5. Processing Repayments

When you accept a deposit, you also decide on the terms of the repayment of the deposit. You may have your own repayment schemes, for example, you may prefer monthly repayment of interest to quarterly repayments, and so on. Or, you may design repayment schedules to suit the convenience of your customer. Your customer may want to get back his deposit in equated monthly instalments, for example.

In Oracle FLEXCUBE, you can customize your repayment schedules for a deposit product. The same schedules will, by default, apply to all deposits involving the product. However, when processing a specific deposit, you can change the repayment schedule which it acquires from the product it involves.

This chapter contains the following sections:

- Section 5.1, "Corporate Deposits Product Preferences"

- Section 5.2, "Corporate Deposits Simulation Contract Input Details"

- Section 5.3, "Corporate Deposits Payment Input Details"

- Section 5.4, "Handling Prepayments"

- Section 5.5, "Foreclosure of Deposit"

- Section 5.6, "Payment Simulation"

- Section 5.7, "Generating Advice"

5.1 Corporate Deposits Product Preferences

This section contains the following topics:

5.1.1 Defining Schedules for Product

You can define schedules for the repayment of various components like the principal, interest, charges and fees.

The attributes of the schedules for a product, are defined through the Product Preferences screen. The following are the attributes of a repayment schedule:

- Mode of liquidation - auto or manual. This can be changed at the time of deposit processing.

- Recomputation of schedules when a repayment of principal is made before it is due.

- Liquidation of back valued schedules upon initiation of a deposit. This can be changed at the time of deposit processing.

- The schedule type - amortized, capitalized or normal

The Automatic Contract Update function automatically liquidates those schedules that you have marked for auto liquidation. If schedules are marked for manual liquidation, you will have to liquidate them through the Contract Schedule Payments function.

Once you specify the attributes of schedules in the Product Preferences screen, you have to define the frequency of repayments in the Product Schedules screen. When processing a deposit, you can change the schedule details that it acquires from the product it involves.

Note

If you do not define any schedules for the product, by default, the deposits involving the product will have bullet (or balloon) schedules. That is, all the components will be liquidated on maturity.

When creating a product in the Product Default Schedules screen, you can define schedules for all deposit components. This involves specifying the reference date, the frequency, the month and the date for each component. All deposits, involving the product, will acquire these attributes.

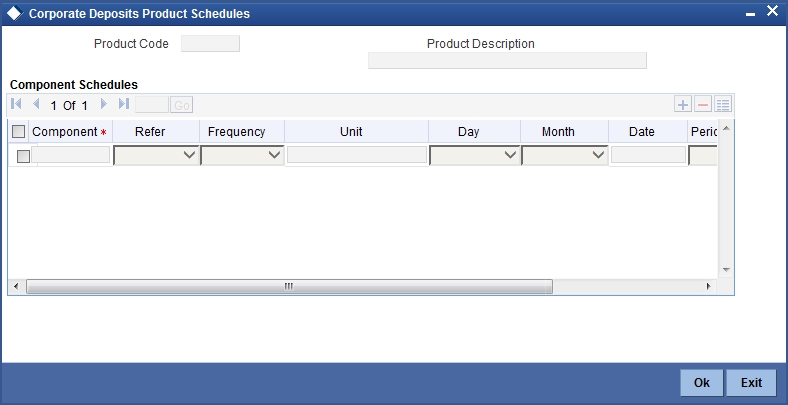

You should define the attributes of the schedules for a product through the ‘Corporate Deposits Product Schedules’ (CDDPRMNT) screen. To invoke the Product Default Schedules screen, click ’Preferences’ button in the Corporate Deposits Product Definition screen. The Product Preferences screen will be displayed, subsequently click ’Schedules’ button.

By default, the product code defined for the product is displayed in this field.

Product Description

By default, the description defined for the product at the product level is displayed in this field.

Component

Define different repayment schedules for the different components according to your needs. First of all, you should specify the component for which you want to define the schedule. All components − the principal and any other component depending upon your ICCF definition for the deposit − are available in the form of an option list. You will have to define schedules for each of them.

If you have indicated (in the Product Preferences screen) that the Schedule Payment Type is amortized, then, you will have to specify the frequency not for the principal but for the amortized principal (principal + total (main) interest accrued on the deposit, equally spread out across the number of schedules). In the option list, you will see Amortized displayed and you will have to define the frequency for this.

When defining repayment schedules for specific deposits, the amount of repayment needs to be specified only for the principal. The interest, commission and fee amounts will be calculated by the system automatically, depending on the repayment date and the principal (amount). However, for deposits with special interest, you will also have to provide the interest amount.

Reference

Indicate whether the dates of repayment schedules should be calculated based on the Value Date (date of initiation of the deposit) of the deposit involving the product, or a Calendar Date.

If you specify that the Reference is the Value Date (date of initiation of the deposit), the dates for schedule repayments will be based on this date and the Frequency.

If the Reference is specified as the Calendar Date, the dates for schedule repayments will be based on the Start Date (specified by you), the Month and the Frequency. The following example illustrates this concept:

Example

If the Value Date of a deposit is December 10, 1997 and you indicate the frequency as monthly and unit as 1, then the first schedule will be liquidated on January 10, 1998, the next one on February 10, 1998, and so on.

For the same deposit if you were to define a fortnightly schedule, you indicate the frequency as monthly and unit as 2. The first schedule will, in this case, be liquidated on December 25, 1997, the next one on February 10, 1998, and so on.

Frequency

For a periodic schedule, indicate the frequency of repayment for each component. This could be:

- Daily

- Weekly

- Monthly

- Quarterly

- Half-yearly

- Yearly

- Bullet

Unit

Specify the number of units for the frequency you have set for a particular component.

For example,

If you want a payment every 15 days, you will have to specify

- The frequency as Daily

- The units as 15

For payments every three weeks, you will have to define

- The frequency as weekly

- The unit as three

Date

Set the Reference as Calendar Date, and the frequency as weekly, quarterly, half-yearly or annual, indicate the month in which the first schedule falls due.

If you have set the Reference as Calendar Date, you should indicate the date on which the schedule should fall due. Specify 31 to indicate that the schedule should fall due on the last day of the month (that is, 31 for months with 31 days, 30 for months with 30 days and 28 or 29, for February).

The schedule repayment dates will be computed using the Frequency, (Start) Month and the (Start) Date.

A schedule date:

- Should be later than or the same as the Value Date.

- Cannot be beyond the Maturity Date.

Further, you can have only one schedule for a component for a date.

5.1.1.1 Setting Product Schedules Preferences

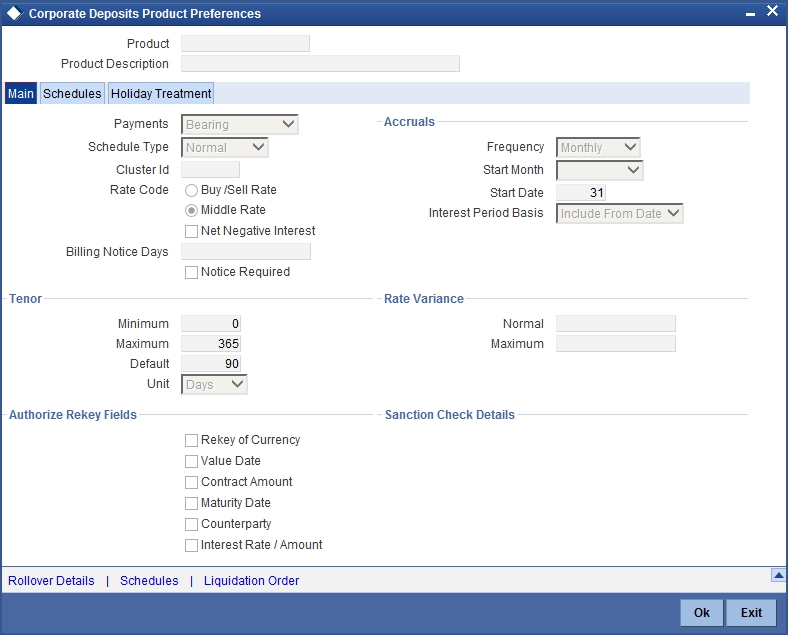

To set the Product Schedule Preferences, click the ‘Preferences’ button in the Corporate Deposits Product Definition Screen (CDDPRMNT)

Payment

Specify whether the payment method for the interest components is to be bearing, discounted, or true discounted. This cannot be changed at the time of processing a deposit.

Bearing

The interest is liquidated on schedule payment date(s).

Example

You have accepted a deposit of USD 10,000 from Ms Yvonne Cousteau, under the ‘Short Term Deposits from Individuals’ scheme, at 10% interest, for a year.

Now, under the bearing type of interest payment method, USD 10,000 is treated as the principal. Here, the deposit of USD 10,000 is collected from Ms Cousteau and the interest on it is paid out over the one year, which is the tenor of the deposit.

Discounted

In this interest payment method, the interest is deducted at the time of initiating the deposit.

For example,

Carrying forward the example of Ms Yvonne Cousteau’s deposit of USD 10,000, under the scheme Short Term Deposits from Individuals, at 10% interest for a year, under the discounted type of interest payment, the total interest (Actual/Actual) calculated for the tenor of the deposit, USD 1,000, is deducted from USD 10,000 and only USD 9,000 is accepted.

This forms the principal of the deposit. At maturity, Ms Cousteau gets back USD 10,000.

True discounted

In this interest payment method, the interest is calculated on the principal in a manner differing slightly from the Discounted method. The interest rate is applied on the Principal instead of the Nominal, as is done in the Discounted method.

This concept is explained in the following example:

You have accepted a deposit of USD 10,000 from Ms Yvonne Cousteau, under the Short Term Deposits from Individuals, at 10% interest, for a year.

