7. Automatic Events in Life-Cycle of Deposit

The following are the various events in the life cycle of a deposit that could be carried out automatically:

- The initiation of a deposit with a Value Date in the future

- The application of the appropriate interest rates for deposits with Floating Interest

- The generation of a Billing Notice as a reminder of a payment

- The liquidation of a scheduled repayment

- The rollover of a deposit

- The periodic accrual of ICCF components

- The application of rate changes with a Value Date in the future

You would have noticed that some activities that can be carried out automatically will be done so only on a specific instruction from you. The following are such activities:

- The liquidation of a scheduled repayment

- Rollover of a deposit

The Automatic Contract Update function should be executed at least twice during the day: once before you begin transaction related activities for the day (that is, as a part of the Beginning of Day activities); and once after you have finished all the transaction related activities for the day. If any transaction related activity is carried out after the function has been run, as part of End of Day (EOD) activities, you have to execute it again so that the processing that may be necessitated by the transaction related activity is carried out.

This chapter contains the following sections:

- Section 7.1, "Branch Parameters"

- Section 7.2, "Automatic Contract Update Function"

- Section 7.3, "Renewal of Deposit"

- Section 7.4, "Interest Rate Revision on Deposit"

- Section 7.5, "Value Dated Changes"

- Section 7.6, "Advices Generated for Value Dated Changes"

7.1 Branch Parameters

This section contains the following topics:

- Section 7.1.1, "Specifying Branch Parameters"

- Section 7.1.2, "Viewing Deposits Branch Parameter Details"

7.1.1 Specifying Branch Parameters

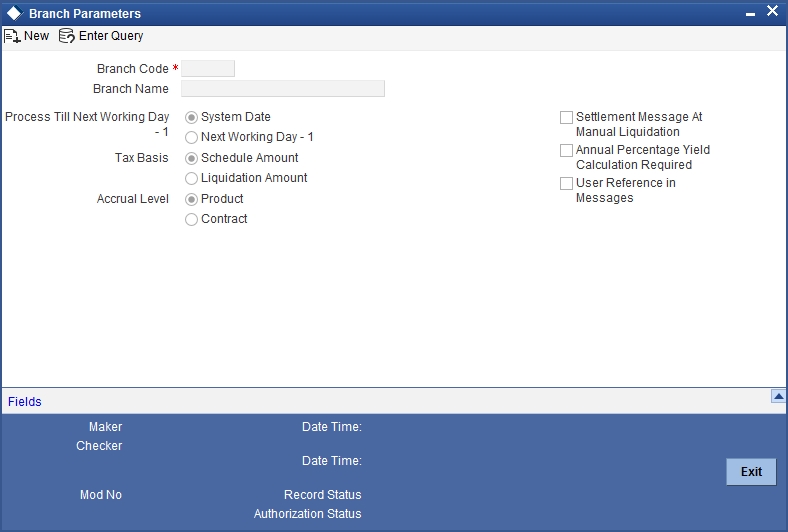

A set of rules that govern deposits disbursed through the Deposits module in a particular branch are defined through the ‘Money Market/Corporate Deposits/Syndication Branch Parameters’ screen. You can invoke the ‘Money Market/Corporate Deposits/Syndication Branch Parameters’ screen by typing ‘LDDBRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the branch code. Branch code is the unique identifier of any branch.

Branch Description

The branch description defined for a particular branch code in the Branch Parameter screen is displayed, wherever the branch code is used.

Processing for Holidays (Automatic Events)

Automatic processing like accruals, scheduled repayment, generation of billing advices or delinquency notices, etc., falling due on a holiday will be processed either on the last working day before the holiday, or on the first working day after it. The definition for this should be as follows:

- System Date

- Next Working Day – 1

System Date

If you specify that processing of automatic events should be done up to the System Date, automatic events scheduled till (inclusive of) today will be processed.

