8. Annexure 3 – Revaluation

Limits and Collateral Management caters to different types of currencies and collaterals backed by marketable securities. Exchange rates and the value of marketable securities are driven by market forces and hence tend to fluctuate over a period of time. Revaluation is essential to keep set limits realistic and to reflect the current market trends.

Revaluation can be of two types:

- Currency Revaluation - The changes in the exchange rates of currencies involved in the active contracts and collateral linked to the Facility affects the Credit Limit under the facility.

- Collateral Revaluation - A change in the market price of a marketable security backing collateral causes a revaluation of the collateral amount.

This section contains the following topics:

8.1 Currency Revaluation

This section contains the following topics:

- Section 8.1.1, "Facility Currency and Utilization Currency"

- Section 8.1.2, "Facility Currency and Collateral Currency"

8.1.1 Facility Currency and Utilization Currency

Currency revaluation is triggered off as a result of the cases explained in the sections explained below.

Consider that a change takes place in the exchange rate between the line currency and the currency of a contract utilizing the limit under the line. Due to this change in exchange rate revaluation takes place in two in the following two stages:

Stage 1 - Currency Revaluation occurs between utilized contract and the credit line of the facility

In the Currency Rates Screen of the Core services module, you can maintain exchange rates for currency pairs that your bank deals with. Along with this, you can also specify the Mid Rate and the Buy or Sell Spread for various currency pairs. After you update and authorize the new exchange rates, they become effective.

While defining a credit line for a facility, you have the option of maintaining currency restrictions for the line. If you do not specify currency restrictions for a facility, then contracts having currencies other than the facility currency, can utilize the limit under the credit line. The revaluation process is applicable for such a line.

If the above conditions hold good, then a change in the exchange rate will trigger of the revaluation process. The system calculates the Facility currency equivalent of all the contracts linked to the facility (using the new exchange rates) and updates the utilization and available amount under the line.

Example

You have defined a line for Loans, and linked the Liability Code Symphony Group to it. The credit limit assigned to the credit line is USD 100,000, the facility currency is USD. No currency restrictions have been maintained for the facility.

| Liability Code | Line Code | Facility Limit | Facility Currency | ||||

|---|---|---|---|---|---|---|---|

| Symphony Group | Loans | 100,000 | USD |

On 01 January 2008 the following Loan contracts has been sent to LCM system for utilization, which are linked to this Credit Line. At the time of saving these utilization details, the line utilization will be computed based on the exchange rates as of the transaction date (i.e. 01 January 2008) of these contracts. The following table contains the details.

| Loan Amount | Exchange Rate | Facility Currency Equivalent (USD) | Utilization | Availability | |||||

|---|---|---|---|---|---|---|---|---|---|

| AUD 15,000 | 1.50 | 22500.00 | 22500.00 | 27500.00 | |||||

| DEM 2,000 | 1.20 | 2400.00 | 2400.00 | 25100.00 | |||||

| GBP10,000 | 0.5 | 20000.00 | 20000.00 | 5100.00 | |||||

| INR 72,000 | 36.00 | 2,000.00 | 2,000.00 | 3100.00 | |||||

| Total | $46900.00 | $3100.00 |

On 01 February 2008 the exchange rates have changed (now 1USD=1.6 AUD). After the exchange rate revision has been changed and authorized, the revaluation process (online process) scans the contracts linked to the line, converts the contract currency to the Facility currency (using the new exchange rates) and updates the line’s utilization and available amount.

The following table indicates these details:

| Loan Amount | Exchange Rate | Facility Currency Equivalent (USD) | Utilization | Availability | |||||

|---|---|---|---|---|---|---|---|---|---|

| AUD 15,000 | 1.60 | 24000.00 | 24000.00 | 26000.00 | |||||

| DEM 2,000 | 1.20 | 2400.00 | 2400.00 | 23600.00 | |||||

| GBP10,000 | 0.5 | 20000.00 | 20000.00 | 3600.00 | |||||

| INR 72,000 | 36.00 | 2,000.00 | 2,000.00 | 1600.00 | |||||

| Total | $48400.00 | $1600.00 |

Stage 2: Revaluation occurs between the facility and the liability which is linked to that facility.

Due to the currency revaluation between utilized contract and the credit line of the facility (as per Stage 1) there will be a revaluation on credit limit utilized by the liability.

