22. Account Revaluation Maintenance

Account revaluation is a process by which the LCY equivalent of balances in the FCY accounts is marked to market.

In all foreign currency accounts, the FCY current balance is displayed along with the LCY equivalent of the current balance. The LCY equivalent current balance is the aggregate of the LCY equivalent of the various transactions that have been posted to the account.

In the ‘Chart of Accounts - GL Details’ screen you specify whether a GL should be revalued or not.

This chapter contains the following section:

22.1 Account Revaluation Setup

This section contains the following topic:

22.1.1 Maintaining Account Revaluation

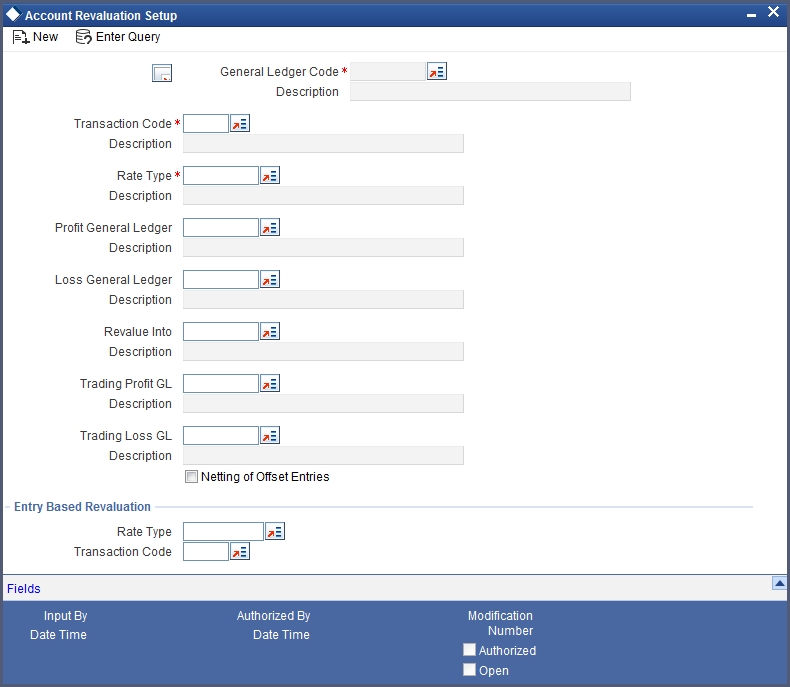

In the ‘Account Revaluation Maintenance’ screen, you specify parameters for account revaluation such as rate type, the GL to which the profit or loss from revaluation should be posted, etc. You can invoke this screen by typing ‘RVDSETUP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen you can maintain the following parameters to define the revaluation parameters for a GL account:

- The general ledger accounts to which the profit or loss on revaluation is to be posted

- The account to which the revaluation profit is to be debited or loss credited

- The rate type to be used to revalue the GL

- The transaction code for posting the revaluation entries

- The rate type to be used for accounting entry-based revaluation of profit and loss GLs

- The transaction code that would be used to post revaluation entries due to accounting entry-based revaluation of profit and loss GLs

General Ledger Code

This is the code of the GL account for which you are specifying revaluation parameters.

Transaction Code

This is the transaction code under which the accounting entries would be posted to the defined revalued GL account

Rate type

This is the rate type to be used for revaluation of this GL

Profit General Ledger

If the result of revaluation is a profit, the profit amount is credited to this profit GL. If, for a GL, you have opted for revaluation split, then Revaluation Profit (as opposed to Trading Profit) is posted into this GL.

Revaluation split segregates revaluation profit / loss into:

- Trading Profit / Loss – Profit / Loss due to revaluation of FCY entries posted into the GL during the current day.

- Revaluation Profit / Loss – Profit / Loss due to revaluation of opening FCY balances (excludes current day’s turnover).

Loss General Ledger

If the result of revaluation is a loss, the loss amount is debited to this loss GL. If, for a GL, you have opted for revaluation split, then Revaluation Loss (as opposed to Trading Loss) is posted into this GL.

Revalue into

This GL account is debited if the result of revaluation is a profit; and credited if the result of revaluation is a loss

This would typically be the GL code being revalued. For all non-contingent GLs belonging to the asset or liability categories, the system defaults to the GL being revalued.

If you wish to specify a different account for posting these entries specify by selecting from the list of maintained GLs. A list of all GLs would be displayed. Select.

Trading Profit Account/Trading Loss Account

This indicates the GL for posting profit/loss due to trading revaluation (Trading Profit / Loss) if you have indicated that revaluation split is required for a GL.

Netting of offset entries

A check against this indicates whether the offset entries for all accounts linked to the GL code need to be netted or not. If checked, a single consolidated entry would be passed (one for profit and one for loss).

Note

Netting of offset entries is applicable only for normal account revaluation and not for accounting entry-based revaluation of Income/Expense GLs.

Accounting entry-based revaluation of Income / Expense GLs

Income/expense GLs that are marked for entry-based revaluation are picked up by the EOD revaluation batch process, which executes before the account revaluation batch process on a given business day.

In the Account Revaluation Maintenance, you must specify the following parameters that would be used by the batch revaluation process, for revaluing FCY entries in Income/Expense GLs:

- Rate type

- Transaction code for posting entry-based revaluation entries

You can maintain these parameters for specific Income/Expense GLs. If you wish to maintain these parameters for all Income/Expense GLs, you can specify the ‘STDPNL’ option in the GL Code field. The ‘STDPNL’ option signifies that the entry-based parameters being maintained are applicable for all Income/Expense GLs.

When the revaluation batch revalues an Income/Expense GL, it uses the rate type and transaction code maintained for the GL in the Account Revaluation screen. If no maintenance exists for the specific GL, the parameters maintained for the ‘STDPNL’ GL Code option are used.