Next Working Day – 1

This specification means that events scheduled for a holiday should be processed on the last working day before the holiday.

If you indicate this, all the events that fall on a day between the current system date and the next working date will be processed.

Specifying Tax Basis

On a deposit you may have to pay tax to the Government on the interest your customer earns. The tax can be paid on the basis of the following:

- Schedule Amount

- Liquidated Amount

Schedule Amount

If you indicate that the tax basis is to be the schedule amount, every time the schedule is liquidated, you will have to withhold 3% tax on USD 200, the schedule amount (USD 200 falls into the first slab). USD 6 will have to be withheld every time an interest schedule of USD 200 is liquidated.

Liquidated Amount

If you indicate that the tax basis is to be the liquidated amount, then the tax will be calculated on USD 1,200, the total interest, which will be liquidated for the deposit at Maturity. This falls into the second slab and hence 4% is applied on USD 1,200. This works out to USD 48, and is spread out over the six schedules. That is, you will have to withhold USD 8, as tax, every time an interest schedule of USD 200 is paid to the customer.

For your branch, you can specify the amount on which tax has to be applied, in Branch Parameters Screen.

This is how it works:

You have the following tax slab for levying tax on interest earned:

0 to 5000 3%

>5000 to 20000 4%

>20000 and above 5%

Now you have a deposit, which starts on 1 January 1998 and ends on 31 March 1998. It has a fortnightly interest payment schedule and at each schedule, USD 200 is paid.

Setting Accrual Level

You can set the accrual at the following level:

- Product

- Contract

Product

To recall, at the time of creating a product, you specify

- Whether accrual of interest is allowed for the product

- The accounting entries that should be passed for the accrual event

- The frequency at which the accrual entries should be passed

A deposit will inherit the accrual frequency defined for the product associated with it. Since the accounts (the accrual account and the income account) are defined for a product, the accrual entries for all deposits involving the product will be passed to the same accounts.

These entries can be passed in two ways:

- An entry for each deposit. The same accrual and income account will be involved for each entry, with the Reference Number of the deposit indicated for each deposit.

- A single consolidated entry for all deposits involving a product. Since the same accrual and income account will be involved in all accrual entries, a single consolidated entry will be passed, with a unique reference number generated for each product.

The idea of generating a single entry for all deposits involving a product is to reduce the number of entries and thus, the processing time. The details of entries passed for each deposit will be available in the Accrual Control Journal, a report that should be generated after the accruals have been made.

Whether interest accrual entries are passed as a single consolidated entry for a product, or as an individual entry for each deposit, should be specified for a branch.

Note

This specification is applicable only for automatic periodic accrual entries. When there is an accrual necessitated by a payment or a change in the terms of a deposit, the entries will be for the specific deposit affected by the change.

Settlement Message At Manual Liquidation

This option specifies whether you want to generate settlement messages for all contracts with manual liquidation. Settlement messages will be generated for all the contracts with manual liquidation according to the parameters you have specified in the Corporate Deposits Branch Parameters screen.

These messages will be generated on the settlement message days prior to the date of repayment of the contract. Each account that is affected by the payment will receive a settlement message.

Annual Percentage Yield Calculation Required

Check this box to indicate that Annual Percentage Yield (APY) should be calculated so as to enable the customer to compare interest rates offered by different banks.

Note

For a contract, APY is calculated during takedown, or during Value Dated amendments or contract amendments resulting in change of cash flows (change of schedule) only if this parameter has been enabled at the Branch as well as the product level. The rates would also be re-calculated whenever there is either liquidation (partial, pre-payment or full liquidation) or rollover.