Under the true discounted type of interest payment, the interest calculated on 10,000, that is USD 900, (arrived at after deducting 10% interest on 10,000) is subtracted from USD 10,000. Only USD 9,100 is accepted as a deposit from Ms Cousteau.

This forms the actual principal of the deposit. At maturity, Ms Cousteau gets back USD 10,000.

Schedule Type

Indicate the type of repayment schedule that you want to have for the product. It could be one of the following:

Capitalized

When you indicate capitalization for the schedules, and define schedules for the various components of the deposit (through the schedule definitions screens), the interest is not paid to the customer on the schedule dates but is capitalized (the unpaid interest is added to the unpaid principal and this becomes the principal for the next schedule).

Note

For capitalization, only the interest component defined as Main Interest in the Product ICCF screen will be considered.

Normal

Indicate Normal as the schedule type, you will be able to define your own schedules through the Product Default Schedules screen. The schedule type applies to all deposits involving the product and cannot be changed during deposit processing.

Auto Liquidation

Components of a deposit can be liquidated automatically or manually. In the Product Preferences screen you have to indicate whether the mode of liquidation of repayment schedules is to be automatic.

Specify Auto liquidation if you want the components of a deposit (involving a product) to be liquidated automatically.

In this case, a schedule will be liquidated automatically on the day it falls due, during beginning of day processing (by the Automatic Contract Update function).

Now, consider the following situation:

- You have indicated automatic liquidation.

- The schedule date falls on a holiday.

- You have specified (through the Contract Preferences screen) that the holiday be ignored while calculating the schedule date.

In such a situation, a repayment falling on a holiday would be processed according to you specification for holiday handling (in the Deposits Branch Parameters screen). It would be as follows:

- If you specified that processing has to be done on the last working day before the holiday for automatic events right up to the day before the next working day, the schedule falling on the holiday will be liquidated during end of day processing on the last working day before the holiday.

- If you specified that processing has to be done only up to the System Date, then only the events scheduled for today (the last working day before the holiday) will be processed. The events of the holiday will be processed on the next working day after the holiday, during beginning of day processing.

Recompute Schedules

Specify whether the interest on the future schedules of a deposit has to be recalculated in the case of a prepayment on a schedule (that is, when a Principal repayment is made before its due date).

Note

Please note that only the subsequent interest schedules will be redefined. The subsequent principal schedules will be marked as paid to the extent of the prepayment. In the case of an amortized schedule, the amount of repayment for the schedule immediately after the prepayment will thus be different from the rest of the schedules.

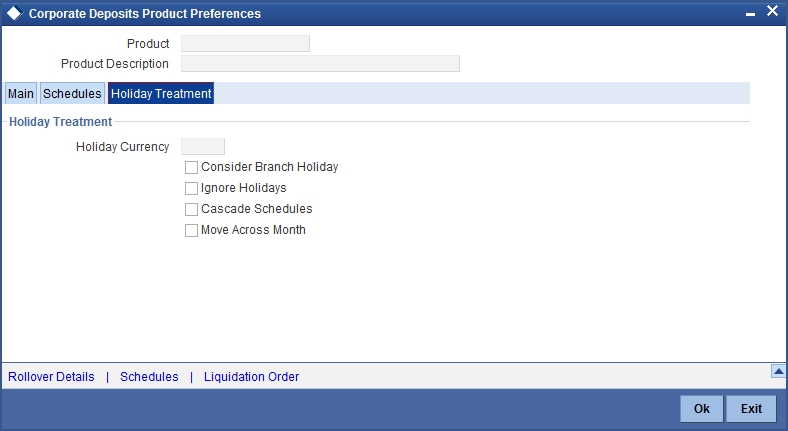

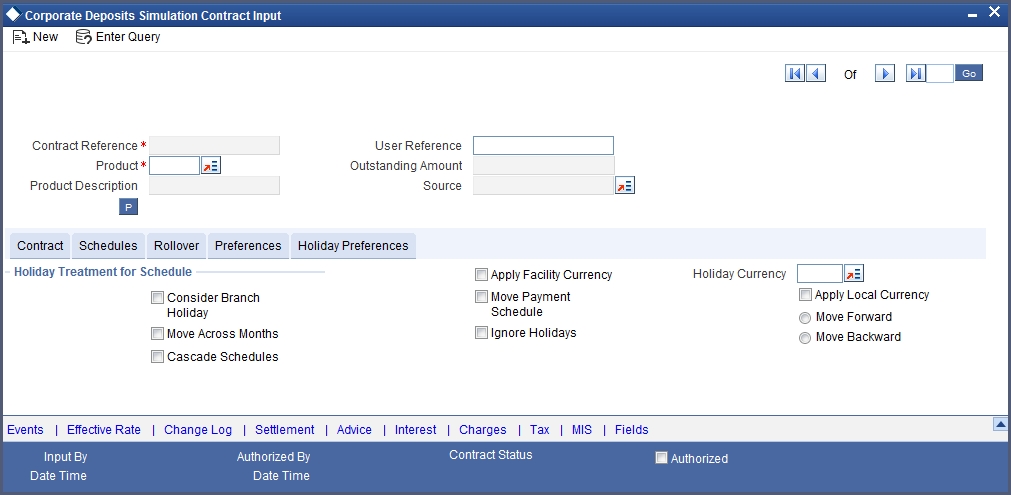

5.1.1.2 Recalculating Schedules for Holiday Calendar Changes

You can indicate the manner in which the payment and revisions schedules are to be recalculated whenever changes are made to the holiday calendar.

Move Payment Schedule

If the holiday calendar change affects any of the payment schedules, the system will re-compute the payment schedule dates.

Move Revision Schedule

If the holiday calendar change affects any of the revision schedules, the revision schedule dates are recomputed.

For payment schedules, outstanding schedules are re-computed (schedules, due spot days after the current application date) whenever there is a change in the Currency Holiday Calendar for the currency of the contract. For other schedules, any schedule after the current system date would be considered for revision.

The re-computation is done for all types (Payment, Revision) of schedules. The rescheduling preferences defined for a product are defaulted to any contract using the product; they can be modified when a contract is entered. After authorization of the contract, they cannot be altered.

5.1.1.3 Liquidating Back Valued Schedules during Initiation

You have to indicate whether for a backdated deposit that has schedules prior to today’s date; the schedules have to be liquidated when the deposit is initiated. A back dated deposit is one which has an initiation date which falls before today’s date.

Note

Please note that the entries associated with each event (initiation and liquidation in this case) will be passed only if they have been defined for the product. Further, the accounts used will be the ones defined for each entry.

5.1.1.4 Defining Repayment Schedules

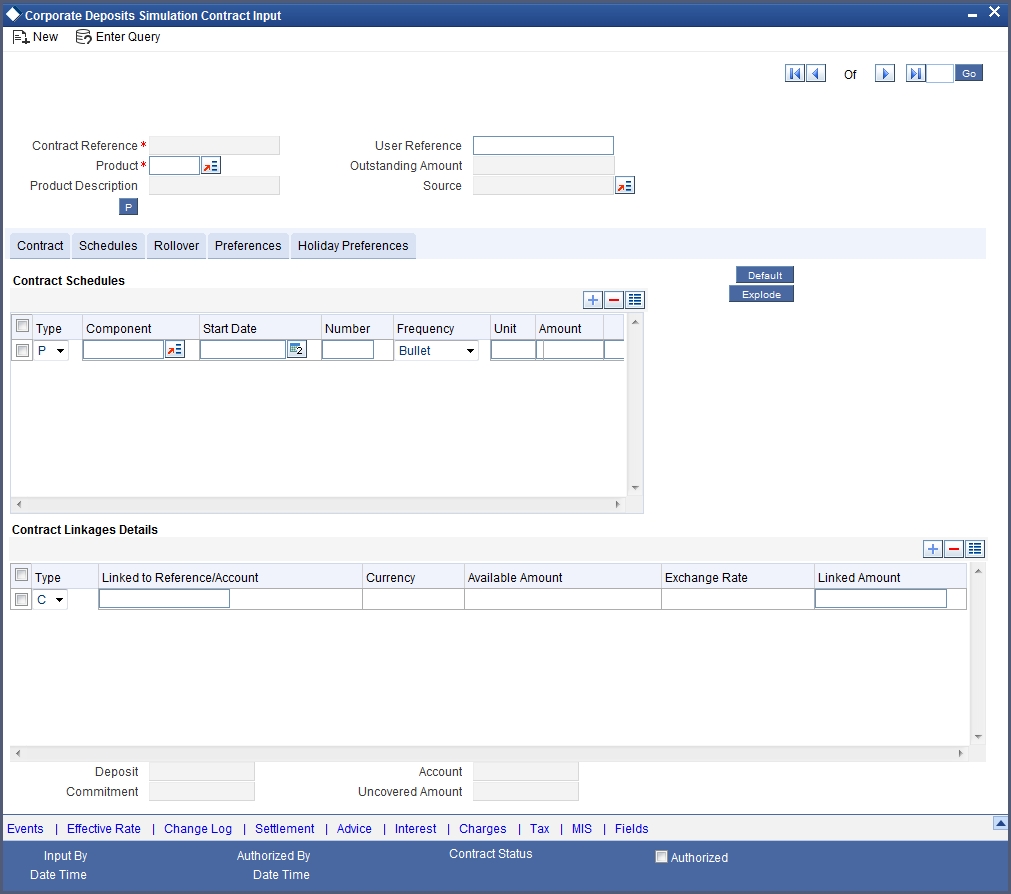

The payment schedules defined for a product will apply to all deposits involving the product. When you process a deposit in the Contract Schedules screen, the details defined for the product (which the deposit involves) will be displayed. You can change the schedules that a deposit acquires, when processing it in the Contract Schedules screen.

You can redo the schedules defined for the product, by clicking ’Default’ button in the Contract Online Schedules screen. The schedules that have not been liquidated and which fall due on the current system date, or later than the current system date, will be erased and you can go on to define the new repayment schedules.

