3. Maintenances and Operations

This chapter contains the following sections:

- Section 3.1, "Maintaining Information"

- Section 3.2, "Maintaining Bank Parameters"

- Section 3.3, "Maintaining Branch Parameters"

- Section 3.4, "Defining UDE Rules"

- Section 3.5, "Providing UDE Values "

- Section 3.6, "Applying the UDE Cascade Function"

- Section 3.7, "Maintaining Adhoc Charge Types"

- Section 3.8, "Maintaining Adhoc Charges"

- Section 3.9, "Maintaining Holiday Periods "

- Section 3.10, "Maintaining Check Lists"

- Section 3.11, "Maintaining System Data Elements "

- Section 3.12, "Maintaining Floating Interest Rates"

- Section 3.13, "Maintaining User Defined Policies "

- Section 3.14, "Maintaining Standard Policies"

- Section 3.15, "Maintaining Bulk Payment Preferences"

- Section 3.16, "Maintaining Legal Heir Details of a Mortgage"

3.1 Maintaining Information

Before you begin using the Mortgages module, you must maintain the following information in the system:

Bank Parameters

These are parameters that you need to specify at the bank level. These will include the following:

- Interest calculation parameters

- Amount blocks on inactive accounts

- Splitting of accounting entries for the offset leg

- Site specific maintenances

Branch Parameters

These are parameters that you need to specify at the branch level. These will determine the following:

- Batch processing during holidays

- Netting of accounting entries for accrual, liquidation and status change

- Default Settlement Accounts

- Format/Mask for generation of Account numbers etc

- The structure of the schedule

- Schedule gap treatment

In addition, you also have to maintain the following:

UDE (User Data Elements) Rules

UDEs are used to build formulae to calculate the amount of interest applicable. These include entities like Interest Rate, Amount Slab etc. that will hold values you provide. The UDEs themselves are defined at the product level but you can use these UDEs to build rules with different conditions based on which the UDE value should be arrived at.

You can maintain the UDE values at Product and Account level. You can also maintain Fixed amount UDEs in other currencies.

Repayment holiday periods

For a calendar year, you can define holiday periods for customers during which they can avail a repayment holidays.

Check Lists

For different events, you can maintain check lists. The check lists that you maintain here will be validated during the execution of that event while processing the mortgage.

System Data Elements (SDEs)

Information that is constantly updated by the system, for instance, the balance in an account, number of transactions processed etc. is referred to as SDEs. This information is readily available for computation of penalties, Interest or charges. You need to identify the SDEs applicable for this module.

You can maintain floating rates for a Rate Code, Currency, Amount Slab and Effective Date combination

User Defined Policies

These are validation and operations that are performed during the life cycle of a mortgage

Promotions

Promotions are special offers whereby you can offer special incentives/ concessions to customers. You can link mortgages to one or more promotions

The above maintenances are discussed in detail in this chapter

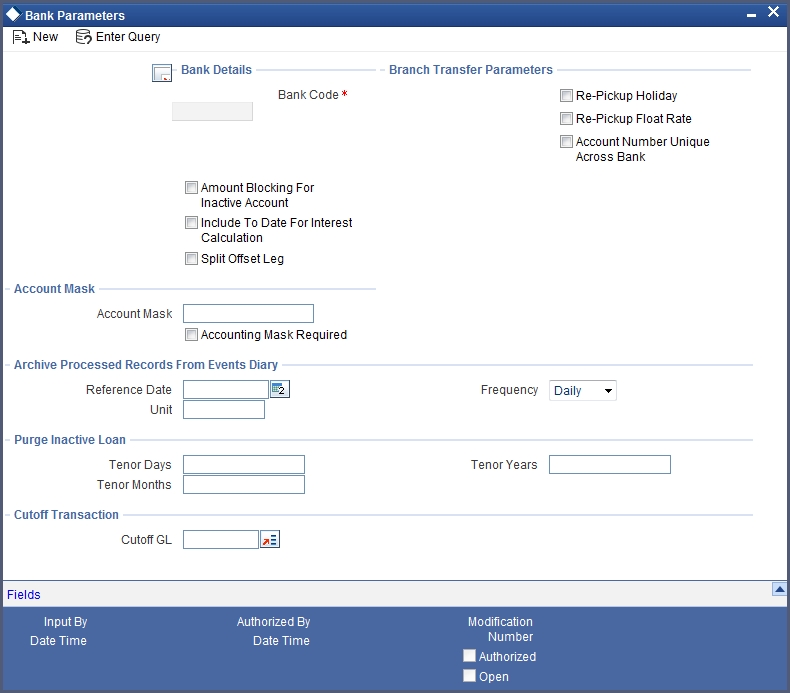

3.2 Maintaining Bank Parameters

You can maintain the bank parameters in the ‘Retail Lending – Bank Parameters’ screen. You can invoke this screen by typing ‘CLDBKPMT’ in the field at the top right corner of the Application toolbar and clicking on the adjoining arrow button.

Here you can capture the following details:

Bank Details

Bank Code

Specify the code that represents your bank

Include To date for Interest Calc

If you check this option, then accrual entries will be passed from the value date + 1 till the maturity date. However, if this box is not checked, then accrual entries will be passed from the value date till the maturity date - 1.

Amount Blocking for inactive account

Indicate whether an amount block needs to be imposed on an inactive account or not

Split Offset Leg

Check this box if you wish to have split accounting entries for the offset leg of a transaction. For example, if a certain transaction debits a particular GL and credits two different GLs (as in off balance sheet entries), the system will pass two debit entries for the first GL to be in sync with the credit entries to the other GLs. If this option is not checked the accounting entries will be as under:

| Dr/Cr | Account | Amount | |||

|---|---|---|---|---|---|

| Dr | 00000001 | 50 | |||

| Cr | 00000011 | 20 | |||

| Cr | 00000022 | 30 |

If this option is checked the accounting entries will be as under:

| Dr/Cr | Account | Amount | |||

|---|---|---|---|---|---|

| Dr | 00000001 | 20 | |||

| Cr | 00000011 | 20 | |||

| Dr | 00000001 | 30 | |||

| Cr | 00000022 | 30 |

Archive Processed Records From Events Diary

The parameter Reference Date, Frequency, Unit will be used to archive the processed records in Event Diary

The archival will be done in EOD by batch function. If this parameter is not set then no archive will be done.

Purge Inactive Loan

Specify the tenor in units of days, months and year, for which you want to keep the inactive mortgages for purging.

Cutoff Transaction

Select the Cutoff GL from the option list. Transactions after 2:00 pm on a day will be considered on the next working day. The accounting entries for such transactions will be passed into the Cutoff GL and not the Settlement GL.

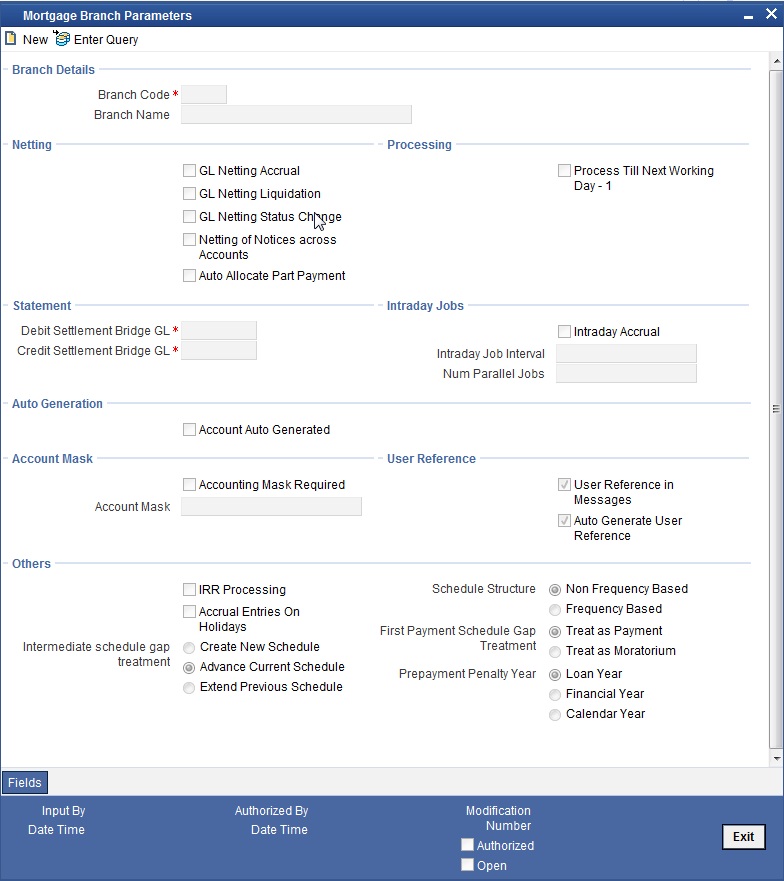

3.3 Maintaining Branch Parameters

You can maintain the branch parameters in the ‘Mortgage – Branch Parameters’ screen. You can invoke this screen by typing ‘MODBRPMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Branch parameters include the following:

Branch Code

You have to indicate the code of the branch for which the parameters have to be maintained. The codes of the various branches of your bank are available in the option list provided.

When you select the code, the branch name is also displayed alongside.

