7. Defining Profit and Charge Products

7.1 Introduction

In this chapter, we shall discuss the manner in which you can define attributes specific to a Profit or Charges product.

7.2 Islamic Profit Distribution Product

This section contains the following topics:

- Section 7.2.1, "Maintaining Islamic Profit Distribution Product"

- Section 7.2.2, "Maintaining Accounting Roles"

- Section 7.2.3, "Maintaining Events "

- Section 7.2.4, "Maintaining Branch and Currency Restrictions"

- Section 7.2.5, "Maintaining Customer Restrictions"

- Section 7.2.6, "Defining Profit Preferences "

- Section 7.2.7, "Maintaining Status Codes "

- Section 7.2.8, "SSIA – Special Type of Savings Account"

- Section 7.2.9, "Transaction Codes for Processing External Charges"

- Section 7.2.10, "Booking of External Charges"

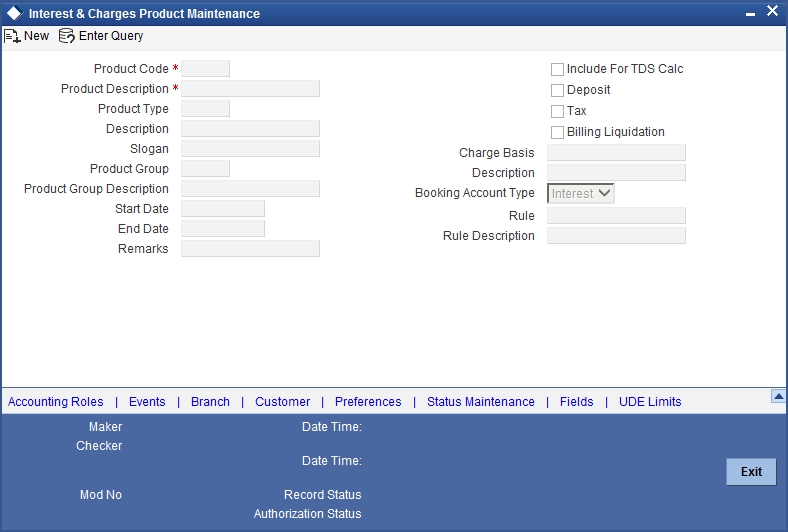

7.2.1 Maintaining Islamic Profit Distribution Product

You can create a profit or charges product in the ‘Islamic Profit Distribution Product Maintenance Detailed’ screen. You can invoke the ‘Islamic Profit Distribution Product Maintenance Detailed’ screen by typing ‘IADPRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

For any product you create in Oracle FLEXCUBE, you can define generic attributes, such as branch, currency, and customer restrictions, accounting roles and heads, etc., by clicking on the appropriate icon in the horizontal array of icons in this screen. For a profit or charges product, in addition to these generic attributes, you can specifically define other attributes. These attributes are discussed in detail in this chapter.

You can define the attributes specific to a profit and charges product in the ‘Islamic Profit Distribution Product Maintenance Detailed’ Main screen and the ‘Islamic Profit Distribution Product Maintenance Detailed Preferences’ screen. In these screens, you can specify the product type and set the product preferences respectively.

For further information on the generic attributes that you can define for a product, please refer the following Oracle FLEXCUBE User Manuals:

- Products

- Settlements

Product Code

The code of the Islamic profit product, for which you are defining preferences, is displayed in this field.

Product Description

Give an appropriate description for the Product Code defined.

Product Type

Specify the type of product you need to create. You can create the following product types:

- Profit – If you are creating a profit product, you must link the product to a Profit Rule that you have already maintained. To recall, a Profit Rule identifies the method in which profit has to be calculated. When you apply this profit product on an account (or account class), the system calculates the profit for the account according to the method specified for the Profit Rule.

When you link a Profit Rule to the product, the description of the rule will be displayed.

Additionally, you have the option to specify whether the profit product has to be considered for TDS (Tax Deducted at Source) calculation or not. To indicate that the product is to be used for computation of TDS, click ‘Include for TDS Calc’ in the Product Definition screen for the Profit product you are maintaining. If you do not want to use a particular profit product to compute TDS, you can leave the box unchecked.

- Charges/Allowances – If you are creating a Charge product, you must specify the basis on which you want to apply the charge.

Refer the section ‘Charge Basis in Oracle FLEXCUBE’ in this manual for more details on various types of charge basis available in Oracle FLEXCUBE.

After you have specified the basis on which you would like to levy the charge, you have to specify the liquidation related details for the charge product, the account classes on which the product should be applied, the frequency of liquidation, the amount or rate of charge to be applied, amongst other details. You specify these details in the Product Preferences screen.

Note

The ‘preferences’ screen that will be displayed during product definition will be either profit preferences or charge preferences, based on the product type. All the other screens are the same for both Profit and Charge products.

- Consolidated Charges – To set up a charge product that would be used for consolidating charges applicable for accounts under an account class, you can select Consolidated Charge as the Product Type, in the ‘Islamic Profit Distribution Product Maintenance Detailed’ screen.

Slogan

Specify a slogan that suitably announces the product to your customers for the product that you are creating.

Start Date

Specify a date from when you want to use the created product. This date is called the product ‘Start Date’. The start and end dates of a product come in handy when you are defining a product for a scheme, which is open for a specific period.

End Date

Specify a date beyond which you do not wish to use for a product that you create. The expiry date is referred to as the product ‘End Date’. You cannot use a product beyond the specified expiry date.

Note

If you do not specify an ‘End Date’, the product can be used until it is closed.

Remarks

Enter information about the product intended for your bank’s internal reference, in this screen. This information will not be printed on any correspondence with the customer.

The remarks are displayed when the details of the Profit or Charge product is displayed or printed.

Include for TDS Calc

Check this box to maintain IP product as a Tax or Non Tax product. Choose the ‘Tax’ option in the Product Type to define the IP product as a Tax product. This allows you to calculate, deduct and view the TDS for the accounts belonging to this product. No accounting entries are available for IACR (Profit accrual) since no accrual is done for the Tax products.

The rule for calculating the profit for TDS and booking is computed using the following two formulas:

Formula 1: Non-Booked No accruals required

TOT_INT_AMOUNT > TDS_LIMIT PROFIT_AMOUNT*TAX_RATE

Formula 2: Booked no accruals

GREATEST [(FORMULA1-TDS_AMOUNT) 0]

You have to maintain the TDS_LIMIT and TAX_RATE UDE's at the rule level for each product, account class, currency and effective date combination.

Note

In case you have defined the IP product as a Tax product, then the ‘Deposit’ check box will be disabled.

In case the Tax check box is left unchecked, the IP product for which you have enabled ‘Include for TDS Calc’ option will be treated as a non-tax product. The credit profit for the account will be calculated and booked using such non-tax products.

For details on setting SDE’s for computing TDS, refer to the section ‘Maintaining SDE for TDS’ under the chapter Maintaining System Data Elements in this (Profit and Charges) user manual.

Deposits

Check this box if you want to apply the IP product on deposit accounts. If you check this box, the system calculates and applies the profit on a time deposit product.

The profit that applies on time deposits may vary with every deposit product you offer. In Oracle FLEXCUBE, profit on a time deposit (and balance type accounts) is calculated on the basis of the Profit Rules and Profit Products that are associated with the deposit account.

For a deposit type Profit product, you have to specify the Unclaimed Deposits GLs that should be used to move the principal and profit amounts of unclaimed deposits. The Accounting Roles for the GLs are ‘PRN_UNCLAIMED’ and ‘INT_UNCLAIMED’ respectively. At the ‘Accounting Role Definition’ level, you need to map these roles to the appropriate Miscellaneous Credit GLs maintained. Also, at IP Product Events level, you need to specify the accounting entries for the event ‘MAT’. For this event, you need to specify all possible accounting entries that will be passed, including the movement of unclaimed deposits to the respective GLs.