The attributes of the schedules inherited from the product can be changed for a deposit through the Contract Preferences screen. However, the schedule payment type - whether amortized, capitalized, or normal − will be as specified for the product. You cannot change it.

Only the attributes that deal with schedules are discussed here. For further details, refer ‘Defining Attributes Specific to a Deposits Product’ chapter in this User Manual.

5.2 Corporate Deposits Simulation Contract Input Details

This section contains the following topics:

- Section 5.2.1, "Maintaining Corporate Deposits Simulation Contract Input Details"

- Section 5.2.2, "Schedules Tab"

- Section 5.2.3, "Features of Contract Preferences Screen"

- Section 5.2.4, "Setting Deposit Schedule Preferences"

5.2.1 Maintaining Corporate Deposits Simulation Contract Input Details

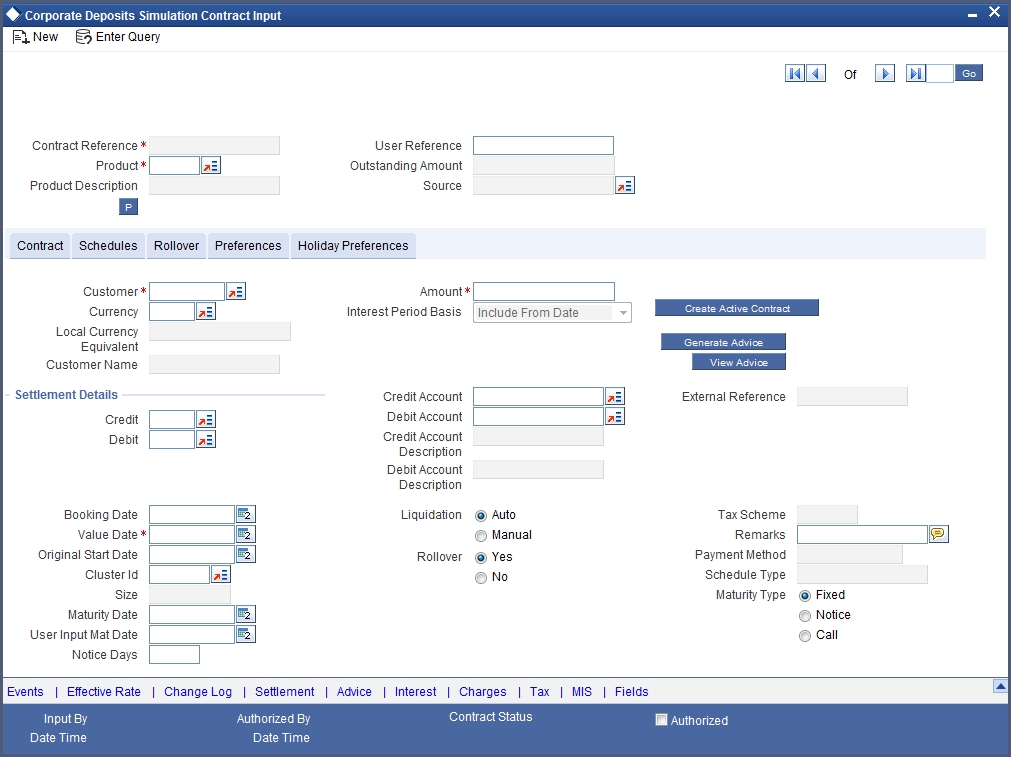

The ‘Corporate Deposits Contract Input’ screen can be invoked by typing ‘LDDCONON’ in the field at the top right corner of the Application Browser and clicking the adjoining arrow button.

5.2.1.1 Specifying Mode of Liquidation

When creating a product, you specify the mode of liquidation − whether automatic or manual. Your specifications will apply to all the deposits involving the product. Through the Contract Preferences screen, you can change the mode of liquidation for the deposit that you are processing, from automatic to manual, or vice versa.

Schedules Type

When creating a product, you define the repayment schedules. The repayment schedule can be:

- Amortized

- Capitalized

- Normal

The schedule type that you define for the product will apply to all deposits involving the product. When you process a deposit, the schedule type will be displayed in the Corporate Deposits Contract Input Preferences screen.

For example, if you have specified ‘amortized’ for the product, this will be applicable to the deposit too. You cannot change it.

Amortization

By specifying that your payment schedules have to be amortized over the period of repayment, you indicate that all the repayments should be in Equated Installments. These repayment schedules will be drawn up taking the Principal and the Main Component (The ‘main’ component is the one you defined for display in the Contract Details screen).

If you specify amortized schedules, schedules will be set in Equated Installments according to the frequency you have defined.

If you have specified that the schedule type is to be “amortized,” you should specify the method in which the amortization is to be applied.

Note

If a deposit is to be amortized, it should have fixed type of interest and bearing interest payment method.

Capitalization

You can capitalize the interest payment on a deposit, by:

- Specifying the type of schedule (through the Product preferences screen). The deposit inherits this from the product.

- Specifying the frequency for the capitalization through the Product Default Schedules screen. The frequency can be changed for the deposit.

The outstanding interest is added to the outstanding principal on the schedule date and this becomes the principal for the next schedule.

Note

Capitalization is done only for the ‘main’ interest, and only, if it is a fixed interest of the bearing type.

Normal

If you have specified normal type of schedules, you will be able to define your own schedules for deposits involving the product.

A schedule date:

- Should be later than, or the same as, the Value Date;

- Can have only one schedule for a component for a date; and

- Cannot be beyond the Maturity Date.

5.2.2 Schedules Tab

When you are in the Contract On-line screens, you will see sections in the screen saying Preferences, Linkages, Schedules and Rollover etc. When you click on any of these, the respective screen will be displayed. To go to the Contract Schedules screen, click on Schedules.

In the Contract Schedules screen, you can define two types of schedules:

- Those for the revision of interest rates for a deposit with periodic interest rates

- Those for repayment of the various components

Frequency

In the CD Contract Schedules screen, select the component for which the Rate Revision frequency has to be defined (say INTEREST1). Check the Rev box (Revision Box) to indicate that it is a rate revision schedule. Next, enter your specifications in the frequency (it could be daily, weekly, etc.), the number, and the unit fields. Also give the Start Date on which the first revision has to take place. For example, if you specify the frequency as weekly, the revision will take place every week beginning on the Start Date that you have specified.

Start Date

In the CD Contract Schedules screen, select the component for which the Rate Revision frequency has to be defined (say INTEREST1). Check the ‘Rev box’ (Revision box) to indicate that it is a rate revision schedule.

Then, instead of specifying the other schedule details like the frequency, the number and unit, indicate the date in the Start Date field. The rate revision will be done on that date.

For the component, you can define a repayment schedule too, if it is to have one.

5.2.2.1 Repayment Schedule

For a repayment schedule, the amount of repayment needs to be specified only for the Principal. The interest, charge and fee components will be calculated by the system automatically, depending on the repayment date and the amount of the principal. However, if the interest type is Special, you should specify the interest amount. Similarly, if the deposit has been defined with any other fixed amount component, you will have to enter an amount for this.

The repayment schedules for the components of a deposit will be those defined for the product it involves. You can change the schedules for a deposit when processing it.

5.2.2.2 Interest Repayment Schedules as Different from Rate Revision Schedules

For a deposit on which floating interest has to be applied at periodic intervals, you may have to define

- An interest rate revision schedule for the interest component

- A repayment schedule

The following example shows how this is achieved.

You have a deposit where for the component interest, you have to define an interest rate revision schedule for revisions every week as well as a monthly repayment schedule. The Start Date of the contract is 1 October ‘97 and the End Date is 30 November ‘97.

The contract has been defined with a periodic rate and the rates in the Floating Rate screen change in the following manner:

| Date | Rate | ||

|---|---|---|---|

| 1 October ‘97 | 12 | ||

| 12 October ‘97 | 11.5 | ||

| 25 October ‘97 | 11 | ||

| 15 November ‘97 | 12 | ||

| 30 November ‘97 | 12.5 |

Defining a frequency based rate revision schedule

To define a schedule with periodic rate code usage, through the Contract Schedules screen, mark the component as a revision schedule (by checking the Rev box) and specify the component, say INTEREST, from the option list.

Give the frequency at which the interest rate has to be refreshed weekly. Give the Start Date, as October 15. The first revision will happen on this day, and every week from then on. Save the inputs.

Defining a date based rate revision schedule

If you were to define specific dates – October 7, October 15 and October 23 - for the rate revisions to happen, then, through the Contract Schedules screen, mark the component as a revision schedule (by checking the Rev box) and specify the component, say INTEREST, from the option list.

Specify the date on which the rate revision is to be done, in the Start Date field, as 7 October. Similarly, define the other dates, but by picking up the same component INTEREST from the option list each time.

Defining a repayment schedule for the same component

Now to define a repayment schedule for the same component, INTEREST, do not check the Rev box. Choose the same component from the option list. Now draw up a repayment schedule for this component. Give a value in the Start Date field, say 31 October 1997. The first interest liquidation will be done on this date.

In the frequency field enter ‘monthly’ and in the unit field specify ‘1’. This means the interest repayments will be done once a month beginning 31 October.

That is, for a contract defined with frequency-based periodic rates, the rates prevailing on the refresh dates will be used for accruals and liquidation.

