11. Deposits Reports

The following are the reports that you can generate for the Deposits module:

- Contract schedules and maturities report

- Forward contracts report

- Value dated amendments report

- Contract events report

- Contract retrieval report

- Memo accrual control journal

- Accrual control journal

- Accrual Analysis Report

- Periodic Rate Revision Report

- Overdue Schedules Report

In the Application Browser these reports are available under the option Reports for the Deposits module.

This chapter contains the following sections:

- Section 11.1, "Contract Schedules and Maturity Report"

- Section 11.2, "Forward Contracts Report"

- Section 11.3, "Value Dated Amendments Report"

- Section 11.4, "Contract Events Report"

- Section 11.5, "Contract Retrieval Report"

- Section 11.6, "Memo Accrual Control Journal"

- Section 11.7, "Accrual Control Journal"

- Section 11.8, "Accrual Control Journal Summary"

- Section 11.9, "Accrual Analysis Report"

- Section 11.10, "Periodic Rate Revision Report"

- Section 11.11, "Overdue Schedules Report"

- Section 11.12, "Overdue Schedules Summary Report"

11.1 Contract Schedules and Maturity Report

This section contains the following topics:

- Section 11.1.1, "Generating Contract Schedules and Maturity Report"

- Section 11.1.2, "Contents of Report"

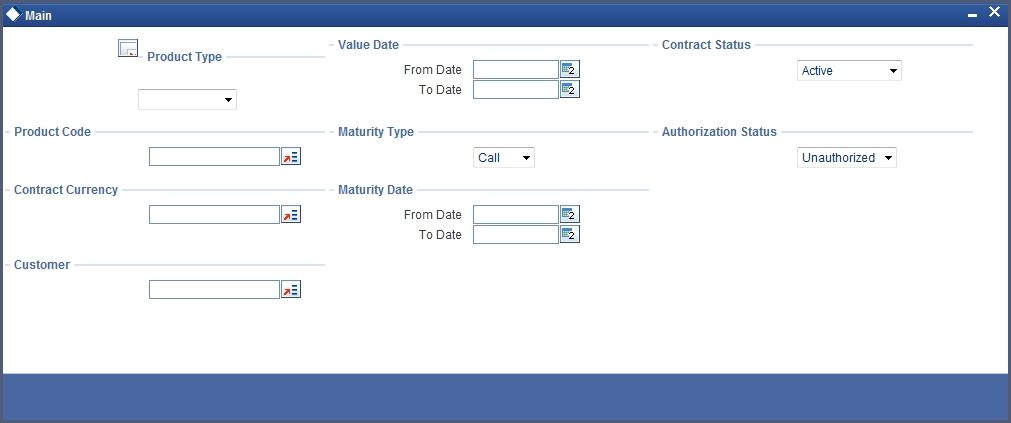

11.1.1 Generating Contract Schedules and Maturity Report

The maturity report gives information about the details of a contract that is:

- Maturing during the period that you specify.

- The details of schedules falling due during that period.

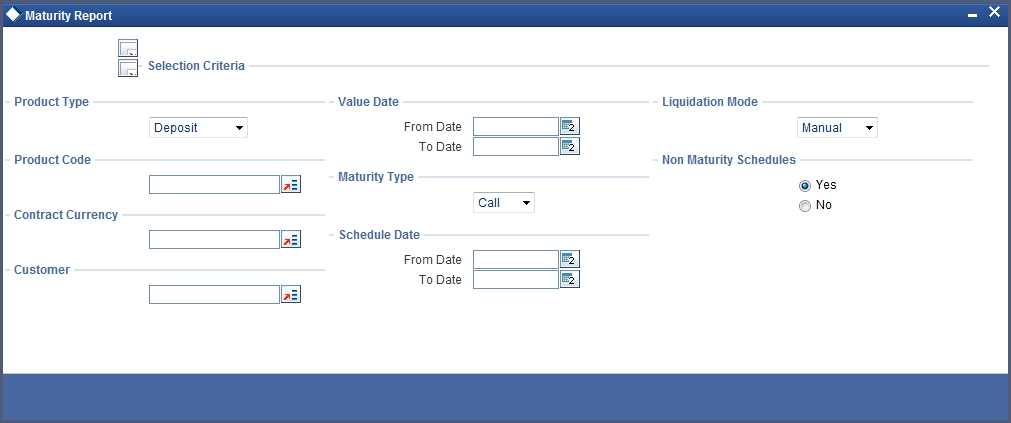

To invoke the screen, choose ‘Report’ from the Application Browser. Thereafter, choose ‘Corporate Deposits’ and ‘Maturity’ under it. You can also invoke this screen by typing ‘LDRPMATR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Selection Options

The report will be generated for all contracts maturing during the period you specify. However to generate a report that includes contracts satisfying certain parameters only, you can specify the following:

Product type

You can generate the Maturity report for a specific product type or for all product types. You can choose to generate the report either for loans, commitments, deposits, or for a combination of any two or for all of them.

