5. Types of Islamic Finances

Oracle FLEXCUBE supports creation of finance accounts for the following product categories:

- Murabaha

- Ijarah

- Istisnaa

- Mudarabah

- Musharaka

- Tawarooq

This chapter contains the following sections:

- Section 5.1, "Finance Accounts"

- Section 5.2, "Murabaha Account Input"

- Section 5.3, "Ijarah Account Input"

- Section 5.4, "Istisnaa Account Input"

- Section 5.5, "Mudarabah Account Input"

- Section 5.6, "Musharaka Account Input"

- Section 5.7, "Tawarooq Account Input"

5.1 Finance Accounts

This section contains the following topics:

- Section 5.1.1, "Murabaha Finance"

- Section 5.1.2, "Ijarah Finance"

- Section 5.1.3, "Istisnaa Finance"

- Section 5.1.4, "Mudarabah Finance"

- Section 5.1.5, "Musharaka Finance"

- Section 5.1.6, "Tawarooq Finance"

5.1.1 Murabaha Finance

Murabaha financing is a contract between a customer and the bank, wherein the bank purchases goods upon request of the client, who makes deferred payments that cover the costs and at an agreed profit margin for the bank.

On completion of the agreed payments, the ownership of the goods is transferred to the customer. This finance may or may not be linked to physical fixed assets.

5.1.2 Ijarah Finance

Ijarah is a lease contract wherein the bank purchases property or capital equipment and leases it to a customer. The bank may rent the property/equipment and receive the rent or invest it in the business and get a share of the profit.

Ownership of the property or equipment passes on to the customer either during the schedules of payment or at the end of the period.

5.1.3 Istisnaa Finance

Istisnaa is similar to a regular financing for working capital. All features are similar to a Murabaha except that the actual delivery of goods happen at a later date after the receipt of all due payments.

5.1.4 Mudarabah Finance

Mudarabah is a contract between the investors and the bank. The investor approaches the bank and shares the investment plans. Based on that, the bank funds the money for the business and shares the profit earned by the investor. The profit is collected as Mudarabah fee.

5.1.5 Musharaka Finance

Musharaka financing is the participation of the bank in a venture by a company or a customer. The customer and the bank together raise the capital, usually the working capital, for the venture. Bank and the customer share the profits and losses as per to mutually agreed proportions.

5.1.6 Tawarooq Finance

Tawarooq is a finance contract between the bank and the customer for buying an underlying commodity from a dealer. At the request of the customer, the bank advises the dealer to sell the commodity at a profit or loss. The sale proceeds of the assets so disposed by the dealer will be paid to the customer.

There cannot be any financing transaction without an underlying commodity.

This chapter guides you through the process creating accounts for the above finances.

5.2 Murabaha Account Input

This section contains the following topics:

- Section 5.2.1, "Creating Murabaha Accounts"

- Section 5.2.2, "Main Tab"

- Section 5.2.3, "Charges Button"

5.2.1 Creating Murabaha Accounts

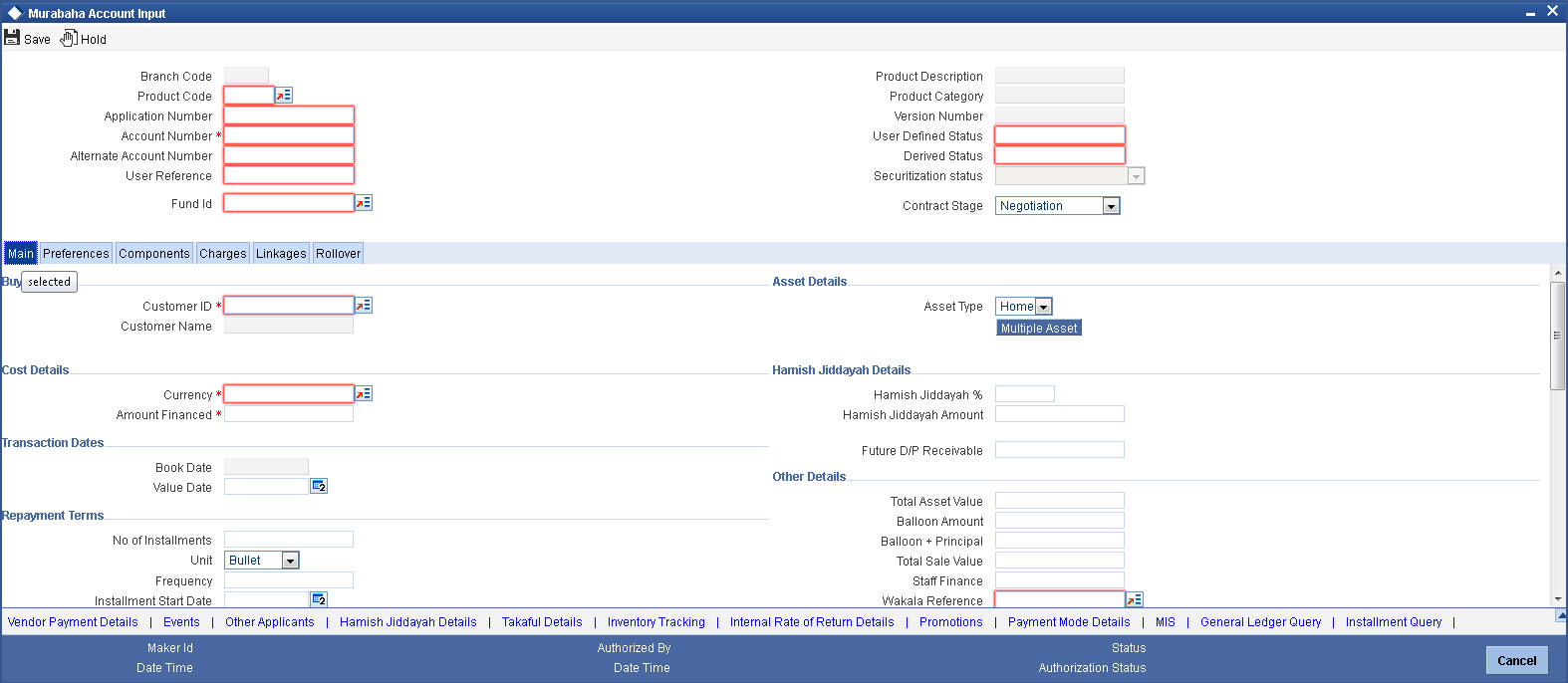

You can create and modify Murabaha accounts using ‘Murabaha Account Details’ screen. To invoke this screen, type ‘CIDMURAC’ in the field at the top right corner of the application tool bar and click the adjoining arrow button.

This section contains the details that are specific to Murabaha accounts. For further details and field information, refer to the section ‘Account Main Details/Light Finances’ under chapter ‘Account Creation’ of ‘Islamic Financing’ user manual.

You can specify the following details:

Product

Specify the product code. The option list displays all valid product codes maintained in the ‘Product Definition’ screen.

Click ‘P’ button to populate the Product Category, Value Date and Maturity Date. Based on the product code selected, the main screen will display all these values.

Product Category

The system displays the product category in this field.

Application Number

The system displays the Application Number in this field.

Note

This is applicable only if the origination of the finance is in Oracle FLEXCUBE or is interfaced.

Branch Code

The system displays the branch code of the current branch.

Account

Specify the account number. If you have set the required parameters at the branch level, the system automatically generates the account number. If the parameter is not set, you need to capture it manually.

Alternate Account Number

Enter the alternate account number. This can be the account number of this account as maintained in the existing system from which Oracle FLEXCUBE received the data.

User Reference

Specify the user reference number. This number can be used to identify the account.

User Defined Status

Specify the status of the account.

Derived Status

The system displays the derived status of the account.

5.2.2 Main Tab

Click ‘Main’ tab to capture the main details of the account.

Specify the following details:

Buyer Details

Customer ID

Specify the customer ID. You can choose the required customer ID from the option list. When you choose it from the option list, the system displays a new screen ‘Find Customer Details’. You can enter search criteria in this screen. For example, you can enter the customer name or number and click on the ‘Search’ button. The system then fetches you all the details corresponding to the customer name or account. Select the required customer ID and click OK button.

Customer Name

Based on the customer ID selected, the system displays the name of the customer.

Asset Details

Asset Type

Specify the asset type. The drop-down list displays the following asset types:

- Home

- Vehicles

- Others

Wakala Reference

Specify the reference number of the Wakala contract.

Balloon Amount

Specify the amount that is being paid as balloon payment. This value cannot exceed the principal amount of the finance. You can specify this value only if the following conditions are met:

- Contract is linked to a Murabaha product

- The box ‘Balloon Required’ is checked in the ‘Product Maintenance’ screen for the linked product.

- The box ‘Recompute schedule on IRR’ is checked in the ‘Product Maintenance’ screen for the linked product.

Fund ID

Specify the fund ID. You can choose the fund id from the option list.

This field will be enabled only for fund branch.

The system populates the fund MIS details for a contract which is linked to the fund ID.

Future D/P Receivable

Your customer need not pay the entire down payment amount in a single installment. The customer can pay it in parts. In such cases, you can specify the amount to be received in the future from the customer. The aggregate of down payments received and ‘Future D/P Receivable’ should be equal to the ‘Down Payment’ amount.

Note

Amount specified in this field cannot exceed the total down payment amount for the contract. This field should be operationally controlled, because the system does not track the ‘Future D/P Receivable’ amount which is received from the customer.

Staff Finance

Specify whether the finance being created for a staff member.

Total Amount

Specify the sum of the financed amount and down payment.

