7. Reports

7.1 Introduction

The report programs available under the Clearing module are explained in this chapter. All activities that are performed by the Clearing module are recorded. The inputs you have made at different stages are pieced together and can be extracted in the form of meaningful reports as and when you may require them. Every day teller doing the financial transactions, print hard copy of the reports.

This chapter contains the following sections:

- Section 7.2, "Inward Clearing Extract Report"

- Section 7.3, "Inward Clearing Extract – Passed Entries"

- Section 7.4, "Inward Clearing Extract - Failed Entries"

- Section 7.5, "Inward Clearing Extract – Rejected Entries"

- Section 7.6, "Inward Clearing Extract – Forcefully Passed Entries"

- Section 7.7, "Inward Clearing Summary Report"

- Section 7.8, "Outward Clearing Failed Transactions Report"

- Section 7.9, "Cheques Due for Realization Report"

- Section 7.10, "Inward Clearing Cheque Reject Report"

- Section 7.11, "Outward Clearing Cheque Reject Report"

- Section 7.12, "Outward Clearing Summary Report"

- Section 7.13, "Clearing Balance Summary Report"

- Section 7.14, "Liquidated Instrument Report"

- Section 7.15, "Instrument Issued Today Report"

- Section 7.16, "Outward Clearing Handoff Report"

- Section 7.17, "Float Extension Report"

- Section 7.18, "On Us Transaction Report"

- Section 7.19, "Funds Availability Simulation Report"

7.2 Inward Clearing Extract Report

This section contains the following topics:

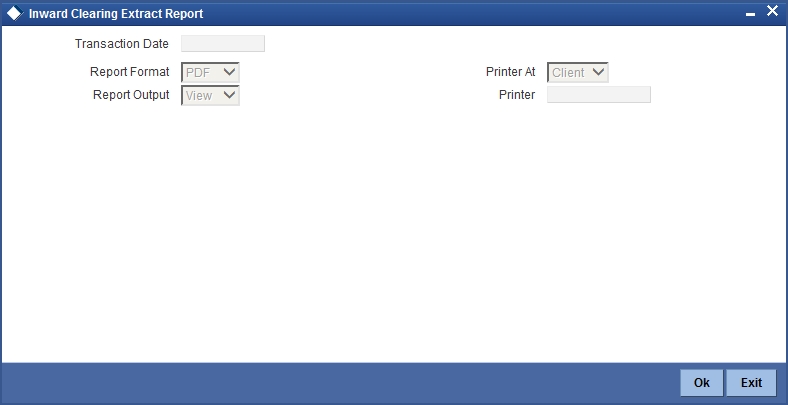

7.2.1 Generating Inward Clearing Extract Report

This Report lists the all inward clearing records. It will have all the records irrespective of their status. You can invoke ‘Inward Clearing Extract Report’ screen by typing ‘CGRINCLR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the transaction date.

Click ‘OK’ button to generate the inward clearing extract report, click ‘Exit’ to return to the Reports Browser.

7.2.2 Contents of the Report

The contents of the report are discussed under the following heads:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the report

The generated report will be ordered by the batch number and currency. The Batch No (4-7 character of Reference Number). The Summation will be for Number of entries, amount.

| Field Name | Description | ||

|---|---|---|---|

| End Point | This indicates the end point. | ||

| Clearing Type | This indicates the clearing type. | ||

| Remitter Branch | This indicates the remitter branch. | ||

| Remitter Account | This indicates the remitter account. | ||

| Beneficiary Account | This indicates the beneficiary account. | ||

| Cheque Number | This indicates the cheque number. | ||

| Entry Number | This indicates the entry number. | ||

| Routing Number | This indicates the routing number. | ||

| Payee | This indicates the payee. | ||

| Instrument Date | This indicates the instrument date. | ||

| Currency | This indicates the currency. | ||

| Cheque Amount | This indicates the cheque amount. | ||

| Status | This indicates the status. |

7.3 Inward Clearing Extract – Passed Entries

This section contains the following topics:

- Section 7.3.1, "Generating Inward Clearing Extract- Passed Entries"

- Section 7.3.2, "Contents of the Report"

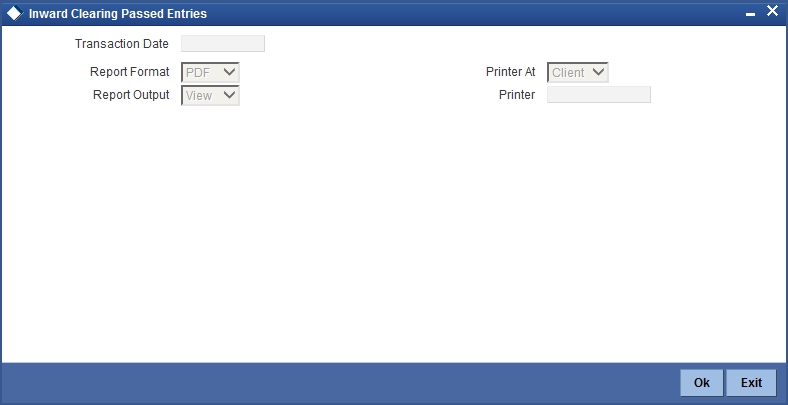

7.3.1 Generating Inward Clearing Extract- Passed Entries

After authorization, all the transactions will come to ‘Clearing Log’ (IFSCLGDT) screen. Here some transactions will go as error, because of lack of funds, or other reasons. A report is required containing data of how many entries passed.

You can invoke ‘Inward Clearing Extract - Passed Entries’ screen by typing ‘CGRCLGPS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the transaction date.

Click ‘OK’ button to generate the inward clearing extract report, click ‘Exit’ to return to the Reports Browser.

