8. Making Manual Disbursements

The Islamic Financing Module of Oracle FLEXCUBE supports the following modes for finance disbursements:

- Auto

- Manual

If you select the mode ‘Auto’, the system will automatically disburse the finances based on the disbursement schedule defined for the product.

In the manual mode, disbursement happens on demand. In this case, disbursement schedules need not be maintained for the ‘PRINCIPAL’ component. Also, you can collect any applicable charges related to the disbursement at the time of making the disbursement. These charges are defined at the product level.

When an Islamic finance is disbursed either in the ‘manual’ or in the ‘auto’ mode, the system will utilize the collateral, collateral pool, facility, or liability only for the amount that is disbursed.

You have to specify the disbursement mode as a preference at the time of setting up a Consumer Lending product in the system.

Refer the section titled ‘Disbursement Mode preferences’ in the ‘Defining Product Categories and Products’ chapter of this User Manual for details.

This chapter contains the following section:

8.1 Manual Disbursement

This section contains the following topic:

- Section 8.1.1, "Disbursing a finance through the ‘Manual’ mode"

- Section 8.1.2, "SWIFT Message Details Button"

- Section 8.1.3, "Advices Button"

- Section 8.1.4, "Fields Button"

- Section 8.1.5, "Check List Button"

8.1.1 Disbursing a finance through the ‘Manual’ mode

You can initiate a manual disbursement through the ‘Manual disbursement’ screen. You can invoke this screen by typing ‘CIDMNDSB’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

To begin the disbursement, click on the ‘New’ icon in the toolbar of the screen. Enter the account number and click the ‘Default’ button. The system defaults the details based on product definition and the account maintained by the bank for the account. You can modify the relevant details.

The following information gets defaulted to the screen:

Transaction Branch Code

The code of the login/sign-on branch is displayed here. However, you can select a different branch from the option list provided. It is the branch where the loan account of the customer resides.

Account Number

Select the Loan Account of the customer to which the disbursement is made. All valid accounts are available in the option list. Select the appropriate one from this list.

Event Sequence Number

Specify the event sequence number.

Product Code

Specify the product code.

Product Description

The system displays the description for the selected product code.

Customer ID

Specify the customer ID

Customer Name

The system displays the name of the customer for the selected customer ID.

Disbursement Details

Currency

The system displays the currency code.

Value Date

This is the date when the credit entry (for the disbursement amount) is posted to the Cr Settlement Bridge. The current system date is displayed here.

Execution Date

This is the date on which the disbursement is booked in the system. The current system date is displayed here. You may change the date to a date in the future before the maturity date of the loan.

Remarks

Capture any additional information about the disbursements, if required.

Total Amount

This displays the sum total of the amount disbursed across the various settlement modes. It gets incremented by the amount settled.

On saving the account, the sum total of the amount disbursed in limit currency is validated against the product transaction limit and the user input limit maintained in the system. The system converts the contract amount to the transaction limit amount using the standard mid rate and check against the transaction limit amount maintained for the product if the contract currency is different from the transaction limit currency.

The system displays an appropriate override/error message if the amount exceeds the allowed input limit. It also indicates the level of authorization required if the transaction the amount is in excess of the transaction limit maintained.

Reference Number

This is auto generated and used as a reference to identify the transaction in the system.

Amount Financed

The system calculates and computes the amount financed into the account, when you click ‘Default’ button.

Amount Disbursed

The system calculates and computes the amount disbursed into the account, when you click ‘Default’ button.

Amount Block

Specify the following under amount blocks:

Amount to be Blocked

Here the system displays the amount to be blocked.

Amount Blocked

The system displays the amount blocked till date.

Last Blocked date

The system displays the last blocked date.

Re-Schedule Amortization on Final disbursement

By default, this field displays the value maintained in the ‘Re-Schedule Amortization on Final disbursement’ field in the ‘Account Details’ screen. During manual disbursement, if this field is checked, if the amount financed is equal to the amount disbursed and if the amortization starts date is not equal to disbursement date, the system displays the override message as ‘Amortization Re-scheduling triggered’.

During authorization, the system will reschedule the amortization schedules.

On reversal of disbursement, amortization reschedule triggered during the final disbursement is reversed and the amortized schedules and maturity date is restored back to state before the disbursement.

Hamish Jiddayah Details

Hamish Jiddayah Amount

Specify the Hamish Jiddayah payment amount.

Percentage of Completion

Specify the percentage of completion based on which the amount to be disbursed is calculated. The entered value should be greater than ‘0’ and less than ‘100’.

