9. Restriction Maintenance at Customer Level

Oracle FLEXCUBE provides a utility to maintain customer level restrictions which can be utilized for transactions like cash withdrawals, non-resident local currency credit restrictions and so on. This can be achieved by maintaining restriction codes and linking these restriction codes to a customer or customer category. The system also provides the facility to track the utilized and unutilized restriction amount for a customer. Additionally, a fee can be charged for branch transactions that exceed the utilized restriction amount.

These restrictions at a customer level can be maintained for the following modules in the Oracle FLEXCUBE Universal Banking system:

- Funds Transfer

- Payments and Collections

- Utility Bill Payments

- Standing Instructions

- Retail Teller

- ATM or Point of Sale Transactions

- Term Deposits

- Loans

- Accounting Entries Upload

- Interest to CASA

For more information on how the utilized restriction amount is tracked in each of these modules, refer to the section ‘Restriction Utilization Tracking’

This chapter contains the following sections:

- Section 9.1, "Restriction Code Maintenance"

- Section 9.2, "Restriction Code- Customer/Customer Category Linkage"

- Section 9.3, "Customer Restriction Inquiry"

- Section 9.4, "Restriction Utilization Tracking"

9.1 Restriction Code Maintenance

This section contains the following topics:

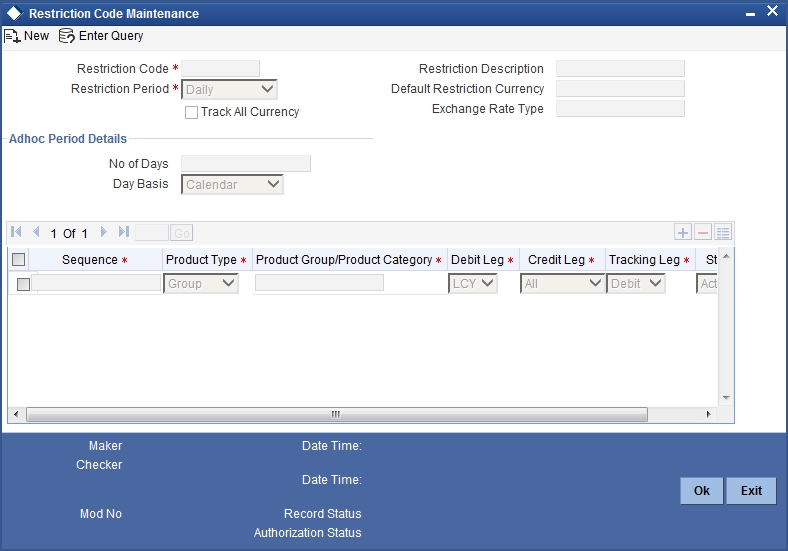

9.1.1 Maintaining Restriction Codes

In the ‘Restriction Code Maintenance’ screen, you can maintain restriction codes. These restriction codes can be linked to a customer or customer category.

For more information on attaching restriction codes to a customer or customer category, refer to the section on ‘Restriction Code- Customer Linkage’ in this module.

You can invoke the ‘Restriction Code Maintenance’ screen by typing STDRSTMT in the field at the top right corner of the application tool bar and clicking the adjoining arrow button.

You can perform the following operations in this screen:

- Input

- Delete (before Authorization)

- Modification: Status can be changed from active to inactive

- Close

- Reopen

- Authorization

Specify the following details:

Restriction Code

Specify a restriction code for customer level tracking.

Restriction Code Description

Specify a description for the earlier specified restriction code.

Restriction Period

Select a restriction period from the drop down list. The list of values displayed is as follows:

- Daily

- Monthly

- Quarterly

- Half Annually

- Annually

Track All Currency

Check this box if you intend to track the restriction amount against a default currency. On checking this field, the transaction amount is converted into the default currency and tracked against the default amount for those currencies for which the restriction amount is not explicitly maintained. In case the restriction amount is maintained for a specific currency, then the transaction amount in that currency is tracked against the respective restriction amount. Provision to maintain the restriction amount is provided in the ‘Restriction Code - Customer Linkage’ screen.

Default Restriction Currency

This field is applicable when the field ‘Track All Currency’ is selected. Select the default currency against which the limit needs to be tracked, from the adjoining option list. If the ‘Track All Currency’ field is selected, then this field needs to be mandatorily updated.

Exchange Rate Type

Select the exchange rate type to be considered for cross currency transactions from the adjoining option list.

If ‘Track All Currency’ is checked, then ‘Default Restriction Currency’ and ‘Exchange Rate Type’ should be mandatorily updated.

