2. Processing Brokerage

2.1 Introduction

A Broker is a party who mediates between a buyer and a seller. The Brokerage paid to a broker is a fee for acting as intermediary between buyer and seller. There are many types of brokerages added in areas such as Money Market, For Ex, Securities, etc.

Brokerage will usually be based on either a percentage of the transaction or a flat fee. They can also be a combination of the two. Oracle FLEXCUBE supports Trade Finance activities, Securities, Derivatives, For Ex Deals etc. where Brokerage is involved.

This manual explains the processing of brokerage in Oracle FLEXCUBE. Using the Brokerage service that Oracle FLEXCUBE provides, you can:

- Capture and maintain the details of brokers - assign a broker code, and record the name and address of the broker

- Specify brokerage discounts for a broker

- Specify the currency of booking

- Specify whether brokerage is to be paid on the deal in advance or in arrears

- Define a brokerage rule with amount slabs for specifying a flat amount, a percentage of the deal or the deal amount, within certain limits

- Specify whether the brokerage amount should be in the deal currency or converted to the LCY

- Book brokerage to an internal account - by debiting the expense and crediting the brokerage payable account (brokerage is booked on initiation of the deal).

- Opt to liquidate brokerage either automatically or manually at deal initiation or liquidation. (You can manually liquidate the consolidated brokerage payable to a broker involved in many deals. That is, a broker may be entitled to brokerage from more than one deal. You can liquidate the brokerage payable for all these deals, once and for all, using the manual liquidation function).

- Associate a broker with a brokerage rule and a product so that the brokerage is applicable to all the deals involving the product

- Make deal - specific changes

- Generate reports on the brokerage payable and the brokerage that has been already paid

You process brokerage in Oracle FLEXCUBE in the following manner:

- Maintain broker details

- Maintain brokerage rules

- Associate a broker and product with a brokerage rule

Associating a broker and a product with a rule is explained in the Products Manual.

- Process brokerage on a contract

This chapter contains the following sections:

- Section 2.2, "Broker Details"

- Section 2.3, "Brokerage Rule Definition"

- Section 2.4, "Broker Association"

- Section 2.5, "Brokerage on a Contract"

- Section 2.6, "Brokerage Discount Maintenance"

- Section 2.7, "Brokerage Liquidation"

- Section 2.8, "Brokerage Association Report"

2.2 Broker Details

This section contains the following topic:

2.2.1 Capturing Broker Details

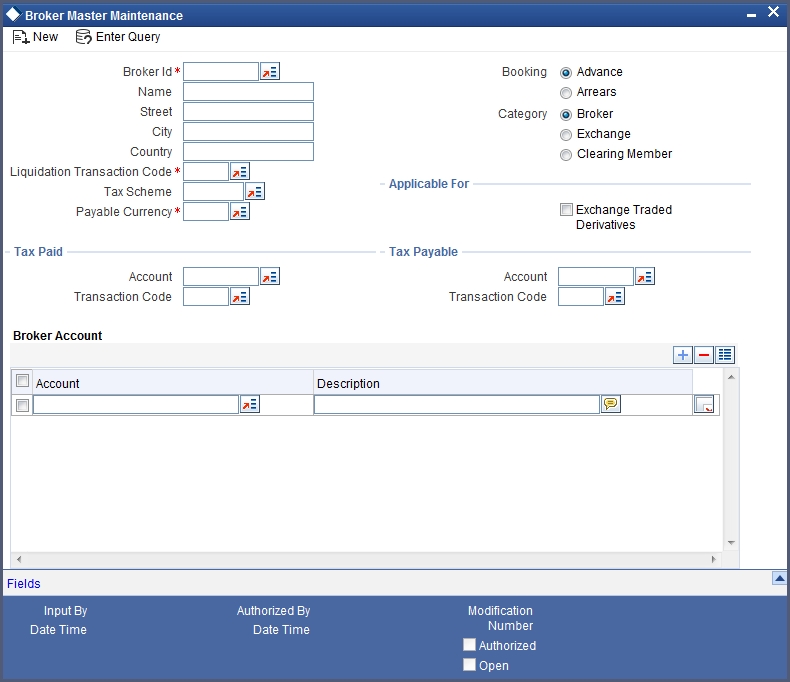

You can capture the basic details of brokers with whom your bank deals with in the ‘Broker Master Maintenance’ screen. In this screen, you can specify the following:

- The broker’s code

- The name and address of the broker

- The booking currency

- The transaction code under which the system should track accounting entries involving the liquidation

- Whether it is to be paid in advance or as arrears

- The tax scheme applicable

- The tax paid and the tax payable accounts

You can invoke the ‘Broker Master Maintenance’ screen by typing ‘BRDMAST’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Broker Identification

In the ‘Broker Master Maintenance’ screen, you should specify a (unique) Broker Identification for every broker with whom you deal. The Broker Identification has to be the same as the broker’s Customer Identification Number (since a broker will have an account with you − that is, will be a customer of your bank). The Customer Identification Number can be selected from a list that is displayed.

This Broker ID will be used to identify the broker. For example, when processing a deal on which you have to pay brokerage, or when generating reports for a broker, you need to enter the code of the broker involved.

Broker’s Address

When you select a Customer Identification Number to identify a broker, the system maps and displays the name and address of the broker .You cannot change the name which displays in this screen, but according to the defined details you can enter the changed address of the broker.

The fields to be entered are as follows:

- Name

- Street

- City

- Country

Liquidation Transaction Code

A broker gets the brokerage amount only after liquidation through the brokerage liquidation function. You should specify a liquidation transaction code from the codes maintained in the Core Entities module of Oracle FLEXCUBE. The system passes accounting entries under the selected transaction code.

Tax Scheme

A tax scheme holds the tax rules for the tax applicable on the brokerage paid.

Payable Currency

The brokerage is booked into the Broker Account defined in this screen. If this account is either not specified or is not available when brokerage is being booked, the brokerage will be booked in any one of the broker’s savings or current accounts (in the currency specified here).

