5. Setting up a Fund

A fund that you process in Oracle FLEXCUBE can be internal or external. An internal fund is one that is created and managed entirely in Oracle FLEXCUBE, and an external fund one that has originated from a system external to Oracle FLEXCUBE. Internal and external funds are further classified into:

- Portfolio

- Mutual funds

To recall, you have already created fund products to group together or categorize Funds that share broad similarities. Under each Product that you have defined, you can enter specific funds based on your requirement.

By default a fund inherits all the attributes of the product associated with it. This means that you will not have to define the general attributes of a fund each time you input a fund involving a product.

This chapter contains the following sections:

5.1 Fund Input

This section contains the following topics:

- Section 5.1.1, "Maintaining Fund On-line Details"

- Section 5.1.2, "Fund Details Tab"

- Section 5.1.3, "Bank Accounts Tab"

- Section 5.1.4, "Net Asset Value Button"

- Section 5.1.5, "Charges Button"

- Section 5.1.6, "Tax Details Button"

- Section 5.1.7, "Settlement Button"

- Section 5.1.8, "MIS Button"

- Section 5.1.9, "Rate Button"

- Section 5.1.10, "Fields Button"

- Section 5.1.11, "Events Button"

- Section 5.1.12, "Message Button"

5.1.1 Maintaining Fund On-line Details

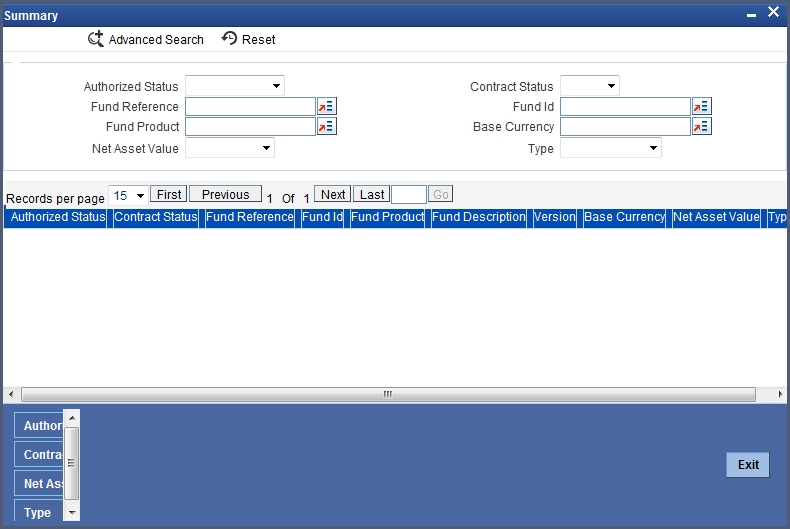

If you are calling a fund online record that has already been defined, choose the Summary option. From the ‘Summary’ screen double-click a class of your choice to open it. You can invoke the ‘Fund On-Line Summary’ screen by typing ‘AMSFNONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The ‘Fund On-Line Summary’ screen can also be invoked by typing ‘AMDFNONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

If you are setting up a new fund, Click the ‘New’ button on the Application tool bar.

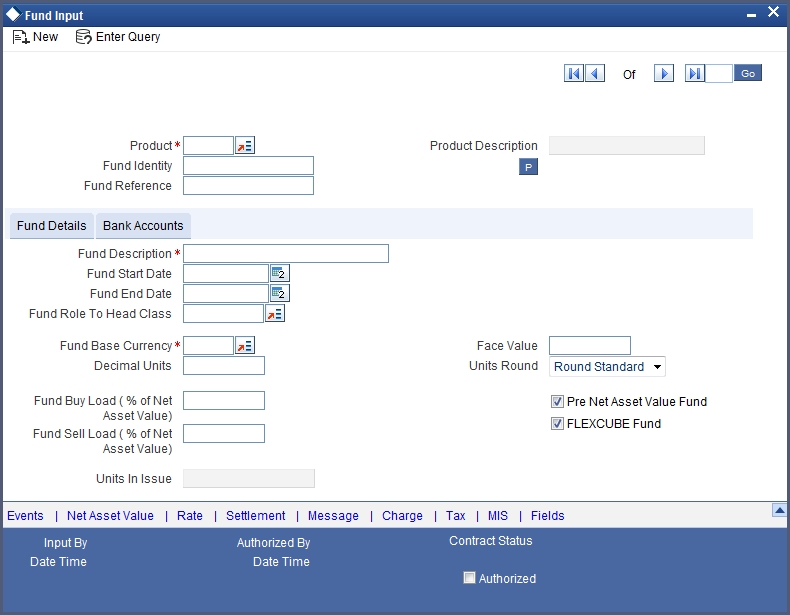

The ‘Fund Online’ screen as it appears contains a header, a footer containing fields that are specific to the fund you are creating, and two tabs (Fund details and Bank accounts). Besides these, you will also notice a horizontal array of six icons along the lines of which you can enter details of a fund. Fund details are grouped into screens according to the similarities they share.

Associating Product to Fund

You should necessarily use a product that has already been created to enter the details of a fund.

Product

Depending on the type of fund you are creating, you can select an appropriate product code from the option list available.

Product Description

Description of the product is defaulted here.

A fund will inherit all the attributes defined for the product associated with it. You can further add details that are specific to the fund like the face value of the units of the fund, the fund base currency, the life span of the fund and so forth and change some of the defaulted attributes.

This feature renders the creation of a fund quick and easy.

Fund Identity

Besides the reference number generated by the system, you should enter a unique six to nine character reference number to identify the fund. By default, Oracle FLEXCUBE defaults the product code and the last five characters of the Fund reference number as the Fund ID. You can change the default.

