4. Maintaining System Data Elements

4.1 Introduction

To calculate profit or charges for an account, you require the following data:

- Principal – The amount for which you want to calculate profit

- Profit period – The number of days for which you want to apply profit

- Profit rate

These components, required to calculate profit, are called ‘data elements’ (the elements that provide the required data to calculate profit). Data elements are of two types:

- System Data Elements (SDEs)

- User Data Elements (UDEs)

System Data Elements (SDEs) can include any of the following:

- Values for data elements like the balance in an account, on which profit has to be applied

- Number of transactions in a day

Information, such as the ones listed above, is constantly updated in the system and is readily available for computation of profit. They are therefore called SDEs.

As a corollary, these values will necessarily be picked up by the system while applying profit. You cannot, for example, indicate to the system that a certain amount should be picked up as the balance, if that is not the balance in the account. On the other hand, you can indicate to the system that profit should be applied at a specific rate. For a certain period, you can indicate that profit should be calculated at five percent. While, for some other period, you can indicate that profit should be applied at six percent.

Thus, the profit rate is a value that you have control on and whose value you can specify. Such elements are called User Data Elements (UDEs). Another example for UDEs is the tier or slab structure based on which profit has to be applied on an account (since you would specify the slab and the tier structure).

SDEs and UDEs are used to build formulae that result in the amount of profit that has to be applied.

4.2 System Data Elements

This section contains the following topics:

- Section 4.2.1, "Maintaining System Data Elements"

- Section 4.2.2, "Maintaining SDE for Profit Calculation on Daily Average Balance"

- Section 4.2.3, "Maintaining SDE for Tax Exemption"

- Section 4.2.4, "Maintaining SDEs for Computing TDS"

- Section 4.2.5, "Maintaining SDEs for Computing Advance Profit"

- Section 4.2.6, "Maintaining SDEs for Computing Overdraft Profit"

- Section 4.2.7, "Maintaining SDE for Computing Commission on Highest Debit Balance"

- Section 4.2.8, "Viewing Customer TDS Details"

- Section 4.2.9, "Maintaining SDEs for Deducting Charges on Dormant Accounts"

- Section 4.2.10, "Implications of Working with User Defined Fields"

4.2.1 Maintaining System Data Elements

You will have different types of accounts in your bank, such as current accounts, savings accounts, etc. On each of these accounts you would want to apply profit differently. On a savings account, for example, you may want to apply credit profit on the basis of the minimum credit balance during the month. On a current account you may want to apply charges on the basis of the turnovers, or, levy debit profit on the basis of overdrafts. Similarly, there may be various criteria based on which you would want to apply profit on an account.

