9. Automatic Daily Processing

The End of Cycle (EOC) events constitute a set of programs, which are automatically triggered during the batch processes. The EOD process is designed to tie up all the operations for a financial day and prepare the system for the next day.

Note

During End of Day, the batch process should be run after End of Transaction Input (EOTI) has been marked for the day, but before End of Financial Input (EOFI) has been marked for the day.

As part of running the End of Day processes for Exchange Traded Derivatives, the system does an automatic Deal Settlement, whereby all deals that were booked during the day will be processed sequentially. This includes:

- For Futures:

- Deals that result in Open Positions in the Basket.

- Deals that close an existing Open Position.

- Deals that Exchange Open Positions for Physicals.

- Automatic Exchange for Physicals (on the Futures Expiry Date)

- For Options:

- Exercise deals.

- Assignment deals

- Automatic Expiry of Out of Money options (on the Option Expiry Date)

- Automatic Exercise / Assignment of In the Money options (on the Option Expiry Date).

All the deals within a basket are processed in the order of the Value Date + Trade Time Stamp of the Deal.

This chapter contains the following sections:

- Section 9.1, "ETD Batch Processes at EOD"

- Section 9.2, "Automatic Events Executed during End of Day for Futures"

- Section 9.3, "Automatic Events Executed during End of Day for Options"

- Section 9.4, "Sample Accounting Entries for the various events"

- Section 9.5, "Future Deals"

- Section 9.6, "Option Deals"

9.1 ETD Batch Processes at EOD

This section contains the following topics:

9.1.1 Invoking the End of Day Batch Start Screen

The ETD batch process is a POST-EOTI batch function. The batch can be run anytime, after marking EOTI and before marking EOFI. As part of End of Day (EOD) process for ETD, the system does an automatic deal settlement in the order in which the deals have been booked during the day.

All deals within a basket are processed in the order of Value Date + Time Stamp of deal. Notional Revaluation done during previous EOD will be reversed before processing for the day begins. If there is a back dated deal, all the events in the basket after the back valued timestamp will be reversed during EOD and all deals booked after that back valued timestamp will be processed again.

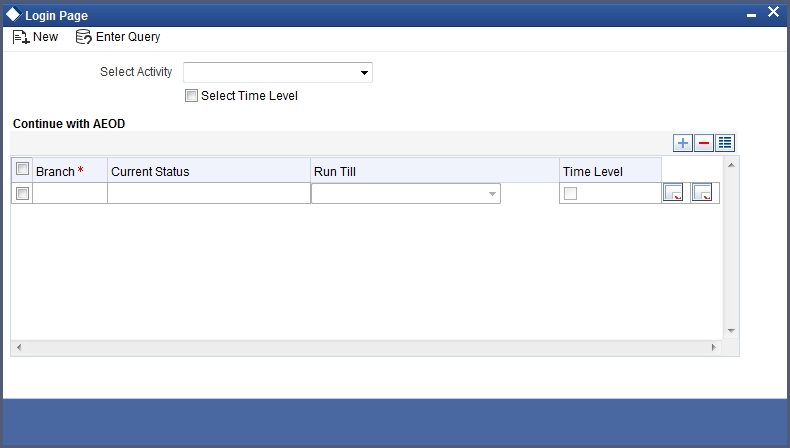

To run the Batch process, use the ‘End of Day Batch Start’ screen. You can invoke this screen by typing ‘AEDEODST’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Thereafter, click ‘Ok’ button, to start the batch process at the EOD.

To exit the screen without running the batch click ‘Exit’ or ‘Cancel’ button.

Note

You cannot cancel an EOD Batch process once it has begun.

9.2 Automatic Events Executed during End of Day for Futures

This section contains the following topics:

- Section 9.2.1, "Settlement of Opening Deals"

- Section 9.2.2, "Realized Revaluation of Open Positions"

- Section 9.2.3, "Settlement of all Closing Deals for the Day"

- Section 9.2.4, "Liquidation of all Open positions on the Expiry Date"

9.2.1 Settlement of Opening Deals

This process will update the Cost of the portfolio based on the new holdings. The events that can be triggered in Oracle FLEXCUBE for settling open deals are:

| Event Code | Description | ||

|---|---|---|---|

| EOLG | Opening of Long Position | ||

| EOSH | Opening of Short Position |

Example

| Opening Position for the day | - | 10 Contracts Long | |||

| Last Market Price | - | 230 USD for 10 contracts. | |||

| Deals for the Day | - | 2 Contracts Long at 25 USD/Contract |

The result of the Settlement Process will be 12 Contracts at 280 USD, where the average cost of holding will be (280/12 USD) 23.33 USD.

9.2.2 Realized Revaluation of Open Positions

As part of this running this process the system will equal the Holding Cost of the portfolio to the Current Market Price and account for the Realized Gain or Loss.