Process Till Next Working Day – 1

This specification will determine the day on which automatic events such accrual, liquidation etc. falling due on a holiday, should be processed. If you select this option, events scheduled for a holiday will be processed on the last working day before the holiday.

For example, assume that the current system date is 15th May ’05. Further, 16th and 17th are holidays. If you select ‘Process Till Next Working Day – 1’, when you execute the batch program during EOD of 15th May, the events due on 16th and 17th will also be processed.

If you do not select this option, processing will be done upto the system date i.e. the current date. The automatic events due on a holiday will be processed as part of the batch program run at BOD on the next working day after the holiday.

Consider the example discussed above, if you do not check this option, the events due on 16th and 17th will be processed as part of BOD operations on 18th May ’05, which the next working day after the holidays.

Netting

Here, you need to indicate the netting preference for posting entries during accrual, liquidation and status change.

If you opt to net, the system will post a single consolidated entry for a GL and Currency combination. If you do not select this option, entries are posted individually for each account.

The GL netting status change option can also be used to indicate installment level status change.

The Netting of Notices across Accounts can be used to indicate that for or all accounts for which the payments falls due on a particular date, the requests for invoice generation should be consolidated.

The mortgage accounts for which the reminder or demand note should be sent is tracked based on the status of the account. The SDE ‘Next Schedule Date’ is set up to arrive at how many no. of days in advance the payment notice should be generated. Based on the status of the mortgage account the corresponding payment invoice format is set up.

The Auto allocate part payment option can be used if you want to do a partial payment through auto allocation. For accounts which are marked for manual allocation of partial amount the payment can be done in bulk using the ‘Consumer Lending – Bulk Payments’ screen.

For more details on Bulk payments refer section ‘Bulk Payments’ in the ‘Operations’ chapter of Retail lending module.

Settlement

The settlement accounts for processing lending transactions have to be specified here. You have to specify the Bridge GL/Account to be used for the settlement of the debit and credit legs of transactions that would be processed at your branch. You can select the accounts from the option lists provided for the same.

Account Auto Generated

You can select this option for automatic generation of account numbers. The system generates the account numbers automatically when you create customer accounts through the ‘Account Details’ screen. If this option is not checked, you have to capture the account number yourself.

For details on creating an account, refer the ‘Account Creation’ chapter of this User Manual.

Accounting Mask Required and Account Mask

To maintain uniformity in the account numbers generated/captured across a branch, you can specify a format/mask for account numbers. If you specify that account numbers should conform to a specific format, you have to specify the mask in the ‘Account Mask’ field.

For example, you may want the account numbers of your branch to be a combination of:

- Branch Code (3 Characters)

- Product (4 Characters)

- Currency (3 Character currency code)

- 5 digit running sequence number

The account mask in this case would be: @ (BRN)@(PROD)@(CCY)@(SEQ:5)

An example of an account number conforming to the above mask would be DOC3ROLUSD60021.

If you opt for auto generation of account numbers but do not specify a mask, the generated number will, by default, conform to the following format:

- 3 character Branch Code

- 4 character Product Code

- Date in Julian format (YYDDD)

- 4 digit running sequence number

An example of an account conforming to the above format is ‘DOCVSIM040960021’ where:

- ‘DOC’ is the Branch Code

- ‘VSIM’ is the Product Code

- ‘04096’ is the date equivalent to 5th April 2004 (04 – Year and 096 is the number of days that have elapsed in the year).

- ‘0021’ is the running sequence number.

Also, if you maintain an account mask but do not opt to auto generate the account numbers, then, during account capture you have to conform to the account mask maintained for the branch. If the account is not as per the mask, the following error message is displayed:

“Account number entered is not conforming to the account mask.”

User Reference Number

Unique Reference per Message

Check this box to generate unique reference number for each payment message generated for the account.If unchecked, payment messages will be populated with account number or user reference number maintained in branch parameters for all payment messages.

User Reference Number in Messages

Check this box to indicate that the User Reference Number provided in the account screen has to be used in Tag 20 of MT103 and Tag 21 of MT202. If the box is unchecked, the mortgage account number will be used instead of the User Ref no.

Auto Generate User Reference Number

Check this box to indicate that system should auto generate user ref no during account creation.

Others

IRR Processing

Check this option to trigger the YACR (Yield Accrual) event for the branch batch.

Schedule Structure

This option is used to indicate if the schedule definitions should honor the end dates or honor the frequencies when the two contradict. The options are:

- Frequency Based

- Non-Frequency Based (the end dates contradict each other)

First Payment Schedule Gap Treatment

Here, you have to specify the manner in which you would like to treat the period/gap between the mortgage disbursement date and the first payment. The options are:

- Treat as Payment

- Treat as Moratorium

For example, assume that you make a disbursement on 1st January and the first payment is due on 1st March. This means that there is a gap of two months between the disbursement and the first payment schedule. You can treat this gap either as a ‘Payment’ schedule or a ‘Moratorium’ schedule. If you opt to treat it as a ‘Payment’ schedule, then, during product creation, you should define the payment schedule with the ‘Schedule Flag’ being ‘Normal’. You should also specify a separate formula for this schedule. This is also done at the product level.

Similarly, if the gap is treated as a ‘Moratorium’, you should define a schedule with type ‘Moratorium’ and also define a moratorium formula for the schedule.

Intermediate Schedule Gap Treatment

Here, you have to specify the manner in which the system should handle gaps between two schedules. The available options are:

- Create New Schedule

- Advance current schedule

- Extend previous schedule

Pre-Payment Penalty Year

Indicate the type of pre-payment penalty year. You can select one of the following options:

- Mortgage Year

- Financial Year

- Calendar Year

Computation of prepaid amount in a year depends upon the selection of the above option. Based on the option selected, the date range is interpreted by the system for considering the ceiling of prepaid amount in a year. You can not change this option after the first authorization of the Mortgage Branch Parameters.

Mortgage Year ranges between value date of the mortgage and completion of that particular year. Financial Year ranges between start date of the financial year and the end date of the financial year. Calendar Year ranges between the start date of the calendar year and end date of the calendar year.

For example, assume the following:

Value Date: 05-JAN-2000

Maturity Date: 05-JAN-2020

- Mortgage Year: Year wise penalty free computation is considered like 05-JAN-2000 to 04-JAN-2001, 05-JAN-2001 to 04-JAN-2002, 05-JAN-2002 to 04-JAN-2003 and so on.

- Financial Year: If financial year is maintained from April to March, in such a scenario, year wise Penalty free computation will be considered like 01-APR-2000 to 31-MAR-2001, 01-APR-2001 to 31-MAR-2002, 01-APR-2002 to 31-MAR-2003 and so on.

- Calendar Year: Year-wise penalty free computation is considered like 05-JAN-2000 to 31-DEC-2000, 01-JAN-2001 to 31-DEC-2001, 01-JAN-2002 to 31-DEC-2002 and so on.

The amount prepaid is stored in a data store year-wise. This data store is value date based. This table is updated at the time of save of payment. Also during deletion and reversal operations this table is updated correctly. The impact of prepaid amount is cancelled from the table during deletion/reversal. The pre-payment penalty amount collected is also stored in the same data store.

At the product level you have to maintain a UDE for handling maximum prepayment amount in a financial year. Let us assume that the UDE is maintained as MAX_PREPAID_PCT. You can maintain the default value of the above UDE from the product. System validates that the extent of pre-paid amount doesn’t exceed the percentage maintained at product level at the time of pre-payment.

After setting up the branch parameters, you have to save the details. Click Save icon to save the details in the system. However, the parameters take effect only after your supervisor authorizes the same.

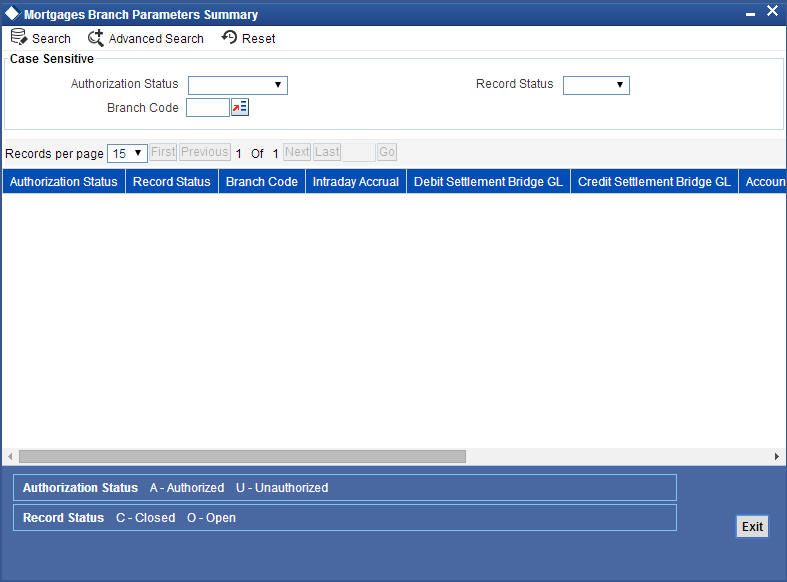

3.3.1 Viewing Mortgages Branch Parameters Summary

You can view a summary of all Mortgages Branch Parameters, through the ‘Mortgages – Branch Parameters Summary’ screen. You can invoke this screen by typing ‘MOSBRPMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query based on all or any of the following criteria:

- Authorization Status

- Branch Code

- Record Status

- Once Auth

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Authorization Status

- Record Status

- Branch Code

- Intraday Accrual

- Debt Settlement BridgeGL

- Credit Settlement BridgeGL

- Accounting Mask Request

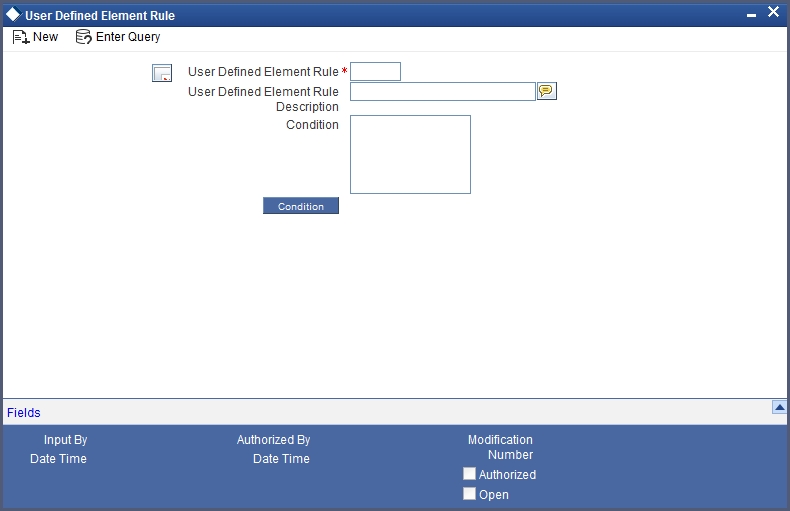

3.4 Defining UDE Rules

User Defined Elements (UDEs) refer to entities like Interest Rates, Amount/Tier Slabs whose value you can specify and at the same time maintain different values with different effective dates. For instance, you can indicate that interest should be calculated at five percent on a certain date and specify a higher rate effective at a later date.

The UDEs, per say, are defined at the product level and the actual values are provided for a combination of Product, Currency, UDE Rule, and Effective Date in the ‘UDE Values’ screen. This will be defaulted at the account level and you can override the same with account specific values.

You can define UDE Rules based on which the UDE Values will be picked up at the account level. UDE Rules are conditional expressions built using the SDEs like Mortgage Amount, Tenor, Rate, Customer Category etc. These rules can be created independently and later attached at the time of maintaining UDE Values. You can associate multiple rules and specify UDE values for each rule. You can maintain the rules in the ‘UDE Rules’ screen. You can invoke this screen by typing ‘CLDUDRMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The following information should be captured to create a UDE Rule:

User Defined Element Rule

You have to specify a unique code consisting of a maximum of four alphanumeric characters, to identify the rule in Oracle FLEXCUBE. This is mandatory to save the record.

Condition

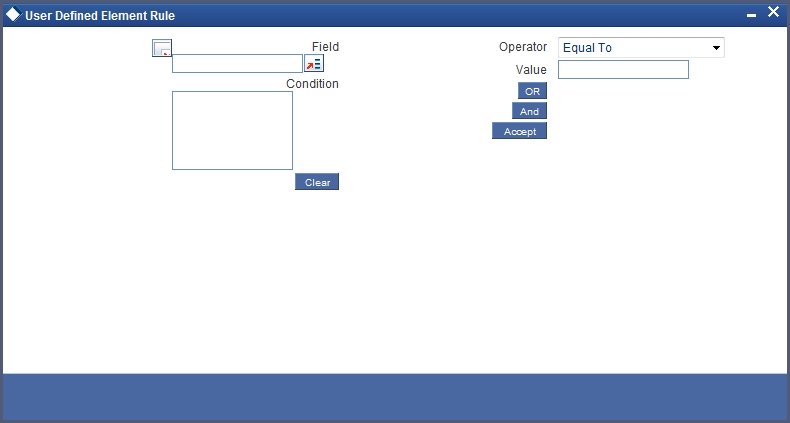

You can build multiple conditions for a rule. To do this, click on ‘Condition’ in the screen above. The following screen is displayed:

You can create conditions using the following:

Field

The SDEs that are factory shipped or maintained in the ‘System Data Elements’ screen are available in this list.

Operators

This list includes the mathematical operators:

- Equal To

- Greater Than

- Greater Than or Equal To

- Less Than

- Less Than or Equal To

- Like

- Not Like

- Not Equal To

- Logical Operators:

- And: Use ’And’

- Or: Use ’OR”

Value

The value of the SDE selected to define the condition should be entered here. The value may be numeric or alphanumeric, as required for the condition.

After building the condition, click ‘Accept’ to accept the same. To remove a condition, click ‘Clear’ in the screen.

After you build the condition(s), click ‘Ok’ in the screen. You will return to the ‘UDE Rules’ screen. The condition defined is displayed in this screen.

Refer the section titled ‘Specifying product Main details’ in the ‘Defining Product Categories and Products’ chapter of this User Manual for details on defining UDEs.

3.5 Providing UDE Values

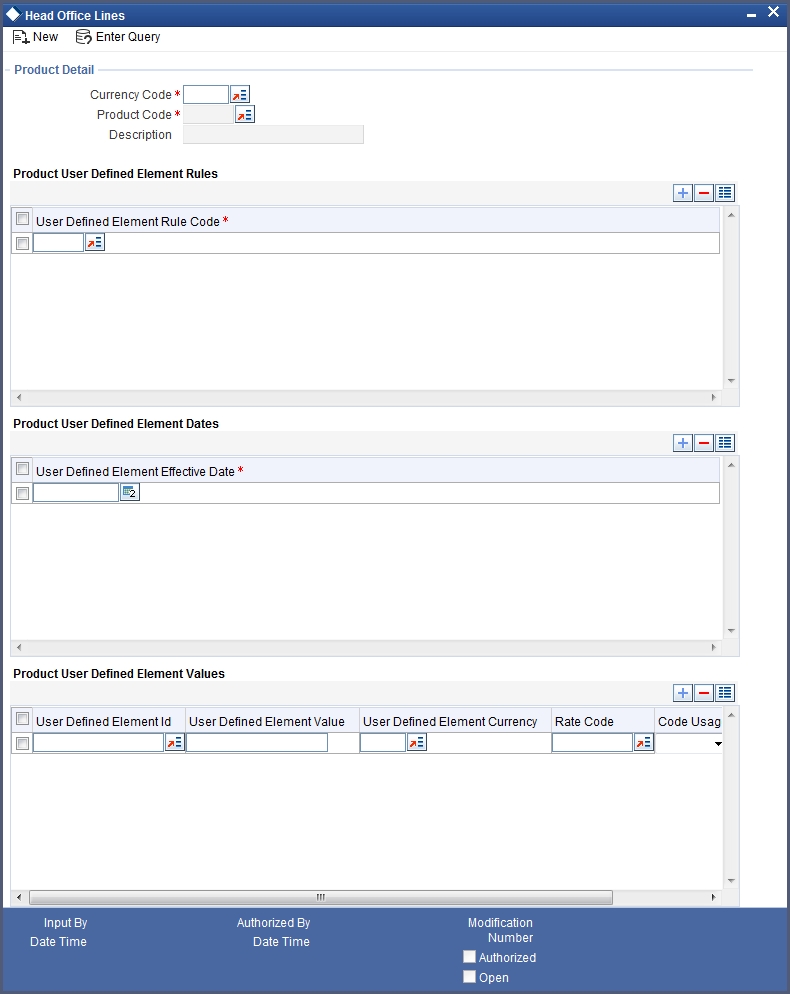

The actual values for the UDEs defined during product creation (in the ‘Main’ tab of the ‘Consumer Lending Product’ screen) is maintained in the ‘UDE Values’ screen. You can invoke this screen by typing ‘CLDUDVMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you can maintain values for a ‘Product Code + Description + Currency Code + UDE Rules + UDE Dates+ UDE Values’ combination. The following details have to be captured here.

Product Detail

Product Code

You have to select the product for which the UDE values have to be maintained. The products offered at your bank are available for selection in the option list provided.

Description

After selecting the product the system will automatically generate a description for the product.

Currency Code

For the product selected, specify the relevant currency. This becomes the UDE currency and the values you capture for the UDE is expressed in this currency. The option list will include the currencies maintained in the ‘Currency Definition’ screen. You can select a relevant code from this list.

For details on ‘Currency Definition’ screen, refer the ‘Currency Maintenance’ chapter of the Core Services User Manual.

Product User Defined Element Rules

User Defined Element Rule Code

Here, you have to associate the relevant UDE Rule(s). The rules maintained in the ‘UDE Rules’ screen are available in the option list. For each associated rule, you can specify UDE values with different effective dates and depending on the rule that the mortgage satisfies, the corresponding UDE values become applicable to the mortgage and same are picked for Interest, Charge, Tax, Commission and Fee computation.

Note

The UDE Rule is mandatory to save the record. The system will automatically link the default rule if you do not associate a rule.