In the contract we are discussing, with the refresh frequency defined as weekly and the Start Date as 15 October, the rate applied for the interest liquidation on 31 October will be as shown below.

| From | To | Rate | |||

|---|---|---|---|---|---|

| 1 October | 15 October | 11.5 | |||

| 16 October | 31 October | 11 |

For a contract defined with date-based Periodic rates, the rates prevailing on the specific refresh dates will be used for accruals and liquidation. Shown below are the rates applicable on the specified revision dates:

| Revision Date | Rate Applicable | ||

|---|---|---|---|

| 7 October | 12 | ||

| 15 October | 11.5 | ||

| 23 October | 11.5 |

In the contract we are discussing, the rates applied for the interest liquidation on 31 October will be as follows:

| From | To | Rate | |||

|---|---|---|---|---|---|

| 1 October | 7 October | 12 | |||

| 8 October | 14 October | 12 | |||

| 15 October | 31 October | 11.5 |

5.2.2.3 Specifying Schedules for Deposit with Fixed Interest Rate

For components of deposits with a fixed rate of interest, you will not have to define interest rate revision schedules. That is, you will have to keep the “Rev” box unchecked while you define the schedules for each component.

The schedules defined for each component at the time of product definition apply to the deposit. However, you can change the frequency, number, unit and the start date to suit the specific requirements of the deposit that you are processing. You will have to specify the amount only if the schedule being defined involves the principal component or a special interest.

The amount for interest, commission and fee components (if they are rates) will be calculated by the system automatically, depending on the start date, number of schedules, frequency and repayment amount of the principal. However, an amount can be entered here for interest only if the Interest Calculation Method has been defined as Special. The fee amount can be input only if it is a flat fee.

For a deposit, you can define repayment schedules that:

- Fall due at regular intervals

- At irregular intervals

Now, if you want to define schedules that fall due at regular intervals, all you have to do is, for a component specify the start date, the frequency, the unit and the principal amount. Since you would have already registered the Maturity Date of the deposit (for a fixed maturity type), in the Contract Details screen, the schedules would automatically be spread out into equal intervals.

Based on this information, the system calculates the dates on which the repayments or interest revisions fall due.

5.2.2.4 Redefining Schedules

Repayments that are scheduled for a date later than today can be redefined. This redefinition can be done even after the deposit has come into effect and a few schedules have been liquidated.

However, schedules with a date earlier than today’s date that are yet to be liquidated cannot be rescheduled. You have to liquidate them through the Manual Liquidation function. Aging analysis and penalty processing will be done on such overdue schedules.

The redefinition of schedules will be done automatically on the following occasions:

- For deposits with fixed interest, charge or fee rates, the schedule amounts for these components will be automatically changed when there is a change in the rate.

- For a deposit with amortized schedules, the schedule amounts will be recalculated when there is a change in the main interest rate.

- When the Principal is increased: the increased amount is added on to the last principal schedule. Other components (interest, commission or fee) that are dependent on the principal of the deposit will be recalculated and spread equally over the rest of the repayment schedules.

- When there is a prepayment of interest and you have defined recalculation of schedules on repayment

There may be some situations wherein you would want to redefine the schedules, i.e., you may want to change the payment dates or amounts. In such cases, click ‘Default’ button in the Contract On-line Schedule Definition screen. All the schedules defined at the product level is displayed.

To redefine a schedule for only one component, highlight the schedule make the changes and select ‘Add’ in the Application tool bar or click add icon.

If the schedules have already been authorized then you will have to make the changes through the Modify function. After making the changes, you can save the redefined schedules by selecting ‘Add’ in the Application tool bar or clicking add icon.

To delete a schedule (before authorization), select ‘Delete’ in the Application tool bar or click delete icon

5.2.2.5 Authorizing Redefined Schedule

The redefinition of schedules for a deposit amounts to a modification of the contract. The contract should be authorized before you can begin the end of day processing.

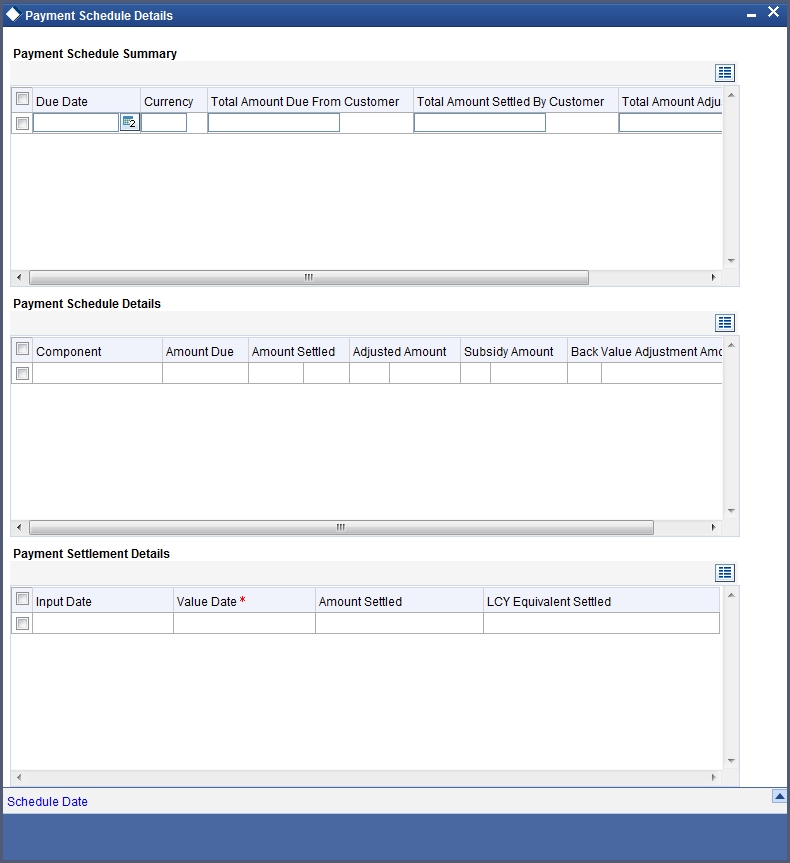

5.2.2.6 Explode Button

When you click ‘Explode’ button in the Contract On-line Schedule Definition screen, you will see the Payment Schedule Details screen. Here you can view the details of the schedules for a particular contract.

In this screen you can see the following details for the component:

- The Due date of the Schedule

- The Amount Due as of the due date

- The amount liquidated against the schedule

5.2.2.7 Interest Rate Revision Schedule

A Floating Rate screen - which contains the market rates for the day − is maintained in the ICCF sub-system so that the latest rates can be applied to contracts.

The market rates vary on a daily basis and are maintained in this screen. The rates can be applied either every time they change or at periodic intervals. Usually, for Money Market contracts, floating rates are applied, i.e., the latest market rate is applied (see the section on Specifying Rate Code Usage in the chapter ‘Processing Interest, Charge or Fee). But in the case of commercial or corporate deposits, these rates can be applied on a periodic basis so that you are in tune with the market rates. At the same time you do not have to apply the market rates on a daily basis.

You can specify whether the latest market rates have to be applied every time they change or if they have to be applied periodically, by defining an attribute called the Rate Code Usage through the Product ICCF Details screen for a floating interest type. If you specify ‘auto’ rate code usage, all the rate changes made during the liquidation or accrual period will be considered. If you specify ‘Periodic’ rate code usage, the rates will be periodically refreshed and will be applied according to the frequency you specify.

For a deposit that has been defined with periodic interest, you can specify the following:

- The frequency at which the periodic rate change has to be applied.

- The dates on which the periodic rate change has to be applied.

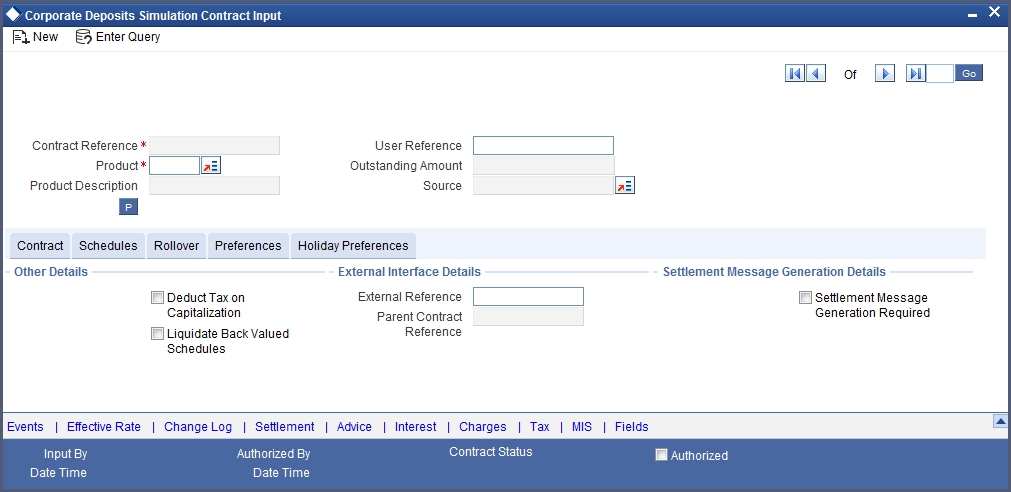

5.2.3 Features of Contract Preferences Screen

Although schedules are inherited by a deposit from the product, through the Contract Preferences screen, you can define your own schedules for a deposit.

A schedule date:

- Should be later than or the same as the Value Date.

- You can have only one schedule for a component for a date, and

- It cannot be beyond the Maturity Date.

5.2.4 Setting Deposit Schedule Preferences

Schedule preferences are the attributes of the repayment schedules defined for the deposit.

The attributes that have been defined for a product are inherited by all deposits involving the product. Some of these attributes can be changed. They are:

- The liquidation of schedules that fall due before the day on which the deposit is booked

- The liquidation mode (auto to manual)

The following attribute defined for the product and inherited by the contract cannot be changed:

- The schedule type - amortized, capitalized, or normal is inherited from the product and displayed for the deposit.

Through a set of fields in the Contract Preferences screen, you can specify an additional set of schedule related attributes for a deposit that you are processing:

- How liquidation dates falling on holidays should be handled.

- Whether schedule dates should be cascaded in case you have indicated that they (schedule dates) be moved forward or backward when they fall on a holiday.

