6. Account Creation

This chapter contains the following sections:

- Section 6.1, "Multiple Asset"

- Section 6.2, "Account Details/Light Finances"

- Section 6.3, "Ar Rahnu Account Details"

- Section 6.4, "Event Checklist"

- Section 6.5, "Down Payment Details"

- Section 6.6, "Inactive Account Details"

- Section 6.7, "Finance Simulation"

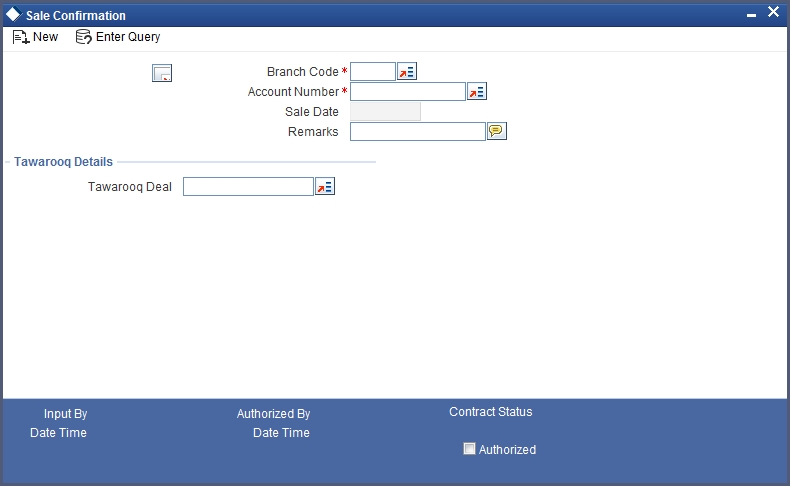

- Section 6.8, "Sales Confirmation"

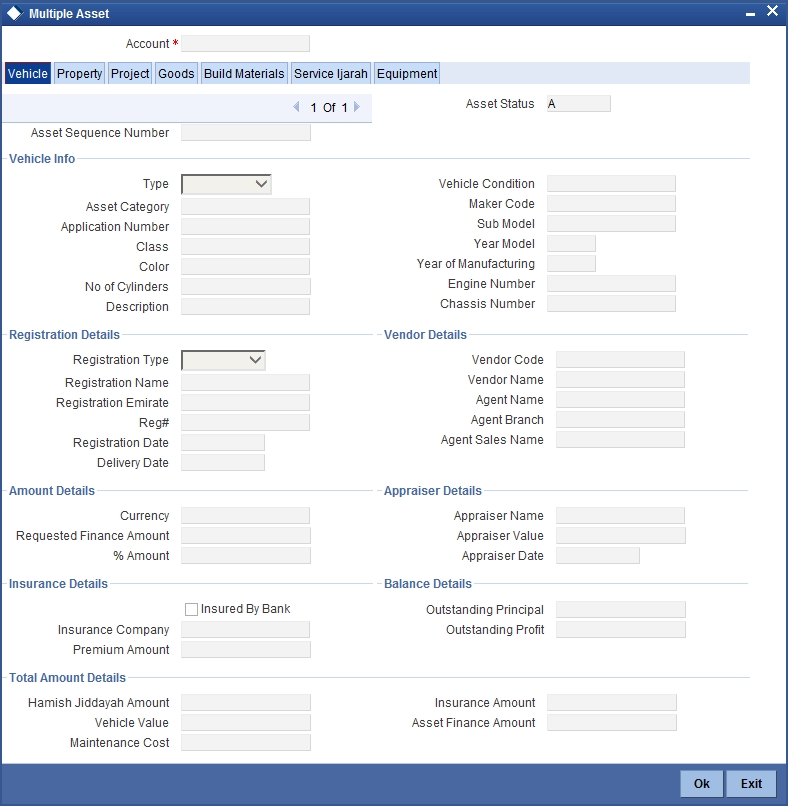

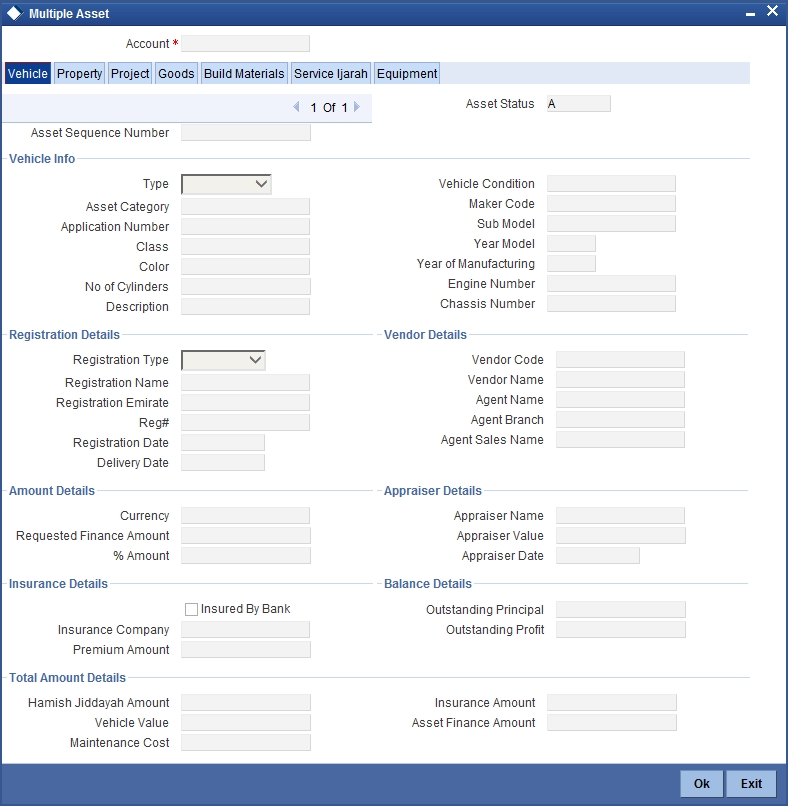

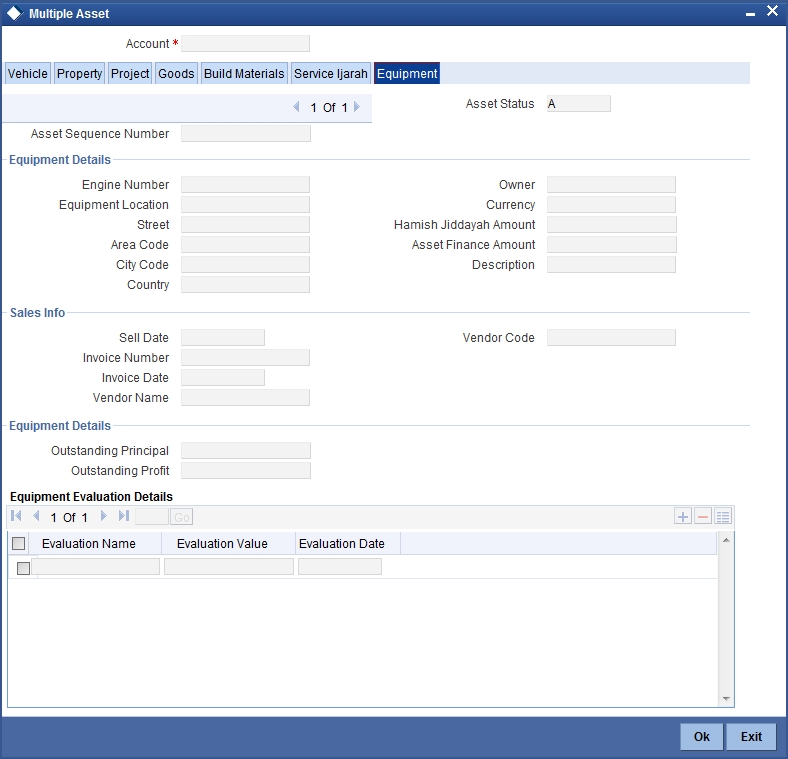

6.1 Multiple Asset

This section contains the following topic:

6.1.1 Creating Multiple Assets

Finance Accounts in the Islamic Financing module represent the receivable accounts that you create while disbursing finance. These accounts derive their feature from the Finance Product. Finance Accounts are mapped to the Asset GL through the accounting Role LOAN_ACCOUNT. This role has to be mapped to the respective Asset GL of the Bank. You can override some product features at the account level.

