63 SPED Fiscal Additional Block/Record Information

This chapter contains these topics:

In this section there is detailed information for each Block. The Source Files section lists which files are used in the program(s) for that block. Next, you will find a brief description of the program(s) for the block and a chart of the records created for each block.

|

Caution: JD Edwards World only generates the records listed in this document. Records and fields related to information that is not available in the system are not generated. |

63.1 Block 0 Records

Block 0 records provide opening, identification, and reference information for the electronic files.

When blocks C, D, G, H, and 1 are run, each one of the programs will write into work file F76B525 the customers, suppliers, items, nature of transaction and fiscal complimentary information, that are needed to generate part of Block 0.

63.1.1 Source Files

The system uses these source files for data for the Block 0 process:

-

Who's Who (F0111)

-

Address Book Master (F0101)

-

Address by Date (F0116)

-

Address Book - Phone Numbers (F0115)

-

Address Book Brazilian Tag File (F76011)

-

Supplemental Data (F00092)

-

Item Master (F4101)

-

Unit of Measure Standard Conversion (F41003)

-

Transaction Nature (F7615B)

-

Generic Item Master Add Info (F704101)

-

Address Book - Contact Phone Numbers (F0115)

-

Address Book - Email/URL addresses (F01018)

-

User Defined Codes (F0005)

-

Company Constants (F0010)

-

ICMS Tax Rates (F7608B)

-

Item Description by Date (F76B4101)

63.1.2 Block 0 - Address Book

These records are written for Block 0 when you run the Sped Fiscal Block 0 Address Book - Company Information program (P76B532):

-

0000 (Opening file and contributor identification)

-

0001 (Opening Block 0)

-

0005 (Contributor complimentary date)

-

0015 (Substitute Contributor)

-

0100 (Accountant information)

63.1.3 Block 0 - Address Book -Participant Data

These records are written for Block 0 when you run the Sped Fiscal Block 0:

-

Participant Data program (P76B533). This program is based on file F76B525.

-

0150 (Participant information)

-

0175 (Participant information changes)

The Sped Fiscal Block 0 Participant Data program (P76B533) uses the Address by Effective Date standard functionality to determine the address book records to report. If there are modifications within the reporting date range, the system writes the address book information to record 0175 of Block 0.

63.1.4 Block 0 - Items and Unit of Measure

These records for Block 0 are generated when you run the Sped Fiscal - Block 0 Items and Unit of Measure programs (P76B534 and P76B537):

-

0190 (Unit of measure) from P76B537

-

0200 (Item code identification) from P76B534

-

0205 (Item coded changes) from P76B534

-

0206 (Item coded for combustible) from P76B534

-

0220 (Item unit conversion) from P76B534

63.1.5 Block 0 - Fixed Assets

These records for Block 0 are generated when you run the SPED Fiscal - Block G - ICMS of Fixed (P76B540):

-

0300 (Good or Components of Fixed Assets) from P76B541

-

0305 (Depreciation Information) from P76B541

-

0500 (Chart of Accounts) from P76B541

-

0600 (Cost Center) from P76B541

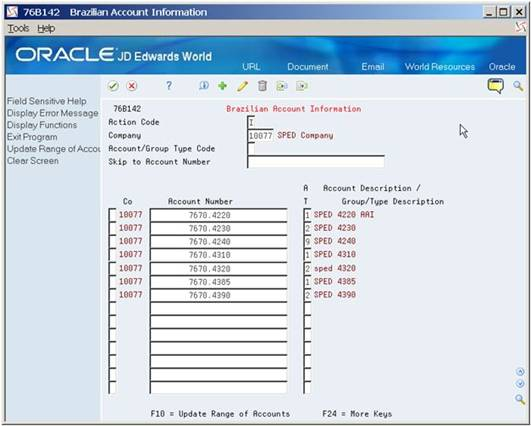

63.1.5.1 Account Information

Accounts related to Fixed Assets must be defined in Brazilian Account Information (P76B142) and their Account/Group Type Code (AGTC) value must be set up with 1 (Asset).

From SPED General Account System Setup G76B0941 choose Brazilian Account Information

Figure 63-1 Brazilian Account Information screen

Description of ''Figure 63-1 Brazilian Account Information screen''

63.1.6 Block 0 - Nature or Operations

The system generates the 0400 (Nature of operation) record for Block 0 when you run the Sped Fiscal - Block 0 Nature of Operations program (P76B535).

