5. Defining ET Instruments

Each instrument that you enter in Oracle FLEXCUBE should necessarily be associated with an instrument product. To recall, you have already defined instrument products to group together or categorize instruments that share broad similarities. Instrument products provide a general framework and serve to classify or categorize instruments.

Under each Product that you have defined, you can enter specific instruments. By default, an instrument inherits all the attributes of the instrument product, which is associated with it. These include:

- Instrument Type

- Asset Type linked to the product

- Whether physical settlement of the underlying asset is possible

- Whether settlement can be made prior to the Expiry Date

This means that you will not have to define the general attributes each time you enter the instrument details. In addition to the product preferences, you will have to capture the other details of the instrument. They include:

- Instrument details

- Underlying Asset details

- Pricing details

- Price movement details

- Max Open and Long positions

- Days of settlement

- Initial margin per contract

This chapter contains the following sections:

- Section 5.1, "Instrument Definition"

- Section 5.2, "Margin Maintenance at Instrument Level"

- Section 5.3, "Margin Details and Instrument Price Details"

5.1 Instrument Definition

This section contains the following topics:

- Section 5.1.1, "Invoking Instrument Definition Screen"

- Section 5.1.2, "Series Button"

- Section 5.1.3, "Examples of Capturing Actual Instruments in Oracle FLEXCUBE"

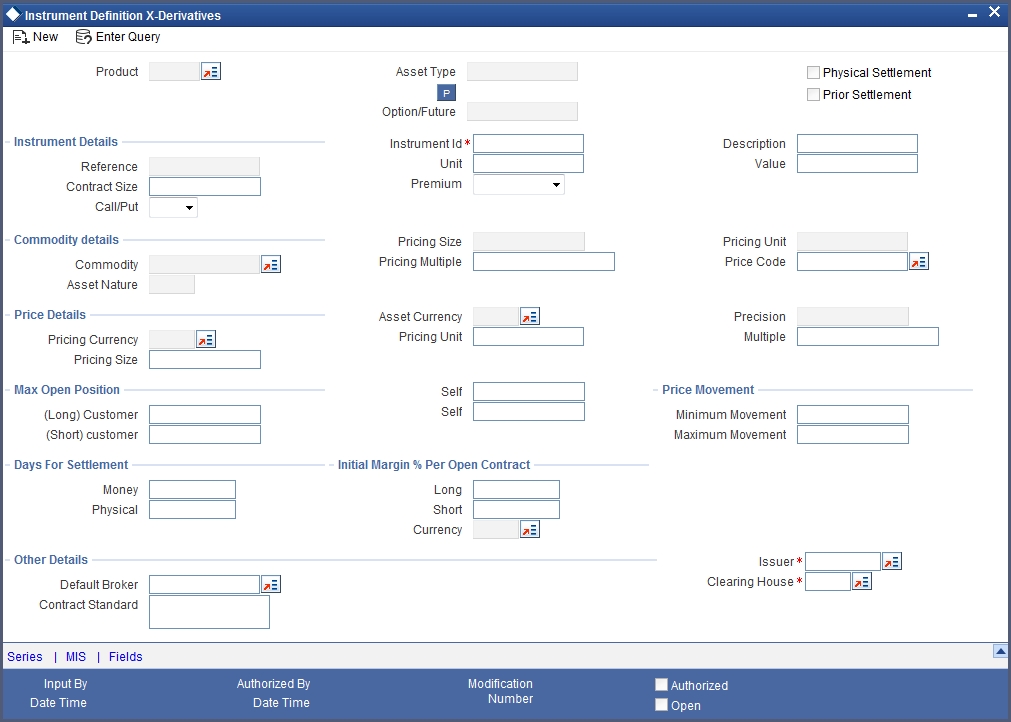

5.1.1 Invoking Instrument Definition Screen

Invoke the ‘Instrument Definition’ screen by typing ‘ENDUINST’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

All ET instruments must be designated at inception either as Future or as Option instruments. At the time of product definition you would have indicated whether the product being defined is meant for future instruments or options. When you associate an instrument with a product, the specifications you made for the instrument product are defaulted to the instrument. You will not be allowed to change the defaulted specifications.

5.1.1.1 Specifying the Instrument details

Reference

In Oracle FLEXCUBE, instrument reference numbers are generated automatically and sequentially by the system. This number tag is used to identify the instrument you are entering. It is also used in all transactions related to this instrument. Here the system generates a unique 16 digit alphanumeric reference value for each instrument.

Instrument Identification

You can provide your own reference number or value for the instrument here. This is called the ‘Instrument Identification’. The ‘Instrument Identification’ in addition to the ‘Reference’ generated by the system identifies the instrument.

The ‘Instrument Identification’ should be unique and cannot be used to identify any other instrument. It also cannot exceed 16 characters. By default, the instrument Reference number generated by the system is taken as the Instrument ID.

Description

Here you can provide a brief description for the instrument. This description cannot exceed 35 characters.

Contract Size and Unit

As part of specifying the instrument details you have to indicate the number of the units of the underlying asset that makes this instrument.

