16 Statutory Account Summary

This chapter contains these topics:

16.1 About Statutory Account Summary

From Correspondence (G74R09), select 21 Statutory Account Summary

Russian Legislation defined Legal Reports to be presented to the Fiscal Authority. One report is the Statutory Account Summary based on Correspondence Accounting information. This process generates the formatted report that meets the legal requirement.

The Statutory Account Summary report is a batch process that takes data from the Correspondence Transaction Detail File, the Account Master File, and the Correspondence Balance File.

The Processing Options establish Selection criteria and Mode of Processing. The information entered in the processing options is validated, if errors are found, a Report indicating the error message prints and the process ends.

The system only prints posted movements from the Correspondence Transaction Detail File that meet the Selection criteria in Processing Options and Data Selection.

16.2 Processing Options

See Section 52.1, "Statutory Account Summary - Detailed (P74R0921)."

See Section 52.2, "Statutory Account Summary - Summary (P74R0921)."

16.3 Data Selection

Data selection is based on F0901 file - Account Master.

You can choose any field in the Account Master File for Data Selection.

If during the process no data is selected as a result of Selection criteria in Processing Options and Data Selection, the following Error Message prints:

-

116V - No Data Found. No data was found for this instance. Check your data selection.

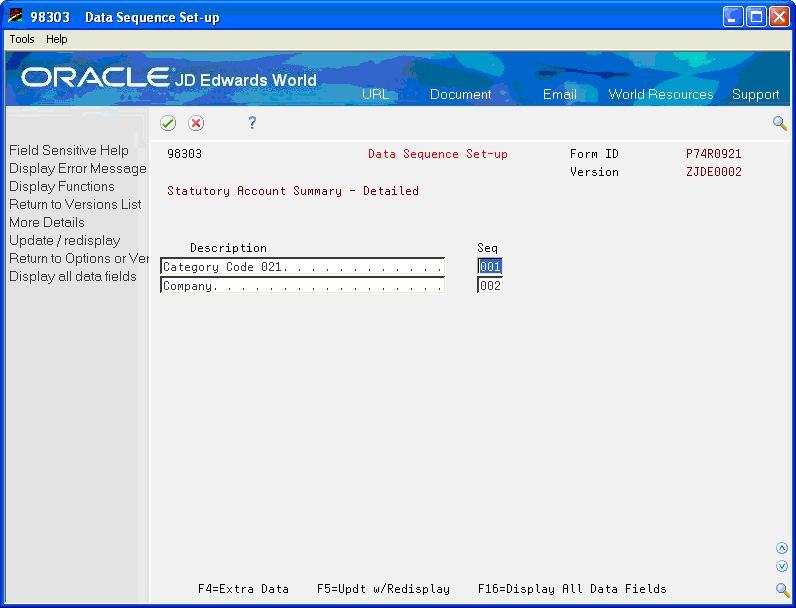

16.4 Data Sequencing

The process contains two DREAM Writer Versions, one to print the report in Detailed mode and the second to print the report in Summary mode.

The Data Sequencing for Summary mode has as first sequence field the Category Code XX, where XX must be the Summary Account Category Code Nbr assigned to contain the Summary Statutory Account Code in the range of 01-20.

The Data Sequencing for Detailed mode has as first sequence field the Category Code XX, where XX must be the Acct Category Code Nbr in the Correspondence Setup File (X0CCNB).

The users are responsible to correctly set the Category Code Number in the first Sequence field of the DREAM Writer.