For every broker, you can specify the currency in which you would like to pay brokerage. If the currency that you specify is not the broker’s account currency, the standard exchange rate (for the day) will be used to convert the brokerage into the currency of the broker’s account.

Booking

You can opt to book the brokerage payable to a broker either in:

- Advance

- Arrears

If you select:

- Advance: brokerage will be booked when the deal is initiated

- Arrears: brokerage will be booked when the deal is liquidated

Category

This defines the category of the entity whether a broker, an Exchange member or a Clearing member

- Broker

- Exchange

- Clearing Member

Applicable For

Check or uncheck the box ‘Exchange Trade Derivatives’ accordingly.

If the flag is checked then it means that the broker defined is available for the Exchange trade derivative module.

Tax Paid

If any tax is to be paid on the brokerage, you have to specify the following details:

- Account – The account from which the broker’s tax component debits

- Transaction code − You have to specify the transaction code for the tax payable account by selecting one from the list so that the system passes accounting entries for this transaction. The transaction code identifies the nature of the entry which passes.

- If any tax is payable on the brokerage, you have to specify the following details:

- Account − The account to which the broker’s tax component credits

- Transaction code – You have to specify the transaction code for the tax payable account so that the system passes accounting entries for this transaction.

Under the ‘Broker Account’ table you can specify the following.

Account

Specify the account of the broker. The adjoining option list gives you a list of accounts. Choose the appropriate one. You cannot specify the same account number for another broker. Each broker should have account numbers unique to him.

Note

It is mandatory for you to specify at least one account number for the broker. If the broker is dealing with Exchange Traded Derivatives, his external accounts have to be maintained here. You cannot specify the same account numbers for different brokers. Each broker should have unique account numbers.

Description

Enter a brief description for the account.

2.3 Brokerage Rule Definition

This section contains the following topics:

- Section 2.3.1, "Invoking ICCF Rule Availability Maintenance"

- Section 2.3.2, "Building a Brokerage Rule"

- Section 2.3.3, "Calculating Brokerage using a Tenor-Based Tier/Slab Structure"

- Section 2.3.4, "The Sequence in Which ICCF Rules are Resolved"

- Section 2.3.5, "Copying an ICCF Rule"

2.3.1 Invoking ICCF Rule Availability Maintenance

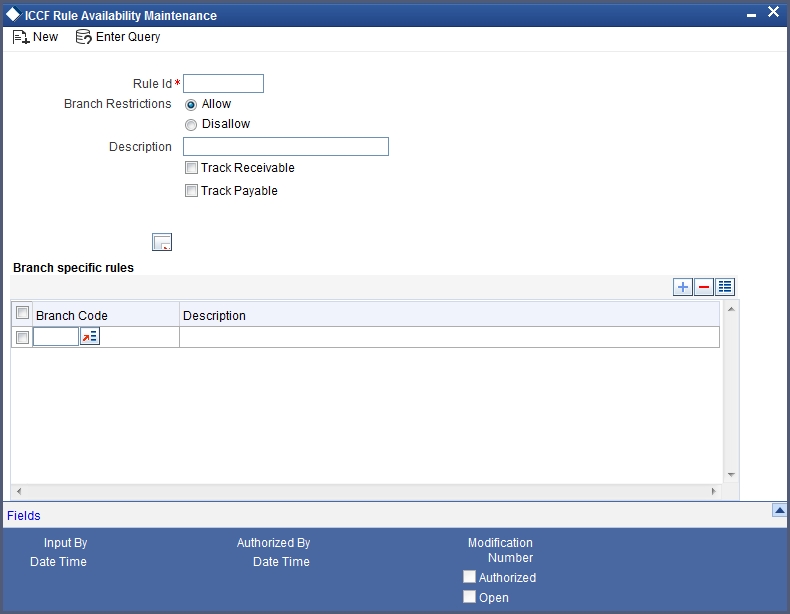

A brokerage rule identifies the basic nature of a brokerage component. Each brokerage rule is defined by a ten-character code, called the Rule ID. Attributes are defined for this Rule ID, which is then associated with a broker and product. When a deal is processed, the brokerage attributes defined for the Rule ID that is associated with a broker and product will be applied on the deal.

A brokerage rule is created in the same way that any Interest, Commission, Charge and Fee (ICCF) rule is created, as follows:

- The rule is created at the head office branch, by giving it a unique identification and description, in the ICCF Rule Availability Maintenance screen. In this screen, the rule is made available for use in the required branches by maintaining an allowed / disallowed list of branches.

- At the required branch, in the ICCF Rule Maintenance Screen, the attributes for the rule are defined. Maintaining the attributes in this screen is subject to whether maintenance of ICCF rules is allowed for the branch, and also whether the rule for which attributes are being defined, is allowed for the branch.

To recall, at the head office of your branch, you can create appropriate ICCF rules and make the rules available to the required branches.

In the ‘ICCF Rule Availability Maintenance’ screen, you can maintain ICCF rules, which you can make available to desired branches. You can do this by maintaining a list of branches for which the use of the rule is allowed, or disallowed. You can invoke this screen by typing ‘CFDICCFR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen, you must specify the following information:

Rule Identification and Description

You must specify a unique identification for the ICCF rule you are creating. If you are creating a brokerage rule, specify a unique identification for the brokerage rule. This is the identification that will be used as to identify for the rule, in all subsequent references to it. You must also specify a unique description for the rule.

Every brokerage rule is identified by a unique ten-character code, called a Rule ID. You can link a valid Brokerage Rule ID to the appropriate broker and product. When a deal is processed, the brokerage attributes defined for the Rule ID that is associated with a broker and product will be applied on the deal.

Note

After the rule has been created in the ICCF Rule Availability Maintenance screen, the attributes for the rule must be defined in the ICCF Rule Maintenance Screen.

Branch Restrictions

You can maintain a list of allowed branches (that is, the rule will be available for use in the allowed list of branches) or disallowed branches (the rule will not be available for use in the branches in the disallowed list).

