Oracle® Retail Sales Audit

Operations Guide

Release 14.1

E58274-02

March 2015

Oracle® Retail Sales Audit Operations Guide, Release 14.1

E58274-02

Copyright © 2015, Oracle and/or its affiliates. All rights reserved.

Primary Author: Anshuman Accanoor

This software and related documentation are provided under a license agreement containing restrictions on use and disclosure and are protected by intellectual property laws. Except as expressly permitted in your license agreement or allowed by law, you may not use, copy, reproduce, translate, broadcast, modify, license, transmit, distribute, exhibit, perform, publish, or display any part, in any form, or by any means. Reverse engineering, disassembly, or decompilation of this software, unless required by law for interoperability, is prohibited.

The information contained herein is subject to change without notice and is not warranted to be error-free. If you find any errors, please report them to us in writing.

If this software or related documentation is delivered to the U.S. Government or anyone licensing it on behalf of the U.S. Government, then the following notice is applicable:

U.S. GOVERNMENT END USERS: Oracle programs, including any operating system, integrated software, any programs installed on the hardware, and/or documentation, delivered to U.S. Government end users are "commercial computer software" pursuant to the applicable Federal Acquisition Regulation and agency-specific supplemental regulations. As such, use, duplication, disclosure, modification, and adaptation of the programs, including any operating system, integrated software, any programs installed on the hardware, and/or documentation, shall be subject to license terms and license restrictions applicable to the programs. No other rights are granted to the U.S. Government.

This software or hardware is developed for general use in a variety of information management applications. It is not developed or intended for use in any inherently dangerous applications, including applications that may create a risk of personal injury. If you use this software or hardware in dangerous applications, then you shall be responsible to take all appropriate fail-safe, backup, redundancy, and other measures to ensure its safe use. Oracle Corporation and its affiliates disclaim any liability for any damages caused by use of this software or hardware in dangerous applications.

Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their respective owners.

Intel and Intel Xeon are trademarks or registered trademarks of Intel Corporation. All SPARC trademarks are used under license and are trademarks or registered trademarks of SPARC International, Inc. AMD, Opteron, the AMD logo, and the AMD Opteron logo are trademarks or registered trademarks of Advanced Micro Devices. UNIX is a registered trademark of The Open Group.

This software or hardware and documentation may provide access to or information on content, products, and services from third parties. Oracle Corporation and its affiliates are not responsible for and expressly disclaim all warranties of any kind with respect to third-party content, products, and services. Oracle Corporation and its affiliates will not be responsible for any loss, costs, or damages incurred due to your access to or use of third-party content, products, or services.

Value-Added Reseller (VAR) Language

Oracle Retail VAR Applications

The following restrictions and provisions only apply to the programs referred to in this section and licensed to you. You acknowledge that the programs may contain third party software (VAR applications) licensed to Oracle. Depending upon your product and its version number, the VAR applications may include:

(i) the MicroStrategy Components developed and licensed by MicroStrategy Services Corporation (MicroStrategy) of McLean, Virginia to Oracle and imbedded in the MicroStrategy for Oracle Retail Data Warehouse and MicroStrategy for Oracle Retail Planning & Optimization applications.

(ii) the Wavelink component developed and licensed by Wavelink Corporation (Wavelink) of Kirkland, Washington, to Oracle and imbedded in Oracle Retail Mobile Store Inventory Management.

(iii) the software component known as Access Via™ licensed by Access Via of Seattle, Washington, and imbedded in Oracle Retail Signs and Oracle Retail Labels and Tags.

(iv) the software component known as Adobe Flex™ licensed by Adobe Systems Incorporated of San Jose, California, and imbedded in Oracle Retail Promotion Planning & Optimization application.

You acknowledge and confirm that Oracle grants you use of only the object code of the VAR Applications. Oracle will not deliver source code to the VAR Applications to you. Notwithstanding any other term or condition of the agreement and this ordering document, you shall not cause or permit alteration of any VAR Applications. For purposes of this section, "alteration" refers to all alterations, translations, upgrades, enhancements, customizations or modifications of all or any portion of the VAR Applications including all reconfigurations, reassembly or reverse assembly, re-engineering or reverse engineering and recompilations or reverse compilations of the VAR Applications or any derivatives of the VAR Applications. You acknowledge that it shall be a breach of the agreement to utilize the relationship, and/or confidential information of the VAR Applications for purposes of competitive discovery.

The VAR Applications contain trade secrets of Oracle and Oracle's licensors and Customer shall not attempt, cause, or permit the alteration, decompilation, reverse engineering, disassembly or other reduction of the VAR Applications to a human perceivable form. Oracle reserves the right to replace, with functional equivalent software, any of the VAR Applications in future releases of the applicable program.

Contents

Improved Process for Oracle Retail Documentation Corrections

Oracle Retail Documentation on the Oracle Technology Network

3Administration and Configuration

Default Security Reference Implementation

Extending the Default Security Reference Implementation

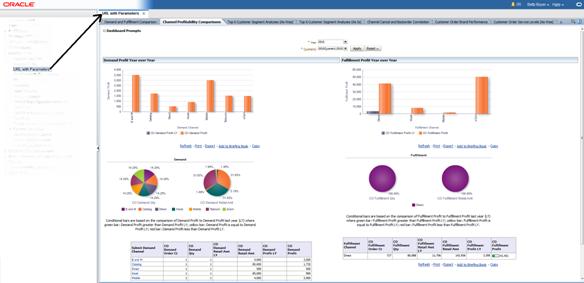

Displaying External Application Contents in Non-SSO Environments

Managing Oracle Metadata Services (MDS)

4Oracle Retail Sales Audit Batch Processes and Designs

Oracle Retail Sales Audit Dataflow Diagram

Oracle Retail Sales Import Process

Oracle Retail Sales Export Process

Batch Design Summary of ReSA Modules

sastdycr (Create Store Day for Expected Transactions)

sagetref (Get Reference Data for Sales Audit Import Processing)

saimptlog/saimptlogi (Import of Unaudited Transaction Data from POS to ReSA)

saimptlogtdup_upd (Processing to Allow Re-Upload of Deleted Transactions)

saimptlogfin (Complete Transaction Import Processing)

savouch (Sales Audit Voucher Upload)

saimpadj (Import Total Value Adjustments From External Systems to ReSA)

satotals (Calculate Totals based on Client Defined Rules)

sarules (Evaluate Transactions and Totals based on Client Defined Rules) 91

sapreexp (Prevent Duplicate Export of Total Values from ReSA)

saexprms (Export of POS transactions from ReSA to RMS)

saexpdw (Export from ReSA to Oracle Retail Analytics)

saexpsim (Export of Revised Sale/Return Transactions from ReSA to SIM)

saexpim (Export DSD and Escheatment from ReSA to Invoice Matching)

saexpgl (Post User Defined Totals from ReSA to General Ledger)

ang_saplgen (Extract of POS Transactions by Store/Date from ReSA for Web Search)

saescheat (Download of Escheated Vouchers from ReSA for Payment)

saescheat_nextesn (Generate Next Sequence for Escheatment Processing)

saexpach (Download from ReSA to Account Clearing House (ACH) System)

saexpuar (Export to Universal Account Reconciliation System from ReSA)

saprepost (Pre/Post Helper Processes for ReSA Batch Programs)

sapurge (Purge Aged Store/Day Transaction, Total Value and Error Data from ReSA)

5In-Context Launching Task Flows In Retail Applications

Limitations of an In-Context Launch Via URLs

List of In-Context Launchable Task Flows

6Customizing Retail Applications

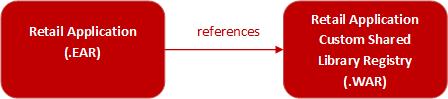

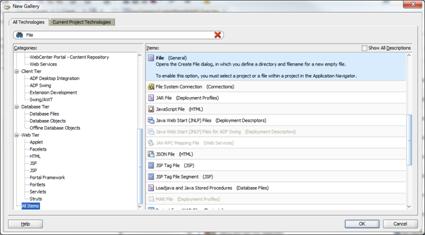

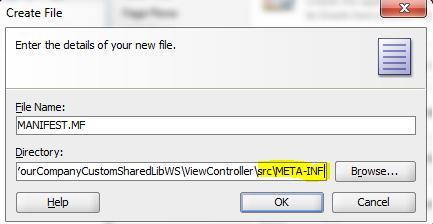

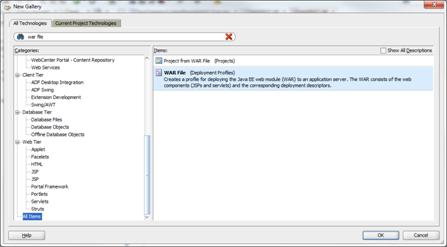

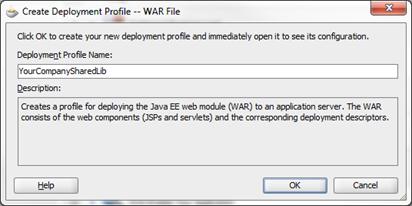

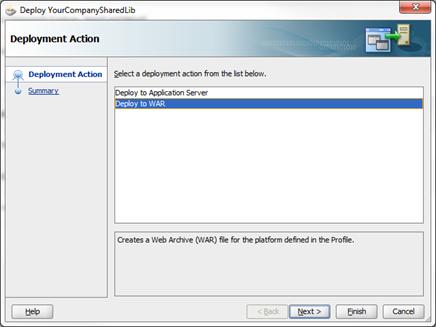

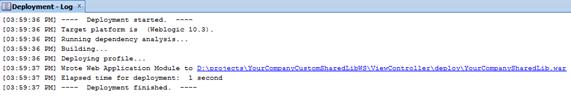

Using Custom Shared Library for Adding Custom Content

Customizing the Retail Application UI

7ReSA ReSTful Web Service Implementation

Common Characteristics of Retail Application ReSTful Web Services

Oracle Retail Sales Audit Operations Guide Release 14.1

Oracle welcomes customers' comments and suggestions on the quality and usefulness of this document.

Your feedback is important, and helps us to best meet your needs as a user of our products. For example:

§ Are the implementation steps correct and complete?

§ Did you understand the context of the procedures?

§ Did you find any errors in the information?

§ Does the structure of the information help you with your tasks?

§ Do you need different information or graphics? If so, where, and in what format?

§ Are the examples correct? Do you need more examples?

If you find any errors or have any other suggestions for improvement, then please tell us your name, the name of the company who has licensed our products, the title and part number of the documentation and the chapter, section, and page number (if available).

Note: Before sending us your comments, you might like to check that you have the latest version of the document and if any concerns are already addressed. To do this, access the new Applications Release Online Documentation CD available on My Oracle Support and www.oracle.com. It contains the most current Documentation Library plus all documents revised or released recently.

Send your comments to us using the electronic mail address: retail-doc_us@oracle.com

Please give your name, address, electronic mail address, and telephone number (optional).

If you need assistance with Oracle software, then please contact your support representative or Oracle Support Services.

If you require training or instruction in using Oracle software, then please contact your Oracle local office and inquire about our Oracle University offerings. A list of Oracle offices is available on our web site at www.oracle.com.

This Oracle Retail Sales Audit Operations Guide provides critical information about the processing and operating details of Oracle Sales Audit (ReSA), including the following:

§ System configuration settings

§ Technical architecture

§ Functional integration dataflow across the enterprise

§ Batch processing

Since ReSA is still closely integrated with the Oracle Retail Merchandising System (RMS) for data inputs, processes, and outputs, see the Oracle Retail Merchandising System Operations Guide for more information.

Audience

This guide is for:

§ Systems administration and operations personnel

§ Systems analysts

§ Integrators and implementers

§ Business analysts who need information about Merchandising System processes and interfaces

Documentation Accessibility

For information about Oracle's commitment to accessibility, visit the Oracle Accessibility Program website at http://www.oracle.com/pls/topic/lookup?ctx=acc&id=docacc.

Access to Oracle Support

Oracle customers have access to electronic support through My Oracle Support. For information, visit http://www.oracle.com/pls/topic/lookup?ctx=acc&id=info or visit http://www.oracle.com/pls/topic/lookup?ctx=acc&id=trs if you are hearing impaired.

Related Documents

For more information, see the following documents in the Oracle Retail Sales Audit documentation set:

§ Oracle Retail Merchandising System Release Notes

§ Oracle Retail Sales Audit Installation Guide

§ Oracle Retail Sales Audit User Guide

§ Oracle Retail Sales Audit Operational Insights Reports User Guide

§ Oracle Retail Merchandising Implementation Guide

§ Oracle Retail Merchandising Security Guide

§ Oracle Retail POS Suite 14.1/Merchandising Operations Management 14.1 Implementation Guide

§ Oracle Retail Merchandising Batch Schedule

§ Oracle Retail Merchandising System documentation

§ Oracle Retail Trade Management documentation

Customer Support

To contact Oracle Customer Support, access My Oracle Support at the following URL:

When contacting Customer Support, please provide the following:

§ Product version and program/module name

§ Functional and technical description of the problem (include business impact)

§ Detailed step-by-step instructions to re-create

§ Exact error message received

§ Screen shots of each step you take

Review Patch Documentation

When you install the application for the first time, you install either a base release (for example, 14.1) or a later patch release (for example, 14.1.1). If you are installing the base release or additional patch releases, read the documentation for all releases that have occurred since the base release before you begin installation. Documentation for patch releases can contain critical information related to the base release, as well as information about code changes since the base release.

Improved Process for Oracle Retail Documentation Corrections

To more quickly address critical corrections to Oracle Retail documentation content, Oracle Retail documentation may be republished whenever a critical correction is needed. For critical corrections, the republication of an Oracle Retail document may at times not be attached to a numbered software release; instead, the Oracle Retail document will simply be replaced on the Oracle Technology Network web site, or, in the case of Data Models, to the applicable My Oracle Support Documentation container where they reside.

This process will prevent delays in making critical corrections available to customers. For the customer, it means that before you begin installation, you must verify that you have the most recent version of the Oracle Retail documentation set. Oracle Retail documentation is available on the Oracle Technology Network at the following URL:

http://www.oracle.com/technetwork/documentation/oracle-retail-100266.html

An updated version of the applicable Oracle Retail document is indicated by Oracle part number, as well as print date (month and year). An updated version uses the same part number, with a higher-numbered suffix. For example, part number E123456-02 is an updated version of a document with part number E123456-01.

If a more recent version of a document is available, that version supersedes all previous versions.

Oracle Retail Documentation on the Oracle Technology Network

Documentation is packaged with each Oracle Retail product release. Oracle Retail product documentation is also available on the following web site:

http://www.oracle.com/technetwork/documentation/oracle-retail-100266.html

(Data Model documents are not available through Oracle Technology Network. These documents are packaged with released code, or you can obtain them through My Oracle Support.)

Documentation should be available on this web site within a month after a product release.

Conventions

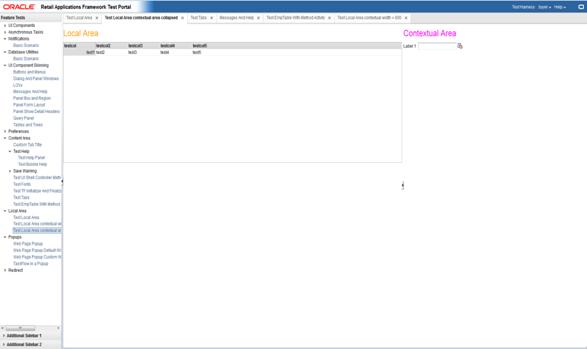

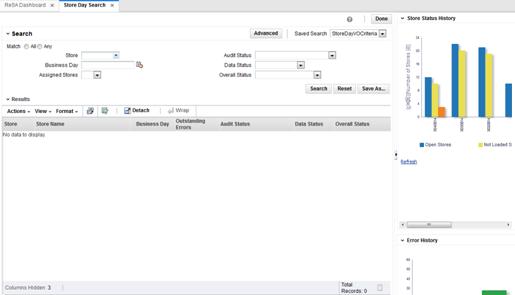

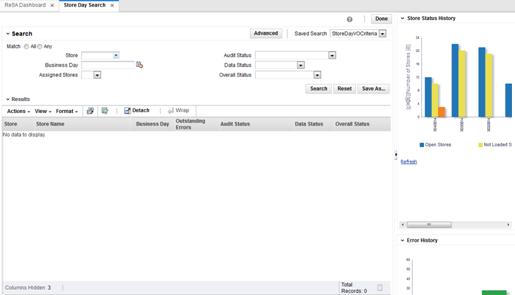

Navigate: This is a navigate statement. It tells you how to get to the start of the procedure and ends with a screen shot of the starting point and the statement “the Window Name window opens.”