16.5 Report

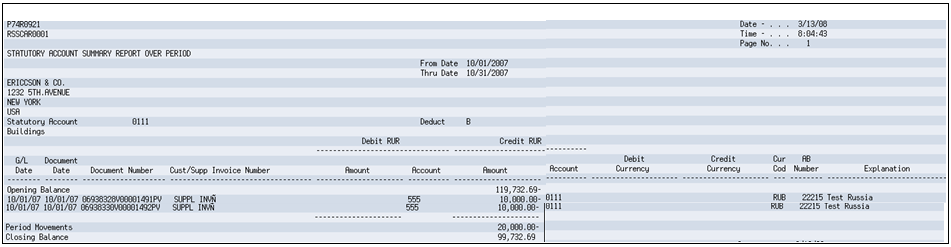

Figure 16-2 Statutory Account Summary Report (1 of 2)

Description of "Figure 16-2 Statutory Account Summary Report (1 of 2)"

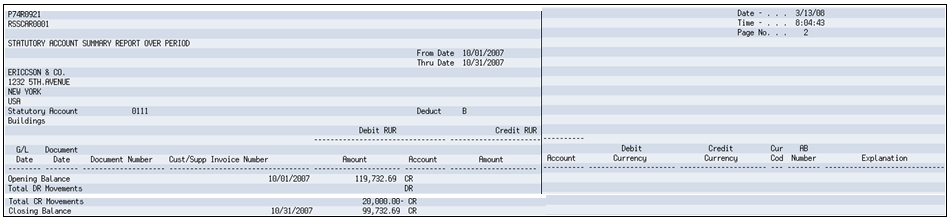

Figure 16-3 Statutory Account Summary Report (2 of 2)

Description of "Figure 16-3 Statutory Account Summary Report (2 of 2)"

16.6 Fields Description

16.6.1 Report Heading

| Field | Explanation |

|---|---|

| Selected Period | From Processing Option 1. |

| Legal Company | From Processing Option 2. |

| Correspondence Account Code | For Summary mode the two-character Summary Statutory Code that resides in the Category Code informed in Processing Option 6.

For Detailed mode the four Statutory Code characters that reside in the Category Code Nbr. indicated in the Correspondence Setup File (X0CCNB). |

| Indication of Deductible or not, or both | From Processing Option 8. |

| Name of the Account | The Name of the Account is retrieved from the Description 1 (DL01) of the UDC 09/nn, where nn is the Category Code Number entered in the Processing Option for Summary mode or, if the PO is left blank, the Category Code Number entered in the Correspondence Setup File (X0CCNB). |

16.6.2 Detail

| Field | Explanation |

|---|---|

| Opening Balance | Retrieved from Correspondence Balance File corresponding to the period of the beginning date.

The obtained amount is Debit Balance (from XBAPYC to XBAN14 fields of F74R0912) - Credit Balance (from XBBGBL to XBAN28 fields of F74R0912). The Bal.FWD is added only if the account is not a Profit & Loss account. For Summary mode or Correspondence Accounts accumulated by Address Book Number, the F74R0912 has several records and then the system prints an accumulation of these amounts. If the Beginning Date does not correspond to the initial day of the period a zero displays. If the net result = positive amount and accounts is A, then print as positive and print in the DR column. If the net result = positive amount and accounts is P, then print as negative and print in the CR column. If the net result = positive amount and accounts is B, then print as positive and print in the DR column. If the net result = negative amount and accounts is A, then print as negative and print in the DR column. If the net result = negative amount and accounts is P, then print as positive and print in the CR column. If the net result = negative amount and accounts is B, then print as positive and Print in the CR column. |

| G/L Date | From the transaction (XLDGJ). |

| Document Date | Invoice Date, Only for Batch I and V. |

| Document number | Concatenating Batch Number, Batch Type, Document Number, and Document Type. |

| Legal Invoice Number | Only for Batch I and V. |

| Debit | Debit amount from F74R0911 (XLAA2).

If XLAA2 is not equal to zero the Primary Account Code is placed. If XLAA2 is equal to zero the Secondary Account Code is placed. |

| Credit | Credit amount from F74R0911 (XLAA3).