The events that can be triggered in Oracle FLEXCUBE for processing Realized Revaluation is:

| Event Code | Description | ||

|---|---|---|---|

| ERVL | Revaluation of Long Position | ||

| ERVS | Revaluation of Short Position |

Let us extend the above example and see what happens when Realized Revaluation is done for all Open Positions in Futures:

Existing Positions:

| Opening Position for the day | 10 Contracts Long. | ||

| Last Market Price | 230 USD for 10 contracts. | ||

| Deals for the Day | 2 Contracts Long at 25 USD/Contract. |

Result

| Result of Settlement Process | 12 Contracts at 280 USD | ||

| Average Cost of Holding | 9280/12) = 23.33 USD | ||

| New Price per Contract | 25 USD | ||

| Revaluation Gain | 1.67 USD per contract = 20.04 for 12 contracts. | ||

| New Holding Cost | 25 USD per contract * 12 contracts = 300 USD. |

9.2.3 Settlement of all Closing Deals for the Day

As part of settling all Closing deals for the day, the system calculates and posts accounting entries for the closure gain or loss.

The events that can be triggered in Oracle FLEXCUBE for processing the closure of deals are:

| Event Code | Description | ||

|---|---|---|---|

| ECLG | Closure of Long Positions | ||

| ECSH | Closure of Short Positions |

9.2.4 Liquidation of all Open positions on the Expiry Date

As of the Expiry Date the system will identify all series expiring on that day and liquidate all Open positions in the series. The system reverses contingents.

The events that will be triggered in Oracle FLEXCUBE for liquidating open positions on the Expiry Date are:

| Event Code | Description | ||

|---|---|---|---|

| EEPL | Liquidation of Long Positions. | ||

| EEPS | Liquidation of Short Positions. |

9.3 Automatic Events Executed during End of Day for Options

This section contains the following topics:

- Section 9.3.1, "Settlement of Opening Deals for Options"

- Section 9.3.2, "Settlement of Closing Deals"

- Section 9.3.3, "Notional Revaluation of Open Positions for Options with Option Style Premium"

- Section 9.3.4, "Automatic Exercise of options/ Assignment of Exercise"

- Section 9.3.5, "Automatic Expiry of Out / At the Money Positions"

- Section 9.3.6, "Reversal of Notional Revaluation for Options with Option Style of Premium"

- Section 9.3.7, "Producing Instrument Detail and Instrument Price Detail Handoffs"

9.3.1 Settlement of Opening Deals for Options

While running this process the system updates the cost of the portfolio based on the new holdings. This is done as per the costing method (Deal Matching / Weighted Average / LIFO / FIFO) defined for the portfolio.

Note

Costing is applicable only for your bank’s own portfolios. For customer portfolios, the system only facilitates the money settlement of the Deal Premium. It does not so any costing.

The events that will be triggered in Oracle FLEXCUBE for processing the settlement of opening deals for options are:

| Event Code | Description | ||

|---|---|---|---|

| EOLG | Opening of Long Positions | ||

| EOSH | Opening of Short Positions |

9.3.2 Settlement of Closing Deals

As part of the settlement of Closing deals for your bank own portfolios, the closure gain or loss will be computed and accounted for depending on the portfolio Costing Method.

While processing settlement of closing deals for customer portfolios the system does not process any accounting for profit and loss. However, the deal premium will be passed from the Broker/Customer to the Customer/Broker.

The events that will be triggered in Oracle FLEXCUBE for processing the settlement of closing deals for options are as follows:

| Event Code | Description | ||

|---|---|---|---|

| ECLG | Closure of Long position | ||

| ECSH | Closure of Short Position |

9.3.3 Notional Revaluation of Open Positions for Options with Option Style Premium

Notional revaluation of open positions can be done only for your bank’s own portfolios. The system does a notional revaluation of open positions to compare the current Option Premium with the Acquisition Premium of the basket and to compute the revaluation gain/loss.

The events that will be triggered in Oracle FLEXCUBE for calculating the Notional Revaluation of open positions is as follows:

| Event Code | Description | ||

|---|---|---|---|

| EVRL | Revaluation of Long Positions. | ||

| ERVS | Revaluation of Short Positions. |

9.3.4 Automatic Exercise of options/ Assignment of Exercise

For Automatic Exercise/Assignment exercise of options the system will identify all ‘In the Money’ instruments on the Expiry Date and fire automatic exercise (for Long Positions) and Assignment of Exercise (for Short Positions) for the portfolio.

The Instrument and the Series (which is being traded) will be marked as Expired and will be unavailable for further trading.

For your bank’s own portfolios, the system will compute the Exercise Gain and Assignment Loss and post relevant accounting entries for the same.

Note

For Customer portfolios, for Options with Future Style Premium, the system does the money settlement for the difference between the underlying asset Spot Price and the Option Strike Price. In addition, the money settlement for the Deal Premium is also calculated.

9.3.5 Automatic Expiry of Out / At the Money Positions

The Automatic Expiry of Out of the Money / At the Money positions will identify all out of/at the money instruments on the Expiry Date and fire an automatic expiry for the portfolio.

The Instrument and Series, which is being traded, will be marked as expired and will not be available for future trading.

For long positions in your bank’s own portfolios, the acquisition premium (paid / to be paid – depending on the Premium Style) will be expensed out. For short positions within your bank’s own portfolios, the received / to be received premium will be credited as income.

