Setting Up the Zip/City/State (Postal Code) Table (WZIP)

Purpose: The Zip/City/State (postal code) table includes the city, state or province, country, tax rates, and geographic zone for postal areas. The city and state or province you enter for a customer in Order Entry or Order Maintenance are validated against this table.

Creating postal code records: You can use the Work with Postal Codes function to enter the information yourself, or purchase it from the U.S. Postal Service to build the table in your database. If you purchase the information from the U.S. Postal Service, use the Load USPS Zip Code File (LZPS) option to upload the data to the Zip/City/State table.

Note: The Load USPS Zip Code File (LZPS) option does not create Zip/City/State Tax Rate records; it only creates Zip/City/State (postal code) records.

Tax rates: You need to set up this table to set up tax rates and, for Canadian addresses, tax calculation methods, if you do not use an external tax system. Even if you use an external tax system, you might still want to establish the Zip/City/State table to help reduce other application errors or to provide an alternative means of calculating tax when there is a communication problem. See About Tax Rates.

Note: The City name must be all upper case in order for the tax rate to apply.

Geographic zones: The Zip/City/State table can be used to identify the geographic zone of a shipping address. Geographic zones are used to divide the country into shipping regions for the purpose of restricting the shipment of weather-sensitive inventory such as plant stock. See Shipping Zone Reservation Overview.

Delivery codes: Some shippers, such as UPS, charge different rates based on the type of delivery address on an order. For example, shipping to a business address is cheaper than shipping to a residential address. You can define the delivery code for a postal area to insure that the best possible rate is charged for shipping an order.

The information you enter through this menu option is not unique to a particular company; it applies to all companies on your system.

Postal code required? The Require postal code? flag in the Country table controls whether a postal code is required for customer addresses. See Setting Up the Country Table (WCTY) for background.

In this chapter:

• Work with Postal Codes Screen

• Work with Zip Tax Rates Screen

• Update Postal Codes by Range Screen

Not in this topic:

• Automatic fill-in of city and state in order entry: If you set the Use Zip/City/State Defaulting? (B13) system control value to Y, the system fills in a customer's city and state in Order Entry or Order Maintenance based on the postal code you enter.

• Tax jurisdictions: You can track tax activity for tax jurisdictions within states. You define a tax jurisdiction as a range of postal codes. See Working with Tax Jurisdiction (WTXJ).

• Postal code formats for pick slips: In order for a postal code to print on pick slips or gift acknowledgments, you must first define the postal code format. See Working with Postal Code Formats (WPCF).

• Postal code format validation: The system calls a user-defined program to validate postal code formats outside the Order Management System environment if the External Postal Code Validation (E62) system control value is selected. This program can be used to validate postal code rules for a specific country; for example, if a postal code for a country contains only 6 numbers and you enter more than 6, the program passes an error message back to Order Management System. See Working with Postal Code Formats (WPCF).

How to display this screen: Enter WZIP in the Fast path field at the top of any menu or select Work with Postal Codes from a menu.

Field |

Description |

Postal code |

The postal code or zip code representing a delivery area. Alphanumeric, 10 positions; optional. |

The city where the customer receives mail or shipments. Alphanumeric, 25 positions; optional. |

|

State |

The state or province where the customer receives mail or shipments. States are defined in and validated against the State table, which is accessible through the Work with Country Table menu option; see Work with States Screen. Alphanumeric, 2 positions; optional. |

Description |

The description of the state, as set up through the Work with States Screen. Alphanumeric, 25 positions; display-only. |

Delivery code |

A code representing the type of delivery address for a postal code. Valid values are: • B = Business address. • R = Residence. • N = No distinction. • ' ' = Blank. Some shippers, such as UPS, charge different rates based on the type of delivery address on an order. For example, shipping to a business address is cheaper than shipping to a residential address. You can define the delivery code for a postal area to insure that the best possible rate is charged for shipping an order. |

|

The system uses the following logic to default a delivery code to a customer address on an order: • The system defaults the delivery code defined for the postal code on the address. • If a delivery code has not been defined for the postal code on the address, the system defaults the delivery code from the Customer table. • If a delivery code has not been defined in the Customer table, the Default Delivery Code for New Order Entry Customers (D13) defaults. Alphanumeric, 1 position; display-only. |

Screen Option |

Procedure |

Change postal code information |

Select Change for a postal code to advance to the Change Postal Codes screen. See the Create Postal Code Screen for field descriptions. |

Delete a postal code |

Select Delete for a postal code. |

Display a postal code |

Select Display for a postal code to advance to the Display Postal Code screen. You cannot change any information on this screen. See the Create Postal Code Screen for field descriptions. |

Work with tax rates |

Select Work with tax rates for a postal code to advance to the Work with Zip Tax Rates Screen. |

Create a postal code |

Select Create to advance to the Create Postal Code Screen. |

Update a postal code range |

Select Updt Pst Cd Range to advance to the Update Postal Codes by Range Screen. |

Purpose: Use this screen to create a postal code.

