5. Processing Transactions - II

This chapter contains the following sections:

- Section 5.1, "Subscription Transaction Detail"

- Section 5.2, "Unitholder Deal Summary"

- Section 5.3, "Mandatory Information for All Transaction Types"

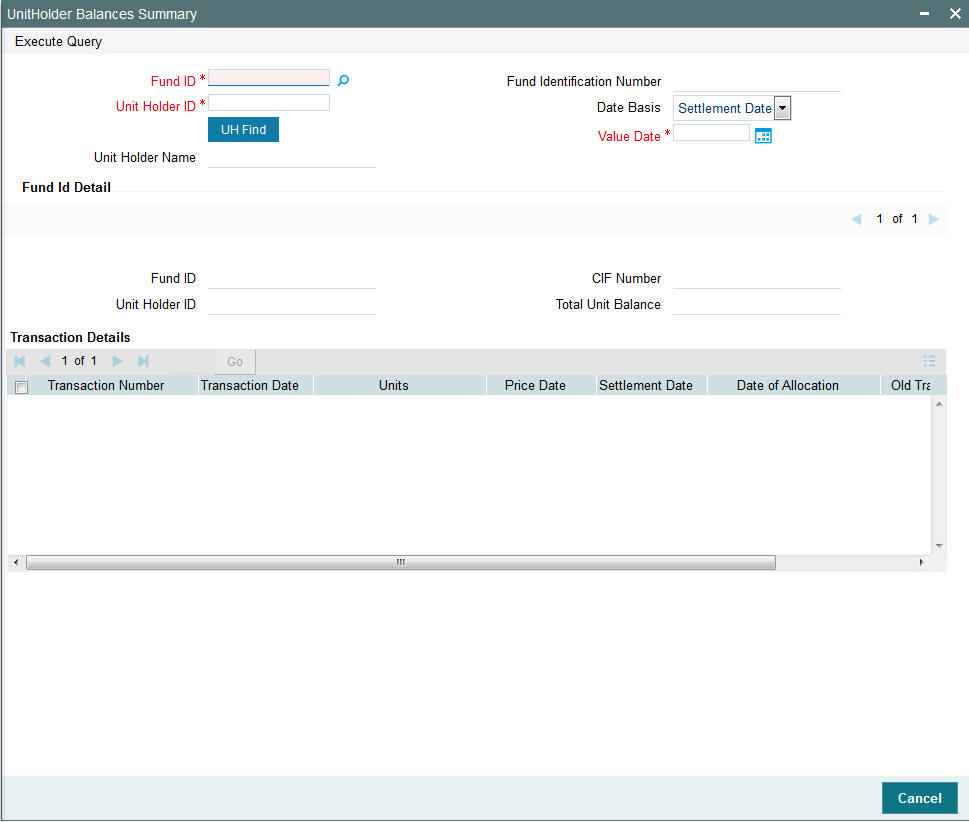

- Section 5.4, "Unit Holder Balances Summary"

- Section 5.5, "Contract Notes for Transactions"

- Section 5.6, "Entering Payment Details for Transactions"

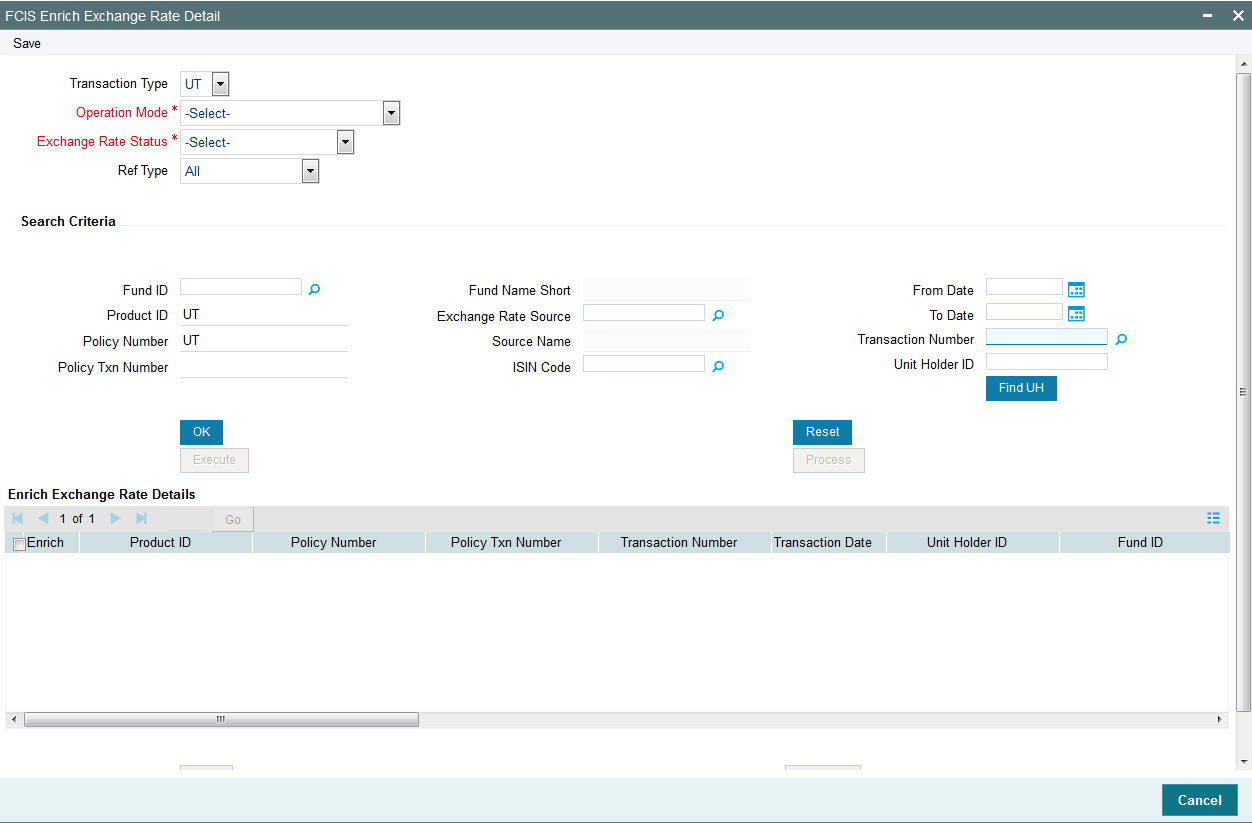

- Section 5.7, "Enrich Exchange Rate Detail"

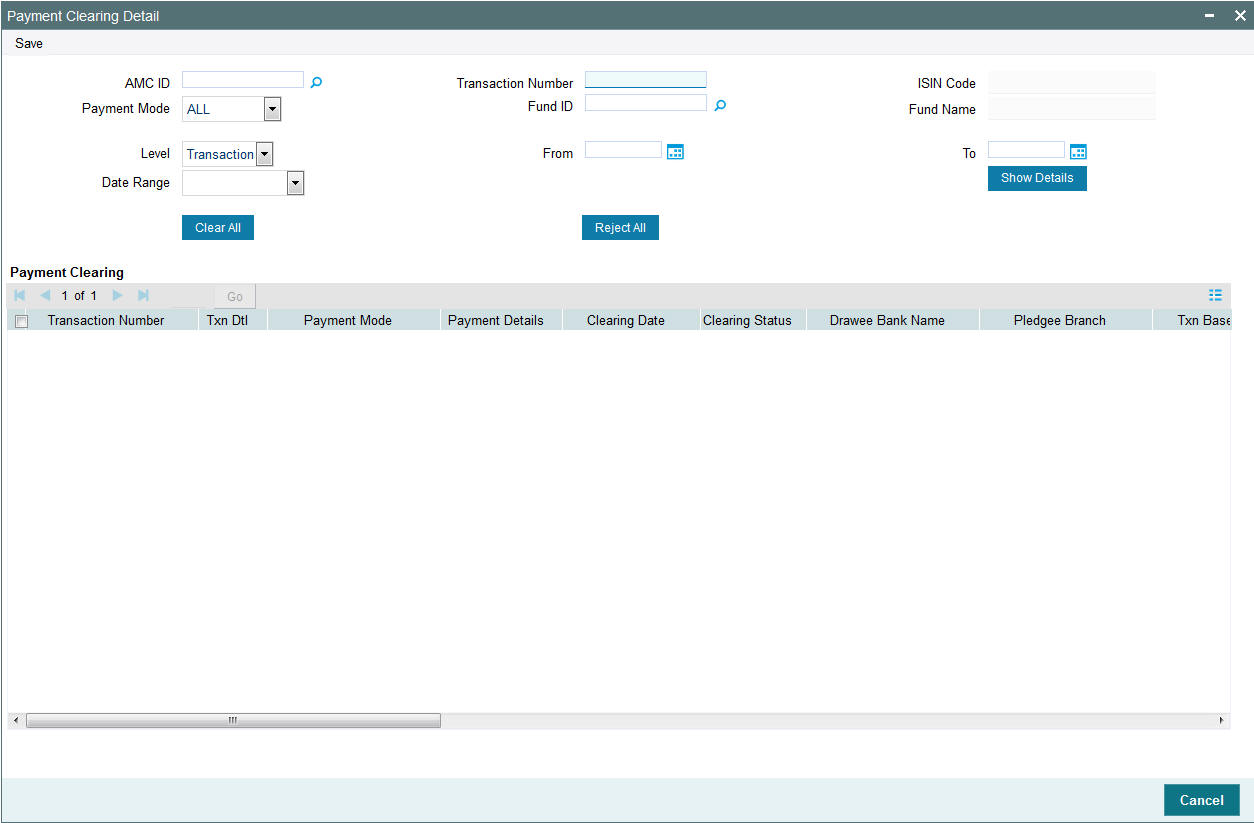

- Section 5.8, "Payment Clearing Detail"

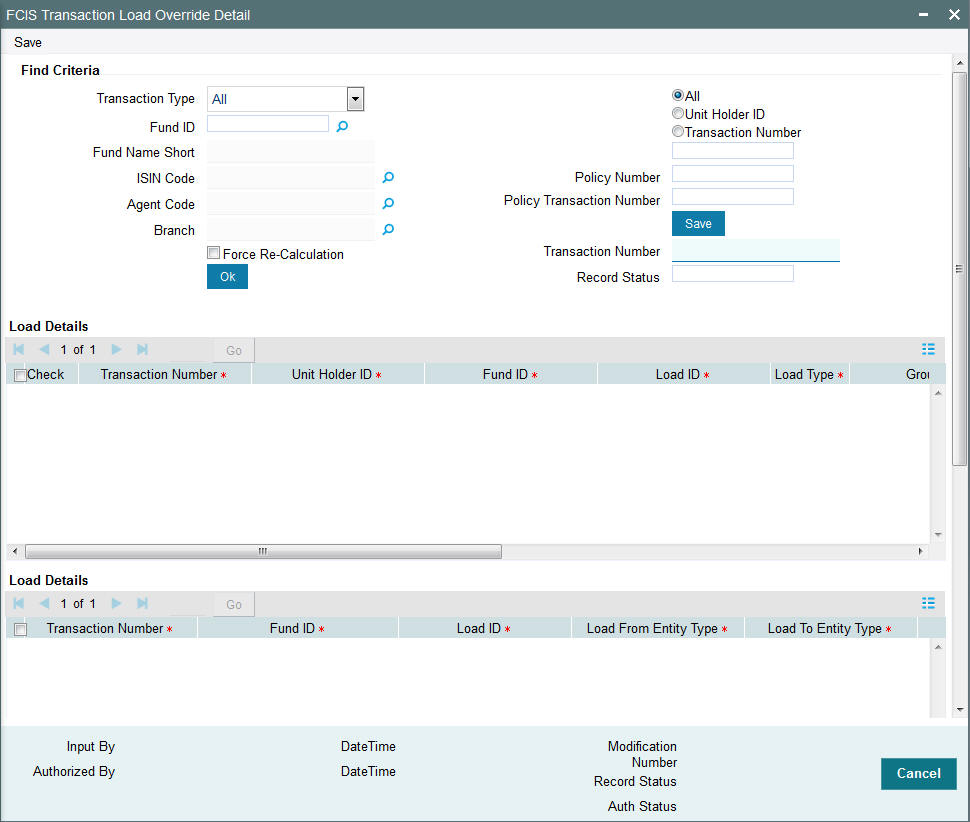

- Section 5.9, "Transaction Load Override"

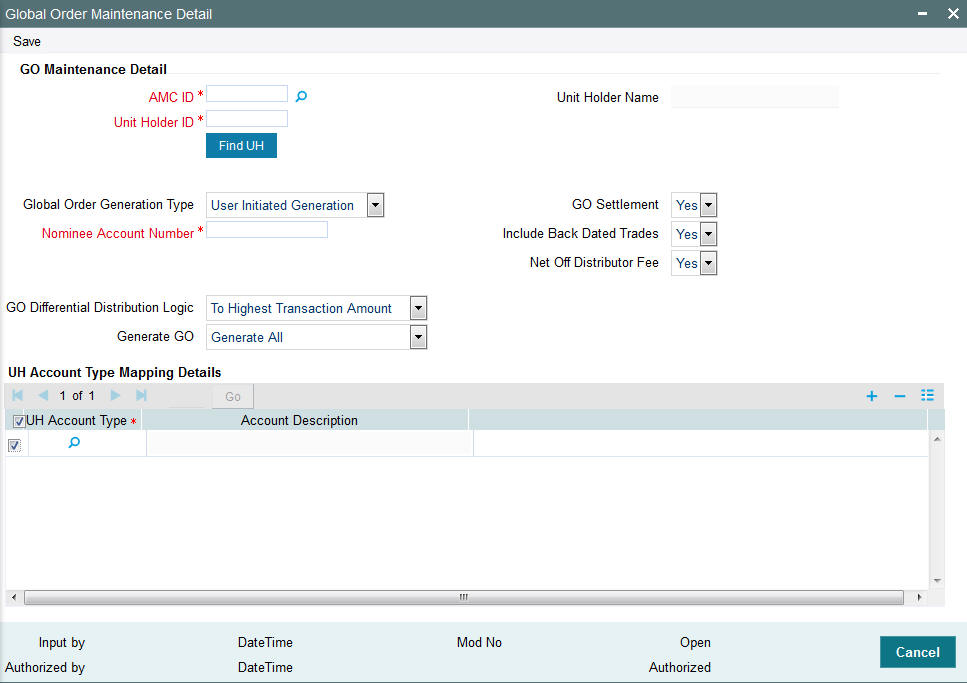

- Section 5.10, "Global Order"Section 5.11, "GO Maintenance Summary"

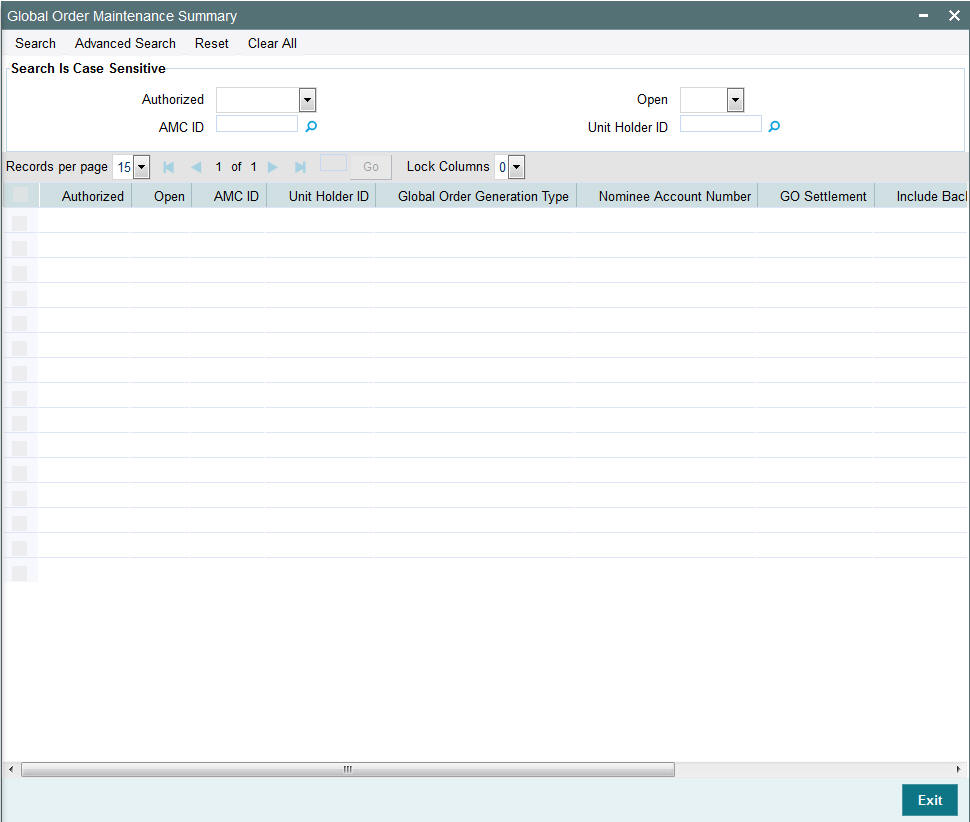

- Section 5.11, "GO Maintenance Summary"

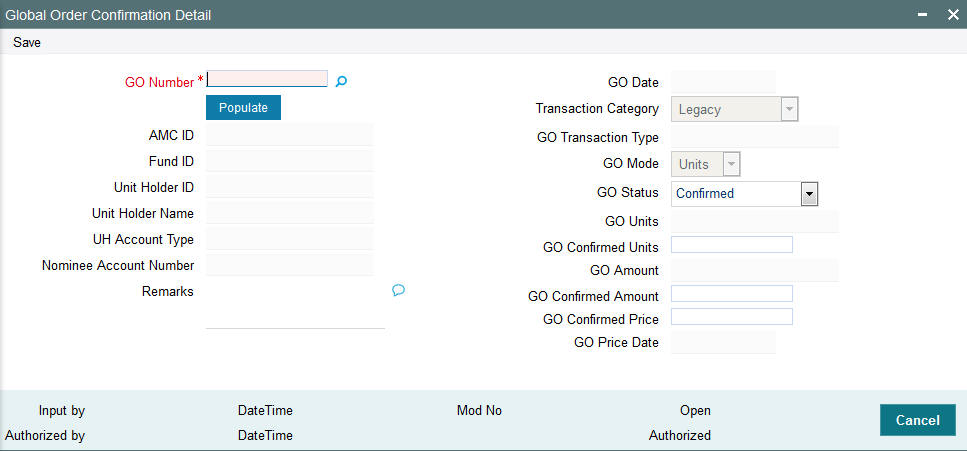

- Section 5.12, "Global Order Confirmation Detail"