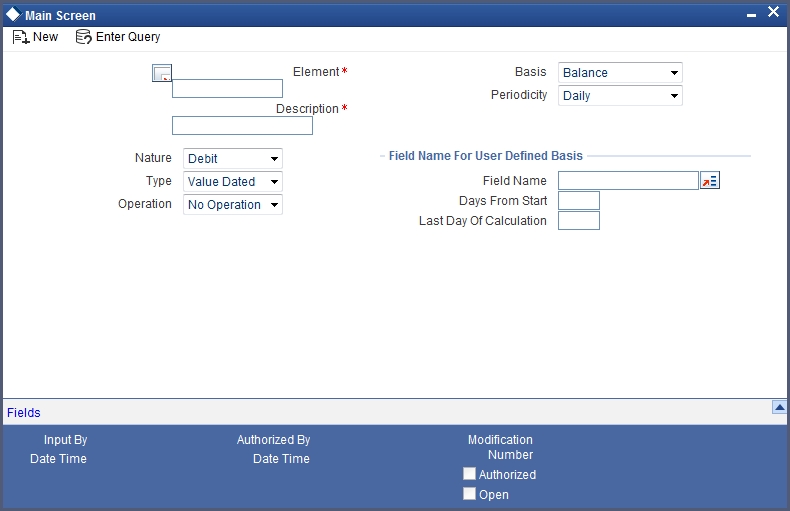

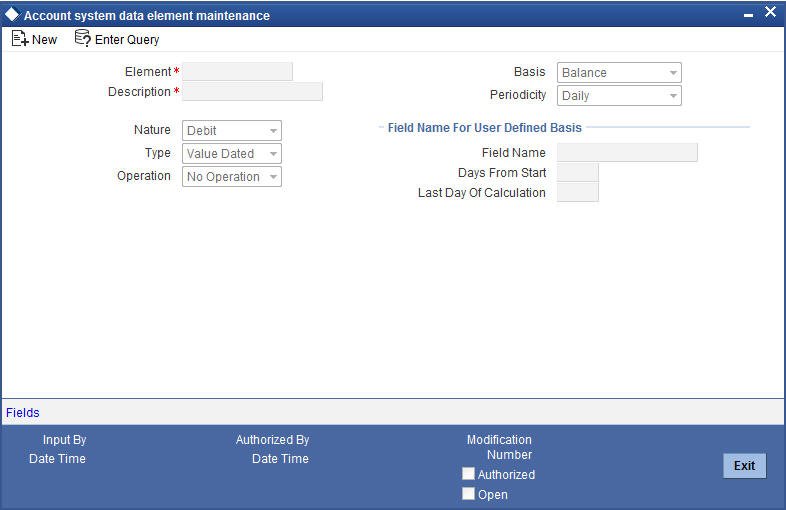

Each such criterion (which the system has to pick up) has to be defined as an SDE in the ‘Account System Data Element Maintenance’ screen. You can invoke the ‘Account System Data Element Maintenance’ screen by typing ‘ICDSDEM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

SDEs should be combined with UDEs into formulae to arrive at a method in which profit or charge has to be calculated.

Follow the example below, which illustrates transactions that typically take place in a current account, to understand how SDEs are defined.

Element

Specify a unique ID for the System Data Element that you are maintaining.

Description

Specify a description of the SDE that you are maintaining in this field.

Basis

Select the Basis for the calculation of Profit from the adjoining drop-down list. This list displays the following values:

- Balance – Select to calculate profit based on the balance in the account.

If you want to apply profit on an account based on the balance in the account, you have to first specify whether you would want to consider booking dated or value dated balances. Subsequently, you have to specify other characteristics for the balance.

When you are setting up the SDE, you can use normal balance or the balance due to the IP transactions. The basis for such SDEs is IP balance.

If the basis of an SDE is IP balance, then by rule, the nature of the SDE will be Net, the type of the SDE will always be the value dated balance and no further operations will be allowed on the SDE.

- Turnover – Select to calculate charges based on the turnovers in the account. Turnovers can either be debit or credit in nature.

The sum of all the debit transactions in an account, in a day, is the daily debit turnover of the account. While calculating the debit turnover, the credit transactions involving the account would not be considered. If there are, say, two debit transactions in an account in a day, the debit turnover for the day would be the sum of the two - irrespective of the credit transactions involving the account on that day. The same concept applies to credit turnovers also. You could have monthly debit or credit turnover also.

- Finance Outstanding – Select to calculate profit based on the finance outstanding in the account.

- Differential Balance – Select to calculate the difference of balance in CASA and principal expected in the loan account. System considers the lesser amount from the principal expected and the CASA account balance for savings accrual in the loan account. If the saving account balance is greater than financing account principal expected, then system will calculate the savings profit on principle expected only. The system will calculate an interest using the IC rule for the CASA balance over and above the financing account’s outstanding amount. This SDE will always get the differential amount even if the CASA and financing account currency is different; however, SDE will always be in CASA account currency.

- Loan Linked – Select to find out if the CASA account is linked to CI component for offsetting the profit. If the CASA account is linked to financing account, then it will return ‘1’ else it will return ‘0’.

Profit can be applied on an account differently, using different data as the basis. That is, you can apply profit on the basis of the item count, the balance, or the turnover in the account. In Oracle FLEXCUBE, Balances and Turnovers are referred to as ‘Basis’. While balances are considered for profit application, turnovers are considered for charges.

Note

- A ‘turnover’ is any movement in an account.

- A SDE based on Finance Outstanding gives outstanding amount of the finance account after deducting the balance in the savings account from the principal amount. Profit for a mortgage account is calculated on the basis of this outstanding amount.

- The booking date is the date on which a transaction is captured in the system. However, the date on which a transaction takes effect (that is, the date as of which the accounting entries are passed and the balances updated) could either be the booking date itself or a date in the past, or future. This date is called the value date of the transaction.

Note

The balance in an account will be different when you consider it to be as of the booking date or as of the value date

Periodicity

Select period over which a balance or a turnover should be considered for profit application, from the adjoining drop-down list. This list displays the following values:

- Daily – Select to consider daily balance or turnover for profit application.