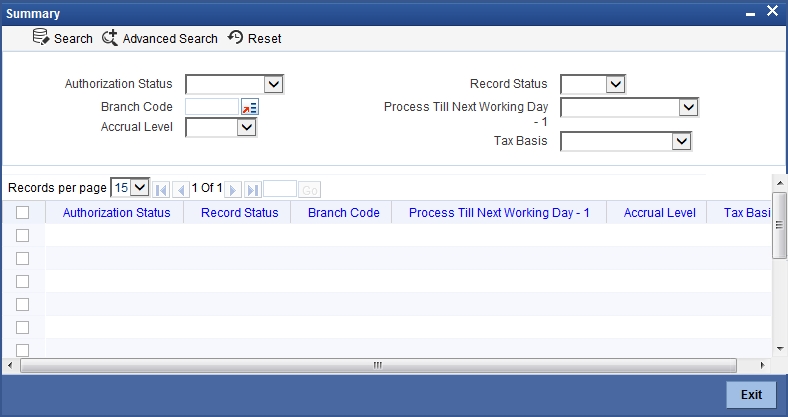

7.1.2 Viewing Deposits Branch Parameter Details

You can view the Deposits Branch Parameter Details using ‘Money Market Corporate Deposits/Syndication Branch Parameter - Summary’ screen. You can invoke the ‘Money Market Corporate Deposits/Syndication Branch Parameter - Summary’ screen by typing ‘LDSBRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen, specify the following details. Based on any of the below details, you can query the cluster details.

Authorization Status

Query details based on authorised or unauthorized.

Branch Code

Specify the branch code for which you want to query the details.

Accrual Level

Set the accrual at the following level:

- Product

- Contract

Tax Basis

Specify the tax basis. On a deposit you may have to pay tax to the Government on the interest your customer earns. The tax can be paid on the basis of the following:

- Schedule Amount

- Liquidated Amount

7.2 Automatic Contract Update Function

This section contains the following topics:

- Section 7.2.1, "Initiating Automatic Contract Update Function"

- Section 7.2.2, "Processing During Beginning of Day"

- Section 7.2.3, "Processing During End of Day"

- Section 7.2.4, "Processing for Holidays"

- Section 7.2.5, "Initiating Future Value Dated Contract"

- Section 7.2.6, "Processing Automatic Repayment"

- Section 7.2.7, "Advices Generated for Repayment"

7.2.1 Initiating Automatic Contract Update Function

You can invoke the Automatic Contract Update function from the Application Browser. For any event involving accounts in a foreign currency, this function will use the conversion rate in the Currency table, for converting an amount to local currency.

Ensure that you update the conversion rates in the Currency table with rates for the day, before you execute the Automatic Contract Update function.

7.2.2 Processing During Beginning of Day

All the automatic events scheduled for the day, except the accrual of ICCF components, will be carried out when the function is executed during the Beginning of Day operations. In addition, all the activities scheduled for the holidays will be carried out if today follows a holiday(s) and you have specified that such activities should be processed on the immediate working day that succeeds a holiday.

7.2.3 Processing During End of Day

When the function is executed during End of Day activities, the processing will be for:

- The accrual of ICCF components scheduled for the day.

- Any Value Dated change (change in interest rates, etc.) that were done during the day with a Value Date as the current system date, and

- Activities scheduled for holidays (if the current system date is preceded by holiday(s) and you have specified that activities falling on holidays should be processed on the last working day preceding a holiday).

If an event scheduled to be automatically carried out is not executed for some reason, it will be reported in the Exception Report generated by the function. The details of an event that could not be initiated along with the reason will be reported in the Exception Report.

7.2.4 Processing for Holidays

Any automatic event that is scheduled for a holiday will be processed as per your specifications in the Branch Parameters table:

- If you have specified that processing must be done on the last working day (before the holiday) for automatic events that fall due on holidays, the events falling on the holiday will be processed during End of Day on the last working day before the holiday.

- If you have specified that processing must be done only up to the System Date (today), then only the events scheduled for the system date (the last working day before the holiday) will be processed. The events that fall due on the holiday will be processed on the next working day after the holiday, during Beginning of Day processing.