Considering the same example as in Stage 1

You have defined a line for Loans, and linked the Liability Code Symphony Group to it. The credit limit assigned to the credit line is USD 100000.This liability is linked only to one Facility (or line code) Loans.

Initially before the change in the exchange rate the utilization of the liability is as shown in the table:

| Liability Code | Line Code | Liability Limit | Liability Currency | Liability | Utilization | Availability | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Symphony Group | Loans | 100,000 | USD | $46900.00 | $53100.00 |

After the change in the exchange rate between the line currency and the currency of a contract utilizing the limit under the line, due to this the utilization at the facility level is will changed. Due to this change the utilization at the Liability level also gets changed as shown in the table below:

| Liability Code | Line Code | Liability Limit | Liability Currency | Liability | Utilization | Availability | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Symphony Group | Loans | 100,000 | USD | $48400.00 | $51600.00 |

8.1.2 Facility Currency and Collateral Currency

Change in exchange rates between the Credit Line currency and the currency of the collateral.

When you update and authorize the exchange rates in the currency table, the system scans all the collateral linked to a line (bearing different currencies). The collateral contribution is then converted the into the line currency (using the latest exchange rates). After the conversion, the collateral contribution to the line is updated.

The calculated limit contribution of the collateral has to be linked to the pool. This pool containing the pool amount will be linked to the Facility. Hence any revaluation at collateral level will affect the pool amount.

Example

You have defined a line for Loans on 01 January 2008, and linked the Liability Code Symphony Group to it. The credit limit assigned to the credit line is USD 100,000, the facility currency is USD. No currency restrictions have been maintained for the facility. Let us say that the Loans line has been backed by Collateral “ABC” and its maximum contribution amount that can be linked to the limit is GBP 10,000.

(1 GBP= 2 USD)

| Collateral Code | Max. Collateral Contribution amount | Collateral | Currency | POOL code | Pool | Currency | Collateral | Pool % linkage | Pool amount | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ABC | 10,000 | GBP | Pool1 | USD | 100% | 20,000 |

Pool contribution to the line

| Pool Code | Pool Currency | Line Code | Line Currency | Pool Line linkage % | Pool contribution | Line Avl. amount | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pool1 | USD | Loans | USD | 100% | $20,000 | $120,000 |

On 01 February 2008 the exchange rates have changed. After the exchange rate revision has been changed and authorized, the revaluation process (online process) scans all the pools where this collateral has been linked and having the above exchange pair will be revaluated.

(1 GBP= 1.5 USD)

| Collateral Code | Line Code | Max. Collateral Contribution amount | Collateral | Currency | Pool code | Pool | Currency | Collateral | Pool % linkage | Pool amount | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ABC | Loans | 10,000 | GBP | Pool1 | USD | 100% | 15,000 |

Pool contribution to the line

| Pool Code | Pool Currency | Line Code | Line Currency | Pool Line linkage % | Pool contribution amount to line | Line available amount | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pool1 | USD | Loans | USD | 100% | $15,000 | $115,000 |

The revaluation in both cases is triggered off automatically whenever there is a change in the exchange rates (i.e. online process).

The process explained above is an online process wherein the change in the currency exchange rate immediately revaluates all the contracts and the collaterals having this exchange pair with the facility currency. If at the LCM Global Parameter maintenance, the option for Revaluate Currency during Offline (batch) has been selected then the currency revaluation as explained above will be taken up as part of revaluation batch process.

8.2 Collateral Revaluation

This section contains the following topics:

- Section 8.2.1, "Collateral Revaluation of Market Based Securities"

- Section 8.2.2, "Collateral Revaluation of Non-Market Based Securities"

8.2.1 Collateral Revaluation of Market Based Securities

Collateral Revaluation will be of two types. These types are explained in the sections below.The assets that are offered as collateral generally back the credit facilities that the bank grants a customer. Your customers can offer ‘marketable securities’ as collateral. As Marketable Securities are by nature given to fluctuations based on the forces of short-term demand and supply, their value also tends to fluctuate.

A rise or fall in the market value of a security, affects its collateral value. Therefore, the value of a collateral should reflect the changes in the value of the securities backing it.

Revaluation of a Collateral is caused only if the value of the marketable security that backs the collateral, fluctuates beyond the price sensitivity you prescribed for the security in the Securities Maintenance screen and the Revaluate collateral check box has been checked for that collateral in the collateral maintenance. Based on these changes, the collateral contribution to the overall credit limit of the customer will increase or decrease. Hence the availability under the line will also change.

