4. Processing Transaction Requests

Transactions are the operations that are requested by investors upon their holdings in any fund, with the prospect of reaping higher returns or distributing their holdings more profitably. To this end, they can enter into any of the following types of transactions:

- IPO

- Purchases (or Subscriptions)

- Sales (or Redemption)

- Switch

- Transfer

- Block

- Unblock

- Consolidation

- Split

- Reissue

- Transaction Enrichment

This chapter enables you to understand how transaction requests are accepted and processed in the FC-IS system. It consists of the following sections:

- Types of Transaction Requests

- Transaction Processing – The flow of events

- Transaction Processing Procedures

- Fields in the Transaction Detail screens

- Fields in the Transaction Summary screens

- Mandatory Information for all transaction types

Finding what You Need in this Chapter

- To understand the different types of transaction requests that may be encountered in an AMC, refer the section Types of Transaction Requests.

- To understand the flow of events according to which transaction requests are accepted and processed in the FC-IS system, refer the section Transaction Processing – The flow of events.

- To understand how to perform any procedures in respect of transaction processing, refer the section Transaction Processing Procedures.

- For a description of all the fields in the Transaction Detail screen, refer the section Fields in the Transaction Detail screens. Similarly, for a description of all fields in the Transaction Summary screen, refer the section Fields in the Transaction Summary screens.

- For an exhaustive list of all mandatory information that you need to capture in the transaction screens, refer the section Mandatory Information for all transaction types.

This chapter contains the following sections:

- Section 4.1, "Types of Transaction Requests"

- Section 4.2, "Transactions Generated by FCC"

- Section 4.3, "Transaction Processing –Flow of Events"

- Section 4.4, "Transaction Processing Procedures"

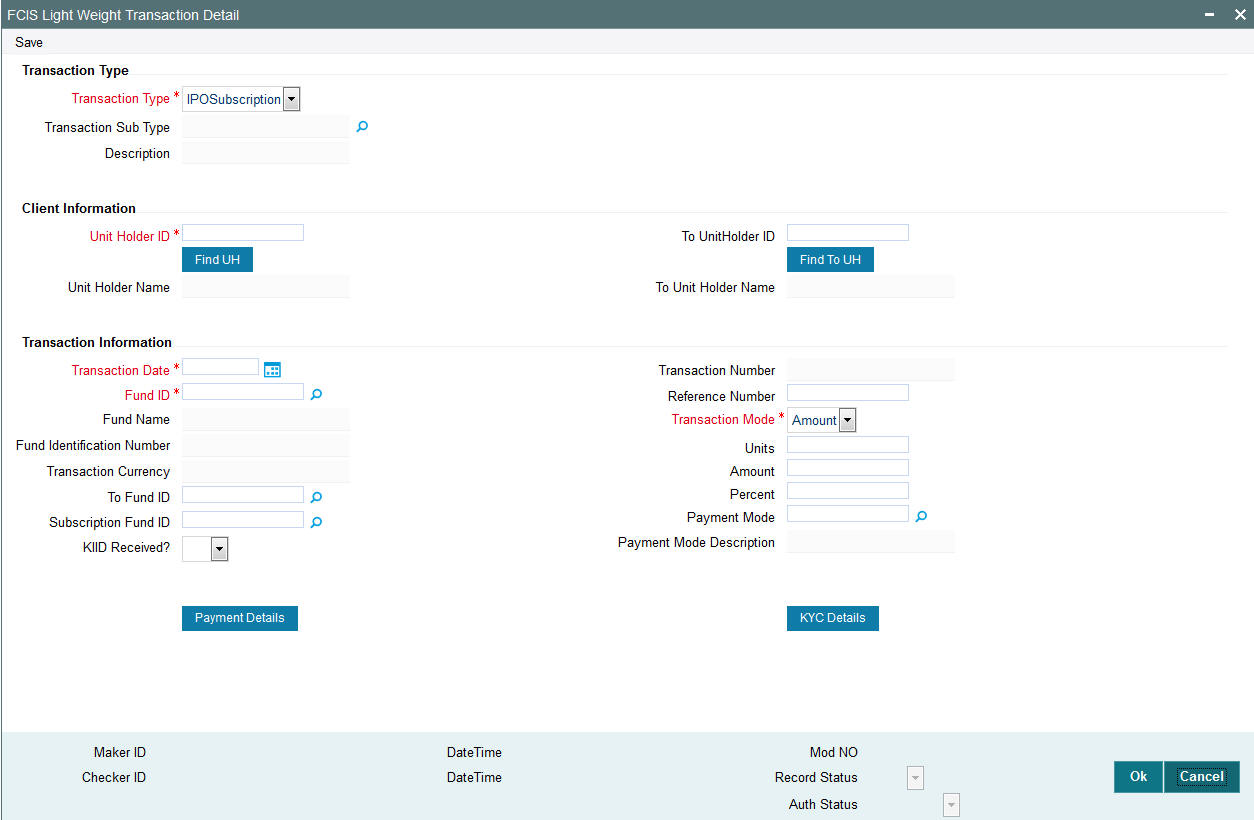

- Section 4.5, "IPO Subscription Detail"

- Section 4.6, "IPO Subscription Summary Screen"

- Section 4.7, "Bulk Transactions"

- Section 4.8, "Bulk Transaction Summary"

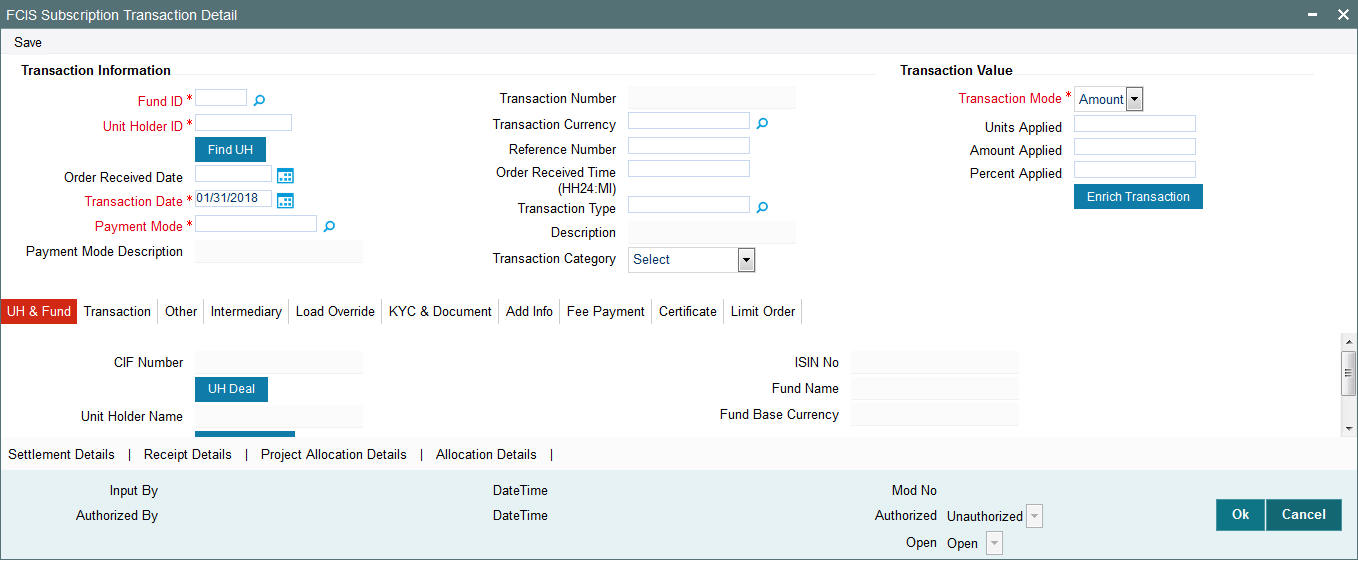

- Section 4.9, "Subscription Transaction Detail"

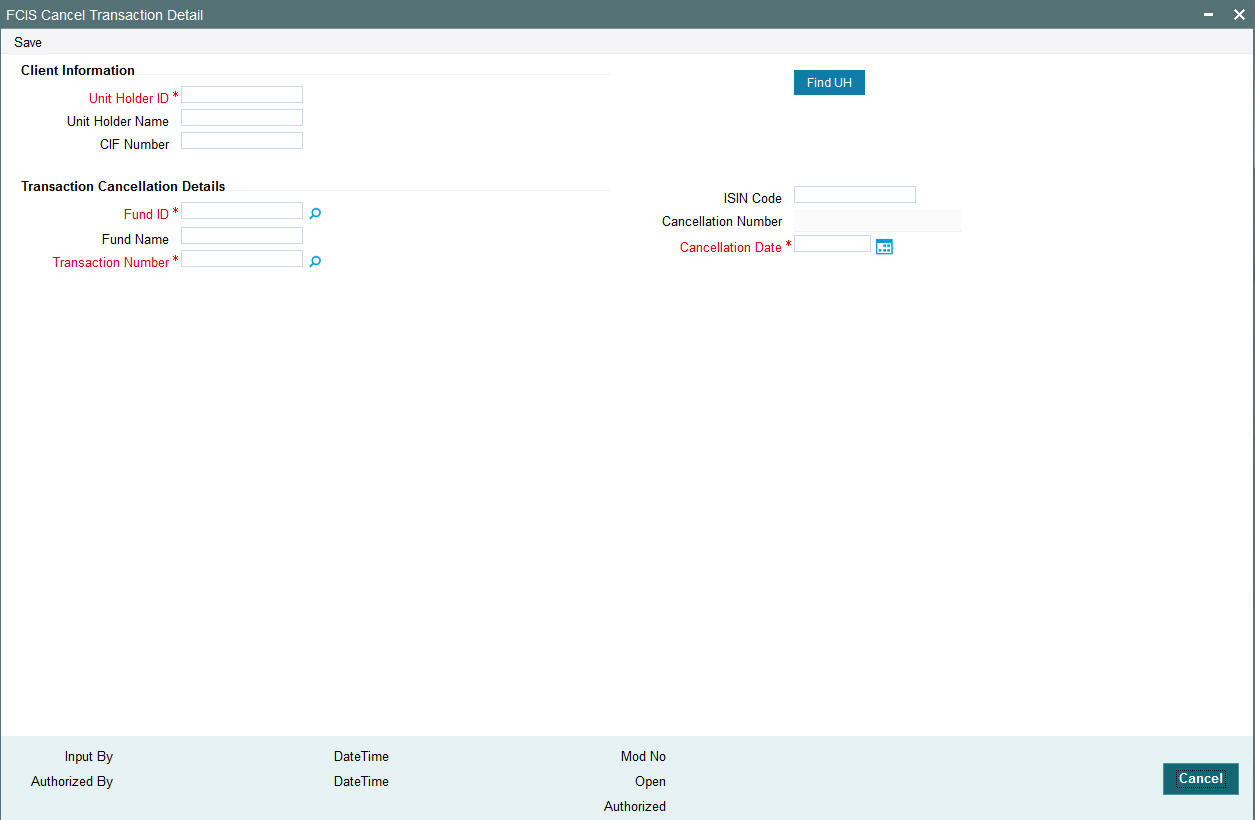

- Section 4.10, "Cancel Transaction Detail"

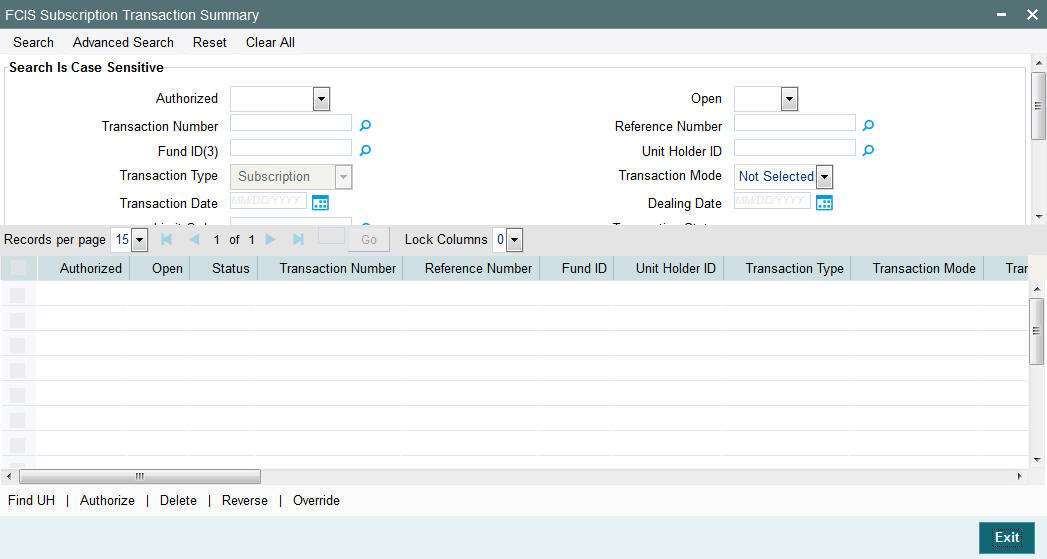

- Section 4.11, "Subscription Transaction Summary Screen"