Note

If the restriction amount is maintained in the transaction currency, then the transaction amount is tracked in that currency. However, if the restriction amount is not maintained in the transaction currency, then the transaction amount is converted to the default currency using the exchange rate type value.

Adhoc Period Days

Number of Days

Specify the number of days for which the transaction limit is applicable.

Day Basis

Select the day basis from the drop-down list. The list displays the following values:

- Calendar: If you select this option, maintained limit is applicable for selected number of calendar days. For instance, if you are transacting on 22 Jan 2015 and number of days as 15, then the set limit is for a period of 15 calendar days from 08 Jan 2015 to 22 Jan 2015.

- Working: If you select this option, maintained limit is applicable for selected number of customer home branch working days. Sunday is weekly holiday in Customer home branch. For instance, if you are transacting on 22 Jan 2015 and number of days as 15, which means set limit is for a period of 15 days from 6 Jan 2015 to 22 Jan 2015.

Sequence

Enter the sequence number. This field indicates the sequence in which the restriction needs to be tracked. Sequence No. 1 is given the highest precedence.

Type

Select the Product Type from the drop down list. The available values are:

- Group

- Category

Note

For all modules, product type should be selected as ‘Group’ except for Loans. For loans, the product type should be selected as ‘Category’.

Product Group/Product Category

Select the Product Group or Product Category (for loans) to be maintained for restriction tracking, from the adjoining option list. The list of values displayed for Product Groups are obtained from the Product Group Maintenance (STDPRGRP) screen. For loans, you can maintain product categories in the ‘Product Category’ (CLDPRCMT) screen.

For more information on the Product Category screen, refer to the section ‘Maintaining Product Categories’ in the ‘Retail Lending’ module.

Debit Leg

Select the currency of the debit leg of the transaction that needs to be considered for tracking, from the drop down list. The list of values is as follows:

- LCY = Branch Currency

- FCY= Any currency other than branch currency

Credit Leg

Select the currency of the credit leg of the transaction that needs to be considered for tracking, from the drop down list. The list of values is as follows:

- All = All Currency

- LCY = Branch Currency

- All FCY = Any currency other than branch currency

- SameFCY = Debit Leg Currency

Tracking Leg

Select the leg of the transaction that needs to be tracked, from the drop down list. The list of values provided are as follows:

- Debit

- Credit

Status

Select the status of each record from the drop down list. The list of values provided are as follows:

- Active

- Inactive

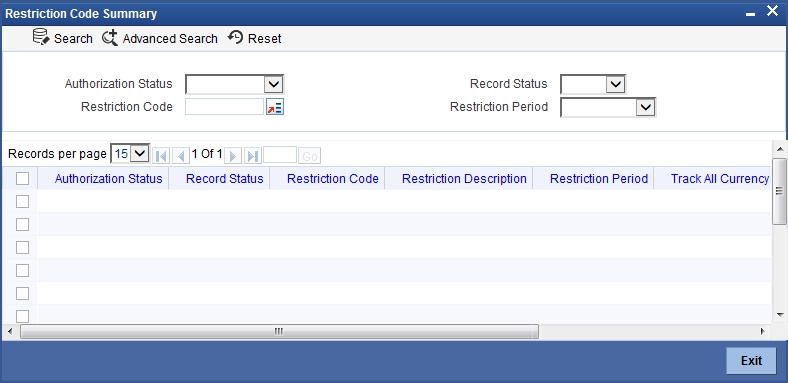

9.1.2 Viewing Restriction Codes

You can view the summary details of the Restriction Codes maintained in the ‘Restriction Code Summary’ screen. To invoke this screen, type ‘STSRSTMT’ in the field at the top right corner of the application tool bar and click the adjoining arrow button.

You can search for a record based on the following parameters:

- Authorization Status

- Restriction Code

- Record Status

- Restriction Period

On updating the above mentioned details, click the search button and the following details are populated:

- Authorization Status

- Record Status

- Restriction Code

- Restriction Description

- Restriction Period

- Track All Currency

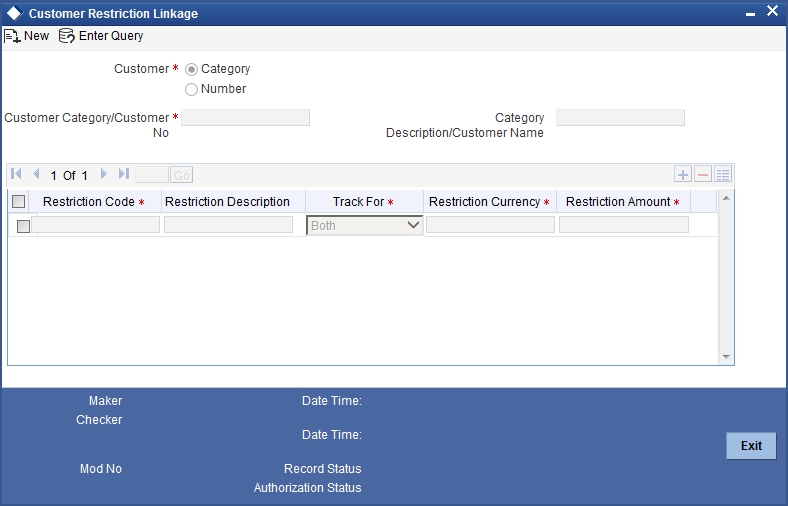

9.2 Restriction Code- Customer/Customer Category Linkage

In the ‘Customer Restriction Linkage’ screen you can link a restriction code to a customer or a customer category. You can invoke this screen by typing “STDCSRST” in the field at the top right corner of the application tool bar and clicking the adjoining arrow button.

Specify the following details in this screen:

Customer

Select number or category to define the restriction linkage to a customer or customer category.

Customer Category/Customer Number

Specify the Customer Category or Customer Number to which the restriction code is to be linked.

Category Description/ Customer Name

Specify the category description or customer name to which the restriction details are linked.

Restriction Code.

Select the relevant restriction code for restriction tracking, from the adjoining option list. All values as maintained in the ‘Restriction Code Maintenance’ screen, are populated in this field.

Restriction Description

Specify a description for the selected Restriction Code.

Track For

Select the type of customer for whom the restriction needs to be tracked, from the drop down list. The list of values provided is as follows:

- Foreign National: If the country code of the ‘Address of Correspondence’ is different from the branch country code, then this customer is classified as a Foreign National.

- Native: If the country code of the ‘Address of Correspondence’ is the same as the branch country code, then this customer is classified as a Native.

- Both: In this case, restrictions can be tracked for both the foreign national and a native customer.

Restriction Amount

Specify a restriction amount in this field.

Restriction Currency

Specify a restriction currency in this field.

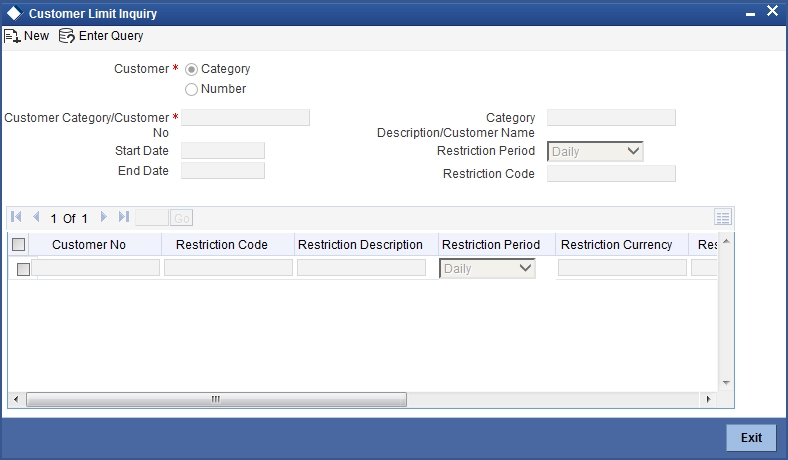

9.3 Customer Restriction Inquiry

In the ‘Customer Limit Inquiry’ screen you can inquire the restriction details (utilized or unutilized) for a customer. You can invoke this screen by typing STDRSINQ in the field at the top right corner of the application tool bar and clicking the adjoining arrow button.

Specify the following details:

Customer

Select Number or Category to define restriction linkage to customer or customer category.

Customer Category/ Customer Number

Specify the customer or customer category as attached to a customer.

Category Description / Customer Name Restriction Period

The category description or the customer name based on the selection made in the ‘Customer Category/Customer Number field, is displayed in this field.

Start Date

Specify the Start Date of the inquiry.

End Date

Specify the End Date of the inquiry.

Restriction Code

Select the restriction code. Alternatively, you can select the restriction code from the option list. The list displays all valid restriction code maintained in the system.

