3. Defining Attributes Specific to Deposit Products

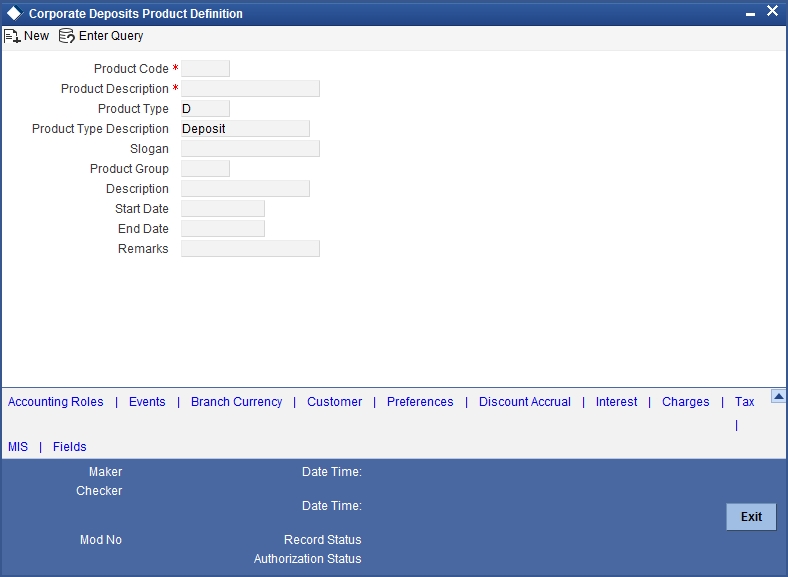

In this chapter, we shall discuss the manner in which you can define attributes specific to a Corporate Deposits product. You can create a deposits product in the ‘Corporate Deposits Product Definition’ screen, invoked from the Application Browser. In this screen, you can enter basic information relating to a deposits product such as the Product Code, the Description, etc.

This chapter contains the following section:

3.1 Corporate Deposits Product Definition

This section contains the following topics:

3.1.1 Defining Corporate Deposits Product Details

In the ‘Corporate Deposits Product Definition’ main screen you can define generic details like the type of product, start date, end date etc. You can invoke the ‘Corporate Deposits Product Definition’ screen by typing ‘CDDPRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

For any product you create in Oracle FLEXCUBE, you can define generic attributes, such as branch, currency, and customer restrictions, interest details, tax details, etc., by clicking the appropriate icon in the horizontal array of icons in this screen.

| Button | Description | ||

|---|---|---|---|

| Accounting Roles | Click this button to define the accounting role to accounting head mapping. | ||

| Events | Click this button to select the events for the product and then maintain event-wise accounting entries and advices. | ||

| Branch & Currency | Click this button to maintain the list of allowed/ disallowed branches and currencies for the product. | ||

| Customer | Click this button to maintain the list of allowed/ disallowed customers/customer categories. | ||

| Preferences | Click this button to define preferences like tenor, rollover parameters, liquidation order etc. | ||

| MIS | Click this button to capture MIS related parameters. | ||

| Interest | Click this button to define the Interest, Commission and Fees details. | ||

| Charges | Click this button to define charge components, rules, events and other associated details. | ||

| Tax | Click this button to associate tax rules and select tax currencies. | ||

| Fields | Click this button to provide values for the UDFs associated with the screen. | ||

| Discount Accrual | Click this button to define preferences related to discount accrual. |

For further information on the generic attributes that you can define for a product, refer the following Oracle FLEXCUBE User Manuals under Modularity:

- Product Definition

- Interest

- Charges and Fees

- Commission

- MIS

- Tax

- User Defined

- Settlements

3.1.2 Preferences Button

Preferences are the options that are available to you for defining the attributes of a product. The options you choose, ultimately, shape the product. For instance, you have the option of making tax applicable to a product, or waiving it. If you specify that tax is applicable for a product, a deposit contract involving the product will inherit the attribute. However, you can change it while processing the deposit.

Similarly, you can choose between the automatic liquidation of schedules and manual liquidation; you can choose to allow rollover for a product, or deny it, and so on. You can define the preferences for a product that you are creating in the ‘Deposits Product Preferences’ screen.