Product

You can generate a product-wise report. For instance you can generate a report on a short term Fixed Deposit having a 90 day tenor.

Currency

Under specific Product type(s) and product(s), you can choose to generate reports in specific currency(s).

Customer

You can generate this report for specific customer(s).

Specifying the period

While generating the report you can specify the period (i.e., the From and To dates) for which the report has to be generated.

Maturity type

You can generate the report only for a particular Maturity Type. The Maturity type of a deposit can be:

- Fixed - this type of deposit has a fixed maturity date.

- Call - If the maturity date is not fixed the deposit can be liquidated any time.

- Notice - The deposit will be liquidated at a certain period of notice. You can specify the number of days of notice. Whenever a report is generated on a notice type of deposit the notice days will be mentioned in it.

For instance if you generate the report only for call deposits or notice deposits the due date column will display call or notice depending on the maturity type that you have specified. Only for deposits with a fixed maturity date will the due date be displayed.

Specifying the schedule date for reporting

You can generate the report based on the schedule date for which payment is due.

Liquidation Mode

Components of a deposit can be liquidated automatically or manually. In auto liquidation a schedule will be automatically liquidated on the day it falls due. In manual liquidation a schedule amount has to be liquidated manually.

You can generate the report based on the liquidation mode that you have specified. The report can be generated only for deposits with auto liquidation or you can generate the report for deposits that have to be manually liquidated.

Interim Schedules

You can generate the report for only those deposits with interim schedules for the specified period. When the maturity date and the due date of the contract are not the same it is an interim schedule. When the maturity date and the due date of the contract are the same then the report generated is for maturity schedule.

11.1.2 Contents of Report

For each schedule, the due date and maturity date will be different. However if it is the last schedule then the due date and the maturity date have to be the same.

The report options that you selected while generating the report are printed at the beginning of the report.

Header

The Header carries the title of the report, information on the branch code, the branch date, the user id, the module name, the date and time at which the report was generated and the page number of the report.

Body

The report is sorted on the Due Date in the ascending order.

Due Date

The Due date is reported when a schedule is being reported. When the maturity of a deposit is being reported, the Due Date will indicate the Maturity Date. For a call contract this will be Call. Similarly for a notice contract this will be Notice.

Customer

This is the CIF ID of the customer involved in the deposit.

Contract reference number

This is the reference number of the deposit being reported.

Maturity Date

When the maturity date and the due date of the deposit are not the same it is an interim schedule and not the maturity schedule.

Component

This is the component of the deposit against which the payment due is being reported. If more than one component falls due on the same day they will be reported one by one.

Currency

This is the SWIFT code of the contract currency.

Due Amount

This is the amount that falls due on the Due Date for the component, as per the schedule defined in the contract. This amount does not consider the unpaid amounts that belong to earlier schedules.

EURO Eqv.

This is the EURO equivalent of the due amount.

Outstanding Amount

This is the total outstanding amount that the customer has to repay. This amount includes amounts belonging to earlier schedules that are still due. In case the customer has made pre-payments the outstanding amount can be less than the due amount.

EURO Eqv.

This is the EURO equivalent of the outstanding amount.

11.2 Forward Contracts Report

This section contains the following topics:

11.2.1 Generating Forward Contracts Report

A forward contract is a deposit with a future value date. The value date is the date on which the deposit takes effect. The tenor of the deposit will begin on this date. All accounting entries for the deposit, all calculations for interest and all the other components based on the tenor will be made from this date onwards.

The forward contract report gives details of all the deposits with a future value date. Only contracts that take effect on a date later than or same as the specified date are included in the report.

You can select the following options based on which the report can be generated.

- You can specify the period for which the report has to be generated.

- You can also generate the report for specific type of products.

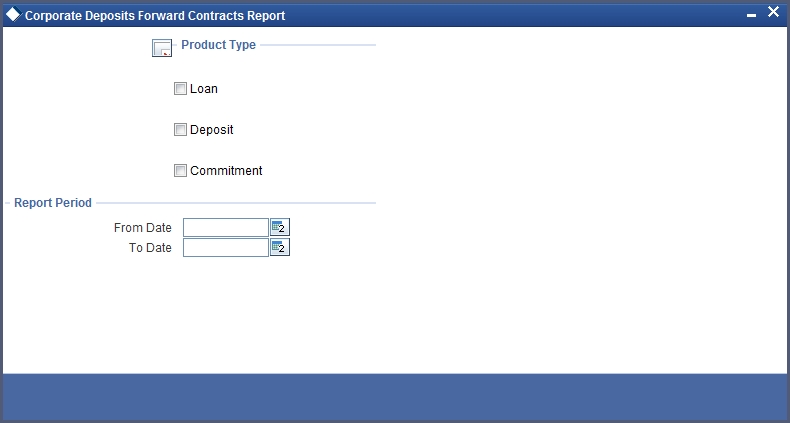

To invoke the screen, choose ‘Report’ from the Application Browser. Thereafter, choose ‘Corporate Deposits’ and ‘Corporate Deposits Forward Contracts Report’ under it. You can also invoke this screen by typing ‘LDRPFRWD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specifying the period

While generating the report you can specify the period (i.e., the From and To dates) for which the report has to be generated.