Amount to be Disbursed

The amount which needs to be disbursed is calculated and displayed here once you specify percentage of completion and move the cursor from ‘Percentage of Completion’ field.

The following steps are involved in calculating amount to be disbursed:

- Click ‘Default’ button. The system computes ‘Amount Financed’ and ‘Amount Disbursed’.

- Specify percentage of completion and move the cursor from ‘Percentage of Completion’ field.

‘Percentage of Completion’ and ‘Percentage of Disbursement’ are directly related. Also,

Percentage of Amount to be Disbursed = (Percentage of Completion – Percentage of Amount Disbursed)

- The system calculates the ‘Percentage of Amount Disbursed’ using the ‘Amount Financed’ and ‘Amount Disbursed’ values computed. Therefore,

Amount to be Disbursed = (Amount Financed * (Percentage of Completion – Percentage of amount Disbursed))/100

You can change the value of ‘Percentage of Completion’ and the system calculates and displays the ‘Amount to be Disbursed’ accordingly, once you move the cursor from ‘Percentage of Completion’.

System displays an override message for the following:

- If the amount that is actually disbursed is different from the amount to be disbursed.

- If the given Percentage of Completion is less than the given value for the same during the previous disbursement.

- During final disbursement, if the percentage of completion is not equal to 100%.

Note

- If the percentage of completion is not defined, then the systems defaults the value to ‘0’.

- The validations and calculations are applicable only for accounts which are maintained as ‘Istisna’ products

Label Account

Select the Finance Account of the customer to which the disbursement is made. All valid accounts are available in the option list. Select the appropriate one from this list.

Remarks

Capture any additional information about the disbursements, if required.

Disbursement Details

The following disbursement details have to be captured in the ‘Disbursement Details’ section of the screen:

Reversed

When you reverse a manual disbursement, the system automatically checks this option to denote that the particular settlement mode has been reversed.

For reversing a disbursement, a different event, REVD (Reverse Disbursement) is triggered.

Settlement Mode

You can make disbursements either through a single mode or by using multiple modes of settlement, depending on the customer’s requirement.

The settlement details that need to be captured depend on the mode you select. The list of modes and the applicable settlement details are given below:

- CASA

- Settlement Branch

- Settlement Account

- Clearing

- Upload Source

- Instrument Number

- Clearing Product

- End Point

- Routing Number

- Clearing Bank

- Clearing Branch

- Sector Code

- External Account

- Upload Source

- Product Category

- Clearing Bank Code

- Clearing Branch Code

- External Account Name

- External Account Number

- Instrument

- Instrument Number

- Settlement Branch

- Settlement Account

- Cash/Teller

- Upload Source

- Settlement Product

Note

Atleast one mode is mandatory to make a disbursement.

Settle Currency

After specifying the settlement mode for the disbursement, select the currency in which the disbursement is to be made. The currencies allowed for the branch are available in the option list provided.

Settlement Amount

Here, you have to capture the disbursement amount that is to be settled through the selected mode in the selected currency.

The ‘Total Amount’ gets incremented by the amount settled and displays the sum total of the amount disbursed across the various settlement modes.

Note that if the box ‘Property Handover’ is not checked, the system will not allow final disbursement.

Original Exchange Rate

The base or actual exchange rate between the account currency and settlement currency gets displayed here.

Exchange Rate

For a customer availing any Relationship Pricing scheme, the customer specific exchange rate derived by adding the original exchange rate and the customer spread maintained for the relationship pricing scheme gets displayed here.

You can change the defaulted rate provided the change is within the variance level maintained for the underlying product.

If Relationship Pricing is not applicable, Exchange Rate will be the same as the Original Exchange Rate.

For more details on customer specific exchange rates, refer the section titled ‘Specifying Pricing Benefit Details’ in Relationship Pricing user manual.

Settlement Currency Equivalent

As mentioned above, if the Mode Currency and Loan Currency are different, the system calculates the Loan Currency equivalent using the exchange rate applicable for the currency pair.

Settlement Branch

Specify the settlement branch.

Account Description

The system displays the account description.

Settlement Account

Specify the settlement account.

Issuing Branch

Specify the issuing branch code.

External Reference Number

The system displays the external reference number.

Additional Details

Click ‘Additional Details’ button to specify the additional details.

Netting Account for Debits

Specify the netting account details for debits.

Suppress Message

Check this box to suppress the message

Customer

Specify the customer details.

Purpose

Specify the purpose of manual disbursement.

Charge Details

Click ‘Compute Charges’ button to calculate the charge details.

Specify the following details in this screen:

Component Name

Select the charge component from the option list provided. This list displays the components of type ‘Charge’ that were associated with the event at the time of defining the product.