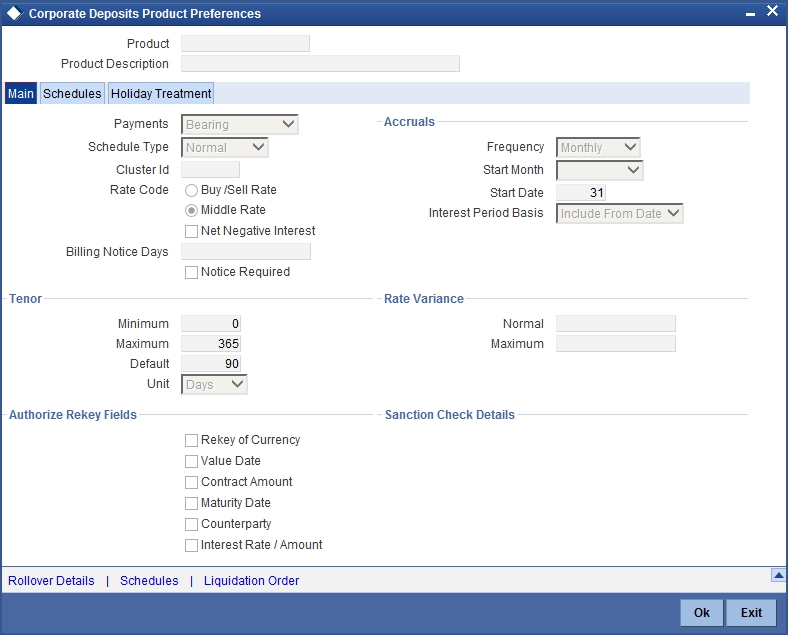

3.1.2.1 Main Tab

Define the main preferences in the ‘Main’ tab of the ‘Deposits Product Preference’ screen..

Payment

Specify the payment method for the main interest is to be the following:

- Bearing

- Discounted

- True Discounted

This cannot be changed at the time of processing a deposit.

Bearing

The interest is liquidated on schedule payment date(s).

Discounted

In this interest payment method, the Interest is deducted from the principal at the time of initiating the deposit.

For example, you have accepted a deposit of USD 10,000 from Mr. Brian Williams, under the Short Term Deposits from Individuals scheme, at 10% interest, for a year.

Under the Discounted type of interest payment, the total interest calculated for the tenor of the deposit, USD 1,000 is deducted from the nominal (USD 10,000) and only USD 9,000 is accepted. This forms the principal of the deposit. At Maturity, Mr. Brian Williams gets back USD 10,000.

The formula for computing discounted interest is P*N*R/100.

Here,

- P - Principal

- N - Period

- R - Annualized Interest Rate

True Discounted

In this Interest payment method, the interest is calculated on the principal in a manner differing slightly from the discounted method. The interest rate is applied on the Principal instead of the Nominal, as is done in the Discounted method.

For example, you have accepted a deposit of USD 10,000 from Mr. Brian Williams, under the scheme Short Term Deposits from Individuals, at 10% interest for a year.

Under the true discounted type of interest payment, the interest calculated on the principal, USD 900, (arrived at after deducting 10% interest on the principal) is deducted from the nominal (USD 10,000) and USD 9,100 is accepted. This forms the actual principal of the deposit. At Maturity, Mr. Brain Williams gets back USD 10,000.

The formula for computing truly discounted interest is P*N*R/[100* (1 + N*R/100)].

Here

- P - Principal

- N - Period

- R - Annualized Interest Rate

Schedule Type

Indicate the type of repayment schedule that you to want have for the product. It could be any of the following:

- Capitalized

- Normal

Capitalized

When you indicate capitalization for the schedules, and define schedules for the various components of the deposit (through the schedule definitions screens), the interest is not paid to the customer on the schedule dates but is capitalized (the unpaid interest is added to the unpaid principal and this becomes the principal for the next schedule).

Note

For capitalization only the interest component, defined as Main Interest in the Product ICCF screen, will be considered.

Normal

Indicate Normal as the schedule type, you will be able to define your own schedules through the Product Default Schedules screen. The Schedule Type applies to all deposits involving the product and cannot be changed during deposit processing.

Cluster Identification

If the deposit you are initiating is a cluster deposit, then the ID of the cluster you have defined for the product involving the deposit will be displayed in the screen by default. However, you can change the cluster for this particular deposit, by changing the cluster ID. Select the ID of your choice from the option list.

Notice Required

Check this box to send a notice before payment due date.

Billing Notice Days

Specify the number of days prior to which the billing notice should be generated.

Setting Accrual Details

Frequency

Apart from the principal, you can have other components for a deposit, such as Interest, Charge or Fees, and these can be accrued over the tenor of the deposit before being realized into the expense or income accounts respectively. You can define the frequency at which you would like to accrue these components as part of the preferences that you specify.

