12. Defining Free Format Messages

In the course of your daily banking operations you may want to generate messages that are not automatically generated by the system or you may have to communicate a message that is very specific to a customer. You can enter the details of such messages in the form of a free format message.

The details of a Free Format Message can be entered in the Free Format Message Maintenance screen. In this screen some of the details you can indicate are:

- The format of the message

- The recipient of the message

- The media through which the message should be transmitted

- The address and location to which the Free Format Message should be sent

This chapter contains the following sections:

- Section 12.1, "Free Format Message Maintenance"

- Section 12.2, "Common Group Message Maintenance"

- Section 12.3, "FFT Template Maintenance"

12.1 Free Format Message Maintenance

This section contains the following topics:

- Section 12.1.1, "Invoking Free Format Message Maintenance Screen"

- Section 12.1.2, "Message Tab"

- Section 12.1.3, "SWIFT Message Details Tab"

- Section 12.1.4, "Free Format Text Tab"

- Section 12.1.5, "Saving the Record"

12.1.1 Invoking Free Format Message Maintenance Screen

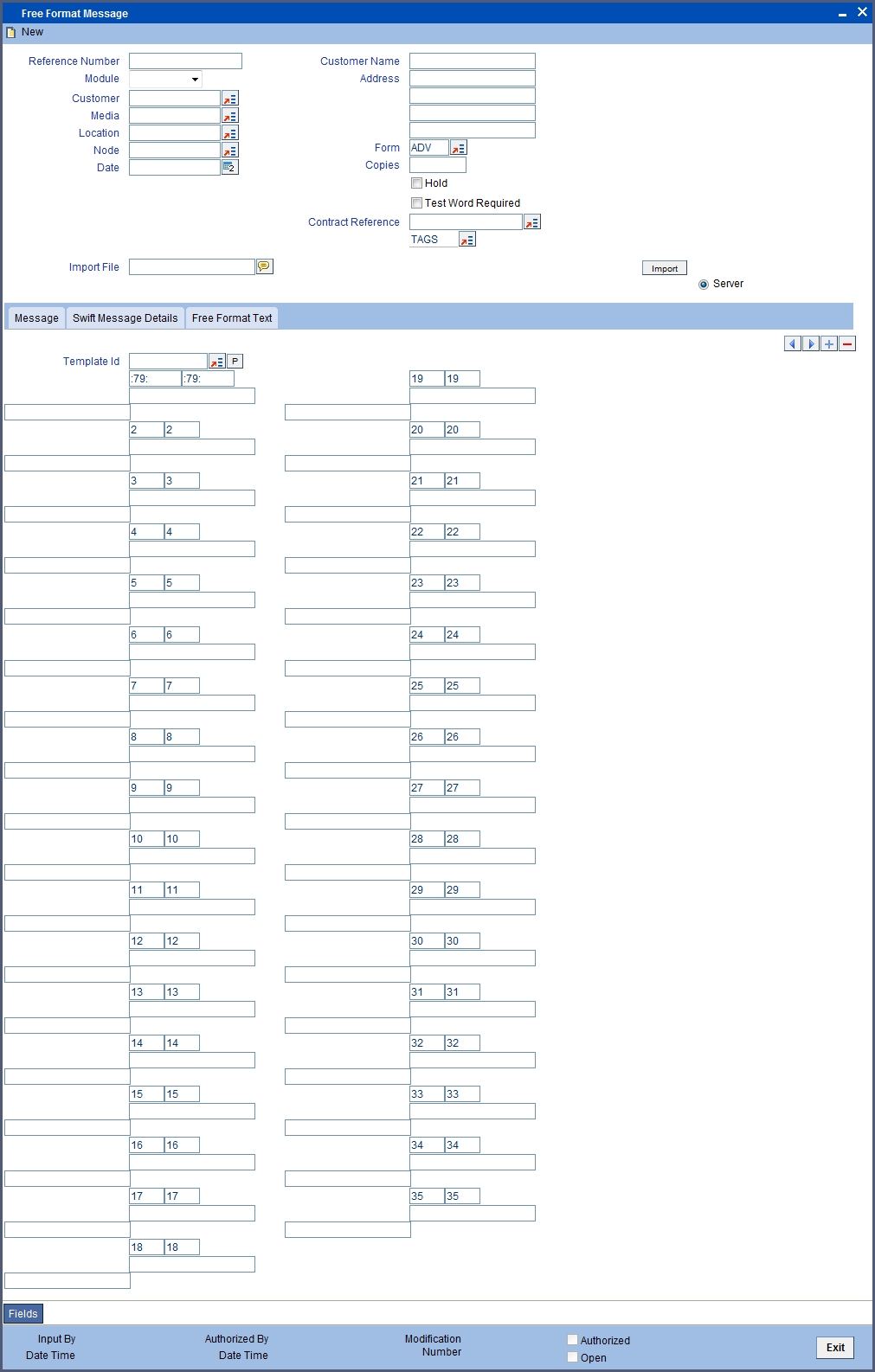

You can also invoke the Free Format Message screen by typing ‘MSDFFTMN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The screen is shown below:

12.1.1.1 Features of Free Format Message Screen

You can specify the following details on this screen.

Document Number

System generates the document number on save.

Module

Select the module from the drop-down menu, for which you are entering the details in this screen.

Customer

Select the code of the customer to whom the message is addressed, from the option list. If the recipient is not a customer of your bank, then specify his/her name in this field.

Media

You can indicate the media through which the Free Format Message should be transmitted. The media through which you can channel a Free Format Message depends on the media types that you have maintained for your branch in the ‘Media Maintenance’ screen. You can choose a media code from the option list that is available.

Location

You should also specify the location of the address. To recall, the location that you specify for an address is the unique identifier between the other addresses of the customer for a given media.

The address of the customer will be automatically displayed based on the customer-location-media combination that you indicate if it has already been maintained in the system.

Node

You can indicate the node from where this Free Format Message has to be generated.

Name

In the case of a walk-in customer, enter the name of the customer to whom the message is to be addressed. If the recipient of the message is a customer of your bank, the customer’s name will be automatically displayed when you indicate the customer’s CIF number in the “Customer” field.

Address

If the recipient of the message is a customer of your bank, the customer’s address will be automatically displayed based on the Customer-Media-Location combination that you have specified.

