the selected transaction, with the selected transaction displayed in view mode

6.4.5 Deleting Amount Block/ Unblock Transaction

You can delete only unauthorized Block/Unblock transactions in the system.

To delete an amount block/unblock transaction that you have previously entered, you must retrieve the same in the Transaction Summary screen, as follows:

- From the main menu, invoke the Transaction Input menu. Select Block transaction type and choose the Summary option. The Block Amount Transaction Summary screen is opened.

- In the Authorization Status field, select the status of the Block transaction that you want to retrieve for deletion. You can only delete records of transactions that are unauthorized. Accordingly, choose the Unauthorized option from the drop down list.

- To retrieve the Block transaction that is to be deleted, specify any or all of the details of the transaction in the corresponding fields on the screen, and click ‘Search’ button. All Block transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Select the Amount Block transaction that you want to delete in the list of displayed transactions, in the lower portion of the screen.

- The Block Transaction Detail screen is opened by double clicking on the selected row in view mode, with the selected amount block/unblock transaction displayed

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

6.4.6 Authorizing Amount Block/ Unblock Transactions

An unauthorized transaction record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Amount Block/ Unblock Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen. Click ‘Search’ button. All transactions with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you wish to authorize. The Amount Block/ Unblock Detail screen is displayed. Select Authorize operation from Action.

When the checker authorizes a transaction, details of validations, if any, that were overridden by the maker of the transaction during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the transaction.

6.4.7 Amending Amount Block / Unblock Transactions

Authorization of amended transactions can only be done from Fund Manager Module and Agency branch Module.

- Select the status of the adjustment transaction that you wish to retrieve for amendment. You can only amend records of transactions that are authorized.

- Specify any or all of the details of the adjustment transaction in the corresponding fields on the screen. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the adjustment transaction that you want to amend. The Adjustment Transaction screen will be displayed in Amendment mode. Click the Unlock operation from the Action list to amend the transaction.

- Amend the necessary information. Click the Save button to save your changes. Only escalation details can be changed during an amend operation.

6.4.8 Authorizing Amended Amount Block/ Unblock Transactions

An amended Amount Block/ Unblock transactions record must be authorized for the amendment to be made effective in the system. The authorization of amended records can only be done from Fund Manager Module and Agency branch Module.

The process of authorization is subsequently the same as that for normal transactions.