The attributes of these other components are defined in the ICCF sub-system of Oracle FLEXCUBE. For components that have been marked for accrual, the frequency is specified in this screen (Product Preferences screen).

When you run the Automatic Contract Update function at the End of Day, the system carries out the accruals according to the frequency that you specified. However, if the accrual date falls on a holiday, then the accruals are done as per your holiday handling specifications in the Branch Parameters screen:

- If you have specified that automatic events are to be processed for a holiday(s) on the working day before the holiday, the accruals falling due on a holiday(s) will be processed during End of Day processing on the last working day before the holiday.

- If you have specified that the automatic events are to be processed for a holiday(s) on the working day following the holiday, the automatic events falling due on a holiday(s) will be processed on the next working day, during the Beginning of Day processing.

The frequency can be one of the following:

- Daily

- Monthly

- Quarterly

- Half yearly

- Yearly

Start Month

If you set the accrual frequency as quarterly, half yearly or yearly, you have to specify the month in which the first accrual has to begin, besides the date.

Start Date

In the case of monthly, quarterly, half yearly or yearly accruals, you should specify the date on which the accruals have to be done. For example, if you specify the date as 30, accruals will be carried out on the 30th of the month, according to the frequency that you have defined.

If you want to fix the accrual date for the last working day of the month, you should specify the date as 31 and indicate the frequency. If you indicate the frequency as monthly, the accruals will be done at the end of every month - that is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February.

If you specify the frequency as quarterly, and fix the accrual date as the last day of the month, then the accruals will be done on the last day of the month at the end of every quarter. It works in a similar fashion for half-yearly accrual frequency.

For instance, if you specify the frequency as half yearly, the start date as 31, and the start month as June, the system will accrue interest for the first time on 30 June 1997 for the period from 01 January to 30 June 1997, and for the second time on 31 December 1997, for the period from 01 July 1997 to 31 December 1997.

Specifying Tenor Related Details

Minimum

Set the minimum limits for deposit tenor.

Maximum

Set the maximum limits for deposit tenor.

For example, you have a product Short Term Deposits for the Corporate Sector - SDC3. This product is for Short Term Deposits for the Corporate Sector. The deposits involving this product will have tenors like three months, six months etc. For such a product you can set a minimum tenor of one month and a maximum tenor of one year.

Default

Specify a standard tenor or a default tenor. The Default tenor is the tenor that is associated with a deposit involving this product. However, the Default tenor applied on a deposit can be changed during deposit processing.

For example, you can define a default tenor; say 6 months, for the product we just discussed, SDC3. This Default tenor will apply to all the deposits involving the product. However, at the time of capturing the details of a deposit, you can change the tenor.

Unit

In the minimum, maximum and default tenor fields, set the duration numerically. Here, specify the unit of the duration. It could be:

- Days

- Months

- Years

For example, to define the default tenor, in the default tenor field, you will define the number and the unit - days, months, years, in the Unit field.

Suppose, for a product, you want to define the default tenor as 150 days. Then you should give the following values in the fields:

Default tenor - 150

Unit - Days

To define a default tenor of 10 months, say, for a product, you should give the following values in the fields:

Default tenor - 10

Unit - months

To define a default tenor of eight years, for a product, you should give the following values in the fields:

Default tenor - 8

Unit - years

You should follow the same process for defining the minimum and maximum tenor for a product.

Specifying Exchange Rate Variance

When a deposit involves a currency conversion the rates defined for the Rate Type, that has been specified for the product, will be picked up by default (examples for Rate Type could be cash rate, borrowing rate, lending rate, etc.,). This default can be changed.

Impose some restrictions on this changed rate, as follows:

Maximum

Do not apply an exchange rate on a deposit, involving the product that you are creating, that is greater than the value that you specify as the Maximum Variance. If the exchange rate exceeds the standard exchange rate by the maximum variance you have defined for the product, then the system will not allow you to store the contract.

For example, you have specified the Normal variance as 3% and the Maximum variance as 6% for Product DD01.

Now, if the Exchange Rate to be applied on a contract in exceeds the standard exchange rate that has been maintained by 4% to 6%, the system will ask you for an override before applying this rate.

However, if the exchange rate exceeds the standard exchange rate by over 6%, then the system will not allow you to store the contract.

Note

The exchange rate variance is a percentage.

Normal

If the Exchange Rate Variance exceeds the Standard Exchange Rate for the Rate Type by this value (normal variance), then the system will ask you for an override before proceeding to apply the exchange rate.