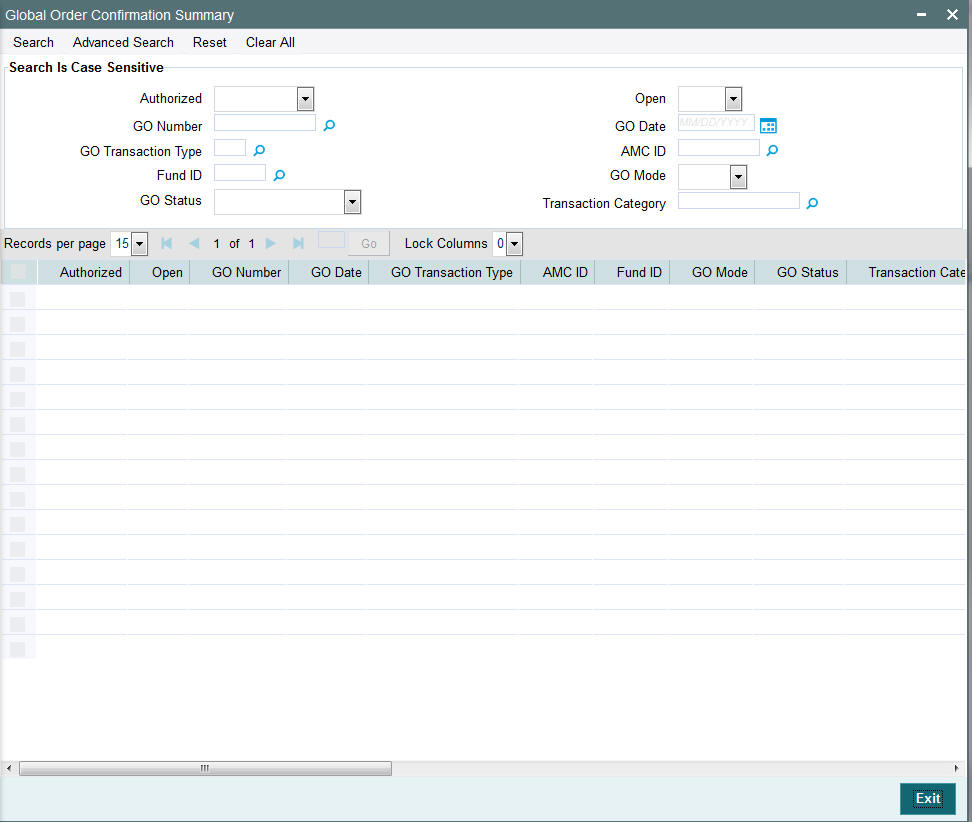

- Section 5.13, "Global Order Confirmation Summary"

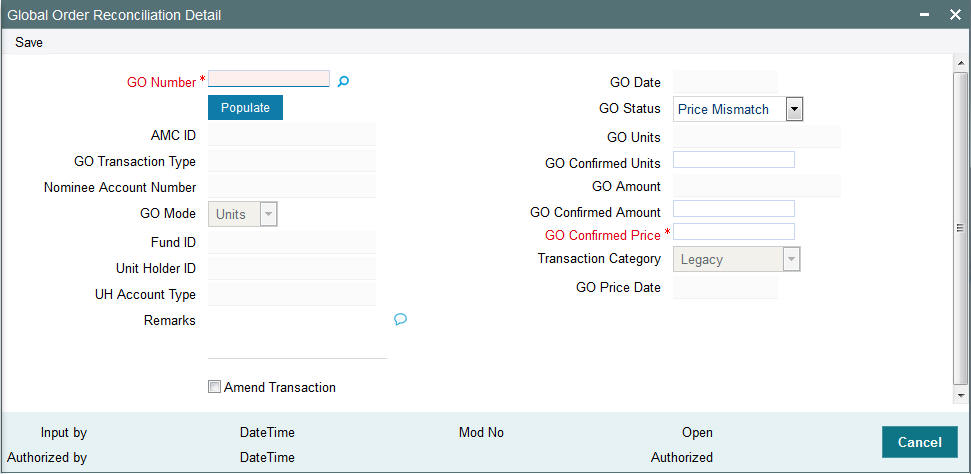

- Section 5.14, "GO Reconciliation Details"

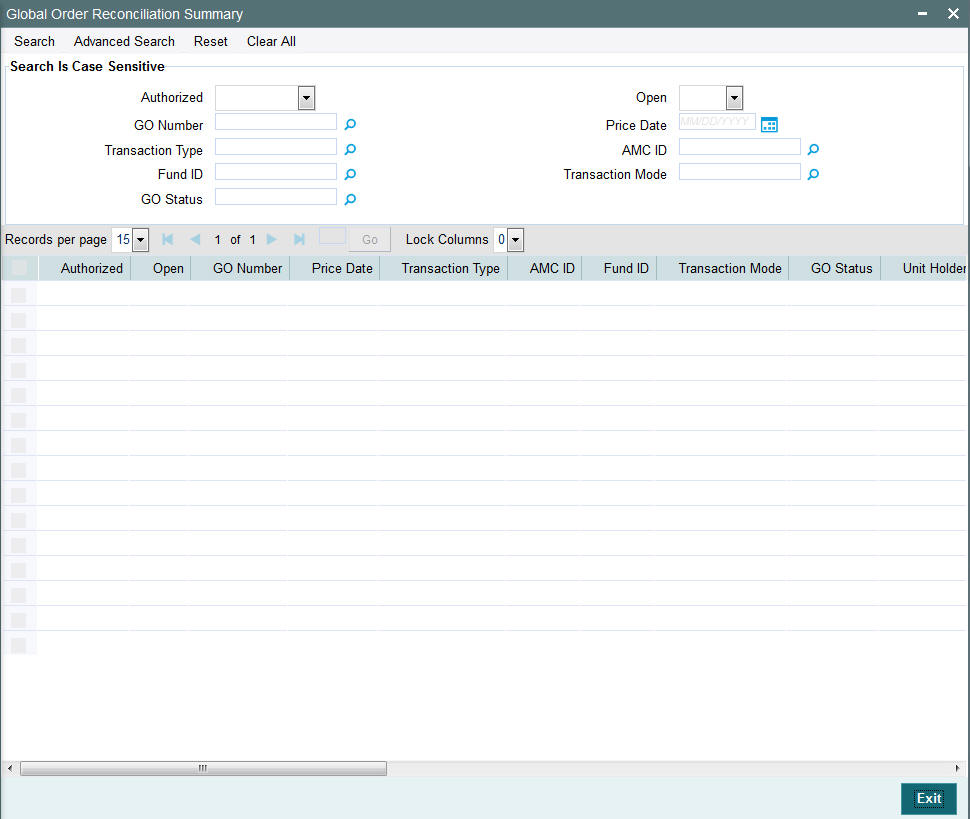

- Section 5.15, "GO Reconciliation Summary"

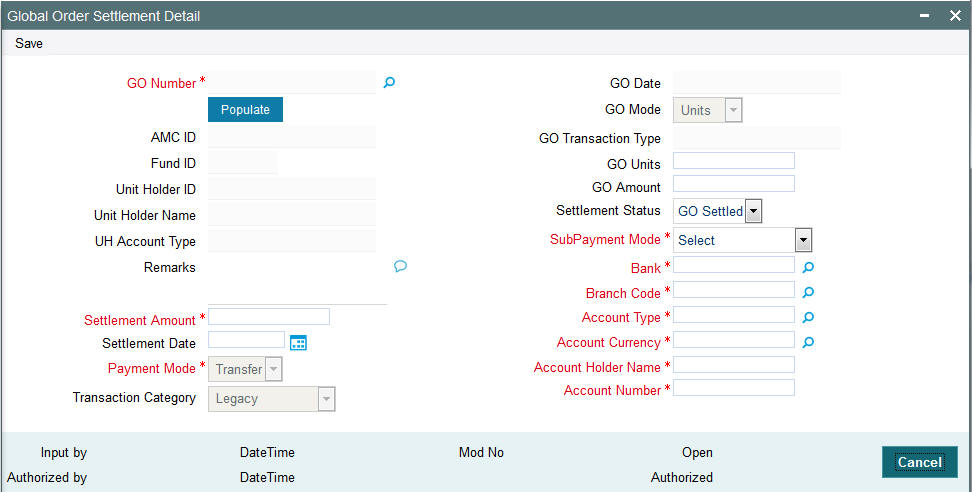

- Section 5.16, "Global Order Settlement Details"

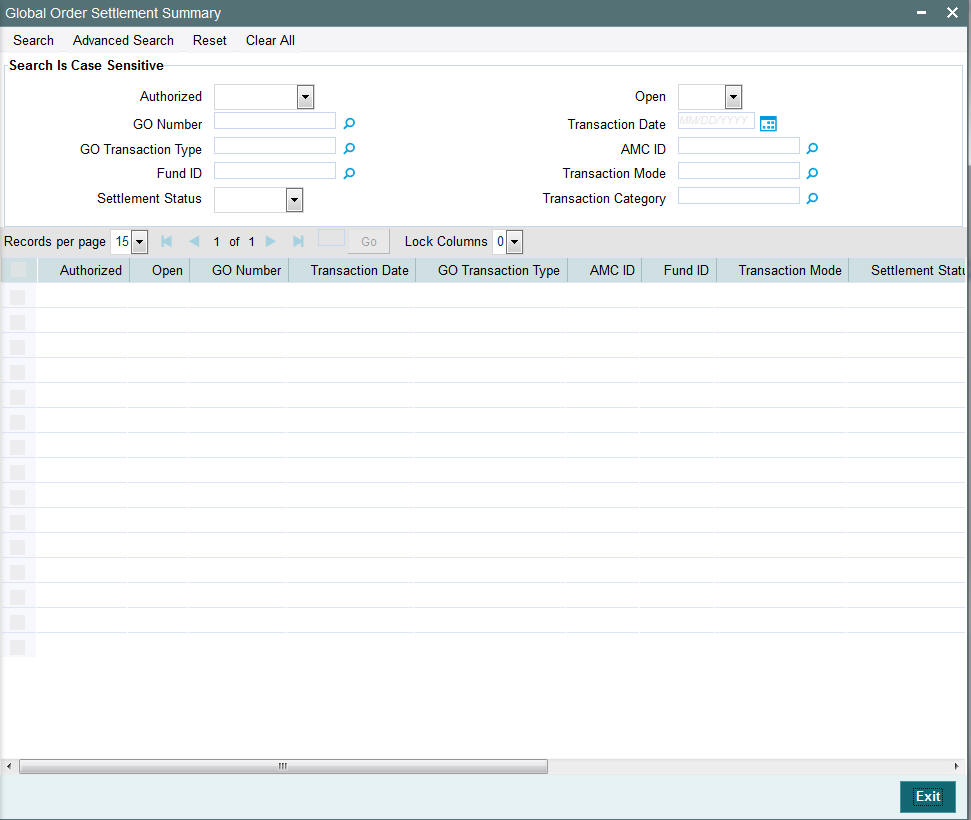

- Section 5.17, "Global Order Settlement Summary"

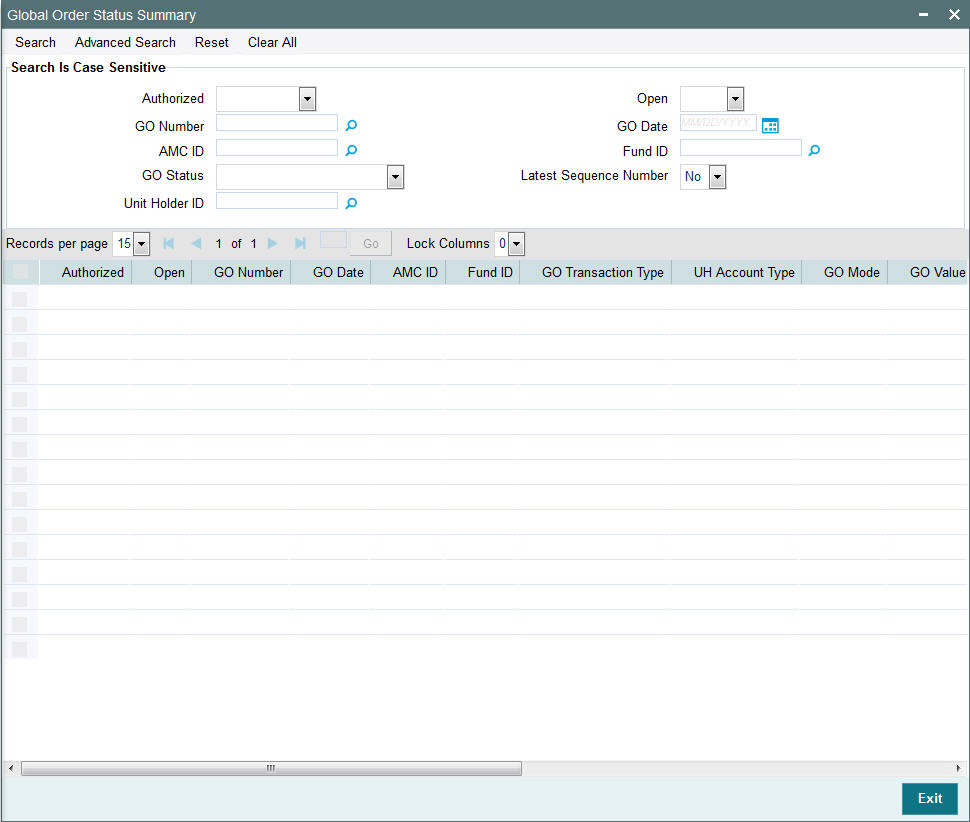

- Section 5.18, "Global Order Status"

- Section 5.19, "ISA Transfer"

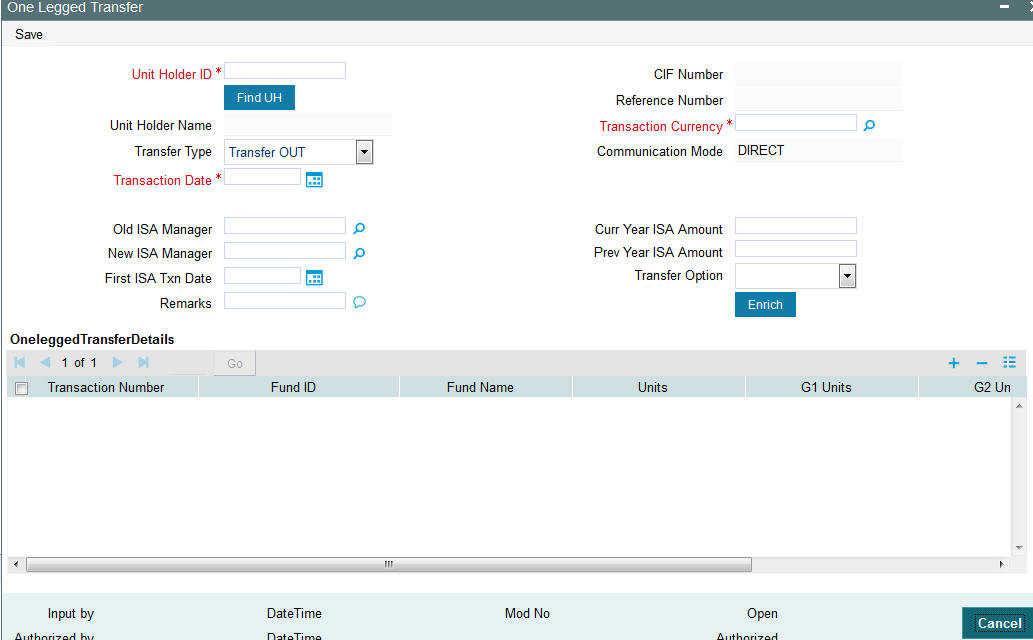

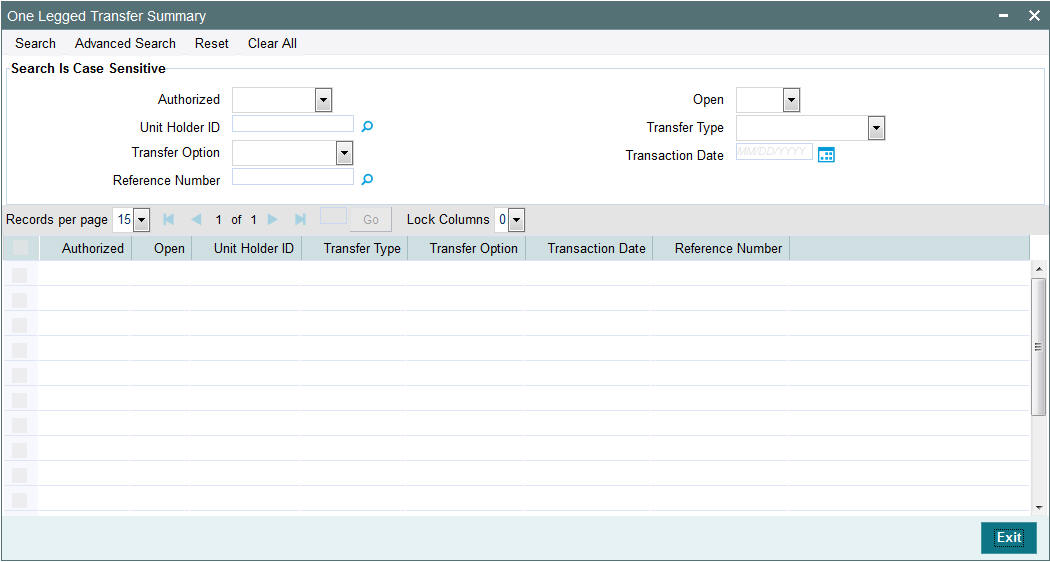

- Section 5.20, "One Legged Transfer Summary"

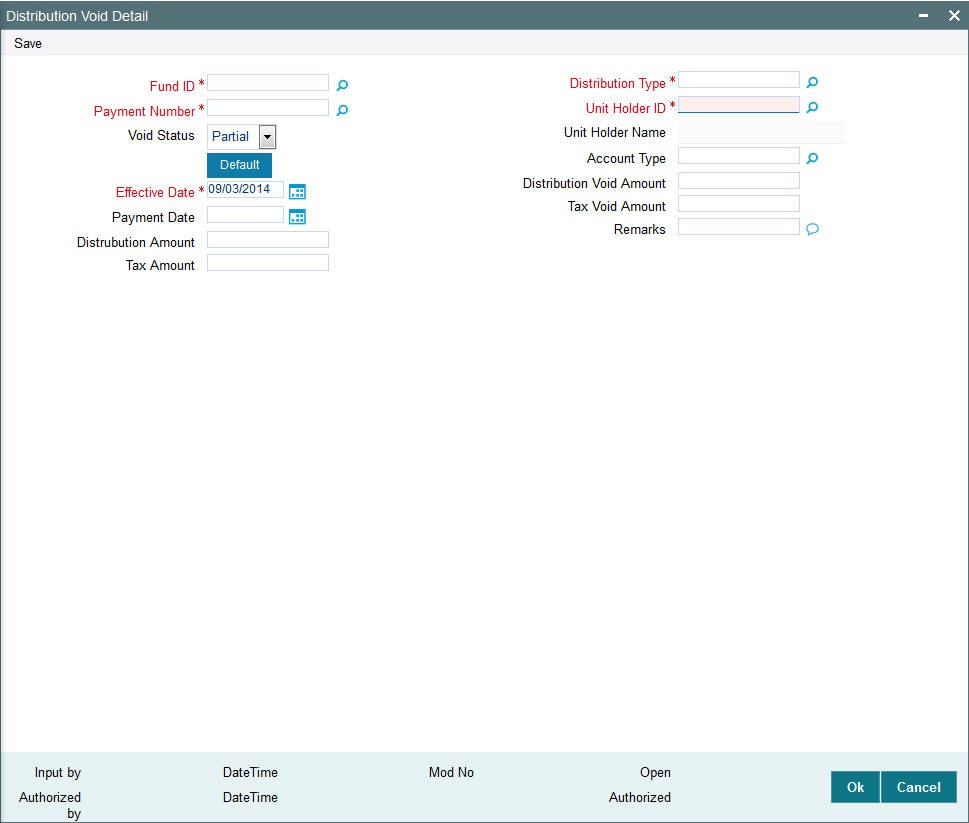

- Section 5.21, "Distribution Void Detail"

