Processing Credit Card Applications

Purpose: Applying for a credit card occurs in two steps:

• Pre-Approval phase: The credit card service determines if the customer is eligible to apply for the credit card being offered.

• Credit Decision phase: If the customer is eligible to apply for the credit card, the customer can accept the credit card offer and complete a credit card application. The credit card service then determines if the customer is approved for the credit card.

In this topic:

• Determining if the Order Qualifies for the Credit Card Application Process

• Determining if the Customer is Eligible for the Credit Card Application Process

• Credit Card Application - Pre-Approval Phase

• Credit Card Application - Credit Decision Phase

• Credit Card Application Process for Current Card Holders

• Credit Card Application: Sample Messages

• Credit Card Application Request Message (CWCreditCardApplicationRequest)

• Credit Card Application Response Message (CWCreditCardApplicationResponse)

For more information: See:

• Credit Card Applications Overview and Setup for an overview of the credit card application process and the required setup.

• Working with Credit Card Application Services (WCCS) for more information on creating a credit card application service. The credit card application service defines which credit cards you wish to offer to your customers.

• Working with Credit Card Application Requests (WCCA) for more information on processing a credit card application outside of an order after the customer has already been pre-approved for the credit card.

• Working with Credit Card Applications by Customer for more information on reviewing the credit card offers that have been presented to the customer and to determine if the customer is currently a card holder.

Purpose: A customer can apply for a credit card during order entry, on a web order, or outside of an order.

• Applying for a Credit Card during Order Entry

• Applying for a Credit Card on Web Orders

• Applying for a Credit Card Outside of an Order

Applying for a Credit Card during Order Entry

In this situation, the system promotes the credit card when a customer places an order.

The system processes credit card applications in order entry in two phases:

• Pre-Approval Phase: The system sends the customer’s name and address information to the credit card service to determine if the customer is eligible to apply for the credit card being offered. See Credit Card Application - Pre-Approval Phase.

• Credit Decision Phase: If the customer qualifies for the credit card, the system prompts the order entry operator to ask the customer if she would like to apply for the credit card. If the customer accepts the credit card offer, the system sends additional customer information to the credit card service to determine if the customer is approved for the credit card. See Credit Card Application - Credit Decision Phase.

Applying for a Credit Card on Web Orders

In this situation, the credit card application process occurs on the web storefront.

If the credit card service approves the customer for the credit card, the customer can use the credit card as payment on the web order.

If the customer uses the credit card as a form of payment on the web order, the system sends the payment information for the new credit card (such as the credit card number, pay type, and authorization number) to CWDirect in the Inbound Order XML Message (CWORDERIN). In addition, if the customer received a discount on the order for applying for the credit card, the system sends the discount code to CWDirect.

Note: If a customer is approved for a credit card on the web storefront, you will need to manually update the Customer Sold To CC App file to indicate that the customer is now a current card holder of the credit card:

Customer Sold To CC App File |

|

Field |

Value |

Company |

The company where the credit card exists in the CC Application Service file. |

Customer # |

The sold to customer’s number. |

Seq # |

The sequence number in the CC Application Service file for the credit card that the customer is a current card holder of. |

Process status |

2R (Credit Decision Phase, Response Received) |

Application response |

A |

Last customer response |

A |

Applying for a Credit Card Outside of an Order

In this situation, the system has completed the Pre-Approval phase of the credit card application process for the customer, but still needs to complete the Credit Decision phase of the credit card application process. This may occur if:

• The customer was pre-approved for the credit card during order entry, but was unable to complete the credit card application process due to errors during processing. If this occurs, the customer receives a letter in the mail containing the credit card offer number to use when applying for the credit card. The customer calls the telephone number on the letter to apply for the credit card.

• The customer receives a promotional letter in the mail indicating that she has been pre-approved for the credit card and containing the credit card offer number to use when applying for the credit card. The customer calls the telephone number on the letter to apply for the credit card.

You can use the Working with Credit Card Application Requests (WCCA) menu option to complete the credit card application process for a customer that has already been pre-approved for the credit card.

The customer provides the credit card offer number and additional customer information; the system sends the additional customer information to the credit card service to determine if the customer is approved for the credit card.

For more information: See Working with Credit Card Application Requests (WCCA) for more information on how to send a Credit Decision credit card application request to the credit card service.

Determining if the Order Qualifies for the Credit Card Application Process

Purpose: Before the system presents a credit card offer to a customer during order entry, the system first determines if the order qualifies for the credit card application process.

• Credit Card Application Service Associated with Order?

• CC Application Mode for Order Type

Illustration of order qualification for credit card application process:

Credit Card Application Service Associated with Order?

In order to perform the credit card application process during order entry, a credit card application service must be associated with the source code on the order.

The Working with Credit Card Application Services (WCCS) menu option defines the credit cards that are available to offer to customers. When you create a credit card application service, you must define the division or entity number that is associated with the credit card application service. When you enter an order, the system compares the division or entity number defined for the source code on the order to the division or entity number defined for the credit card application service. If the division or entity number defined for the source code on the order matches the division or entity number defined for one or more credit card application services, the order is eligible to present a credit card offer to the sold to customer on the order.

CC Application Mode for Order Type

If a credit card offer is associated with the source code on the order, the system looks at the setting of the CC application mode field for the order type on the order to determine how the credit card application is processed.

• Automatic CC application mode: If the CC application mode is set to A (Automatic), the system will automatically send the customer information defined on the order header to the credit card service to determine if the customer qualifies for the credit card offer.

• Manual CC application mode: If the CC application mode is set to M (Manual), the system will not automatically determine if the customer qualifies for the credit card offer. Instead, the order entry operator must manually select to send the customer information to the credit card service to determine if the customer qualifies for the credit card offer. You can manually send a Pre-Approval credit card application request to the credit card service during order entry by using the CC Application Request option on the Display More Options Screen. While the request is being processed, the operator can exit the Display More Options screen and continue entering the order.

• Not eligible for CC application: If the CC application mode is set to N (Not available) or blank, the order is not eligible for the credit card application process.

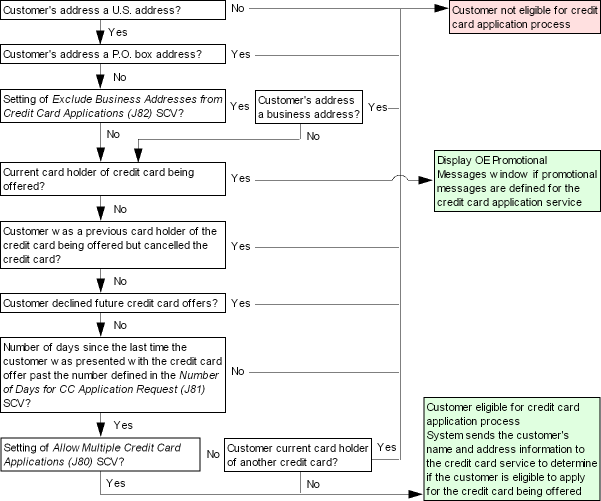

Determining if the Customer is Eligible for the Credit Card Application Process

Purpose: If the order qualifies for the credit card application process, the system determines if the sold to customer on the order is eligible for the credit card application process.

• Allow Multiple Credit Card Applications?

• Calculating the Last Time the Credit Card was Offered

Illustration of customer eligibility for credit card application process:

Only certain types of customer addresses qualify for the credit card application process.