Indicating Values to be Re - keyed during Authorization

Specify the values that the authorizer of a deposit contract has to rekey at the time of authorizing.

All operations on a deposit (Input, Modification, Reversal, Manual Liquidation or Manual Roll-over) have to be authorized:

- By a user other than the one who carried out the operation

- Before you can begin the End of Day operations

When you invoke a deposit for authorization - as a cross-checking mechanism to ensure that you are calling the right deposit - you can specify that the values of certain fields should be entered before the other details are displayed. The complete details of the deposit will be displayed only after the values to these fields are entered. This is called the rekey option. The fields for which the values have to be given are called the rekey fields.

If no rekey fields have been defined, the details of the deposit will be displayed immediately once the authorizer calls the deposit for authorization. The rekey option also serves as a means of ensuring the accuracy of inputs.

Specify any or all of the following as rekey fields:

- Currency

- Value Date

- Contract amount

- Maturity Date

- Counter Party

- Interest Rate / Amount

- Fee Currency

- Fee Amount

- Fee Refund Amount

- Fee value Date

- Fee Start Date

- Fee End Date

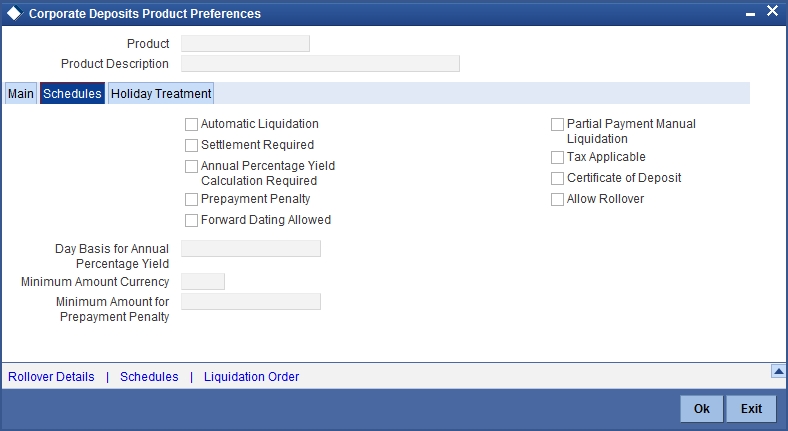

3.1.2.2 Schedules Tab

Define schedule related preferences in the ’Schedules’ tab of the ‘Corporate Deposits Product Preferences’ screen.

In this screen, specify the following details:

Components of a deposit can be liquidated automatically or manually. You should indicate whether the mode of liquidation of repayment schedules is to be automatic. Specify Auto liquidation if you want the components of a deposit involving this product to be liquidated automatically.

If you opt for automatic liquidation, a schedule will be automatically liquidated on the day it falls due, during Beginning of Day processing (by the Automatic Contract Update function.)

The manner in which the automatic schedule liquidation date falling on a holiday will be handled is based on your holiday handling specifications in the Branch Parameters table:

- If a schedule falls on a holiday it will be processed on the last working before the holiday - during End of Day processing - if you specified that processing (of such schedules) has to be done on the last working day before the holiday.

- If you have specified that processing has to be done only up to the System Date (today), then only the events scheduled for today (the last working day before the holiday) will be processed. The events of the holiday are processed on the next working day after the holiday, during Beginning of Day processing.

If you do not specify Auto liquidation, you have to give specific instructions for liquidation through the Manual Liquidation screen on the day you want to manually liquidate the schedule.

Annual Percentage Yield Calculation Required

Oracle FLEXCUBE allows you to calculate the Annual Percentage Yield (APY) so as to enable your customer to compare interest rates offered by different banks. Select this option to indicate that for contracts involving this product, APY should be calculated during take down, or during Value Dated amendments or contract amendments resulting in change of cash flows (change of schedule).

Note

APY is calculated for a contract only if this parameter has been enabled at the Branch as well as the Product level.

You can calculate the APY by using the following formula:

APY earned = 100 * [(1+Interest Earned / Balance) ^ (365/Days in Period) -1]

Where,

- Balance - is the average daily balance in the account for the period.

- Interest Earned - is the actual amount of interest earned on the account for the period.

- Days in Period - is the actual number of days for the period. The days in terms will be determined by the compounding frequency (specified in the field - Day Basis for APY).

Recompute Schedules

When defining the preferences for a product, you have to specify whether the interest on the future schedules of a deposit (involving the product) has to be recalculated in case of an advance repayment on a schedule (that is, when a repayment is made before its due date).