To recall, the attributes for the rule are defined, in the ICCF Rule Maintenance Screen. Maintaining the attributes in this screen, for a branch, is subject to whether maintenance of ICCF rules is allowed for the branch, and also whether the rule for which attributes are being defined, is allowed for the branch.

For details about the Common Branch Restrictions, refer the Security Management System user manual.

2.3.2 Building a Brokerage Rule

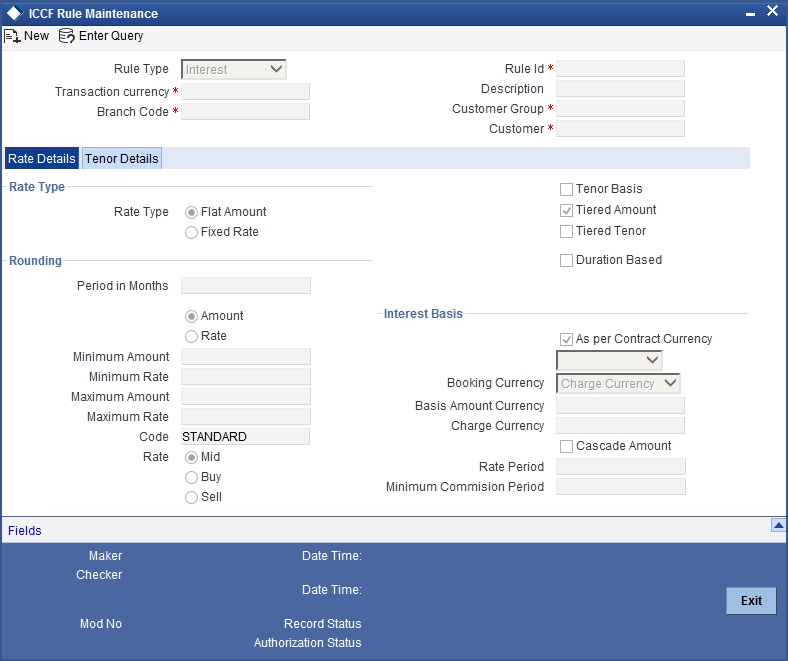

After a brokerage rule has been created in the ‘ICCF Rule Branch Availability Maintenance’ screen, the attributes of the brokerage rule are defined in the ‘ICCF Rule Maintenance’ screen. You can invoke this screen by typing ‘CFDRUMNE’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. While indicating the rule type in this screen, choose Brokerage from the option list.

If you are defining a brokerage type of component, you need to specify the following details through the ICCF Rule Maintenance Screen.

Rule Type

Specify whether the Rule type for calculating brokerage is Aggregation Type or Individual Type.

- Aggregation type indicates that brokerage is calculated on the total value of the deals

- Individual Type indicates that brokerage is calculated on a deal-by -deal basis

Rule Identification

Enter the ID of the rule for which you are defining attributes. Every brokerage rule is identified by a unique ten-character code, called a Rule ID. You can link a valid Brokerage Rule ID to the appropriate broker and product. When a deal is processed, the brokerage attributes defined for the Rule ID that is associated with a broker and product will be applied on the deal.

To recall, the Rule ID for a brokerage rule is specified in the ICCF Rule Branch Availability maintenance. Accordingly, in the Rule ID field in this screen, you must select the ID of the brokerage rule that you wish to build by maintaining the attributes.

The option list in the Rule ID field is populated based on the following conditions:

- Only those Rule IDs that are available for users at the current branch according to the ICCF Rule Branch Availability maintenance are displayed

- The maintenance of ICCF rules must be allowed for users at the current branch, according to the restrictions maintained in the Common Branch Restrictions maintenance for the restriction type ICCFRULE.

If no Common Branch Restrictions have been maintained, and the restriction type ICCF RULE has not been maintained in the SMS Branch Restriction Type maintenance, the option list in the Rule ID field only displays those rules that are available for users in the current branch, according to the ICCF Rule Branch Availability maintenance.

Description

Enter a description for the brokerage rule. This description will be associated with the brokerage rule for information retrieval purposes.

Transaction Currency

If you wish to define the attributes for all currencies, you can select the ALL option in the Currency Code field to indicate this. If you are maintaining the attributes for the selected ICCF rule in specific currency other than the ALL, select the Transaction Currency on which the rule mapping maintenance is to be made applicable.

Customer Group

Select the customer group on which the rule mapping maintenance is to be made applicable. You can create a generalized brokerage rule mapping record by selecting the ALL option in the Customer Group field. This specification is defaulted to the Customer and Customer Account fields. You are forbid to change the specification.

Customer

Specify the Customer ID of the customer for whom you are maintaining the rule mapping.

Branch Code

If you are maintaining the attributes for the selected ICCF rule from the head office branch, you can select the branch for which the attributes are being defined. If you wish to define the attributes for all branches, you can select the ALL option in the Branch Code field to indicate this.

If you are maintaining the attributes for the selected ICCF rule from a branch other than the head office, you can only select those branches that are found in the allowed list of branches for:

- the ICCF rule definition Restriction Type (ICCFRULE), in the Common Branch Restrictions maintenance for the current branch

- the selected rule being built, according to the ICCF Rule Availability maintenance

In other words, the option list in the Branch Code field would display only those branches that are allowed both for the rule and the current branch.

Defining the brokerage rule application factors

You can apply a brokerage rule on any contract, irrespective of the currency of the contract, the customer and the branch involved.

In the ICCF Rule Details screen, rules to be applicable for contracts involving all branches, transaction currencies, customers and customer categories must be maintained at the head office branch. Subsequently, you can maintain the specific rules to be applicable for contracts involving for the following combinations:

- A specific branch, customer category, customer and currency

- A specific branch, customer category, customer and all currencies

- A specific branch, customer category, currency and all customers

- A specific branch, currency and all customer categories and customers

- A specific branch, customer categories and all currencies and customers

- A specific branch and all customer categories, customers and currencies

- A specific customer category, customer, currency, and all branches

- A specific customer category, customer and all currencies and branches

- A specific customer category, currency and all customers and branches

- A specific currency and all customer categories, customers and branches

- A specific customer category and all customers, currencies and branches

- All branches, customer categories, customers and currencies

Note

As mentioned earlier, the rules applicable for combinations involving all branches (the ALL option in the Branch Code field) can be maintained only from the head office branch.