The system allows you to do the following actions on the Finance accounts:

- Account Main Details Maintenance/Light Finances

- Liability details and UDE Values Maintenance

- Account Preferences/Defaults

- Account Component schedules

- Charges Maintenance and Settlement details

- Linkages Information

- Events, Events Due and Events Overdue

6.2 Account Details/Light Finances

This section contains the following topics:

- Section 6.2.1, "Creating Account Details/ Light Finances"

- Section 6.2.2, "Main Tab"

- Section 6.2.3, "Preferences Tab"

- Section 6.2.4, "Components"

- Section 6.2.5, "Charges Tab"

- Section 6.2.6, "Linkage Details Tab"

- Section 6.2.7, "Advices Tab"

- Section 6.2.8, "Fields Tab"

- Section 6.2.9, "Check List Tab"

- Section 6.2.10, "Asset Details Tab"

- Section 6.2.11, "Other Applicants Button"

- Section 6.2.12, "Party Details Button"

- Section 6.2.13, "Payment Mode Details Button"

- Section 6.2.14, "Internal Rate of Return Details Button"

- Section 6.2.15, "Events Button"

- Section 6.2.16, "General Ledger Query Button"

- Section 6.2.17, "Installment Query Button"

- Section 6.2.18, "Documents Button"

- Section 6.2.19, "Hamish Jiddayah Details Button"

- Section 6.2.20, "Vendor Payment Details Button"

- Section 6.2.21, "Ijarah Button"

- Section 6.2.22, "Insurance Details Button"

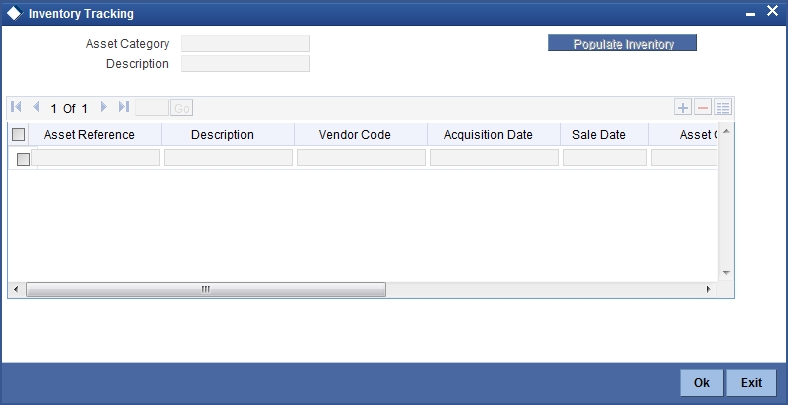

- Section 6.2.23, "Inventory Tracking Button"

- Section 6.2.24, "Collaterals Button"

- Section 6.2.25, "Party Details Button"

- Section 6.2.26, "Block Details Button"

- Section 6.2.27, "Multiple Asset Button"

- Section 6.2.28, "Multifinance Button"

- Section 6.2.29, "Viewing Summary for CL Accounts"

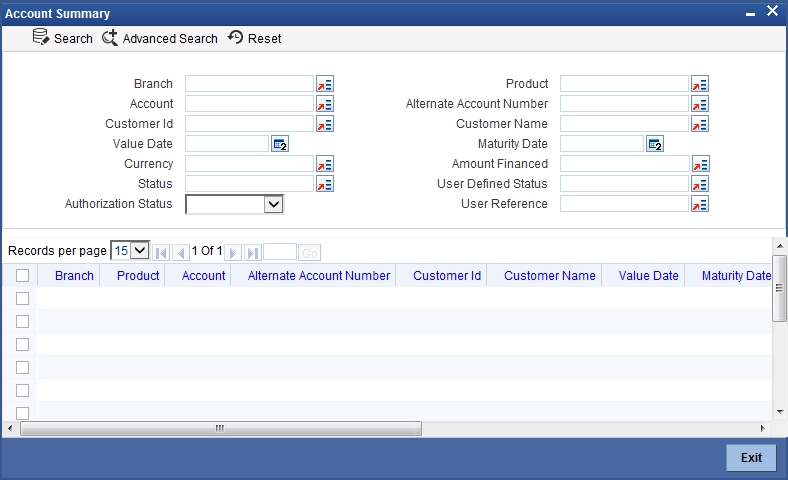

6.2.1 Creating Account Details/ Light Finances

The account screen accepts the Customer, Currency and Amount Financed and creates a Light Finance. This is a default Finance that takes all other details from the defaults the product provides. For creating simple accounts in the Islamic Financing module, you can follow this simple process. These Finances are called Light Finances in the Islamic Financing module. You can invoke the ‘Islamic Account’ screen by typing ‘CIDACCNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following in the Account Details screen:

Product Code

Click on the option list to select a Product Code from the list of values. Double click on a

Product Code to select a particular code. The product codes are maintained in the Product Definition screen.

Click ‘P’ button to populate the Product Category, Value Date, Maturity Date based on the Product Code selected, the main screen will display all these values.

Product Category

The system displays the product category in this field.

Application Number

The system displays the Application Number in this field.

Note

This is applicable only if the origination of the finance is in Oracle FLEXCUBE or is interfaced.

Version Number

The system displays the current Version Number of the account. A new version number is created when changes like Roll over, Amendment are made to a finance.

Branch

The system displays the Branch Code of the branch into which the user has logged in, for which the UDE values are maintained.

Account Number

Based on the parameters that setup at the branch level, the account number would be either auto generated or would have to be captured in this field.

Contract Status

After you enter the account number, the system displays the status of the account in this field. This is based on the products status maintenance rules.

Alternate Account Number

Enter the alternate account number in this field. It can be an account number in the existing system from which the account has migrated to Oracle FLEXCUBE.

6.2.2 Main Tab

You can specify the following customer details:

Customer ID

To select a customer ID, click on the option list button. A new screen called Find Customer Details is displayed. You can enter search criteria in this screen. For instance, you can enter the customer name or number and click on the ‘Search’ button. The system then fetches you all the details corresponding to the Customer name or account. Once you find all the details, click on OK to return to the account details screen.

The Customer ID can be picked using a query type LOV as shown below. Enter the relevant search conditions and the satisfying set of records can be selected.

The Search Customer pattern can be provided in the main screen and this will be used along with other selections made in the query LOV screen.

Fund ID

Select the fund id from the adjoining option list. The system defaults the value of ‘Default Mudarabah Fund’ as fund ID.

The system populates the fund MIS details for a contract which is linked to the Fund ID.

Currency

To select a currency, click on the option list button. A list of currencies is displayed. Double click to select a currency.

Total Sales Value

The system displays the total of principal and profit amount as of initiation date. If the box ‘Recompute schedule on IRR’ is checked in the ‘Product Maintenance’ screen for the linked product and balloon amount is provided, the system will compute this value as the sum of principal, normal profit, balloon principal and balloon profit.

Securitization status

The system displays the securitization status. The status can be anyone of the following:

- Blank – Indicates account is not involved in securitization, that is it not part of the securitization pool

- Marked for securitized – Indicates finance account is part of securitization contract (on batch); however, the securitization batch is not executed yet.

- Securitized – Indicates the successful completion of batch process.

6.2.2.1 Finance Contract Input against Murabaha Bills

When a finance is associated to a Murabaha bill you need to provide the bill details when you input a finance contract.

Bill Reference Number

Select the Bill reference number from the option list. The option list contains all active, authorized bill contracts that have not been linked to a finance, yet to be crystallized and have the crystallization type set as linked finance.

For such finance contracts, the counterparty is same as that of the bill. The value date of the finance is defaulted to the maturity date of the bill.

The finance amount is computed from the various amounts input in the crystallization preferences of the Murabaha bills contract. It is computed as the sum of the bill amount to be crystallized and the charge amount being transferred (if charges are not being liquidated as a part of the bill).

Once a finance is linked to the Bill, amendment of the crystallization parameters for the bill is not allowed. When the bill reference number is linked and the finance is saved, the BLNK event is triggered in the Murabaha bill.

Event reversals in Bills/Finances

For linked finances, reversal of specific events is allowed. As the finance comes into existence after the bill is liquidated, subsequently, it is similar to an independent finance contract. Then all events and event reversals allowed for a normal finance are allowed for the linked finance as well.

Wakala Reference Number

Select the reference number of the from the option list. The option list contains all Wakala account numbers. The period of Wakala is from value date of Wakala account to value date of Murabaha account.

Note

While booking the Murabaha account the system will calculate the profit amount for the Wakala period, which is linked with Wakala account.

6.2.2.2 Payment and Liquidation of Bills linked to finances

Partial payments of bills with linked finances, is allowed to the extent of the bill outstanding amount minus the amount of the finance.

Partial Liquidation of the bill from collaterals is allowed to the extent of the collateral available with the bill after reducing the collateral that has been earmarked to be used for liquidation during the crystallization.

Collateral taken over

This check box is checked if the collateral linked is been taken over.

Click 'Takeover Details' button to view details of the take over.

You can view the following details in this screen:

- Collateral Code – The system displays the collateral code.

- Amount Settled – The system displays the amount settled.

- Date of Take Over – The system displays the date of taken over.

- Branch Code – The system displays the branch code.

- Account Number- The system displays the account number.

- Taken over reference – The system displays the taken over reference number.

- Event Sequence Number – The system displays the event sequence number of MLIQ event fired during takeover process.

Effective Date

You can specify the following detail here:

Effective Date

The effective date is used to pick the UDE value and apply it for the given period. The system displays this date from the General UDE maintenance screen.

For a product + currency combination, if the UDE values are not maintained for the effective date, then the system defaults ’0‘. You can edit it. You can maintain different effective dates for the same UDE with different values. For instance, you can give different effective dates for different rate types maintained for the moratorium UDE.

User Defined Element Values

The UDE values for each Account are maintained here. After clicking the ‘Product Default’ button, the UDE values default from the UDE values maintenance for the Product, Currency, effective dates combination. The system disables this section. These can be overridden by providing account level UDE values. For this, you need to click the ‘Edit UDE Details’ button. After changing the details, the system re-computes the schedules. On saving the contract, the system prompts the changed details.