For instance, let us assume that the underlying asset for an instrument is Wheat. Each instrument entitles the holder to buy or sell 100 Kilograms of Wheat. You entries in the Contract Size and Unit fields will be as follows:

| Field | Value | ||

|---|---|---|---|

| Contract Size | 100 | ||

| Unit | Kilograms. |

Similarly, if the underlying asset is happens to be a currency - DEM and if each instrument entitles the holder to buy or sell 1,000,000 DEM your entries in the respective fields should look like this:

| Field | Value | ||

|---|---|---|---|

| Contract Size | 1,000,000 | ||

| Unit | DEM |

Value

In addition to specifying the Contract Size and Unit you can capture additional details pertaining to the instrument or the underlying.

The details that you capture in this field are meant for your bank’s internal reference and will not be used for processing the contract.

Call/Put

While capturing the details of an Option instrument, you need to indicate whether the option is a Call or a Put option. In the ETD module the Call and Put Options are treated as two separate instruments in all respects.

Therefore, when an Exchange issues Call and Put options on the same underlying assets, you need to have defined two instruments to take care of the two Options.

Premium

Indicate the premium style, which should be picked up for the particular option.

You can choose one of the following options here:

- Choose Option Style for booking the Premium Amount for the Deal during the Opening/Closing of the Position, along with the deal. This means there is no Variation Margin (Cash Settlement of Revaluation Differences based on Daily Closing Price of the Instrument) to be processed for such instruments. For your own portfolios, you are allowed to do a Notional Revaluation for such Instruments.

- Choose Option with Futures Style for not booking the Premium Amount during the Opening/Closing of Position, i.e. there is no exchange of Cash during the deal. But based on the every day closing prices of the Instrument, there will be a variation Margin Computation that has to be exchanged between the Portfolio and Broker (Revaluation based on Cash Basis).

5.1.1.2 Specifying the Underlying Asset details

Underlying Asset

After you have indicated the instrument details, you must specify the underlying asset, which is to be linked to the instrument being defined. The option list available for this field is populated based on the Asset Type linked to the product involving this instrument. You can select an appropriate underlying code.

Pricing Multiple

Specify the Pricing Multiple of the underlying here. The Pricing Multiple is the multiplication factor that should be applied to the Price of the Underlying to arrive at the price per contract.

Example

Let us assume that you are maintaining the details of a Gold Option. The Contract Size you have specified is as follows:

| Field | Value | ||

|---|---|---|---|

| Contract Size | 10 | ||

| Unit | Kilograms. |

The underlying you have linked to this instrument is Gold and it is priced in terms of 10 grams.

The Pricing Multiple that you define for this contract will be:

10 kilograms of gold/10 grams of gold = 1000.

Thus, on the option Exercise Date if the Spot Price of Gold is 50 USD for 10 grams of gold, the instrument will be considered to be at the money, if it has a Strike Price of 50000 USD (50 USD X 1000) per contract.

Indicate the multiplication factor that should be applied to the commodity price of the underlying.

Price Code

A single underlying can be linked to several instruments issued at various exchanges. As a result, there might be slight price variations in the closing price of the same underlying in each exchange where the instrument is traded.

Since the system automatically picks up all open position contracts for auto Expiry/Exercise, on the expiry date of the instrument, the closing price of the underlying is required for triggering this process. Therefore, if each of the exchanges where the underlying trades is identified by a unique price code, it becomes possible to associate the price code to be used to pick up the closing price of the underlying for processing the Expiry/Exercise event.

On saving the record, the other details of the underlying - such as the Pricing Size, the Pricing Unit and the Nature of the Asset - are defaulted from the Underlying Asset Maintenance screen, depending on the underlying that you link with the instrument. You cannot change them.

5.1.1.3 Specifying the Price Details of the Instrument

Pricing Currency and Asset Currency

As part of specifying the Pricing Details you have to indicate the currency in which the instrument is to be priced in. The asset currency of the product involved in the instrument is defaulted as the pricing currency.

You can change the pricing currency only if the underlying asset also happens to be a currency. In such a case, since the asset currency differs from the pricing currency you have to change it manually.

Example

Scenario I

Let us carry forward the earlier example of the Gold Option. In this example the Pricing Currency is USD. The Asset Currency will also be USD. Therefore, if you were to take a long Position (Call), the system will pass Contingent Entries to the Continent Bought and Contingent Bought Offset GLs. Both the entries will be posted in USD.

Scenario II

You are processing a DEM Call Option priced in USD. In this case the Pricing Currency will be USD and the Asset Currency will be DEM. Therefore, if you were to take a long position (Call), the system will post Contingent Entries to the Contingent Bought and Contingent Bought Offset GLs. In this case, the Contingent Asset entry will be posted in DEM (asset currency) and the Contingent Bought Offset will be posted in USD (pricing currency).

Precision

You have to specify the maximum decimal places that can be allowed for quoting the Instrument price.

Pricing Size, Pricing Unit and Instrument Pricing Multiple

While specifying the contract size of the Gold Option instrument we had indicated that the contract size was 10 kilograms of Gold. Now, as part of specifying the premium of this option if we were to specify that it should be quoted per every gram of gold, the instrument pricing size and unit will be as follows:

| Field | Value | ||

|---|---|---|---|

| Instrument Pricing Size | 1 | ||

| Instrument Pricing Unit | Gram |

Consequently, the multiplication factor to arrive at the Cost Per Contract (Pricing Multiple) equals 10000.

