5. Processing Repayments

When you make a money market deal, you also decide on the terms of the repayment of the placement or borrowing. You may have your own repayment schemes; for example, you may prefer monthly repayments of interest or the repayment of the principal on maturity, and so on. Or, you may design repayment schedules to suit the convenience of your customer. Your customer may want the repayments done daily, instead of every week, for example.

In Oracle FLEXCUBE, you can customize your repayment schedules for a money market product. The same schedules will, by default, apply to the deals involving the product. However, when processing a specific deal, you can change the repayment schedule, which it inherits, from the product it involves.

This chapter contains the following sections:

- "Example 5.1" on page 1

- "Example 5.2" on page 2

- "Example 5.3" on page 5

- "Example 5.4" on page 7

- "Example 5.5" on page 8

- "Example 5.6" on page 9

- "Example 5.7" on page 10

- "Example 5.8" on page 14

- "Example 5.9" on page 15

- "Example 5.10" on page 15

- "Example 5.11" on page 16

- "Example 5.12" on page 20

- "Example 5.13" on page 20

5.1 Defining Schedules for a Product

You can define repayment schedules for the interest or interest type of ICCF components like a tenor based charge or fee and the principal of a Money Market deal, while defining a product.

The attributes of the schedules for a product are defined through the Product Preferences screen. The following are the attributes of a repayment schedule:

- Mode of liquidation − auto or manual. This can be changed at the time of deal processing.

- Liquidation of back valued schedules upon initiation of a deal. This can be changed at the time of deal processing.

However, for a deal, you can have:

- Only a maturity schedule for the principal and no interim schedules

- Interim schedules for the interest

- Only normal type of schedules for interest. Schedules cannot be capitalized or amortized

- No schedules for commission, charge or fees

A discussion on these attributes follows in this chapter.

The Automatic Contract Update function executed as part of the MM Batch Daily routine automatically liquidates schedules that you have marked for auto liquidation. If schedules are marked for manual liquidation, you will have to liquidate them through the Contract Schedule Payments function.

Once you specify the attributes of schedules in the Product Preferences screen, the default schedules, which you want, applied to the deals involving the product, and are specified through the Product Schedules screen.

At the time of deal processing you can change the schedules which have been inherited by the deal, to suit your needs.

If the interest specified is an amount and not a rate (Special type of Interest), you should enter this amount for the interest component. You should specify the number of schedules for the component (interim schedules and maturity schedule). You can give the Start Date, Frequency and Unit afresh or let the details inherited from the product remain.

Note

If schedules are not defined for the product, then the borrowings or placements under it will have bullet (or balloon) schedules by default. That is, all the components will be liquidated on maturity.

Since for a money market deal, the principal is always repaid at Maturity, you need not define a schedule. By default, the principal will have a bullet schedule.

5.2 Product Schedule Preference Details

This section contains the following topics:

- “Setting Product Schedule Preferences” on page 3

- “Mode of Liquidation” on page 3

- “Liquidating Back Valued Schedules During Initiation” on page 4

- “Specifying the Payment Method” on page 4

- “Indicating the Schedule Type” on page 4

5.2.1 Setting Product Schedule Preferences

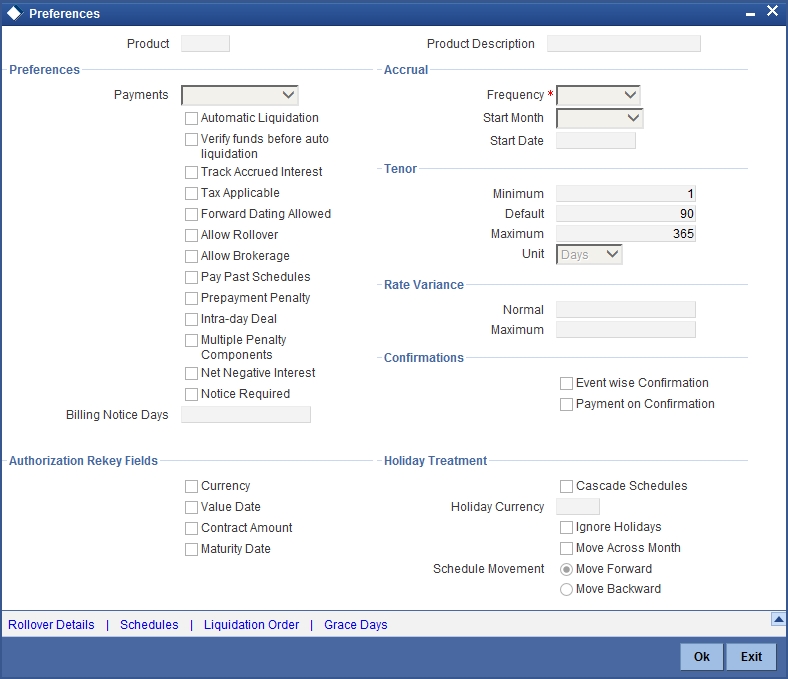

You should define the attributes of the schedules for a product through the Preferences screen.

