11 Set Up Correspondence

This chapter contains these topics:

11.1 Setting Up Correspondence

The correspondence functionality is highly dependent on very accurate system set up. For that reason, any change to set up after correspondence functionality is enabled should be done very carefully and only by the most experienced users; otherwise, there is a potential risk of creating integrity issues.

Correspondence set-up is required in the following areas:

-

Set up correspondence constants (P74R0900)

-

Set up correspondence method (P74R0902)

-

Set up correspondence rules (P74R0903)

-

Set up correspondence accounts (P74R0901)

-

Set up correspondence UDC (74R/LT)

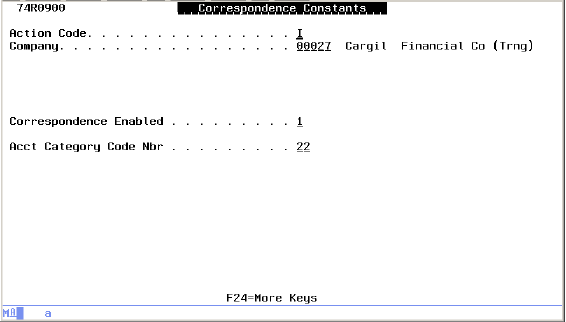

11.2 Setting Up Correspondence Constants (P74R0900)

Correspondence constants are defined by company. Correspondence functionality could be enabled or disabled, but once it is enabled, it shouldn't be disabled unless it will not be required in the future.

The information set up in the constants file (F74R0900) for a company is:

-

Correspondence enabled / disabled

-

Legal chart of account defined in category code number or obj.sub

Company 00000 is used as the default; therefore, correspondence constants must be defined for company 00000. Additionally, it is mandatory to define correspondence constants for all companies for which correspondence is disabled, because the system will look for information about a given company. If that information is not found, the system will look for company 00000. If correspondence is enabled for company 00000, the system will assume that correspondence is also enabled for the given company, unless correspondence is specifically disabled for that company.

Figure 11-1 Correspondence Constants screen

Description of "Figure 11-1 Correspondence Constants screen"

To set up correspondence constants

From (G74R09), choose option 2 (Correspondence Constants)

-

Type A (Add) in the Action Code field.

-

Complete the following:

-

Company - Enter the company number to which the constants apply.

-

Correspondence Enabled - Enter 1 to indicate that correspondence accounting is enabled, or leave blank if correspondence accounting is disabled.

-

Acct Category Code Nbr - Enter the category code number (21, 22, or 23) where the legal chart of accounts is kept. If this field is left blank, it indicates that the legal chart of accounts is kept in the OBJ.SUB account structure.

Note:

The example screen, above, indicates the category code (G/L Reporting Code) 22 is used for the legal chart of accounts. -

-

Press Enter to save the constants.

-

Press F3 to exit.

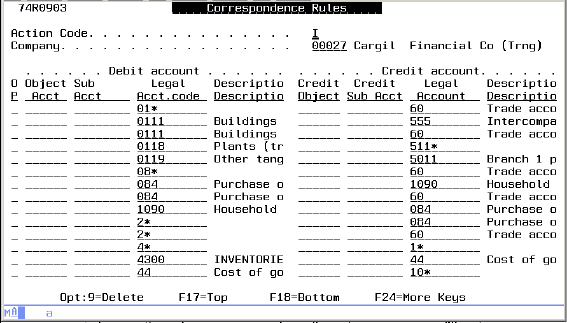

11.3 Setting Up Correspondence Rules (P74R0903)

The purpose of this program is to allow entering of the accounting rules provided by the Russian government for the accounts to which transactions can be credited and debited.

Correspondence rules are defined in pairs (Account Debit / Account Credit) based on the legal chart of accounts. The rules are defined by company. Company 00000 is allowed and provides a default definition. If a particular company needs a different definition than the one provided by the default, then a definition for that company should be entered.

The rules can be defined at different account levels, and the editing routine searches for the more detailed rule up to the more generic rule, according to the following hierarchy:

-

Detailed level (whole account)

-

First four characters of account

-

First three characters of account

-

First two characters of account

-

First character of account

To set up correspondence rules

From (G74R09), choose option 4 (Correspondence Rules)

-

Type A (Add) in the Action Code field.

-

In the Company field, enter the number of the company to which the correspondence rules apply.

-

Complete the following under Debit account:

-

Object Acct - If the company uses OBJ/SUB legal accounts, enter the object code for the debit account. If the company stores the legal account in the category code 21, 22, or 23, leave this field blank.

-

Sub Acct - If the company uses OBJ/SUB legal accounts, enter the sub account code for the debit account. If the company stores the legal account in the category code 21, 22, or 23, leave this field blank.

-

Legal Acct. code - If the company uses category code 21, 22, or 23 to store the legal account, enter the legal account for the debit account. If the company uses OBJ/SUB legal accounts, leave this field blank.

Note:

The example screen, above, uses the legal account codes, which are stored in category code 22 (G/L Reporting Code) for this company. The accounts you enter could be either OBJ/SUB or legal account code stored in the category code, depending on the correspondence constants setting for the company.

-

-

Complete the following under Credit account:

-

Object Acct - If the company uses OBJ/SUB legal accounts, enter the object code for the credit account. If the company stores the legal account in the category code 21, 22, or 23, leave this field blank.

-

Sub Acct - If the company uses OBJ/SUB legal accounts, enter the sub account code for the credit account. If the company stores the legal account in the category code 21, 22, or 23, leave this field blank.

-

Legal Acct. code - If the company uses category code 21, 22, or 23 to store the legal account, enter the legal account for the credit account. If the company uses OBJ/SUB legal accounts, leave this field blank.

-

-

Repeat steps 4 and 5 for each additional debit and credit correspondence account pair that are required for this company.