For your customer portfolios, the basket is marked as ‘Expired’. In case of Options with Future style of Premium, the money settlement of the premium will be done during the Expiry event.

9.3.6 Reversal of Notional Revaluation for Options with Option Style of Premium

Reversal of Notional revaluation will be done only for your bank’s own portfolios.

The event that will be triggered in Oracle FLEXCUBE for the reversal of Notional Revaluation is:

| Event Code | Description | ||

|---|---|---|---|

| RRVL | Reversal of Notional Revaluation for Long Positions. | ||

| RRVS | Reversal of Notional Revaluation for Short Positions. |

Note

For Options with future style of premium, the system does a Realized Revaluation.

9.3.7 Producing Instrument Detail and Instrument Price Detail Handoffs

The instrument details and instrument price details that were created or modified during the day can be handed off in an XML format using the Instrument Batch Handoff process. This batch process collects the data of the instrument details that are either created or modified during the day and generates a notification for the same.

To run the Instrument Batch Handoff process automatically at EOD, you must maintain two mandatory programs – for instrument detail and instrument price detail - under the batch operations. You can do this using the ‘Mandatory Batch Program Maintenance’ screen.

9.3.7.1 Maintaining Function Inputs

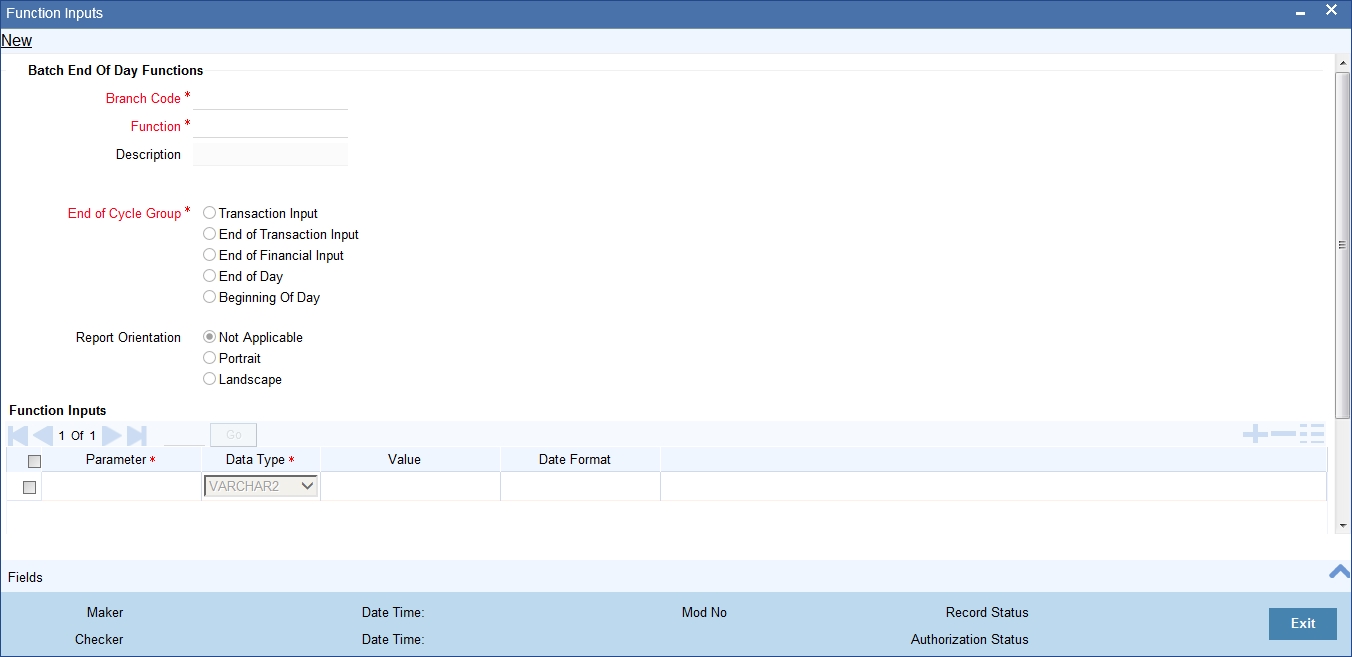

Prior to maintaining the mandatory programs, you must first maintain the function inputs for Batch EOD Functions. You can do this using the ‘Batch EOD Function Inputs’ screen. You can invoke this screen by typing ‘BADEODFE’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can maintain the function inputs for Batch EOD Functions by specifying the following details:

- Branch of the bank involved

- Function Identification of the EOD function

- EDINPRHF for Instrument Price Details Handoff

- EDINSTHF for Instrument Details Handoff

- End of Cycle Group to which the function belongs (in this case you must choose End Of Day)

- Orientation of the generated report (this is optional)

After specifying the above details, you can add the functions input for the function in the ‘Function Inputs’ table. You must mandatorily specify the Parameter and Data Type for each function. Now you can proceed with maintaining the Instrument Batch Handoff process as a mandatory program.