5.1.1.4 Specifying the Price Movement Details

Minimum Movement

To be able to trade in the instrument, the exchange might specify a certain minimum movement in the price of the instrument. The price that you enter in this field is merely for information purposes and is not used during contract processing. This value is also referred to as the Tick Size of the Instrument.

Maximum Movement

The value that you capture in this field is meant for your internal reference only. No processing is done in Oracle FLEXCUBE based on this value. This price is set at the exchange and is indicative of the forward movement in the instrument price. When the instrument price reaches this limit, trading in this instrument will be suspended for the particular day by the exchange.

5.1.1.5 Specifying Maximum Open Positions details

Certain exchanges you deal in may place restrictions to mitigate the default risk by the various investors. Irrespective of the exchange having this restriction, your bank may want to impose a restriction on the open positions held by your portfolio customers. You can do this by specifying the maximum open long and short positions.

Your entries in this field are meant purely for information purposes. Oracle FLEXCUBE being a back end processing system will not perform any validations against these values that you capture in these fields.

5.1.1.6 Specifying the Days for Settlement

Money

Specify the Money settlement days here. When a particular deal involves money settlement, (Option Premium in case of an Open Deal for an Option or an Exercise deal) the money settlement days are used to arrive at the date on which the money settlement should take place.

For instance if you indicate that the money settlement date is two days, the system calculates the money settlement date in the following manner:

Deal Date + 2 Working Days

Your entry in this field determines the Value Date for Money Settlement.

Physical

When a particular deal involves physical settlement of the underlying asset, (Exercise of Stock Options or Interest Rate Options) you need to indicate the physical settlement days. The system calculates the Value Date of the Physical Settlement based on the number of days that you specify in this field.

For instance, if you specify the number of days as one, the value date for physical settlement of the underlying asset will be done in the following manner:

Deal Date + 1 Working Day

5.1.1.7 Specifying the Initial Margin for Open contracts

Long and Short

In certain exchanges it is mandatory that you deposit as collateral (Initial Margin), a fixed percentage of the Contract Value. You need to specify the percentage of initial margin for every open contract held by the investor. The percentage that you specify can change on a day-to-day basis. Similarly the percentage per Open Short Contract may differ from the percentage per Open Long Contract

Since the ETD module does not calculate the Initial Margin Requirements, the value that you specify in this field represents an approximate percentage that will be required as Initial Margin. The percentage of the contract amount that you enter in these fields will not be considered for processing.

Currency

Indicate the currency in which the percentage amount is to be paid. This field assumes significance only when the margin amount is paid in cash. A list of currencies maintained in Oracle FLEXCUBE is displayed in the available option list. You can choose the appropriate currency.

5.1.1.8 Specifying Other details

Default Broker

Your bank may trade in instruments involving brokers and clearing houses. You have to indicate the ID of the broker/clearing member involved in the deal. A list of all customers categorized as brokers and clearing members through the Customer Information maintenance screen are available in the list of options. You can choose the appropriate ID.

Subsequently, whenever this instrument is chosen in the deal, the broker for the deal is defaulted from this value. You can change the broker ID if necessary.

Issuer

This is the ID of the exchange that has issued the particular instrument. The list of options available for this field contains a list of all customers categorized as Issuers through the Customer Information File details screen. You can associate the appropriate issuer ID with this instrument.

Clearing House

You have to capture the ID of the clearing house where the settlement of trades is to take place.

The daily settlement of trades is Oracle FLEXCUBE will be carried out, based on your holiday specifications in the Holiday Calendar maintenance screen. Processing for a day is skipped, if both the branch and the clearing house are configured for a holiday as of the processing date.

Contract Standard

You can capture additional information about the ETD instrument that you are processing. The additional text that you capture should not exceed 255 characters. The details that you capture in this field can pertain to any of the following:

- Instrument involved in the deal

- Underlying asset

- Physical settlement of the deal

- Money settlement of the deal

This information will be printed on all the advices that are sent to your portfolio customers if you identify Contract Standard as an Advice Tag, while specifying message formats in the Messaging sub-system.

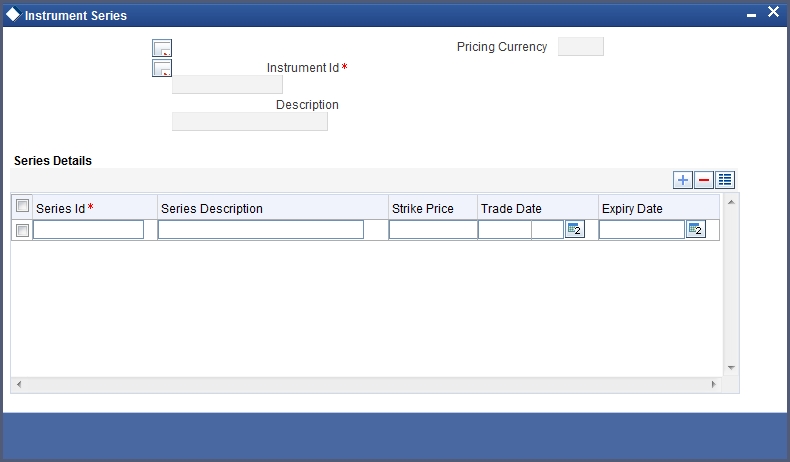

5.1.2 Series Button

A single instrument can have multiple series attached to it. At a given point in time multiple series of the same instrument can be traded simultaneously depending on the expiration months for each series.

