6. Batch Processing

The batch process of Collections module is explained in this chapter. The batch process takes place in different phases. And collection batch will be processed after the Loans batch.

This chapter contains the following section:

6.1 Batch Process Flowchart

This section contains the following topics:

- Section 6.1.1, "Processing Batch"

- Section 6.1.2, "Extraction of Data from Loans"

- Section 6.1.3, "Processing Collection"

- Section 6.1.4, "Uploading the Collection Details"

6.1.1 Processing Batch

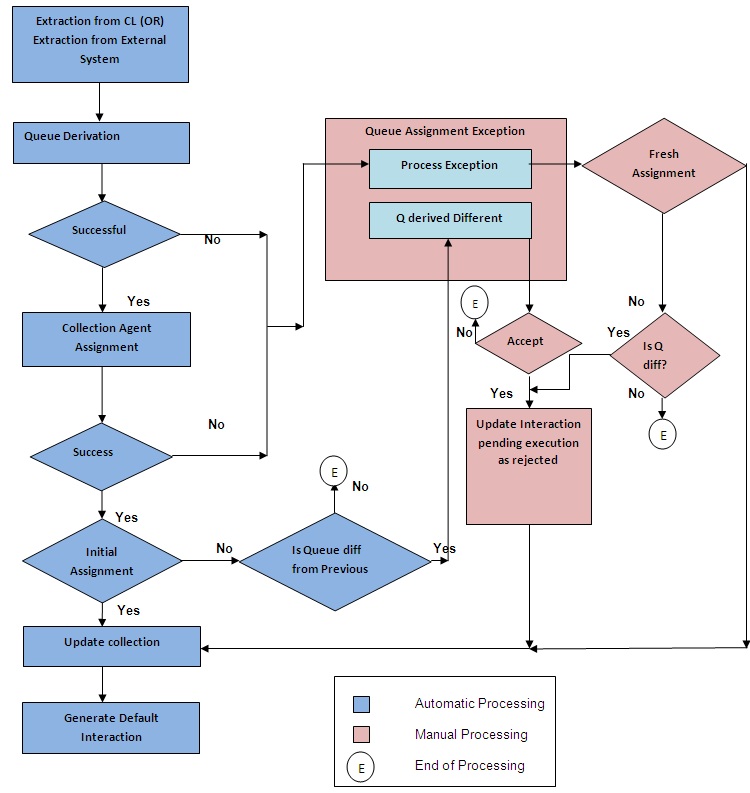

The tasks which will be carried out by the Batch in connection with the Collection Process is explained in the flowchart below.

6.1.2 Extraction of Data from Loans

Loan accounts with amount dues are extracted to CN (Collection) module. While processing the data the details required for the SDE’s mentioned under the Queue derivation logic are extracted and made available for further processing.

Note

You can also upload the details of asset from external system using General Interface.

6.1.3 Processing Collection

Extracted data from the loans module or the asset details are used for further processing. During the batch process run the following sub processes related to collection are performed:

- System checks for collection records which are due for closure with the due amount in the contract as zero and the contracts which are back to normal status. Pending collection messages are cancelled and interactions (other than executed) are cancelled.

Note

If the check box ‘Wait for Child Collection to Close’ is checked in the ‘Collection Online’ screen, then system waits for the child collection to close and only then the parent collection will be closed.

- System checks for multiple mapping of collection reference and the base table is taken for Queue Assignment Exception. The same is picked up next day from the ‘Queue assignment Exception’ screen after confirming the new queue assigned for these collections.

- Agents are assigned based on the allocation maintained in the collection agent group level for the various collection Agents. If another loan of the customer has been assigned to a particular collection agent, then a subsequent one (assigned to the same group) will also be assigned to the same collection agent.

- The default action record is assigned at the interaction data for the newly created Collection references i.e. the action code that appears first in the Action –Result –Next Action mapping.

- New interaction for the records is displayed for which the next action date is due. The stage is updated after verifying the authorization.

- Based on the State mapping maintenance, collection state change happens during the batch process

- PTP charge processing happens after verifying the dates have been honoured or not. For broken promise, a charge is calculated on the basis amount.

Reminder messages are generated during the BOD or EOD batch run. CNMS event is fired in the Collection references wherever applicable. The corresponding batch function ID is CNDREMSG.

Refer ‘Maintenances and Operations’ and ‘Collection Contract Online’ chapters of the CN (Collections) module user manual to know more about the details of collection sub process.