- The holiday screen, of the country of the deposit currency, which has to be checked before setting automatic schedules.

- Whether back valued schedules should be liquidated on deposit initiation.

- The type of amortization, if amortization has been specified for

the product and therefore, the deposit.

Move Across Months

If you have chosen to move a schedule falling due on a holiday to the next working day, or to the previous working day, and it crosses over into another month, the schedule date will be moved only if you so indicate. If not, the schedule date will be kept in the same month.

For example,

You have defined a repayment schedule that falls due on April 30, 1998. This happens to be a holiday. You indicated that in case of a holiday, the schedule date is to be moved forward to the next working day.

If you also indicated that the schedule can be moved across the month, then the schedule will be automatically moved to May 1, 1998 (the next working day). If you disallowed movement across the month, but indicated forward movement for the schedule, the schedule date will be automatically moved (backward in this case) to the last working day of the same month, that is, to April 29, 1998 (despite your having indicated a forward movement into the next working day).

Scenario 2:

You have defined a repayment schedule that falls due on May 1, 1998. This happens to be a holiday. You indicated that in case of a holiday, the schedule date is to be moved backward to the previous working day.

If you also indicated that the schedule can be moved across the month, then the schedule will be automatically moved to 30 April 1998, the previous working day.

If you disallowed movement across the month, but indicated backward movement for this schedule, the schedule date will be automatically moved (forward in this case) to the next working day of the same month, that is, to 2 May 1998 (despite your having indicated a backward movement into the previous working day). The idea being that the schedule is not moved across months.

Cascade Schedules

The question of cascading schedules arises only if:

- You have specified that a schedule falling due on a holiday has to be moved forward or backward; and,

- The schedule has been defined with a definite frequency.

If you have indicated that schedules should be cascaded, the schedule date for the next payable schedule will depend on how the schedule date was moved for a holiday. The following example illustrates how this concept of cascading schedules functions.

For example,

A monthly schedule has been defined with backward movement and a schedule date falling due on April 30, 1998 was moved to April 29, 1998, April 30, 1998 being a holiday.

The schedule date for May depends on whether you have chosen to cascade schedules. If you have, the schedule date for May will be set as May 29, 1998, as the frequency has been specified as monthly. For subsequent schedules also, May 29, 1998 will be considered the last schedule date. That is, the next schedule will be June 29, the following one July 29, and so on, until another holiday is encountered.

If you have not specified that schedules have to be cascaded, the date originally specified, will be the date for drawing up the schedules. Even if the April month end schedule has been moved to April 29, 1998, the next schedule will remain May 30, 1998. The following one will be June 30, and so on.

Even if another holiday is encountered, and the schedule date for that particular schedule is moved suitably, 30 will remain the date for the following schedule, whenever it falls.

When you cascade schedules, the last schedule (at maturity), however, will be liquidated on the original maturity date and will not be changed like the interim schedules. Hence, for this particular schedule, the interest calculation days may vary from those of previous schedules, as the case may be.

5.2.4.1 When Repayment Schedule is Holiday

You have specified that repayment schedules should be generated automatically once you indicate the frequency, number and the date of first repayment. When the system computes the repayment dates based on these values, there is a chance that one or more schedules fall due on a holiday. In such a case, you have two choices:

- Ignore the holiday and retain the schedule due date

- Move it either backward or forward, by specifying so.

A schedule date falls on a holiday and you have not specified that holidays are to be ignored at the time of schedule definition. In this case, you should indicate the movement of the schedule date:

- Move Forward - to the next working day

- Move Backward - the previous working day

Since the schedule date itself is moved to a working day, the payment will be processed on the day it falls due, as of that day.

If you specify that holidays are to be ignored, the schedule dates will be fixed without taking the holidays into account.

If a schedule date falls on a holiday, the processing of such a schedule is determined by your holiday handling specifications for automatic processes, in the Branch Parameters screen:

- If you specified that processing has to be done on the previous working day for automatic events right up to the day before the next working day, the schedule falling on the holiday will be liquidated during end of day processing on the previous working day.

- If you have specified that processing has to be done only up to the System Date, then only the events scheduled for the System Date will be processed. The events of the holiday will be processed on the next working day during beginning of day processing.

Holiday Currency

You can specify the country of the deposit currency for which the holiday screen should be checked before drawing the payment schedules related to the deposit. In case a schedule falls on a holiday and you have specified that the schedule be moved forward or backward, the movement happens according to the holidays in this country.

By default, the currency to be checked is the deposit currency. If a currency other than this is specified, the holiday screen will be checked for both the currencies.

For further details , refer ‘Capturing the Details of a Deposit’ chapter in this User Manual.

5.2.4.2 Liquidating Back Valued Schedules

If you specified, while defining the product, that for a back-dated deposit with repayment schedules prior to today’s date, the schedules have to be liquidated when the deposit is initiated, the same will apply to the deposit you are entering.

However, through this screen, you can choose not to liquidate back valued schedules.

For example,

Deposits can be initiated:

- As of today,

- A date in the future, or

- As of a date in the past.

Suppose today is October 15, 1997 and you book a deposit of 15,000 USD with the value date (date on which the deposit comes into effect) as September 15, 1997. Accounting entries will be passed with the Initiation Date on September 15.

But if there had been an interest payment schedule for September 30, 1997 for 500 USD, then if you specify that back valued schedules should be liquidated, the liquidation entries for this schedule will also be passed.

If you specify that back dated schedules are not to be liquidated; only accrual entries will be passed till today.

Please note that the entries associated with each event (initiation and liquidation in this case) will be passed only if they have been defined for the product. Further, the accounts used will be the ones defined for each entry.

5.3 Corporate Deposits Payment Input Details

This section contains the following topics:

- Section 5.3.1, "Making Manual Payments"

- Section 5.3.2, "Split Settlements Button"

- Section 5.3.3, "Tax Button"

- Section 5.3.4, "Settlement Button"

- Section 5.3.5, "Viewing Schedule Breakup Details"

5.3.1 Making Manual Payments

The various components in a contract can be liquidated either automatically or manually. The mode of liquidation of each component is specified at the time of defining a product and then again, at the time of deposit processing. An automatic liquidation is done on schedule payment days by the Automatic Contract Update program.

Even if you have defined a contract with automatic liquidation, you can liquidate it manually, a day before the schedule dates.

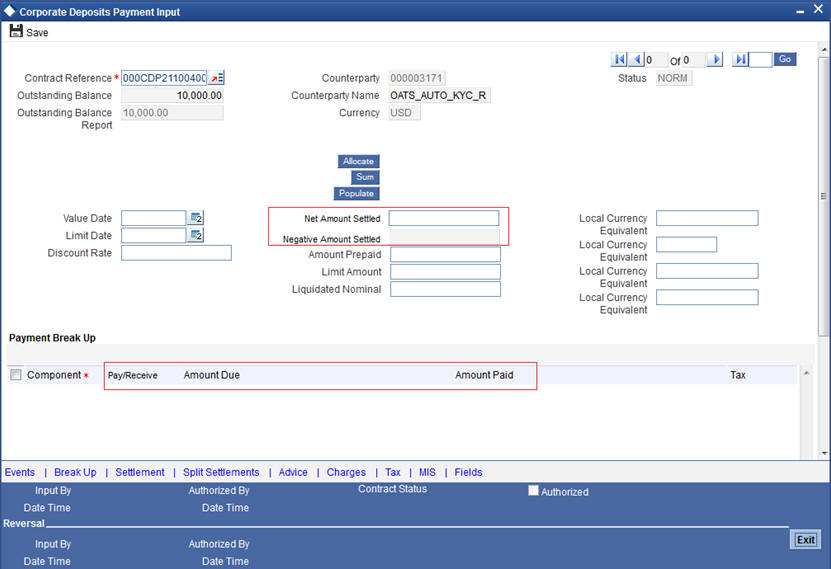

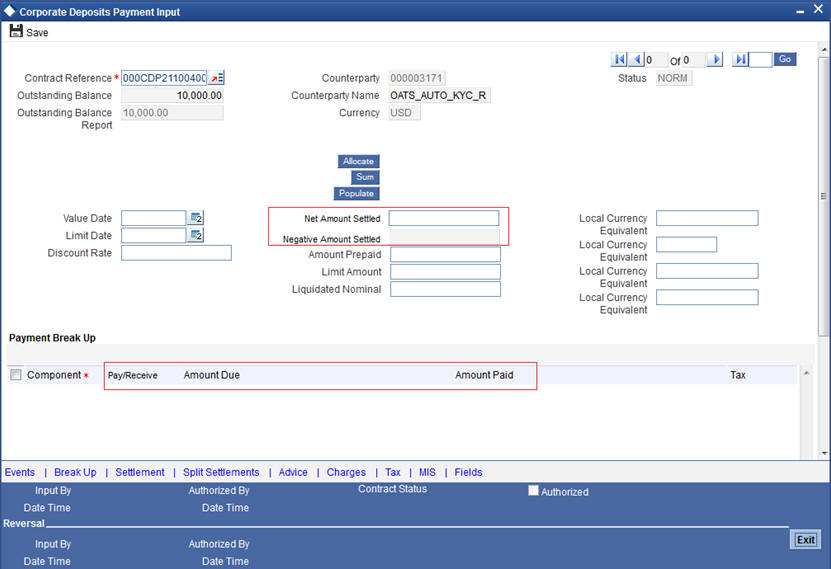

You can invoke ‘Corporate Deposits Payment Input’ screen by typing ‘LDDPMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The following operations can be performed on a payment through the Contract Schedule Payments screen:

- Input of Manual payments

- Deletion manual payments

- Reversal manual payments

The manual payments made through this function can be:

- Scheduled payments which are due

- Payments which are made prior to a scheduled payment date. (These are called Prepayments and they can be made even if the deposit has been defined for automatic liquidation of components).