7.3.2 Contents of the Report

The contents of the report are discussed under the following heads:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the report

The generated report will be ordered by the batch number and currency. Batch No (4-7 character of Reference Number). The Summation will be for Number of entries, amount.

| Field Name | Description | ||

|---|---|---|---|

| End Point | This indicates the end point. | ||

| Clearing Type | This indicates the clearing type. | ||

| Remitter Branch | This indicates the remitter branch. | ||

| Remitter Account | This indicates the remitter account. | ||

| Beneficiary Account | This indicates the beneficiary account. | ||

| Cheque Number | This indicates the cheque number. | ||

| Entry Number | This indicates the entry number. | ||

| Routing Number | This indicates the routing number. | ||

| Remarks | This indicates the remarks. | ||

| Instrument Date | This indicates the instrument date. | ||

| Currency | This indicates the currency. | ||

| Amount | This indicates the amount. |

7.4 Inward Clearing Extract - Failed Entries

This section contains the following topics:

- Section 7.4.1, "Generating Inward Cleating Extract - Failed Entries"

- Section 7.4.2, "Contents of the Report"

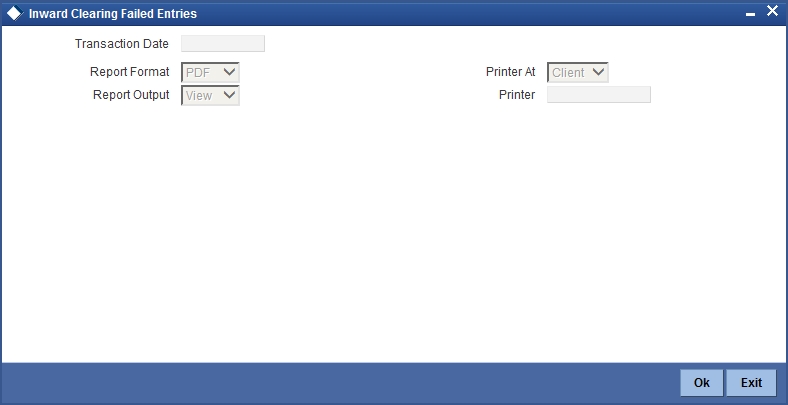

7.4.1 Generating Inward Cleating Extract - Failed Entries

This Report lists the failed inward clearing records. You can invoke ‘Inward Clearing Extract - Failed Entries’ screen by typing ‘CGRCLREF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Transaction Date

Specify the transaction date.

Click ‘OK’ button to generate the inward clearing extract report, click ‘Exit’ to return to the Reports Browser.

7.4.2 Contents of the Report

The contents of the report are discussed under the following heads:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the report

The generated report will be ordered by the batch number and currency. The Batch No (4-7 character of Reference Number). The Summation will be for Number of entries, amount.

| Field Name | Description | ||

|---|---|---|---|

| End Point | This indicates the end point. | ||

| Clearing Type | This indicates the clearing type. | ||

| Remitter Branch | This indicates the remitter branch. | ||

| Remitter Account | This indicates the remitter account. | ||

| Beneficiary Account | This indicates the beneficiary account. | ||

| Cheque Number | This indicates the cheque number. | ||

| Entry Number | This indicates the entry number. | ||

| Routing Number | This indicates the routing number. | ||

| Failed Reason | This indicates the failed reason. | ||

| Remarks | This indicates the remarks. | ||

| Instrument Date | This indicates the instrument date. | ||

| Currency | This indicates the currency. | ||

| Amount | This indicates the amount. |

7.5 Inward Clearing Extract – Rejected Entries

This section contains the following topics:

- Section 7.5.1, "Generating Inward Clearing Extract - Rejected Entries"

- Section 7.5.2, "Contents of the Report"

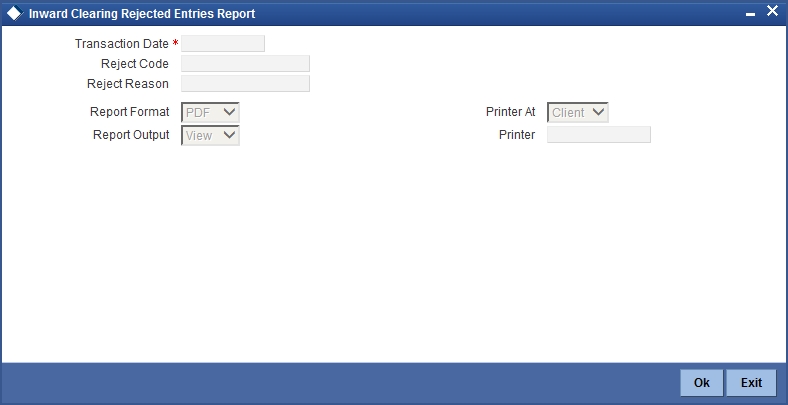

7.5.1 Generating Inward Clearing Extract - Rejected Entries

This Report lists the reject inward clearing records. The bank may wish to reverse some of the passed cheques. A report is required of how many cheques reversed with details.

You can invoke ‘Inward Clearing Extract - Rejected Entries’ screen by typing ‘CGRCHREV’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Transaction Date

Specify date of transaction of inward clearing extract for which you wish to generate report, from the adjoining calendar.

Reject Code

Specify reject code of the inward clearing extract for which you wish to generate report, from the adjoining option list.

Reject Reason

Reason for the rejection of the inward clearing extract is defaulted here based the specified reject code.

Click ‘OK’ button to generate the inward clearing extract report, click ‘Exit’ to return to the Reports Browser.

7.5.2 Contents of the Report

The contents of the report are discussed under the following heads:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated, the module of the report and reject code.

Body of the report

The generated report will be ordered by the batch number and currency. The Batch No (4-7 character of Reference Number). The Summation will be for Number of entries, amount.

| Field Name | Field Description | ||

|---|---|---|---|

| Transaction Branch | This indicates the transaction branch. | ||

| Remitter Account | This indicates the remitter account. | ||

| Beneficiary Account Number | This indicates the beneficiary account. | ||

| Customer Name | This indicates the customer name. | ||

| Cheque Number | This indicates the cheque number. | ||

| Batch Number | This indicates the batch number | ||

| Currency | This indicates the currency of the transaction | ||

| Total Amount | This indicates the total amount | ||

| Total Number of Records | This indicates the total number of records | ||

| Value Date | This indicates the value date. | ||

| Reject Reason | This indicates the reject reason. | ||

| Currency | This indicates the currency. | ||

| Amount | This indicates the amount. |

7.6 Inward Clearing Extract – Forcefully Passed Entries

This section contains the following topics:

- Section 7.6.1, "Generating Inward Clearing Extract - Forcefully Passed Entries"

- Section 7.6.2, "Contents of the Report"

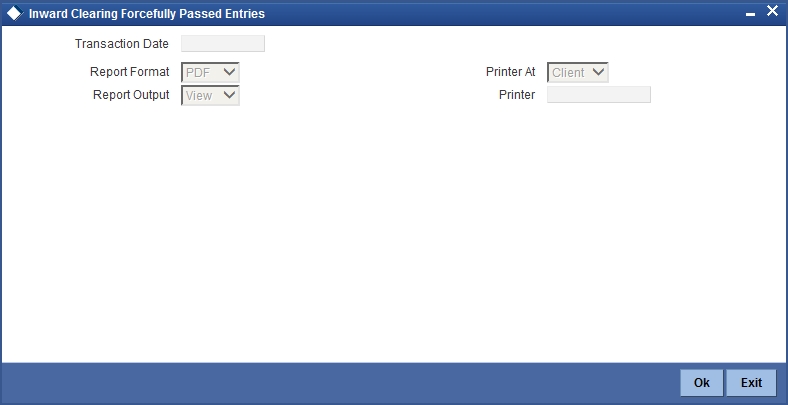

7.6.1 Generating Inward Clearing Extract - Forcefully Passed Entries

The bank will forcefully pass some of the entries which had failed earlier. A report is required of how many passed forcefully with details. You can invoke ‘Inward Clearing Extract – Forcefully passed Entries’ screen by typing ‘CGRCLFPS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the transaction date.