You will be required to enter the address in the case of a Walk-in customer. The format of the address depends on the media through which the Free Format Message is transmitted.

If the address is for the media type Mail, you can enter the customer s address in the four rows under this field. Each line that you enter can contain a maximum of 35 characters.

If the media of transmission is Telex, the address should be expressed numerically.

If you are defining a SWIFT address, the address should be of eight or eleven alphanumeric characters.

Contract Reference

You can indicate the code assigned to the customer who is the recipient of the message. This is the code that you assigned to the customer in the Customer Information File (CIF). This option list displays all the contract reference number for those branches for which you have access right.

External Reference Number

The system displays external reference number on save.

Form

If the message to be sent is in the form of a template, you can choose the template from the option list.

Hold

Messages that are put on hold are temporarily stopped from being generated. If you have indicated that messages should be generated in the background, the Free Format Message that you have defined will be immediately sent when you save the record. If for some reason you do not want to immediately send the message, you can place it on hold. In this case, the message will appear in the Outgoing Message Browser, but will be in the hold status. You will have to release the message before you generate it from the Outgoing Browser.

Copies

Enter the number of copies of the Free Format Message that should be sent to the customer at the time it is generated.

If you indicate that more than one copy should be sent to a location, the first message will be the original and the others will be marked as ‘copy’.

Testword Required

Indicate whether a test word needs to be inserted the telex message manually before it is generated from your branch.

The following details are displayed on the screen:

- Reference Number

- Date

- Tags

12.1.1.2 Importing Advice Format from an ASCII File on the Server

The server indicates the machine on which the database of your bank is installed. To import a format from an ASCII file on the server:

- Select the radio button against ‘Server’.

- Specify the full path to the file on the server which contains the format you want to import.

- Thereafter, click ‘Import’ button.

The file containing the format of the message will be displayed on the screen.

12.1.1.3 Importing Advice Format from ASCII File on Client

Client refers to your own machine. To import a format from an ASCII file on the client:

- Click against the field marked Client,

- Specify the full path to the file on the client which contains the format you want to import, and

- Thereafter, click ‘Import’ button.

The file containing the format of the message will be displayed on the screen.

12.1.2 Message Tab

You can enter the details of a Free Format Message either by:

- Using the format editor on the screen, or

- Importing the format from an ASCII file. This can be located either on the server or the client.