How to display this screen: Select Create at the Work with Postal Codes Screen.

Field |

Description |

Postal code |

The postal code or zip code representing a delivery area. The first three positions of your entry must match a valid SCF for the state and country. See Working with SCF Codes (WSCF) for background. Alphanumeric, 10 positions. Create screen: required. Change screen: display-only. |

City |

The city where a customer receives mail or shipments. The City name must be all upper case in order for the tax rate from the Work with Zip Tax Rates Screen to apply. Alphanumeric, 25 positions. Create screen: required. Change screen: display-only. |

State |

The code representing the state where the customer receives mail or shipments. State codes are defined in and validated against the State table, accessible at the Work with States Screen through the Work with Countries menu option. This code is required if the Require state? flag for the country is selected. The system validates that your entry is a state assigned to the SCF derived from the first three positions of the postal code. See Working with SCF Codes (WSCF). Alphanumeric, 2 positions. Create screen: may be required. Change screen: display-only. |

Country |

A code representing a country. Country codes are defined in and validated against the Country table; see Setting Up the Country Table (WCTY). The system defaults the Default Country for Customer Address (B17). Alphanumeric, 3 positions; required. |

Delivery code |

A code representing the type of delivery address for a postal code. Valid values are: • Business • Residential • No Distinction • Blank Some shippers, such as UPS, charge different rates based on the type of delivery address on an order. For example, shipping to a business address is cheaper than shipping to a residential address. You can define the delivery code for a postal area to insure that the best possible rate is charged for shipping an order. |

|

When the system defaults a delivery code to a customer address on an order, it uses: 1. The delivery code for the postal code on the address if any; otherwise, 2. The delivery code from the Customer table, if any; otherwise; 3. The Default Delivery Code for New Order Entry Customers (D13). Optional. |

Geographic zone |

A code representing a geographic region. Geographic zones are used to divide the country into shipping regions for the purpose of restricting the shipment of weather-sensitive inventory such as plant stock. Geographic zones are used in conjunction with zone reservation codes, assigned to items or SKUs, to control item reservation in order entry. Zone reservation coded items/SKUs are not reserved during order entry; instead they are reserved during pick generation, at an optimal time for shipping. Zone reservation logic requires: • The item/SKU must be assigned a zone reservation code. • The offer associated with the order must be assigned a season code. • The shipping address for the order must be assigned to a geographic zone, using either the postal zip code of the ship to address, or the SCF (Sectional Center Facility) code of the ship to address. The SCF code consists of the first three digits of the zip code. See Working with SCF/Ship Via Values (WSHV). • For each zone reservation code, you must define zone date windows for all geographic zones in the country. See Shipping Zone Reservation Overview for a discussion. Alphanumeric, 3 positions; optional. |

Store tax code |

The cross-reference to the corresponding tax code in a point-of-sale system. This field is available only if you have defined a Default Location for ORCE Integration (K69). Alphanumeric, 8 positions; optional. |

Purpose: The basic steps that the system takes in calculating tax are outlined below. Also presented below are a summary of the places where you can define tax rates, methods, and exemptions.

The system follows two basic paths in evaluating each order for tax depending on whether you process orders that are subject to VAT.

VAT is a taxing method that applies in only certain states in countries. When an order is subject to VAT, the customer is charged a tax-inclusive price, and the tax amount is “hidden” on the order detail line for the item, not included in the Tax bucket for the order.

Note: You cannot use both an external tax system and tax-inclusive pricing (VAT) in the same company.

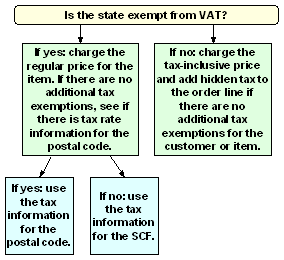

Tax-inclusive pricing? If the Tax Included in Price (E70) system control value is selected, the system follows the steps presented below in determining how to calculate tax on an order.

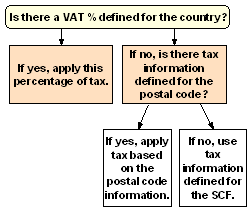

If the Tax Included in Price (E70) system control value is unselected, the system follows the steps presented below in determining how to calculate tax:

The system follows the steps above only if you are not using an external tax system.

Tax exemptions: Any of the following tax exemptions might prevent an order or an item from being taxed:

• customer tax exemptions or overrides (see Working with Customer Tax Status)

• the VAT exempt flag for the item/SKU (see Working with Existing Items (MITM))

• item tax exemptions and exceptions for U.S. states (see Working with Item Tax Exemptions (WITX))

• GST and PST item exemptions and exceptions for Canadian provinces (see Working with GST Tax Exemption Status (MGTX))

• the S/H exclude tax? field for a special handling format (see Establishing Additional Charge Codes (WADC))

Note: VAT does not apply to an order unless a tax rate is specified for the SCF for the shipping address.