U.S. Address? The credit card application process is available only for U.S. residents.

The system looks at the Country code defined for the customer’s address to determine if the customer’s address is a U.S. address.

P.O. Box Address? The credit card application process is not available for P.O. box addresses.

The system looks at the customer’s Street address to determine if the customer’s address is a P.O. box. If the customer’s Street address starts with the text PO, P.O., POB, BX or BOX, the customer’s address is a P.O. box.

Business Address? The system looks at the setting of the Exclude Business Addresses from Credit Card Applications (J82) system control value to determine if customers with a business address are excluded from the credit card application process. An address is identified as a business address if the Delivery code field for the customer is set to B (business).

• If this system control value is set to Y, customers with a business address are excluded from the credit card application process.

• If this system control value is set to N or , customers with a business address are included in the credit card application process.

The credit card application process is not available if the customer is a current card holder of the credit card being offered. Instead, the system displays the OE Promotional Messages Window to the customer, which displays any promotional messages that have been defined for the credit card to present to current card holders. See Credit Card Application Process for Current Card Holders.

The system looks at the Application status field in the Customer Sold To CC App file to determine if the customer is a current card holder of the credit card being offered.

• If the Application status field is A (Approved), the customer is a current card holder of the credit card being offered and cannot reapply for the credit card being offered.

• If the Application status field is blank or R (Refused), the system continues with the credit card application process.

The credit card application process is not available to customers that have declined all future credit card offers or to customers that were previous card holders of the credit card being offered, but have since cancelled the credit card.

The system looks at the setting of the Last customer response field in the Customer Sold To CC App file:

• If the Last customer response field is set to C (Cancelled), the customer was a previous card holder of the credit card being offered, but has since cancelled the credit card.The credit card application process is not available for this customer.

• If the Last customer response field is set to D (Decline future offers), the customer has requested to decline all future credit card offers. The credit card application process is not available for this customer.

If the Last customer response field is not set to C (Cancelled) or D (Declined future offers), the system continues with the credit card application process.

Allow Multiple Credit Card Applications?

The system looks at the setting of the Allow Multiple Credit Card Applications (J80) system control value to determine if a customer can apply for each type of credit card application being offered.

Each credit card application is assigned to an entity or division. For example, if you sell two different brands of apparel, you may wish to define a different credit card application for each apparel brand.

• If this system control value is set to Y, the customer can apply for one credit card for each type of credit card application being offered. During order entry, the system determines which credit card is associated with the order by matching the division and entity associated with the source code on the order to the division or entity defined for a credit card application service.

• If the customer is not a current card holder of the credit card being offered for the order, the system continues with the credit card application process.

• If the customer is a current card holder of the credit card being offered for the order, and a promotional message has been defined for the credit card, the system displays the OE Promotional Messages Window. See Credit Card Application Process for Current Card Holders.

• If this system control value is set to N, the system can apply for one credit card, across all types of credit card applications being offered. During order entry, the system determines which credit card is associated with the order by matching the division and entity associated with the source code on the order to the division or entity defined for a credit card application service.

• If the customer is not a current card holder of the credit card being offered for the order, the system looks at the Customer Sold To CC Application file to determine if the customer is a current card holder of a different credit card. If the customer is a current card holder of another credit card, the system does not offer the credit card to the customer. If the customer is not a current card holder of another credit card, the system continues with the credit card application process.

• If the customer is a current card holder of the credit card being offered for the order, and a promotional message has been defined for the credit card, the system displays the OE Promotional Messages Window. See Credit Card Application Process for Current Card Holders.

Multiple credit card application summary: The table below explains the credit card application process that occurs, based on the setting of the Allow Multiple Credit Card Applications (J80) system control value.

Credit card offer for order |

Current Credit Cards for Customer |

Allow multiple credit cards? |

Results |

BRAND 1 HOUSE CARD |

NONE |

N or Y |

The system continues with the credit card application process since the customer is not a current card holder of any credit cards. |

BRAND 1 HOUSE CARD |

BRAND 1 HOUSE CARD |

N or Y |

The system does not continue with the credit card application process since the customer is already a current card holder of the credit card being offered. If a promotional message has been defined for the credit card in Working with Credit Card Application Services (WCCS), the system displays the OE Promotional Messages Window. |

BRAND 1 HOUSE CARD |

BRAND 2 HOUSE CARD |

N |

The system does not continue with the credit card application process since the customer is a current card holder of the BRAND 2 HOUSE CARD and the Allow Multiple Credit Card Applications (J80) system control value is set to N. |

Y |

The system continues with the credit card application process since the customer is not a current card holder of the BRAND 1 HOUSE CARD and the Allow Multiple Credit Card Applications (J80) system control value is set to Y. |

Calculating the Last Time the Credit Card was Offered

The system looks at the setting of the Number of Days for CC Application Request (J81) system control value to determine how often a credit card offer should be presented to a customer during order entry.

During order entry, the system compares the date of the customer’s last response to the current date and the number of days defined in this system control value to determine whether to present the new credit card offer to the customer again.

If the number of days has not been reached: If the last time the customer was offered the credit card is less than or equal to the number of days defined in the Number of Days for CC Application Request (J81) system control value, the system does not continue with the credit card application process.

Example: If the number of days defined in the Number of Days CC Application Request (J81) system control value is 30, the last time the customer was offered the credit card is 11/15 and the current date is 11/30, the system does not present the credit card offer again since 30 days has not passed since the last time the customer was offered the credit card.

If the number of days has been reached: If the last time the customer was offered the credit card is greater than the number of days defined in the Number of Days for CC Application Request (J81) system control value, the system continues with the Pre-Approval phase of the credit card application process.

Example: If the number of days defined in the Number of Days CC Application Request (J81) system control value is 30, the last time the customer was offered the credit card is 10/15 and the current date if 11/30, the system presents the credit card offer to the customer since 30 days has passed since the last time the customer was offered the credit card.

Allow multiple credit card applications: If the Allow Multiple Credit Card Applications (J80) system control value is set to Y, the system performs a separate calculation for each credit card offer to determine the last time the credit card was offered to the customer.

Example: The Number of Days for CC Application Request (J81) system control value is set to 30. Two credit card offers exist: one credit card for the Apparel division (division 1) and one credit card for the Home Goods division (division 2). The customer placed an order for the Apparel division yesterday and was offered the Apparel credit card. The customer places another order today:

• If the order placed today is also for the Apparel division, the system will not offer the Apparel credit card to the customer again since 30 days has not yet passed since the last time the credit card was offered to the customer.

• If the order placed today is for the Home division, the system will offer the Home credit card to the customer since this credit card has not yet been offered to the customer.

