16. Batch Processing

The events that are to take place automatically are triggered off during what is called the Batch Process. The batch process is an automatic function that is run as a mandatory Beginning of Day (BOD) and/or End of Day (EOD) process. During EOD, the batch process should be run after end-of-transaction-input (EOTI) has been marked for the day, and before end-of-financial-input (EOFI) has been marked for the day. This chapter details the various batch operations that are done in this module.

This chapter contains the following sections:

16.1 Batch Processes

This section contains the following topics:

- Section 16.1.1, "Batch Process for Liquidating PDC Linked Schedules"

- Section 16.1.2, "Processing of Customer De-duplication Batch"

- Section 16.1.3, "Processing Message Generation for Combined Statement"

- Section 16.1.4, "Sweep In and Sweep Out Batch Processing"

16.1.1 Batch Process for Liquidating PDC Linked Schedules

You can configure the batch process for liquidating PDC linked schedules to process the payment of loan account components if the debit settlement mode is opted as PDC. This batch ‘PDDLNLIQ is run either as EOD or as an intraday batch. The batch processes the liquidation of all accounts for which the schedule date or PDC activation date and customer value date is less than the application date.

On the cheque date the clearing transaction triggers the following accounting entries:

| Debit/Credit | Amount | Accounting Role | Description | ||||

|---|---|---|---|---|---|---|---|

| Debit | Cheque Amount | CLRNG_ACCOUNT | Clearing Account | ||||

| Credit | Cheque Amount | CLRNG_OFS_ACCOUNT | Beneficiary Account |

During liquidation the beneficiary account of the PDC contract is used as Debit Settlement Bridge. The system passes accounting entries fro MLIQ as follows:

| Debit/Credit | Amount Tag | Accounting Role | |||

|---|---|---|---|---|---|

| Debit | PRINCIPAL_LIQD | Beneficiary Account of PDC contract | |||

| Credit | PRINCIPAL_LIQD | Loan Account | |||

| Debit | MAIN_INT_LIQD | Beneficiary Account of PDC contract | |||

| Credit | MAIN_INT_LIQD | Main Interest Receivable |

Note

If a PDC is returned or bounced due to any reason then you can represent the same PDC for payment again.

16.1.2 Processing of Customer De-duplication Batch

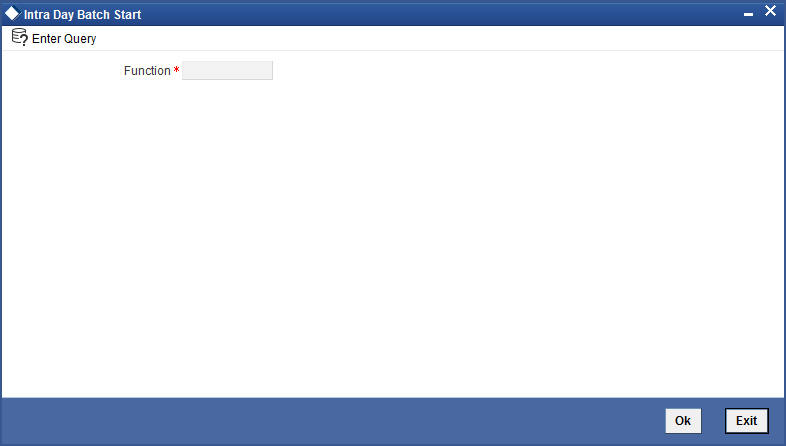

You can use this screen in case of a rule change and the reports need to be taken for the list of duplicate customers. You can invoke the ‘Intra Day Batch Start’ screen by typing ‘BABIDBAT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the De-duplication batch function id ‘DEDUPEOD’ to run the customer de-duplication batch.

Only open customer accounts will be considered for the de-duplication check.

System initiates the de-duplication process based on the status maintained for deduplication check at head office with the status ‘U’ (Unprocessed). and ‘P’ (Processed).internally.

16.1.3 Processing Message Generation for Combined Statement

An EOD batch STCDSMT is run to process the message generation based on the statement cycle maintained in the ‘Combined Statement Maintenance’ screen.You can generate the message from the outgoing message browser once the EOD batch is processed. If the customer account in the statement plan belongs to different branches then the statement plan will display the account balance from the customer local branch. During EOD, combined statement will be generated monthly, whereas system applies charges to charge account based on the IC liquidation frequency.

16.1.4 Sweep In and Sweep Out Batch Processing

The Sweep In and Sweep Out process is handled by an EOD batch STSWEEP. All the utilized deposit accounts in a day are fetched by the batch STSWEEP due to CASA linkage. The amount block is then released to the CASA account by breaking the deposit.

Sweep In Process

During Sweep In Process the system:

- Releases the amount blocked for the deposit accounts for the utilized amount.

- Transfers the amount to relevant CASA account.

- Updates the deposit account balance.

Note

Other deposits are considered only after utilizing cover account created for account.

Sweep Out Process

During Sweep Out process the system:

- Check for the credit balance in the CASA account.

- Transfer the credit balance or the linked amount to the relevant deposit account.

- Updates the utilized amount for the transferred amount.

Note

Other deposits are considered only after utilizing cover account created for account.