Let us assume, you are maintaining the details of Wrought Iron Futures, traded in the London metal exchange. The instrument has two series attached to it. The details of the series are as follows:

Series I

| Series | Description | ||

|---|---|---|---|

| Series ID | LME – Wrought Iron Futures – DEC 2000 series | ||

| Opening Day | 01 Dec 2000 | ||

| Lifetime | 6 months |

Series II

| Series | Description | ||

|---|---|---|---|

| Series ID | LME – Wrought Iron Futures – JAN 2001 series | ||

| Opening Day | 01 Dec 2001 | ||

| Lifetime | 5 months |

In the subsequent section, we will see how these details can be captured in the Series Definition screen.

To define the tradable series for each instrument click ‘Series’ button in the ‘Instrument Definition - XDerivatives’ screen. The ‘Instrument Series’ screen is displayed.

Each time the exchange introduces a new series for the instrument, the instrument maintenance record should be unlocked and the details of the new series captured.

Series Id

To identify the series, you need to assign a unique 16 character code to the series. After you associate a code with the series, you have to capture a brief description of the series. This description will be associated with the series for information retrieval purposes.

Strike Price

While capturing the details of an option instrument, you need to indicate the price at which the option buyer can purchase the asset for a call option or sell the asset in the case of a put option.

The Strike Price is specified in terms of the Pricing Size and Unit maintained for the Instrument. Therefore, it is multiplied by the instrument pricing multiple to arrive at the contract value.

Trade Start Date and Expiry Date

You can indicate the time period for which the series can be traded in the market by specifying the following:

- Trade Start Date

- Expiry Date

The Trade Date is the first date on which the series can be traded in the market. The value dates of deals involving the particular series cannot be earlier than the Trade Date.

The Expiry Date is the date on which the series expires. The value dates of any of the deals involving the series cannot be later than the expiry date. The automatic Expiry/Exercise liquidation of all open positions for a series is done as part of the End of Day activities on the expiry date of the series.

5.1.3 Examples of Capturing Actual Instruments in Oracle FLEXCUBE

In this section we will see how the details of actual ET instruments, traded in the market can be captured using the ETD module of Oracle FLEXCUBE.

Given below are some samples:

5.1.3.1 Example I - One Month Euribor Futures

Contract Standard

The European Interbank Offered Rate (EURIBOR) for one-month euro time deposits.

Contract Value

EUR 3,000,000

Settlement

Cash Settlement, payable on the first exchange trading settlement day immediately following the Last Trading Date.

Price Determination

In percent, with three decimal places, expressed as 100 minus the going rate of interest.

Minimum Price Change

0.005 percent, equivalent to a value of EUR 12.50.

Maturity Months

The six nearest calendar months. The longest term available is therefore six months.

Last Trading Day – Final Settlement Day

Two exchange trading days prior to the third working Wednesday of the respective settlement month, provided that on that day the FBE/ACI has determined the reference interest rate EURIBOR pertaining to one-month euro time deposits; otherwise, the preceding day. Trading in the maturing contract ceases at 11:00 am CET.

Daily Settlement Price

The volume-weighted average price of the last five trades of the day, provided they are not older than 15 minutes; or, if more than five trades have occurred during the final minute trading, then the volume weighted average price of all trades that occurred during that final minute. If such a price cannot be determined, or if the price so determined does not reasonably reflect prevailing market conditions, then Eurex will establish the official settlement price.

Final Settlement Price

Eurex establishes the final settlement price at 11:00 am CET on the last trading day based on the reference interest rate (EURIBOR) for one-month euro time deposits as determined by FBE/ACI. To fix the Final Settlement Price, the EURIBOR rate is rounded to the nearest price interval (0.005, 0.01 or multiple thereof) and is then subtracted from 100

Trading Hours

8.45 am until 7.00 pm CET.

In Oracle FLEXCUBE

To fit this requirement in Oracle FLEXCUBE you have to specify the following details in the Instrument Definition screen:

| Field | Value | ||

|---|---|---|---|

| Product Code | FEU1 | ||

| Option/Future | Future | ||

| Asset Type | Time Deposit | ||

| Physical Settlement | Yes | ||

| Settle Before Expiry | Yes |

Instrument Details

| Field | Value | ||

|---|---|---|---|

| Reference | 000FEU100123 | ||

| Instrument | 1-Month-Euribor-TimeDeposit-Future | ||

| Nature of Asset | Real | ||

| Asset Currency | EUR | ||

| Contract Size | 1 | ||

| Contract Size Unit | Deposit | ||

| Contract Value | 3000000 | ||

| Pricing Currency | EUR | ||

| Pricing Size | 1 | ||

| Pricing Size Unit | Deposit/30000 | ||

| Pricing Unit Multiple | 30000 | ||

| Precision | 3 | ||

| Minimum Price Movement | 0.005 |

Underlying Asset Details

| Field | Value | ||

|---|---|---|---|

| Underlying Asset | ETD (1-Month-Euribor-TimeDeposit) | ||

| Pricing Size | 1 | ||

| Pricing Size Unit | Deposit / 30000 | ||

| Pricing Unit Multiple | 30000 | ||

| Price Code | EUREX |

5.1.3.2 Example II – Option on Three month Euribor Futures

Contract Standard

Three-Month EURIBOR Futures. The nominal value of one futures contract is EUR 1,000,000.