Once an ICCF Rule has been defined, you should associate it with a broker and product through the Brokerage Association screen. Depending on the broker and product involved in a contract, the appropriate rule will be made applicable.

Rate Type

The Rate Type indicates whether the Brokerage to be applied for the Rule ID is a flat amount or a percentage of the basis amount.

Select the rate type from the following:

- Flat amount – You can specify a fixed amount as brokerage. This will be the brokerage amount for all contracts involving the brokerage rule you are defining.

- Fixed rate - You can specify a percentage as brokerage. The rate that you specify will be applied on the contract amount to calculate the brokerage amount.

The specific rates and amounts applicable have to be specified subsequently through this screen.

Rounding

When rule type is brokerage no need to give value in this field.

Amount Limits for a Brokerage Calculation

If you indicated that brokerage should be calculated as a flat amount, you can specify the amount range (minimum and maximum amounts) within which the amount calculated using the brokerage rate should fall.

Rate Limits for a Brokerage for Brokerage Calculation

If you have chosen not to maintain the minimum and maximum amounts, you can specify the minimum and maximum rates for brokerage calculations. If the brokerage calculated using this Rule ID exceeds the amount calculated using the maximum rate specified here, the maximum rate amount will be applied as brokerage. Similarly, if the brokerage amount falls below the amount calculated using the minimum rate, the minimum rate amount will be considered as brokerage.

Note

If you have specified a flat amount as the Rule Type, then you need not specify the minimum and maximum amount/rate limits.

Tenor basis

You should specify whether the Rule ID you are defining is to be applied based on the tenor of the contract. The tenor of the contract is calculated as the difference between the Maturity Date and the Value Date of the contract. After the tenor is calculated, brokerage will be computed based on the tenor slabs defined in the ‘Tenor Based Rates’ section of the screen. The following sections will explain how brokerage is calculated using a tenor based structure.

Interest Basis

This specifies the calculation basis for the brokerage based on the Contract Currency or Rule Currency. Check this box if you wish to calculate the brokerage based on the contract currency. If you wish to calculate the brokerage based on the rule currency, then you have to choose the brokerage calculation value from dropdown list next to this field.

Tiered Amount

You can define the brokerage to be applied on contracts in any one of the following ways:

- In a tier structure (cumulative)

- In a slab structure (non-cumulative)

You should first indicate whether the Basis Amount that you specify subsequently should be considered as a Slab or a Tier. Check the ‘Tiered Amount’ option if you wish to maintain the Basis Amount structure as Tiers. Leave it blank if you are maintaining a slab structure.

The Basis Amount is the upper limit of the slab or tier to which a particular rate or amount should be applied as brokerage.

As per Contract Currency

This specifies whether the brokerage is paid in the charge currency or in the currency of the contract.

Tiered Tenor

Tiered tenor is applicable only for duration based (explained later) brokerage. You can indicate that brokerage is to be calculated on the basis of a tiered tenor structure, by choosing the Tiered Tenor option.

Rate

Code

For a contract, you can calculate brokerage in a currency other than the contract currency. The rate code specified here will be used to compute exchange rates between the currency pair involved in the contract.

Specify whether the currency rate for deal or slab currency from the following:

- Mid

- Buy

- Sell

Booking Currency

You should indicate the currency in which the brokerage amount is to be calculated:

- Charge Ccy - If you specify the brokerage currency as charge currency, brokerage will be calculated in the currency selected in the ‘Charge Currency’ field. For a contract in foreign currency, the contract amount is converted into the charge currency equivalent before brokerage is applied.

- Contract Ccy - If you specify the brokerage currency as the contract currency, brokerage will be calculated in the currency of the contract

Bracket Tenor

You can create a Brokerage Rule which calculates brokerage charges on the basis of an amount structure. In this table you define the different attributes of amount structure based on which the brokerage charges would be calculated.

Basis Amount To

You should specify the upper limit of the slab or tier to which a particular rate or amount should be applied as brokerage. The brokerage rate or amount (depending on the rate type) is to be specified in the subsequent field.

Fixed Rate

If the brokerage is in the form of a percentage of the contract amount, you should specify the applicable rate. This rate will be applied for the Basis Amount To, depending on whether you have defined the application basis as a slab or a tier.

Charge Unit

The Charge Unit specifies the unit for rounding up a brokerage basis amount to the nearest amount. The brokerage will be calculated on the rounded basis amount.

Flat Amount

If the brokerage is in the form of a flat amount, the amount should be specified. This amount will be applied for the Basis Amount To, depending on whether you have defined the application basis as a slab or a tier.

Floor Basis Amount

You should specify this only if the amount basis is a Tier. This will be the upper limit of the previous tier limit. By default, the amount specified as the Basis Amount To for the previous tier limit will be displayed. For the first limit in the tier do not specify this.

This amount is used to calculate the brokerage, along with the Floor CCF Amount that is to be specified next.

Floor CCF Amount

You should specify this only if the Rule Type is a Commission.

This amount need not be the same as the amount calculated using the Basis Amount and rate for the previous slab.

Tenor Based Rates

Tenor From and Tenor To

You can define a tenor-based tier or slab structure for every amount slab that you have built.

The Tenor From refers to the start of the tenor period and the Tenor To refers to the end of the period. The rate or flat amount will be specified subsequently.

Note

Note that the Tenor From and Tenor To is defined in days.

Fixed rate

If the brokerage is to be calculated as a percentage, you should specify the applicable rate against each tenor. This rate will be applied on the transaction amount, based on the amount slab and on whether the application basis defined for the tenor based structure is a slab or a tier.