Examples of when to present the credit card offer to the customer:

Order date |

CC App Mode |

Last Customer Response |

SCV J81 |

Results |

9/30 |

A (Automatic) |

on 9/15: R (customer refused offer), or blank (customer never presented offer), or A (accepted; only if the previous application is incomplete, indicating the customer is not a current card holder) |

blank |

The system automatically presents the credit card offer to the customer since the Number of Days for CC Application Request system control value is set to blank. |

9/30 |

A (Automatic) |

on 9/15: R (customer refused offer), or blank (customer never presented offer), or A (accepted; only if the previous application is incomplete, indicating the customer is not a current card holder) |

30 |

The system does not automatically present the credit card offer to the customer since the last refusal date is less than 30 days. The system does not continue with the credit card application process. |

10/20 |

A (Automatic) |

on 9/15: R (customer refused offer), or blank (customer never presented offer), or A (accepted; only if the previous application is incomplete, indicating the customer is not a current card holder) |

30 |

The system automatically presents the credit card offer to the customer since the last refusal date is greater than 30 days. |

10/20 |

A (Automatic) |

D (declined future offers), or C (cancelled card) |

30 |

The system does not present the credit card offer to the customer because: • the customer has requested to decline all future credit card offers. • the customer was previously a card holder of the credit card being offered and has since cancelled the credit card. The system does not continue with the credit card application process. |

9/30 |

M (Manual) |

on 9/15: R (customer refused offer), or blank (customer never presented offer), or A (accepted; only if the previous application is incomplete, indicating the customer is not a current card holder) |

blank |

The system presents the credit card offer to the customer since the Number of Days for CC Application Request system control value is set to blank. A message similar to the following displays: Credit card application request sent. If the operator tries to manually send another credit card application request, a message similar to the following displays: Credit card application request already sent. |

9/30 |

M (Manual) |

on 9/15: R (customer refused offer), or blank (customer never presented offer), or A (accepted; only if the previous application is incomplete, indicating the customer is not a current card holder) |

30 |

The system does not present the credit card offer to the customer since the last refusal date is less than 30 days. A message similar to the following displays: # of days since last credit card application request has not been reached. The system does not continue with the credit card application process. |

10/20 |

M (Manual) |

on 9/15: R (customer refused offer), or blank (customer never presented offer), or A (accepted; only if the previous application is incomplete, indicating the customer is not a current card holder) |

30 |

The system presents the credit card offer to the customer since the last refusal date is greater than 30 days. A message similar to the following displays: Credit card application request sent. If the operator tries to manually send another credit card application request, a message similar to the following displays: Credit card application request already sent. If the customer’s address does not qualify for the credit card offer, a message similar to the following displays: Address does not meet CC Application Request criteria. |

10/20 |

M (Manual) |

D (Declined Future Offers), or C (Cancelled Card) |

30 |

The system does not present the credit card offer to the customer because: • the customer has requested to decline all future credit card offers. • the customer was previously a card holder of the credit card being offered and has since cancelled the credit card. A message similar to the following displays: Customer has declined or cancelled future offers. The system does not continue with the credit card application process. |

Credit Card Application - Pre-Approval Phase

Purpose: During the pre-approval phase of the credit card application process, the system sends a Pre-Approval Credit Card Application Request Message (CWCreditCardApplicationRequest) to the credit card service to determine if the customer qualifies for the credit card being offered.

• Pre-Approval Credit Card Application Process Flow

• What Happens When a Pre-Approval Credit Card Application is Declined?

• What Happens When a Pre-Approval Credit Card Application is Approved?

Pre-Approval credit card application illustration:

Pre-Approval Credit Card Application Process Flow

If the customer is eligible for the credit card application process, the system sends a Pre-Approval Credit Card Application Request Message (CWCreditCardApplicationRequest) to the credit card service.

To generate a Pre-Approval Credit Card Application Request Message (CWCreditCardApplicationRequest), the system performs the following steps.

1. The system looks at the setting of the CC Application Mode for Order Type to determine how to send the Pre-Approval credit card application request to the credit card service.

• If the CC application mode for the order type on the order is set to A (Automatic), the system automatically sends the Pre-Approval Credit Card Application Request Message (CWCreditCardApplicationRequest) to the credit card service to determine if the customer qualifies for the credit card offer. The order entry is unaware that the Pre-Approval credit card application request was sent to the credit card service and continues entering the order.

• If the CC application mode is set to M (Manual) for the order type on the order, the order entry operator must manually select to send the Pre-Approval Credit Card Application Request Message (CWCreditCardApplicationRequest) to the credit card service. You can manually send a Pre-Approval credit card application request to the credit card service during order entry by using the CC Application Request option on the Display More Options Screen. While the request is being processed, the operator can exit the Display More Options screen and continue entering the order.

2. The system looks at the Integration layer process setting for the credit card application service to determine the integration layer process used to process the Pre-Approval credit card application request. The delivered integration layer process is CREDIT_APP. See Working with Credit Card Application Services (WCCS) for more information on creating and working with credit card application services.

Note: If an integration layer process is not defined for the credit card application service, the system does not generate a Pre-Approval credit card application request. The system does not continue with the credit card application process.

3. The system sends the Credit Card Application Request Message (CWCreditCardApplicationRequest) to the outbound queue defined for the CREDIT_APP integration layer process and waits for a response from the credit card service.

Pre-Approval request: The following information is included in the pre-approval credit card application request.

See Credit Card Application Request Message (CWCreditCardApplicationRequest) for a description of the data in this message and see Credit Card Application: Sample Messages for a sample message.

Pre-Approval Credit Card Application Request |

|

Attribute Name |

Description |

Message |

|

source |

RDC |

target |

IL |

type |

CWCreditCardApplicationRequest |

CWCreditCardApplicationRequest |

|

type |

PreApproval |

ApplicationRequest |

|

companyID |

A code for the company where the order was placed. |

createDate |

The date the order was placed, in MMDDYYYY format. |

merchantReference |

Concatenated field made up of company code + sold to customer number + credit card application service sequence number. |

actionCode |

PreApproval |

customerNbr |

The sold to customer number on the order. |

entity |

A code for the entity defined for the credit card application service. |

division |

A code for the division defined for the credit card application service. |

firstName |

The sold to customer’s first name. |

initial |

The sold to customer’s middle initial. |

lastName |

The sold to customer’s last name. |

companyName |

The company name defined for the sold to customer. |

suffix |

The sold to customer’s suffix. |

addressLine1 |

The sold to customer’s street address. |

addressLine2 |

The second address line defined for the sold to customer’s address. |

addressLine3 |

The third address line defined for the sold to customer’s address. |

addressLine4 |

The fourth address line defined for the sold to customer’s address. |

apartment |

The apartment number defined for the sold to customer’s address. |

city |

The city defined for the sold to customer’s address. |

state |

A code for the state defined for the sold to customer’s address. |

zip |

The postal code defined for the sold to customer’s address. |

country |

A code for the country defined for the sold to customer’s address. |

soldtoEmail |

The sold to customer’s primary email address. |

phoneNumber |

The sold to customer’s home/evening phone number. |

shiptoAddressLine1 |

The ship to customer’s street address. |

shiptoAddressLine2 |

The second address line defined for the ship to customer’s address. |

shiptoAddressLine3 |

The third address line defined for the ship to customer’s address. |

shiptoAddressLine4 |

The fourth address line defined for the ship to customer’s address. |

shiptoApartment |

The apartment number defined for the ship to customer’s address. |

shiptoCity |

The city defined for the ship to customer’s address. |

shiptoState |

A code for the state defined for the ship to customer’s address. |

shiptoZip |

The postal code defined for the ship to customer’s address. |

shiptoCountry |

A code for the country defined for the ship to customer’s address. |

shiptoEmail |

The ship to customer’s email address. |

4. The system creates a record in the Customer Sold To CC Application file for the Pre-Approval credit card application request.

Customer Sold To CC Application file: You can review the records in the Customer Sold To CC Application file on the Work with CC Application By Customer Screen.