Product User Defined Element Dates

User Defined Element Effective Date

You have to specify the effective dates for the UDE values. This is the date on which the UDE value becomes applicable in the system. The date should be in MM-DD-YYYY format. For a rule, you can maintain UDE values with different effective dates.

Product User Defined Element Values

UDE ID

The UDEs defined for the selected product is automatically displayed here.

UDE Value

For each UDE displayed for the selected product, enter the UDE value. As mentioned, you can maintain values with different effective dates. Note that the UDE values should fall within the minimum and maximum limit specified for the UDEs linked to the product.

Rate Code

If you want the UDE to have a floating interest rate, select the applicable rate code from the option list. Depending on the rate code selected, the rates are picked up from the ‘Floating Rate Code Definition’ screen. In this case, the value captured for the UDE becomes the spread against the rate code.

For instance, assume that the rate code is ‘MIBOR’ and the UDE value is 2 (positive spread). If the rate picked up as per the rate code (taking into consideration the effective date, amount slab and tenor) is 5%, then the actual interest applicable would be 7% (5 + 2). Similarly, if it were a negative spread, the interest would be 3% (5 – 2).

For details on maintaining floating rate codes, refer the section titled ‘Maintaining Floating Interest Rates’ in this chapter.

UDE Currency

The Currency of the UDE for UDE of Amount type will be captured

Code Usage

This is applicable only if you associate a ‘Rate Code’ with the UDE. It indicates the frequency at which you want to refresh the floating rates. The options are:

- Automatic: This implies that the rates will be automatically refreshed every time a rate change occurs. Therefore, rates are reapplied to the mortgages as and when there is a rate change.

- Periodic: This means that the rates will be refreshed based on the Rate Revision Schedule maintained at the component level (in the ‘Components’ tab of the ‘Consumer Lending Product’ screen).

It is mandatory to specify the Rate Code usage if the rate code is maintained.

Cascade

You can change the UDE values even after creating accounts under the product. The cascade feature is used to determine the manner in which the change should be handled. If you choose to cascade (select ‘YES’), the change becomes applicable to all the existing accounts under the product. However, if you do not cascade the changes, the new UDE values become applicable only to accounts created subsequent to the change.

3.5.1 Maintaining Fixed Amount UDEs in other Currency

To maintain UDEs in a currency different from the mortgage currency, you have to maintain the values separately for each currency. At the time of mortgage creation, the values defined for the UDE Currency is picked up and is displayed (in the ‘Ude Value’ field of the ‘Account Details’ screen) after conversion into the mortgage currency equivalent.

For example, assume that at the product level (Product Code: HOME), you define three UDEs (of type ‘Amount’), each in a different currency.

- UDE1 in CLP (mortgage currency)

- UDE2 in USD

- UDE3 in GBP

At the time of capturing the values for these UDEs in the ‘UDE Values’ screen, you have to maintain UDE values for the following three combinations:

- HOME + CLP + Default UDE Rule + Effective Date + UDE1

- HOME + USD + Default UDE Rule + Effective Date + UDE2

- HOME + GBP + Default UDE Rule + Effective Date + UDE3

At the account level, the value corresponding to the UDE currency (as specified at the product level) is picked up. For UDE1, the value corresponding to the first combination is picked up, likewise for UDE2 and UDE3 the values corresponding to the 2nd and 3rd combinations resp. are picked up.

The values, however, are displayed after conversion into the mortgage currency equivalent.

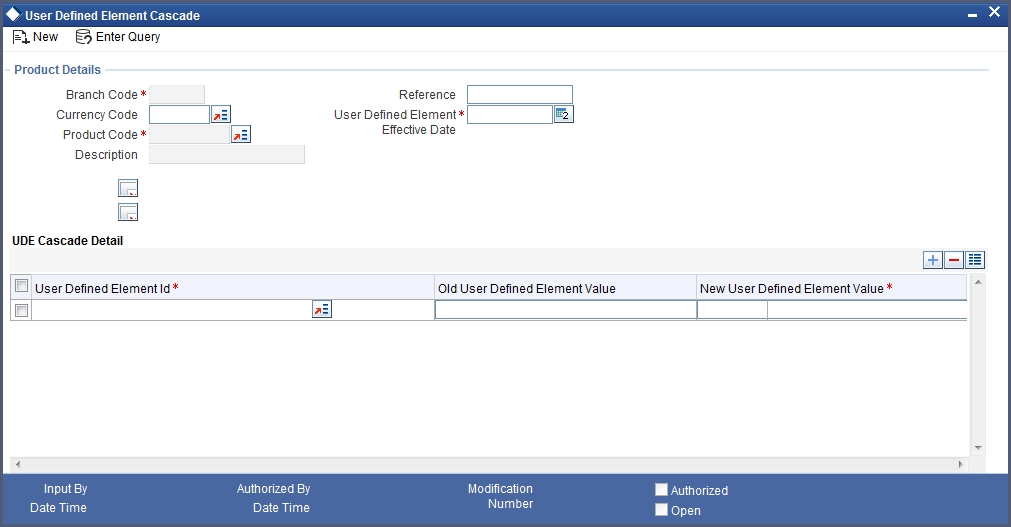

3.6 Applying the UDE Cascade Function

You also have the feature to change the value of a UDE for all the existing accounts under a product. However, the change will be applicable only to the existing accounts. UDE values for new accounts created under the product will be picked as per your specifications in the ‘UDE Values’ screen.

You can define new UDE values for existing accounts in the ‘UDE Cascade’ screen. To invoke this screen type ‘CLDUDCMT’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

The code of the login branch is displayed here. The following information is captured in this screen:

Product Details

Reference

After saving the UDE cascade function, Reference will be generated by system itself

Branch code

Input the branch code in which the relevant data is maintained

CCY Code

Select a currency maintained for the product from the option list provided. The UDE value is applied in the currency selected here

Product Code

Select a product for which you have to change the UDE value. The change becomes applicable to all the existing accounts under the product

UDE Effective Date

The date on which the new UDE value is brought into effect is captured here. The date format should be ‘MM-DD-YYYY’

After you specify the effective date, the system automatically generates a unique ‘Reference’ Number

Change Cascaded

UDE Id

The option list will display the UDEs defined for the selected product. Select the UDE that requires a change in value. When you select the UDE, the ‘Old Ude Value’ is also displayed in the next field.

New UDE Value

Provide the new value for the selected UDE

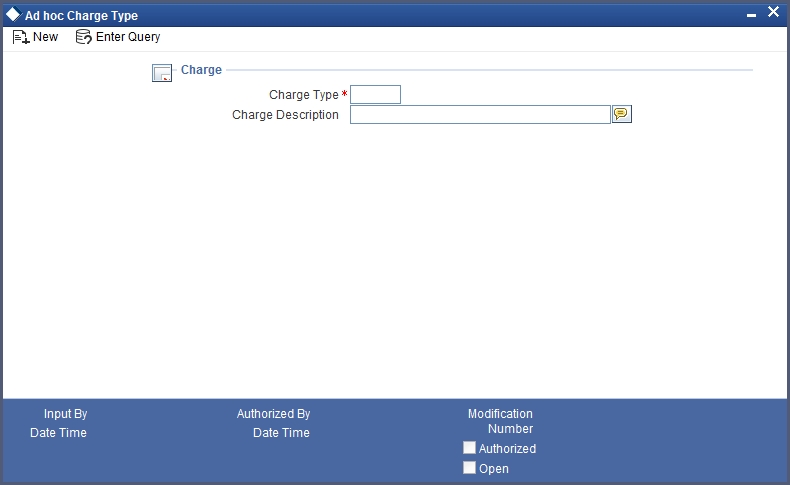

3.7 Maintaining Adhoc Charge Types

In order to maintain the various ad hoc charge types invoke the ‘Adhoc Charges Type’ screen. This screen allows you to capture and store ad hoc charge types such as legal fees, notary fees, and administration fees etc. which are applicable at the collection stage of the mortgage. You can invoke this screen by typing ‘CLDADCMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Charge Type

Specify the charge type that can be levied on a mortgage in case of any delayed repayments. The valid values are of the type Admin Fee, Legal Fee, etc

Charge Desc

Specify a detailed description of the Charge Type

3.8 Maintaining Adhoc Charges

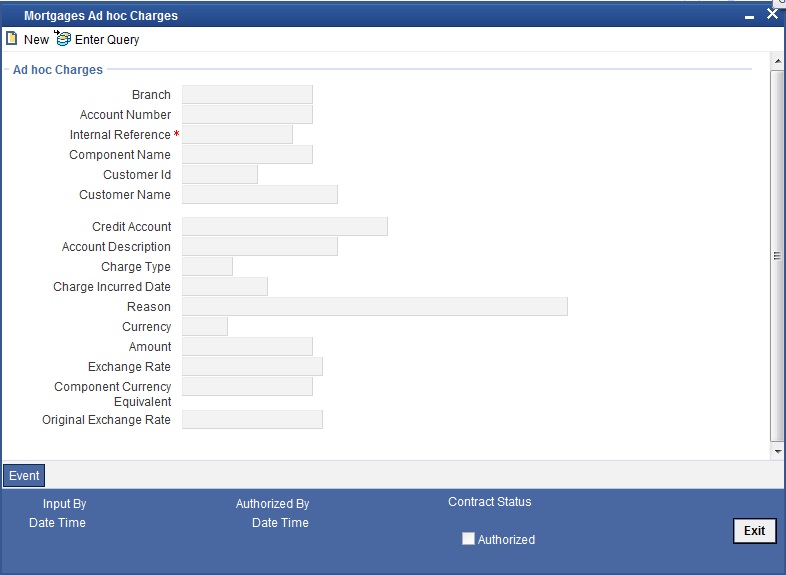

You can maintain adhoc charges in the system using the ‘Adhoc Charges’ screen. You can invoke this screen by typing ‘MODADCHG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You need to enter the following details in the screen above:

Branch

Select the branch code of the bank that is servicing the mortgage.