However the UDE are only those defined at the product level. No new UDEs can be introduced at the account level.

The system checks whether the UDE values fall within the minimum and maximum limits specified for the UDEs linked to the product. If a UDE value falls outside the permissible limits, the system will throw an error message,

If there are no product level UDE values maintained, the system will default the UDE value to Zero. However, at the time of saving, if UDE values are zero or any invalid value, then an override will be raised with an appropriate error message. If required this can be configured as an error message. In case of an ERROR, you will have to give a valid value. While if it is an OVERRIDE, you can overlook the message and continue and if it is for an ONLINE AUTHORIZATION the parameter should be authorized appropriately.

You can specify the following details for the UDE values:

User Defined Element ID

To select a UDE Id, click the option list. A list of UDE Ids is displayed. Double click to select a UDE ID.

User Defined Element Values

Specify the Actual Value for the UDE based on the effective Date in this field. The value specified here should fall within the minimum and maximum limits maintained for the UDE linked to the underlying product.

Note

Input to this field is mandatory if you maintain a UDE.

Rate Code

Select the code for the Floating Rates if any and the spread on it applicable in this field by clicking the option list. A list of values is displayed. Double click on a value to select it.

Code Usage

Select the Code usage which can be periodic or automatic in this field.

Resolved Value

This denotes the final value of a UDE. Resolved value = Rate code value taken from Floating Rate Maintenance + the spread [UDE Value].

6.2.3 Preferences Tab

The defaults are maintained by the bank. Depending upon the combination of various preferences, the bank can have various account preferences. The defaults primarily are based on product definition and can be overridden.

6.2.3.1 Account Preferences

Check Book Facility

If you select this option, Checks or coupon books (for disbursement) can be written against the Finance account.

Atm Facility

If you select this option, you can access the finance account through ATM operations.

Passbook Facility

If you select this option, you can get a Passbook issued to the finance account holder and the passbook operations such as Updating are available for the account.

Amend Past Paid Schedule

This preference determines if you can modify any feature such as profit rate, installment amount which affects already paid schedules. If you select this is option then the paid schedules are recalculated and liquidations on them are recognized as pending as appropriate.

Liquidate Back Valued Sch

While making payments to several schedules that are overdue, you can maintain a default Order upon which all components of a schedule are cleared.

Liquidate Residual Value

If you select this option, the residual amount automatically liquidated with the last EMI schedule.

Maximum Renegotiations

Specify the maximum number of renegotiation allowed for the account.

Note

If maximum renegotiation is not maintained, system will perform renegotiation without any restrictions. If the maximum renegotiation value is given as ‘zero’, system will raise override in the first renegotiation itself.

Renegotiation No

The system displays the renegotiation count. This is the number of renegotiations that are already performed on the account.

6.2.3.2 Specifying Grace period

Supplier

The system displays the supplier grace period and frequency for Murabaha contracts maintained at the product level, based upon this period the first installment date of the finance contract will be derived. However you can modify it. After modification you can edit and explode the schedules from the ‘Components’ tab. The modified schedules will be displayed after explode.

Customer

The system displays customer grace period and frequency for Murabaha contracts maintained at the product level, based upon this period the first installment date of the finance contract will be derived. However you can modify it. After modification you can edit and explode the schedules from the ‘Components’ tab. The modified schedules will be displayed after explode.

Note

- The grace period and frequency will be disabled for the copy operation

- The grace period and frequency can be kept blank, if you do not want to have the grace period

6.2.3.3 Loan Settlement Notice

The system displays the following loan settlement details based on the values specified at ‘Value Dated Amendments’ level:

- Loan Settlement Request

- Notice Date

- Expected Closure Date

6.2.3.4 Status Change Mode

Select the status change mode. The options available are:

- Auto

- Manual

The system defaults Auto as the status change mode.

While processing End of Day, the system picks only those accounts with Auto as status change mode. The processing of the accounts which are picked up is based on the status options set at the product level.

6.2.3.5 Liquidation Preferences

You can maintain the following liquidation preferences:

Liquidation Mode

The system defaults the mode of liquidation from the product level. However you can modify the same to indicate the mode of liquidation that you are maintaining. You can select one of the following options:

- Manual

- Auto

- Component

Partial Liquidation

If you select this option, system will perform partial auto liquidation.

Auto Liqd Reversed Pmt

If auto liquidation has been reversed in an account, it will be retried depending upon the status of this field. If this option is selected, then the auto liquidation is retried.

Retries Auto Liquidation Days

When auto liquidation option is chosen and funds are not available, the number of times the system can retry auto liquidation is determined by this field.

If blank, the number of retries is infinite.

Retries Advice Days

Number of retries for an advice is defaulted here from the product maintenance level; however, you can modify if needed. The value should be less than the value maintained for ‘Retries Auto Liquidation Days’.

Close Collateral

Check this box if you need to close the collateral automatically on full payment, during auto liquidation.

6.2.3.6 Profit Sharing Details

For Mudaraba accounts, you can capture profit sharing details between the Mudarib and Rabbul-Mal using the ‘Islamic Account Details - Preferences’ screen. Note that the following fields are applicable only for account under products under the Mudaraba product category:

- Bank Share %

- Customer Share %

Refer the section ‘Creating a Mudaraba Account’ in the chapter titled ‘Defining Islamic Product Categories and Products’ in this User Manual for further details about this screen.

6.2.3.7 Track Receivable Preferences

If you select this option, it tracks the amount to be liquidated as a receivable if funds are not available. So upon any subsequent credit, the receivables are blocked and allocated to the pending liquidation.

Auto Liquidation

Selecting this option implies that the Track receivable option is for Auto Liquidations

Note

By default, the system selects this option.

Manual Liquidation

Selecting this option implies that the Track receivable option is for Manual Liquidations

Note

By default, the system selects this option.

6.2.3.8 Rollover Preferences

Auto or Manual

This option is used to determine if the Rollover is system driven or not .If you select the option Auto Rollover, then upon maturity, the Account will be rolled over automatically by the system Rollover batch run in BOD.

If you select the option Manual roll over, then the system does not perform the auto rollover and you can perform a manual rollover.

Note

By default, the system selects the ‘Auto’ option.

Rollover Type

The options are:

- Special Amount: If your rollover is a special amount, select this option and capture the amount that has to be rolled over.

- Custom: If the rollover type is ‘Custom’, then select the ‘Component Names’ that have to be rolled over.

6.2.3.9 UDE Rollover Preferences

If you select this option, you determine if at the time of rollover the UDE value would be defaulted from the product or from the account.

6.2.3.10 Schedule Basis Preferences

This flag will determine if at the time of rollover the schedule would be defaulted from the product or from the account.

Multiple Down Payment Required

Check this field to do multiple down payments. You can check this field only when Auto disbursement option is selected at product level.

6.2.3.11 Rollover Components

This option is applicable when Rollover Type is Custom. The option list provided will display the components relevant to the account from which you can choose the components that are to be rolled over.

6.2.3.12 UDE Rate Plan

Start Date

Specify the start date of the rate plan.

End Date

Specify the End date of the rate plan.

Note

Customer will be sent a notice prior to the completion of the rate plan period. Customer can change the rate plan within the rate plan period by doing a value dated amendment. If you try to amend the rate plan after the rate plan period, then the system displays the configurable override message as ‘UDE plan cannot be changed’.

If the customer does not contact bank to change the rate plan within the specified time period, then the bank will continue with the current rate plan.

6.2.3.13 Intermediary Details

You can capture the Intermediary Details at the finance account level to keep track of the accounts created through Intermediaries. Islamic account details screen allows linking of multiple intermediaries to a single finance. In case of multiple intermediaries, you need to maintain the applicable intermediary percentage against the finance.

Intermediary Initiated

Check this box to indicate that the finance has been initiated by an intermediary.

Intermediary Code

If you have checked the box 'Intermediary Initiated', you need to specify the code of the intermediary who has initiated the finance. The adjoining list of values displays all valid and active intermediary codes maintained in the system. You can select the appropriate one. Using this option you can link multiple intermediaries along with the respective percentage for the individual intermediary against the finance amount.

Intermediary Name

The system defaults the name after code and ratio is entered.

Intermediary Ratio

Specify the ratio of individual intermediary contribution against the finance amount.

Note

Sum of intermediary’s ratio need not be equal to 100.

6.2.4 Components

Clicking against ‘Components’ tab in the ‘Account Details’ screen invokes the following screen:

You can specify the following details for the components:

Component Name

The components defined for the selected product get defaulted here.

Description

After you specify the component Name, the system displays the description of the component in the adjacent field.

Waive

Select this option to waive the component for the account.

Main component

The system selects the component of the finance designated as main component in the product level in this field.

Capitalized

Select this option if the scheduled amounts are to be capitalized.

Liquidation Mode

The system defaults the mode of liquidation from the product level. However you can modify the same to indicate the mode of liquidation of the component from the drop-down list. The following options are available for selection:

- Auto

- Manual

Note

This is applicable only if ‘Liquidation mode’ is selected as ‘Component’ at the account preference level.

Component Ccy

The system displays the currency associated with the component in this field. The value is defined at Product level.

Penal basis Comp

The system displays the basis for calculating compensation component in this field.

Special Profit

Select this option to denote if the component is a special Profit type. This implies that the computed value of the component can be overridden with the entered value.