Customer Sold To CC Application file |

|

Field |

Description |

Company |

The company code from the Order Header file. |

Customer # |

The customer number from the Order Header file. |

Seq # |

The sequence number from the CC Application Service file for the credit card application service associated with the order. |

Process status |

1S = 1st Pass Sent. The system has generated and sent the Pre-Approval credit card application request to the credit card service and is waiting for a response. |

Created by user |

The user ID for the order entry operator. |

5. CWIntegrate translates the Credit Card Application Request Message (CWCreditCardApplicationRequest) into the format required by the credit card service and sends the formatted message to the credit card service.

6. The credit card service receives the formatted request message, processes the Pre-Approval request, and sends back a response message indicating if the customer qualifies for the credit card.

7. CWIntegrate translates the response message into the Credit Card Application Response Message (CWCreditCardApplicationResponse) required by CWDirect and sends the message to CWDirect.

8. The CREDIT_APP inbound queue receives the Pre-Approval Credit Card Application Response Message (CWCreditCardApplicationResponse).

Pre-Approval response: The following information is included in the Pre-Approval credit card application response.

See Credit Card Application Response Message (CWCreditCardApplicationResponse) for a description of the data in this message and Credit Card Application: Sample Messages for a sample message.

Pre-Approval Credit Card Application Response |

|

Attribute Name |

Description |

Message |

|

source |

IL |

target |

CWDirect |

CWCreditCardApplicationResponse |

|

mode |

Online |

ApplicationResponse |

|

companyID |

A code for the company where the order was placed. |

merchantReference |

Concatenated field made up of company code + sold to customer number + credit card application service sequence number. |

customerNbr |

The number assigned to the sold to customer. |

ccAccountNumber |

The credit card number assigned to the sold to customer. For Pre-Approval responses, the credit card number is zero-filled. A credit card number is not assigned to the sold to customer until the credit card service approves the customer for the credit card. |

creditLImit |

The credit limit assigned to the customer if the customer is approved for the credit card. This field is zero-filled if the customer is not eligible to apply for the credit card. |

applicationStatus |

Valid values: A = Pre-Approval Approved. PC = Process Complete; customer not eligible to apply for the credit card. |

actionCode |

PreApproval |

ccOfferNbr |

The credit card offer number defined for the Pre-Approval credit card application request. This field is populated only if the applicationStatus is A, indicating the customer is eligible to apply for the credit card. The customer can use this number if the credit card application process cannot be completed during order entry. |

9. The system updates the Customer Sold To CC Application file with the information received in the Credit Card Application Response Message (CWCreditCardApplicationResponse).

Customer Sold To CC Application file: You can review the records in the Customer Sold To CC App file using the Work with CC Application By Customer Screen.

Customer Sold To CC Application file |

|

Field |

Description |

Company |

The company code from the Order Header file. |

Customer # |

The customer number from the Order Header file. |

Seq # |

The sequence number from the CC Application Service file for the credit card application service associated with the order. |

Process status |

1R = 1st Pass Received and Approved. 1F = 1st Pass Received and Failed. In this situation, the system displays a description of the error in the Error text field. |

Application response |

A code representing the response received from the credit card service. Valid responses are: A = The Pre-Approval credit card application was approved. PC = Process Complete; customer not eligible to apply for the credit card. |

CC offer |

The credit card offer number assigned to the customer, indicating the customer is eligible to apply for the credit card. This field is populated only if the Process status is 1R, indicating the customer is eligible to apply for the credit card. The customer can use the credit card offer number to apply for the credit card outside of an order; see Working with Credit Card Application Requests (WCCA). |

Initial credit limit |

The credit limit for the credit card. This field is populated only if the customer is eligible to apply for the credit card (the Process status is 1R); otherwise, this field remains blank. |

Last customer response date |

The date the Pre-Approval credit card application was processed. |

Error code |

A code that identifies the error that occurred during the Pre-Approval phase of the credit card application process. This field is populated only if the Process status is 1F. |

Error text |

A description of the error that occurred during the Pre-Approval phase of the credit card application process. This field is populated only if the Process status is 1F. |

Created by user |

The user ID for the order entry operator. |

10. By the time the order entry operator presses F9 to accept the order details, a Pre-Approval credit card application response should have been received from the credit card service, indicating whether the customer qualifies for the credit card. See:

• What Happens When a Pre-Approval Credit Card Application is Declined?

• What Happens When a Pre-Approval Credit Card Application is Approved?

Note: If the Pre-Approval credit card application response has not been received by the time the order entry operator presses F9, the system will wait for a response based on the Wait time defined for the CREDIT_APP integration layer process. If a response has not been received at the end of the Wait time, the system ends the credit card application process and continues with regular order entry.

What Happens When a Pre-Approval Credit Card Application is Declined?

A Pre-Approval credit card application is declined if the Application status in the Credit Card Application Response Message (CWCreditCardApplicationResponse) is PC (Process Complete; customer not eligible).

In this situation, the system ends the credit card application process and continues with regular order entry.

What Happens When a Pre-Approval Credit Card Application is Approved?

A Pre-Approval credit card application is approved if the Application status in the Credit Card Application Response Message (CWCreditCardApplicationResponse) is A (Approved).

In this situation, the system displays the Credit Card Application Request Window when the order entry operator presses F9 to accept the order details.

Credit Card Application Request Window

If the customer has been Pre-Approved for the credit card being offered, the Credit Card Application Request window displays for the operator to ask whether the customer is interested in applying for the credit card, explaining their credit line and optionally, offering a discount and/or free freight on the order.

How to display this screen: This window displays when you press F9 after entering the details on an order in order entry if the customer has been Pre-Approved for the credit card being offered.

Credit Card Application Request

Customer # 534 MIRANDA, BERNADETTE T

KAB KIDS PREAPPROVED FOR $ 3,500

SS# - - Date of birth Home phone (Eve) Marital status

Calculate freight? Y Discount % 10.00

F9=Accept F11=Decline F12=Cancel |

Field |

Description |

Customer # |

A code for the sold to customer that has been pre-approved for the credit card being offered. Numeric, 9 positions; display-only. |

Customer name (unlabeled field below Customer #) |

The name of the sold to customer that has been pre-approved for the credit card being offered. Company name: Alphanumeric, 30 positions; display-only. Sold to name: Alphanumeric, 40 positions; display-only. |

Credit card description (unlabeled field below Customer name) |

A description of the credit card being offered to the customer. This is the Description defined for the credit card application service; see Working with Credit Card Application Services (WCCS). Alphanumeric, 30 positions; display-only. |

Preapproved for |

The initial credit limit on the credit card that the sold to customer has been pre-approved for. Numeric, 5 positions; display-only. |

|

(Social security number) |

The sold to customer’s social security number. The sold to customer must provide the social security number in order to be approved for the private label credit card. Numeric, 9 positions; required. |

The sold to customer’s date of birth. The sold to customer must provide the date of birth in order to be approved for the private label credit card. Numeric, 6 positions (MMDDYY format); required. |

|

The sold to customer’s home phone number. The customer’s evening phone number defaults, but you can override it. The sold to customer must provide the home phone number in order to be approved for the private label credit card. Alphanumeric, 10 positions; required. |

|

Marital status |

The sold to customer’s marital status. Valid values: • M = Married • L = Legally separated • U = Unmarried Alphanumeric, 1 position; optional. |