63.1.7 Block 0 - Observation Fiscal Books

The system generates these records for Block 0 when you run the Sped Fiscal - Block 0 Observation Fiscal Books program (P76B536):

-

0450 (Fiscal complementary information)

-

0460 (Observation fiscal book)

63.1.8 Contents of Block 0 Records

This table describes the contents of the Block 0 records.

| Record | Description of Content | Compliance and Occurrence |

|---|---|---|

| 0000 (Opening file and Contributor Identification) | Includes information about the taxpayer from data stored in the F0101, F76011, and the Sped Fiscal Constant Setup file. | Mandatory

One record |

| 0001 (Block zero opening) | Includes information about Block 0.

This data is based on a fixed value from the Sped Fiscal Constant. |

Mandatory

One record |

| 0005 (Contributor complementary date) | Includes additional information about the taxpayer from data stored in the F0101, F76011, and Sped Fiscal Constant. | Mandatory

One record |

| 0015 (Substitute contributor) | Includes information about bookkeeping from data stored in the source files and Sped Fiscal Constant. | Conditional

Multiple records |

| 0100 (Accountant) | Includes information about the accountant for the reporting company from the F0101, F76011, and Sped Fiscal Constant. | Mandatory

One record |

| 0150 (Participant data) | Includes information about the suppliers, customers, and consumers from data in the F0101, F76011, and Sped Fiscal Constant, and in UDCs | Mandatory/Conditional

Multiple records |

| 0175 (Participant information changes) | Includes address information about suppliers, customers, and consumers from data in the F0101 and F76011 files. | Mandatory/Conditional

Multiple Records There should be one 0175 record per 0150 record |

| 0190 (Unit of measure) | Includes the unit of measure and unit of measure description from UDC table 00/UM. | Mandatory

Multiple records |

| 0200 (Item code identification) | Includes information about items from the F4101 file. | Mandatory

Multiple records |

| 0205 (Item code changes) | Includes information about items from the F76B4101 file. | Mandatory/Conditional

Multiple records One record per 0200 record |

| 0206 (Item coded for combustible) | The JD Edwards World software does Not include data for this record | Populated with blanks |

| 0220 (Item unit conversion) | Includes information about the unit of measure conversion and factor from the Unit of Measure Standard Conversion file (F41003). | Mandatory/Conditional

Multiple records per 0190 record |

| 0300 (Good or Components) | Includes information about Good or Components of Fixed Assets. | Mandatory/Conditional

Multiple records |

| 0305 (Depreciation Information) | Includes information about the depreciation of Fixed Assets and is mandatory when the field IDENT_MERC of the record 300 is equal to 1. | Mandatory/Conditional Multiple records |

| 0400 (Nature of operation) | Includes the transaction nature for items from the F7615B file. | Mandatory/Conditional

Multiple records |

| 0450 (Fiscal complementary information) | Access to file F76B525 with

Job number and record '0450' and move field ds80 to file INMG and access a UDC 40/PM. REF_INF_OBS = TUINMG e TXT = UDC description. |

Mandatory/Conditional

Multiple records |

| 0460 (Observation fiscal book) | The JD Edwards World software does not include data for this record | Populated with blanks |

| 0500 (Chart of Accounts) | Includes information about the accounts informed in record 0300 | Mandatory/ConditionalMultiple records

Do not report two or more records with the same combination of content in the fields COD_CTA and DT_ALT |

| 0600 (Cost Center) | Includes information about the Cost Center of record 0305. | Mandatory/ConditionalMultiple records |

| 0999 (End Block 0) | Includes information about the block. | Mandatory

One record The system inserts this record when you execute Sped Fiscal. (P76B169) Block 9 |

63.2 Block C Records

You generate Block C records using program P76B527 to report notas fiscais related to the sales and purchasing of goods.

63.2.1 Source Files

The system uses these source files for data for the Block C process:

-

Nota Fiscal Header - Brazil (F7601B)

-

Nota Fiscal Detail - Brazil (F7611B)

-

Nota Fiscal Taxes Detail(F76B4001)

63.2.2 Contents of Block C Records

This table describes the contents of the Block C records.