Forward Dating Allowed

The Value Date of a deposit (that is, the date on which it is initiated) can be:

- The date on which it is input (booked)

- A date in the past

- A date in the future

Indicate whether a deposit involving a product can have a Value Date in the future. A deposit can have a value date in the future only if you have allowed it for the product, which it involves. An initiation date in the past or today can be indicated for any deposit.

When a deposit with a Value Date in the future is stored, no accounting entries will be passed on the date of input. The deposit will be initiated by the Automatic Contract Update function during the Beginning of Day (BOD) processes on the Value Date (date of initiation). All the necessary accounting entries will be passed on this date.

However, if the initiation date (Value Date) falls on a holiday, then, the deposit will be initiated as per your holiday handling specifications in the Branch Parameters screen:

- If you have specified that automatic processes are to be carried out for holidays, the deposit slated for initiation on the holiday will be initiated during End of Day processing on the last working day before the holiday.

If you have specified that the automatic processes are to be carried out only till the System Date (today s date), the deposit slated for initiation on the holiday will be initiated on the next working day, immediately after the holiday, during Beginning of Day processing.

Partial Payment – Manual Liquidation

Opt for partial payment as manual liquidation for your deposit.

Apply Tax

Specify whether tax should be applied on deposits involving a product. If tax is specified for the product, you can waive it for specific deposits. However, if you have specified that tax is not applicable to the product, you will not be able to levy tax on any deposit involving the product.

Allowing Pre-Payment With Over Draft Schedules

Indicate whether a penalty is to be applied on a deposit involving the product if a withdrawal is made before it is due. If you have made a principal repayment before the schedule date, you can give a lower interest on the amount that is repaid to the customer before it is due. A prepayment is a withdrawal that is made before it is due. The following example explains a prepayment.

For example, Parivallal Express Services has deposited USD 10,000 at 14% interest on 1 January 1998. The deposit is to mature on 31 March 1998. There are three monthly payment schedules for the interest and the principal is to be paid at maturity.

Now, Parivallal withdraws the entire principal on 31 January 1998, that is, on the first schedule payment date of the interest. This amounts to a prepayment. You have accepted the deposit on the understanding that it will be with you for three months. When it is withdrawn in just one month you have the option of charging a prepayment penalty. This could be in the form of a lower rate of interest (lower than the 14% that was to be paid on the principal for three months) for the one-month period, or a flat amount.

For the amount that is paid in advance, the penalty interest (that is, the rate of interest that is lower than the normal interest rate, or it can be a flat one-time prepayment penalty amount) should be specified when the repayment is being processed for the deposit. Here is another example to explain the concept:

However, through the Product Preferences screen, you can only indicate whether penalty can be applied on deposits involving the product. The actual rate or the amount has to be specified when the prepayment is processed, through the ‘Manual Liquidation’ screen.

Certificate of Deposit

If the product you are defining involves contracts that are certificates of deposits, you should specify so in this screen.

Net Negative Interest

Check this box to net the positive and negative amount paid to the customer. You can check this box only if ‘Negative Interest Allowed’ and ‘Main Component’ are checked for a product.

Allow Rollover

Specify whether a deposit, involving the product you are defining, can be rolled- over into a new deposit if it is not liquidated on its Maturity Date.

When creating a product you can specify whether roll-over of a deposit, involving the product, is allowed. If you specify that roll-over is allowed for the product, it will be applicable to all the deposits involving the product. However, at the time of processing a specific deposit involving this product, you can indicate that roll-over is not allowed.

However, if you specify that roll-over is not allowed for a product, you cannot rollover a deposit involving the product. The terms of a deposit that is rolled- over can be the same as those of the original deposit or they can be different. (The terms that can be changed are discussed in the chapter Rolling- over a deposit. Please refer this chapter). If the terms should be different, they should be specified during deposit processing.

Day Basis for Annual Percentage Yield

As a product preference, if you have indicated that APY should be calculated for contracts involving the product, you will have to specify the frequency at which APY calculation should be performed. You can enter the number of days per year for APY calculation here.

The following example illustrates the manner in which APY is calculated and the variations that may occur.

Minimum Amount Currency

Specify the currency of the minimum amount for auto liquidation.

Minimum Amount for Auto Liquidation

During auto liquidation for your deposit, you can specify a minimum amount that should be liquidated.

Your specification for a product will apply to all contracts involving the product. On automatic liquidation, if a schedule amount is more than the defined Minimum Amount for Auto Liquidation, the system checks the payment account for the available balance.