Product type

You can generate the Forward contracts report for a specific product type or of all product types. For instance you can specify the type of product whose details the report should contain. It could be either for loans, commitments or deposits.

11.2.2 Contents of Report

The report options that you selected while generating this report are printed at the beginning of the report.

Header

The Header carries the title of the report, information on the branch code, the branch date, the user id, the module name, the date and time at which the report was generated and the page number of the report.

Body of Report

The report can be sorted on the Value Date or the Contract Reference Number in the ascending order.

Product Type

This is the type of product for which the report is being generated.

Contract Reference Number

This is the reference number of the deposit being reported.

Counterparty Number

This is the CIF ID of the customer involved in the deposit.

Counterparty Name

This is the name of the customer involved in the deposit.

Amount

This is the principal amount involved in the deposit.

Euro Eqv.

This is the amount converted into EURO

Value Date

This is the date on which the deposit takes effect.

Maturity Type

This is the maturity type of the deposit. It could be fixed, call or notice.

Maturity Date

This is the date on which the deposit matures. The maturity date is generated in the report only in case of fixed maturity deposits.

Notice Days

The number of days of notice will be generated in the report if it is a notice deposit.

Apart from these details, the body of the report displays the following charge and interest details also.

Charge Details

The charge details are:

- Component

- Amount

- EURO Eqv.

- Waiver

Interest Details

The interest details are:

- Component

- Amount

- EURO Eqv.

- Rate

- Rate Code

- Spread

- Waiver

11.3 Value Dated Amendments Report

This section contains the following topics:

11.3.1 Generating Value Dated Amendments Report

Value Dated Amendments, are changes to the terms of a deposit which affect its financial details. The changes to the terms of a deposit take effect on a particular date, called the Value date. You can make changes to the various components of a deposit, like increase in the principal, change in interest rate, etc.

The Value Dated Amendments report gives details on any changes made to the terms of a deposit that come into effect on a future Value Date.

The options for which you can generate the report are as follows:

- You can specify the period for which the report has to be generated.

- You can also generate the report for a specific type of product.

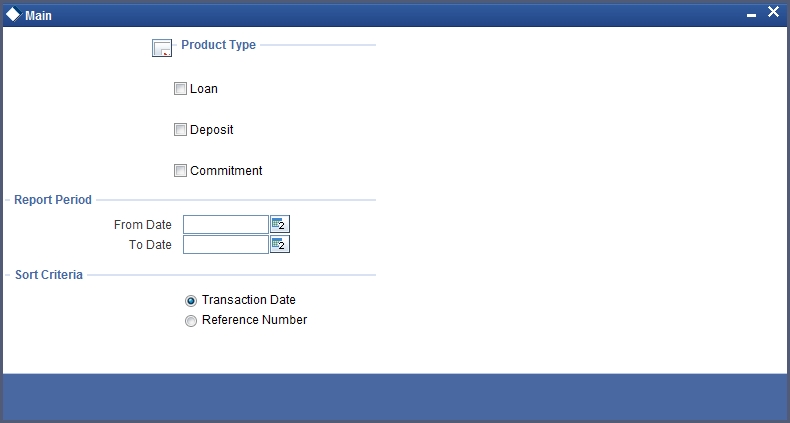

To invoke the screen, choose Report from the Application Browser. Thereafter, choose Corporate Deposits and Corporate Deposits Forward Changes Report - Options under it. You can also invoke this screen by typing ‘LDRPFWCH’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specifying the period

While generating the report you can specify the period (i.e. the ‘From’ and ‘To’ dates) for which the report has to be generated. All the amendments that have been input and are due to come into effect during this period will be generated in the report.

Product type

You can generate the Value Dated Amendments report for a specific product type or for all product types. You can generate the report either for loans, commitments, deposits, or for a combination of any two or all of them.

11.3.2 Contents of Report

The report options that you selected while generating this report are printed at the beginning of the report.

The contents of the Corporate Deposits Forward Changes Report - Options have been discussed under the following heads:

Header

The Header carries the title of the report, information on the branch code, the branch date, the user id, the module name, the date and time at which the report was generated and the page number of the report.

Body of Report

The report can be sorted on the Contract Reference number or the Value Date of the change, in the ascending order.

Contract reference number

This is the reference number of the deposit being reported.

Counter party

This is the CIF ID of the customer involved in the deposit.

Counter party name

This is the name of the customer involved in the deposit.

Maturity date

This is the date on which the deposit matures. The maturity date is reported only in case of fixed maturity deposits.

Value date

This is the date on which the changes specific to the deposit are to take effect.

