17. Reports

During the day, or at the end of the day, you may want to retrieve information on any of the several operations that were performed during the day in your bank. You can generate this information in the form of reports in Oracle FLEXCUBE.

For every module you can generate reports, which give you data about the various events in the life of a specific contract, or across contracts, at a specific point in time. You can have analysis reports, daily reports, exception reports (reports on events that ought to have taken place on the contract but have not, due to various reasons), and history reports and so on.

From the Application Browser, select the Reports option. A list of all the modules to which you have access rights are displayed in the screen. When you click on a module, all the reports for which you have access rights under the selected module are displayed. Click on the report you want to generate. You will be given a selection Criteria based on which the report would be generated.

This chapter contains the following sections:

- Section 17.1, "Maintaining Printing Options for Reports"

- Section 17.2, "Account Cheque Details Report"

- Section 17.2, "Account Cheque Details Report"

- Section 17.3, "CASA Stop Payment Report"

- Section 17.4, "Account Statement Reports"

- Section 17.5, "PDC Summary Report"

- Section 17.6, "Cheque Cancellation Report"

- Section 17.7, "Interest Statement Report"

- Section 17.8, "Dormant Activated Report"

- Section 17.9, "Stop Cheques Maintained Report"

- Section 17.10, "Post Dated Cheques Due Today Report"

- Section 17.11, "Inter-Branch Accounts Opened Today Report"

- Section 17.12, "Account Status Movement Report"

- Section 17.13, "Variances Maintained Today Report"

- Section 17.14, "Operating Instructions Not Captured Report"

- Section 17.15, "Minor Customer Details Report"

- Section 17.16, "CASA-Overdraft Report"

- Section 17.17, "Insignificant Balance Dormant Account Report"

- Section 17.18, "CRR Movement Report"

- Section 17.19, "VAT Deduction Report"

- Section 17.20, "Customer De-duplication Report"

- Section 17.21, "Account Opened and Activated Report"

- Section 17.22, "Account Block and Reason Report"

- Section 17.23, "Account Closure and Reason Report"

- Section 17.24, "Passbook Details Report"

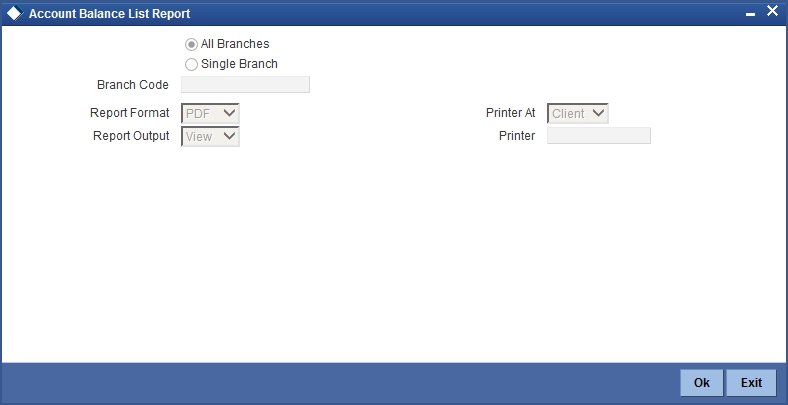

- Section 17.25, "Account Balance List Report"

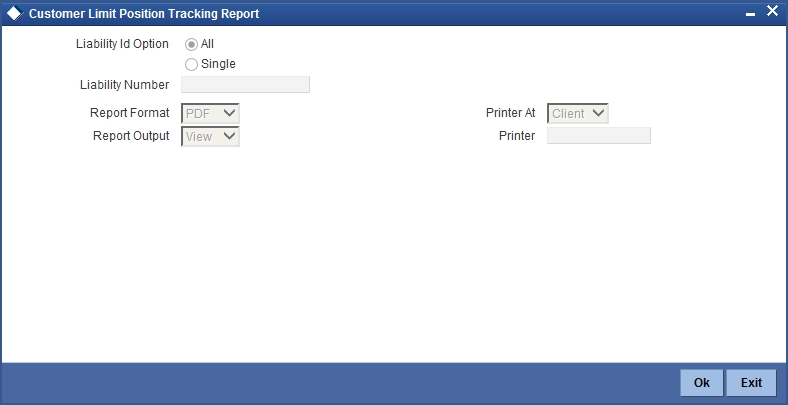

- Section 17.26, "Customer Limit Position Tracking Report"

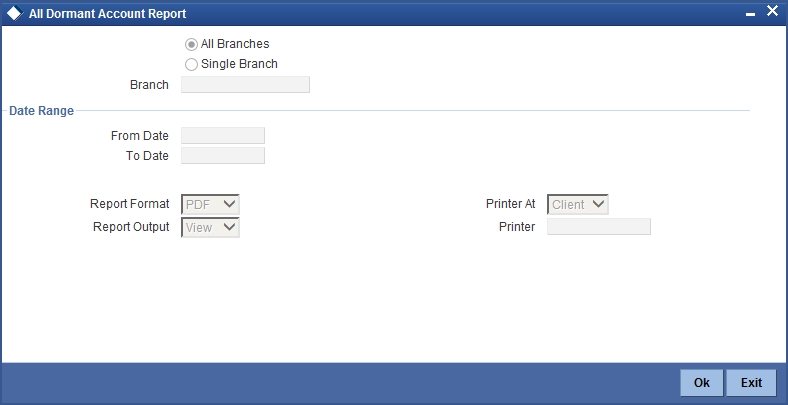

- Section 17.27, "All Dormant Account Report"

- Section 17.28, "Debit Card Issued Report"

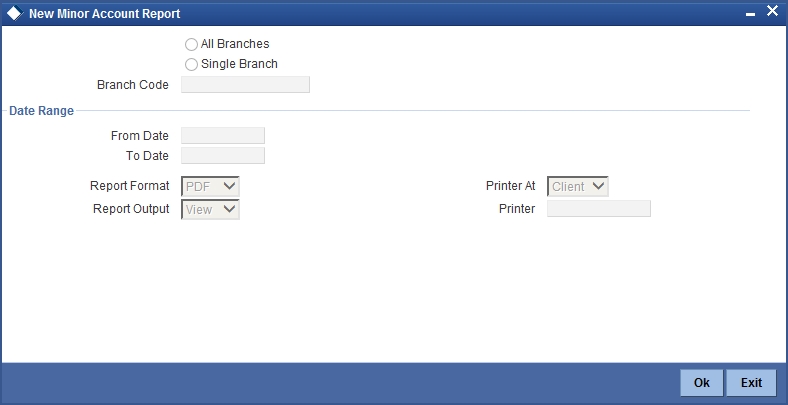

- Section 17.29, "New Minor Account Report"

- Section 17.29, "New Minor Account Report"

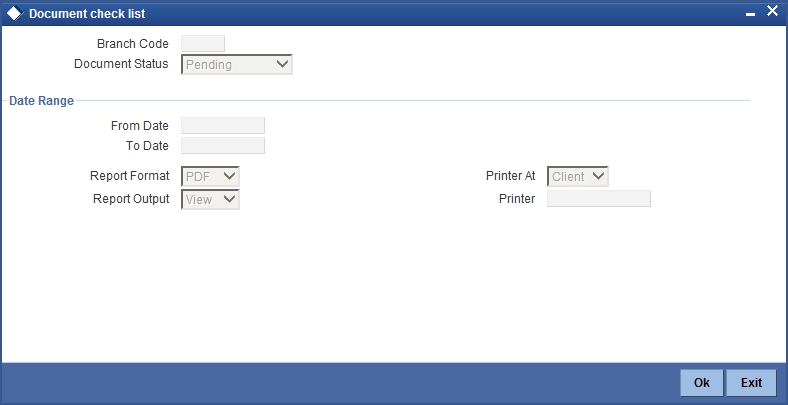

- Section 17.30, "Document Checklist Report"

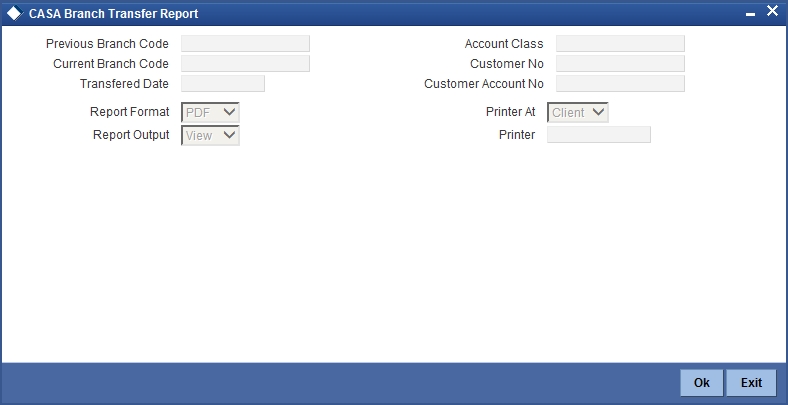

- Section 17.31, "Customer Account Branch Transfer Report"

- Section 17.32, "Customer Cheque Discounting Report"

- Section 17.33, "Cancelled or Rejected Report"

- Section 17.34, "Large Debit Balance Report"

- Section 17.35, "Ad-Hoc Combined Statement"

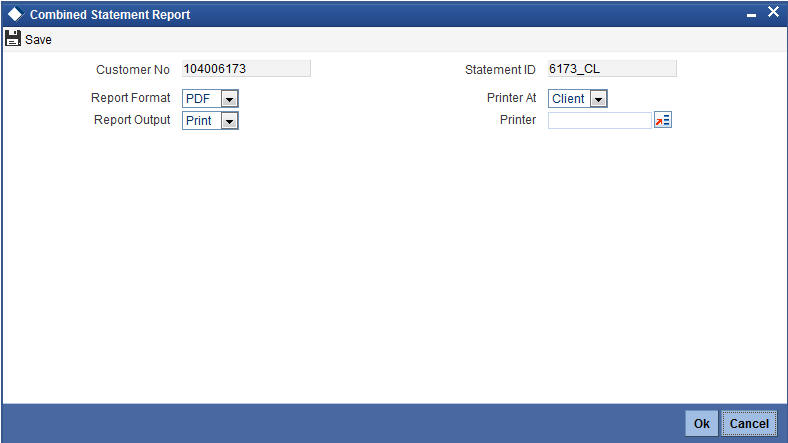

- Section 17.36, "Combined Statement Generation Report"

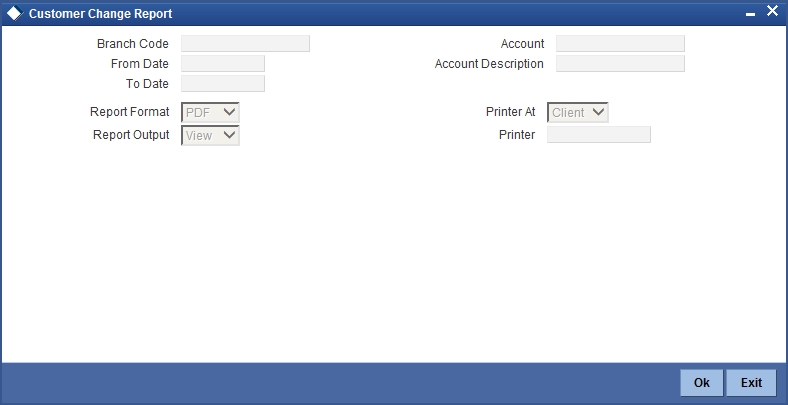

- Section 17.37, "Customer Change Report"

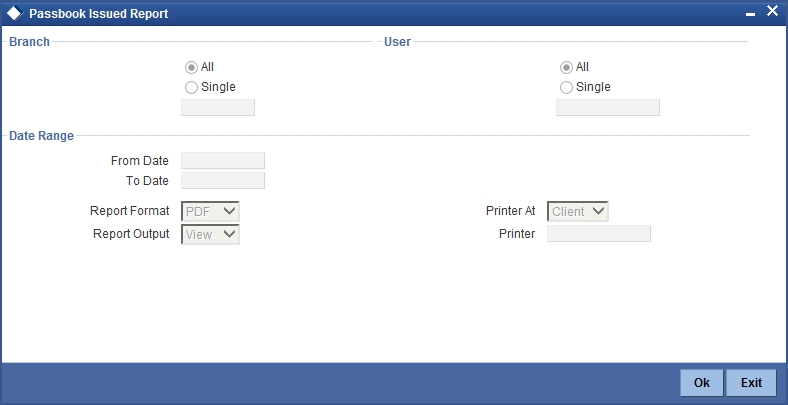

- Section 17.38, "Passbook Issued Report"

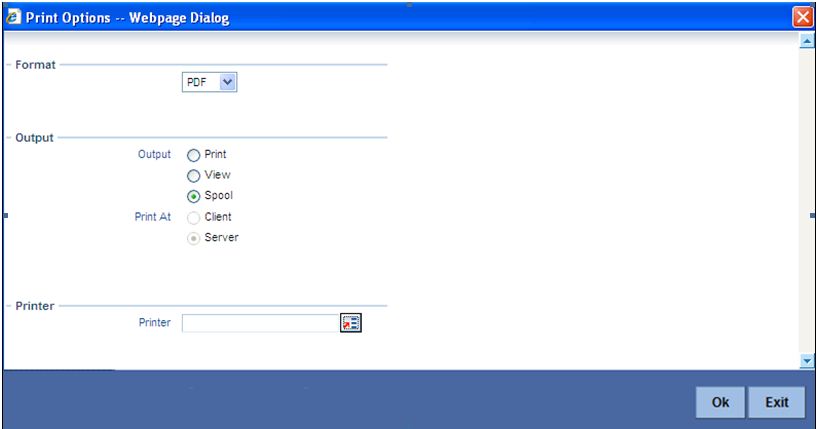

17.1 Maintaining Printing Options for Reports

You can indicate preferences to print a report, while generating a report; however, the preferences are general.