Template ID

Select template id from the option list.

Click ‘P’ button to populate the template details into field 79 by resolving the substitution variables. You can modify the fields under Tag 79. However, the substitution variables are already resolved and defaulted. While modifying the message, you should specify the values directly and not the substitution variables again. System formats the amount and date based on default format at the application level.

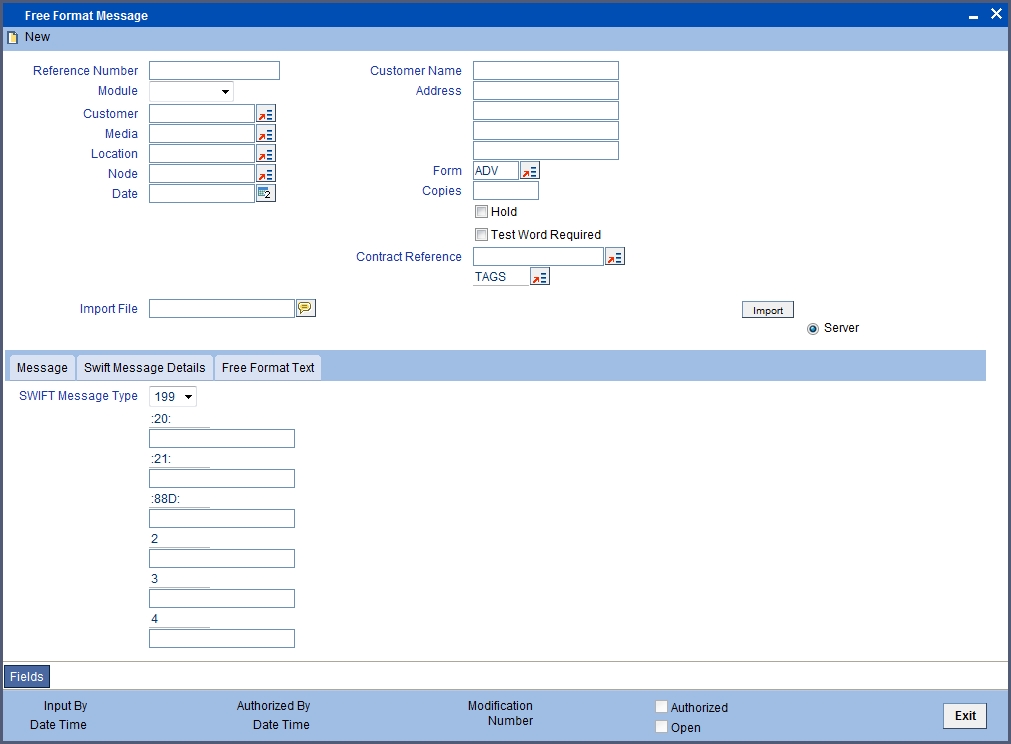

12.1.3 SWIFT Message Details Tab

You can view the SWIFT messages by clicking the ‘SWIFT Messages’ tab. The screen will be displayed as follows.

12.1.4 Free Format Text Tab

To enter a format using the format editor, click free format text icon positioned next to the text of the message. In the note pad that is invoked you can actually tailor an advice to suit your requirements. Keywords to format the advice (similar to what is used in the Advice Format Maintenance) can be used here too in order to get the desired format. The following table contains a comprehensive list of the key words that can be used in the format editor.

| Keyword | Significance | ||

|---|---|---|---|

| #NL | Indicates the number of lines that should be contained in a page when the message is printed | ||

| #NC | Indicates the number of columns that should be contained in a page when the message is printed | ||

| #RH | Indicates the start of the Report Header section | ||

| #PH | Indicates the beginning of the Header for a page | ||

| #EH | Indicates both the end of the Header section of the report or the end of Header section of a page | ||

| #RF | Indicates the start of the Report Footer section | ||

| #PF | Indicates the start of the Footer of a page | ||

| #EF | Indicates both the end of the Footer of a report or page | ||

| #B | Indicates the start of the body of the message | ||

| #EB | Indicates the end of the body of the message | ||

| #CL | Indicates that you can collapse a line | ||

| #EC | Indicates the end of a line that you have collapsed | ||

| #LOOP | Indicates the beginning of a loop | ||

| #ENDLOOP | Indicates the end of a loop | ||

| #IF | Indicates a Conditional section | ||

| #ANDIF | Indicates a Conditional section | ||

| #ORIF | Indicates a Conditional section | ||

| #ENDIF | Indicates the end of a Conditional section |

A Free Format Message will be sent depending on your specifications in the ‘Background Process’ screen.

