7. Rolling Over a Deal

A rollover is a renewal of a deal. Instead of liquidating a deal on maturity, you can roll it over into a new deal. The outstanding principal of the old deal is rolled over with or without the interest outstanding on it. When a deal is rolled over (renewed), it is processed in the following manner:

- The original deal is liquidated, and,

- A new deal is initiated

You can rollover a deal that you are processing provided it is allowed for the product the money market deal involves.

For a product with rollover defined, you can specify if deals involving the product should inherit:

- The attributes defined for the ICCF components (interest, charges and fees) from the product, or,

- Those defined for the initial deal. This gains significance if you changed the attributes that the (initial) deal acquired from the product. The rolled over deal will acquire the changed attributes.

In addition, you have to specify the following for a product defined with rollover:

- Whether it is to be rolled over along with outstanding interest

- Whether the interest that has been accrued on a placement is to be considered a part of the ‘utilized amount’ for the purpose of risk tracking if you are rolling over a placement with interest.

- Whether tax has to be applied on the rolled over deal

- Whether the principal of the rolled over interest should be taxed

However, when processing a deal, you can change the attributes that the deal acquires from the product. At the time of processing the deal, you can indicate if a rollover is to be automatic or manual; the maturity type (fixed, call or notice); the maturity date for a fixed maturity deal; and the notice days.

You should also indicate if:

- Only the outstanding principal is to be rolled over,

- The outstanding principal is to be rolled over with interest, or

- If a special amount is to be rolled over. (if a part of the principal and interest from the old deal has been liquidated and only the outstanding principal − with or without interest − is rolled over, it is called a special amount).

When a deal is rolled over, the new contract continues to have the reference number of the old deal.

This chapter contains the following sections:

- “Specifying Rollover for a Product” on page 2

- “Specifying Contract Rollover Details” on page 6

- “Processing of Rolled over MM Contract” on page 10

- “Rolling over a Deal Manually” on page 11

- “Advices for a Rolled Over Deal” on page 11

- “Authorizing a Manual Rollover” on page 12

7.1 Specifying Rollover for a Product

When defining a product, you have to specify whether deals involving the product can be rolled over. If rollover has been allowed for a product, all the deals involving the product can, by default, be rolled over.

Note

However, a deal involving such a product will be rolled over only if it is not liquidated on its Maturity Date. You can choose not to rollover a deal that involves a product with the rollover facility. You can indicate this when processing the deal.

This section contains the following topics:

- “Mode of Rollover (Manual or Automatic)” on page 2

- “Impact of Liquidation Mode on Rollover” on page 2

7.1.1 Mode of Rollover (Manual or Automatic)

For a deal involving a product for which a rollover is allowed, you should specify the mode of rollover - automatic or manual - during processing.

7.1.2 Impact of Liquidation Mode on Rollover

The mode of liquidation of a deal (automatic or manual) has the following impact when the rollover is carried out:

Specification |

Treatment |

Auto liquidation and auto rollover |

The old deal will be liquidated and a new one initiated on the Maturity Date of the deal during the BOD (Beginning Of Day) run of the Automatic Contract Update function. If the Maturity Date falls on a holiday then the liquidation and the rollover will be processed as per your holiday handling specifications in the Branch Parameters screen. If you specified (in the Branch Parameters screen) that processing has to be done today (the last working day before the holiday) for automatic events right up to the day before the next working day, the schedule falling on the holiday will be liquidated during end of day processing on the last working day before the holiday. If you specified that processing has to be done only up to the System Date (today), then only the events scheduled for today (the last working day before the holiday) will be processed. The events falling on the holiday will be processed on the immediate working day after the holiday, during beginning of day processing. |

Auto liquidation (of principal) and manual rollover |

The old deal will be liquidated automatically on the Maturity Date. If the deal has to be rolled over, the rollover instructions should be specified for the deal before the Maturity Date. If the contract has not been liquidated because of lack of funds in the repayment account, you can give rollover instructions even after the maturity date saying that the contract has to be rolled over as of the maturity date. |

Manual liquidation (of principal) |

Rollover has to be manual. The deal will not be liquidated by the Auto Liquidation function. You can either liquidate it or specify that it has to be rolled over. This can be specified at any time - before or after the Maturity Date of the deal, if the contract has not yet been liquidated. |

If you have defined that the deal be liquidated manually, you cannot roll it over automatically. When a deal is rolled over or renewed for the interest, charge or fee components, it can assume the following attributes:

- Those of the product involving the deal being rolled over, or

- Those of the old deal itself

You can specify this at the time of deal processing (of the old deal).