Contract Value

One Three-Month EURIBOR Futures contract.

Settlement

The exercise of a Three-Month EURIBOR Futures option results in the creation of a corresponding Three-Month EURIBOR Futures position for the buyer as well as the seller to whom the exercise is assigned. The position is established after the Post-Trading Period of the exercise day, and is based on the agreed exercise price.

Price Determination

In points, with three decimal places.

Minimum Price Change

0.005 of a point, equivalent to a value of EUR 12.50.

Last Trading Day

Two exchange trading days prior to the third Wednesday of the respective settlement month, provided that on that day the FBE/ACI has determined the reference interest rate EURIBOR pertaining to three-month euro time deposits; otherwise, the preceding day. Trading in the maturing contract ceases at 11:00 a.m. CET.

Daily Settlement Price

The last traded price of the trading day; or, if the last traded price is older than 15 minutes or does not reasonably reflect the prevailing market conditions, then Eurex will establish the official settlement price.

Exercise

American style, i.e. an option can be exercised up to the end of the Post-Trading Period on any exchange trading day during the lifetime of the option.

Expiration Months

The next four months within the cycle March, June, September and December; i.e. options contracts are available with a lifetime of 3, 6, 9 and a maximum of 12 months. The maturity month of the underlying futures contract and the expiration month of the option are identical.

Exercise Value

Options series have exercise prices with intervals of 0.10 of a point (e.g. 96.40, 96.50, 96.60). Twenty-one exercise prices are introduced initially for each expiration month.

Option Premium

The premium is settled using the ‘futures-style’ method.

Trading Hours

8:30 a.m. until 7:00 p.m. CET.

In Oracle FLEXCUBE

To fit this requirement in Oracle FLEXCUBE you have to specify the following details in the Instrument Definition screen:

| Field | Value | ||

|---|---|---|---|

| Product Code | OEU3 | ||

| Option/Future | Option | ||

| Asset Type | Interest Rate Future | ||

| Physical Settlement | Yes | ||

| Settle Before Expiry | Yes |

Instrument Details

| Field | Value | ||

|---|---|---|---|

| Reference | 000OEU300123 | ||

| Instrument | Option on Three-Month EURIBOR Futures contract. | ||

| Nature of Asset | Contingent | ||

| Asset Currency | EUR | ||

| Contract Size | 1 | ||

| Contract Size Unit | Future Contract | ||

| Contract Value | One Three-Month EURIBOR Futures contract. | ||

| Pricing Currency | EUR | ||

| Pricing Size | 1 | ||

| Pricing Size Unit | Future Contract / 30000 | ||

| Pricing Unit Multiple | 30000 | ||

| Precision | 3 | ||

| Minimum Price Movement | 0.005 | ||

| Contract Standard | Three-Month EURIBOR Futures. The nominal value of one futures contract is EUR 1,000,000. |

Underlying Asset Details

| Field | Value | ||

|---|---|---|---|

| Underlying Asset | One Three-Month EURIBOR Futures contract. | ||

| Pricing Size | 1 | ||

| Pricing Size Unit | Future Contract / 30000 | ||

| Pricing Unit Multiple | 30000 | ||

| Price Code | EUREX |

5.1.3.3 Example III – Equity Options on German Shares

Contract Size

Contracts are generally based on 100 shares of the underlying instrument. However, for shares with a nominal or calculated value of DEM 50 or equivalent in euro, the contract size is 10 shares. Options on Munich Re and Allianz have a contract size of 50 shares.

Minimum Price Change

The minimum price change for options is EUR 0.01. In the case of options on shares with a nominal value of DEM 50, price changes of DEM 0.1 are possible.

Settlement

Physical delivery of 10, 50, or 100 shares, respectively, of the underlying security.

Settlement Day

Two exchange trading days after exercise.

Last Trading Day

The third Friday of the expiration month, if this is an exchange trading day; otherwise, the exchange trading day immediately preceding that Friday.

Daily Settlement Price

The last traded price of the trading day; or, if the last traded price is older than 15 minutes or does not reasonably reflect the prevailing market conditions, then Eurex will establish the official settlement price.

Exercise

American style, i.e. an option can be exercised until 18:30 on any exchange trading day during the lifetime of the option, except on days where resolutions regarding dividends take place.

Expiration Months

Group A shares: the three nearest calendar months, as well as the following two months within the cycle March, June, September and December thereafter (i.e. up to a maximum lifetime of 9 months).