This number, in addition to the 'Fund Reference Number', will be used to identify the fund.

Fund Reference Number

In Oracle FLEXCUBE, reference numbers are generated automatically and sequentially by the system. This number tag is used to identify the fund you are defining. Hence, the system generates a unique number for each fund.

The fund reference number is a combination of a three-digit branch code, a four-character product code, a five-digit Julian Date, and a four-digit serial number. The Julian date has the following format:

‘YYDDD’

Here, YY stands for the last two digits of the year and DDD for the number of day (s) that has/have elapsed in the year.

For example, January 31, 1999 translates into the Julian date: 99031. Similarly, February 5, 1999 becomes 99036 in the Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those elapsed in February (31+5 = 36).

Every transaction in a fund is tracked against the Fund reference. This reference is also used for MIS tracking.

5.1.2 Fund Details Tab

You can maintain the following details here:

Fund Description

You should specify a short description that will enable you to identify the fund quickly.

The short description that you specify is for information purposes only and will not be printed on any customer correspondence.

Fund Start Date

When you create a fund, you must also specify the life span (start and end date) of the fund. The period that you specify, as the life span of a fund should fall within the life span of the product associated with the fund.

Fund End Date

The end date for a close-ended fund refers to the fund termination date (after which, subscription and redemption is disallowed).

Note

If you do not specify an End Date for the fund, the fund is taken to be an open-ended fund. It is important to note that you cannot associate an open-ended fund with a closed end fund product.

Fund Role To Head Class

To recall, while defining a product you have already indicated the accounting roles and heads that are applicable to the product. These become applicable to all funds to which the product is associated.

While processing a fund, you have the option to change the Role to Head mapping class defaulted from the product. The accounting entries that are passed for the fund will be posted to accounts based on the Accounting Role to Head class that you associate with it.

Indicating the fund category

While creating a fund you should indicate to which category the fund belongs. Funds in Oracle FLEXCUBE are categorized into:

- Internal Funds

- External Funds

An internal fund is one that is created and managed entirely in Oracle FLEXCUBE, and an external fund one that has originated from a system external to Oracle FLEXCUBE, for example, Oracle FLEXCUBE Investor Servicing.

Fund Base Currency

The base currency is the currency in which the Fund should be denominated. You can select a currency code from the option list that is displayed. The NAV and dividend declarations for the Fund will be expressed and calculated in this currency.

Subscriptions can be made to the fund in a currency that is different from the base currency; but entitlement and benefits will be calculated in the fund base currency. The standard exchange rate defined for the currency pair is used for the conversion.

For example, You have set up a fund with the base currency as USD. The subscription price of a unit of the fund is USD 10.

You have received an investment of DEM 10,000 to the fund. The existing exchange rate for the currency pair is 1:2.

The allotment of units for the investment is made based on the USD equivalent of the Investment amount. In this case 500 units of the fund will be allotted for the invested amount.

Face Value

For the mutual funds that you set up, you should indicate the face value of each unit of the fund.

Decimal Units

You can indicate the number of decimal units up to which fractional units of the fund can be allotted. This preference together with the rounding preference that you specify is used to determine the allocation of fractional units of the fund.

For example, You have received an investment of USD 10,000 to a fund. The subscription price of a unit of the fund is USD 55. In this case, the number of units that you would allot from the fund is a fraction and amounts to 181.818181 units.

Decimal units = 2

Rounding preference = Round up

In this case, the number of units that should be allocated is 181.82 Units.

Units Round

When allocating units of a fund, you may encounter fractional units. Therefore, you need to specify preferences as to how the fractional units should be rounded. The options available are:

| Option | Details | ||

|---|---|---|---|

| Round Standard | The fraction will be rounded up to the next full unit if fraction is greater than 0.5, else it will be rounded down to the previous full unit. | ||

| Round Up | The fraction will be rounded up to the next full unit. | ||

| Round Down | The fraction will be rounded down to the previous full unit. |

Fund Buy Load

The fund buy load indicates the percentage of the NAV that should be added to the NAV of a unit of the fund to calculate the price at which the unit can be subscribed.

The buy load is used to calculate the price at which a unit of the fund should be sold. It is expressed as a percentage of the NAV.

Subscription price = NAV + Buy Load

Fund Sell Load

The fund sell load indicates the percentage of the NAV that should be subtracted from the NAV of a unit of the fund to calculate the price at which the unit can be subscribed.

The sell load is used to calculate the price at which a unit of the fund should be redeemed. It is expressed as a percentage of the NAV.

Redemption price = NAV - Sell Load

Indicating the Fund Pricing Strategy

The pricing strategy for a fund indicates when and at what price units of the fund should be allocated. The options available are:

- Pre NAV

- Post NAV

The pricing strategy helps to determine:

- The price at which subscription or redemption should be made

- When the allocation of units can be done

If you choose the pre-NAV option, the NAV of the fund calculated at Beginning of Day (BOD) will be the basis on which the price of a unit of the fund is determined. For funds with pre NAV pricing, subscription and redemption can be done immediately.

If you select the post-NAV funding strategy, the NAV calculated at End of Day (EOD) would be used to determine the price of a unit of the fund. As the price of a unit of the fund is determined using the NAV calculated during EOD; any allocation or redemption of units from the fund can be done only after the EOD is run.