This is a code sample

It is used to display examples of code

The purpose of the Oracle Retail Sales Audit (ReSA) is to accept transaction data from Point-Of-Sale (POS) and Order-Management-System (OMS) applications and move the data through a series of processes that culminates in clean data. Data that ReSA finds to be inaccurate is brought to the attention of the retailer’s sales auditors who use the features of the sales audit system to correct the exceptions.

By using ReSA, retailers can quickly and accurately validate and audit transaction data before it is exported to other applications. ReSA uses several batch-processing modules to do the following:

§ Import POS/OMS transaction data sent from the store to the ReSA database.

§ Produce totals from user-defined totaling calculation rules that a user can review during the interactive audit.

§ Validate transaction and total data with user-defined audit rules that generate errors whenever data does not meet the criteria. You can review these errors during the interactive audit.

§ Create and export files in formats suitable for transfer to other applications.

§ Update the ReSA database with adjustments received from external systems on previously exported data.

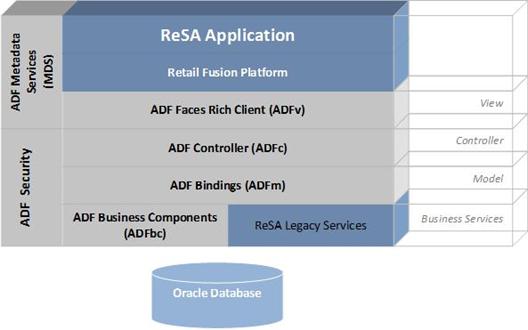

This chapter describes the overall software architecture for Oracle Retail Sales Audit and provides a high-level discussion of the general structure of the system, including the various layers of Java code.

Overview

Retail applications are based on the Oracle Application Development Framework (ADF). The building blocks of ReSA are as follows:

§ Oracle ADF application

§ Pro*C batch jobs

§ OBIEE and BI publisher for business intelligence reports.

The Oracle Database is integral to the application and the core business logic is implemented using PL/SQL packages/functions and used by the batch jobs, user interface and the business intelligence reports.

The following diagram shows the key components that make up the the architecture of ReSA.

Batch Overview

The ReSA batch job implements the same Pro*C batch structure as the RMS. For more information on the RMS Pro*C architecture, see the Oracle Retail Merchandising System Operation Guide, Volume 3 - Back End Configuration and Operations.

Application Overview

The ReSA application is based on the Oracle Application Development Framework (ADF).

Oracle Application Development Framework (ADF)

Oracle Application Development Framework (ADF) supports organizations in building cutting-edge rich enterprise business applications that are able to be customized and personalized in all dimensions. Customizations are global changes, visible to all users, which are performed by an administrator. Personalizations are user-made changes that are only visible to the person making the change. ADF is based on the Java Enterprise Edition platform.

Model-View-Controller (MVC) Architectural Pattern

Applications built using ADF follow a Model-View-Controller (MVC) architectural pattern. The goal of the MVC pattern is to clearly separate the application’s functionality into a set of cooperating components.

ADF provides a set of components that realize the goals of each part of the MVC pattern:

§ Model is realized by the ADF Bindings Layer.

§ Controller is realized by the ADF Controller Layer.

§ View is realized by the ADF Faces Layer.

§ ADF Business components and other back-end components that exist below the Model layer are called Business Services.

ADF Security

The ADF security layer provides the following:

§ Provides standards based (Oracle Platform Security Services (OPSS)) security framework with default roles and permissions.

§ Tools to generate file-based identity store (for both Oracle Internet Directory (OID) and Active Directory (AD)) based on the framework.

§ Tools to migrate file-based security store into a database for Quality Assurance (QA) and production environments.

§ Provides reference implementation for clients to manage the security based on their business needs.

§ Provides OPSS-based batch security framework (RAF).

§ Provides tools/documentation to implement centralized logout in Single Sign-On (SSO) (Oracle Access Management (OAM)) environments.

ADF View (ADFv)

The View layer provides the user interface to the application. The view layer uses HTML, rich Java components, or XML and its variations to render the user interface. JSF-based tag libraries are used to display the User Interface (UI).

ADF Controller (ADFc)

This is the steering part of the ADF. It determines the flow and control transfer. The Controller layer controls the application's flow. Web-based applications are composed of multiple web pages with dynamic content. The controller layer manages the flow between these pages. Different models can be used when building this later. The most prominent architecture for Java-based web applications relies on a servlet that acts as the controller. The Apache Jakarta Struts controller, an open source framework controller, is the de facto standard for Java-based web systems. Oracle ADF uses the struts controller to manage the flow of web applications.

ADF Business Components (ADFbc)

The business service layer manages the interaction with a data persistence layer. It provides services as data persistence, object/relational mapping, transaction management, and business logic execution.

Business Components easily map the database object and extend it with business logic, validation, and so on.

The idea behind Business Components is to abstract the data layer from the view layer. This is a key concept in the MVC pattern. Business Components expose the interface to the view layer by using an application module which contains View Object. Those view objects contain a specific usage of the data layer.

ADF Business Components implements the business service through the following set of cooperating components:

§ Entity object – An entity object represents a row in a database table and simplifies modifying its data by handling all data manipulation language (DML) operations for you. It can encapsulate business logic for the row to ensure that your business rules are consistently enforced. You associate an entity object with others to reflect relationships in the underlying database schema to create a layer of business domain objects to reuse in multiple applications.

§ View object – A view object represents a SQL query. You use the full power of the familiar SQL language to join, filter, sort, and aggregate data into exactly the shape required by the end-user task. This includes the ability to link a view object with others to create master-detail hierarchies of any complexity. When end users modify data in the user interface, view objects collaborate with entity objects to consistently validate and save the changes.

§ Application module – An application module is the transactional component that UI clients use to work with application data. It defines a data model that you can update and top-level procedures and functions (called service methods) related to a logical unit of work related to an end-user task.

ADF Model (ADFm)

This is the component that acts as the connector between the view and business logic layers.

The Model layer connects the Business Services to the objects that use them in the other layers. Oracle ADF provides a Model layer implementation that sits on top of Business Services, providing a single interface that can be used to access any type of Business Services.

Developers get the same development experience when binding any type of Business Service layer implementation to the view and Controller layers. The Model layer in Oracle ADF served as the basis for JSR 227, A Standard Data binding & Data Access Facility for J2EE.

Oracle Metadata Services (MDS)

The ability of an application to adapt to changes is a necessity that needs to be considered in the application design and should drive the selection of the development platform and architecture. Flexible business applications must be able to adapt to organizational changes, different end user preferences, and changes in the supported business are required.

MDS is the customization and personalization framework integral to Oracle Fusion Middleware and a key differentiator of the Oracle development platform. MDS provides a repository for storing metadata for applications, such as customizations and persisted personalization files and configurations.

Retail applications allow the following through MDS:

§ Personalization of saved searches through MDS.

§ Implicit personalization of few ADF UI attributes.

§ Customization of dashboards through Oracle Composer.

Retail Fusion Platform

The Retail Fusion Platform (commonly referred to as Platform) is a collection of common, reusable software components that serve as a foundation for building Oracle Retail’s next generation ADF-based applications. The Platform imposes standards and patterns along with a consistent look and feel for Oracle Retail’s ADF applications.

Data Access Patterns

Database interaction between the middle tier and database is done using the industry standard Java Database Connectivity Protocol (JDBC). JDBC facilitates the communication between a Java application and a relational database.

Database Access Using ADFbc

JDBC is engrained within Oracle ADF Business Components as the primary mechanism for its interaction between the middle tier and database. SQL is realized within ADF business components to facilitate create, read, update, and delete (CRUD) actions.

Connection Pooling

When the application disconnects a connection, the connection is saved into a pool instead of being actually disconnected. A standard connection pooling technique, this saved connection enables Retail Applications to reuse the existing connection from a pool. In other words, the application does not have to complete the connection process for each subsequent connection.

ReSA Database Services

ReSA Legacy services are implemented in PL/SQL packages. The invocation of these backend components are encapsulated in ADF business components, typically as Java wrappers that internally make use of JDBC to invoke the PL/SQL package calls.

To support ReSA legacy services implementing CRUD operations needing a dedicated connection, the standard application module connection pooling is enhanced to provide a dedicated connection till the end of the work flow. The special handling of reserving an AM connection is implemented only for scenarios that demand it.

Data Storage

The Oracle Database realizes the database tier in a Retail Application’s architecture. It is the application's storage platform, containing the physical data (user and system) used throughout the application. The database tier is only intended to handle the storage and retrieval of information and is not involved in the manipulation or delivery of the data. This tier responds to queries; it does not initiate them.

Accessing Merchandising System Data in Real Time

The data that Retail Application utilizes is located in both application-specific tables and merchandising system (RMS, for example) tables. Because Retail Applications share the same schema as the merchandising system (RMS, for example), the application is able to interact with the merchandising system's data directly, in real time.

This chapter is intended for administrators who support and monitor the running system.

This chapter discusses the Functional Security for Retail Applications and the components used to implement it. Functional security is based on Oracle Platform Security Services (OPSS). For more information on OPSS, see Oracle Fusion Middleware Application Security Guide.

The content in this chapter is not procedural, but is meant to provide descriptive overviews of the key system parameters.

This chapter consists of the following sections:

§ Retail Roles

§ Retail Role Hierarchy

§ Default Security Reference Implementation

§ Extend the Default Security Reference Implementation

Retail Roles

By default, users are not assigned to permissions directly as access is assigned to roles. Users, with roles assigned to them, group particular permissions required to accomplish a task. Instead of assigning individual permissions, roles match users with the permissions required to complete their particular task.

There are two main types of roles:

§ Enterprise

§ Application

The Identity Store contains enterprise roles that are available across applications. These are created as groups in Lightweight Directory Access Protocol (LDAP), making them available across applications.

Applicable Retail Applications security provides four types of roles:

§ Abstract

§ Job

§ Duty

§ Privilege

Applicable Retail Applications record abstract roles and jobs as enterprise roles. Duty and privilege roles are recorded as application roles.

Security Policy Stripe

Application roles are stored in the application specific policy store. These roles and role mappings are described in the jazn-data.xml file under the RESA policy stripe.

Abstract Roles

Abstract roles are associated with a user, irrespective of the user’s job or job function. These are also roles that are not associated with a job or duty. These roles are normally assigned by the system (based on user attributes), but can be provisioned to a user on request.

Naming Convention: All the Retail Abstract role names end with _ABSTRACT

Example: APPLICATION_ADMIN_ABSTRACT

Job Roles

Job roles are associated with the job of an employee. An employee, with this job, can have many job functions or job duties.

Note: These roles are called Job roles as the role names closely map to the jobs commonly found in most organizations.

Naming Convention: All the Retail Job role names end with _JOB

Example: AUDITOR_JOB

Duty Roles

Job duties are tasks a person must do on a job. A person is hired into a job role. These are the responsibilities a person has for a job.

Duty roles are roles that are associated with a specific duty or a logical grouping of tasks. Generally, the list of duties for a job is a good indicator of what duty roles should be defined.

Duty roles should:

§ Read as a job description at a job posting site

§ Duties that we create should be self-contained and pluggable into any existing or new job or abstract role

Naming Convention: All the Retail duty role names end with _DUTY

Example: RESA_STOREDAY_MGMT_DUTY

Privilege Roles

Privilege is the logical collection of permissions. A privilege can be associated with any number of UI components. Privileges are expressed as application roles.

Naming Convention: All the Retail Privilege role names end with _PRIV

For example: SEARCH_STOREDAY_PRIV

Privilege roles carry security grants.

Example:

<grant>

<grantee>

<principals>

<principal>

<name>SEARCH_STOREDAY_PRIV</name>

<class>oracle.security.jps.service.policystore.ApplicationRole</class>

</principal>

</principals>

</grantee>

<permissions>

<permission>

<class>oracle.adf.controller.security.TaskFlowPermission</class>

<name>/WEB-INF/oracle/retail/apps/resa/storeday/search/publicui/flow/SearchStoreDayFlow.xml#SearchStoreDayFlow</name>

<actions>view</actions>

</permission>

</permissions>

</grant>

Retail Role Hierarchy

Retail role hierarchies are structured to reflect the retail business process model.

Job roles inherit duty roles. For example, the Allocator Job role inherits the ALC_ALLOC_SYSTEM_OPTIONS_INQUIRY_DUTY roles.

<app-role>

<name>RESA_STOREDAY_MGMT_DUTY</name>

<class>oracle.security.jps.service.policystore.ApplicationRole</class>

<members>

<member>

<class>oracle.security.jps.internal.core.principals.

JpsXmlEnterpriseRoleImpl</class>

<name>AUDITOR_JOB</name>

</member>

</members>

</app-role>

Duty roles inherit Privilege roles. Duty roles can inherit one or more other Duty roles.

For example: RESA_STOREDAY_MGMT_DUTY inherits RESA_STOREDAY_INQUIRY_DUTY role.

<app-role>

<name> RESA_STOREDAY_INQUIRY_DUTY</name>

<class>oracle.security.jps.service.policystore.ApplicationRole</class>

<members>

<member>

<class>oracle.security.jps.service.policystore.ApplicationRole</class>

<name> RESA_STOREDAY_MGMT_DUTY</name>

</member>

</members>

</app-role>

For example: RESA_STOREDAY_INQUIRY_DUTY role inherits the SEARCH_STOREDAY_PRIV role

<app-role>

<name>SEARCH_STOREDAY_PRIV</name>

<class>oracle.security.jps.service.policystore.ApplicationRole</class>

<description>A privilege for searching for store days.</description>

<members>

<member>

<name>RESA_STOREDAY_INQUIRY_DUTY</name>

<class>oracle.security.jps.service.policystore.ApplicationRole</class>

</member>

</members>

</app-role>

Default Security Reference Implementation

Retail applications ship with default security reference implementations. The source of truth for a default reference implementation is jazn-data.xml.

For more information on security, see the Oracle Retail Merchandising Security Guide.

Extending the Default Security Reference Implementation

The common decisions made to match your enterprise to the default security reference implementation include the following:

§ Do the default job roles match the equivalent job roles in your enterprise?

§ Do the jobs in your enterprise exist in the security reference implementation?

§ Do the duties performed by the jobs in your enterprise match the duties in the security reference implementation?

Note: Make sure that the policy store is loaded with the default security configuration. For more information, see the post-installation steps in the Oracle Retail Sales Audit Installation Guide.

Important: It is important when constructing a role hierarchy that circular dependencies are not introduced. Best practice is to leave the default security configuration in place and first incorporate your customized application roles in a test environment.

Using The Retail Application Security Role Manager

Retail Applications provides a way in which retailers can modify the default roles to map to their security groups through the Retail Application Security Role Manager (RASRM).

RASRM is installed along with the Retail Application. Users with proper security privileges to access RASRM can launch RASRM by clicking on a link from the Retail Application’s global menu.

For more details about using RASRM, see the Oracle Retail Merchandising Security Guide.

Displaying External Application Contents in Non-SSO Environments

Retail Applications allow retailers to display content from external applications. These contents are typically business intelligence reports from a third-party application that are configured to display within the Retail Application’s dashboard.

Some of these contents might be secured. You need to log in before the contents can be accessed and displayed.

In non-SSO environments, when you log out of the Retail Application, you may not be logged out of any secured content to which you had configured access. It is highly recommended that you only configure access to external content in a SSO-enabled environment where the application logout manages the logout from any other secured content that was previously accessed.

Managing Oracle Metadata Services (MDS)

Retail Applications are built using ADF, and one of the features within ADF is the Oracle Metadata Services (MDS) framework which provides a facility for retailers to customize the applications.

For more information about MDS, see Oracle Fusion Middleware Fusion Developer’s Guide for Oracle Application Development Framework (http://docs.oracle.com/cd/E16764_01/web.1111/b31974/customize.htm).

Purging the MDS Repository Before Patch Installation

A common problem when a patch is installed for Retail Application is that certain screens would fail to load or UI elements fail to display data properly.

The cause of this issue is commonly attributed to user personalizations on screen elements that are now removed in the patch.

For example, prior to patching the application, you may have saved search criterias on certain screens as a way to conveniently recall the desired search results whenever you use the application. Those saved search criterias are persisted by ADF in the MDS repository. If the patch involves the removal of one of the search criterias, applying the patch will cause the screens, that have those search criterias, to fail to load.

The MDS repository is configured in the WebLogic server where the Retail Application is deployed. The repository is database-based and is organized or subdivided into partitions. Retail Applications are deployed with their own partition within the server’s MDS repository.

Prior to patch installation, it is recommended that retailers delete the MDS partition for the Retail Application in order to prevent runtime issues caused by stale user personalizations.

For ReSA, the MDS partition to be deleted is EarResaPortal.

To delete the partition, refer the Deleting a Metadata Partition Using Fusion Middleware Control section, in the Oracle Fusion Middleware Administrator’s Guide (http://docs.oracle.com/cd/E23943_01/core.1111/e10105/repos.htm).

Note: After deleting the MDS partition, all user personalizations on the application will be lost. You need to reapply your personalizations on the application screens.

This chapter describes the batch processing modules that ReSA uses.

The term store day is used throughout this chapter. Store day describes all transactions that occur in one business day at one store or location. Because retailers need the ability to audit transactions on a store-by-store basis for a defined period of time, store day data is maintained separately beginning with the initial import of data from the POS/OMS system.

Oracle Retail Sales Audit Dataflow Diagram

The following diagram illustrates how data flows within ReSA and between ReSA and other applications.

Note: All integrations are not depicted in this diagram.

Oracle Retail Sales Audit Dataflow Diagram

Oracle Retail Sales Audit Dataflow Diagram

Oracle Retail Sales Import Process

Importing data from the POS to ReSA is a multi-step process that involves several ReSA batch processes:

1. sastdycr.pc prepares the ReSA tables for data upload.

2. Reference File Creation involves two processes:

a. sagetref.pc creates a number of reference files to be used for validation in the File Validation/Upload Process.

§ one of the reference data files created by sagetref contains code values from the RMS CODE_HEAD and CODE_DETAIL tables. If the codes that ReSA uses are customized during the implementation, a library must be recompiled. This is discussed in detail in the Design Assumptions section of the sagetref program level information below.

§ The way primary variants are set up in RMS affects the data collected by sagetref and used in the File Validation/Upload Process. This is discussed in detail in the Design Assumptions section of the sagetref program level information below.

b. rmst_saimptlog_promo.ksh transforms a promotions file from Oracle Retail Price Management (RPM) to the ReSA reference file format

3. The POS File Validation/Upload Process can be executed one of two sub-processes:

a. saimptlogi.c validates files and uploads their transactions into the ReSA tables. This includes (as necessary) creating errors for the auditors to address.

b. saimptlog.c validates POS files and creates Sql*Loader Files. This includes (as necessary) creating errors for the auditors to address.

§ A Sql*Load process moves the transactions and errors into the ReSA tables.

c. Both saimptlog and saimptlogi create a voucher file to be used in later processing.

4. saimptlogfin.pc executes a number of import cleanup processes.

5. savouch.pc processes voucher sales and redemptions.

6. saimpadj.pc imports adjustments.

Each of the processes related to the import process are discussed in more detail at the program level later in this chapter.

Oracle Retail Sales Import Process

POS File Validation/Upload Sub-Process – saimptlog vs. saimptlogi

saimptlogi.c and saimptlog.c perform the same business functions. Saimptlogi.c inserts directly into the database. Saimptlog uses SQL*Load to insert data. A retailer trickle polling or exporting a relatively small TLOG would be a good candidate to use saimptlogi.c. The detail discussion of these programs below contains more detail about the processing of these jobs.

Total Calculations and Rules

By providing additional values against which auditors can compare receipts, totaling is integral to the auditing process. Totaling also provides quick access to other numeric figures about the day’s transactions.

Totaling in ReSA is dynamic. ReSA automatically totals transactions based on calculation definitions that the retailer’s users create using the online Totals Calculation Definition Wizard. In addition, the retailer is able to define totals that come from the POS, but that ReSA does not calculate. Whenever users create new calculation definitions or edit existing ones, they become part of the automated totaling process the next time that satotals.pc runs.

Evaluating rules is also integral to the auditing process. Rules make the comparisons among data from various sources. These comparisons find data errors that could be the result of either honest mistakes or fraud. Finding these mistakes during the auditing process prevents these errors from being passed on to other systems, (for example, a merchandising system, a data warehouse system, and so on).

Like totaling, rules in ReSA are dynamic. They are not predefined in the system—retailers have the ability to define them through the online Rules Calculation Definition Wizard.

Errors uncovered by these rules are available for review during the interactive audit. Like satotals.pc, after users modify existing rules or create new ones, they become part of the rules the next time that sarules.pc runs.

Totals when Transactions are Modified

If a retailer modifies transactions during the ReSA interactive audit process, the totaling and auditing processes run again to recalculate store day totals. The batch module sapreexp.pc tracks all changed totals for the store day since the last export by comparing the latest prioritized version of each total defined for export with the version that was previously sent to each system. The module writes the changes to revision tables that the export modules later recognize as ready for export.

Oracle Retail Sales Export Process

ReSA prepares data for export to applications after:

§ Some or all of the transactions for the day are imported (depending upon the application receiving ReSA’s export).

§ Totals have run.

§ Audit rules have run.

§ Errors in transactions and totals relevant for the system receiving the associated data are eliminated or overridden. Depending upon the application, exported data consists of either transaction data or totals, or both. The process of exporting transaction data varies according to the unit of work selected in ReSA’s system options. There are two units of work, transaction and store day. If the unit of work selection is transaction, ReSA exports transactions to downstream applications (for example, RMS, SIM, RA, etc) as soon as they are free of errors. If the unit of work selection is store day, transactions are not exported until all errors for that store day are either overridden or corrected. The data export jobs to the various downstream applications can be run multiple times in a day.

Full Disclosure and Post-Export Changes

If a retailer modifies data during the interactive audit that was previously exported to RMS, ReSA export batch modules re-export the modified data in accordance with a process called full disclosure. Full disclosure means that any previously exported values (dollars, units, and so on) are fully backed out before the new value is sent.

For example: a transaction originally shows a sale of 12 items, and that transaction is exported. During the interactive audit, a retailer determines that the correct amount is 15 items, (where three are more than the original amount) and makes the change. ReSA then flags the corrected amount for export to the application.

The detail discussion of these programs below contains more detail about the processing of these jobs.

Batch Design Summary of ReSA Modules

The following list summarizes the ReSA batch modules that are involved with processing POS/OMS transaction data, audit totals and rules, exports to other applications, and modifications and adjustments.

Import Process Programs

§ sastdycr.pc (Create Store Day for Expected Transactions)

§ sagetref.pc (Get Reference Data for Sales Audit Import Processing)

§ rmst_saimptlog_promo.ksh (Transform Promotion Reference File from RPM format to Sales Audit Import Processing File Format)

§ saimptlog.c/saimptlogi.c (Import of Unaudited Transaction data from POS to ReSA)

§ saimptloglogtdup_upd (Processing to Allow Re-Upload of Deleted Transactions)

§ saimptlogfin.pc (Complete Transaction Import Processing)

§ savouch.pc (Sales Audit Voucher Upload)

§ saimpadj.pc (Import Total Value Adjustments From External Systems to ReSA)

Totals/Rules Programs

§ satotals.pc (Calculate Totals based on Client Defined Rules)

§ sarules.pc (Evaluate Transactions and Totals based on Client Defined Rules)

Export Programs

§ sapreexp.pc (Prevent Duplicate Export of Total Values from ReSA)

§ saexprms.pc (Export of POS transactions from ReSA to RMS)

§ saordinvexp.pc (Export Inventory Reservation/Release for In Store Customer Order and Layaway Transactions from ReSA)

§ saexpdw.pc (Export from ReSA to Oracle Retail Analytics)

§ saexpsim.pc (Export of Revised Sale/Return Transactions from ReSA to SIM)

§ saexpim.pc (Export DSD and Escheatment from ReSA to Invoice Matching)

§ saexpgl.pc (Post User Defined Totals from ReSA to General Ledger)

§ ang_saplgen.ksh (Extract of POS Transactions by Store/Date from ReSA for Web Search )

§ saescheat.pc (Download of Escheated Vouchers from ReSA for Payment)

§ saescheat_nextesn.pc (Generate Next Sequence for Escheatment Processing)

§ saexpach.pc (Download from ReSA to Account Clearing House (ACH) System)

§ saexpuar.pc (Export to Universal Account Reconciliation System from ReSA)

Other programs

§ saprepost.pc (Pre/Post Helper Processes for ReSA Batch Programs)

§ sapurge.pc (Purge Aged Store/Day Transaction, Total Value, and Error Data from ReSA)

sastdycr (Create Store Day for Expected Transactions)

Module Name |

sastdycr.pc |

Description |

Create Store Day for Expected Transactions |

Functional Area |

Oracle Retail Sales Audit |

Module Type |

Business Processing |

Module Technology |

ProC |

Integration Catalog ID |

RSA15 |

Design Overview

The sastdycr batch program will create store/day, import log, and export log records. This program should run prior to uploading the sales data from POS/OMS for a given store/day. Store/days will be created for any open store expecting sales.

Scheduling Constraints

Schedule Information |

Description |

|

Processing Cycle |

Daily – In the date set phase. |

|

Scheduling Considerations |

It should run before the DTESYS batch program and before the next store/day’s transactions are received. |

|

Pre-Processing |

NA |

|

Post-Processing |

dtesys |

|

Threading Scheme |

NA |

Restart/Recovery

The logical unit of work in this program is store. Records are committed to the database when the commit counter is reached. The commit counter is defined by the value of INCREMENT_BY on the ALL_SEQUENCE table for the sequence SA_STORE_DAY_SEQ_NO_SEQUENCE.

Key Tables Affected

|

Table |

Select |

Insert |

Update |

Delete |

|

ALL_SEQUENCES |

Yes |

No |

No |

No |

|

SYSTEM_OPTIONS |

Yes |

No |

No |

No |

|

STORE |

Yes |

No |

No |

No |

|

SA_STORE_DAY |

Yes |

Yes |

No |

No |

|

COMPANY_CLOSED |

Yes |

No |

No |

No |

|

COMPANY_CLOSED_EXCEP |

Yes |

No |

No |

No |

|

LOCATION_CLOSED |

Yes |

No |

No |

No |

|

PERIOD |

Yes |

No |

No |

No |

|

SA_STORE_DATA |

Yes |

No |

No |

No |

|

SA_IMPORT_LOG |

No |

Yes |

No |

No |

|

SA_EXPORT_LOG |

No |

Yes |

No |

No |

|

SA_FLASH_SALES |

No |

Yes |

No |

No |

Integration Contract

Integration Type |

NA |

File Name |

NA |

Integration Contract |

NA |

Design Assumptions

NA

sagetref (Get Reference Data for Sales Audit Import Processing)

Module Name |

sagetref.pc |

Description |

Get Reference Data for Sales Audit Import Processing |

Functional Area |

Oracle Retail Sales Audit |

Module Type |

Integration |

Module Technology |

ProC |

Integration Catalog ID |

RSA00 |

Design Overview

This program will fetch all reference information needed by SAIMPTLOG.PC for validation purposes and write this information out to various output files. The following files are produced:

§ Items - contains a listing of all items in the system.

§ Wastage - contains information about all items that have wastage associated with them.

§ Reference Items - contains reference items, or below transaction-level items.

§ Primary Variant - contains primary variant information.

§ Variable Weight UPC - contains all variable weight Universal Product Code (UPC) definitions in the system.

§ Store/Days - contains all of the valid store/day combinations in the system.

§ Codes & Code Types - contains all code types and codes used in field level validation.

§ Error Codes & Descriptions - contains all error codes, error descriptions, and systems affected by the error.

§ Store POS Mappings

§ Tender Types

§ Merchants

§ Partners

§ Suppliers

§ ReSA Employees

§ Banners

§ Currency Codes

§ Promotions (from RPM)

§ Physical Warehouses

§ Inventory Statuses

These files will be used by the automated audit to validate information without repeatedly hitting the database.

When running sagetref.pc, retailers can either create and specify the output files, or create only the output that they desire. For example, a retailer interested in only creating a more recent employeefile would simply place a hyphen (-) in place of all the other parameters, but still specify an employeefile name. This technique can be applied to as many or as few of the parameters as retailers wish. Note, however, that the item-related files (itemfile, refitemfile, wastefile, and primvariantfile) contain significant interdependence. Thus, item files must all be created or not created together.

In the list of reference data files files above, standard UOM is part of the itemfile. To obtain the value, ReSA converts the selling Unit of Measure (UOM) to the standard UOM during batch processing. This conversion enables ReSA to later export the standard UOM to the systems that require its use.

Scheduling Constraints

Schedule Information |

Description |

|

Processing Cycle |

Daily – Anytime – Sales Audit is a 24/7 system. |

|

Scheduling Considerations |

This module should be executed in the earliest phase, before the first import of RTLOGs into ReSA. |

|

Pre-Processing |

Sastrdaycr.pc |

|

Post-Processing |

Saimptlog.pc or saimptlogi.pc |

|

Threading Scheme |

NA |

Restart/Recovery

NA

Key Tables Affected

|

Table |

Select |

Insert |

Update |

Delete |

|

ITEM_MASTER |

Yes |

No |

No |

No |

|

ITEM_LOC |

Yes |

No |

No |

No |

|

VAR_UPC_EAN |

Yes |

No |

No |

No |

|

SA_STORE_DAY |

Yes |

No |

No |

No |

|

SA_STORE |

Yes |

No |

No |

No |

|

SA_IMPORT_LOG |

Yes |

No |

No |

No |

|

CURRENCIES |

Yes |

No |

No |

No |

|

ADDR |

Yes |

No |

No |

No |

|

CODE_DETAIL |

Yes |

No |

No |

No |

|

SA_ERROR_CODES |

Yes |

No |

No |

No |

|

SA_STORE_POS |

Yes |

No |

No |

No |

|

POS_TENDER_TYPE_HEAD |

Yes |

No |

No |

No |

|

NON_MERCH_CODE_HEAD |

Yes |

No |

No |

No |

|

PARTNER |

Yes |

No |

No |

No |

|

SUPS |

Yes |

No |

No |

No |

|

SA_STORE_EMP |

Yes |

No |

No |

No |

|

STORE |

Yes |

No |

No |

No |

|

BANNER |

Yes |

No |

No |

No |

|

CHANNELS |

Yes |

No |

No |

No |

|

CLASS |

Yes |

No |

No |

No |

|

VAT_CODES |

Yes |

No |

No |

No |

|

RPM_PROMO_V |

Yes |

No |

No |

No |

|

RPM_PROMO_COMP_V |

Yes |

No |

No |

No |

|

WH |

Yes |

No |

No |

No |

|

INV_STATUS_CODES |

Yes |

No |

No |

No |

|

SA_STORE_DATA |

Yes |

No |

No |

No |

Integration Contract

Integration Type |

Download from RMS |

File Name |

Determined by runtime parameters |

Integration Contract |

IntCon000113 (itemfile) IntCon000114 (wastefile) IntCon000115 (refitemfile) IntCon000116 (primvariantfile) IntCon000117 (varupcfile) IntCon000118 (storedayfile) IntCon000119 (promfile) IntCon000120 (codesfile) IntCon000121 (errorfile) IntCon000122 (storeposfile) IntCon000123 (tendertypefile) IntCon000124 (merchcodesfile) IntCon000125 (partnerfile) IntCon000126 (supplierfile) IntCon000127 (employeefile) IntCon000128 (bannerfile) IntCon000129 (promfile) IntCon000130 (whfile) IntCon000131 (invstatusfile) |

File Name: Item File

The Item File file name (Itemfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Item |

Char(25) |

|

Item number |

|

Dept |

Number(4) |

|

Department ID |

|

|

Class |

Number(4) |

|

Class id |

|

|

Subclass |

Number(4) |

|

Subclass ID |

|

|

Standard UOM |

Char(4) |

|

Standard Unit of Measure |

|

|

Catchweight Ind |

Char(1) |

|

Catch weight indicator |

|

|

Class vat Ind |

Char(1) |

|

Class Vat Ind |

File Name: Waste Data File

The Waste Data File file name (wastefile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Item |

Char(25) |

|

Item number |

|

Waste type |

Char(6) |

|

Waste type |

|

|

Waste pct |

Number(12,4) |

|

Waste pct |

File Name: Reference Item Data

The Reference Item Data file name (ref_itemfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Ref Item |

Char(25) |

|

Reference Item number |

|

Item |

Char(25) |

|

Item number |

File Name: Primary Variant Data File

The Primary Variant Data File file name (prim_variantfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Location |

Number(10) |

|

Location number |

|

Item |

Char(25) |

|

Item number |

|

|

Prim Variant |

Char(25) |

|

Primary variant |

File Name: Variable Weight UPC Definition File

The Variable Weight UPC Definition File file name (varupcfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Format Id |

Char(1) |

|

Format id |

|

Format desc |

Char(20) |

|

Format description |

|

|

Prefix length |

Number(1) |

|

Pefix Length |

|

|

Begin item digit |

Number(2) |

|

Item digit begin |

|

|

Begin var digit |

Number(2) |

|

Var digit begin |

|

|

Check digit |

Number(2) |

|

Check digit |

|

|

Default prefix |

Number(1) |

|

Default prefix |

|

|

Prefix |

Number(1) |

|

Prefix |

File Name: Valid Store/Day Combination File

The Valid Store/Day Combination File file name (storedayfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Store |

Number(10) |

|

Store number |

|

Business date |

Char(8) |

|

Buisness date in YYYYMMDD format |

|

|

Store day seq no |

Number(20) |

|

Store day sequence number |

|

|

Day |

Number(3) |

|

Day |

|

|

Tran no generated |

Char(6) |

|

Generated transaction number |

|

|

POS data expected |

Char(1) |

|

If system_code is POS, then Y; otherwise N |

|

|

Currency rtl dec |

Number(1) |

|

Currency rtl dec |

|

|

Currency code |

Char(3) |

|

Currency code |

|

|

Country id |

Char(3) |

|

Country ID |

|

|

Vat Include Ind |

Char(1) |

|

Vat Include Indicator |

File Name: Codes File

The Codes File file name (codesfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Code type |

Char(4) |

|

Code type |

|

Code |

Char(6) |

|

Code ID |

|

|

Code seq |

Number(4) |

|

Code sequence |

File Name: Error Information File

The Error Information File file name (errorfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Error code |

Char(25) |

|

Error code |

|

System Code |

Char(6) |

|

System Code |

|

|

Error desc |

Char(255) |

|

Error description |

|

|

Rec solution |

Char(255) |

|

Error rectify solution |

File Name: Store POS Mapping File

The Store POS Mapping File file name (storeposfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Store |

Number(10) |

|

Store |

|

POS Type |

Char(6) |

|

Point Of Sale type |

|

|

Start Tran No. |

Number(10) |

|

Start transaction number |

|

|

End Tran No. |

Number(10) |

|

End transaction number |

File Name: Tender Type Mapping File

The Tender Type Mapping File file name (tendertypefile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Group |

Char(6) |

|

Tender type Group |

|

Id |

Number(6) |

|

Tender type ID |

|

|

Desc |

Char(120) |

|

Tender type description |

File Name: Merchant Code Mapping File

The Merchant Code Mapping File file name (merchcodesfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Non Merch Code |

Char(6) |

|

Non-merchant code |

File Name: Partner Mapping File

The Partner Mapping File file name (partnerfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Partner Type |

Char(6) |

|

Partner Type |

|

Partner Id |

Char(10) |

|

Partner ID |

File Name: Supplier Mapping File

The Supplier Mapping File file name (supplierfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Supplier |

Number(10) |

|

Supplier ID |

|

Sup status |

Char(1) |

|

Supplier status |

File Name: Employee Mapping File

The Employee Mapping File file name (employeefile) is not fixed; it is determined by a runtime parameter.

Note: The data in the employee file is not used anymore with the removal of store user audit and the deprecation of system option, AUTO_VALIDATE_TRAN_EMPLOYEE_ID.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Store |

Number(10) |

|

Store ID |

|

POS Id |

Char(10) |

|

Point Of Sale ID |

|

|

Emp Id |

Char(10) |

|

Employee ID |

File Name: Banner Information File

The Banner Information File file name (bannerfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Store |

Number(10) |

|

Store ID |

|

Banner data |

Number(4) |

|

Banner ID |

File Name: Currency Information File

The Currency Information File file name (currencyfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Currency Code |

Char(1) |

|

Currency Code |

File Name: Promotion Information File

The Promotion Information File file name (promfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Promotion |

Number(10) |

|

Promotion ID |

|

|

Component |

Number(10) |

|

Component ID |

File Name: Physical Warehouse Information File

The Physical Warehouse Information File filename (whfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Warehouse |

Number(10) |

|

Warehouse ID |

File Name: Inventory Status Information File

The Inventory Status Information File file name (invstatusfile) is not fixed; it is determined by a runtime parameter.

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

|

Inventory Status |

Char(10) |

|

Inventory Status |

Design Assumptions

Making Changes in the CODE_DETAIL Table

After making changes in the code_detail table for code_types that ReSA uses, the library programs must be recompiled. Follow these steps:

1. Navigate to the $l directory and recompile libresa.a and install:

make -f retek.mk resa

make -f retek.mk install

2. Navigate to the $c directory and recompile the next libraries:

make -f mts.mk resa-libchange

make -f mts.mk resa

a. Recompile the appropriate library depending upon which of the following products is being used:

resa-rms

resa-rdw

resa-ach

resa-uar

resa-im

make -f mts.mk ( name of library )

b. make -f mts.mk resa-install

Primary Variant Relationships

Depending upon a retailer’s system parameters, the retailer designates the primary variant during item setup (through the front-end) for several reasons. One of the reasons is that, in some cases, an item may be identified at the POS by the item parent, but the item parent may have several variants.

The primary variant is established through a form at the item location level. The retailer designates which variant item is the primary variant for the current transaction level item. For more information about the new item structure in RMS, see the Oracle Retail Merchandising System User Guide.

In the example shown in the diagram below, the retailer has established their transaction level as an Item Level 2. Note that the level of the primary variant is Item Level 1, and Item Level 3 is the sub-transaction level (the refitem).

The retailer set up golf shirts in the merchandising system as its Item Level 1 above the transaction level. The retailer set up two items at level 2 (the transaction level) based on size (small and medium). Note that the retailer assigned the level 2 items to all of the available locations (Minneapolis, China, and Fargo). The retailer also designated a primary variant for a single location – a medium golf shirt, in the case of Minneapolis, and a small golf shirt, in the case of China. The retailer failed to designate a primary variant for Fargo.

The primary variant affects ReSA in the following way. Sometimes a POS system does not provide ReSA with item level 2 (transaction item) data. For example, assume that the POS system in Minneapolis sold 10 medium golf shirts and 10 small golf shirts but only informed ReSA that 20 golf shirts were sold. 20 golf shirts presents a problem for ReSA because it can only interpret items at item level 2 (the transaction level). Thus, because medium golf shirts was the chosen primary variant for Minneapolis, the SAGETREF.PC module automatically transforms the 20 golf shirts into 20 medium golf shirts. If the same type of POS system in China informed ReSA of 20 golf shirts (instead of the 10 medium and 10 small that were sold), the sagetref.pc module would transform the 20 golf shirts sold in China into 20 small golf shirts. As the table shows, small golf shirts was the chosen primary variant for the China location. ReSA then goes on to export the data at the item 2 level (the transaction level) to, for example, a merchandising system, a data warehouse, and so on.

Note: Depending upon system parameters, if a retailer fails to set up the primary variant for a location, an invalid item error is generated during batch processing. In the example below, if the POS system in Fargo sold 10 medium golf shirts and 10 small golf shirts, but only informed ReSA that 20 golf shirts were sold, the sagetref.pc module would not have a way to transform those 20 golf shirts to the transaction level. Because ReSA can only interpret items above the transaction level in conjunction with a primary variant, the invalid item error would occur during batch processing.

Primary Variant Relationships

rmst_saimptlog_promo (Transform Promotion Reference File from RPM Format to Sales Audit Import Processing File Format)

Module Name |

rmst_saimptlog_promo.ksh |

Description |

Transform Promotion Reference File from RPM format to Sales Audit Import Processing file format |

Functional Area |

Oracle Retail Sales Audit |

Module Type |

Integration |

Module Technology |

Ksh |

Integration Catalog ID |

RSA13 |

Design Overview

This script converts the prmdtldm.txt file (which is extracted by the prmdtlex.ksh Oracle Retail Extract, Transform, and Load (RETL) script from the RPM application) into the file format expected by the ReSA module saimptlog.

Scheduling Constraints

|

Schedule Information |

Description |

|

Processing Cycle |

Ad Hoc |

|

Frequency |

Daily |

|

Scheduling Considerations |

NA |

|

Pre-Processing |

prmdtlex.ksh RETL script from the RPM application |

|

Post-Processing |

saimptlog.pc |

|

Threading Scheme |

NA |

Restart/Recovery

This is a standard RETL script. No restart/recovery is used.

Key Tables Affected

NA

Integration Contract

Integration Type |

Upload to ReSA |

File Name |

Determined by runtime parameter. |

Integration Contract |

IntCon000006 (prmdtldm.txt input) IntCon000119 (promfile output) rmst_saimptlog_promo.schema |

Design Assumptions

NA

saimptlog/saimptlogi (Import of Unaudited Transaction Data from POS to ReSA)

Module Name |

saimptlog.c saimptlogi.c |

Description |

Import of Unaudited Transaction data from POS to ReSA |

Functional Area |

Oracle Retail Sales Audit |

Module Type |

Integration |

Module Technology |

ProC |

Integration Catalog ID |

RSA11a RSA11b |

Design Overview

Importing POS and Order Management System (OMS) data to ReSA is a 5 or 6 step process depending on whether saimptlogi or saimptlog is used. Saimptlog produces SQL*Loader files, while saimptlogi does inserts directly into the database. Saimptlogi is meant for use in a trickle feed environment.

To import POS and OMS data, perform the following:

1.

![]() SAGETREF must be run to generate the current reference files:

SAGETREF must be run to generate the current reference files:

§ Items

§ Wastage

§ Sub-transaction level items

§ Primary variant relationships

§ Variable weight PLU

§ Store business day

§ Code types

§ Error codes

§ Store POS

§ Tender type

§ Merchant code types

§ Partner vendors

§ Supplier vendors

§ Employee ids

§ Banner ids

§ Currency File

§ Warehouse File

§ Inventory Status File

These files are all used as input to SAIMPTLOG and SAIMPTLOGI. Because SAIMPTLOG and SAIMPTLOGI can be threaded, this boosts performance by limiting interaction with the database.

2. Either SAIMPTLOG or SAIMPTLOGI must be run against each file. The files are the transaction log files in Oracle Retail compatible format called RTLOG. The retailer is responsible for converting its transaction logs to RTLOGs. Both SAIMPTLOG and SAIMPTLOGI create a write lock for a store/day combination on ReSA tables and then set the data_status to loading until SAIMPTLOGFIN is executed. SAIMPTLOG generates distinct SQL*Loader files for that store/day for the sa_tran_head, sa_tran_item, sa_tran_disc, sa_tran_igtax (item Level Tax not VAT), sa_tran_payment ( Payment details), sa_tran_tax, sa_tran_tender, sa_error, sa_customer, sa_cust_attrib, and sa_missing_tran tables, whereas SAIMPTLOGI inserts data to the database directly. Both produce an Oracle Retail formatted voucher file for processing.

3. SQL*Loader is executed to load the transaction tables from the files created by SAIMPTLOG. The store/day SQL*Loader files can be concatenated into a single file per table to optimize load times. Alternatively, multiple SQL*Loader files can be used as input to SQL*Loader. SQL*Loader may not be run in parallel with itself when loading a table. Header data (primary keys) must be loaded before ancillary data (foreign keys). This means that the sa_tran_head table must be loaded first, sa_tran_item before sa_tran_disc, and sa_customer before sa_cust_attrib. The remaining tables may be loaded in parallel.

4. SAVOUCH is executed to load each of the voucher files in Oracle Retail standard formatted. SAVOUCH may not be multi-threaded.

5. SAIMPTLOGFIN is executed to populate the sa_balance_group table, cancel post voided transactions and vouchers, validate missing transactions, and mark the import as either partially or fully complete loaded. SAIMPTLOGFIN may not be multi-threaded.

Note: This design covers only Steps 2 and 3.

Scheduling Constraints

|

Schedule Information |

Description |

|

Processing Cycle |

Ad Hoc |

|

Frequency |

Daily |

|

Scheduling Considerations |

saimptlog.c or saimptlogi.c should run after sagetref.pc to get the reference files. |

|

Pre-Processing |

saprepost saimptlog pre – change constraints on ReSA tables or saprepost saimptlogi pre – change constraints on ReSA tables. |

|

Post-Processing |

saprepost saimptlog post – change back constraints on ReSA tables or saprepost saimptlogi post – change back constraints on ReSA tables. sqlldr – use sql loader to load data into ReSA tables (for saimptlog only). |

|

Threading Scheme |

saimptlog and saimptlogi may be threaded as long as the parallel executions do not include the same store/day. |

Restart/Recovery

NA

Key Tables Affected

|

Table |

Select |

Insert |

Update |

Delete |

|

SA_ROUNDING_RULE_HEAD |

Yes |

No |

No |

No |

|

SA_ROUNDING_RULE_DETAIL |

Yes |

No |

No |

No |

|

SA_STORE_DAY |

Yes |

No |

Yes |

No |

|

SA_TRAN_HEAD |

No |

Yes |

No |

No |

|

SA_CUSTOMER |

No |

Yes |

No |

No |

|

SA_CUST_ATTRIB |

No |

Yes |

No |

No |

|

SA_TRAN_ITEM |

No |

Yes |

No |

No |

|

SA_TRAN_IGTAX |

No |

Yes |

No |

No |

|

SA_TRAN_DISC |

No |

Yes |

No |

No |

|

SA_TRAN_TAX |

No |

Yes |

No |

No |

|

SA_TRAN_TENDER |

No |

Yes |

No |

No |

|

SA_TRAN_PAYMENT |

No |

Yes |

No |

No |

|

SA_ERROR |

No |

Yes |

No |

No |

|

SA_MISSING_TRAN |

No |

Yes |

No |

No |

|

ALL_SEQUENCES |

Yes |

No |

No |

No |

Integration Contract

Integration Type |

Upload to ReSA |

File Name |

Determined by runtime parameter |

Integration Contract |

Inputs from sagetref.pc:

IntCon000113 (itemfile) IntCon000114 (wastefile) IntCon000115 (refitemfile) IntCon000116 (primvariantfile) IntCon000117 (varupcfile) IntCon000118 (storedayfile) IntCon000119 (promfile) IntCon000120 (codesfile) IntCon000121 (errorfile) IntCon000122 (storeposfile) IntCon000123 (tendertypefile) IntCon000124 (merchcodesfile) IntCon000125 (partnerfile) IntCon000126 (supplierfile) IntCon000127 (employeefile) IntCon000128 (bannerfile) IntCon000129 (promfile) IntCon000130 (whfile) IntCon000131 (invstatusfile) |

|

Inputs from POS: IntCon000048 (RTLOG) |

|

|

Outputs (if using saimptlog SQL Loader Option – note that saimptlogi inserts directly into ReSA tables and does not create these output files)

IntCon000160 (SAVO) IntCon000161 (satdisc.ctl) IntCon000162 (saigtax.ctl) IntCon000163 (sacust.ctl) IntCon000164 (sathead.ctl) IntCon000165 (satitem.ctl) IntCon000166 (sattend.ctl) IntCon000167 (satypmt.ctl) |

|

|

|

IntCon000168 (samisstr.ctl) IntCon000169 (sattax.ctl) IntCon000170 (sacustatt.ctl) IntCon000171 (saerror.ctl) |

The input files for this program are reference files generated by sagetref.pc and RTLOGs. For the input file specificatiosn, refer to the details for the sagetref.pc program.

Output File Layout

File Name: SAVO (Sales Audit Voucher File)

|

Record Name |

Field Name |

Field Type |

Default Value |

Description |

|

FHEAD |

File Type Record Descriptor |

Char(5) |

FHEAD |

File type Record descriptor |

|

SA File Line No |

Char(10) |

|

Sales Audit File Line number |

|

|

Translator Id |

Char(5) |

SAVO |

Identifies transaction type |

|

|

Sys Date |

Char(14) |

|

System date in YYYYMMDDHHMMSS format |

|

|

Is business date |

Char(8) |

|