Account Number

Select the account number on which the charges are to be levied from the option list.

Internal Ref No

A unique identifier for the specific ad hoc charge is displayed here. This is system generated.

Component Name

Select the component that is to be used to track the ad hoc charge from the option list.

Credit Account

Specify the account (GL) to which the ad hoc charges collected are to be credited from the option list. This in most cases is the account of the Collection Agency.

Charge Type

Select the charge type to be levied on a mortgage from the option list. The values in the option list are the charge types maintained using the Adhoc Charge Type maintenance.

Charge Incurred date

Specify the date on which the charge is to be levied on the customer. This cannot be a future date. Also, it should pass the accounting for ad hoc charges with a back date.

Reason

Specify the reason for which the charge is being levied on the account.

Currency

Select the currency for the adhoc charge.

Amount

Specify the amount of the ad hoc charge to be levied on the customer account.

Original Exchange Rate

The base or actual exchange rate between the account currency and settlement currency gets displayed here.

Exchange Rate

For a customer availing any Relationship Pricing scheme, the customer specific exchange rate derived by adding the original exchange rate and the customer spread maintained for the relationship pricing scheme gets displayed here.

You can change the defaulted rate provided the change is within the variance level maintained for the underlying product.

If Relationship Pricing is not applicable, Exchange Rate will be the same as the Original Exchange Rate.

You can reverse the adhoc charges entered in the system. The Reversal button is enabled for all authorized adhoc charges entered in the system. The contract status for the adhoc charge will have the value as ‘PAID’ or ‘REVERSED’. Post reversal of the adhoc charge, the contract status is displayed as ‘REVERSED’.

At the time of Authorizing of reversal of Adhoc Charges, re-computation of IRR is done by the system if IRR is applicable for the product. The unauthorized reversals can be deleted and authorized. The delete and Authorize buttons will be enabled for unauthorized reversals.

The event code used for reversal of adhoc charge is RADC (Reversal of Adhoc Charge).

Adhoc charge reversal is not allowed if any event happens after the adhoc charge event. In such case, the event needs to be reversed first and then only adhoc charge can be reversed. The possible events are ALIQ/MLIQ, VAMI, DSBR, REVN.

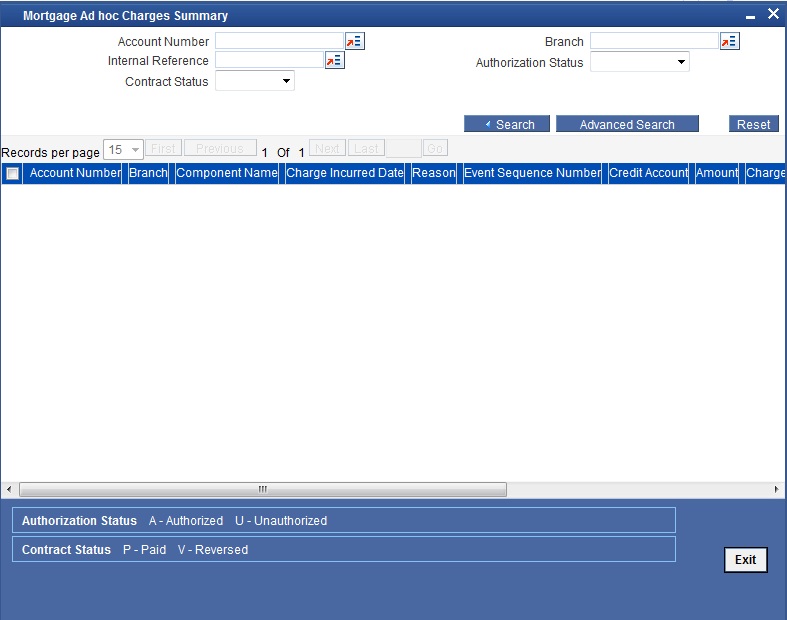

3.8.1 Viewing Mortgage Adhoc Charges Summary Screen

You can view a summary of all Mortgage Adhoc Charges, through the ‘Mortgage Adhoc Charges Summary’ screen. You can invoke this screen by typing ‘MOSADCHG’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query based on all or any of the following criteria:

- Account Number

- Internal Reference Number

- Contract Status

- Branch

- Authorization Status

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Account Number

- Branch

- Component Name

- Charge Incurred Date

- Reason

- Event Sequence Number

- Credit Account

- Amount

- Charge Type

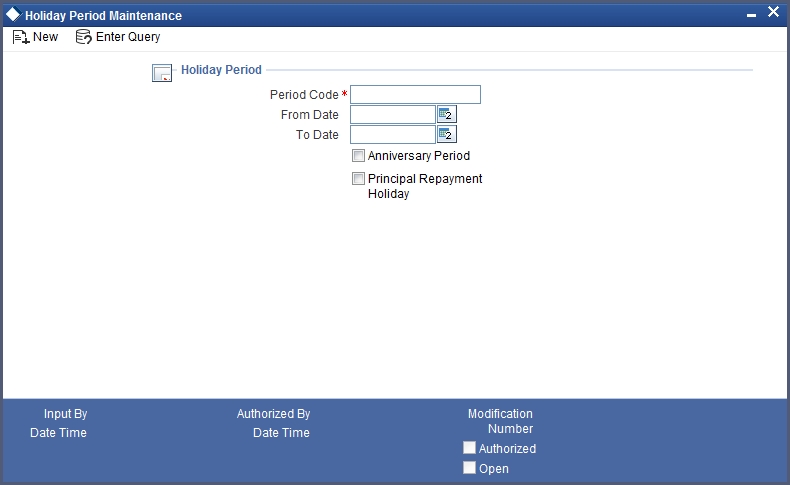

3.9 Maintaining Holiday Periods

You can identify certain periods in the calendar as holiday periods when customers would have other expenses and would like to avail a repayment holiday. This would typically be during Christmas/New Year or for anniversary celebrations. Although, Interest computation continues for this period, repayments are not scheduled.

You can define repayment holiday periods in the ‘Holiday Period’ screen.

You can invoke this screen by typing ‘CLDHOLMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The following information is captured to define a holiday period:

Period Code

You have to capture a unique code to identify the period in the system. The code can comprise of 30 alphanumeric characters.

Date From and Date To

For the period code specified, capture the holiday period i.e. the start date and end date for the holidays. The date format should be ‘MM-DD-YYYY’. It is mandatory to specify the date range to save the holiday period.

Anniversary Period

This option is used to define an anniversary period. If you check this option, the holidays will be repeated every year for the given range of dates. By default, the system checks this option.

Principal Repayment Holiday

If you check this option, the system will apply the holiday period to the principal component alone. The simple interest formula defined at the product level will not be affected. By default, this option is unchecked. However, you may modify it.

While defining a mortgage contract, you may apply the holiday period codes maintained using this screen.

For example, suppose that a product has dual formula for the MAIN_INT component as shown:

| Formula Name | Formula Type | ||

|---|---|---|---|

| FRM_MAIN_INT | Amortized | ||

| FRM_MAIN_INT_1 | Non-amortized |

A holiday period ‘PRINHOL’ is maintained as shown below:

| Field | Value | ||

|---|---|---|---|

| Period Code | PRINHOL | ||

| From Date | 1-Oct-00 | ||

| To Date | 1-Nov-00 | ||

| Anniversary Period | Y | ||

| Principal Repayment Holiday | Y |

Contract details are shown in the following table:

| Contract Details | |||

|---|---|---|---|

| Value Date | 01-Jan-2000 | ||

| Maturity Date | 31-Dec-2000 | ||

Once ‘PRINHOL’ has been linked as holiday period linkage, the system will generate Comp SCH as shown in the following table:

| Formula | First Due Date | No. of Schedules | Frequency | Schedule Type | |||||

|---|---|---|---|---|---|---|---|---|---|

| FRM_MAIN_INT | 01-Feb-2000 | 8 | 1 | Monthly | |||||

| FRM_MAIN_INT_1 | 01-Oct-2000 | 1 | 1 | Monthly | |||||

| FRM_MAIN_INT | 01-Nov-2000 | 8 | 1 | Monthly | |||||

| FRM_MAIN_INT | 01-Dec-2000 | 8 | 1 | Bullet |

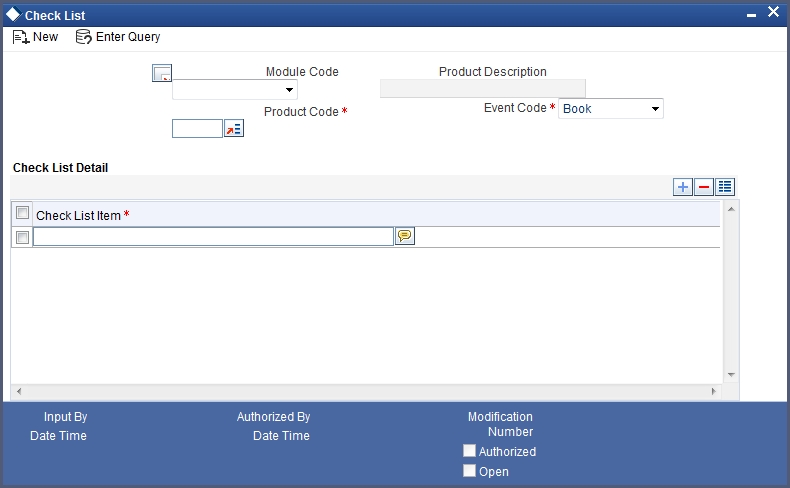

3.10 Maintaining Check Lists

You can maintain check list for different events using the ‘Check List Maintenance’ screen. The check lists that you maintain here will be validated during the execution of that event while processing the mortgage. For E.g.- A checklist of documents required for mortgage processing can be maintained like ID proof, Bank statements, Income etc.

