15. Maintaining Exchange Rates

In the Currency Rates screen, you can maintain exchange rates for a currency pair, the rates at which you buy and sell one currency for another.

A bank determines its buy and sell rate for a currency pair by applying a spread (i.e., its profit margin) to the mid-rate of the currency pair. Mid rate is the basic rate at which a currency pair is exchanged.

The spread applied for a currency pair varies with the transaction type, while the mid-rate usually remains constant. Consequently, different rates are applicable to different transaction types. For instance dollars in currency are purchased at a certain rate, while USD traveler’s checks are bought at a different rate. In Oracle FLEXCUBE, you can define a rate type which you would like to associate with a transaction type e.g., ‘CASH’, ‘TRAVCHKS’, etc., in the Rates screen.

In the Currency Rates Maintenance screen, you define the mid-rate, buy and sell spread applicable to each rate type; the buy and sell exchange rates are computed by the system.

Buy rates and sell rates can either be maintained by individual branches or can be input by the HO and propagated to all the branches.

If the flag ‘Copy Exchange Rates to Branches’ is set to Yes at ‘Bank Parameter Level’, then on authorization of exchange rate maintenance:

- If the branch for which the rate is being uploaded or maintained is the head office branch, then the rate would be copied to all those branches that have the same country code as the head office branch.

- If the branch for which the rate is being uploaded or maintained is not the head office branch, but it has the same country code as the head office branch, then the rate being uploaded or maintained would be specific to the branch and would not be copied to any other branch.

- If the branch for which the rate is being uploaded or maintained is not the head office branch and also does not have the same country code as the head office branch, then the rate being maintained would be copied to all the branches that has the same country code linked as the branch for which the rate is being maintained or uploaded.

In the Bank-wide Preferences screen, if you have not specified ‘copy exchange rate to branches’ then the ‘Currency Exchange Rates Input’ screen is maintained at the branch level by the different branches.

This chapter contains the following sections:

- Section 15.1, "Currency Exchange Rate Maintenance"

- Section 15.2, "Specifying Limits for Cross Currency Transactions"

15.1 Currency Exchange Rate Maintenance

This section contains the following topics:

- Section 15.1.1, "Maintaining Currency Exchange Rates"

- Section 15.1.2, "Authorizing Exchange Rates"

- Section 15.1.3, "Revising Exchange Rates"

- Section 15.1.4, "Viewing Exchange Rates"

- Section 15.1.5, "Currency Rate Notification"

15.1.1 Maintaining Currency Exchange Rates

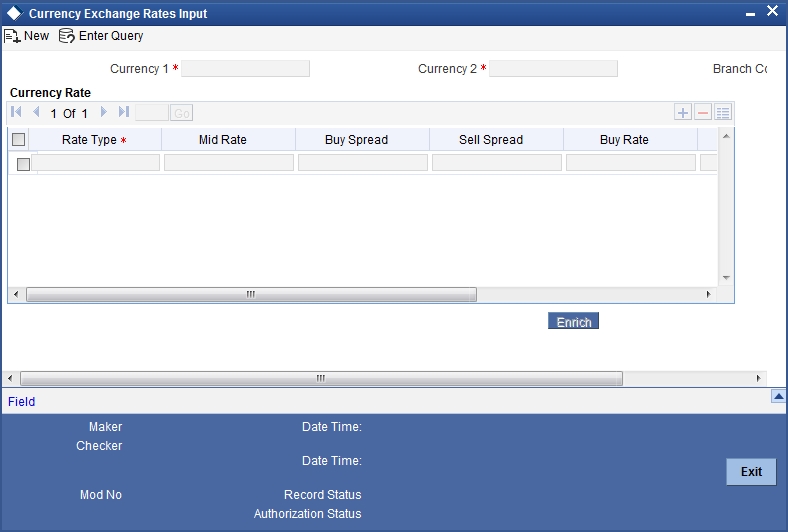

You can invoke this screen by typing ‘CYDRATEE’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.The screen appears as shown below:

In this screen you maintain the following parameters for each rate type of a currency pair:

- Mid rate

- Buy spread and Sale spread

- Buy rate and Sale rate

Currency 1 and 2

Specify the currency pair for which you want to compute the exchange rates. The list displays the currency pair that are maintained for the country to which the branch belongs.

The pair should be selected keeping in mind the quotation method for exchange rates as followed by the market. The system offers the choice of maintaining both the currencies as currency1 or currency 2 -- USD against DEM and DEM against USD.

For the pair specified the following parameters need to be maintained to arrive at the buy and sell rate of currencies:

- Rate Type

- Mid Rate

- Buy Spread

- Sell Spread

Rate Type

This is the rate type for which you are maintaining exchange rates for a currency pair. For different transaction categories your bank would like to maintain different exchange rates. For example, traveller’s check is purchased at a certain rate whereas a bill of exchange is bought at a different rate.

In the front-end-modules, where you define products to cater to the various transaction types of your bank, you can link an appropriate rate type to the product. For instance, you create a product to cater to outgoing cross currency transfers by SWIFT. For this product, if you define the rate type to be STANDARD then for all contracts linked to this product, the Standard Rate Type would be applied.