Tax

Check this box if you want to use profit products for computing the TDS (Tax Deducted at Source) on the profit earned for a customer. In Oracle FLEXCUBE you can compute TDS only for savings, current, and TD accounts. However, this facility is not applicable for deposits booked under the Finances.

Billing Liquidation

Check this box to use charge products for billing liquidation on the charges levied for a customer. In Oracle FLEXCUBE, all the charge products specified for billing liquidation will not be liquidated during the IP EOD process; however, will be processed during the invoice generation maintained for the consolidated billing product. As a result, the system handles the EOD processing separately for billing products and non billing products.

An unchecked box will indicate that the product is a non billing product.

Note

The Billing Liquidation check box is applicable only for charge products and consolidated charge products.

Charge Basis

Specify the basis on which you want to apply the charge, if you are creating a charge product, from the adjoining option list. You can choose to apply charges on the basis of any of the following:

- NUM-ACCT-STMTS (Number of Account Statements): You can fix the number of free account statements for a liquidation cycle. For every extra account statement that you issue, you can levy a charge.

- NUM-CHQ-RET (Number of cheques returned): Every cheque that bounces is recorded in the Cheques Returned file. You can charge a compensation on every bounced cheque.

- NUM-CHQ-ISS (Number of cheques issued): For every extra cheque leaf issued, you can levy a charge.

- NUM-STOP-PAY (Number of Stop Payments): You can levy a charge for every stop payment instruction.

- TURNOVER (Total turnover): You can charge on the basis of the turnover in an account. You can opt to levy charges on turnovers exceeding a ‘free amount’ that you specify in the Charge Product Preferences screen.

- ITEM-COUNT (Number of transactions): If the number of transactions during a liquidation cycle exceeds a certain number, you can levy a charge.

- FNET-TURNOVER-DR (Dr Turnover): You can charge a customer on the basis of the debit turnover in an account. This will return a value if the account is in debit else zero will be returned.

- NET-TURNOVER-CR (Cr Turnover): You can also charge a customer based on the net credit turnover in the account. (Sum of all credits – the sum of all debits) = net credit turnover. This will return a value if the account is in debit else a value of zero will be returned. Turnovers will be applied on an account only if the transaction code associated with the credit entry is defined with ‘IP Balance Inclusion’ option.

- EXTCHG (External Charge): You can charge the customer on the basis of the turnover of external transactions with a charge rate as 1.The turnover is always in the account frequency.

- ACCOUNT-OPENING: You can charge the customer at the time of opening an account.

Description

Description of the selected charge basis is defaulted here.

Booking Account Type

Select the Booking Account Type based on the IP product type you are creating, from the adjoining drop-down list. This list displays the following values:

- Profit – Select to liquidate profit and charge into the Profit Booking Account maintained at the IP Special Conditions Maintenance level.

- Charge – Select to liquidate profit and charge to the Charge Booking Account maintained at the IP Special Conditions Maintenance level.

Rule

Specify the rule you wish to apply for the IP product from the adjoining option list.

Rule Description

Description of the selected rule is defaulted here.

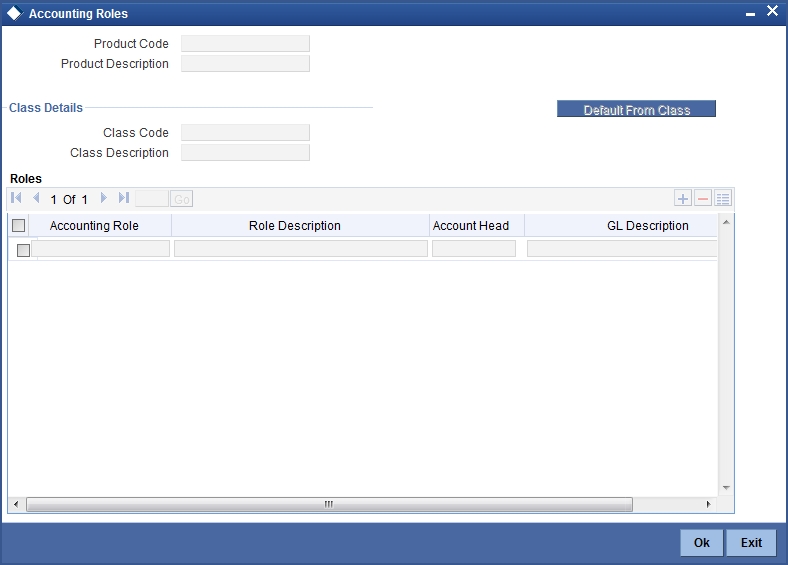

7.2.2 Maintaining Accounting Roles

To invoke ‘Accounting Roles’ screen click ‘Accounting Roles’ button from the ‘Islamic Profit Distribution Product Maintenance Detailed’ screen

The following parameters are maintained in this screen:

Product Code

Code of the product for which you want to define accounting roles, is defaulted here.

Description

Description of the product code is defaulted here.

Class Details

You can maintain the following class details here:

Class Code

Specify a valid code of the product for which you are defining the Branch and Currency restrictions, from the adjoining option list.

Class Description

Description of the specified class code is defaulted here.

Roles

Accounting Roles are tags that identify the type of accounting entry that is posted to an accounting head which in turn refer to the different GLs and SLs maintained in your Chart of Accounts.

Accounting Role

Specify a valid accounting role to which you want to post the accruals accrued till date when the account moves to the specified status, from the adjoining option list.

Role Description

Description of the specified accounting role is defaulted here.

Accounting Head

Specify a valid accounting head to which you want to post the accruals accrued till date when the account moves to the specified status, from the adjoining option list.

GL Description

Description of the specified GL is defaulted here.

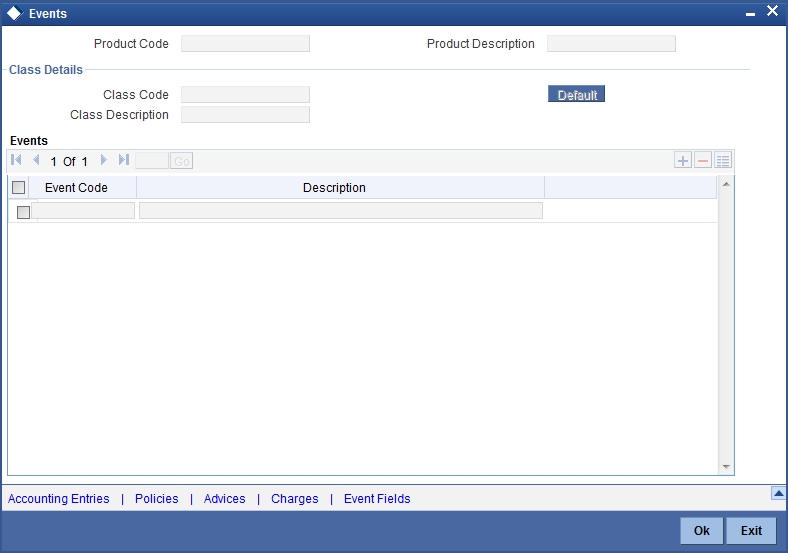

7.2.3 Maintaining Events

To invoke ‘Events’ screen, click ‘Events’ button from the ‘Islamic Profit Distribution Product Maintenance Detailed’ screen.

The following parameters are maintained in this screen:

Product Code

Code of the product for which you want to define events, is defaulted here.

