19. Period Code Maintenance

Banks, like all business houses compute their profits and losses and assess their financial position at the end of each financial year, which typically extends to 12 months -- from January to December or from March to April. However, this could be changed, depending upon the Bank’s policies and regulatory requirements.

For interim reporting needs, the financial year is further divided into accounting periods, the duration of which is again determined by the bank’s accounting requirements. For example, your bank’s Board of Directors meets once a month therefore, you would divide the financial cycle into monthly periods.

The financial year and the accounting periods are referred to in the Oracle FLEXCUBE system as the ‘Financial Cycle’ and the ‘Financial Periods’ respectively and are maintained at the bank level by your Head Office branch.

At the end of each financial period and financial cycle you can generate profit and loss statement and a balance sheet. The system also offers you the flexibility of keeping a financial period/financial cycle open, allowing you to post adjustments to it and obtain a revised profit or loss statement/balance sheet. You can maintain these details in the ‘Period Code Maintenance’ screen.

This chapter contains the following section:

19.1 Period Code Maintenance

This section contains the following topics:

19.1.1 Maintaining Period Code

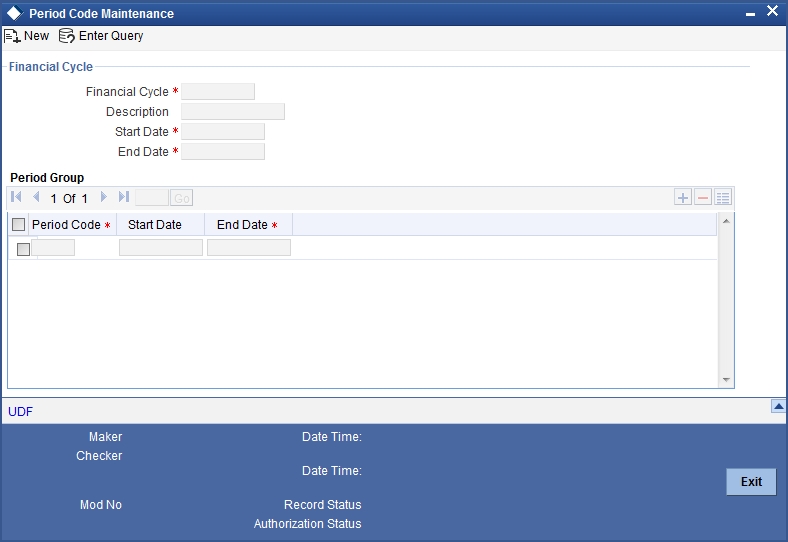

You can invoke this screen by typing ‘STDPRCDE’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen appears as shown below:

In this screen you define the following:

- The financial cycle of your bank giving the start date and end date of each financial year

- The period group - financial periods into which each financial cycle is to be divided

The following are the features of the Period Code screen

Financial Cycle

For each financial cycle you maintain the following parameters:

Cycle

This is a code for the financial cycle. It acts as an identifier for the cycle. For example, while posting adjustments into a previous financial cycle -- you would identify the year through this code.

Input the code using a maximum of 9 characters, alphanumeric.

For example, the financial cycle extends from 1st April to 31st March in India. A bank here could define its code for the year 1996-97 as FY 1996-97.

Description

This describes the financial cycle. Enter description using a maximum of 35 characters, alphanumeric. Taking the above example, you could enter Financial Year - 1996-97.

Start Date

This is the first day of this Financial Cycle

End Date

This is the last day of this Financial Cycle

Period Group

The financial cycle defined above, can be divided into different accounting periods. To define individual accounting periods click on the first row under period code. A period called ‘FIN’ is created by the system. This is an open ended period coinciding with the last day of the financial cycle (for details refer to the section ‘System Functions’).

You can maintain the following parameters for each accounting period within a financial cycle:

Period Code

This code identifies the accounting period. Enter a code using a maximum of 3 characters, alphanumeric. For example, if your period length is a quarter you can enter - Q1 for the first period; Q2 for the second; Q3 for the third and so on. If your period length is a bimonthly you can enter BM1, BM2. If your period length coincides with a month you can input M1, M2.

Start Date

This is the first day of the corresponding period

End Date

This is the last date of the corresponding period. ‘End date’ of a period should always end on a month end. Please note:

- The period codes could be of varying lengths but no gaps should be left between periods

- The duration of two periods should not overlap

- You can modify the period code of the current or a future period; however, a past period cannot be modified even if it has not been closed

- All details maintained in the ‘Period Code Screen’ will automatically apply to any new branch opened by you in the Branch Parameters Screen

- The current financial cycle code and the current period code are displayed in the ‘Branch Parameters Screen’

Period Code Status

After authorisation, you can view whether a financial period is open or it has been closed. Each branch can view the status of a period in every other branch. Click the period whose status you want to view.

Branch

Displays the codes of the different branches of your bank

Status

Displays the corresponding status of the period code highlighted. ‘O’ - indicates open status; ‘C’ - indicates closed status

Note

The current financial cycle code and the current period code are displayed in the ‘Branch Parameters Screen’

All details maintained in the ‘Period Code Screen’ will automatically apply to any new branch if incorporated to your bank post maintenance of this screen. The status of all periods in the new branch will be open.

19.1.2 System Functions

The system offers you the flexibility of posting transactions into a previous accounting period which has passed its due end date. For example, lets assume your bank’s financial cycle extends from 1st January to 31st December; the first period starts on 1-01-96 ends on 31-03-96. Even beyond 31-03-96 you can keep the period open to be able to post for example, expense bills you expect to receive in April. After you have posted all adjustments, you can close the period.

Even after you have closed the last accounting period of a year, the system offers you the flexibility of posting adjustments to the financial year.

For each financial year the system generates an open status period called FIN. Its start and end dates coincide with the last date of the financial cycle. Into this one day period you can post the accumulated profits and loss for the financial cycle, general reserves, and statutory reserves for the current year after paying off the dividends. After this one day period is closed the status of the financial cycle in the made by field ‘status’ is displayed as closed. With this the financial year stands closed and no adjustments can be posted to it.

Closure of a period/financial cycle can be invoked through the General Ledger/ Core Services module. The branches of the bank should close this period/financial cycle.