Click ‘OK’ button to generate the inward clearing extract report, click ‘Exit’ to return to the Reports Browser.

7.6.2 Contents of the Report

The contents of the report are discussed under the following heads:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the report

The generated report will be ordered by the batch number and currency. The Batch No (4-7 character of Reference Number). The Summation will be for Number of entries, amount.

| Field Name | Field Description | ||

|---|---|---|---|

| End Point | This indicates the end point. | ||

| Clearing Type | This indicates the clearing type. | ||

| Remitter Branch | This indicates the remitter branch. | ||

| Remitter Account | This indicates the remitter account. | ||

| Beneficiary Account | This indicates the beneficiary account. | ||

| Cheque Number | This indicates the cheque number. | ||

| Entry Number | This indicates the entry number. | ||

| Routing Number | This indicates the routing number. | ||

| Previous Status | This indicates the previous status. | ||

| Current Status | This indicates the current status. | ||

| Payee | This indicates the payee. | ||

| Instrument Date | This indicates the instrument date. | ||

| Currency | This indicates the currency. | ||

| Amount | This indicates the amount. |

7.7 Inward Clearing Summary Report

This section contains the following topics:

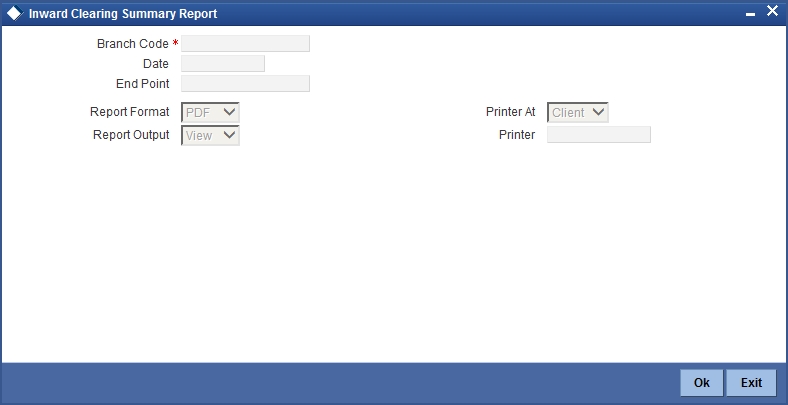

7.7.1 Generating Inward Clearing Summary Report

Cheques are processed in various Inward Clearing types, Currencies, and Batches throughout the day. These Inward Clearing Cheques are either processed successfully or rejected, based on the accounts fund position, status, etc.

You can generate ‘Inward Clearing Summary Report’ to help the branches in balancing inward clearing transactions. This report lists all the inward clearing transactions processed on that day. The transactions are grouped by batches. You can invoke ‘Inward Clearing Summary Report’ screen by typing ‘CGRINCLG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.CGRINCLG__CVS_MAIN

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

Date

Specify the date for which you wish to generate the report from the adjoining calendar.

End Point

Specify cheque number which you wish to maintain as an end point to generate the report, from the adjoining option list.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

7.7.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Inward Clearing Summary Report is as follows:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| End Point | Indicates End Point | ||

| Clearing House Name | Indicates Clearing House Name | ||

| Clearing House | Indicates Clearing house | ||

| Currency | Indicates Currency | ||

| Batch Number | Indicates Batch Number | ||

| Debit Amount | Indicates Sum of Cheque Amount of the batch | ||

| Rejected Amount | Indicates Sum of amount of the rejected cheques of the batch | ||

| Passed Amount | Indicates Sum of amount of the passed cheques of the batch |

7.8 Outward Clearing Failed Transactions Report

This section contains the following topics:

- Section 7.8.1, "Generating Outward Clearing Failed Transaction Report"

- Section 7.8.2, "Contents of the Report"

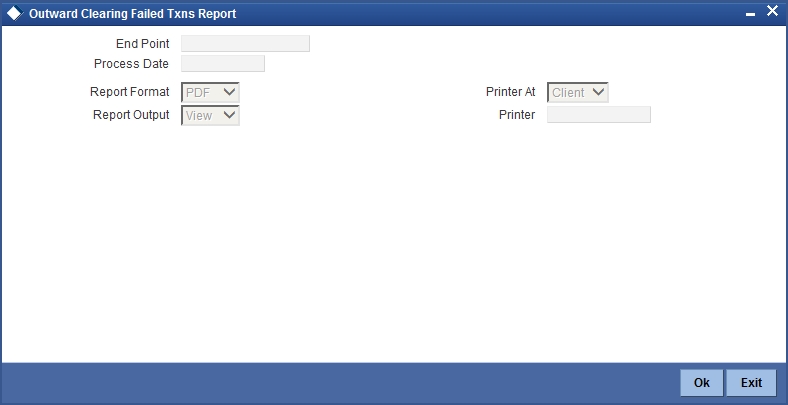

7.8.1 Generating Outward Clearing Failed Transaction Report

Outward clearing cheques are settled by forwarding them to clearing houses. On the due date of settlement, credits are received from the other banks, through the clearing house. Subject to the returns, the funds are credited to the customer accounts. If an outward clearing transaction fails, then you can generate ‘Outward Clearing Failed Transactions Report’ to list transactions which failed on that day. This report groups all failed transactions based on the instrument and clearing type of the transaction.

You can invoke ‘Outward Clearing Failed Transactions Report’ screen by typing ‘CGROCFTN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

End Point

Specify cheque number which you wish to maintain as an end point to generate the report, from the adjoining option list.

