25. Batch Processes

25.1 Introduction

The End of Cycle process constitutes a set of programs that mark the logical beginning or end of a cycle of events. You are required to execute many routine functions everyday as part of the End of Cycle process. These functions can be classified as:

- Beginning of Day (BOD) programs

- End of Day programs (EOD)

The various BOD and EOD functions that are processed by the system are documented in this chapter.

This chapter contains the following sections

- Section 25.2, "Beginning of Day Processing"

- Section 25.3, "Triggering Securities MSTL Batch"

- Section 25.4, "EOD Processing for Unrealized Revaluation"

25.2 Beginning of Day Processing

Before you start entering deals in the system, you must perform the Beginning of Day operations. The Beginning of Day operations that you must perform include daily processing of events for:

- Settlements (Money as well as Security settlements)

- Bonds

- Coupon payment

- Redemption (both series and quantity)

- Maturities

- Calls

- End of Trading

- Equities

- Dividend payment (both cash and stock)

- Bonus

- Rights (Tear-Off, Expiry)

- Warrants (Detachment, Expiry)

25.2.1 Processing Daily Events

The daily events processing program is run as a mandatory program at the beginning of each working day and can be run only once during the day. This program selects the events that have to be processed at BOD for all the branches.

As part of daily events the following will be selected and processed:

- All coupons, which have the next coupon, date within ex-days from today

- All confirmed calls, final maturities, series or quantity redemption activities, which are within, spot days from today

- Primary to secondary conversions for securities with primary date less than or equal to today

- Bonus/rights tear-off for securities for which the bonus tear-off date is less than or equal to today

- Warrants detachment for securities, for which the warrants detachment date is less than or equal to today

- Cash dividends for securities with dividend detachment date less than or equal to today

- End of trading is defined for securities, which are due for redemption or maturity

Deals, which were posted on the previous day with today’s date as the settlement date, will also be processes and settled. For all such deals the contingent entries are reversed and the money settlement, asset and liability, profit and loss booking is done.

25.2.2 Invoking the Automatic Daily Program

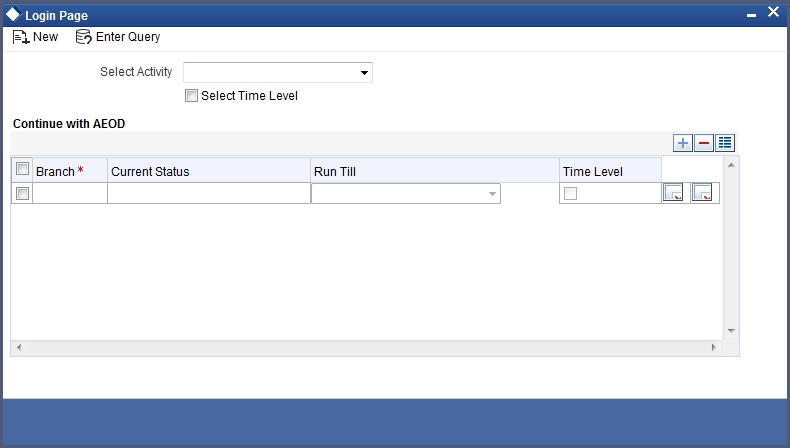

To run the Batch process, invoke the ‘End of Day Batch Process’ screen.

You can invoke the ‘End of Day Batch Process’ screen by typing ‘AEDEODST’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The system picks up the batch in accordance with the mandatory batch programs maintenance. Click ‘Ok’ button to run the batch. To exit the screen without running the batch, click on the ‘Exit’ button.

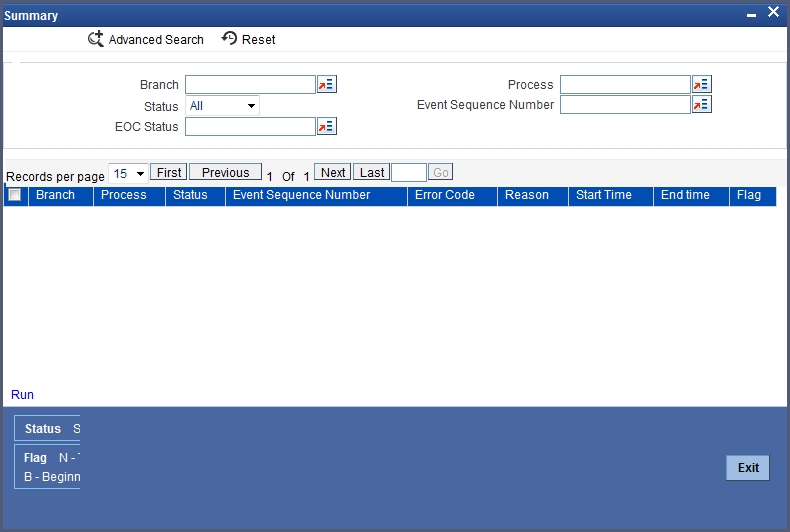

Once you have run the batch, the system will prompt you to verify the status of the activity from the monitor screen. The screen displays the details as shown.

25.3 Triggering Securities MSTL Batch

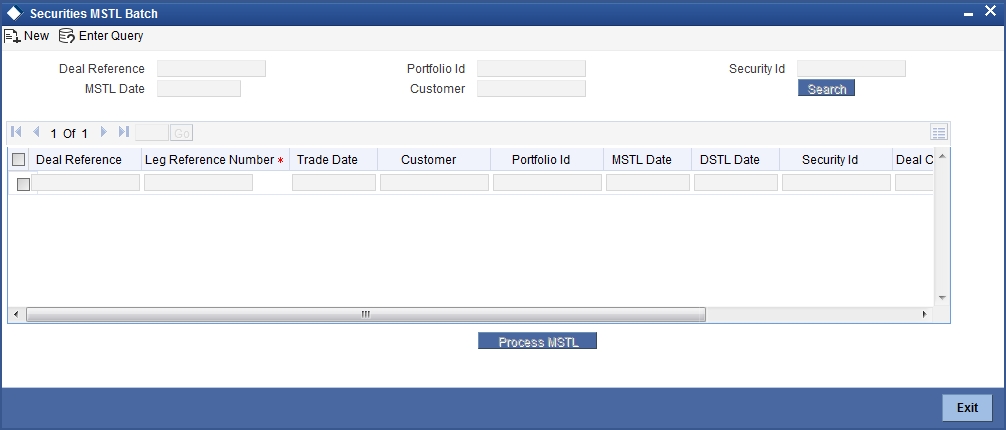

In case of authorized security deals, Oracle FLEXCUBE automatically initiates MSTL (money settlement of securities deal) during BOD operation. If MSTL event fails during BOD, you can manually process the event during the day using 'Securities MSTL Batch' screen.

For example, if the customer bank account does not have sufficient balance for settlement on the MSTL date and the bank account does not offer an overdraft facility, the MSTL event fails during BOD operations. In that case, the system will again attempt it during EOD operations. If sufficient balance is available in the account during EOD operations, the MSTL event will be triggered, thus debiting the settlement amount against the buy transaction.

If the account has sufficient balance during the day, you can manually process MSTL using 'Securities MSTL Batch' screen.

To invoke this screen, type ‘SEDINTBT’ in the field at the top right corner of the application toolbar and click the adjoining arrow button.

Based on one or more of the following criteria, you can search for the transactions within the current branch that failed during EOD or BOD operations.

MSTL Date

If you wish to filter the search results based on the MSTL date, specify the date here. The system will show all the transactions which are not processed till this date.

Customer

If you wish to filter the search results based on the customers, specify customer number whose details will be displayed. The system will show all the transactions of a respective customer for those MTSL that failed.

Portfolio

You can choose to search the deals of a particular portfolio. Specify the portfolio ID.

Security ID

You can choose to search the deals of a security code and process the code of MSTL based on this.

Deal Reference

You can choose to search the deals based on deal reference number and process the MSTL for a single deal.

Once you click ‘Search’ button, the system displays the list of deals that match the selection criteria. Click ‘Process MSTL’ button to manually process MSTL for the selected deals.

You can process the records based on the filter criteria. However you cannot process selective records.

25.4 EOD Processing for Unrealized Revaluation

Details of EOD processing for Unrealized Revaluation are explained below.

25.4.1 Unrealized Revaluation for Unsettled Buy and Sell Deals

If the revaluation method for unrealized revaluation is set to ‘MTM-EIM’, the unrealized revaluation for the unsettled buy and sell deals will be done as of the revaluation date. The revaluation date is actually the Processing Date + Spot Days (this is arrived on the basis of the market for revaluation defined in the Security Online screen).

Revaluation profit/loss is found out per unit of security and scaled up to find out the profit/loss for the deal quantity.

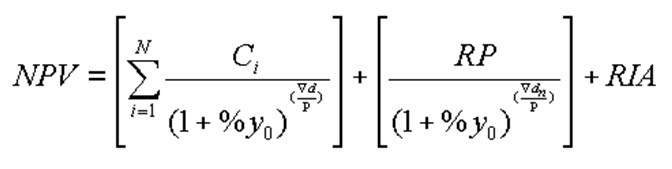

The coupon cash flows and the forward price between the revaluation date and the deal settlement date is discounted to the revaluation date. The YTM with effective date of the deal settlement date is used to compute the net present value. The interest accrued for the period between the coupon date or the security start date and the revaluation date is excluded from the NPV obtained and the clean price is obtained.

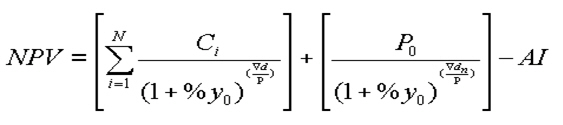

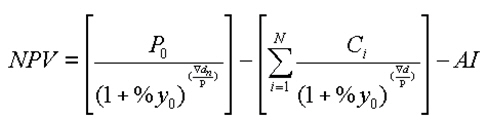

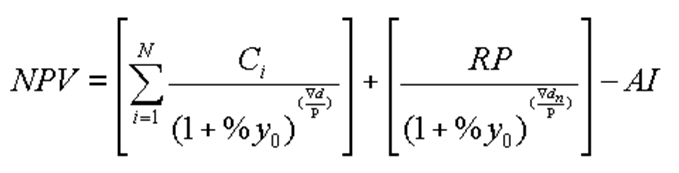

The NPV is computed on the basis of the following formula:

Case 1 – Revaluation Date <= Deal Settlement Date

Where,

| NPV | Net Present Value of the deal | ||

|---|---|---|---|

| N | Total number of Coupon cash flows between the deal settlement date and the revaluation date. | ||

| Ci | ith coupon | ||

| y0 | Periodic Deal YTM | ||

| ∇d | Coupon Date – Revaluation Date | ||

| p | Reinvestment Period | ||

| P0 | Forward Flat Purchase Price | ||

| ∇dn | Deal Settlement Date – Revaluation Date | ||

| AI | Accrued Interest as of the revaluation date |

Case 2 – Revaluation Date > Deal Settlement Date

Where,

| NPV | Net Present Value of the deal | ||

|---|---|---|---|

| N | Total number of Coupon cash flows between the deal settlement date and the revaluation date. If the deal is an EX deal, then the first coupon cash flow from the settlement will not be included i.e.) C1 = 0 | ||

| Ci | ith coupon | ||

| y0 | Periodic Deal YTM | ||

| ∇d | Coupon Date – Revaluation Date | ||

| P | Reinvestment Period | ||

| P0 | Forward Flat Purchase Price | ||

| ∇dn | Deal Settlement Date – Revaluation Date | ||

| AI | Accrued Interest as of the revaluation date |

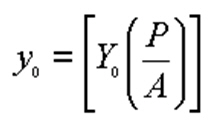

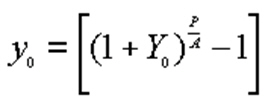

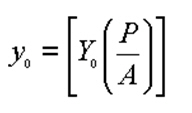

The Periodic Deal YTM is computed from the annual deal YTM based on the annualizing method specified at the security definition.

While capturing the details of the security if you have selected Simple as the annualizing method the following formula will be used to compute the periodic YTM for the deal.

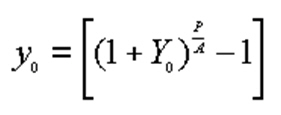

If you select Compound as the annualizing method, the annual YTM for the deal is computed using the following formula.

Where

| y0 | Periodic Deal YTM | ||

|---|---|---|---|

| Y0 | Annual Deal YTM | ||

| P | Reinvestment Period | ||

| A | Day count Denominator Method, as specified in the Security Definition screen. |

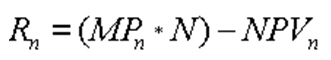

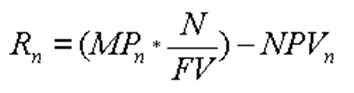

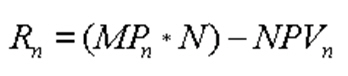

The computed NPV is marked against the market price and revaluation profit /revaluation loss is booked. The revaluation profit /loss is computed using the following formula:

Unsettled Buys

If you have selected Units as the Quantity Quotation Method, the formula used to compute the Revaluation profit /loss is:

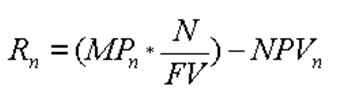

If you have selected Nominal as the Quantity Quotation Method the below formula will be used to compute the Revaluation profit / loss.

Where

| Rn | Revaluation Profit or Loss on the revaluation date. | ||

|---|---|---|---|

| MPn | Market Price(Clean) on the revaluation date. | ||

| N | Deal Quantity. | ||

| NPVn | Net Present Value of the deal on the revaluation date. | ||

| FV | Face Value of the security. |

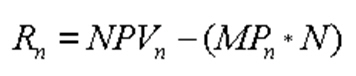

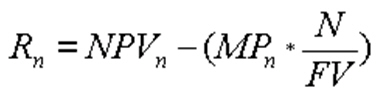

Unsettled Sells

If the Quantity Quotation Method is Units the below formula will be used to compute the Revaluation profit /loss.

When the Quantity Quotation Method is Nominal the formula used for computing the Revaluation profit /loss is:

Where,

| Rn | Revaluation Profit or Loss on the revaluation date | ||

|---|---|---|---|

| MPn | Market Price(Clean) on the revaluation date | ||

| N | Deal Quantity | ||

| NPVn | Net Present Value of the deal on the revaluation date |

25.4.2 Unrealized Revaluation for Settled Deals

If the revaluation method for Unrealized revaluation is set to ‘MTM-EIM’, the unrealized revaluation for settled deals will be done as of the revaluation date.

All the coupon cash flows between the revaluation date and redemption date along with the redemption price is discounted to the revaluation date. The YTM, which is effective as of the revaluation date for the deal, is used to discount the cash flows as of revaluation date. The Net Present Value (NPV) is arrived by excluding the accrued interest as of the revaluation date from the sum of the discounted cash flows.

The NPV is computed on the basis of the following formula:

Case 1 – EX Deal and Revaluation Date in the same coupon period of settlement date

Where,

| NPV | Net Present Value of the deal | ||

|---|---|---|---|

| N | Total number of Coupons between the revaluation date and the Redemption date excluding the first cash flow from the deal settlement date.i.e. C1 = 0 | ||

| Ci | ith coupon | ||

| y0 | Periodic Deal YTM | ||

| ∇d | Coupon Date – Revaluation Date | ||

| P | Reinvestment Period | ||

| RP | Redemption Price | ||

| ∇dn | Redemption Date – Revaluation Date | ||

| RIA | Pending Interest amount Received in advance as of the Revaluation Date. |

Case 2 – CUM Deal or Revaluation date and settlement date are in different coupon periods

Where,

| NPV | Net Present Value of the deal | ||

|---|---|---|---|

| N | Total number of Coupons between the revaluation date and the Redemption date excluding the first cash flow from the deal settlement date. | ||

| Ci | ith coupon | ||

| y0 | Periodic Deal YTM | ||

| ∇d | Coupon Date – Revaluation Date | ||

| P | Reinvestment Period | ||

| RP | Redemption Price | ||

| ∇dn | Redemption Date – Revaluation Date | ||

| AI | Accrued Interest as of the revaluation date |

The Periodic Deal YTM is computed from the annual deal YTM based on the annualizing method specified in the security definition screen.

If the annualizing method selected is Simple, the formula used for computing the periodic YTM for the deal is:

If you select Compound as the annualizing method the formula used for computing the annual YTM for the deal will be:

Where,

| y0 | Periodic Deal YTM | ||

|---|---|---|---|

| Y0 | Annual Deal YTM | ||

| P | Reinvestment Period | ||

| A | Day count Denominator Method specified at the security definition |

The computed NPV is marked against the market price and the revaluation profit /revaluation loss is also booked. The revaluation profit /loss is computed using the formula mentioned below.

Settled Deals

If Quantity Quotation Method is ‘Units’ the formula used for computing the Revaluation profit / loss is:

If Quantity Quotation Method is ‘Nominal’ the formula used to compute the Revaluation profit / loss is:

Where

| Rn | Revaluation Profit or Loss on the revaluation date | ||

|---|---|---|---|

| MPn | Market Price(Clean) on the revaluation date | ||

| N | Deal Quantity | ||

| NPVn | Net Present Value of the deal on the revaluation date | ||

| FV | Face Value of the security |

The following examples illustrates the computation of revaluation profit / loss using the formula mentioned above.

25.4.3 Illustrations

The following set of parameters will be considered in the examples given below:

| Security Code | XXXX-BOND-01 | ||

|---|---|---|---|

| Face Value | USD 100 | ||

| Quantity Quotation Method | Unit | ||

| Redemption Date | 01-July-2003 | ||

| Redemption Price | USD 105 | ||

| Numerator Day count method | Actual | ||

| Denominator Day count method | 365 Days | ||

| Annualizing Method | Simple | ||

| Coupon Rate | 5% | ||

| Coupon frequency | Monthly | ||

| Reinvestment period | 183 Days |

The coupon cash flows for a single bond are:

| Coupon Event Date | Coupon | ||

|---|---|---|---|

| 01-Jan-2003 | USD 0.42 | ||

| 01-Feb-2003 | USD 0.42 | ||

| 01-Mar-2003 | USD 0.38 | ||

| 01-Apr-2003 | USD 0.42 | ||

| 01-May-2003 | USD 0.41 | ||

| 01-Jun-2003 | USD 0.42 | ||

| 01-Jul-2003 | USD 0.41 |

25.4.3.1 Unsettled EX Buy Deal - Revaluation date prior to Deal settlement Date

| Deal Settlement Date | 27-Feb-2003 | ||

| Record Date | 25-Feb-2003 | ||

| Revaluation Date | 15-Jan-2003 | ||

| Deal Quantity | 100 | ||

| Deal Price | USD 99.95 | ||

| Annual YTM | 21.351% | ||

| Periodic YTM | 21.351% | ||

| Accrued Interest as of Revaluation date from previous coupon date (01-Jan-2003 to 15-Jan-2003) | USD 19.18 | ||

| Market Price as of Revaluation Date | USD 102 |

During revaluation of unsettled forward deals all the coupons between the revaluation date and the deal settlement date are discounted to the revaluation date.

So the effective coupon cash flow that are considered during revaluation for the deal will be:

| Coupon Event Date | Coupon | ||

|---|---|---|---|

| 01-Feb-2003 | USD 42.47 |

The computation of net present value for the deal is done in the following manner:

| Date | Ci | ∇d | 1+ y0 | ∇d/P | (1+ y0) ^(∇d/P) | Disc. Ci | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01-Feb-03 | 42.47 | 17 | 1.21351 | 0.046575 | 1.009054 | 42.09 | |||||||

| 27-Feb-03 | 9995 | 43 | 1.21351 | 0.117808 | 1.023060 | 9769.71 | |||||||

| 9811.80 |

The accrued interest as of the revaluation date is excluded from the NPV computed and the Flat NPV as of revaluation date is derived.

Flat NPV = NPV – AI = 9811.80 – 19.18 = 9792.62

Revaluation profit or loss is computed by marking the flat NPV obtained against the flat market price. Using the formula mentioned above the Revaluation Profit / Loss = (102 * 100) – 9792.62 = 407.38.

Revaluation Profit = USD 407.38.

25.4.3.2 Unsettled CUM Sell Deal – Revaluation Date after Deal Settlement Date

| Deal Settlement Date | 15-Jan-2003 | ||

|---|---|---|---|

| Record Date | 25-Jan-2003 | ||

| Revaluation Date | 20-Mar-2003 | ||

| Deal Quantity | 100 | ||

| Deal Price | USD 100.25 | ||

| Annual YTM | 15.54504% | ||

| Periodic YTM | 15.54504% |

Accrued Interest as of Revaluation date from previous coupon date (01-Mar-2003 to 20-Mar-2003) – USD 26.03.

Market Price as of Revaluation Date – USD 102

During revaluation of past unsettled cum deals all the coupons between the deal settlement date and the revaluation date are discounted to the revaluation date. Therefore, the effective coupon cash flow that are considered during revaluation for the deal will be

| Coupon Event Date | Coupon | ||

|---|---|---|---|

| 01-Feb-2003 | USD 42.47 | ||

| 01-Mar-2003 | USD 38.36 |

The computation of net present value for the deal is as illustrated below:

| Date | Ci | ∇d | 1+ y0 | ∇d/P | (1+ y0) ^(∇d/P) | Disc. Ci | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01-Feb-03 | -42.47 | -47 | 1.15545 | -0.128767 | 0.981566 | -43.26 | |||||||

| 01-Mar-03 | -38.36 | -19 | 1.15545 | -0.052055 | 0.992507 | -38.65 | |||||||

| 15-Jan-03 | 10025 | -64 | 1.15545 | -0.175342 | 0.974983 | 10282.23 | |||||||

| 10200.32 |

The accrued interest as of the revaluation date is excluded from the NPV computed and Flat NPV as of revaluation date is derived.

Flat NPV = NPV – AI = 10200.32 – 26.03 = 10174.29

Revaluation profit or loss is computed by marking the flat NPV obtained against the flat market price using the formula mentioned above.

Revaluation Profit /Loss = 10174.29 - (102 * 100) = - 25.71

Revaluation Loss = USD 25.71

25.4.3.3 Unsettled EX Sell Deal – Revaluation Date after Deal Settlement Date

| Field | Field Description | ||

|---|---|---|---|

| Deal Settlement Date | 27-Jan-2003 | ||

| Record Date | 25-Jan-2003 | ||

| Revaluation Date | 20-Mar-2003 | ||

| Deal Quantity | 100 | ||

| Deal Price | USD 99.30 | ||

| Annual YTM | 19.72949% | ||

| Periodic YTM | 19.72949% | ||

| Accrued Interest as of Revaluation date from previous coupon date (01-Mar-2003 to 20-Mar-2003) | USD 26.03 | ||

| Market Price as of Revaluation Date | USD 102 |

During revaluation of past unsettled cum deals all the coupons between the deal settlement date and the revaluation date (first coupon from settlement date are ignored while constructing the cash flows) are discounted to the revaluation date.

Therefore, the effective coupon cash flow, considered during revaluation for the deal are:

| Coupon Event Date | Coupon | ||

|---|---|---|---|

| 01-Mar-2003 | USD 38.36 |

The computation of the net present value for the deal is done as shown in the table below:

| Date | Ci | ∇d | 1+ y0 | ∇d/P | (1+ y0) ^(∇d/P) | Disc. Ci | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01-Mar-03 | -38.36 | -19 | 1.19729 | -0.052055 | 0.990671 | -38.72 | |||||||

| 27-Jan-03 | 9930 | -52 | 1.19729 | -0.142466 | 0.974673 | 10188.03 | |||||||

| 10149.31 |

The accrued interest as of the revaluation date is excluded from the NPV computed and Flat NPV as of the revaluation date is derived.

Flat NPV = NPV – AI = 10149.31 – 26.03 = 10123.29

Revaluation profit or loss is computed by marking the flat NPV obtained against the flat market price using the formula mentioned above.

Revaluation Profit / Loss = 10123.29 - (102 * 100) = 76.71

Revaluation Loss = USD – 76.71

25.4.3.4 Settled CUM Deal – Revaluation Date in the same Coupon Period as of the Settlement Date

| Field | Description | ||

|---|---|---|---|

| Deal Settlement Date | 15-Jan-2003 | ||

| Record Date | 25-Jan-2003 | ||

| Revaluation Date | 26-Jan-2003 | ||

| Deal Quantity | 100 | ||

| Deal Price | USD 100.25 | ||

| Annual YTM | 15.54504% | ||

| Periodic YTM | 15.54504% | ||

| Accrued Interest as of Revaluation date from previous coupon date (01-Jan-2003 to 26-Jan-2003) | USD 34.25 | ||

| Market Price as of Revaluation Date | USD 102 |

During revaluation of settled cum deals all the coupons between the revaluation date and the redemption date are discounted to the revaluation date.

Therefore, the effective coupon cash flow considered during revaluation for the deal is:

| Coupon Event Date | Coupon | ||

|---|---|---|---|

| 01-Feb-2003 | USD 42.47 | ||

| 01-Mar-2003 | USD 38.36 | ||

| 01-Apr-2003 | USD 42.47 | ||

| 01-May-2003 | USD 41.10 | ||

| 01-Jun-2003 | USD 42.47 | ||

| 01-Jul-2003 | USD 41.10 |

The computation of net present value for the deal is done as shown in the table below:

| Date | Ci | ∇d | 1+ y0 | ∇d/P | (1+ y0) ^(∇d/P) | Disc. Ci | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01-Feb-03 | 42.47 | 6 | 1.15545 | 0.016438 | 1.002378 | 42.37 | |||||||

| 01-Mar-03 | 38.36 | 34 | 1.15545 | 0.093151 | 1.013550 | 37.84 | |||||||

| 01-Apr-03 | 42.47 | 65 | 1.15545 | 0.178082 | 1.026065 | 41.39 | |||||||

| 01-May-03 | 41.10 | 95 | 1.15545 | 0.260274 | 1.038323 | 39.58 | |||||||

| 01-Jun-03 | 42.47 | 126 | 1.15545 | 0.688525 | 1.051144 | 40.40 | |||||||

| 01-Jul-03 | 41.10 | 156 | 1.15545 | 0.852459 | 1.063701 | 38.63 | |||||||

| 01-Jul-03 | 10500 | 156 | 1.15545 | 0.852459 | 1.063701 | 9871.19 | |||||||

| 10111.40 |

The accrued interest as of the revaluation date is excluded from the NPV computed and Flat NPV as of revaluation date is derived.

Flat NPV = NPV – AI = 10111.40– 34.25 = 10077.15

Revaluation profit or loss is computed by marking the flat NPV obtained against the flat market price using the formula mentioned above.

Revaluation Profit / Loss = (102 * 100) - 10077.15 = 122.85

Revaluation Profit = USD 122.85

25.4.3.5 Settled EX Deal – Revaluation Date and Settlement Date are in Different Periods

| Field | Description | ||

|---|---|---|---|

| Deal Settlement Date | 27-Jan-2003 | ||

| Record Date | 25-Jan-2003 | ||

| Revaluation Date | 10-Feb-2003 | ||

| Deal Quantity | 100 | ||

| Deal Price | USD 99.30 | ||

| Annual YTM | 19.72949% | ||

| Periodic YTM | 19.72949% | ||

| Accrued Interest as of Revaluation date from previous coupon date (01-Feb-2003 to 10-Feb-2003) | USD 12.33 | ||

| Market Price as of Revaluation Date | USD 102 |

During revaluation of settled ex deals (revaluation date and settlement date are from different coupon periods) all the coupons between the revaluation date and the redemption date are discounted to the revaluation date. Therefore, the effective coupon cash flow that considered during revaluation for the deal is as follows:

| Coupon Event Date | Coupon | ||

|---|---|---|---|

| 01-Mar-2003 | USD 38.36 | ||

| 01-Apr-2003 | USD 42.47 | ||

| 01-May-2003 | USD 41.10 | ||

| 01-Jun-2003 | USD 42.47 | ||

| 01-Jul-2003 | USD 41.10 |

The computation of the NPV for the deal is done as shown in the table below:

| Date | Ci | ∇d | 1+ y0 | ∇d/P | (1+ y0) ^(∇d/P) | Disc. Ci | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01-Mar-03 | 38.36 | 19 | 1.19729 | 0.052055 | 1.009417 | 38.00 | |||||||

| 01-Apr-03 | 42.47 | 50 | 1.19729 | 0.136986 | 1.024973 | 41.43 | |||||||

| 01-May-03 | 41.10 | 80 | 1.19729 | 0.219178 | 1.040255 | 39.51 | |||||||

| 01-Jun-03 | 42.47 | 111 | 1.19729 | 0.304110 | 1.056286 | 40.20 | |||||||

| 01-Jul-03 | 41.10 | 141 | 1.19729 | 0.386301 | 1.072036 | 38.33 | |||||||

| 01-Jul-03 | 10500 | 141 | 1.19729 | 0.386301 | 1.072036 | 9794.45 | |||||||

| 9991.92 |

The accrued interest as of the revaluation date is excluded from the NPV computed and the Flat NPV as of revaluation date is derived.

Flat NPV = NPV – AI = 9991.92 – 12.33 = 9979.59

Revaluation profit or loss is computed by marking the flat NPV obtained against the flat market price using the formula mentioned above

Revaluation Profit / Loss = (102 * 100) - 9979.59 = 224.41

Revaluation Profit = USD 220.41

25.4.3.6 Settled EX Deal – Revaluation date and settlement date in the same period

| Deal Settlement Date | 27-Jan-2003 | ||

| Record Date | 25-Jan-2003 | ||

| Revaluation Date | 29-Jan-2003 | ||

| Deal Quantity | 100 | ||

| Deal Price | USD 99.30 | ||

| Annual YTM | 19.72949% | ||

| Periodic YTM | 19.72949% | ||

| Pending Interest Received in Advance as of Revaluation Date (29-Jan-2003 to 01-Feb-2003) | USD 4.11 | ||

| Market Price as of Revaluation Date | USD 102 |

During revaluation of settled ex deals (revaluation date and settlement date are in the same coupon periods) all the coupons between the revaluation date and the redemption date are discounted to the revaluation date excluding the first coupon cash flow from the settlement date.

Therefore, the effective coupon cash flow that considered during revaluation for the deal will be as follows:

| Coupon Event Date | Coupon | ||

|---|---|---|---|

| 01-Mar-2003 | USD 38.36 | ||

| 01-Apr-2003 | USD 42.47 | ||

| 01-May-2003 | USD 41.10 | ||

| 01-Jun-2003 | USD 42.47 | ||

| 01-Jul-2003 | USD 41.10 |

The computation of net present value for the deal is done as shown in the table below:

| Date | Ci | ∇d | 1+ y0 | ∇d/P | (1+ y0) ^(∇d/P) | Disc. Ci | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01-Mar-03 | 38.36 | 31 | 1.19729 | 0.084932 | 1.015411 | 37.77 | |||||||

| 01-Apr-03 | 42.47 | 62 | 1.19729 | 0.169863 | 1.031059 | 41.19 | |||||||

| 01-May-03 | 41.10 | 92 | 1.19729 | 0.252055 | 1.046432 | 39.27 | |||||||

| 01-Jun-03 | 42.47 | 123 | 1.19729 | 0.336986 | 1.062558 | 39.97 | |||||||

| 01-Jul-03 | 41.10 | 153 | 1.19729 | 0.419178 | 1.078401 | 38.11 | |||||||

| 01-Jul-03 | 10500 | 153 | 1.19729 | 0.419178 | 1.078401 | 9736.64 | |||||||

| 9932.95 |

The pending interest amount received in advance as of the revaluation date is included to the NPV computed and Flat NPV as of revaluation date is derived.

Flat NPV = NPV + RIA = 9932.95 + 4.11 = 9937.06

The Revaluation profit or loss is computed by marking the flat NPV obtained against the flat market price using the formula mentioned above.

Revaluation Profit /Loss = (102 * 100) - 9937.06 = 262.94

Revaluation Profit = USD 262.94