7.2.5 Initiating Future Value Dated Contract

A future dated deposit is one that has a Value Date that is later than the date on which it is booked. The Automatic Contract Update function will initiate the deposit on the Value Date of the deposit.

If there were holiday(s) preceding today, future dated deposits that were dated for the holiday(s) will also be initiated if you have specified that events falling on a holiday should be processed, on the next working day.

All the initiation related entries specified for the product involved in the deposit will be passed automatically. If currency conversions are involved, the conversion rates as of today will be picked up from the Currency Table. For a future dated contract falling due today, if there is also a rate change today, the interest amounts are also recalculated for the schedules.

7.2.6 Processing Automatic Repayment

For deposits that have been defined with automatic liquidation of repayments, the liquidation will be carried out by the Automatic Contract Update function.

The schedule will be automatically liquidated on the day it falls due, during Beginning of Day processing.

Now, if you have indicated automatic liquidation, the schedule date falls on a holiday, and you have specified that the holiday be ignored (through the Contract Preferences screen), the liquidation falling due on the holiday, depends on your holiday handling specifications in the Branch Parameters screen:

- If you have specified that processing has to be done today (the last working day before the holiday) for automatic events right up to the day before the next working day the schedule falling on the holiday will be liquidated during End of Day processing on the last working day before the holiday.

- If you have specified that processing has to be done only up to the System Date (today), then only the events scheduled for today (the last working day before the holiday) will be processed. The events of the holiday are processed on the next working day after the holiday, during Beginning of Day processing.

7.2.7 Advices Generated for Repayment

Advices are generated by the Automatic Contract Update function during Beginning of Day processing. While defining a product you may have specified that an advice is to be generated to intimate the customer every time a payment has been liquidated. This will be applicable to all deposits involving the product. (Refer chapter on product definition). However, for a particular deposit, you can suppress this advice.

If a repayment advice has been specified for a deposit, it will be generated by the Automatic Contract Update function when you run it at the Beginning of Day.

7.2.7.1 Generation of Billing Advices and Delinquency Notices

A billing notice or advice can be generated, for the benefit of a customer, as a reminder that a payment is due. When defining a product, you can specify the number of working days before the repayment date, when a billing notice is to be generated.

The notice is generated as part of the Automatic Contract Update function when you run it at the Beginning of Day. The billing advice is generated for the mail medium. This notice will be generated for repayment of all components.

If you have specified that a notice is to be generated on a certain day and it happens to be a holiday, then the notice is generated depending on your holiday handling specifications in the Branch Parameters screen:

- If you have specified that automatic processes are to be carried out up to the next working day, the notices slated for generation on the holiday will be generated during End of Day processing on the last working day before the holiday.

- If you have specified that the automatic processes are to be carried out only till System Date (today’s date), notices slated for generation on the holiday will be generated on the next working day immediately after the holiday during Beginning of Day processing.

If the number of days is increased, the system checks for deposit with a payment date between the old and the new number of days and will send a billing notice.

If the number of days is decreased, the system will check to see if a notice has been sent already, to avoid duplication. If not, it will send the notice.

7.3 Renewal of Deposit

This section contains the following topics:

- Section 7.3.1, "Renewing Deposits Automatically"

- Section 7.3.2, "Advices for Renewal"

- Section 7.3.3, "Accrual of ICCF Components"

- Section 7.3.4, "Contents of Accrual Control Journal"

7.3.1 Renewing Deposits Automatically

A Rollover is renewal of a deposit. For a deposit to be rolled over it:

- Should be past it Maturity Date

- Should not have been liquidated

If you have specified automatic liquidation and automatic rollover for a deposit, the old deposit will be liquidated and a new one initiated on the Maturity Date of the deposit during the BOD (Beginning of Day) run of the Automatic Contract Update function.

If the Maturity Date falls on a holiday, the liquidation and the rollover will be processed as per your holiday handling specifications in the Branch Parameters screen.