Discount % |

The discount percentage to take off the order. This field does not display if the Discount % field defined for the credit card application service is blank; see Working with Credit Card Application Services (WCCS). The system applies this discount to the order if the customer agrees to apply for the credit card offer. The discount is applied to the Discount % field on the order header. If a discount % is already defined on the order header, the system adds this discount to the existing discount. The discount is stored in the Discount % field in the Order Ship To file; if there are multiple ship to customers on the order, the system applies the discount to all of the ship to customers on the order. Note: • The system applies the discount to the order even if the customer is not approved for the credit card. • If you remove the discount % from the order header, the system will not be able to reapply the credit card application discount % to the order. • The system does not apply the discount to the order if the customer does not apply for the credit card. Numeric, 5 positions with a 2-place decimal; display-only. |

Calculate freight |

Defines whether the system calculates and adds freight charges, any service charges by ship via, and any C.O.D. charges to the order. This setting defaults from the Calculate freight field on the order header; however, you can override it. Valid values: • Y = The system calculates freight for the order based on the freight method defined for the source code. • N = The system does not calculate freight for the order. The system offers free freight for the order if the customer agrees to apply for the credit card offer. If there are multiple ship to customers on the order, the calculate freight setting applies to all of the ship to customers on the order. Note: • The system applies free freight to the order even if the customer is not approved for the credit card. • The system does not offer free freight for the order if the customer does not apply for the credit card. Alphanumeric, 1 position; required. |

Window Option |

Procedure |

Apply for the credit card offer |

If the customer wishes to apply for the credit card offer, the customer must provide the following information in order to proceed with the credit card application: • SS # Once the customer provides the additional information, the order entry operator can press F9 to send a Credit Decision credit card application request to the credit card service; see Credit Card Application - Credit Decision Phase. Note: If the customer does not provide the social security number, date of birth, and home phone number, the order entry operator will need to press F11 to decline the credit card offer. |

Decline the credit card offer |

Press F11. The system sends a Credit Decision credit card application request to the credit card service indicating the customer has declined the credit card offer. When the response is received back from the credit card service, the system updates the Customer Sold To CC Application file indicating the customer refused the credit card offer. You can review the credit cards that have been offered to the customer at the Work with CC Application By Customer Screen. At this point, the system ends the credit card application process and the order entry operator can continue with the order. See Credit Decision Phase: Customer Refuses Credit Card Offer to review a sample of the messages that are generated when the customer refuses the credit card offer. Note: If you enter the customer’s social security number, date of birth, and home phone number at this window and then the customer declines the credit card offer, the system sends the customer’s social security number, date of birth, and home phone number to the credit card service with a decline response. |

Return to the order without accepting or declining the credit card offer |

Press F12. Use this option if the customer finishes placing the order before the Pre-Approval response has been received from the credit card service or if the customer gets disconnected before the order has been completed. The record in the Customer Sold To CC App file remains in a Pre-Approval Received status with a blank customer response. The system uses the setting defined in the Number of Days for CC Application Request (J81) system control value to determine the next time to offer the credit card to the customer again. Note: If you select this option, the system will redisplay the Credit Card Application Request window each time you press F9 until you have completed the order. |

Credit Card Application - Credit Decision Phase

Purpose: During the Credit Decision phase of the credit card application process, the system sends a Credit Decision Credit Card Application Request Message (CWCreditCardApplicationRequest) to the credit card service to determine if the customer is approved for the credit card being offered.

Credit Decision credit card application illustration:

Credit Decision Credit Card Application Process Flow

The Credit Decision phase of the credit card application process is initiated when:

• A customer responds to a credit card offer at the Credit Card Application Request Window in order entry. Note: If the customer refused the credit card offer at the Credit Card Application Request Window, the system still sends a Credit Decision credit card application request to the credit card service, indicating that the customer refused the credit card offer.

• You press F9 at the Create Credit Card Application Request Screen to send a credit card application request to the credit card service outside of an order.

Once a response is made to the credit card offer, the system sends a Credit Decision Credit Card Application Request Message (CWCreditCardApplicationRequest) to the credit card service.

To generate a Credit Decision Credit Card Application Request Message (CWCreditCardApplicationRequest), the system performs the following steps.

1. The system looks at the Integration layer process setting defined for the credit card offer in Working with Credit Card Application Services (WCCS) to determine the integration layer process used to process the Credit Decision credit card application request. The delivered integration layer process is CREDIT_APP.

2. The system sends the Credit Card Application Request Message (CWCreditCardApplicationRequest) to the outbound queue defined for the CREDIT_APP integration layer job and waits for a response from the credit card service.

Approval request: The following information is included in the Credit Decision credit card application request.

See Credit Card Application Request Message (CWCreditCardApplicationRequest) for a description of the data in this message and see Credit Card Application: Sample Messages for a sample message.

Credit Decision Credit Card Application Request |

|

Attribute Name |

Description |

Message |

|

source |

RDC |

target |

IL |

type |

CWCreditCardApplicationRequest |

CWCreditCardApplicationRequest |

|

type |

CreditDecision |

ApplicationRequest |

|

companyID |

A code for the company where the order was placed. |

createDate |

The date the order was placed. |

merchantReference |

Concatenated field made up of company code + sold to customer number + credit card application service sequence number. |

actionCode |

CreditDecision |

customerNbr |

The sold to customer number. |

division |

A code for the division associated with the source code on the order header. |

firstName |

The sold to customer’s first name. |

initial |

The sold to customer’s middle initial. |

lastName |

The sold to customer’s last name. |

addressLine1 |

The sold to customer’s street address. |

city |

The city defined for the sold to customer’s address. |

state |

A code for the state defined for the sold to customer’s address. |

zip |

The postal code defined for the sold to customer’s address. |

country |

A code for the country defined for the sold to customer’s address. |

phoneNumber |

The sold to customer’s home/evening phone number. |

soldtoEmail |

The sold to customer’s primary email address. |

shiptoAddressLine1 |

The ship to customer’s street address. |

shiptoCity |

The city defined for the ship to customer’s address. |

shiptoState |

A code for the state defined for the ship to customer’s address. |

shiptoZip |

The postal code defined for the ship to customer’s address. |

shiptoCountry |

A code for the country defined for the ship to customer’s address. |

shiptoEmail |

The ship to customer’s primary email address. |

dateOfBirth |

The sold to customer’s date of birth, in MMDDYYYY format. This field is populated only if the customer accepts the credit card offer. |

socialSecurityNbr |

The sold to customer’s social security number. This field is populated only if the customer accepts the credit card offer. |

customerResponse |

Valid values: A = Accepted; the customer has accepted the credit card offer and wishes to apply for the credit card. R = Refused; the customer has refused the credit card offer. |

ccOfferNbr |

The credit card offer number that was assigned to the sold to customer during the Pre-Approval phase of the credit card application process. |

3. The system updates the Customer Sold To CC Application file with the Credit Decision request information sent to the credit card service.

Customer Sold To CC Application file: You can review the records in the Customer Sold To CC App file using the Work with CC Application By Customer Screen.