Description

Description of the product code is defaulted here.

Class Details

You can maintain the following class details here:

Class Code

Specify a valid code of the product for which you are defining the events, from the adjoining option list.

Class Description

Description of the specified class code is defaulted here.

Roles

Accounting Roles are tags that identify the type of accounting entry that is posted to an accounting head which in turn refer to the different GLs and SLs maintained in your Chart of Accounts.

Accounting Role

Specify a valid accounting role to which you want to post the accruals accrued till date when the account moves to the specified status, from the adjoining option list.

Role Description

Description of the specified accounting role is defaulted here

Event Details

You can maintain the following event details here:

Select the event for which you are specifying the accounting role and account head, from the adjoining option list. When you liquidate or accrue profit or charge, the accounting entries will be posted to the specified GL/SLs for the event.

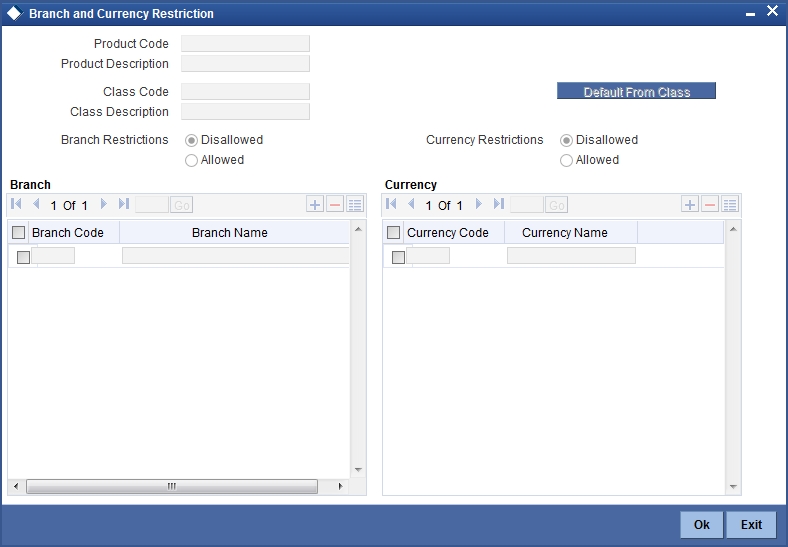

7.2.4 Maintaining Branch and Currency Restrictions

To invoke ‘Branch/Currency Restrictions’ screen, click ‘Branch’ button from the ‘Islamic Profit Distribution Product Maintenance Detailed’ screen.

The following parameters are maintained in this screen:

Product Code

Code of the product for which you want to define branch and currency restrictions, is defaulted here.

Description

Description of the product code is defaulted here.

Class Code

Specify a valid code of the product for which you are defining the Branch and Currency restrictions, from the adjoining option list.

Class Description

Description of the specified class code is defaulted here.

Branch Restrictions

Select a valid option to indicate the type of branch list you want to maintain from the options. The following options are available for selection:

- Disallowed – Select if you want to maintain a list of disallowed branches for a product.

- Allowed – Select if you want to maintain a list of allowed branches for a product.

Currency Restrictions

Select a valid option to indicate the type of currency list you want to maintain from the options. The following options are available for selection:

- Disallowed – Select if you want to maintain a list of disallowed branches for a product.

- Allowed – Select if you want to maintain a list of allowed branches for a product.

Branch Code

You have to maintain the following branch details for the list type you have selected at ‘Branch Restrictions’ level:

Branch Code

Specify a valid code of the branch you want to add to the specified branch restriction list, from the adjoining option list.

Branch Name

Name of the specified branch is defaulted here.

Currency

You have to maintain the following currency details for the list type you have selected at ‘Currency Restrictions’ level:

Currency Code

Specify a valid code of the currency you want to add to the specified currency restriction list, from the adjoining option list.

Currency Name

Name of the specified currency code is defaulted here.

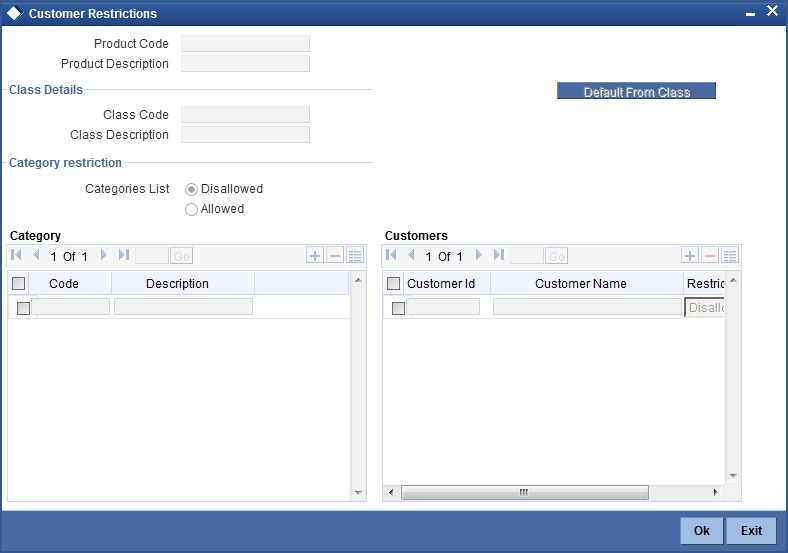

7.2.5 Maintaining Customer Restrictions

To invoke ‘Customer Restrictions’ screen, click ‘Customer’ button from the ‘Islamic Profit Distribution Product Maintenance Detailed’ screen.

The following parameters are maintained in this screen:

Product Code

Code of the product for which you want to define customer restrictions, is defaulted here.

Description

Description of the product code is defaulted here.

Class Details

You can maintain the following class details here:

Class Code

Specify a valid code of the product for which you are defining the customer restrictions, from the adjoining option list.

Class Description

Description of the specified class code is defaulted here.

Branch Restrictions

You can maintain customer restrictions based on the branches of your bank:

Categories List

Select a valid option to indicate the type of branch list you want to maintain from the options. The following options are available for selection:

- Disallowed – Select if you want to maintain a list of disallowed branches for a product.

- Allowed – Select if you want to maintain a list of allowed branches for a product.

Category

You have to maintain the following category details:

Code

Specify a valid code of the category for which you want to maintain customer restriction, from the adjoining option list.

Description

Description of the specified category code is defaulted here.

Customers

You have to maintain the following customer details:

Customer ID

Specify a valid ID of the customer for whom you want to maintain customer restrictions, from the adjoining option list.

Customer Name

Name of the specified customer code is defaulted here.

Restriction Type

Select the type of restriction you want to maintain for the selected customer, from the adjoining drop-down list. This list displays the following values:

- Disallowed – Select if you want to add the customer to the disallowed list.

- Allowed – Select if you want to add the customer to the allowed list.