- Monthly – Select to consider monthly balance or turnover for profit application.

- Quarterly (three months) – Select to consider quarterly balance or turnover for profit application.

- Semiannual (six months) – Select to consider semiannual balance or turnover for profit application.

- Annual – Select to consider annual balance or turnover for profit application.

- Periodic – Select to consider periodic balance or turnover for profit application.

- Liquidation Cycle – Select to consider liquidation cycle or turnover for profit application.

When a balance or turnover has to be picked up for profit application, it will be picked up for this period.

An example for a balance with daily periodicity could be the daily net balance in the account. Similarly, the monthly minimum credit balance, monthly maximum debit balance, etc. are examples of a balance with monthly periodicity. Similarly, you could consider the minimum credit balance over a quarter for profit application.

Note

This periodicity is for picking up the value of an SDE. It is not the periodicity at which profit is liquidated. The periodicity with which profit is liquidated is called ‘Liquidation Frequency’. Whenever profit has to be liquidated, either according to the liquidation frequency or on an ad-hoc basis, the balance will be picked up based on the SDE periodicity and applied for the entire liquidation period.

Note

The periodicity that you define for an SDE is not the same as the periodicity of rule application (defined for a profit rule). The periodicity of rule application (which could be daily or by periodic) also has a role in the way an SDE is picked up.

For further details please refer the ‘Maintaining Rules’ chapter of this user manual.

Nature

Select the nature of the balance or turnover, once you fix the ‘basis’ on which you want to apply profit for the specified SDE, from the adjoining drop-down list. This list displays the following values:

- Debit – Select if you need to define the nature of the balance or turnover as Debit.

- Credit – Select if you need to define the nature of the balance or turnover as Credit.

- Net – Select if you need to define the nature of the balance or turnover as Net.

In the example discussed in the beginning of this section, we have seen various types of balances: on certain days there is a debit balance while on certain other days there is a credit balance in the account. These are referred to as debit balances and credit balances respectively.

Each balance in turn will have a periodicity and an aggregation operation attached to it.

Type

Select the date to be used for calculation, if you have indicated that the SDE is to be calculated on the turnover of an account, from the adjoining drop-down list. This list displays the following values:

- Booking Dated – Select if you need to use booking date as date for calculation.

- Value Dated – Select if you need to use value date as date for calculation.

Operation

Select the method in which a balance or turnover should be picked-up over its periodicity, from the adjoining drop-down list. This list displays the following values:

- No Operation – Select if you do not want to pick-up balance or turnover.

- Average – Select if you do want average method to pick-up balance or turnover.

- Minimum – Select if you do want minimum method to pick-up balance or turnover

- Maximum – Select if you do want maximum method to pick-up balance or turnover

- Summary – Select if you do want summary method to pick-up balance or turnover

- Count – Select if you do want count method to pick-up balance or turnover

As discussed under ‘Periodicity’, for the ‘Minimum’ credit balance that has to be picked up over a month or the ‘Maximum’ debit balance for the month, the ‘Minimum’ and ‘Maximum’ denote an aggregation operation. Another aggregation operation would be the ‘average’. For example, you could have the average monthly debit balance or the average monthly credit balance as the attributes of an SDE.

If you choose to apply profit on the basis of the credit, debit or the net balance, you can specify that the balance to be considered is:

- the minimum

- the maximum

- the average balance in the account, over the period specified by you

Note

If the periodicity for an SDE is daily and the basis is balance, then the balance taken will always be the net balance for the day. It cannot be the minimum, maximum or average balance.

The aggregation operation of ‘sum’ can be used when you want the SDE to return a value that is a sum of a few values. A typical usage of this aggregation operation will be when you want the sum of turnovers (debit or credit), or a sum of debit or credit items, over a period.

Field Name for User Defined Basis

You can maintain the following parameters here:

Field Name

Specify a valid field name for user defined basis from the adjoining option list.

Days from Start

Specify day from when you want to compute profit for an account on the monthly minimum credit balance, the maximum monthly debit balance, or the average balance for a specific period.

The balance in the account, between the date that you specify here and the date that you specify in the ‘Last Day of Calculation’, will be used for calculation of profit.

The default value in this field is maintained as ‘1’. However, you can modify, if needed. For example, if you want to calculate profit from the 15th of a month enter ‘15’ here.