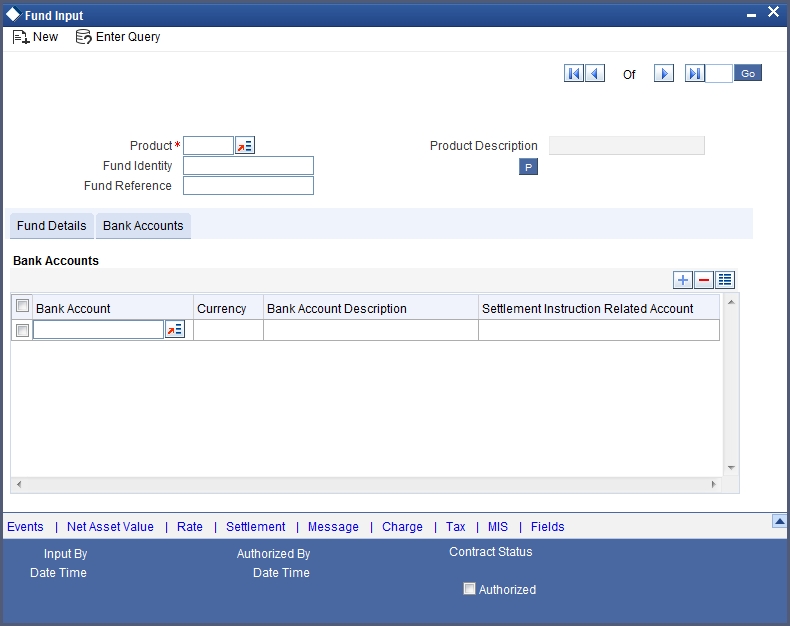

5.1.3 Bank Accounts Tab

Click the tab titled 'Bank Accounts' from the ‘Fund On-Line’ screen to indicate the asset settlement accounts that should be used in the accounting entries that are passed for the fund.

Specify the following details.

Indicating settlement accounts for a fund

A fund that you create can have bank accounts in different currencies. However it is mandatory for you to indicate an asset account in the base currency of the fund. These accounts will be used when investments are made into the fund in a currency other than the fund base currency.

Note

You can maintain only one bank account for a specific currency. The Bank settlement account is unique for a particular fund.

For external funds

For external funds, you can specify the related account number. This is the number by which the fund is identified in the external system.

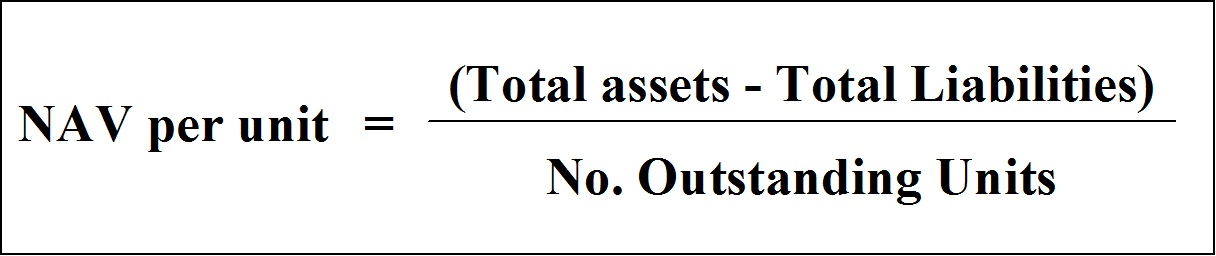

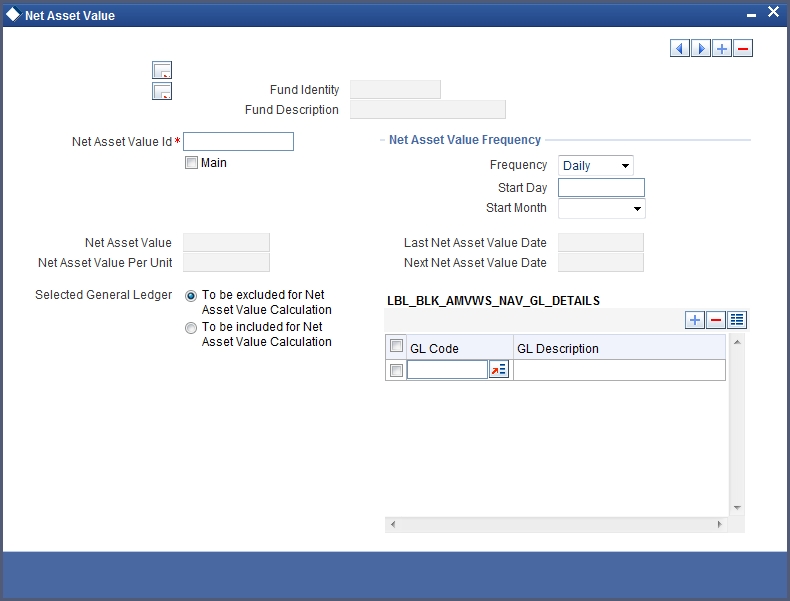

5.1.4 Net Asset Value Button

In Oracle FLEXCUBE, the NAV of a fund is computed using the following formula:

The total assets and liabilities are computed based on the GL + MIS balances for the fund. For the purpose of NAV calculation, you can indicate the GLs that should be considered for NAV calculation. You can indicate these GLs by maintaining either a list of GLs that should be included or excluded for NAV calculations.

You can define several NAV calculation methods for a Fund. Each NAV for the fund can be defined with a set of GLs to be included or excluded and NAV calculation frequency preferences. Click ‘Net Asset Value’ button from the ‘Fund On-Line’ screen to invoke the GLs for ‘NAV Calculation’ screen.

5.1.4.1 Identifying a GL Combination for NAV Calculation

The NAV of a fund is calculated using the balances of a combination of GLs that you define. You can define several sets of GL combinations for the purpose of NAV calculation. Each such GL combination should be assigned a unique identification ID.