Special Profit Amount

Enter the amount for the special profit in this field.

When a value-dated change is made to decrease the account maturity date, outstanding amount in profit and principal is equally divided and added to the remaining schedules. In such cases, the system displays the outstanding profit amount in this field.

Settlement Ccy

Click on the option list to choose a settlement currency from the list of currencies.

Double click on a value to select it.

The settlement currency is maintained as a default for both Credits and Debits.

Payment Mode (Dr/Cr)

The system defaults the values from the payment mode details specified in the ‘Account Details - Main’ screen. However, you can modify this if you have checked the option ‘Allow Corporate Access’ in ‘Branch Parameters – Detail View’ screen. The options for debit mode are CASA, Credit Card, Debit Card, Clearing, External Account, Electronic Pay Order, Internal Check, Instrument, GIRO and Cash/Teller.

The options for credit mode are CASA, Clearing, External Account, Instrument, and Cash/Teller.

The values in these modes are:

- CASA

- Branch: Click on the option list to choose the branch in which the customer account resides. . Double click on a branch to select it.

- Account: Click on the option list to choose the account in the branch

selected. Double click on an account to select it. Credit Card / Debit

Card

- Card Number: This field captures either the Credit No or the Debit No details based on the selection.

The card must be a valid card whose number can be checked with a modulo logic or maintenance file.

- Clearing Network

- Clearing Bank Code: Click on the option list to select the bank code as per clearing maintenance. Double click on a bank code to select it.

- Clearing Branch Code: Click on the option list to select the clearing bank branch. Double click on a branch code to select it.

- Instrument No: Enter the number on the instrument presented for clearing in this field. Double click on a value to select it.

- Routing No: Enter the routing number of the branch selected for clearing in this field.

- Clearing Product Code: Click on the option list to choose a product code if the clearing is using a Oracle FLEXCUBE clearing product. Double click on a branch to select it.

- End Point: This field picks up the end point maintained in the clearing system.

- Sector Code: Click on the option list to choose the clearing sector code. Double click on a sector code to select it.

- External Account

- Clearing Bank Code: Click on the option list to choose the external bank code as per clearing maintenance.

- Clearing Branch Code: Click on the option list to choose the external bank branch used for clearing.

- Ext Acc No: Enter the external account number in this field.

- Ext Acc Beneficiary Name: Enter the name of the beneficiary of the external account in this field.

- GIRO

- Auto/Manual GIRO – Select Auto GIRO for automatic direct debit or else select Manual.

- Bank/Plus GIRO – Select the GIRO clearing system used, which can be either Bank or Plus.

- GIRO Number – This is applicable only for corporate customers and not for individual customers. You have to enter the GIRO number.

- Payer Bank Name – Specify the name of the bank from which the amount is paid.

- Payer Branch - Specify the branch from which the amount is paid.

- Payer Account - Specify the account from which the amount is paid.

- Payer Bank Address - Specify the address of the bank from which the amount is paid.

- Instrument / Cash / Teller

- AC Branch: Click on the option list to choose branch where the account is serviced. Double click on a branch to select it.

- Product or Account: If the payment mode is Account, this field specifies the CASA/GL account to be debited. If the payment is through Instrument/Cash, it denotes the teller product to be used.

Note

The system will allow you to specify the credit and debit payment modes only if you have checked the option ‘Allow Corporate Access’ in the ‘Branch Parameters – Detail View’ screen. If you have not checked the option, the system will default the values as maintained in the fund branch account. You will not be allowed to modify this.

Use Guarantor Details

Check this box to indicate whether the guarantor accounts have to be used for debit settlement.

6.2.4.1 Guarantor Account Details

While booking an account, you can capture the guarantor’s accounts along with the default settlement account. In case of insufficient funds in the default settlement account during any liquidation event, the system will utilize funds from the customer’s current or savings account. If funds are still insufficient, the system will look into the guarantor’s accounts instead. You can have multiple guarantors for an account. The system will check for funds in all the accounts of one guarantor and go to the other only if the schedule is not liquidated fully.

You can capture the guarantor and guarantor account details in the ‘Guarantor Details’ screen. To invoke this screen, you need to click ’Guarantor’ button in the ‘Account Details – Component’ screen.

Guarantor CIFs

Seq No

This is a display only field. It will indicate the order in which the guarantors will be considered for settlement, until the full settlement amount gets covered by the funds available. This means that the system will check for funds availability in all the Current and Savings accounts belonging to a CIF and then move to the next CIF only if the required amount is not achieved.

Customer No

You can select the guarantor’s CIF from the option list. This list displays all valid and authorized CIF ids whose status is ‘Normal’.

Customer Name

Here the name of the customer is displayed based on the CIF id chosen.

Guarantor Accounts

Here you need to specify details of the guarantor accounts that have to be considered for settlement. These accounts will be considered only if the schedule amount has not been covered by the funds available across all current and savings accounts belonging to the guarantor CIF specified in the above section.

Seq No

This is a display only field. It will indicate the order in which the guarantor’s accounts will be considered for settlement, until the full settlement amount gets covered by the funds available.

Branch

The system displays the branch in which the chosen account resides.

Account No.

Here you can specify the account number that should be considered as the guarantor account for settlement. You can select the account number from the option list which will display all open Current and Savings Accounts.

This account will be debited if the other accounts belonging to guarantor CIF ids are not able to meet the required amount.

Note

Advice generation for guarantor’s accounts, if debited, will be processed following split settlements process.

CCY

This is a display only field. The guarantor account currency will be defaulted here.

Customer No

Based on the account chosen, the guarantor’s CIF is displayed here.

If the option ‘Verify Funds’ for the component is selected, the system will first check the default settlement account for availability of funds. In case of insufficient funds, system will liquidate the schedule amount to the extent of available funds in the default settlement account. For the remaining amount, the system will look for funds in the customer’s current/savings accounts after the days specified in the ‘Customer CIF A/C After: Days’ field in the ‘Product Maintenance – Preferences’ screen. The system will first scan the customer’s current accounts followed by the customer’s savings accounts for the availability of funds. If sufficient funds are available, the required amount will be liquidated.

However, if funds are insufficient in the customer’s accounts, then after the days specified in the ‘Guarantor CIF A/C After: Days’ field in the ‘Product Maintenance – Preferences’ screen, the system will first scan the guarantor’s current accounts followed by the guarantor’s savings accounts for the availability of funds. The system will look up the relevant accounts based on the maintenance in the ‘Guarantor Details’ screen. For a guarantor CIF, if there are no accounts maintained in the ‘Guarantor Details’ screen, then system will process all the current and savings account of the guarantor CIF randomly.

The batch processing will continue following the same pattern if funds are not available at primary settlement account level on the next day too.

If the option ‘Verify Funds’ for the component is not selected, the system will utilize funds only from the default settlement account and will not consider customer accounts or the guarantor CIF’s current and savings accounts.

6.2.4.2 Settlement Mode

Click ’Debit Settlement Mode’ tab after clicking ‘Payment Settlement Mode’ button in the ‘Account Details – Components’ screen.

Dr Prod Ac

Specify the product/account used to debit the finance account in this field.

Dr Acc Brn

Click on the option list to choose the branch of the customer account which is to be debited. Double click on a value to select it.

Click ’Credit Settlement Mode’ tab after clicking ‘Payment Settlement Mode’ button in the ‘Account Details – Components’ screen

Here you need to specify the following details:

Cr Prod Ac

Enter the details of the product/account used to credit the finance account in this field.

Cr Acc Brn

Click on the option list to select the branch of the customer account which is to be credited from the list of values.

Double click on a value to select it.

Service Branch

Click on the option list to select the branch the services the customer account.

Double click on a value to select it.

Service Account

Click on the option list to select the account in the service branch.

Double click on a value to select it.

All modes except CASA needs service account. Adjustments, etc. will be settled through this account.

IRR Applicable

Check this option to indicate that the component is to be considered for IRR calculation for the account. This field is applicable to profit, charge and fee components. For adhoc charge, charge, compensation and prepayment compensation components, the value will be defaulted from the product level and you will not be able to modify it.

This field will not be available for input if ‘Accrual Required’ and ‘IRR Applicable’ are left unchecked at the product level.

Note

- For bearing type of component formula this option will be enabled only if ‘Accrual Required’ is checked for the component at the product level.

- For discounted or true discounted type of component formula this option will be allowed irrespective of whether the ‘Accrual Required’ option is checked or not at the product component level.

- If the option ‘Accrual Required’ is unchecked and ‘IRR Applicable’ is checked, then discounted component will be considered as a part of total discount to be accrued for Net Present Value (NPV) computation.

- If both ‘Accrual Required’ and ‘IRR Applicable’ are checked, then discounted component will be considered for IRR computation.

- Upfront Fee component will be considered for IRR only when ‘Accrual Required’ and ‘IRR Applicable’ both are checked.

- For upfront fee component, if ‘IRR Applicable’ is checked, then ‘Accrual Required’ has to be checked.

Funded during Rollover

Select this option if the component can be funded during the rollover process.

Funded During INIT

This field indicates if the component can be funded during the INIT event.

Original Exchange Rate

The base or actual exchange rate between the account currency and settlement currency gets displayed here.