Amount

This is the original principal amount involved in the deposit.

Currency

This indicates the contract currency.

Transaction Date

This is the date on which the deposit was disbursed.

Amendment date

This is the date, on which the changes that are defined are to take effect (value date of the amendment).

New maturity date

If the amendment being reported is for changing the maturity date of the deposit, the new maturity date will be reported.

Differential amount

This is the amount by which the total principal amount is increased.

Revolving flag

This is reported only for commitments. It reports whether the commitment is revolving or non-revolving.

Component name

This is the name given to the interest component.

New rate

If the amendment being reported is for changing the maturity date of the deposit, the new rate of the interest component is reported.

Old rate

This is the old rate of the main interest.

New rate code

If the deposit has floating interest and the amendment being reported is for a change in the rate code, the new floating rate code defined for the interest is reported.

Old rate code

This is the old floating rate code of the deposit.

New spread

If the deposit has a floating interest and the amendment being reported is for a change in the spread the new spread is reported.

Old spread

This is the old spread for the floating interest deposit

New amount

This is the new principal amount specified for the deposit.

Old amount

This is the original principal amount of the deposit

11.4 Contract Events Report

This section contains the following topics:

11.4.1 Generating Contract Events Report

Contract events are events that have taken place during the tenor of a deposit.

Contract Events report gives a list of all the events that have taken place during the tenor of a deposit. The events are listed by their Value Date.

You can generate the report for the following options:

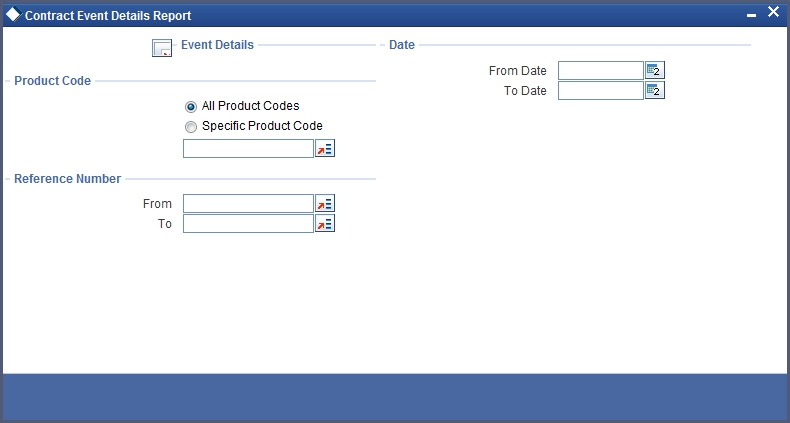

Specifying the period

While generating the report you can specify the period (i.e., the from and to dates), for which the report has to be generated. All the events that have taken place on the deposit during this period will be reported.

Reference number

You can generate the report based on the contract reference number. All the events that have taken place on the particular contract, for the specified period will be reported in the report.

To invoke the screen, go to ‘Report’ on the Application Browser. Click ‘Corporate Deposits’ and select ‘Contract Event’ under it. Otherwise, use the code ‘LDRPEVNT’ on the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

11.4.2 Contents of Report

The contents of the Contract Event Details Report have been discussed under the following heads:

Header

The Header carries the title of the report, information on the branch code, the branch date, the user id, the module name, the date and time at which the report was generated and the page number of the report.

Body

The report can be sorted on the Reference Number of the contract:

Product Code

This is the code of the product for which the details are being reported.

Reference Number

This is the reference number of the deposit being reported.

Counterparty

This is the CIF ID of the customer involved in the deposit.

Currency

This is the SWIFT code of the contract currency.

Event Code

This is the code of the event for which details are being reported.

Event Description

This is the description of the event.

Sequence No

This is the sequence number of the event.

Event Date

This indicates the date on which the event took place.

ICCF Event Date

This indicates the date on which the ICCF event took place.

Item Name

This indicates the name of the item.

Item Value

This indicates the value of the item.

The list of events for which the report will be generated is as follows:

| Event Code | Event Description | ||

|---|---|---|---|

| BOOK | Booking | ||

| INIT | Initiation | ||

| CONF | Confirmation | ||

| DELT | Deletion | ||

| REVC | Reversal of Contract | ||

| REVP | Reversal of Payment | ||

| CAMD | Contract Amendment | ||

| VAMB | Booking Value dated amendment | ||

| VAMI | Initiating Value dated amendment | ||

| IRRN | Rate Revision | ||

| ACCR | ICCF Accrual | ||

| LIQD | Liquidation | ||

| ROLL | Rollover | ||

| NOTC | Notice | ||

| REAS | Reassign User | ||

| STCH | Status Change | ||

| SCDT | Schedule Date |

11.5 Contract Retrieval Report

This section contains the following topics:

11.5.1 Generating Contract Retrieval Report

The Contract Retrieval report gives you comprehensive information about a deposit. Information about deposits that are active, liquidated and reversed can be retrieved through this report. You can generate the report for a variety of reasons.