Net Asset Value Identification

If you have defined several GL combinations for calculating the NAV of a fund, you can assign one of the combinations as the Main NAV.

For external funds, the GL combination marked as the Main NAV is handed off to Oracle FLEXCUBE Investor Servicing.

5.1.4.2 Specifying GLs for NAV Calculation

You can specify the GLs to be included for calculating the NAV of a fund either in the form of an ‘included’ or ‘excluded’ list. You can indicate your preference by choosing the appropriate option under the field 'Selected GLs'.

The entire list of GLs maintained at your bank is displayed under the head GLs available. If you have maintained an included list, the GLs displayed in the selected column only will be considered for NAV calculation. If you selected the 'excluded' option, all GLs other than the ones in the excluded list will be considered for NAV calculation.

The list of GLs for NAV calculations can be maintained under GL code. Their inclusion/exclusion depends on the selection of ‘To be included for Net asset value calculation’ and ‘To be excluded for net asset value calculation’ options.

Net Asset Value (NAV) Frequency

You can maintain the following parameters here:

Frequency

You can indicate the frequency, with which the Net Asset Value of a fund should be calculated. The frequency that you specify can be:

- Daily

- Monthly

- Quarterly

- Annually

Oracle FLEXCUBE will automatically calculate the NAV of a fund, as part of the end of cycle processing based on the preferences that you specified here.

Start Day

In the case of monthly, quarterly, half yearly or yearly frequencies, you should specify the date on which the NAV should be calculated during the month. For example, if you specify the date as ‘30’, NAV will be calculated on that day of the month, depending on the frequency.

If you want to fix the NAV calculation date for the last working day of the month, you should specify the date as ‘31’ and indicate the frequency. If you indicate the frequency as monthly, the NAV of the fund will be calculated at the end of every month -- that is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February.

If you specify the frequency as quarterly and fix the calculation date as 31, the NAV will be calculated on the last day of the month at the end of every quarter. It works in a similar fashion for half-yearly and yearly calculation frequency.

Start Month

If you set the calculation frequency as quarterly, half yearly or yearly, you have to specify the month in which the NAV calculation for the fund should be done, besides the date on which the calculation should be done.

For example, you have selected the half-yearly option and specified the start month as June and the start date as 31.

In this case, Oracle FLEXCUBE will calculate the NAV of the fund first on 30 June for the period from January 1 to June 30 and second on 31 December for the period from 1 July to 31 December.

If the calculation date falls on a holiday

If the NAV calculation date falls on a holiday, the calculation is done as per your holiday handling specifications in the ‘Branch Parameters’ screen.

The System provides two Basis Amount tags for NAV Charge calculation:

- NAVAMT – For this amount tag, no holiday treatment is available. It is used for daily, monthly, quarterly, half yearly as well as annual funds.

- NAV-ANNULZD-AMT – This tag is available only for daily funds.

For Daily NAV funds in respect of which the NAV charges (NAVC) are charged using the Basis Amount tag NAV-ANNULZ-AMT, NAV charges are computed for all days in a year, including both business days as well as intervening holidays.

The charges in respect of a Daily NAV fund using the NAV-ANNULZD-AMT Basis Amount tag are computed as follows:

Example - Pre-NAV Fund (NAV computed during BOD)

| System Date | NAV Charge Date before start of Processing | Current Processing Till Date | Number Of Days | ||||

|---|---|---|---|---|---|---|---|

| 19th July 2003 | 18th July 2003 | 19th July 2003 | 1 | ||||

| 22nd July 2003 | 19th July 2003 | 22nd July 2003 | 3 | ||||

| 23rd July 2003 | 22nd July 2003 | 23rd July 2003 | 1 | ||||

| 2nd August 2003 | 23rd July 2003 | 2nd August 2003 | 10 |

Example - Post-NAV Fund (NAV computed during EOD)

Branch Parameters Preference: Process Till Next Working Day –1

| System Date | NAV Charge Date before start of Processing | Current Processing Till Date | Number Of Days | ||||

|---|---|---|---|---|---|---|---|

| 19th July 2003 | 18th July 2003 | 21st July 2003 | 3 | ||||

| 22nd July 2003 | 21st July 2003 | 22nd July 2003 | 1 | ||||

| 23rd July 2003 | 22nd July 2003 | 31st July 2003 | 9 | ||||

| 2nd August 2003 | 31st July 2003 | 2nd August 2003 | 2 |

Branch Parameters Preference: Process Till System Date

| System Date | NAV Charge Date before start of Processing | Current Processing Till Date | Number Of Days | ||||

|---|---|---|---|---|---|---|---|

| 19th July 2003 | 18th July 2003 | 19th July 2003 | 1 | ||||

| 22nd July 2003 | 19th July 2003 | 22nd July 2003 | 3 | ||||

| 23rd July 2003 | 22nd July 2003 | 31st July 2003 | 9 | ||||

| 2nd August 2003 | 31st July 2003 | 2nd August 2003 | 2 |

Charge computation is done as follows:

NAV Amount of Fund – USD 105,000

Units in issue – 10,000

Annualized NAV Amount – 105,000/365 = USD 287.67 (Rounded according to the Fund Base Currency Rounding Rules)

Charge Amount = 2% of NAV Annualized Amount = USD 5.75.

This charge amount will be multiplied with the Number Of Days as in Illustration 1 and 2 before the rounding rules are applied.

5.1.4.3 NAV Calculation Updates

The following NAV details are available and displayed for each fund (internal and external):

- The NAV of the fund (as of the last time it was calculated)

- The NAV of a unit (as of the last time it was calculated)

- The last date on which the NAV was calculated

- The next date on which the NAV will be calculated

Moving between the NAV combinations defined for a fund

To move between the NAV combinations defined for a fund, use the buttons provided for the same at the bottom of the screen:

- Click the back arrow button to view the previous version.