The following are the common preferences you can maintain to print a report:

Format

Select the format in which you want the report to be generated from the options provided in the drop-down list. The following options are available:

- HTML

- RTF

- Excel

Output

Select the output for the report from the options provided. The following options are available:

- Print – select this option if you wish to print the report

- View – select this option if you wish to view the contents of the report

- Spool – select this option if you wish to spool the report for further use

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Specify the name of the printer or select it from the option list provided. All the configured printers are displayed in the list.

This is applicable only if you have specified the output as ‘Print’.

Note

You can query or modify the account details of the customers whose accounts are permitted to you for the query/modification in the ‘Group Code Restriction’ screen.

17.2 Account Cheque Details Report

This section contains the following topics:

- Section 17.2.1, "Generating Account Cheque Details Report"

- Section 17.2.2, "Selection Options"

- Section 17.2.3, "Contents of the report"

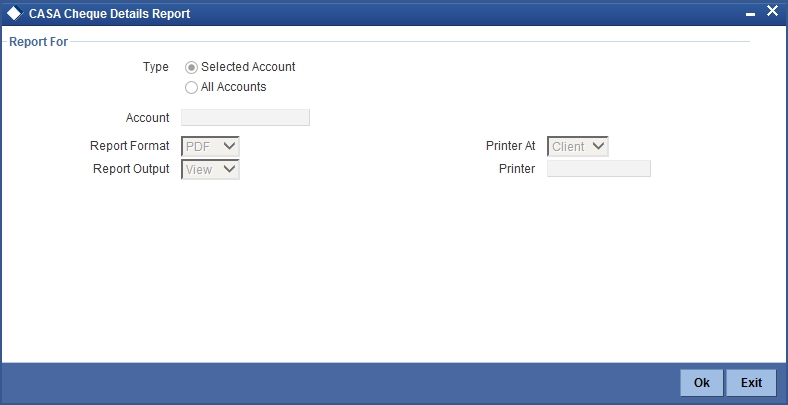

17.2.1 Generating Account Cheque Details Report

This report gives details of the Cheques used, cancelled and rejected for an account. You can invoke this screen by typing ‘CARPCKDT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

17.2.2 Selection Options

You can indicate the following preferences for generating the report:

Report For

Select the option ‘Selected Account’ if you want to generate the cheque book details report for a selected account. Select the option ‘All Accounts’ if you want to generate reports for all accounts.

Account

If you have selected the option ‘Selected Account’ select the account for which the cheque detail report has to be generated from the adjoining option list.

17.2.3 Contents of the report

The options that you specified while generating the report are printed at the beginning of the report. The contents of the Cheque Book Details Report are discussed under the following heads:

Header

The Header carries the title of the Report, information on the branch code, branch date, the date and time of report generation, the user-ID of the user generating the report, module, page and the event date.

Body of the report

| Field | Description | ||

|---|---|---|---|

| Account | The account number of the customer | ||

| Description | The description of the account | ||

| Check Number | The Cheque leaf number | ||

| Status | The status of the cheque | ||

| Amount | The amount for which the cheque is issued | ||

| Presented On | The date on which the cheque is presented in the bank | ||

| Date on Cheque | The date as given on the cheque | ||

| Beneficiary | The name of the person in whose name the cheque is issued |

17.3 CASA Stop Payment Report

This section contains the following topics:

- Section 17.3.1, "Generating CASA Stop Payment Report"

- Section 17.3.2, "Selection Options"

- Section 17.3.3, "Contents of the report"

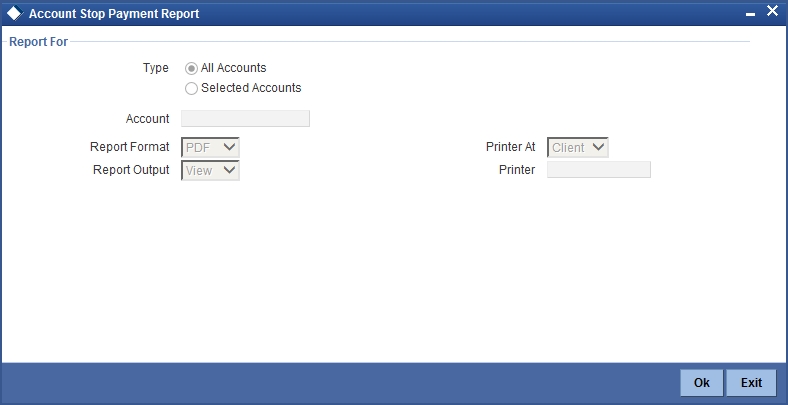

17.3.1 Generating CASA Stop Payment Report

This report gives details of the stop payment details issued on a cheque. You can invoke this screen by typing ‘CARPSPMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

17.3.2 Selection Options

You can indicate the following preferences for generating the report:

Report For

Select the option ‘Selected Account’ if you want to generate the cheque book details report for a selected account. Select the option ‘All Accounts’ if you want to generate reports for all accounts.

Account

If you have selected the option ‘Selected Account’ select the account for which the cheque detail report has to be generated from the adjoining option list.

17.3.3 Contents of the report

The options that you specified while generating the report are printed at the beginning of the report.

The contents of the Stop Payment Report are discussed under the following heads:

Header

The Header carries the title of the Report, information on the branch code, branch date, the date and time of report generation, the user-ID of the user generating the report, module, page and the event date.

Body of the report

| Field | Description | ||

|---|---|---|---|

| Account | The account number of the customer | ||

| Description | The description of the account | ||

| Stop Payment No | The stop payment instruction number | ||

| Type | The stop payment can be issued either on an amount or on cheque(s) | ||

| Start Check No | The starting cheque leaf number | ||

| End Cheque No | The ending cheque leaf number | ||

| Amount | The amount for which stop payment is done | ||

| Effective Date | The date from which the stop payment is effective | ||

| Expiry Date | The date on which the stop payment validity will expire |

17.3.4 Customer Statistics Report

The table below displays customer statistics for the last six months.

Body of the report

| Field | Description | ||

|---|---|---|---|

| Customer Number | FLEXCUBE Customer Number | ||

| Account No | FLEXCUBE Account Number | ||

| Acc Currency | Account Currency | ||

| Cust. Name | Customer name | ||

| Acc Branch | The branch in which the account was created | ||

| Last Debit | Last debit amount on the account for the month | ||

| Last Credit | Last credit amount on the account for the month | ||

| Last Over Draft | Last overdraft amount on the account for the month | ||

| Simple Average Balance | Simple Average balance of the account for the month | ||

| Minimum Balance | Minimum balance of the account for the month | ||

| Maximum balance | Maximum balance of the account for the month | ||

| No of Dr transactions | Number of debit transactions for that month | ||

| No of Cr Transactions | Number of credit transactions for that month | ||

| Closing Balance | Month end closing balance of that account | ||

| Total Balance | The balance of account (including the limit + uncleared / uncollected funds) | ||

| No of Returned Cheques | Total number of cheques returned on the account for that month | ||

| Debit Interest | Month END IC (Debit interest liquidated for that account only will be considered) | ||

| N.S.F | Number of transactions which could not be completed owing to Insufficient Balance in the account for the month | ||

| CHG'BLE TR | Number of chargeable transactions for the month | ||

| DB.CHK.RTD | Number of cheques returned for the month | ||

| Debit AVG | Debit average for the month | ||

| Days in Debit | Number of days in debit for the month | ||

| Monthly Debit AVG | Debit average for the month | ||

| Credit AVG | Credit average | ||

| Days in Credit | Number of days in Credit for the month | ||

| Monthly Credit AVG | Monthly credit average | ||

| XOD AVG | Excess overdraft average for the month | ||

| DAYS XOD | Number of days in excess overdraft for the month | ||

| MNTH AV | Excess overdraft average | ||

| Number of times gone into Overdraft | Number of times the account went into overdraft for the month |

Note

The balance is shown in terms of the account currency.

17.4 Account Statement Reports

This section contains the following topics:

- Section 17.4.1, "Generating Account Statement Reports"

- Section 17.4.2, "Contents of the report"

- Section 17.4.3, "Viewing Charge Details"

- Section 17.4.4, "Viewing Events"

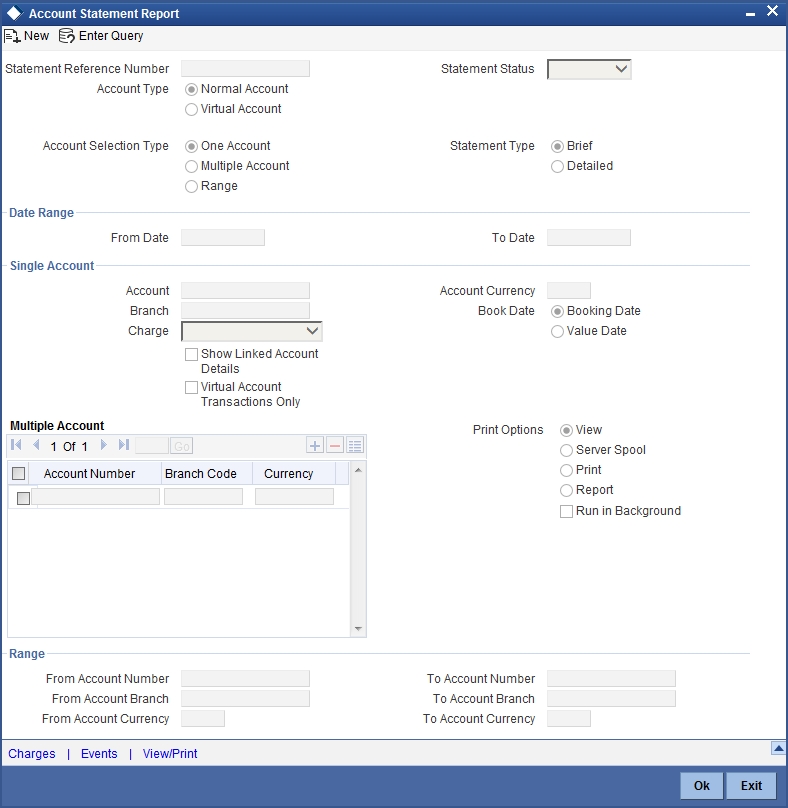

17.4.1 Generating Account Statement Reports

You can get the details of the account statement reports using ‘Account Statement Reports’ screen. You can invoke this screen by typing ‘ACDOPTN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can indicate the following preferences for generating the report:

Account Type

Select the type of account you want to view. The types of accounts that can be selected are as follows:

- Normal Account: This option can be selected if a statement needs to be generated for physical accounts.

- Virtual Account: This option can be selected if a statement needs to be generated for virtual accounts.

If physical account is chosen, then virtual account numbers will not be displayed in the ‘Account Number’ field. If Virtual Account is chosen, then the physical account numbers will not be displayed in the ‘Account Number’ field.

