3 Set Up Taxes And Withholding

This chapter contains these topics:

3.1 Overview of Withholdings Setup

You must set up withholding information in the JD Edwards World software before the system can calculate withholdings on Argentinean transactions.

-

VAT withholding concepts

-

Legal VAT withholding concepts

-

RG 726 and RG 615 setup

-

Withholding constants

-

Allowed values

-

Supplier fiscal situation check

-

Replies from the tax authority

-

AFIP information manual maintenance

-

Localized supplier information

-

-

VAT tax codes

-

VAT withholding percentages

-

Base reduction

-

Limit amount

-

Supplier reduction

The system uses the Argentine withholding functionality when you process payments in the base software system.

3.2 Understanding VAT Withholding in Argentina

The Administración Federal de Ingresos Públicos (AFIP, the Federal Administration of Public Income) is the fiscal authority in Argentina and it establishes VAT withholdings in the General Resolution 18.

Also, R.G. 726/99 stipulates that VAT withholdings for payments must be calculated every month based on the classification that is published by AFIP for each supplier.

Depending on the classification that AFIP assigns the supplier, you must apply either the general percentage for RG 18 or a substitute percentage.

AFIP's General Resolution 3732 defines rates for specific cases and determines how VAT withholding must be calculated:

-

The calculation base for VAT withholding is the VAT amount specified in the voucher. You define the VAT Calculation Basis in the Tax Code Definition program.

See ***.

-

For vouchers where VAT is not identified (that is a Tax Rate/Area record set up with a 0% rate and a tax explanation code different from E), VAT withholding must be calculated on the estimated VAT amount. In this case, the system obtains that VAT amount by calculating the voucher gross amount, minus the non-taxable amounts minus any discounts; and multiplying the result by the number obtained from dividing the applicable VAT rate by the sum of 100 plus the VAT rate. The formula is the following:

Description of the illustration ''formula_vat_amount.gif''

The system retrieves the VAT rate to use in the preceding formula according to the following logic:

-

From the field VAT Rate Not Identified in the Numeric tab of the Additional Tax Rate Information program (P704008A)

-

If the Additional Tax Rate Information is blank, the system retrieves the rate from the processing options for the PO - PCG process - ARG program (P76A570) in the VAT Unidentified tab

-

If the information on both fields is blank, then the system does not calculate the withholding.

-

When you work with the Create Payment Control Group program (R04570), the system saves the calculation basis amount in the User Amount field (URAT) in the temporary PCG Detail Information Tag Table (F760473A) file. You can review the payment amount and corresponding tax withholdings in the Print PCG Detail - ARG report (R760476A) that the process generates.

JD Edwards Localizations for Argentina only saves the calculation base to a final table (in the URAT field of the A/P Ledger Tag Table - ARG table - F760411A) and uses it to calculate and apply VAT Withholdings, when you work with these programs and processes:

-

V.A.T Withholding Certificate – ARG (R7604522A)

-

Reprint V.A.T. Withholding Certificate - ARG (R7604521A)

The following reports retrieve and display the information about the calculation basis saved:

-

Withholdings ledger report

-

SICORE report.

3.2.1 Understanding VAT Withholding Setup for RG 726

You can also set up your system to calculate VAT withholding according to the RG 615 for companies that export products following these steps:

- 1 - Set up Withholding Constants

-

The system uses the withholding solution from the base software together with the country-specific functionality in specific cases. It uses the supplier type listed in the RG 726 and the option to apply the RG 615 in the specific Address Book Category Codes set up by the user.

- 2 - Set up Allowed Values

-

Set up the allowed values in the user defined code table that matches the Address Book Category Code for RG 615. A single value in this UDC table is enough to indicate the withholding percentage.

See Section 2.1, "Setting Up User Defined Codes for Argentina"

- 3 - Formatting AFIP Inquiry

-

Every month, the AFIP publishes on its website the fiscal situation of every taxpayer using a 4-values code. Companies can check the fiscal situation of their suppliers by submitting a text file with the tax ID of the supplier and the tax ID of the inquiring company.

When you use the option Formatting AFIP Inquiry in the Withholding Setup menu for Argentina (G76A041), the system generates the plain text file F76A8013 in the server data library. You then transfer this information to a file using FTP so you can submit it to AFIP's website.

This process does not generate any listings or reports. You can define the data selection criteria. Oracle recommends running the process for all the suppliers.

See Section 4.1, "Processing Options for Shipment Supplier Information to AFIP (P76A8013)".

- 4 - Formatting AFIP Answer

-

After submitting the inquiry to AFIP, the fiscal authority replies by sending a plain text file to the inquiring company with the fiscal situation of the suppliers listed and additional information. You must use FTP to upload the file to the F76A8010 file in the server data library. The process generates the matching records in the F76A8011 file and adds additional data that the system uses later in the process.