You can generate the report for the following options:

Product type

You can generate the Contract Retrieval report for a specific product type or for all product types. You can choose to retrieve information only about loans, commitments, deposits, or for a combination of any two or for all of them.

Product

You can generate a product-wise report. For instance you can generate a report on a short term Fixed deposit having a 90 day tenor.

Currency

Under specific Product type(s) and product(s), you can choose to generate the report for deposits in a specific currency(s).

Customer

You can generate this report for specific customer(s).

Specifying the period

While generating the report you can specify the period (i.e. the ‘From’ and ‘To’ dates) for which the report has to be generated. The details of all the deposit made during the specified period will be generated in the report.

Maturity type

You can generate the report only for a particular Maturity Type. The Maturity type of a deposit can be:

- Fixed - this type of a deposit has a fixed maturity date.

- Call - If the maturity date is not fixed the deposit can be liquidated any time.

- Notice - The deposit will be liquidated at a certain period of notice. You can specify the number of days of notice. Whenever a report is generated on a notice type of deposit the notice days will be mentioned in it.

You can generate the report either for fixed maturity deposit, call deposits or notice deposits, for a combination of one or more of them.

Specifying the maturity dates

If you have advanced or post-phoned the maturity date of the deposit, while generating the report you have to specify the original maturity date along with the new maturity date. You can do this by way of specifying the ‘From’ and ‘To’ maturity dates.

Contract status

You can generate the report based on the status of the deposit. For example, the status of the deposit could be active or liquidating. All the deposits with the specified status for the specific period will be reported. You can also generate the report for a combination of status codes.

Auth status

You can generate the report for deposits either with an authorized or unauthorized status.

To invoke the screen, choose ‘Report’ from the Application Browser. Thereafter, choose ‘Corporate Deposits’ and ‘Contract Retrieval’ under it. You can also invoke this screen by typing ‘LDRPRETR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

11.5.2 Contents of Report

The contents of the Contract Retrieval report have been discussed under the following heads:

Header

The Header carries the title of the report, information on the branch code, the branch date, the user id, the module name, the date and time at which the report was generated and the page number of the report.

Body of Reports

Product

This is the product for which the report is generated.

Description

This is the description of the product for which details are being reported.

Product type

This is the product type to which the generated report belongs.

Payment method

This is the method in which the payments are being made.

Contract reference number

This is the reference number of the deposit being reported.

Contract status

This is the current status of the deposit.

Outstanding amount

This is the total outstanding amount that the customer has to repay. This amount includes amounts, belonging to earlier schedules that are still due. In case the customer has made pre-payments, the outstanding amount may be less than the due amount.

EURO Equivalent

This is the EURO equivalent of the outstanding amount.

User Ref. No

This is the user reference number.

Customer

This is the name of the customer.

Related Ref No

This is the related reference number.

Contract Currency

This is the currency in which the contract is defined.

Contract Amount

This is the contract amount.

Original Start Date

This is the original start date of the contract.

Booking Date

This is the booking date of the contract.

Value Date

This is the value date of the contract.

Maturity Type

This is the type of maturity of the contract.

Maturity Date

This is the maturity date of the contract.

Notice Days

This is the notice days.

Tenor

This is the tenor of the contract

User Defined Status

This is the user defined status of the contract.

Auth Status

This is the authorization status of the contract.

Broker

This is the broker code of the contract

Cluster ID

This is the cluster ID.

Cluster Size

This is the size of the cluster.

Credit Line

This is the credit line of the contract.

Tax Scheme

This is tax scheme of the contract

Commitment Type

This is the type of commitment.

Schedule Type

This is the type of schedule.

Amortization Type

This is the type of amortization

Liquidation Mode

This is the mode of liquidation of the contract.

Rollover Allowed

This indicates if rollover is allowed for the contract.

Rollover Mode

This is the mode of rollover.

Rollover Count

This is the rollover count.

Status Control

This is the status control of the contract.

Template Status

This is the template status of the contract.

Component

This is the component of the deposit against which, the payment due is being reported. If more than one component falls due on the same day, then they will be reported one at a time.

Currency

This is the SWIFT code of the contract currency.

Rate type

This is the interest rate type of the deposit. It could be fixed, floating or special.

Code Usage

If the interest rate type is set to floating, then this indicates whether the rate usage is automatic or periodic.

Interest basis

This is the basis on which interest is calculated.

Rate code

If the interest rate type is set to floating, then the rate code defined for the deposit is reported.

Current rate (%)

This is the interest rate applicable for the component, as of the date of report generation.

Current spread

If the interest rate type is floating the current spread, applicable over the rate maintained, is reported as of today.

Flat amount

When the interest rate type is special the flat amount applicable is reported.