Customer Sold To CC Application file |

|

Field |

Description |

Company |

The company code from the Order Header file. |

Customer # |

The customer number from the Order Header file. |

Seq # |

The sequence number from the CC Application Service file for the credit card application service associated with the order. |

Process status |

2S = 2nd Pass Sent |

CC offer |

The credit card offer number assigned to the customer, indicating the customer was approved during the Pre-Approval phase of the credit card application process. |

Date of birth |

The customer’s date of birth, in MMDDYYYY format. |

Social security # |

The customer’s social security number. |

Marital status |

The customer’s marital status. |

Initial credit limit |

The credit card limit assigned to the credit card that is being offered to the customer. |

Last customer response |

The response received from the customer at the Credit Card Application Request Window for the credit card offer. Valid values: A = Customer accepted the credit card offer. R = Customer refused the credit card offer. |

Last customer response date |

The date when the customer responses to the credit card offer. |

Created by user |

The user ID for the order entry operator. |

4. CWIntegrate translates the Credit Decision Credit Card Application Request Message (CWCreditCardApplicationRequest) into the format required by the credit card service and sends the formatted message to the credit card service.

5. The credit card service receives the formatted request message, processes the Credit Decision request, and sends back a response message indicating if the customer has been approved for the credit card.

6. CWIntegrate translates the response message into the Credit Decision Credit Card Application Response Message (CWCreditCardApplicationResponse) required by CWDirect and sends the message to CWDirect.

7. The CREDIT_APP inbound queue receives the Credit Decision Credit Card Application Response Message (CWCreditCardApplicationResponse).

Approval response: The following information is included in the Credit Decision credit card application response.

See Credit Card Application Response Message (CWCreditCardApplicationResponse) for a description of the data in this message and Credit Card Application: Sample Messages for a sample message.

Approval Credit Card Application Response |

|

Attribute Name |

Description |

Message |

|

source |

IL |

target |

CWDirect |

CWCreditCardApplicationResponse |

|

mode |

Online |

ApplicationResponse |

|

companyID |

A code for the company where the order was placed. |

merchantReference |

Concatenated field made up of company code + sold to customer number + credit card application service sequence number. |

customerNbr |

The sold to customer number. |

ccAccountNumber |

The credit card number for the credit card assigned to the customer. This is populated only if the credit card service approved the customer for the credit card. |

creditLimit |

The credit limit for the credit card assigned to the customer. This is populated only if the credit card service approved the customer for the credit card. |

applicationStatus |

Valid values: A = Approved; the credit card service has approved the customer for credit card. R = Refused; the credit card service has declined the customer for the credit card. |

actionCode |

CreditDecision |

applicationNbr |

The credit card application number assigned to the sold to customer. This is populated only if the credit card service approved the customer for the credit card. |

ccOfferNbr |

The credit card offer number assigned to the sold to customer. This is populated only if the credit card service approved the customer for the credit card. |

errorCode |

A code for the error that occurred during the Credit Decision phase of the credit card application process. |

errorText |

A description of the error that occurred during the Credit Decision phase of the credit card application process. |

8. The system updates the Customer Sold To CC Application file with the information received in the Credit Card Application Response Message (CWCreditCardApplicationResponse).

Customer Sold To CC Application file: You can review the records in the Customer Sold To CC Application file using the Work with CC Application By Customer Screen.

Customer Sold To CC Application file |

|

Field |

Description |

Company |

The company code from the Order Header file. |

Customer # |

The customer number from the Order Header file. |

Seq # |

The sequence number from the CC Application Service file for the credit card application service associated with the order. |

Process status |

Valid values: 2R = 2nd Pass Received. 2F = 2nd Pass Received and Failed. |

Application response |

Indicates whether the credit card service accepted or refused the credit card application. Valid values: A = Accepted. The credit card service approved the customer’s credit card application and assigned a credit card to the customer. R = Refused. The credit card service refused the customer’s credit card application and did not assign a credit card to the customer. blank = Error. An error occurred during the Credit Decision phase of the credit card application process. The Error text field provides a description of the error. |

Application # |

The credit card application number assigned to the customer. This is populated only if the Application response is A or R. |

CC offer |

The credit card offer number assigned to the customer during the Pre-Approval phase of the credit card application process. |

Initial credit limit |

The credit limit offered to the customer. |

Last customer response |

The last response received from the customer to the credit card offer. Valid values: A = Accepted credit card offer. R = Refused credit card offer. |

Last customer response date |

The date when the customer last responded to the credit card offer. |

Error code |

A code for the error that occurred during the Credit Decision phase of the credit card application process. |

Error text |

A description of the error that occurred during the Credit Decision phase of the credit card application process. |

Created by user |

The user ID for the order entry operator. |

9. The order entry operator remains on the Credit Card Application Request Window until a response is received from the credit card service. The Wait time defined for the CC Application Process integration layer process defines how long the system waits for a response. See:

• What Happens When Credit Decision Response is Not Received?

• What Happens When a Credit Decision Response is Declined?

• What Happens When a Credit Decision Response is Approved?

What Happens When Credit Decision Response is Not Received?

If a Credit Decision Credit Card Application Response Message (CWCreditCardApplicationResponse) is not received within the defined wait time, the system displays the Credit Card Application Response Window, indicating the system timed out before a response could be received. In this situation, the system updates the Customer Sold To CC Application file and ends the credit card application process.

• If the Credit Decision process was initiated in order entry, the customer will receive a letter in the mail containing a credit card offer number. The customer will need to call the number provided in the letter in order to complete the credit card application process. See Working with Credit Card Application Requests (WCCA) for more information on completing the credit card application process outside of an order.

• If the Credit Decision process was initiated in Working with Credit Card Application Requests (WCCA), the customer will need to call again in order to apply for the credit card.

What Happens When a Credit Decision Response is Declined?

If the credit card application is declined, the Credit Card Application Response Window displays indicating the customer was not approved for the credit card.

Credit Card Application Response Window

The Credit Card Application Response window indicates the customer was not approved for the credit card.

This window also displays if an error occurred during processing.

How to display this screen: This window displays when the Credit Decision Credit Card Application Response Message (CWCreditCardApplicationResponse) is received from the credit card service indicating the credit card service did not approve the customer for the credit card. This window also displays if an error occurred during the Credit Card Application - Credit Decision Phase.

Credit Card Application Response

Customer # : 534 HYNENAN, FRANCIS P

KAB KIDS Credit Card Application could not be processed. Contact HSBC - ERR

F3=Exit F12=Cancel |

Field |

Description |

Customer # |

A code for the sold to customer that has applied for the credit card being offered. Numeric, 9 positions; display-only. |

Customer name (unlabeled field below Customer #) |

The name of the sold to customer that has applied for the credit card being offered. Company name: Alphanumeric, 30 positions; display-only. Sold to name: Alphanumeric, 40 positions; display-only. |

Credit card description (unlabeled field below Customer name) |

A description of the credit card being offered to the customer. This is the Description defined for the credit card application service; see Working with Credit Card Application Services (WCCS). Alphanumeric, 30 positions; display-only. |

Error text |

A description of the reason why the customer was not approved for the credit card. Alphanumeric, 75 positions; display-only. |

What Happens When a Credit Decision Response is Approved?

If the credit card application is approved, the Credit Card Application Approval Window displays with the customer’s credit limit and account number.

The operator can use this window to inform the customer that she has been approved for the credit card and provide the customer’s credit limit and credit card number.

If the Credit Decision process was initiated in order entry, the operator can also ask the customer if she would like to use the credit card as payment on the order. If the customer decides to use the credit card as payment on the order, the system prepopulates the payment screen with the pay type and credit card number defined for the credit card.