5.2.2 Mode of Liquidation

Components of a deal can be liquidated automatically or manually. In the Product Preferences screen you should indicate whether the mode of liquidation of repayment schedules is to be automatic.

Specify Auto liquidation if you want the components of a deal (involving a product) to be liquidated automatically. If you so specify, a schedule will be automatically liquidated on the day it falls due, during beginning of day processing (by the Automatic Contract Update function.)

Now, consider the following situation:

- You have indicated automatic liquidation

- The schedule date falls on a holiday, and

- You have specified (through the contract preferences screen), that the holiday be ignored while calculating the schedule date

In such a situation, a repayment falling on a holiday would be processed according to your specifications for holiday handling (in the MM Branch Parameters screen). It would be as follows:

- If you have specified that processing has to be done (on the last working day before the holiday) for automatic events right up to the day before the next working day, the schedule falling on the holiday will be liquidated during end of day processing on the last working day before the holiday.

- If you have specified that processing has to be done only up to the System Date (today), then only those events scheduled for today (the last working day before the holiday) will be processed. The events falling due on the holiday are processed on the next working day after the holiday, during beginning of day processing.

If a borrowing has been defined for verification of funds before automatic liquidation (through the Contract On-line Preferences screen), those components whose schedule dates fall on the same day will be liquidated in the order you have specified when defining the product.

If the funds are insufficient, the liquidation is done to the extent of the available balance in the repayment account. The components will be liquidated in the order that you specify. This will be reported in the Exception Report generated at the end of every day, automatically (by the Automatic Contract Update function). If you have not specified that the funds be verified, and there are insufficient funds in the repayment account:

- The repayment account will be put into a debit balance (if you have allowed overdraft) and the schedules for the components liquidated to the extent of the debit balance that you have allowed for the account. You can liquidate beyond the allowed debit balance for an account after overriding a warning message. This override will be recorded for audit trail purposes. Debit interest, as specified for the type of account (current or savings); will be applied on the debit balance.

- If the repayment account has not been defined with overdraft, the liquidation will not be processed.

If you specify manual liquidation for deals involving the product, then you will have to do the liquidation manually, through the Manual Liquidation screen.

5.2.3 Liquidating Back Valued Schedules During Initiation

You have to indicate whether for a backdated deal that has schedules prior to today’s date; the schedules have to be liquidated when the deal is initiated. A back dated deal is one, which has an initiation date, which falls before today’s date.

5.2.4 Specifying the Payment Method

You have to specify whether the payment method for the main interest is to be bearing, discounted, or true discounted. This cannot be changed at the time of processing a deal.

Bearing

The interest is liquidated on schedule payment date(s).

Discounted

In this interest payment method, the interest is deducted at the time of initiating the deal.

True discounted

In this interest payment method, the interest is calculated on the principal in a manner differing slightly from the ‘Discounted’ method. The interest rate is applied on the Principal instead of the Nominal, as it is done in the ‘Discounted’ method.

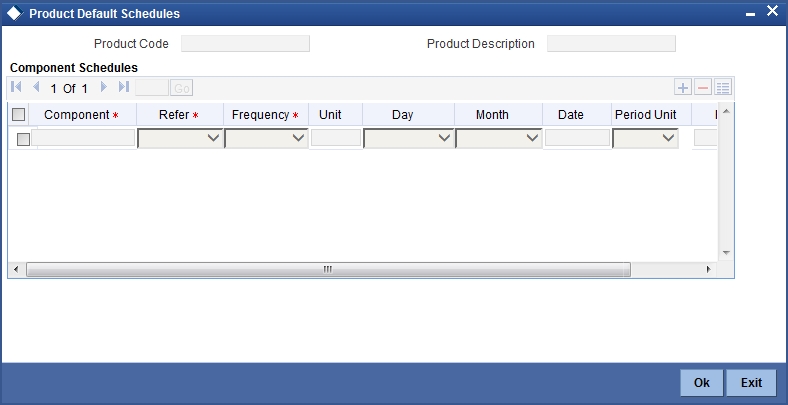

To go to the Product Default Schedules screen, click on the Schedules button in the Product Preferences screen.

5.2.5 Indicating the Schedule Type

You can define schedules for each component for the product through the Product Default Schedules screen. This involves specifying the reference date, the frequency, the month and date for each component.

5.3 Features of the Product Default Schedules Screen

When creating a product (in the Product Default Schedules screen), you can define schedules for all deal components. This involves specifying the reference date, the month and the date for each component etc. All deals, involving the product, will acquire these attributes.

Component

You can define different repayment schedules for the different components according to your needs. First of all, you should specify the component for which you want to define the schedule. All components − the principal and any other component depending upon your ICCF definition for the deal − are available in the adjoining option list. You will have to define schedules for each of them.

When defining repayment schedules for specific deals, the amounts for components like interest, commission, and fee will be calculated by the system automatically, depending on the repayment date and amount of the principal. However, for deals with special interest, you will also have to provide the interest amount.

Refer

Indicate whether the dates of repayment schedules should be calculated based on the Value Date (date of initiation of the deal) of the deal involving the product, or a Calendar Date. If you specify that the Reference is the Value Date (date of initiation of the money market deal), the dates for schedule repayments will be based on this date and the Frequency.