You can invoke this screen by typing ‘CLDCHKMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The following details have to be captured here:

Event Code

Select the event code for which check list items have to be maintained from the drop down list.

Check List Item

Specify the check list item name that you want to maintain for the selected event. The check list items that you maintain here will be validated by the system during that event, while processing the mortgage.

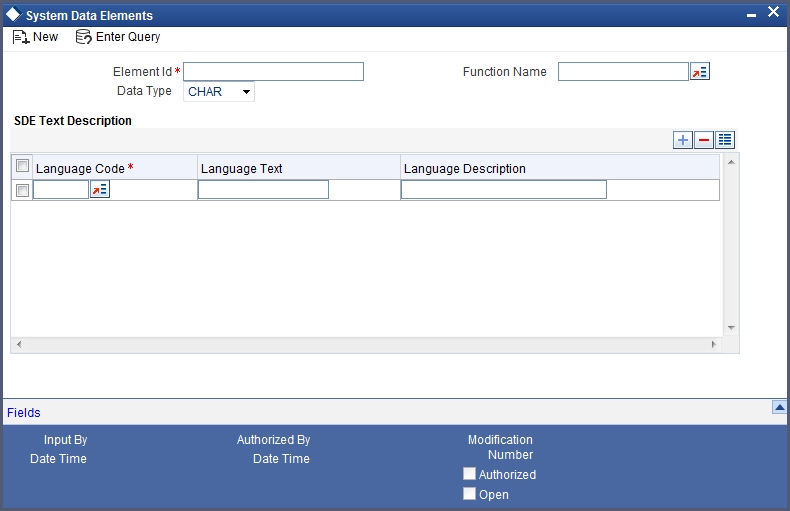

3.11 Maintaining System Data Elements

The balance in the account for which the interest has to be calculated depends on the activities that take place in the customer account over a period of time. This information is constantly updated in the system and is readily available for computation of interest or charges. Data elements of this sort are called ‘System Data Elements’ (SDEs) because the values for the SDEs are necessarily picked up by the system while applying interest. You cannot input the values for these elements.

You can capture the various SDEs in the ‘System Data Elements’ screen. You can invoke this screen by typing ‘CLDSDEMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You have to maintain the following to define a SDE:

Element ID

Capture an id to uniquely identify the SDE in the system. You can devise an Id comprising a maximum of 30 alphanumeric characters.

Function Name

Here, you have to associate the Oracle function which would calculate the SDE value internally. The values available in the option list are factory shipped. The system picks up the value computed by the function for use in interest calculation.

Data Type

This indicates the nature of the data the SDE represents. The options are:

- Character

- Number

- Date

Language Code and Language Text

Select a language for the SDE being defined. You can select a code from the option list provided. The system automatically displays the corresponding text in the language selected for the SDE.

Language Description

Here, you have to provide the description of the SDE being defined, in the language selected. The description should not exceed 30 alphanumeric characters.

System Data elements can be balances like PRINCIPAL_EXPECTED, PRINCIPAL_OVERDUE etc. Some Oracle FLEXCUBE entities required for formula generation/rule set up will be factory shipped.

The list of standard SDEs available for use are given below:

| Name | Description | ||

|---|---|---|---|

| TENOR | Duration for which the mortgage is applied for in days | ||

| CUSTOMER_CATEGORY | Category of the customer of the mortgage which is maintained at the customer information file level | ||

| BRANCH_CODE | Code of the branch where the mortgage account is opened | ||

| ACCOUNT_CCY | Mortgage account's currency | ||

| LOAN_STATUS | Status of the mortgage account | ||

| CUSTOMER_ID | Primary customer's id for a mortgage account | ||

| NO_OF_RPMNT_SCHS | Number of repayment schedules excluding the moratorium ones | ||

| INCREASED_PRINCIPAL | Increase in the principal | ||

| DAYS | Days in a month | ||

| YEAR | Days in a year | ||

| RISK_CLASSIFICATION | Risk classification at line level which can be used at status change | ||

| PREPAID_AMOUNT | Amount that has been prepaid | ||

| MORA_OUTSTANDING | Total moratorium outstanding amount | ||

| TOTAL_MORA_AMOUNT | Total moratorium amount | ||

| INDEX_CCY | Index currency | ||

| NEXT_WORKDAY | Next working day of the branch | ||

| LAST_WORK_DAY | Last working day of the branch | ||

| TODAY | Today's branch date | ||

| TOTAL_PRINCIPAL | Amount for which the mortgage is applied for | ||

| AMOUNT_FINANCED | Amount for which the mortgage is applied for | ||

| PRINCIPAL | Amount disbursed | ||

| INT_SUSPENSION_DATE | Interest suspension date based on risk classification. If classification is C, then the suspension date is one year from today's date. If classification is D, then the suspension is immediate. | ||

| COMPOUND_VALUE | Amount compounded within a schedule and is used internally | ||

| RESIDUAL_DAYS | Tenor of the mortgage | ||

| WORST_SCH | Worst Instalment Status | ||

| APPLICATION_DATE | Application date in mortgage origination | ||

| APPLICATION_SCORE | Application score in mortgage origination | ||

| APPLICATION_TENOR | Application tenor in mortgage origination | ||

| APPLICATION_PRINCIPAL | Application principal amount in mortgage origination | ||

| _OVR_DAYS | <Component> overdue days | ||

| _EXPECTED | <Component> expected amount | ||

| _OUTSTAND | <Component> outstanding amount | ||

| _CCY | <Component> currency | ||

| _OVERDUE | <Component> overdue amount | ||

| _INS_OVR_DAYS | <Component> number of days between the schedule due date and the maturity date | ||

| _FN_NO_REPAY_SCH | <Component> number of schedules for a component if periodic | ||

| NET_PRINCIPAL | <Component> amount financed | ||

| _SCHODUE | <Component> schedule amount due less amount settled | ||

| EMI_AMOUNT | The EMI amount for amortized mortgage contracts, in the current schedule for rental cash flow type of Mortgages | ||

| TOTAL_SCHODUE | Amount overdue for the schedule. | ||

| TOTAL_OUTSTANDING | Total Outstanding Balance of an Account. | ||

| CUSTOMER_CREDIT_RATING | Holds the Credit Rating information of Customer |

The ‘Customer Credit Rating’ field at the Customer level will be used as a SDE CUSTOMER_CREDIT_RATING for defining status change rules. This will also be available for provision rule definition at the MO product level.

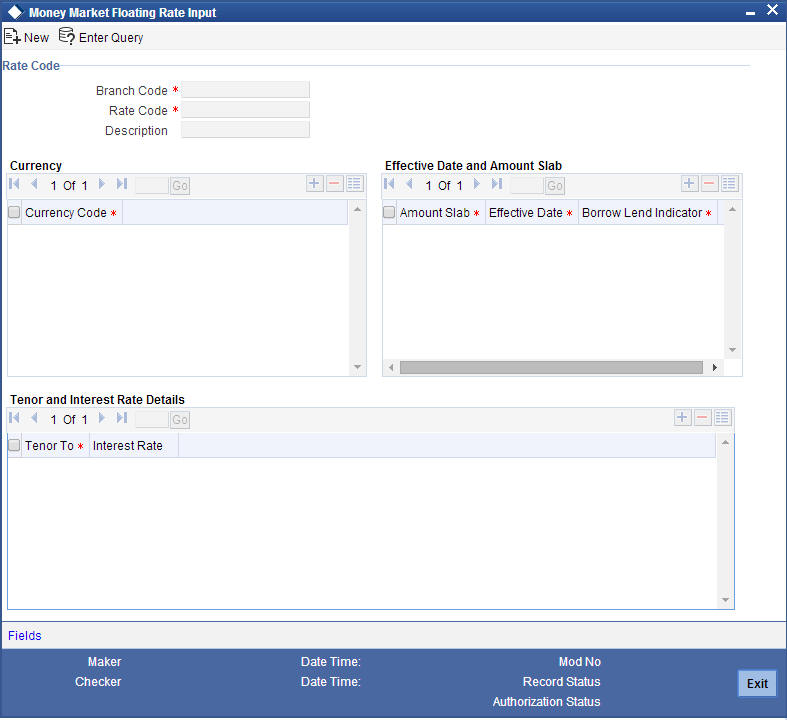

3.12 Maintaining Floating Interest Rates

You can apply interest either as ‘Fixed’ rate or as ‘Floating’ rate. A Floating Rate corresponds to the market rates for the day. These rates are maintained and updated daily (or whenever they change,) in the 'Money Market Floating Rate Input' screen. You can invoke this screen by typing ‘CFDFLTRI’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The floating interest rates are defined through this screen. A Rate Code identifies a set of rates defined for a combination of Currency, Amount Slab (optional) and Effective Date. Also, for each such combination, you can maintain rates that can differ by each tenor.