- Back valued date payments. The value date for such payments cannot be earlier than the most recent schedule that was due. If there is more than one schedule outstanding and you want to assign the value date of each schedule payment, you should enter the liquidation of each schedule separately.

The value date you have entered will be used for all the entries generated by the system.

5.3.1.1 Input of Manual Payments

Once you enter the deposit reference number in the Contract Schedule Payments you will see the following details displayed on the screen:

- The counterparty name

- The currency of the deposit

- The total outstanding amount as of the value date (the date on which the payment is being made) and the deposit version.

The Value Date here, is the date on which the liquidation entries will be passed. When you enter a Value Date in this screen, if there are any payments due on that date, they will be displayed and you can liquidate them.

If there are no schedules due on that date, the schedule becomes a prepayment. But this is only if the Value Date is not a back valued date. You can have a back valued date but it cannot be earlier than the last schedule that was due. (You can also liquidate back valued schedules by entering a Limit amount)

If the Value Date is today or a date in the future, the prepayment is processed.

The Payment Limit Date or Amount of the payment should be given at the time of payment. If you have given a payment limit date, the system shows all the components which are due till the limit date. If you have given the amount limit in the Amount field, it shows all the schedules for the limit amount.

For example,

Say for a particular contract, there are two interest schedules to be paid on Ms Yvonne Cousteau’s Domestic term Deposit — one on 1 October 1997 and the other on 15 October 1997. The third schedule is due on 30 October 1997.

If you give the Limit date as 25 October, (today’s date) the system will show you the amounts due for the interest component on the schedule dates of 1 October, and 15 October.

If you give the limit date as 1 November 1997, the system will show you the schedules falling on 1 October, 15 October and 30 October, and you can liquidate them accordingly.

Since today’s date is October 25, if you pay the schedule due on 30 October, it amounts to a pre-payment. You can charge a prepayment penalty rate or an amount which you enter in this screen.

Note

While the Prepayment Limit Date is used to pick up the schedules pending as of that date, the Value Date is taken into account by the system for passing accounting entries.

Alternatively, the system picks up a schedule according to the amount being paid. You will see the next schedule, which is due, within the limit of this amount. If the amount being paid is more than the total amount payable for the next schedule, the next schedule will be considered. The total amount due for these schedules is displayed.

For example,

System date: 01 June:

Payment schedules for a contract are as follows:

| Sch Date | 30 June | 31 July | 30 August | ||||

|---|---|---|---|---|---|---|---|

| Principal | 1000 | 1000 | 1000 | ||||

| Interest | 100 | 100 | 100 | ||||

| Commission | 50 | 50 | 50 | ||||

| Fee | 20 | 20 | 20 |

For the above schedule, if a prepayment is made as of an amount, the system validates it in the following manner:

- Suppose the amount paid is USD 1000. The next available schedule is as of 30 June and the total amount due is USD 1170. This schedule will be picked up for processing and you can make the payments.

- If the amount paid is USD 1170, which is equal to the schedule amount of 30 June, again only the schedule for 30 June will be picked up for processing.

- If the amount paid is USD 1,270 which is more than the amount due for the schedule of 30 June, the schedule of 31 July will be picked up by the system for processing. After completely liquidating the schedule of 30 June, you can liquidate the interest schedule as of 31 July, which is the next schedule.

- If the amount paid is USD 1300, the schedule for 31 July will be picked up for processing. The complete schedule of 30 June can be liquidated along with the interest component of 31 July. The remaining USD 30 can be used to partially liquidate the commission component for 31 July.

You have to enter the actual amount being paid in the Net Amount Settled field. If there are both positive and negative amount to be settled, then the net amount should be specified here. This amount can either be allocated to the various components manually, by entering the break up of the amount against the various components, or automatically by clicking the Allocate button. The total negative amount that should be settled is displayed in Negative Amount Settled field. Partial payment of negative amount is restricted. Back dated payment of interest amount is allowed till last payment date or amendment date, whichever occurs later.

The automatic allocation is done based on the Liquidation order you have defined for the product. If you have not specified the order of liquidation for the principal and the interest type of components, the amount will be allocated for liquidation in the following order:

- Interest

- Principal

Note

If a payment that covers both past and future schedules is made, the system will force you to pay out the past schedules before the future schedules are paid.

If an ICCF component is based on the outstanding principal you will not be able to make a payment where the amount is more than what is due for the component as of the system date.

5.3.1.2 Deleting Manual Payments

Payments made using the Manual payments function can be deleted before the payment is authorized.

All the entries passed during the payment will also be deleted. All the schedules will be restored to the original status. In short, the pre-payment status of the contract will be restored.

Select ‘Delete’ in the Application tool bar or click delete icon. You will be prompted to confirm the deletion. After your confirmation, all the entries that have been saved, but not authorized, will be deleted.

5.3.1.3 Reversing Manual Payments

You can reverse authorized manual payments. The system makes the following validations before reversing a payment:

- A principal payment can be reversed only if the payment date is equal to, or later than, the last interest and commission schedule due date.

- An interest payment can be reversed only in the chronological order of its payment.

In the Contract view screen, to reverse a payment, you have to invoke the manual payments function and specify the Contract Reference Number. You have to enter the ‘Amount Paid’. You have to click on Reverse in the Processing sub-menu of the Application toolbar.

If the payment involves accounts in different currencies, the conversion rates to be used for reversal will be picked up from the contract as specified during Contract Input.

If a new payment account was specified for a component during the input of the payment, the reversal will be done to the new account. If the new account is in a currency different from that of the contract and a conversion rate was specified, the rate from the payments function will be used for the reversal.

The reversal of a payment may sometimes entail a change in the status of a contract. If the contract is set for automatic status change, this change will be made by the system automatically.

Automatic payments made by the Automatic Contract Update program can also be reversed through the manual payments function.

5.3.2 Split Settlements Button

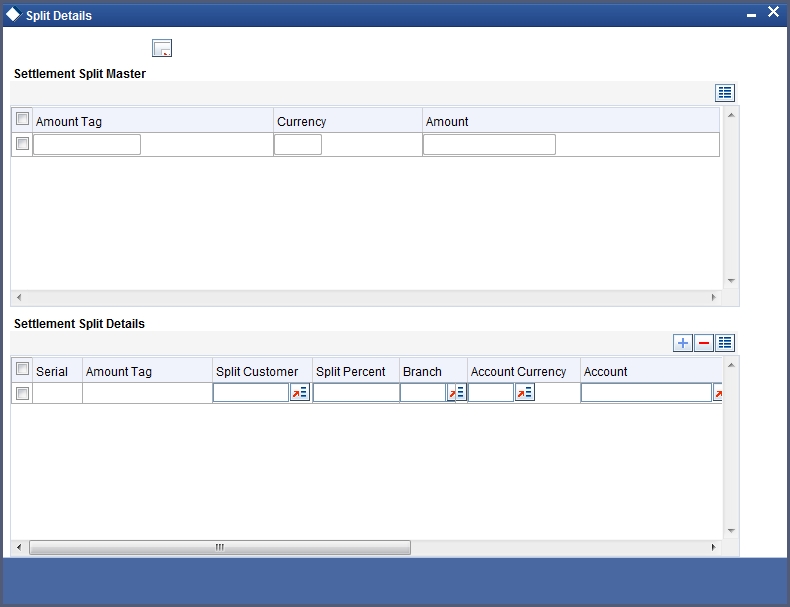

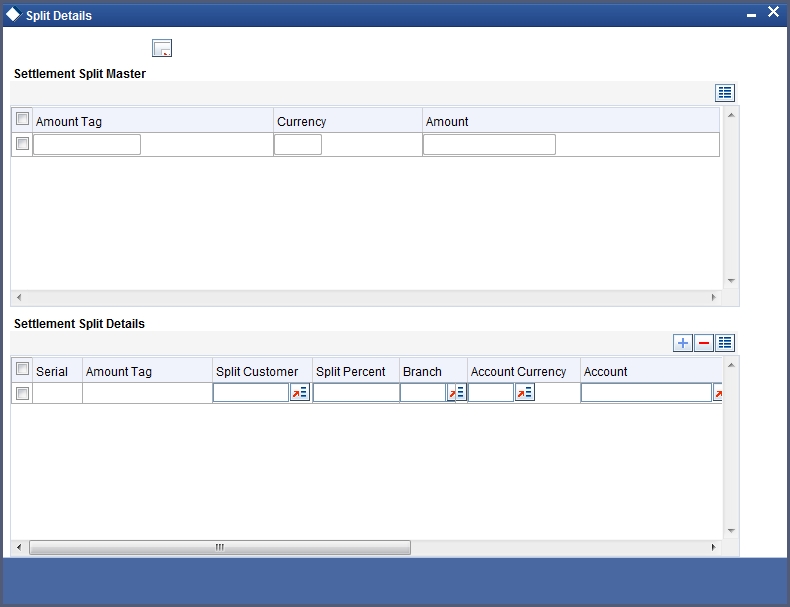

You can specify the details of the split settlement for the each loan contract through the ‘Split Details’ screen. Click ‘Split Settlements’ in the ‘Corporate Deposits Payment Input’ screen to invoke this screen.

In this screen, the following details are displayed:

- All the Amount tags involved in the contract. For example, on booking a new contract, the only tag allowed is PRINCIPAL. This is referred to as the Basis Amount tag. You can choose to split each of the basis amount tags displayed here.

- The currencies associated with the amount tags.

- The amount for each amount tag. For example, the amount involved in the contract is displayed against the amount tag ‘PRINCIPAL / INTEREST’. The amount displayed is in the currency associated with the amount tag.

Note

The amount tags are displayed only if they are defined for the event that is being processed. Further, the interest tag is populated only if it is defined as a main component.

If there are no settlement tags for the event being processed, the system displays the message as ‘There are no Settlement tags to be split for the Current Event’.