Group B shares: the three nearest calendar months, as well as the following three months within the cycle March, June, September and December thereafter (i.e. up to a maximum lifetime of 12 months).

Group C shares: the three nearest calendar months, as well as the following three months within the cycle March, June, September and December thereafter, and the following two months within the cycle June and December thereafter (i.e. up to a maximum lifetime of 24 months).

Exercise Price

Options series may have the following exercise prices:

Shares with a nominal or calculated value of DEM 50 Shares with a nominal or calculated value of DEM 50

| Exercise Prices | Exercise Price Intervals | ||

|---|---|---|---|

| EUR 1 to EUR 20 | EUR 1 | ||

| EUR 22 to EUR 50 | EUR 2 | ||

| EUR 52,50 to EUR 100 | EUR 2,50 only the two next expiration months | ||

| EUR 55 to EUR 100 | EUR 5 | ||

| EUR 110 to EUR 200 | EUR 10 | ||

| EUR 220 to EUR 500 | EUR 20 | ||

| EUR 525 to EUR 1.000 | EUR 25 only the two next expiration months | ||

| EUR 550 to EUR 2.000 | EUR 50 | ||

| EUR 2.100 and above | EUR 100 |

Shares with a nominal or calculated value of DEM 5 and DEM10 or equivalent in euro:

| Exercise Prices | Exercise Price Intervals | ||

|---|---|---|---|

| EUR 1 to EUR 20 | EUR 1 | ||

| EUR 22 to EUR 50 | EUR 2 | ||

| EUR 52,50 to EUR 100 | EUR 2,50 only the two next expiration months | ||

| EUR 55 to EUR 200 | EUR 5 | ||

| EUR 210 and beyond | EUR 10 |

For each expiration month, there are at least three call and three put series, providing an in-the-money, at-the money and out-of-the-money exercise price. For options contracts with lifetimes of 18 or 24 months (XXL Options), the exercise price intervals are doubled.

Underlying Instruments

Eurex equity options on German shares are traded in the following groups according to their expiration months:

| Group A | Group B | Group C | |||

|---|---|---|---|---|---|

| 1, 2, 3, 6 and 9 months | 1, 2, 3, 6, 9 and 12 months | 1, 2, 3, 6, 9, 12, 18 and 24 months |

Shares with a (calculated) nominal value of DEM 5 or equivalent in euro:

| Adidas (ADS) | Bay. Hypo- und Vereinsbank (HVM) | Allianz-Holding (ALV) | |||

| Degussa Hüls (DHA) | Dresdner Bank (DRB) | BASF (BAS) | |||

| Henkel Vz. (HEN3) | Lufthansa (LHA) | Bayer (BAY) | |||

| Metro (MEO) | Mannesmann (MMN) | Commerzbank (CBK) | |||

| Münchener Rück- versicherung (MUV2) | RWE (RWE) | Daimler Chrysler (DCX) | |||

| SAP Vz. (SAP3) | Thyssen Krupp (TKA)* | Deutsche Bank (DBK) | |||

| Schering (SCH) | Deutsche Telekom (DTE) | ||||

| Hoechst (HOE) | |||||

| Siemens (SIE) | |||||

| VEBA (VEB) | |||||

| VW (VOW) | |||||

| Münchener Rückversicherung (MVUZ) |

Shares with a nominal or calculated value of DEM 50 or equivalent in euro:

| Karstadt (KAR) | BMW (BMW) | ||

| Linde (LIN) | Preussag (PRS) | ||

| MAN (MAN) | VIAG (VIA) |

Trading Hours (CET)

9:00 a.m. until 5:00 p.m. CET.

All equity options are subject to mandatory market making.

Option Premium

Payable in full on the exchange trading day immediately following the trade date.

In Oracle FLEXCUBE

The details that you specify in the Instrument Definition screen should be as follows:

| Field | Value | ||

|---|---|---|---|

| Product Code | OTSK | ||

| Option/Future | Option | ||

| Asset Type | Equity | ||

| Physical Settlement | Yes | ||

| Settle Before Expiry | Yes |

Instrument Details

| Field | Value | ||

|---|---|---|---|

| Reference | 000OTSK00123 | ||

| Instrument | Option on Allianz -Holding (ALZ) | ||

| Nature of Asset | Real | ||

| Asset Currency | EUR | ||

| Contract Size | 100 | ||

| Contract Size Unit | Shares | ||

| Call Put Indicator | Call | ||

| Pricing Currency | EUR |

| Field | Value | ||

|---|---|---|---|

| Pricing Size | 1 | ||

| Pricing Size Unit | Share | ||

| Pricing Unit Multiple | 100 | ||

| Precision | 2 | ||

| Minimum Price Movement | 0.01 | ||

| Money Settlement Days | 1 | ||

| Physical Settlement days | 2 | ||

| Contract Standard | 100 Shares of Allianz-Holding of par value 5 DEM each (or equivalent in EUR) |

Underlying Asset Details

| Field | Value | ||

|---|---|---|---|

| Underlying Asset | Allianz-Holding | ||

| Pricing Size | 1 | ||

| Pricing Size Unit | Share | ||

| Pricing Unit Multiple | 100 | ||

| Price Code | FSE |

5.1.3.4 Example IV – Dax® Futures

Contract Standard

The Deutscher Aktienindex (DAX ).