Balloon + Principal

Specify the sum of the balloon amount and principal amount.

Cost Details

Currency

Specify the currency of the account. The option list displays all valid currency codes maintained in the system. Choose the appropriate one.

Amount Financed

Specify the total principal amount of the finance.

Note

If the checkbox ‘Calculate Gross Principle’ is checked, then the amount financed is the gross principal.

Sale Value

Total Sale Value

The system displays the total of principal and profit amount as of initiation date. If the box ‘Recompute schedule on IRR’ is checked in the ‘Product Maintenance’ screen for the linked product and balloon amount is provided, the system will compute this value as the sum of principal, normal profit, balloon principal and balloon profit.

URBOUN

Hamish Jiddayah

Specify the finance amount paid by the customer upfront – Owners contribution. In case of Ijarah contracts, for a financial lease the down payment will be considered entirely towards the principal. In case of an operational lease, the entire down payment will be considered as income. Note that the down payment amount cannot be amended after authorization.

Book Date

Specify the book date of the finance in this field using the date button. You can use the date button to choose the date from the calendar.

Value Date

Specify the value date of the finance. You can use the date button to choose the date from the calendar.

Contract Status

Contract Status

Based on the account number selected, the system displays the status of the account in this field. This is based on the products status maintenance rules.

Payment Terms

Number of Installments

Specify the number of installments. This is the number of times the schedule is repeated for a chosen frequency. If the frequency is ‘Monthly’ and number is ‘1’, it implies once a month.

Unit

Enter the installment unit for the component for the schedule. The units of frequency definition can be Daily, Weekly, Bullet, Monthly, Quarterly, Half Yearly or Yearly.

Select the unit of the schedule from the option list.

Frequency

This is the number of times the schedule will repeat for a unit. If it is 2 and the unit is ‘Monthly’, it implies twice a month.

Installment Start Date

Specify the start date of the installment. This may be used to schedule an installment on a particular date of the month.

Effective Date

You can specify the following detail here:

Effective Date

The effective date is used to pick the UDE value and apply it for the given period. The system displays this date from the General UDE maintenance screen.

For a product + currency combination, if the UDE values are not maintained for the effective date, then the system defaults ’0‘. You can edit it. You can maintain different effective dates for the same UDE with different values. For instance, you can give different effective dates for different rate types maintained for the moratorium UDE.

For further information on the other tabs of the screen, refer to the section ‘Account Main Details/Light Finances’ under chapter ‘Account Creation’ of ‘Islamic Financing’ user manual.

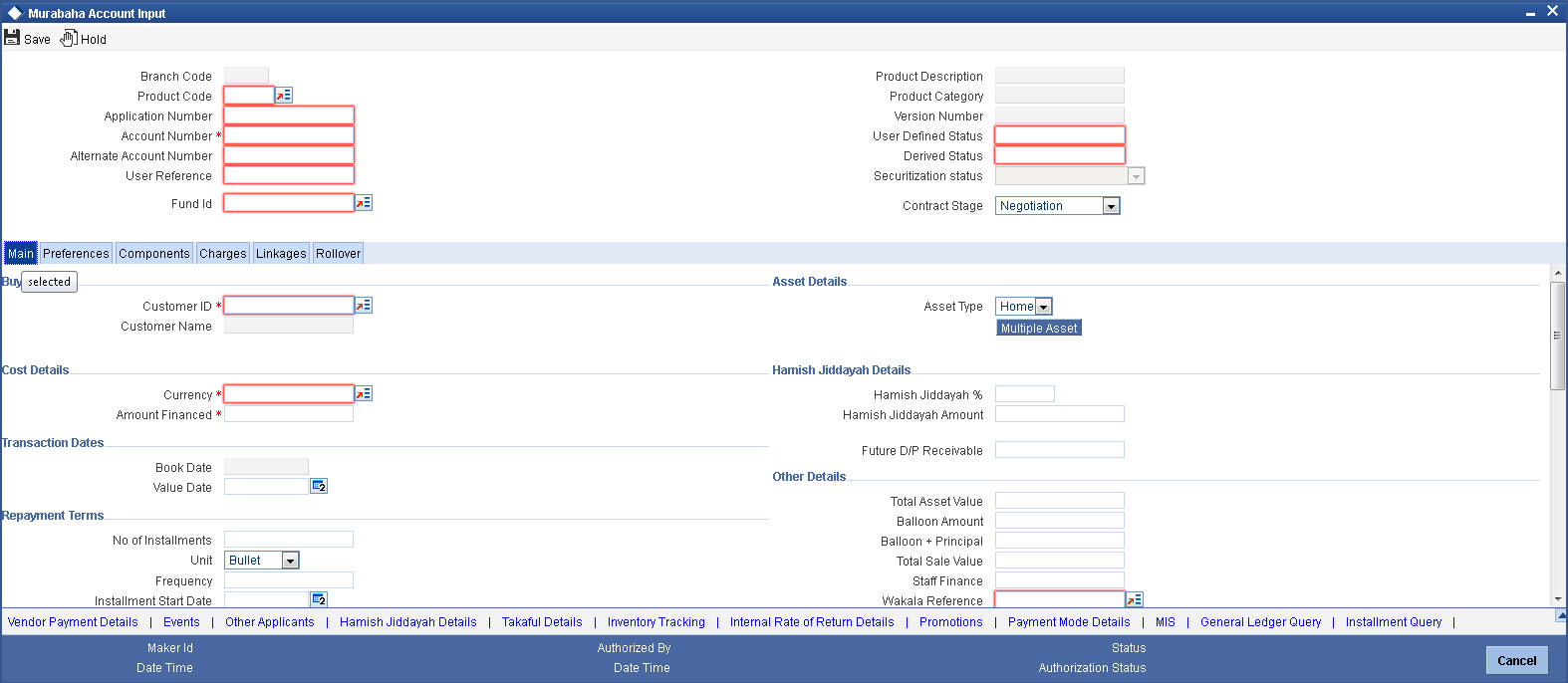

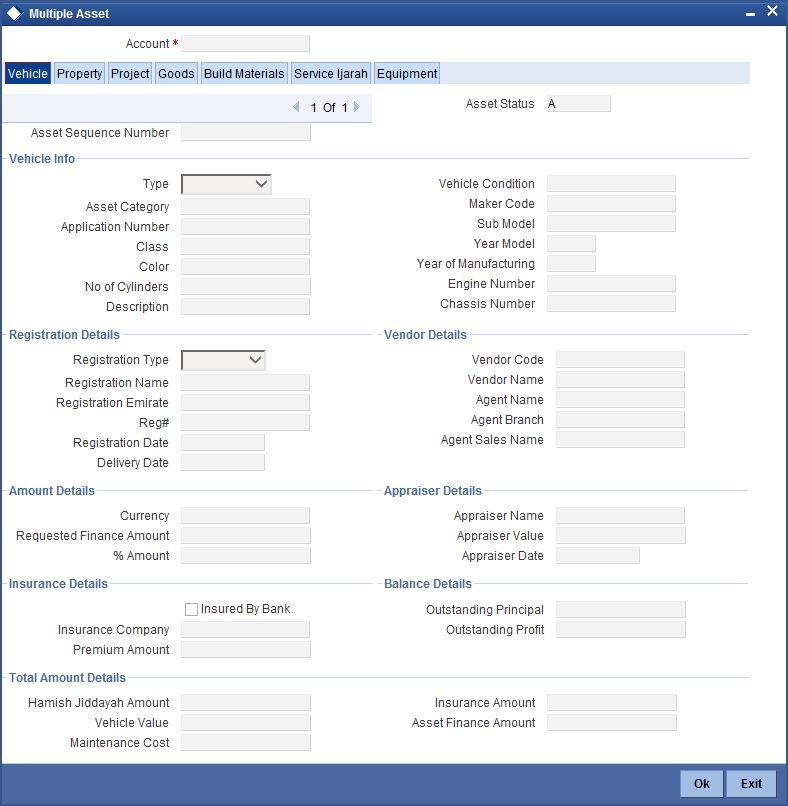

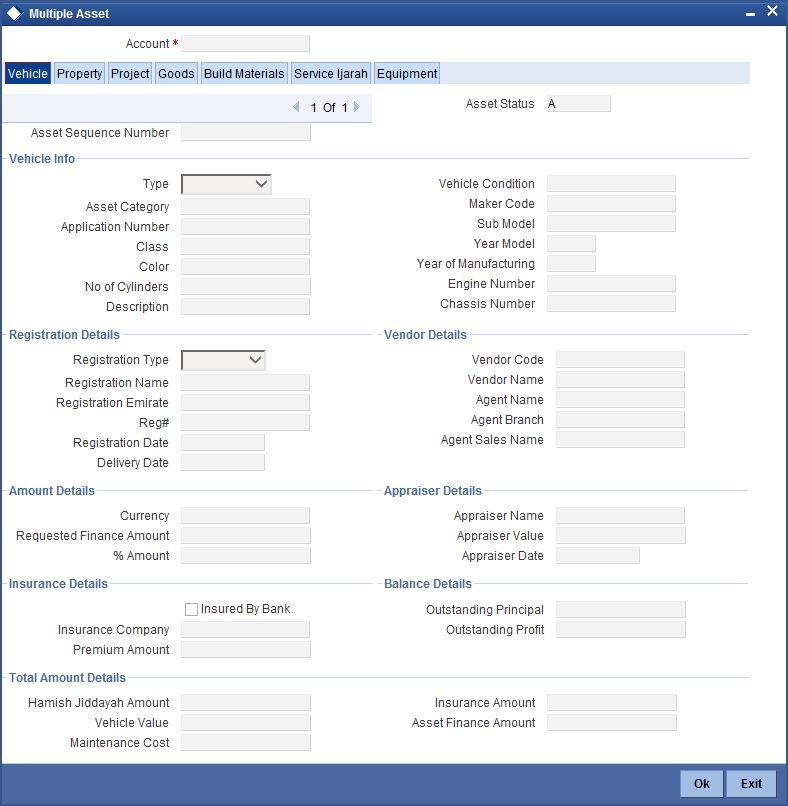

5.2.2.1 Capturing Multiple Asset Details

Click ‘Multiple Asset’ button under ‘Asset Details’ to capture the additional details about multiple assets linked to the account. Based on the product code chosen, the system identifies the asset category linked to the account and displays the appropriate screen. In case of a Murabaha account, the following screen is displayed.