Process Date

Specify the date when the outward clearing transaction was processed from the adjoining Calendar.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

7.8.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Outward Clearing Failed Transactions Report is as follows:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| End Point | Indicates the end point | ||

| Transaction Date | Indicates the date of transaction | ||

| Instrument Type | Indicates the instrument type | ||

| Instrument No | Indicates Instrument Number | ||

| XREF | Indicates External Reference Number | ||

| Acc Branch | Indicates Payee Account Branch | ||

| Beneficiary Account Number | Indicates the beneficiary account number | ||

| Instrument CCY | Indicates the instrument currency | ||

| SC CCY | Indicates the charge currency | ||

| Transaction Status | Indicates the transaction status | ||

| Reference Number | Indicates FCC Reference Number | ||

| Routing No | Indicates Clearing Routing Number | ||

| Remitter Account | Indicates Payee Account Number | ||

| Beneficiary Account Description | Indicates the Beneficiary Account Description | ||

| Instrument Amount | Indicates Instrument Amount | ||

| SC Amount | Indicates Service Charge Amount | ||

| Reject Reason | Indicates Cheque Reject Remarks |

7.9 Cheques Due for Realization Report

This section contains the following topics:

- Section 7.9.1, "Generating Cheques Due for Realization Report"

- Section 7.9.2, "Contents of the Report"

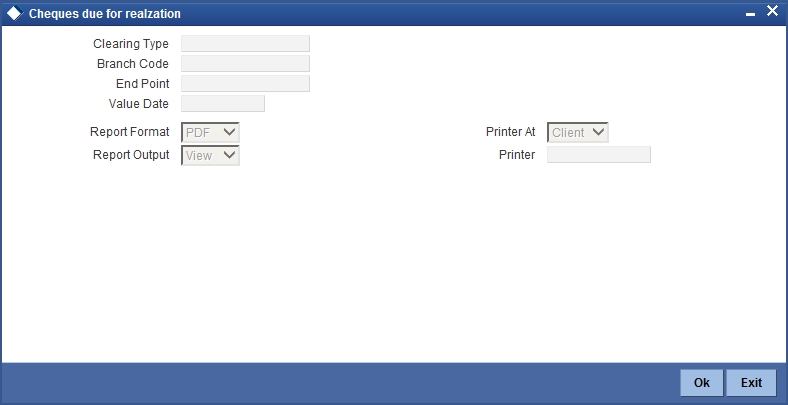

7.9.1 Generating Cheques Due for Realization Report

Instruments that need to be credited to the customer’s account are lodged in clearing. On the clearing due date, the cheques are realized and the accounts are credited, subject to the returns. Simultaneously branches open various clearing sessions based on the requirements and lodge cheques.

You can generate ‘Cheques Due for Realization Report’ to list cheques that are due for realization for that day. This report lists cheques which were already due for credit to the accounts value date. You can invoke ‘Cheques Due for Realization Report’ screen by typing ‘CGRCDTOD’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Clearing Type

Specify clearing type for which you wish to generate the report, form the adjoining option list.

Value Date

Specify clearing value date of the outward clearing transaction from the adjoining calendar.

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

End Point

Specify cheque number which you wish to maintain as an end point to generate the report, from the adjoining option list.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

7.9.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Cheques Due for Realization Report is as follows:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| End Point | Indicates Clearing End Point | ||

| Origination Branch | Indicates the origination branch | ||

| Clearing type and description | Indicates the clearing type and description | ||

| Instrument type | Indicates the instrument type | ||

| Currency | Indicates the currency of the transaction | ||

| Account Number | Indicates Account Number | ||

| Name | Indicates Account Holder Name | ||

| Bank Code | Indicates Bank Code | ||

| Instrument No | Indicates Instrument Number | ||

| Amount in TCY | Indicates the Amount in TCY | ||

| Transaction Seq NO | Indicates the transaction sequence number | ||

| Deposit Date | Indicates Cheque Deposited Date | ||

| Product Code | Indicates the product code | ||

| Value Date | Indicates value date | ||

| Transaction Ltrl | Indicates Transaction ltrl |

7.10 Inward Clearing Cheque Reject Report

This section contains the following topics:

- Section 7.10.1, "Generating Inward Clearing Cheque Reject Report"

- Section 7.10.2, "Contents of the Report"

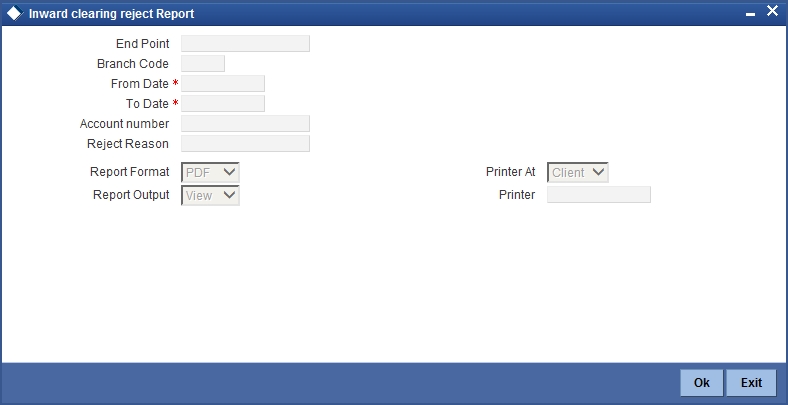

7.10.1 Generating Inward Clearing Cheque Reject Report

Cheques which were presented in inward clearing are cleared after verifying the following:

- Balance in the account

- Signature of Account holder

- Mandatory validations

If the presented cheque fails in any of the above validations, then the Drawee Bank rejects the cheque. Subsequently, these cheques are returned to clearing house, with reasons for not honoring it.

You can generate ‘Inward Clearing Cheque Reject Report’ with details of cheques which were rejected during inward clearing process for a given period. This report groups cheques, based on the end point, branch code, and totals provided for instrument amount.

You can invoke ‘Inward Clearing Cheque Reject Report’ screen by typing ‘CGRICLRS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

From Date

Specify the date from when you wish to generate the report from the adjoining calendar.

To Date

Specify the date till when you wish to generate the report from the adjoining calendar.

End Point

Specify cheque number which you wish to maintain as an end point to generate the report, from the adjoining option list.

Account Number

Specify account number to which the rejected inward clearing cheque was submitted, from the adjoining option list.