11.6 Memo Accrual Control Journal

This section contains the following topics:

11.6.1 Generating Memo Accrual Control Journal

The Memo Accrual Function will give you the latest accrual amounts for all components of a contract for which accruals are applicable, without actually passing the accrual entries. Through this function you can generate the Memo Accrual Control journal.

You can generate the report for the following options:

Product

You can generate the report for specific products or all.

Accrual Processing Date

You can generate the report to get the accrual figures as of a specific date.

11.6.2 Contents of Report

Apart from the header the following information is provided for each contract:

Body of Report

Accrual processing date

This is the date, as of which the accrual entries for the deposit were passed.

Contract reference number

This is the reference number of the deposit being reported.

Status

This is the current status of the deposit being reported.

Component

This is the component of the deposit against which accrual entries are being reported.

Currency

This is the SWIFT code of the contract currency.

Current accrual

This is the amount for which accruals are projected for the current month.

Outstanding accrual

This is the total amount that is due for the deposit, which is yet to be liquidated.

11.7 Accrual Control Journal

This section contains the following topics:

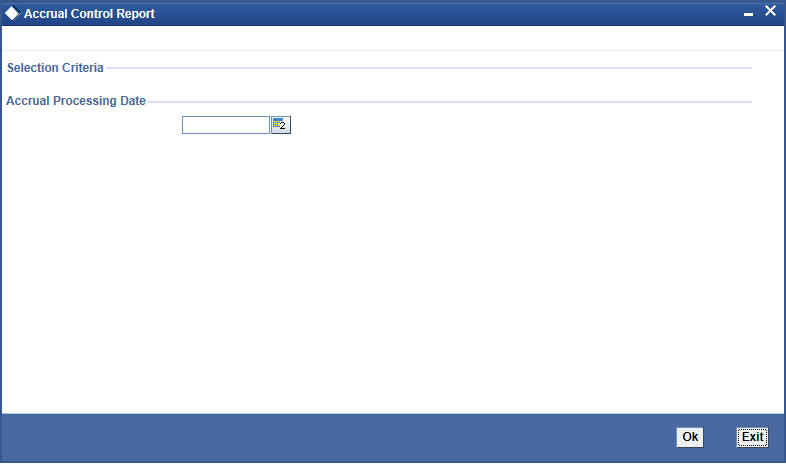

11.7.1 Generating Accrual Control Journal Report

The accrual control journal gives the details of accruals done on deposits, as of a specific date. For Non Accrual Basis (NAB) contracts, the interest, commission, fees, penalty interest and penalty commission are calculated but no accrual entries are passed.

You can generate the report for the following options:

Accrual Processing Date

You can generate the report by way of specifying the dates on which the accrual entries will be passed.

To invoke the screen, go to ‘Report’ on the Application Browser. Click ‘Corporate Deposits’ and select ‘Accrual Control’ under it. Otherwise, use the code ‘LDRPACCR’ on the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

11.7.2 Contents of Report

The contents of the Accrual Control Report have been discussed under the following heads:

Header

The Header carries the title of the report, information on the branch code, the branch date, the user id, the module name, the date and time at which the report was generated, the page number of the report and accrual processing date.

Body

Contract reference number

This is the reference number of the deposit being reported.

Status

This is the current status of the deposit being reported.

Component

This is the component of the deposit against which accrual entries are passed.

Currency

This is the SWIFT code of the contract currency.

Accrual

If there is accrual or not.

Current accrual

This is the amount for which accrual entries are passed for the current month.

Outstanding accrual

This is the total amount that has been accrued till date, for the deposit.

11.8 Accrual Control Journal Summary

This section contains the following topics:

- Section 11.8.1, "Generating Accrual Control Journal Summary Report"

- Section 11.8.2, "Contents of Report"

11.8.1 Generating Accrual Control Journal Summary Report

The Accrual Control List Summary report summarizes the details of accruals done for particular contracts.

11.8.2 Contents of Report

The contents of the Accrual Control List Summary have been discussed under the following heads:

Header

The Header carries the title of the report, information on the branch code, the branch date, the user id, the module name, the date and time at which the report was generated, the page number of the report and accrual processing date.

Body Product

This is the product for which the report is being reported.

Component

This is the component of the deposit against which accrual entries are passed.

Currency

This is the SWIFT code of the contract currency.

Status

This is the current status of the deposit being reported.

Accrual

If there is accrual or not.

Cumulative current accrual

This is the amount for which accrual entries are passed, for the current month.

Cumulative outstanding accrual

This is the total amount that has been accrued so far, for the deposit.

Accrual reference number

This is the reference number of the accrual being reported.