Exchange Rate

For a customer availing any Relationship Pricing scheme, the customer specific exchange rate derived by adding the original exchange rate and the customer spread maintained for the relationship pricing scheme gets displayed here.

You can change the defaulted rate provided the change is within the variance level maintained for the underlying product.

If Relationship Pricing is not applicable, Exchange Rate will be the same as the Original Exchange Rate.

For more details on customer specific exchange rates, refer the section titled ‘Specifying Pricing Benefit Details’ in Relationship Pricing user manual.

6.2.4.3 Maintaining Schedule Details

Specify the following details.

Type

Select the type of schedule from the option list. Schedule can be a payment, a disbursement or a rate revision schedule.

Schedule Flag

Select the option for the Schedule flag from the option list.

The options are Normal or Moratorium.

Select the option Moratorium if there are no scheduled repayments for the component for the Moratorium period. However the component is accrued for a certain Moratorium period.

Formula

Enter the formula used to compute the component for that schedule.

First Due Date

Enter the first due date for the schedule for the component. The first due date can be defined based on the value date for the finance or a calendar date.

Note

Amortization schedule start date added with a given frequency in ‘Maturity Details’ screen, will give the first due date.

No.

Enter the number of times the schedule is repeated for a chosen frequency for the schedule. If the Frequency is Monthly and Number is 1, it implies once a month.

Freq

This implies the number of times the schedule will repeat for a Unit. If it is 2 and the Unit is Monthly, it implies twice a month.

Unit

Enter the installment unit for the component for the schedule. The units of frequency definition can be Daily, Weekly, Bullet, Monthly, Quarterly, Half Yearly or Yearly.

Select the unit of the schedule from the option list.

Due Date On

This option may be used to schedule an installment on a particular date of the month.

End Date

End date for the component for the schedule will be computed from the start date, frequency, unit and number for the schedule

Amount

The amount of payment done, disbursement or repayment, is displayed in this field.

Capi

Select this option if the schedule amounts are to be capitalized.

Note

The system by default does not select this option.

Waive

Select this option to specify if you need to allow a waiver of the component payments for the schedule.

Note

The system by default does not select this option.

A schedule can be either applicable or capitalized or waived.

Down Payment Amount

Specify the down payment amount for each schedule.

6.2.4.4 Schedule Details

Click ’Explode’ button to view the following Schedule details:

Schedule No

The system generates and displays a sequential schedule number for installments.

Due Date

The system displays the due date of the payments and disbursements in this field.

Amount Due

The system displays the amount due for the schedule in this field.

Amount Settled

The system displays the settlement amount for the schedule in this field.

Emi Amount

The EMI that should be repaid in this schedule is displayed in this field.

Amort Prin

The system displays the principal that has to be amortized in this field. This field will be relevant for the Profit component that is being amortized.

Accrued Amount

In this field, the system displays the amount accrued for the component for the schedule.

Capit

The flag is used to display that the schedule installment is capitalized.

Waive

Select this option to indicate if this particular amount which is due will be waived or not.

6.2.4.5 Editing the Default Schedule

In case of a forward Ijarah having property handover, you need to manually edit the exploded payment schedules for the main profit component. Click ’Edit’ button to make any change to the scheduling and after you have made changes, click ’Explode’ button to see the changes made.

If you select any component and click ’Edit’ button, you can make changes to the schedules which are defaulted from the product to the account. You will have to specify repayment schedules for the profit component during the moratorium period and the handover period.

If you click the ‘Explode’ button, other components will get adjusted according to change made to any of the attribute. The system will also compute the Internal Rate of Return (IRR) on clicking this button. If the box ‘Recompute schedule on IRR’ is checked for the linked product, the system will recalculate schedules based on IRR.

Select the Principal Component. Click on ‘Disbursals’ to see the Disbursal schedule. This gives the list of Schedules for the disbursements and their corresponding Disbursement amounts.

You can check the details of the due date of the schedule and the Amount to be disbursed from the ‘Schedule Due Date’ field and the ‘Amount To Disburse’ field respectively.

In this screen, you can also enter the following details of a contractor for each of the disbursals done:

Purpose

Specify the purpose of disbursement from the option list. This can also be maintained in the field ‘Type’ in the ‘Limits Type maintenance’ screen.

CIF Id

Specify the CIF for each contractor from the option list.

Amount

Specify the amount to be disbursed against the CIF Id for the purpose mentioned.

Note

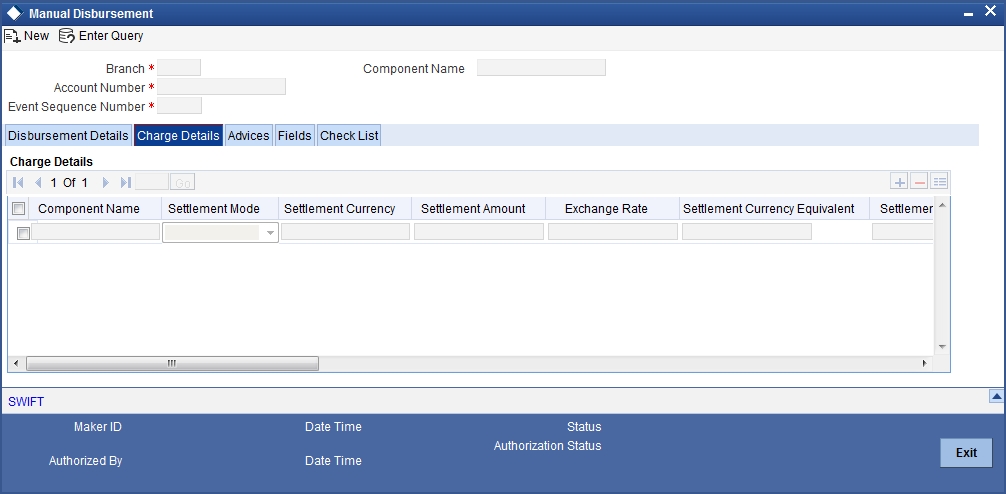

- You can override the settlement details at the ‘Manual Disbursement’ screen

- The system displays an override if the disbursement is done before the projected schedule date

- The system displays an override if the disbursement amount given for a particular contractor is more than the projected amount specified for that schedule.

- The system throws an error if the disbursement amount for a particular contractor is more than the sum of the entire projected amount given for a contract.

- In case of auto-disbursement, if the box ‘Property Handover’ is not checked, the system will not allow final disbursement.

6.2.4.6 Schedule- wise Split Settlement for Auto Disbursement

Oracle FLEXCUBE allows you maintain split details for schedule-wise auto disbursement in a finance account, only if you have set the disbursement mode to ‘Auto’ in the Account Preferences tab of the Islamic Financing Product screen

In the Islamic Account (CIDACCNT) screen, click ‘Product Default’ button after entering product code, customer ID, currency and the amount, to default the product level component and schedule details of the selected product in the component tab of the account details screen.

You can view the disbursement schedule and maintain the schedule- wise finance split details for auto disbursement in the Disbursal screen. To do this, first select the principal component in the component tab and then click on ‘Disbursals’ button.

The system displays the list of Schedules for the disbursements and their corresponding Disbursement amounts.

Schedule Due Date

The system displays the due date of the schedule.

Total Disbursement Amt

The system displays the total disbursement amount for the specified finance account.

Amount to Disburse

The system displays the amount to be disbursed.

Already Disbursed Amt

The system displays the amount which has been disbursed.

Note

Oracle FLEXCUBE allows auto disbursal only for the principal component.

Split Details

You can maintain the following split details:

Percentage

Specify the split percentage of the disbursement amount.

Note

The system displays an error, if the information on amount or percentage is missing.

Amount

Specify the split amount for the schedule. Split amount is calculated based on the percentage and the disbursal amount.

If you specify only the amount and not the percentage, the system calculates the percentage of the amount to be disbursed and displays it in the percentage field.

Note

- The system validates if the amount and percentage are not entered and if split for the same disbursement schedule is available

- If one disbursement schedule maintains one split with percentage and other split with amount, system maintains either amount or percentage for the disbursement schedule.

- If the total amount is less than the amount to disburse for the schedule, system adjusts the rest of the amount in last split of the particular schedule and percentage gets calculated based on the amount.

- The system displays an error, if you specify an amount greater than that of the disbursement schedule

- The system displays an error, if the total amount or total percentage maintained exceeds the amount to disburse or 100 percent.

Settlement Account Branch

Specify the branch of the customer account. The adjoining option list displays the list of valid open branches maintained in the system. You can choose the appropriate one.

Settlement Account Number

Specify the settlement account number. The adjoining option list displays the valid accounts maintained for the given branch. You can choose the appropriate one.

Split sequence number

The sequence number for each split is auto generated by the system on save.

Payment Mode

The system displays ACC as the payment mode for disbursal.

Settlement Account Currency

Once you choose the account number, the currency of the settlement account gets defaulted.

Customer

Once you choose the account number, the customer id gets defaulted.

It is mandatory to re-enter the split settlement details during VAMI, if there is a change in the disbursement schedule. For the disbursed schedules, the split settlement amendment would be ignored during VAMI.

During BOD, the system checks the finance split settlement details before taking the Credit Settlement details of the principal component. The credit settlement details of the principal component /Service account would be considered only in the absence of split settlement details for that particular schedule.