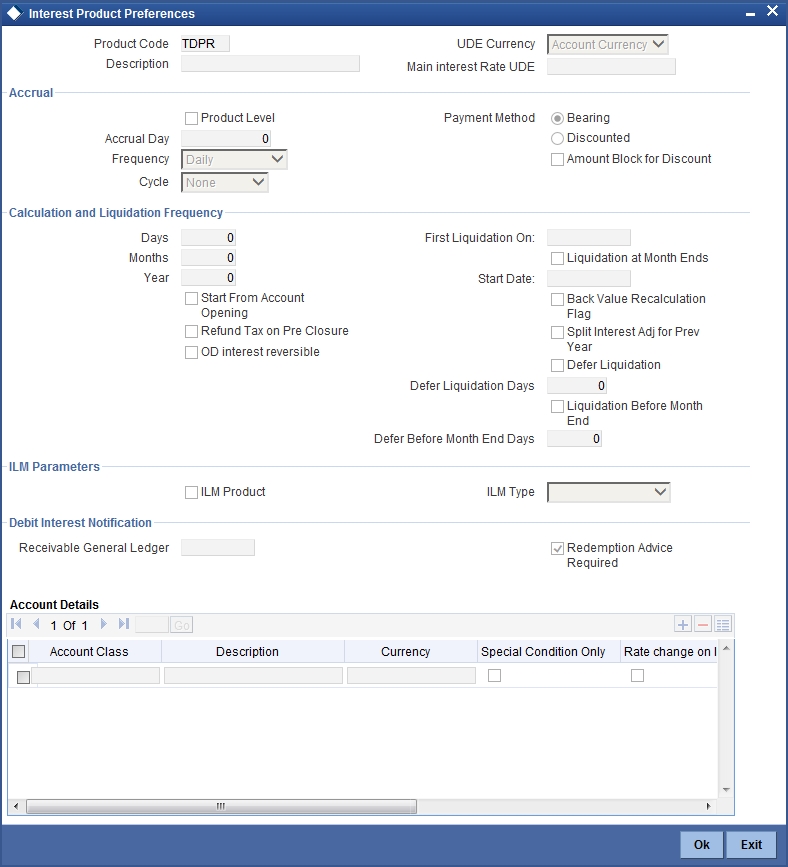

7.2.6 Defining Profit Preferences

While creating a profit product, you identify one rule or profit calculation method that you would like to use to calculate profit for the product. In linking a product to a rule, you identify how the principal, period, and rate components are to be picked up from accounts on which the product should be applied. You are yet to identify the accounts, or account classes, on which you would apply the product.

In the Profit Product Preferences screen, specify the profit accrual and liquidation details for the product. These specifications are referred to as ‘Preferences’. In addition, you also make the product applicable on an account by linking an account class or an account itself, to the product.

For a profit product you can define the following preferences:

- The account class and currency combination on which you would like to apply the product

- Accrual related details

- Whether accrual entries for all accounts linked to the product should be passed at the product level. If not, they will be passed for each account separately.

- The frequency at which profit should be automatically accrued

- Whether automatic accruals should always take place on a month-end

- Liquidation related details

- The frequency of liquidation

- Whether profit should be applied right from the day the account is opened.

- The date on which the first liquidation should be done for accounts linked to the product.

- Whether automatic liquidation’s should always take place on a month-end.

To invoke the ‘Profit Preferences’ screen click ‘Preferences’ button from the ‘Islamic Profit Distribution Product Maintenance Detailed’ screen.

Note

You can apply a product to any number of accounts or account classes. When you apply a product to many account classes, profit for all the accounts will be calculated according to the rule or the calculation method to which the product is linked. That is, principal, period, and type of rate which is not the numeric value will be picked up from the accounts in the same manner. Also, the accrual and liquidation details for all the account classes will be the same. You can thus have all the attributes except those of UDEs like the rate, tier structure, etc. same for accounts belonging to different account classes.

Product Code

Code of the product for which you want to define preferences, is defaulted here.

Description

Description of the product code is defaulted here.

UDE Currency

Select a valid currency for the UDE from the adjoining drop-down list. This list displays the following values:

- Account Currency – Select if you want to maintain UDE currency as account currency.

- Local Currency – Select if you want to maintain UDE currency as local currency.

7.2.6.1 Profit Tab

Specify the profit details by clicking on the ‘Profit’ tab in the ‘Profit Preferences’ screen.

Reallocation through Header

Check this box to reallocate profit through header.

Accrual

While building a formula for the rule to which you have linked the product, if you indicated that the result of the formula is profit that should be accrued, then the system accrues the profit amount for all the accounts linked to the product. While defining the preferences for this product, you can choose to pass the accrual entries as follows:

- Pass an accrual entry for each account

- Consolidate the profit to be accrued for individual accounts and track it against the product.

If you choose the latter option, the cumulative value of all the accruals, for accounts linked to the product will be passed as a single accounting entry.

Product Level

Check this box to accrue profit at the product level.

If the check box is checked, then the system consolidates the accrued profit for all accounts linked to the product and posts a single entry for the product. A report will be generated with the details of accruals for each account as part of EOC.

If the check box is unchecked, then the system accrues profit for each account linked to the product, and posts an accrual entry for each account individually. The account for which the accrual entry is passed will be shown when you retrieve information about an entry.

Accrual Day

Specify a valid day on which you want to accrual the profit and charges. For a non-daily accrual frequency, the ‘Accrual Day’ indicates the day of the month on which the accruals have to be carried out. For example, an Accrual Day of 25 indicates an automatic accrual should be done on 25 of the month, as per the frequency.

Frequency

Select the frequency with which you want to accrue profit for the account classes, from the adjoining drop-down list. This list displays the following values:

- Daily – Select if you want to accrue daily

- On liquidation – Select if you want to accrues only when you liquidate profit

- Monthly – Select if you want to accrue monthly

- Quarterly – Select if you want to accrue quarterly

- Semi-annual – Select if you want to accrue semi-annual

- Annual – Select if you want to accrue annually

Periodic accruals for all formulae for which profit has to be accrued will be done during the EOD processing, for each account linked to the product. Entries will be passed to the accrual accounts that you have specified while creating the product.

If you have specified that accrual entries have to be passed for a product rather than for individual accounts, a consolidated entry will be passed for the formula, for all the accounts linked to the product. If not, an entry will be passed for each account individually.

Accruals will also be performed whenever there is profit liquidation. For an account on which a liquidation is done out of turn, accrual entries will be passed till the date of liquidation. The next accruals for the account will be done from the next day onwards.

Cycle

Select month to maintain the frequency cycle, in which you want to accrue the profit, from the adjoining drop-down list, if you have maintained the frequency as quarterly, semiannual, or annual. This list displays all the months in a year.

Payment Method

Select the payment method for the main profit from the options. The following values are available for selection. This cannot be changed at the time of processing a deposit.

- Bearing – Select if you want to book the TD without liquidating the profit for the account. At EOD system accrues the profit and at BOD the system liquidates based on the maturity date.

- Discounted – For discounted products,

- the payment of profit is upfront

- no profit liquidation on maturity date

In case of true discounted, the payment method is calculated based on the formula maintained in the IP rule definition and the profit is calculated based on the formula defined at the rule level.

Note

The rule you define for true discounted products is applied exclusively for the discounted products.

The rule is maintained in the following two ways:

- Formula 1 Non-booked:

DEPOSIT_AMOUNT * TENOR * RATE / 100 * YEAR

The first formula is used for calculating the profit.

- Formula 2 Booked:

FORMULA1 / POWER ((1 + RATE/100), (TENOR/YEAR))

The second formula is used for discounting the result of formula 1.

To define the formula for the rule and to calculate the TD profit, SDE titled ‘Deposit_Amount’ is used.

LM Parameters

You can maintain the following LM parameters here:

Integrated LM Product

Check this option if you want to use the product for Integrated Liquidity Management processing.

Integrated LM Type

Select the type of system account to which you want to link the product from the adjoining drop-down list. This list displays the following values:

- Pool Lead – Select to apply the rule to Header Accounts in a structure.

- Pool Reallocation: Select to apply the rule to Parent and Child Accounts below the Header Account.

Note

This field is enabled only when you check ‘Integrated LM Product’ check box.

Calculation and Liquidation

Just as you defined the accrual related details for account classes linked to a product, you should define liquidation related details as part of preferences for the product.