| Record | Description of Content | Compliance and Occurrence |

|---|---|---|

| C001 (Opening Block C) | Includes information about the block. | Mandatory

One Record |

| C100 (Hierarchy 2) | Includes information about notas fiscais. The information is based on the F7611B, F7601B and F76B4001 files. Documents to be considered are Nota Fiscal Paper (Code '01) and NF- e (Code '55') | Multiple records |

| C110 (Supplemental information) | Includes supplemental information for notas fiscais. | Multiple records per C100 record |

| C113 (Referenced fiscal document) | This is complementary information of the document that is being written in the C100 record. | Multiple records per C100 record |

| C130 (ISSQN, IRRF, and Social Security) | Includes information about the ISSQN, IRRF, and Social Security taxes | One record per C100 record |

| C140(Invoices) | Includes information about Invoices related to Paper Nota Fiscal (type 1 ) | One record per C100 record |

| C141 (Invoice due date) | Includes information about the invoice due date. | Multiple records per C140 record |

| C160 (Transported volumes) | Transportation/Vehicle Information | One record per C100 record |

| C170 (Document details) | Lists the details of the nota fiscal (type 1 and 55) | Multiple records per C100 record |

| C172 (ISSQN operations) | This record is generated for paper notas fiscais (type 1) that include ISS tax (service ) | One record per C170 record |

| C176 ICMS-ST Compensation | Information about nota fiscal eligible to ICMS-ST compensation (types 1 and 55) | Conditional

Outbound notas fiscais only |

| C179 (ICMS Substitution Additional Information) | Paper Nota Fiscal (type 1) with ICMS Substitution information) | One record per C170 record |

| C190 (Document Analytic Register) | Includes information from the F7601B and F7611B files. | One record per C100 record |

| C990 (End Block C) | Includes information about Block C. | Mandatory

One record The system inserts this record when you execute the Sped Fiscal - Block 9 Control (P76B169) |

63.3 Block D Records

You generate Block D records using program P76B528 to report service notas fiscais. Only data related to electronic notas fiscais for the telephone industry is reported.

Records that are populated:

-

D001 (Opening Block D)

-

D500 (Communication and Telecommunication Service Receipts)

-

D590 (Analytical Record)

-

D990 (End Block D)

63.3.1 Source Files

This table describes the contents of the Block D records.

| Record | Description of Content | Compliance and Occurrence |

|---|---|---|

| D001 (Opening Block D) | Includes information about the block. | Mandatory

One record |

| D500 (Nota fiscal for telecommunications) | Includes information about the nota fiscal for telecommunications from the F7601B file. | Conditional

Multiple records |

| D590 (Analytical record of the document) | Includes information about the transaction from the F7611B file. | One record per D500 record |

| D990 (Ending Block D) | Includes information about Block D. | Mandatory

One record The system inserts this record when you execute the Sped Fiscal - Block 9 Control (P76B169) |

63.4 Block E Records

You generate Block E records using program P76B529 to report Imposto sobre Circulação de Mercadorias e Serviços(ICMS) and Imposto sobre Produtos Industrializados (IPI) information included in notas fiscais.

63.4.1 Source Files

The system uses these files for source data for the Block E process:

-

Nota Fiscal Header - Brazil (F7601B) via F7611BJD

-

Nota Fiscal Detail - Brazil (F7611B) via F7611BJD

-

Nota Fiscal Taxes Detail(F76B4001)

-

IPI Period Balance(F76B522)

63.4.2 Contents of Block E Records

This table describes the contents of the Block E records.

| Record | Description of Content | Compliance and Occurrence |

|---|---|---|

| E001 (Opening Block E) | Includes information about the block | Mandatory

One record |

| E100 (Period of verification for ICMS) | Includes information about the reporting period from the setup information. | Mandatory

One record |

| E110 (ICMS tax verification - own operations) | Includes information about ICMS taxes from the F7601B and F76B521 files. | Mandatory

One record per period |

| E116 (obligations of The ICMS to Collect-Owner Operations) | The objective of this record is to list the executed payments (special debits) or pending payments, related to the verification of the ICMS - Owner Operations in the period. The sum of the value of the obligations of this record must be equal to the sum of fields VL_ICMS_RECOLHER and DEB_ESP in the E110 record. | 1:N (several child records may exist per parent record) |

| E200 (ICMS tax verification period, tributary Substitution) | Includes information about the reporting period from the setup information. | One record per period |

| E210 (ICMS tax verification, tributary substitution) | Includes information about ICMS taxes from the F7601B and F76B521 files. | Multiple records per period |

| E250 (Obligations of the ICMS to Collect - Substitution Tax) | The objective of this record is to list executed payments (special debits) or pending payments, related to the ICMS Substitution Tax owed by state in the period. The sum of all listed obligation values in this record should be equal to the sum of fields VL_ICMS_RECOL_ST (record E210) and field DEB_ESP_ST. | 1:N (several child records may exist per parent record) |

| E500 (IPI tax verification period) | Includes information about the reporting period from the setup information. | One record per period |

| E510 (IPI values consolidation) | Includes information about IPI taxes from the F7611B file. | Multiple records per period |

| E520 (IPI verification) | Includes information about IPI taxes from the F7611B and F76B522 files. | Multiple records per period |

| E990 (Ending block) | Includes information about Block E. This record must be present in the electronic file. | Mandatory

One record |

63.5 Block G Records

Run Sped Fiscal - Block G Opening (P76B540) to generate Block G opening (G001) and Closing (G990) records.