For a detailed explanation of the fields in this screen, refer to the section ‘Multiple Asset Details’ in chapter ‘Account Creation’ of this user manual.

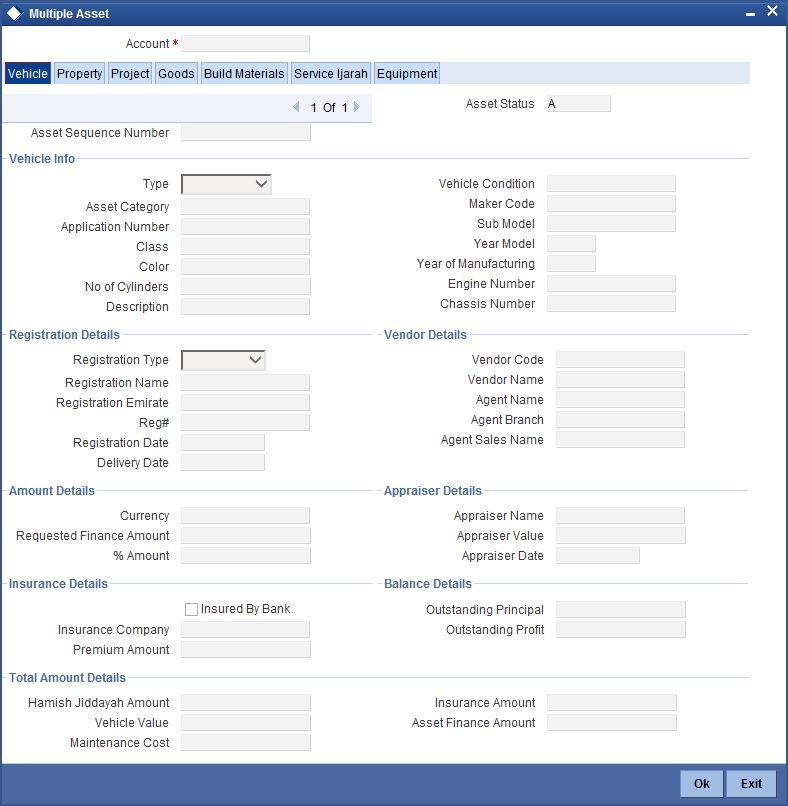

5.2.3 Charges Button

Click ‘Charges’ tab to invoke the following details:

You can specify the following details:

Component Header

Component Name

Specify the component name.

Click ‘+’ button to specify other necessary details.

Calculation Type

The system displays the type of calculation.

Component Currency

The system displays the currency associated with the component. The component currency is defaulted from the Product level.

Settlement Currency

Specify the settlement currency code. Alternatively, you can select settlement currency code from the option list. The list displays all settlement currency code maintained in the system.

Effective Date

Select the effective date from the adjoining calendar.

Service Branch

Specify the service branch code. Alternatively, you can select service branch code from the option list. The list displays all service branch code maintained in the system.

Service Account

Specify the service account number. Alternatively, you can select service account number from the option list. The list displays all service account number maintained in the system.

Due Date

The system displays the due date.

Amount Due

The system displays the due amount.

Amount Waived

The system displays the amount waived.

Details

Event Code

The system displays the event code.

Amount Settled

The system displays the amount settled.

Schedule Date

The system displays the schedule date.

5.3 Ijarah Account Input

This section contains the following topics:

- Section 5.3.1, "Creating Ijarah Accounts"

- Section 5.3.2, "Main Tab"

- Section 5.3.3, "Inventory Tracking Tab"

- Section 5.3.4, "Ijarah Tab"

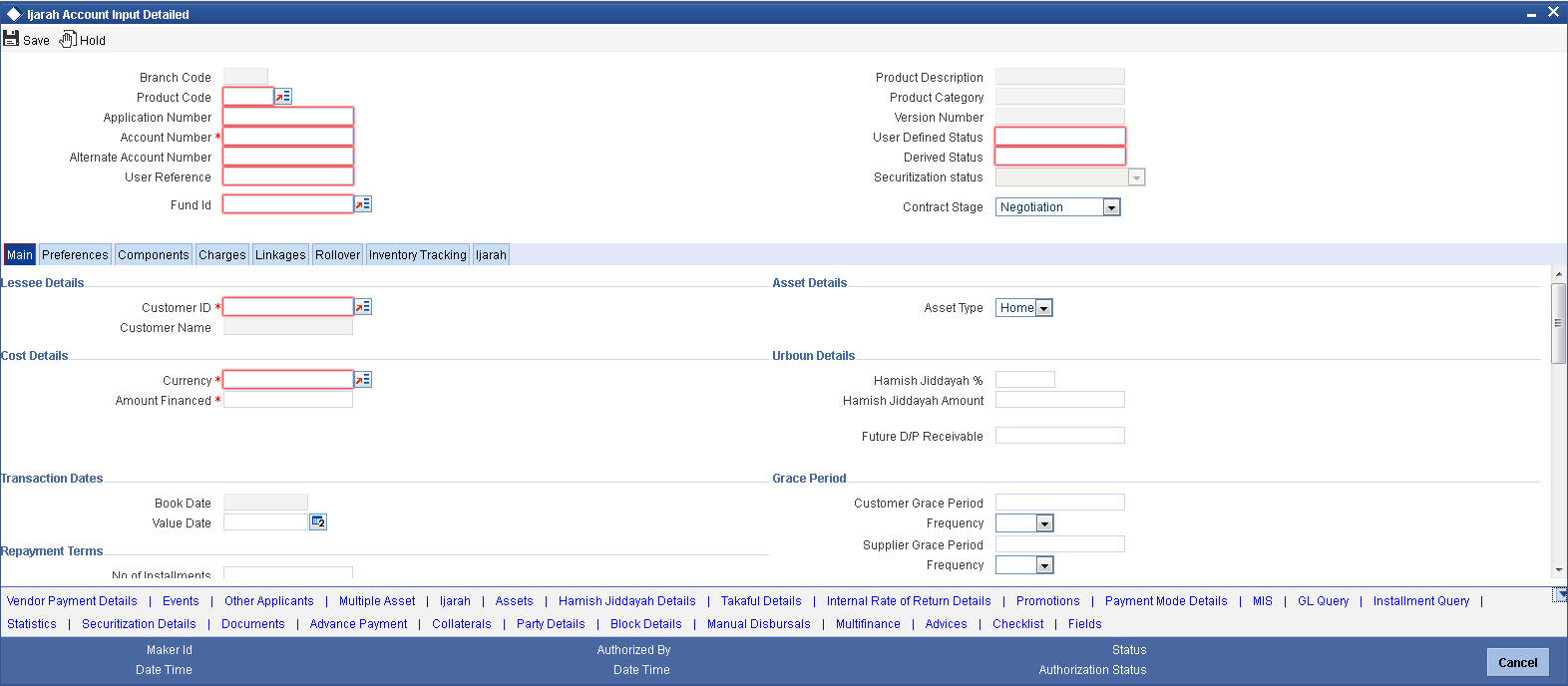

5.3.1 Creating Ijarah Accounts

You can create and modify Ijarah accounts using ‘Ijarah Account Details’ screen. To invoke this screen, type ‘CIDIJAAC’ in the field at the top right corner of the application tool bar and click the adjoining arrow button.

This section contains the details that are specific to Ijarah accounts. For further details and field information, refer to the section ‘Creating Murabaha Accounts’ in this chapter.

5.3.2 Main Tab

Click ‘Main’ tab to capture the main details of the account.

Specify the following details:

Lessee Details

Customer ID

Specify the customer ID. You can choose the required customer ID from the option list.

Customer Name

Based on the customer ID selected, the system displays the name of the customer.

Contract Status

Contract Details

Specify the status of the contract. The drop-down list displays the following statuses:

- Under Construction

- Post Construction

- Negotiation

Choose the appropriate one.