Account Selection Type

You have to indicate the account selection type of the customer. The options available are:

- One Account

- Multiple Account

- Range

Statement Type

You have to indicate the statement type of the customer. The options available are:

- Brief

- Detailed

Date Range

You can indicate the following:

From Date

Specify the date from when you are generating this report.

To Date

Specify the date till when you are generating this report.

Single Account

Account Number

Specify the account number. The option list displays all valid account numbers. Choose the appropriate one.

To view the joint holder’s details of an account and the mode of operation maintained at the account level, place the cursor on the Account Number field and press Ctrl+J. The system displays the ‘Joint Holder’ screen.

For more information on the ‘Joint Holder’ screen refer to the section ‘Joint Holder Maintenance’ in this User Manual.

Branch

The system displays the branch code of the selected account number.

Account Currency

Specify the account currency. The option list displays all valid account currencies. Choose the appropriate one.

For virtual accounts based on the Virtual Account Number and Account Currency combination the physical account is identified.

Charge

You have to indicate the type of charges. The options available are:

- Null - Select this option If statement needs to be generated devoid of charge

- Fixed Charge - Select this option If statement needs to be generated with a fixed amount of charge

- Based on date Range - Select this option of statement needs to be generated and the charge for the same will be based on the duration of the period selected. (Difference between the from date and the to-date)

- Online Charge – Select this option if the statement needs to be generated and online charge is included.

Virtual Account Transactions Only

The field is enabled if Normal Account is selected in the ‘Account Type’ field. Check this field if you want to view only those transactions that are performed using virtual accounts. While generating the statement for a physical account only the transactions that are done using the virtual account are displayed.

Show Linked A/C Details

Check this box if you wish to show linked account details. If virtual account is selected in the ‘Account Type’ field, then this field is disabled.

Dates

You have to indicate the type of dates. The options available are:

- Booking Dated

- Value Dated

Note

Value Date option is disabled for Virtual Accounts.

Select Multiple Accounts

Account Number

Specify the account number. The option list displays all valid account numbers. Choose the appropriate one.

Branch Code

The system displays the branch code of the selected account number.

Currency

Specify the currency of the account.

Range Account

From Account Number

Specify the account number from which the report needs to be generated. You can select the appropriate number from the adjoining option list that displays all the accounts maintained in the system.

To Account Number

Specify the account number to which the report needs to be generated. You can select the appropriate number from the adjoining option list that displays all the accounts maintained in the system.

From Account Branch

The system displays the branch code of the selected account number.

To Account Branch

The system displays the branch code of the selected account number.

From Account Currency

Specify the account currency from which the report needs to be generated. You can select the appropriate currency from the adjoining option list that displays all the currencies maintained in the system.

To Account Currency

Specify the account currency to which the report needs to be generated. You can select the appropriate currency from the adjoining option list that displays all the currencies maintained in the system.

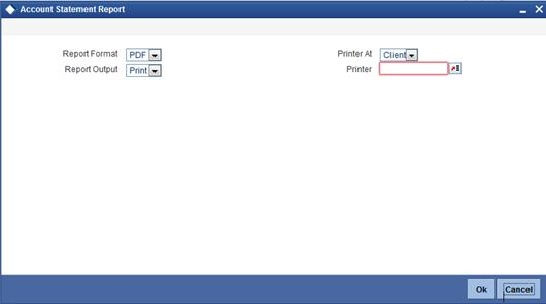

Print Options

You have to indicate the type of print options. The options available are:

- View - Select this option to view the content of account statement.

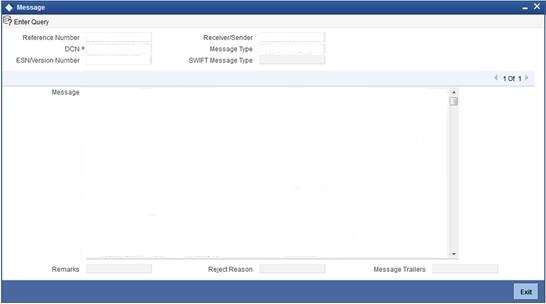

- For Single Account, on click of ‘OK’ button, the following

‘Message’ screen is invoked.

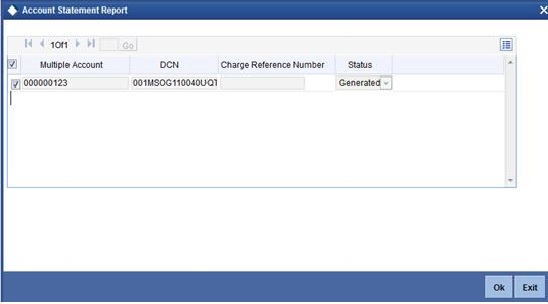

- For Multiple

Accounts or Range of Accounts, on click of ‘OK’ button, the

system invokes the following Account Statement Report with Multiple Account

DCN list screen.

- On double click of each account in the multi grid the ‘Message’ screen is invoked.

- For Single Account, on click of ‘OK’ button, the following

‘Message’ screen is invoked.

- Server Spool - Select this option to spool the account statement for further use.

- Print - Select this option to print the account statement.

- Report - Select this option to get the account statement as a report.

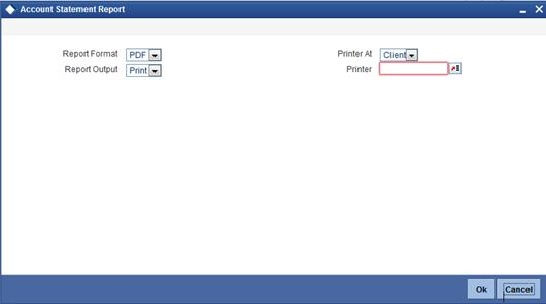

- For ‘Single Account’, on click of ‘OK’ button

the system invokes the following Report screen.

- Click ‘OK’ from this screen to generate the account statement in the report format chosen.

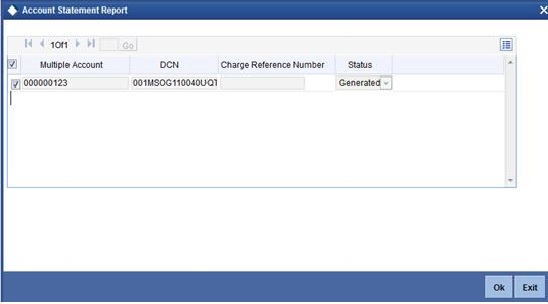

- For Multiple Accounts and Range of Accounts, on click of 'OK' button

the following Multiple account DCN list screen is invoked.

- On

click of 'OK' button in the above screen the system invokes the Account

Statement Report screen.

- From the report screen on click of 'OK' button a single account statement for all the multiple accounts in the 'Report Format' chosen is generated.

- For ‘Single Account’, on click of ‘OK’ button

the system invokes the following Report screen.

17.4.2 Contents of the report

The options that you specified while generating the report are printed at the beginning of the report.

The contents of the Account Statement Report are discussed under the following heads:

Header

An Account Statement is the record of transactions and their effect on account balances over a specified period of time for a given account. An Account Statement lists the debits and credits that took place over a time period.

The Header carries the title of the Report, information on the Account Number of the user generating the report.

Body of the report

| Field | Description | ||

|---|---|---|---|

| Branch Name | This is the branch where the account resides. | ||

| Branch Address 1 | This is the address of the branch. | ||

| Branch Address 2 | This is the address of the branch. | ||

| Branch Address 3 | This is the address of the branch. | ||

| Account Number | Details about customer account Number. | ||

| From date | This is from date. | ||

| To date | This is to date. | ||

| Page Number | This is the page number. | ||

| As of Date | As of date. | ||

| Customer Number | This is the customer number. | ||

| Customer Name | This is the customer name. | ||

| Customer Address 1 | This is the address of the customer. | ||

| Customer Address 2 | This is the address of the customer. | ||

| Customer Address 3 | This is the address of the customer. | ||

| Customer Address 4 | This is the address of the customer. | ||

| Opening Balance | This is the opening balance of the customer. | ||

| Transaction code Description | This is the description of the transaction code. | ||

| Transaction reference Number | This is the reference number of the account for which transaction details is being reported | ||

| Opening Date | The opening date of the account. | ||

| Previous Date | Gives the date of the previous statement. | ||

| Transaction Booking Date | This is the transaction booking date. | ||

| Transaction Amount | This is the transaction amount. | ||

| Additional Information | Gives some additional information. | ||

| Debit-Credit Indicator | This indicates the nature of the transaction – debit or credit. | ||

| Closing Balance | This indicates the closing balance. | ||

| Available Balance | This indicates the available balance. | ||

| Blocked Balance | This indicates the blocked balance. | ||

| Uncollected Balance | This indicates the uncollected balance. | ||

| Number of Debits | Indicates the number of debit transactions. | ||

| Number of Credits | Indicates the number of credit transactions. | ||

| Total Debit Value | Indicates the total debit value. | ||

| Total Credit Value | Indicates the total credit value. | ||

| Current Average Monthly Balance | Indicates the current average monthly balance. | ||

| Previous Average Monthly Balance | Indicates the previous average monthly balance. | ||

| Current Average Quarterly Balance | Indicates the average quarterly balance. | ||

| Previous Average Quarterly Balance | Indicates the previous average quarterly balance. |

Note

The month end job ACBCSTAT batch runs in EOFI to compute account statistics and ACSTHAND batch runs at EOTI with daily frequency.

Note

For book dated statement, tags CURAVGMTHLYBAL and PREVAVGMTHLYBAL will compute the book dated current and previous average monthly balance.

For value dated statement, tags CURAVGMTHLYBAL and PREVAVGMTHLYBAL will compute the value dated current and previous average monthly balance.

Click ’OK’ button when you have specified your preferences in the ‘Account Statement Reports’ screen. The ‘Print Options’ screen gets displayed, where you can specify the preferences for printing the report.

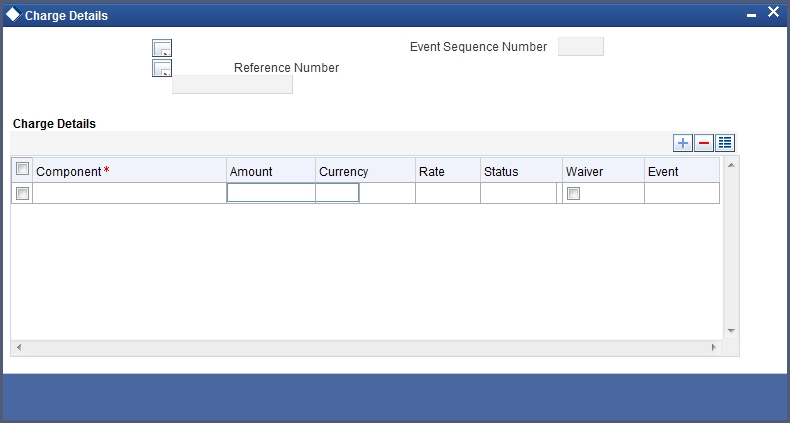

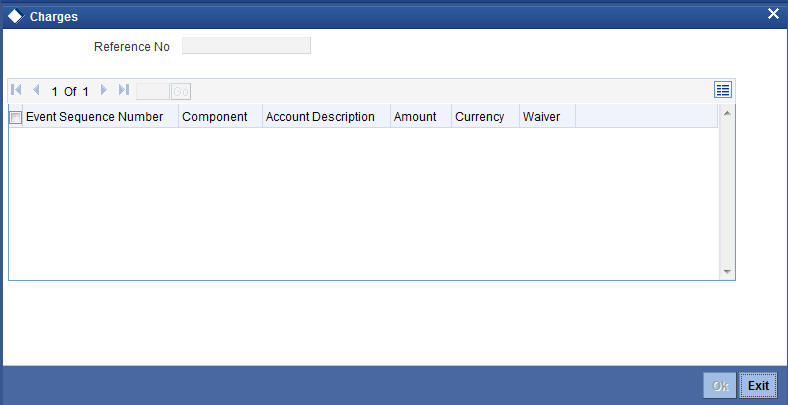

17.4.3 Viewing Charge Details

You can view the charges for online statement generation in the ‘Charge Details’ screen. Click on ‘Charges’ button to invoke ‘Charge Details’ screen.

Contract Reference

System displays the contract reference number here.

Charge Liquidation

System displays the following details under this section:

- ESN - Event sequence number

- Component - Charge component name

- Charge Currency - Charge currency

- Charge Amount - Computed charge amount

- Waiver - If this box is checked, then charge will be waived.