You can liquidate profit for an account:

- periodically

- on an ad hoc basis

Monthly liquidation of profit on an account is an example of periodic liquidation. When you do not liquidate profit on an account at fixed intervals, the liquidation is referred to as ‘ad hoc liquidation’.

If you opt to liquidate profit periodically, you can automate the liquidation process. The automatic processes that are generated at the end of day will liquidate profit for those accounts that are marked for liquidation.

You can perform an ad hoc liquidation on accounts anytime, even if the accounts are marked for auto liquidation.

Note

You should necessarily liquidate profit before you:

- close an account

- change its account class

- change the calculation account

Frequency

The term ‘liquidation frequency’ refers to the interval between successive periodic liquidation’s. You can specify the liquidation frequency for the profit product that you are creating.

Days

Specify a valid number of days after which you want to liquidate profit.

Months

Specify a valid number of months after which you want to liquidate profit.

Year

Specify a valid number of years after which you want to liquidate profit.

Profit for the accounts linked to the product will be liquidated automatically according to your specifications, during the end-of-day processing on the day the liquidation becomes due.

To specify ad hoc liquidation for a product, enter a zero for day, month, and year in the liquidation frequency.

Ad-hoc liquidation can be carried out any time on an account, even if it has been defined for automatic liquidation. An ad-hoc liquidation of profit for an account (defined for auto liquidation) will liquidate profit till the date you specify when you carry out ad-hoc liquidation. The subsequent automatic liquidation will be for the remaining days in the liquidation period.

Note

For a product, you specify

- Whether the account closing month has to be included for profit application

- Whether the profit applied for the current month during ad hoc liquidation depends on this parameter for the product.

Profit for the current month will be applied during ad-hoc liquidation only if the definition is that account closing month should be included for profit application. If not, the next automatic liquidation will process profit for the entire month.

First Liquidation On

Specify the First Liquidation Date from the adjoining calendar, after defining the liquidation frequency. The frequency and the date will be used to arrive at the first and subsequent dates of liquidation for the accounts linked to the product.

The First Liquidation Date thus determines the date on which the first liquidation should be carried out for all accounts linked to a product. Subsequent liquidation dates will be fixed based on this date and the frequency of liquidation.

Liquidation at Month Ends

Check this box if you want to liquidate on the last working day of the month, if you have selected liquidation frequency as months or multiples of a month.

If you check this box, you should specify the Liquidation Start Date as the last date of the month from which you would begin liquidation.

For example, for a month-end quarterly liquidation beginning March ‘98, you should have the Liquidation Start Date as 31st March, ‘98. You should also check the box ‘Liquidation at month-ends’ check box.

Thus, all the accounts that are linked to a product will have the same liquidation date, fixed using the first liquidation date, and frequency, irrespective of their account opening date. The first ever profit liquidation would, therefore, be for a period that may not reflect the frequency of liquidation for the product.

Thus, accounts that were opened anytime during this quarter will have varying number of profit days, depending on the date they were opened.

Also, the month in which the account was opened will be considered for profit application depending on your definition at Rule Maintenance level. During subsequent automatic liquidation’s, profit will be applied for a quarter, provided there are no ad-hoc liquidations on an account during the quarter.

Start Date

The system displays the Start Date based on the First Liquidation Date and the Liquidation Frequency that you specify. The Start Date that is displayed is the First Liquidation Date - the Liquidation Frequency.

For example, if you specified the First Liquidation Date as 31 January 2000, and the Liquidation Frequency as 1 Month, the system will display the Start Date as 1 January 2000.

Start From Account Opening

Check this box if you want to liquidate profits periodically according to a frequency determined by the Account Opening Date. .

For example, the liquidation frequency is defined as quarterly for a product, starting from the Account Opening Date. For each account, the periodic liquidation will fall due a quarter from its Account Opening Date. Thus, there will not be a fixed periodic liquidation date for all accounts linked to the product; it will depend on the Account Opening Date of each account.

Note

If you have selected both ‘Start from Account Opening’ and ‘Liquidation at Month End’ days, then precedence is given to Start from Account Opening i.e. Liquidation happens based on the account opening date and not on month ends.

Refund Tax on Pre Closure

Check this box to refund tax whenever a pre closure of a term deposit takes place in the system.

If this check box is checked, tax collected on the profit due to the customer will be refunded on pre closure of a deposit. Tax will be refunded for the profit that is calculated from the deposit value date till the pre closure date.

When you process a foreclosure for a term deposit, the system will first check whether the ‘Refund Tax on Pre closure’ option is selected for the profit product that is attached to the term deposit account. If selected, system will refund all the taxes that are levied till date for the deposit.

Note

This option will be enabled only when you maintain deposit type of profit products.

Back Value Recalculation Flag

Check this box if you want to recalculate profit for all accounts associated with this product and adjust the difference in profit during the next liquidation, as profit adjustment entry when an accounting entry is passed into the previous liquidation period.

Defer Liquidation

Check this box if you may wish to defer the calculation and liquidation of periodic profit on an account for a few days beyond the end date of each profit period. This deferment will allow the inclusion of profit adjustments due to back-valued entries posted into the account after the period end date.

Defer Liquidation By Days

Specify the number of calendar days by which you wish the profit liquidation for a period to be deferred.

Liquidation Before Month End

Check this box if you want to liquidate the profit by a specified number of days before the month end for all accounts linked to the product, the IP product preferences if you have set the profit liquidation frequency to a monthly, yearly, quarterly cycle at ‘Profit Preferences level’.

Defer Before Month End Days

Specify the number of days before which profit should be liquidated. The system arrives at the profit liquidation date based on the number of days that you specify.

Zakat Product

Check this box if you want to maintain IP product as Zakat product.

Zakat is a charge that needs to be collected from savings accounts and term deposit accounts of customers who are not exempt from this charge. You need to maintain the liquidation type as ‘ad-hoc’. Hence you should not specify the liquidation details pertaining to periodic liquidation.

For further details refer the section titled ‘Liquidation Related Details’ in ‘Islamic Accounts’ User Manual.

You need to use the SDE ‘CURR_VD_BAL’ in order to fetch the amount on which the Zakat needs to be levied and the SDE ‘APPLY_ZAKAT’ to identify whether the customer account is exempt from Zakat or not.

You need to maintain the threshold amount and the Zakat percentage as UDEs.

Account Details

The following account details are maintained here:

Account Class

Specify a valid account class to which you wish to link the product from the adjoining option list. The option list displays only the account class maintained at Islamic Account Class Maintenance level.

Description

Description of the selected account class is defaulted here.

Currency

Specify the currency of the Account Class on which you would like to apply the charge product, from the adjoining option list.

Special Condition Only

Check this box if you want to maintain it as a special condition.

Repopulate at Liquidation

Check this box if you want to repopulate during profit liquidation.

Repopulate UDE at Rollover

Check this box if you want to repopulate UDE during profit rollover.

Open

Check this box to apply product on an account class. If you uncheck this box, you can temporarily stop applying a product on an account class.