You can specify the split details for each of the amount tags in the Settlement Split Details section of the screen. Click the ‘Add’ button to maintain the split details. The sequence number and the split amount tags are automatically generated by the system. For example, if the Basis amount tag is PRINCIPAL, then the system creates the split amount tag as PRINCIPAL_S01, where S01 is the split sequence number. Each subsequent split amount tag is suffixed by S02, S03 and so on.

For each spilt amount tag, specify the following details:

Amount

Specify the amount for the split amount tag. This amount should not be greater than the amount of the corresponding basis amount tag. The split amount is in the currency of the basis amount tag.

Branch

Specify the settlement branch for the split amount tag. This adjoining option list displays all valid branches maintained in the system. You can choose the appropriate one.

Account Currency

Specify the currency of the account that should be used to do the settlement.

Account

Specify the settlement account for the split amount tag. This account should be valid account of the branch selected earlier.

Exchange Rate

If the basis amount currency is different from the account currency, then specify the exchange rate that should be used for the currency conversion.

5.3.3 Tax Button

When there are taxes charged on the interest, principal etc., the payment of the component will always include the corresponding tax amount. If the payment does not include the full amount due, the proportional tax amount must be liquidated. You should input the total amount to be applied to the component. The system then calculates the corresponding tax amount (based on the tax rate) and distributes the amount paid between the component and the tax.

Example

If you have to pay a customer USD.1000 in interest, and the tax rate is 10%, the payment of USD 1000 is automatically distributed into USD.909.09 (interest) and USD.90.91 (the tax component.). The tax component is withheld (debited from the customer) and credited to a Tax Payable account to be paid to the Government.

Total tax is always calculated on the full schedule. Therefore, if there is a rounding difference, it will be adjusted in the last liquidation.

Example

In the above instance, the tax component has come to USD.90.91for that schedule. Suppose the total tax component is USD 273. if this is to be debited from the customer in three schedules the total will come to USD 272.73 (90.91+90.91+90.91=272.73). During the last liquidation, the system will round off the total of such schedules for tax to the nearest decimal point, i.e., USD 273.

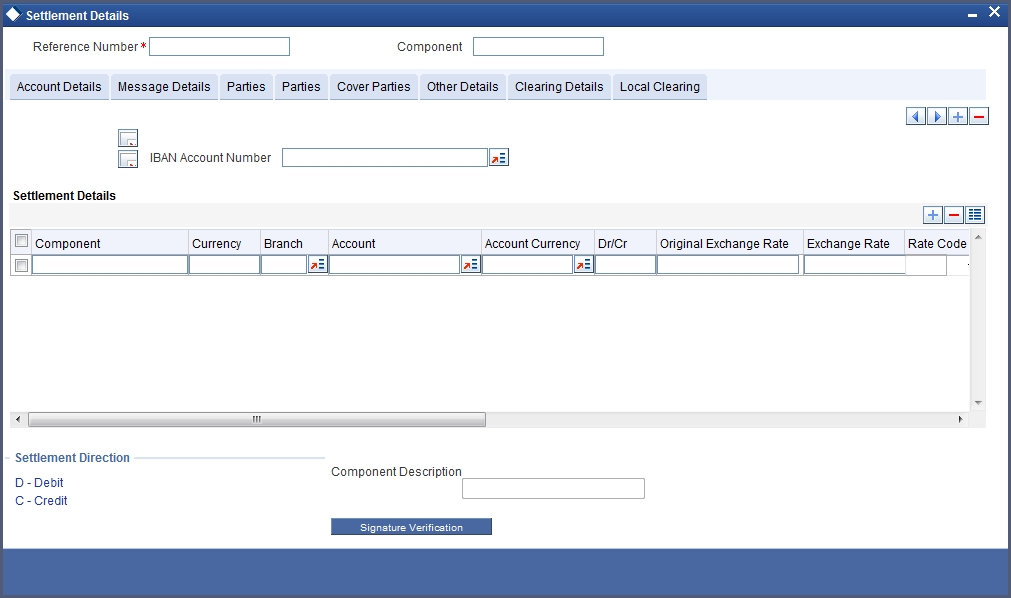

5.3.4 Settlement Button

When the contract and the accounts for payment are in different currencies, you may enter the Exchange Rate for conversion in the Settlements screen. If the customer account for a component was expressly not defined at the time of contract input, you will have to specify an account at the time of payment, through the Settlements screen.

The payment accounts can also be changed for the various components at the time of payment. The new payment accounts will only be used for that particular session of the manual payment function.

Example,

For instance, you have named an account A1 for a particular component at the time of contract input, but during manual payment you wish to change it to A2. Once this particular payment is carried out, the system will show the default account as A1 for that component. A2 is used only for the session that you have specified for manual payment.

Click ‘Settlement’ button in the ‘Corporate Deposits Contract Input’ screen to invoke the ‘Settlement Details’.

- The currency (of the contract components) and the branch will be displayed

- You can change the payment account.

- You can specify the exchange rate, if the Settlement Account Currency is different from the contract currency.

- You can capture the ERI (Euro Related Information) Currency.

- You can capture the ERI Amount.

5.3.4.1 Furnishing ERI Value in Messages

SWIFT messages (MT 100/MT 202) generated towards settlement can furnish the value of the settlement amount in both the settlement account currency, and an ERI currency. If you opt to furnish the ERI value of the amount, you have to enter the following in the Settlement Message Details screen:

- The ERI currency

- The ERI Amount

The system defaults to the ERI currency specified for the customer and currency combination. You can change the default ERI currency. The ERI amount that you specify will be validated against the Tolerance Limit specified for the ERI currency.

Note

On 1 January 1999, eleven countries that are part of the European Union embarked on the first phase of economic integration, called the ‘Economic and Monetary Union’ (EMU). The EMU ushered in a new, single European currency: the Euro (EUR). You can handle the Euro, in Oracle FLEXCUBE, by capturing information such as the ERI information in this screen.

5.3.4.2 Suppressing Messages

Settlement messages, defined for components that fall due, will be generated automatically when you execute the Settlement Generation function at the end of day. You can suppress the generation of the settlement message, defined for a component, by clearing the check-box in the ‘Gen Message’ field in the Contract Settlement Message Details screen.

Depending on the component, the system will also display whether the account involved has to be debited or credited:

- P indicates you credit (Pay to) the account involved

- R indicates you debit (Receive from) the account involved

5.3.5 Viewing Schedule Breakup Details

In the Schedules tab, you can view the Schedule Breakup details.

You will see the following in this screen:

Component

In this screen you can see the schedules being paid on account of this particular payment for which you are doing manual liquidation. The component getting paid is displayed.

Due Date

The due date of the component being liquidated is displayed.

This field displays the amount which is due for payment for a particular component.

Amount Paid

This is the amount being paid for a particular component. This amount must be less than or equal to the total amount due for the component.

5.4 Handling Prepayments

When a prepayment is made for the principal, it constitutes a violation of the contract. In such cases, a penalty in the form of an increased interest for deposits is charged. A prepayment with penalty can be made only under certain conditions. Prepayment penalty can be charged only if the contract has:

- Bearing interest

- Fixed interest rate

- Fixed maturity

- Does not have amortized schedules

The following assumptions are made for prepayments with penalty

- The rate input by you will be a differential rate and added to the contract in case of deposits. The effective rate will be arrived at as follows: Prepayment rate = Contract rate effective - (minus) Rate input by you for deposits.

- All calculations will be done until the previous calendar day.

- The rate applicable to the rest of the deposit will be the contract rate itself. The penal rate is charged only on that portion of the component which has been paid before it was due.

During any payment with a fixed rate, a check will be made to find out whether the payment is a prepayment or a normal payment. For a prepayment you will be allowed to input a penalty rate. You have to input the penalty rate that you want to charge the customer for breaking the contract. This rate cannot be greater than the contract rate. The system will default to zero as the penalty rate.

The actual contract rate will be used to compute the interest and accrual entries will be passed. In addition to these entries the interest calculated for the broken principal using the difference of the contract rate and the penalty rate that you have specified will be liquidated into the interest payment account. The balance interest difference between the old rate and the new rate will be passed to the Interest Expense account.

The above changes will not apply for floating and periodic rate contracts because in such contracts the interest schedules are not calculated in advance. The interest schedule amount is calculated only on the schedule date or due to a rate change. Thus when a prepayment is done the amount due on the next interest schedule is not available. Hence, the adjustment due to the new rate is not possible.

The dates too will be stored. These dates will be arrived at as follows:

- The from date will be the contract value date

- The to date will be today’s date

This information will be used to adjust the interest schedule immediately after today. The interest due and interest accrued will be appropriately updated after the schedules are recalculated as a result of the principal prepayment. The accrual amounts, like the current accrual and last months accruals will also be updated suitably in case of the period of calculation spreading across months. In addition, all past interest schedules will be adjusted accordingly using this adjustment amount. Suitable changes will be made to handle recovery situations with these updates.

There will be no impact on Tax as the interest paid out on prepayment will be a net of the interest already paid off and the interest due today. In case of a negative interest the principal account will be hit. The adjusted accruals will also be reversed in case of a reversal of prepayment with penalty.

If a prepayment penalty is entered, only the principal can be prepaid. The other components will be automatically liquidated. If prepayment of a component is done, then the schedules of the components for which this component is the basis will be recomputed automatically.

This is illustrated in the table below.

| Component | Basis Amount | Category | |||

|---|---|---|---|---|---|

| Interest | Principal | Expected |

If principal, which is the basis for interest (which is calculated on the Expected amount of the basis component) is prepaid, then the interest (which is a component based on principal) for the future schedules will be recomputed automatically.