Waiver

Check this box to waive the charge.

Charge Amount

System displays the calculated charge amount here. You can amend this, if required.

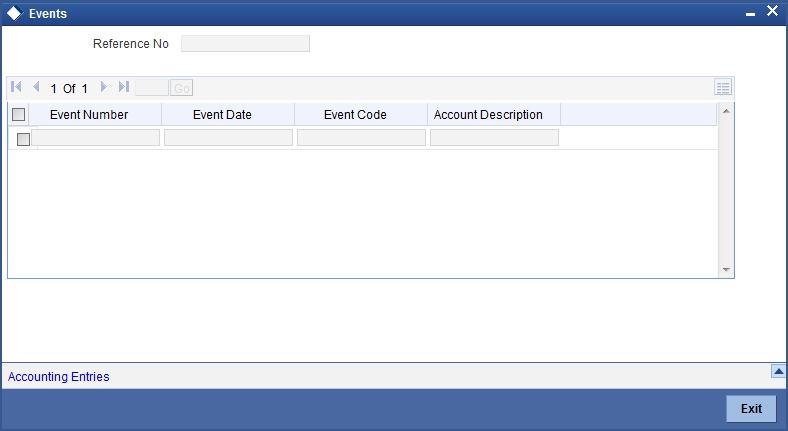

17.4.4 Viewing Events

Click on ‘Events’ button to invoke ‘Events’ screen.’

Reference Number

System displays the reference number here.

Events

System displays the following details under this section:

- Event Number - Event sequence number

- Event Date- Date of the event

- Event Code - event code of the transaction

- Description - event code description

17.5 PDC Summary Report

This section contains the following topics:

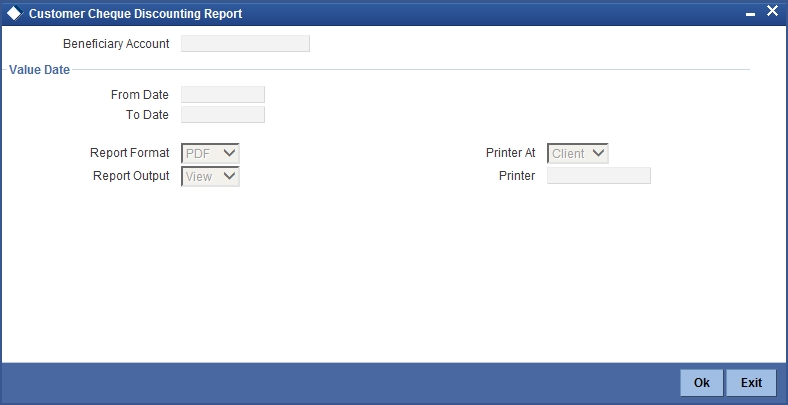

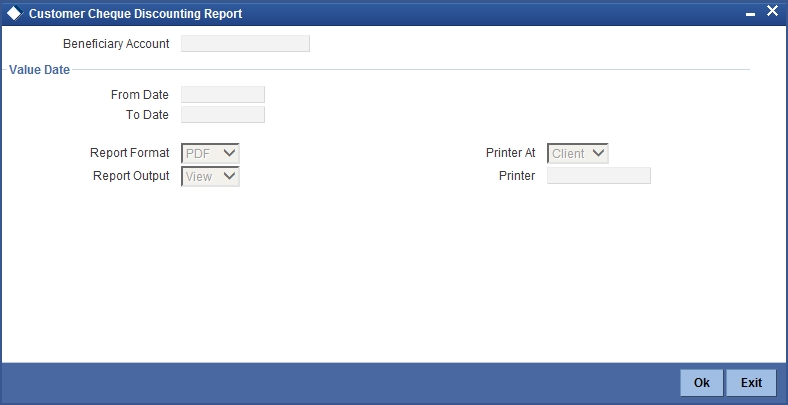

17.5.1 Generating PDC Summary Report

PDC Summary report displays the details of all the cheques discounted for an account.You can generate report for post dated cheque details using ‘Customer Cheque Discounting Report’ screen by typing ‘PDRCHDRF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details here:

Beneficiary Account

Specify the beneficiary account. The adjoining option list displays the list of all the valid beneficiary accounts maintained in the system. You can choose the appropriate one.

Value Date

From Date

Enter the date from when you are generating this report.

To Date

Enter the date till when you are generating this report.

Click ‘OK’ button to generate the report. Click ‘Exit’ to return to the Reports Browser.

17.5.2 Contents of the report

The generated report will have the following information:

| Field Name | Field Description | ||

|---|---|---|---|

| Account No./Deposit No. | This indicates the TD account Number | ||

| Product code | This indicates the product code | ||

| Product description | This indicates the product description | ||

| Customer ID | This indicates the customer Id | ||

| Customer Name | This indicates the customer name | ||

| Cheque number | This indicates the cheque number | ||

| Discounted date | This indicates the discounted date | ||

| Cheque date | This indicates the cheque date | ||

| Cheque CCY | This indicates the cheque currency | ||

| Cheque amount | This indicates the cheque amount | ||

| Cheque Status | This indicates the cheque status | ||

| Drawer identification | This indicates the drawer identification | ||

| Drawer Name | This indicates the drawer name | ||

| Drawer bank code (for the cheque) | This indicates the drawer bank code for the cheque |

Aggregation Fields

| Field Name | Field Description | ||

|---|---|---|---|

| Total cheque amount | This indicates the total cheque amount | ||

| Total Number of cheque | This indicates the total number of cheque |

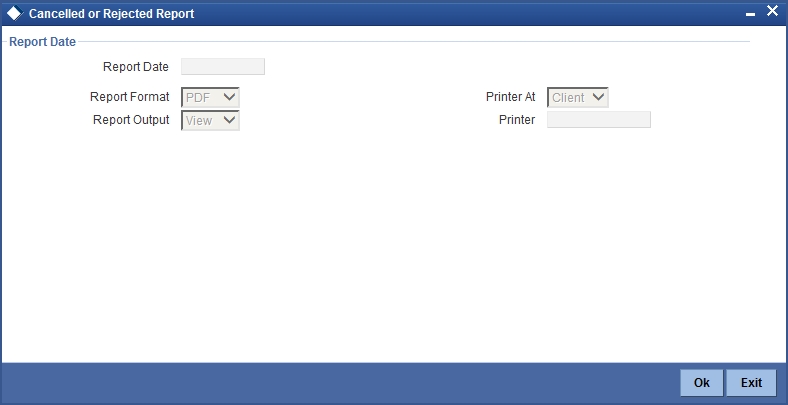

17.6 Cheque Cancellation Report

This section contains the following topics:

17.6.1 Generating Cheque Cancellation Report

Oracle FLEXCUBE generates a report that contains the details of cheques that are cancelled and revised on a daily basis. This report is generated everyday during end of day operations.

17.6.2 Contents of the Report

The report contains the following details:

Header

| Field Name | Field Description | ||

|---|---|---|---|

| Report Name | Report name | ||

| Bank Code / Bank Name | Bank code and bank name | ||

| Branch Code / Branch Name | Current branch code and branch name | ||

| Op ID | Current user | ||

| Report Run Date | Current system date | ||

| Report Run Time | Current system time |

Body

| Field Name | Field Description | ||

|---|---|---|---|

| Product Code | PDC Product | ||

| Account Number | Beneficiary account number | ||

| Account Name | Beneficiary account description | ||

| Cheque Purchase Number | Transaction reference number | ||

| Cheque Number | Instrument Number | ||

| Purchase Amount | Cheque amount; Purchase/discount will be done for the entire amount | ||

| Currency | Currency of the instrument | ||

| Interest Amount | Interest Amount (Interest will be applicable for cheques discounted only. Interest will be computed from the purchase date till the liquidation date) | ||

| SC Amount | Service charge amount | ||

| Clearing Transaction Reference Number | Outward clearing transaction reference number for pdc purchased | ||

| Teller ID | Maker ID of the transaction | ||

| Authorizer ID | Checker ID of the transaction | ||

| Status | Cheque status | ||

| Reject Code | Reject code for cancellation | ||

| Reject Reason | Reject reason for cancellation |

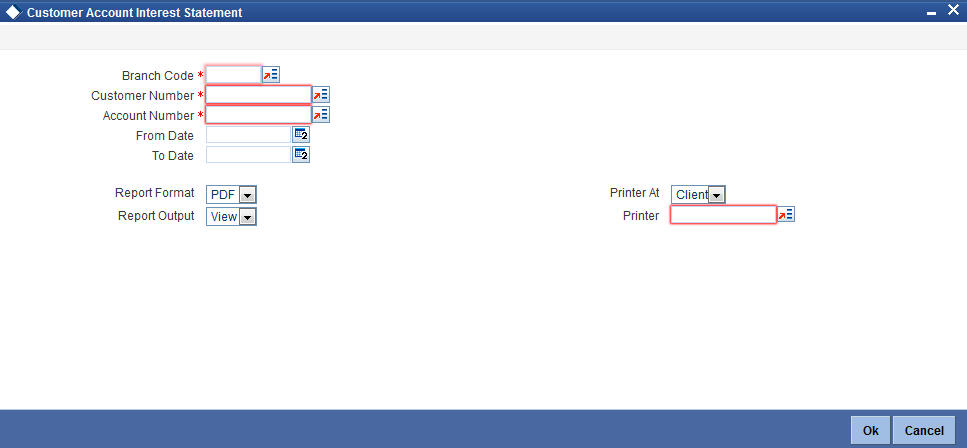

17.7 Interest Statement Report

This section contains the following topics:

17.7.1 Generating Interest Statement Report

Oracle FLEXCUBE facilitates generation of the Interest Statement Report for Customer Accounts without liquidating the Customer Accounts.

You can generate Interest Statement Report for Customer Accounts using ‘Customer Account Interest Statement’ screen. You can invoke this screen by typing ‘CARINSTM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid branch code in which the customer has an account. The adjoining option list displays all valid and authorized Branch codes. You can select the appropriate one.

Customer Number

Specify a valid customer identification number. The adjoining option list displays all valid and authorized customer identification numbers. You can select the appropriate one.

Account Number

Specify a valid customer account number for which you wish to generate the interest statement report. The adjoining option list displays all valid, authorized savings and current account numbers. You can select the appropriate one.

From Date

Specify the date from when you wish to generate the interest statement report for the specified customer account, from the adjoining calendar.

To Date

Enter the date till when you wish to generate the interest statement report for the specified customer account, from the adjoining calendar.

Note

‘To Date’ cannot be a future date

17.7.2 Contents of the Report

The report contains the following details:

Header

| Field Name | Field Description | ||

|---|---|---|---|

| Report Name | Report name | ||

| Bank Code / Bank Name | Bank code and bank name | ||

| Branch Code / Branch Name | Current branch code and branch name | ||

| Op ID | Current user | ||

| Report Run Date | Current system date | ||

| Report Run Time | Current system time |

Body of the Report

The generated report will provide the following information:

| Field Name | Field Description | ||

|---|---|---|---|

| Customer Number | Indicates the customer number | ||

| Account Number | Indicates the account number | ||

| Currency | Indicates the currency of the transaction | ||

| Name | Indicates the name of the customer | ||

| Product | Indicates the product for which the credit and debit details are displayed | ||

| From Date | This indicates date from when the interest is computed | ||

| To Date | This indicates date till when the interest is computed | ||

| Interest Balance | Indicates the interest balance | ||

| Number of Days | This indicates number of days for which the interest is computed | ||

| Interest Rate | This indicates interest rate based on which the interest is computed | ||

| Amount | This indicates calculated interest amount | ||

| Total Credit Capitalized | Indicates the total credit capitalized | ||

| Total Debit Capitalized | Indicates the total debit capitalized | ||

| Total Tax Amount | This indicates the total tax amount over the interest amount in the specified period |

Note

If the customer account is linked to multiple products or formulae, then the interest statement displays the credit and debit interest details separately for that customer account.