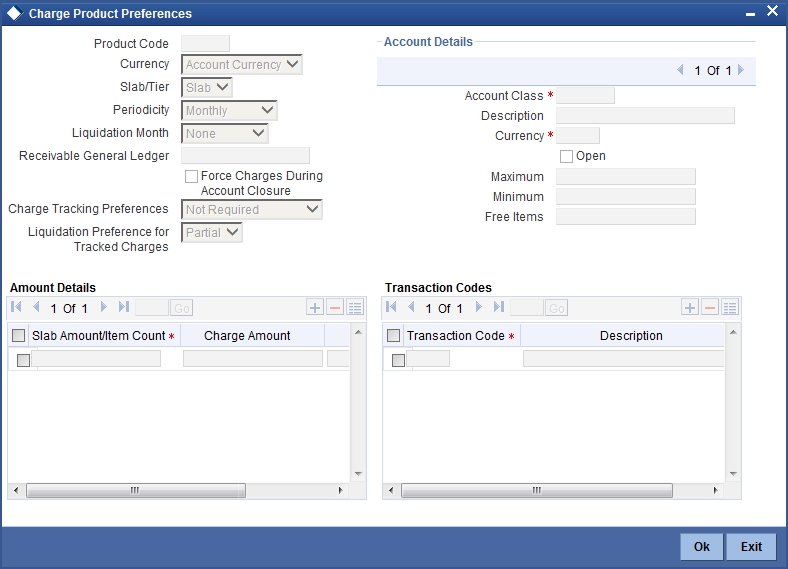

7.2.6.2 Charges Tab

To recall, when creating a product in the IP module, you must first specify whether it is a Profit or a Charge product. This is called the product type.

If the product type is Charges, you have to specify the basis on which you would like to levy the charge. In the ‘Product Preferences’ screen, you have to specify the liquidation related details for the charge product, the account classes on which the product should be applied, the frequency of liquidation, the amount or rate of charge to be applied, amongst other details.

For applying charges on an account, you can define a General Condition or a Special Condition. Charges thus applied will figure in the Account Statement for the account.

While creating a Charge product, you will recall, you identify the basis on which you would levy the charge. You are yet to identify the account classes on which you would apply the product, and the following details:

- The currency in which you would like to levy the charge

- The periodicity with which you would levy the charge (and for a non-monthly cycle, the month from which you would like to begin liquidation).

- Whether you would levy the charge on tier or slab structures

- The account class-currency combination on which you would apply the Charge product.

- The minimum and the maximum charge for the product

- The numeric values of the slab/tier, the charge amount, and the charge rate

- The number of free transactions

Note

You can apply a product to any number of account classes. When you apply a product to many account classes, charges for all the accounts belonging to the classes will be calculated in a similar fashion. You can also apply several products on an account.

Slab / Tier

Select a valid basis to levy the charge for a charge product from the adjoining drop-down list. This list displays the following values:

- Slab – If you want to levy charges on slab basis.

- Tier – If you want to levy charges on the tier basis.

Periodicity

Select the liquidation frequency for the Charge product that you are creating if you opt to liquidate charges periodically, from the adjoining drop-down list. This list displays the following values:

- Ad-Hoc – Select if you want to liquidate on ad-hoc basis.

- Monthly – Select if you want to liquidate on monthly basis.

- Quarterly – Select if you want to liquidate on quaterly basis.

- Semi Annual – Select if you want to liquidate on semi annual basis.

- Annual – Select if you want to liquidate on annual basis.

- Daily – Select if you want to liquidate on daily basis.

Charges for all the accounts linked to the product will be liquidated, automatically, according to your specifications, during the EOD processing on the day the liquidation is due.

Liquidation Month

Specify the first month on which you would like to liquidate charges, if you opted to liquidate charges on a quarterly, half-yearly, or yearly basis, from the adjoining option list. This list displays the names of months in a year.

Receivable General Ledger

Specify Receivable GL which is to be used for storing debit charges on a temporary basis from the adjoining option list. You can specify the Receivable GL only for products linked to rules having debit formulae.

This feature is applicable only for the debit profit on the account calculated through the IP module.

Account Details

The following account details are maintained here:

Account Class

Specify the account class on which you would like to apply the charge product, from the adjoining option list.

Description

Description of the selected account class is defaulted here.

Currency Code

Specify the currency of the Account Class on which you would like to apply the charge product, from the adjoining option list.

Open

Check this box to apply product on an account class. If you uncheck this box, you can temporarily stop applying a product on an account class.

Maximum

Specify the charge amount you want to maintain as the maximum of the amount range that can be applied for the account.

Minimum

Specify the charge amount you want to maintain as the minimum of the amount range that can be applied for the account.

Free Items

Specify the number of items on which you would not like to levy charges, as ‘Free Items’. If the items exceed the value that you specify here, a charge would apply.

You would specify an amount as a ‘Free Item’ in case you identified the ‘Charge Basis’ for the product, as ‘Turnover’.

When charge is calculated on a charge basis other than ‘TURNOVER’, you would specify the number or items, in this field.

Amount Details

The following amount details are maintained here:

Slab Amount

Specify amount you want to maintain as slab for the charge product.

Charge Amount

Specify the charge amount of the specified product.

Charge Rate

Specify the charge amount of the specified product.

Transaction Codes

The following transaction code details are maintained here:

Transaction Code

Specify the transaction code of the charge product from the adjoining option list.

Description

Description of the specified transaction code is defaulted here.

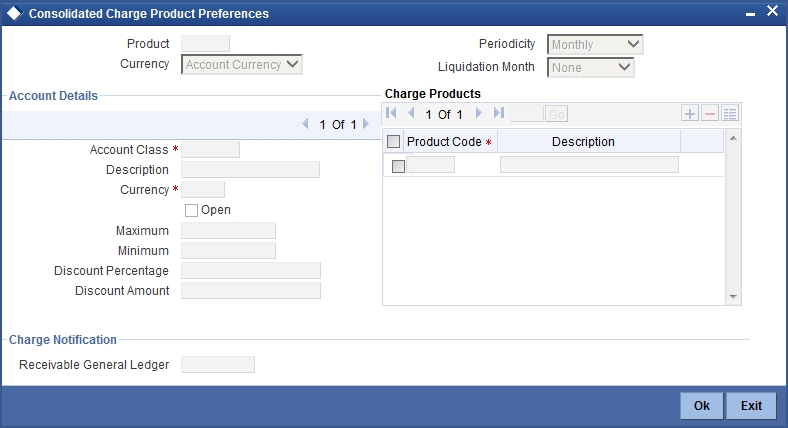

7.2.6.3 Consolidated Charges Tab

When you create a consolidated charge product, you can define the properties for the product such as accounting roles and accounting heads, events, branch and customer restrictions in the same manner as you would do for a normal Profit and Charges product.

You can also set the following specific preferences for a consolidated charges product in the Profit Preferences screen.

You can apply consolidated charges for an account as a special condition at the ‘Islamic Customer Accounts Detailed’ screen.

You can maintain the following parameters here:

Periodicity

Select the liquidation frequency for the Consolidated Charge product that you are creating if you opt to liquidate charges periodically, from the adjoining drop-down list. This list displays the following values:

- Ad-Hoc – Select if you want to liquidate on ad-hoc basis.

- Monthly – Select if you want to liquidate on monthly basis.

- Quarterly – Select if you want to liquidate on quaterly basis.

- Semi Annual – Select if you want to liquidate on semi annual basis.

- Annual – Select if you want to liquidate on annual basis.

- Daily – Select if you want to liquidate on daily basis.

Consolidated charges for all the accounts linked to the product will be liquidated, automatically, according to your specifications, during the EOD processing on the day the liquidation is due.

Liquidation Month

Specify the first month on which you would like to liquidate consolidated charges, if you opted to liquidate consolidated charges on a quarterly, half-yearly, or yearly basis, from the adjoining option list. This list displays the names of months in a year.

Charge Notification

Before applying consolidated charges on personal current accounts, you can choose to notify your customers through Charge Notification messages.

Receivable General Ledger

Specify Receivable GL which is to be used for storing debit consolidated charges on a temporary basis from the adjoining option list. You can specify the Receivable GL only for products linked to rules having debit formulae.

Account Details

The following account details are maintained here:

Account Class

Specify the account class on which you would like to apply the consolidated charge product, from the adjoining option list.