The output file F768011 maintains history records of the replies received form AFIP for every month. You can run the process as often as desired. To run it, use the option Formatting AFIP Answer in the Withholding Setup menu for Argentina (G76A041).

Note:

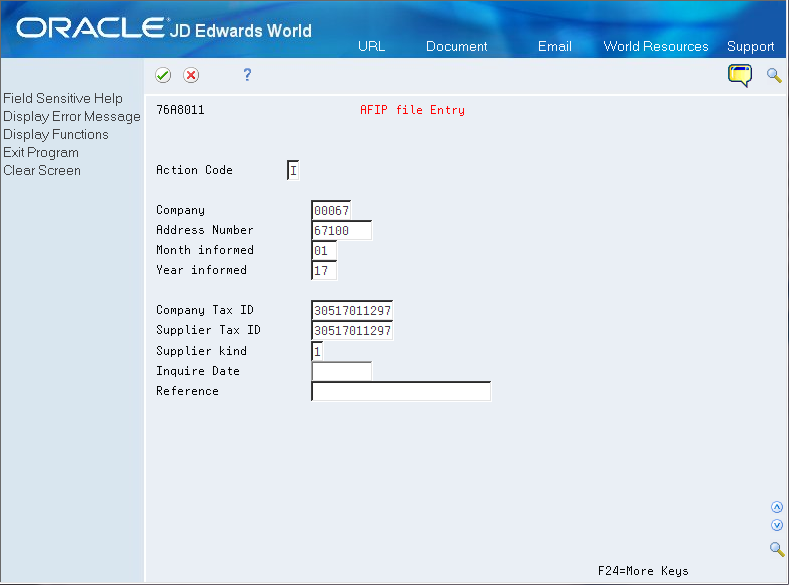

When you receive the information from AFIP you can choose to get the reply with or without the company name of the suppliers. JD Edwards only processes files without the supplier company name. - 5 - AFIP File Entry

-

Use the option AFIP File Entry in the Withholding Setup menu for Argentina (G76A041) to manually maintain and revise information in the AFIP files.

See Section 3.7, "Set Up and Maintain AFIP File Information".

3.3 Before You Begin

-

Verify that the following user defined codes tables are set up:

-

Tax/Withholding Codes (system 70, type BT)

-

Concepts (system 70, type CO)

-

Jurisdictions (system 70, type JR)

-

Legal Concepts (system 70, type LG)

See Section 2.1, "Setting Up User Defined Codes for Argentina"