After you authorize the price change:

- The price change is compared with the last price stored in the Collateral Maintenance screen.

- If the price change (in percentage) of the security is greater than the Price-Increase-Sensitivity defined for the collateral or less than the Price-Decrease-Sensitivity defined for the collateral, the revaluation process will be triggered off. Otherwise the price change will not affect the existing collateral value.

If the revaluation causes the collateral value to raise, this new value is compared with the Cap Amount that you specified for the collateral in the Collateral Maintenance screen.

- If the computed value is less than the cap amount then the collateral contribution will be increased to that effect on account of the revaluation. The available amount under the credit line increases.

- If it exceeds the Cap amount then the cap amount will be taken as the collateral contribution.

Similarly, if the market price of the security decreases, the collateral contribution to the overall limit of the customer also decreases and as a result, the available amount under the credit line reduces.

Example

Your customer XYZ has 1000 units of Debentures’08 that have been issued by Reliance as part of her portfolio, which you consider as Collateral. The Market value of the Debentures’08 is $ 50 per unit. You have defined the Price Increase and Decrease Sensitivity for this security to be 8% and 5% respectively. Let the customer have credit limit of USD 1 million for the facility of line code “Loans”.

You have specified that this collateral’s contribution to the overall Limit of the customer should be $ 50,000.

The maximum amount that it can contribute to the overall limit of the customer as $ 60,000 (Cap Amount).

| Liability Code | Line Code | Liability Limit | |||||

|---|---|---|---|---|---|---|---|

| Symphony Group | Loans | $1million | |||||

| Collateral Code | Pool amount Collateral POOL code Cap Amount Collateral Contribution amount | Pool % linkage | |||||

| ABB | $50,000 100% Pool1 $60,000 $50,000 | ||||||

Pool contribution to the line

| Pool Code | Pool Currency | Line Code | Line Currency | Pool Line linkage % | Pool contribution amount to line | Line available amount( credit limit + Pool contribution) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pool1 | USD | Loans | USD | 100% | $50,000 | $1.05million |

A Rise in Value

The market value of Debentures2008 has increased to $55, which is a 10% increase over the old market price of $50.

At the time you update the Market price of Debentures 2008 in the Securities Maintenance screen, the revaluation process is triggered off, as the increase (10%) is higher than the Increase sensitivity (8%) defined for Debentures 2008. The value of this collateral now stands at $ 55,000. As this amount is less than the Cap Amount you specified for the collateral the Credit Limit available to the XYZ has increased by $ 5,000, as a result of the revaluation.

| Collateral Code | Collateral Contribution amount | Cap Amount | POOL code | Collateral | Pool % linkage | Pool amount | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ABB | $55,000 | $60,000 | Pool1 | 100% | $55,000 |

Pool contribution to the line

| Pool Code | Pool Currency | Line Code | Line Currency | Pool Line linkage % | Pool contribution amount to line | Line available amount | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pool1 | USD | Loans | USD | 100% | $55,000 | $1.055 million |

A Rise in Value beyond the Cap Amount

The market value of Debentures2008 has increased to $65 which is a 30% increase over the old market price of $50.

At the time you update the Market price of Debentures2008 in the Securities Maintenance screen, the revaluation process is triggered off, as the increase (30%) is higher than the Increase Sensitivity (8%) defined for Debentures 1999. The value of this collateral now stands at $ 65,000. As this amount is more than the Cap Amount of $60,000 that you specified for the collateral, the Credit Limit available to the XYZ will be increased. However, the increase will not exceed the Cap Amount.

XYZ’s maximum amount that is contributed to the overall limit will now stand at $ 60,000 (cap Amount) and not at $65,000 (market value) as a result of the revaluation.

| Collateral Code | Collateral Contribution amount | Cap Amount | POOL code | Collateral | Pool % linkage | Pool amount | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ABB | $60,000 | $60,000 | Pool1 | 100% | $60,000 |

Pool contribution to the line

| Pool Code | Pool Currency | Line Code | Line Currency | Pool Line linkage % | Pool contribution amount to line | Line available amount | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pool1 | USD | Loans | USD | 100% | $60,000 | $1.06 million |

A fall in value

The market value of Debentures2008 has decreased to $45, which is a 10% decrease from the old market price of $50. At the time you update the Market price of Debentures2008 in the Securities Maintenance screen, the revaluation process is triggered off, as the decrease (11.11%) is higher than the decrease sensitivity (5%) defined for Debentures 1999.