Reject Reason

Specify rejection code for rejection of the cheque from the adjoining option list.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

7.10.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Inward Clearing Cheque Reject Report is as follows:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| RM ID | Relationship manager ID | ||

| Account No | Indicates Remitter Account Number | ||

| Account Desc | Indicates Account Description | ||

| Instrument type | Indicates Instrument type | ||

| Instrument No | Indicates Instrument No | ||

| Instrument CCY | Indicates Instrument Currency | ||

| Instrument Amount | Indicates Instrument Amount | ||

| Cheque Return date | Indicates Transaction date | ||

| Routing No | Indicates Clearing routing no | ||

| Clearing Ref No | Indicates FCC Contract reference no | ||

| TXN No | Indicates Xref | ||

| Telephone No | Indicates Contact No | ||

| Reject reason | Indicates Reject reason | ||

| Auth ID | Indicates Authorizer Id | ||

| Auth ID date | Indicates Authorizer date and time |

7.11 Outward Clearing Cheque Reject Report

This section contains the following topics:

- Section 7.11.1, "Generating Outward Clearing Cheque Reject Report"

- Section 7.11.2, "Contents of the Report"

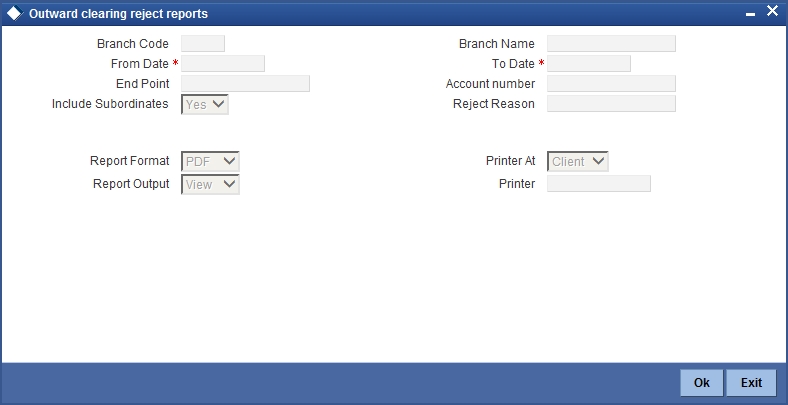

7.11.1 Generating Outward Clearing Cheque Reject Report

You can generate a report of outward clearing cheque rejections using ‘Outward Clearing Reject Report’ screen. This screen gives the details of the cheques those were bounced during a given period. You can invoke ‘Outward Clearing Cheque Reject Report’ screen by typing ‘CGROCLRS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

From Date

Specify the date from when you wish to generate the report from the adjoining calendar.

To Date

Specify the date till when you wish to generate the report from the adjoining calendar.

End Point

Specify cheque number which you wish to maintain as an end point to generate the report, from the adjoining option list.

Account Number

Specify account number to which the rejected inward clearing cheque was submitted, from the adjoining option list.

Reject Reason

Specify rejection code for rejection of the cheque from the adjoining option list.

Include Subordinates

The relationship managers can generate the reports for the customers who are associated with their subordinate RMs. Choose one of the following options:

- Yes – Select this box to include the customers assigned to your subordinate RMs.

- No – Select this to generate the report only for the customers assigned to you, excluding the customers assigned to your subordinate RMs.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

7.11.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Inward Clearing Cheque Reject Report is as follows:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Rm ID | Relationship Manager ID | ||

| Transaction Branch | Transaction Branch | ||

| End Point | End Point | ||

| Remittance Account | Remittance Account | ||

| Account Description | Account Description | ||

| Instrument type | Instrument type | ||

| Instrument No | Instrument Number | ||

| Instrument CCY | Instrument Currency | ||

| Instrument Amt | Instrument Amount | ||

| Cheque Return Date | Cheque Return Date | ||

| Routing No | Routing No | ||

| Reference No | Reference No | ||

| Transaction No | Transaction No | ||

| Contact No | Contact No | ||

| Auth ID | Auth ID | ||

| Auth Time | Auth Time | ||

| Reject Reason | Reject Reason |

7.12 Outward Clearing Summary Report

This section contains the following topics:

- Section 7.12.1, "Generating Outward Clearing Summary Report"

- Section 7.12.2, "Contents of the Report"

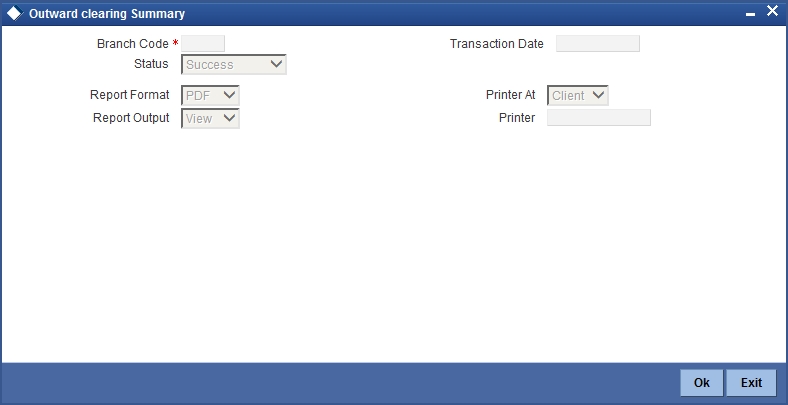

7.12.1 Generating Outward Clearing Summary Report

When a customer submits instruments of various other banks to credit their accounts, they are lodged into outward clearing and are moved to clearing settlement. You can generate ‘Outward Clearing Summary Report’ to provide list of the transactions processed successful or rejected while processing outward clearing. The results are grouped based on the endpoint, clearing type, and transaction currency.

You can invoke ‘Outward Clearing Summary Report’ screen by typing ‘CGROCSAR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

Transaction Status

Select status of the transaction from the adjoining drop-down list. This list displays the following values:

- Success – Select if the transaction was processed successfully.

- Rejected – Select if the transaction was rejected.