Settlement Mode

You can use multiple modes of settlement for charge settlement also. The list of modes applicable is same as the one allowed for finance disbursement.

Settlement Currency

After specifying the settlement mode, select the currency in which the charge is to be collected. The currencies allowed for the branch are available in the option list provided.

Settlement Amount

If a formula is maintained for charge calculation at the product level, the system calculates the charge on the amount being disbursed using the formula. The same is then displayed in the here.

Exchange Rate and Settlement Currency Equivalent

This information is applicable if the Mode Currency is different from the Finance Currency. The exchange rate that is defaulted from the Standard Exchange Rate Maintenance is used to convert the charge amount to the Finance Currency equivalent.

The system displays the following details:

- Settlement Branch

- Settlement Account

- External Account

- Additional Details

8.1.2 SWIFT Message Details Button

Click ‘SWIFT Message Details’ button in ‘Islamic Account Details’ screen to invoke the following screen:

You can specify the following details:

Account

Specify the account number.

Beneficiary Institution

Beneficiary Institution

Specify the beneficiary institution details. Alternatively, you can select the beneficiary institution details from the option list. The list displays all valid beneficiary institution details maintained in the system.

Sender To Receiver Information

Sender To Receiver Information

Specify the sender to receiver information details. Alternatively, you can select the sender to receiver information details from the option list. The list displays all valid sender to receiver information details maintained in the system.

Message Details

Cover Required

Check this box if applicable.

Payment Details

Payment Details

Specify the payment details.

Charge Details

Account Currency

Specify the account currency code.

Our Correspondent

Specify the correspondent details.

Receiver

Specify the receiver details.

Transfer Type

Specify the type of transfer.

Remitter - All Charges

Select the remitter - al charges option that you are maintaining. The options are as follows:

- Charges

- Remitter 1

Ordering Institution

Ordering Institution

Specify the ordering institution details. Alternatively, you can select the ordering institution details from the option list. The list displays all valid ordering institution details maintained in the system.

Ordering Customer

Ordering Customer

Specify the ordering customer details. Alternatively, you can select the ordering customer details from the option list. The list displays all valid ordering customer details maintained in the system.

Intermediary Reimbursement Institution

Intermediary Institution

Specify the intermediary institution details. Alternatively, you can select the intermediary institution details from the option list. The list displays all valid intermediary institution details maintained in the system.

Ultimate Beneficiary

Ultimate Beneficiary

Specify the ultimate beneficiary details. Alternatively, you can select the ultimate beneficiary details from the option list. The list displays all valid ultimate beneficiary details maintained in the system.

Beneficiary Institution for Cover

Beneficiary Institution

Specify the beneficiary institution details. Alternatively, you can select the beneficiary institution details from the option list. The list displays all valid beneficiary institution details maintained in the system.

Receiver Correspondence

Receiver Correspondent

Specify the receiver correspondent details. Alternatively, you can select the receiver correspondent details from the option list. The list displays all valid receiver correspondent details maintained in the system.

Account with Institution

Account with Institution

Specify the account with institution details. Alternatively, you can select the account with institution details from the option list. The list displays all valid account with institution details maintained in the system.

Intermediary

Intermediary

Specify the intermediary details. Alternatively, you can select the intermediary details from the option list. The list displays all valid intermediary details maintained in the system.