Contract Value

EUR 25 per DAX index point.

Settlement

Cash settlement based on the Final Settlement Price, payable on the first exchange trading day following the Last Trading Day.

Price Determination

In points, with one decimal place.

Minimum Price Change

0.5 of a point, equivalent to a value of EUR 12.50.

Maturity Months

The three successive quarterly months within the cycle March, June, September and December.

Last Trading Day

The third Friday of each maturity month, if this is an exchange trading day; otherwise, the exchange trading day immediately preceding that Friday. Trading ceases at the start of the call phase of the Intraday Auction on the electronic trading system of the Frankfurt Stock Exchange (Xetra ), at 1:00 p.m. CET.

Daily Settlement Price

The last traded price of the trading day; or, if the last traded price is older than 15 minutes or does not reasonably reflect the prevailing market conditions, then Eurex will establish the official settlement price.

Final Settlement Price

The value of the DAX , determined on the basis of the aggregate prices of the DAX component shares on the Last Trading Day, as determined in the Intraday Auction on the electronic system of the Frankfurt Stock Exchange (Xetra ), at 1:00 p.m. CET.

Trading Hours

8:25 a.m. until 5:00 p.m. CET.

In Oracle FLEXCUBE

To fit this requirement in Oracle FLEXCUBE you have to specify the following details in the Instrument Definition screen:

| Field | Value | ||

|---|---|---|---|

| Product Code | FDAX | ||

| Option/Future | Future | ||

| Asset Type | Index | ||

| Physical Settlement | No | ||

| Settle Before Expiry | Yes |

Instrument Details

| Field | Value | ||

|---|---|---|---|

| Reference | 000FDAX00123 | ||

| Instrument | DAX-Future | ||

| Nature of Asset | Real | ||

| Asset Currency | EUR | ||

| Contract Size | 1 | ||

| Contract Size Unit | Point | ||

| Contract Value | EUR 25 per DAX ® index point | ||

| Pricing Currency | EUR | ||

| Pricing Size | 1 | ||

| Pricing Size Unit | Point | ||

| Pricing Unit Multiple | 25 | ||

| Precision | 1 | ||

| Contract Standard | The Deutscher Aktienindex (DAX ® ). |

Underlying Asset Details

| Field | Value | ||

|---|---|---|---|

| Underlying Asset | The Deutscher Aktienindex (DAX ® ). | ||

| Pricing Size | 1 | ||

| Pricing Size Unit | Point | ||

| Pricing Unit Multiple | 25 | ||

| Price Code | DAX-5:30 Quote |

5.1.3.5 Example V – Dax® Options

Contract Standard

The Deutscher Aktienindex (DAX).

Contract Value

EUR 5 per DAX index point.

Settlement

Cash settlement, payable on the first exchange trading day following the Last Trading Day.

Price Determination

In points, with one decimal place.

Minimum Price Change

0.1 of a point, equivalent to a value of EUR 0.50.

Last Trading Day

The third Friday of each maturity month, if this is an exchange trading day; otherwise, the exchange trading day immediately preceding that Friday. Trading ceases at the start of the call phase of the Intraday Auction on the electronic trading system of the Frankfurt Stock Exchange (Xetra ), at 1:00 p.m. CET.

Daily Settlement Price

The last traded price of the trading day; or, if the last traded price is older than 15 minutes or does not reasonably reflect the prevailing market conditions, then Eurex will establish the official settlement price.

Final Settlement Price

The value of the DAX, determined on the basis of the aggregate prices of the DAX component shares on the Last Trading Day, as determined in the Intraday Auction on the electronic system of the Frankfurt Stock Exchange (Xetra ), at 1:00 p.m. CET.

Exercise

European style, i.e. an option may only be exercised on the Last Trading Day of the respective option series, up to the end of the Post-Trading Period.

Expiration Months

The three nearest calendar months, the three following months within the cycle March, June, September and December thereafter, as well as the two following months of the cycle June and December thereafter; i.e. options contracts are available with a lifetime of 1, 2, 3, max 6, max 9, max 12, as well as max 18 and max 24 months.

Exercise Price

Exercise price intervals for DAX(r) Options are as follows:

| Expiration months with a remaining term up to | Number of exercise prices | Exercise price intervals, in Index Points | |||

|---|---|---|---|---|---|

| 9 months | 9 | 50 | |||

| 12 months | 5 | 100 | |||

| 24 months | 5 | 200 |

At least five exercise prices are introduced initially for each expiration month.

Option Premium

The EUR equivalent of the premium in points is payable in full, on the first exchange trading day following the trade date.

Trading Hours (CET)

8:25 a.m. until 5:00 p.m.