- Click the forward arrow button to view the next version.

Confirming your specifications

After you have defined the GLs for NAV calculation, click ‘Ok’ button to confirm your specifications. Click ‘Exit’ button to delete your specifications. In either case, you will be returned to the ‘Funds On-Line’ screen.

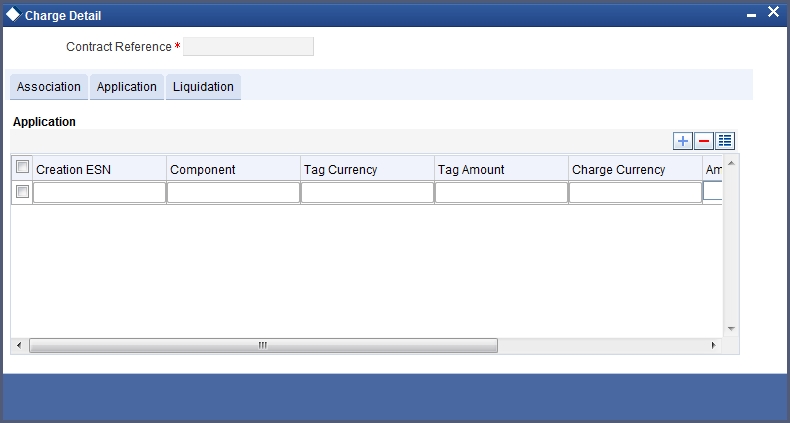

5.1.5 Charges Button

To maintain a fund, your bank may incur several expenses. You can levy the expenses that you incur as charges on a customer. The charges that you collect can be applicable for the following events:

- Subscription

- Redemption

- Dividend Payment

From the ‘Fund On-Line’ screen, click ‘Charges’ button. The ‘Charge Detail’ screen will be displayed.

The characteristic feature of a charge is that it is always booked in advance and is not accrued, as a charge is collected only when it is due. Each time you create a fund, you need not specify when and how the charges should be collected.

To recall, you have defined the attributes of a charge by defining a ‘Rule’. A rule identifies the basic nature of the charge. You have further defined a Charge class where you have enriched the attributes of a rule. We shall refer to these classes as 'components'. Each charge component in turn is linked to a fund product. All the charge components linked to a product are defaulted to the funds associated with it. Thus each time you create a fund, you need not specify when and how charges should be collected.

However, while creating a fund, you can choose to associate a charge component with it. Further, you can modify some of the attributes defined for the applicable component.

Contract Reference Number

Specify the contract reference number for which you need to maintain charges.

5.1.5.1 Association Tab

All the charge components applicable to the fund will be displayed together with the rule that is linked to the component.

In this section of the screen you can:

- Change the charge rule linked to the component

- Disassociate a charge component from the fund

Changing the charge rule linked to a component

The rule that is linked to a charge component is displayed next to the component. The adjoining option list displays a list of all the charge rules maintained. Select the appropriate rule from the option list. The new rule will be made applicable to the charge component.

Disassociating a charge component from a fund

You can disassociate a charge component from the fund. In the 'Association' section of the ‘Contract Charge’ screen, click against the waive option positioned next to the component.

In this case, the charge component is attached to the fund but is not calculated.

5.1.5.2 Application Tab

In the application section of the screen, you can indicate the charge components that should be applied to the fund. The list of components that is displayed depends on the charge components that you have associated to the fund.

The following details of the component are also displayed:

- The basis component on which the charge is levied

- The currency of the basis amount

- The basis amount

- The charge amount

- The currency in which the charge amount is defined

You can change the charge amount that is calculated using the class applicable to the component.

Waiving a charge for a fund

You also have the option to waive a component for a fund. To waive a charge for a fund, check against the 'waiver' option in the application section of the screen. The charge will be calculated but not applied.

Note

You can waive a charge only if it is yet to be liquidated.

5.1.5.3 Liquidation Tab

When a charge component that is applied to a fund is liquidated, the relevant accounting entries are passed. The ‘Contract Charge’ screen will be displayed:

- The charge components that have already been liquidated

- The amount that was liquidated

- The currency in which it was liquidated

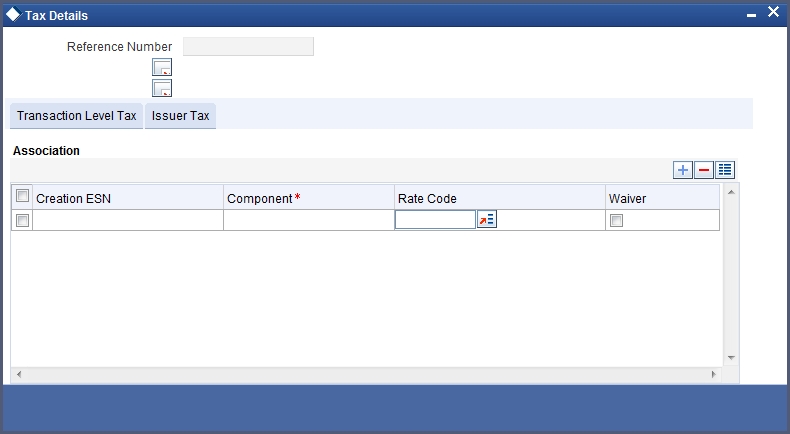

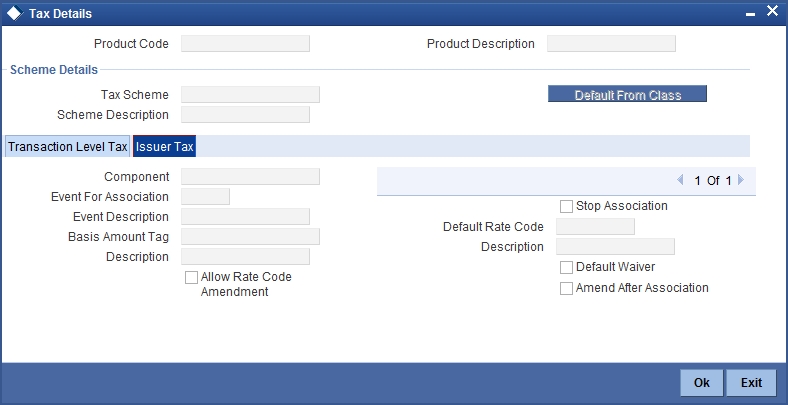

5.1.6 Tax Details Button

The tax details specified for the product to which the fund is associated is automatically applied. However, while processing a fund, you can waive the application of tax on the fund.

You can invoke the ‘Tax Details’ screen by clicking ‘Tax’ button from the ‘Fund On-Line’ screen.

Reference Number

The reference number of the fund for which you are defining transaction tax details is displayed. The screen will contain a list of all the tax components applicable to the fund.

5.1.6.1 Transaction Level Tax Tab

You can maintain the following parameters here:

Association

All the tax components applicable to the fund you are processing will be displayed together with the rule linked to the component.

In this section of the screen you can:

- Change the tax rule linked to a component

- Disassociate a tax rule from a component

Component

The rule that is linked to a tax component is displayed next to the component. To link a new rule to the component, click the adjoining option list from the field titled 'Rule'. Select the appropriate rule from the option list that is displayed. The new rule will be made applicable to the component.

Disassociating a tax component from a fund

You can disassociate a tax component from the fund. In the 'Association' section of the ‘Contract Tax’ screen, click against the waive option positioned next to the component.

In this case, the tax component is attached to the fund but is not calculated.

Application

In the application section of the screen, you can indicate the tax components that should be applied to the fund. The list of components that is displayed depends on the tax components that you have associated with the fund. The following details of the component are also displayed:

- The basis component on which the tax is levied

- The currency of the basis amount

- The basis amount

- The tax amount

- The currency in which the tax amount is defined

You can change the tax amount that is calculated using the rule applicable to the component.

Waiving tax on a fund

You also have the option to waive a tax component for a fund. To waive a tax component for a fund, check against the 'waiver' option in the application section of the screen. The tax will be calculated but not applied.

Note

You can waive tax only if it is yet to be liquidated.

Liquidation

When a tax component that is applied to a fund is liquidated, the relevant accounting entries are passed. The contract tax screen displays:

- The tax components that have already been liquidated

- The amount that was liquidated

- The currency in which it was liquidated

5.1.6.2 Issuer Tax Tab

You can maintain the following parameters here:

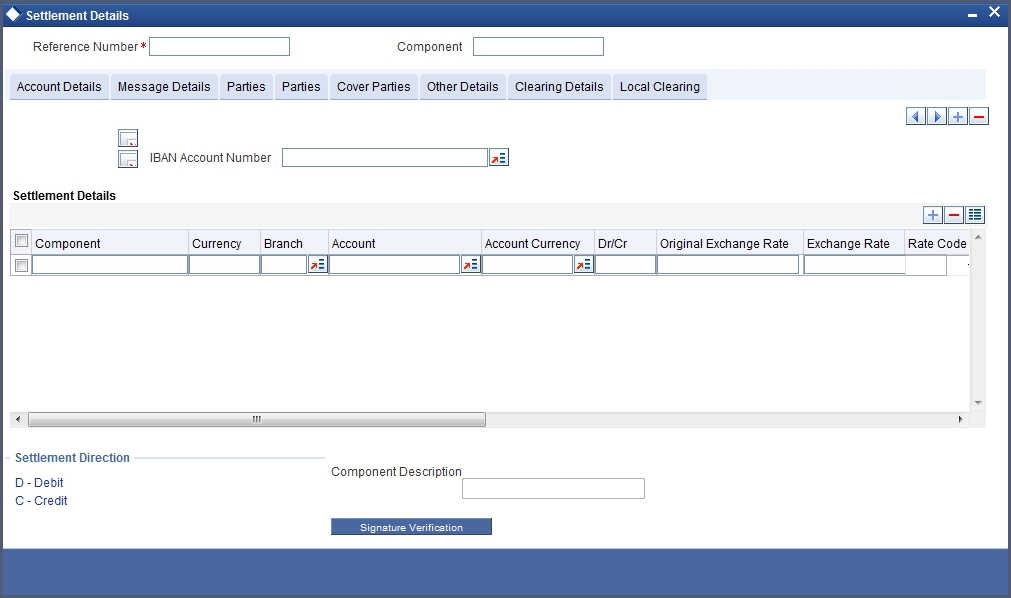

5.1.7 Settlement Button

Through the settlement screens you can view the fund accounts to which entries for the applicable charges and taxes are posted. These details are available in the ‘Settlement Message’ screen. Click ‘Settlement’ button from the ‘Fund On-Line’ screen, to invoke the ‘Settlement Details’ screen.

Besides the settlement components, the other details available include:

- The currency in which the component is expressed

- The payment account and currency

- The branch of your bank to which the account belongs

All the settlement components applicable to the fund are expressed in the fund base currency. To recall, you have already indicated a settlement account in the fund base currency in the ‘Bank Accounts’ screen. This account will be used as the settlement account for the displayed components.