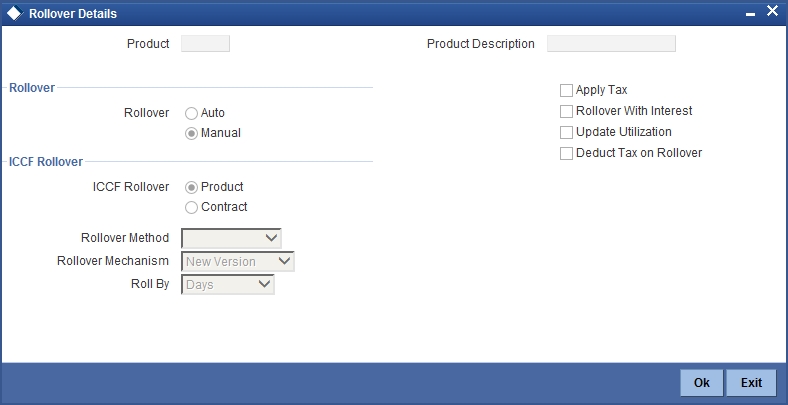

Specify the rollover details for the product you are defining, by invoking the ‘Rollover details’ screen using the ‘Rollover’ button in the ‘Product Preferences’ screen.

The following are the features of the product rollover details screen:

Mode of Rollover

For deals involving a product for which a rollover is allowed, you should specify the mode of rollover - automatic or manual - during processing.

A deal will be automatically rollover on the maturity date if ‘Auto’ is selected at the product level.

If you choose ‘Manual’, on the maturity of a deal, you will need to manually indicate for rollover.

ICCF Rollover

The interest, charge and fee components of the new (rolled over) deal can be picked up either from the old deal or from the product involving the old deal.

Choose the option:

- Product if you want the system to pick up the components from the product involving the old deal.

- Contract if you want the system to pick up the components from the old deal.

The following example illustrates this point:

For example, when defining a placement product you specified that all placements involving it will have interest schedules every month and a processing fee.

Assume you have processed a placement involving this product, with the following attributes:

- Interest payment only on Maturity Date

- No fees

When rolling over this placement, you have two options:

You can indicate that the interest and fee details specified for the product are to be applied to the new (rolled over) placement. In such a case, the new placement will have interest payment schedules every month and a processing fee.

You can specify that the interest and fee details defined for the placement being rolled over (old placement), be made applicable to the new one. In this case, the new placement will have only one interest payment schedule on Maturity Date and will have no fee.

In addition, you have to specify the following details for a product for which rollovers are permitted:

Update Utilization

Whether the credit limit utilization is to be updated when a placement is rolled over. That is, the interest that has been accrued on a placement is also considered as a part of the ‘utilized amount’ for the purpose of risk tracking. The following example illustrates how this concept works.

This option applies only if you want to roll over a deal with interest.

Apply Tax

For tax to be applicable on a rolled over deal:

- It should be applicable to the product involving the deal

- It should not have been waived for the old deal

You should indicate whether tax has to be applied on the rolled over deal also.

Rollover with Interest

You have to specify whether the deal that you are rolling over should be rolled over along with the outstanding interest. If you so specify, the principal of the new deal will be the sum of the outstanding principal and the outstanding interest on the old deal. This applies only to deals with a bearing (add-on) method of interest liquidation.

If all the outstanding interest is paid out, then the deal can be renewed without the interest. If not, it will be rolled over with the interest that is still outstanding on it.

A deal is rolled over with only the main interest that is outstanding. The main interest is that interest component which you specify as the ‘main interest’ in the ICCF Product Details screen (this will be displayed in the Contract Main screen). Other interest components and the penalty interest if any will not be rolled over.