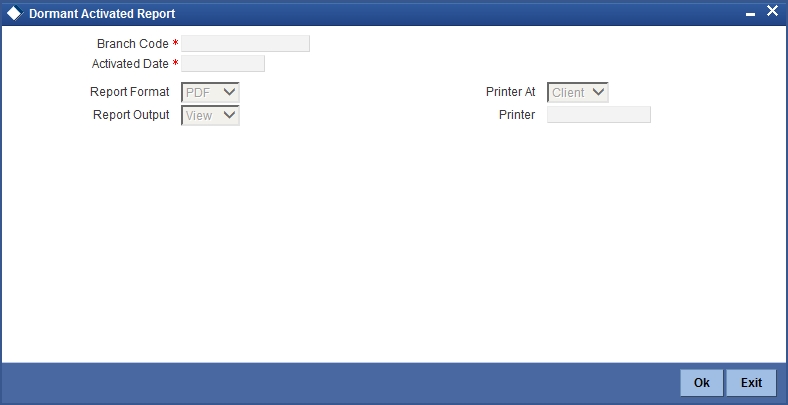

17.8 Dormant Activated Report

This section contains the following topics:

17.8.1 Generating Dormant Activated Report

An account is moved to Dormancy state in the absence of any customer initiated transaction, in that account, for a period maintained at ‘Account Class Maintenance’ level. After a specific period, the status will be changed to unclaimed deposit.

These accounts are activated, once the customer initiates a transaction. At the end of the Dormant Activity, you can generate ‘Dormant Activated Report’ as part of EOD, which summarizes the transaction in the dormant accounts. It is a report of dormant accounts which were activated on that day. The accounts in this report are grouped based on the account class and currency type of the account.

You can invoke ‘Dormant Activated Report’ screen by typing ‘STRDAEOD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code for the Branch in which the customer has an account from the adjoining option list.

Activated Date

Specify a valid date, when the dormant account was activated, from the adjoining calendar.

17.8.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The other content displayed in the Dormant Activated Report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Branch | Indicates Branch Code and Branch Name | ||

| Module | The module from which the report was generated | ||

| Run Date | Indicates Date on which report is generated | ||

| Run Time | The time at which the report was generated | ||

| User ID | Indicates User ID of the user who generated the report | ||

| Page No | The page number of the report |

Body of the Report

The following details are displayed as body of the generated report, grouped by the product code and currency:

| Field Name | Field Description | ||

|---|---|---|---|

| Product Code | Indicates Account Class | ||

| Currency | Indicates Currency of the Account | ||

| The dormant details for each account class and currency are displayed in the report | |||

| Account | Indicates Customer Account | ||

| Account Name | Indicates Account Description | ||

| Day’s Credit Amount | Indicates Sum of Transaction Credit Amount for today in Account Currency | ||

| Day’s Debit Amount | Indicates Sum of Transaction Debit Amount for today in Account Currency | ||

| Book Balance | Indicates Book Balance | ||

| Dormancy Start Date | Indicates Dormancy Start Day | ||

| Dormant Days | Indicates Number of Dormant Days | ||

| Maker ID | Indicates Maker id of the Transaction | ||

| Checker ID | Indicates Checked Id of the transaction | ||

| Txn code | Indicates Transaction code of the Transaction | ||

| Txn Description | Indicates Transaction Description of the Transaction. | ||

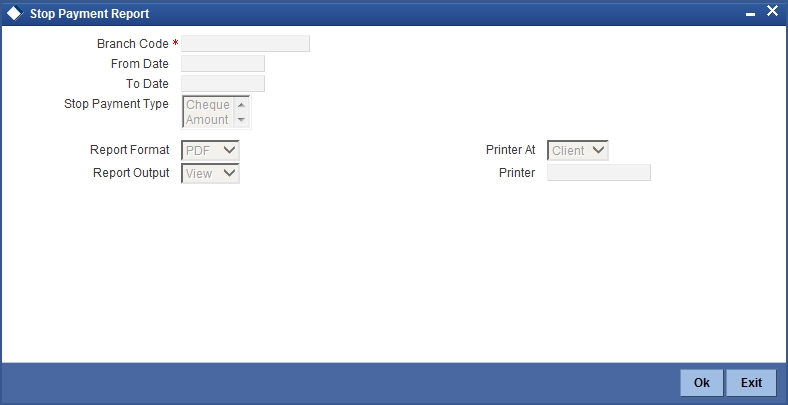

17.9 Stop Cheques Maintained Report

This section contains the following topics:

- Section 17.9.1, "Generating Stop Cheques Maintained Report"

- Section 17.9.2, "Contents of the Report"

17.9.1 Generating Stop Cheques Maintained Report

When a customer losses cheque leaf issued for a Savings or Current Accounts, the same is informed to the respective branch. The corresponding branch updates these details in the system to avoid paying-out of these cheques.

During EOD, you can generate ‘Stop Cheques Maintained Report’, which lists out all the stop payment instruction carried out on that day. Stop cheques in this report are grouped based on the account type.

You can invoke ‘Stop Cheques Maintained Report’ screen by typing ‘STRSPEOD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code for the Branch in which the customer has an account from the adjoining option list.

From Date

Specify a valid date, from when the report is generated, from the adjoining calendar.

To Date

Specify a valid date, till when the report is generated, from the adjoining calendar.

Stop Payment Type

Select stop payment type for which you wish to generate the report from the adjoining drop-down list. This list displays the following values:

- Cheque

- Amount

17.9.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The other content displayed in the Stop Cheques Maintained Report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Branch Date | Indicates the branch date | ||

| Branch | Indicates Branch Code and Branch Name | ||

| Run Date | Indicates Date on which report is generated | ||

| User ID | Indicates User ID | ||

| Module | Indicates the module code | ||

| Run Time | Indicates the time on which the report is generated |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Account Number | Indicates Customer Account Number | ||

| Account Desc | Indicates Account description | ||

| Customer Id | Indicates Customer Id | ||

| Customer Name | Indicates Customer Short Name | ||

| Currency | Indicates Currency of the Account | ||

| Stop Payment Type | Indicates Stop Payment Type | ||

| Chq St No. | Indicates Cheque Start Number | ||

| Chq End No. | Indicates Cheque End Number | ||

| Amount | Indicates Cheque Amount | ||

| Stop Chq Date | Indicates Stop Cheque Date | ||

| Reason | Indicates Reason for Stop Payment |

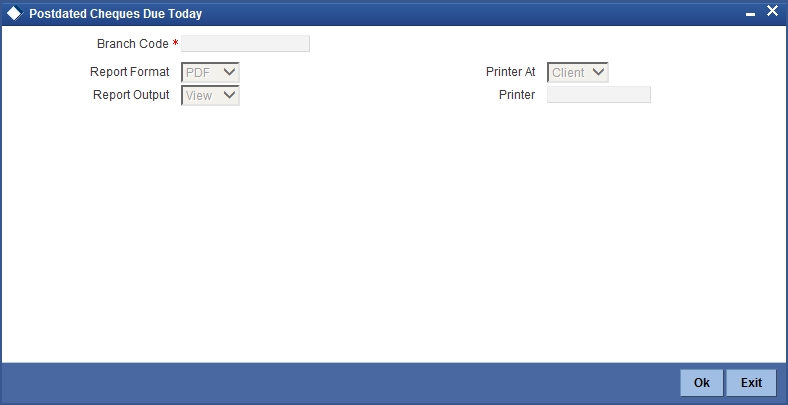

17.10 Post Dated Cheques Due Today Report

This section contains the following topics:

- Section 17.10.1, "Generating Post Dated Cheques Due Today Report"

- Section 17.9.2, "Contents of the Report"

17.10.1 Generating Post Dated Cheques Due Today Report

Branches collect PDC to ensure recovery and credit the customer accounts on the scheduled date. These cheques are presented in the outward clearing on the agreed due date.

During EOD, you can generate ‘Post Dated Cheques Due Today Report’, which lists details of all the PDC that were due and were cleared on that day. Transactions in this report are grouped based on the Instrument and clearing type of the cheques. Report also provides a Branch-wise presentation of cheques.

You can invoke the ‘Post Dated Cheques Due Today Report’ screen by typing ‘PDRDTTOD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code for the Branch in which the customer has an account from the adjoining option list.

17.10.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. The other content displayed in the Post Dated Cheques Due Today Report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Report Name | Indicates Report Name | ||

| Branch Code / Branch Name | Indicates Current Branch code and Branch Name | ||

| User ID | Indicates the Identification of the User | ||

| Module | Indicates the Module of the Report | ||

| Report Run Date | Indicates Current Branch Date | ||

| Report Run Time | Indicates Current Branch Time | ||

| Branch Date | Indicates the date of Branch in which report is taken. | ||

| Page No | Displays Page No out of total No of pages in report. |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Instrument Type | Indicates PDC Type | ||

| Clearing Type | Indicates Clearing Product description of the PDC | ||

| Account No | Indicates Account Number (Beneficiary Account Number) | ||

| Acct. Name | Indicates Description of the Account if it is FCUBS account. If it is not, then it is left blank | ||

| Bank Code | Indicates Bank Code of the Issuer | ||

| Cheque No | Indicates Cheque number | ||

| CCY | Indicates the Currency of the Transaction | ||

| Cheque Amount | Indicates Cheque Amount | ||

| Transaction Seq No. | Indicates Transaction Sequence No. | ||

| Deposit Date | Indicates Cheque Deposit Date | ||

| Instr. Date | Indicates Activation Date | ||

| Value Date | Indicates Value Date of the Cheque | ||

| Total Amount (Branch) | Indicates the total amount |

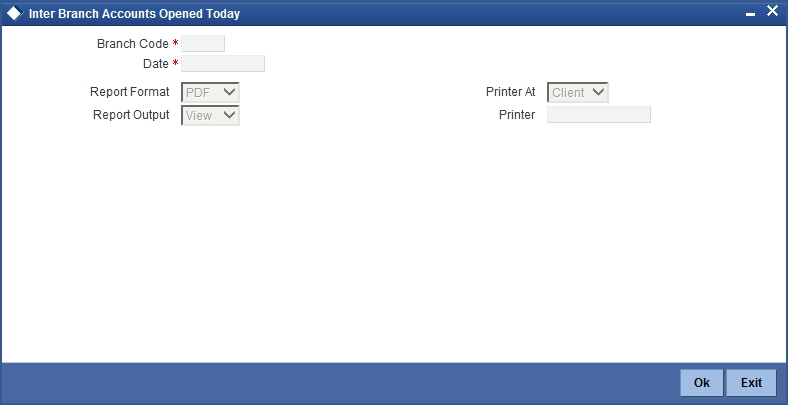

17.11 Inter-Branch Accounts Opened Today Report

This section contains the following topics:

- Section 17.11.1, "Generating Inter-Branch Accounts Opened Today Report"

- Section 17.11.2, "Contents of the Report"

17.11.1 Generating Inter-Branch Accounts Opened Today Report

Oracle FLEXCUBE provides customers a facility to open an account in the branch of their choice. You can generate ‘Inter Branch Accounts Opened Today Report’ to enable the branch, to have a control over all the accounts opened on other branches. This report lists the accounts created by the Bank Staff, who have Multiple Branch Operational Rights. However, the account branch and the Maker’s home branch should not be the same.

You can invoke the ‘Inter-Branch Accounts Opened Today Report’ screen by typing ‘STRIBRAC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

Date

Specify the date for which you wish to generate the report, from the adjoining calendar.

17.11.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Inter Branch Accounts Opened Today Report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Branch | Indicates Branch Code and Branch Name | ||

| Run Date | Indicates Date on which report is generated | ||

| Run Time | Indicates the time on which the report is generated | ||

| Module | The module from which the report is generated | ||

| User ID | Indicates User ID | ||

| Page No | The page number of the report |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Branch Code | Indicates Branch code of the Account | ||

| Customer ID | Indicates Customer ID | ||

| Customer Short Name | Indicates Customer Short name | ||

| Account Class | Indicates Account Class of the Account | ||

| Account No | Indicates Account Number | ||

| Account Desc | Indicates Account description | ||

| Account Opening Date | Indicates Account Opening Date |

17.12 Account Status Movement Report

This section contains the following topics:

- Section 17.12.1, "Generating Account Status Movement Report"

- Section 17.12.2, "Contents of the Report"

17.12.1 Generating Account Status Movement Report

You can maintain Account Status Movement conditions at the ‘Account Class’ level, based on the conditions decided by your Bank and the compliance requirements of the Central Bank. During EOD, based on these and the conduct of accounts, system automatically classifies the assets on the daily basis. Based on this classification, system recognizes and provisions the income.

You can generate ‘Account Status Movement Report’ to enable the branches to follow-up the accounts so that the status of the accounts does not change to NPL status. This report lists CASA accounts that have moved to status based on the Account Class type of the account.