63.5.1 Technical Notes:

A custom program is required to populate other records. We suggest that you call your custom program from the Block G program, J76B540.

If you write a custom program to create Record G125, note that:

-

For each record in Block G, Record G125, it is mandatory that you generate one record in the F76B525 file with the following format:

-

AWJBNO: JOB Number

-

AWRDTY: Block Record

-

AWDS80: Description (Fixed Asset Number, 8 positions)

-

AWBLSQ: Block Sequence

-

AWRPSQ: Reporting Report Seq

-

|

Note: Before that, you should delete the record in file F76B525 with the following logic:Delete from F76B525 all records with the same Job Number, Report Sequence and Block Sequence. |

63.5.2 Contents of Block G Records

The system processes records for items for which records exist in the Block 0. This table describes the contents of the records.

| Record | Description of Content | Compliance and Occurrence |

|---|---|---|

| G001 (Opening Block G) | Includes information about the block | Mandatory

One record |

| G990 (End Block G) | Includes information about Block G. | Mandatory

One Record The system inserts this record when you execute the SPED Fiscal - Block 9 Control & Ending program (P76B169) |

63.6 Block H Records

You generate Block H records to process information related to physical inventory and inventory control. The system processes records for items for which records exist in Block 0.

63.6.1 Technical Notes:

Record H020 is conditional. In order to print this record:

-

Inventory Reason defined in Block H - Inventories (P76B530) processing option must have Special Handling Code (SPHD) =1 , and

-

Information is included for the report period, and

-

Fiscal Note type is not standalone, and

-

Amount totals (ICMS Taxable Amount and ICMS Amount) are other than 0 (zero)

63.6.2 Source Files

The system uses these source files for the Block H process:

-

Item Master (F4101)

-

Item Ledger File (F4111)

-

Item Master Localization Tag (F704101)

-

SPED Fiscal Block H Inventory file (F76B156)

63.6.3 Contents of Block H Records

This table describes the contents of Block H records.

| Records | Description of Content | Compliance and Occurrence |

|---|---|---|

| H001 (Opening Block H) | Includes information about the block. | Mandatory

One record |

| H005 (Inventory totals) | Includes information about the inventory from the F4111 file. | Conditional

One record |

| H010 (Inventory) | Includes information about the inventory quantities of each item for items that appear in Block 0. The items must also exist in the F4101 and F4111 files. | Conditional

Multiple records. |

| H020 (Inventory Additional Information) | Reports ICMS information related to the transactions selected | Conditional.

Multiple records |

| H990 (End Block H) | Includes information about Block H. | Mandatory

One record The system inserts this record when you execute the Sped Fiscal- Block 9 Control & Ending program (P76B169). |

63.7 Block 1 Records

You generate Block 1 records to report other required information.

63.8 Block 9 Records

Block 9 - Registers - Generation (P76B169) is a program delivered with Sped Contabil that writes records for block 9 records and writes data to the closing records for blocks 0, C, D, E, G, H and 1.

| Record | Description |

|---|---|

| 0990 | Block 0 Closing |

| C990 | Block C Closing |

| D990 | Block D Closing |

| E990 | Block E Closing |

| G990 | Block G Closing |

| H990 | Block H Closing |

| 1990 | Block 1 Closing |

63.8.1 Contents of Block 9

This table describes the contents of Block 9 records.

| Record | Description of Content | Compliance and Occurrence |

|---|---|---|

| 9001 - Block 9 Opening | Includes a hard-coded value to indicate records exist in the file. | Mandatory

One record |

| 9900 - Block 9 File records | Includes information about the total number of records for each type in the flat file. | Mandatory

Multiple records. |

| 9990 - Block 9 Closing | Includes the total number of lines for block 9. | Mandatory

One record |

| 9999 - Block 9 Flat File Closing | Includes the total number of lines for the electronic file. | Mandatory

One Record |