Deduct Tax on Rollover

When a deal is initiated, tax is applied on the principal of the deal. Now, when this deal is rolled over or renewed, you have two choices (depending on the tax laws of your Government):

- Apply tax on the principal, (outstanding principal + outstanding interest or only the outstanding principal depending on your specifications), of the new deal, or,

- Since the principal of the old deal has already been taxed once, you can choose to waive the tax on the principal of the rolled over deal. However, if this principal has the outstanding interest from the old deal incorporated, then only this portion will be taxed.

This option applies only to tax on principal and not to tax on interest.

This field assumes importance, only if:

- Tax (for principal as well as interest) has not been waived on the old deal

- Tax, has not been waived on the rolled over deal

If this tax is not waived for the old deal, it will be applied on the new deal; if it is waived on the old deal it will not be applied on the renewed deal.

Specify Deduct Tax on Rollover, if tax on the old deal has to be liquidated before it is rolled over.

Note

If Rollover is of type P (Principle), P+I (Principle + Interest) and P+I-T (Principal + Interest - Tax), the tag 32H in MT 320 will be populated with a value 0 (Zero).

If Rollover Type is Special Amt the tag 32H will be populated with difference in Principal+/- Interest liquidated in the same cash flow.

Roll By

Indicate the tenor basis upon which the maturity days specified for the rolled-over contract will be reckoned. The options are Days, Months, Quarters, Semi-annuals and Years.

If you specify the ‘days’ maturity basis, and do not specify the maturity days, the system ‘rounds’ the tenor of the original contract to the nearest maturity days basis. The rounded tenor is considered as the new tenor of the rolled-over contract.

Rollover Mechanism

This indicates whether rolling over a contract using the product must create a new version of the existing contract, a new contract or a chills contract that can be linked to the parent contract. You can choose from the following options:

- New Version - A new version will get created in existing MM deal as part of rollover, with the same details specified in the contract ‘Rollover Details’ screen.

- Spawn Contract - In this mechanism, the existing contract will get liquidated and the system will book a new contract as part of rollover, with the details specified in the contract ‘Rollover Details’ screen. Booking of the new contract happen through the MMAUTDLY batch.

- Linked Contract - In this mechanism, a new MM deal will be created manually and linked to the parent deal. On the maturity date of the parent contract, the contract will get liquidated into a rollover wash GL and the new contract that was input will get initiated automatically.

You can select ‘Linked Contract’ only in case you have checked the option ‘Auto’ for rollover.

Rollover Method

If you have indicated the rollover mechanism applicable for contracts using the product in the Rollover Mechanism field as ‘Spawn Contract’, you can use this field to indicate whether a single new contract must be created for the rolled over amount, or whether the original contract must be split into multiple contracts, or consolidated with other contracts into a single new contract, when rolled over using the rollover operation. Accordingly, select any of the options, ‘Normal’, ‘Split’ or ‘Consolidated’, in this field, as applicable.

7.2 Specifying Contract Rollover Details

By default, a contract that is marked for rollover will be rolled over with all the terms of the original contract. However, you can change certain terms by specifying them in the Rollover tab of the ‘Money Market Contract input’ screen. To invoke this screen, type ‘’MMDTRONL’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

The rollover specified for the product will get defaulted to the deal. The rollover parameters are explained in detail in the section ‘Features of the product rollover details screen’.

The following are the features of the contract rollover screen:

- “Special Rollover Amount” on page 7

- “Rolling over a Contract Manually” on page 9

- “Specifying the Maturity Details” on page 10

7.2.1 Special Rollover Amount

When you roll over a deal you can roll over:

- The outstanding principal of the deal

- The outstanding principal and the outstanding interest together, or,

- An amount that is different from the total of the outstanding principal and the outstanding interest. This is a ‘special’ amount.

The ‘special’ amount is:

- Less than the outstanding principal + interest. This is because the amount by which it is less is liquidated against the interest and principal of the old deal and the rest is rolled over.

- The special amount can never be more than:

- The outstanding principal + interest of the old deal

- The outstanding principal

If it is, then you will have to initiate a new deal.