If the funds available in the account exceed the defined minimum amount, the schedule is liquidated entirely or to the tune of the available funds in the account. If the funds in the payment account are less than the minimum amount specified for the product, the system liquidates the schedule only if it can be entirely liquidated. If not, the system marks the schedule as ‘pending’ until there are sufficient funds in the account.

The liquidation order is used, when you want to liquidate the dues in a certain order, say interest first and then the principal. For instance, if there is a penalty interest, you may wish to recover it first.

Suspense General Ledger for Depreciation Assignment

Specify the suspense GL for depreciation. It is mandatory only if the ‘Assignment Allow’ option is checked and the product is of Type Deposit.

A suspense GL is used for split interest (the interest is split between the old counter party and the new assignment party from the assignment date) and total coupon interest (the Assignment party gets the entire interest) type of assignments.

For such Assignment types, the system creates a new deposit for the Assignment party for the Assignment amount. The suspense GL that you select in this field is debited for the Assignment amount, instead of debiting the account of the new counterparty.

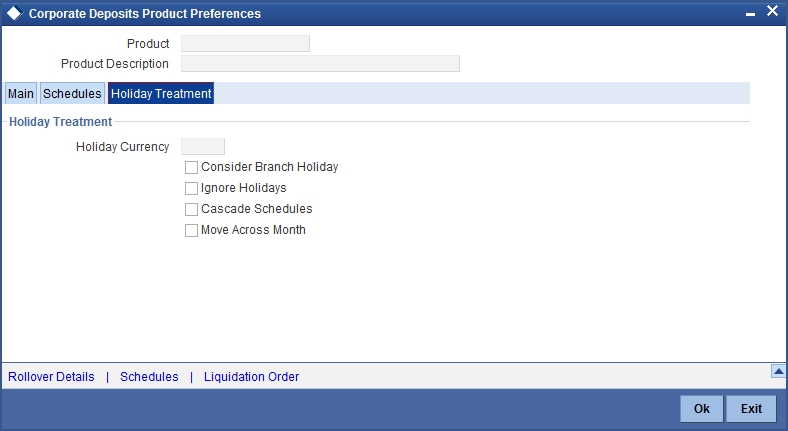

3.1.2.3 Holiday Treatment Tab

Specify holiday handling preferences for processing schedules falling due on holidays in the ‘Holiday Treatment’ tab of the ‘Corporate Deposits Product - Preferences’ screen.

In this screen, specify the following details:

Specifying Details of Holiday Currency

Specify here the country of the deposit currency for which the holiday table should be checked before drawing the payment schedules related to the deposit.

By default, the currency to be checked is the deposit currency. If the input here is different from the deposit currency, the holiday table is checked for both the currencies.

Consider Branch Holiday

Specify whether the system should consider local branch holiday while processing the deposit payments. In case you opt for this and do not check the ‘Ignore Holiday’ option, the system takes the schedule movement defined for the local branch holiday and the holidays defined for each currency in the list.

The preference you maintain here will be defaulted at the contract and you can also choose to change it for the specific contract.

Ignore Holidays

You have defined automatic repayment schedules, but there is a chance that one or more schedules may fall due on a holiday. In such a case, you have two choices:

- Ignore the holiday and retain the due date on that day

- Move it either backward or forward, by specifying so in the subsequent fields in this screen.

Check this box if you wish to ignore holidays at the time of drawing up schedules.

Cascade Schedules

The question of cascading schedules arises only if:

- You have specified that a schedule falling due on a holiday has to be moved forward or backward; and,

- The schedule has been defined with a definite frequency.

If you check this box to cascade schedules, the schedule date following the changed date will be shifted in accordance with the changed date as per the frequency.

If you opt not to cascade schedules, even if one of the schedule dates are changed, the following schedules will be fixed as per the original definition.

Move Across Months

If you have chosen to move a schedule falling due on a holiday either to the next working day or the previous one and it crosses over into a different month, the schedule date will be moved only if you so indicate in this field. If not, the schedule date will remain in the same month.

Check this box if you want to allow movement across the month for a schedule date that has been moved forward or backward.