9.3.7.2 Maintaining Mandatory Batch Programs

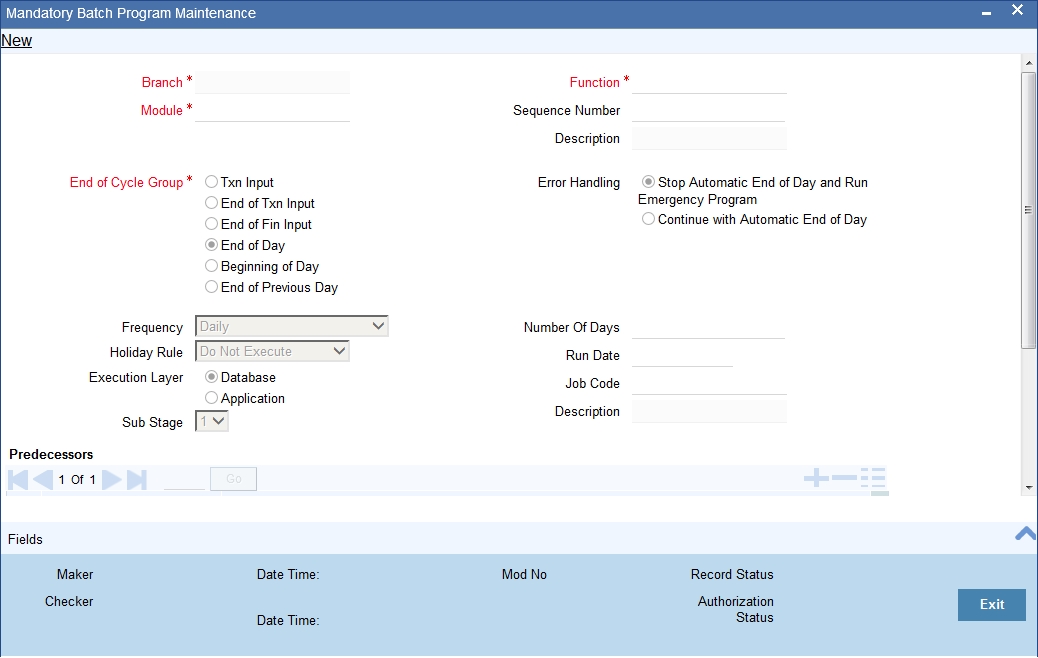

You can maintain the Instrument Batch Handoff process as a mandatory program using the ‘Mandatory Batch Program Maintenance’ screen. You can invoke this screen by typing ‘EIDMANPE’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can maintain the details of the batch program by specifying the following:

- Branch of the bank involved

- Module involved

- Function Identification of the EOD function

- EDINPRHF for Instrument Price Details Handoff

- EDINSTHF for Instrument Details Handoff

- End of Cycle Group to which the function belongs (in this case you must choose End Of Day)

- Error Handling measures to be taken

- Frequency of running the program

- Holiday rule for specifying whether the program should be executed on holidays or not.

9.3.7.3 Initiating the Instrument Handoffs

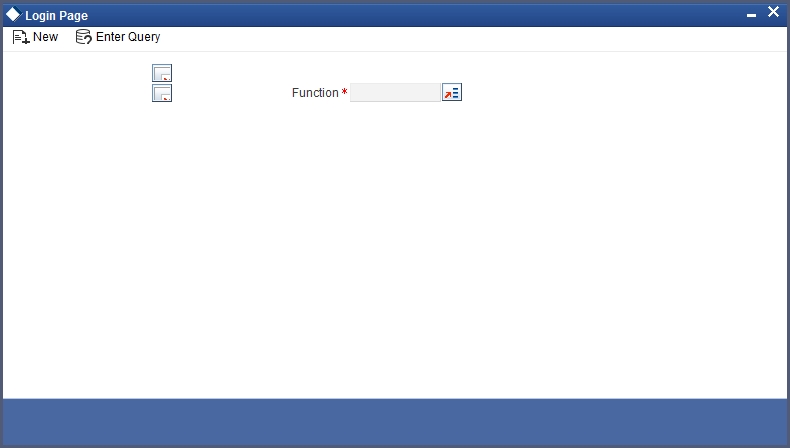

Use the ‘Intra Day Batch Start’ screen to initiate the instrument details and instrument price details handoffs. You can invoke this screen by typing ‘BABIDBAT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

To start the handoff, specify the respective Function Id in the ‘Intra Day Batch Start’ screen and click ‘Ok’ button.

9.4 Sample Accounting Entries for the various events

In this section we have given samples of accounting entries that will be posted during the batch processing programs for Futures as well as Options.