You can invoke the ‘Account Status Movement Report’ screen by typing ‘STRCASTM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

Account Number

Specify the account number for which the report has to be generated, from the adjoining option list.

Account Status

Specify the status of the Account number from the adjoining option list.

17.12.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Inter Account Status Movement Report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Branch Date | Indicates the branch date | ||

| Branch | Indicates Branch Code and Branch Name | ||

| Run Date | Indicates Date on which report is generated | ||

| User ID | Indicates User ID | ||

| Module | Indicates the module code | ||

| Run Time | Indicates the time on which the report is generated | ||

| Page No | The page number of the report |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Account Class | Indicates Account Class of the Account | ||

| Account Number | Indicates Account Number | ||

| Customer Id | Indicates Customer Number | ||

| Customer | Indicates Customer Short Name | ||

| Checker ID | Indicates Checker ID | ||

| No. of Days | Indicates Number of Days the account is in the current status | ||

| Account Status | Indicates Account Status | ||

| From Status | Indicates the Status from which the account moved to the current status |

17.13 Variances Maintained Today Report

This section contains the following topics:

- Section 17.13.1, "Generating Variances Maintained Today Report"

- Section 17.13.2, "Contents of the Report"

17.13.1 Generating Variances Maintained Today Report

When a customer opens an account, the system updates interest rates based on those maintained at the Product level. However; branches can have an account level variance.

You can generate ‘Variances Maintained Today Report’ to inform branches about the variances maintained for that day. This report lists details of CASA and TD accounts for which the interest variances are maintained for the day. You can invoke the ‘Variances Maintained Today Report’ screen by typing ‘STRSPCON’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

17.13.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Variances Maintained Today Report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Branch Date | Indicates the branch date | ||

| Branch | Indicates Branch Code and Branch Name | ||

| Run Date | Indicates Date on which report is generated | ||

| User ID | Indicates User ID | ||

| Module | Indicates the module code | ||

| Run Time | Indicates the time on which the report is generated |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Account Number | Indicates Account Number | ||

| Customer Id | Indicates Customer Number | ||

| Customer Name | Indicates Customer Short Name | ||

| Account Class | Indicates Account Class of the account | ||

| Product | Indicates Product used for account | ||

| Effective Date | Indicates Effective Date of new UDE values | ||

| UDE Value | Indicates new values of UDE |

Note

Variance maintained for the TD accounts is displayed for the current day.

If the account is a CASA account, system will not display the variance maintained for the current day. A back dated value has to provided as input parameter to view the variance report for CASA accounts

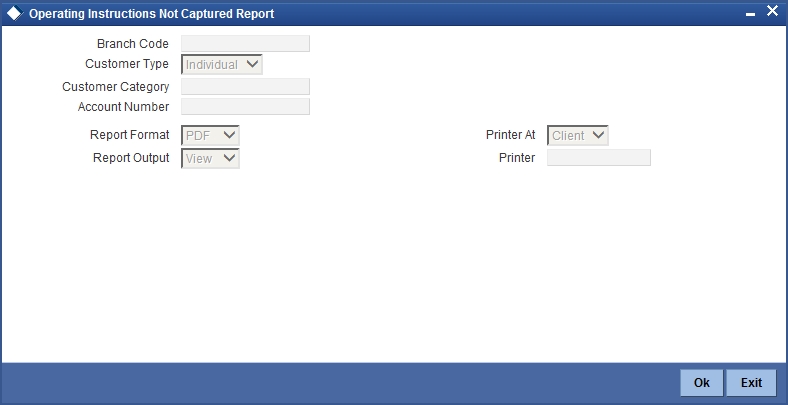

17.14 Operating Instructions Not Captured Report

This section contains the following topics:

- Section 17.14.1, "Generating Operating Instructions Not Captured Report"

- Section 17.14.2, "Contents of the Report"

17.14.1 Generating Operating Instructions Not Captured Report

Oracle FLEXCUBE facilitates maintenance of operating instructions for a customer account. If an operating instruction is maintained for an account, then while processing transactions pertaining to that account the system validates the instructions.

You can generate ‘Operating Instructions Not Captured Report’ to list the accounts for which the following operating instructions are not maintained:

- Mode of operation

- Account signatory details

- Nominee details

- Minor and guarantor details

You can invoke the ‘Operating Instructions Not Captured Report’ screen by typing ‘CAROPICT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

Customer Type

Select customer type of the account for which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Individual – Select if the customer type is individual.

- Corporate-Select if the customer type is Corporate

- Bank-Select if the customer type is Bank

- All

Customer Category

Specify a valid category of the customer for whose account you wish to generate a report, from the adjoining option list.

Account Number

Specify a valid account number for which you wish to generate a report, from the adjoining option list.

17.14.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Operating Instructions Not Captured Report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Bank Code | Indicates Bank Code | ||

| Bank Name | Indicates Bank Name | ||

| Branch Code | Indicates Branch code | ||

| Branch | Indicates Branch Name | ||

| Run Date | Indicates Date on which report is generated | ||

| User ID | Indicates User ID | ||

| Run Time | Indicates the time on which the report is generated |

Body of the Report

The following details related to every customer are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Customer Number | Indicates Customer Identification ID | ||

| Account Details | |||

| Account Number | Indicates Account Number | ||

| Account Description | Indicates Account Details | ||

| Account Open date | Indicates Account Opening Date | ||

| Mode of Operation | Indicates Operation Details | ||

| Signatory Details Maintained | Indicates Account Signature | ||

| Account Status | |||

| Status code | Indicates Status Code | ||

| Status description | Indicates Status Description | ||

| Minor Details | |||

| Is Minor | Indicates Customer Minor status | ||

| Guardian Name | Indicates Guardian Name | ||

| Nominee Name | Indicates Nominee Name | ||

| Maker ID | Indicates Maker ID | ||

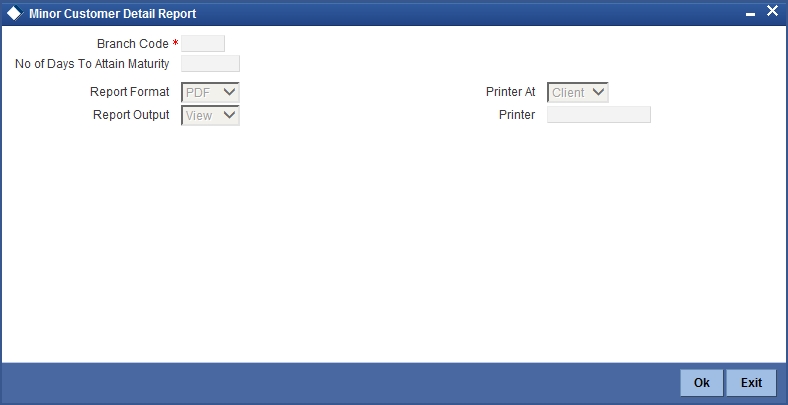

17.15 Minor Customer Details Report

This section contains the following topics:

- Section 17.15.1, "Generating Minor Customer Details Report"

- Section 17.15.2, "Contents of the Report"

17.15.1 Generating Minor Customer Details Report

Customer documentation standards for Minor Account are different from a regular Account. Minor accounts are also restricted to certain classes of transactions based on the set-up maintained at ‘Bank Parameters’ level.

You can generate ‘Minor Customer Details Report’ to view list of minor customers, which aid the Bank while auditing and controlling the account. This report lists details of all Minor Accounts available in the system for a given branch code, maturity type, days to attain age and date of attaining the age.

You can invoke the ‘Minor Customer Details Report’ screen by typing ‘CARMICUS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

No. of Days to Attain Maturity

Specify the number of days within which the Minor Account attains maturity.

17.15.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Minor Customer Details Report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Bank | Indicates Bank Name | ||

| Branch | Indicates Branch Name | ||

| Run Date | Indicates Date on which report is generated | ||

| User Id | Indicates Operator ID | ||

| Run Time | Indicates Run Time |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Customer ID | Indicates Customer ID | ||

| Customer Name | Indicates Customer Name | ||

| Date of Birth | Indicates Date of Birth | ||

| Date of Maturity | Indicates Date of Maturity | ||

| Legal Guardian | Indicates Name of the guardian | ||

| Contact No | Indicates Contact Number | ||

| Status | Indicates Customer status | ||

| No of Days for maturity | Indicates the number of days for maturity |

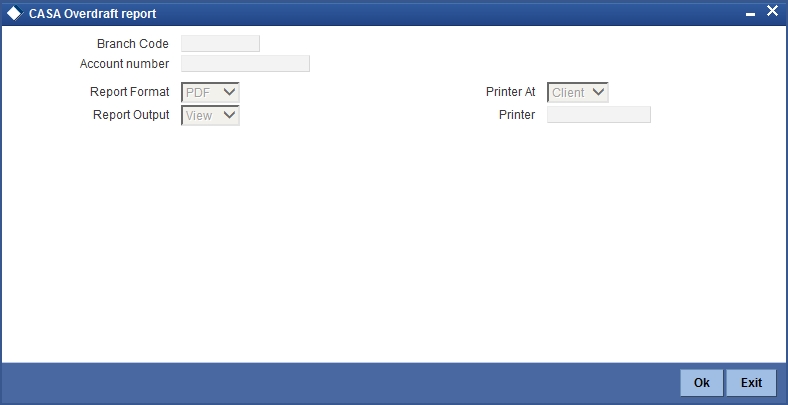

17.16 CASA-Overdraft Report

This section contains the following topics:

17.16.1 Generating CASA-Overdraft Report

Oracle FLEXCUBE facilitates to view the overdraft accounts details in the system. The overdraft account can be a current or saving account, which will have the limits attached. Each limit will have the Limit amount, limit start and end date. You can generate ‘CASA-Overdraft Report’ to view the operative overdraft limit and current outstanding for each account. This report lists customer accounts which have the overdraft facility and limits that are associated to them.

The transaction details are grouped based on the Account Class. You can invoke ‘CASA-Overdraft Report’ screen by typing ‘CAROVDFT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated, from the adjoining option list.

Account Number

Specify a valid account number maintained in the specified Branch for which you wish to generate report, from the adjoining option list.

17.16.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the CASA-Overdraft Report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Bank | Indicates Bank Name | ||

| Branch | Indicates Branch Name | ||

| Run Date | Indicates Date on which report is generated | ||

| User Id | Indicates Operator ID | ||

| Run Time | Indicates Run Time |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Branch Code | Indicates the branch code | ||

| Account Class | Indicates the account class | ||

| Customer ID | Indicates the customer identification number | ||

| Customer Name | Indicates the name of the customer | ||

| Account Number | Indicates Customer Account Number | ||

| Account Currency | Indicates the account currency | ||

| Book Balance | Indicates Account current balance | ||

| Line details for each account | |||

| Line Start Date | Indicates the line start date | ||

| Line Expiry Date | Indicates the line expiry date | ||

| Line Currency | Indicates Line Currency | ||

| Line Amount | Indicates Line Amount | ||

| Overdraft Start date | Indicates Temporary Over draft limit start date | ||

| Overdraft End Date | Indicates Temporary Over draft limit expiry date | ||

| OD Currency | Indicates Over draft currency | ||

| OD Limit | Indicates Temporary Over draft Limit in LCY | ||

| Latest Debit Date | Indicates Latest debit transaction date | ||

| Latest Credit Date | Indicates Latest credit transaction date | ||

| Latest Debit Txn | Indicates Latest debit transaction amount | ||

| Latest Credit Txn | Indicates Latest credit transaction amount | ||

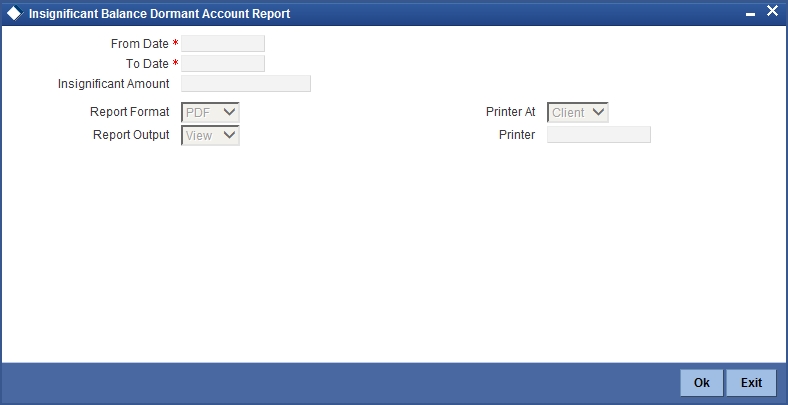

17.17 Insignificant Balance Dormant Account Report

- Section 17.17.1, "Generating Insignificant Balance Dormant Account Report"

- Section 17.17.2, "Contents of the Report"

17.17.1 Generating Insignificant Balance Dormant Account Report

If there are no customer initiated transactions for the period set at the product level, the CASA account status will be changed to dormancy. After a specific period in the dormancy status, the money is transferred to the unclaimed General Ledger account as decided by the bank. If any of the accounts have a credit balance that is less than the amount specified in the dormant status, then you can view details of these accounts in Insignificant Balance Dormant Account Report. This report will generate a list of dormant accounts which have credit balances less than the minimum amount.