Description

Description of the selected account class is defaulted here.

Currency

Specify the currency of the Account Class on which you would like to apply the consolidated charge product, from the adjoining option list.

Open

Check this box to apply product on an account class. If you uncheck this box, you can temporarily stop applying a product on an account class.

Maximum

Specify the consolidated charge amount you want to maintain as the maximum of the amount range that can be applied for the account.

Minimum

Specify the consolidated charge amount you want to maintain as the minimum of the amount range that can be applied for the account.

Discount Percentage

Specify a valid discount percentage, if any, you want to apply for the consolidated charge calculated for the product. After the discounting has been applied, the Maximum and Minimum validations are performed.

The discount, if any, which is applicable, can also be specified as a flat discount amount.

Discount Amount

Specify a valid flat discount amount, if any, you want to apply for the consolidated charge calculated for the product. After the discounting has been applied, the Maximum and Minimum validations are performed.

The discount, if any, which is applicable, can also be specified as a percentage of the calculated consolidated charge amount

Charge Products

You can apply a charge product on an account in two ways:

- By linking an account class to a charge product, thereby making the product applicable to all the accounts of the class. This method of linking accounts is called the definition of a General Condition; or

- By linking an account itself to the product. This method of linking accounts is called the definition of a Special Condition.

Often, you may calculate charges for several account classes using the same Charge Basis. In such a case, you can apply the same charge product on all the account classes. In the Charge Product Preferences screen you can link a product to an account class(es).

However, since the actual charge values that you wish to apply on each account class may be different, you can specify different values for each of the account class.

Product Code

Specify a valid product code to which you want to link the consolidated charges, from the adjoining option list.

Description

Description of the specified product is defaulted here.

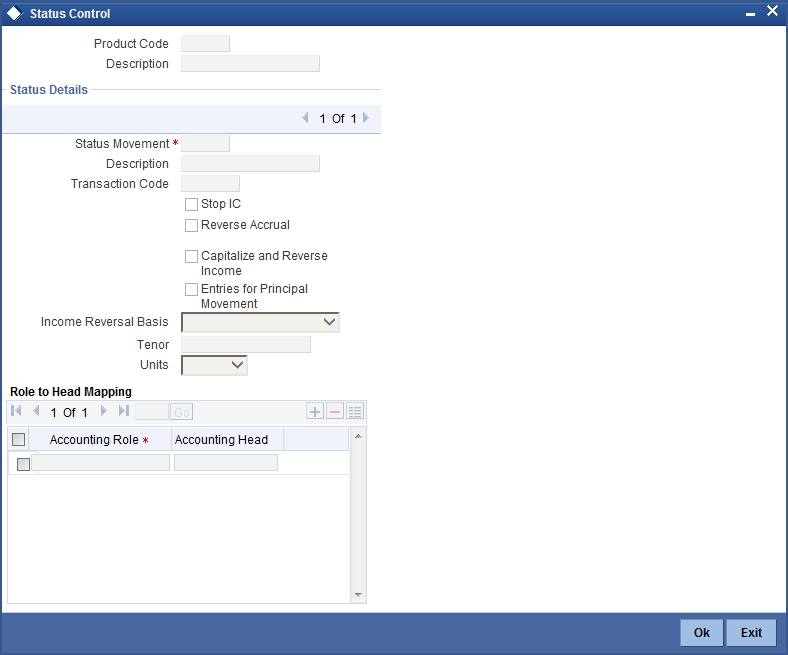

7.2.7 Maintaining Status Codes

While defining a Profit/Charge product, you can maintain different status codes and specify parameters based on which accrual and application of profit/charges will take place for the status of the account.

Status codes are maintained through the ‘Status Control’ screen. You can invoke the ‘Status Control’ screen by clicking the ‘Status Maintenance’ button in the ‘Islamic Profit Distribution Product Maintenance Detailed’ screen.

The following parameters are maintained in this screen:

Product Code

Code of the product for which you want to define status codes, is defaulted here.

Description

Description of the product code is defaulted here.

Status Details

You can maintain the following status details here:

Status

Specify a valid status codes applicable to the product, from the adjoining option list. Use the add button to add a new status and the attributes for the same. You can use the navigation buttons to move from one status to the other. The option list displays status codes with status type ‘Account’.

Description

Description of the specified status is defaulted here.

Transaction Code

Specify a valid transaction to track the accounting entries resulting from the movement of the account to the specified status, from the adjoining option list. Transaction code is used to identify the nature of the accounting entries posted.

Stop IP

Check this box if you want the system to stop processing Profit and Charges when the account moves to the status that is being defined. If not checked, profit and charges will continue to be applicable on the account.

Reverse Accrual

Check this box if you want to reverse all the accruals processed till date when the account moves into the specified status.

Role to Head mapping

Accounting Roles are tags that identify the type of accounting entry that is posted to an accounting head which in turn refer to the different GLs and SLs maintained in your Chart of Accounts.

Accounting Role

Specify a valid accounting role to which you want to post the accruals accrued till date when the account moves to the specified status, from the adjoining option list.

Accounting Head

Specify a valid accounting head to which you want to post the accruals accrued till date when the account moves to the specified status, from the adjoining option list.

Further accruals will be posted to the account heads specified here if the account heads maintained for the next status is not different from the ones specified for the current status.

7.2.8 SSIA – Special Type of Savings Account

SSIA refers to a special type of savings account used for promoting savings by customers. This scheme was introduced between May 1st 2001 and April 30th 2002 and will last for 5 yrs. Though there is no provision to open a new SSIA after April 30th 2002, you may transfer an SSIA from one institution to another.

Depending on the policies of your government, you can maintain a minimum and a maximum deposit amount for an SSIA. Further, you can also assign a fixed allowance rate on the deposited amount if the deposit is within the specified limits. The deposit may be made by means of a cash deposit, a journal entry or a teller transaction.

On maturity (after 5 yrs), you can collect an exit tax on the profit component alone. A customer can make a partial or total withdrawal from his SSIA before the 5-year term in which case tax will be applicable on the full amount (including the principal). When a customer requests for withdrawal of a certain amount from the SSIA, the account is debited for an amount that is inclusive of the tax component as well, so as to ensure that the customer receives the amount requested for, at any point of time before maturity. This is illustrated in the following example.

A customer can make more than one lodgment (deposit) in a month into an SSIA. You can generate a report at the end of a month to ascertain the number of lodgments made during the month. If the deposit exceeds the maximum permissible limit, you can refund the excess to the customer. On maturity, you can send the details of the SSIA to the Revenue department to claim the allowance made to the customer.

7.2.8.1 Setting Up Charge Product for SSIA Processing

Specifying the account class

All SSIA accounts will be made to report to an account class defined for the purpose. You can select the account class in the ‘IC - Charge Product Preferences’ screen.

Identifying the charge basis

When setting up a charge product for SSIA, you have to identify the basis on which you want to calculate the allowance on the deposit made into an SSIA.

To recall, for SSIA processing, you may use one of the following charge bases:

- NET-TURNOVER-DR – will return a value if the account is in debit else the value will be zero.

- NET-TURNOVER-CR – will return a value if the account is in debit else the value will be zero.

Since the allowance is made for the net credit turnover (Sum of all credits – the sum of all debits) in the account, the charge basis would typically be ‘NET-TURNOVER-CR’.