If the Reference is specified as the Calendar Date, the dates for schedule repayments will be based on the Start Date (specified by you), the Month and the Frequency. The following example illustrates this concept.

If Reference is set to Value Date (deal initiation date), you need to specify only the Frequency (monthly, quarterly etc.) and the unit of frequency (if you specify the frequency as weekly and the unit as 1, it means once a week). The system will set the schedule according to the Frequency and Unit of Frequency you have specified, beginning on the Value Date.

Frequency

For a periodic schedule, you can indicate the frequency of repayment for each component. This could be:

- Daily

- Weekly

- Quarterly

- Monthly

- Half-yearly

- Yearly

- Bullet

By default, the frequency will be Bullet, meaning all the repayments will be made on maturity. If the frequency is defined as Bullet, you cannot enter a value into the subsequent fields.

Unit

You can specify the number of units for the frequency you have set for a particular component.

For example, if you want a payment every 15 days, you will have to specify

- the frequency as Daily and

- the units as 15.

For payments every three weeks, you will have to define

- the frequency as weekly and

- the unit as three.

Day

If you have set the Reference as Calendar Date and the frequency as weekly, quarterly, half-yearly or annual indicate the day on which the first schedule falls due. Based on this, the subsequent schedule dates will be calculated.

Month

If you have set the Reference as Calendar Date and the frequency as weekly, quarterly, half-yearly or annual indicate the month in which the first schedule falls due. Based on this, the subsequent schedule dates will be calculated.

Date

If you have set the Reference as Calendar Date, you should indicate the date on which the schedule should fall due. Specify 31 to indicate that the schedule should fall due on the last day of the month (that is, 31 for months with 31 days, 30 for months with 30 days and 28 or 29, for February).

The schedule repayment dates will be computed using the Frequency, (Start) Month and the (Start) Date.

A schedule date:

- should be later than or the same as the Value Date,

- It cannot be beyond the Maturity Date.

Period Unit

You need to specify the unit for the interest period. The available options are as follows:

- Days

- Months

- Years

5.4 Defining Repayment Schedules

The payment schedules defined for a product will apply to all deals involving the product. When you process a deal in the Contract Schedules screen, the details defined for the product (which the deal involves) will be displayed. You can change the schedules that a deal acquires when processing it in the the ‘Money market Contract Input’ screen - Schedules tab (MMDTRONL).

You can redo the schedules defined for the product, by clicking on ‘Schedules’ in the ‘Money market Contract Input’ screen. The schedules that have not been liquidated and which fall due on the current system date, or later than the current system date, will be erased and you can go on to define the new repayment schedules.

The attributes of the schedules inherited from the product can be changed for a deal through the Contract Preferences screen.

5.5 Setting Deal Schedule Preferences

Schedule preferences are the attributes of the repayment schedules defined for the deal. The attributes that have been defined for the product are inherited by all deals involving the product. Some of these attributes can be changed. They are:

- The liquidation of schedules that fall due before the day on which the deal is booked

- The liquidation mode (auto to manual)

Click ‘Preferences’ to specify an additional set of schedule-related attributes.

How liquidation dates falling on holidays should be handled

- Whether schedule dates should be cascaded in case you have indicated that they (schedule dates) be moved forward or backward in case of a holiday

- The holiday table of the country of the deal currency that has to be checked before setting automatic schedules

- Whether back valued schedules should be liquidated on deal initiation

- Whether, in case of a placement, the availability funds in the repayment account has to be verified if components have the same schedule date and repayment account, and automatic liquidation has been specified

The Contract Online screens are available under MM in the Application Browser.

5.6 Specifying the Contract Preferences

Although schedules are inherited by a deal from the product, through the Contract Preferences screen, you can to define your own schedules for a deal.

A schedule date:

- Should be later than or the same as the Value Date

- You can have only one schedule for a component for a date, and

- It cannot be beyond the Maturity Date

This section contains the following topics:

- “Liquidating Back Valued Schedules” on page 9

- “When the Repayment Schedule Date is a Holiday” on page 9

- “Moving Schedules Forward or Backward” on page 9

- “Moving Schedule Dates Across the Month” on page 10

- “Specifying the Holiday Currency” on page 10

- “Specifying the Mode of Liquidation” on page 10

- “Cascading Schedules” on page 10

5.6.1 Liquidating Back Valued Schedules

If you have specified, while defining the product, that a back-dated deal with repayment schedules prior to today’s date, the schedules have to be liquidated when the deal is initiated, the same will apply to the deal you are entering.

However, through this screen, you can choose not to liquidate back valued schedules.

5.6.2 When the Repayment Schedule Date is a Holiday

You have specified that repayment schedules should be generated automatically once you indicate the frequency, number and the date of first repayment. When the system computes the repayment dates based on these values, there is a chance that one or more schedules fall due on a holiday. In such a case, you have two choices:

- Ignore the holiday and retain the schedule due date or

- Move it either backward or forward, by specifying so. If you specify that holidays are to be ignored, the schedule dates will be fixed without taking the holidays into account. In such a case, if a schedule date falls on a holiday, the processing of such a schedule is determined by your holiday handling specifications for automatic processes, in the Branch Parameters screen:

- If you have specified that processing has to be done on the previous working day for automatic events right up to the day before the next working day the schedule falling on the holiday will be liquidated during end-of-day processing on the previous working day.