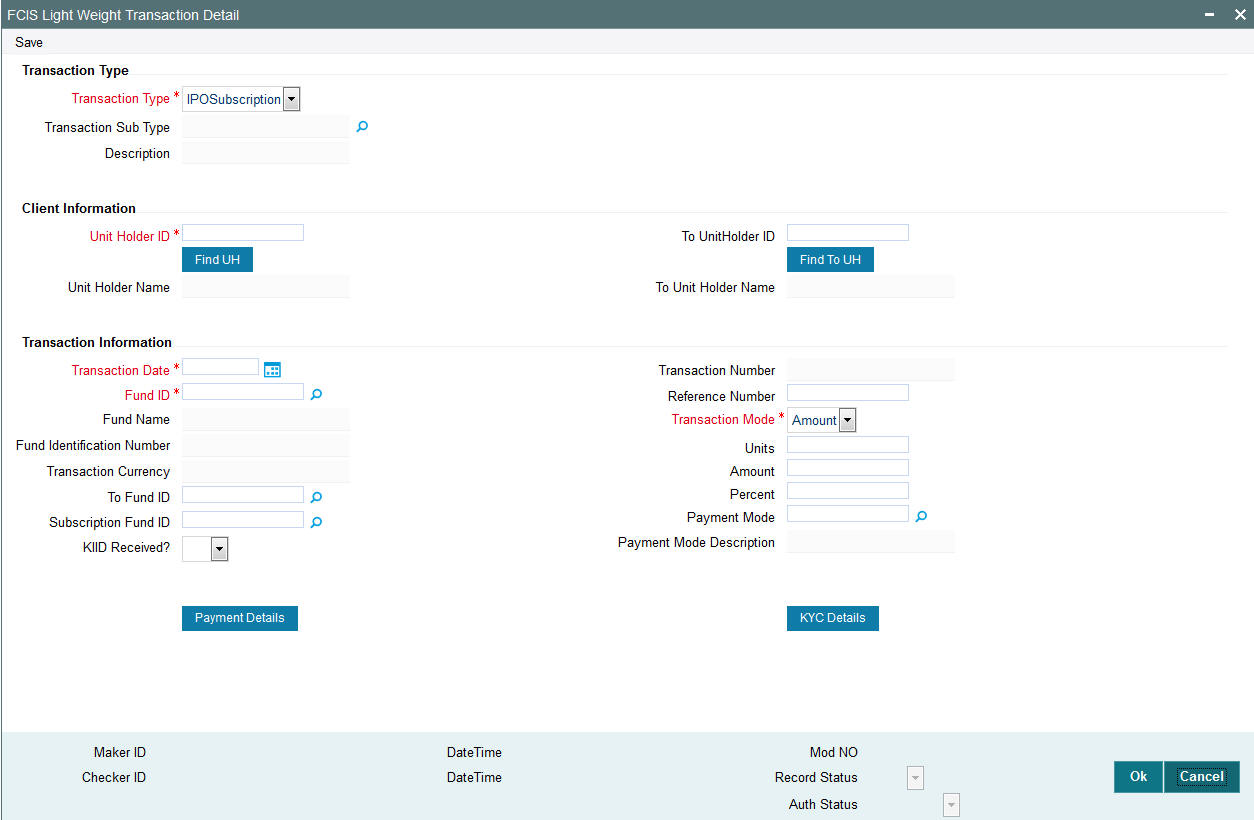

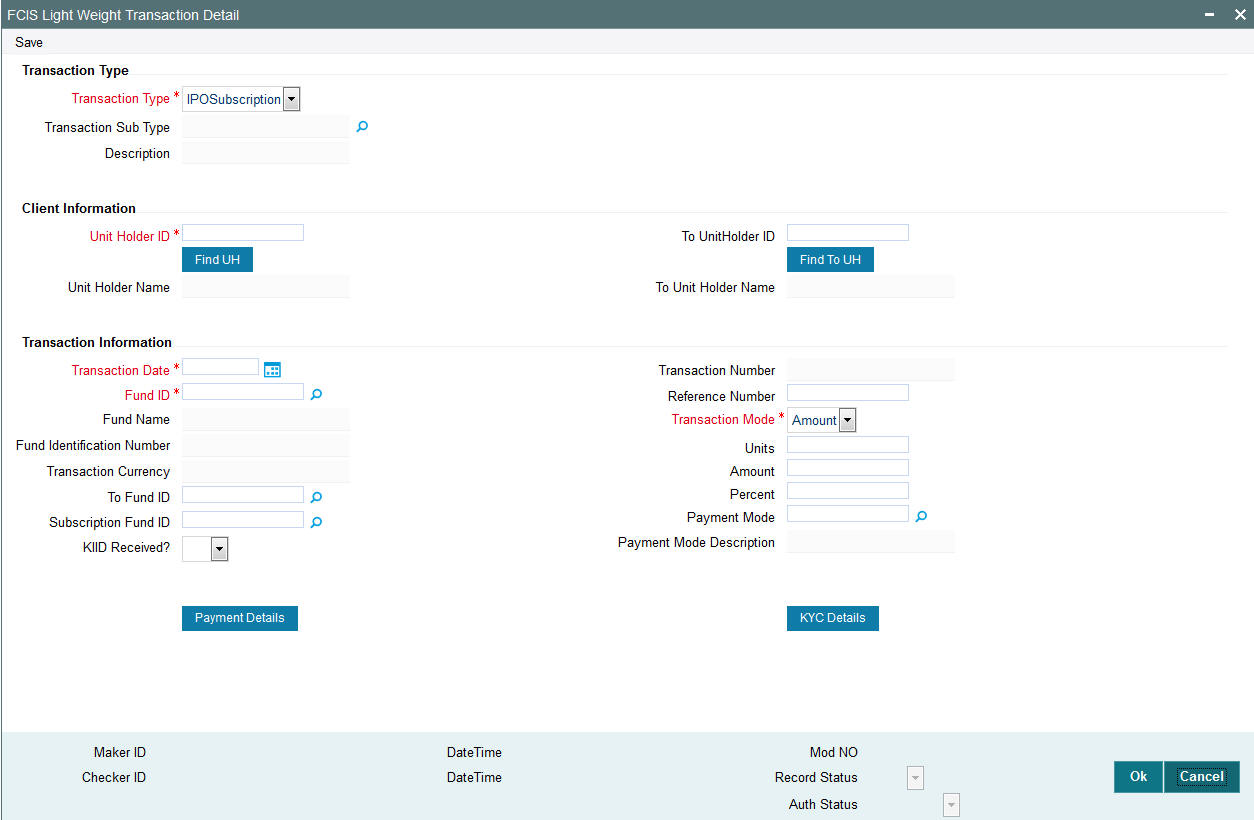

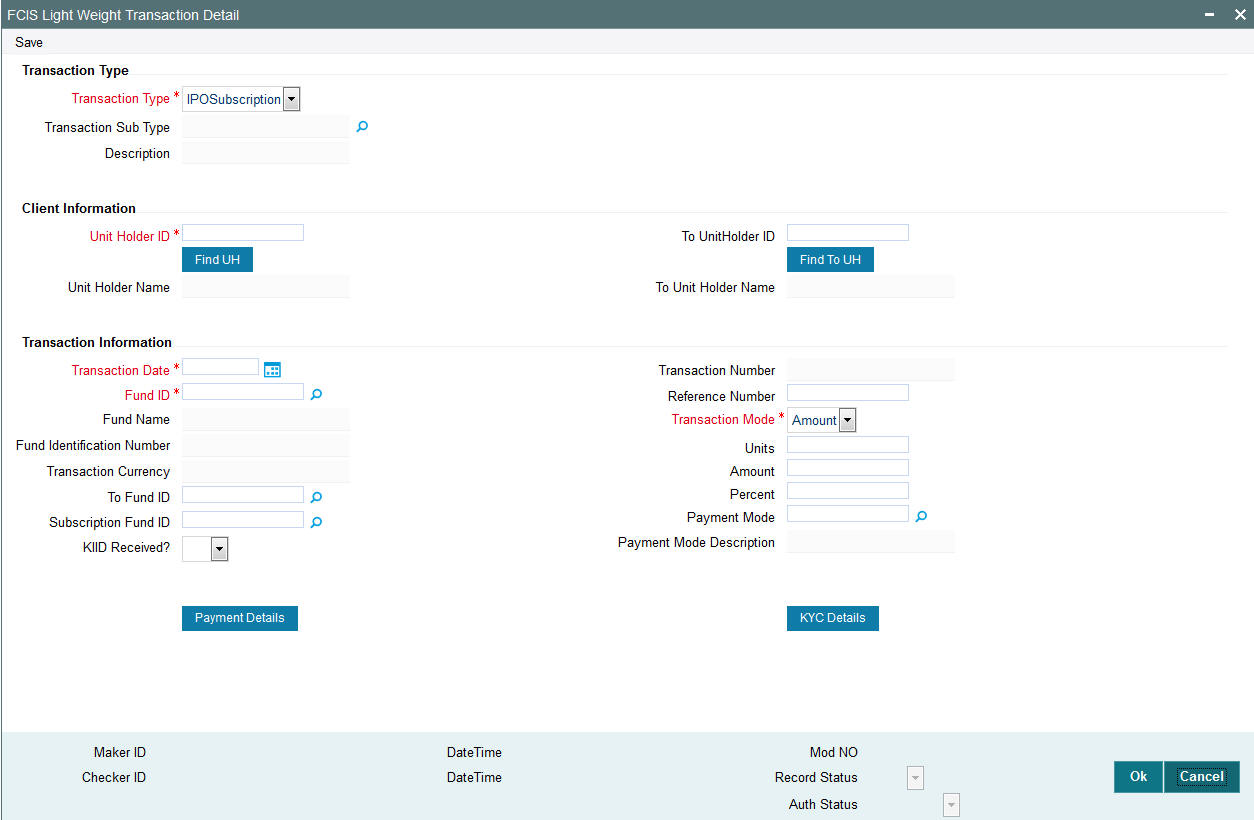

- Section 4.12, "Light Weight Transaction Detail"

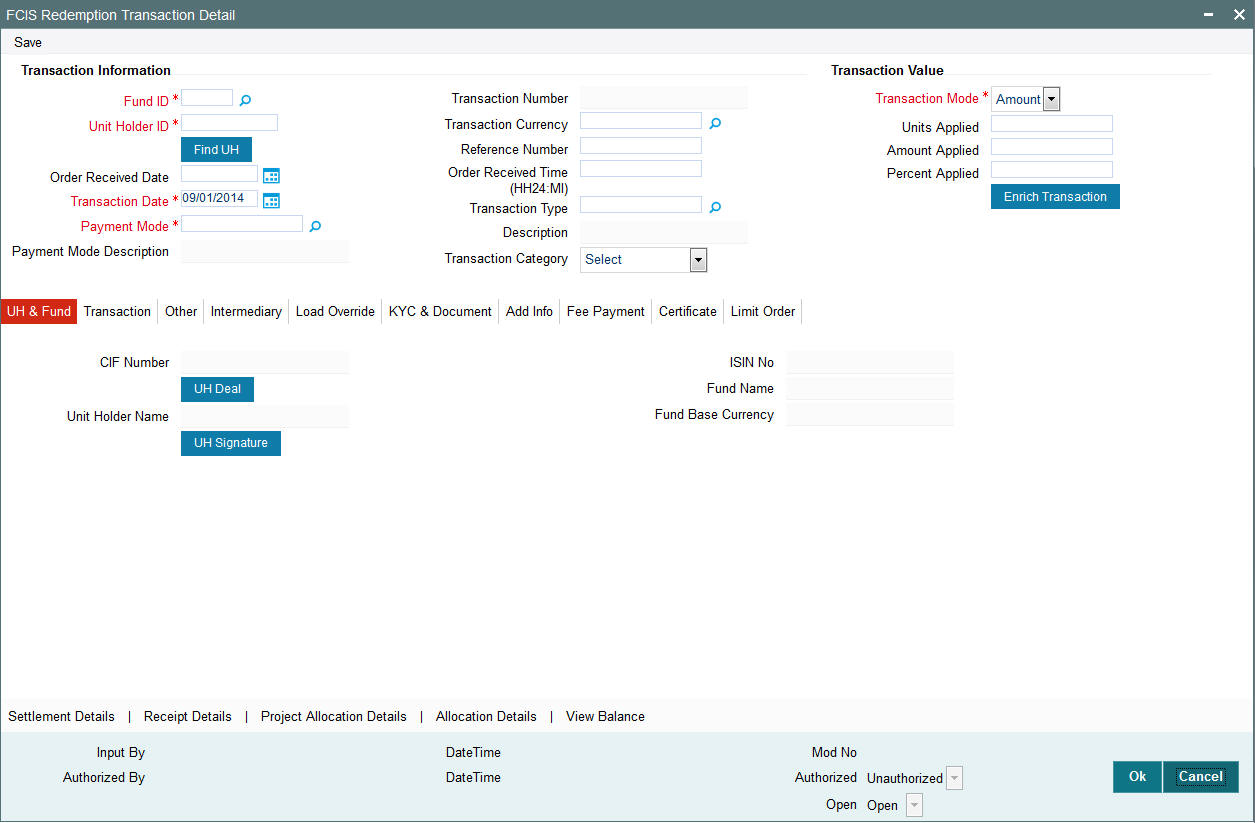

- Section 4.13, "Redemption Transaction Detail"

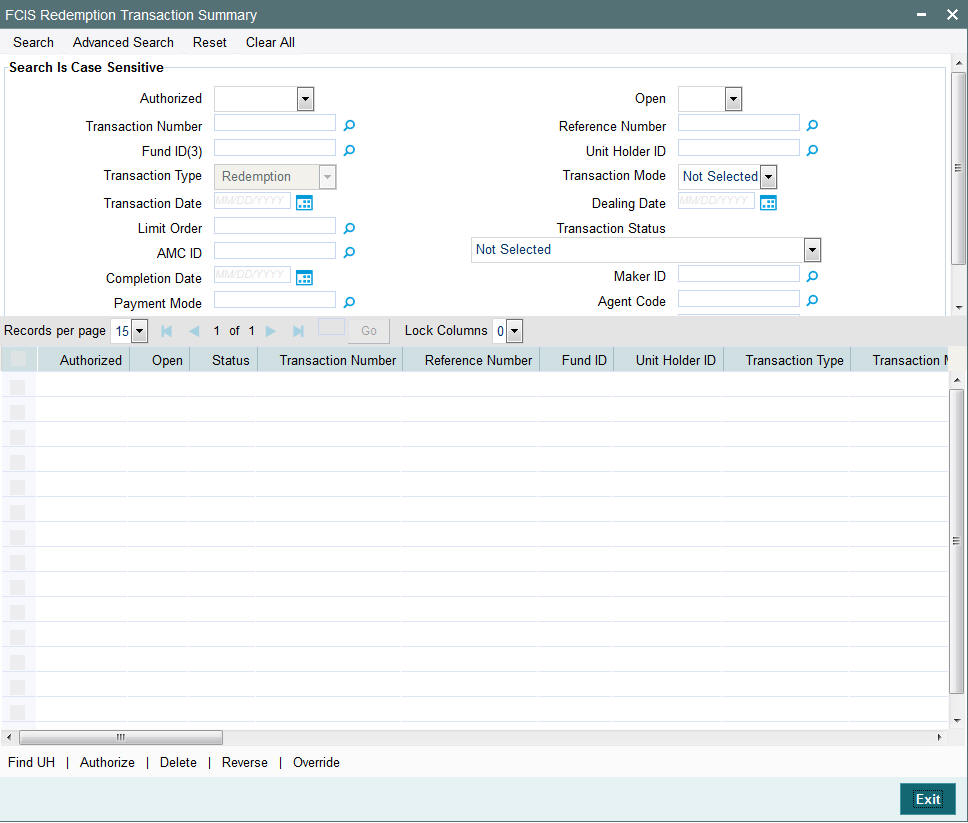

- Section 4.14, "Redemption Transaction Summary"

- Section 4.15, "Light Weight Transaction Detail"

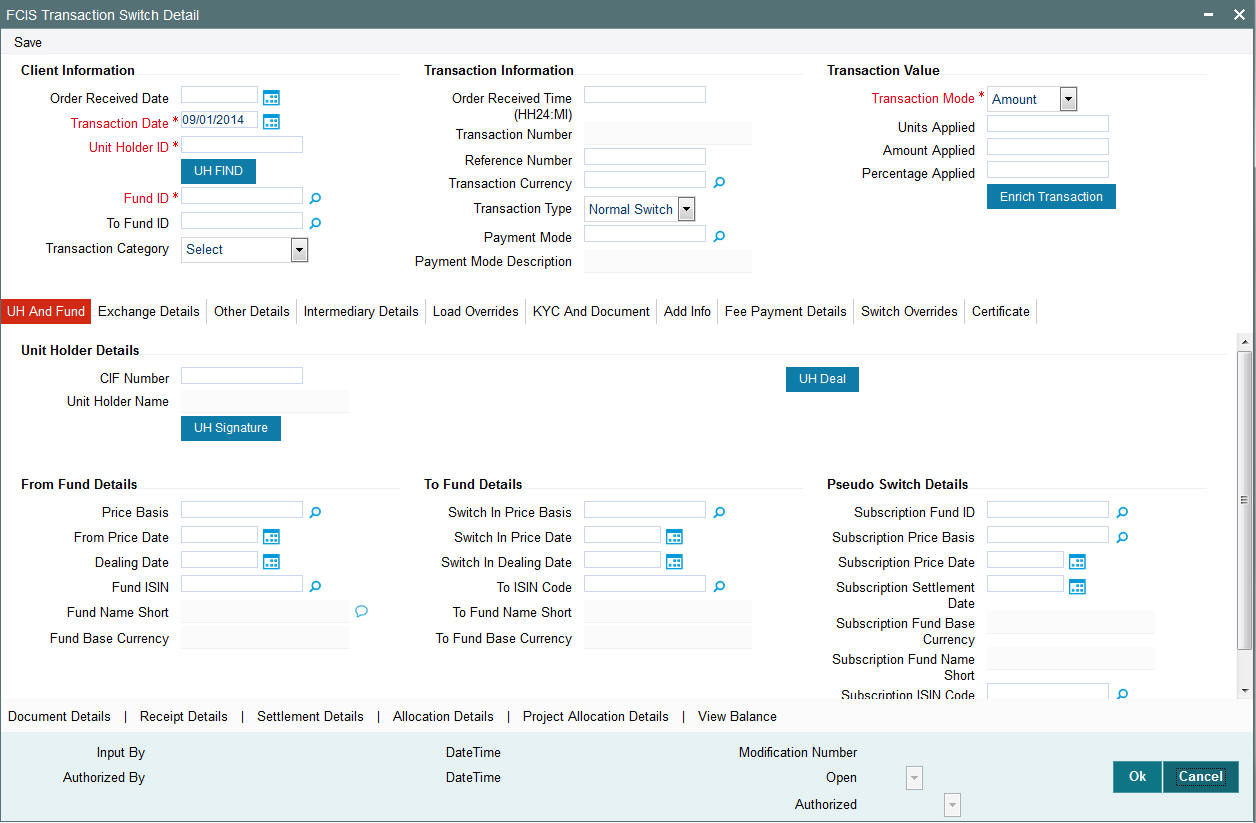

- Section 4.16, "Transaction Switch Detail"

- Section 4.17, "Light Weight Transaction Detail"

- Section 4.18, "Transaction Switch Summary Screen"

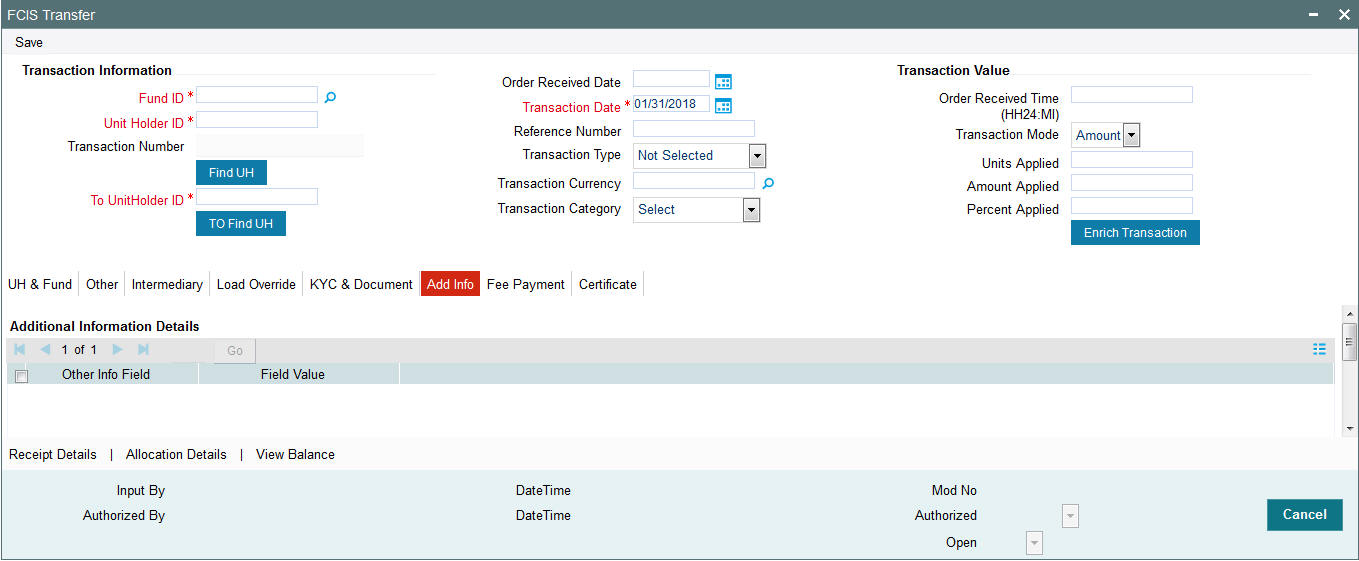

- Section 4.19, "Transfer Detail"

- Section 4.20, "Light Weight Transaction Detail"

- Section 4.21, "Transfer Summary Screen"

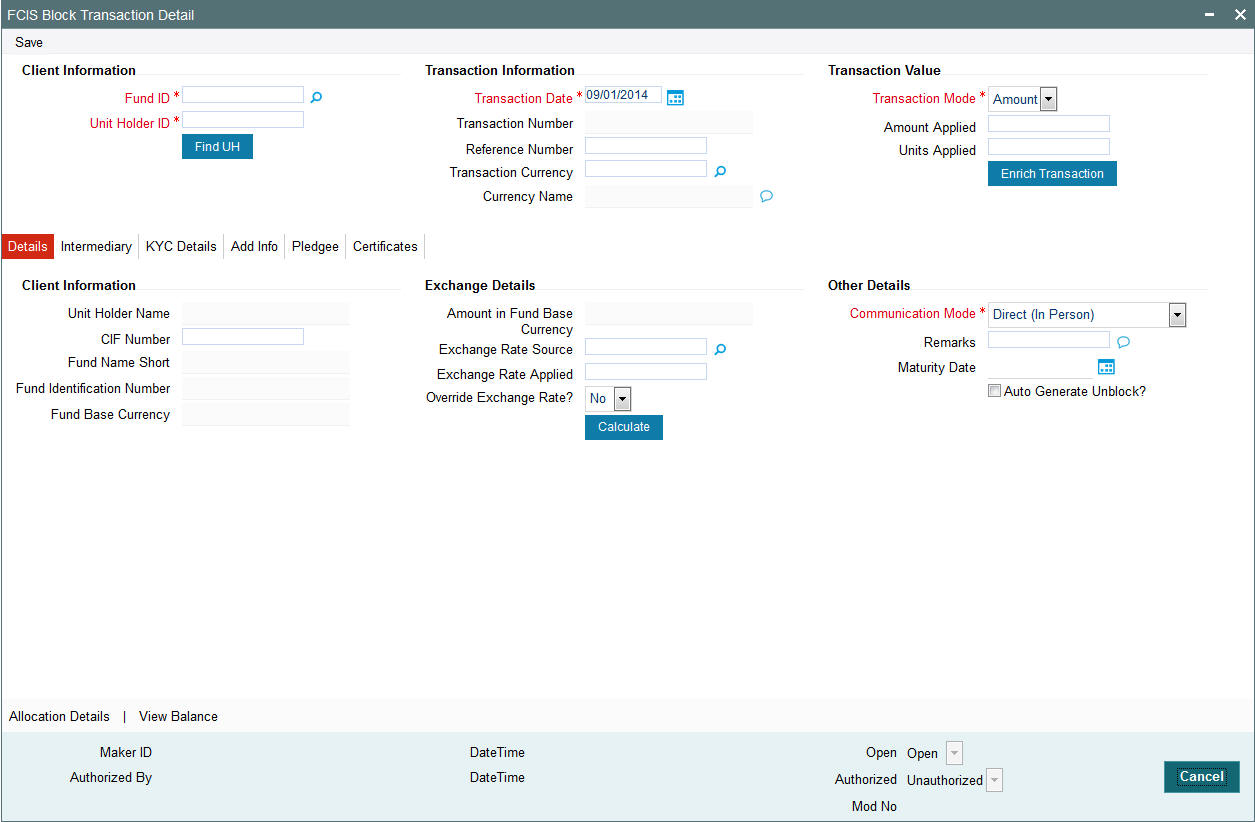

- Section 4.22, "Block Transaction Detail"

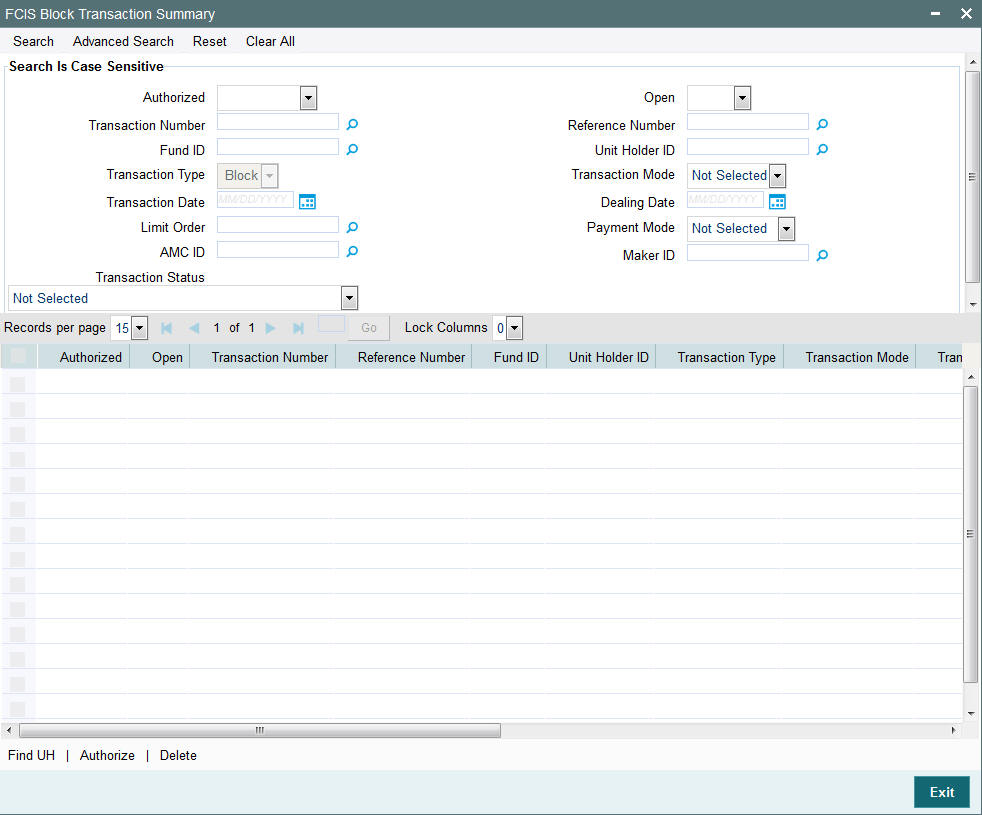

- Section 4.23, "Block Transaction Summary Screen"

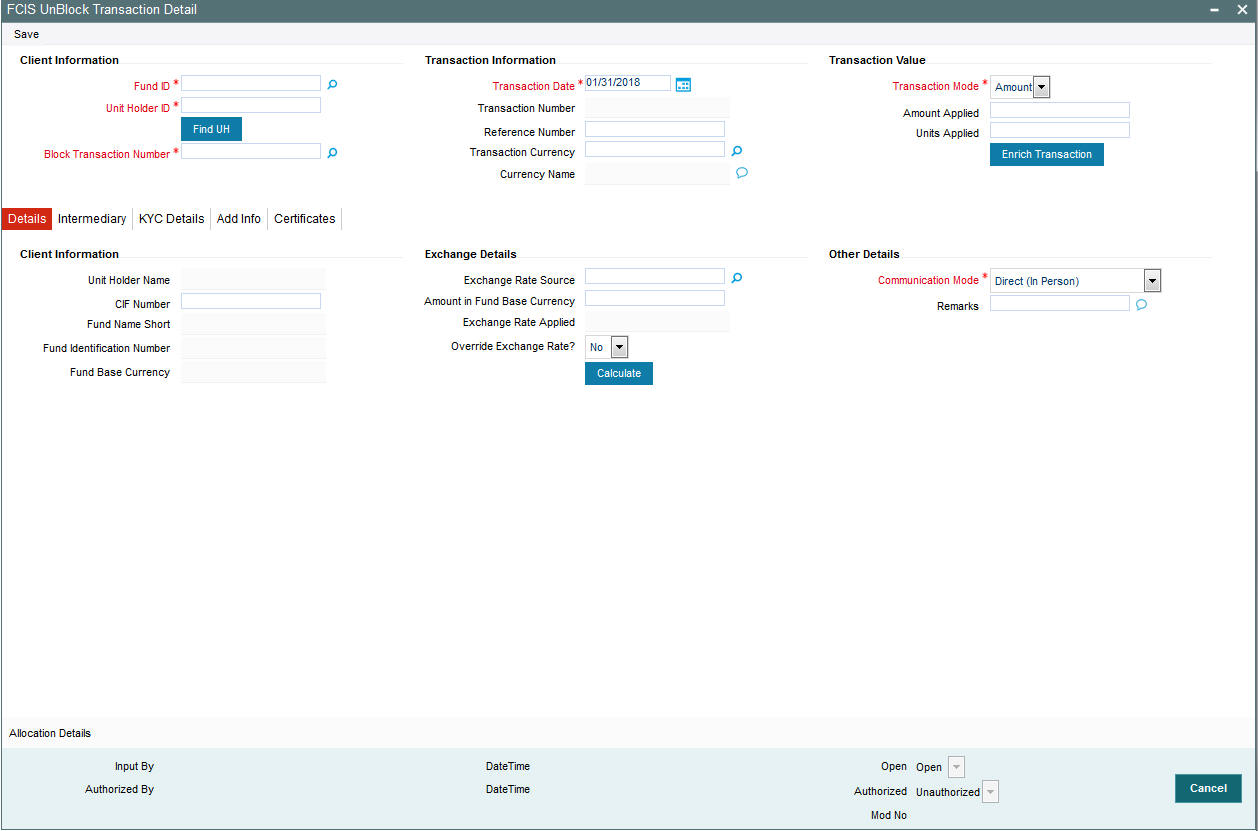

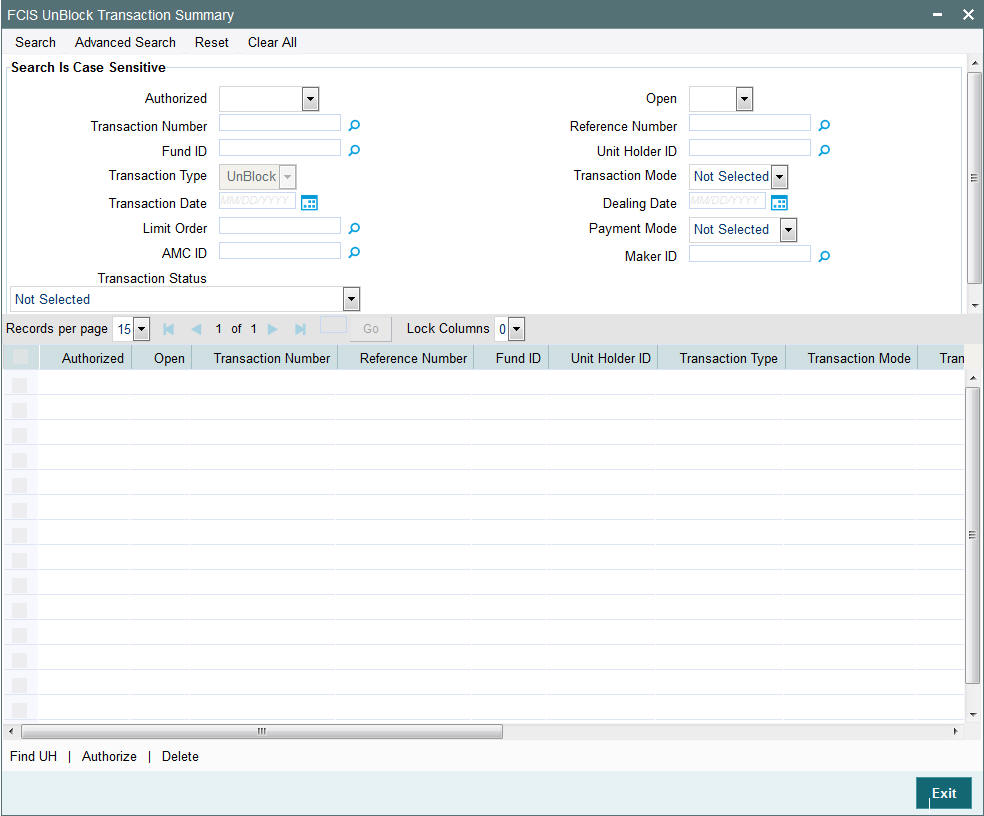

- Section 4.24, "Unblock Transaction Detail"

- Section 4.25, "Unblock Transaction Summary Screen"

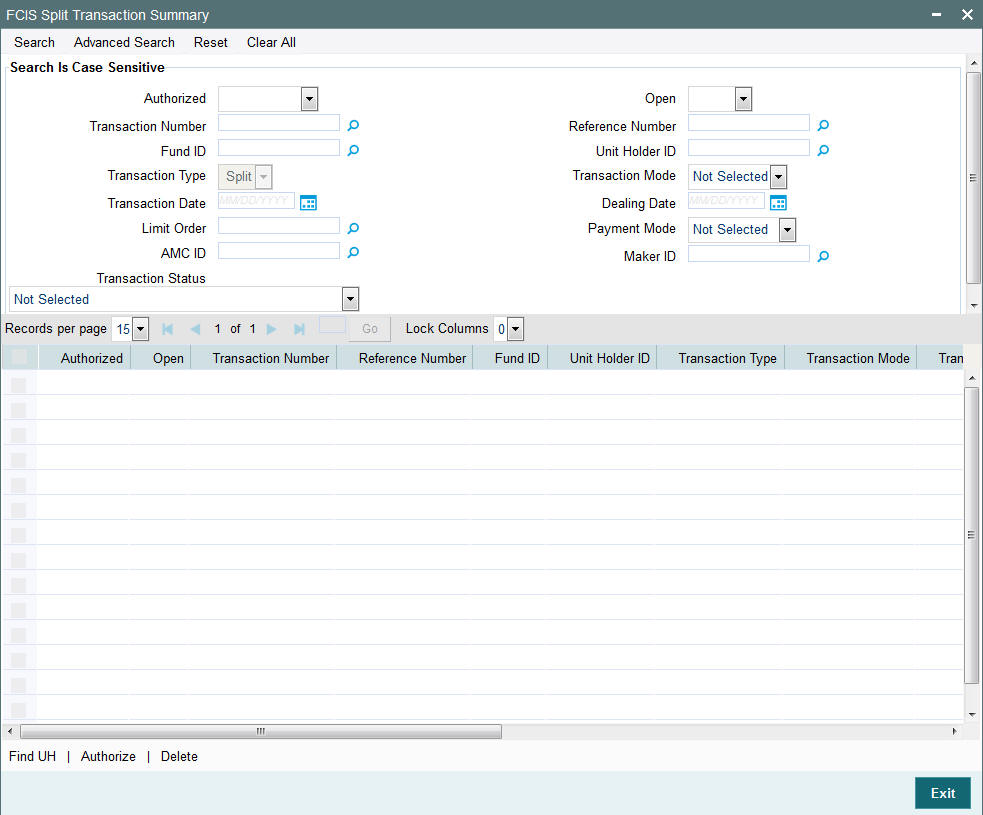

- Section 4.26, "Split Transaction Detail"

- Section 4.27, "Split Transaction Summary Screen"

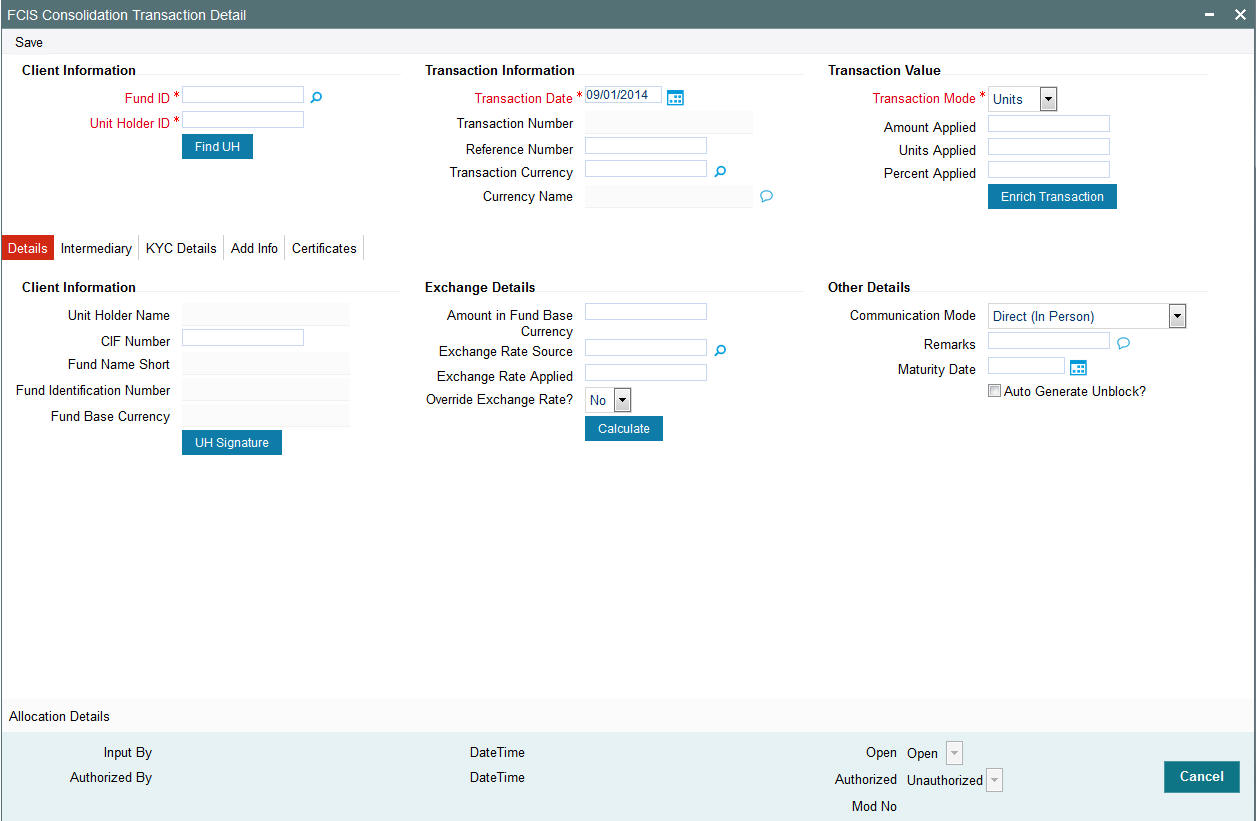

- Section 4.28, "Consolidation Transaction Detail"

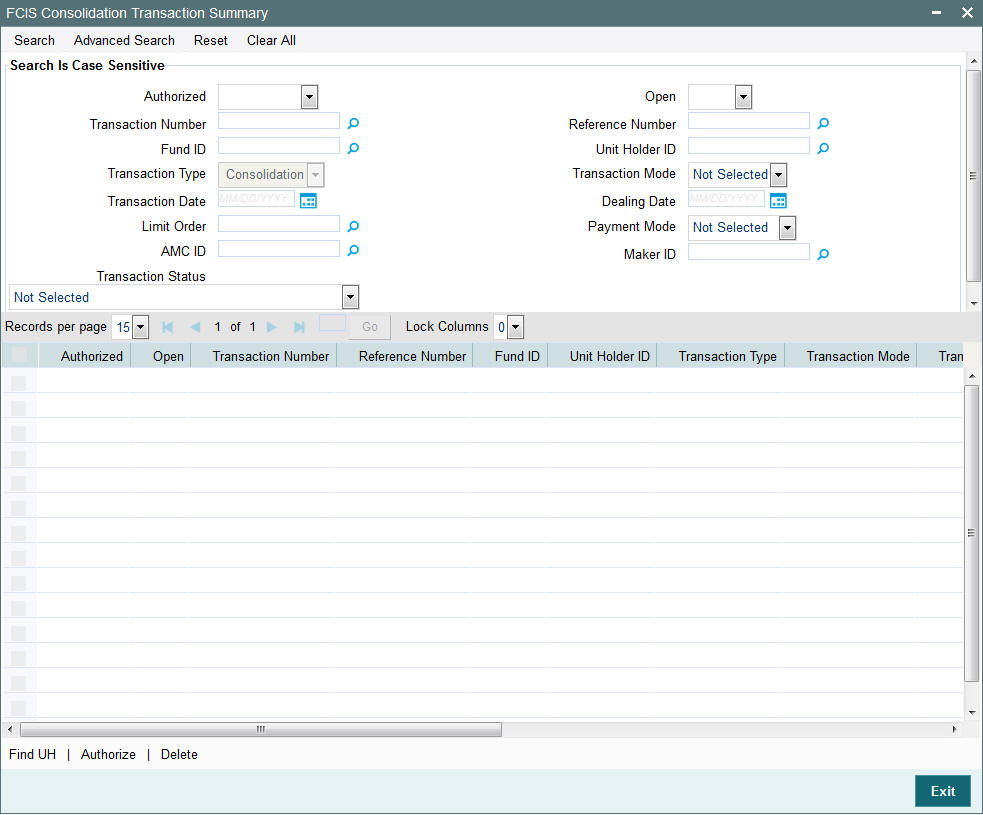

- Section 4.29, "Consolidation Transaction Summary Screen"

- Section 4.30, "Reissue Transaction Detail"

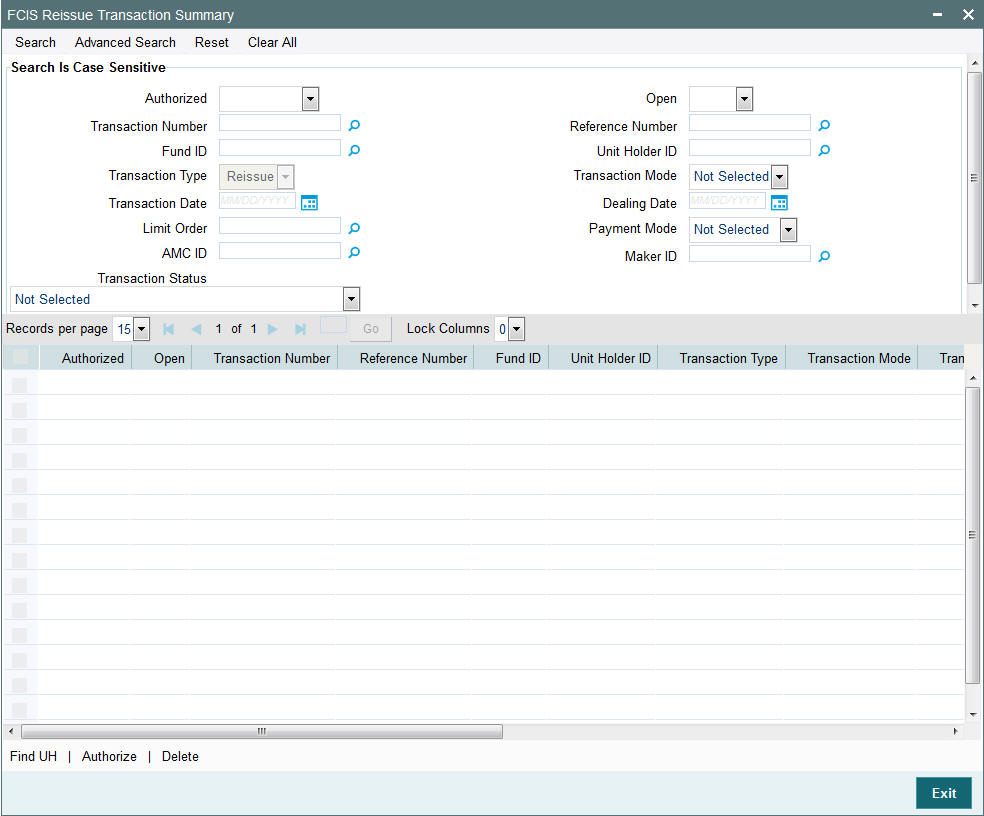

- Section 4.31, "Reissue Transaction Summary Screen"

- Section 4.32, "Defaulting of Price Date in Transaction Screens"

- Section 4.33, "Completing Transaction"

- Section 4.34, "Processing Back Data Propagation for Transactions"

4.1 Types of Transaction Requests

This section contains the following topic:

4.1.1 Types of Transaction Requests

IPO Subscription and Subscription

When an investor chooses to invest capital into a fund, the investment is typically made by ‘buying’ units in the fund. This is also known as ‘subscribing’ into the fund.