- If you have specified that processing has to be done today (the last working day before the holiday) for automatic events right up to the day before the next working day, the schedule falling on the holiday will be liquidated during End of Day processing on the last working day before the holiday.

- If you have specified that processing has to be done only up to the System Date (today), then only the events scheduled for today (the last working day before the holiday) will be processed. The events of the holiday will be processed on the next working day after the holiday, during Beginning of Day processing.

If you have defined that the deposit be liquidated manually, you cannot roll it over automatically.

When a deposit is rolled over or renewed for the interest, charge or fee components, it can assume the following attributes:

- Those of the product involving the deposit being rolled over, or

- Those of the original deposit itself.

You can specify this at the time of processing the old deposit.

7.3.2 Advices for Renewal

When creating a product, you can opt to generate an advice that would intimate your customer that a deposit (the customer’s) is rolled over. This will apply to all deposits involving the product. (Refer chapter on product definition).

The Automatic Contract Update function generates the advices, if you have specified them for the renewal of the deposit, during its Beginning of Day run.

7.3.3 Accrual of ICCF Components

When you are defining the interest, commission, charge or fee components (ICCF components) for a deposit product, you should also specify whether accruals have to be done for the accruable ICCF components. You can specify this through the Product- ICCF details screen.

If accruals should be done, the frequency of accrual should also be specified for a product (through the Product Preferences screen, at the time of product definition).

For all deposits for which accruals fall due today, the Automatic Contract Update function will pass the accrual entries. Accrual of interest, commission, charge or fee is done during the End of Day processing of the Automatic Contract Update function. In some cases, if an event occurs in between two scheduled accruals, accrual entries are passed for that event, immediately.

For example,

The last accrual date for Ms Yvonne Cousteau’s deposit was 31 March 1998 and the next one is due on 30 April 1998. Now, if a manual liquidation is done on 15 April 1998, the accrual entries are passed immediately by the system.

If a schedules accrual falls on a holiday, the accruals are done as per your holiday handling specifications for automatic processes, in the Branch Parameters screen.

- If you have specified that processing has to be done today (the last working day before the holiday), for automatic events right up to the day before the next working day, the events falling on the holiday will be processed during End of Day on the last working day before the holiday.

- If you have specified that processing has to be done only up to the System Date (today), then only the events scheduled for today (the last working day before the holiday) will be processed. The events of the holiday will be processed on the next working day after the holiday, during Beginning of Day processing.

The accrual and income accounts will be picked up based on your definition in the Chart of Accounts. An Accrual Control Journal is generated by the Automatic Contract Update function, reporting the details of the accruals performed.

Interest Accruals

During periodic accruals for a contract, interest accruals also depend on the interest period basis defined for the contract. The interest period basis determines whether the interest calculation for schedules takes into account the schedule start dates or the end dates, or both, or whether it excludes both. For each of the interest period basis options, interest accruals would take place as follows:

- For the options ‘Include To Date’ and ‘Exclude From and To Dates’, accruals do not begin from the contract value date, but from the next day after the contract value date.

- For the options ‘Include To Date’ and ‘Include From and To Dates’, accruals for the schedule date are effected before liquidation, and not during the End of Day processes.

7.3.4 Contents of Accrual Control Journal

The memo accrual function will give you the latest accrual amounts for all components of a live contract without actually passing the accrual entries. The memo accrual function generates the Memo Accrual Control Journal that reports the accrued amounts for the various components of the contract, (like interest, commission, charge or fee) that are due on each deposit as of the current system date.

7.4 Interest Rate Revision on Deposit

The type of interest that is applicable on a deposit depends on the definition of the product that it involves. If floating interest rates are applicable for a product, the frequency at which the changing interest rates should be applied on contracts involving it will also be defined for the product.

The Interest Rate Type of a product can be one of the following: fixed, floating, zero or special. The floating interest rates are defined through this screen. A Rate Code identifies a set of rates defined for a combination of Currency, Amount Limit (optional) and Effective Date. When processing a deposit, you should link it to the floating rate table by indicating the Rate Code.