The following details have to be captured here:

Rate Code and Description

You can maintain new rate codes and also provide values for existing ones (like MIBOR, LIBOR etc). For a new code, you need to capture a unique id. The id can include a maximum 10 alphanumeric characters.

Quote Basis for Loans

Select the quote basis for calculating the float rate per annum from the drop down list. The list displays the following values:

- Exponential 252-

- Linear 360

- Exponential 365

- Per Annum

Currency

You have to associate each Rate Code with a currency. You can define rates for the same Rate Code in different currencies. Select a currency from the option list provided.

Each rate that you define for a Rate Code and Currency combination should have an Effective Date associated with it. This is the date on which the rate comes into effect. Once a rate comes into effect, it will be applicable till a rate with another Effective Date is given for the same Rate Code and Currency combination.

Note

The rates will be applied to a contract depending on whether it has been defined with ‘Automatic’ Rate Code Usage or ‘Periodic’ Rate Code Usage. You can specify this in the ‘UDE Values’ screen.

Amount Slab

For a specific Rate Code and Currency combination, you can define an amount slab. However, this is not mandatory. A rate that has been defined for an Effective Date - Amount Slab combination will be applicable to an amount less than or equal to the specified amount.

Borrow/Lend Indicator

For every Amount Slab - Effective Date combination, you should define the rate to be applied as a borrow rate, a lend rate or a mid rate. Borrow rates are applied for mortgages taken by the bank and lend rates applied on mortgages disbursed.

Tenor and Interest Rates

The rates that will be applied for a given combination of Amount Slab – Effective date – Lend/Borrow Indicator can be tenor based. In this screen, you can also define interest rates for different tenors.

For instance, for an amount slab you can maintain rates for the Rate Code LIBOR for tenors 1 - 30 Days, 30 – 90 Days and so on. If you do not maintain tenor wise interest rates, you have to maintain the tenor as ‘0’ and then specify the rate. This is mandatory to save the details.

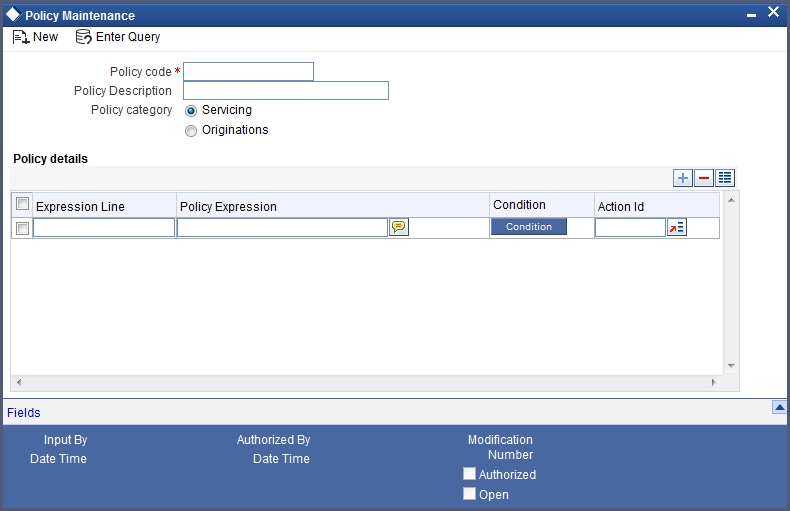

3.13 Maintaining User Defined Policies

User defined Policies are special validations and operations to be performed before or after a life cycle event of a mortgage. You can maintain policies in the ‘User Policy’ screen.

You can invoke this screen by typing ‘CLDPOLMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details to maintain a policy:

Policy Code and Policy Description

A policy code identifies a policy uniquely in the system. The code is used to link the policy to a product/account. You can devise a code consisting of a maximum of 20-alphanumeic characters.

Also, for the code captured, provide a brief description in not more than 35 alphanumeric characters. The description is used for information purposes only.

Policy Category

Select the category to which the policy should belong. This implies if the Policy is to be linked to an Application (Origination and API or Product setup). The two options are:

- Origination

- Servicing

Policy Details

Expression Line

You can maintain multiple expressions for a policy and each expression is identified by a unique serial number. The serial number can consist of a maximum 6 digits.

Policy Expression

Here, you have to specify the expression for the policy which when satisfied by the mortgage, will trigger the corresponding action. You can maintain multiple expressions and action codes under a policy. Depending on the expression that is evaluated successfully, appropriate ‘Action Id’ is triggered. However, an expression is not mandatory to define a policy.

Action Id

You have to select the action that is to be triggered when the corresponding expression becomes valid for the mortgage. This refers to the wrapper name that is mapped to the actual PL/SQL code that executes the policy. Select the action id from the option list provided. The values available in the list are factory shipped.

The policies defined through ‘User Policy’ screen become available for association at the ‘Product Category’ level.

For more details, refer the section titled ‘Maintaining Product Categories’ in the ‘Defining Product Categories and Products’ chapter of this User Manual.

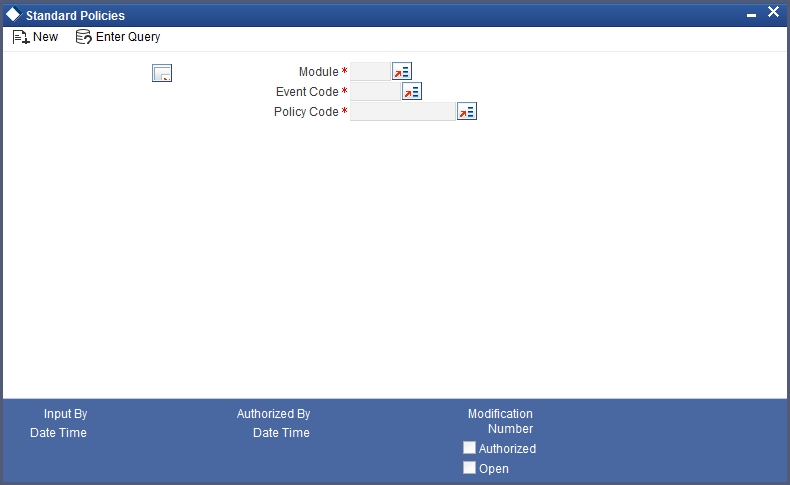

3.14 Maintaining Standard Policies

You can also categorize the policies defined through the ‘User Policy’ screen as standard policies’ in the ‘Standard Policies’ screen.

You can invoke this screen by typing ‘CLDSTDPL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

To maintain a standard policy, you have to specify the following in the screen:

Module

A standard policy is defined for a Module and Event combination. You have to select the module for which the policy should be applied. The option list will display the list of valid Oracle FLEXCUBE modules.

Event Code

The events defined for the selected Module are displayed in the option list provided. You may select an event from this list.

Policy Code

The policies maintained in the ‘User Policy’ screen are available in the option list provided. Select the appropriate policy for the selected Module and Event combination.

3.15 Maintaining Bulk Payment Preferences

If indicated at the Mortgages/Commitments level that bulk payments need to be maintained for an account, then preferences for the bulk payments are maintained at the Bulk Payment Preferences screen. Under a Mortgage/Commitment a customer can make multiple disbursements under that Mortgage/Commitment account. These multiple payments are treated as separate transactions with separate products and interest components. On payment of the Principal amount of any of the mortgages the Mortgage/Commitment is restored to the customer. As these multiple disbursals are treated as individual transactions, hence the Bulk Payment option provides the customer to make a single payment across for multiple payments. This payment can be configured to be split automatically among the different disbursals made based on a defined rule.