Treat Special Amount As

If you specified that the principal of the new money market deal is meant to be a special amount you also have to indicate the manner in which the special amount is to be treated. You can choose any one of the following options:

- Rollover Amount

- Liquidation Amount

- Maximum Rollover Amount

- Ignore

The amount that is rolled-over will depend on the treatment that you specify. You can choose not to treat the special amount in a specific manner by choosing to ignore this option.

Rollover Amount:

If the outstanding amount is 20,000 and the special amount is given as 25,000 the additional 5000 will get added to the money market deal.

If the outstanding amount is 30,000 and the special amount is given as 25,000 the additional 5000 will get liquidated.

The Outstanding Amount is the sum of all the components put together.

Liquidation Amount:

If the outstanding amount is 20,000 and the special amount is given as 25,000 you will not be allowed to rollover.

If the outstanding amount is 30,000 and the special amount is given as 5,000 the additional 5000 will get liquidated.

Note that the individual components will be liquidated in the liquidation order.

Maximum Rollover Amount:

If the outstanding amount is 20,000 and the special amount is given as 25,000 you can rollover the entire outstanding amount. .

If the outstanding amount is 30,000 and the special amount is given as 25,000 only 25,000 will be rollover and the remaining 5000 will be liquidated.

Parent Reference

In the linked rollover scenario, Parent Reference Number indicates the parent deal for which the child deal is being booked. While booking a new child deal, you need to specify the parent deal’s contract reference number or select the appropriate on from the adjoining option list. You will be able to choose a parent deal that satisfies the following conditions:

- Product code is the same as that of the child deal.

- Counterparty is the same as that of the child deal.

- Currency is the same as that of the child deal.

- Maturity Date is the same as the value date of the child deal.

Count

For a deal that has been rolled over, this field indicates the number of times it has been rolled over.

Rollover Mechanism

This indicates whether the rolled over contract will create a new version of the existing contract, a new contract or a child contract that can be linked to the parent contract. You can choose from the following options:

- New Version - A new version will get created in existing MM deal as part of rollover, with the same details specified in the contract ‘Rollover Details’ screen.

- Spawn Contract - In this mechanism, the existing contract will get liquidated and the system will book a new contract as part of rollover, with the details specified in the contract ‘Rollover Details’ screen. Booking of the new contract happen through the MMAUTDLY batch.

- Linked Contract - In this mechanism, a new MM deal will be created manually and linked to the parent deal. On the maturity date of the parent contract, the contract will get liquidated into a rollover wash GL and the new contract that was input will get initiated automatically.

You can select ‘Linked Contract’ only in case you have checked the option ‘Auto’ for rollover mode.

Rollover Method

If you have indicated the rollover mechanism as ‘Spawn Contract’, you can use this field to indicate whether a single new contract must be created for the rolled over amount, or whether the original contract must be split into multiple contracts, or consolidated with other contracts into a single new contract, when rolled over using the rollover operation. Accordingly, select any of the options, ‘Normal’, ‘Split’ or ‘Consolidated’, in this field, as applicable.

7.2.2 Rolling over a Contract Manually

You can roll over a deal manually through the Rollover Details screen.

If a deal has to be rolled over:

- The latest activity on the deal has to be authorized

- It should be past its maturity date; and

- It should not have been liquidated

Two activities take place when a deal is rolled over:

- The original deal is liquidated and

- A new deal is initiated

However, the Reference Number of the renewed or rolled over deal will be the same as that of the old deal.

7.2.3 Specifying the Maturity Details

The Maturity Type, which you have specified for the old deal, will apply to the deal being rolled over, by default. However, you can change the Maturity Type through this screen. If the maturity type is to be changed, you have to specify the new Maturity Type for the rolled over or renewed deal. It could be:

Maturity Type |

Details |

Fixed |

This type of deal has a fixed Maturity Date. For a deal with a fixed maturity date, you enter the changed date on which the deal should be liquidated. |

Call |

The Maturity Date is not fixed. The deal can be liquidated anytime. |

Notice |

The deal will be liquidated at a certain period of notice. The number of days of notice should be specified in this screen. This is only for information purposes. Whenever a report is generated on a notice type of deal, the notice days will be mentioned on it. For a deal with notice type of maturity, you have to enter the Maturity Date once the notice is issued to the counterparty (customer). |

For a deal maturing at notice, enter the notice period (in days) in this field. This is only for information purposes. Whenever a report is generated on a notice type of deal, the notice days will be mentioned on it. For a deal with notice type of maturity, you have to enter the Maturity Date once the notice is issued to the counterparty (customer).