Flat Amount

To levy a flat charge, specify the flat amount. This amount will be applied on the Basis Amount, depending on whether you have defined the application basis as a slab or a tier.

2.3.3 Calculating Brokerage using a Tenor-Based Tier/Slab Structure

Calculation of brokerage using a Tenor-Based Tier/Slab Structure is explained with an example

Let us assume that you have defined a brokerage rule, to be associated with contracts based on the following tenor basis:

| Amount Basis | Tenor | ||||||

|---|---|---|---|---|---|---|---|

| (Slab) | (0-100 days) | (101-200 days) | (201-250 days) | ||||

| 0 - 100,000 | 0.1% | 0.15% | 0.17% | ||||

| 100,001 - 1,000,000 | 0.2% | 0.25% | 0.3% | ||||

| 1,000,001 - 99,000,000 | 0.5% | 0.75% | 1% | ||||

Let us see how the brokerage is calculated for the following contract:

Contract Amount = USD 800,000

Tenor = 250 days (assuming that the difference between the maturity date and value date is 250 days)

Brokerage for non-cumulative amount and tenor structure:

The contract amount is USD 800,000, which falls under the second amount slab. The contract duration is 250 days, which falls under the third tenor defined for this amount slab.

Therefore, brokerage= 800,000 * 0.3% = 2400.

Brokerage for a tiered amount and non-tiered tenor combination:

For this combination, the contract amount will be distributed amongst the various slabs and depending on the tenor, the rate corresponding to the tenor will be used to calculate the brokerage.

Brokerage for the first 100,000 (1st amount slab) is calculated as follows:

The contract tenor is 250 days, which falls in the 3rd tenor.

Therefore, brokerage = 100,000 * 0.17% = USD 170

Brokerage on the remaining 700,000 = 700,000 * 0.3% = USD 2100

The total brokerage = (170+2100) = 2270

Specifying a Duration Based Brokerage

At the time of defining a brokerage rule, you can also specify whether the brokerage amount should be calculated based on the duration of the contract. In effect, you indicate whether the duration of the contract is a component in the formula for calculating the brokerage amount.

The formula used will be (Rate %* Contract Amount*Duration of the contract)

The duration of the contract will be calculated based on the Interest basis that you specify. You can either choose to apply the interest basis associated with the contract currency or opt for a different Interest basis from the drop-down list. Interest basis is defaulted from the Currency Definition table if you select the ‘As per contract ccy’ option.

2.3.4 The Sequence in Which ICCF Rules are Resolved

ICCF Rules that you maintain are resolved in the following sequence:

| Rule | Branch | Customer Category | Customer | Currency | |||||

|---|---|---|---|---|---|---|---|---|---|

| Specific | Specific | Specific | Specific | Specific | |||||

| Specific | Specific | Specific | Specific | ALL | |||||

| Specific | Specific | Specific | ALL | Specific | |||||

| Specific | Specific | ALL | ALL | Specific | |||||

| Specific | Specific | Specific | ALL | ALL | |||||

| Specific | Specific | ALL | ALL | ALL | |||||

| Specific | ALL | Specific | Specific | Specific | |||||

| Specific | ALL | Specific | Specific | ALL | |||||

| Specific | ALL | Specific | ALL | Specific | |||||

| Specific | ALL | ALL | ALL | Specific | |||||

| Specific | ALL | Specific | ALL | ALL | |||||

| Specific | ALL | ALL | ALL | ALL |

2.3.5 Copying an ICCF Rule

In order to make the definition of ICCF rules easier, you can copy an existing rule and modify its attributes.

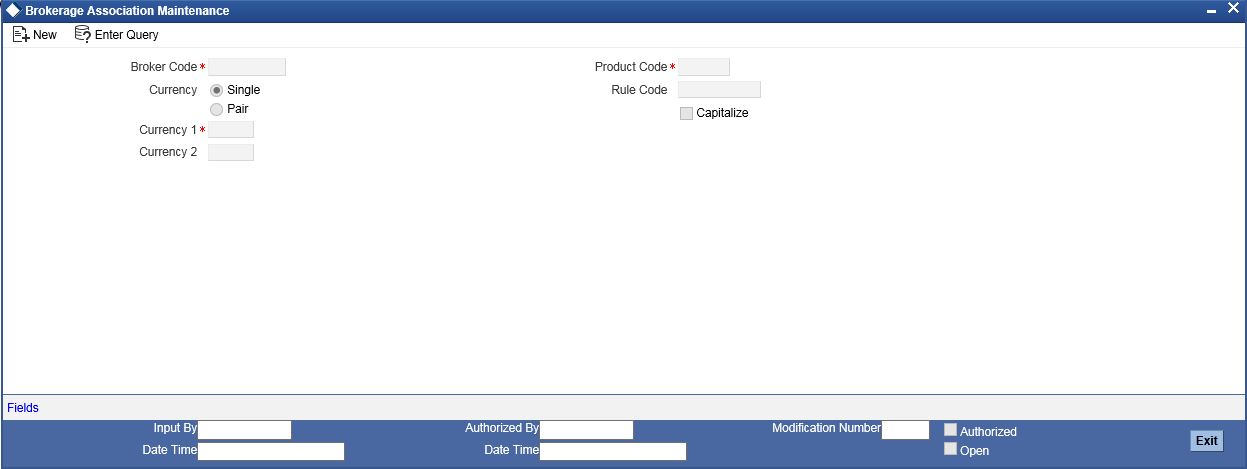

2.4 Broker Association

This section contains the following topics:

2.4.1 Associating a Broker and product with a Rule

Brokerage association enables you to link a product, a rule, a currency or a currency pair (in the case of foreign exchange products) and a broker.

Further, you can make a Brokerage Rule applicable for a broker, product and currency combination.

For a Foreign Exchange deal, you can make the brokerage applicable only when the contract involves a specific currency pair.