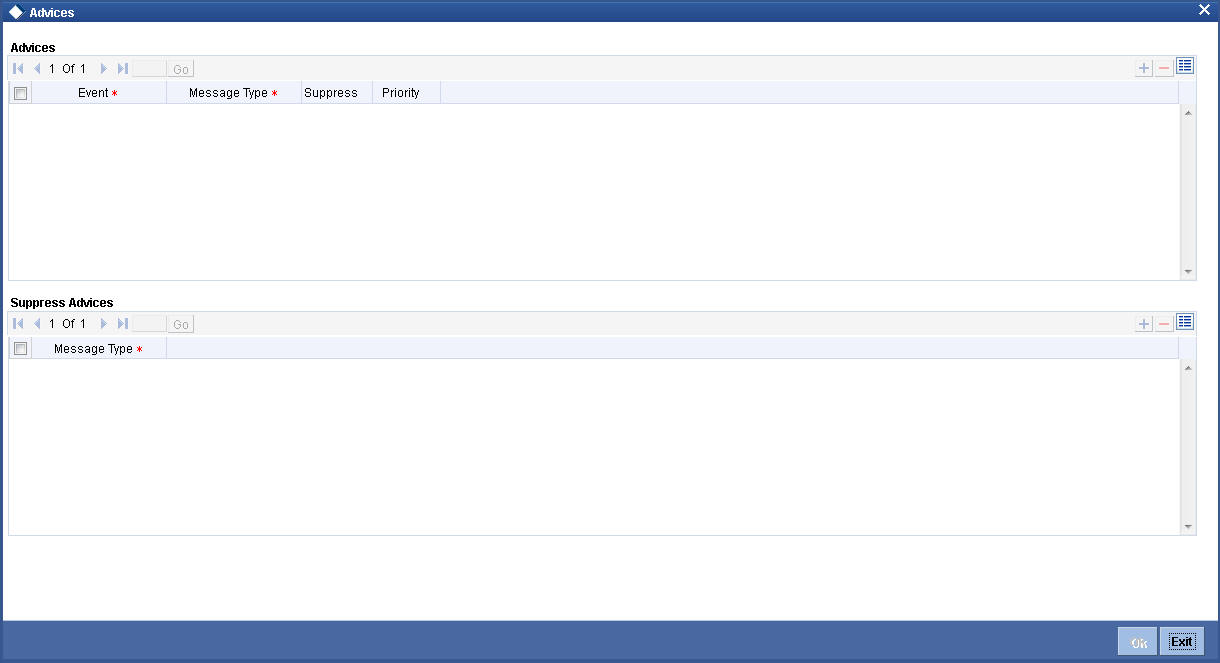

8.1.3 Advices Button

You can view the advices defaulted which also includes the Payment Message in the ‘Advices’ screen. To invoke this screen, click ‘Advices’ button on the ‘Manual Disbursement’ screen. You can also choose to suppress the messages as required.

You can opt to suppress the Payment Message defaulted in case you do not need a credit through swift message .

The defaulted details can be overriden at this stage and if the settlement mode is changed to anything other than CASA, the swift message is automatically suppressed.

You can specify the following details:

Advices

Event

The system displays the event details.

Message Type

The system displays all the advices for all the events for the account. The list will include all the advices that are defined at the product level.

Suppress

Select if the generated advice to be suppressed or not for a particular event from the drop-down list. The list displays the following values:

- Yes

- No

Priority

Click on the option list to select the priority of generation. The following values are displayed.:

- High

- Medium

- Low

Double click on a value to select it.

Suppress Advices

Advice Name

Specify the advice name.

8.1.4 Fields Button

Click ‘Fields’ button to capture field values.

You can specify the following details:

Character Fields

Field Name

Specify the field name.

Field Value

Specify the field value.

Number Fields

Field Name

Specify the field name.

Field Value

Specify the field value.