Upper and lower case? The City name must be all upper case in order for the tax rate to apply.

Work with Zip Tax Rates Screen

Purpose: Use this screen to work with tax information for shipments to a postal code.

How to display this screen: Select Work with tax rates for a postal code at the Work with Postal Codes Screen.

Note:

• The system does not consider the settings at this screen if you use an external tax system unless the Use Standard Tax Calc if Tax Interface Communication Fails (J13) system control value is selected and the integration with the external tax system fails.

• The system automatically creates a zip tax rate record if you update postal codes by range (Updt Pst Cd Range at the Work with Postal Codes Screen). The zip tax rate’s effective date is the date when you process this update. See Update Postal Codes by Range Screen.

• Uploading postal code information through the Load USPS Zip Code File (LZPS) option does not automatically create zip tax rate records.

• The City name must be all upper case in order for the tax rate to apply.

Field |

Description |

The date when this tax information became effective for orders in this postal code. Whenever you perform pick slip preparation, bill, or maintain the order, the system calculates tax based on the tax rates in effect when the order was first entered. Numeric, 6 positions; optional. |

|

Tax rate |

The tax rate for the postal code. Numeric, 5 positions with a 2-place decimal; optional. |

GST rate |

The rate of Canadian Goods and Services tax for this province. If there is not a GST rate defined for the postal code, but a GST/PST tax method is defined, the system uses the default GST Rate (A90). Numeric, 5 positions with a 2-place decimal; optional. |

PST rate |

The rate of the Canadian Provincial Services tax for this province. Numeric, 5 positions with a 2-place decimal; optional. |

A code that determines the method of calculating total tax on goods shipped to Canadian provinces. This calculation method varies depending on the province where you are shipping the order. Valid codes for this field are: • Calculate GST First (Goods and Services Tax) = Calculate the GST on the order, including freight and handling, if applicable. Add this amount to the order total, then calculate the PST on the result. Calculation (where O = the order total subject to tax): O * GST rate = GST amount GST amount + ((GST amount + O) * PST rate) = order tax

Example: The order total subject to tax = $10.00 GST rate = 10% PST rate = 5% $10 * 10% = $1.00 GST amount $1 GST amount + (($1 + $10) * 5%) = $1 + ($11 * 5%) = $1.60 |

|

|

• Calculate PST First (Provincial Services Tax) = Calculate the PST on the order, including freight and handling, if applicable. Add this amount to the order total, then calculate the GST on the result. Calculation (where O = the order total): O * PST rate = PST amount PST amount + ((PST amount + O) * GST rate) = order tax

Example: The order total subject to tax = $10.00 GST rate = 10% PST rate = 5% $10 * 5% = $.50 PST amount $.50 PST amount + (($.50 + $10) * 10%) = $.50 + ($10.50 * 10%) = $1.55 |

|

• Calculate PST/GST Separately = Calculate GST and PST separately; neither tax is subject to the other. Calculation (where O = the order total) S = (O * GST) + (O * PST) Example: The order total subject to tax = $10.00 GST rate = 10% PST rate = 5% ($10 * 10%) + ($10 * 5%) = $1 + $.50) = $1.50 Optional. |

Tax freight |

Indicates whether the shipping charges on the order are taxed (Frt and Frt+ amounts). Valid values are: • Yes = The customer pays tax on freight. • No = The customer does not pay tax on freight. Note: This flag acts as an override to the Tax on Freight (B14) system control value if the system control value is selected. If the order uses the tax rate for the postal code, but the Tax on Freight (B14) field is unselected, the system uses the value from the System Control table. If the system control value is unselected, you cannot override this value by selecting it here. |

Tax handling |

Indicates whether handling charges on the order are taxed (special handling, guaranteed service charges, and other handling charges). • Yes = The customer pays tax on the handling charges. • No = The customer does not pay tax on the handling charges. Note: This flag acts as an override to the same setting for the SCF; see Working with SCF Codes (WSCF), and the Tax on Handling (B15) system control value if the system control value is selected. If the order uses the tax rate for the postal code, but the Tax on Handling (B15) field is unselected, the system uses the value from the System Control table. If the system control value is unselected, you cannot override this value by selecting it here. • If the S/H exclude tax? field for the special handling code is selected, the handling charge is not evaluated for tax. |

Screen Option |

Procedure |

Change existing tax rate information |

Type over the information you want to change, or just delete existing information. You can change any field but the Effect date (Effective date). |

Delete tax rate information |

Select Delete for a tax rate record. |

Switch to ADD Mode |

Select Add. |

Update Postal Codes by Range Screen

Purpose: Use this screen to update postal code information, such as delivery code and tax information, for a range of postal codes.