This is a nil Balance Dormant Account Report for CASA Accounts. Accounts are grouped based on the product type. You can invoke ‘Insignificant Balance Dormant Account Report’ screen by typing ‘CARDORAC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

From Date

Specify a valid date from when you wish to generate the report from the adjoining calendar.

To Date

Specify a valid date till when you wish to generate the report from the adjoining calendar.

Insignificant Amount

Specify the insignificant amount balance available in the account for which the report is being generated.

17.17.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Insignificant Balance Dormant Account Report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Bank | Indicates Bank Name | ||

| Branch | Indicates Branch Name | ||

| Run Date | Indicates Date on which report is generated | ||

| User Id | Indicates Operator ID | ||

| Run Time | Indicates Run Time |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Product | Indicates the product | ||

| Account Number | Indicates the account number | ||

| Customer No | Indicates the customer number | ||

| Customer Name | Indicates Customer Name | ||

| Maker Id | Indicates Maker Id | ||

| Dormancy Date | Indicates Account dormant date | ||

| Dormant Days | Indicates Dormancy days | ||

| Available balance | Indicates Account available balance |

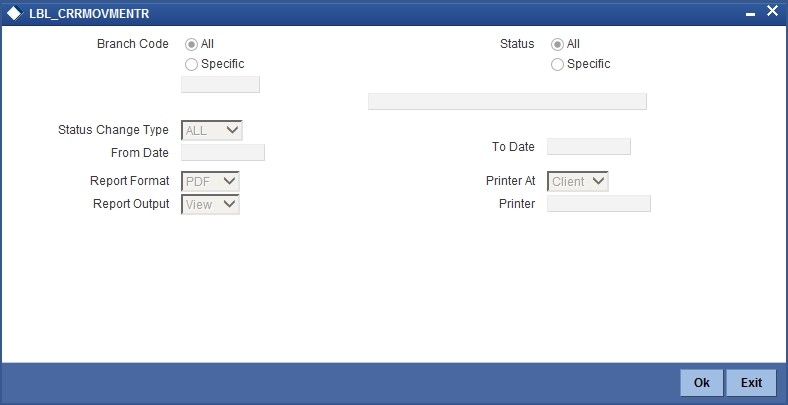

17.18 CRR Movement Report

This section contains the following topics:

17.18.1 Generating CRR Movement Report

Credit Risk Rating (CRR) is analysed by Oracle FLEXCUBE Retail, to determine whether an asset is a performing asset or not. The bank can be track either at customer level or at account level based on preferences maintained by the system. You can generate ‘CRR Movement Report’ with details of status change.

You can invoke ‘CRR Movement Report’ screen by typing ‘ACRSTMOV’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Select Branch code for which you want to generate the report from the options. The following options are available for selection:

- All – Select if you want to generate the report for all the branch codes.

- Specific – Select if you want to generate the report for a specific code.

If you have selected specific, specify a valid branch code for which you want to generate the report, from the adjoining option list.

Status

Select status for which you want to generate the report from the options. The following options are available for selection:

- All – Select if you want to generate the report for all status types.

- Specific – Select if you want to generate the report for a specific status.

If you have selected specific, specify a valid transaction code for which you want to generate the report, from the adjoining option list.

Status Change Type

Select a valid type of status change for which you want to generate the report, from the adjoining drop-down list. This list displays the following values:

- CASA – Select if you want to generate report for CASA accounts.

- Loans – Select if you want to generate report for Loan accounts.

- All – Select if you want to generate report for Loan accounts.

From Date

Specify a valid date from when you wish to generate the interest accrual report from the adjoining calendar.

To Date

Specify a valid date till when you wish to generate the interest accrual report from the adjoining calendar.

17.18.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the ‘CRR Movement Report’ is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Report Name | Indicates Report Name | ||

| Bank Code / Bank Name | Indicates Bank code and Bank Name | ||

| Branch Code / Branch Name | Indicates Current Branch code and Branch Name | ||

| Report Run Date | Indicates Current Branch Date | ||

| Report Run Time | Indicates Current Branch Time | ||

| Op Id | Indicates Logged in user | ||

| From Date | Indicates Date captured as start date | ||

| To Date | Indicates Date captured as end date |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Module | Indicates ‘ST’ for CASA Accounts, ‘CL’ for Loan Accounts, ‘CI’ for Islamic Financing, ‘LE’ for leasing, and ‘MO’ for Mortgages | ||

| Customer Number | Indicates Customer Number | ||

| Customer Name | Indicates Customer Name | ||

| Account Number | Indicates CASA Loan Account Number | ||

| Customer Previous CRR | Indicates Previous CIF Status | ||

| Customer Current CRR | Indicates Current CIF Status | ||

| Account Previous Status | Indicates, | ||

| Account Current Status | Indicates, | ||

| Status Change Date | Indicates, | ||

| Available Balance/Outstanding Balance | Indicates, | ||

| CCY | Indicates, |

17.19 VAT Deduction Report

This section contains the following topics:

17.19.1 Generating VAT Deduction Report

Oracle FLEXCUBE generates a report that contains the details of VAT deduction from CASA account for every branch on a monthly basis. For generating this report, the following conditions should be met:

- ‘Charge 1’ needs to be defined as service charge and ‘Charge 2’ as VAT.

- If VAT needs to be computed based on the service charge, ‘Charge 1’ must be the basis for ‘Charge 2’.

- If ‘Charge 3’ is defined as another service charge and VAT needs to be computed on this charge, then ‘Charge 4’ must be defined as VAT with ‘Charge 3’ as the basis.

You can use the UDF ‘TRNCODE_TYPE’ to define the type of charge vs. VAT, service charge or other charge.

The VAT deduction report is generated during end of day operations at the month end, based on the following parameters.

- Branch Code

- VAT Deducted Date

Based on the above details, the system generates the report.

17.19.2 Contents of the Report

The report contains the following details:

Header

| Field Name | Field Description | ||

|---|---|---|---|

| Report Name | Report name | ||

| Bank Code / Bank Name | Bank code and bank name | ||

| Branch Code / Branch Name | Current branch code and branch name | ||

| Report Run Date | Current branch date | ||

| Report Run Time | Current branch time |

Body

| Field Name | Field Description | |||

|---|---|---|---|---|

| Product Code | Product code | |||

| Product Name | Product description | |||

| Currency | Account currency | |||

| Account Number | Account number | |||

| Customer Name | Customer short name | |||

| SC - Basis [Percentage / Fixed Amount] | Service charge rule method will be provided. | Fixed Amount or Rate | ||

| SC - Applicable [Percentage / Fixed Amount] | Percentage or fixed amount applicable for service charge | |||

| Service Charge | Service charge in local currency | |||

| VAT - Basis [Percentage / Fixed Amount] | VAT Rule Method will be provided. Fixed Amount or Rate | |||

| VAT - Applicable [Percentage / Fixed Amount] | Percentage or Fixed Amount applicable | |||

| VAT Deducted | VAT in local currency | |||

| Transaction Reference Number | Reference number of the transaction |

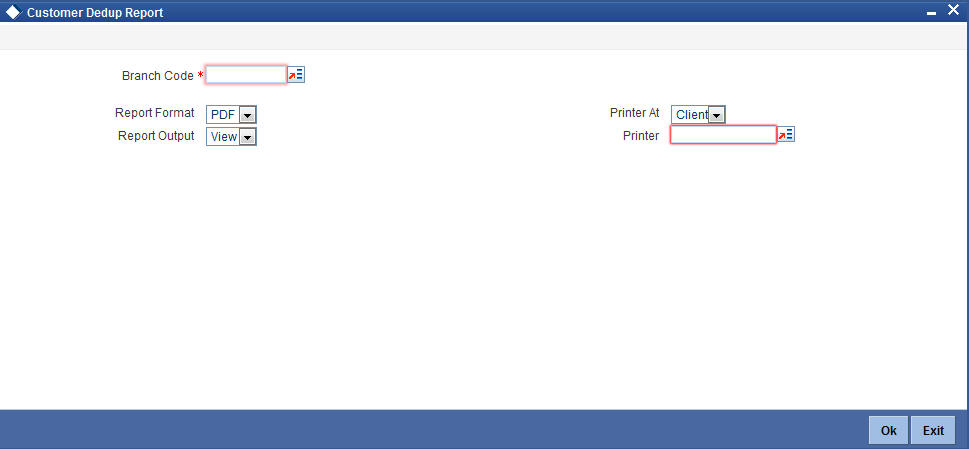

17.20 Customer De-duplication Report

This section contains the following topics:

- Section 17.20.1, "Generating Customer De-duplication Report"

- Section 17.20.2, "Contents of the Report"

17.20.1 Generating Customer De-duplication Report

Oracle FLEXCUBE generates a report that contains the details of the duplicate Customers based on De-duplication rule condition maintained in the system. To invoke ‘Duplicate Customer List’ screen, type ‘STRPDEDP’ in the field at the top right corner of the Application toolbar and click the adjoining arrow button.

Branch Code

Specify the branch code for which you want to generate the report of the duplicate customers.

17.20.2 Contents of the Report

The report contains the following details.

Header

| Field Name | Field Description | ||

|---|---|---|---|

| Branch Code / Branch Name | Branch Code, All option can be selected if the report needs to be for all the branches | ||

| Dedup Rule Condition | Parameter based on which the de-duplication validation is done |

Body

| Field Name | Field Description | ||

|---|---|---|---|

| Customer Number | Customer Id of the duplicate customers | ||

| Customer Type | Type of the customer for the which the duplicate id is found | ||

| Short Name | Short name | ||

| SSN | Social Security Number of the customer | ||

| Full Name | Full name |

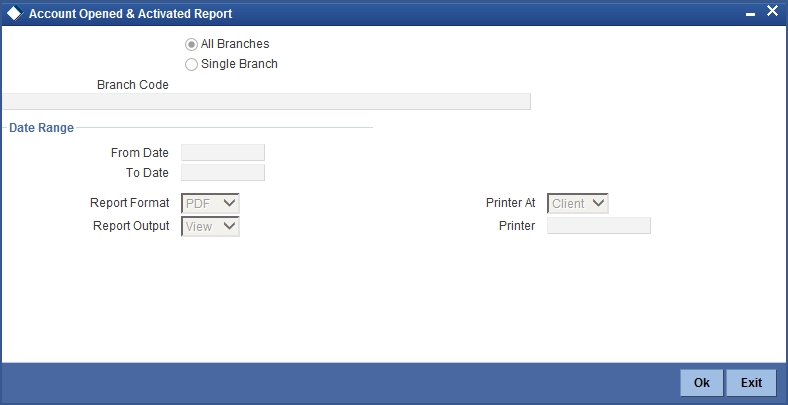

17.21 Account Opened and Activated Report

This section contains the following topics:

- Section 17.21.1, "Generating Account Opened and Activated Report"

- Section 17.21.2, "Contents of the Report"

17.21.1 Generating Account Opened and Activated Report

You can generate Account Activated Report using ‘Account Opened and Activated Report’ screen. You can invoke this screen by typing ‘CARPAACC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Branch Code

You can generate this report for all the branches or a single branch alone. You can indicate the branch for which the report is being generated using the following options:

- All – If you choose this, the system will generate the report for all the branches.

- Single – If you choose this, you need to specify the branch code for which the report should be generated. The option list displays all valid branch codes maintained in the system. Choose the appropriate one.

Date Range

From Date

Specify a valid date from when you wish to generate the report from the adjoining calendar.

To Date

Specify a valid date till when you wish to generate the report from the adjoining calendar.