Depending on the component, Oracle FLEXCUBE indicates whether the account involved in an entry has to be debited or credited:

- ‘P’ indicates you credit (Pay to) the account involved

- ‘R’ indicates you debit (Receive from) the account involved

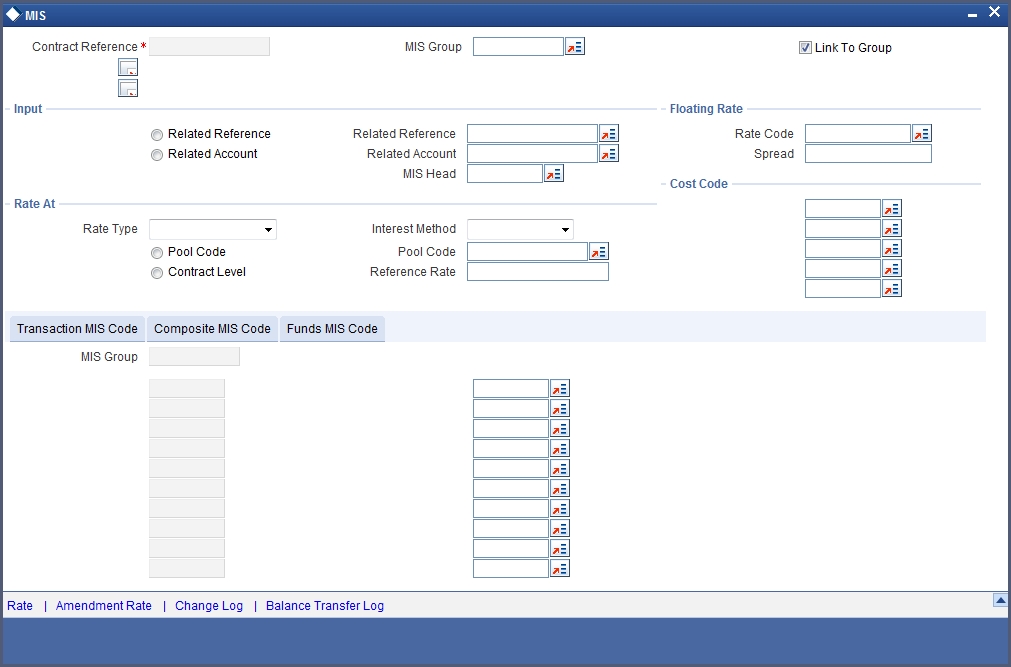

5.1.8 MIS Button

The MIS details you would define for a fund and a product are similar. The entities defined for the customer will be picked up by default and they can be changed.

Click ‘MIS’ button from the ‘Fund On-Line’ screen to invoke the ‘MIS’ screen.

For a fund, the transaction type of MIS class, the cost code and pool code will be picked up from the product under which the fund is processed. The composite MIS code is defaulted from the definition made for the customer involved in a transaction involving the fund.

The Fund MIS code is defaulted from the product involved in the fund. The first fund MIS code is reserved for the Fund ID and cannot be changed. This facilitates the breaking up of balances for NAV computation.

The interest calculation method for the refinancing rates of the pool will also be picked up by default from Pool Codes maintenance and can be changed.

For an account, the transaction type of MIS class will be picked up from the account class, along with the cost codes and pool codes. The composite type of MIS class will be defaulted from those defined for the customer. These can be changed.

The interest calculation method for the refinancing rates of the pool will also be picked up by default from Pool Codes maintenance and can be changed.

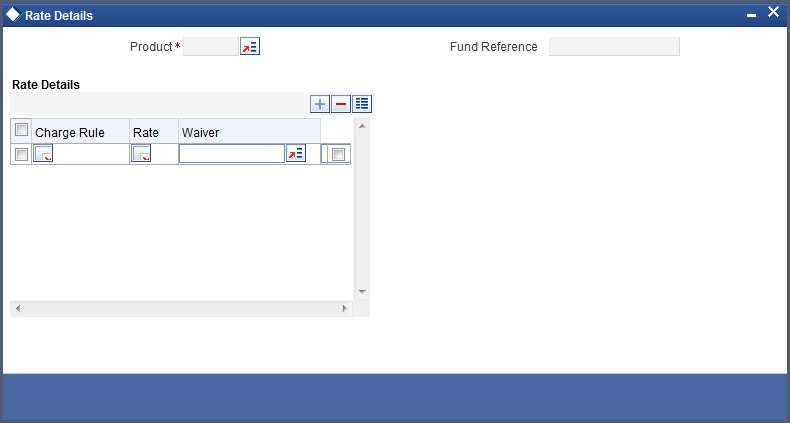

5.1.9 Rate Button

For a specific fund, you can override charges that have been specified for the fund through the charge rule associated with the fund. You can specify special rates for a charge rule; alternatively, you can waive the charges altogether.

You can define specific rates for charges applicable on NAV, for a specific fund. You can also make a specific charge rule applicable on NAV, for a specific fund.

Click on the ‘Rate’ button in the ‘Fund On-Line’ screen to apply specific charge rules with specific rates for NAV charges. The ‘Rate Details’ screen is opened.

In this screen, you can specify the following:

- The charge rule that is to be used for computing special charges on NAV that is specifically applicable for the fund. The adjoining option list displays a list of those rules mapped to the product and for which the application event is NAVC.

- You can associate all those NAV charges for which you wish to specify a special rate, that is, different from the rate maintained in the charge rule. You can also choose to waive it completely. If you do not maintain a specific rate, the rate maintained for the selected charge rule in the Charge Rule Definition is used in NAV charge computation.. If you wish to enter a specific rate for the rule, you can specify it in the Rate field. If you have opted for the waiver of charges, you must specify a specific rate.