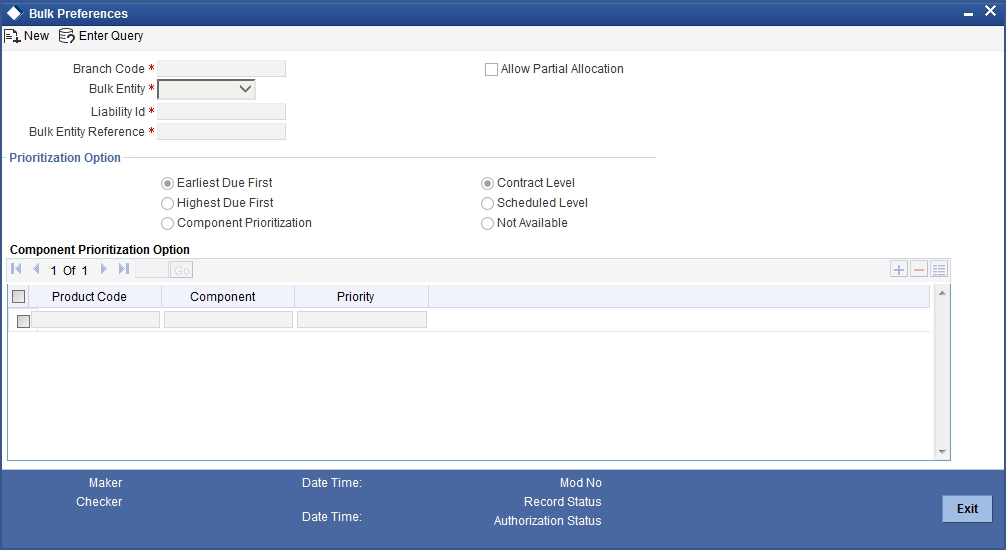

The Bulk Payment Preferences screen can be used for maintaining the priority for auto as well as manual liquidation of bulk payments. Invoke this screen by typing ‘CLDBPPRF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The following details need to be specified for maintaining the bulk payment preferences for multiple disbursals made under a single line/commitment:

Branch

The branch where the bulk payments preferences are maintained for a CL account is displayed here. The maintenance is done at this branch. The preferences maintained for each mortgage/commitment are only for this branch.

Bulk Entity

Select the bulk entity applicable for these payments from the option list provided. You can select the following values

- Limit Line – This option displays all the valid limit lines in the current branch which have been attached to any of the mortgage accounts.

- Commitment – The valid commitment reference numbers attached to any of the mortgage accounts in the current branch is displayed on selecting this option.

Bulk Entity Reference

Specify the bulk entity reference number associated with the relevant mortgage account. The bulk entity reference lists values as ‘ALL’ indicating that the rule is common for all references attached to a branch and not a specific reference maintained for that particular branch. On selecting a bulk entity reference number the customer mortgage ID is populated in the liability ID section. In case of limits the liability ID for the line linked is populated in the corresponding Liability ID section.

Liability ID

The Liability ID is populated with the customer mortgage ID on selecting a specific bulk reference number.

Allow Partial Liquidation

Check this box to indicate that the partial payment is allowed for the individual mortgage amounts. If the payment amount is sufficient to liquidate only partially as against the total due amount then if the partial liquidation option is allowed then a partial amount is allocated against the total due amount.

Partial allocation is allowed for dues for all priority options. For all prioritization options, if the total payment amount provided for bulk payment only partially satisfies liquidation, then partial amount is allocated against the amount due, only if the Partial allocation box is checked otherwise the schedule is skipped from liquidation.

Prioritization Option

Select the appropriate prioritization option. You can select the following options:

- Earliest Due First

- Highest Due First

- Component Prioritization

On selecting Component Prioritization the ‘Component Prioritization’ details are enabled for entry. However on selecting the same Account level and Schedule Level are disabled for entry.

The following Priority combinations can be selected:

- Earliest Due first /Account level/partial allocation allowed.

- Earliest Due first /Account level/partial allocation not allowed.

- Earliest Due first /Schedule level/partial allocation allowed.

- Earliest Due first /Schedule level/partial allocation not allowed.

- Highest Due first / Account level/partial allocation allowed.

- Highest Due first /Account level/partial allocation not allowed.

- Component Prioritization/ partial allocation allowed.

- Component Prioritization/ partial allocation not allowed.

Earliest due first date

When you make this selection you can only specify the account level option. When the available amount is allocated while indicating account level or schedule level, amongst the due amounts belonging to the eligible accounts, then the account priority is applied in case of multiple accounts. The schedules with earliest due date are considered first and liquidation amount is allocated based on the due date at schedules level. In case of conflict arisen, the earliest value date and highest due is considered for resolution. If the value dates and highest due are the same then the resolution is carried out on the basis of the account number, that is, the earlier account number is considered first.

Highest Due First

When you make this selection you can also specify the account level. On allocating the bulk amount while indicating account level, the highest due amount within the accounts is determined and all components due in this account are marked for payment followed by the next highest due available among the rest of the accounts. In a conflict the earliest valued date is considered. If the value dates are same then the accounts are prioritized based on the account numbers.

Component Prioritization

Check this box to define the order for liquidation for components across products. When you make this selection you must also select the option N/A. The liquidation order defined here overrides the product liquidation order. If Component prioritization option is chosen then the fields under component prioritization options frame will be enabled.

According to the priority defined allocation of the bulk amount is done for all accounts. Similar to the cases described above the value date and highest due is considered for allocation, in cases of conflict due to value date and highest due the resolution is brought about by account number.

Component Prioritization Options

The component details related to prioritization are enabled for entry once the ‘Component Prioritization’ is enabled

Product Code

Specify the component product code for which liquidation prioritization details are maintained.

Note

Products not listed in prioritization will not be considered for liquidation.

Component

Specify the component for which prioritization is maintained

Priority

Specify the priority for the component. The priority is a unique numeric character input by a user. The lower the number value the higher is the priority applied to the component.

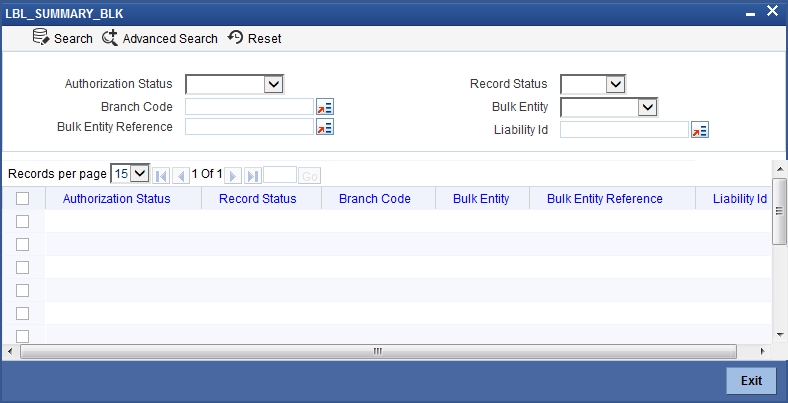

3.15.1 Viewing Summary Records

You can view and amend details of a particular record by using the ‘Summary’ screen. You can invoke this screen by typing ‘CLSBPPRF’ the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

To view a particular record double click on the desired record displayed in the list of records. The required record is enabled for action.

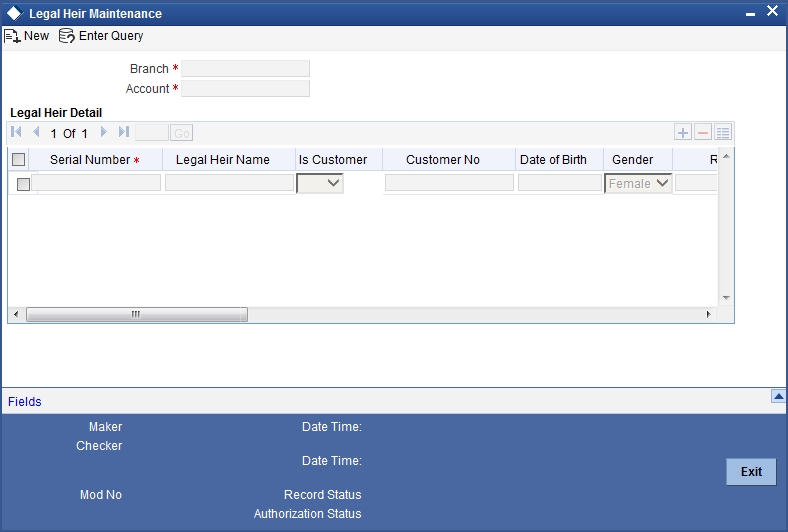

3.16 Maintaining Legal Heir Details of a Mortgage

You can maintain the details of a legal heir of a mortgage in ‘Legal Heir Maintenance’ screen. To invoke this screen type ‘STDMOHEI’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In ‘Legal Heir Maintenance’ screen, you can specify the details of the legal heir.

Branch Code

Specify the branch code of the legal heir. This adjoining option list displays all valid branches maintained in the system. You can choose the appropriate one.

Account

Specify the account number of the reverse mortgage loan.

Legal Heir Detail

Serial No

Specify the serial number of the legal heir detail.

Legal Heir Name

Specify the name of the legal heir of the mortgage loan. The legal heir need not be the customer of the bank.

Is Customer

You can choose the appropriate value from the drop-down list to indicate whether the heir is a customer of the bank or not.

- Yes

- No

Customer No

Specify the customer number if the legal heir is the customer of the bank.

Relation

Specify the relationship that the legal heir shares with the customer.

Date of Birth

Specify the date of birth of the legal heir.

Gender

Specify the gender (male/female) of the heir.

Percentage

Specify the percentage in the property that the heir holds.

Address Line1, 2, 3, 4

Specify the address of domicile of the customer. Four lines have been provided for this. Each line can have a maximum of 105 alphanumeric characters.

Country

Specify the country of domicile of the customer. This adjoining option list displays all valid Country codes maintained in the system.

Nationality

Specify the nationality of the heir.

Telephone

Specify the telephone number of the heir.

Specify the e-mail id of the heir.

Fax

Specify the fax number of the heir.