If you have selected ‘Restriction Period’ as Adhoc, then you should select Restriction Code and End Date. Then the system will show the utilization based on the restriction code maintenance. From date will be derived by the system based on the restriction code maintenance i.e. number of days and calendar days/business days.

Note

Restriction code will be applicable only for Ad-hoc. End date will be enabled and start date will be disabled for Ad-hoc enquiry.

Customer Number

The Customer ID is defaulted in this field.

Restriction Code

The Restriction Code defined for customer level tracking is displayed in this field.

Restriction Description

The description of the relevant restriction code is displayed in this field.

Restriction Period

The restriction period is defaulted in this field. One of the following values are displayed in this field:

- Daily

- Monthly

- Quarterly

- Semi Annually

- Annual

Restriction Amount

The restriction amount is defaulted in this field.

Restriction Currency

The restriction currency is defaulted in this field.

Start Date

The start date of the inquiry is defaulted in this field.

End Date

The end date of the inquiry is defaulted in this field.

Utilized Amount

The Utilized Restriction Amount is defaulted in this field.

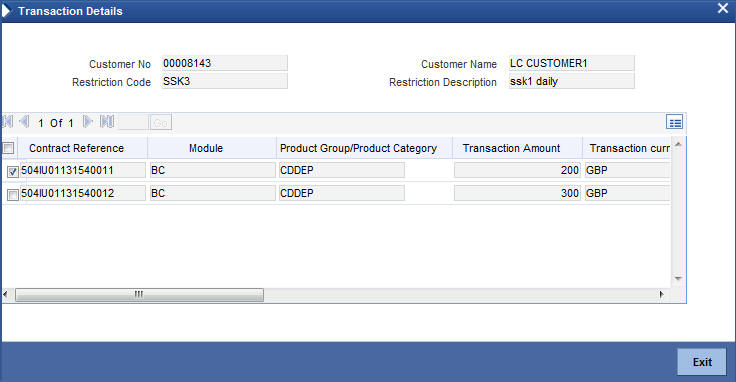

Click the Transaction Details button to view the following details of the transaction:

In this screen the following details are displayed:

- Contract Reference Number

- Module

- Product Group or Product Category

- Transaction Amount

- Transaction currency

- Transaction Date

- Exchange Rate Type

- Tracking Leg

- Dr. Account Number

- Credit Account Number

- Restriction Currency

- Restriction Amount

Note

In case there are multiple (dr/cr) accounts involved in a transaction then under ‘Customer Limit Inquiry – Transaction Details’ screen, only one of the account will be displayed. However, for utilization amount consideration the amount as applicable for the customer will be considered.

9.4 Restriction Utilization Tracking

The system provides the facility to track the utilized and unutilized restriction amount for a customer. The restriction amount is tracked on a cumulative basis and across channels, for the restriction period maintained based on the transaction date. The restrictions are tracked against the sole owner or against the primary holder (in case of joint accounts).These restrictions can be maintained and tracked for different modules of the FLEXCUBE Universal Banking system. The scope of restriction utilization tracking in each module is detailed below:

Term Deposits

In Term Deposits, a CASA account is tracked for restriction amount utilization, when it is debited or credited while funding or due to redemption of a TD account.For multiple modes of payments (e.g. TD funding), the individual record (credit or debit amount) is tracked against the customer (primary holder) of the impacted CASA account. TD top-up facility is also considered for restriction utilization tracking.

For TD, a configurable override ST-CUS-099 is provided. When the error code is configured as an error and if the utilization amount breaches the restriction, then the transaction stops. When the error code is configured as an override the transaction proceeds even when the restriction amount is breached.

Interest to CASA

CASA account interest liquidation (not just settlement account for TD but all CASA accounts) is also tracked for restriction utilization. For CASA IC, a configurable override ST-CUS-099 is provided. When the error code is configured as an error and if the utilization amount breaches the restriction, then the transaction stops. When the error code is configured as an override the transaction proceeds even when the restriction amount is breached.

Retail Teller and Utility Payment

In the Retail Teller and Utility Payment module, if any transaction amount exceeds the maintained restriction amount (transaction amount + utilized amount > restriction amount), an override is provided which can be configured in the ‘Error Code Maintenance’ (CSDOVDME) screen. For more information on this maintenance, refer to the section ‘Specifying Override Type’ in this module.

In the Utility Payments module, the restriction amount is checked as on the execution date before the transaction is processed.

Standing Instructions

In the Standing Instructions module, if any transaction amount exceeds the maintained restriction amount (transaction amount + utilized amount > restriction amount), then the SI fails. The restriction amount is checked as on the execution date, before the transaction is processed.