Last Day of Calculation

Specify day till when you want to compute profit for an account. You may have to consider the balances or turnovers, only during a specific period of the month.

For example, in some countries, credit profit for Savings Bank accounts is given for the minimum credit balance in the account during the month, between the 10 and 25 of the month. To define an SDE that returns the minimum balance between 10 and 25 of the month, you should define it as follows:

| Basis | Balance | ||

|---|---|---|---|

| Nature | Credit | ||

| Type | Value dated | ||

| Periodicity | Monthly | ||

| Operation | Minimum | ||

| Days from Start | 10 | ||

| Last Day of Calculation | 25 |

The minimum balance between 10 and 25 (both inclusive) will be returned by this SDE. However, the number of profit days will be the entire month, unless you specify otherwise while defining the profit calculation formulae for a Profit Rule involving the SDE

For further details please refer ‘Building formulae’ chapter of this User Manual.

The following is a list of the SDEs already available in the system:

- ACCOUNT_LIMIT

- ACCOUNT _TOD

- LINE_AMOUNT

- REPORTING_AMOUNT

- DAYS

- MONTH

- YEAR

- MIN_BAL_REQD

- CURRENT_BAL

- OPENING_BAL

- MON_AVG_BAL_CONS

- OD_APPLICABLE

4.2.2 Maintaining SDE for Profit Calculation on Daily Average Balance

You need to maintain an SDE for profit calculation on daily average balance. This SDE gives the difference between the ‘PRINCIPAL_EXPECTED’ and the value dated balance of the CASA account.

The system calculates profit on the minimum of the ‘PRINCIPAL_EXPECTED’ and the value dated balance of the CASA account. If the CASA account balance is greater than the ‘PRINCIPAL_EXPECTED’ amount, the system calculates the savings profit on the PRINCIPAL_EXPECTED amount only. For calculating profit on the balance over and above the PRINCIPAL_EXPECTED amount, an SDE basis ‘Differential Balance’ is maintained at ‘Profit & Charges – System Data Element Maintenance’ level. This SDE gives the difference of PRINCIPAL_EXPECTED component in the finance account and the balance in the CASA account.

| CASA Balance (USD) | MO Finance Principal Expected (USD) | CL_EXPECTED (USD) | |||

|---|---|---|---|---|---|

| 10000 | 15000 | 0 | |||

| 5000 | 10000 | 0 | |||

| 15000 | 10000 | 5000 | |||

| 8000 | 8000 | 0 |

Similarly, you need to create another SDE by name ‘CL_LINKED’. This SDE can be used to check whether the CASA account is linked to a savings component of a contract for offsetting the profit. You also need to define the purpose formula for calculating profit on the excess amount.

Note

- System recalculates the EMI if there is any change in rate; principal amount; or maturity date.

- You cannot change the debit settlement details of the saving accountduring value dated amendment of the account.

- You cannot close the CASA account linked to the financing account until the financing account is liquidated.

- If a CASA account is linked to a financing account, then it cannot be linked to another financing account.

- If the CASA account is linked to ‘Mudarabah investment funds’, then it should not be linked to the Islamic financing account.

- CASA account and financing account should belong to one customer; however both accounts can be in different currencies.

4.2.3 Maintaining SDE for Tax Exemption

Deposit Profit Retention Tax (DPRT) is payable on profit on deposits and accounts. Customers belonging to certain customer categories can be exempted from paying DPRT. For maintaining DPRT exemption for accounts, you need to use the SDE provided for this purpose.

By attaching this ‘DPRT_TEST’ SDE to a rule and building that rule into a profit product and attaching the product to an account class, you can ensure that no DPRT is deducted from the profit on accounts under that account class. You have to specify the parameters for this SDE in line with the parameters that you set for the other SDEs that you use to calculate profit in the same rule.

4.2.4 Maintaining SDEs for Computing TDS

Oracle FLEXCUBE provides you the facility to compute TDS (Tax Deducted at Source) on profit earned for a customer. The IP products are classified as Tax and Non-tax product. Non-Tax products are used to compute the credit profit for the account and the Tax products are used to calculate the TDS amount and also book.

All the accounts belonging to product, for which the check box ‘Include for TDS Calc’ is enabled, will be taken for computing the TDS. Three new SDEs are created for this purpose:

- TDS_AMOUNT

- TOT_INT_AMOUNT

- PROFIT_AMOUNT

For computing TDS on profit earned for a customer, you need to use the following SDEs available in the system:

- TDS_AMOUNT – the total TDS amount deducted from the customer account.