Transaction Date

You can generate this report for the transactions having a specific transaction date. Select the transaction date using the adjoining calendar button.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

7.12.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Outward Clearing Summary Report is as follows:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| No of Txns | Indicates No of Transactions | ||

| Product | Indicates the product | ||

| Transaction Ccy | Indicates the transaction currency | ||

| Transaction Date | Indicates the transaction date | ||

| Amount credited | Indicates Credit amount for outward transactions | ||

| Amount Return | Indicates Return amount for outward transactions | ||

| Net amount in TCY | Indicates Total net amount for outward cheque transactions | ||

| Net amount in LCY | Indicates Total net amount for outward LCY transactions |

7.13 Clearing Balance Summary Report

This section contains the following topics:

- Section 7.13.1, "Generating Clearing Balance Summary Report"

- Section 7.13.2, "Contents of the Report"

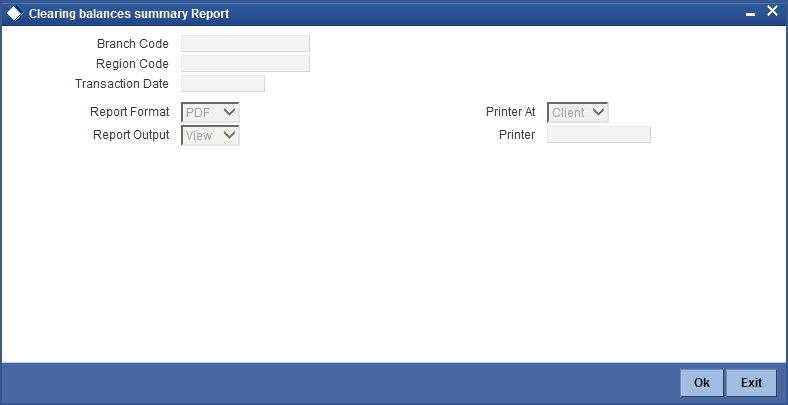

7.13.1 Generating Clearing Balance Summary Report

Clearing houses are conducted region-wise and a pool of branches of each bank participates in each clearing house to settle the funds. You can generate ‘Clearing Balance Summary Report’ to get region-wise summary details of clearing house details, clearing, and amount cleared for that day. The details are grouped based on the clearing house and branch. You can invoke ‘Clearing Balance Summary Report’ screen by typing ‘CGRBLSUM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

Region Code

Specify a valid region code of the clearing house for which you wish to generate clearing balance summary, from the adjoining option list.

Transaction Date

Specify the transaction date. In the report, the system will include all the transactions entered on the date specified here.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

7.13.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Clearing Balance Summary Report is as follows:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Status | Indicates the status of the clearing balance | ||

| Clearing House | Indicates Clearing house description | ||

| Clearing Branch. | Indicates Clearing branch code | ||

| Region code | Indicates Region code | ||

| Region name | Indicates Region name | ||

| Inward Txn date | Indicates the inward transaction date | ||

| Outward Txn Date | Indicates the outward transaction date | ||

| No. Of Inward Cheques | Indicates the number of inward cheques | ||

| Inward Amount (LCY) | Indicates the inward amount in local currency | ||

| No. of Outward cheques | Indicates Cheque count | ||

| Outward amount (LCY) | Indicates the outward amount in local currency | ||

| Amount Brought (LCY). | Indicates Sum of all instruments amount |

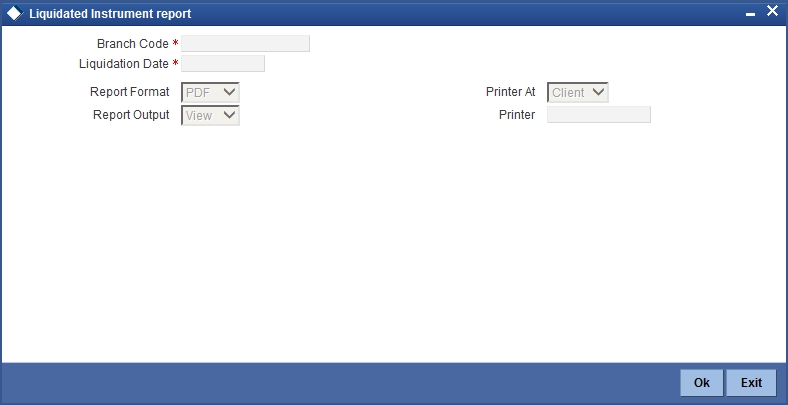

7.14 Liquidated Instrument Report

This section contains the following topics:

7.14.1 Generating Liquidated Instrument Report

When a bank issues instruments to its customers and non-customers, they can be issued against CASA, Cash or GL Account. You can generate ‘Liquidated Instrument Report’ with complete details of instruments and the corresponding beneficiary. The details are grouped based on the instrument type.

You can invoke ‘Liquidated Instrument Report’ screen by typing ‘CGRLQINT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated from the adjoining option list.

Liquidation Date

Specify the liquidation date when the instrument was liquidated from the adjoining calendar.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

7.14.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Liquidated Instrument Report is as follows:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Reference No | Indicates Reference no | ||

| Instrument Type | Indicates Instrument Type | ||

| Instrument Number | Indicates Instrument No | ||

| Issued Date | Indicates Instrument Date | ||

| Currency | Indicates Instrument currency | ||

| Instrument Amount | Indicates Instrument Amount | ||

| Beneficiary Name. | Indicates Customer Name | ||

| Total count & Amount | Indicates Transaction count and amount |

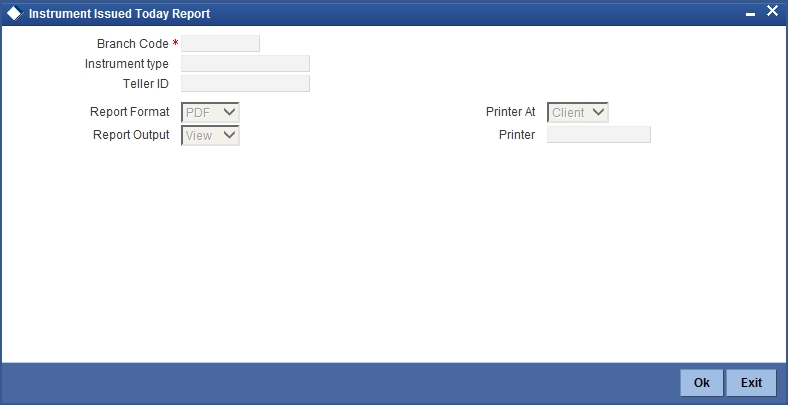

7.15 Instrument Issued Today Report

This section contains the following topics:

- Section 7.15.1, "Generating Instrument Issued Today Report"

- Section 7.15.2, "Contents of the Report"

7.15.1 Generating Instrument Issued Today Report

Banks issue various types of instruments like DD/BC/TCs etc to their customers. You can generate ‘Instrument Issued Today’ report with the details of the customers and the issued instruments, for the run date. As per regulatory requirements, PAN no. is also maintained for instruments issued with higher amounts.