- If you have specified that processing has to be done only up to the System Date, then only the events scheduled for the System Date will be processed. The events of the holiday are processed on the next working day during beginning -of-day processing.

5.6.3 Moving Schedules Forward or Backward

A schedule date falls on a holiday and you have not specified that holidays are to be ignored at the time of schedule definition. In such a case, you should indicate the movement of the schedule date forward or backward to the next working day, or the previous working day, respectively. Since the schedule date itself is moved to a working day, the payment will be processed on the day it falls due, as of that day.

5.6.4 Moving Schedule Dates Across the Month

If you have chosen to move a schedule falling due on a holiday to the next working day, or on the previous working day, and it crosses over into another month, the schedule date will be moved only if you so indicate. If not, the schedule date will be kept in the same month.

5.6.5 Specifying the Holiday Currency

You can specify the country of the deal currency for which the holiday table should be checked before drawing the payment schedules related to the deal. In case a schedule falls on a holiday and you have specified that the schedule be moved forward or backward, the movement happens according to the holidays in this country.

By default, the currency to be checked is the deal currency. If a currency other than this is specified, the holiday table will be checked for both the currencies.

5.6.6 Specifying the Mode of Liquidation

When creating a product, you specify the mode of liquidation - whether automatic or manual. Your specifications will apply to all deals involving the product.

Through the Contract Preferences screen, you can change the mode of liquidation for the deal that you are processing, from automatic to manual, or vice versa.

5.6.7 Cascading Schedules

The question of cascading schedules arises only if:

- You have specified that a schedule falling due on a holiday has to be moved forward or backward; and

- The schedule has been defined with a definite frequency

If you have indicated that schedules should be cascaded, the schedule date for the next payable schedule will depend on how the schedule date was moved for a holiday. The following example illustrates how this concept of cascading schedules functions:

When you cascade schedules, the last schedule (at maturity), however, will be liquidated on the original maturity date and will not be changed like the interim schedules. Hence, for this particular schedule, the interest calculation days may vary from those of previous schedules, as the case may be.

5.7 Revision and Repayment Schedules

In the Contract Schedules screen, you can define two types of schedules:

- Those for the revision of interest rates for a deal with floating interest rates, and

- Those for repayment of the various components.

This section contains the following topics:

- “Interest Rate Revision Schedule” on page 11

- “Specifying the Rate Revision Frequency” on page 11

- “Specifying the Rate Revision Dates” on page 11

- “Repayment Schedule” on page 11

- “Interest Repayment Schedules as Different from Rate Revision Schedules” on page 12

- “Specifying Schedules for a Deal with a Fixed Interest Rate” on page 13

5.7.1 Interest Rate Revision Schedule

A Floating Rate Table - that contains the market rates for the day − is maintained in the ICCF sub-system so that the latest rates can be applied to deals.

The market rates vary on a daily basis and are maintained in this table. The rates can be applied either every time they change or at periodic intervals. Usually, for Money Market deals, floating rates are applied, i.e., the latest market rate is applied (see the section on Specifying Rate Code Usage in the chapter ‘Processing Interest, Charge and Fee’). You can also apply these rates on a periodic basis so that you are in tune with the market rates (as opposed to fixed interest rates which remain the same for the entire period of the deal), and at the same time you do not have to apply the market rates on a daily basis.

You can specify whether the latest market rates have to be applied every time they change, or if they have to be applied periodically, by defining an attribute called the Rate Code Usage through the Product ICCF Details screen for a floating interest type. If you specify ‘auto’ rate code usage, all the rate changes made during the liquidation or accrual period will be considered. If you specify ‘periodic’ rate code usage, the rates will be periodically refreshed and the rates as of a specific frequency, or date, will be applied.

For a deal that has been defined with Periodic Interest that has to be applied at periodic intervals, you can specify the following:

- The frequency at which the periodic rate change has to be applied

- The dates on which the periodic rate change has to be applied

5.7.2 Specifying the Rate Revision Frequency

In the MM Contract Schedules screen, select the component, for which the Rate Revision frequency has to be, defined (say INTEREST1). Select the Type as 'R' (Revision), then enter your specifications in the frequency (it could be daily, weekly, etc.), the number, and unit fields. Also give the Start Date on which the first revision has to take place.

For example, if you specify the frequency, as weekly, the revision will take place every week beginning on the Start Date that you have specified.

5.7.3 Specifying the Rate Revision Dates

Revision frequency has to be defined (say INTEREST1).

Then, instead of specifying the other schedule details like the frequency, the number and unit, indicate the date in the Start Date field. The rate revision will be done on that date.

5.7.4 Repayment Schedule

For a repayment schedule, the amount of repayment needs to be specified only for the Principal. The interest, commission and fee components will be calculated by the system automatically, depending on the repayment date and amount of the principal. However, if the interest type is Special, you should specify the interest amount. Similarly, if the deal has been defined with any other fixed amount component, you will have to enter an amount for this. The repayment schedules for the components of the deal will be those defined for the product it involves. You can change the schedules for a deal when processing it.