-

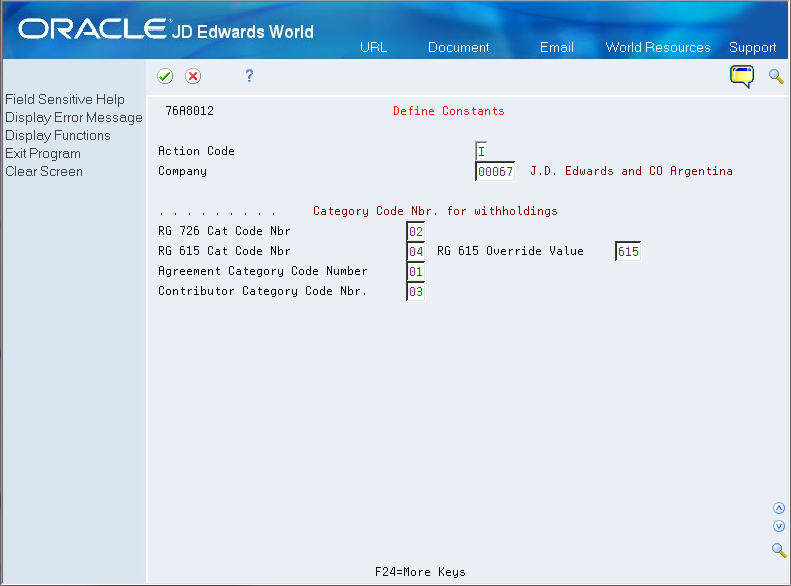

3.4 Set Up Withholding Constants

From Withholding Setup (G76A041), choose Define Constants

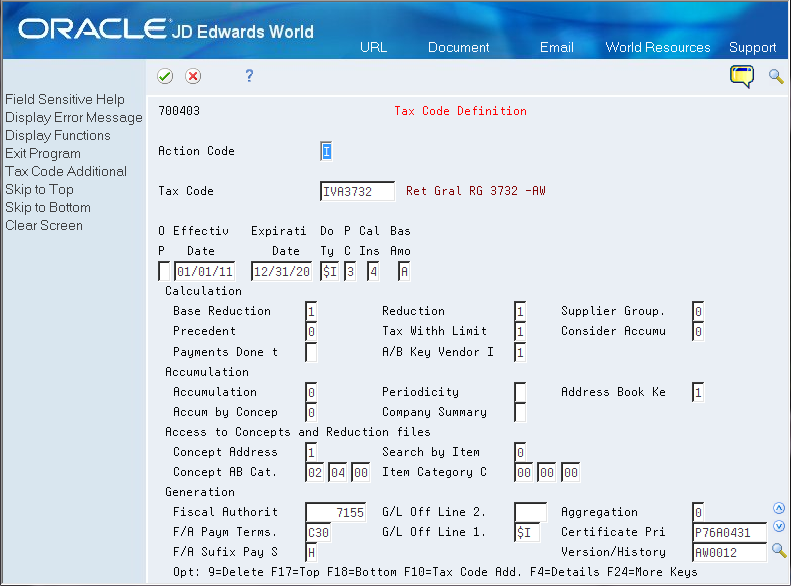

Figure 3-1 Withholding Setup - Define Constants screen

Description of ''Figure 3-1 Withholding Setup - Define Constants screen''

For each company, use this program to specify the category code number that the system uses to retrieve information for different purposes.

|

Note: To apply the withholding percentages for RG 615, you must specify the Address Book category code number for the RG and also the value used in the UDC that the RG 615 specifies. |

3.5 Set Up Tax Code

From Tax/Withholding Setup (G7004), choose Tax Code Definition

Use the tax codes program to specify the date type that the system uses when processing and calculating withholdings.

3.6 Set Up Tax Code Definition

From Tax/Withholding Setup (G7004), choose Tax Code Definition

Use the tax codes definition program to set up every tax code and how the system calculates and operates with the selected tax or withholding. Some characteristics that you specify in this program are the calculation basis, if the tax code uses accrued amounts from previous payments, if it works with the supplier category codes, and so on.

|

Note: If the RG 726 or 615 are applicable to your company, you must set up the system to use the country-specific Address Book category codes. If the regulations are not applicable, do not specify an address book category code number in this program. |

To set up Tax Code Definitions

On Tax Code Definition

For every tax code concept, complete the following fields:

| Field | Explanation |

|---|---|

| Tax Code | A value from the Tax Withholding Codes UDC table (system 70, type BT) that identifies a legal concept for a tax or withholding. |

| Effective Date | Enter the first day on which the tax or withholding term is effective. |

| Expiration Date | Enter the expiration date of the tax or withholding terms. |

| Document type | A value from the UDC table Document Type - All Documents (system 00, type DT) that identifies the document type used for the tax or withholding. |

| Person or Corporation Code | A code that designates the type of taxpayer.Valid values for non-U.S. clients are (used with the 20-digit Company field and Individual field):

|

| Calculation Instance | A code that specifies if the Tax/Withholding is calculated at Voucher Entry or voucher Payment event. It also indicates if the calculation shall be done on entire voucher amount, per voucher suffix amount or on payment amount. |

| Base Amount | A code that specifies the voucher amount that the system uses as base amount for calculations.

When setting up a tax code definition to use when calculating withholding according to RG 3732, use code A when the calculation base for VAT withholding is the VAT amount specified in the voucher, and use code B when the amount is discounted. |

| Base Reduction | A code that indicates the processing order of the amounts that make the Base Amount before applying a Base Reduction: Voucher Base Amount (B), Precedents Amount (P), Supplier Reduction Amount (RS), Payments to other companies (POC). Valid values are:

1: B 2: B + P 3: B + RS. 4: B + POC 5: B + P + RS 6: B + P + POC. 7: B + RS + POC 8: B + P + RS + POC. |

| Base Reduction | A code that indicates if the Base and/or Tax/Withholding amount have a reduction on the corresponding calculated amount by Voucher Supplier. |

| Supplier Group | An option that specifies whether the system verifies if there is a Supplier group for a tax code that composes proportionally the Supplier Voucher. If enabled, the system checks the Supplier Group File in tax or withholding calculations and divides the Tax/ Withholding amount proportionally. |

| Precedent | An option that specifies if the system must consider another tax code before working with the Tax Code being set up. Valid values are:

0: The Tax Code doesn't have precedents. 1: The Tax Code has precedents. |

| Tax Withholding Limit | A code that indicates the existence of a Limit Amount for the calculated Tax/Withholding amount. Valid values are:

0: There is no limit amount for the Tax/Withholding calculated. 1: There is a limit amount for the Tax/Withholding calculated. In this case, the system accesses the Tax/Withholding Limit Amount file when working with the tax code. |

| Consider Accumulated Amount | An option that indicates whether the system considers the accumulated amounts of the Tax Code in the Base and Tax/Withholding calculations. |

| Payments Made to Other Companies | A code that indicates if supplier payments made to other companies exist and how to consider them when calculating Tax/Withholding amounts. |