If XLAA3 is not equal to zero the Primary Account Code is placed. If XLAA3 is equal to zero the Secondary Account Code is placed. |

| Debit Currency | If transaction Currency Code is different from the Domestic Currency Code of the Company (XLCO) in F74R0911, the amount from the CA record of F74R0911 is shown in this field, corresponding to the record being printed:

Debit Amount (XLAA2 from F74R0911) |

| Credit Currency | If transaction Currency Code is different from the Domestic Currency Code of the Company (XLCO) in F74R0911, the amount from the CA record of F74R0911 is shown in this field, corresponding to the record being printed:

Credit Amount (XLAA3 from F74R0911) |

| Transaction Currency Code | Retrieved from F74R0911 record. |

| Address Book Number | Retrieved from F74R0911 (XLAN8). |

| Explanation | Is the field GLEXA, from the file F0911, that corresponds to the transaction of F74R0911 that is being processed. |

16.6.3 Footer

| Field | Explanation |

|---|---|

| Period Movements | Aligned with its column, the added up of the Debit Amounts included in the detail.

Aligned with its column, the added up of the Credit Amounts included in the detail. This is the summary of the detail transactions and does not include the opening balance. |

| Closing Balance | This is the addition of the Opening Balance and the Period Movements. The value is aligned as follows:

If DR and UDC 09/21 desc 2 = A then appear in DR col as positive amount. If DR and UDC 09/21 desc 2 = P then appear in CR col as negative amount. If CR and UDC 09/21 desc 2 = A then appear in DR col as negative amount. If CR and UDC 09/21 desc 2 = P then appear in CR col as positive amount. If DR and UDC 09/21 desc 2 = B then appear in DR col as positive amount. If CR and UDC 09/21 desc 2 = B then appear in CR col as positive amount. |

16.6.4 Separate Final Page

| Field | Explanation |

|---|---|

| Initial Opening Balance date | Entered in Processing Option 1. |

| Opening Balance | Retrieved from Correspondence Balance File corresponding to the period of the beginning date. The obtained amount is Debit Balance - Credit Balance.

For Summary mode, the F74R0912 has several records and the system prints a sum of these amounts. If the Beginning Date does not correspond to the initial day of the period a zero displays. For All Accounts calculate the opening net balance by adding up the appropriate period DR column - CR column from the balance file for that account. (XBAN15 - XBAN28) subtracted from (XBAN01 to AN014). The Bal.FWD is added only if the account is not a Profit & Loss account. If the net result is a positive amount and accounts is A, then print as positive and print literal as DR. If the net result is a positive amount and accounts is P, then print as negative and print literal as CR. If the net result is a positive amount and accounts is B, then print as positive and print literal as DR. If the net result is a negative amount and accounts is A, then print as negative and print literal as DR. If the net result is a negative amount and accounts is P, then print as positive and print literal as CR. If the net result is a negative amount and accounts is B, then print as positive and print literal as CR. |

| Total DR Movements | Aligned with the previous amount, the added amount of the Debit Amounts included in the detail.

DR literal prints on the right side of the amount. |

| Total CR Movements | Aligned with the previous amount, the added amount of the Credit Amounts included in the detail.

CR literal prints on the right side of the amount. |

| Ending Closing Balance date | Entered in Processing Option 1. |

| Closing Balance | If Closing Date does not correspond to the initial day of the period a zero displays.

For All Accounts calculate the closing net balance by adding up the appropriate period DR column - CR column from the balance file for that account. (XBAN15 - XBAN28) subtract from (XBAN01 to AN014). If the net result is a positive amount and accounts is A, then print as positive and print literal as DR. If the net result is a positive amount and accounts is P, then print as negative and print literal as CR. If the net result is a positive amount and accounts is B, then print as positive and print literal as DR. If the net result is a negative amount and accounts is A, then print as negative and print literal as DR. If the net result is a negative amount and accounts is P, then print as positive and print literal as CR. If the net result is a negative amount and accounts is B, then print as positive and print literal as CR. |

| Literal 'ERROR' | Displays if closing calculated balance is not equal to the corresponding closing balance from F74R0912 File.

Note, the Closing balance calculation is: Beginning Balance Amount + Accumulated Debit Amounts - Accumulated Credit Amounts. If Beginning/Closing Date does not correspond to final day of the period this verification is not made. |