Effective From Date

For principal prepayments in respect of contracts for which the interest calculation for schedules includes the To Date of the schedule, or both the From and To Dates (as specified in the Interest Period Basis preference in the contract details), you can specify whether the interest schedules must be recomputed with effect from the Value Date of the prepayment, or on the next working day after the Value Date.

Note

- This specification is not applicable for contracts for which the Interest Period Basis indicated is either ‘Include From Date’ or ‘Exclude From and To Dates’.

- If the prepayment Value Date is a payment schedule date for any of the interest components, the interest schedules are recomputed with effect from the next day after the Value Date of the prepayment; and the ‘Value Date + 1’ option is defaulted in the Effective From field and cannot be changed.

- If the prepayment Value Date is not a payment schedule date for any of the interest components, the interest schedules are recomputed based on the specification in the Effective From field.

- The split based on the value of ‘Effective from’ is not applicable for penalty components.

5.5 Foreclosure of Deposit

You have the option to foreclose a discounted deposit entered in Oracle FLEXCUBE. While defining a deposit product, you will need to define additional accounting entries for the amount tag Component_DADJ for the liquidation event.

In this case, the excess interest that was discounted in advance for the deposit will be collected from the customer.

For example,

You have accepted a deposit for USD 20000 at the rate of 10% on 1 January 2001. The deposit matures on 31 December 2001.

Original interest calculation period: 01 Jan to 31 December 2001.

Original interest = USD 2000

On 30 June, your customer requests you to close the deposit. The excess interest that was discounted in advance and to be collected from the customer is derived as follows:

Interest discounted in advance on USD 20000 = 2000

Interest on 20000 between 1 July to 31 December = 1000

Excess interest to be collected from the customer = USD 1000 (2000-1000)

5.6 Payment Simulation

This section contains the following topic:

5.6.1 Simulating Payments

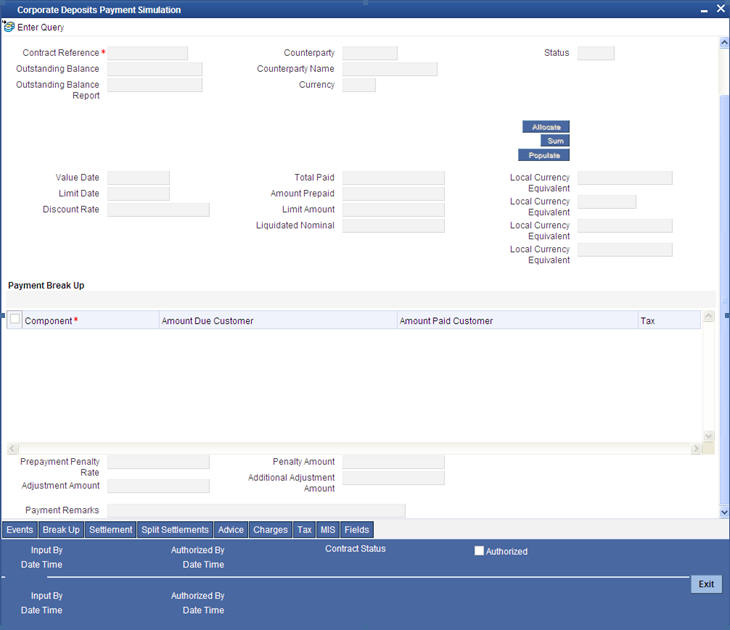

Payments for corporate deposits can be simulated using the 'Corporate Deposits Payments Simulation' screen. In addition to this, you can save simulated Payments like a normal Payment with the payment status as ‘Simulated’. You can invoke this screen by typing ‘LDDSIMPT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Note

The ‘Corporate Deposits Payment Simulation’ screen is similar to ‘Corporate Deposits Payment Input’ screen.

For further details on ‘Corporate Deposits Payment Simulation’ screen, refer ‘Making Manual Payments’ section in this User Manual.

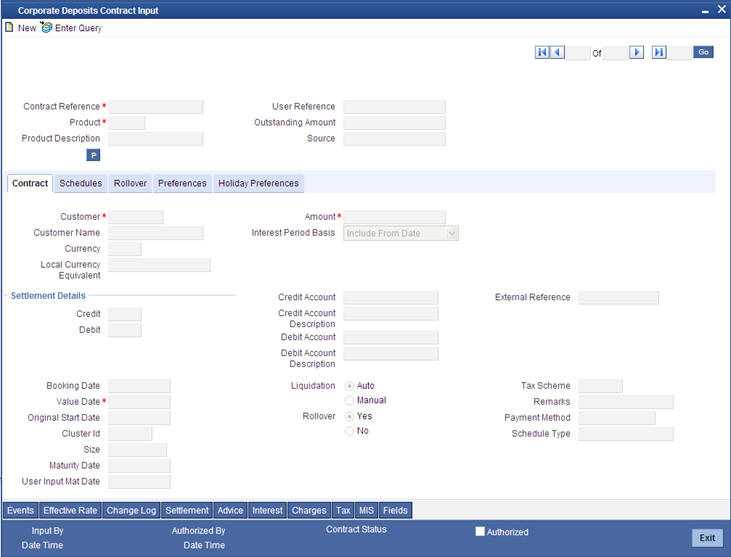

Click 'Simulate' button to invoke the ‘Corporate Deposit Contract Input’ screen with the affected schedules having impact of the simulated payment.

For further details on ‘Corporate Deposits Contract Input’ screen, refer ‘Specifying Deposit Details’ section in the ‘Capturing Details of Deposit’ chapter of this User Manual.

You can query the simulated Payment in the 'Loans & Deposit Payment Input' Screen. You can invoke this screen by typing ‘LDDPMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The simulated payment can be saved as a normal Payment with the payment status as ‘Paid’. Every simulated Payment gets deleted as a part of the EOD batch.

5.7 Generating Advice

This section contains the following topic:

5.7.1 Generating Advice

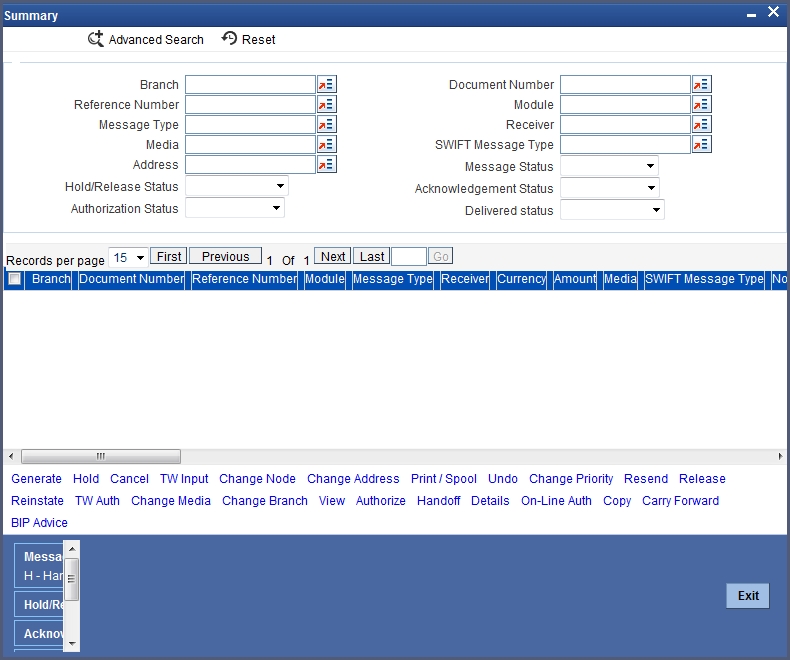

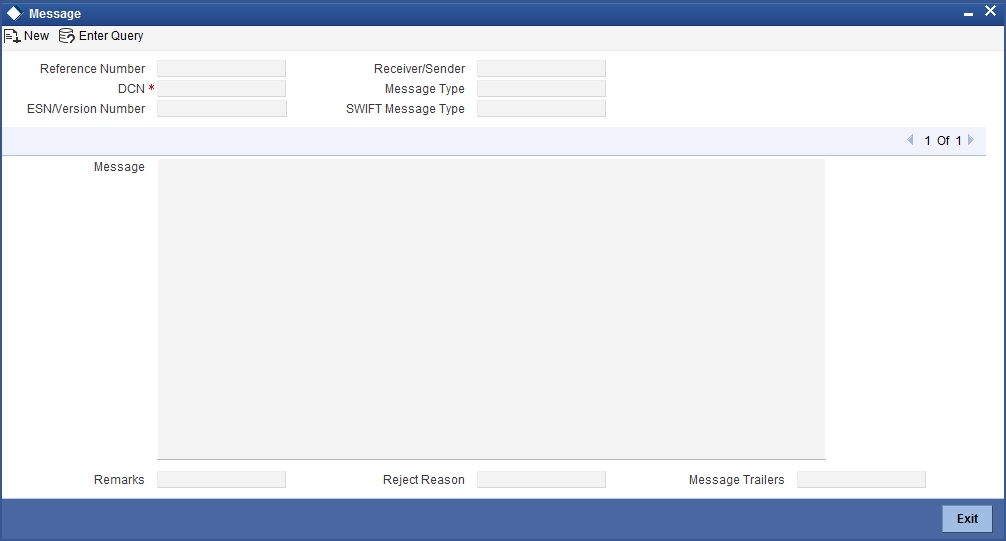

You can generate advice for every Payment Simulation, by invoking the ‘Outgoing Message Browser’ screen. This advice is addressed to the Customer, which gives the complete payment details related to the Deposit Account before and after Payment Simulation. You can invoke this screen by typing ‘MSSOUBRS’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can view the generated advice in the ‘Message Details’ screen. Click ‘View’ button in the ‘Outgoing Message Browser’ screen to invoke this screen.

For further details on ‘Outgoing Message Browser’ screen, refer ‘Manual Generation of Outgoing Messages’ section in the ‘Processing Outgoing Messages’ chapter of the ‘Messaging System’ User Manual.