Credit Card Application Approval Window

This window indicates the customer’s credit card application was approved by the credit card service and provides the customer’s credit limit and credit card number.

If the Credit Decision process was initiated in order entry, the operator can also ask the customer if she would like to use the credit card as payment on the order. If the customer decides to use the credit card as payment on the order, the system prepopulates the payment screen with the pay type and credit card number defined for the credit card.

How to display this screen: This window displays when the credit card service approves the customer for the credit card.

Credit Card Application Approval

Customer # : 547 DIGESO, SYLVESTER

KAB KIDS Approved for $ : 3500

Account # : 7196218800002112

F3=Exit F8=Use as Payment Method F12=Cancel |

Field |

Description |

Customer # |

A code for the sold to customer that has been approved for the credit card being offered. Numeric, 9 positions; display-only. |

Customer name (unlabeled field below Customer #) |

The name of the sold to customer that has been approved for the credit card being offered. Company name: Alphanumeric, 30 positions; display-only. Sold to name: Alphanumeric, 40 positions; display-only. |

Credit card description (unlabeled field below Customer name) |

A description of the credit card. This is the Description defined for the credit card application service; see Working with Credit Card Application Services (WCCS). Alphanumeric, 30 positions; display-only. |

Approved for |

The initial credit limit assigned to the customer’s credit card. Numeric, 5 positions; display-only. |

Account # |

The customer’s credit card number. Numeric, 20 positions; display-only. |

Window Option |

Procedure |

Use the credit card as payment on the order Note: This option displays only if the Credit Decision process was initiated during order entry. |

Press F8. If the Display Order Recap (A75) system control value is selected, the system defaults the credit card account number to the Credit card # field on the Work with Order/Recap Screen. In addition, if a pay type has been defined for the credit card application service, the system defaults the pay type to the Pay type field. If the Display Order Recap (A75) system control value is unselected, the system defaults the credit card account number to the Credit card # field on the Enter Payment Method Screen. In addition, if a pay type has been defined for the credit card application service, the system defaults the pay type to the Pay type field. Note: If you exit out of the Credit Card Application Approval Window and do not select to use the credit card as payment on the order, the system will not be able to retrieve the credit card account number if the customer later decides to use the credit card as payment on the order. Before exiting the window, you should recite the credit card number to the customer so that she can write it down until the credit card is delivered in the mail. The customer’s credit card number is not stored in the CWDirect database. |

Credit Card Application Process for Current Card Holders

Purpose: Once a customer is a current card holder, she can use it as payment for an order.

Determining if a customer is a current card holder: During order entry, the system determines which credit card is associated with the order by matching the division and entity associated with the source code on the order to the division or entity defined for a credit card application service in Working with Credit Card Application Services (WCCS).

Once the system determines which credit card offer is associated with the order, the system determines if the sold to customer on the order is a current card holder of the credit card by looking at the Customer Sold To CC Application file.

• If the Process status field is 2R (Credit Decision Response Received), the Customer last response field is A (Accepted) and the Application response field is A (Approved) in the Customer Sold To CC Application file, then the system considers the customer a current card holder.

• If the Application response field is set to a value other than A (Approved), then the system does not consider the customer a current card holder.

You can review the credit card offers that were presented to the sold to customer at the Work with CC Application By Customer Screen.

OE Promotional Messages Window

Use this window to display promotional messages in order entry to customers who are card holders of a credit card in the CC Application Service file.

How to display this screen: This window displays during order entry after the operator enters order header information based on the setting of the Allow Multiple Credit Card Applications (J80) system control value and whether:

• the division or entity associated with the source code on the order header matches the division or entity defined for a credit card in the CC Application Service file, and

• the customer is a current card holder of a card in the CC Application Service file, and

• order entry messages have been defined for the credit card in the CC Application Service file.

If you allow multiple credit cards: If the Allow Multiple Credit Card Applications (J80) system control value is set to Y, the system displays the OE Promotional Messages window if the customer is a current card holder of the credit card associated with the order.

• If the customer is not a current card holder of the credit card associated with the order, the system begins the credit card application process to determine if the card should be offered to the customer.

• If the source code on the order is not associated with a credit card in the CC Application Service file, the system does not display the OE Promotional Messages window and does not initiate the credit card application process.

If you do not allow multiple credit cards: If the Allow Multiple Credit Card Applications (J80) system control value is set to N, the system displays the OE Promotional Messages window if the source code on the order is associated with a credit card in the CC Application Service file and the customer is a current card holder of a card in the CC Application Service file.

• If the customer is a current card holder of the credit card associated with the order, the system displays the OE Promotional Window for that card.

• If the customer is not a current card holder of the credit card associated with the order, but is a current card holder of another card in the CC Application Service file, the system displays the OE Promotional Window for all of the credit cards that the customer is a current card holder of.

• If the customer is not a current card holder of any credit card in the CC Application Service file, the system will begin the credit card application process to determine if the credit card associated with the order should be offered to the customer.

• If the source code on the order is not associated with a credit card in the CC Application Service file, the system does not display the OE Promotional Messages window and does not initiate the credit card application process.

Example: The following credit cards exist in the Credit Card Application file.

SCV J80 |

Credit Card for Order |

Customer’s Current Cards |

Results |

Y |

CARD1 |

CARD1 CARD2 |

The system displays the OE Promotional Messages window for CARD1. |

Y |

CARD2 |

CARD1 |

The system begins the credit card application process since the Allow Multiple Credit Card Applications (J80) system control value is set to Y and the customer is not a current card holder of the credit card associated with division 02 (CARD2). |

Y |

CARD3 |

CARD1 CARD2 |

The system begins the credit card application process to determine if the customer should be offered CARD3. |

Y |

CARD3 |

no card defined |

The system begins the credit card application process to determine if the customer should be offered CARD3. |

Y |

No card defined |

CARD1 CARD2 |

The system does not display the OE Promotional Messages window and does not initiate the credit card application process. |

N |

CARD1 |

CARD1 CARD2 |

The system displays the OE Promotional Messages window for CARD1. |

N |

CARD2 |

CARD1 |

The system displays the OE Promotional Messages window for CARD1. |

N |

CARD3 |

CARD1 CARD2 |

The system displays the OE Promotional Messages window for CARD1 and then displays the window again for CARD2. |

N |

CARD3 |

No card defined |

The system begins the credit card application process to determine if the customer should be offered CARD3. |

N |

no card defined |

CARD1 CARD2 |

The system does not display the OE Promotional Messages window and does not initiate the credit card application process. |

OE Promotional Messages

ISABELLA BIRD

Use your Isabella Bird card today and you will receive an additional 5% on your order.

Press Enter to exit |

Field |

Description |

Credit card description (unlabeled field below window title) |

A description of the private label credit card, as defined in Working with Credit Card Application Services (WCCS). Alphanumeric, 30 positions; display-only. |

Message |

Up to four lines of text to display a promotional message to the private label credit card holder. The promotional message is defined for the private label credit card using Working with Credit Card Application Services (WCCS). Alphanumeric, four 60 positions fields; display-only. |

Credit Card Application: Sample Messages

Purpose: A sample of the messages that are generated during the credit card application process are displayed below.