9.5 Future Deals

This section contains the following topics:

- Section 9.5.1, "Instrument Details - CME-90 day US T-bill-Future"

- Section 9.5.2, "Deal I – Reference Number D20101"

- Section 9.5.3, "Deal II – Reference Number D20302"

- Section 9.5.4, "Deal III – Reference Number D20401"

9.5.1 Instrument Details - CME-90 day US T-bill-Future

| Fields | Values | ||

|---|---|---|---|

| Instrument Product | BNDF | ||

| Instrument Type | Future | ||

| Underlying Asset Type | Bond | ||

| Nature of Underlying Asset | Real | ||

| Underlying Asset | 90 Day US T-Bill | ||

| Underlying Asset Currency | USD | ||

| Instrument ID | CME-90 day US T-bill-Future | ||

| Pricing Currency | USD | ||

| Contract Size | 100 | ||

| Contract Size Unit | T-Bill | ||

| Pricing Precision | 4 Decimals | ||

| Instrument Pricing Size | 1 | ||

| Instrument Pricing Size Unit | Unit | ||

| Instrument Pricing Size Multiple | 100 | ||

| Underlying Pricing Size | 1 | ||

| Underlying Pricing Size Unit | T-bill | ||

| Underlying Pricing Unit Multiple | 100 | ||

| Underlying Price Code | CME | ||

| Min Price Movement | 0.01 | ||

| Max Price Movement in a Day | 10% | ||

| Max Long Position Customer | 10000 | ||

| Max Short Position customer | 10000 | ||

| Max Long Position Self | 100000 | ||

| Max Short Position Self | 100000 | ||

| Default Broker ID | CITI | ||

| Issuer Exchange | CME | ||

| MSTL Days | 1 | ||

| Physical Settlement Days | 2 | ||

| Initial Margin per Open Long | 10% | ||

| Initial Margin per Open Short | 10% | ||

| Clearing House | NSCC | ||

| Margin CCY | USD |

Series I

| Field | Value | ||

|---|---|---|---|

| Instrument Series | Nov-00 | ||

| Instrument Description | Bonds future 90 Day T-Bill USCMENon-00 | ||

| Instrument Start Date | 28-Aug-2000 | ||

| Instrument Expiry Date | 24-Nov-2000 |

As mentioned earlier in the manual, each time you process a deal with the following combination:

Basket = Portfolio ID + Instrument ID + Series ID + Broker + Broker Account

The system assigns a unique reference number known as the Basket Reference Number to this combination.

The details of the Basket involved in the deals used in our examples are as follows:

| Basket Reference Number | - | BSK001 | |||||

| Portfolio ID | - | PF001 | |||||

| Instrument ID | - | CME-90 day US T-bill-Future | |||||

| Series ID | - | Nov-00 | |||||

| Broker ID | - | CITI | |||||

| Broker Account | - | CB001 |

9.5.2 Deal I – Reference Number D20101

Nature of Contract - Open Long Position for Own Portfolio

| Field | Value | ||

|---|---|---|---|

| Deal Number | D20101 | ||

| Deal Type | LS | ||

| Deal Product | DP03 | ||

| Instrument ID | CME-90 day US T-bill-Future | ||

| Instrument Series | Nov-00 | ||

| Buy/Sell | B | ||

| Booking Date | 21-Nov-2000 | ||

| Value Date | 21-Nov-2000 | ||

| Trade Rate | 97 | ||

| No. of Contracts | 200 |

The Basket BSK001 will be updated with a balance of 200 Long contracts.

The event that needs to be processed in the Basket because of this Deal is: EOLG. The accounting entries posted for this event are as follows:

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Contingent Asset | Debit | USD | 1940000 | Bought Asset at Asset Currency | |||||

| Contingent Asset offset | Credit | USD | 1940000 | Bought Asset at Pricing Currency |

Realized Revaluation entries at EOD

Let us assume that the EOD price of the Instrument is 97.25 USD. At the End of Day the event ERVL will be triggered and the following entries will be passed:

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Contingent Asset | Debit | USD | 5000 | Increase in Contingent asset on Revaluation in Pricing Currency | |||||

| Contingent Asset offset | Credit | USD | 5000 | ||||||

| Customer | Debit | USD | 5000 | Revaluation Gain realized in pricing currency | |||||

| Income | Credit | USD | 5000 |

9.5.3 Deal II – Reference Number D20302

Nature of Contract - Partial Liquidation of Long Position for your Own Portfolio.

| Field | Value | ||

|---|---|---|---|

| Deal Number | D20302 | ||

| Deal Type | LS | ||

| Deal Product | DP03 | ||

| Instrument ID | CME-90 day US T-bill-Future | ||

| Instrument Series | Nov-00 | ||

| Buy/Sell | S | ||

| Booking Date | 23-Nov-2000 | ||

| Value Date | 23-Nov-2000 | ||

| Expiry Date | 24-Nov-2000 | ||

| Trade Rate | 97.75 | ||

| No. of Contracts | 100 |

In this case since the Portfolio, Instrument, Series, Broker and Broker Account combination is the same as the one that was used to process the earlier deal – D20101, the system uses the same basket BSK001.

The balance in the basket prior to processing this deal was 200 Long contracts. Since we are processing a short deal the balance in the basket will come down to 100 long contracts.