Invoke the ‘Brokerage Association Maintenance’ screen by typing ‘BRDASSOC’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Features of the screen

You have to give the following inputs in the Broker Association screen to define an association:

- Broker Code (or Broker ID): Enter the broker code, or select a Broker Code from the option list by clicking on the option list available

- Product Code: Select a Product Code from the option list

- Currency: If the rule you are defining is for MM contracts in a specific currency, enter the S.W.I.F.T. Code of the currency in this field. If the rule being defined is for Foreign Exchange contracts, you can make it applicable for contracts involving a specific currency pair by entering the pair at Currency1 and Currency2. SWIFT code here means the ISO code for currency as specified in SWIFT standards.

The attributes of the brokerage rule will be associated with contracts defined in this combination.

Rule Code: Select a Rule Code from the option list. This rule associates with the Broker + Product and currency or currency pair combination.

Note

While processing security deals you can choose to add the brokerage computed at the deal level to the cost of the asset, instead of being expensed while processing the SE deal.

2.5 Brokerage on a Contract

This section contains the following topics:

2.5.1 Brokerage Details Maintenance

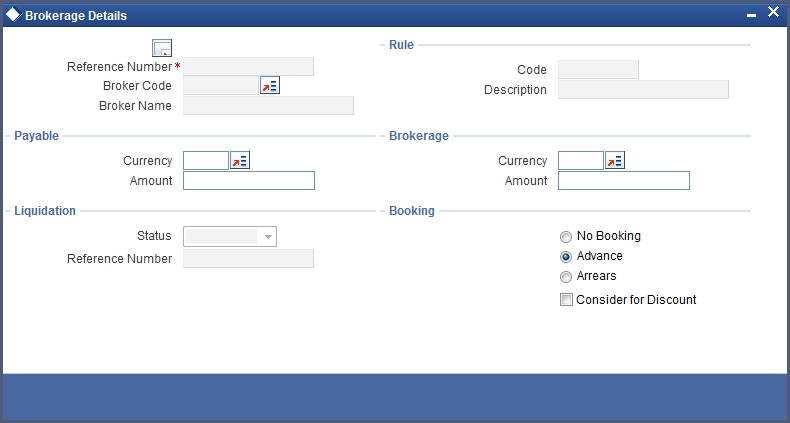

When capturing the details of a contract, you will have to specify the brokerage details applicable to the contract. By default, the brokerage details specified for the product apply to the contract as well. However, if you want to change some details, like the booking of brokerage — whether the brokerage should be booked in advance, in arrears, or waived altogether − or the currency of the contract, you will have to invoke the ‘Brokerage Details’ screen.

You can invoke this screen through the Contract Details screen by clicking ‘Brokerage’ button in the screen.

In case of a new contract, if brokerage already exists for the product, to which the contract is associated, the system will pick up the values and display them in this screen. However, if the product has not been associated with a brokerage rule, you will not see any values in this screen.

You can define brokerage for a specific contract, even if it has not been defined for the other contracts involving the product.

When you invoke the Contract Brokerage Details screen, you can change the values only if you have clicked the Modify option from the Action Menu.

You have to give the following inputs in the Brokerage Details screen to define the contract brokerage details:

Reference Number

This is a display field which displays the corresponding contract reference number.

Broker Code

This displays the broker code selected in the contracts main screen

Broker Name

This displays the description of the broker code.

The broker code displays along with the broker’s name in the screen. You cannot change the broker, through this screen, for the contract that you are processing.

Payable

If the brokerage Payable Currency is the same as the brokerage Paid Currency, then the same amounts (brokerage paid and brokerage payable) displays against the currencies. You can change these currencies if you wish to. While you cannot alter the brokerage payable amount which displays, you can change the ‘brokerage paid amount’ value.

- Currency: This is the currency which books the brokerage amount specified in the Broker Master screen

- Amount: This displays the brokerage amount calculated for the transaction

Liquidation

This designates the status of the brokerage, whether the brokerage is liquidated or is still outstanding for the contract. If it is liquidated, it displays the liquidation reference number.

- Status: This represents the status of the brokerage amount .whether it is Outstanding/Liquidated

- Reference number: If the brokerage Amount pertaining to that contract is liquidated then the liquidation reference no that is generated for brokerage wil be displayed here.

Rule

This indicates the brokerage rule code and description on the basis of which brokerage is calculated.

- Code

- Description

Brokerage

- Currency: This indicates the currency in which brokerage is paid. Select a currency code from the option list

- Amount: This field displays the amount payable to the broker .You cannot change this amount

Booking

This indicates when the brokerage applicable to the transaction is booked. The preference that you specify for the broker becomes default. You have the option to change the default , that is ,from advance to arrears or from arrears to advance. To waive brokerage for the transaction, choose the 'No Booking' option.

The options available are as follows:

- No Booking

- Advance

- Arrears

Consider for Discount

This option is defaulted from the deal product level. However, checkbox is unchecked if the booking method is other than ‘Advance’.

2.6 Brokerage Discount Maintenance

This section contains the following topics:

2.6.1 Maintaining Brokerage Discounts

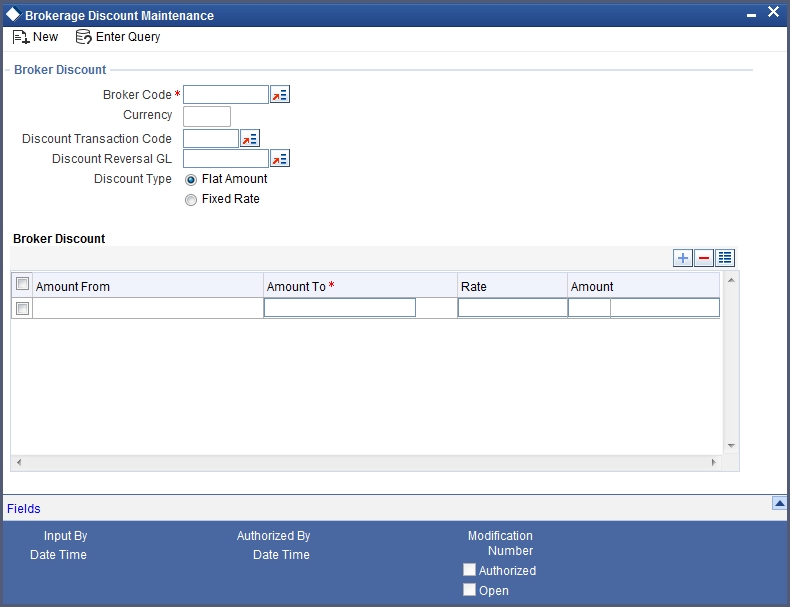

A stockbroker who carries out buy and sell orders at a reduced commission compared to a full-service broker, but provides no investment advice is called as a Discount Broker.