- TOT_INT_AMOUNT - the total profit amount for the customer for the current financial year. This encapsulates the credit profit accrued across the customer’s account.

- PROFIT_AMOUNT – captures the profit amount for the period for a particular customer account. This is the amount used for computing the TDS amount.

By attaching these SDEs to a rule, building that rule into a profit product and attaching the product to an account class, you can ensure that these SDEs are used in the formula for computing the TDS amount for accounts under that account class. You have to specify the parameters for these SDEs in line with the parameters that you set for the other SDEs.

Refer to the ‘Building Formulae’ chapter of this user manual for more details on creating a formula.

4.2.5 Maintaining SDEs for Computing Advance Profit

You can maintain SDE for advance profit calculation on the withdrawal amount from the customer account. All accounts belonging to a product, for which the option ‘Advance Profit’ in ‘Notice Preferences’ screen is enabled, are taken up for computing the Advance Profit.

For computing the advance profit you have to specify the preferences as follows:

- Element - ADV_INT_BASIS

- Description - ADV_INT_BASIS

- Basis - ‘Advance Profit

- Periodicity - ‘Liquidation Cycle’

- Nature - ‘Net’

- Type - ‘Booking Dated’

- Operation - ‘No operation’

4.2.6 Maintaining SDEs for Computing Overdraft Profit

For customer accounts where the customer uses the overdraft facility against the collateral, lower profit rates are applied initially for the overdraft amount utilized and then the profit rate goes higher.

The following two SDEs are used to compute the overdraft profit rate:

- OD_PROFIT_CALC – used to calculate P*R value, where P and R values are obtained from the data store. The lowest profit rate is used first for profit calculation and then it moves towards higher profit rate maintained in Collateral Pool Maintenance screen.

- DLY_NET_VD_BAL - used to get the available balance in the account.

When customer repays the overdraft utilized amount, the higher profit rate overdraft is repaid before repaying the lower profit rate overdraft facility.

4.2.7 Maintaining SDE for Computing Commission on Highest Debit Balance

You can maintain an SDE for calculating commission on Highest Debit Balance (HDB) with following details. This SDE gives the highest Debit Balance of the month.

SDE Name: HDB

| Basis | Periodicity | Nature | Type | Operation | |||||

|---|---|---|---|---|---|---|---|---|---|

| Balance | Monthly | Debit | Value Dated | Maximum |

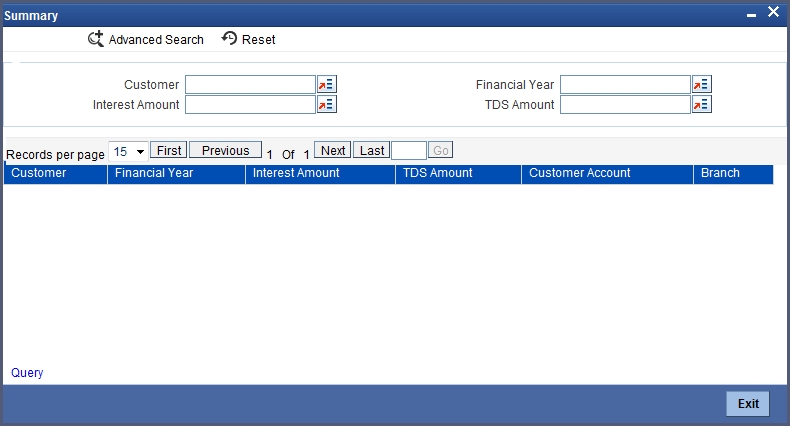

4.2.8 Viewing Customer TDS Details

You can view the TDS details of the customer in the ‘Interest and Charges TDS Query’ screen. You can invoke the ‘Profit & Charges TDS Query’ screen by typing ‘TDSQUERY’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can maintain the following parameters here:

Customer

Specify a valid customer number based on which you wish to query, from the adjoining option list.

Financial Year

Specify a valid financial year based on which you wish to query, from the adjoining option list. The Financial year must be a past year.

Profit Amount

Specify a valid profit amount based on which you wish to query, from the adjoining option list.

TDS Amount

Specify a valid TDS amount based on which you wish to query, from the adjoining option list.

Branch

Select a valid branch code if you need to view records based on the branch code of the account.