- If the background process is running, a free format text that you define will be immediately sent at the time you save the record.

- If the background process is not running, the Free Format Message that you have defined will be displayed in the Outgoing Message browser from where you can process as you would any other outgoing message.

12.1.5 Saving the Record

After you have made the mandatory entries, save the record. A free format record that you have defined should be authorized by a user bearing a different login ID, before the End of Day (EOD) process is run. Click ‘Exit’ or ‘Cancel’ to return to the Application Browser.

12.2 Common Group Message Maintenance

This section contains the following topics:

12.2.1 Maintaining Common Group Messages

You can maintain common messages that need to be sent to a group, in the ‘Common Group Message Maintenance’ screen. You can invoke the ‘Common Group Message Maintenance’ screen by typing ‘MSDCOMPM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details in this screen:

Customer

Select the code of the customer to whom the message is addressed, from the option list.

Media

The media through which the common group message is transmitted is displayed here. ‘SWIFT’ is displayed, by default.

Location

Specify the location of the address. The location of an address is the unique identifier between the other addresses of the customer for a given media.

Node

Select the node at which the database of your branch is installed, from the option list provided.

Name

Specify the name of the customer to whom the message is to be addressed. If the recipient of the message is a customer of your bank, the customer’s name will be automatically displayed when you specify the customer code.

Address 1-4

If the recipient of the message is a customer of your bank, the address gets automatically displayed based on the Customer-Media-Location combination that you have specified.

You need to specify the address in case of a walk-in customer.

Form

Select a template from the option list, if you wish to send the message in the form of a template.

SWIFT Message Type

Specify the type of the SWIFT message to be sent to the customer from the adjoining option list.

Number of Copies

Specify the number of copies of the message that should be sent to the customer at the time it is generated.

Response To

Select the type of the previous SWIFT message, in response to which the common group message is being sent. The following options are provided in the drop-down list:

- Incoming

- Outgoing

Reference Number for Query

When a common group message is sent, the reference number specified here will help to query and fetch the original message date and MT type from the Incoming/Outgoing Browser, depending on the value of ‘Response To’.

Hold

Check this box to indicate that you want to keep the generation of the message on hold. Messages that are put on hold are temporarily stopped from being generated. The message will have to be released before it can be generated.

Import File

Specify the full path of the file on the server which contains the format you want to import.

Server

Select this option to import a format from an ASCII file on the server. The server indicates the machine on which the database of your bank is installed.

The following fields are displayed on this screen:

Reference number

This is the system generated unique reference number for the message, called DCN.

Date

The Date defaulted will be the system date.

71B – Details of Charges

Specify charge details for the specified message type from the adjoining option list.

The following options are available for MT n90 and MT n91 messages, if you have selected Category 1 or Category 2 message types:

| Code | Description | Reason | |||

|---|---|---|---|---|---|

| AMND | Amendment | Payment order was changed based on a request to do so from the (original) sending bank or as a result of receiving amended information from the (original) sending bank. | |||

| CANF | Cancellation Fee | Used when fees are assessed for cancellation of a payment. | |||

| CLEF | Clearing Fee | Used when fees are assessed for standard processing of financial institution type transfers (Category 2 MT payments). | |||

| INVS | Investigation | Used when charges are being assessed for investigation or request for information required to complete payment processing. | |||

| NSTP | Non STP charge | Charge for a payment that required an intervention during processing. | |||

| OURC | OUR charging option used | Claim is being submitted in response to receiving a customer payment (Category 1 MT payment) with OUR in field 71A Details of Charges. |

Template ID

Select template id from the option list. On clicking ‘P’ button, the template details are defaulted into field 79 by resolving the substitution variables. You can modify the fields under Tag 79. While modifying the message, you have to specify the values directly and not the substitution variables again.

Click ‘Import’ button to import the file and display the format of the message on the screen.

12.2.2 Saving the Record

Save the record after specifying the mandatory details and click ‘Exit’ or ‘Cancel’ button to return to the Application Browser.