6.2.4.7 Rate Revision Schedule

Select a component which has rate revision defined. To view the details of the Rate revision schedule, click on the ’Revisions’ button. This lists the details of the revisions done on the Components. This lists the revision date against the component name. This also has an application option which displays if the revision was applied or not.

You can check the details of the name of the component that is revised and the date when it has been revised from the field Component name and Revision date respectively.

6.2.4.8 Maintaining Nominal Disbursal Schedules for Principal Component

If you select the ‘Construction Period Profit Basis’ as ‘Nominal’ in the ‘Product Maintenance’ screen, then it is mandatory to maintain nominal disbursal schedules. Click on the ’Nominal Disbursals’ button to capture nominal disbursals.

Start date

The start date of the Disbursement Schedule is defaulted from the product. However, you can modify this date.

End date

The end date of the Disbursement Schedule is defaulted from the product. However, you can modify this date.

Amount

The system equally divides the amount financed across number of disbursal schedules and displays it in this field the following scenario.

- If disbursement mode is ‘manual’ and the construction period profit basis is ‘nominal’

- However, you can modify the disbursal amount in case the construction period profit basis is ‘nominal’ and the disbursement mode is ‘manual’.

Purpose

Specify the purpose of disbursement from the option list. This can also be maintained in the field ‘Type’ in the ‘Limits Type maintenance’ screen.

CIF Id

Specify the CIF for each contractor from the option list.

Amount

Specify the amount to be disbursed against the CIF Id for the purpose mentioned.

Note

- You can override the settlement details at the ‘Manual Disbursement’ screen

- The system displays an override if the disbursement is done before the projected schedule date

- The system displays an override if the disbursement amount given for a particular contractor is more than the projected amount specified for that schedule.

- The system throws an error if the disbursement amount for a particular contractor is more than the sum of the entire projected amount given for a contract.

6.2.5 Charges Tab

This module is used for calculating and applying charges on an account. To calculate the charges that we would like to levy on an account, we have to specify the basis on which we would like to apply charges. For example, we may want to apply charges on the basis of the debit turnover in an account. When we define a Charge product, we have to specify the Charge basis. When we apply the charge product on an account or an account class, charges for the account will be calculated on this basis.

The following details are captured:

Component Name

The system displays the name of components defined as type ‘Charge’ for the associated product.

Component Ccy

The system displays the currency associated with the component. The component currency is defaulted from the Product level

Settlement Ccy

Click on the option list to choose the details of the currency in which the payments are to be made in this field. A list of currencies is displayed. Double click on a value to select it.

Dr Payment Mode

Click on the option list to choose the details of the mode of payment (For debit payments) in this field. A list of values includes CASA, Cash/Teller, Instrument, External Account, Electronic Pay Order, Internal Check, Clearing, Debit Card, Credit Card and PDC.

Note

If the Debit Settlement mode is selected as PDC, then the other debit settlement details are not maintained.

If the debit Settlement is PDC then the liquidation mode of the component should be manual.

The Debit Settlement can be chosen as PDC only when contract is amortized.

Note

The system will allow you to specify the debit payment mode only if you have checked the option ‘Allow Corporate Access’ in the ‘Branch Parameters – Detail View’ screen. If you have not checked the option, the system will default the values as maintained at the fund level. You will not be allowed to modify this.

Cr Payment Mode

Click on option list to choose the mode of payment by which the account is credited. The list of values includes A list of values includes CASA, Cash/Teller, Instrument, External Account, and Clearing.

Service Account

Enter the details of the Product/Account to be used for payments in this field. The adjustments etc will be settled through this account.

Service Branch

Click on option list to choose the details of the branch where the dr/cr account resides. A list of values is displayed. Double click on a value to select it.

Due Date

Enter the date on which the charge is applicable.

Amount Due

Enter the details of the amount due for repayment in this field.

Waive

Select this option to waive off the charges.

Funded during INIT

Select this option if the component can be funded during finance initiation.

Funded during Rollover

Select this option if the component can be funded during the rollover process.

For each component, the following details are displayed:

- Event Code

- Component Name: A component will be of type ‘Charge’

- Amount Due: The amount due for repayment in this field

- Amount Settled: The settled amount in this field

- Schedule Due Date: The scheduled date for repayment in this field

- Waive: If this option is checked, the charge defined for event is waived off

6.2.6 Linkage Details Tab

At the time of Finance account capture, the Linkages to securities backing the finance are captured. They include:

- The reference number of the Collateral, Collateral Pool, Line, Account, Amount block, Guarantee Collection Bill is linked.

- The amount which is attributed to the particular reference number is also captured.

- The account input screen captures the Linkages as shown below

You can specify the following collateral and linkage details:

Collateral Linkage Details

You can maintain the following collateral details here:

Linkage Type

Select a type of linkage to which you need to link the specified account from the adjoining drop-down list. This list displays the following values:

- New Collateral – Select if you need to link the account to new collateral.

- Collateral – Select if you need to link the account to existing collateral.

- Collateral Pool – Select if you need to link the account to collateral pool.

- Facility – Select if you need to link the account to a facility.

Linkage Reference No

Specify a valid linkage reference number for the selected linkage type from the adjoining option list. Linkage reference number is not applicable for ‘New Collateral’ linkage types.

Note

If you maintain ‘Linkage Type’ as ‘New Collateral’ and maintain linkage reference number, then the system displays an error message.

Description

Description of the linkage type is defaulted here; however, you need to specify description if the ‘Linkage Type’ is ‘New Collateral’.

Linkage Branch

Branch code of the branch in which the linkage is maintained is defaulted here; however, you need to specify branch code if the ‘Linkage Type’ is ‘New Collateral’, from the adjoining option list.

Linkage Currency

Currency code of the currency maintained for linkage is defaulted here; however, you need to specify the currency, if the ‘Linkage Type’ is ‘New Collateral’, from the adjoining option list.

Overall Amount

Specify overall amount of the collateral if you have selected ‘Linkage Type’ as ‘New Collateral’. The system displays values of different parameters based on the linkage type.

- If the linkage type is ‘Collateral’, then the system displays the collateral value as the overall amount.

- If the linkage type is ‘Collateral Pool’, then the system displays the pool amount as the overall amount.

- If the linkage type is ‘Facility’, then the system displays the effective line amount as the overall amount.

Collateral Category

Category of the collateral is displayed here, if the ‘Linkage Type’ is maintained as ‘Collateral’; however, you need to specify collateral category if the ‘Linkage Type’ is ‘New Collateral’, from the adjoining option list.

Hair Cut %

Percentage of hair cut for the collateral is displayed here, if the ‘Linkage Type’ is maintained as ‘Collateral’; however, you need to specify ‘Hair Cut %’ if the ‘Linkage Type’ is ‘New Collateral’, from the adjoining option list.

Limit Amount

The system displays the following as limit amount based on the selected linkage type, on saving the finance account:

- If the ‘Linkage Type’ is ‘New Collateral’, then the system displays the value computed after applying Hair Cut percentage on the amount.

- If the ‘Linkage Type’ is ‘Collateral’, then the system displays the limit amount of the selected collateral as the limit amount of the account.

- If the ‘Linkage Type’ is either ‘Collateral Pool’ or ‘Facility’, then the system displays the overall amount as the limit amount of the account.

Linked Amount

The system displays the linked amounted computed after applying the linked percentage on the limit amount, on saving the finance account.

Linked %

Specify linked percentage you want to apply on the limit amount of the account.

Utilization Order

Specify a valid order in which you need to utilize the linkage linked to the account. The system utilizes the linkage in an ascending order.

Utilized Amount

Utilized amount of the account is displayed here.

Commitment Product

Commitment product of the selected collateral is displayed here, if the ‘Linkage Type’ is maintained as ‘Collateral’; however, you need to specify a valid commitment product, which is open and authorized if the ‘Linkage Type’ is ‘New Collateral’, from the adjoining option list.

Taken Over Collateral

The system displays the taken over collateral as ‘Yes’ if the collateral is taken over. The system defaults the status as ‘No’ if the collateral is not taken over.

Note

While saving an account:

- The system generates a unique collateral code for the collateral, automatically created. This unique code is the finance account number concatenated with a three digit unique number.

- The system validates if the Amount Financed is greater than the Linked Amount of the Collateral Linkage Details Block.

- If the amount is greater, then the system will auto track the remaining amount against the Liability ID of the customer.

- If the Liability ID does not have sufficient available balance, then the system displays the override message as ‘The liability does not have enough available balance. Do you want to continue?’.

- If the ‘Linkage Type’ is ‘New Collateral’, then the system creates and authorizes the collateral with ‘Collateral Type’ as ‘Normal’ and assigns the Liability ID of the customer. However, you can manually create collateral with different type and link it to the account.

When an account is deleted, the system re-instates the collateral if it is utilized by the account and closes the collateral that was created new, automatically.

Linkage Details

You can maintain the following linkage details here:

Linkage Type

Click on the option list to choose the details of the linkage type. A list of values is displayed. Double click on a value to select it.

The valid values are Line, Deposit, Guarantee, Amount Block, CASA Account, Collateral Pool, and Collateral.

Customer ID

Click on the option list to choose the ID of the customer to be used for corresponding linkage type. A list of values is displayed. Double click on a value to select it.