It used to be that only the wealthy could afford a broker and access to the stock market. The internet has brought an explosion of discount brokers which let you trade at a smaller brokerage. However, it is important to remember that discount brokers don't provide personalized advice. Because of discount brokers, nearly anybody can afford to invest in the market.

We can maintain discount for a Broker through the ‘Brokerage Discount Maintenance’ screen. You can invoke this screen by typing ‘BRDDISCO’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. Amount Slabs can be maintained in this screen where a discount will be done on the brokerage amount that is due for the broker.

2.7 Brokerage Liquidation

This section contains the following topics:

2.7.1 Liquidating Brokerage Manually

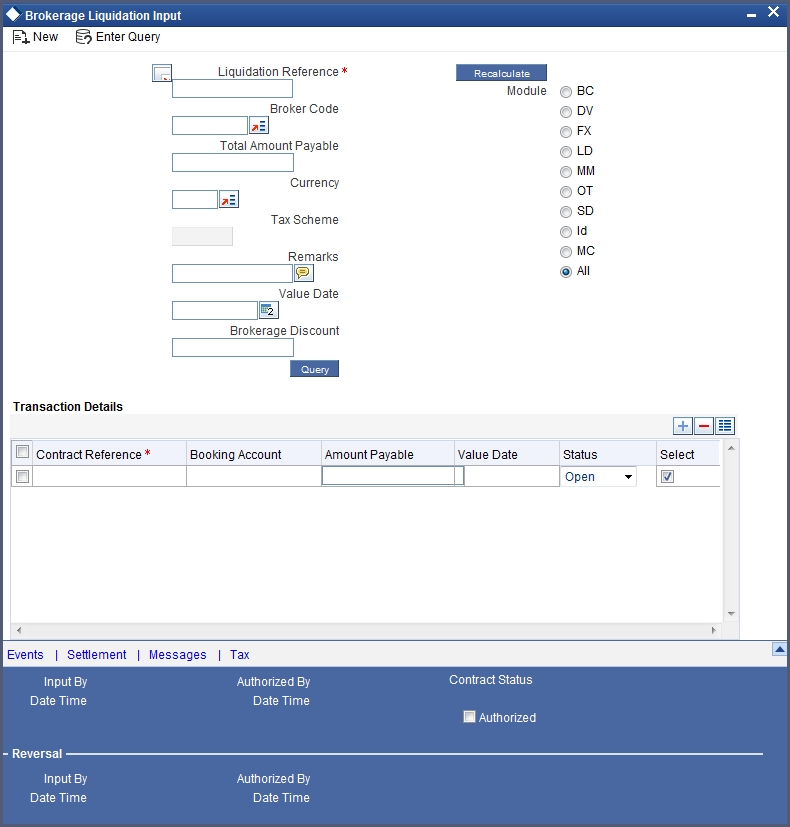

You can liquidate brokerage payable on a contract through the ‘Brokerage Liquidation Input’ screen. You can invoke this screen by typing ‘BRDLIQD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. In this screen, you can opt to liquidate the consolidated brokerage (due from more than one contract) that is due to a broker.

Broker Code

Select the broker code for which brokerage is liquidated from the option list. To manually pay brokerage for various contracts, involving a specific broker, you have to specify the Broker Code of the individual concerned.

Value Date

Contracts whose value date is same as that is mentioned here will be queried.

Currency

Select from the option list, the currency in which the brokerage has to be paid to the broker.

Module

Choose the module for which the brokerage is being calculated. If you wish to calculate brokerage for all the modules, choose the ‘ALL’ option. The date on which the brokerage is booked will also be displayed in this screen. Brokerage is calculated for the following modules:

- BC

- DV

- FX

- LD

- MM

- OT

- SD

- ID

- MC

Liquidation Reference Number

Each broker code associates a Liquidation reference number. The Liquidation Ref No is automatically generated by the system. This number is based on the event code (not on the product code) and is used to generate the transaction reference number for the liquidation. The particular broker code you have specified displays this number in this screen.

Tax Scheme

The tax scheme you have defined for the broker displays in this field. The tax scheme applicable on the brokerage would be the scheme specified in the Broker Master Detail screen.

Total Amount Payable

Select the check box against each Contract Reference number to populate the Total Amount Payable field in the screen. As and when you select a contract, the brokerage amount applicable to the contract gets added to the amount displayed in the Total Amount Payable field.

Brokerage Discount

This displays the discount amount if any discounting is attached at the broker level.

Remarks

You can enter some information about the broker confirmation which is internal to the bank. This is not printed on any correspondence with the counterparty.

Query

Click ‘Query’ button to see all the contracts for which brokerage is yet to be paid, after the required inputs are given.

Recalculate

On clicking ‘Query’ button, the system will fetch all contracts and by default the Select check box will be selected and the total amount payable will display the consolidated amount. If only a few contracts need to be liquidated then we can uncheck those contracts and recalculate the total amount field.

Transaction Details

The contract details displays in the Transaction Details section of the screen.

- Contract Reference

- Booking Account

- Amount Payable

- Value Date

- Status

Tax

You can invoke the ‘Tax Details’ screen by clicking ‘Tax’ button in the ‘Brokerage Liquidation Input’ screen. In this screen you will see the tax details applicable on the contract.