• Pre-Approval Phase: Customer Approved for Credit Card Application

• Pre-Approval Phase: Customer Declined for Credit Card Application

• Credit Decision Phase: Customer Accepts Credit Card Offer and is Approved

• Credit Decision Phase: Customer Accepts Credit Card Offer and is Declined

• Credit Decision Phase: Customer Refuses Credit Card Offer

Pre-Approval Phase: Customer Approved for Credit Card Application

In this situation, the credit card application request is approved by the credit card service, indicating the customer is qualified to apply for the credit card.

Pre-Approval request message:

<Message source="RDC" target="IL" type="CWCreditCardApplicationRequest">

<CWCreditCardApplicationRequest type="PreApproval">

<ApplicationRequest companyID="555" createDate="09262007" merchantReference="555000000550005" actionCode="PreApproval" customerNbr="000000550" division="06" firstName="SUSAN" initial="E" lastName="RUDESEAL" addressLine1="9444 BOCA RIVER CR" city="WEST COVINA" state="CA" zip="91790" country="USA" phoneNumber="9786322723" soldtoEmail="srudeseal@msn.com" shiptoAddressLine1="9444 BOCA RIVER CR" shiptoCity="WEST COVINA" shiptoState="CA" shiptoZip="91790" shiptoCountry="USA" shiptoEmail="srudeseal@msn.com" />

</CWCreditCardApplicationRequest>

</Message>

Pre-Approval response message:

<Message source="HSBC" target="CWDirect">

<CWCreditCardApplicationResponse mode="Online">

<ApplicationResponse companyID="555" merchantReference="555000000550005" customerNbr="000000550" ccAccountNumber="************0000" creditLimit="03000" applicationStatus="A" actionCode="PreApproval" ccOfferNbr="71801048711625" />

</CWCreditCardApplicationResponse>

</Message>

Pre-Approval Phase: Customer Declined for Credit Card Application

In this situation, the credit card application request is declined by the credit card service, indicating the customer is not qualified to apply for the credit card.

Pre-Approval request message:

<Message source="RDC" target="IL" type="CWCreditCardApplicationRequest">

<CWCreditCardApplicationRequest type="PreApproval">

<ApplicationRequest companyID="555" createDate="09262007" merchantReference="555000000377005" actionCode="PreApproval" customerNbr="000000377" division="06" firstName="BARBARA" lastName="ABRAMSON" addressLine1="25 FRENCH RD" city="TEMPLETON" state="MA" zip="014681135" country="USA" shiptoAddressLine1="25 FRENCH RD" shiptoCity="TEMPLETON" shiptoState="MA" shiptoZip="014681135" shiptoCountry="USA" />

</CWCreditCardApplicationRequest>

</Message>

Pre-Approval response message:

<Message source="HSBC" target="CWDirect">

<CWCreditCardApplicationResponse mode="Online">

<ApplicationResponse companyID="555" merchantReference="555000000377005" customerNbr="000000377" ccAccountNumber="************0000" creditLimit="00000" applicationStatus="PC" actionCode="PreApproval" />

</CWCreditCardApplicationResponse>

</Message>

Credit Decision Phase: Customer Accepts Credit Card Offer and is Approved

In this situation, the customer accepts the credit card offer and the credit card application request is approved by the credit card service.

Credit Decision request message:

<Message source="RDC" target="IL" type="CWCreditCardApplicationRequest">

<CWCreditCardApplicationRequest type="CreditDecision">

<ApplicationRequest companyID="555" createDate="09262007" merchantReference="555000000548005" actionCode="CreditDecision" customerNbr="000000548" division="06" firstName="GWENDOLYN" lastName="SHEPARD" addressLine1="102 E FULLER ST" city="VISTA" state="CA" zip="92084" country="USA" phoneNumber="9786322723" soldtoEmail="gshepard@msn.com" shiptoAddressLine1="102 E FULLER ST" shiptoCity="VISTA" shiptoState="CA" shiptoZip="92084" shiptoCountry="USA" shiptoEmail="gshepard@msn.com" dateOfBirth="02281964" socialSecurityNbr="562626560" customerResponse="A" ccOfferNbr="71801048709763" />

</CWCreditCardApplicationRequest>

</Message>

Credit Decision response message:

<Message source="HSBC" target="CWDirect">

<CWCreditCardApplicationResponse mode="Online">

<ApplicationResponse companyID="555" merchantReference="555000000548005" customerNbr="000000548" ccAccountNumber="************2122" creditLimit="04000" applicationStatus="A" actionCode="CreditDecision" applicationNbr="070926200008" ccOfferNbr="71801048709763" />

</CWCreditCardApplicationResponse>

</Message>

Credit Decision Phase: Customer Accepts Credit Card Offer and is Declined

In this situation, the customer accepts the credit card offer, but the credit card application request is declined by the credit card service.

Credit Decision request message:

<Message source="RDC" target="IL" type="CWCreditCardApplicationRequest">

<CWCreditCardApplicationRequest type="CreditDecision">

<ApplicationRequest companyID="555" createDate="09242007" merchantReference="555000000534005" actionCode="CreditDecision" customerNbr="000000534" division="06" firstName="FRANCIS" initial="P" lastName="HYNENAN" addressLine1="19 S END" city="TEXAS CITY" state="TX" zip="77590" country="USA" phoneNumber="5086529489" shiptoAddressLine1="19 S END" shiptoCity="TEXAS CITY" shiptoState="TX" shiptoZip="77590" shiptoCountry="USA" dateOfBirth="10121986" socialSecurityNbr="577175552" customerResponse="A" ccOfferNbr="71801048591694" />

</CWCreditCardApplicationRequest>

</Message>

Credit Decision response message:

<Message source="HSBC" target="CWDirect">

<CWCreditCardApplicationResponse mode="Online">

<ApplicationResponse companyID="555" merchantReference="555000000534005" customerNbr="000000534" actionCode="PreApproval" errorCode="ERR" errorText="Credit Card Application could not be processed. Contact HSBC - ERR" />

</CWCreditCardApplicationResponse>

</Message>

Credit Decision Phase: Customer Refuses Credit Card Offer

In this situation, the customer refuses the credit card offer.

Credit Decision request message:

<Message source="RDC" target="IL" type="CWCreditCardApplicationRequest">

<CWCreditCardApplicationRequest type="CreditDecision">

<ApplicationRequest companyID="555" createDate="09262007" merchantReference="555000000550005" actionCode="CreditDecision" customerNbr="000000550" division="06" firstName="SUSAN" initial="E" lastName="RUDESEAL" addressLine1="9444 BOCA RIVER CR" city="WEST COVINA" state="CA" zip="91790" country="USA" phoneNumber="9786322723" soldtoEmail="srudeseal@msn.com" shiptoAddressLine1="9444 BOCA RIVER CR" shiptoCity="WEST COVINA" shiptoState="CA" shiptoZip="91790" shiptoCountry="USA" shiptoEmail="srudeseal@msn.com" customerResponse="R" ccOfferNbr="71801048711625" />

</CWCreditCardApplicationRequest>

</Message>

Credit Decision response message:

<Message source="HSBC" target="CWDirect">

<CWCreditCardApplicationResponse mode="Online">

<ApplicationResponse companyID="555" merchantReference="555000000550005" customerNbr="000000550" applicationStatus="R" actionCode="CreditDecision" />

</CWCreditCardApplicationResponse>

</Message>

Credit Card Application Request Message (CWCreditCardApplicationRequest)

The CWCreditCardApplicationRequest message generated by CWDirect is used to send credit card application requests to a private label credit card service for approval.

This message is used for two phases of the credit card application process: