8. Registration of an Islamic Collection Bill

8.1 Introduction

The details of an Islamic collection bill are captured through the ‘Islamic Bills & Collections - Contract Registration Details’ screen. No accounting entries are passed nor will any charges be levied during the registration of a collection bill.

A collection bill is registered based on the first set of documents (original or duplicate) received. On registration, a Contract reference number is allocated to the bill.

At the time of processing a collection bill that has already been registered, you only need to only specify the collection reference of the bill. All the details entered at the time of registration will automatically be picked up and defaulted to the contract main screen.

8.2 Registration Screen

This section contains the following topics

- Section 8.2.1, "Invoking the Registration Screen"

- Section 8.2.2, "Specifying the Parties Involved in a Collection Bill"

8.2.1 Invoking the Registration Screen

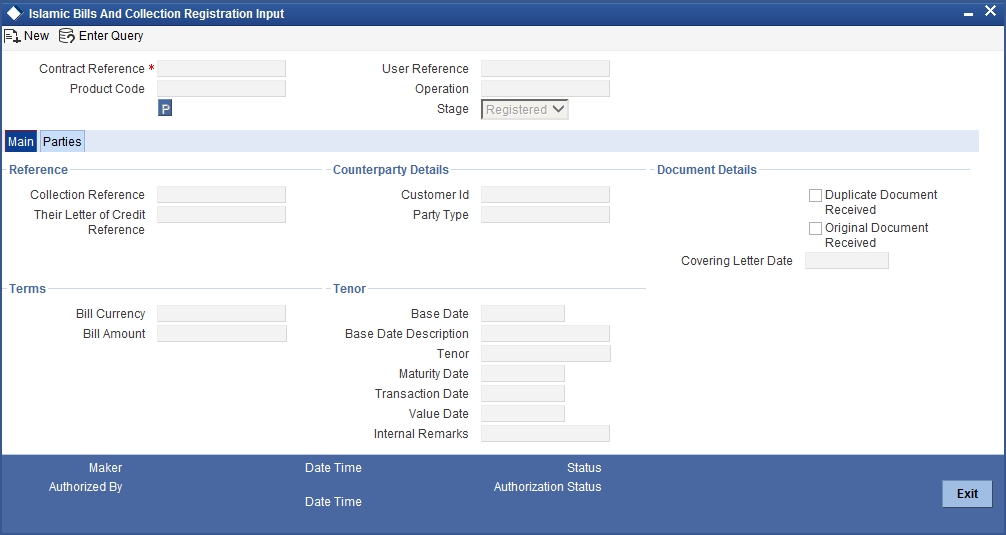

You can invoke the ‘Islamic Bills and Collections Registration Input’ screen by typing ‘IBDTRGON’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. The ‘Islamic BC Registration Input’ screen will be displayed. All the operations for which you have access rights under the Islamic BC module will be displayed. Select ‘New’ from the Actions menu in the Application tool bar or click new icon.

If you are calling a bill that has already been registered, click on Summary. The details of the bill that you have registered will be displayed in a tabular form. From the summary screen, you can open an existing registered bill by double clicking the reference number of the bill.

You can enter the details of the registration of a collection bill by:

- Copying the details from an existing contract and only changing details that are different for the contract you are entering

- Entering the details of the Registration afresh by using your keyboard and the option lists that are available at various fields.

To facilitate quick input, you need to just enter the product code. Based on the product code you choose, many of the fields will be defaulted. You can overwrite these defaults to suit your requirement. You can further add details specific to the collection bill, like the bill amount, the tenor and the party details of the bill.

8.2.1.1 Specifying References of the Bill

The bills that come to your bank for collection can be raised against an LC drawn at an earlier date by another bank.

Collection Reference

Enter a unique reference that will help you identify the collection bill. In case of an outgoing collection bill you can specify an identification of your own. In case of an incoming bill, you can indicate the reference assigned to the bill by your confirming bank.

Their Letter of Credit Reference

If you are processing an outgoing bill under an LC that was issued by another bank, you can enter the Reference number assigned to the LC by the other bank.

8.2.1.2 Specifying Counterparty Details

In this section specify the following details:

Customer ID

Enter the name or CIF Id (as the case may be) of the counterparty to the bill.

In the case of an Import bill, you should specify details of the ‘Drawee’ of the bill. If the Drawee is a customer of your bank you should specify the CIF Id assigned to the customer, the other details of the bill will be automatically picked up.

If you are processing an Export bill you should specify details of the ‘Drawer’ of the bill. If the drawer is a customer of your bank you should specify the CIF Id assigned to the customer, the other details of the bill will be automatically picked up.

Party Type

Specify the party type of the customer indicated in the ‘customer’ field. If you are processing an import bill this field is defaulted with DRAWEE. If you are processing an export bill it is defaulted to DRAWER.

8.2.1.3 Specifying Document Details

In this section specify the following details:

Duplicate Document Received

This field is applicable only for Documentary bills. Here you can indicate whether the duplicate set of documents that are required under the bill have been received.

Note

If you had indicated negatively in the ‘Document Original Received’ field you should indicate positively in this field. This is because the bill contract should be entered based on the first set of documents that are received.

Original Document Received

This field is applicable only for Documentary bills. Here you can indicate whether the original set of documents that are required under the bill have been received.

Covering Letter Date

This field is applicable only for Documentary bills. Here you can indicate the date printed on the covering letter based on which the contract was entered.

This date can be used to retrieve information on pending documents.