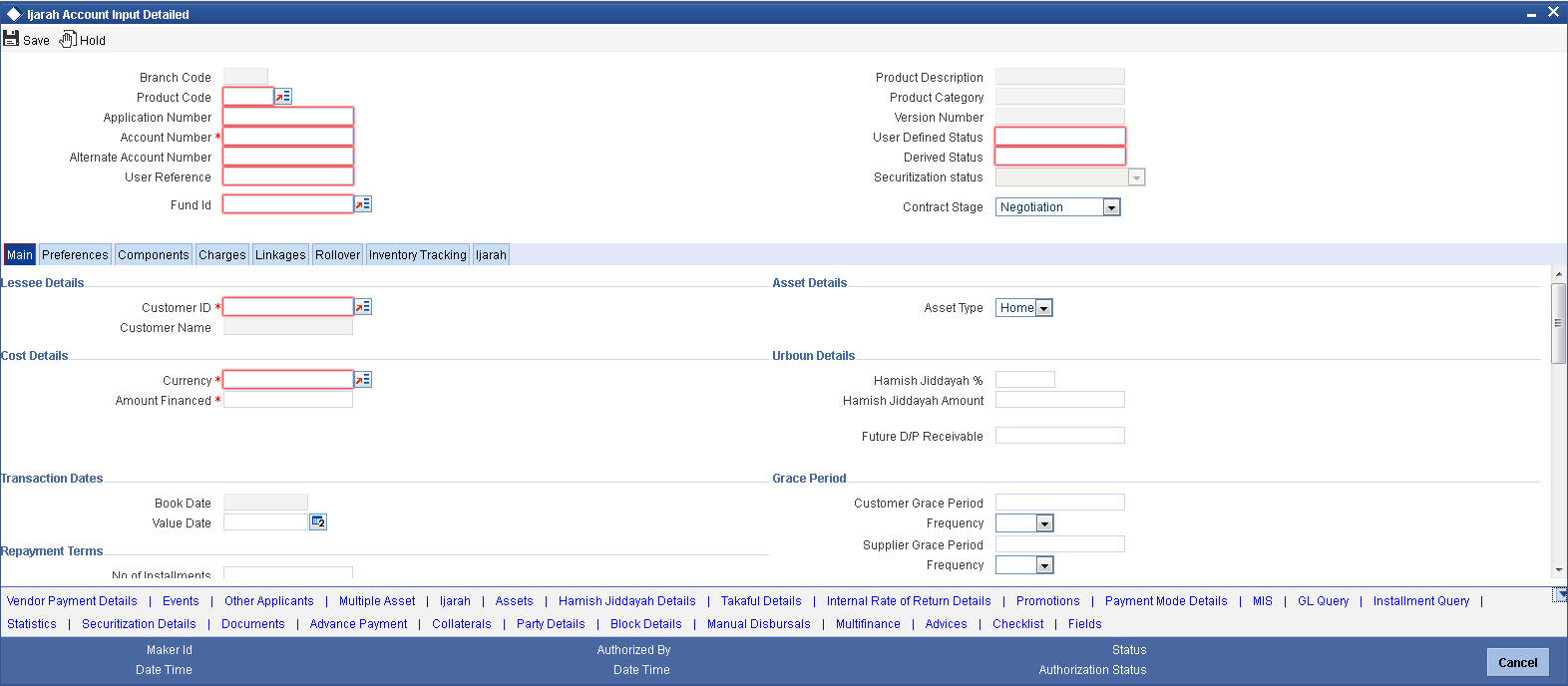

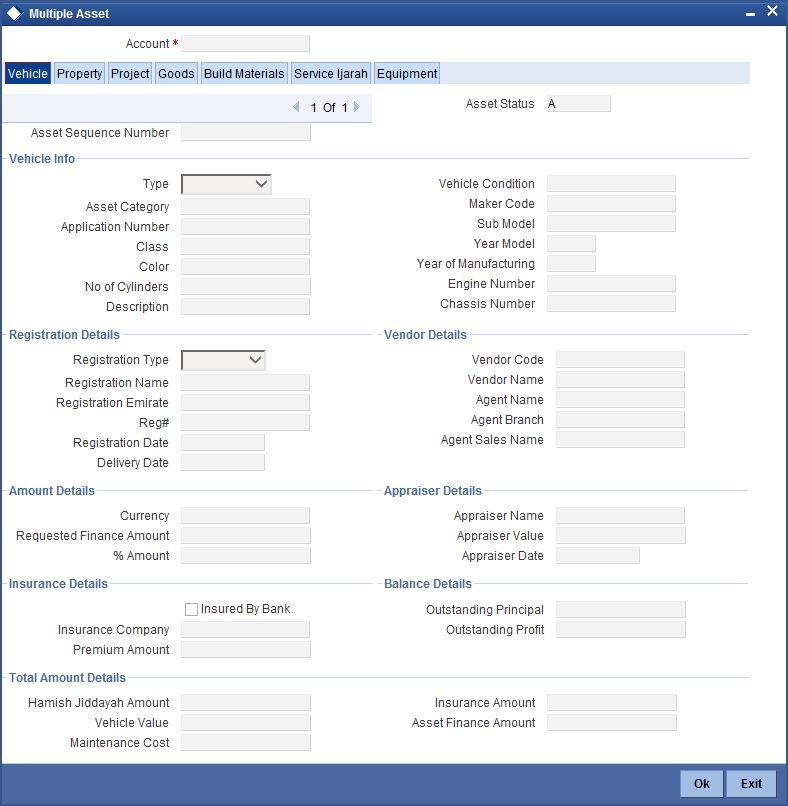

5.3.2.1 Capturing Multiple Asset Details

Click ‘Multiple Asset’ button under ‘Asset Details’ to capture the additional details about multiple assets linked to the account. Based on the product code chosen, the system identifies the asset category linked to the account and displays the appropriate screen. In case of an Ijarah account, the following screen is displayed.

For a detailed explanation of the fields in this screen, refer to the section ‘Multiple Asset Details’ in chapter ‘Account Creation’ of this user manual.

5.3.3 Inventory Tracking Tab

Click ‘Inventory Tracking’ tab to capture the details related to inventory.

For a detailed explanation of the fields in this screen, refer to the section ‘Details of Inventory’ in chapter ‘Account Creation’ of this user manual.

5.3.4 Ijarah Tab

Click ‘Ijarah’ tab to capture the details specific to Ijarah.

For a detailed explanation of the fields in this screen, refer to the section ‘Details of Ijarah’ in chapter ‘Account Creation’ of this user manual.

For further information on the other tabs of the screen, refer to the section ‘Account Main Details/Light Finances’ under chapter ‘Account Creation’ of ‘Islamic Financing’ user manual.

5.4 Istisnaa Account Input

This section contains the following topics:

- Section 5.4.1, "Creating Istisnaa Accounts"

- Section 5.4.2, "Main Tab"

- Section 5.4.3, "Inventory Tracking Tab"