In the ‘Main’ tab of the screen, you have to specify other additional details also. You can do this in the appropriate sub-screens, as mentioned below:

Each of the above sub-screens is explained in details in the following sections.

| Button | Remarks | ||

|---|---|---|---|

| Rollover Details | Click this button to invoke the ‘Rollover Details’ screen. | ||

| Schedules | Click this button to define schedule details for different components. | ||

| Liquidation Order | Click this button to maintain order for liquidation of components. |

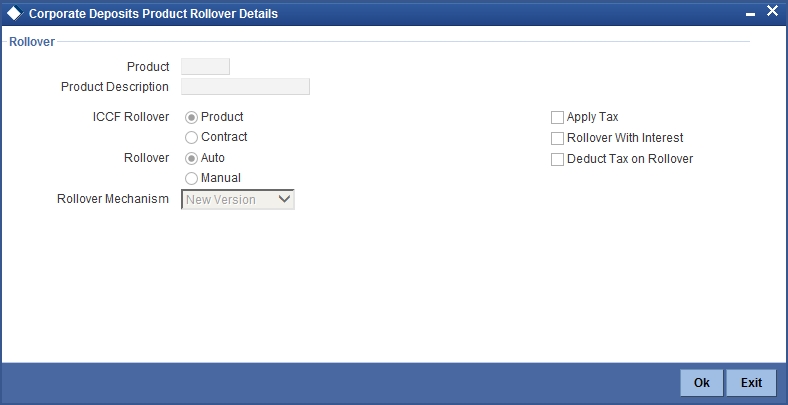

3.1.2.4 Rollover Button

Specify additional details pertaining to rollover in the ‘Rollover Details’ screen. To invoke this screen, click ‘Rollover Details’ button in the ‘Deposits Product Preferences’ screen.

For a detailed explanation on the above screen, refer the chapter ‘Rolling-over a Deposit’ in this User Manual.

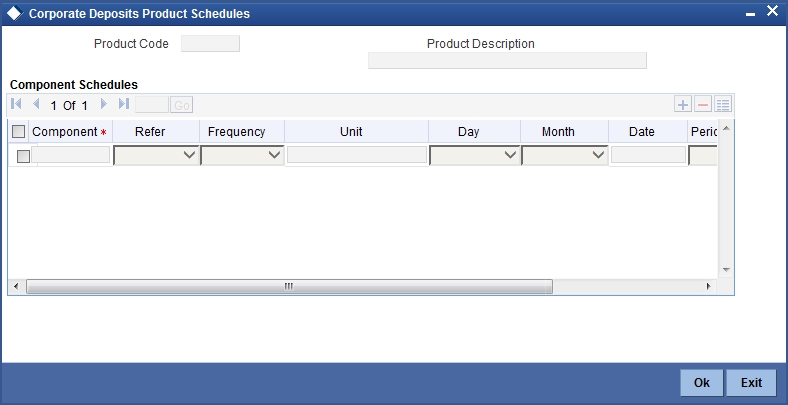

3.1.2.5 Schedules Button

When creating a deposit product, you can define schedule details such as the reference date, the frequency, the month and the date for each component. You can capture these details in the ‘Product Default Schedules’ screen. To invoke this screen, click ‘Schedules’ button in the ‘Deposits Product Preferences’ screen.

For a detailed explanation on the above screen, refer the section titled ‘Specifying Schedule Details for Components’ in the ‘Processing Repayments’ chapter of this User Manual.

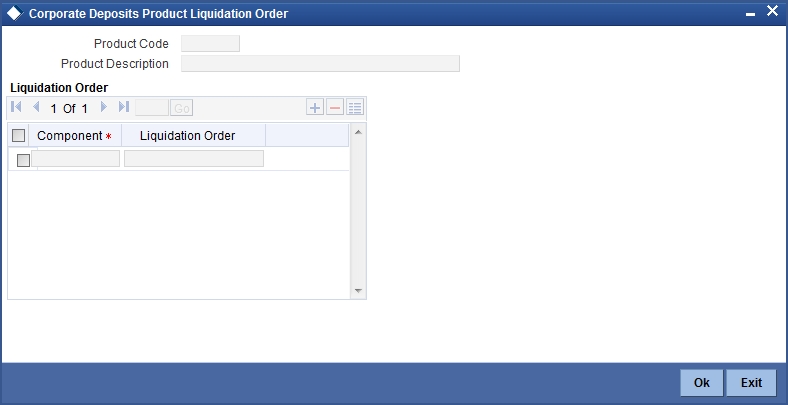

3.1.2.6 Liquidation Order Button

If you have defined automatic liquidation for the product, you can specify the order of liquidation of the various components. The components should have the following:

- Schedules that fall due on the same day

- The same repayment account

Specify the order of liquidation in the ‘Component Liquidation Order’ screen. You can invoke the ‘Component Liquidation Order’ screen by clicking ‘Liquidation Order’ on the ‘Corporate Deposits Product – Preferences’ screen.