7.3 Processing of Rolled over MM Contract

As you may recall, in case of contract roll-over, you can create a new child contract and link it to the parent contract. In such cases, on saving the child contract, the system triggers the BOOK event on the child contract and the RAMD event on the parent. As a result, the instruction status of the child contract gets updated as ‘Complete’. During the linkage between child and parent, the system will update the special amount field of the parent contract with the contract amount of the child contract.

When a child contract is reversed without the linked parent being rolled over, the system will trigger the RAMC event on the parent and the Rollover Instruction Status will be updated as ‘Incomplete’. Rollover of a contract will be allowed only if the Rollover Instruction Status is ‘Complete’.

If the parent contract has already been rolled over and the child contract has been reversed, then the system will trigger the REVC event on the child contract. As a result, the child contract will be reversed successfully. However, since the parent contract has been rolled over, it will not be impacted by the reversal of the child contract.

You can view details of the ROLL event in the ‘Payments’ screen where you can manually reverse the contract. This will in turn trigger the REVP event, which will update the Rollover Instruction Status of the contract as ‘Incomplete’.

Note

- A rollover child cannot be linked to a parent contract for which the Rollover Instruction Status is ‘Complete’.

- Amendment and reversal of a parent contract will not be allowed if the Rollover Instruction Status of the contract is ‘Complete’.

If the amount on the child contract is less that that of the parent contract for a placement contract, then the difference in the amounts will be credited to the customer account and a receive notice will be sent to the customer indicating the same for parent contract. If the amount on the child contract is greater that that of the parent contract for a placement contract, then the difference in the amounts will be debited from the customer account and a payment message will be sent to the customer indicating the same for the child contract.

In the MM confirmation message, field 23 of the message will be populated as ‘ROLL’ for the Child Contract.

7.4 Rolling over a Deal Manually

You can roll over a deal manually through the Rollover Details screen. If a deal has to be rolled over:

- The latest activity on the deal has to be authorized

- It should be past its maturity date; and

- It should not have been liquidated

Choose Rollover from the Processing sub menu of the Application toolbar when the deal you want to rollover is highlighted in the Contract Summary screen or Contract Detailed screen. By default, the deal will be rolled over with the same terms as the original deal. However, you can change certain terms through the Rollover Details Screen:

- You can apply − on the renewed deal − the interest, charge and fee applicable to the product of the old deal, or, if these have been changed for the old deal, you have the choice of applying the changed terms (for ICCF components only) of the old deal to the rolled over deal.

- You can change the Maturity Type (fixed, call or notice); the Maturity Date; and in case of a notice type of maturity, you can change the notice days.

Two activities take place when a deal is rolled over:

- The original deal is liquidated, and

- A new deal initiated

However, the Reference Number of the renewed (or rolled over) deal will be the same as that of the old deal.

7.5 Advices for a Rolled Over Deal

In the Product Events Definition screen, you define the events for which advices are to be generated, for deals involving a product. An advice will be generated when a deal is rolled over, if so specified for the product the deal involves. Generation of advices upon rollover, if specified, will be as follows:

- When the deal is rolled over with interest (that is, the entire outstanding amount in the original deal is rolled over without any component of the original deal being liquidated) the liquidation advice for the original deal will not be generated. Instead, a rollover advice, with the details of the liquidation of the original deal and its subsequent rollover into a new deal, will be generated.

- When the deal is rolled with an amount that is not the entire outstanding amount in the original deal, the liquidation advice(s) for the original deal will be generated along with the rollover advice.

7.6 Authorizing a Manual Rollover

The operations on a deal like input; modification, manual liquidation and manual rollover have to be authorized by a user other than the one who performed the operation. All the deals should be authorized before you can begin the end of day operations.

When a deal has been rolled over manually, you have to do the following two authorizations:

- Liquidation of the original deal

- Initiation of the new deal

When you call such a deal for authorization, the details of the liquidation of the original deal will be displayed.