Settlements

You can invoke the ‘Settlement Details’ screen by clicking ‘Settlement’ button in the ‘Brokerage Liquidation Input’ screen.

Events

You can invoke the ‘Event Details’ screen by clicking ‘Events’ button in the ‘Brokerage Liquidation Input’ screen to view the events associated with brokerage liquidation.

Advices

If any brokerage advices are present, they can be viewed from the ‘Contract Advices’ screen. Click ‘Advices’ button in the ‘Brokerage Liquidation Input’ screen.

2.7.2 Accounting Entries Button

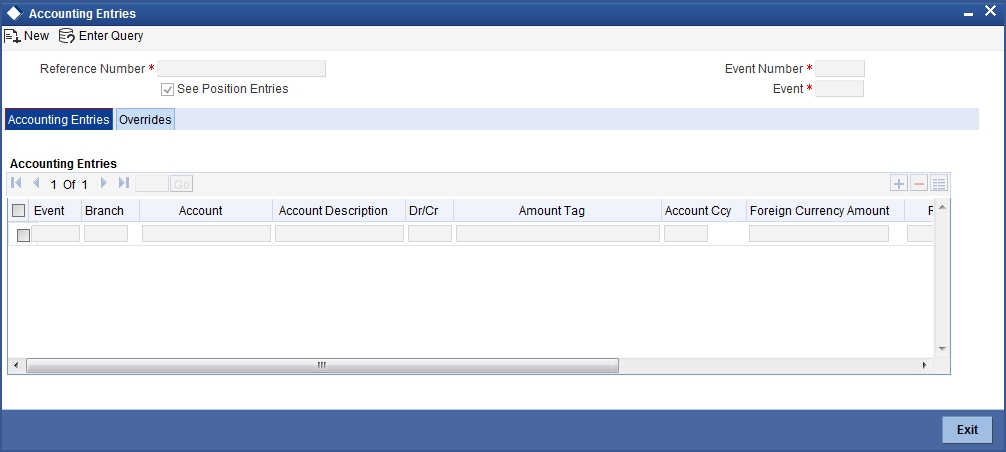

The brokerage that is calculated on a contract is parked in a suspense account before it is paid to the broker. This account would be an internal account of the bank. It is specified at the time of defining the accounting roles and event-wise accounting entries for the product (which involves the contract on which brokerage is to be calculated). Accounting entries for brokerage liquidation are defined at the time of product definition, both, for booking, or, initiation and liquidation.

The brokerage payable account (the broker’s account into which the actual brokerage for a particular deal is to be paid) is defined in the brokerage liquidation screen in the Settlements module.

Although a broker may have to be paid brokerage on several deals, the manual liquidation function of the system consolidates these into a single settlement amount to be passed to the settlement account. The brokerage payment advice specified at the time of defining advices for a product will be triggered.

If you click ‘Accounting Entries’ button on the ‘Events’ screen invoked from the contract main screen, you will see the accounting entries screen for the particular Liquidation reference number. The event is ‘Liquidation’ and the transaction date is today’s date.

You will see the following in the ‘Accounting Entries’ screen:

- Value date

- Branch

- Account no

- Ccy

- Dr/Cr

- Transaction code

- FCY amount

- Exchange rate for FCY

- LCY amount

2.8 Brokerage Association Report

This section contains the following topics:

2.8.1 Generating Brokerage Association Report

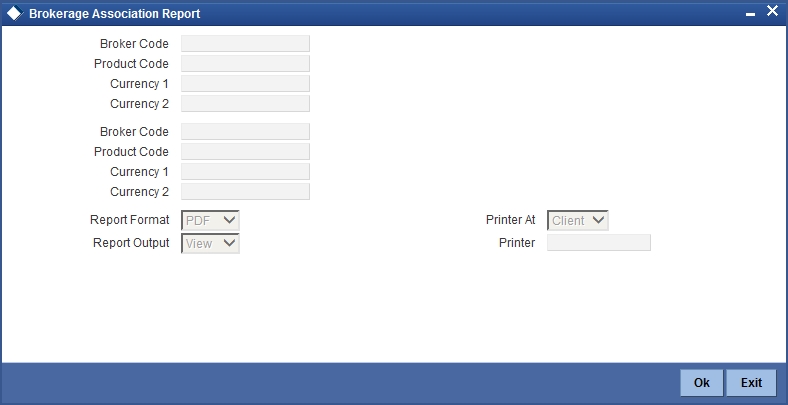

This report gives details of all associated brokers. It is printed daily as part of the batch process. You can configure this report to display details of brokerage contract. You can generate the report based on the following criteria:

- The From and the To record which includes broker and product code, currencies involved in transactions

You can invoke this screen by typing ‘BRRASSOC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details:

Broker Code

Specify the broker code from which you want to generate the report.

Product Code

Specify the product code for which you want to generate the report.

Currency 1

Specify the first currency from which you want to generate the report.

Currency 2

Specify the second currency from which you want to generate the report.

Broker Code

Specify the broker code until which you want to generate the report.

Product Code

Specify the product code until which you want to generate the report.

Currency 1

Specify the first currency to which you want to generate the report.

Currency 2

Specify the second currency to which you want to generate the report.

Once you have specified the details, click ‘OK’ button to generate the report.

2.8.2 Contents of the Report

The contents of the ‘Brokerage Association Report’ are discussed under the following heads:

Header of the Report

The Header carries the title of the Report, information on the branch code, the branch date, the user ID, the module name, the date and time at which the report was generated and the page number of the report.

Body of the Report

The details of the borrower that would be displayed in the report are as follows:

| Field Name | Field Description | ||

|---|---|---|---|

| Record Number | This is the sequence number of the record | ||

| Broker Code | This is the code that identifies the broker | ||

| Product Code | This is the product code | ||

| Rule | This rule is made available for use in the required branches by maintaining an allowed/ disallowed list of branches. | ||

| Currency 1 | This is the currency of booking associated to the broker | ||

| Currency 2 | This is the currency of booking associated to the broker |