6.1.4 Uploading the Collection Details

Entering high volume collection details can be laborious and time consuming. You can avoid entering such details using the Batch Upload Function.

6.1.4.1 Customer Interactions upload

You can upload the Customer Interactions done by the Collection Agents through the Generic Interface module. It should contain the following details:

| Sl. No. | Column Name | Width | Type | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | COLLECTION_REF | 16 | CHARACTER | This will identify the collection in the System. | |||||

| 2 | SOURCE_CODE | 15 | CHARACTER | This will identify the External system who is sending in the details | |||||

| 3 | COLLECTION_AGENT_ID | 15 | CHARACTER | Identifies the a Valid Collection Agent defined in the System | |||||

| 4 | ASSET_REFERENCE_NUMBER | 35 | CHARACTER | Valid Loan reference in the System | |||||

| 5 | LOAN_BRANCH | 35 | CHARACTER | The Branch in which the Loan was issued | |||||

| 6 | ACTION_CODE | 20 | CHARACTER | Valid Follow up mode defined in the System | |||||

| 7 | ACTION_DATE | 11 | DATE | ||||||

| 8 | RESULT_CODE | 20 | CHARACTER | Valid Result code in the System | |||||

| 9 | RESULT_DATE | 11 | DATE | ||||||

| 10 | NEXT_ACTION_CODE | 20 | CHARACTER | ||||||

| 11 | NEXT_ACTION_DATE | 11 | DATE | Usually the date agreed upon by the customer to honor the payment due | |||||

| 12 | PTP_AMOUNT | 22 | NUMBER | The promised to pay amount in Asset Currency.(Could be multiple) | |||||

| 13 | PTP_DATE | 11 | DATE | The date on which the above amount has been agreed to pay.(Could be multiple) | |||||

| 14 | MEDIA | 15 | CHARACTER | Media for Message Generation | |||||

| 15 | INTERACTION_DETAILS | 2000 | CHARACTER | The Details of the conversation | |||||

| 16 | INTERACTION_PLACE | 35 | CHARACTER | Place of interaction , if not phone | |||||

| 17 | INTERACTION_DATE | 11 | DATE | Date of Interaction | |||||

| 18 | INTERACTION_HR | 2 | NUMBER | Hour | |||||

| 19 | INTERACTION_MIN | 2 | NUMBER | Minute | |||||

| 20 | CUSTOMER_EMAIL_ID | 105 | CHARACTER | Email ID of the Customer | |||||

| 21 | CUSTOMER_MOBILE | 20 | CHARACTER | Mobile number of the Customer. |

6.1.4.2 Asset Details Upload

You can upload the Asset Details using the following fields in an ASCII file. The upload is through Generic Interface module.

| Field Name | Length | Type | Description | ||||

|---|---|---|---|---|---|---|---|

| SOURCE_CODE | 15 | CHARACTER | Source code to identify the External system | ||||

| ASSET_REFERENCE | 35 | CHARACTER | Reference number used to identify the Asset at the source | ||||

| PRODUCT | 4 | CHARACTER | If there is something like a product code in the external system | ||||

| COUNTERPARTY | 9 | CHARACTER | Counterparty id for the Asset | ||||

| CUST_CATEGORY | 10 | CHARACTER | Customer Category | ||||

| CUST_GROUP | 10 | CHARACTER | Customer Group | ||||

| CUST_CRDT_RATING | 10 | CHARACTER | Customer Credit Rating | ||||

| CUST_STATUS | 4 | CHARACTER | Customer Level status | ||||

| ASSET_BOOKING_DATE | 11 | DATE | Booking date of the Asset. | ||||

| ASSET_VALUE_DATE | 11 | DATE | Value Date of the Asset | ||||

| ASSET_MATURITY_DATE | 11 | DATE | Maturity Date of the Asset. | ||||

| SETTLEMENT_ACC | 20 | CHARACTER | Settlement Account number. | ||||

| SETTLEMENT_ACC_BRN | 3 | CHARACTER | Branch where the Settlement Account is available | ||||

| CUST_CHARGE_GROUP | 10 | CHARACTER | Customer Charge Group | ||||

| ASSET_OUTSTANDING | 22 | NUMBER | Outstanding Principal Amount of the Asset | ||||