When Funds in Repayment Account are Insufficient

When funds are insufficient, the component(s) for which funds are available will be liquidated in the order that you have specified. Liquidation of those components for which funds are insufficient is dependent on, whether you have specified, that the availability of funds has to be verified (You can specify this in the Contract Preferences screen by checking the Verify Funds field). If you have indicated that the availability of funds has to be ascertained and the funds are insufficient, then the components that leave the repayment account with a debit balance will not be liquidated. The liquidation will be done to the extent of the balance available in the repayment account and in the order of liquidation. The payment schedules for those components, which have not been liquidated or have been partly liquidated, will be left as outstanding.

If you do not want to Ascertain Availability of Funds

If you have not indicated that the availability of funds has to be verified before liquidation, all the components will be liquidated leaving the repayment account with a debit balance. However, you have to specify that overdraft facility is available for the repayment account. The payment schedule will be marked as liquidated. If the account has an overdraft limit and that limit has been exceeded, the components due will be liquidated, after recording an automatic override for exceeding the limit.

On the repayment account that has a debit balance, the debit interest as specified for the type of account (current or savings), through the Interest and Charges sub-system of Oracle FLEXCUBE, will be applied. If the repayment account has not been defined for overdraft, the schedules will not be liquidated if the funds are insufficient.

Note

If you do not specify the liquidation order, the components will be liquidated in the following order:

- Penalty Interest

- Interest

- Principal

An Example of Defining Deposit Product

Let us assume that amongst other financial services, you bank is offering short-term deposits. Short-term deposits can be of different types:

Short Term Deposits for Domestic customers

Short Term Deposits for overseas customers

Short Term Deposits for three months and Short Term Deposits for six months are examples of specific services that you offer. Each of these services can, therefore, be considered products. Let us consider the steps involved in accepting a short-term deposit from a Domestic customer. You would specify:

The deposit amount

The tenor of the deposit

The rate of interest

The tax details

The GLs and customer accounts to which the accounting entries should be posted.

The advices that should be generated

If you accept 20 deposits a day, you would repeat these operations as many times. By defining Short Term Deposits For Domestic Customers as a product and defining attributes for it, you will be able to render these operations easier. For example, for a product, you can define, among other attributes, the following:

The standard tenor

The rate of interest

The tax details

The GLs to which the accounting entries should be posted

The advices that should be generated

Every time you accept a short-term loan from a Domestic customer, the system will pick up the details defined for the product Short Term Deposit for Domestic Customers.

Every deposit that you accept inherits the attributes of the product that it involves. However, you can change the inherited attributes for a specific deposit to suit your requirements.

The advantage of defining a product is that you simplify the task of accepting deposits. The following example, illustrates the concept of products.

For example, a deposit could be of any of the following types:

Demand Deposit

Certificate of Deposit

Term Deposit

Cluster Deposit

You can define any number of Term Deposit products having varying tenors, rates of interest, you can allow or deny roll-over, apply or waive tax and so on. Each of these types of deposit definitions, with their specific set of attributes constitutes a product.

For instance, under Term Deposits, you may accept Short Term Deposits and Long Term Deposits. Under the category Short Term Deposits, you may have a further sub-division of categories:

Domestic Short Term Deposits (Short Term Deposits from individuals within the country).

Corporate Short Term Deposits (Short Term Deposits from Corporate Houses).

You can define two different products one for short-term deposits in the Domestic sector and the other for short-term deposits in the corporate sector.

SDD1 - Short Term Deposits for the Domestic sector

SDC2 - Short Term Deposits for the corporate sector:

Attributes of SDD 1:

Rate of interest - 14%.

Maximum tenor - 2 years.

Quarterly interest payments, Principal payment at maturity.

Attributes of SDC 2:

Rate of interest - 16%.

Maximum tenor - six months.

Repayment at Maturity.

In this example, only three attributes have been defined. You can define many more attributes for a product.

All the deposits involving SDD1 are Short Term Deposits from individuals and they inherit the attributes of SDD1. You do not have to specify the terms each time you process a short-term deposit from an individual if you define SDD1 and input deposits involving it. The same is the case with SDC2, a short-term deposit product for the Corporate sector.

Similarly, you may have Long Term Deposits from the Domestic sector and from the Corporate sector. These broad categories of deposits share common attributes and hence you can define each of these as a product.

Since you define products for convenience, the attributes defined for the product are inherited by all the deposits involving the product. Yet you have room for flexibility. You can change the inherited attributes of a specific deposit to suit your customer s requirements at the time of processing the deposit.