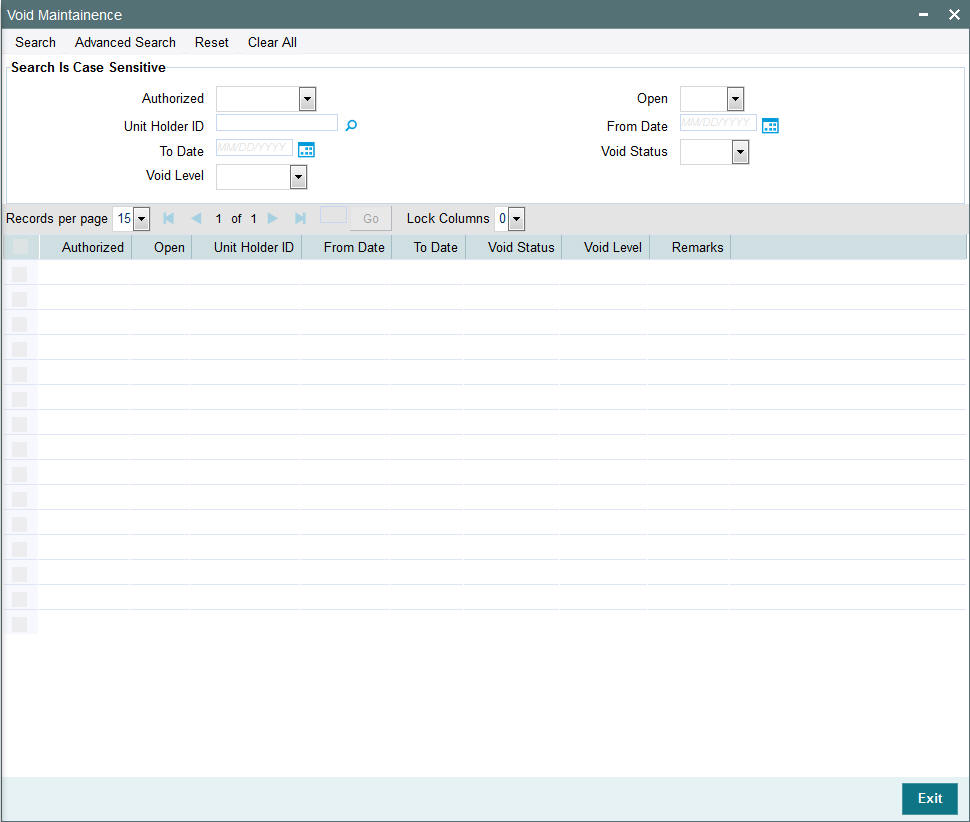

- Section 5.22, "Distribution Void Summary"

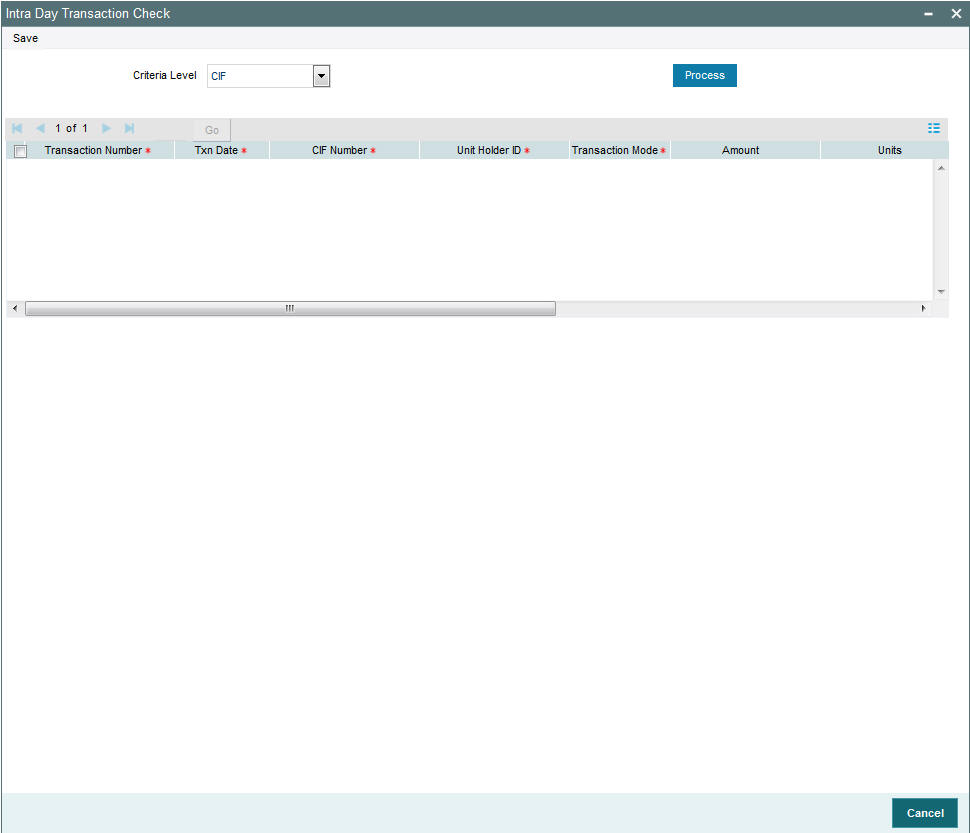

- Section 5.23, "Intra-day Checks for Transactions"

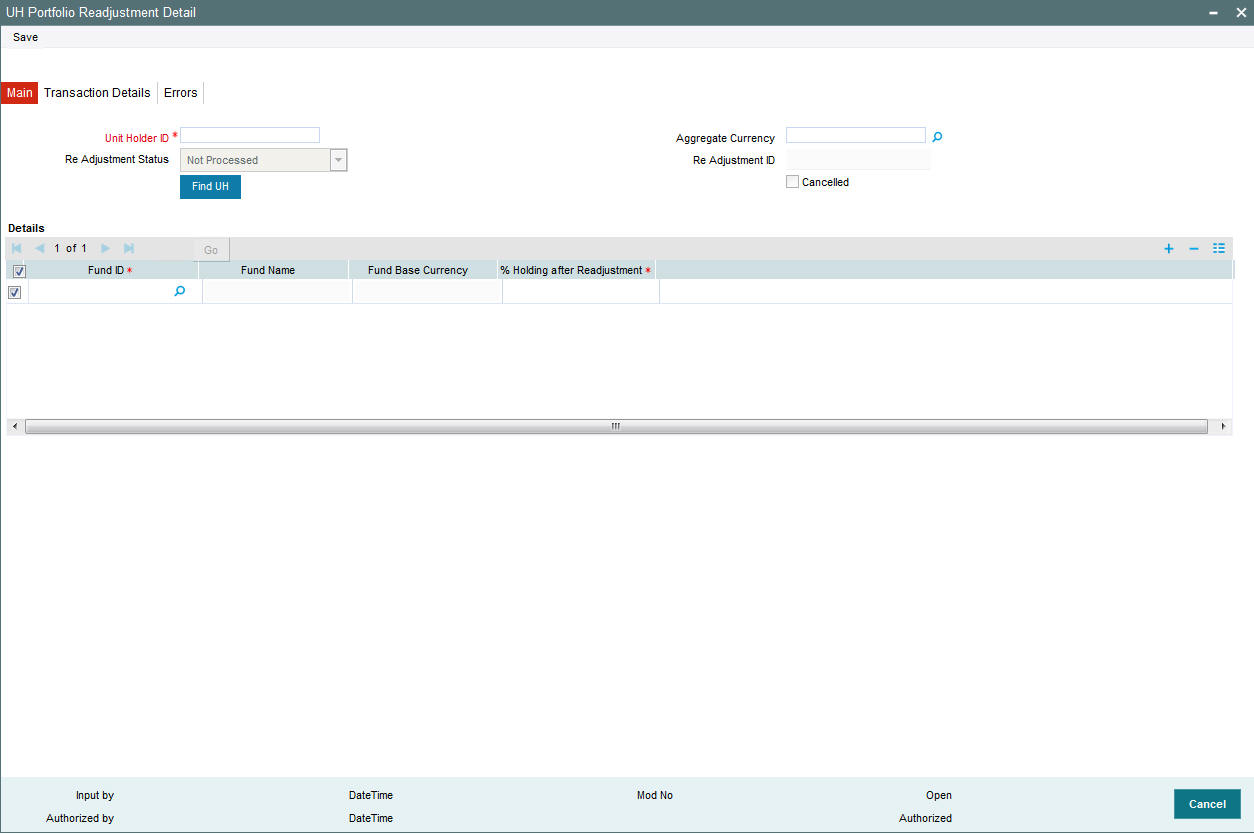

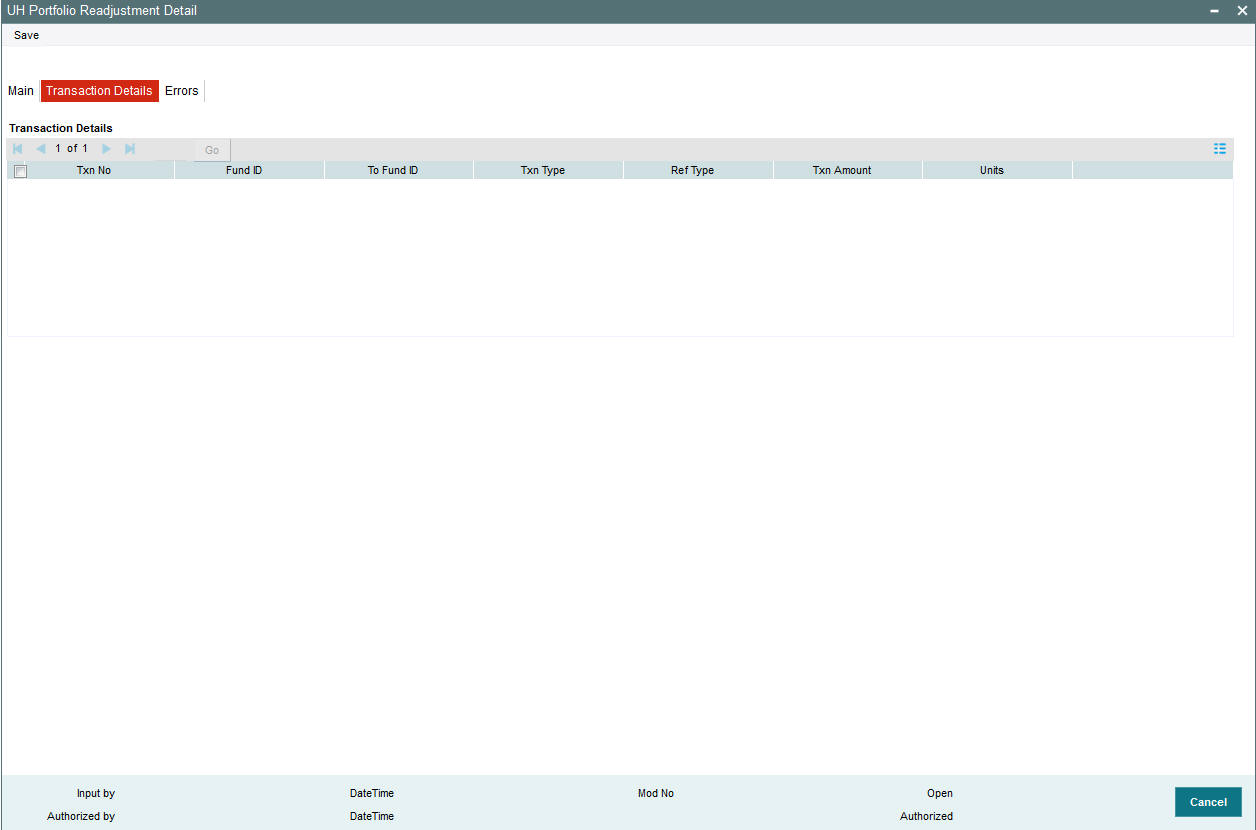

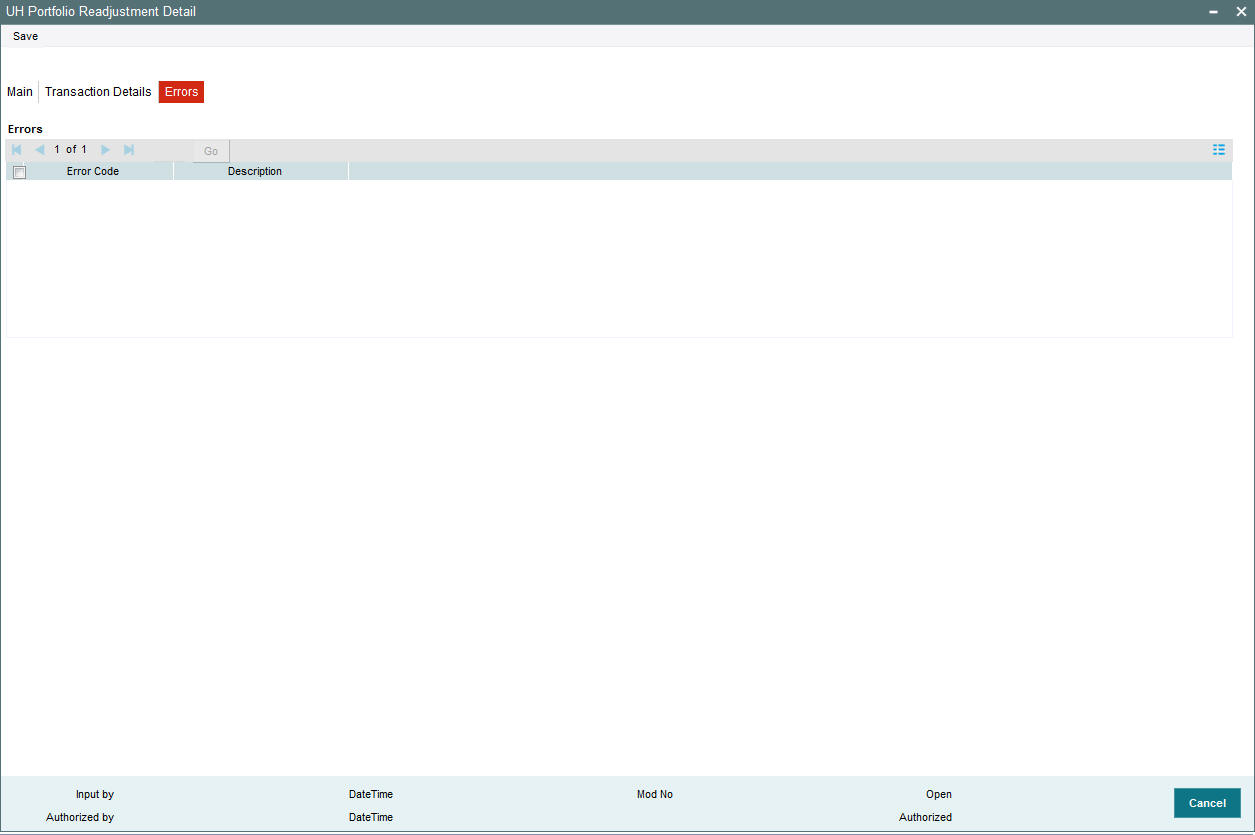

- Section 5.24, "UH Portfolio Readjustment Details"

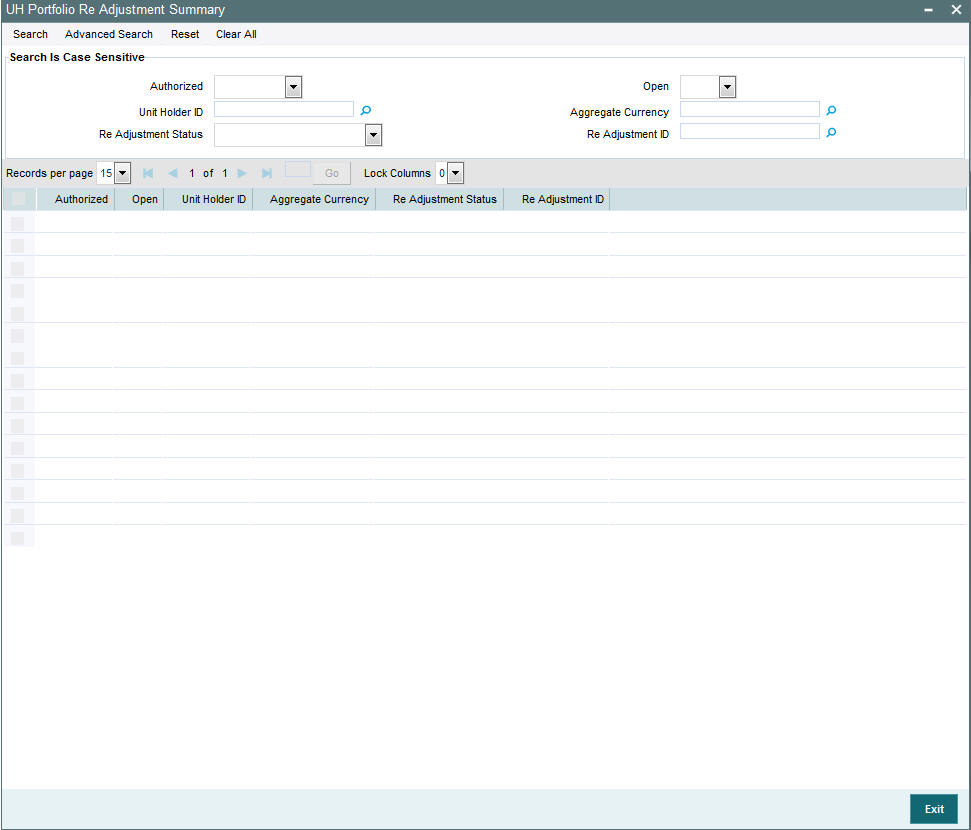

- Section 5.25, "UH Portfolio Readjustment Summary"

- Section 5.26, "Help Desk Facility"

- Section 5.27, "Help Desk Summary"

- Section 5.28, "Sending and Receiving Messages"

- Section 5.29, "RTA Transfer Details"

- Section 5.30, "RTA Transfer Summary"

- Section 5.31, "Consolidation of Portfolios"

- Section 5.32, "Batch Update of Transaction Date"

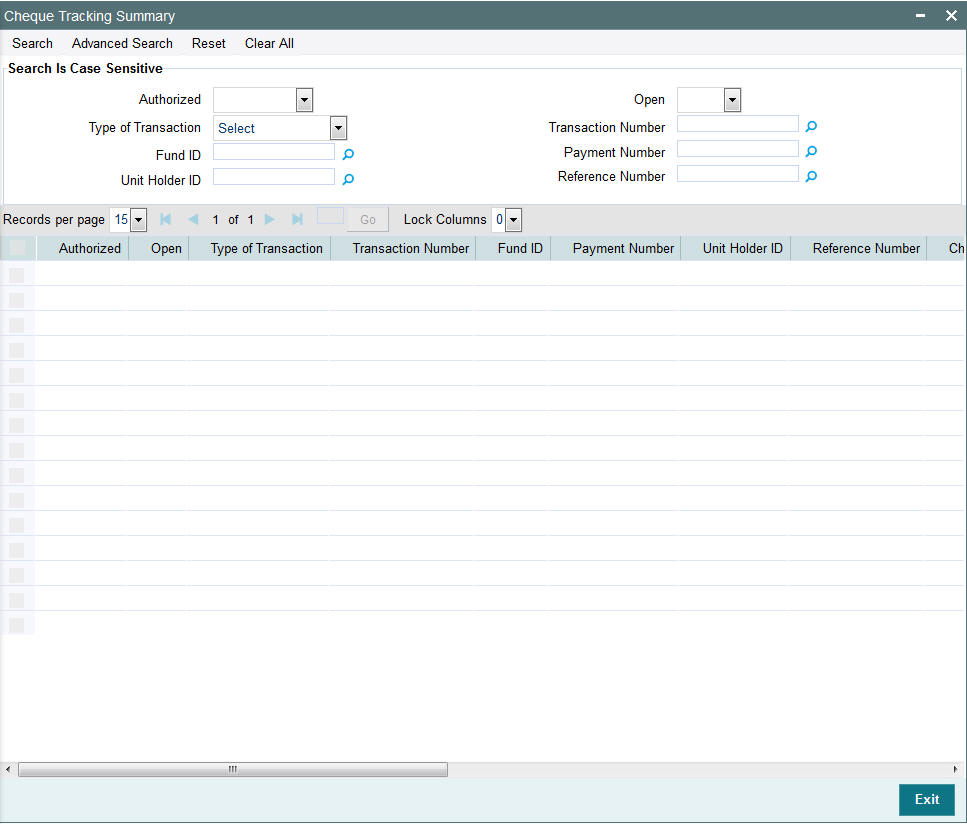

- Section 5.33, "Tracking Cheques"

5.1 Subscription Transaction Detail

This section contains the following topics:

- Section 5.1.1, "Invoking Subscription Transaction Details"

- Section 5.1.2, "Transaction Tab "

- Section 5.1.3, "Allocation Details Button"

- Section 5.1.4, "KYC & Document Tab"

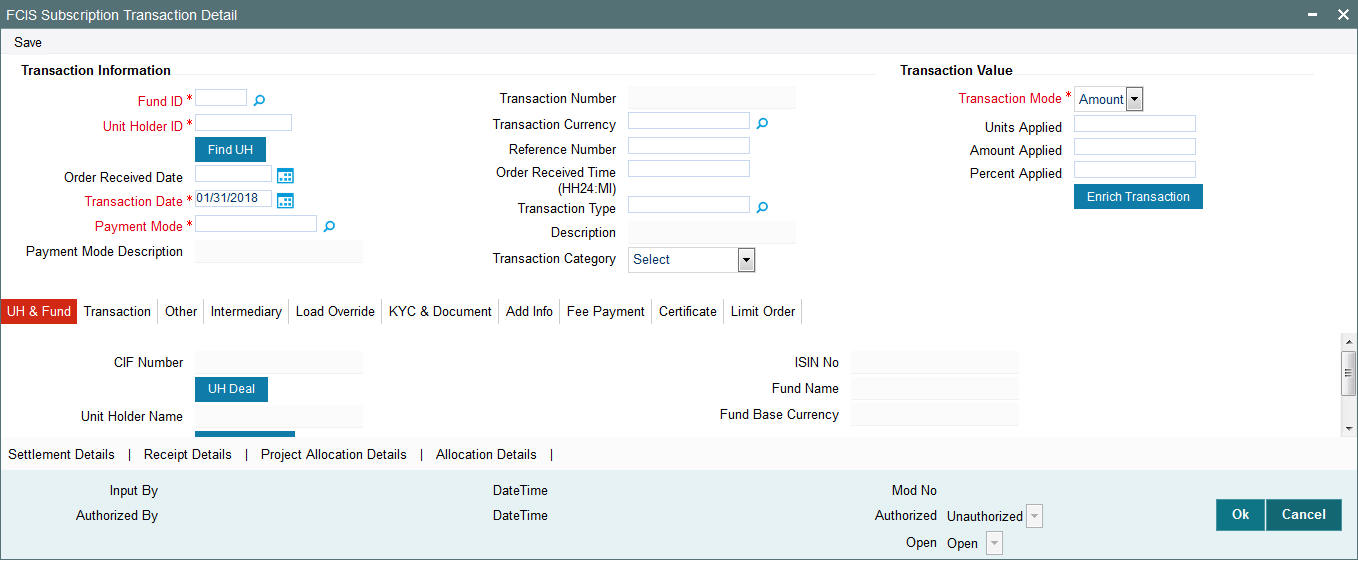

5.1.1 Invoking Subscription Transaction Details

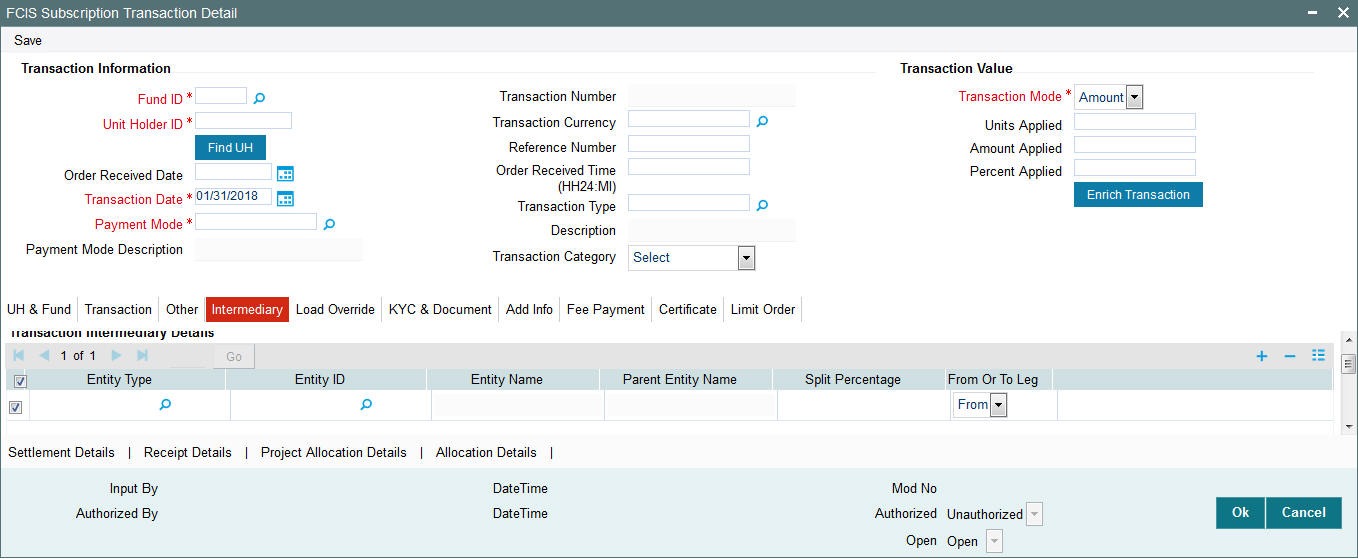

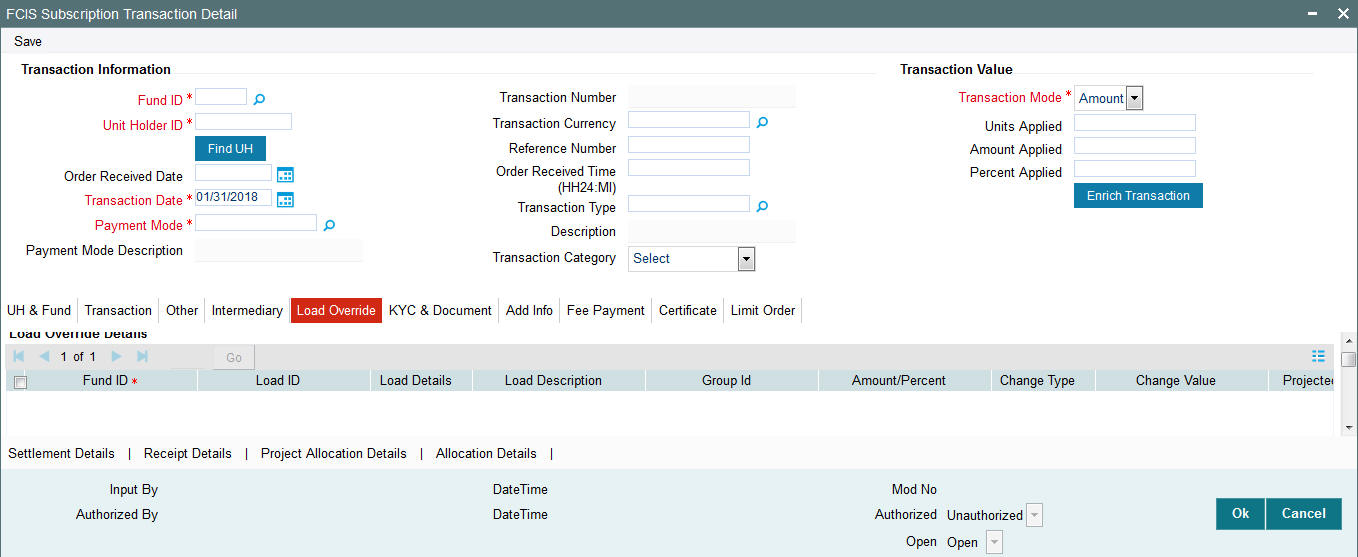

For any transaction type, you can use the Transaction Detail screen to enter new transactions into the system.

You can access this screen if it is contained the menu access privileges given to the user group or user role that your user profile is associated with, as set up by the User Administrator for the agency branch installation.

Typically, all users belonging to the Teller user group can enter new transactions in this screen.

Client Information Section

In this section, specify the details of the CIF customer or the investor that has requested for the transaction.

To retrieve a CIF customer number or a unit holder number, click Find.

CIF Number

Alphanumeric, Optional

Specify the number of the CIF customer for whom the transaction is being entered, in this field.

You must select a CIF that is not restricted (or does not belong to a restricted category) for the fund into which the transaction is being entered. If not, the system does not allow the transaction to be saved.

Unit Holder

12 Characters Maximum, Alphanumeric, Optional. This information is mandatory if you have specified a CIF number.

Select the unit holder for whom the transaction request is being entered.

When you specify the CIF Number, all the unit holders that fall under the CIF are displayed in the drop down list in this field. You can make your choice from this list.

If you have selected a unit holder for the selected CIF using the Find link, the name and number of the selected unit holder is displayed here.

You must select a unit holder that is not restricted (or does not belong to a restricted category) for the fund into which the transaction is being entered. If not, the system does not allow the transaction to be saved.

To Client Information Section

In this section, you must specify the unit holder or the CIF unit holder to whom the transfer of ownership is being affected in the case of transfer transactions.

This section is not applicable to any other transaction type other than transfer.

CIF Number

Alphanumeric, Optional

Specify the number of the CIF customer to whom the transfer is being effected, in this field.

You must select a CIF that is not restricted (or does not belong to a restricted category) for the fund into which the transaction is being entered. If not, the system does not allow the transaction to be saved.

Unit Holder

12 Characters Maximum, Alphanumeric, Optional. This information is mandatory if you have specified a CIF number.

Select the unit holder to whom the transfer of ownership is being affected.

When you specify the CIF Number, all the unit holders that fall under the CIF are displayed in the drop down list in this field. You can make your choice from this list.

If you have selected a unit holder for the selected CIF using the Find link, the name and number of the selected unit holder is displayed here.

You must select a unit holder that is not restricted (or does not belong to a restricted category) for the fund into which the transaction is being entered. If not, the system does not allow the transaction to be saved.

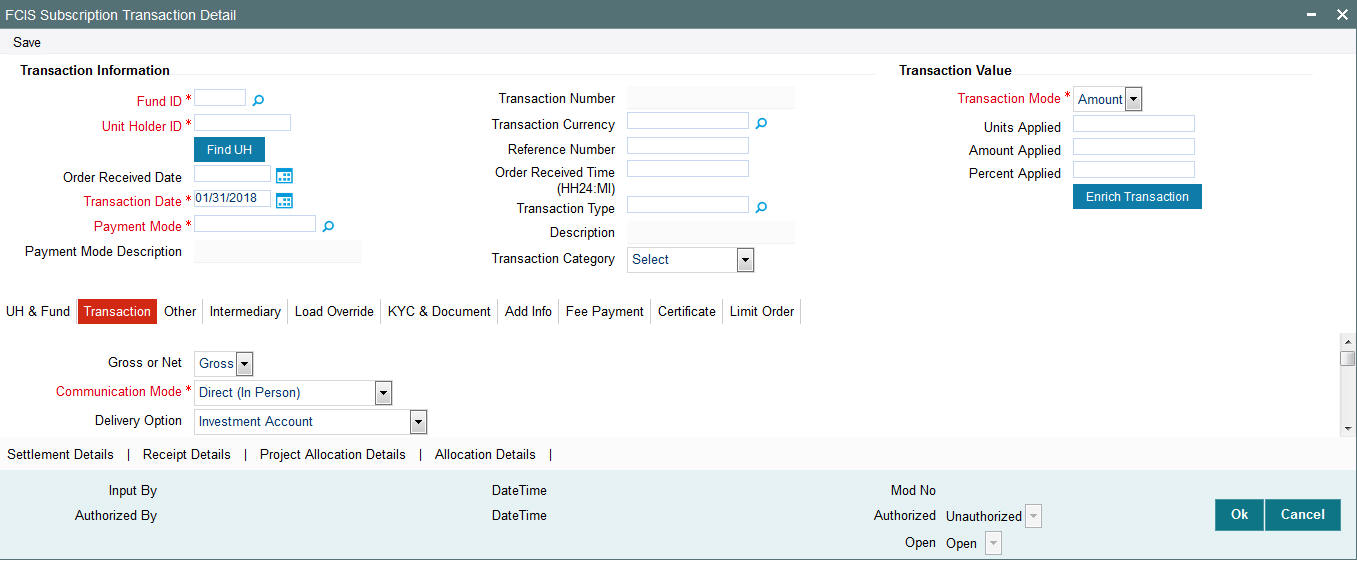

5.1.2 Transaction Tab

The following are the fields in the screen:

Unit Holder ID

Specify the Unit holder for the transaction entered. To locate a unit holder click on “Find”

Transaction Date

Date format (dd-mm-yyyy), Mandatory

Specify the date on which the transaction request is being entered into the system. The application date is displayed here by default, and is deemed to be the transaction date.

You can enter an earlier date (for a backdated transaction) that falls within the backdating limit specified for the fund in which the transaction is being requested.

The date that you specify here must not be a designated holiday in the system. If you do specify a holiday, the system prompts you to specify a different date.

For check redemption transactions, you must specify the issue date of the check here.

For redemption, switch or transfer transactions, if the unit holder account has a stop instruction (i.e., is frozen), then you can only input the transaction if the transaction date is ahead of the Stop Account Release Date specified in the account profile. For transfer transactions, this validation is made only for the transferor account.

In case of future dated transactions, the transaction date cannot be greater than the future dating limit specified in the Transaction Processing Rules screen.

Reference Number

16 Characters Alphanumeric, Mandatory

Specify a unique reference number that will be used to identify the transaction in the system. Typically, this number is the number of the application that is used to enter this transaction. It will be the initial identification for the transaction, before the actual transaction number is generated by the system.

If the reference number is designated to be a system-generated number for the agency branch, this field is disabled when you open the screen. The system will internally generate and display this number when you save the transaction.

Fund Id

Alphanumeric, Mandatory

Select the fund in which the transaction is being requested.

The funds displayed in the drop down list are authorized funds with a latest prevalent set of fund rules and rule effective date. They are also funds for which the type of transaction that you are entering is permissible, as defined in the Transaction Processing Rules records for the funds.

When you select the fund, the name of the fund as specified in the Fund Demographics screen is displayed in the Fund name field. Also, the base currency for the fund is retrieved from the fund rules and displayed in the Fund Base Currency field in this screen.

Transaction Number

16 Character Maximum, Alphanumeric, System-generated

This is a unique number automatically assigned to each transaction by the system. It is internally generated upon successful entry of the transaction and after all validations have been made. The transaction number generated by the system is in the format TT-YYYY-JJJ-NNNNNNN

Where,

TT - Transaction type (01 - IPO Subscription, and so on)

YYYY - Year of processing

JJJ - Julian date

NNNNNNN- Running sequence number for the day

ISIN Code

12 Characters Maximum; Alphanumeric; Mandatory

Select the ISIN Code of the fund in which the transaction is being requested, from the options provided. If you specify the ISIN Code of a fund, the ID of the fund is displayed in the Fund field and name of the fund is displayed in the Fund Name field.

Fund Base Currency

Display Only

When you select the fund in which the transaction is being entered, the base currency of the fund is retrieved from the fund rules and displayed here.

Price Basis

Alphanumeric, Mandatory

The default price basis defined in the Distributor Price Basis Setup, if any, for the fund, transaction type, distributor and investment account type involved in the transaction, is displayed in this field.

If no price basis has been maintained in the Distributor Price Basis Setup, the default price basis specified for the fund and transaction type for the transaction, from the fund rules, is displayed here.

You can override the default when you enter the transaction.

From Price Date

This field is enabled when you select the fund in which the requested transaction is to be put through. The price date is arrived at by taking into consideration several conditions. You can modify the same.

If you have defined a different trade cycle for the fund in the ‘Override Trade Cycle Date’ screen and the transaction falls within the override period mentioned in this maintenance, the system will default the price date from the maintenance.

Note

This field is enabled only if you select a fund for which you have indicated forward pricing is applicable.

Refer the chapter ‘Other Fund Activities’ for more details on maintaining alternate trade cycles for a fund.

Price Basis for From Fund (For Switch Transactions Only)

Alphanumeric, Mandatory

The default price basis defined in the Distributor Price Basis Setup, if any, for the ‘from’ fund, transaction type, distributor and investment account type involved in the transaction, is displayed in this field.

If no price basis has been maintained in the Distributor Price Basis Setup, the default price basis specified for the ‘from’ fund and transaction type for the transaction, from the fund rules, is displayed here.

You can override the default when you enter the transaction.

Price Basis for To Fund (For Switch Transactions only)

Alphanumeric, Mandatory

The default price basis defined in the Distributor Price Basis Setup, if any, for the ‘to’ fund, transaction type, distributor and investment account type involved in the transaction, is displayed in this field.

If no price basis has been maintained in the Distributor Price Basis Setup, the default price basis specified for the ‘to’ fund and transaction type for the transaction, from the fund rules, is displayed here.

You can override the default when you enter the transaction.

Transaction Type

Alphanumeric; Mandatory

Specify whether the transaction involves an initial purchase, subsequent purchase or a limit order buy or sell transaction.

When the transaction is saved, the system checks to see if the balance for the unit holder at a customer / investment type is zero, or if there is no underlying balance. If so, and the type of transaction selected is not ‘Initial Purchase’, the system displays a warning, which can be overridden.

Also, if the ‘Initial Purchase’ option is chosen, and the unit holder holds any balance at the customer / investment type level, or if there is any underlying balance, the system displays a warning, which can be overridden.

In case of Switch transactions, specify the type of switch the unitholder has opted for. The values defined as a part of Parameter Maintenance will be available in the drop-down list.

In case of Transfer transaction, you can specify whether the transaction involves scrip-less to scrip-based conversions and vice versa. In case of scrip-less to scrip-based conversions, select the option ‘Book to Certificate’ and in case of scrip-based to scrip-less conversion, select ‘Certificate to Book’.

Liquidation Indicator

Alphanumeric; Mandatory

Specify if the redemption transaction involves a limit order sell, by selecting it from the list.

Product

Alphanumeric, Mandatory

If the selected investor is eligible for tax-exemption, select the tax product in which the investor wishes to purchase units, in this field. When you select the product, you are indicating to the system that this transaction will affect the used up amount of the non-taxable limit set up for the selected unit holder in the Non-Tax Limits Setup options.

The proceeds of the transaction will also be reflected in the system database as non-taxable holdings for the investor.

To Fund

Alphanumeric, Mandatory for switch transactions

Select the fund to which the selected unit holder has requested to switch or exchange the investment. If you specify the Fund ID, the ISIN Code of the fund is displayed in the To ISIN Code field.

To ISIN Code

12 Characters Maximum; Alphanumeric; Mandatory

Select the ISIN Code of the fund to which the selected unit holder has requested to switch or exchange the investment, from the options provided. If you specify the ISIN Code of a fund, the ID of the fund is displayed in the To Fund field.

From Issued Balances

Optional

In the case of transaction types other than IPO or subscription, specify whether the transaction value must be reckoned from the unit holder’s issued balances or the non-issued balances. Select ‘Yes’ to indicate that the value must be reckoned from the issued balances, and ‘No’ to indicate that it must be reckoned from the non-issued balances.

The issued balances are the portions of the unit holder’s balance for which certificates have been issued. The non-issued balance is that portion for which certificates have not been issued. The unit holder can choose to enter into transactions (other than IPO and subscription) using either portion of the balance, but not both in a single transaction.

If you select the option ‘Both’ and the selected unitholder has requested certificates, system will first try to redeem all the units from the certificates provided. If units in excess of the certificates provided are to be redeemed, system will first redeem the scrip-less holdings using FIFO logic. In such cases, during transaction entry, system will check whether the unit holder has sufficient scrip-less certificate balance to process the redemption transaction.

The following example illustrates this:

Case 1

Assume that a unitholder has 1000 certificate balance and 1000 scrip-less balance. During redemption entry the investor specifies 1200 units to be redeemed and provides certificates worth 800 units, then system will redeem 800 units from the scrip-based holdings and the remaining 400 from scrip-less holdings.

Case 2

Assume that the unitholder has 1000 certificate balance and 1000 scrip-less balance. During redemption entry the investor specifies 1400 units to be redeemed and provides certificates worth 300 units, system will not allow you to save this redemption, since the unitholder does not have sufficient scrip-less holdings.

Certificates Required?

Optional

For funds that have the certificate option as specified in the Shares Characteristics rules, specify whether the selected unit holder has requested certificates. If yes, then choose the Yes option in this field, and specify the number of certificates requested in the Number of Certificates field.

Number of Certificates

Mandatory only if you have chosen the ‘Yes’ option in the Certificate Required field.

Select the denomination of certificates, whether single or multiple, that will be involved in the transaction, if certificates have been requested.

- For IPO and subscription, specify whether the unit holder has requested a single certificate or multiple certificates.

- For redemption, switch and transfer, specify whether a single certificate or multiple certificates are being redeemed, switched or transferred. For transfer transactions, specify whether the transferee unit holder has requested single or multiple certificates.

If you choose the ‘Multiple’ option in this field, then the certificates involved in the transaction will be reckoned in denominations governed by the maximum and minimum certificate denominations specified for the fund in the Shares Characteristics rule.

Transaction Mode

Alphanumeric, Mandatory

Select the mode in which the transaction is being requested. An investor can choose to transact using a specific amount, or a certain number of units held, or a percentage of the units held. Accordingly, select the appropriate option.

For check redemption transactions, which you enter for an investor with check writing facility in a fund for which check writing is allowed, the mode of the transaction is considered by default to be ‘amount’. It cannot be changed.

For redemption transactions involving scrip-based and Certificate option funds, you can choose to transact using a specific amount.

Fee Calculation Basis

Optional

Specify whether the transaction fee should be computed in terms of the fund base currency or the transaction currency.

If the Fee currency is based on transaction currency then the load amount will be calculated in terms of the transaction currency and all Fund Base Currency equivalents for Settlement Amount, Net Amount and Gross Amount will be calculated after converting the FBC equivalent from Amount in Transaction Currency.

This option will be displayed only if the fee computation in terms of the transaction currency is allowed for the fund involved in the transaction.

This option is applicable only for IPO subscription, subscription, redemption and switch transactions.

Gross or Net

Alphanumeric, Mandatory

Specify whether the value of the transaction is to be considered as a gross value from which the loads would be deducted or as a net figure apart from the loads.

For check redemption transactions, which you enter for an investor with check writing facility in a fund for which check writing is allowed, the value of the transaction is considered by default as a net figure, and it cannot be changed.

Transaction Currency

Alphanumeric, Mandatory

Select the currency in which the payments for the transaction will be made or accepted. The drop down list contains currencies that are valid as transaction currencies for the fund, from the Fund Transaction Currency list in the fund rules.

If the specified unit holder’s preferred currency is a valid transaction currency for the fund, it is displayed here by default. If not, the base currency for the selected fund is displayed here by default. In either case, you can change these default specifications and make your choice from the list.

Exchange Rate Source

Alphanumeric, Mandatory

Select the exchange rate source from which the exchange rates are to be derived for the transaction. The default source for the AMC is displayed here, from the Defaults Maintenance.

Transaction Value

Numeric, Optional

Specify the value of the transaction here. You could express this either as a specific amount, a specific number of shares, or a percentage of shares, as applicable.

If you specify an amount or a number of shares here, the value should fall within the following ranges:

- It must be greater than the minimum transaction amount (or minimum number of shares) specified for the selected transaction type in the Transaction Processing Rules profile for the fund.

- It must be less than the maximum transaction amount (or maximum number of shares) specified for the selected transaction type in the Transaction Processing Rules profile for the fund.

- It must be factorable by the step amount range (or the step units range) specified for the selected transaction type in the Transaction Processing Rules profile for the fund.

- For check redemption transactions, which you enter for an investor with check writing facility in a fund for which check writing is allowed, the transaction amount that you specify here must fall within the minimum and maximum limits specified in the fund rules, for such transactions.

For instance, If the step amount is 10 and the minimum amount is 100, the allowable values are 100,110, 120 etc.

For transactions by gross amount, a transaction value that exceeds the Minimum Amount for Tax ID that has been specified in the fund rules, the system validates the availability of the PAN Number in the unit holder account profile. If the PAN Number has not been specified in the profile, you must enter a transaction value that does not exceed the Minimum Amount for Tax ID value, or make a change to the unit holder account and specify the PAN Number, and then attempt to input the transaction.

Amount in Fund Base Currency

Display Only

When you specify an amount as the transaction value, the system computes the equivalent of the same in the base currency of the selected fund and displays it here.

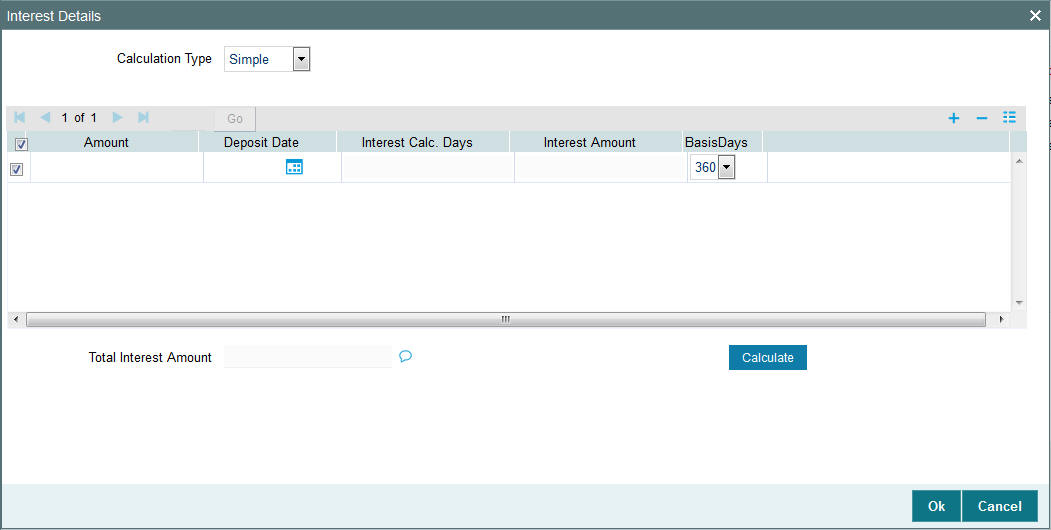

Interest Amount

The system computes the interest amount based on the interest calculation days, interest rate provided by you in the ‘Interest Calculation Screen’ (explained below). You will be able to change the amount displayed if required.

Interest Calculator

Click ‘Details’ button in the ‘Transaction‘ tab of the ‘FCIS Subscription Transaction Detail’ screen, to invoke the Interest Calculation Screen.

The following are the fields in this screen:

Calculation Type

Mandatory

Select the calculation type from option list. The options available are:

- Simple

- Complex

Basis Days

Mandatory, Numeric

Select the interest basis days, based on which the interest will be calculated. The options available are:

- 360 days

- 365 days

Transaction Interest Calculation Section

Amount

Display Only

The transaction value provided by you is displayed here. You will not be able to change the amount displayed.

Transaction Currency

Display Only

The system displays the transaction currency that is selected in the ‘Subscription’ screen.

Interest Amount

Display

The system computes the interest amount based on the interest calculation days, and interest rate provided by you. You cannot change the amount displayed.

Click ‘Calculate’ button after providing the necessary information for the system to compute the interest amount. The interest amount will be calculated and displayed in the field ‘Interest Amount’.

Payment Date

Display Only

When you make a deposit to the bank, the date of payment will be displayed here.

No. of Days

Display Only

The system displays the number of days the interest calculation has to be done for a policy.

Note

- Click ‘Ok' button to return to the transaction screen

- Click ‘Cancel’ button to withdraw the data entered and you can not save the data

- Click ‘Calculate’ button after providing the interest calculation days and interest rate to calculate the interest amount.

- Click ‘Refresh’ button if you require making any changes to the data provided by you.

For more details, refer to ‘Maintaining Interest Rate Details’ section which is discussed later in this chapter.

Override Exchange Rate?

Check Box, Optional

Select this option if you want to override the computed exchange rate.

The ‘Calculate’ link for exchange rate calculation

To compute the exchange rate that will be applied for the transaction, select this link. The system computes the exchange rate and displays it in the Exchange Rate Applied field.

Exchange Rate Applied

Numeric, Mandatory

When you select the exchange rate source, the system computes the actual exchange rate applied using the transaction currency, fund base currency and the value of the transaction, and displays the same here.

You can override this value when you enter the transaction. To do so, select the Override Exchange Rate box, and then specify the desired exchange rate value in this field.

When you override the computed exchange rate, the overridden value must fall within the fluctuation range allowed for the transaction currency - fund base currency pair, in the Currency Pair Setup records.

FX Deal Date

Date; Optional

The system will display the ‘FX Deal Date’ during transaction enrichment for subscription, redemption and pseudo-switch transactions, which you can override if required. However, if the date you specify is lesser than the application date or greater than the FX Value Date, the system will display an error message. The date should also be a TBC working day.

The date defaulted by the system will include the allocation lag for the fund; if the date so derived (after allowing for the allocation lag) is a TBC holiday, the system will display the next TBC working day.

Note

- If the client country parameter ‘FORWARD_FX_RATE’ is set as false, the system will allow only the application date as the FX deal date.

- For all transactions other than subscription, redemption and pseudo-switch, the system will use the spot FX rate where the FX Value date, FX deal date and the Transaction date are the same

FX Value Date

Date; Optional

The system will display the settlement date in this field. For subscription transactions, the date will be inclusive of the maximum clearing period for the instrument, based on the actual calendar and taking into account TBC holidays. For multi-payment transactions, the settlement date would be inclusive of the maximum clearing period of all the instruments supported in the transactions.

For redemption transactions, the date derived will include the payment lag based on the payment lag calendar basis and after taking into account TBC holidays.

You can override this value, if required.

Note

If the client country parameter ‘FORWARD_FX_RATE’ is set as false, the system will allow only the application date as the FX value date.

If the system-derived FX deal date is greater than the date derived by the system as the FX Value Date or specified by you after overriding the default value), the system will default the FX Deal Date here

Communication Mode

Alphanumeric, Optional

Specify the mode through which the transaction request was communicated. This could either be Direct or Telephone.

For check redemption transactions, which you enter for an investor with check writing facility in a fund for which check writing is allowed, you must specify the communication mode as ‘Check Writing’.

Whenever an initial subscription with a mode of communication that is part of the restrictive list maintained for the fund, is entered into the system, system throws up an error and does not allow you to save the transaction.

LOI Transaction

Alphanumeric, Optional

If the unit holder subscribing to the fund is designated as a Letter of Intent investor, then specify if the present transaction is to be deemed and processed as a Letter of Intent transaction. This information is applicable only for IPO, subscription and switch-in transactions.

Payment Mode

Alphanumeric, Mandatory

Select the mode in which the unit holder intends to pay the applicable charges levied for the transaction. The payment could be made through:

- Cash

- Check

- Check – Banker’s Check

- Check – Self Check

- Draft

- Credit Card

- Account Transfer

- In Kind Payment

- Multi Payment Facility

For check redemption transactions, the payment mode is not applicable.

Settlement Date

Date Format; Optional

The system computes the settlement date for the transaction according to the payment lag defined for the transaction type, in the Transaction Processing Rules for the fund. The settlement date is computed as (Transaction Date + Payment Lag), and displayed in this field. You can alter the computed date and specify the required date in this field.

If you have defined a different trade cycle for the fund in the ‘Override Trade Cycle Date’ screen and the transaction falls within the override period mentioned in this maintenance, the system will default the settlement date from the maintenance.

Refer the chapter ‘Other Fund Activities’ for more details on maintaining alternate trade cycles for a fund.

If the client country parameter ‘HSBCSPECIFIC’ is set to true for your installation, system will allow you to enter a settlement date greater than, equal to or lesser than the transaction date only in case of subscription transactions.

EUSD Option

Optional

The EUSD option specified for the unit holder is defaulted here provided the fund is a ‘EUSD In Scope’ fund. However, you can modify this value. The options available are

- Withholding tax

- Exchange of information

- Tax exemption certificate

System calculates the EUSD tax based on the option specified here. However, EUSD tax is deducted from the settlement amount only if the EUSD option is Withholding tax.

Dealing Date

Date Format; Optional

The dealing date as maintained for the fund in the Specific Fund Price Date Setup screen is defaulted to this field. The date displayed here can be altered, if required, and you can specify the desired dealing date.

In case dealing date is not maintained for the fund or the fund is not a specific price date fund, dealing date will be equal to the transaction date and cannot be changed.

If you have defined a different trade cycle for the fund in the ‘Override Trade Cycle Date’ screen and the transaction falls within the override period mentioned in this maintenance, the system will default the dealing date from the maintenance.

Refer the chapter ‘Other Fund Activities’ for more details on maintaining alternate trade cycles for a fund.

Completion Date

Display

The date of completion of the transaction is displayed here.

If your installation has not requested for KYC checks, then:

- Allocation happens before clearing/settlement – In this case, during clearing, the transaction is marked as completed and the Completion date is defaulted with the Clearing date.

- Allocation happens after clearing – In this case, during allocation, transaction is marked as completed and Completion date is defaulted with the Allocation date.

The Completion Date can only be viewed in modes other than the New Mode.

Completion Date is applicable only for subscription, redemption, switch and transfer transactions.

Change in Beneficial Ownership

For transfer transactions, check this box to indicate that the transaction involves a change in beneficial ownership of transferred units.

Remarks

255 Characters Maximum, Alphanumeric, Optional

Descriptive text about the transaction can be entered here.

During transaction amendment, you can capture any appropriate remarks for the amendment here.

Lock-in Period for Gain Days

Numeric, Optional

The default lock-in period for the funds where IOF/IRRF are applicable is defaulted here. This can however be modified.

Note

Reversals are not allowed post allocation. However if there is any judicial blocking (partial or full) or the subscription is partially redeemed the reversals will not be allowed.

Reversal Code

Optional

This field is only available during transaction amendment, and you can use it to capture the appropriate rejection code, if any, for the amendment. The codes available in the option list are specific to the transaction type being amended.

Additionally, you can also specify appropriate remarks for the amendment in the Remarks field.

Cancel Instruction

Alphanumeric; Optional

You can use this field to indicate whether standing instructions defined in respect of a unit holder, in the selected fund, are to be cancelled. If you select this option, all standing instructions for the transaction is cancelled, including those that are to be generated after an automatic redemption occurs. Select the ‘Standing Instruction’ option in this field to indicate cancellation of standing instructions.

If this option has been chosen in the General Operating Rules for the fund, the automatic redemption process generates redemption transactions for unit holders in the fund, with the ‘Cancel Instruction’ option automatically set.

If this option has been set for the transaction in this field, the End of Day process cancels all standing instructions (irrespective of the transaction type) for the unit holder in the fund after the outflow transactions (redemption, switch and transfer) involving the unit holder have been allocated for the day.

Note

Reversal or amendment of an outflow transaction for which Cancel Instruction has been set to ‘Standing Instruction’, would re-instate the standing instructions.

Maturity Date

Date Format (dd-mm-yyyy), Optional

If the fund in which the transaction is being put through is a closed-end fund, then specify the maturity date for the transaction in this field.

In case of block transactions, enter the maturity date of the block transaction. If the system date is equal to or greater than the date specified here, and the Auto generate Unblock option is checked then system generates an automatic unblock transaction on the date specified here. If the maturity date falls on a holiday, then the unblock transaction will be generated on the next working day.

Auto generate Unblock

Optional

If this option is checked, then the transaction will be automatically unblocked by the system on the maturity date.

This is applicable only for Block transactions. Auto Generate unblock will be generated during the EOD process ‘BOD Subscription Transaction Maturity Date Settlements’.

Block ID

Mandatory

Select the ID of the transaction you wish to unblock. The option list displays the ID of all the block transactions mapped to the unitholder and fund ID specified.

This is applicable only for Unblock transactions.

Payment Allowed

Optional

For redemptions using Cash Direct accounts, you can use this field to indicate whether relevant documents related to payment for the redemption transaction have been received at the time of transaction entry.

By default, this box is checked; if you wish to withhold payment due to not receiving payment-related documents, you can uncheck this box. Transactions, in respect of which this box is unchecked, can be allotted but not confirmed.

Generate Certificates for Spillover

Optional

If this option is checked and if the last certificate is to be partially redeemed, system will generate certificate for spill-over units. By default, this option will be checked.

If you un-check this option, then in case of partial outflow if the last certificate is partially redeemed, the remaining units will be converted into scrip-less holdings.

System will mark the source of units for the relevant inflow (which is redeemed), in ageing to indicate the extent of the remaining units as Normal.

This option is applicable only for Redemption, Switch and Transfer transactions.

Auto Clear Provisional Balance

Optional

For redemption, switch or transfer transactions by 100%, you can use this field to indicate that the outflow transaction should include units in provisional balance.

If the unit holder account has any authorized/unauthorized/un allotted transaction for the same combination of fund and policy with ‘Auto Clear Provisional Balance’ checked, then you will not be allowed to check this box.

Auto Clear Reinvestments

Optional

You can use this field to indicate that 100% outflow transactions (redemption, switch and transfer) should include freeze held and reinvestment units.

Note

The ‘Auto Clear Provisional Balance’ and ‘Auto Clear Reinvestments’ fields will be checked or unchecked based on the specification for the same in the Defaults Maintenance. However, you can change the defaulted value. These options will be enabled if the transaction mode is ‘Percent’ and the transaction value is ‘100’.

Switch – In Exchange Rate Source (For Switch transactions only)

Alphanumeric, Optional

Select the exchange rate source from which the exchange rates are to be derived for the switch – in leg of the transaction. The default source for the AMC is displayed here, from the Defaults Maintenance.

The “Calculate” link for switch – in exchange rate calculation

To compute the exchange rate that will be applied for the switch – in leg transaction, select this link. The system computes the exchange rate and displays it in the Switch - In Exchange Rate Applied field.

Switch – In Exchange Rate Applied (For Switch transactions only)

Numeric, Optional

When you select the exchange rate source, the system computes the actual exchange rate applied using the transaction currency, fund base currency and the value of the switch – out settlement value, and displays the same here.

During allocation, the system picks up the prevailing exchange rate on the application date and converts the switch-out settlement amount (in the From Fund base currency) to its equivalent in the To Fund base currency as the switch -in transaction amount.

Override Switch – In Exchange Rate (For Switch transactions only)

Check Box, Optional

Select this option if you want to override the computed switch - in exchange rate.

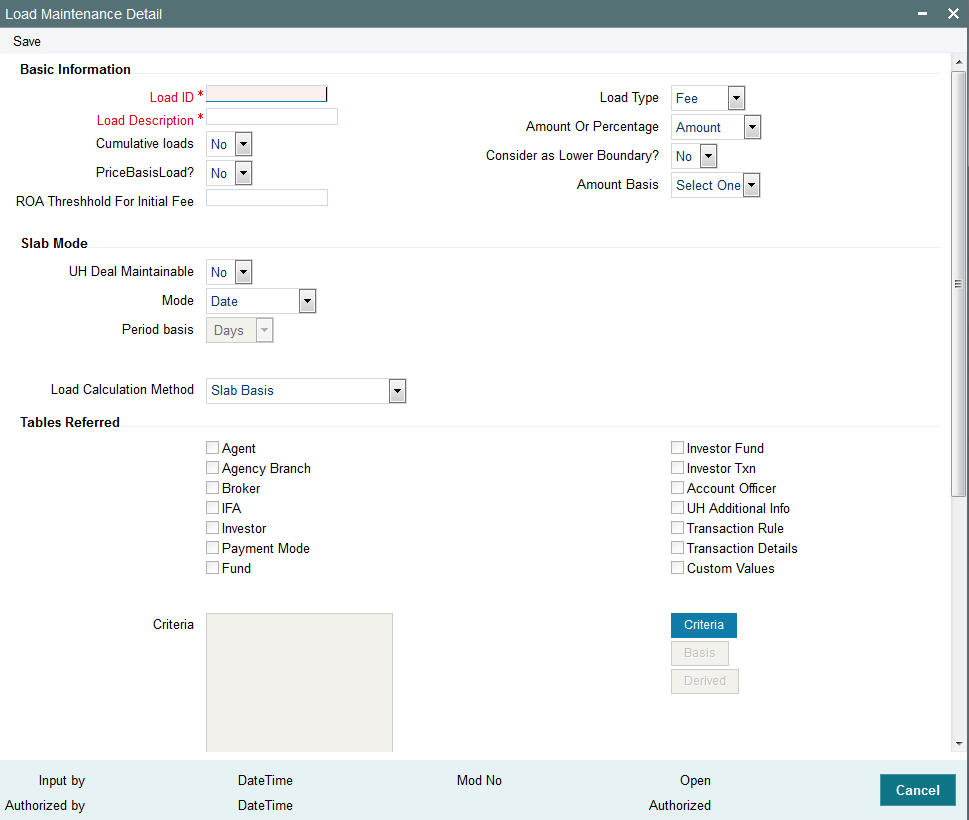

Fee Details

In this section, specify the transaction time fee details for the requested transaction.

Calculate Fee

Click this link to trigger the computation of the transaction time fee. The system computes the fee and displays the fee value both in the base currency of the selected fund as well as in the selected currency for the transaction.

Fee in Fund Base Currency

Display Only

When you click the Calculate link, the system computes the transaction time fee in the base currency of the selected fund, and displays the same in this field.

Fee in Transaction Currency

Display Only

When you click the Calculate link, the system computes the transaction time fee in the base currency of the selected fund, and displays the same in the Fee in Fund Base Currency field. It also computes the equivalent of the same in the currency specified for the transaction, and displays the same in this field.

Override Fee?

Optional

Select this option to indicate to the system that you want to override the computed transaction fee component.

Fee after Override

Numeric, Optional

If you are overriding the computed transaction time fee, then indicate the changed value for the fee in this field.

The Save Button

Click this button to save the details you have specified. If there are any mandatory details that you have not supplied, the system does not save the transaction, but prompts you to specify the same before you can click the Save button again.

When you save a new or amended transaction by clicking this button, the transaction number for the transaction is generated and displayed.

Cancel

Click this button to clear the details that you have specified, from the screen. A newly opened screen, with only the default information is displayed, so that you can make your specifications afresh.

5.1.2.1 Projected Allocation Details Link

If you wish to see a projected picture of how the transaction would most possibly be allocated before you actually save the transaction, then click the ‘Project Allocation Details’ link.

When you do so, the system temporarily saves the transaction into temporary stores in the database and gives it a unique key string. The system then performs a ‘mock’ temporary allocation, and displays the details of the same in the Allocation Projection screen .

The following allocation details are displayed:

The Allocation Details section

Fund ID

Display Only

The ID of the fund through which the transaction is done. In the case of a switch transaction, this is the ‘switch from’ fund.

The Product ID

Display Only

The ID of the tax product, if the transaction involved a tax exemption eligible investor.

Units

Display Only

The number of units allocated in respect of the transaction.

Unit Price

Display Only

The unit price that is prevalent for the transaction type, as on the date of the temporary allocation.

Load Amount

Display Only

The sum total of loads applicable for the transaction.

The Gross Amount in Fund Base Currency

Display Only

For transactions that are put through on a gross basis, the actual transaction amount in fund base currency, without any reduction of applicable loads, is displayed here.

For transactions that are put through on a net basis, the amount displayed here is the sum of transaction amount (i.e., the transaction value) and the applicable loads, in the fund base currency.

The Net Amount in Fund Base Currency

Display only

For transactions that are put through on a gross basis, the actual transaction amount in fund base currency, after reduction of applicable loads, is displayed here.

For transactions that are put through on a net basis, the amount displayed here is the actual transaction amount in the fund base currency. The loads would be added to this value to arrive at the total settlement amount.

Settlement Amount in Transaction Currency

Display Only

The settlement amount is the amount that the unit holder (or the third party, as specified in the transaction details) would actually pay for the transaction.

For transactions that are put through on a gross basis, the gross amount in fund base currency would be converted to the equivalent amount in the transaction currency and displayed here.

For transactions that are put through on a net basis, the sum of the net amount in fund base currency and the applicable loads would be displayed here.

To understand how the amount projections are made, consider the following example:

Performance Fee Details section

For hedge funds the related performance fee details will be calculated during allocation.

The following details are displayed:

- Linked transaction number

- Identification of the data element associated with performance fee

- Description associated with the data element

- Value associated with the data element

5.1.3 Allocation Details Button

You can view the allocation details related to a transaction in ‘Transaction Allocation Details’ screen. To invoke this screen, click ‘Allocation Details’ button in Transaction Details screen.

The following details related to the allocation are displayed:

- Fund ID

- Allocation date and allotted amount

- Unit price and confirmed units

- Settlement amount in transaction currency

- Gross and Net amounts in Fund Base Currency

- Rejected number of units

The following details related to Load are displayed:

- Load Id and description

- Load amount

- Load amount in fee currency

The following details related to Performance Fee are displayed:

- Linked transaction number

- Incoming/ Outgoing transaction

- Identification of the data element associated with performance fee

- Description associated with the data element

- Value associated with the data element

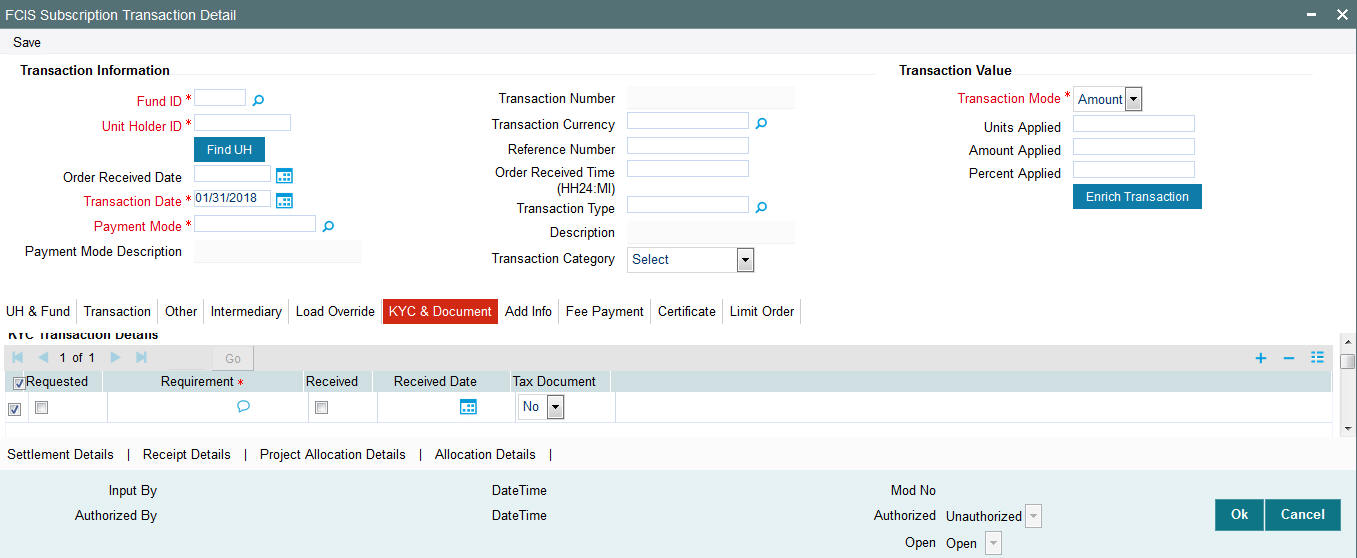

5.1.4 KYC & Document Tab

You need to specify the list of required KYC documents for this transaction. System allows you to save the transaction even if the unitholder has not submitted all the required KYC documents. However, you will not be allowed to perform the completion operation on that transaction unless all the required documents have been received from the investor. This feature will be available only if your installation has requested for it.

To invoke the Transaction KYC Details Screen, click on the ‘KYC & Document’ tab. The following screen is invoked:

The following details will be captured:

Requested

Check those documents that have been requested from the investor.

Requirements

Specify the list of KYC documents required for this transaction.

You may add additional documents to the existing KYC list until the transaction is completed. However, if you add additional documents once the ‘All the requested KYC documentation has been received’ check box has been checked, system will uncheck the option.

Received

Check this option to indicate that the investor has submitted the required document.

Received Date (DD/MM/YYYY)

Specify the date on which the document was received.

Tax Document

Use this check box to identify the submitted document as tax document. During Subscription and IPO Subscription transactions, investor should provide Form 60/61 if investor does not have a PAN. If investor fails to provide Form60/61, transaction will not be processed and system will throw up an error.

If the account is a joint account, then Form 60/61 should be provided for all the joint holders without PAN as well. System will not allow you to save the transaction if all the tax documents are not provided by the investor.

Delete

Use this check box to identify any document that must be marked for deletion. In the desired row, check this box. When you have selected all the documents to be deleted, click the Delete Row link at the top of the section.

However, you are not allowed to delete documents marked as requested, saved and authorized.

The Add Row link

Click add icon to add a new row in this section.

Chasing Date (DD/MM/YYYY)

Optional

In case the KYC list is incomplete for the transaction and the document has been requested, enter the date on which the document chasing action must be initiated.

Each time a document is requested from the investor, you must capture a chasing date for that document.

After you have entered the required document details, click the Close button to close the screen.

This feature is only available if your installation has requested for it.

KYC Received

Check this option once all the requested documents have been received from the investor. You will not be allowed to check this option until all the requested documents have been marked as received.

You are not allowed to check this option until all the required KYC documents have been received both at the unit holder level and at the transaction level.

5.2 Unitholder Deal Summary

This section contains the following topics:

- Section 5.2.1, "Invoking Unitholder Deal Summary Screen"

- Section 5.2.2, "Broker Details Section"

- Section 5.2.3, "Settlement Details Button"

- Section 5.2.4, "Pledgee Details Tab"

- Section 5.2.5, "Fee Payment Details Tab"

- Section 5.2.6, "Certificate Details Tab"

- Section 5.2.7, "Load Override Tab"

- Section 5.2.8, "Limit Orders Tab"

- Section 5.2.9, "Allocation Details Button"

- Section 5.2.10, "Document Details Section"

- Section 5.2.11, "Add Info Tab"

5.2.1 Invoking Unitholder Deal Summary Screen

If you wish to view the details of all the UH deals set up for the unit holder, type UTSUHDEL in the field at the top right corner of the Application tool bar and click on the adjoining arrow button. The following screen is displayed

You may wish to view the details of a particular record, in which case, you will have to enter relevant search criteria in the Quick Find Options and the Advanced Find Options. The system will display the records that match the search criteria you have specified.

The Transaction Date records matching the search criterion specified are displayed in row lists in the lower grid portion of the screen. From this results list, choose the unit holder deal that you want to view by clicking on the record twice.

When you click on the Search Unit Holder/ Customer button alongside the Action Buttons, the Unit Holder - Deal Setup screen is invoked in View mode as shown below, where you can view the details of the record.

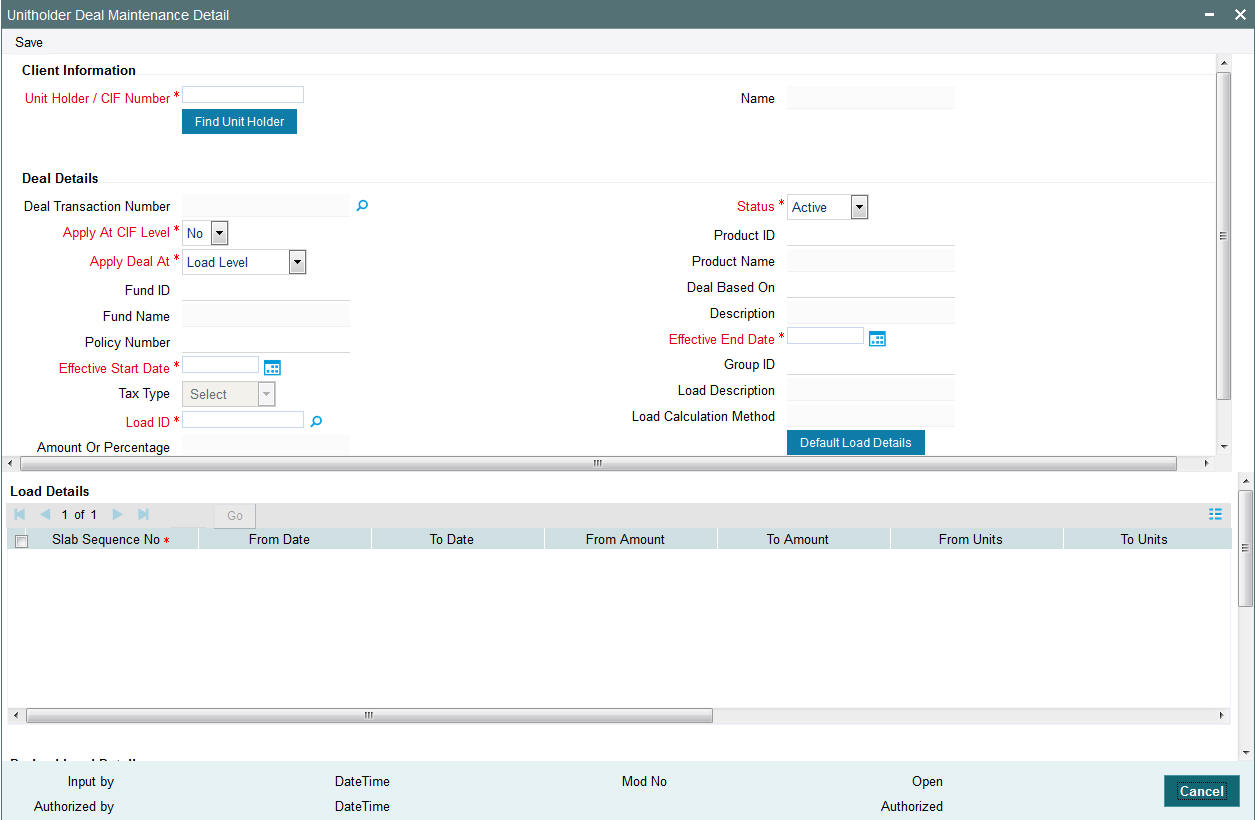

You can invoke this screen by typing UTDUHDEL in the field at the top right corner of the Application tool bar and click on the adjoining arrow button. The following screen is displayed:

Click the ‘Close’ button to return to the Find Options screen.

5.2.2 Broker Details Section

If a broker has been identified as an intermediary for the transaction, then you must identify the same in this section, along with the commission percentage split for the broker.

If brokers are designated as mandatory for the fund in which the transaction is being put through, then you must specify at least one broker as mandatory information in this section. If brokers are not mandatory for the fund, and you do not specify any broker in this section, then the system reckons the broker as DIRECT and designates the same as the default broker.

Entity ID

Alphanumeric, Optional

Select the code of the broker that has been identified as the intermediary for the transaction.

By default, the code of the unit holder’s default broker is displayed here. You can specify other brokers too by selecting them from the list. To invoke the list, click add icon that is found alongside the Broker Code field. You can also search for the broker using broker legacy codes.

Entity Name

Alphanumeric, Optional

When you select the broker code, the name of the broker is displayed. You can also choose to select the name of the broker for the transaction.

By default, the code of the unit holder’s default broker is displayed here. You can specify other brokers too by selecting them from the list. To invoke the list, click add icon that is found alongside the Broker Name field

Parent Entity Name

Display Only

When you select the broker code, the name of the parent broker for the selected broker is displayed.

Split Percentage

Numeric, Optional

Specify the percentage of total commission that is to accrue to the selected broker. The sum of all the percentages specified for any brokers identified for the transaction must equal one hundred percent.

From Or to leg

Mention the start and end point of the transaction date

Delete?

Optional

Select this option to mark the selected broker as inapplicable for the transaction.

To delete any given row in the grid, check the Delete? check box, and then click the Delete link at the right bottom of this section. The checked rows are deleted. If you delete a row in which a broker has been selected, then that broker is not deemed as an intermediary for the transaction.

To add a new row at the bottom of the grid in this section, click the Add link.

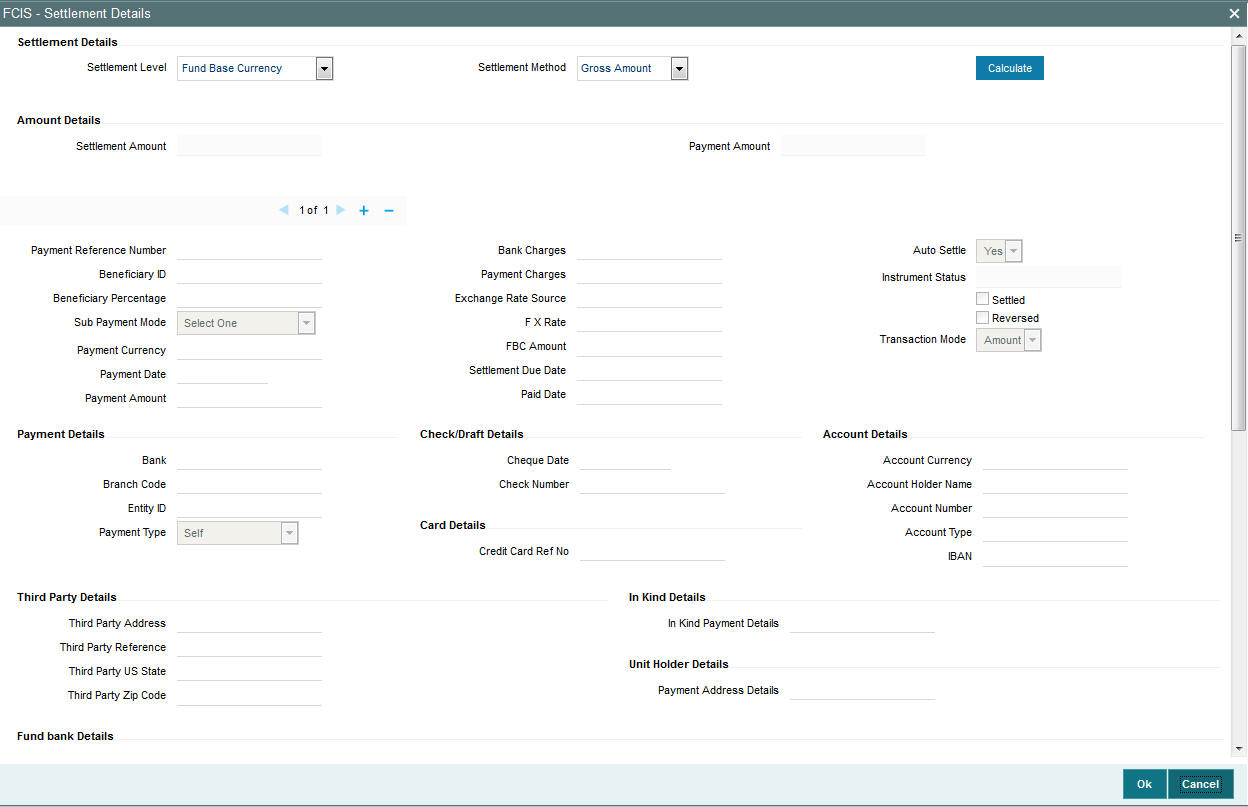

5.2.3 Settlement Details Button

In this section, you can capture the details of settlement and payment made for the transaction in the case of IPO, subscription and redemption transactions. Payment Details link is displayed on selecting any Payment Mode other than ‘Cash’ and ‘Against Payment’. Click the Payment Details link to invoke the Settlement Information screen .

When you have entered a new IPO or Subscription transaction in this screen, you need not specify the payment details before you save the transaction. You can subsequently authorize the transaction, and then specify the payment details through the ‘Modify’ operation. The transaction will then be subsequently allocated when these payment details are cleared.

For a redemption transaction, the payment details are mandatory and you can specify the same after you save the transaction in this screen.

Following are the fields in Settlement Instructions screen:

Settlement Details Section

Settlement Level

Display

The settlement level currency defined at the segment level is defaulted here. You are not allowed to modify this.

Settlement Method

Mandatory

The settlement method is the method of comparison between the amount received from the investor and the amount utilized in case of IPO subscription and Subscription transactions. Following are the methods available:

- Gross Amount – If you choose this method, then the sum of payment amount will be compared with the gross amount of the transaction (either in the fund base currency or the transaction base currency, as specified).

- Net of Agent Fees – If you choose this option, then the sum of Payment amount in FBC will be compared with the difference between the settlement amount and the sum of all load amounts whose From and To Entity Type is Agent.

Payment Amount (in FBC) = Settlement Amount - [(To Load Amount + To Derived Load Amount) - (From Load Amount + From Derived Load Amount)]

- Net of FM Fees – If you opt for this, then the sum of Payment amount (in FBC) will be compared with the difference between the settlement amount and the sum of all load amounts whose To and From Entity Type is AMC.

Payment Amount (in FBC) = Settlement Amount - [(To Load Amount + To Derived Load Amount) - (From Load Amount + From Derived Load Amount)]

- Net of All Fees - If you choose this option, then the sum of Payment amount (in FBC) will be compared with the difference between the settlement amount and the sum of all loads whose To and From Entity type is UH.

Payment Amount (in FBC) = Settlement Amount - [(From Load Amount + From Derived Load Amount) - (To Load Amount + To Derived Load Amount)]

During clearing subscription transactions and confirming redemption transactions, system checks if the sum of the payments is equal to the settlement as per the settlement method rule specified here.

For redemption transactions, the payment amount is compared with the settlement amount and the settlement method is defaulted to ‘Gross Amount’. You will not be allowed to modify this.

Payment Details section

Payment Reference Number

Alphanumeric, Mandatory

Enter a unique reference number for this payment.

Beneficiary ID

Alphanumeric; Optional

In case of a redemption transaction, where the transaction has been initiated by the primary unit holder and the ‘Redemption Payout’ option is checked at the unit holder level (in the ‘Unit Holder Maintenance Detail’ screen), the system will default the beneficiaries maintained for the unit holder when you save the transaction. You can change these details, if required.

Additionally, the system will also default the bank details maintained at the unit holder level for the beneficiaries, if you do not capture settlement details before saving the transaction,

If multiple beneficiaries have been linked to the unit holder, the redemption proceeds will be paid to each beneficiary in the transaction base currency. The order in which the beneficiaries will be paid out is derived from the order maintained for the beneficiaries at the unit holder level.

Settlement %

Numeric; Optional

The system will default the percentage for each beneficiary from the unit holder level. You can change it, if required. If the total percentage maintained for all beneficiaries at the unit holder level does not add up to 100%, the system will include the main unit holder as a beneficiary and credit the reminder of the payout to him.

However, while modifying the defaulted details, if you remove the main unit holder and include another beneficiary and the total payout percentage does not add up to 100%, the remaining will not be paid to the main unit holder. Instead the system will credit it to the last beneficiary in the list of beneficiaries.

Note

Beneficiary ID and Settlement Percentage fields are applicable only for redemption transactions.

Sub Payment Mode

Conditional

If the mode of payment is ‘Multi payment facility’, then select the sub payment mode.

For all other modes of payment, payment mode specified for the transaction is defaulted as the sub payment mode and you are not allowed to change it.

Payment Currency

Mandatory

Specify the currency in which the payment must be made for the selected payment mode. By default, it is reckoned to be the Transaction Currency.

Payment Date (dd/mm/yyyy)

Mandatory

Enter the date of payment. By default, the transaction date is displayed. If the transaction date is not specified, then the application gets defaulted here. You can change this, if required.

Note

Payment Date cannot be back dated.

Payment Amount

Mandatory

Enter the payable amount. Amount entered here will be reckoned in the payment currency.

Bank Charges

Numeric, Display

This is the charges to be borne by the AMC. This amount is inclusive of the charges for payment. Amount entered here will be reckoned in the payment currency.

If the mode of payment is Demand Draft or Outstation Cheque, based on the load maintained for the combination of AMC and transaction currency, the applicable amount slab will be displayed here on tabbing out of the payment amount field.

While processing settlements, the bank charges will be added to the payment amount for settling the transaction.

This field will be displayed only if the client country parameter ‘BANKCHARGES’ is set to true for your bank.

Note

DD charges can be calculated in multiple currencies. The Load Id for the AMC should be defined in PARAMS maintenance delimited by “-“. For instance, EUR-5555, USD-6666, then 5555 and 6666 are Load Ids. If it is a mono-currency installation, load Id alone should be stored.

The load Id should be amount based with the return value as amount. Please note that there will not be any check to this effect and you need to maintain appropriate value since it is a one-time setup.

Exchange Rate Source

Alphanumeric, Mandatory

Select the exchange rate source from which the exchange rates are to be derived for the transaction. The source specified in the transaction screen is displayed here. You can modify this, if required.

Upon modifying the exchange rate source, if the payment currency differs from the fund base currency (FBC)/ transaction currency (TC) and if the payment amount is greater than or equal to zero, then system computes and displays the FBC Amount in the fund base currency/transaction base currency equivalent.

If both the currencies are same then the payment charges is deducted from the payment amount and displayed as FBC/TC amount in case of Subscription transactions. For redemption transactions, the payment charges is added to the payment amount and displayed as FBC/TC amount.

FX Rate

Mandatory

FX rate for the chosen exchange rate source is displayed here.

On modifying the FX rate, if the payment currency differs from the fund base currency (FBC)/transaction currency (TC), and the FX rate is greater than or equal to zero, then system calculates and displays the FBC/TC amount based on the payment amount, payment charges and FX rate.

Due Date (DD/MM/YYYY)

Display

Settlement Due date calculation is based on Payment Lag Calendar basis, payment lag and dealing date. The Payment lag calendar basis determines whether AMC, Currency, Fund or System Calendar will be considered to identify holidays.

For redemptions, Settlement due date and Settlement date/Value date is defaulted based on the Currency Cut Off Time and payment lag for the fund and redemption transaction type.

For instance, If the Cutoff time for the currency USD is 11:00 am and the Payment lag is 1 for the fund - transaction type, and the system time is well below the specified cut off time, then system will calculate the settlement due date/Settlement date by adding the payment lag (1 Business day of the currency calendar) to the dealing date of the transaction. If the System time falls after the cutoff time of the currency then settlement date/due date will be defaulted with the sum of dealing date, payment Lag + 1 Business day. If this derived date falls on currency holiday then get the next working date based on currency calendar and default it. If currency calendar is not maintained then the same date is defaulted.

For Subscriptions, Settlement due date is defaulted based on adding the dealing date, for the transaction type and payment lag maintained for the fund and subscription transaction type. If the due date falls on a holiday then the next working date is arrived based on fund calendar. If no Fund calendar is maintained, then system checks for the AMC and system calendar respectively.

If dealing date for a transaction is not specified then system calculates the dealing date based on the dealing lag maintenance and adds the payment lag maintained for the combination of fund and transaction type.

Paid Date (DD/MM/YYYY)

You need to specify the paid date for subscription transactions. In case of redemption transactions, system defaults the paid date based on the dealing date, payment lag and currency cutoff -time. However, you are allowed to modify this.

On specifying the paid date, System calculates the FBC/TC amount based on the Exchange Rate source and FX Rate entered.

Note

Paid Date cannot be less than Payment Date and the transaction date. However, it can be back dated or future dated. You will not be allowed to enter paid date if you have not specified the exchange rate information.

Auto Settle

By default, this option is set to ‘No’. However, you can change this. If you set this option to ‘Yes’, then the particular payment is settled by auto clearing process based on the settlement due date.

You can override the auto settlement process by specifying the paid date and manually settling the payment.

Payment Type

Mandatory

This defines the type of payment. Following are the options available:

- Retained By: If case of any rounding differences between the transaction amount and the payment amount, you can enter the rounding difference as a separate payment entry with the Payment type as ‘Retained By’.

- Absorbed: In case the payment received is more than the amount used for unitization then you can enter a separate payment entry with payment type as ‘Absorbed’.

- Self: Use this type if the payments are received from the customer.

- Third Party: If the beneficiary name of the bank account is different from the registered holder’s name for redemption payment then the payment type should be defaulted as ‘Third Party’. In case of subscription, if the remitter’s name is different from the registered holder’s name, then the payment type should be defaulted as ‘Third Party’.

If you have selected ‘Cheque’ or ‘Money Transfer’ as the mode of payment, then you must enter multiple instruments of the same payment type. However, if the mode of payment is ‘Multi Payment Mode’, then you can enter multiple instruments of different payment type.

Instrument Status

Display

The status of the instrument as indicated in the Payment Clearing screen is displayed here.

Settled?

Optional

Check this option if the settlement is complete.

Transactions can be marked as ‘Settled’ only if all the payment are settled and the sum of the payment amount is equal to the transaction amount in terms of the fund base currency. Also the units in Provisional Balance will be moved to Unit balance.

Note

- During allocation of a non cash based subscription transaction, system checks the clearing status of the transaction. If it is cleared, then the transaction is marked as settled and the unit holder’s unit balance will reflect the units that were allotted for that transaction.

- On authorizing the payment entries for an allotted transaction, system checks the clearing status of the transaction. If it is cleared, then the transaction is marked as settled and units allotted for that transaction will be moved from the provisional balance to unit balance for that unit holder.

- If settlement status for the transaction is settled then on changing the settlement information i.e. if the settlement amount in FBC/TC is not equal to the amount used for unitization then the settlement status will be marked as Unsettled.

Reverse?

Optional

You can reverse the payment, both multiple and single payment (s) provided there are no linked transactions. In case there is no transaction linked to the current transaction, then on reversal, system changes the settlement status as Unsettled and moves the Units from Unit Balance to Provisional Balance.

Note

Only Settled payments can be reversed. You can modify the settlement instructions of the transaction post utilization also. However, allocation happens even in the absence of any payment instruction.

Calculate Link

Click on this link to calculate Exchange rate and FBC amount based on the entered payment amount and payment charges.

Note

In the Settlement Instruction screen, you can enter the charges for payment. This feature is only available if your installation has specifically requested for it. For an exhaustive note on this feature, refer the Annexure.

Payment Details Link

Click ‘Payment Details’ button under Pymt Dtls to invoke the Payment Details screen. The payment details include the following:

- The type of payment i.e., whether the payment is being made by the unit holder that has requested the transaction or by an external third party.

- The details of the bank and branch of the bank for the payment

- The details of any payment instruments such as checks, the number, date and the clearing date.

- In the case of payment by account transfer, the details of the bank account to which /from which the payment is being made.

- The unit holder’s address details for check based payments

- The details of the unit holder’s bank

Note

- For check redemption transactions, which you enter for an investor with check writing facility in a fund for which check writing is allowed, the payment details are not applicable, and need not be specified.

- If the client country parameter ‘DEFAULTPAYMENT’ is set to true, then the settlement details maintained for the combination of unit holder, fund, transaction type, payment mode and transaction currency are defaulted.

Payment Details for Mode of Payment as Check, Credit Card, Debit Card or Draft and for Mode of Payment as Multi Payment Facility with sub mode of payment as Check, Credit Card, Debit Card or Draft

Capture the following details if the mode of payment chosen is check, credit card, debit card or demand draft:

Payment Type

Alphanumeric, Mandatory

The payment type refers to whether the payment is being made by the unit holder who has requested for the transaction or by an external third party. Accordingly, select “self” if the unit holder is making the payment, and select “third party” if the payment is being made by an external party other than the unit holder.

Drawee Branch

Alphanumeric, Mandatory

Specify the name of the bank where the payment instrument is drawn, if the mode of payment is Check, Credit Card, Debit Card or Draft.

Drawee Branch

Alphanumeric, Mandatory

Specify the branch of the selected bank where the payment is drawn, if the mode of payment is Check or Draft.

Check Number/ Card Number/Draft Number

16 Characters Maximum, Alphanumeric, Optional

Specify the number of the payment instrument, the check, the credit/debit card or the demand draft.

Check Date/ Draft Date

Date, (dd-mm-yyyy) Optional

Specify the date on which the check or demand draft is drawn.

Card Reference Number

Alphanumeric, Optional

In the case of payment by credit card or debit card, specify the reference number of the credit card/debit card that is being used to make the payment.

Unit holder Address

Alphanumeric, Optional

You may specify the address of the unit holder involved in the transaction.

Payment Details for Transfer Mode of Payment and for Mode of Payment as Multi Payment Facility with sub mode of payment as Transfer or as Advice

Capture the following details if the mode of payment chosen is transfer:

Payment Type

Alphanumeric, Mandatory

The payment type refers to whether the payment is being made by the unit holder who has requested for the transaction or by an external third party or by a broker. Accordingly, select “self” if the unit holder is making the payment, “third party” if the payment is being made by an external party other than the unit holder, and select “broker” if the payment is being made by a broker.

Maintained Bank Accounts

Alphanumeric, Mandatory

If you have chosen ‘Self’ as the payment type, bank details are defaulted based on the combination of transaction type, fund Id, payment mode and transaction currency maintained for the unit holder.

The system displays the accounts available for a unit holder (in the option list) for IPO subscription, subscription and redemption transactions in the following order:

- Account maintained for ‘All’ funds and ‘All’ transaction types

- Account for the specified fund and transaction type

- Account for the specified payment mode in the order mentioned above

- Account in the specific currency or ‘MCY’ (Multi Currency) in the order specified above

If neither transaction currency account nor multi-currency account is available, the transaction is saved as an ‘Incomplete’ one in case of subscription and IPO transactions. You will have to input payment details later to complete it. In case of redemption and pseudo-switch transactions, the system fails the transaction if the Payment Mode is ‘Transfer’ and allows saving of the transaction if the Payment Mode is ‘Cheque’.

Note

The same logic holds true for SI transactions as well.

If you selected ‘Third Party’ as the payment type, all the banks maintained in the system are available in the option list. You must choose the one that will be used to make the payment.

All those accounts belonging to the account type allowed for the combination of type of transaction and the fund involved will be available.

Branch

When you select the back account of the unit holder that is being used to make the payment, the name of the branch of the bank in which the account resides is displayed here.

In case of third party payment, all the branches maintained for the selected bank are displayed in the option list. You must choose the one that will be used to make the payment.

Account Number

When you select the back account of the unit holder that is being used to make the payment, the account number of the transfer account is displayed here.

In case of third party payment, enter the number of the back account that is being used to make the payment.

Account Type

When you select the back account of the unit holder that is being used to make the payment, the type of the transfer account is displayed here.

For third party payments, select the type of the transaction account from the drop down list.

Account Currency

Display Only

When you select the back account of the unit holder that is being used to make the payment, the currency of the transfer account is displayed here.

This currency must be the same as the transaction currency. If this is not so, the unit holder must specify an account in which the account currency is the same as the transaction currency.

Account Holder Name

Display Only

When you select the back account of the unit holder that is being used to make the payment, the name of the holder of the transfer account is displayed here.

Transfer Reference Number

Alphanumeric, Optional

Specify the reference number of the transfer that is being used to make the payment.

Broker ID

Mandatory

If you have chosen “broker” as the Payment Type, you need to specify the identification code maintained for the broker in the system.

Routing Bank Details Link

Click on this link to view the routing details for the bank. The details are picked up from the unit holder level.

For further information on this screen, refer ‘The Bank Details’ section of the Managing Investor Accounts chapter under Volume II

Payment Details Mode of Payment as In Kind Payment and for Mode of Payment as Multi Payment Facility with sub mode of payment as In Kind Payment

In Kind Payment Details

Mandatory

If the payment is made in kind instead of cash, for instance, in the form of securities or bonds, you need to capture the details of the instrument being pledged.

The following details of fund involved in the transaction and the bank details of the unit holder maintained at the unit holder level are picked up and displayed for all modes of payment and sub payment modes:

- ISIN Code

- Fund

- Fund Base Currency

- Bank and Branch Code

- Account Currency

- Account Number

- Account Name

- Whether direct debit is applicable

- Whether the account is closed

If the mode of payment is Multi Payment Facility and the sub mode of payment is Against Payment, the above mention unit holder’s bank details and the fund details are displayed.