12.3 FFT Template Maintenance

This section contains the following topics:

12.3.1 Maintaining SWIFT FFT Template

System has the facility to create SWIFT templates for free format messages with the help of resolver for predefined variable fields (for example; amount, applicant/beneficiary name, tenor, maturity etc.). This helps avoiding predation of message which are repetitive in nature for example bill acceptance message, availment confirmation or payment tracers etc. A dictionary of field resolvers is available in Oracle FLEXCUBE. You can create template as and when required with the combination of hard coated text and the field resolvers.

You can define templates for Free Format Messages which contains Template id, Language code and Free Format Text (Only for MT499 and MT799) using the ‘Swift FFT Template screen Maintenance’ screen. You can invoke this screen by typing ‘MSDFFTMP’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details:

Template ID

Specify the template id.

Language Code

Specify a valid language code. The adjoining option list displays all the valid language code maintained in the system. You can choose the appropriate one.

Free Format Text

Specify the Substitution Variables. You can identify these variables by prefixing them with ‘@’ or by some other special character.

Swift Message Type

Select the Swift Message type from the drop-down list. You have the following options:

- MT799

- MT499

- MT999

Following are the substitute variables:

| Message | Substitution Variables | Description | |||

|---|---|---|---|---|---|

| MT799 | LC_AMOUNT | LC Amount | |||

| LC_CCY | LC Currency | ||||

| LC_LIABILITY | LC Outstanding Amount | ||||

| ISSUE_DATE | LC Issue Date | ||||

| LC_TENOR | LC Tenor | ||||

| EXPIRY_DATE | LC Expiry Date | ||||

| EXPIRY_PLACE | LC Expiry Place | ||||

| CLOSURE_DATE | LC Closure Date | ||||

| LC_CONTRACT_REF | LC Contract Reference Number | ||||

| LC_USER_REF | LC User Reference Number | ||||

| SHIPMENT_FROM | Shipment From | ||||

| SHIPMENT_TO | Shipment To | ||||

| PORT_LOADING | Port of Loading | ||||

| PORT_DISCHARGE | Port of Discharge | ||||

| CREDIT_AVL_WITH | Credit Available with | ||||

| INCO_TERM | Inco Term | ||||

| APPLICABLE_RULE | Applicable Rule | ||||

| BENEFICIARY | Beneficiary | ||||

| APPLICANT | Applicant | ||||

| REIMB_BANK | Reimbursing Bank | ||||

| OLD_BEN | Old Beneficiary before the amendment | ||||

| OLD_REM | Old Reimbursing bank before the amendment | ||||

| MT499 | OLD_ADV | Old Advising bank before the amendment | |||

| APP_BANK | Applicant Bank | ||||

| CLAIM_BANK | Claiming Bank | ||||

| CNF_BANK | Confirming Bank | ||||

| ADV_BANK | Advising Bank | ||||

| ADV_THRU_BANK | Advice Thru Bank | ||||

| LATEST_SHIPMENT_DATE | Latest Shipment Date | ||||

| SHIPMENT_PERIOD | Shipment Period | ||||

| CONFIRMED_AMT | Confirmed LC Amount | ||||

| UNCONFIRMED_AMT | Unconfirmed LC Amount | ||||

| AVAILED_AMOUNT | Availed Amount | ||||

| REB_UT_AMOUNT | Reimbursement Amount undertaken | ||||

| REB_NUT_AMOUNT | Reimbursement Amount not undertaken | ||||

| DRAWER | Drawer | ||||

| DRAWEE | Drawee | ||||

| FORFAIT_HOUSE | Forfaiting house / bank | ||||

| REMIT_BANK | Remitting Bank | ||||

| COL_BANK | Collecting Bank | ||||

| DISC_BANK | Discounting Bank | ||||

| NEGO_BANK | Negotiating Bank | ||||

| TRF_BANK | Transferee Bank | ||||

| BILL_AMT | Bill Amount | ||||

| BILL_CCY | Bill Currency | ||||

