3. Ramadan Maintenance

Zakat is a charge which is applied on the balance in an account if the balance is above a certain threshold amount. This charge is applicable only to savings accounts and Term Deposits (TD). It cannot be levied on current accounts.

The minimum threshold amount above which Zakat will be payable is decided every year before Ramadan. In addition, the percentage to be applied on the capital amount for calculation of Zakat is also decided.

This charge is levied on the savings accounts and TD accounts at Ramadan. For savings accounts, Zakat is computed on the balance as on the first day of Ramadan for all active accounts. The applicable amount is then deducted from the accounts.

In the case of TD accounts, Zakat is computed whenever there is a redemption of the principal. It is computed on the redeemed principal amount, provided the first day of Ramadan (for any one year of the TD tenor) falls between the profit start date of the deposit and the maturity date.

For computation and collection of Zakat you need to capture the first day of Ramadan every year.

This chapter contains the following sections:

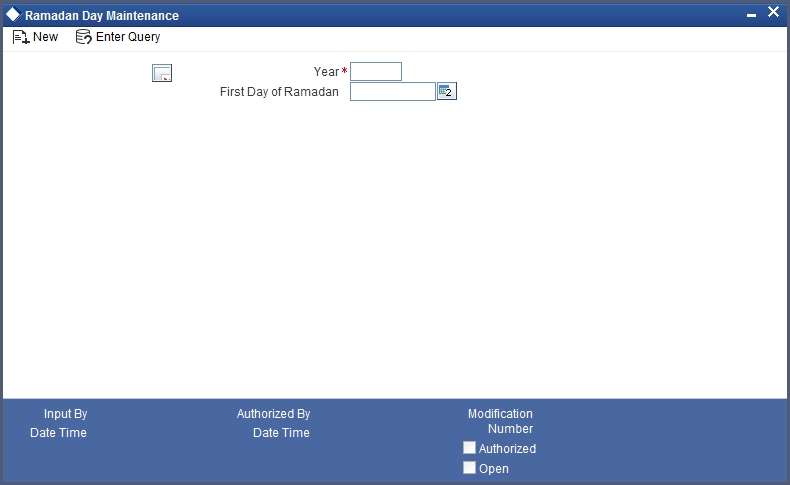

3.1 Maintaining Ramadan Day

You can capture the first day of Ramadan for a given year in the ‘Ramadan Day Maintenance’ screen. This is a bank-level maintenance that needs to be done at your Head Office. To invoke the ‘Ramadan Day Maintenance’ screen, type ‘CSDRAMDN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can specify the following details:

Year

Specify the year for which you are capturing the first day of Ramadan. Note that you cannot maintain multiple records for the same year.

First Day of Ramadan

Specify the date on which Ramadan starts in the specified year. Note that the date should be valid as per the Ramadan calendar.

Refer the chapters titled ‘Defining the attributes specific to an Interest or Charge product’ and ‘Daily Processing of Interest and Charges’ in the Interest and Charges User Manual for details on Zakat computation and application.