- If you have indicated a specific rate for NAV charge computation, you can waive it if required. If you have opted for the waiver of charges, you must specify a specific rate.

- For all the charge rules that are maintained in the ‘Special Rates’ screen, the Minimum and Maximum values for the NAV Charge maintained in the ICCF Rule Maintenance are not considered during charge calculation.

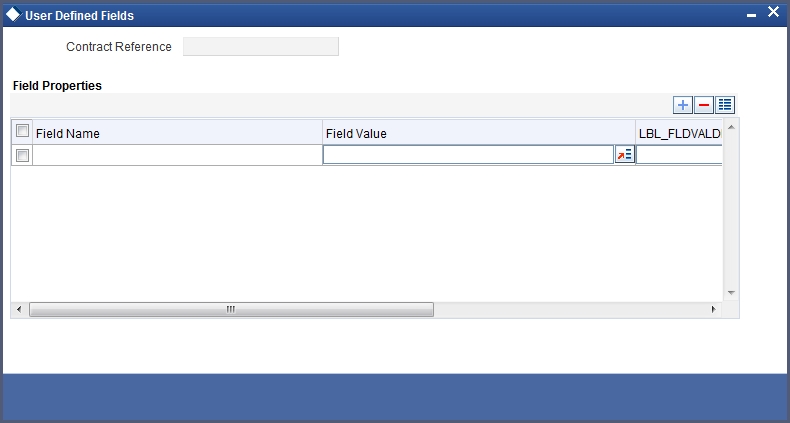

5.1.10 Fields Button

When you click on the ‘Fields’ button, the ‘User Defined Fields’ screen will be displayed.

Specify the values in the fields and click ‘Ok’ button.

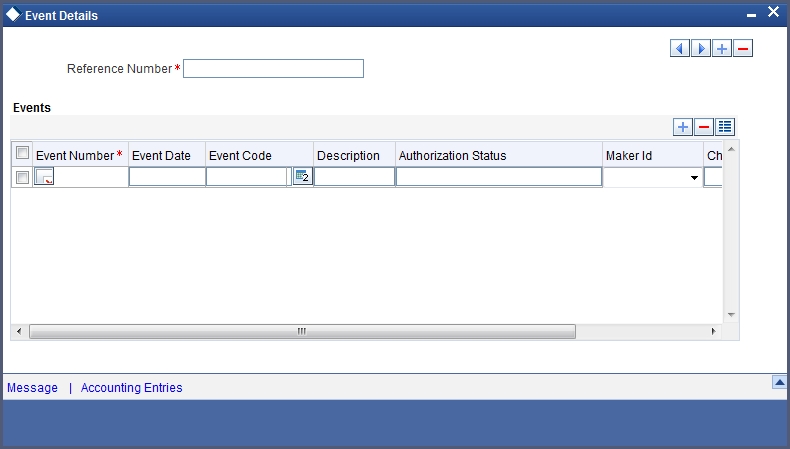

5.1.11 Events Button

When you click on the ‘Events’ button, the ‘Event Details’ screen will be displayed.

Specify the following details.

Reference Number

In Oracle FLEXCUBE, reference numbers are generated automatically and sequentially by the system while creating the fund online. The reference number for the contract is displayed in this field.

Events

Specify the following details.

Event Number

This number is generated by the system based on the number of events fired relating to the fund.

Event Date

Date on which the event is triggered is displayed here.

Event Code

The system defaults the code as per the fund product which is mapped to the fund id when the particular event is triggered based on the corporate manual actions.

Description

This displays the description for the corresponding event code.

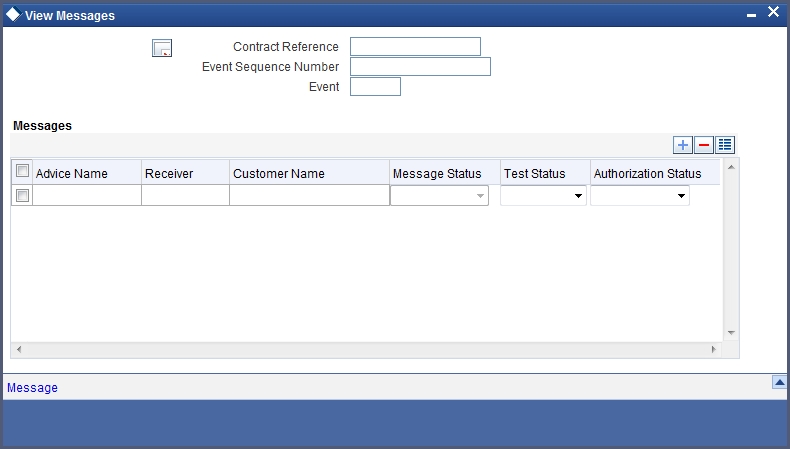

5.1.12 Message Button

When you click on the ‘Message’ button, the ‘View Messages’ screen will be displayed.

Specify the following details.

Contract Reference

In Oracle FLEXCUBE, reference numbers are generated automatically and sequentially by the system while creating the fund online. The reference number for the contract is displayed in this field.

Event Sequence Number

Specify the event sequence number.

Event

Specify the event.

Message Tab

Enter the following details:

- Message Type

- Receiver

- Currency

- Amount

- Status

- BOILERPLATETXT

- Name

- Media

- Address

- Exception

- Products

- Interest

- User Defined Fields

- Settlements

For further information on the generic attributes that you can define for a product, please refer the following Oracle FLEXCUBE User Manuals.