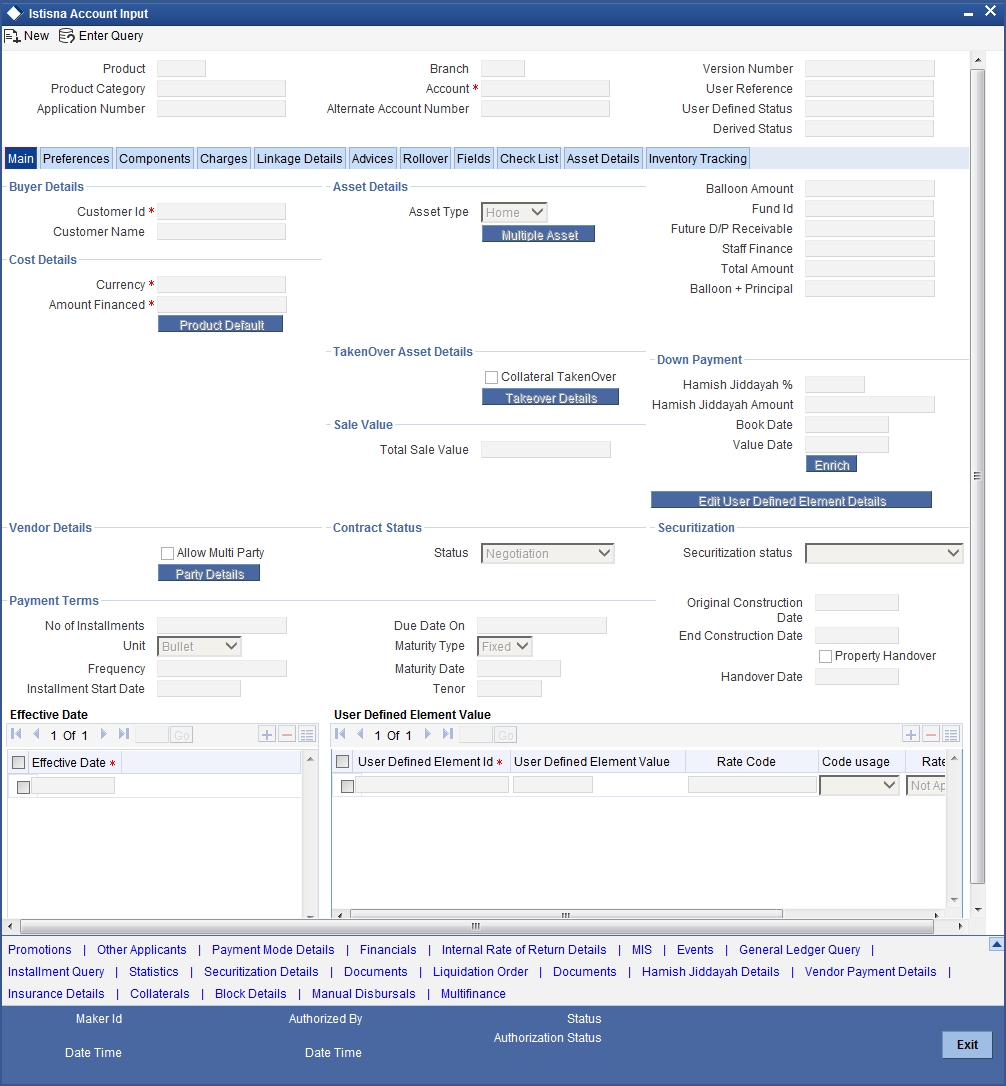

5.4.1 Creating Istisnaa Accounts

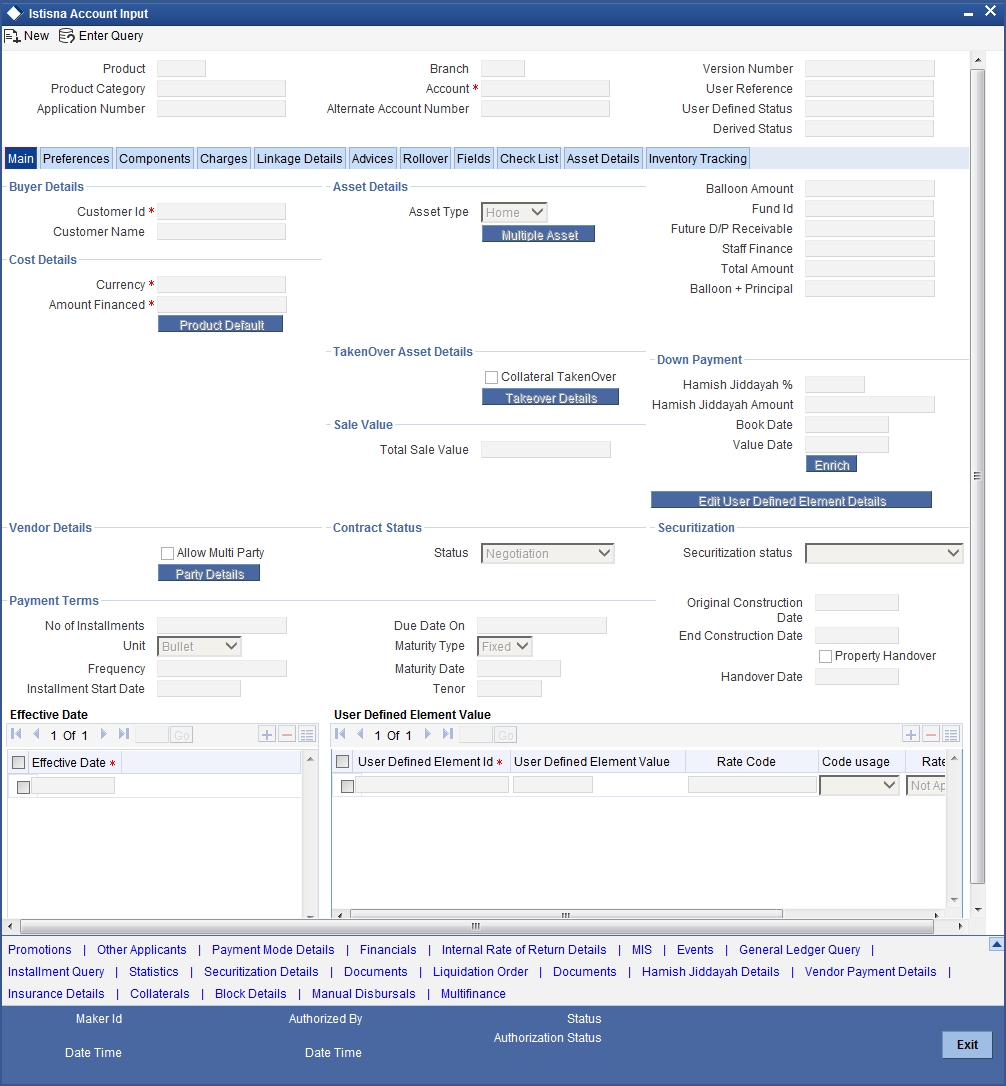

You can create and modify Istisnaa accounts using ‘Istisnaa Account Details’ screen. To invoke this screen, type ‘CIDISTAC’ in the field at the top right corner of the application tool bar and click the adjoining arrow button.

This section contains the details that are specific to Istisnaa accounts. For further details and field information, refer to the section ‘Creating Murabaha Accounts’ in this chapter.

5.4.2 Main Tab

Click ‘Main’ tab to capture the main details of the account.

Specify the following details:

Buyer Details

Customer ID

Specify the customer ID. You can choose the required customer ID from the option list.

Customer Name

Based on the customer ID selected, the system displays the name of the customer.

Payment Terms

Original Construction Date

Specify the start date of the construction for which the customer has sought the finance.

End Construction Date

Specify the end date of the construction for which the customer has sought the finance.

Property Handover

Check this box to enable property handover period for the Ijarah account.

Handover Date

Specify the date on which the property should be handed over.

Vendor Details

Allow Multi-Party

Check this box to allow multiple parties for the account.

Contract Status

Status

Specify the contract status. The drop-down list displays the following options:

- Negotiation

- Under Construction

- Post Construction

Choose the appropriate one.

5.4.2.1 Capturing Multiple Asset Details

Click ‘Multiple Asset’ button under ‘Asset Details’ to capture the additional details about multiple assets linked to the account. Based on the product code chosen, the system identifies the asset category linked to the account and displays the appropriate screen. In case of an Istisnaa account, the following screen is displayed.

For a detailed explanation of the fields in this screen, refer to the section ‘Multiple Asset Details’ in chapter ‘Account Creation’ of this user manual.

5.4.2.2 Capturing Party Details

Click ‘Party Details’ button under ‘Vendor Details’ to capture the details about parties linked to the account. The system displays the following screen.

For a detailed explanation of the fields in this screen, refer to the section ‘'Party Details’ in chapter ‘Account Creation’ of this user manual.

5.4.2.3 Preferences Tab

Click ‘Preferences tab’ to capture the preference details.

Percentage of Completion

The system displays the maximum work completion percentage specified for all the Manual Disbursements against the account. The system displays the value when we query for Istisna account.

5.4.3 Inventory Tracking Tab

Click ‘Inventory Tracking’ tab to capture the details related to inventory.

For a detailed explanation of the fields in this screen, refer to the section ‘Details of Inventory’ in chapter ‘Account Creation’ of this user manual.

For further information on the other tabs of the screen, refer to the section ‘Account Main Details/Light Finances’ under chapter ‘Account Creation’ of ‘Islamic Financing’ user manual.

5.5 Mudarabah Account Input

This section contains the following topics:

- Section 5.5.1, "Creating Mudarabah Accounts"

- Section 5.5.2, "Main Tab"

- Section 5.5.3, "Inventory Tracking Tab"