5.7.5 Interest Repayment Schedules as Different from Rate Revision Schedules

For a deal on which floating interest has to be applied at periodic intervals, you may have to define:

- An interest rate revision schedule for the interest component, as well as

- A repayment schedule

The following example shows how this is achieved:

You have a deal where for the component interest; you have to define an interest rate revision schedule for revisions every week as well as a fortnightly interest repayment schedule. The Start Date of the deal is 1 October ‘97 and the End Date is 31 October ‘97. The deal has been defined with a periodic rate and the rates in the floating rate table change in the following manner:

Date |

Rate |

1 October ‘97 |

12 |

12 October ‘97 |

11.5 |

25 October ‘97 |

11 |

15 November ‘97 |

12 |

30 November ‘97 |

12.5 |

Defining a frequency based rate revision schedule

To define a schedule with periodic rate code usage, through the Contract Schedules screen, mark the component as a revision schedule and specify the component, say INTEREST, from the picklist. Give the frequency at which the interest rate has to be refreshed, say weekly. Give the Start Date, say 8 October. The first revision will happen on this day, and every week from then on. Save the inputs.

Defining a date based rate revision schedule

If you were to define specific dates − 7 October, 15 October and 23 October − for the rate revision to happen, then, through the Contract Schedules screen, mark the component as a revision schedule and specify the component, say INTEREST, from the picklist.

Specify the date on which the rate revision is to be done, in the Start Date field, as 7 October. Similarly, define the other dates, but by picking up the same component INTEREST from the picklist each time.

Defining a repayment schedule for the same component

Now to define a repayment schedule for the same component, INTEREST,click schedules Tab and choose the component interest from the picklist. Now draw up a repayment schedule for this component. Give a value in the Start Date field, say 15 October 1997. The first interest liquidation will be done on this date.

In the frequency field enter ‘monthly’ and in the unit field specify ‘2’. This means the interest repayments will be done every fortnight beginning 15 October.

That is, for a deal defined with frequency-based periodic rates, the rates prevailing on the refresh dates will be used for accruals and liquidation. In the deal we are discussing, with the refresh frequency defined as weekly and the Start Date as 15 October, the rate applied for the interest liquidation on 15 October will be as follows:

From |

To |

Rate |

1 October |

8 October |

12 |

9 October |

15 October |

11.5 |

For a deal with Periodic rate code usage (date based), the rates prevailing on the specific refresh dates will be used for accruals and liquidation. Shown below are the rates applicable on the specified revision dates.

Revision Date |

Rate Applicable |

7 October |

12 |

15 October |

11.5 |

23 October |

11.5 |

In the deal we are discussing, the rates applied for the interest liquidation on 15 October will be as follows:

From |

To |

Rate |

1 October |

7 October |

12 |

8 October |

14 October |

12 |

15 October |

|

11.5 |

5.7.6 Specifying Schedules for a Deal with a Fixed Interest Rate

For components of deals with a fixed rate of interest, you will not have to define interest rate revision schedules. The schedules defined for each component at the time of product definition apply to the deal. However, you can change the frequency, number, unit and the start date to suit the specific requirements of the deal that you are processing. You will have to specify the amount only if the schedule being defined involves the principal component or a special interest. But in the case of Money Market deals, the principal is repaid at Maturity.

The amount for interest, commission and fee components (if they are rates) will be calculated by the system automatically, depending on the start date, number of schedules, frequency and repayment amount of the principal. However, an amount can be entered here for interest only if the Interest Calculation Method has been defined as Special. The fee amount can be input only if it is a flat fee. For a money market deal, you can define repayment schedules that:

- Fall due at regular intervals, or

- At irregular intervals

Now, if you want to define schedules that fall due at regular intervals, all you have to do is, for a component, specify the start date, the frequency, the unit and the principal amount. Since you would have already registered the Maturity Date of the money market deal (for a fixed maturity type), in the Contract Details screen, the schedules would automatically be spread out into equal intervals. Based on this information, the system calculates the dates on which the repayments or interest revisions fall due.

For example, consider the following details for a deal: A borrowing of USD 100,000 comes into effect on 1 January 1998 and matures on 31 October 1998. Suppose you want to have 10 monthly schedules for interest payment, you have to specify the Start Date as 31 January 1998, the frequency as monthly, the unit as 1. The interest schedules would be spread out over 10 months and would fall due every month-end.

Now, you have a 15 month borrowing beginning 1 January 1998 and ending 31 March 1999. Suppose, you want to define four quarterly schedules and three monthly schedules for interest payment of this loan, these are irregular schedules and the ‘Number’ field assumes importance here. Here, for the component interest, you have to give the Start Date as 31 March 1998, the frequency as quarterly and the unit as 1. The number of such schedules will be four. Hence your quarterly schedule dates will be calculated as:

- 31 March 1998 (Start Date),

- 30 June 1998,

- 30 September 1998,

- 31 December 1998.