The instrument details are grouped based on the instrument type and currency wise. You can invoke ‘Instruments Issued Report’ screen by typing ‘CGRINSTR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Branch Code

Specify a valid code of the Branch in which report is being generated, from the adjoining option list.

Instrument Type

Specify instrument type for which you need to generate the report from the adjoining option list.

Teller ID

Specify a valid ID of the teller for which you need to generate the report from the adjoining option list.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

7.15.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Instrument Issued Today Report is as follows:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Teller ID | Indicates the teller ID | ||

| Instrument Currency | Indicates Instrument currency | ||

| Instrument type | Indicates Instrument type | ||

| Issuer Short Name | Indicates Account description | ||

| Instrument Date | Indicates Instrument Date | ||

| Instrument Number | Indicates the instrument number | ||

| Payable bank | Indicates Payable bank code | ||

| Contract Ref no | Indicates Contract reference no | ||

| Xref | Indicates Reference no | ||

| Instrument Amount | Indicates Instrument Amount | ||

| Instrument No | Indicates Instrument No | ||

| Account Currency | Indicates Account Currency | ||

| Account Currency Amount | Indicates Account amount | ||

| Charge Ccy | Indicates Charge Currency | ||

| Charge Amt | Indicates Charge Amount | ||

| Payable Branch | Indicates the payable branch | ||

| Identifier Name | Indicates the name of the identifier | ||

| Pan Card Number | Indicates the PAN card number | ||

| No of Instruments of this type | Indicates Total no of instruments | ||

| Total Amount for this type | Indicates Total amount for each instrument type | ||

| Total amount for this currency | Indicates Total amount for each instrument currency |

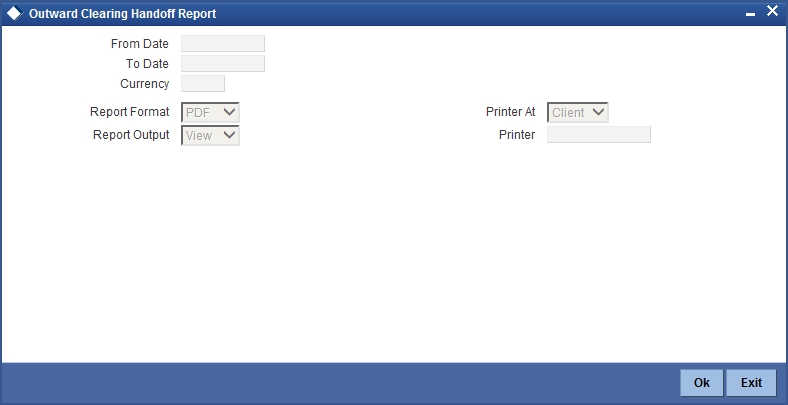

7.16 Outward Clearing Handoff Report

This section contains the following topics:

- Section 7.16.1, "Generating Outward Clearing Handoff Report"

- Section 7.16.2, "Contents of the Report"

7.16.1 Generating Outward Clearing Handoff Report

Outward clearing instruments received from the customers are lodged and sent to end point clearing for crediting the customer accounts. On the clearing value date, the funds are made available to the customers. You can generate ‘Outward Clearing Handoff Report’ to list complete details of outward clearing transaction handoff.

You can invoke ‘Outward Clearing Handoff Report’ screen by typing ‘CGROCGHR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

From Date

Specify the date from when you wish to generate the report from the adjoining calendar.

To Date

Specify the date till when you wish to generate the report from the adjoining calendar.

Currency

Specify a valid currency in which the outward clearing transaction was handed-off, from the adjoining option list.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

7.16.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report. Other content displayed in the Outward Clearing Handoff Report is as follows:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Account Branch | Indicates Originating branch | ||

| Clearing Branch | Indicates Transaction branch | ||

| Remitter Account | Indicates Payee Account | ||

| TXN Seq No | Indicates FCC Contract reference no | ||

| Instr No | Indicates Instrument No | ||

| Instr Date | Indicates Cheque Issue date | ||

| Routing No | Indicates Routing No | ||

| Beneficiary Account | Indicates Drawee account | ||

| Acc Ccy | Indicates Beneficiary Account currency | ||

| Amount | Indicates Instrument Amount | ||

| Clg type | Indicates Clearing product code | ||

| End Point | Indicates Outward clearing branch |

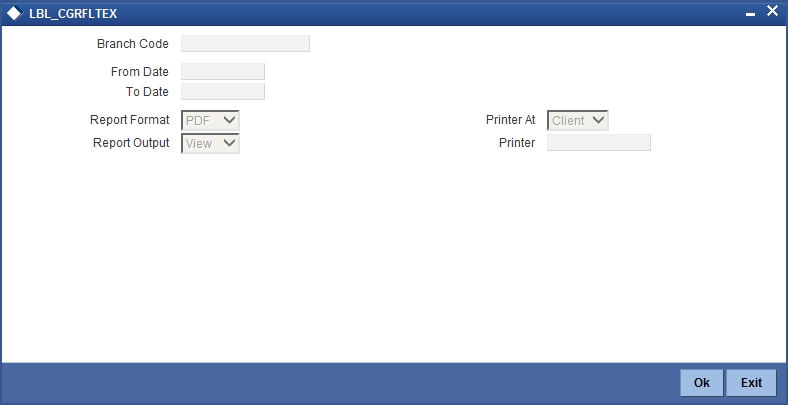

7.17 Float Extension Report

This section contains the following topics:

7.17.1 Generating Float Extension Report

You can generate a float extension report to view the list of cheque transactions processed in float extension batch.

You can invoke ‘Float Extension Report’ screen by typing ‘CGRFLTEX’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following here:

Branch Code

Select the transaction branch of the float extension from the adjoining option list.

From Date

Indicate the date from which transactions are extended. The system defaults current date. From Date should be lesser than or equal to ‘To Date’.

To Date

Indicate the date to which the transactions are extended. The system defaults current date. To Date should be lesser than or greater to ‘From Date’

7.17.2 Contents of the Report

The contents of the report are discussed under the following heads:

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

The selection criteria used for the generation of the report is displayed below the header.