Customer Account

Select a valid account number if you need to view records based on the customer account from the adjoining option list.

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Branch

- Customer Account

- Customer

- Financial Year

- Profit Amount

- TDS Amount

4.2.9 Maintaining SDEs for Deducting Charges on Dormant Accounts

Oracle FLEXCUBE facilitates collection of charges on customer accounts that are dormant. The dormancy period is determined by the number of days the accounts have been inactive in the current liquidation cycle. However, the period for which the accounts have a full amount block will not be included for calculation of dormancy days. The accounts may be blocked either internally for being linked to finances availed by the customers or specifically, at the customer’s request.

For computing charges on accounts with dormant status, you need to use the following SDEs available in the system:

- Ac-Dormancy-Days: As stated earlier, charge will be computed based on the number of days the account was dormant in the current liquidation cycle.

- Ac-Dormant: This SDE will indicate whether the account is dormant or not depending on the dormancy period that you maintain.

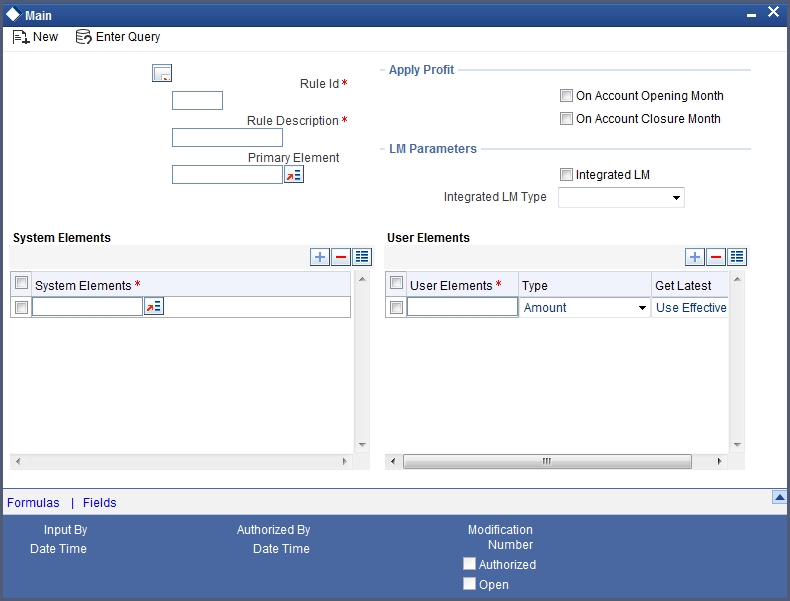

You can then, attach these SDEs to a charge computation rule maintained through the ‘Profit & Charges Rule Maintenance’ screen.

For further details on defining a rule, refer ‘Maintaining Profit Rules’ chapter of this user manual.

Subsequent to defining a rule, you can create a formula to compute the charges. The result obtained by using the formula will give you the charge that has to be applied on a dormant account.

For further details on creating a formula, refer ‘Building Formulae’ chapter of this user manual.

The ‘Rule’ can then be linked to the appropriate product that you have maintained for calculation of charge on dormant accounts. You may link the product to an account class,(at ‘Profit Product Preferences’ level) if you want to apply the same rule for all accounts reporting to a specific account class (General Condition). To define a special charge for a specific customer, you can link the product to the account itself (special condition) rather than linking it to an account class.

For further details on applying profit/charge product on an account, refer to ‘Profit Application’ chapter of this user manual.

4.2.10 Implications of Working with User Defined Fields

To associate different tax statuses with individual customers belonging to the same account class, you may choose to associate the corresponding SDE with a user-defined field maintained at the ‘Customer Accounts Maintenance’ level.

For example, for each customer of your bank, at the ‘Customer Accounts Maintenance’ level, you have created a user-defined field (UDF) called TAXABLE. The options available for this field are as follows:

- 1 – Indicating that the tax should be levied on profit earned by the particular customer.

- 0 – Indicating that tax should be waived

Let us assume that you are defining an SDE called Apply Tax at ‘SDE Maintenance’ level. You identify TAXABLE as the UDF that is to be associated with this SDE. However, when defining the TAXABLE field at ‘User Defined Values’ level in the Core Services module, ensure that you have marked TAXABLE as a mandatory field.

Select 1 from the option list to indicate that tax needs to be levied on the profit earned by a particular customer. Select zero to indicate that tax on profit can be waived.