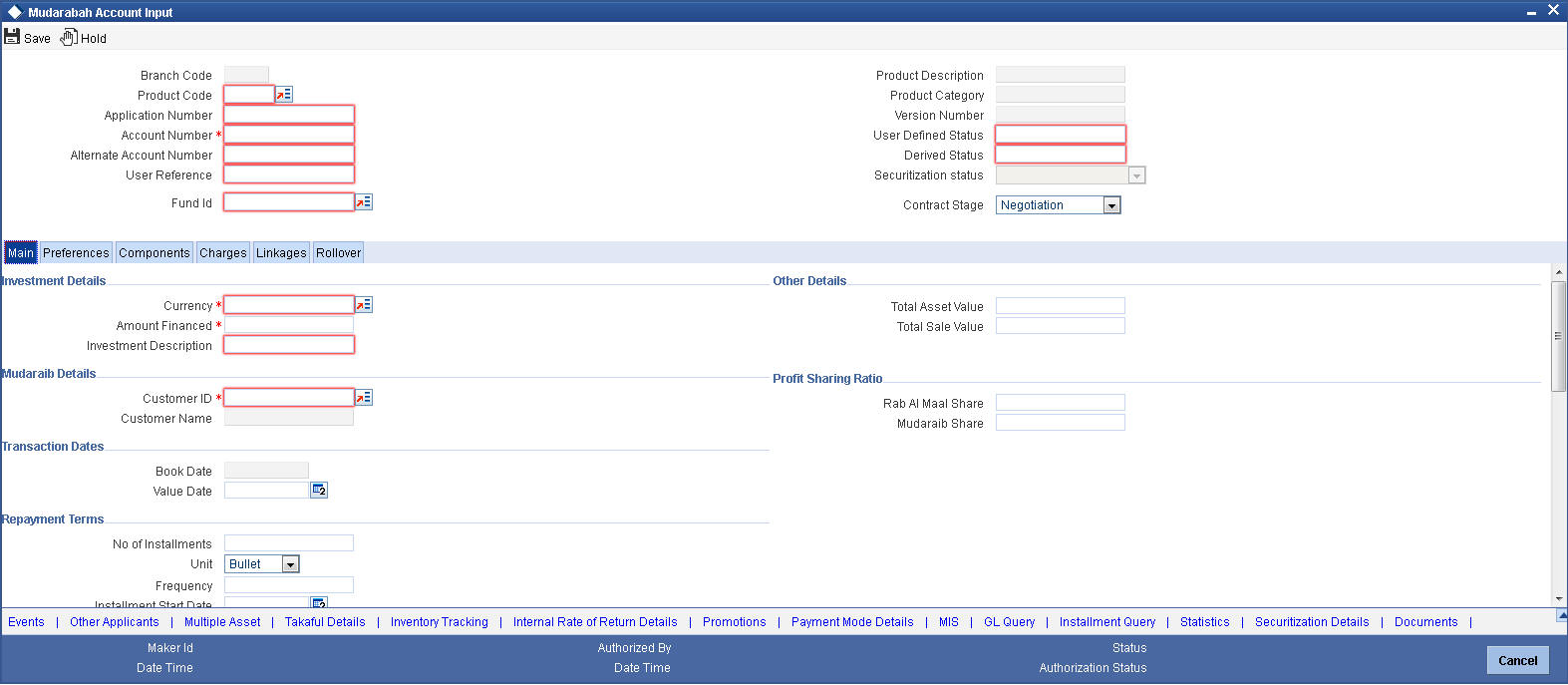

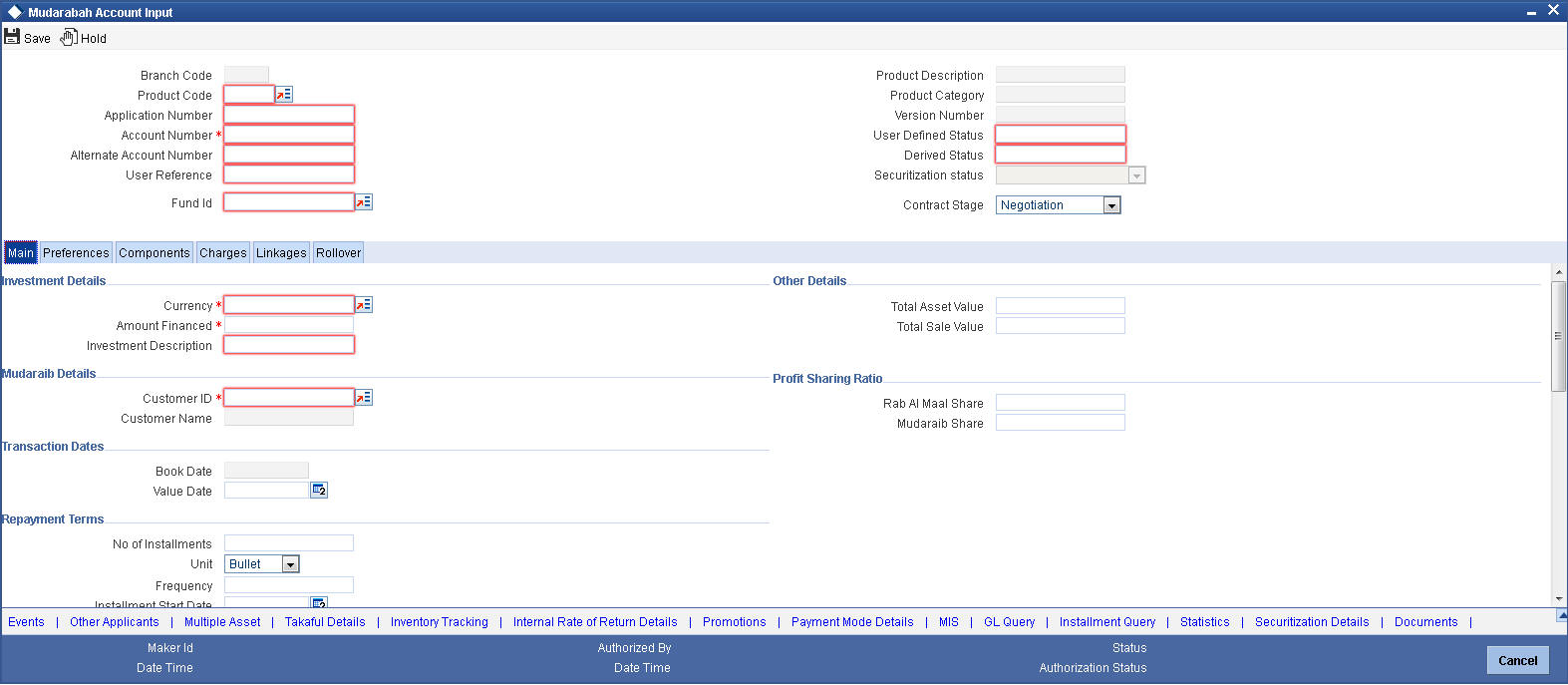

5.5.1 Creating Mudarabah Accounts

You can create and modify Mudarabah accounts using ‘Mudarabah Account Details’ screen. To invoke this screen, type ‘CIDMUDAC’ in the field at the top right corner of the application tool bar and click the adjoining arrow button.

This section contains the details that are specific to Mudarabah accounts. For further details and field information, refer to the section ‘Creating Murabaha Accounts’ in this chapter.

5.5.2 Main Tab

Click ‘Main’ tab to capture the main details of the account.

Specify the following details:

Investment

Investment Description

Specify a brief description of the investment.

Currency

Specify the currency of the account. The option list displays all valid currency codes maintained in the system. Choose the appropriate one.

Amount Financed

Specify the total principal amount of the finance.

MUDARAIB

Customer ID

Specify the customer ID. You can choose the required customer ID from the option list.

Customer Name

Based on the customer ID selected, the system displays the name of the customer.

Profit Sharing Ratio

The system displays the percentage of principal amount contributed by the bank and the customer.

RAB AL MAAL

Branch

The system displays the branch ain which the customer has the account.

Profit Sharing Ratio

The system displays the percentage of principal amount contributed by the bank and the customer.

Book Date

Specify the book date of the finance in this field using the date button. You can use the date button to choose the date from the calendar.

Value Date

Specify the value date of the finance. You can use the date button to choose the date from the calendar.

5.5.2.1 Capturing Multiple Asset Details

Click ‘Multiple Asset’ button under ‘Asset Details’ to capture the additional details about multiple assets linked to the account. Based on the product code chosen, the system identifies the asset category linked to the account and displays the appropriate screen. In case of a Mudarabah account, the following screen is displayed.

For a detailed explanation of the fields in this screen, refer to the section ‘Multiple Asset Details’ in chapter ‘Account Creation’ of this user manual.

5.5.3 Inventory Tracking Tab

Click ‘Inventory Tracking’ tab to capture the details related to inventory.

For a detailed explanation of the fields in this screen, refer to the section ‘Details of Inventory’ in chapter ‘Account Creation’ of this user manual.

For further information on the other tabs of the screen, refer to the section ‘Account Main Details/Light Finances’ under chapter ‘Account Creation’ of ‘Islamic Financing’ user manual.

5.6 Musharaka Account Input

This section contains the following topics:

- Section 5.6.1, "Creating Musharaka Accounts"

- Section 5.6.2, "Main Tab"

- Section 5.6.3, "Inventory Tracking Tab"