A customer can either be the primary applicant or any of the other applicants for which the linkage type has been maintained.

Linked Ref No

Click ‘L’ button to choose linkage reference number be used for corresponding field.

Linkage Amount

Enter the linkage amount in this field.

Secured Portion

Enter the part of the principal that is backed by some asset in this field.

Amount Block No

Specify the amount block number imposed on the linked account, if applicable.

6.2.7 Advices Tab

Advices that may be generated whenever the account level status changes or whenever a particular event is fired can be linked at the Product level. Priorities of the advice can be changed and also a particular advice for an event can be suppressed. Generation of an advice across the life of the account can also be suppressed.

You can specify the following Advice details:

Msg Type

The system displays all the advices for all the events for the account. The list will include all the advices that are defined at the product level.

Suppress

This field allows the user to suppress the generation of the advice for a particular event. The options are Yes and No.

Priority

Click on the option list to select the priority of generation. A list of values is displayed. Double click on a value to select it.

The options are High, Medium or Low.

6.2.7.1 Suppress Advices across the Account

The generation of an advice across the life of the account can be suppressed.

Message Type

Click on the option list to select the type of advice, the generation of which can be suppressed across the account. A list of values is displayed. Double click on a value to select it.

The list includes advices defined at the product level.

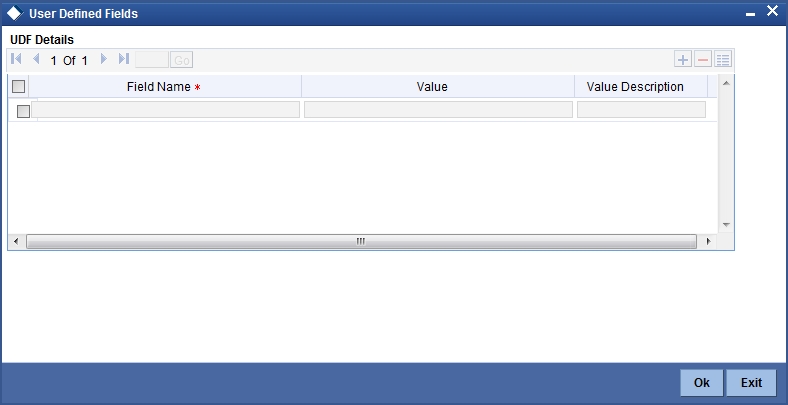

6.2.8 Fields Tab

The User Defined Fields are defined at the Product level. These fields are available in the UDF tab at the time of account creation.

The system shows all the UDF descriptions defined at the Product level.

Enter the UDF value against each field.

6.2.9 Check List Tab

The Check lists are defined at the Product level. These fields are available in the ‘Check List’ tab at the time of account creation.

6.2.10 Asset Details Tab

You can capture the fixed asset details using this screen. Click on the ‘Asset Details’ tab to invoke this screen. This screen is enabled provided the ‘Lease Asset Booking’ is checked for that product.

You can capture the following fixed asset details:

Fixed Asset Product

Here the system displays the fixed asset product defined in the Ijarah Lease product.

Fixed Asset Contract Reference Number

This will be a display item that will be used to display the fixed assets contract reference number. The fixed asset reference number would be generated on the launch of the Asset details form.

Fixed Asset User Reference Number

This is a text item. This will be defaulted to the FA contract reference number and can be modified. This will be populated as the user reference number of the asset that will be uploaded.

Finance Currency

Here in this field the system displays the currency of the lease account.

Asset Category

Here you can select one of the valid fixed asset categories from the option list given.

Description

In this field the system displays the description of the chosen category.

Location Code

Here you can select one of the valid fixed assets location codes maintained in the system from the option list.

Description

In this field the system displays the description of the chosen location.

Asset Cost

This field is used to display the cost of the asset created. This cost is nothing but the sum of ‘Amount Financed’ and the ‘Down Payment’ for the lease account..

Asset Status

Here in this field the system displays the text ‘Capitalized’.

Booking Date

Here the system displays the booking date of the asset. This is nothing but the booking date of the lease account.

Capitalization Date

Here the system displays the capitalization date of the asset. This is same as the value date of the lease account.

6.2.11 Other Applicants Button

The details of the liability parties to the account are maintained in this field. Other Applicants of a finance include Co-signers and Guarantors.

You can specify the following details of the Co-applicants:

Customer ID

To select the customer ID of the co-applicant, click on the option list. A list of customer IDs is displayed. Select the customer ID of the co-applicant.

Customer Name

After you enter the name of the Customer, the system displays the name of the customer in this field.

Responsibility

In this field, you can select the details of the co-applicants and their responsibility as a Co-signer or as a guarantor from the option list. You can enter the details like the guarantor, co-signer, main addressee, advice notice receiver, and borrower etc., who is relevant to a joint account relationship. During initiation of the account, the primary customer is defaulted to ‘Borrower’ with 100% Liability and value date as the effective date. Your are allowed to maintain multiple applicants (customer id) for a finance with the same responsibility (Borrower).

Note

While there is no processing impact, the difference will become important when the original debtor is absconding and the finance is unpaid etc.

Liability %

In this field, you can enter the contribution of the co-applicants to the Finance. You can specify the Liability of the co-applicant if any, in case of a Finance default. You can also specify the percentage of profit split among different co-applicants. It is not made mandatory to maintain ‘Liability %’ for the responsibility ‘Borrower’. There could be borrowers with 0% liability.

Note

The sum of ‘Liability %’ for all the customers of a finance to be equal to 100%

Liability Amount

The system calculates and displays the upper limit of the liability in terms of the amount in this field. You may override the computed value.

Effective Date

This field is used to capture the date from which the % profit split among co-applicants of the finance will be taken into consideration. During the initiation of the finance, the value date of the finance will be defaulted as the effective date. During VAMI, the same effective date will be retained, you can however edit it.

Note

The effective date can not be a date prior to the finance initiation date. It is also necessary that there is one record for the initiation date. The effective date for all the applicants is the same.

6.2.11.1 Holiday Periods

Ignore holidays

If you select this option, then while processing schedules, the system does not check if a schedule falls on a holiday.

Note

By default, the system selects this option.

Cascade Schedules

If you select this option, then when a particular schedule falls due on a holiday and it is moved to the next or previous working day based on the module level branch parameters, the movement cascades to other schedules too. If not, then only the affected schedule will be moved to the working day and other schedules will be unaffected.

Note

By default, the system selects this option.

Move across Month Allowed

If you select this option, the system allows you to move a schedule/value date etc falling on a holiday to the next / prior working day, which falls in a different month.

Note

By default, the system selects this option.

If Ignore Holidays is False and If Move Across Months is also false, then the system will have an inconsistency and so it will not consider the holidays.

Move across month – Forward /Backward

If you select the option ‘Move across month’ this option specifies if the movement can be forward or backward.

Note

By default, the system selects this option.

6.2.11.2 Maintaining the UDE values

The system displays the UDE values from that of the UDE values maintenance screen. These values can be overridden by providing account level UDE values. However, the value can be maintained only for those UDEs defined at the product level. No New UDEs can be introduced at the account level.

You can specify the following details for the UDE values:

Effective Date

The effective date is used to pick the UDE value. The system displays this date from the General UDE maintenance screen.

For a product + currency combination, if the UDE values are not maintained for the effective date, then the system defaults “0” which the user can then edit.

UDE ID

To select a UDE Id, click on the option list. A list of UDE Ids is displayed. Double click to select a UDE ID.

UDE Value

Enter the Actual Value for the UDE based on the effective Date in this field.

Note

Mandatory if a UDE is maintained.

Rate Code

Select the code for the Floating Rates if any and the spread on it applicable in this field by clicking on the option list button. A list of values is displayed. Double click on a value to select it.

Code Usage

Enter the Code usage which can be periodic or automatic in this field.

Customer A/C After: Days

Specify the days after which system should check the guarantor’s account for funds, in case funds are insufficient in the customer’s other accounts too.

6.2.12 Party Details Button

Click on the ‘Party Details’ button to view manual disbursals already done for the contractor. In this screen the system displays the progressive cash outflows that have been done so far and the details of each manual disbursement done by the Bank.

You can view the following details for each of the manual disbursal done:

- Date of disbursement (Value Date)

- Total Amount

- Contract status

- CIF of Contractor

- CIF Name

- Purpose

- Amount for each contractor (Settlement Amount)

- Currency

Click ’Party Details’ tab on the ‘Manual’ screen to view the customer details.

In this screen you can view the folowing details:

- CIF of Contractor

- CIF name

- Purpose

- Date – The latest disbursement value date

- Total Disbursal amount – The total amount to be disbursed throughout the life cycle of a finance

- Eligible Disbursal amount – The amount to be disbursed as of the schedule date of disbursement

- Actual Disbursal amount – The amount which is actually disbursed

6.2.13 Payment Mode Details Button

You can specify the mode of bill payment in Oracle FLEXCUBE. Click ‘Payment Mode Details’ button on the ‘Account Details’ screen and invoke the ‘Settlement Details’ screen.

Here, you can capture the following details.