Mid Rate

Mid rate is an indicative exchange rate for a currency pair. It is the average of the buy and sell rate quoted by the market for a currency pair.

For example,

currency 1 = USD

Currency 2 = INR

Buy rate -- 1 USD = 1.7020 INR

Sell rate -- 1 USD = 1.7040 INR

Mid-Rate = 1.7030

Buy Spread

This is the buy spread for a currency pair. It can be defined as the profit margin specified over the mid rate when you buy currency 1 for currency2. You can define the buy spread in two ways -- either in points or in percentage. The system computes the effective buy spread for you.

Sale Spread

This is the sell spread for a currency pair. It can be defined as the profit margin specified over the mid rate when you sell currency 1 for currency 2. You can define the sell spread either in points or in percentage. The system computes the effective sell spread for you.

Buy Rate

Buy rate is the rate of exchange for a currency pair, which is computed by the system based upon the mid rate, the spread specified, the spread definition and the quotation method maintained in the ‘Currency definition’ screen.

Sale Rate

Sell rate is the rate of exchange for a currency pair, which is computed by the system based upon the mid rate, the spread specified, the spread definition and the quotation method maintained in the ‘Currency definition’ screen.

You can also input the buy and sell rate for a currency pair. In which case, the system will compute the spread for the rate type.

Rate Date

This is a display field. When you enter the exchange rate for a currency pair, the system will default the Rate Date as the Application Date. The rate date will always be less than or equal to the application date.

Rate Serial

This is a running serial number for the Rate Date. You need to specify the serial number. You entry will be validated for uniqueness. For example, there could be only one exchange rate between USD and EUR for 31/07/2003 with Rate Type STANDARD with Rate Serial as 0001. Thus, this will be a unique rate serial for a currency pair, rate type combination for a given rate date.

When you enter the exchange rate for a currency pair, the system will default the Rate Date as the Application Date and the Rate Serial as the latest available serial for the currency pair + 1. The Rate Serial Number will be system generated. However, you can modify it if required. This number takes into account the Rate Serial Number present in the Currency Rates History screen too. The Rate Serial Number and the Rate Date will be displayed during authorization of the Rate in the Currency Authorization screen.

15.1.2 Authorizing Exchange Rates

Authorization of exchange rates is done from the Currency Exchange Rates input screen. Details like old value, new value for each field (buy rate, mid rate etc) are displayed. Click authorise icon to authorize the record.

15.1.3 Revising Exchange Rates

For revising the exchange rates for your bank or the branches invoke the ‘Currency Maintenance’ screen. Click the currency pair whose exchange rate you want to revise and click unlock icon on the toolbar. Input/modify the new rates for the pair.

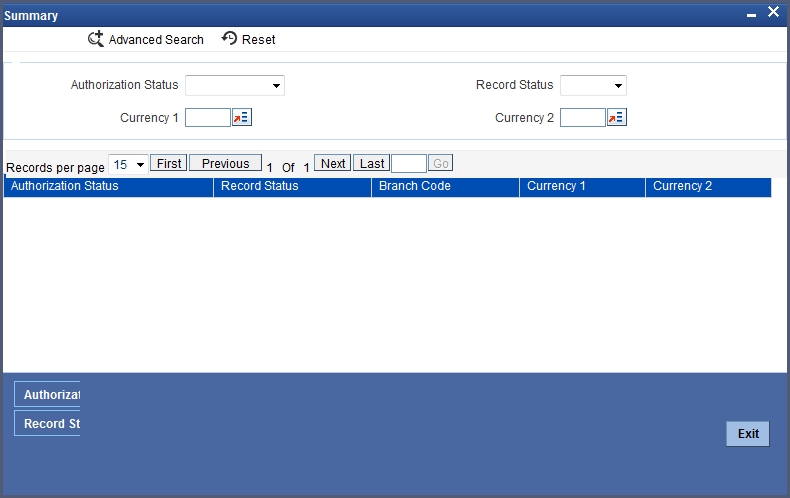

15.1.4 Viewing Exchange Rates

You can view the exchange rates in the ‘Currency Exchange Rates View’ screen. You cannot input any values. You also have the option of specifying whether you want to view authorized rates or the unauthorized rates for any currency pair.

You can invoke this screen by typing ‘CYSRATES’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen appears as shown below:

If the branches pick up the exchange rates maintained by the HO, then each time you invoke the ‘currency view’ screen from a branch it is advisable to update this screen with the latest rate input, from the HO. To do this, click on ‘Refresh’. Refresh updates the screen with the last exchange rates input.

15.1.5 Currency Rate Notification

You can update the exchange rates in the screen or upload through XML or upload through generic interface. The system generates a notification on authorization of the modified exchange rates.

If the parameter ‘Copy Exchange Rates to Branches' at bank parameter level is selected, then the rates will be populated and notifications will be generated in all the branches.