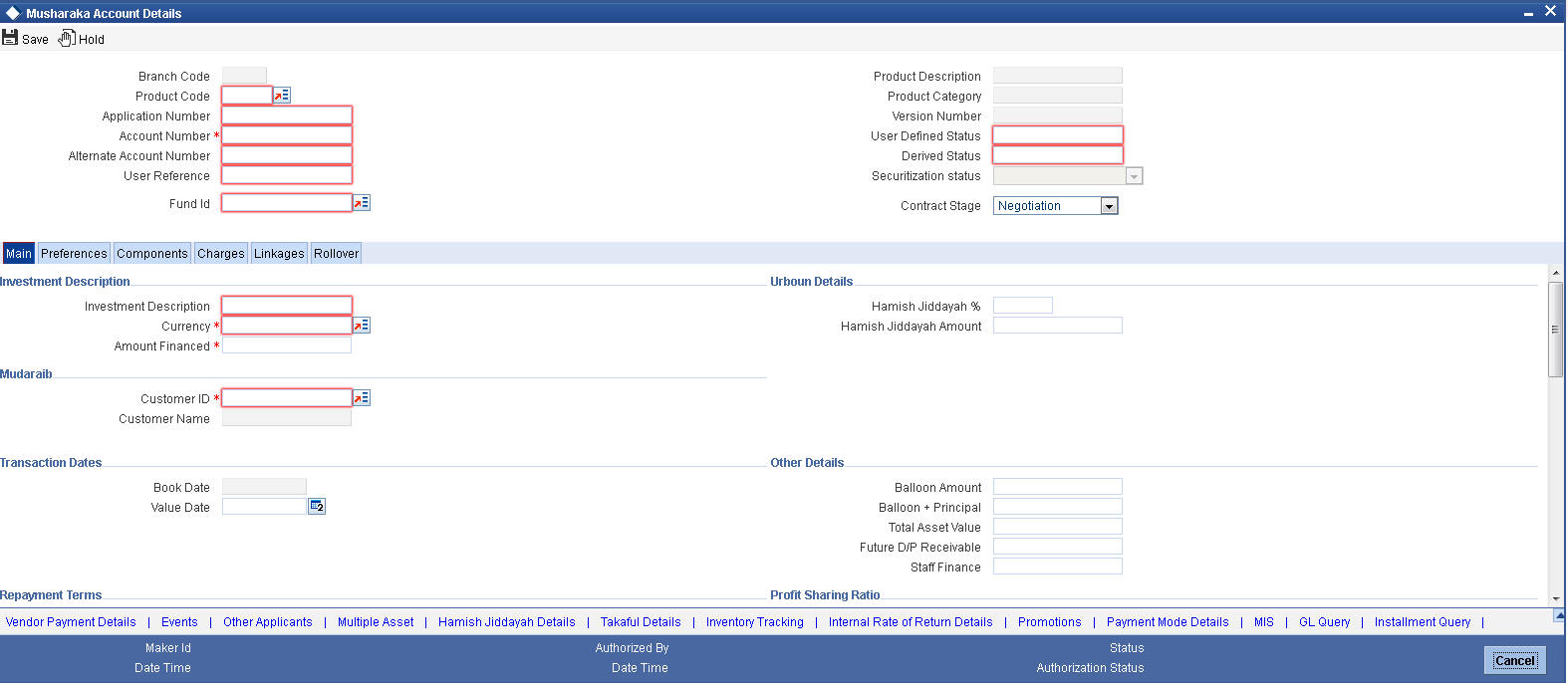

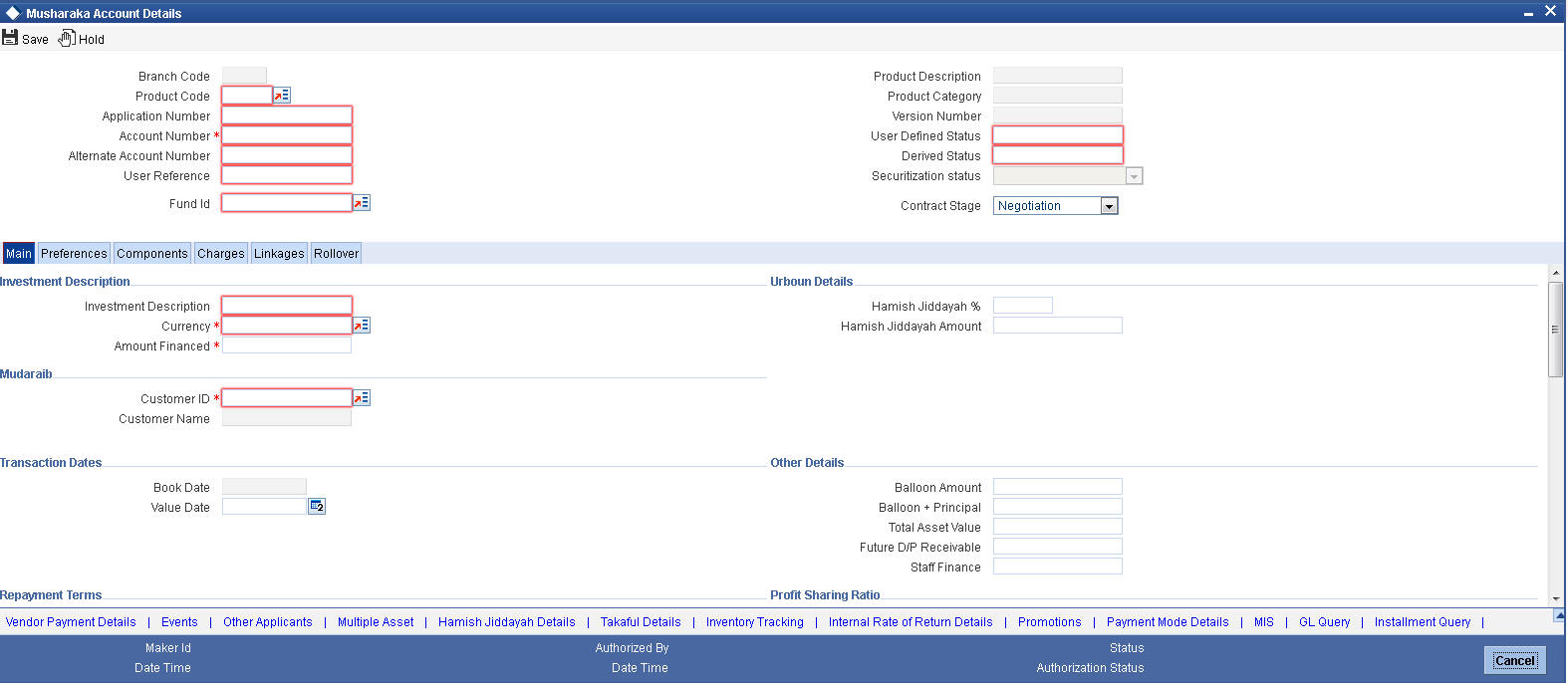

5.6.1 Creating Musharaka Accounts

You can create and modify Musharaka accounts using ‘Musharaka Account Details’ screen. To invoke this screen, type ‘CIDMUSAC’ in the field at the top right corner of the application tool bar and click the adjoining arrow button.

This section contains the details that are specific to Musharaka accounts. For further details and field information, refer to the section ‘Creating Murabaha Accounts’ in this chapter.

5.6.2 Main Tab

Click ‘Main’ tab to capture the main details of the account.

Specify the following details:

Investment

Investment Description

Specify a brief description of the investment.

Currency

Specify the currency of the account. The option list displays all valid currency codes maintained in the system. Choose the appropriate one.

Amount Financed

Specify the total principal amount of the finance.

Custom Share

Customer ID

Specify the customer ID. You can choose the required customer ID from the option list.

Customer Name

Based on the customer ID selected, the system displays the name of the customer.

Profit Sharing Ratio

The system displays the percentage of principal amount contributed by the bank and the customer.

Bank Share

Branch

The system displays the branch ain which the customer has the account.

Profit Sharing Ratio

The system displays the percentage of principal amount contributed by the bank and the customer.

Book Date

Specify the book date of the finance in this field using the date button. You can use the date button to choose the date from the calendar.

Value Date

Specify the value date of the finance. You can use the date button to choose the date from the calendar.

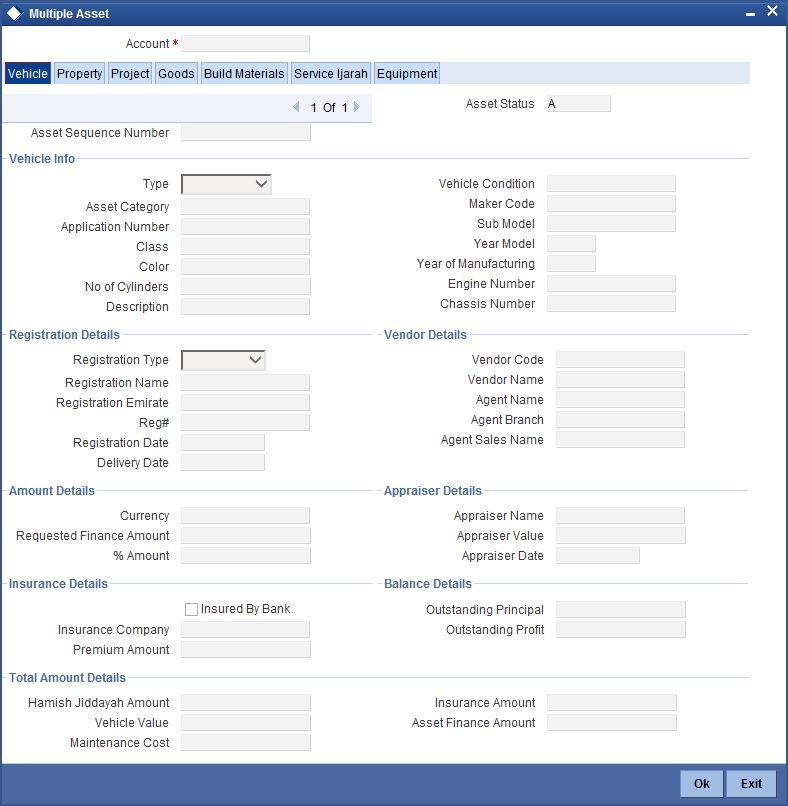

5.6.2.1 Capturing Multiple Asset Details

Click ‘Multiple Asset’ button under ‘Asset Details’ to capture the additional details about multiple assets linked to the account. Based on the product code chosen, the system identifies the asset category linked to the account and displays the appropriate screen. In case of a Musharaka account, the following screen is displayed.

For a detailed explanation of the fields in this screen, refer to the section ‘Multiple Asset Details’ in chapter ‘Account Creation’ of this user manual.

5.6.3 Inventory Tracking Tab

Click ‘Inventory Tracking’ tab to capture the details related to inventory.

For a detailed explanation of the fields in this screen, refer to the section ‘Details of Inventory’ in chapter ‘Account Creation’ of this user manual.

For further information on the other tabs of the screen, refer to the section ‘Account Main Details/Light Finances’ under chapter ‘Account Creation’ of ‘Islamic Financing’ user manual.

5.7 Tawarooq Account Input

This section contains the following topics:

- Section 5.7.1, "Creating Tawarooq Accounts"

- Section 5.7.2, "Main Tab"

- Section 5.7.3, "Inventory Tracking Tab"

