Processing Direct Bank Disbursements

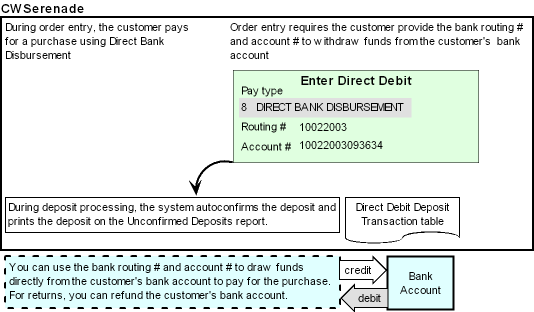

Overview: Direct bank disbursement is a payment method in which a customer can pay for a purchase directly out of his or her bank account. To use a direct bank disbursement pay type on an order, the customer must provide the routing number and account number of the bank account. The customer’s bank uses the routing number and account number to draw funds directly from the customer’s bank account in order to pay for the order. The customer’s bank also uses the bank routing number and account number to refund the customer’s bank account for any returns.

Direct bank disbursements process:

In this topic:

• Direct Bank Disbursement Processing

• Direct Bank Disbursement Setup

Direct Bank Disbursement Processing

To process a direct bank disbursement:

In regular order entry: When you add a direct bank disbursement pay type to an order, the system displays the Enter Direct Debit For Window (Direct Bank Disbursement Payment Type), which requires the routing number and account number of the customer’s bank account. A credit card number is not relevant for a direct bank disbursement pay type, so the system defaults the Description of the direct bank disbursement pay type to the Credit card number field.

During deposits: During deposits processing, the system auto-confirms the deposit and prints the deposit on the Unconfirmed Deposits report.

Note: An integration between CWSerenade and a bank system is not currently implemented.

Returns: If you process a return against the direct bank disbursement pay type, the system creates a credit invoice for the refund amount. When you process deposits for the credit invoice, the system generates a deposit request for the amount the bank will refund the customer’s bank account.

Note: Returns are available for deposit processing after you use the Process Refunds menu option (MREF) to generate the credits.

General Ledger posting: During deposits processing, the system posts to the following general ledger accounts for direct bank disbursements.

Transaction Type |

Credit |

Debit |

Positive (deposits) |

Sales general ledger number for the Pay Type |

A/R cash G/L # for the Credit Card Deposit Bank # (C56) system control value |

Negative (refunds) |

Returns general ledger number for the Pay Type |

A/R cash G/L # for the Credit Card Deposit Bank # (C56) system control value |

Restrictions:

• Order API interface, business-to-business orders, and membership orders: You cannot enter a direct bank disbursement payment method on an order API order, business-to-business order, or membership order. The system displays the error Direct Disbursement N/A.

• Deferred or installment billing: You cannot use deferred or installment billing with a direct debit disbursement pay type. See Working with Flexible Payment Options (WFPO) for more information on setting up payment plans for deferred and installment billing.

Direct Bank Disbursement Setup

To use Direct Bank Disbursments, you must create a direct bank disbursement pay type.

Setting up the direct bank disbursement pay type: When creating a direct bank disbursement pay type in Working with Pay Types (WPAY), set:

• Pay category: enter Credit Card as the pay category

• Card type: enter Direct Bank Disbursement as the card type

• Deposit service: enter USR as the deposit service

Note: You cannot assign a credit card number format to a direct bank disbursement pay type; instead, the description of the direct bank disbursement pay type displays in the Credit card number field.