You have to specify for the same component − the interest - the Start date as 31 January 1999, the frequency as monthly, the unit as 1, and the number as ‘3’, if you want to fix three monthly payment schedules after 31 December 1998. They will be calculated as falling due on:

- 31 January 1999

- 28 February 1999

- 31 March 1999

5.8 Redefining Schedules

Repayments that are scheduled for a date later than today can be redefined. This redefinition can be done even after the deal has come into effect and a few schedules have been liquidated.

However, schedules with a date earlier than today’s date that are yet to be liquidated cannot be rescheduled. You have to liquidate them through the Manual Liquidation function. Aging analysis and penalty processing will be done on such overdue schedules if they are borrowings.

The redefinition of schedules will be done automatically on the following occasions:

- When the Maturity Date is changed − a change in the Maturity

Date will be handled in the following manner:

- Extension of the Maturity Date: The principal repayment schedule that was defined for the earlier Maturity Date will be moved to the new Maturity Date. Other components (interest, commission or fee) that are dependent on the tenor of the deal will be recalculated and spread equally over the rest of the repayment schedules for these components.

- Advancement of the Maturity Date: All the schedules that are beyond the new Maturity Date will be advanced to the new Maturity Date. The amount of other components (interest, commission or fee) that are dependent on the tenor of the deal will be recalculated and spread equally over the rest of the repayment schedules for these components.

- When the Principal is increased: the increased amount is added on to the last principal schedule. Other components (interest, commission or fee) that are dependent on the principal of the deal will be recalculated and spread equally over the rest of the repayment schedules.

- When there is a prepayment of interest and you have defined recalculation of schedules on repayment.

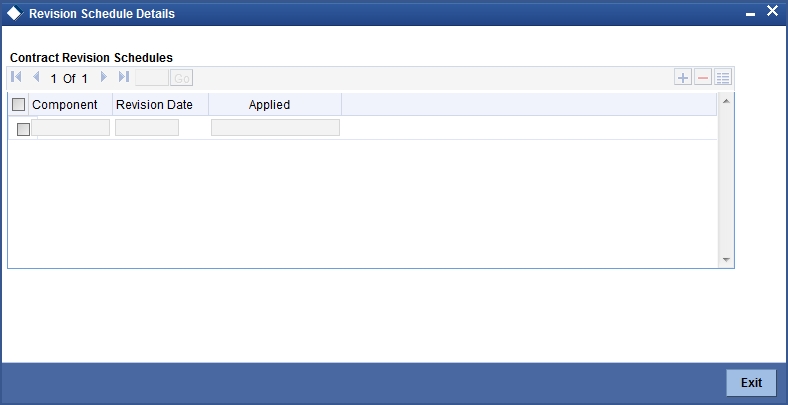

There may be some situations wherein you would want to redefine the schedules, i.e.; you may want to change the payment dates or amounts. In such cases, you can change the schedules by invoking the Contract Input screen and going to the Schedule Redefinition screen by clicking on the ‘Revision Details’ button. If you click the redefinition button on the schedules screen, all the schedules with today’s date or a date in the future will be erased and you will be allowed to enter a new set of schedules.

To redefine a schedule for only one component, highlight the schedule and make the changes. If the schedules have already been authorized, then you will have to make the changes through the Modify function. After making the changes, you can save the redefined schedules by clicking save icon. To delete a schedule (before authorization) click delete icon.

5.8.1 Authorizing a Redefined Schedule

A redefined schedule has to be authorized before it can be used.

5.9 Viewing Schedule Details

When you click on the 'Default' button in Schedules tab, you will see the ‘Payment Schedule Details’ screen. Here you can view the details of the schedules for a particular deal.

In this screen you can see the following details for the component:

- The Due date of the Schedule

- The Amount Due as of the due date

- The amount liquidated against the schedule

5.10 Viewing Revision Schedule Details

When you click on the Revision Details sub screen you will see the ‘Revision Schedule Details’ screen. Here you can view the details of the revision schedules for a particular deal.

In this screen you can see the following details for the component:

- The revision date and

- Whether it has been applied

5.11 Making Manual Payments

The various components in a deal can be liquidated either automatically or manually. The mode of liquidation of each component is specified at the time of defining a product and then again, at the time of deal processing. An automatic liquidation is done on schedule payment days by the Automatic Contract Update program.

Even if you have defined a deal with automatic liquidation, you can liquidate it manually a day before the schedule date. However, payment will not be allowed if the Rollover Instruction Status for the contract is ‘Complete’.

You can invoke the ‘Money Market Payment Input’ screen from the Application Browser by typing ‘MMDPAMIN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can do the following operations the manual payments function:

- Input of Manual payments

- Deletion of manual payments, and

- Reversal of manual payments

The manual payments made through this function can be:

- Scheduled payments, which are due.

- Payments which are made prior to a scheduled payment date. (these are called prepayments and they can be made even if the deal has been defined for automatic liquidation of components).

- Back value dated payments. The value date for such payments cannot be earlier than the most recent schedule that was due. If there is more than one schedule outstanding and you want to assign the value date of each schedule payment, you should enter the liquidation of each schedule separately.