The investor can subscribe to a fund either during its Initial Public Offering (IPO) Period, or later. If the subscription is made during the IPO Period, the resulting transaction is an IPO subscription transaction, and the unit price for these transactions is fixed, generally the par value of the units, and not dependent on the prevalent net asset value for the fund.

If the investor’s subscription is made after the initial IPO Period, the resulting transaction is known plainly as a subscription transaction, and the unit price for these transactions will vary on a fixed frequency basis, depending upon the prevalent net asset value of the fund.

Redemption

When an investor decides to pull investment out of a fund (or disinvest in a fund), the units held by the investor are sold back to the fund (“redeemed”) at the prevalent Net Asset Value on the date of sale. This kind of a transaction is known as a redemption transaction. An investor can redeem all the holdings (complete redemption) or part of the holdings (partial redemption)

While “redeeming” or selling back units to the fund, the investor recovers the value of the holdings in the fund at that given point in time. It also means that the fund buys back its units from the investor.

An investor can redeem a specified number of units, or a specified amount, or a specified percentage of the holdings in any fund.

The fund may also prompt the investor to partially redeem the holdings under the following circumstances:

- The minimum registered capital has fallen below the minimum limit defined for the fund in the fund rules. In such a case, the redemption transaction is not allocated at all.

- The fund investor category limit falling down to the minimum limit defined for the fund in the fund rules.

Partial redemption may also occur due to other prevailing circumstances.

The AMC can set a limit on the total volume of redemption transactions that would be accepted for a fund on a given business day. The limit could be specified in terms of a percentage or an amount. Redemption transactions that are requested which result in exceeding the limit set for the fund will not be accepted, in such a case.

In the system, if the investor’s balance reduces to zero as an account of a redemption transaction, the investor’s account will be marked as pending closure.

Redemption through check writing

An investor may also request for the check writing facility, for usage of holdings in any of the funds. In such a case, a checkbook is issued to the investor for each fund. The investor may issue checks for payments, to any third party.

When these checks are presented at the specified bank, they are sent to the appropriate clearing house. The bank then sends a file to the AMC, containing used check information from the clearing house.

When the AMC receives details of used checks from the bank, a redemption transaction is initiated in the investor’s account, and units are redeemed in the fund for which the checkbook was issued, to the extent of amount used on each check. No payment details are required for such redemption transactions.

Switch

An investor may choose to “switch” the investment in one fund, to another fund, for any reason. This would mean redeeming the investment in one fund and investing this redeemed capital in the other desired fund. This kind of exchange or switch is called a switch transaction.

In the system, a switch transaction is processed as two separate transactions, the first involving a redemption from the first fund, and the second involving a subscription to the second fund. The switching facility in the system provides for switching either between funds in the same fund family, or between any two funds of the AMC. Switching within the same fund is defined as ‘Bed and Breakfast switch’ (the ‘Switch from’ fund and the ‘Switch to’ fund in a switch transaction is same).

Transfer

An investor may choose to transfer ownership of holdings in any fund to another investor. This kind of a transfer of ownership is called a transfer transaction.

A transfer transaction is different from a switch transaction in the sense that in a transfer transaction, the fund remains the same whereas the unit holder changes.

Block / Unblock

Typically, when lien is noted in respect of an investor’s holdings in a fund either in part or entirely, the concerned units are said to be “blocked”. These blocked units are subsequently (and temporarily) unavailable to the investor for further transacting. Blocking of units could also occur due to any reason other than lien noting. The process of blocking units is called a block transaction.

To release the blocked units for further transacting, the investor must ‘unblock’ these units, or the lien must be lifted. This is known as an unblock transaction.

Split / Consolidation / Reissue

In certain funds, the investors receive certificates that are representative of their holdings (investment units) in the fund. These funds are called scrip-based funds. In certain funds, the investors are given units for their investment in the fund, without certificates. These funds are called scrip-less funds.

In certain funds, the investor is given the option of requesting for certificates. If the investor chooses to receive certificates, then the fund furnishes the same. If not, then no certificates are issued. Such funds are termed as certificate-option funds.

In scrip-based funds and certificate option funds where certificates have been requested for, an investor may choose to:

- Split a single certificate into certificates of smaller denominations, resulting in a split transaction.

- Merge many certificates of smaller denominations into a single certificate of their total denomination, resulting in a consolidation transaction.

- Seek a ‘reissue’ of certificates for reasons of losing a certificate or mutilation of certification etc, resulting in a reissue transaction. In such an event, the reissued certificates are printed with a ‘Duplicate’ tag on them.

The FCIS system provides the facility to process any of the transaction types enumerated above.

4.2 Transactions Generated by FCC

This section contains the following topics:

- Section 4.2.1, "Generating Subscription Transaction"

- Section 4.2.2, "Generating Redemption Transaction"

4.2.1 Generating Subscription Transaction

To recall, at installations where Oracle FLEXCUBE Corporate (FCC) is also present, an interface is defined between FCC and FCIS. A ‘Sweep-Out’ event in FCC triggers a subscription transaction and ‘Sweep-In’ FCC event triggers net redemption transaction in FCIS.

Whenever a ‘Sweep-Out’ event occurs in an FCC account, a subscription transaction is triggered in the corresponding unit holder account in FC-IS. The subscription transaction is generated as an authorized transaction. During authorization, FC-IS debits the FCC account for the gross transaction amount and the relevant FCC GL entries are posted. The payment details will be defaulted with the details of the Sweep-Out FCC Account.

After the sweep-out event, an End of Cycle (EOC) operation checks the FCC account balance. If the balance exceeds the sweep-out limit, then the surplus balance will be moved to FCIS. All Fund level validations for subscription is applicable for sweep-out transactions.

4.2.2 Generating Redemption Transaction

Similarly, a ‘Sweep-In’ event in an FCC account triggers a redemption transaction in the corresponding unit holder account in FC-IS. On allocation, FC-IS credits the FCC account with the net redeemable amount. The payment details will be defaulted with the details of the Sweep-In FCC Account.

Whenever a retail teller transaction is authorized in FCC, a Sweep-In process is triggered in FCC and a corresponding redemption transaction is triggered in FCIS.

Note

- Sweep-In transactions are applicable only for Retail teller transactions.

- You will not be allowed to reverse subscription/redemption transactions generated due to the Sweep-In/Sweep-Out. Sweep-In/Sweep-Out is originated from the default bank accounts maintained for the unit holder in FC-IS.

4.3 Transaction Processing –Flow of Events

This section contains the following topics:

- Section 4.3.1, "Unauthorized Stage"

- Section 4.3.2, "Authorized Stage"

- Section 4.3.3, "Amendment Stage"

- Section 4.3.4, "Allocation of Transactions"

4.3.1 Unauthorized Stage

The transaction is first initiated into the system database when it is entered into the Transaction Detail screen for the required transaction type. In this screen, it is saved as an unauthorized transaction, which means that it is not reflected in the system’s financial data stores as yet.

The transaction is given a unique identification called the Transaction Number.

During this unauthorized phase of the transaction, you can edit the details of the transaction as many times as is deemed necessary, using the Edit operation through the Transaction Summary screen. The transaction number is not changed when you edit a transaction.

An unauthorized transaction can only be edited by the user who initiated it into the system.

Due to various reasons, the supervisor can also reject transactions. Any such rejected transaction can also be edited.

4.3.2 Authorized Stage

When the transaction is authorized, the value of the transaction will be reflected in the system database.

The user who enters the transaction in the system cannot authorize it. A user other than the one that entered the transaction can perform authorization.

When a transaction is authorized, the authorizer must re-key the transaction amount or number of units, which was specified for the transaction during transaction entry. When this is successfully done, the transaction can be authorized.

The events that take place when you authorize a transaction can be understood from the table given below:

Online Allocation facility |

Mode of Payment |

Check / Credit Card / Transfer allocations on par with cash |

Upon Authorization |

Allocation of Units |

Available |

Cash |

|

Confirmed units allocated |

Confirmed units allocated upon authorization |

Available |

Check / Credit Card / Transfer |

Available |

Provisional Units allocated |

Provisional Units allocated upon authorization, confirmed units on the date on which the check / credit card / transfer instrument is cleared in the system |

Available |

Check / Credit Card / Transfer |

Not Available |

No allocation at authorization |

Confirmed units are allocated only on the date on which the check / credit card / transfer instrument is cleared in the system |

Not Available |

Cash |

|

Units allocated by End of Day processes on the date of authorization |

Units allocated by End of Day processes on the date of authorization |

Not Available |

Check / Credit Card / Transfer |

Available |

Provisional Units allocated by the End of Day processes on the date of authorization |

Provisional Units allocated by the End of Day processes on the date of authorization, confirmed units on the date on which the check / credit card / transfer instrument is cleared in the system. |

Not Available |

Check / Credit Card / Transfer |

Not Available |

No allocation at authorization |

Units allocated by End of Day processes on the date on which the payment instrument is cleared in the system |

“*” – as designated in Transaction Processing Rules for the fund |

||||

4.3.3 Amendment Stage

After authorization, changes to a transaction request can only be made through an amendment. You can no longer “edit” the transaction through the Transaction Summary screen. You must choose the Amend menu option. Therefore, amendments are operations that you can perform only on authorized transaction records.

The amendment facility is not available for the following types of transactions:

- Block

- Unblock

- Consolidation

- Split

- Reissue

You can amend an authorized transaction:

- Before the units in respect of the transaction have been allocated.

- After the allocation of units in respect of the same

- Within the default amendment period specified in the Defaults Maintenance

When you amend a transaction, the amended record is saved as an unauthorized transaction, with a transaction number that is different from that of the original transaction before amendment.

Subsequently, the amended transaction must be authorized again for it to be effective. The authorization of an amended transaction can be done only from the Fund Manager module.

Note

Once a transaction is amended and the amendment has been subsequently authorized, it cannot be amended again.

4.3.4 Allocation of Transactions

Once a transaction is authorized, the units in respect of it must be allocated to the concerned unit holder. The unit holder’s balance holdings in the system database must reflect the changes due to the acquisition or the sale of units due to the transaction. The allocation processes in the system perform this function.

To understand how allocation is performed, refer to the Allocation chapter in Fund Manager User Manual.

Allocation can be performed in any (or all) of the following three ways:

Online Allocation

The allocation is performed at the time the transaction is authorized, i.e., simultaneously with authorization. This is true for amended transactions for which the amendment is authorized, too. Online allocation is only possible if it is designated as available in the Transaction Processing Rules for the fund.

Allocation by the End of Day processes

All transactions that have been entered and authorized on a given business day will be automatically allocated by the End of Day processes that are performed at the installation for that business day.

Allocation through the Menu

You can also manually trigger the allocation for a transaction through the corresponding menu item in the End of Day menu category in the Fund Manager component.

You can use this facility to perform allocation for transactions involving payment instruments, on the clearing date.

Note

If the application is offline, you can capture the transaction through webservice only if there is an entry for that function ID in ‘GWTMS_ AVAIL OPERATIONS’ table.

4.4 Transaction Processing Procedures

This section contains the following topic:

4.4.1 Requesting Transaction

Before you enter a transaction request from an investor into the system, ensure that the following details have been taken care of:

- All required static data maintenance for the branch in which you are accepting the transaction must be in place, including the user profiles.

- The investor that is requesting the transaction must be set up as a valid unit holder in the system, with a Unit Holder ID and a unit holder account.

You can accept and process an IPO or subscription transaction request for an unauthorized unit holder.

Note

You can accept redemption, transfer and unblock transaction requests from unit holders whose account is pending closure in the system.

- The funds in which the transaction is requested must be authorized funds that are effective in the system as on the date of the transaction.

- The date and time on which you enter the transaction request into the system must be within the Start and End Dates (and Start and End Times) specified for the requested transaction type, in the Transaction Processing Rules.

Maintenance for check writing facility

For investors using check writing facility, you must ensure that the following have been maintained, before you enter check redemption transactions:

- For each unit holder who requests use of the check writing facility, it must be specified as allowed, in the account profile, either while creating the account or through an information change.

- The check vendors who will print the checkbooks for investors using the check writing facility, as entities in the system, through the Entity Maintenance. The vendors must also be associated with the funds for which they would print the checkbooks.

- In the System Parameters, you must maintain ‘MMF Check’ as one of the communication modes through which a transaction request can be entered.

- The rules that will govern the processing of the check redemption transactions, for each fund. You maintain these rules in the General Operating Rules for a fund.

For a detailed description of these rules, refer the chapter ‘Setting up Fund Rules’, in the Fund Setup User manual.

- The details of checkbooks requested by unit holders for each fund must be maintained, through the Check Book Request screen.

- Interface definitions that will be used to upload details of used checks from the clearing house, as a bulk file. The upload file contains the number of each check that has been issued, as well as the amount on each check.

- Interface definitions that would be used to export details of checkbook requests from unit holders to the designated check vendors, and to import details of checkbooks printed against requests, from the check vendors.

You define these interfaces using the Interface Definition facility in the system. You can use the Online Execution of Interfaces menu option to execute these interfaces. This option would execute each of the following interfaces that you have defined:

- To export details of checkbooks requested by unit holders to the designated check vendors

- To import details of checkbooks printed by check vendors against requests received

- To trigger automatic generation of check redemption transactions based on the information in the upload file sent by the clearing house or bank. You can also manually enter the redemption transactions in the system, in the Transaction Detail screen for Redemption.

Specifying Details for Limit Order Transactions

You can enter limit order transactions in the same manner as you would a normal subscription transaction (for a buy order) or a normal redemption transaction (for a sell order), in the corresponding transaction input detail screens. In other words, you can enter a buy order in the Subscription Detail screen, and a sell order in the Redemption Detail screen in the same manner as you would normal subscription and redemption transactions. You must, however, specify the options for the limit orders, in each case.

After you have initiated the transactions in the corresponding transaction input screens, the orders would be executed according to the options you have specified, either automatically by the end of day processes (if allowed for the fund) or after manual confirmation is received (if automatic processing is not allowed for the fund)

Limit orders can be executed whenever the desired price is prevalent within a specified period (price-based) or on a specified future date (date based).

Specifying Delivery Options

This feature is only available if your installation has requested for it. To learn how to specify delivery options for a transaction, refer the Annexure.

Specifying KYC documents details

You can maintain KYC lists for the combination of country type and the investor category. You can check the documents received from the investor while processing a transaction.

System allows you to save with the transaction even if the unitholder has not submitted all the required KYC documents. However, you will not be allowed to perform the completion operation on that transaction unless all the required documents have been received from the investor.

For information on setting up KYC lists, refer the chapter ‘Maintaining Reference Information’ in Reference Information User manual.

This feature is only available if your installation has requested for it.

4.5 IPO Subscription Detail

This section contains the following topics:

- Section 4.5.1, "Invoking IPO Subscription Detail Screen"

- Section 4.5.2, "UH and Fund Tab"

- Section 4.5.3, "Transaction Tab"

- Section 4.5.4, "Other Tab"

- Section 4.5.5, "Intermediary Tab"

- Section 4.5.6, "Load Override Tab"

- Section 4.5.7, "KYC& Document Tab"

- Section 4.5.8, "Add Info Tab"

- Section 4.5.9, "Fee Payment Tab"

- Section 4.5.10, "Certificate Tab"

- Section 4.5.11, "Limit Order Tab"

- Section 4.5.12, "Saving Transaction"

4.5.1 Invoking IPO Subscription Detail Screen

Enter an IPO transaction request into the system in the following sequence of events:

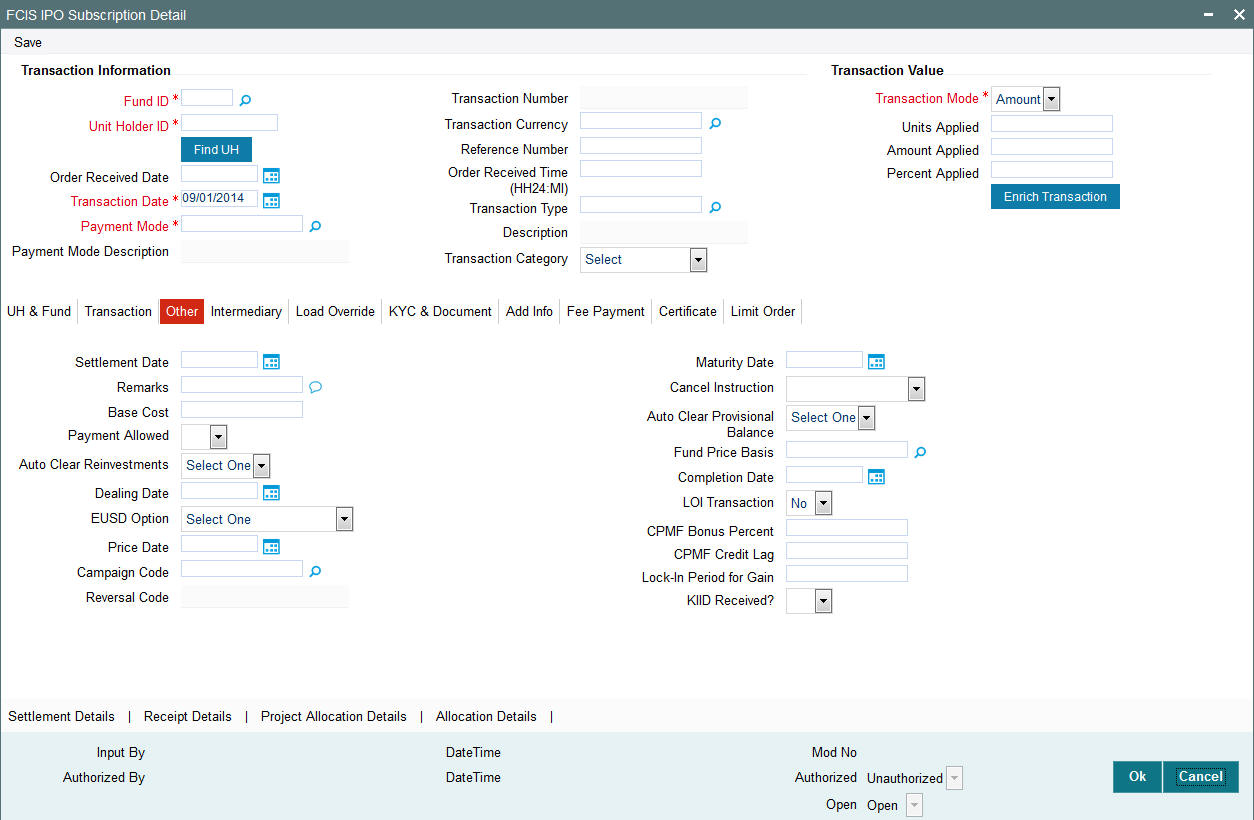

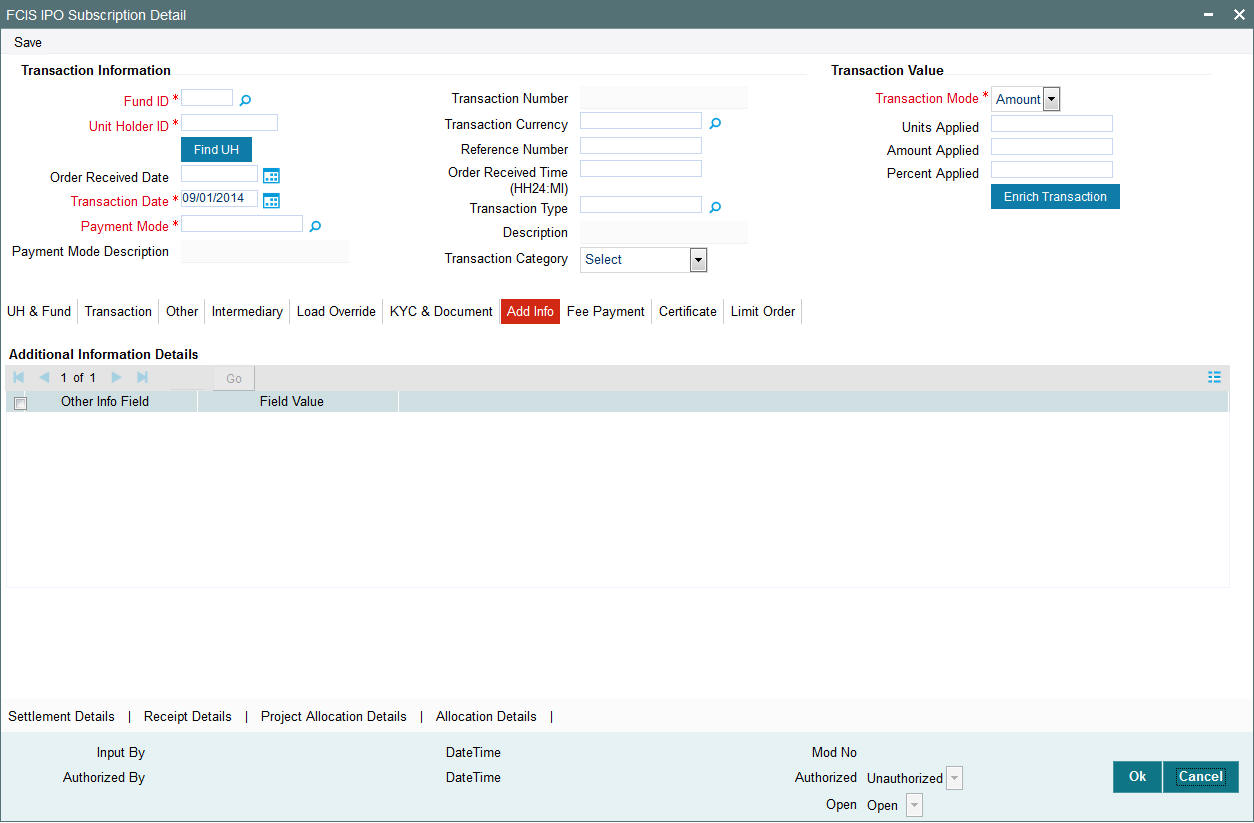

Invoke the ‘’FCIS IPO Subscription Detail’ screen by typing ‘UTDTXN01’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select 'New' from the Actions menu in the Application tool bar or click new icon to enter the details of the IPO Subscription transaction.

Specify the Transaction Information, Unit Holder ID, Transaction Date and Fund ID

Specify the unit holder that has requested the transaction, in the Transaction Information section. Specify the ID of the unit holder in the Unit Holder field.

You must select a unit holder that is not restricted (or does not belong to a restricted category) for the fund into which the transaction is being entered. If not, the system does not allow the transaction to be saved.

When you specify the unit holder,

- The IPO funds in which the specified unit holder can transact are displayed in the Fund Id list of values.

- The transaction date is reckoned to be the application date by default. You can alter this and specify any date that is not designated as a holiday in the system. If you do specify a holiday, the system prompts you to specify a different date.

If you specify an earlier date, the fund that you choose for the transaction must be one for which backdating of transactions is allowed in the Transaction Processing Rules. The specified earlier date must also be within the backdating limit, as specified for the fund in the Transaction Processing Rules.

- Specify the reference number for the transaction in the Reference Number field. If the reference number is designated to be system-generated for the agency branch, then the Reference Number field is locked and the number will be generated by the system when you save the transaction.

- Select the fund in which the requested transaction is to be put through, from the drop down list in the Fund Id field.

- You can select Transaction Mode from drop down list. Enter the Transaction Currency in the Transaction Currency Field or select using the LOV.

- Select Transaction Sub Type and Payment Mode from drop down list.

- An IPO transaction can be put through in either an Amount or a Units mode.

- In the Transaction Sub Type field, specify whether the transaction is an initial purchase. After entering all details in Transaction Information section click on ENRICH TRANSACTION button which will default all values from FUND & Unit Holder

- Select the currency in which the amount value for the transaction will be reckoned, in the Transaction Currency field. The currency you select here must be one that is a valid transaction currency designated for the selected fund in the Fund Transaction Currency rule.

- Select the mode in which the payment for the transaction will be made, in the Payment Mode field. After entering all values click on Enrich. The list of transactions applicable for the Unit Holder selected is defaulted in UH and Fund section.

Transaction Category

Optional

Select the type of transaction from the adjoining drop-down list. Following are the options available in the drop-down list:

- Legacy/Direct Business

- Advised Business

- Execution Only

This field is enabled after you click ‘Enrich’ button.

Order Received Date

Date Format; Optional

Specify the order received date.

Order Received Time (HH24:MI)

Time Format; Mandatory

Specify the order received time.

Deriving the order received date and time

The system will validate the Fund cut off based on the Order received time and not the actual time the Transaction is captured in the system. The transaction date will be derived by the system based on these two fields. For instance, if the Fund Cut off is 14.00 hrs at a Fund level and the transaction is captured at 15.00 hrs in the system with the Order Received time as 13.00 then the system should validate the time maintained at Order Received time and not the time the transaction is actually captured. This will be considered as the same day transaction.

If all the below mentioned transactions are captured on 15-Oct-2012 at 16:00 hrs then the transaction dates will be derived as detailed below. In case the transaction date is amended then the system has to consider the amended transaction date. Post authorisation of the transaction, you cannot amend order received date and time.

Fund Cut off |

Order Received Date |

Order Received time |

Transaction Date |

14:00 |

15-Oct-2012 |

13:50 |

15-Oct-2012 |

14:00 |

15-Oct-2012 |

14:10 |

16-Oct-2012 |

14:00 |

14-Oct-2012 |

13:25 |

14-Oct-2012 |

14:00 |

14-Oct-2012 |

15:15 |

15-Oct-2012 |

4.5.2 UH and Fund Tab

UH Deals Button

- Click on the UH Deals button to view the details of all the deals set up for the unit holder. Enter the relevant search criteria in the Find Options screen. The system will display the records that match the search criteria you have specified.

- Choose the unit holder deal that you want to view by clicking on the View button alongside the record. The Unit Holder - Deal Setup screen is invoked in View mode, where you can view the details of the record.

4.5.3 Transaction Tab

Click on Transaction tab in the FCIS IPO Subscription Detail screen.

- Specify the net value exclusive of the loads, in the Gross or Net field.

- Specify the value of the transaction, in the Transaction Value field. This value will be validated against the minimum, maximum and step values specified for IPO transactions in the Transaction Processing Rules for the fund. It is also validated against the amount / units limit values maintained for both the communication mode selected for the transaction, and the investor category of the selected unit holder. A warning, which can be overridden, is displayed if the value is not within the limits.

For transactions by gross amount, a transaction value that exceeds the Minimum Amount for Tax ID that has been specified in the fund rules, the system validates the availability of the PAN Number in the unit holder account profile. If the PAN Number has not been specified in the profile, you must enter a transaction value that does not exceed the Minimum Amount for Tax ID value, or make a change to the unit holder account and specify the PAN Number, and then attempt to input the transaction.

- Select the exchange rate source to be used, in the Exchange Rate Source field.

- Click the Calculate button. The system obtains the applicable exchange rate for the application date and computes the equivalent of the transaction value in the fund base currency. This value is displayed in the Amount in Fund Base Currency field. The applied exchange rate is also displayed in the Override Exchange Rate field.

Specify the Settlement Information, Payment Type and the bank account for Transfer mode of payment

- Payment Details button is enabled for payment modes other than ’Cash’ and ‘Against Payment’. Click on the Payment Details button to specify the settlement information. If the payment for the transaction is proposed to be made by check, credit card, debit card, transfer, in kind or multi payment modes, then you must specify settlement instructions in the settlement information screen and the payment details such as the payment type, in the Payment Details screen.

- For payments by account transfer, you must select the bank account that will be used to make the payment, in the Maintained Bank Accounts field in the Payment Details section

If you wish to override the applied exchange rate at this stage, select the ‘Yes’ option in the Override Exchange Rate field. Specify the overridden exchange rate in the Applied Exchange Rate field, and click the Calculate button again. If overridden, the overridden exchange rate should be within the permitted fluctuation limits defined in the Source Maintenance.

View the projected allocation details, if necessary under transaction

- At this stage, the transaction is ready to be saved. If you wish to see a projected picture of how the transaction would most possibly be allocated, then click the Project Allocation Details button in Transaction section.

You can view the projected allocation details only for funds in which the ageing policy is FIFO (first-in, first-out) or Transaction Receipts. If the prices are not available for IPO transactions on the transaction date, the latest available price is picked up for allocation.

- When you do so, the system temporarily saves the transaction into temporary stores in the database and gives it a unique key string. The system then performs a ‘mock’ temporary allocation, and displays the details of the same in the Allocation Projection screen. The following allocation details are displayed:

- The Fund ID and ISIN Code

- The Product ID

- The number of units allocated, in the Units field.

- The Spill Over Product ID and the number of spillover units, in the Spill Over Units field.

- The Unit Price for the transaction, as on the date of the temporary allocation.

- The total load amount, in the Load Amount field.

- The Gross and Net Amounts in fund base currency

- The Settlement Amount in the transaction currency

The following Load Details are displayed:

- The Fund ID and the ISIN Code

- The Load ID

- The Load Description

- The Load Amount

After you have viewed the projected allocation details, click the Close button to close the screen.

4.5.4 Other Tab

Click on ‘Other’ tab in the FCIS IPO Subscription Detail screen.

In this section Settlement Date, Dealing Date, Price Date, Maturity Date, Completion Date & Fund Price Basis will get defaulted when Enrich Transaction button is pressed. User can also allow changing these fields. Other fields in this section are Auto Clear Reinvestments, Auto Clear Provisional Balance, Payment Allowed, LOI transaction, EUSD Option, Cancel Instruction, Base Cost, CPMF Credit Lag, CPMF Bonus Percent, and Lock in period for Gain & Remarks.

By default, the settlement date is arrived at by taking the payment lag defined for the fund in the Transaction Processing Rules into consideration.If you have defined a different trade cycle for the fund in the ‘Override Trade Cycle Date’ screen and the transaction falls within the override period mentioned in this maintenance, the system will default the settlement date from the maintenance. The date displayed here can be altered, if required, and you can specify the requisite settlement date.

Price Date

The field From Price Date is enabled when you select the fund in which the requested transaction is to be put through. The fund should be one for which you have specified forward pricing is applicable. The price date is arrived at by taking into consideration several conditions. This is explained in the section ‘Defaulting of Price Dates in the Transaction’ Screens in this chapter. You can modify this field.

If you have defined a different trade cycle for the fund in the ‘Override Trade Cycle Date’ screen and the transaction falls within the override period mentioned in this maintenance, the system will default the price date from the maintenance.

Dealing Date

By default, the dealing date is derived based on the dealing date maintained for the fund in the Specific Fund Price Date Setup screen. The date displayed here can be altered, if required, and you can specify the requisite dealing date. Dealing date will not be displayed on the screen if it is not maintained for a fund or the fund is not a specific price date fund. System will default the transaction date as the dealing date.

If you have defined a different trade cycle for the fund in the ‘Override Trade Cycle Date’ screen and the transaction falls within the override period mentioned in this maintenance, the system will default the dealing date from the maintenance.

Refer the chapter ‘Other Fund Activities’ in the Fund Manager User Manual for more details on maintaining alternate trade cycles for a fund

Specify the Maturity Date for closed-end funds

If the fund in which the transaction is being put through is a closed-end fund, then specify the maturity date for the transaction in the Maturity Date field. This field is only applicable for AMCs that have opted for the maturity date facility.

Specify the Letter of Intent Applicability

If the unit holder that is subscribing to the fund through IPO is designated as a Letter or Intent investor, then specify if the present transaction is to be deemed and processed as a Letter of Intent transaction.

This specification is only applicable for LOI unit holders that are transacting in a fund in a group for which LOI is deemed as allowed.

This specification is only applicable for LOI unit holders that are transacting in a fund in a group for which LOI is deemed as allowed.

Specify the Price Basis

Specify the price basis for IPO transactions, for the fund, distributor and investment account type for the transaction. This information is defaulted for the combination either from the Distributor Price Basis Setup, if maintained, or from the fund rules for the selected fund and transaction type. You can override the default if required.

KIID Received

Optional

Select if IPO subscription is KIID complaint or not from the drop-down list. Following are the option available in the drop-down list:

- Blank

- Yes

- No

The system will default the KIID compliant at the transaction level upon the selection of the Unitholder and Fund in the transaction screens. If the ‘UCITS Fund’ at the Fund level is ‘Yes’ and the UH mapping to the Fund in the ‘UH KIID Compliance’ tab is ‘NO’ then at the transaction level, the system will default the ‘KIID Complaint’ to ‘No’. The other combinations is as follows:

UCITS Fund Yes/No |

UH Mapping at the KIID Compliance TAB |

‘KIID Complaint’ at Txn level will default to |

Yes |

No |

No |

Yes |

Yes |

Yes |

No |

NA |

Blank |

If the KIID Received is set to ‘No’, the system display the following error message while saving the transaction:

The Unit holder has not received the KIID

If the flag is set to ‘YES’ there will be no error message and treated as if the UH has received the KIID. The system will always look at the latest UCITS fund mapping maintained at the UH level.

If the transaction is being done in a fund which is not a UCITS Fund then the field KIID received at transaction level will be defaulted to Blank. You cannot change this option to either a Yes or No at the transactions level if it is not a UCITS Fund.

The business user can change the KIID Compliant flag at the transaction from ‘No’ to ‘Yes’ and proceed with the transaction capture but visa versa is not possible. The record at the Unit Holder level will however not get updated. You will have to manually update the same.

In case of backdated transactions, if transaction date is less than effective date, system will default the KIID Compliant field to ‘No’ and then you need to manually override it.

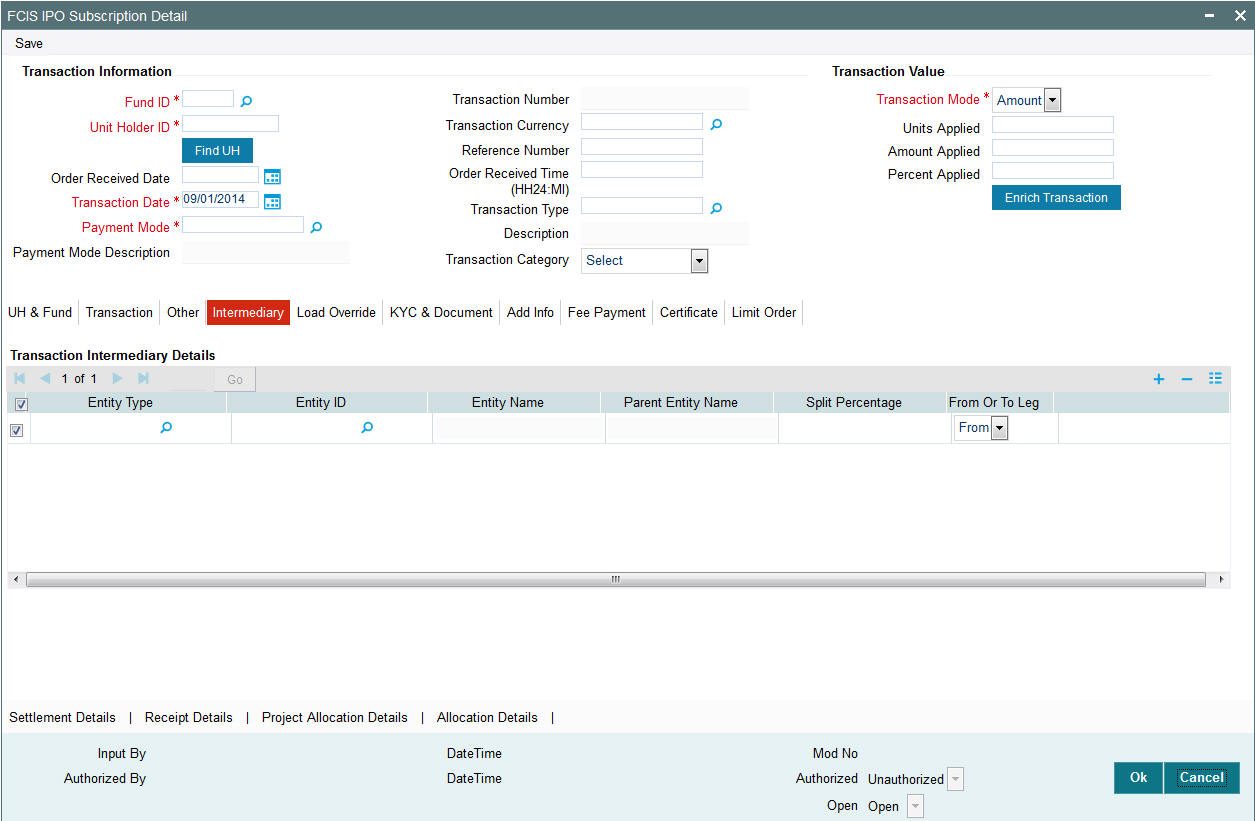

4.5.5 Intermediary Tab

Click on ‘Intermediary’ tab in the FCIS IPO Subscription Detail screen.

If a broker has been identified as an intermediary for the transaction, then you must identify the same in this section, along with the commission percentage split for the broker.

If brokers are designated as mandatory for the fund in which the transaction is being put through, then you must specify at least one broker as mandatory information in this section. If brokers are not mandatory for the fund, and you do not specify any broker in this section, then the system reckons the broker as DIRECT and designates the same as the default broker.

Broker Code

Select the code of the broker that has been identified as the intermediary for the transaction.

By default, the code of the unit holder’s default broker is displayed here. You can specify other brokers too by selecting them from the list. To invoke the list, click the button that is found alongside the Broker Code field.

You can also search for the broker using broker legacy codes.

Broker Name

When you select the broker code, the name of the broker is displayed.

Parent Entity Name

When you select the broker code, the name of the parent broker for the selected broker is displayed.

Split Percentage

Specify the percentage of total commission that is to accrue to the selected broker. The sum of all the percentages specified for any brokers identified for the transaction must equal one hundred percent.

Delete

If the client country parameter ‘TXNBROKERS’ is set to false for your installation, you can enter agent-agency branch as intermediary. You can select at least one set of Agent, Agency branch, Account Officer and IFA combination as part of unitholder.

The intermediaries maintained during unit holder creation get defaulted during Transaction, Bulk Transactions and Standing Instruction maintenance and can be overridden.

In such cases, following are the fields in this section:

Entity type

Select the entity type that has been identified as the intermediary for the transaction.

