11 Print the EU Sales Listing

This chapter contains the topic:

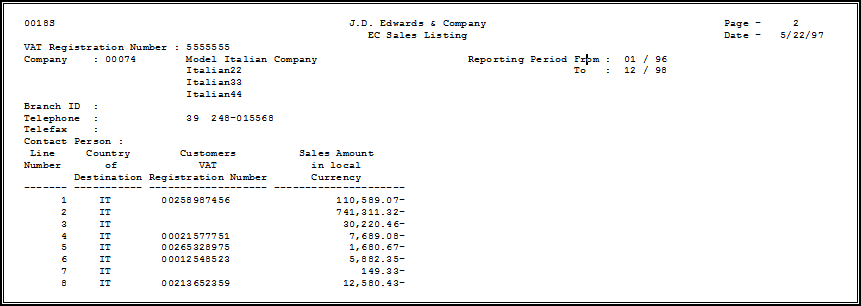

11.1 Printing the EU Sales Listing

From General Systems (G00), choose Tax Processing and Reporting

From Tax Processing and Reporting (G0021), choose EU VAT Processing

From EU VAT Processing (G00211), choose EU Sales Listing

Businesses in the United Kingdom that exceed the limit of intra-union trade must submit the EU Sales Listing report on a quarterly basis if they:

-

Supply goods to an entity that is registered for VAT in another EU-member country

-

Send goods to an entity that is registered for VAT in another EU-member country for process

-

Return processed goods to an entity that is registered for VAT in another EU-member country

-

Transfer goods from one EU-member country to another EU-member country in the course of business

The EU Sales Listing report provides the following information about customers:

-

VAT number

-

Country of destination

-

Total amount in local currency

The EU Sales Listing report is based on the information in the Sales/Use/VAT Tax file (F0018). If you plan to run the EU Sales Listing, ensure that the processing options in the post program are set up to automatically update this file.

11.1.1 Before You Begin

-

Enter VAT registration numbers and country codes for each customer. See Section 8.1, "Setting Up for European Union (EU) Reporting."