Accounting Entries Upload

A file upload facility has been provided from the external channels to the FCUBS system. With this facility you can upload files to debit or credit transactions of specific customer accounts. The Generic Interface (GI) facility is utilized for this purpose. For more information on this utility, refer to the section ‘Processing File Upload Facility from Channels’ in the CASA module.

While uploading the accounting entries, the restriction amount is verified for multiple entries as a single transaction and not as individual entries. A Unique Reference number is used to identify a set of transaction entries. The first serial number of the Unique Reference number is considered to obtain the debit/credit indicator. The contra pair with the contra debit/credit indicator is identified using the amount tag field. Restriction amount utilization is tracked, if either of the two legs (debit/credit) is posted to a CASA account. If both the legs of the transaction are posted to a GL account, then restriction amount will not be tracked.

If the contra leg is not available, then customer limit is not tracked. If a verified transaction entry breaches the restriction amount, then either of the two scenarios can take place:

- the transaction fails and subsequent measures to handle this failure is applied

- the transaction continues by breaching the restriction amount. For this an override is provided which can be configured in the ‘Error Code Maintenance’ (CSDOVDME) screen. For more information on this maintenance, refer to the section ‘Specifying Override Type’ in this module.

Loans

In the Loans module, restriction utilization is tracked for a customer’s CASA account when it is debited or credited during loan repayment or disbursement. Restriction amount utilization is tracked during disbursement, increase in principal and during loan repayment (including scheduled and unscheduled payment, prepayment, pre/part closure).

For disbursement, the principal amount is considered for tracking the restriction utilization amount. For loan repayment, principal (includes principal and profit for Islamic accounts) and interest components (all interest component along with penal interest) are considered for tracking the restriction utilization amount. In case of increase in principal, only the incremental increase in principal is considered for restriction utilization tracking.

If the utilized restriction amount for a customer exceeds the transaction amount, then the repayment or disbursement transaction is stopped for a channel based transaction, while a configurable override is provided for transactions performed by a bank user. For multiple modes of payment or disbursement, the individual record (credit/debit amount) is tracked against the respective customer (primary holder) of the impacted CASA account. The restriction amount utilization is tracked as on the Book Date of the event.

Note

Charges are not considered while tracking the utilized restriction amount.

The following are also included as part of the scope for restriction amount tracking:

Events such as renegotiation, split rollover and consolidated rollover

Mortgages, Lease and Islamic Loans

ATM/POS

For ATM/POS transactions, the restrictions are tracked once the amount block is in place. On release of the amount block for ATM/POS transactions, the utilized restriction amount is reduced by that amount. When the settlement file is uploaded, the restriction is tracked for the transaction amount. If an ATM transaction follows the direct debit flow of a transaction rather than amount block, then the restriction utilization is tracked for the transaction amount.

Funds Transfer

In the Funds Transfer module, the restriction code is checked at the Book and Amendment event of the contract and the utilization is tracked based on the booking date of the contract.

For a consolidated booking, restriction amount utilization is not tracked for parent internal transfer contract. This check is done only for the child contracts based on the products maintained in the ‘Restriction Code Maintenance’ screen. The currency to be used for restriction validation is derived from the parent contract. This is applicable for single debit multi credit, bulk file upload or MT101/MT102 contracts as well. Restriction amount utilization is tracked for customer transfers or internal transfers as well.

For split contracts, the utilized restriction amount is tracked as a normal contract, if such products are maintained in the ‘Restriction Code Maintenance’ screen.

For manually input contracts, an override is provided which can be configured in the ‘Error Code Maintenance’ (CSDOVDME) screen.

For uploaded contracts through STP, the contract is processed based on the source parameter setup for On Override / On Error.

For internal transfers received from the FCDB system, the contract is processed based on the source code FCAT. The system displays an error in case the transaction breaches the restriction amount.

Payments and Collections Module

The restriction code is checked as on the Book and Amendment event of the contract and utilization is updated based on the booking date of the contract. Single Debit Multi Credit contract is also tracked for restriction amount utilization. Since individual contracts are created in the PC module, restriction check is applied based on the product group setup at the Restriction Code Maintenance level. The maintenance can be done for any type of products.

For manually input contracts, an override is provided which can be configured in the ‘Error Code Maintenance’ (CSDOVDME) screen.

For online transactions received from the FCDB system, the contract is processed based on the source code FCAT and the system raises an error if the limit breaches.

For uploaded contracts from CPG, the system uses the STP preference or source parameters based on the message type or source code.