Entity ID

For each entity type, specify the intermediary in this field. The name of the selected intermediary is displayed in the Entity Name field.

While entering a transaction, system will default the intermediary specified here. However, you can override the defaulted value.

Entity Name

When you select the broker code, the name of the broker is displayed.

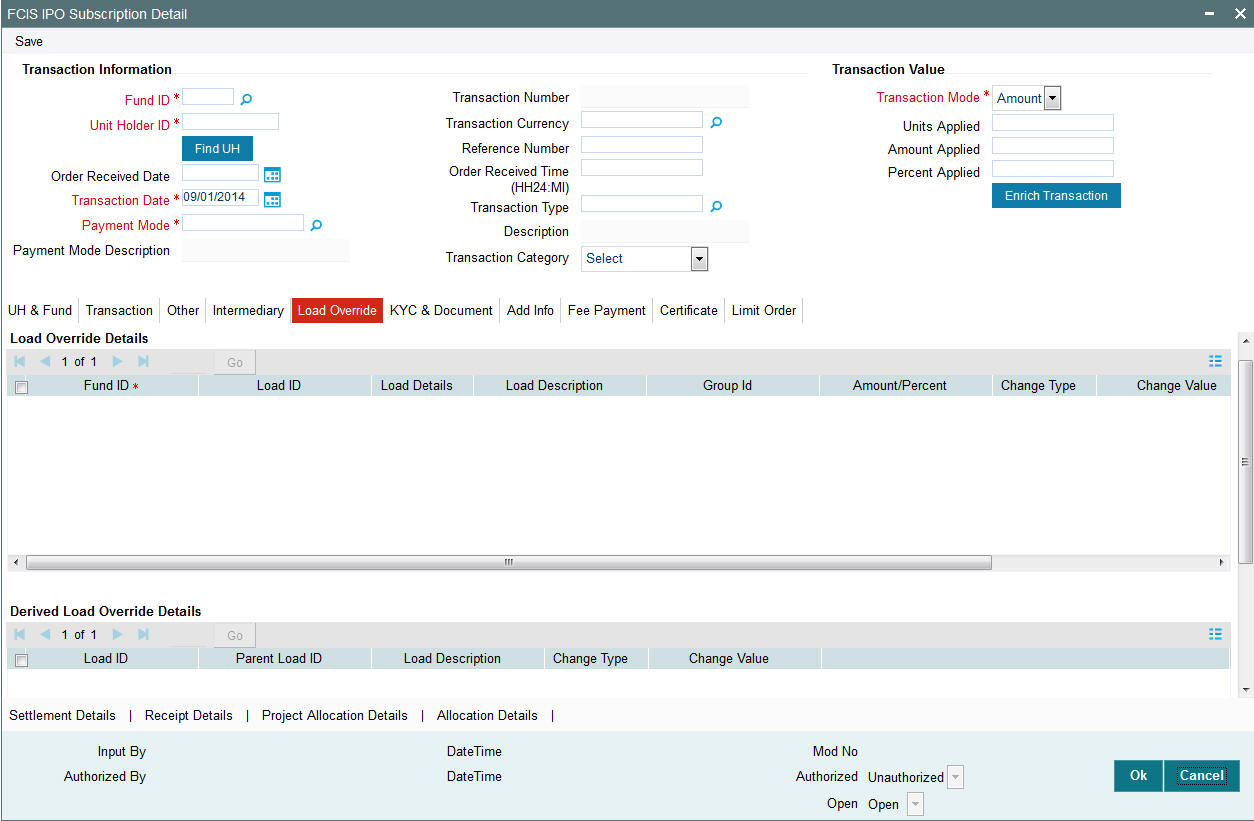

4.5.6 Load Override Tab

Click on ‘Load Override’ tab in the FCIS IPO Subscription Detail screen.

In this section, you can override or alter the value of any load (including derived loads, if any) mapped to the selected fund and applicable for the transaction type, which is to be computed at the time of allocation. The frequency of computation for such loads would be "allocation".

This section is only enabled for funds that have allocation time loads mapped to them as applicable for the transaction type.

Fund ID

When you select the fund in which the transaction is to be put through, any mapped allocation time loads are displayed as a list in this section.

Load ID

The ID of the allocation time load that has been mapped to the fund for the transaction type is displayed here. The load ID is displayed as a link. To view details of the load, click the ID link.

If a derived load has been mapped, it is also displayed here and can be overridden.

Load Description

The description of the allocation time load that has been mapped to the fund for the transaction type is displayed here.

Amount Percent

The type of the allocation time load that has been mapped to the fund for the transaction type is displayed here. The ‘type’ of the load refers to the base value upon which the load is applied. There are two possible types – amount-based loads, and percentage-based loads.

Project Return Value

The System populates the return value from the load setup.

If the UH Deal maintained is same for Unit Holder, Load and Fund Setup then overridden value from UH Deal is displayed.

If there are criteria based loans in UT transactions, the criteria is evaluated and only loads applicable for the transaction is displayed.

You can view the applicable loads and projected return values by clicking ‘Enrich Transaction’ in the transaction screen.

The system uses the projected return value for load amount computation and also to compute the net amount to AMC while generating GO

In LEP transactions, if there are criteria based loads, the criteria is evaluated during UT transaction generation and it will be used during allocation.

Change type

When you override or alter an allocation time load at the time of entering a transaction, you can effect the change in any of the following ways:

Discount (reducing the load return value in all the slabs)

Increase (increasing the load return value in all slabs)

Return Value (assigning an altered return value that will be applicable to all the loads)

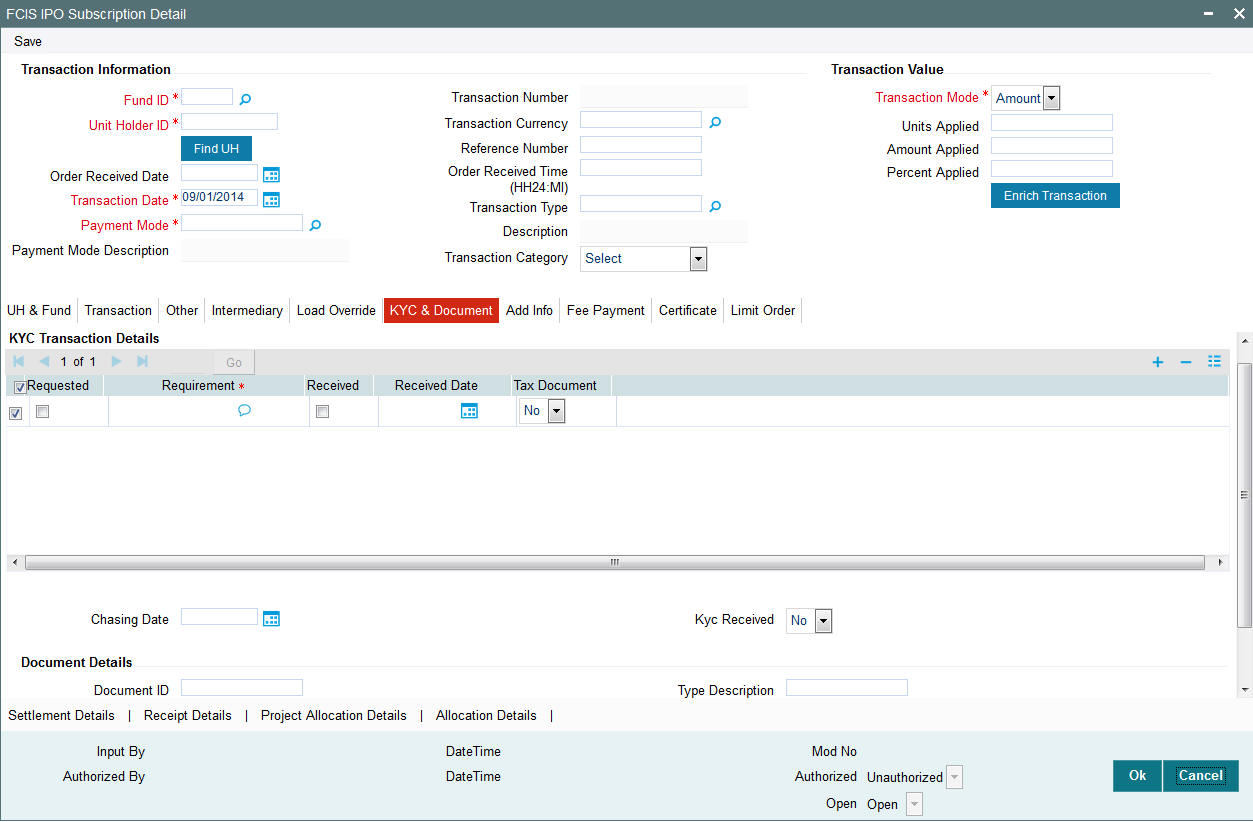

4.5.7 KYC& Document Tab

Click on ‘KYC’ tab in the FCIS IPO Subscription Detail screen.

- Click on the KYC and Documents section to access the KYC Transaction KYC Details screen. List of KYC documents required for the unit holder is displayed. Mark all documents that have been received from the investor along with the date on which it was received.

- If the investor has not completed the KYC requirements, specify the date on which document chasing must be initiated.

- If during a subscription or IPO transaction, the inflow amount is greater than the maximum amount for Tax Id, system verifies if the unit holder has a Tax ID maintained (PAN). If PAN is not specified, system verifies Tax Document in KYC.

- The system checks if the current transaction is an initial purchase or a subsequent one - based on the actual transactions carried out by the UH. In the case of an initial purchase, the system allows you to save an IPO transaction even if the UH has not met the KYC requirements.

Note

If no list has been maintained for this transaction, you may still record the KYC list for the transaction as well as the unit holder. If KYC list is not maintained for your installation, system will consider the documents as submitted by default.

4.5.8 Add Info Tab

Click on ‘Add Info’ tab in the FCIS IPO Subscription Detail screen.

The Add Info Tab

Click on the Transaction Add Info Tab to enter any additional information for the transaction. You can only maintain additional information if any information heads have been maintained in the System Parameters, to be applicable for the segment.

4.5.9 Fee Payment Tab

Click on ‘Fee Payment’ tab in the FCIS IPO Subscription Detail screen.

- If you have selected a fund for which transaction entry charges or allocation charges (or both) are applicable, then the following fields are enabled for data entry:

- If a transaction entry charge or transaction time fee is applicable for the fund the transaction time fee equivalent in both fund currency and transaction currency is computed by the system and displayed.

- If you wish to override this fee specify the overridden value in the Fee after Override field.

- If you have selected a fund for which transaction entry charges or allocation charges (or both) are applicable, then the following fields are enabled for data entry:

- By clicking ‘UH Deal’ button you can obtain the field- Transaction Fee & Fee in Fund Base Currency. These fields will come under Fee Payment Section denoted by ‘Fee Payment’ button.

- Specify any remarks for the transaction, in the Remarks field.

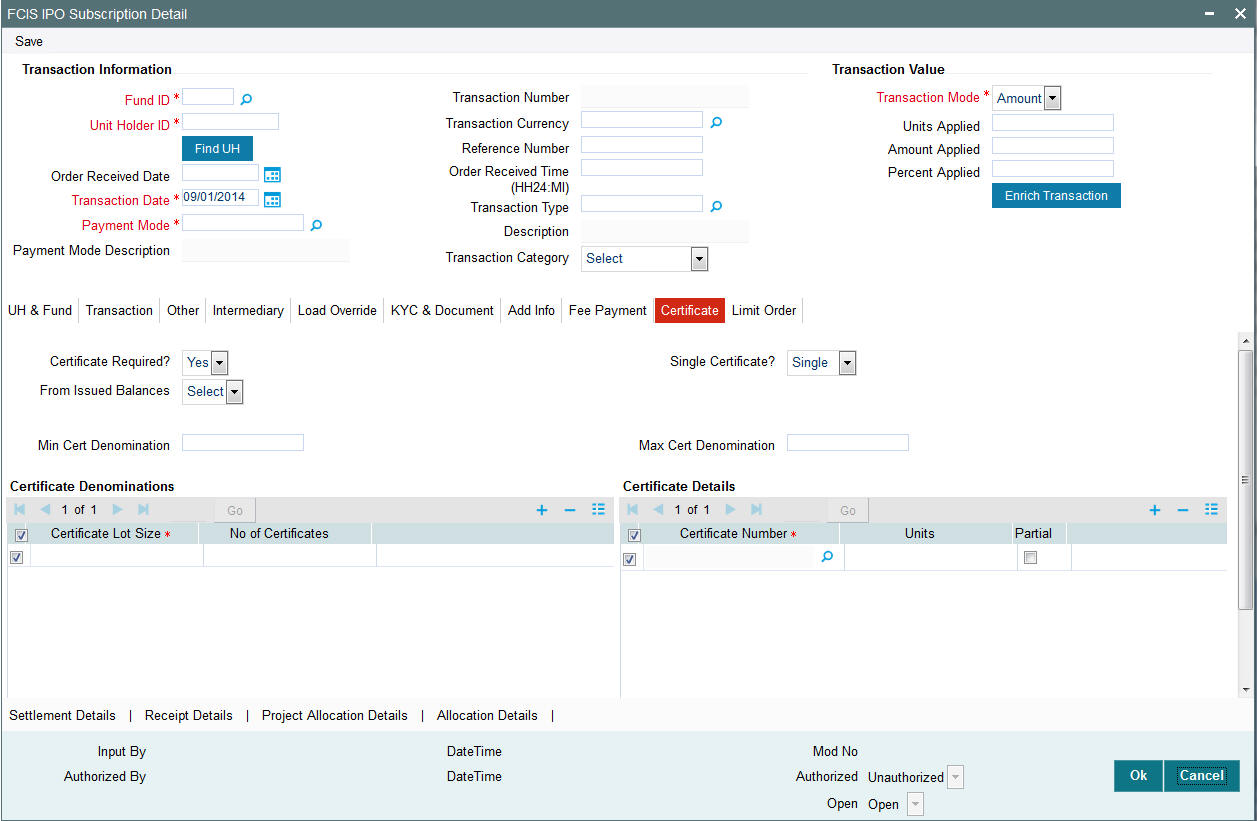

4.5.10 Certificate Tab

Click on the certificate tab in the FCIS IPO Subscription Detail screen.

- If the fund you have chosen is a Certificate Option fund as specified in the Shares Characteristics, and the unit holder has requested for certificates, then choose ‘Yes’ in the Certificate Required field.

- Specify whether a single certificate or multiple certificates have been requested, in the Number of Certificates field. If single certificates have been designated for the fund, you cannot specify multiple certificates here.

- If you have selected a certificate option fund, then all certificate information fields are enabled. The fields are Certificate Required, Single Certificate, From Issued Balances, and Max Cert Denomination & Min Cert Denomination under Certificate Section.

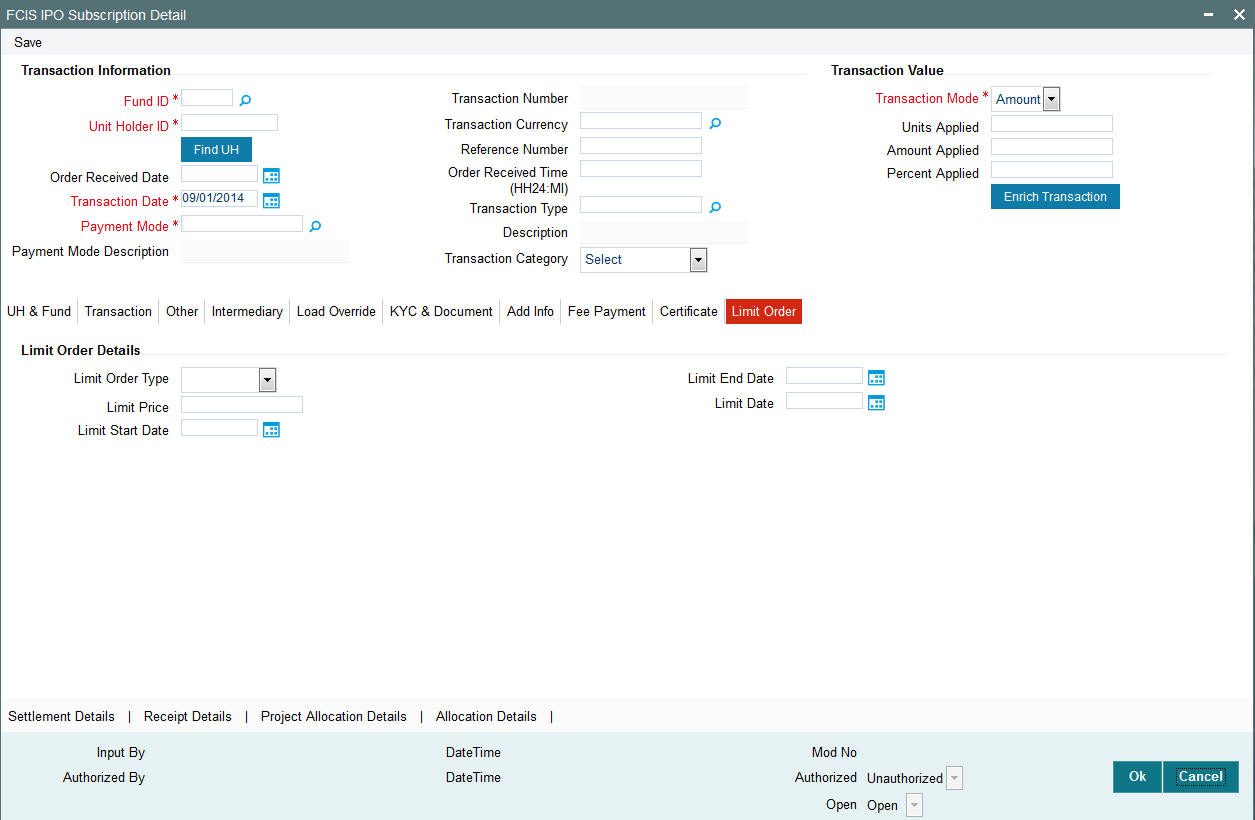

4.5.11 Limit Order Tab

Click on ‘Limit Order’ tab in the FCIS IPO Subscription Detail screen.

Select the ‘Limit Order for Subscription’ (buy) option in the Type of Transaction field. The Limit Order section is enabled.

To set up a price-based limit order, specify the following details in the Limit Order section:

- Select ‘Price Based’ in the Limit Order Type field.

- Specify the price for the limit order, in the Limit Price field. This represents the price equal to or below which the transaction must be put through (for buy orders).

- Specify the period within which the limit order must be executed, by indicating the boundary dates, in the Limit Start Date and Limit End Date fields.

To set up a date-based limit order, specify the following details in the Limit Order section:

- Select ‘Date Based’ in the Limit Order Type field.

- Specify the future date on which the limit order transaction must be executed, in the Limit Date field.

4.5.12 Saving Transaction

- At this stage, you can save the transaction by clicking the Save button at the bottom of the Transaction Information Section. The transaction is saved, and the system generated transaction number (and the reference number, if any) is displayed.

Note

If the Auto-authorization feature is enabled for the Save operation for the AMC ID, then the transaction is saved as an authorized transaction. If not, it is saved as an unauthorized transaction. In either case, the Transaction Number is generated and displayed when you invoke the Save operation.

- Alternatively, the following information may also need to be captured before you save an IPO transaction.

- In the Intermediary section, ensure that all the identified brokers for the unit holder, that have not been disabled as on the application date, have been selected, and that the commission split percentages for all selected brokers sum up to one hundred percent.

- In the Settlement Details under Transaction Section, you may need to capture the payment details for the transaction.