15.2 Specifying Limits for Cross Currency Transactions

Typically, the exchange rates applicable for cross currency funds transfer or teller transactions is defaulted by the system depending upon the preference indicated in the product preferences, for the product involving the transaction.

In your bank, for high-value cross currency transactions, you may want the user to manually enter the exchange rate involved, rather than let the system automatically pick up a default rate during transaction input.

You can define such a preference to be applicable to cross currency transactions involving:

- A currency pair

- A specific product, or all products

- A specific module, or all modules

- A specific branch, or all branches

- A specific rate code

The transaction amount limit, above which the exchange rate must be entered, for a high value transaction, could be defined in terms of currency pair where the currency of the transaction is currency1 in the CCY pair defined in the maintenance.

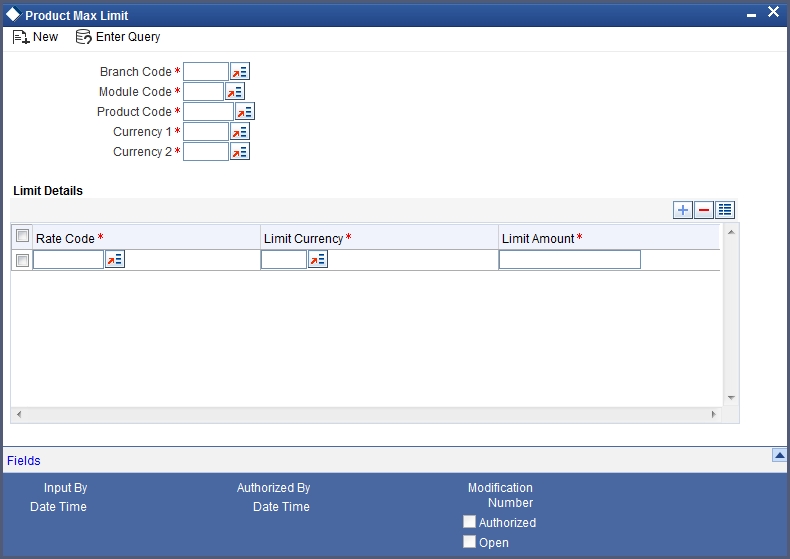

To ensure that users manually enter exchange rates for high-value cross currency transactions in Oracle FLEXCUBE, you must specify the limit amounts that must be validated for each transaction in terms of currency pair, product, module, and branch combination. You can use the ‘Product Limits Maintenance’ screen to specify the limits.

When you have specified these limits, the system automatically validates the amount with each transaction for the currency pair, product, module and branch combination, and accordingly, if the limits are exceeded, enforces the manual entry of exchange rates.

In case, the limit between ccy1 and ccy2 is given in ccy2, the system will automatically convert the transaction amount to an amount in ccy2 using standard mid rate and check against the limit amount whether or not manual entry of exchange rates is required. You can invoke the ‘Product Limits Maintenance’ screen, by typing ‘CSDPXMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen appears as shown below:

You must specify the branch for which the limit amount will be applicable. You can specify that the limits must be applicable for all branches.

You must specify the module for which the limit amount will be applicable. You can indicate that these limits must be applicable for both the Data Entry (DE) and Funds Transfer (FT) modules.

You must specify the product, transactions involving which the limit amount will be applicable. You can specify that the limits must be applicable for all products.

You need to specify the currency1 applicable for defining the Transaction Amount limit, beyond which the system will not default the Auto Exchange Rate.

All valid currencies defined in the Currency Pair Maintenance will appear for selection. This currency is always the transaction currency of the contract.

Currency2

You need to specify the currency2 applicable for defining the Transaction Amount limit, beyond which the system will not default the Auto Exchange Rate.

All valid currencies defined in the Currency Pair Maintenance will appear for selection. The Currency2 should be part of a Currency Pair Maintenance in which the Currency1 defined here is the first currency. Currency 2 can be specified as ALL.

Specifying Limit Details

Rate Code

You need to specify the Rate Type (code) for the Exchange Rate Limit

Limit Currency

You need to specify the currency in which the Limit Amount should be expressed. All valid currencies defined in the system will be applicable for selection. There will be a validation for the limit currency as either Currency1 or Currency2.

Limit Amount

You need to specify the maximum amount up to which the system should default the Exchange Rate or perform the Rate Variance validation.

15.2.0.1 Validating Exchange Rate Limits

The Funds Transfer Contract Input will default the Rate only if the Transaction Amount is less than the Maximum Amount defined for the Rate Code maintained at the product level for FT. If the amount is more than the specified amount, then the system will not default the Rate. Instead, it will force the user to enter the Rate. Once the user enters the Rate, the system will not add the Customer Spread etc. as this will be final Exchange Rate for the contract.

The Rate Variance validation will also be done only if the amount is less than the maximum amount defined for the Rate Code maintained at the product level for FT. If the amount is more than the specified amount, the system will not perform the Rate Variance validation. Instead, there will be an override to specify that the transaction amount is greater than the maximum amount for Rate Variance check.

For details about how limits are applied when a transaction is entered, refer the chapter Processing a Funds Transfer, in the Funds Transfer user manual.