Debit and Credit Payment Modes

Specify the mode of payment by which the account is debited and credited, in the respective fields. The option list provides the following values:

- CASA

- Credit Card

- Clearing

- Debit Card

- External Account

- Electronic pay order

- GIRO

- Internal Cheque

- Instrument

- Cash/Teller

Note

The system will allow you to specify the settlement details only if you have checked the option ‘Allow Corporate Access’ in the ‘Branch Parameters – Detail View’ screen. If you have not checked this option, the system will default the values as maintained in the fund branch account. You will not be allowed to modify this.

Debit and Credit product account

Enter the Product / Account to be used for Debit/Credit payments in this field.

Debit and Credit account branch

Click option list to choose the details of the branch where the Dr account resides. A list of values is displayed. Double click on a value to select it.

Click on option list to choose the mode of payment by which the account is credited. The list of values includes a list of values which includes CASA, Cash/Teller, Instrument, External Account, and Clearing.

Amount Financed

Specify the total principal amount of the finance.

Note

If Calculate Gross Principle is checked, then the amount financed is the gross principal.

Net Principal

The Net Principal is the actual principal amount financed. It is system calculated and excludes any other funded components.

Value Date

Enter the Value date of the finance in this field using the date button.

Maturity Date

Enter the maturity date in this field.

If you are not sure of the maturity date, enter the tenor of the finance in either days or months or years as say 3M for 3 Months etc. The system automatically calculates the date after you press the ‘Enter’ button.

Maturity Type

Select the Fixed or Call option to specify the type of finance maturity.

Note

The system by default selects the option Fixed. For the Call option, the maturity date will not be computed upfront.

If you choose the ‘Call’ option, IRR processing will not be applicable to the account.

Index Exch Rate

Enter the exchange rate for index currency in this field.

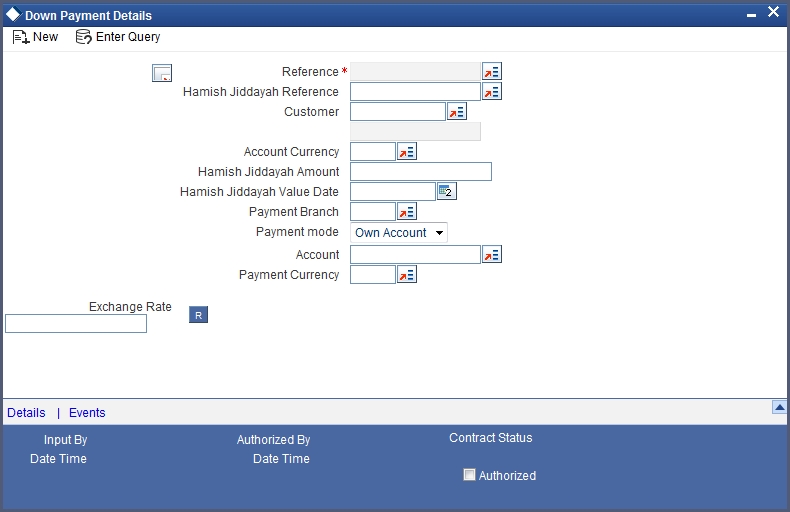

Hamish Jiddayah %

Specify the down payment percentage you need for Hamish Jiddayah. You can enter values between 1 to 100.

When you click ‘Product Default’ button, the system defaults the Hamish Jiddayah % maintained at the product level.

When the account is saved, the system validates the Hamish Jiddayah % with Minimum Hamish Jiddayah % maintained at the product level.

Even if the Hamish Jiddayah Minimum % is not maintained at product level you can proceed with the save operation by giving the % at the Islamic Finance account level.

Note

- The Hamish Jiddyah Percentage can be in decimals but not be <0.

- The minimum value is any percentage >0. Max value is 100.

Hamish Jiddayah Amount

In this field, enter the finance amount paid by the customer upfront– Owners contribution. In case of Ijarah contracts, for a financial lease the down payment will be considered entirely towards the principal. In case of an operational lease the entire down payment will be considered as income. Note that the down payment amount cannot be amended after authorization.

When you click on the ‘Enrich’ button and you have maintained values for both Hamish Jiddayah % and amount, then the system calculates and computes the Hamish Jiddayah % based on the value maintained for Hamish Jiddayah Amount.

Future D/P Receivable

Your customer need not pay the entire down payment amount in a single installment. The customer can pay it in parts. In such cases, you can specify the amount to be received in the future from the customer. The aggregate of down payments received and ‘Future D/P Receivable’ should be equal to the ‘Down Payment’ amount.

For instance, suppose the down payment is 10000 BHD, down payment received is 8000 BHD and future down payment is 2000 BHD, then Disbursement event will be triggered.

Note

Amount specified in this field cannot exceed the total down payment amount for the contract. This field should be operationally controlled, because the system does not track the ‘Future D/P Receivable’ amount which is received from the customer.

Total Amount

Specify the sum of amount financed and down payment.

Balloon Amount

Specify the amount that is being paid as balloon payment. This value cannot exceed the principal amount of the finance. You will be allowed to specify this value only if the following conditions are met:

- Contract is linked to a Murabaha product

- The box ‘Balloon Required’ is checked in the ‘Product Maintenance’ screen for the linked product.

- The box ‘Recompute schedule on IRR’ is checked in the ‘Product Maintenance’ screen for the linked product.

Bank Share%

The system displays the percentage of principal amount that is contributed by the bank. The value automatically increases or decreases based on principal increase or principal payment.

Customer Share%

The system displays the percentage of principal amount that is contributed by the customer based on the down-payment,

Note

The system will modify the bank’s share and customer’s share percentages if there is any principal increase or principal payment.However the same will be reset to previous values, on reversal of payment.

6.2.14 Internal Rate of Return Details Button

Click on the ‘IRR Details’ button and invoke the ‘IRR DETAILS’ screen. This screen displays the IRR value for the chosen component for different effective dates. The values are displayed in the descending order of the dates.

6.2.15 Events Button

An ‘event’ may be defined as any action starting from application entry to collections. This module captures the details of events applicable to the account. The screen has a separate out the processed and the unprocessed events under two different headings.

6.2.15.1 Processed Events

The processed events are all the events which have already taken place. This displays the details like the sequence number of the event. The date on which the event was processed, the value date, the event code, a brief description of the event by clicking on ‘Events’ button. The screen also displays the details of the events according to the events selected.

The following details are displayed:

Branch Code

The branch code of the account maintained in the valid tables of consumer lending is displayed here.

Account Number

Applicant’s account number, which is auto generated if it is so maintained under the branch parameter is displayed here.

Alt Acc No

Alternate account number of the applicant is displayed here.

Application Num

The application number captured at the time of finance initiation is displayed here.

Customer id

Applicant’s customer Id is displayed here.

Product Code

Product code of the product associated with the account, defaulted from Product definition is displayed here.

Product Category

The product category availed by the customer is displayed here.

Amount Financed

The total finance amount is displayed here.

Ccy

Currency in which the transaction will be conducted for the account is displayed here.

Down payment Amount

The amount paid by the customer upfront is displayed here. This is used for information only.

Maturity Date

Maturity date for the finance account is displayed here.

Value Date

Value date for the account is displayed here.

User Defined Status

The user defined status for the account is displayed here.

6.2.15.2 Events

Seq No

The sequence number for the account is displayed here.

Processed Date

The date on which the event takes place is displayed here. It is the same as system date.

Execution Due Date

The date of execution of the events as maintained in the valid table that is captured during application entry is displayed here.

Code

The event code is displayed here.

Description

A description for the event occurred is displayed here.

6.2.15.3 Advices

DCN

A system generated number for reference is displayed here.

Msg Type

The type of advice generated for the event is displayed here. This is applicable only if maintained at the product level for the particular event.

6.2.15.4 Entries

Dr/Cr

This field indicates if the event occurring is a Debit or Credit event.

Branch

The branch in which the event occurred is displayed here.

Account Number

The number of the account affected by the event as maintained in the valid table is displayed here.

Ac Ccy

The currency involved in the event is displayed here.

Event Fcy Amount

Foreign currency amount involved with the event, if any.

Exch Rate

Exchange rate associated with the account is displayed here.

Event Lcy Amount

Local currency amount involved with the event, if any is displayed here. These events are maintained in the Event entries table.

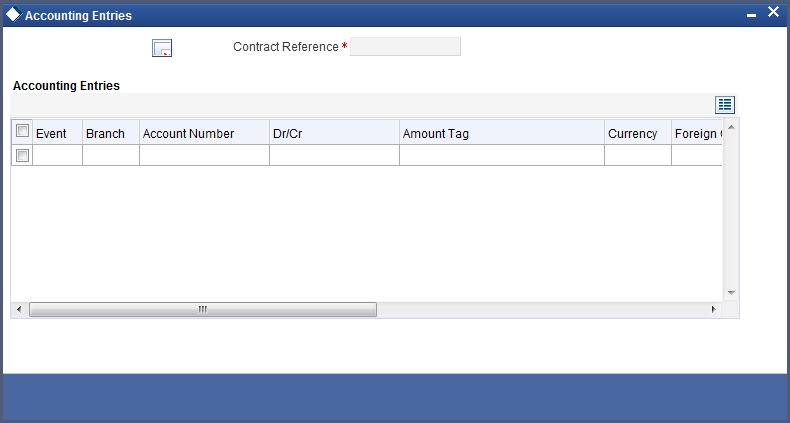

Value Date