5.7.1 Creating Tawarooq Accounts

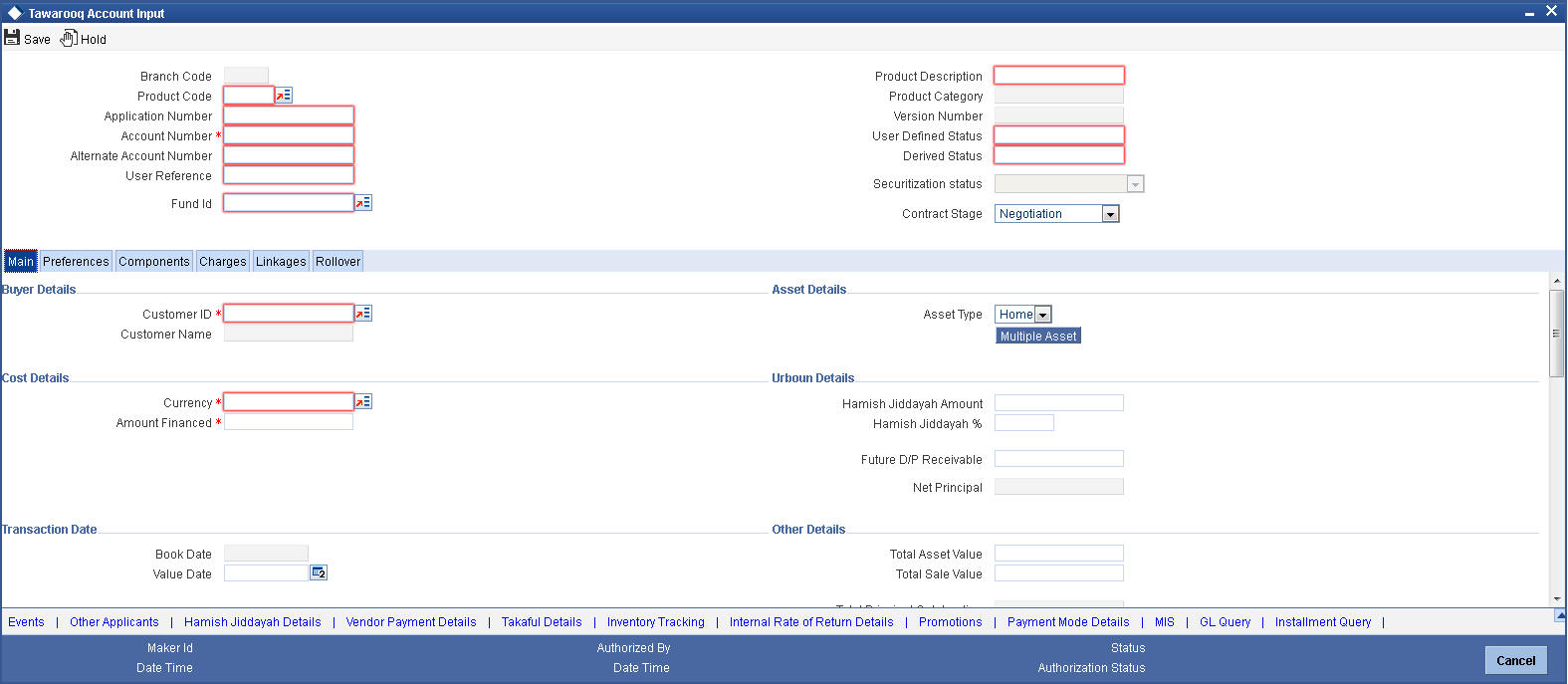

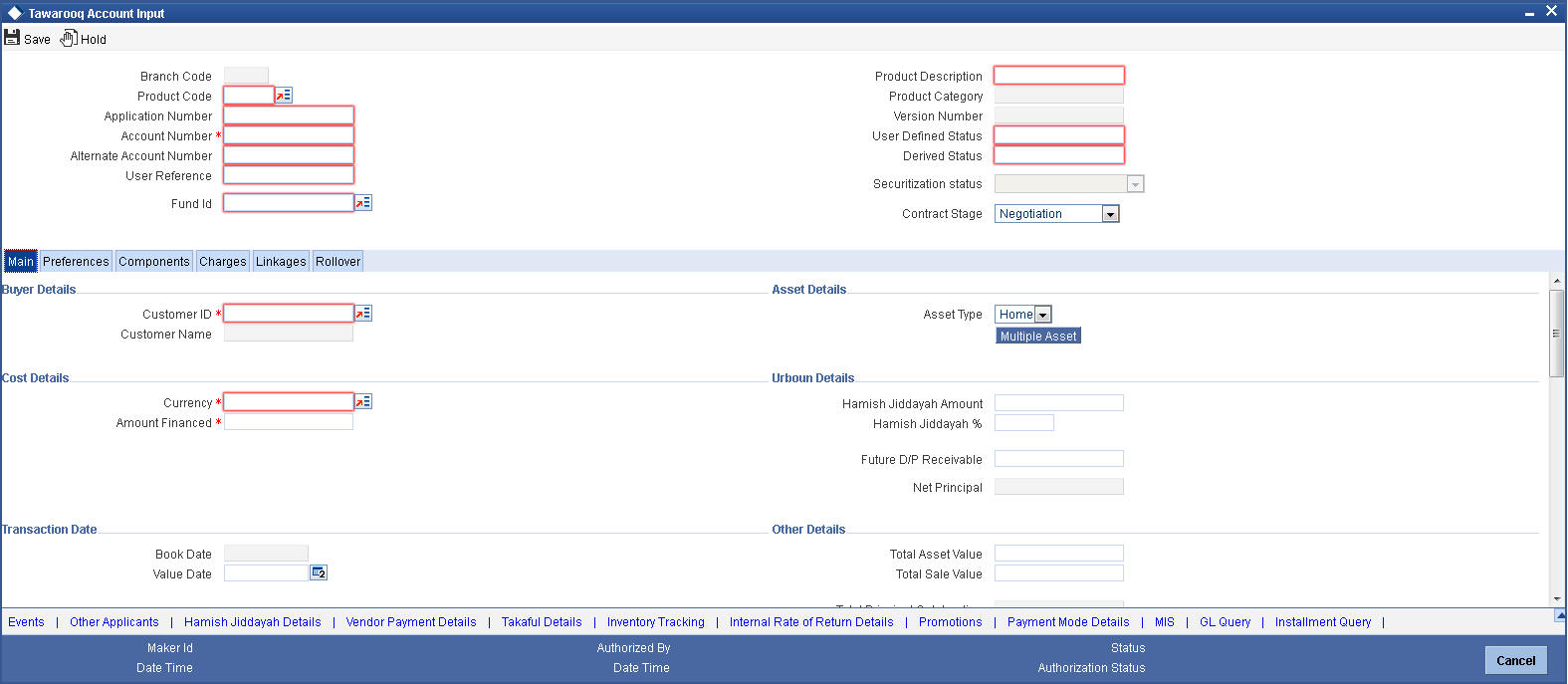

You can create and modify Tawarooq accounts using ‘Tawarooq Account Details’ screen. To invoke this screen, type ‘CIDTAWAC’ in the field at the top right corner of the application tool bar and click the adjoining arrow button.

This section contains the details that are specific to Tawarooq accounts. For further details and field information, refer to the section ‘Creating Murabaha Accounts’ in this chapter.

5.7.2 Main Tab

Click ‘Main’ tab to capture the main details of the account.

Specify the following details:

Buyer Details

Customer ID

Specify the customer ID. You can choose the required customer ID from the option list.

Customer Name

Based on the customer ID selected, the system displays the name of the customer.

Cost Details

Currency

Specify the currency of the account. The option list displays all valid currency codes maintained in the system. Choose the appropriate one.

Amount Financed

Specify the total principal amount of the finance.

Hamish Jiddayah

Specify the finance amount paid by the customer upfront – Owners contribution. In case of Ijarah contracts, for a financial lease the down payment will be considered entirely towards the principal. In case of an operational lease, the entire down payment will be considered as income. Note that the down payment amount cannot be amended after authorization.

Contract Status

Status

Specify the contract status. The drop-down list displays the following options:

- Negotiation

- Under Construction

- Post Construction

Choose the appropriate one.

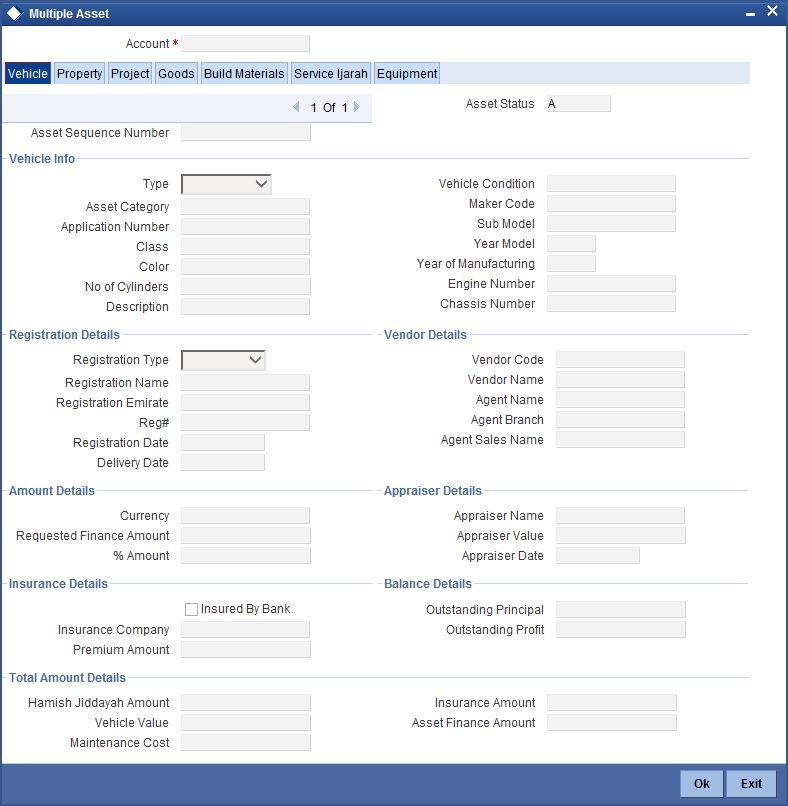

5.7.2.1 Capturing Multiple Asset Details

Click ‘Multiple Asset’ button under ‘Asset Details’ to capture the additional details about multiple assets linked to the account. Based on the product code chosen, the system identifies the asset category linked to the account and displays the appropriate screen. In case of a Tawarooq account, the following screen is displayed.

For a detailed explanation of the fields in this screen, refer to the section ‘Multiple Asset Details’ in chapter ‘Account Creation’ of this user manual.

5.7.3 Inventory Tracking Tab

Click ‘Inventory Tracking’ tab to capture the details related to inventory.

For further information on the other tabs of the screen, refer to the section ‘Account Main Details/Light Finances’ under chapter ‘Account Creation’ of ‘Islamic Financing’ user manual.