- In the Load Override section, you may need to override an allocation-frequency charge or load. There are three options available for such overrides - Discount, Return Value and Increase. ‘Discount’ will reduce the slab value by the specified percent/amount for all slabs. ‘Increase’ will increase the slab value by the specified percent/amount for all slabs. ‘Return Value’ will change the return value for all the slabs to the specified percent/amount.

- In the Certificate Details section, you may need to alter the minimum and maximum denominations. An override of these specifications is possible if it is allowed as designated in the fund rules.

- In the Document Details section, you may need to capture the document id of the unit holder. You can either enter the document id or choose the same from the option list provided. This section will be enabled only if your installation is integrated with DMS.

- You can now save the transaction.

4.6 IPO Subscription Summary Screen

This section contains the following topics:

- Section 4.6.1, "Retrieving a Record in FCIS IPO Subscription Summary Screen"

- Section 4.6.2, "Editing FCIS IPO Subscription Record"

- Section 4.6.3, "Viewing FCIS IPO Subscription Record "

- Section 4.6.4, "Deleting FCIS IPO Subscription Record"

- Section 4.6.5, "Authorizing FCIS IPO Subscription Record "

- Section 4.6.6, "Amending FCIS IPO Subscription Record "

- Section 4.6.7, "Authorizing Amended FCIS IPO Subscription Record "

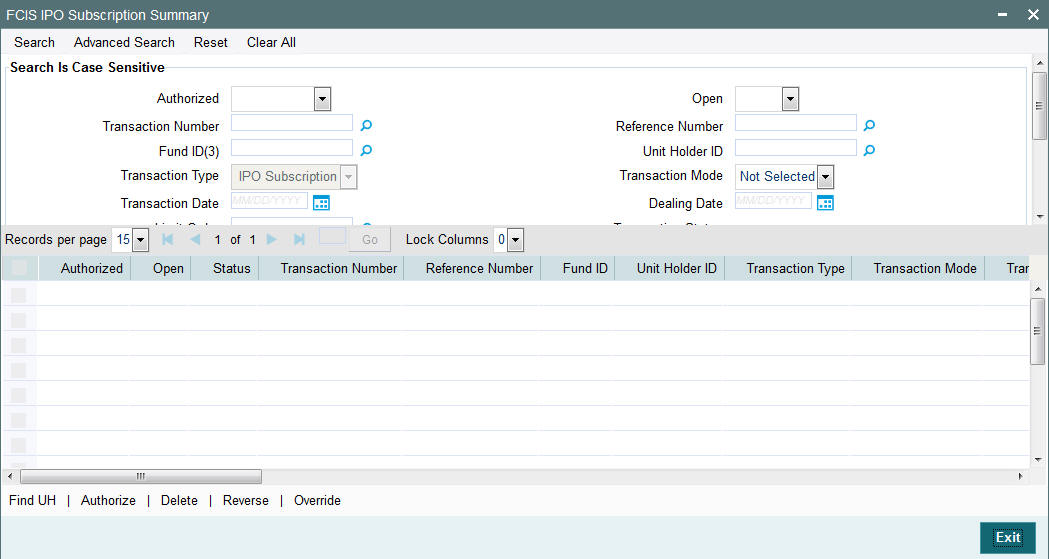

4.6.1 Retrieving a Record in FCIS IPO Subscription Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

Invoke the ‘FCIS IPO Subscription Summary’ screen by typing ‘UTSTXN01’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button and specify any or all of the following details in the corresponding details.

- The status of the record in the Authorization Status field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Record Status field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Transaction Number

- Reference Number

- Fund ID

- Unit Holder ID

- Transaction Type

- Transaction Mode

- Transaction Date

- Dealing Date

- Limit Order Details

- Payment Mode

- Completion Date

- Agent Code

- AMC

- Maker ID

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Transaction Number

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

4.6.2 Editing FCIS IPO Subscription Record

You can modify the details of FCIS IPO Subscription record that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the FCIS IPO Subscription Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorization Status field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The FCIS IPO Subscription Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

Click Save to save your changes. The FCIS IPO Subscription Detail screen is closed and the changes made are reflected in the FCIS IPO Subscription Summary screen.

4.6.3 Viewing FCIS IPO Subscription Record

To view a record that you have previously input, you must retrieve the same in the FCIS IPO Subscription Summary screen as follows:

- Invoke the FCIS IPO Subscription Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the unauthorized / Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The FCIS IPO Subscription Detail screen is displayed in View mode.

4.6.4 Deleting FCIS IPO Subscription Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the FCIS IPO Subscription Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. . The FCIS IPO Subscription Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

4.6.5 Authorizing FCIS IPO Subscription Record

- An unauthorized FCIS IPO Subscription record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the FCIS IPO Subscription Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS IPO Subscription Detail screen is displayed. Select Authorize operation from the Action List.

When a checker authorizes a record, details of validation, if any, that were overridden by the maker of the record during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the record.

4.6.6 Amending FCIS IPO Subscription Record

After a FCIS IPO Subscription record is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the FCIS IPO Subscription Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The FCIS IPO Subscription Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes

4.6.7 Authorizing Amended FCIS IPO Subscription Record

An amended FCIS IPO Subscription record must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module and Agency Branch module.

The subsequent process of authorization is the same as that for normal transactions.

4.7 Bulk Transactions

This section contains the following topics:

- Section 4.7.1, "Invoking Bulk Transaction Screen"

- Section 4.7.2, "Settlement Details Button"

- Section 4.7.3, "Processing Dilution Levy"

- Section 4.7.4, "Viewing Balance Button"

4.7.1 Invoking Bulk Transaction Screen

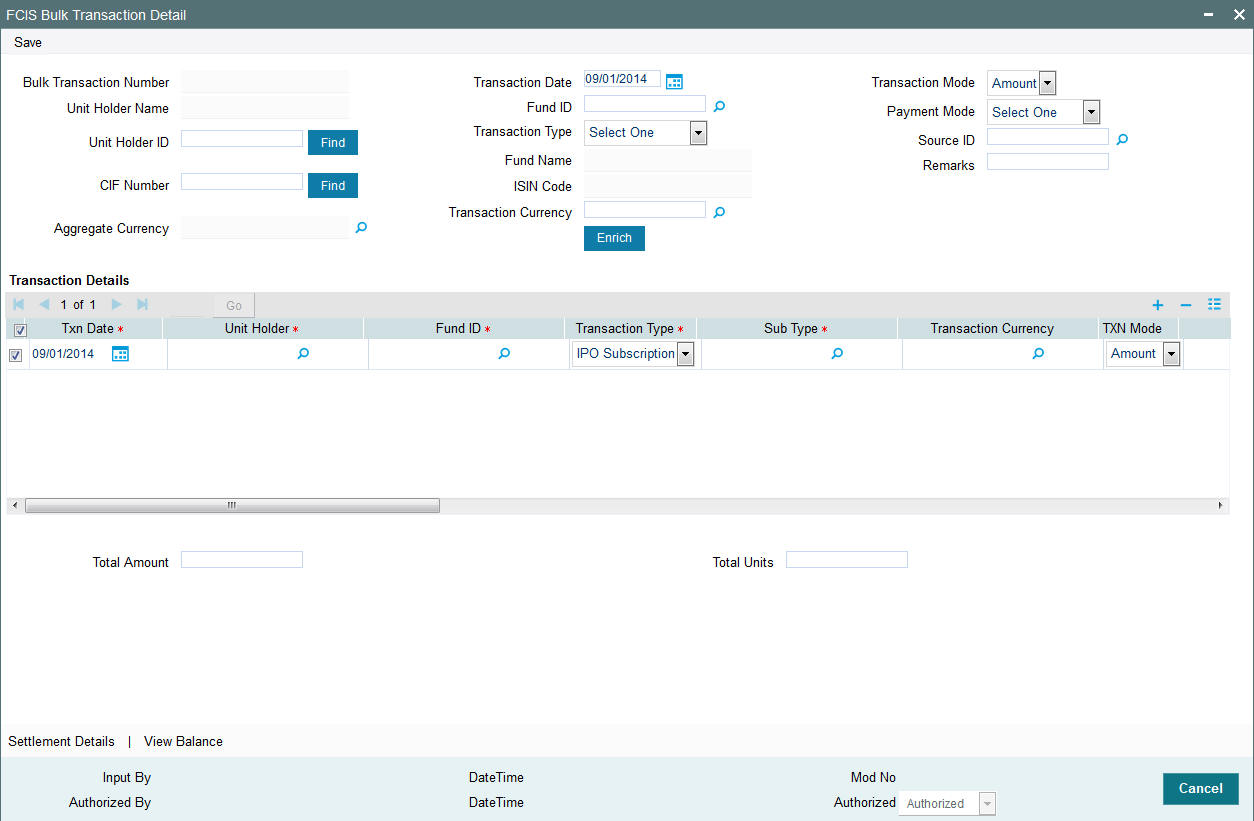

You may need to enter multiple transactions in multiple funds for a unit holder. Use ‘FCIS Bulk Transaction’ screen for such requirements. You can invoke this screen by typing ‘UTDTXNB’ in the field at the top right corner of the Application tool bar and click the adjoining arrow. The screen is displayed below:

You can maintain the following details:

Bulk Transaction Number

When you save the multiple transactions that you have entered in this screen, a bulk transaction number is generated by the system for each set of multiple transactions entered. You can use the bulk transaction number to retrieve the transactions, in the Bulk Transactions Summary screen.

Transaction Date

The transaction date is defaulted. However, you can modify the same.

Transaction Mode

Select the mode of transaction. The options available are:

- Amount

- Units

- Percent

Unit Holder ID

Specify the unit holder ID. You can also click the ‘Find’ button to list the unit holder IDs maintained in the system. Select the required ID.

Unit Holder Name

The name of the unit holder is displayed.

CIF Number

Specify the CIF number of the unit holder for whom you wish to enter multiple transactions. You can also click the ‘Find’ button to list the CIF number maintained in the system. Select the required ID.

Aggregate Currency

Conditional

Specify the aggregate currency. You can also select the currency from the option list provided. The list consists of valid and authorised currencies maintained in the system.

Aggregate currency is used in case of multiple transactions with multiple currencies. This currency is used as an intermediate currency to do settlement between outflow and inflow transactions. If the fund base currency is same for all the funds involved in the transaction, then the system defaults the aggregate currency as the fund base currency. However, if the currency is different, then the system prompts to enter the aggregate currency on save.

Fund ID

Specify the transaction Fund ID.

Transaction Type

Select the type of transaction from the drop-down list. The options available are:

- IPO Subscription

- Subscription

- Redemption

- Switch

- Transfer

- Multi Transaction

For a unit holder, you can capture multiple redemptions, for which multiple settlements and subscriptions are captured through one wrapper reference number. This wrapper reference will be the reference number for all the subscription and redemption transactions. If you select the ‘Multi Transaction’ option, then the system will link all the transactions to one reference number. For instance, you can capture multiple transactions as follows:

Outflows,

- Redeem 1000 units from F1 as R1.

- Redeem 5000 USD from F2 as R2.

- Redeem 50% from F3 as R3.

Inflows,

- Invest 30% into F4 as S1.

- Invest 1000 USD to F5 as S2.

- Invest remaining into F6 as S3.

All these transactions will be linked to one wrapper reference number.

Transaction Category

Optional

Select the type of transaction from the adjoining drop-down list. Following are the options available in the drop-down list:

- Legacy/Direct Business

- Advised Business

- Execution Only

This field is enabled after you click ‘Enrich’ button.

Fund Name

The name of the fund is displayed.

ISIN Code

Specify the ISIN code.

Payment Mode

Select the mode of payment from the drop-down list. The following are the options available:

- Cash

- Cheque

- Money Transfer

- Multi Payment

Source ID

Select the source through which the transactions are routed.

Remarks

You can specify any remarks for the transactions.

These details are defaulted for all the transactions that you enter through the bulk transaction entry operation. However, if you wish to enter details specific to a particular transaction, you can change the default and make your specification in the ‘Transaction Details’ section.

Transaction Details section

You can enter information that is specific to each individual transaction that you wish to enter.

To add a new transaction, click the ‘Add’ (+) button. To delete a transaction that you have entered, select the transaction row and click the ‘Delete’ (-) button.

Transaction Date

Date Format; Mandatory

The system displays the transaction date. However you can amend the same.

Unit Holder

Alphanumeric; 12 Characters; Mandatory

Specify the unit holder details.

You can query for unit holder ID by clicking on ‘Fund UH’ button.

Fund ID

Alphanumeric; 6 Characters; Mandatory

The system displays the fund ID. However you can amend the same.

Transaction Type

Mandatory

Select the type of transaction from the drop-down list. The list displays the following values:

Sub Type

Alphanumeric; 1 Character; Mandatory

Specify the sub type. Alternatively, you can select the sub type from the option list. The list displays all valid sub types maintained in the system.

Transaction Currency

Alphanumeric; 3 Characters; Optional

The system displays the transaction currency. However, you can amend this value.

TXN Mode

Optional

Select the mode of transaction from the drop-down list. The list displays the following values:

- Amount

- Units

- Present

- Residual

TXN Value

Numeric; 22 Characters; Mandatory

Specify the transaction value.

Payment Mode

Alphanumeric; 2 Characters; Optional

Specify the mode of payment. Alternatively, you can select payment mode from the option list. The list displays all valid mode of payment maintained in the system.

Gross or Net

Optional

Select Gross or Net option from the drop-down list.

To Unit Holder ID

Alphanumeric; 12 Characters; Optional

Specify To unit holder ID. You can query for To Unit holder ID by clicking ‘Find UH’ button.

To Fund ID

Alphanumeric; 6 Characters; Optional

Specify the To Fund ID. Alternatively, you can select To Fund ID from the option list. The list displays all valid To Fund ID maintained in the system.

Reference Number

Alphanumeric; 16 Characters; Optional

Specify the reference number.

Txn Number

Alphanumeric; 16 Characters; Optional

Specify the transaction number.

Click ‘Detail’ button to get the transaction details.

Click ‘Clear’ button to clear all the transaction details.

Click ‘Log’ button to view the transaction error details. The ‘Log’ field will log the overrides (warning messages) and error messages. You can view overrides/ error post authorization of the bulk transaction. On launching the sub screen; system will display the following:

- Transaction Number

- Error/ Override

- Code

- Description

Transaction Number

Alphanumeric; 16 Characters; Optional

Specify the transaction number.

Error/Override

Alphanumeric; 50 Characters; Optional

Specify the error or override details.

Code

Alphanumeric; 20 Characters; Optional

Specify the code.

Description

Alphanumeric; 255 Characters; Optional

Specify the error description.

Operate?

Optional

Select the operate status from the drop-down list. The list displays the follwoing values:

- Edit

- Delete

Units Classification

Alphanumeric; 1 Character; Optional

Specify the unit classification details.

Age out Preference

Alphanumeric; 1 Character; Optional

Specify the age out preference details.

Status

Alphanumeric; 4000 Characters; Optional

Specify the status of transaction.

Total Amount

Numeric; 22 Characters; Optional

Specify the total amount.

Total Units

Numeric; 22 Characters; Optional

Specify the total units.

Note

- For multi transactions, only redemption and subscription transactions are allowed

- For multi transaction, the transaction date and the unit holder ID are defaulted from the header and you cannot modify the same.

- For subscription transactions, you can select the following transaction modes:

- Amount

- Units

- Percentage

- Residual

- For redemption transactions,’ Residual’ transaction mode is not applicable

- You have to maintain different fund IDs for multiple transactions

4.7.2 Settlement Details Button

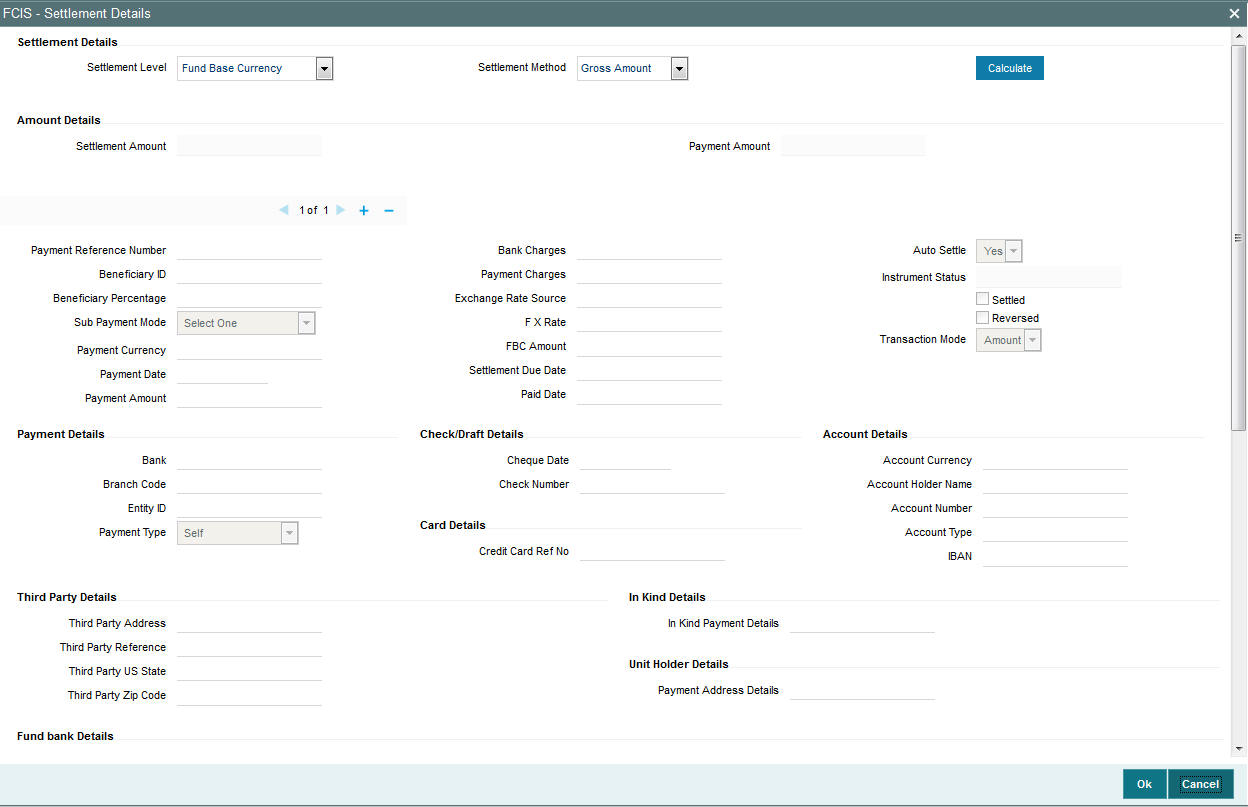

Here, you can maintain settlement details only for the multi transactions. Click the ‘Settlement Details’ button to invoke the ‘Settlement Details’ screen. The screen is displayed below:

4.7.2.1 Settlement Details

Settlement Level

The settlement level is displayed.

Settlement Method

The method of settlement is displayed.

4.7.2.2 Transaction Settlement Details

Payment reference Number

Specify the payment reference number.

Sub Payment Mode

Select the mode of payment. The following options are available:

- Demand Draft

- Pay Order

- Against Payment

- In Kind Payment

- CMA Cheque

- Broker Cheque

- Cashier Cheque

- Foreign Cheque

- Government Cheque

- Other Institution Cheque

- Out Of Town Cheque

- Payroll Deduction Cheque

- Reserve Bank Cheque

- Debit Card

- Credit Card

- Advice

- CMA Transfer

- Direct Debit

- Money Transfer

- Telegraphic transfer

- Wire Transfer

Payment Currency

Specify the payment currency. You can also select the currency from the adjoining option list. The list consists of valid and authorised currencies maintained in the system.