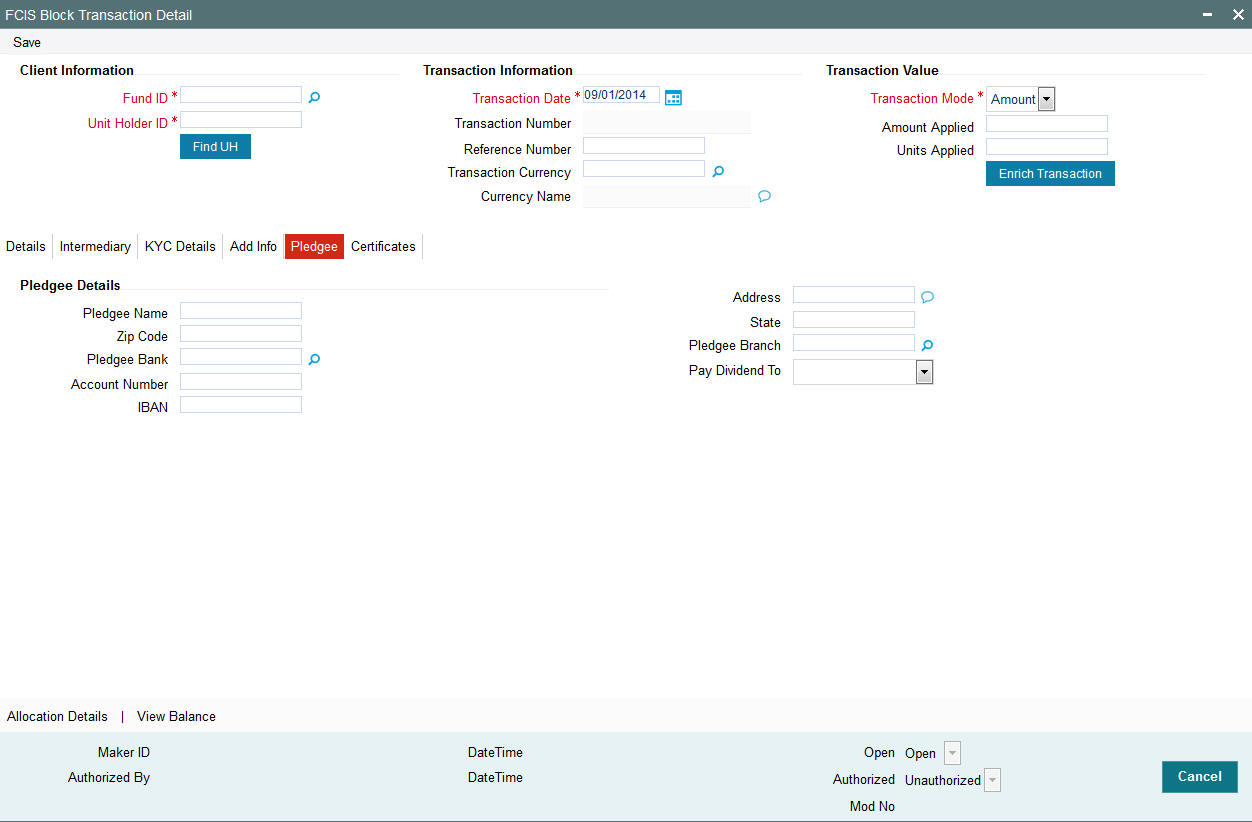

5.2.4 Pledgee Details Tab

In case of an investor has taken a loan on the units in a fund and those units are blocked, you can indicate whether the dividend proceeds on the blocked units should be paid to the pledgor, pledgee or to hold back the payment.

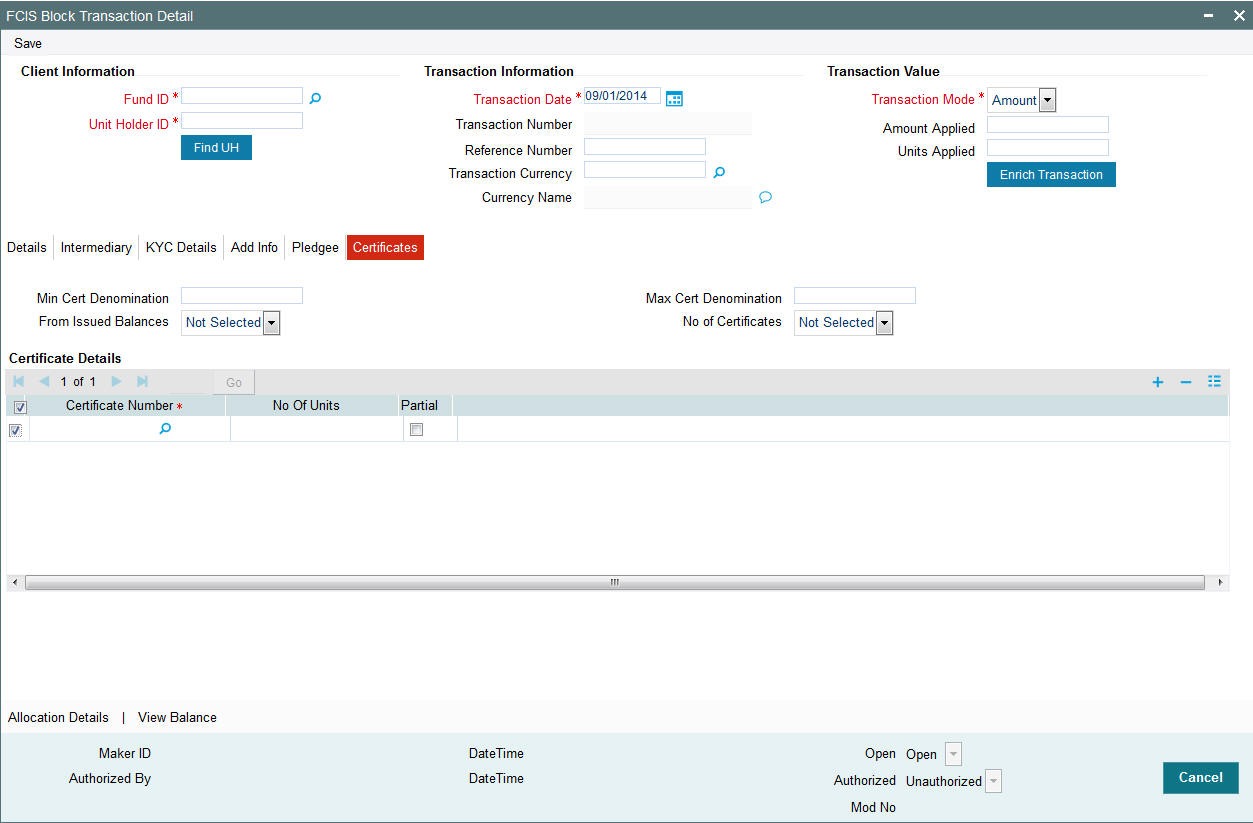

This section is applicable only to Block transactions. Click on the ‘Pledgee’ tab in the FCIS Block Transaction Detail screen to invoke the following screen.

Pay Dividend To

Alphanumeric, Optional

Indicate whether the dividend proceeds on the blocked units should be paid to the pledgor, pledgee or to hold back the payment.

- If you opt to hold back, Dividend on blocked units will not be paid/reinvested until all the blocked units are unblocked.

- If you opt to pay dividend to the pledgor, dividend on blocked units will be credited to unitholder bank account depending on the UH IDS setup.

- If you opt to pay the dividend to the pledgee, dividend on blocked units will be credited to pledgee bank account irrespective of UH IDS setup.

Note

If no option is selected, then dividend on blocked units will be paid / reinvested to the unitholder account depending on the UH IDS.

You will be allowed to capture the following details only if you have chosen to pay the dividend to the pledgee.

Pledgee Name

60 Characters Maximum, Alphanumeric, Mandatory

Specify the name of the person or institution with which units are pledged for the block transaction.

Address

255 Characters Maximum, Optional

Enter the address of the pledgee.

Zip Code

6 Characters Maximum, Optional

Specify the zip code of the specified city of residence of the pledgee.

State

60 Characters Maximum, Alphanumeric, Optional

Specify the state in which the city of residence of the pledgee is located.

Pledgee Bank

12 Characters Maximum, Alphanumeric, Mandatory

From the list, select the name of the bank in which the account is held.

Pledgee Branch

12 Characters Maximum, Alphanumeric, Mandatory

From the list, select the name of the branch of the bank in which the account is held.

Account Number

16 Characters Maximum, Alphanumeric, Mandatory

Specify the number of the account held by the pledgee in the selected bank.

5.2.5 Fee Payment Details Tab

You can capture the details of any payments made towards the transaction time fee, in this section. When you select the fund in which the transaction is to be put through, this section is enabled only if any transaction time fees are mapped to the fund as chargeable for the transaction type.

Fee Payment Details for Mode of Payment as Check, Credit Card or Draft

Capture the following details if the mode of fee payment chosen is check, credit card or demand draft:

Drawee Bank

Alphanumeric, Optional

Specify the name of the bank where the fee payment instrument is drawn, if the mode of payment is Check, Credit Card or Draft.

Drawee Branch

Alphanumeric, Optional

Specify the branch of the selected bank where the fee payment is drawn, if the mode of payment is Check or Draft.

Check Number/ Card Number/Draft Number

16 Characters Maximum, Alphanumeric, Optional

Specify the number of the fee payment instrument being either check, the credit card or the demand draft.

Check Date/Credit Card Date/Draft Date

Date, (dd-mm-yyyy) Optional

Specify the date on which the check or demand draft is drawn, or the credit card payment is made.

Clearing Date

Date, (dd-mm-yyyy) Optional

Specify the date on which the check / draft is expected to be cleared.

The clearing date should not be earlier than the check / draft date, and must not be a designated holiday in the system.

Card Reference Number

Alphanumeric, Optional

In the case of fee payment by credit card, specify the reference number of the credit card that is being used to make the fee payment.

Fee Payment Details for Transfer Mode of Payment

Capture the following details if the mode of fee payment chosen is transfer:

Maintained Bank Accounts

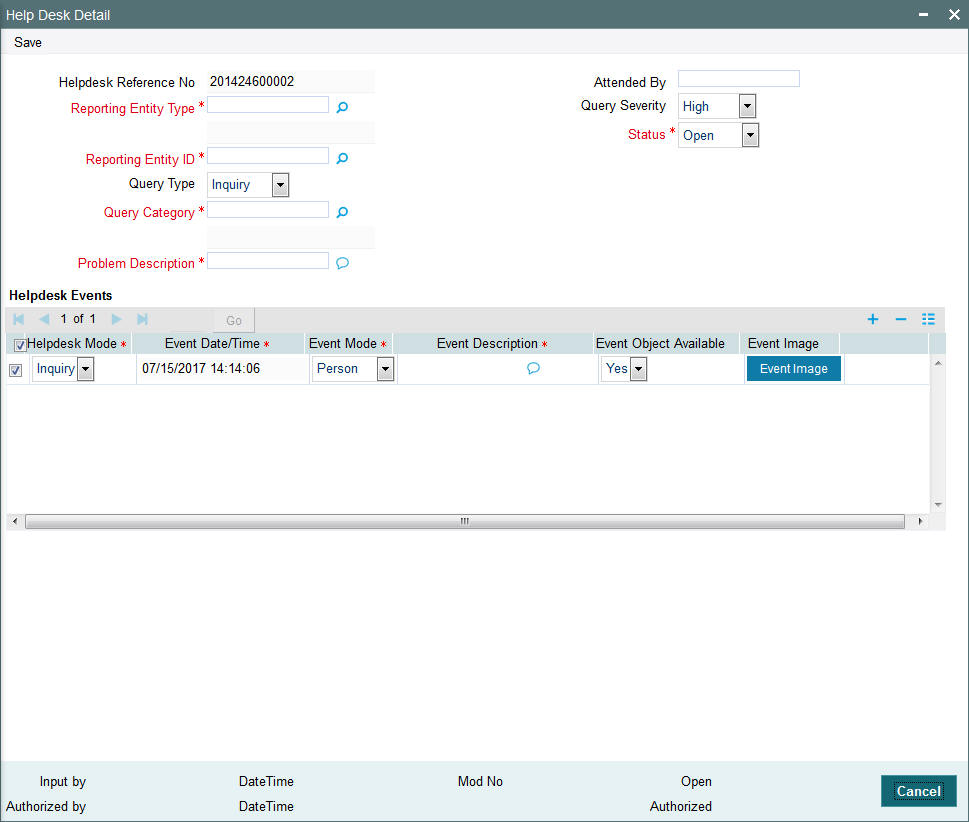

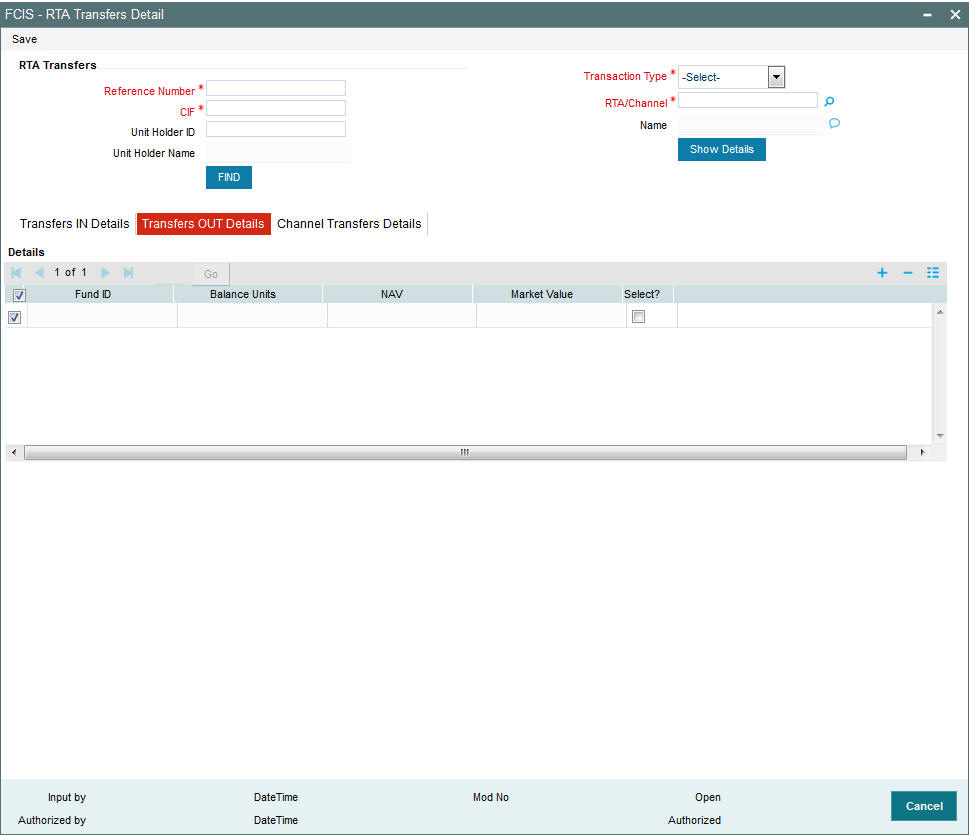

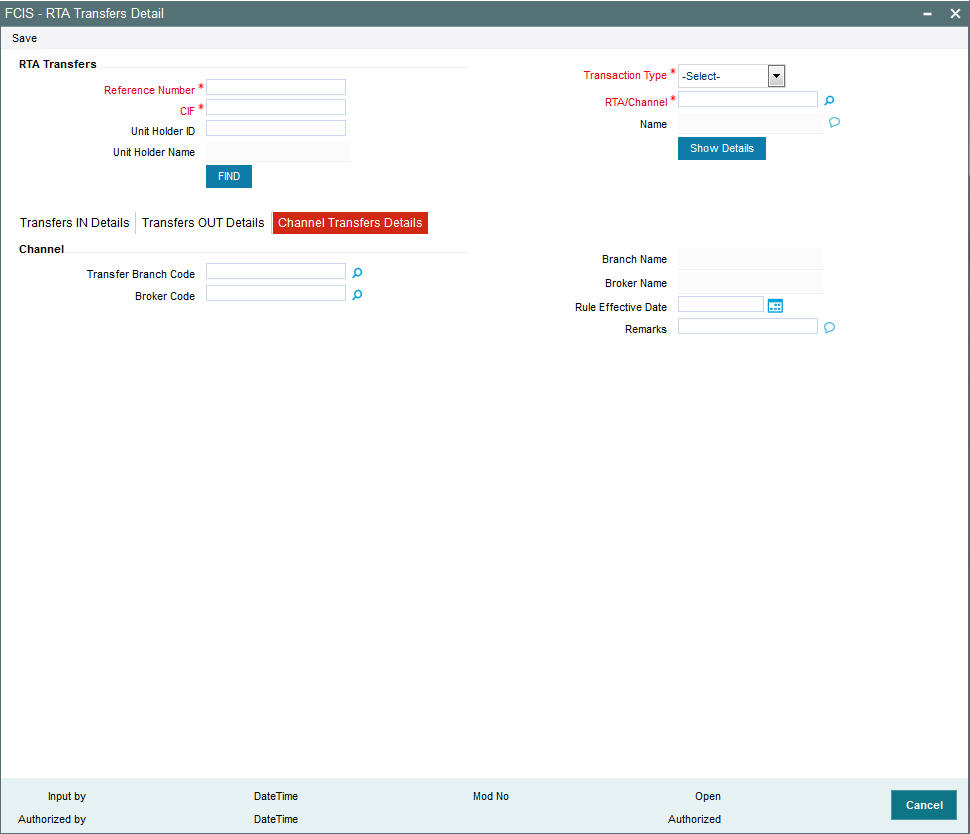

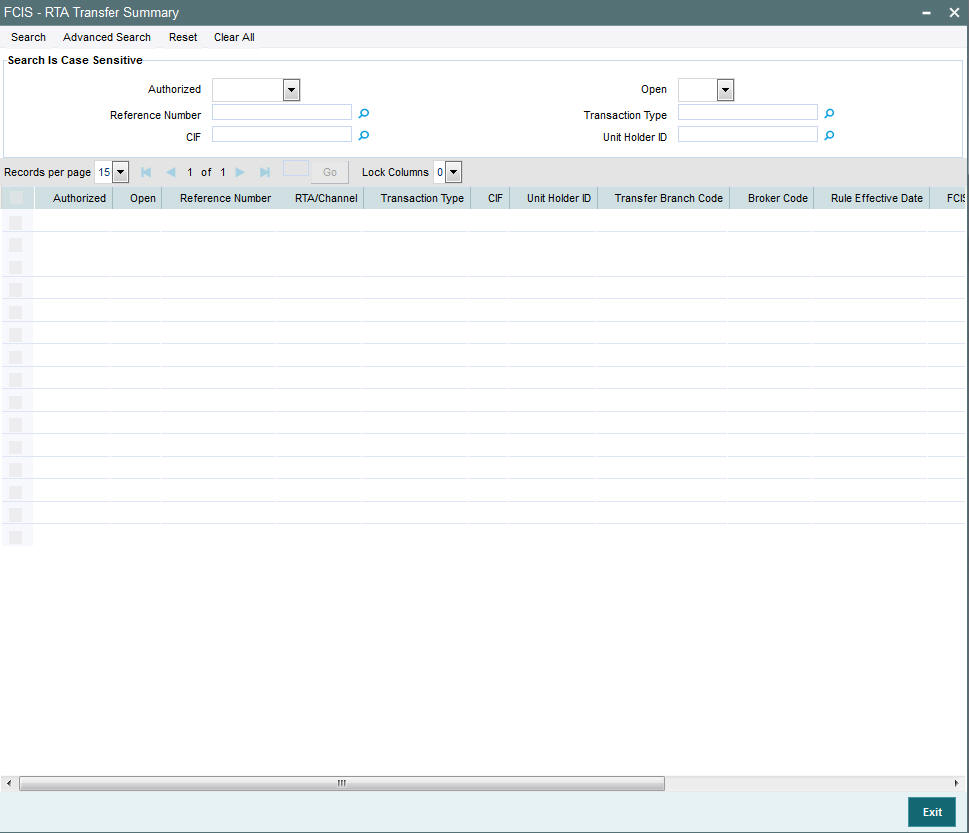

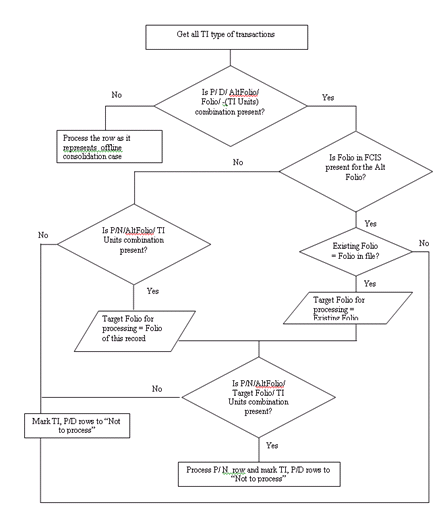

Alphanumeric, Mandatory