Specifying the transaction code

A Transaction Code is associated with every accounting entry in Oracle FLEXCUBE. To track the credit entries posted to an SSIA account, you have to associate the transaction codes for which the ‘IC Balance Inclusion’ option is checked. This is a mandatory requirement for processing SSIA. The transaction code is selected at the time of defining accounting entries in the ‘Product Event Accounting Entries Maintenance’ screen. Thus, all accounting entries that are generated as a result of lodgments into an SSIA account will be tracked under the transaction code for which ‘IC Balance Inclusion’ option is enabled.

Specifying the accounting roles

The customer is always debited for the charge amount, for an SSIA however, the customer will be credited with the charge amount, which is referred to as an allowance on the deposit.

The following accounting roles will be maintained for SSIA:

| Accounting Role | Description | Dr/Cr Indicator | |||

|---|---|---|---|---|---|

| CR_ALLOWANCE (SSIA Receivable A/C) | Allowance made on the SSIA deposit | Dr | |||

| CHG_BOOK (Customer A/C) | Allowance received by the customer. | Cr |

Defining a slab/tier structure

To recall, you can calculate allowance on an SSIA based on the net credit turnover in the account. The amount limits (minimum and maximum) that will be eligible for an allowance (a fixed rate decided by your bank) can be maintained as a tier or slab structure.

You can define the slab structure in the ‘IC - Charge Product Preferences’ screen.

7.2.8.2 Processing Allowance on SSIA

At the end of the month, the following processing will be done on the account:

All lodgments to the SSIA will be totaled at the end of the month. The allowance amount will be calculated on the deposited amount. The following entries are passed:

| Dr/Cr | Entries | ||

|---|---|---|---|

| Dr | SSIA Receivable A/C | ||

| Cr | Customer A/C |

The allowance will be recovered from the revenue department by means of a direct debit. The following entries will be passed for this:

| Dr/Cr | Entries | ||

|---|---|---|---|

| Cr | SSIA Receivable A/C | ||

| Dr | Nostro |

The SSIA will be set up in the Customer Accounts Maintenance screen. Refer to the ‘Core Entities’ User Manual for more details.

Note

You can define custom fields (UDFs – User Defined Fields) to maintain SSIA related information. This information will be used for storing information and will not involve any processing. The UDFs will be used to communicate the SSIA related information to the revenue department, based on which your bank is reimbursed for the allowance made to the customers.

Refer to the ‘User Defined Fields’ User Manual for more details on defining a custom field.

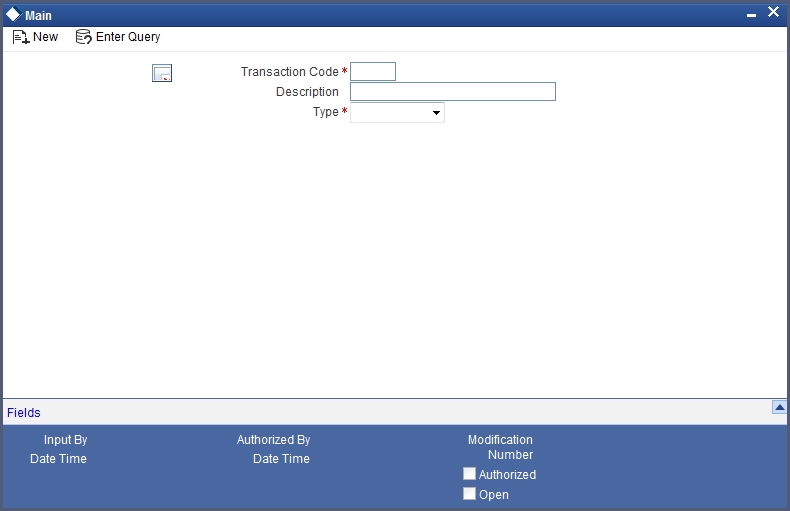

7.2.9 Transaction Codes for Processing External Charges

A Transaction Code is associated with each accounting entry in Oracle FLEXCUBE. All external charges for billing have to be booked using external transaction codes. For this you need to maintain a list of transaction codes that can be used for booking and calculation of external charges.

You can invoke the ‘External Transaction Code Maintenance’ screen by typing ‘ICDTRNCD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specifying the transaction code

Specify a unique transaction code for external transactions.

Specify a unique identification for the transaction code you are creating. This code will be used for external transactions. You must also specify a unique description for the transaction code.

Specifying the Transaction Type

While maintaining the transaction code, you can define the following types of transaction codes:

- Lcy Amount – the amounts specified for the external transactions will be in the local currency.

- ACY Amount – the amounts specified for the external transactions will be in the account currency.

- Count – the system will base the external transaction on the basis of the count.

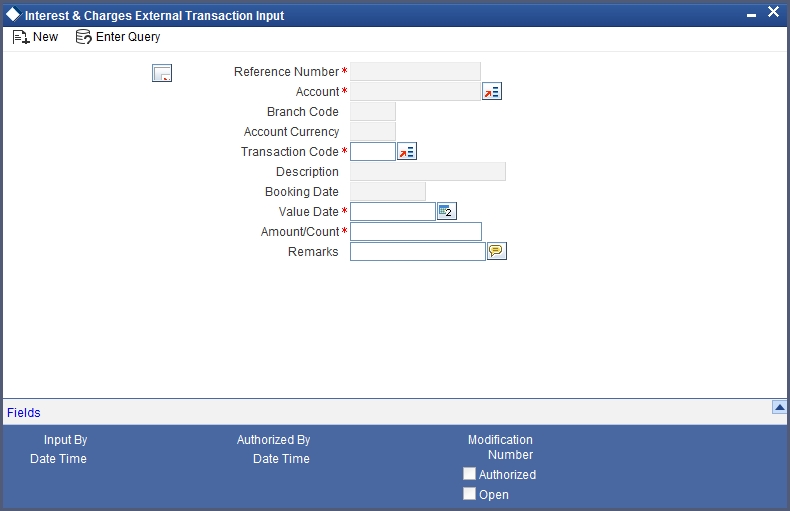

7.2.10 Booking of External Charges

Through the External Transactions screen you can capture the data for NON Oracle FLEXCUBE related charges. You can invoke this screen by typing ‘ICDCHONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specifying the Reference Number

In Oracle FLEXCUBE, the reference number will be generated in a running sequence and is unique for each transaction.

Indicating the Account

Select the customer account number from the option list for which you want to apply the charge. The branch and the currency of the account are automatically displayed by the system. You cannot change these values.

Indicating the Transaction Code

The transaction code you have maintained for external transactions in the External Transaction screen will be displayed in the option list. System will use the code you specify here during IC batch data collection and calculation. The description you have maintained for the transaction code will also be displayed in the next field and you are not allowed to change this description.

Displaying the Booking date

The system defaults the current system date and you will not be allowed to change this date.

Specifying the Value Date

In Oracle FLEXCUBE, charges are calculated based on Value date or Booking date. Hence it is very vital to maintain a value date for the transaction. In case you do not define a value date here, the system will default the current system date as the value date. Make sure that the value date is not less than the last liquidation date for all charge products linked to the account which you have specified in the previous field. The value date defined for a transaction will be used during the data collection of Charges and Charge calculation.

Maintaining the Amount /Count

The value you have maintained in this field will be used in two different ways depending on the type defined for the transaction code. While defining the transaction code, if you have maintained the transaction code type as:

- Amount - the system uses the value you have define in this field to calculate the charge for turnover.

- Count - the system will apply the value maintained in this field to derive the total count while calculation the charge.

System allows you to maintain negative and positive value in this field. Negative value can be maintained for reversing a transaction. The system stores the ACY value data only if you have defined transaction type as ACY amount for the transaction code and similarly the LCY value data is stored only when the transaction type is LCY amount.

Specifying the Remarks

You can specify any remarks you think necessary for the external transaction you have defined. This will be in free format text.