The market value of this collateral now stands at $ 45,000. XYZ’s credit limit will stand decreased by $ 5,000 as a result of the revaluation.

| Collateral Code | Collateral Contribution amount | Cap Amount | POOL code | Collateral | Pool % linkage | Pool amount | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ABB | $45,000 | $60,000 | Pool1 | 100% | $45,000 |

Pool contribution to the line

| Pool Code | Pool Currency | Line Code | Line Currency | Pool Line linkage % | Pool contribution amount to line | Line available amount | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pool1 | USD | Loans | USD | 100% | $45,000 | $1.045 million |

This process explained above is online process where in the change in the Security Price immediately revaluates all the collateral linked to these securities. If at the LCM Global Parameter maintenance, the option for 'Revaluate Market Online' has been selected, as batch, then the collateral revaluation as explained above will be taken up as part of revaluation batch process.

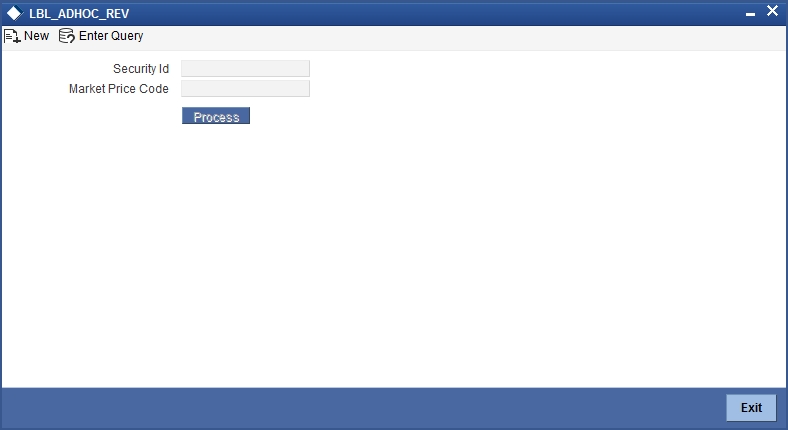

Adhoc Revaluation of Market Based Collaterals

In the ‘Adhoc Revaluation’ screen, specific market based collaterals can be chosen to forcefully run the revaluation process. If such collateral values have to be revised then an input file containing the latest security price has to be sent to system prior running the Collateral Force Revalue.

8.2.2 Collateral Revaluation of Non-Market Based Securities

Collateral revaluation of non-market based securities is not subjected to market fluctuation. Hence if such collateral values have to be revised then an input file containing the collateral code of all such collaterals and the latest revised collateral value must be sent to the system.

The revaluation process takes place online when ever there is a change in the collateral value.

Example

Non market Based collateral Fixed Deposit (having 100% lendable margin) has been linked to a facility on 1st January 2008 owned by a XYZ customer having the liability Symphony Group.

| Liability Code | Line Code | Liability Limit | |||

|---|---|---|---|---|---|

| Symphony Group | Loans | $1million |

| Collateral Code | Collateral Value | Collateral Contribution amount | Pool code | Collateral | Pool % linkage | Pool Amount | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fixed Deposit | $50,000 | $50,000 | Pool1 | 100% | $50,000 |

Pool contribution to the line

| Pool Code | Pool Currency | Line Code | Line Currency | Pool Line linkage % | Pool contribution amount to line | Line available amount | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pool1 | USD | Loans | USD | 100% | $50,000 | $1.05million |

After one Year on 1st January 2009 the Fixed Deposit amount has increased due to interest earned. Now having a revised value as $55,000. Now the latest value has to be sent to the LCM system via input file and then the “Collateral Force Revalue” for this collateral has to be triggered manually.

The revaluation increases the overall limit amount as shown below.

| Liability Code | Line Code | Liability Limit | |||||

|---|---|---|---|---|---|---|---|

| Symphony Group | Loans | $1million | |||||

| Collateral Code | Pool amount Collateral Pool code Collateral Contribution amount Collateral Value | Pool % linkage | |||||

| Fixed Deposit | $55,000 100% Pool1 $55,000 $55,000 | ||||||

Pool contribution to the line

| Pool Code | Pool Currency | Line Code | Line Currency | Pool Line linkage % | Pool contribution amount to line | Line available amount( credit limit + Pool contribution) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pool1 | USD | Loans | USD | 100% | $55,000 | $1.055million |