8.2.1.4 Specifying Terms of a Bill

The terms that you define for a collection bill, while registering it, will form the basis on which the bill will be processed. You can specify the following terms for a bill:

Bill Currency

Specify the currency in which the bill is drawn.

Bill Amount

Specify the amount for which the bill is drawn.

While processing a bill that was registered, all the terms that you specify during registration will be displayed in the respective fields of the Contract Main screen.

8.2.1.5 Specifying Tenor Details for a Bill

You can specify the following tenor related details here.

Base Date

The base date is the date from which the tenor specified for the bill becomes effective. The base date is used to calculate the maturity date of the bill. In effect the tenor of the bill will begin from the base date.

If you are processing a sight bill, the base date is the lodgment date and for a usance bill it can be the Invoice date or the Shipping Date.

Tenor

Usance bills are generally associated with a tenor. The tenor of a bill is always expressed in days. The standard tenor defined for the product involved in the bill is defaulted. You can change the default to suit the tenor of the bill you are processing. However the tenor that you specify for a bill should be within the minimum and maximum tenor specified for the product involved in the bill.

Note

The tenor of a sight bill is always defaulted to zero days. You will not have an option to change it.

Transit Days

The transit days refer to the expected number of transit days for a sight or matured usance bill. The transit days will be used in the computation of the maturity date of the bill.

Maturity Date

The maturity date is the date on which the bill falls due for payment. The maturity date that you specify should be a date later than or equal to the Value date specified for the bill. The maturity date is calculated in the following manner based on the entries you have made to the previous fields:

Maturity Date = Base date + Tenor + Transit days

You can change the maturity date of a bill that is arrived at using the above method.

Base Date Description

Here you can specify a description of the base date specified in the earlier field. For example, you can indicate that the base date is the lodgment date or the shipment date etc.

Liquidation Date

The liquidation date is the date on which the bill was entered into Oracle FLEXCUBE. The system defaults the liquidation date to the current system date (today’s date). You cannot amend or change the defaulted date.

Value Date

This is the date from which the bill becomes effective. The accounting entries triggered off by events like input, amendment and liquidation hitting the Nostro and customer accounts will be passed as of the value date.

The value date should be earlier than or same as today’s date. If you do not enter a value date for a bill, the system defaults to today’s date. You can enter a value date of your choice; however it can be one of the following:

- Today’s Date

- A date in the past

- A date in the future (you can enter a date in the future only if future dating has been allowed for the product)

Note

The Value date of a bill should not be earlier than the Start Date or later than the End Date specified for the product involved in the bill.

Internal Remarks

Enter information for the internal reference of your bank. This information will be made available at the time you retrieve the information on the bill.

Note

These remarks will not be printed on any of the advices generated for the bill.

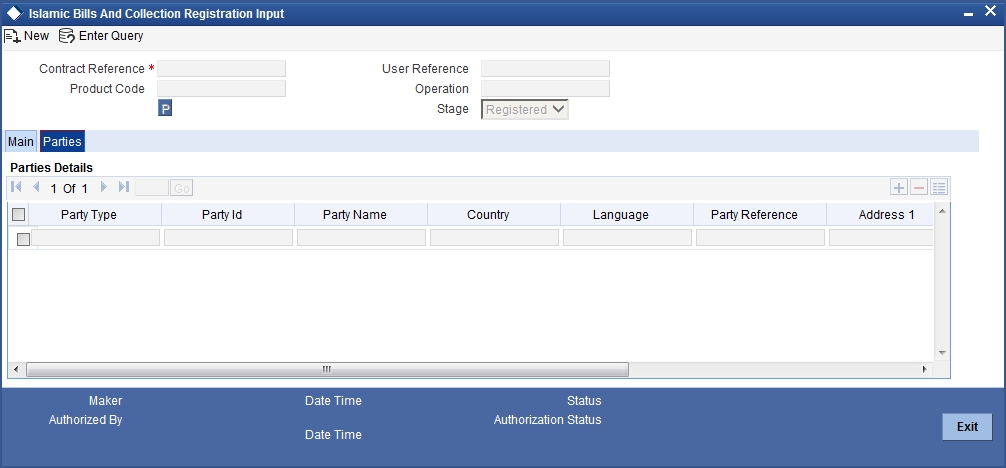

8.2.2 Specifying the Parties Involved in a Collection Bill

In the ‘Islamic Bills and Collections Registration Input’ screen, you can capture details pertaining to all the parties involved in a bill.

You can capture the following details in the bill you are registering:

- Party type of the customer

- CIF Id assigned to the party

- Country to which the party belongs

- Language in which tracers and messages should be sent to the party

- Party’s mail address

The parties that can be involved in a collection bill not only depend on the type of bill you are processing but also on the operation that you are performing on the bill.

While registering a bill, both incoming and outgoing, the only operation that is possible is Collection. The following table indicates the parties that can be involved in a collection bill.

| Operation | Party Type | Party Description | |||

|---|---|---|---|---|---|

| DRAWER | Drawer | ||||

| DRAWEE | Drawee | ||||

| REMITTING BANK | Remitting Bank | ||||

| Collection | COLLECTING BANK | Collecting Bank | |||

| CASE NEED | Case Need | ||||

| GURANTOR | Guarantor | ||||

| THROUGH BANK | Through Bank | ||||

| ISSUING BANK | Issuing Bank |

At the time of processing a bill, which was registered, the documents, tracers, advices and messages applicable to the bill will be sent to the concerned parties based on the details you specify in this screen.

Note

You can use a particular Party Type only once in a bill that you register.