The value date you have entered will be used for all the entries generated by the system.

This section contains the following topics:

- “Input of Manual Payments” on page 17

- “Paying Tax” on page 18

- “Using the Settlements Screen” on page 19

5.11.1 Input of Manual Payments

Once you enter the deal reference number in the Contract Schedule Payments you will see the following details displayed on the screen:

- Counterparty Name

- The currency of the deal

- Status of the borrowing

- The total outstanding amount as of the value date (the date on which the payment is being made) and the deal version

The Value Date here, is the date on which the liquidation entries will be passed. When you enter a Value Date in this screen, if there are any payments due on that date, they will be displayed and you can liquidate them.

If there are no schedules due on that date, the schedule becomes a prepayment. But this is only if the Value Date is not a back valued date. You can have a back valued date but it cannot be earlier than the last schedule that was due. (You can also liquidate back valued schedules by entering a Limit amount).

If the Value Date is today or a date in the future, the prepayment is processed.

The Payment Limit Date or Amount of the payment should be given at the time of payment. If you have given a payment limit date, the system shows all the components, which are due till the limit date. If you have given the amount limit in the Amount field, it shows all the schedules for the limit amount.

Note

While the Prepayment Limit Date is used to pick up the schedules pending as of that date, the Value Date is taken into account by the system for passing accounting entries.

Alternatively, the system picks up a schedule according to the amount being paid. You will see the next schedule, which is due, within the limit of this amount. If the amount being paid is more than the total amount payable for the next schedule, the next schedule will be considered. The total amount due for these schedules is displayed.

You have to enter the actual amount being paid in the Net Amount Settled field. If there are both positive and negative amount to be settled, then the net amount should be specified here. This amount can either be allocated to the various components manually, by entering the break up of the amount against the various components, or automatically by clicking the Allocate button. The total negative amount that should be settled is displayed in Negative Amount Settled field. Partial payment of negative amount is restricted. Back dated payment of interest amount is allowed till last payment date or amendment date, whichever date occurs later.

The automatic allocation is done based on the Liquidation order you have defined for the product. If you have not specified the order of liquidation for the principal and the interest type of components, the amount will be allocated for liquidation in the following order:

- Penalty interest (if one has been applied)

- Interest

- Principal

Note

If a payment that covers both past and future schedules is made, the system will force you to pay out the past schedules before the future schedules are paid. If an ICCF component is based on the outstanding principal you will not be able to make a payment where the amount is more than what is due for the component as of the system date.

In the Contract Schedule payment screen, you have a set of icons using which you can navigate to the following screens:

‘Settlements’ - Click to go to the Settlement Message Details screen

‘Tax’ - Click to see the Tax details screen

‘Advices’ - Click to see the Advices screen. You can suppress advices using this screen.

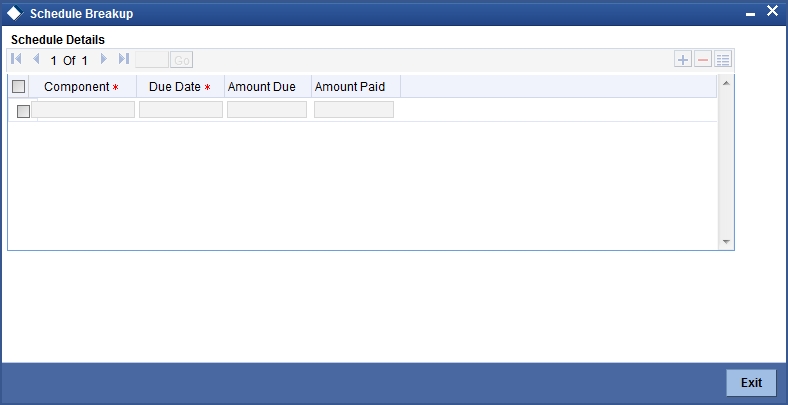

‘Breakup’ - Click to view the Schedule Breakup screen.

‘Events’ - Click to view the Events screen.

Settlement Sequence Number

Choose a settlement instruction by specifying a settlement sequence number. You can skip this field if any default settlement instruction is already provided.

Note

At the time of specifying settlement instructions, it is now possible to choose from multiple instructions that are maintained for the same branch, customer, currency, module and product combinations. You can choose any settlement instruction from a list of values. The list of values displays the Settlement Sequence Number and Settlement Instruction Description.

Settlement Instruction Description

Specifies the description of the selected settlement instruction.

5.11.2 Paying Tax

When there are taxes charged on the interest, etc., the payment of the component will always include the corresponding tax amount. If the payment does not include the full amount due, the proportional tax amount must be liquidated. You should input the total amount to be applied to the component. The system then calculates the corresponding tax amount (based on the tax rate) and distributes the amount paid between the component and the tax.

For example, if a customer owes USD 1000 in interest (tax inclusive), the tax rate is 10% and he pays you USD 1000, the payment is automatically distributed into USD 909.09 (interest) and USD 90.91 (the tax component)

The customer will still owe you USD 90.91 in interest and USD 9.09 tax in tax.

