3. Defining MIS Cost Codes

An MIS cost code represents the notional cost incurred for a transaction. An MIS cost code can be attached either to an account or to a contract, in the following manner:

- You can link a Cost Code to an account class. This will default to the accounts maintained under the account class. You can change this default. Alternatively, you can link an MIS Cost Code to an account when maintaining it.

- When creating a product, you can identify the Cost Codes against which contracts involving the product should be reported.

- When processing a contract, the Cost Codes identified for the product (the contract involves) will automatically default. These defaults can be changed. If cost codes have not been identified for the product, you can identify one for the contract.

The notional cost will be reported in the profitability report.

This chapter contains the following section:

3.1 MIS Cost Code Maintenance

This section contains the following topics:

- Section 3.1.1, "Invoking the MIS Cost Codes Screen"

- Section 3.1.2, "Operations on the MIS Cost Code Record"

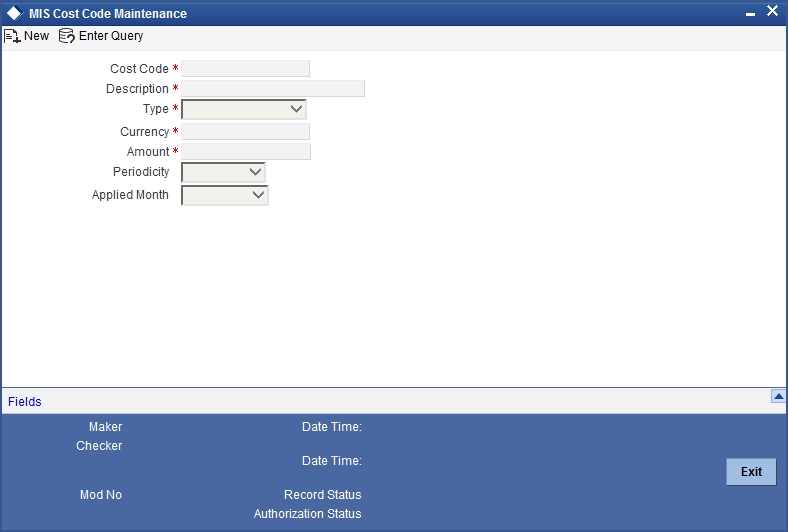

3.1.1 Invoking the MIS Cost Codes Screen

You can invoke this screen by typing ‘MIDXCODE’ in the field at the top right corner of the Application toolbar and clicking the adjoining arrow button.

If you are creating a new MIS Cost Code, select ‘New’ from the Actions Menu in the Application toolbar or click new icon. The ‘MIS Cost Code Maintenance’ screen is displayed without any details.

If you are calling an MIS Cost Code that has already been defined, double-click on an MIS Cost Code from the summary screen.

Type

The MIS Cost Code can belong to one of the following types:

Number of Transactions

This typically applies for calculating the cost of processing a transaction involving an account.

You can indicate the amount to be considered as the notional cost for each transaction.

For example, you may incur a certain amount for every transaction you process of a savings account a particular category. This cost could be different for processing transactions in a different type of savings account or for current accounts. You should define different MIS Cost Codes and link them to the appropriate account classes.

Event based Charges

The notional cost applicable for processing an event can be defined as a cost code. Typically, this applies for a contract.

For example, for processing an event in the life-cycle of a loan, you may want to attach a certain cost. You can define a cost code for it and link it to the product.

Similarly, you can define a different notional cost for different events in the life-cycle of a contract. Thus, you can have a cost code for initiating a loan, one for liquidating interest, and so on, and link them to the product with the appropriate event codes.

The notional cost that you define will be taken as the cost per event.

Duration based charges

These changes are applied typically for a contract. The notional cost in this case, is calculated on the basis of a specific duration. This notional cost is defined for a cost code. The following example illustrates how this cost is applied on a contract.

For example, if a loan is live for a month, the notional cost you incur is a specific amount. You would define a duration based cost code, define the periodicity as 'monthly'. For every month a loan linked to the cost code is live, the notional cost will be applied.

Cost

The notional cost, along with the currency in which it is expressed should be indicated for the cost code. The cost will be applied based on the Cost Code type, as follows:

| Cost Code Type | Description | ||

|---|---|---|---|

| Number of Transactions | The amount is taken as the cost per transaction | ||

| Event | The amount is taken as the cost per event | ||

| Duration | The amount is taken as the cost for the period defined as the periodicity, for the cost code |

If a currency conversion is involved during reporting, the prevailing conversion rate will be used.

Periodicity

This is the periodicity at which the costs defined have to be applied. In the profitability report, the notional cost reported would depend on the periodicity defined for the cost code.

For a quarterly, half-yearly or yearly periodicity, you should also indicate the first month of application. The subsequent application months would be computed based on this.

3.1.2 Operations on the MIS Cost Code Record

On an existing MIS Cost Code record, you can perform any of the following operations (if any function under the Actions Menu is disabled, it means that the function is not allowed for the record):

- Amend the details of an MIS Cost Code

- Authorize an MIS Cost Code

- Copy the details an MIS Cost Code on to a new one

- Print the details of an MIS Cost Code

- Delete an MIS Cost Code

Please refer to the manual on Common Procedures for details of these operations.