The rates will be applied to a contract depending on whether it has been defined with Auto Refresh or Periodic Refresh.

The changes in floating rate can be applied on a contract in two ways. In one method called the Auto Refresh method, all the rate changes during the liquidation or accrual period will be considered. In the other method called the Periodic Refresh method, the rates as of a specific frequency or date will be applied.

The Effect of Interest Period Basis on Application of Rate Revisions

| From | To | Rate | |||

|---|---|---|---|---|---|

| 01 October | 14 October | 12 | |||

| 15 October | 30 October | 11.5 |

For floating rate contracts, the application of rate revisions also depends on the interest period basis for interest calculation that has been defined for the contract. The interest period basis determines whether interest calculation for schedules takes into account the From Date, To Date, both the From and To Dates, or excludes both.

For floating rate contracts with Auto Refresh, the revised rate is applied on and after the revision date, for accruals and liquidation. For such contracts, if the interest calculation for schedules takes into account either the To Date or both the From and To Dates, the revised rate is effective on the revision date provided the revision date is not also an interest payment schedule date for the contract. If so, the revised rate is effective on (and following) the next day after the revision date.

For floating rate contracts with Periodic Refresh, the revised rate is applied on and after each refresh date. For such contracts, if the interest calculation for schedules takes into account either the To Date or both the From and To Dates, the revised rate is effective on the refresh date provided the refresh date is not also an interest payment schedule date for the contract. If so, the revised rate is effective on (and following) the next day after the refresh date.

7.5 Value Dated Changes

Value Dated Changes are changes to a contract that come into effect on a specific date called the Value Date. Changes in the interest applied, collection of additional fees, etc., are examples of value dated changes that can be made to a contract.

Such changes indicated for a deposit (through the Value Dated Changes Screen), falling due today (i.e., the Value Date is today’s date), are executed by the Automatic Contract Update function during Beginning of Day. All the necessary accounting entries will be passed and advices specified for the event are generated.

If the Value Dated change is in the rate or amount of any accruable component, the accruals will be done for the deposit with the old rate or amount, as of the previous day (yesterday).

If the Maturity Date of a deposit has been changed so that the contract matures today, the deposit will be liquidated provided all the prerequisites for such a liquidation are met.

Note

For contracts in respect of which the interest calculation for schedules includes the To Date of the schedule, or both the From and To Dates (as specified in the Interest Period Basis preference in the contract details), a value dated amendment such as rate change or principal amendment is effected either on the Value Date of the change, or on the next working day after the Value Date, depending upon the ‘Effective From’ specification made for the value dated amendment.

For such contracts, if the Value Date is a payment schedule date for any of the interest components, the changes come into effect only on the next day after the Value Date of the change; if not, they will come into effect on the Value Date of the change. If the Value Date is not a payment schedule date for any of the interest components, the interest schedules are recomputed based on the specification in the Effective From field.

7.6 Advices Generated for Value Dated Changes

When creating a product, you can specify the advices that are to be generated when a value dated change is made on contracts involving the product. For a deposit involving the product, you can suppress these advices, if you do not want them generated. The Automatic Contract Update function generates the advices you have specified for the deposit, during the Beginning of Day processes. If the value dated change falls on a holiday then its processing and the generation of the advice will be done as per your holiday handling specifications in the Branch Parameters screen.

For example, if you have so specified:

- A future dated contract with a value date of today will be initiated and a contract advice will be generated for the benefit of the customer. If any component (like discounted interest, tax on principal, etc.) is liquidated on takedown, an advice will be generated for each of them.

- In case a change entered through the value dated changes function is due today and is executed, an advice, notifying the customer about the new terms of the contract will be generated.

- In case a floating/periodic rate that affects a contract has changed, an advice notifying the customer of the new rate applicable for the contract will be generated.