11.9 Accrual Analysis Report

This section contains the following topics:

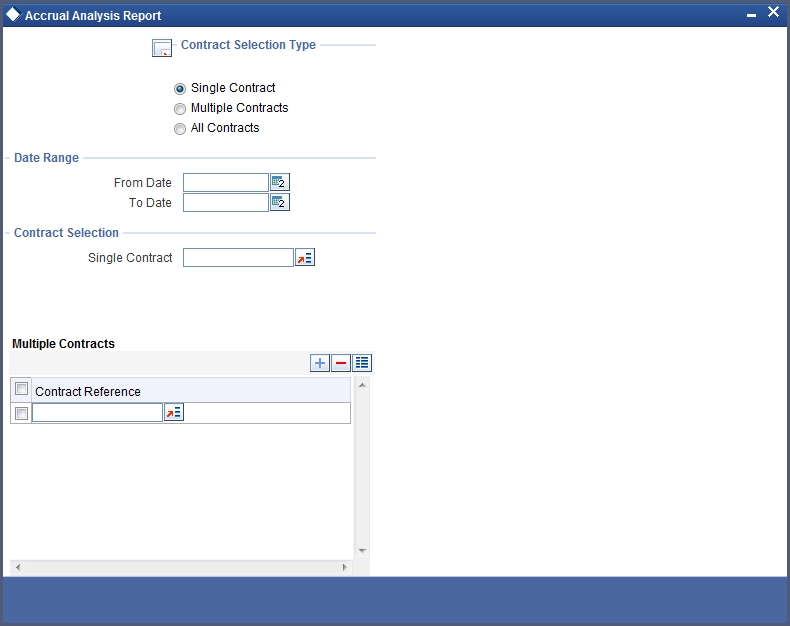

11.9.1 Generating Accrual Analysis Report

The interest accrual analysis report will give you the interest accrual details. You can generate this report by using ‘Accrual Analysis Report’ screen.

To invoke the screen, type ‘LDRPCALC’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

You can generate the report for the following option:

Contract Selection Type

Indicate the type of contract for which you want to generate report. The following are the options available:

- Single Contract

- Multiple Contracts

- All Contracts

Date Range

Specify the date range to generate the report.

Contract Selection

If you have selected the ‘Single Contract’ option, then select a single contract to generate the report. However, if you selected ‘Multiple Contract’ option, then select the multiple contracts under the ‘Multiple Contracts’ section.

11.9.2 Contents of Report

The contents of interest accrual analysis report have been discussed under the following heads:

Header of Report

The ‘Header’ carries the title of the report, branch code, branch date, user ID, module, date and time at which the report has been generated and the page number of the report.

Body of Report

Reference No

This is the contract reference number.

Counterparty

This is the counterparty ID and name.

Value Date

This is the value date of the contract.

Maturity Date

This is the maturity date of the contract.

Component

This is component of the contract.

Int. Method

This is the interest calculation method.

Start Date

This is the start date of the contract.

End Date

This is the end date of the contract.

Basic Amount

This is the basic amount of the contract.

Rate

This is the rate of interest.

No. of Days

This is the number of days.

Interest Amount

This is the interest amount.

11.10 Periodic Rate Revision Report

This section contains the following topics:

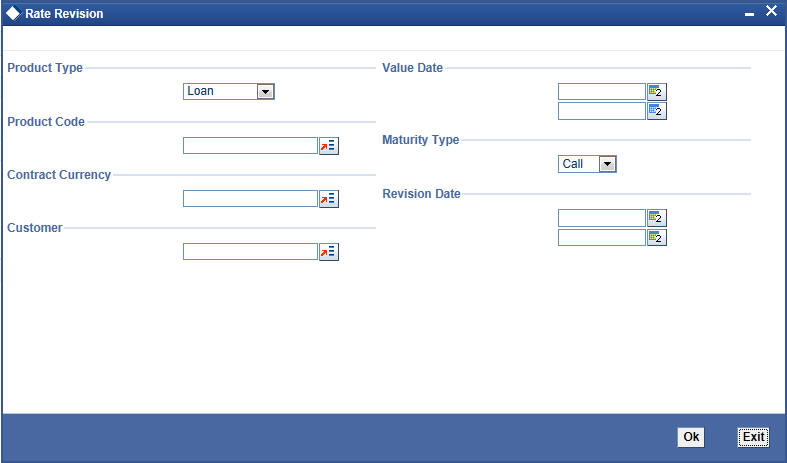

11.10.1 Generating Periodic Rate Revision Report

The periodic rate revision report will give you the details of the periodic rate revisions. You can generate this report by using ‘Rate Revision’ screen.

To invoke the screen, type ‘LDRPREVN’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

You can generate the report for the following option:

Product Type

Indicate the type of product from the adjacent drop-down list.

Value Date

Specify the value date.

Product Code

Specify the product.

Maturity Type

Indicate the type of maturity from the drop-down list.

Contract Currency

Specify the contract currency.

Revision Date

Specify the date of rate revision.

Customer

Specify the customer.

11.10.2 Contents of Report

The contents of periodic rate revision report have been discussed under the following heads:

Header of Report

The ‘Header’ carries the title of the report, branch code, branch date, user ID, module, date and time at which the report has been generated and the page number of the report.

Body of Report

Revn Date

This is the date of the rate revision.

Rate Code

This is the rate code.