Payment Date

Specify the payment date.

Payment Amount

The payment amount is displayed.

Bank Charges

Specify the bank charges.

Payment Charges

Specify the payment charges.

Exchange Rate Source

Specify the source of exchange rate. You can also select the source of exchange rate from the adjoining option list. This exchange rate source is used to convert aggregate currency to transaction currency and vice versa.

FX Rate

Specify the foreign exchange rate.

FBC Amount

Specify the fund base currency amount.

Due Date

Specify the due date of the transaction.

Paid Date

Specify the paid date of the transaction.

Auto Settlement

Select ‘Yes’ option if you require auto settlement.

Payment Type

Select the type of payment:

- Self

- Third Party

- Broker

- Retained

- Absorbed/Paid Back

- Advanced Payment

Settlement Status

The status of the settlement is displayed.

Instrument Status

The status of the instrument is displayed

Settled

Check this option if the transaction is settled.

Reversed

Check this option if the transaction is reversed.

Txn Mode

Select the mode of transaction:

- Amount

- Percent

- Units

- Residual

For multi transactions, the ‘Units’ transaction mode is not applicable.

Payment Value

Specify the value of payment.

Click ‘Calculate’ button to calculate the settlement amount.

4.7.2.3 Amount Details

Settlement Amount

The settlement amount is displayed.

Payment Amount

The payment amount is displayed.

4.7.2.4 Processing Multi Transactions

To process the outflow transactions, execute the ‘Multiple Transaction Generation’ batch as part of EOD process. While processing multi transactions, settlement will take precedence over the subscription transactions to be generated (with the exception of settlement of residual). Also, while doing settlement or while generating subscription the following will be the precedence order:

- Fixed – Units (Not applicable for settlement)

- Fixed – Amount (For subscription transaction generation, both unit and amount takes same priority)

- Percentage

- Residual

The system will either create settlement entries or create subscription transactions as per the multiple transactions. Once all the redemption transactions are allocated and settled, the subscription transactions are generated by a BOD batch. If any of the redemption transaction is not allotted, then the system will not pick up the entire wrapper transaction for settlement. In this case, the subscription transaction is also not created.

Note

- Each outflow and inflow transactions are saved as separate transactions but against the same wrapper reference number

- Backdated and future date transactions are allowed only for the out flow transactions

- The transaction date for the subscription transaction will be the highest settlement date of the redemption transactions.

- The settlement details entered at the individual transaction level will be overridden by the settlement details maintained at the multi transaction level.

- Settlement for the subscription transaction will always be by cash and the redemption transaction settlement will be based on the settlement details you have maintained.

- Reversing multiple transactions is not allowed from the ‘FCIS Bulk Transaction’ screen. However, you can reverse the individual transaction from online transaction screen.

- You can modify the individual linked transaction using the online transaction screen. In this case, the system will display a warning message indicating the transaction is a linked transaction

- On saving the multi transaction, if any transaction fails, the system will display an error message. However, it saves the remaining transactions. You can correct the failed transactions and save it again.

4.7.3 Processing Dilution Levy

The Inflow breach factor for IN transactions and Outflow breach factor for OUT transactions are considered for arriving at the fund inflow/outflow dilution levy breach limit (Fund Corpus * Inflow / Outflow Breach Factor < Net Amount in FBC) for the day. For validating the dilution limit breach, a project allocation is done with the available price for the transaction and thereby the net amount of that transaction is calculated.

Dilution levy is validated against the gross transaction amount. If gross transaction amount is is greater than the dilution levy breach limit, then a warning message is displayed by the system as follows:

The transaction exceeds the dilution levy breach limit

Dilution levy value can be overridden. The overridden value is considered only if the transaction is breaching the dilution levy limit amount. If a transaction is saved and if there are overrides while saving such a transaction, then the following warning message is displayed by the system.

Transactions are saved with overrides

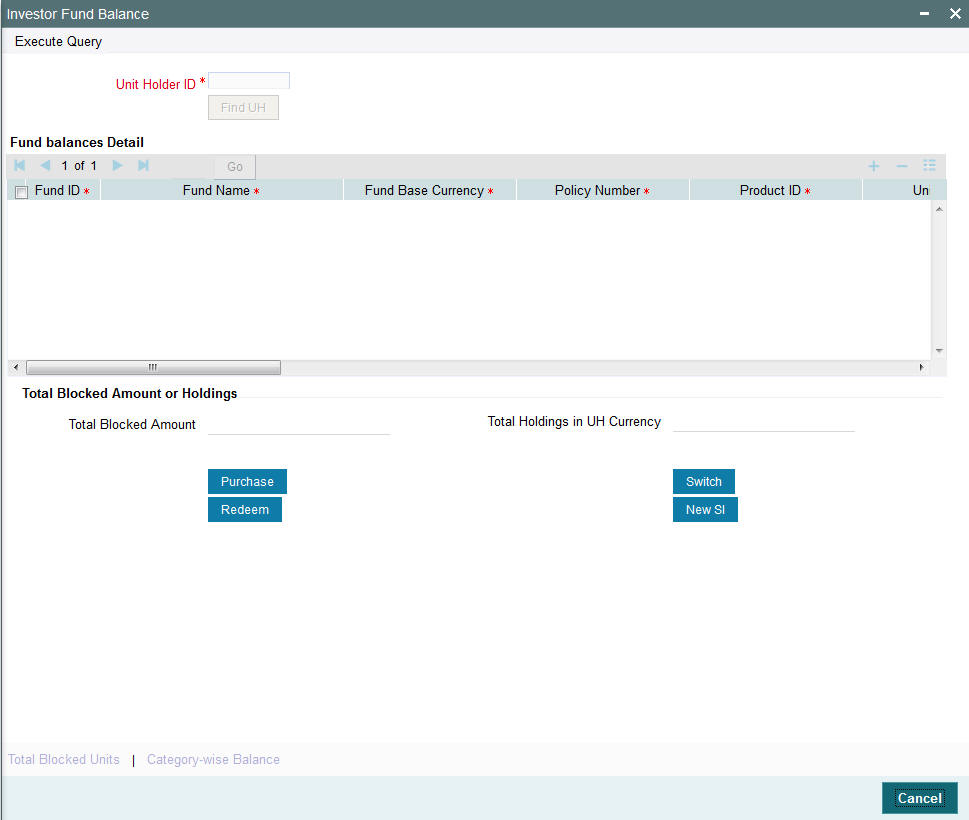

4.7.4 Viewing Balance Button

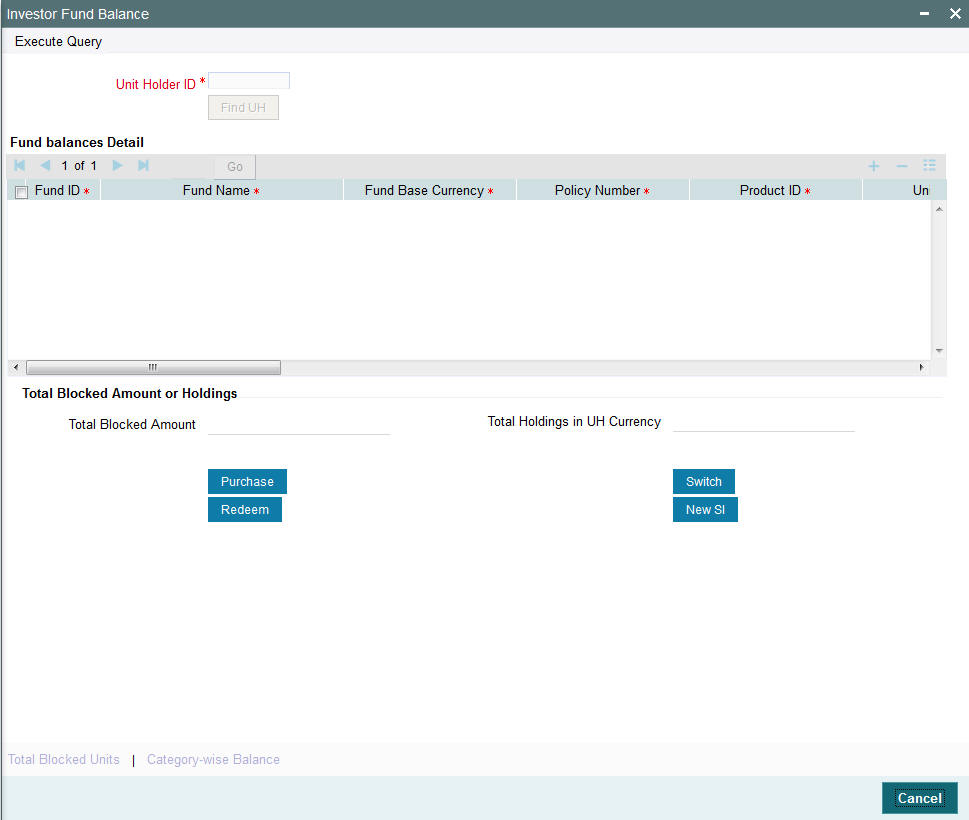

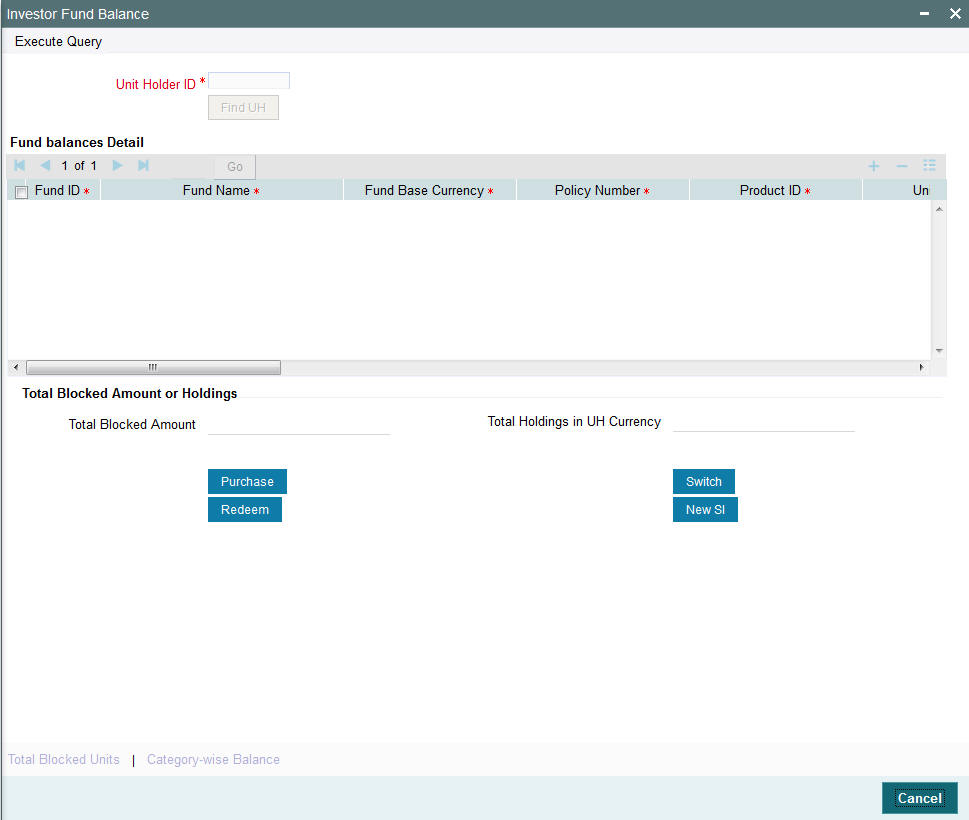

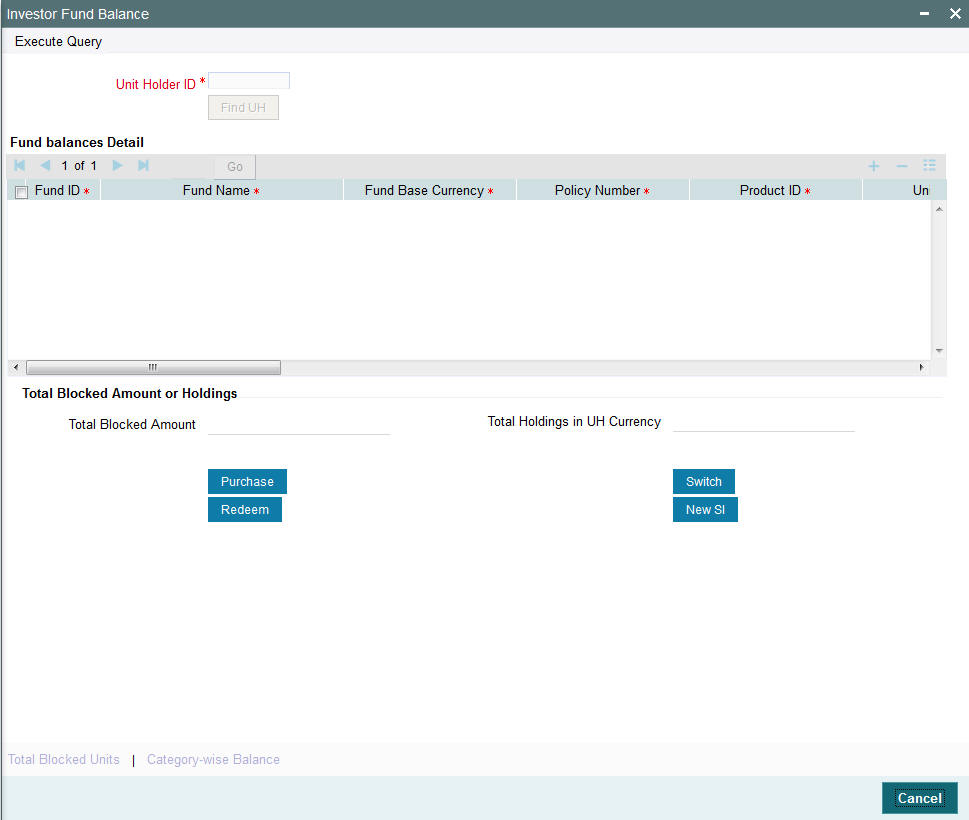

You can view the available fund balance details of a unit holder. For this, click the ‘View Balance’ button in the ‘FCIS Bulk Transaction Detail’ screen. The ‘Investor Fund Balance’ screen is displayed in view mode displaying the unit holder fund balance details

4.8 Bulk Transaction Summary

This section contains the following topics:

- Section 4.8.1, "Invoking Bulk Transactions Summary Screen"

- Section 4.8.2, "Retrieving a Record in FCIS Bulk Transaction Summary Screen"

- Section 4.8.3, "Editing FCIS Bulk Transaction Record"

- Section 4.8.4, "Viewing FCIS Bulk Transaction Record "

- Section 4.8.5, "Deleting FCIS Bulk Transaction Record"

- Section 4.8.6, "Authorizing FCIS Bulk Transaction Record "

- Section 4.8.7, "Amending FCIS Bulk Transaction Record "

- Section 4.8.8, "Authorizing Amended FCIS Bulk Transaction Record "

4.8.1 Invoking Bulk Transactions Summary Screen

The following operations can be performed for multiple transactions using ‘FCIS Multiple Transaction’ screen:

- New - You can capture outflows and inflows transactions in this screen. This will then be grouped under one transaction.

- Modify - You can modify the unauthorized multi transactions. Click ‘Unlock’ option in the action menu and amend the individual transaction by editing each transaction using ‘Edit’ option available in the ‘Transaction Details’ section in the ‘FCIS Bulk Transaction Detail’ screen.

- Delete - To delete a particular transaction, unlock the unauthorized record and select the ‘Delete’ option available in the ‘Transaction Details’ section in the ‘FCIS Bulk Transaction Detail’ screen.

- Authorize - Authorizing the multi transaction results in authorizing all the linked transactions along with it.

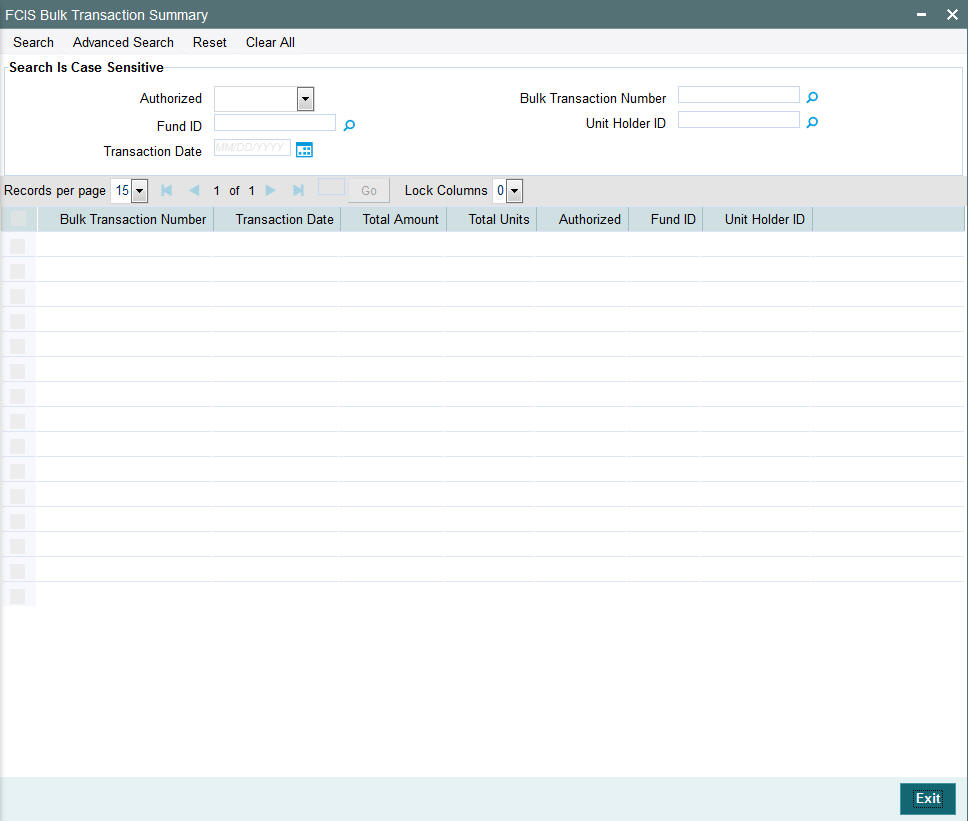

4.8.2 Retrieving a Record in FCIS Bulk Transaction Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

Invoke the ‘FCIS Bulk Transaction Summary’ screen by typing ‘UTSTXNB’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button and specify any or all of the following details in the corresponding details.

- The status of the record in the Authorization Status field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Record Status field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Bulk Transaction Number

- Maker ID

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Bulk Transaction Number

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

For example:

You can search the record for Fund ID by using the combination of % and alphanumeric value as follows:-

- Search by A%:- System will fetch all the records whose Fund ID starts from Alphabet ‘A’. For example:- AGC17,AGVO6,AGC74 etc.

- Search by%7:- System will fetch all the records whose Fund ID ends by numeric value’ 7’ . For example: AGC17, GSD267, AGC77 etc.

- Search by%17%:- System will fetch all the records whose Fund ID contains

the numeric value 17. For example: GSD217, GSD172, AGC17 etc.

4.8.3 Editing FCIS Bulk Transaction Record

You can modify the details of FCIS Bulk Transaction record that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the FCIS Bulk Transaction Summary screen from the Browser.