| ASSET_PRINC_DUE | 22 | NUMBER | Due amount for the Principal | ||||

| ASSET_OTHER_DUE | 22 | NUMBER | Due amount for the other components | ||||

| ASSET_CCY | 3 | CHARACTER | Currency of the Asset | ||||

| ASSET_BRN | 3 | CHARACTER | Asset branch | ||||

| ASSET_BRN_LCY | 3 | CHARACTER | Local Currency of the asset branch | ||||

| ASSET_TOTAL_OVD | 22 | NUMBER | Total Overdue amount for the Asset. | ||||

| ASSET_SCH_OVD | 3 | NUMBER | Number of Schedules in Overdue status | ||||

| ASSET_EARLIEST_OVD | 5 | NUMBER | Number of days by which the earliest schedule is overdue | ||||

| ASSET_UDEF_STATUS | 4 | CHARACTER | User defined status Assigned to the Asset. | ||||

| ASSET_AMOUNT | 22 | NUMBER | Asset Contract Amount | ||||

| USERDEF_C1 | 35 | CHARACTER | User defined Character fields | ||||

| USERDEF_C2 | 35 | CHARACTER | User defined Character fields | ||||

| USERDEF_C3 | 35 | CHARACTER | User defined Character fields | ||||

| USERDEF_C4 | 35 | CHARACTER | User defined Character fields | ||||

| USERDEF_C5 | 35 | CHARACTER | User defined Character fields | ||||

| USERDEF_C6 | 35 | CHARACTER | User defined Character fields | ||||

| USERDEF_C7 | 35 | CHARACTER | User defined Character fields | ||||

| USERDEF_C8 | 35 | CHARACTER | User defined Character fields | ||||

| USERDEF_C9 | 35 | CHARACTER | User defined Character fields | ||||

| USERDEF_C10 | 35 | CHARACTER | User defined Character fields | ||||

| USERDEF_N1 | 22 | NUMBER | User Defined Number fields | ||||

| USERDEF_N2 | 22 | NUMBER | User Defined Number fields | ||||

| USERDEF_N3 | 22 | NUMBER | User Defined Number fields | ||||

| USERDEF_N4 | 22 | NUMBER | User Defined Number fields | ||||

| USERDEF_N5 | 22 | NUMBER | User Defined Number fields | ||||

| USERDEF_N6 | 22 | NUMBER | User Defined Number fields | ||||

| USERDEF_N7 | 22 | NUMBER | User Defined Number fields | ||||

| USERDEF_N8 | 22 | NUMBER | User Defined Number fields | ||||

| USERDEF_N9 | 22 | NUMBER | User Defined Number fields | ||||

| USERDEF_N10 | 22 | NUMBER | User Defined Number fields | ||||

| USERDEF_D1 | 11 | DATE | User Defined Date fields | ||||

| USERDEF_D2 | 11 | DATE | User Defined Date fields | ||||

| USERDEF_D3 | 11 | DATE | User Defined Date fields | ||||

| USERDEF_D4 | 11 | DATE | User Defined Date fields | ||||

| USERDEF_D5 | 11 | DATE | User Defined Date fields | ||||

| USERDEF_D6 | 11 | DATE | User Defined Date fields | ||||

| USERDEF_D7 | 11 | DATE | User Defined Date fields | ||||

| USERDEF_D8 | 11 | DATE | User Defined Date fields | ||||

| USERDEF_D9 | 11 | DATE | User Defined Date fields | ||||

| USERDEF_D10 | 11 | DATE | User Defined Date fields |

6.1.4.3 Payment Details Upload

You can upload the payment details through the Generic Interface module. It should contain the following details:

| Field Name | Length | Type | Description | ||||

|---|---|---|---|---|---|---|---|

| SOURCE_CODE | 15 | CHARACTER | Source code to identify the External system | ||||

| ASSET_REFERENCE | 35 | CHARACTER | Reference number used to identify the Asset at the source | ||||

| PAYMENT_ESN | 4 | NUMBER | Event Sequence number for the payment. | ||||

| PAYMENT_AMOUNT | 22 | NUMBER | Payment Amount | ||||

| PAYMENT_CCY | 3 | CHARACTER | Payment Currency | ||||

| PAYMENT_DATE | 11 | CHARACTER | Date of payment | ||||

| COLLECTION_AGNT | 9 | CHARACTER | Collection Agent ID associated with the Payment. | ||||

| REVERSAL_ESN | 4 | NUMBER | The ESN of the Reversal of payment. | ||||

| REVERSAL_DATE | 11 | CHARACTER | Date on which the reversal happened. | ||||

| PAYMENT_STATUS | 1 | CHARACTER | ‘A’ for Active,’R’ for Reversed. |

Refer ‘Generic Interface’ user manual for more details on upload functionality.