Customer

This is the customer for whom the rate has been revised.

Contract Ref. Number

This is the contract reference number.

Ccy

This is the currency of the contract.

Contract Amount

This is the contract amount.

Component

This is the deposit component.

Ccy

This is the currency

Current Rate

This is the current rate of interest.

Current Spread

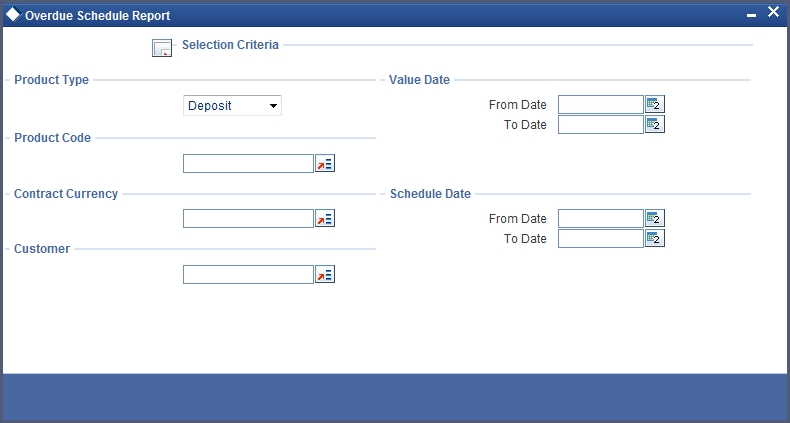

11.11 Overdue Schedules Report

This section contains the following topics:

11.11.1 Generating Overdue Schedules Report

Repayment schedules can be defined for various components of a product such as principal, interest, commission and fees. These schedules will apply to all the deposits involving the product, unless redefined at the time of processing the deposit.

The Overdue Schedules report gives details of all repayment schedules of a deposit that are overdue (i.e., are not paid even when they are beyond, their scheduled repayment dates).

You can generate the report for the following options:

Product type

You can generate the report for a specific product type or for all product types. You can generate the report for loans, commitments, deposits, for a combination of any two or for all of them.

Product

You can generate a product-wise report for schedules that are overdue. For instance, you can generate the report about overdue schedules of a long term deposit product, having a tenor of 15 years.

Currency

Under specific Product type(s), you can choose to generate reports in a specific currency(s).

Customer

You can generate this report for specific customer(s).

Specifying the period

While generating the report you can specify the period (i.e., the from and to dates) for which the report has to be generated.

Specifying the schedules

You can generate the report for specific schedules involving the product. Schedules that have not been defined or liquidated are examples for such schedules.

To invoke the screen, go to ‘Report’ on the Application Browser. Click ‘Corporate Deposits’ and select ‘Overdue Schedules’ under it. Otherwise, use the code ‘LDRPOSCH’ on the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

11.11.2 Contents of Report

The contents of the Overdue Schedule Report have been discussed under the following heads:

Header

The Header carries the title of the report, information on the branch code, the branch date, the user id, the module name, the date and time at which the report was generated and the page number of the report.

Body of Report

Due Date

The Schedule Due Date is reported when a schedule is being reported. When the maturity of a deposit is being reported, the Due Date will be the Maturity Date. For a call contract this will be Call. Similarly for a notice contract this will be Notice.

Overdue days

This indicates the number of days for which the payment is overdue.

Customer

This is the CIF ID of the customer involved in the deposit.

Contract reference number

This is the reference number of the deposit being reported.

Status

This is the current status of the contract being reported.

Component

This is the component of the deposit against which the payment due is being reported. If more than one component falls due on the same day they will be reported one after another.

Currency

This is the SWIFT code of the component currency.

Overdue amount

This is the total amount that is overdue for the component, as per the schedule defined in the contract. This amount takes into consideration, all amounts belonging to earlier schedules that are still due.

EURO Eqv.

This is the EURO equivalent of the overdue amount.

11.12 Overdue Schedules Summary Report

This section contains the following topics:

- Section 11.12.1, "Generating Overdue Schedules Summary Report"

- Section 11.12.2, "Contents of Report"

11.12.1 Generating Overdue Schedules Summary Report

The Overdue Schedules Summary report summarizes the details of each contract:

11.12.2 Contents of Report

Apart from the header the following information is provided for each contract:

Body of Report

Due Date

The Due Date is reported when a schedule is being reported. When the maturity of a deposit is being reported, the Due Date will indicate the Maturity Date. For a call contract this will be Call. Similarly for a notice contract this will be notice.

Overdue days

This indicates the number of days for which the schedule payment is overdue.

Product

This is the product for which the report is being generated.

Component

This is the component of the deposit, against which the payment due is being reported. If more than one component falls due on the same day they will be reported one after another.

Currency

This is the SWIFT code of the contract currency.

Status

This is the current status of the contract being reported.

Cumulative overdue amount

This is the total amount that is overdue for the component(s), as of the date of report generation.