| OS_AMOUNT | Bill Outstanding amount | ||||

| VALUE_DATE | Bill Value date | ||||

| TRANSACTION_DATE | Bill transactions date | ||||

| TRANSIT_DAYS | Transit days | ||||

| BILL_TENOR | Bill Tenor | ||||

| BILL_MATURITY | Bill Maturity date | ||||

| LIQUIDATION_DATE | Bill Liquidation date | ||||

| INCO_TERM | Inco Term | ||||

| OUR_LC_REF | Our LC Ref No | ||||

| THEIR_LC_REF | Their LC Ref No | ||||

| BC_CONTRACT_REF | BC Contract Reference Number | ||||

| BC_USER_REF | BC User Reference Number | ||||

| BROK_DETAILS | Broker, Brokerage and Brokerage Currency | ||||

| SHIPMENT_FROM | Shipment From | ||||

| SHIPMENT_TO | Shipment To | ||||

| MT999 | LC_CCY | LC Currency | |||

| LC_LIABILITY | LC Outstanding Amount | ||||

| ISSUE_DATE | LC Issue Date | ||||

| LC_TENOR | LC Tenor | ||||

| EXPIRY_DATE | LC Expiry Date | ||||

| EXPIRY_PLACE | LC Expiry Place | ||||

| CLOSURE_DATE | LC Closure Date | ||||

| LC_CONTRACT_REF | LC Contract Reference Number | ||||

| LC_USER_REF | LC User Reference Number | ||||

| SHIPMENT_FROM | Shipment From | ||||

| SHIPMENT_TO | Shipment To | ||||

| PORT_LOADING | Port of Loading | ||||

| PORT_DISCHARGE | Port of Discharge | ||||

| CREDIT_AVL_WITH | Credit Available with | ||||

| INCO_TERM | Inco Term | ||||

| APPLICABLE_RULE | Applicable Rule | ||||

| BENEFICIARY | Beneficiary | ||||

| APPLICANT | Applicant | ||||

| REIMB_BANK | Reimbursing Bank | ||||

| OLD_BEN | Old Beneficiary before the amendment | ||||

| OLD_REM | Old Reimbursing bank before the amendment | ||||

| OLD_ADV | Old Advising bank before the amendment | ||||

| APP_BANK | Applicant Bank | ||||

| CLAIM_BANK | Claiming Bank | ||||

| CNF_BANK | Confirming Bank | ||||

| ADV_BANK | Advising Bank | ||||

| ADV_THRU_BANK | Advice Thru Bank | ||||

| LATEST_SHIPMENT_DATE | Latest Shipment Date | ||||

| SHIPMENT_PERIOD | Shipment Period | ||||

| CONFIRMED_AMT | Confirmed LC Amount | ||||

| UNCONFIRMED_AMT | Unconfirmed LC Amount | ||||

| AVAILED_AMOUNT | Availed Amount | ||||

| REB_UT_AMOUNT | Reimbursement Amount undertaken | ||||

| REB_NUT_AMOUNT | Reimbursement Amount not undertaken | ||||

| DRAWER | Drawer | ||||

| DRAWEE | Drawee | ||||

| FORFAIT_HOUSE | Forfaiting house / bank | ||||

| REMIT_BANK | Remitting Bank | ||||

| COL_BANK | Collecting Bank | ||||

| DISC_BANK | Discounting Bank | ||||

| NEGO_BANK | Negotiating Bank | ||||

| TRF_BANK | Transferee Bank | ||||

| BILL_AMT | Bill Amount | ||||

| BILL_CCY | Bill Currency | ||||

| OS_AMOUNT | Bill Outstanding amount | ||||

| VALUE_DATE | Bill Value date | ||||

| TRANSACTION_DATE | Bill transactions date | ||||

| TRANSIT_DAYS | Transit days | ||||

| BILL_TENOR | Bill Tenor | ||||

| BILL_MATURITY | Bill Maturity date | ||||

| LIQUIDATION_DATE | Bill Liquidation date | ||||

| INCO_TERM | Inco Term | ||||

| OUR_LC_REF | Our LC Ref No | ||||

| THEIR_LC_REF | Their LC Ref No | ||||

| BC_CONTRACT_REF | BC Contract Reference Number | ||||

| BC_USER_REF | BC User Reference Number | ||||

| BROK_DETAILS | Broker, Brokerage and Brokerage Currency | ||||

| SHIPMENT_FROM | Shipment From | ||||

| SHIPMENT_TO | Shipment To |

In case of a Bill contract under an LC, the system resolves all tags applicable to MT799 and MT499. In such cases, the tags related to Bills are resolved based on the corresponding Bill contract. Similarly, the tags related to LC are resolved based on the LC contract which is linked to the Bill contract.