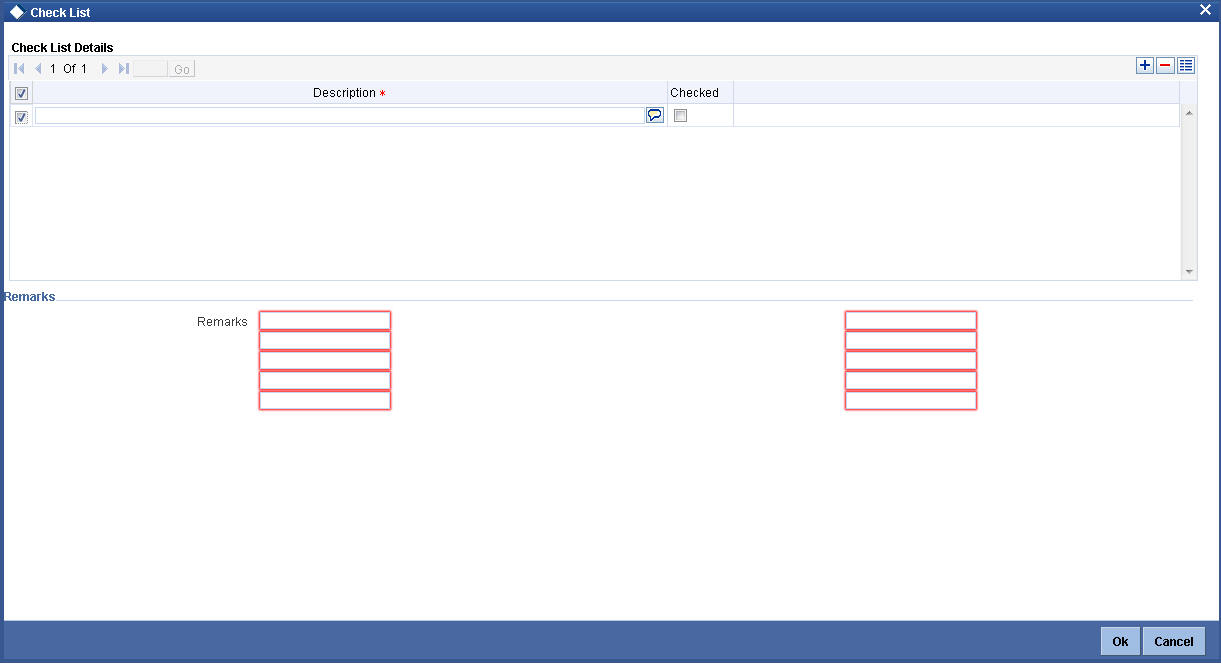

8.1.5 Check List Button

To every online event, you can associate check list items through the ‘Event Checklist’ screen. To view the checklist items associated with the ‘Disbursement’ event (DSBR), click on the ‘Check List’ tab.

This screen displays the check list items for DSBR. All check list items have to be verified for successful disbursement of the finance. To do this, check the ‘Verified’ box against each check list item.

You may also capture any additional information/remarks, if required.

Click on ‘Ok’ button to Save and return to the ‘Manual disbursement’ screen.

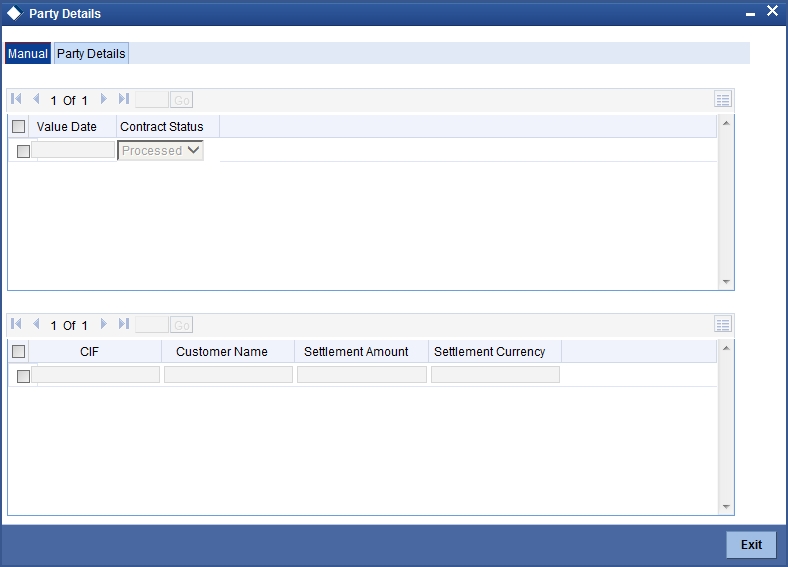

Click on the ‘Party Details’ button to view manual disbursements already done for the contractor. In this screen the system displays the progressive cash outflows that have been done so far and the details of each manual disbursement done by the Bank.

You can view the following details for each of the manual disbursement done:

- Date of disbursement (Value Date)

- Total Amount

- Contract status

- CIF of Contractor

- CIF Name

- Purpose

- Amount for each contractor (Settlement Amount)

- Currency

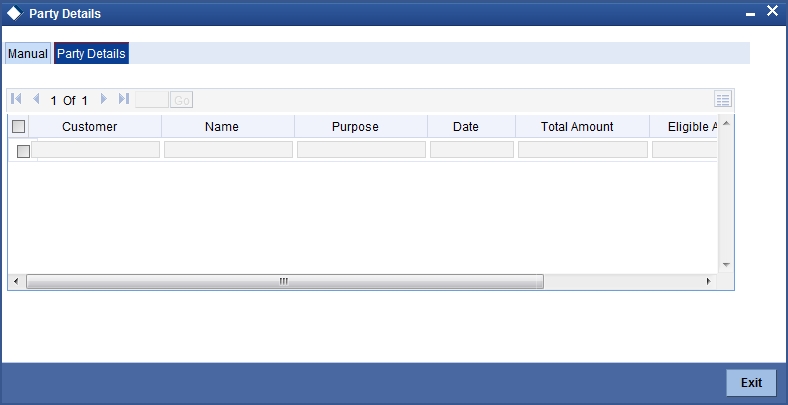

Click ‘Party Details’ tab on the ‘Party Details’ screen to view the customer details.

In this screen you can view the following details:

- Customer

- Name

- Purpose

- Date – The latest disbursement value date

- Total amount – The total amount to be disbursed throughout the life cycle of a finance

- Eligible amount – The amount to be disbursed as of the schedule date of disbursement

- Actual amount – The amount which is actually disbursed

Click on ‘Ok’ button to Save and return to the ‘Manual disbursement’ screen.