Body of the Report

| Field Name | Field Description | ||

|---|---|---|---|

| Float Extension Reference Number | Indicates the Float Extension Reference Number generated by the system. | ||

| Execution Date | Indicate the Date of Execution | ||

| Branch Code | Indicates Branch Code | ||

| Remitter Account | Indicates the Remitter Account Number | ||

| Beneficiary Account | Indicates the Beneficiary Account Number. | ||

| Float Days Extended | Indicates the number of Float Days extended. | ||

| Status | Indicates the Status of execution. | ||

| Old Value Date | Indicates Value Date before float extension. | ||

| New Value Date | Indicates Value Date after float extension. | ||

| Clearing Type | Indicates the Clearing product code. | ||

| Sector Code | Indicates the Sector Code | ||

| Clearing Bank Code | Indicates the clearing bank code | ||

| Clearing Branch Code | Indicates the clearing branch code | ||

| Instrument Number | Indicates the Instrument Number of Cheque/DD/BC | ||

| Currency | Indicates the Currency of the Instrument | ||

| Instrument Amount | Indicates the Amount of the Instrument | ||

| Entry Number | Indicates Entry Sequence Number of Float Extension. | ||

| Instrument Date | Indicates the Date of the Instrument |

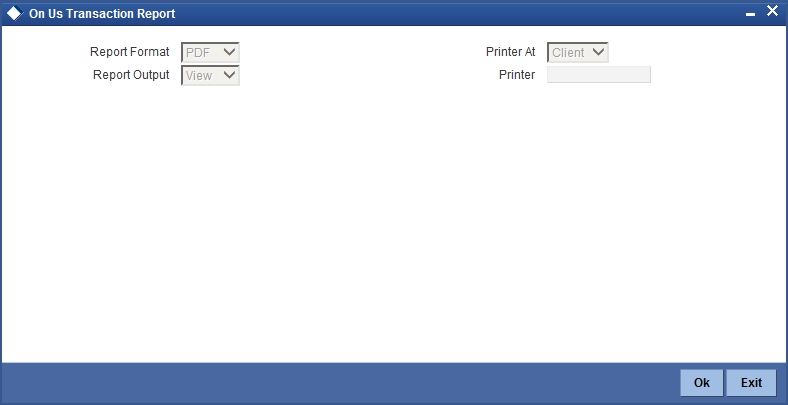

7.18 On Us Transaction Report

This section contains the following topics:

7.18.1 Generating On Us Transaction Report

You can invoke ‘On Us Transaction Report’ screen by typing ‘CGRPOUTN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

7.18.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report.

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, the date and time at which it was generated and the module of the report.

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Field Description | ||

|---|---|---|---|

| Account Number | Indicates the account number | ||

| Customer Name | Indicates the name of the customer | ||

| Debit/Credit Indicator | Indicates whether the transaction is credit or debit | ||

| Currency | Indicates the currency of the account | ||

| Amount | Indicates the amount | ||

| Instrument Number | Indicates the instrument number | ||

| Description | Gives brief on the transaction | ||

| Value Date | Indicates value date | ||

| Input Branch | Indicates the input branch | ||

| Maker ID | Indicates the identification of the maker of the record | ||

| Input Date | Indicates the date of input | ||

| Reference Number | Indicates the reference number |

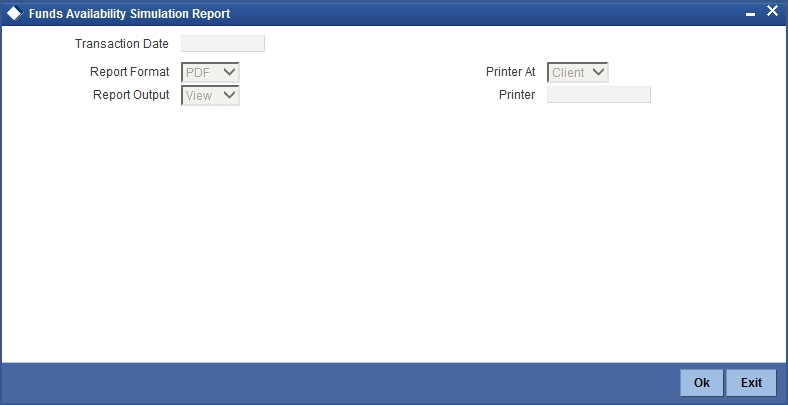

7.19 Funds Availability Simulation Report

This section contains the following topics:

- Section 7.19.1, "Generating Funds Availability Simulation Report"

- Section 7.19.2, "Contents of the Report"

7.19.1 Generating Funds Availability Simulation Report

Funds Availability Simulation Report is used to generate details of the accounts with possible insufficient balances.

You can invoke ‘Funds Availability Simulation Report’ screen by typing ‘CGRINSIM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following parameters here:

Transaction Date

Select the transaction date from the adjoining calendar.

Report Format

Select the format in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- HTML – Select to generate report in HTML format.

- RTF – Select to generate report in RTF format.

- PDF – Select to generate report in PDF format.

- EXCEL – Select to generate report in EXCEL format.

Report Output

Select the output in which you need to generate the report from the adjoining drop-down list. This list displays the following values:

- Print – Select to print the report.

- View – Select to print the report.

- Spool – Select to spool the report to a specified folder so that you can print it later.

Printer At

Select location where you wish to print the report from the adjoining drop-down list. This list displays the following values:

- Client – Select if you need to print at the client location.

- Server – Select if you need to print at the server location

Printer

Select printer using which you wish to print the report from the adjoining option list.

7.19.2 Contents of the Report

The parameters specified while generating the report are printed at the beginning of the report.

Header

The Header carries the Branch of the report, information on the branch and date, the ID of the user who generated the report, currency of the instrument the date and time at which it was generated and the module of the report.

| Field Name | Description | ||

|---|---|---|---|

| Transaction Date | Indicates the transaction Date | ||

| Transaction Branch | Indicates the transaction Branch | ||

| User ID | ID of the user who generated the report, | ||

| Date and time | Date and time of the report generation | ||

| Module | Module of the Report |

Body of the Report

The following details are displayed as body of the generated report:

| Field Name | Description | ||

|---|---|---|---|

| Account Number | Indicates the Account of the remitter | ||

| Name | Indicates the customer name. | ||

| Available Balance | This would be Remitter Account's available Balance without adding uncollected funds or cover account/limits funds | ||

| Uncollected Funds | This field will include uncollected funds excluding the withdrawable uncollected funds | ||

| Available Balance Including Limits/Cover account | This field will hold the available balance including limits/cover account+ withrawable uncollected funds | ||

| Total Check Amount | Sum of all check amount for the account | ||

| Difference | This will have difference of (Available Bal Including Limits/Cover + withdraw able Uncollected fund)- Total Check Amount | ||

| OD Type | DAUD/DAIF | ||

| Check Number | This indicates the cheque number | ||

| Check Amount | This indicates the cheque amount |