In Oracle FLEXCUBE

The details that you specify in the Instrument Definition screen should be as follows:

| Field | Value | ||

|---|---|---|---|

| Product Code | ODAX | ||

| Option/Future | Option | ||

| Asset Type | Index | ||

| Physical Settlement | No | ||

| Settle Before Expiry | Yes |

Instrument Details

| Field | Value | ||

|---|---|---|---|

| Reference | 000ODAX00123 | ||

| Instrument | DAX-Option | ||

| Nature of Asset | Real | ||

| Asset Currency | EUR | ||

| Contract Size | 1 | ||

| Contract Size Unit | Point | ||

| Contract Value | EUR 5 per DAX index point | ||

| Call Put Indicator | Call | ||

| Pricing Currency | EUR | ||

| Pricing Size | 1 | ||

| Pricing Size Unit | Point | ||

| Pricing Unit Multiple | 5 | ||

| Precision | 1 | ||

| Minimum Price Movement | 0.1 | ||

| Money Settlement Days | 1 | ||

| Physical Settlement days | 2 | ||

| Contract Standard | The Deutscher Aktienindex (DAX ®) |

Underlying Asset Details

| Field | Value | ||

|---|---|---|---|

| Underlying Asset | The Deutscher Aktienindex (DAX ®). | ||

| Pricing Size | 1 | ||

| Pricing Size Unit | Point | ||

| Pricing Unit Multiple | 5 | ||

| Price Code | DAX-Daily-5.30 |

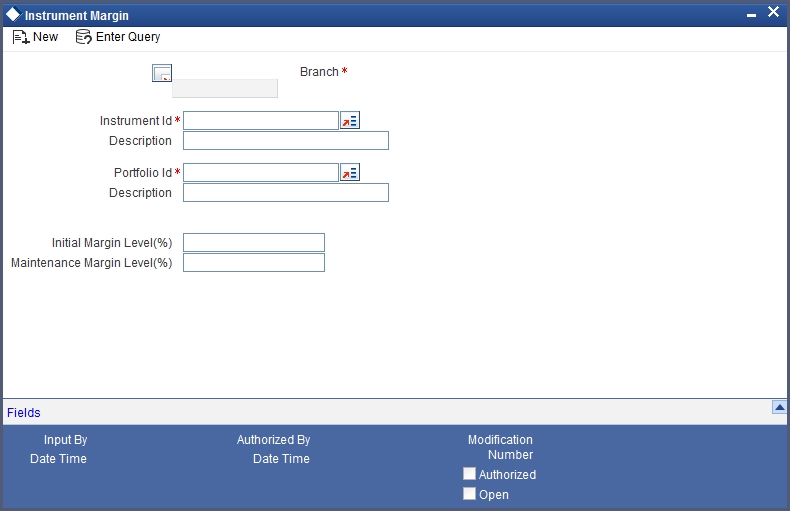

5.2 Margin Maintenance at Instrument Level

This section contains the following topics:

5.2.1 Invoking the Instrument Margin Screen

Initial and maintenance margins are maintained at the instrument level for a combination of instrument ID and portfolio. The ‘Instrument Margin’ screen can be used to capture details regarding percentage of initial and maintenance margins for each open contract.

Invoke the ‘Instrument Margin’ screen by typing ‘ENDINMRG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Branch

The current logged-in branch is displayed here.

Instrument Identification

Select the instrument ID from the adjoining list of values provided.

Portfolio Identification

Select the portfolio ID from the adjoining list of values provided.

Initial Margin Level (%)

Indicate the initial margin percentage per open contract for a combination of instrument ID and Portfolio.

Maint Margin Level (%)

Indicate the maintenance margin percentage per open contract for a combination of instrument ID and Portfolio.

5.3 Margin Details and Instrument Price Details

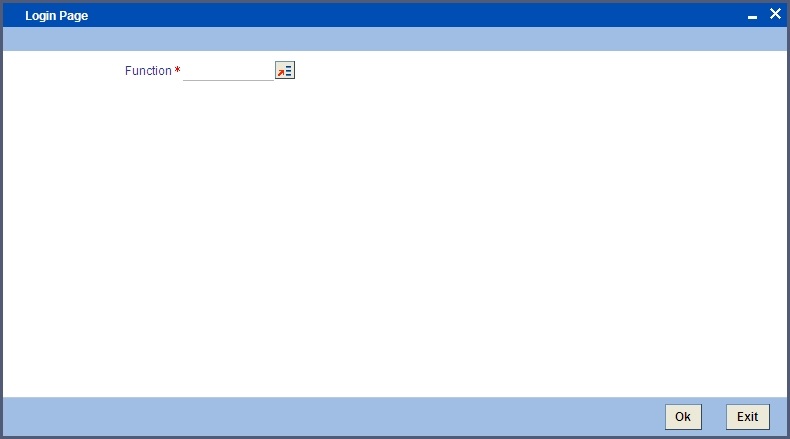

Use the ‘Intra Day Batch Start’ screen to upload the following details into Oracle FLEXCUBE from an external system:

- Initial and maintenance margin details (Function Id - MGSCHUPL)

- Instrument Price details (Function Id - EDINPRUP)

To start the upload, specify the respective Function Id in the ‘Intra Day Batch Start’ screen and click ‘Ok’ button.

The system processes records with the details one by one and uploads all the valid records into the system and rejects ones with errors. The system also checks for duplicate records and if they exist, then they are amended.