17.21.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Report Name | Indicates Report Name | ||

| Branch Code / Branch Name | Indicates Current Branch code and Branch Name | ||

| User ID | Indicates the Identification of the User | ||

| Module | Indicates the Module of the Report | ||

| Report Run Date | Indicates the date on which the report was generated | ||

| Report Run Time | Indicates the time of report generation |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Category | Indicates the category | ||

| Branch Code | Indicates the branch code | ||

| Branch Name | Indicates the name of the branch | ||

| Customer Account | Indicates customer account | ||

| Customer Name | Indicates customer name | ||

| Account Open Date | Indicates the date when the account was opened | ||

| Account Type | Indicates the type of account | ||

| Currency | Indicates the account currency | ||

| RM Code | Indicates the relationship manager code | ||

| Passport/Licence Number | Indicates the passport or license number | ||

| Maker | Indicates the name of the maker of the record | ||

| Maker Date | Indicates the date when the record was created | ||

| Checker | Indicates the name of the checker who authorized the record | ||

| Checker Date | Indicates the date on which the record was authorized |

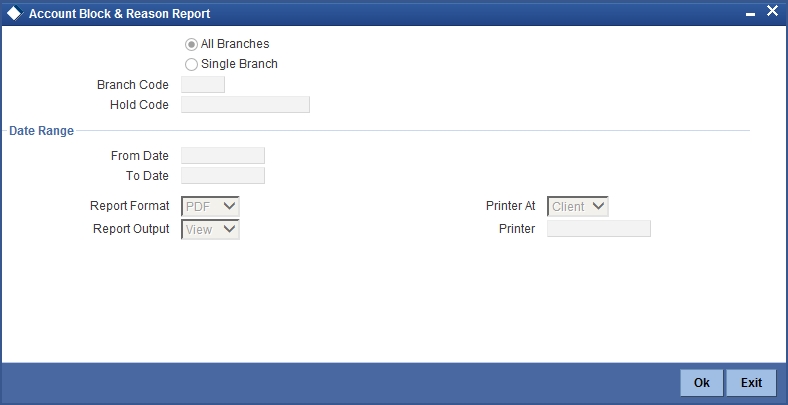

17.22 Account Block and Reason Report

This section contains the following topics:

- Section 17.22.1, "Generating Account Block and Reason Report"

- Section 17.22.2, "Contents of the Report"

17.22.1 Generating Account Block and Reason Report

You can generate Account Blocked Report using ‘Account Block and Reason Report’ screen. You can invoke this screen by typing ‘CARPACCB’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Branch Code

You can generate this report for all the branches or a single branch alone. You can indicate the branch for which the report is being generated using the following options:

- All – If you choose this, the system will generate the report for all the branches.

- Single – If you choose this, you need to specify the branch code for which the report should be generated. The option list displays all valid branch codes maintained in the system. Choose the appropriate one.

Hold Code

The system allows to generate the amount block report based on hold code criteria.

Date Range

From Date

Specify a valid date from when you wish to generate the report from the adjoining calendar.

To Date

Specify a valid date till when you wish to generate the report from the adjoining calendar.

17.22.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Report Name | Indicates Report Name | ||

| Branch Code / Branch Name | Indicates Current Branch code and Branch Name | ||

| User ID | Indicates the Identification of the User | ||

| Module | Indicates the Module of the Report | ||

| Report Run Date | Indicates the date on which the report was generated | ||

| Report Run Time | Indicates the report generation time |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Branch | Indicates the branch code | ||

| Branch Name | Indicates the name of the branch | ||

| Account Number | Indicates the customer account number | ||

| Currency | Indicates the account currency | ||

| Amount Block Number | Indicates the amount block number | ||

| Hold Code | Indicates the hold code | ||

| Customer Name | Indicates the name of the customer | ||

| Maker | Indicates the maker ID of the record | ||

| Maker Date | Indicates the date when the record was created | ||

| Checker | Indicates the checker ID of the record | ||

| Checker Date | Indicates the date on which the record was authorized | ||

| Blocked Date | Indicates the blocked date | ||

| Expiry Date | Indicates the date of expiry of Block | ||

| Amount | Indicates the blocked amount | ||

| Reason | Indicates the reason of Block |

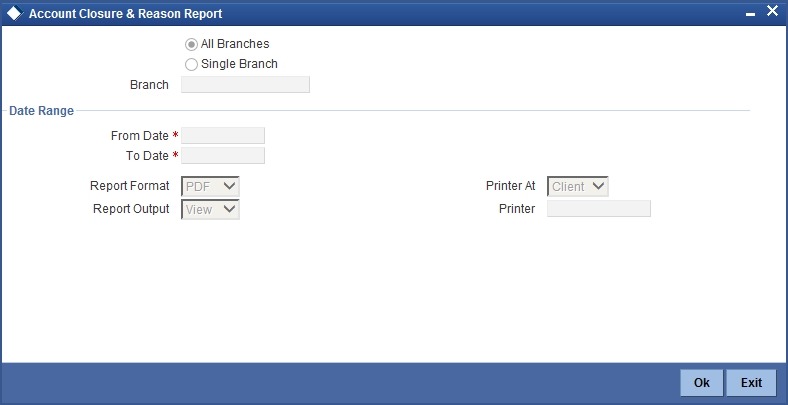

17.23 Account Closure and Reason Report

This section contains the following topics:

- Section 17.21.1, "Generating Account Opened and Activated Report"

- Section 17.23.2, "Contents of the Report"

17.23.1 Generating Account Closure and Reason Report

You can generate Account Closure Report using ‘Account Closure and Reason Report’ screen. You can invoke this screen by typing ‘CARPACCL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Branch Code

You can generate this report for all the branches or a single branch alone. You can indicate the branch for which the report is being generated using the following options:

- All – If you choose this, the system will generate the report for all the branches.

- Single – If you choose this, you need to specify the branch code for which the report should be generated. The option list displays all valid branch codes maintained in the system. Choose the appropriate one.

Date Range

From Date

Specify a valid date from when you wish to generate the report from the adjoining calendar.

To Date

Specify a valid date till when you wish to generate the report from the adjoining calendar.

17.23.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Report Name | Indicates Report Name | ||

| Branch Code / Branch Name | Indicates Current Branch code and Branch Name | ||

| User ID | Indicates the Identification of the User | ||

| Module | Indicates the Module of the Report | ||

| Report Run Date | Indicates the date on which the report was generated | ||

| Report Run Time | Indicates time of report generation |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Branch Code | Indicates the branch code | ||

| Branch Name | Indicates the name of the branch | ||

| Closure Date | Indicates the closure date of the Account | ||

| Account Number | Indicates the customer account number | ||

| Account Currency | Indicates the account currency | ||

| Customer Name | Indicates the name of the customer | ||

| Accrued Profit Amount | Indicates the accrued profit amount | ||

| Account Current Balance | Indicates the current account balance | ||

| Reason | Indicates the reason of the closure | ||

| Approved By | Indicates by whom the account closure is approved | ||

| Maker ID | Indicates the Maker ID of the record | ||

| Checker ID | Indicates the Checker ID who authorized the record |

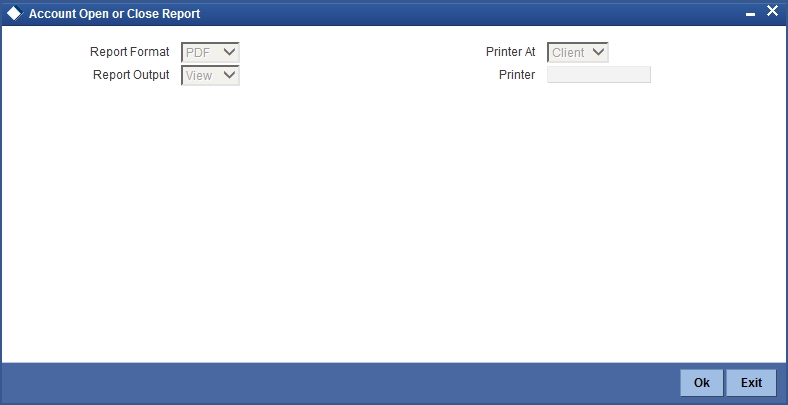

17.23.3 Account Open or Close Report

This section contains the following topics:

- Section 17.23.4, "Generating Account Open or Close Report"

- Section 17.23.5, "Contents of the Report"

17.23.4 Generating Account Open or Close Report

You can generate Account Open or Closure Report using ‘Account Open or Close Report’ screen. You can invoke this screen by typing ‘CARPAOCR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

17.23.5 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the report is as follows:

Header

The following details are displayed in the header section:

| Field Name | Field Description | ||

|---|---|---|---|

| Report Name | Indicates Report Name | ||

| Branch Code / Branch Name | Indicates Current Branch code and Branch Name | ||

| User ID | Indicates the Identification of the User | ||

| Module | Indicates the Module of the Report | ||

| Report Run Date | Indicates the date on which the report was generated | ||

| Report Run Time | Indicates the time of report generation |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

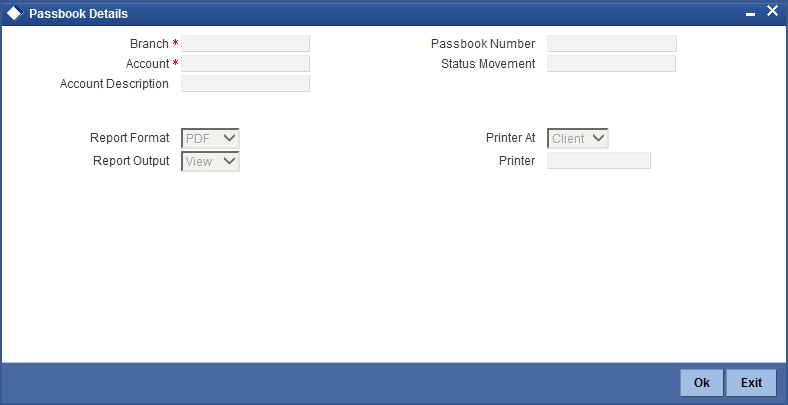

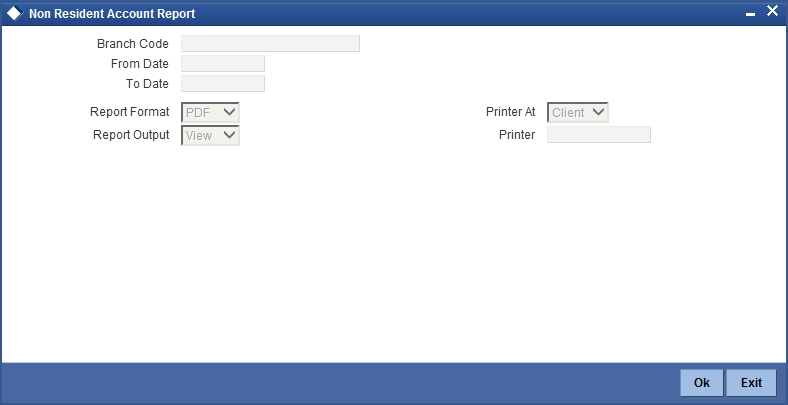

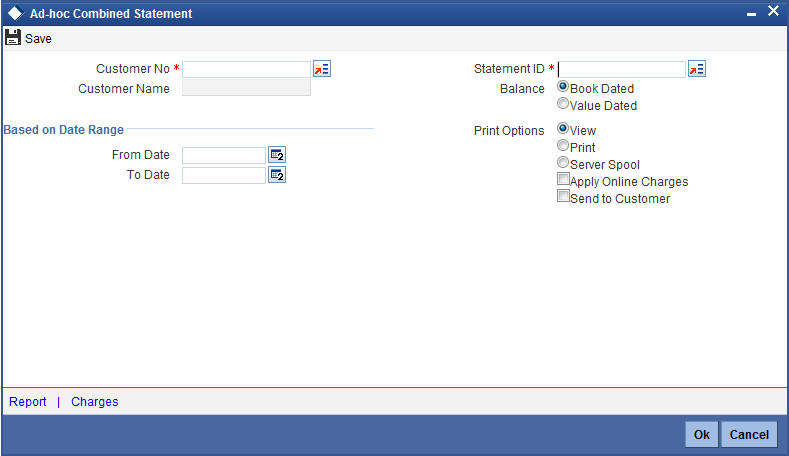

| Account Number | Indicates the customer account number | ||