Total tax is always calculated on the full schedule. Therefore, if there is a rounding difference, it will be adjusted in the last liquidation.

In the above example, the tax component has come to USD 90.91 for that schedule. Suppose the total tax component is USD 273. If this is paid in three schedules the total will come to USD 272.73 (90.91 + 90.91 + 90.91 = 272.73). During the last liquidation, the system will round off the total of such schedules for tax to the nearest decimal point, i.e., USD 273.

5.11.3 Using the Settlements Screen

When the deal and the accounts for payment are in different currencies, you may enter the Foreign Exchange rate for conversion in the Settlements screen. If the customer account for a component was expressly not defined at the time of deal input, you will have to specify an account at the time of payment, through the Settlements screen.

The payment accounts can also be changed for the various components at the time of payment. The new payment accounts will only be used for that particular session of the manual payment function.

For instance, you have named an account A1 for a particular component at the time of deal input, but during manual payment you wish to change it to A2. Once this particular payment is carried out, the system will show the default account as A1 for that component. A2 will be used only for the session that you have specified for manual payment.

In this screen,

- The currency (of the contract components) and the branch will be displayed

- You can change the payment account

- You can specify the exchange rate, if the settlement account currency is different from the contract currency

5.11.3.1 Suppressing Messages

Settlement messages, defined for components that fall due, will be generated automatically when you execute the Settlement Generation function at the end of day. You can suppress the generation of the settlement message, defined for a component, by clearing the check-box in the ‘Gen Message’ field in the ‘Contract Settlement Message Details’ screen.

5.11.3.2 Viewing the Schedule Breakup Details

In the Schedule Payments screen, you will see a row of icons. Click ‘Breakup’ to view the Schedule Breakup screen .

You will see the following in this screen:

Component

In this screen you can see the schedules being paid on account of this particular payment for which you are doing manual liquidation. The component getting paid is displayed.

Due Date

The due date of the component being liquidated is displayed.

Amount Due

The amount outstanding for the component being liquidated is displayed here.

Amount Paid

You can see here the amount paid for the component as of the value date (the current system date).

5.12 Deleting Manual Payments

Payments made using the Manual payments function can be deleted before the payment is authorized.

All the entries passed during the payment will also be deleted. All the schedules will be restored to the original status. In short, the prepayment status of the deal will be restored.

From the Actions Menu, select Delete or click ‘Exit’ or ‘Cancel’ in the toolbar. You will be prompted to confirm the deletion. Once you confirm it, all the entries that have been saved but not authorized, will be deleted.

5.13 Reversing Manual Payments

You can reverse authorized manual payments. The system makes the following validations before reversing a payment:

- A principal payment can be reversed only if the payment date is equal to, or later than, the last interest and commission schedule due date.

- An interest payment can be reversed only in the chronological order of its payment.

In the Contract view screen, to reverse a payment, you have to invoke the manual payments function and specify the Contract Reference Number. You have to enter the ‘Amount Paid’. You have to click on Reverse in the Processing sub-menu of the Actions Menu.

If the payment involves accounts in different currencies, the conversion rates to be used for reversal will be picked up from the deal as specified during Contract Input.

If a new payment account was specified for a component during the input of the payment, the reversal will be done to the new account. If the new account is in a currency different from that of the deal and a conversion rate was specified, the rate from the payments function will be used for the reversal.

The reversal of a payment may sometimes entail a change in the status of a borrowing. If the borrowing is set for automatic status change, this change will be made by the system automatically.

Automatic payments made by the Automatic Contract Update program can also be reversed through the manual payments function.

Reversal of payment will not be allowed if the Rollover Instruction Status of the contract is ‘Complete’.

5.13.1 Saving and Authorizing Manual Payments

You have to save a manual payment after entering all the required details in the system. Click Save icon on the Toolbar or choose ‘Save’ from the Actions menu to save an account. On saving the transaction, the amount is validated against the product transaction limit and the user input limit maintained in the system. The system displays an appropriate override/error message if the amount exceeds the allowed input limit. It also indicates the level of authorization required if the transaction the amount is in excess of the transaction limit maintained.

The system converts the contract amount using the standard mid rate to the transaction limit currency and check against the transaction limit amount maintained for the product if the contract currency is different from the transaction limit currency.

The payment becomes effective only after authorization. To authorize, click ‘Authorize’ icon on the Application toolbar.

You should enter the Reference number, the value date of the payment and the amount paid. The payment details are displayed along with the overrides and authorization is sought. If you choose not to authorize the manual payment, the authorization screen is dismissed.

You cannot authorise a manual payment in the following cases:

- the contract has multilevel of authorization pending, the same will be done using the ‘Multilevel Authorization Detailed’ screen

- the level of authorization is greater than or equal to ‘N’

- the ‘Nth’ or the final level of the users authorization limit is less than the difference between amount financed and sum of the limits of all the users involved in authorizing a transaction, this case holds good when the ‘Cumulative’ field is checked in the ‘Product Transaction Limits Maintenance’ screen

- the transaction amount is greater than the authorizer’s authorization limit if the ‘Cumulative’ field is unchecked in the ‘Product Transaction Limits Maintenance’ screen.