How to display this screen: Select Updt Pst Cd Range at the Work with Postal Codes Screen.

Field |

Description |

Country |

A code representing a country. Country codes are defined in and validated against the Country table. The system defaults the Default Country for Customer Address (B17). Alphanumeric, 3 positions; required. |

Postal code range |

The range of postal codes you wish to update. Enter the beginning postal code in the From range field and ending postal code in the To range field. An error message similar to the following indicates if you enter a postal code in the To field that is greater than the postal code in the From field: From zip (01601) is greater than to zip (01600).

Numeric, 5 positions; required. |

The system requires entry in one of the following fields: |

|

Delivery code |

A code representing the type of delivery address for the range of postal codes. Valid values are: • Business • Residential • No Distinction • Blank Some shippers, such as UPS, charge different rates based on the type of delivery address on an order. For example, shipping to a business address is cheaper than shipping to a residential address. You can define the delivery code for a postal area to insure that the best possible rate is charged for shipping an order. |

|

The system uses the following logic to default a delivery code to a customer address on an order: • The system defaults the delivery code defined for the postal code on the address. • If a delivery code has not been defined for the postal code on the address, the system defaults the delivery code from the Customer table. • If a delivery code has not been defined in the Customer table, the Default Delivery Code for New Order Entry Customers (D13) defaults. Optional. |

Tax rate |

The tax rate for the postal code. Numeric, 5 positions with a 2-place decimal; optional. |

GST rate |

The rate of Canadian Goods and Services tax for this province. If there is not a GST rate defined for the postal code, but a GST/PST tax method is defined, the system uses the default GST Rate (A90). Numeric, 5 positions with a 2-place decimal; optional. |

PST rate |

The rate of the Canadian Provincial Services tax for this province. Numeric, 5 positions with a 2-place decimal; optional. |

GST/PST method |

A code that determines the method of calculating total tax on goods shipped to Canadian provinces. This calculation method varies depending on the province where you are shipping the order. Valid codes for this field are: • Calculate GST First (Goods and Services Tax) = Calculate the GST on the order, including freight and handling, if applicable. Add this amount to the order total, then calculate the PST on the result. • Calculate PST First (Provincial Services Tax) = Calculate the PST on the order, including freight and handling, if applicable. Add this amount to the order total, then calculate the GST on the result. • Calculate GST/PST Separately = Calculate GST and PST separately; neither tax is subject to the other. See GST/PST method for an example of each GST/PST method. Optional. |

Tax freight? |

Indicates whether the shipping charges on the order are taxed (Frt and Frt+ amounts). Valid values are: • Selected = The customer pays tax on freight. • Unselected = The customer does not pay tax on freight. Note: This flag acts as an override to the Tax on Freight (B14) system control value if the system control value is selected. If the order uses the tax rate for the postal code, but the Tax on Freight (B14) field is unselected, the system uses the value from the System Control table. If the system control value is unselected, you cannot override this value by selecting it here. |

Tax handling? |

Indicates whether special handling charges on the order are taxed (special handling, guaranteed service charges, and other handling charges). • Selected = The customer pays tax on the handling charges. • Unselected = The customer does not pay tax on the handling charges. Note: • This flag acts as an override to the Tax on Handling (B15) system control value if the system control value is selected. If the order uses the tax rate for the postal code, but the Tax on Handling (B15) field is unselected, the system uses the value from the System Control table. If the system control value is unselected, you cannot override this value by selecting it here. • If the S/H exclude tax? field for the special handling code is selected, the handling charge is not evaluated for tax. |

Geographic zone |

A code representing a region of the country. Geographic zones are used to divide the country into shipping regions for the purpose of restricting the shipment of weather-sensitive inventory such as plant stock. Geographic zones are used in conjunction with zone reservation codes, assigned to items or SKUs, to control item reservation in order entry. Zone reservation coded items/SKUs are not reserved during order entry; instead they are reserved during pick generation, at an optimal time for shipping. |

|

Zone reservation logic requires: • The item/SKU must be assigned a zone reservation code • The offer associated with the order must be assigned a season code • The shipping address for the order must be assigned to a geographic zone, using either the postal zip code of the ship to address, or the SCF (Sectional Center Facility) code of the ship to address. The SCF code consists of the first three digits of the zip code. See Working with SCF/Ship Via Values (WSHV). • For each zone reservation code, you must define zone date windows for all geographic zones in the country. See Shipping Zone Reservation Overview. Alphanumeric, 3 positions; optional. |

| Setting Up the Country Table (WCTY) | Contents | SCVs | Search | Glossary | Reports | Solutions | XML | Index | Setting Up Customer Profiles (WPFL) |

WZIP OMS 17.1 September 2018 OTN