The accounting entries posted for partial liquidation of long contracts will be as follows:

Event Code - ECLG

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Contingent Asset | Debit | USD | 3500 | Increase in Contingent Asset | |||||

| Contingent Asset offset | Credit | USD | 3500 | ||||||

| Contingent Asset offset | Debit | USD | 977500 | Eq. Amt in pricing currency | |||||

| Contingent Asset | Credit | USD | 977500 | Sold Asset in Asset Currency | |||||

| Settlement Bridge | Debit | USD | 977500 | Closing Price in Pricing Currency | |||||

| Control | Credit | USD | 977500 | ||||||

| Control | Debit | USD | 974000 | Holding Cost in Pricing Currency | |||||

| Settlement Bridge | Credit | USD | 974000 | ||||||

| Control | Debit | USD | 3500 | Gain on closure in Pricing Currency | |||||

| Income | Credit | USD | 3500 |

9.5.4 Deal III – Reference Number D20401

Nature of Contract – Settlement by exchange of physicals on Contract Expiry (Own Long Position).

| Field | Value | ||

|---|---|---|---|

| Deal Number | D20401 | ||

| Deal Type | XPL |

| Field | Value | ||

|---|---|---|---|

| Deal Product | DP04 | ||

| Instrument ID | CME-90 day US T-bill-Future | ||

| Instrument Series | Nov-00 | ||

| Booking Date | 24-Nov-2000 | ||

| Value Date | 24-Nov-2000 | ||

| Expiry Date | 24-Nov-2000 | ||

| Trade Rate | 97.80 | ||

| No. of Contracts | 100 |

The Current balance in the Basket is 100 long contracts. Since the instrument expires on 24-Nov-00, all 100 contracts within the basket will cease to exist on the Expiry Date.

The accounting entries that will be posted for the settlement of exchange of physicals on contract expiry will be as follows:

Event Code - EEPL

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Contingent Asset | Debit | USD | 1500 | Increase in contingent asset in Asset Currency | |||||

| Contingent Asset offset | Credit | USD | 1500 | Increase in contingent asset in pricing currency. | |||||

| Contingent Asset offset | Debit | USD | 978000 | Reversal of contingents on EFP | |||||

| Contingent Asset | Credit | USD | 978000 | ||||||

| Real Asset | Debit | USD | 978000 | EFP value in Asset Currency | |||||

| Settlement Bridge | Credit | USD | 978000 | EFP value in Pricing Currency | |||||

| Settlement Bridge | Debit | USD | 1500 | Gains on EFP | |||||

| Control | Credit | USD | 1500 |

9.6 Option Deals

This section contains the following topics:

- Section 9.6.1, "European Option Deals with Option Style Premium"

- Section 9.6.2, "Deal I – Reference Number D10103"

- Section 9.6.3, "Deal II –Reference Number D10201"

- Section 9.6.4, "Deal II –Reference Number D10402"

- Section 9.6.5, "American Option Deals with Future Style Premium"

- Section 9.6.6, "Deal I – Reference Number D20104"

- Section 9.6.7, "Deal II – Reference Number D20601"

9.6.1 European Option Deals with Option Style Premium

In the earlier section we had a look at the sample accounting entries that were triggered during EOD processing of future deals. We will now have a look at the accounting entries that will get triggered during BOD and EOD processing for Option deals with Option and Future style premium.

The Instrument involved in all the European option deals is - CME-90dayUSTbill-96-Option-Call. The details of this instrument are given below:

9.6.1.1 Instrument Details - CME-90dayUSTbill-96-Option-Call

| Fields | Values | ||

|---|---|---|---|

| Instrument Product | BNEO | ||

| Instrument Type | Option | ||

| Underlying Asset Type | Bonds | ||

| Nature of Underlying Asset | Real | ||

| Underlying Asset | 90 Day T-Bill US | ||

| Underlying Asset Currency | USD | ||

| Call Put Indicator | Call | ||

| Instrument ID | CME90DTB-CL-E-0P | ||

| Instrument Series | 96 Nov-00 | ||

| Instrument Description | BondsOption90 Day T-Bill USCME96 Nov-00 | ||

| Instrument Start Date | 28-Aug-2000 | ||

| Instrument Expiry Date | 24-Nov-2000 | ||

| Pricing Currency | USD | ||

| Contract Size | 100 | ||

| Contract Size Unit | T-Bill | ||

| Pricing Precision | 4 Decimals | ||

| Instrument Pricing Size | 1 | ||

| Instrument Pricing Size Unit | Unit | ||

| Instrument Pricing Size Multiple | 100 | ||

| Underlying Pricing Size | 1 | ||

| Underlying Pricing Size Unit | T-bill | ||

| Underlying Pricing Unit Multiple | 100 | ||

| Underlying Price Code | CME | ||

| Min Price Movement | 0.01 | ||

| Max Price Movement in a Day | Nil | ||

| Max Long Position Customer | 10000 | ||

| Max Short Position customer | 10000 | ||

| Max Long Position Self | 100000 | ||

| Max Short Position Self | 100000 | ||

| Default Broker ID | CITI | ||

| Issuer Exchange | CME | ||

| MSTL Days | 1 | ||

| Physical Settlement Days | 2 | ||

| Initial Margin per Open Long | Nil | ||

| Initial Margin per Open Short | 10% | ||

| Clearing House | NSCC | ||

| Margin CCY | USD |

The details of the basket involved in the option deals in our example are as follows:

| Basket Reference Number | - | BSK002 | |||

| Portfolio ID | - | PF001 | |||

| Instrument ID | - | CME90DTB-CL-E-0P | |||

| Series ID | - | 96/Nov-00 | |||

| Broker ID | - | CITI | |||

| Broker Account | - | CB001 |

9.6.2 Deal I – Reference Number D10103

Nature of Contract - Open Long European call with Option style Premium on own account

| Field | Value | ||

|---|---|---|---|

| Deal Number | D10103 | ||

| Deal Type | LS | ||

| Deal Product | DP03 | ||

| Instrument ID | CME90DTB-CL-E-0P | ||

| Instrument Series | 96/Nov-00 | ||

| Strike Price | 96 | ||

| Buy/Sell | B | ||

| Booking Date | 21-Nov-2000 | ||

| Value Date | 21-Nov-2000 | ||

| Expiry Date | 24-Nov-2000 | ||

| Trade Rate | 1.95 | ||

| Premium Style | Option | ||

| No. of Contracts | 80 |

As a result of processing this deal, the system creates a basket BSK002 with the following combination:

PF001 + CME90DTB-CL-E-0P + 96/Nov-00 + CITI + CB001

The basket will be created with a balance of 80 Long contracts.

At EOD, the event that needs to be processed in the Basket because of this Deal is: EOLG. The accounting entries posted for this event are as follows

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Contingent Asset | Debit | USD | 768000 | Bought Asset Value | |||||

| Contingent Asset Offset | Credit | USD | 768000 | ||||||

| Premium Paid | Debit | USD | 15600 | Deal Premium | |||||

| Settlement Bridge | Credit | USD | 15600 |

For the event ERVL, the following entries will be posted:

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Unrealized Expense | Debit | USD | 160 | Notional Loss on Reval | |||||

| Reval Liability | Credit | USD | 160 |

9.6.3 Deal II –Reference Number D10201

Nature of Contract - Open Long European Call with Option style Premium on own account

| Field | Value | ||

|---|---|---|---|

| Deal Number | D10201 | ||

| Deal Type | LS | ||

| Deal Product | DP03 | ||

| Instrument ID | CME90DTB-CL-E-0P | ||

| Instrument Series | 96/Nov-00 | ||

| Strike Price | 96 | ||

| Buy/Sell | B | ||

| Booking Date | 22-Nov-2000 | ||

| Value Date | 22-Nov-2000 | ||

| Expiry Date | 24-Nov-2000 | ||

| Trade Rate | 1.9 | ||

| Premium Style | Option | ||

| No. of Contracts | 20 |

The balance in the basket prior to processing this deal was 80 Long contracts. Since we are processing a long deal the current balance in the basket will go up to 100 Long contracts.

At EOD, the event that needs to be processed in the Basket because of this Deal is EOLG. The accounting entries posted for this event are as follows:

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Contingent Asset | Debit | USD | 192000 | Bought Asset Value | |||||

| Contingent Asset Offset | Credit | USD | 192000 | ||||||

| Premium Paid | Debit | USD | 3800 | Deal Premium | |||||

| Settlement Bridge | Credit | USD | 3800 |

ERVL will be triggered and the following entries will be posted:

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Reval Asset | Debit | USD | 40 | Notional Gain on Reval | |||||

| Unrealized Gain | Credit | USD | 40 |

9.6.4 Deal II –Reference Number D10402

Nature of Contract – Auto Exercise of Long position in an In the Money European Call on Expiry.

| Field | Value | ||

|---|---|---|---|

| Deal Number | D10402 | ||

| Deal Type | LS | ||

| Deal Product | DP03 | ||

| Instrument ID | CME90DTB-CL-E-0P | ||

| Instrument Series | 96/Nov-00 | ||

| Strike Price | 96 | ||

| Booking Date | 27-Nov-2000 | ||

| Value Date | 24-Nov-2000 | ||

| Expiry Date | 24-Nov-2000 | ||

| No. of Contracts | 100 |

The current balance in the basket BSK002 is 100 long contracts. Since the instrument expires on 24-Nov-2000, all 100 contracts within the basket will cease to exist on the Expiry Date.

The accounting entries that will be posted for the automatic exercise of long positions of the In the Money European call option deals (D10103 and D10201) will be as follows:

Event Code - EXRL

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Contingent Asset Offset | Debit | USD | 960000 | Reversal of Contingents | |||||

| Contingent Asset | Credit | USD | 960000 | ||||||

| Control | Debit | USD | 19400 | ||||||

| Premium Paid | Credit | USD | 19400 | ||||||

| Settlement Bridge | Debit | USD | 18000 | Spot Strike Difference | |||||

| Control | Credit | USD | 18000 | ||||||

| Expense | Debit | USD | 1400 | Loss on Exercise | |||||

| Control | Credit | USD | 1400 |

9.6.5 American Option Deals with Future Style Premium

The Instrument involved in all the American option deals is - NSE-HLL-230-Option-Put. The details of this instrument are given below:

9.6.5.1 Instrument Details - NSE-HLL-230-Option-Put

| Fields | Values | ||||

|---|---|---|---|---|---|

| Instrument Product | EQAO | ||||

| Instrument Type | Option | ||||

| Underlying Asset Type | Equity | ||||

| Nature of Underlying Asset | Real | ||||

| Underlying Asset | HINDLEVER | ||||

| Underlying Asset Currency | INR | ||||

| Call Put Indicator | Put | ||||

| Instrument ID | NSE-HLL-230-Option-Put | ||||

| Instrument Series | 23 Jan-01 | ||||

| Instrument Description | EquityOptionHINDLEVERNSE230 Jan-01 | ||||

| Instrument Start Date | 30-Oct-2000 | ||||

| Instrument Expiry Date | 26-Jan-2001 | ||||

| Pricing Currency | INR | ||||

| Contract Size | 100 | ||||

| Contract Size Unit | Share | ||||

| Pricing Precision | 2 Decimals | ||||

| Instrument Pricing Size | 1 | ||||

| Instrument Pricing Size Unit | Share | ||||

| Instrument Pricing Size Multiple | 100 | ||||

| Underlying Pricing Size | 1 | ||||

| Underlying Pricing Size Unit | Share | ||||

| Underlying Pricing Unit Multiple | 100 | ||||

| Underlying Price Code | NSE | ||||

| Min Price Movement | 0.05 | ||||

| Max Long Position Customer | 10000 | ||||

| Max Short Position customer | 10000 | ||||

| Max Long Position Self | 100000 | ||||

| Max Short Position Self | 100000 | ||||

| Default Broker ID | SCG | ||||

| Issuer Exchange | NSE | ||||

| MSTL Days | 1 | ||||

| Physical Settlement Days | 2 | ||||

| Initial Margin per Open Long | 5% | ||||

| Initial Margin per Open Short | 10% | ||||

| Clearing House | NSCCL | ||||

| Margin CCY | INR | ||||

The details of the basket involved in the option deals in our example are as follows:

| Basket Reference Number | - | BSK003 | |||

| Portfolio ID | - | PF001 | |||

| Instrument ID | - | NSE-HLL-230-Option-Put | |||

| Series ID | - | 230 Jan-01 | |||

| Broker ID | - | CITI | |||

| Broker Account | - | CB001 |

9.6.6 Deal I – Reference Number D20104

Nature of Contract - Open Short in American Put Future Style Option.

| Fields | Value | ||

|---|---|---|---|

| Deal Number | D20104 | ||

| Deal Type | LS | ||

| Deal Product | DP03 | ||

| Instrument ID | NSE-HLL-PUT-A-FP | ||

| Instrument Series | 230/Jan-01 | ||

| Strike Price | 230 | ||

| Buy/Sell | S | ||

| Booking Date | 21-Nov-2000 | ||

| Value Date | 21-Nov-2000 | ||

| Expiry Date | 25-Jan-2001 | ||

| Trade Rate | 35 | ||

| No. of Contracts | 20 |

As a result of processing this deal, the system creates a basket BSK003 with the following combination:

PF001 + NSE-HLL-230-Option-Put + 230 Jan-01+ CITI + CB001

The basket will be created with 20 short contracts.

At EOD, the event that needs to be processed in the Basket because of this Deal is: EOSH. The accounting entries posted for this event are as follows

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Contingent Asset | Debit | INR | 390000 | ||||||

| Contingent Asset Offset | Credit | INR | 390000 | Asset value net of premium. |

For the event ERVS, the following entries will be posted:

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Contingent Asset | Debit | INR | 6000 | Increase in Asset | |||||

| Contingent Asset Offset | Credit | INR | 6000 | ||||||

| Customer | Debit | INR | 6000 | Realized gain on revaluation | |||||

| Income | Credit | INR | 6000 |

9.6.7 Deal II – Reference Number D20601

Nature of Contract - Assignment Prior to Expiry of Own Short Position in American Put.

| Fields | Value | ||

|---|---|---|---|

| Deal Number | D20601 | ||

| Deal Type | XRS | ||

| Deal Product | DP04 | ||

| Instrument ID | NSE-HLL-PUT-A-FP | ||

| Instrument Series | 230/Jan-01 | ||

| Strike Price | 230 | ||

| Booking Date | 28-Nov-2000 | ||

| Value Date | 28-Nov-2000 | ||

| Expiry Date | 25-Jan-2001 | ||

| No. of Contracts | 20 |

At EOD, the event that needs to be processed in the Basket because of this Deal is EAXS. The accounting entries posted for this event are as follows:

| Accounting Role | Dr/Cr Indicator | Currency | Amount | Description | |||||

|---|---|---|---|---|---|---|---|---|---|

| Contingent Asset Offset | Debit | INR | 404000 | Reversal of contingents | |||||

| Contingent Asset | Credit | INR | 404000 | ||||||

| Control | Debit | INR | 50000 | Spot strike difference | |||||

| Settlement Bridge | Credit | INR | 50000 | ||||||

| Settlement Bridge | Debit | INR | 56000 | Deal Premium | |||||

| Control | Credit | INR | 56000 | ||||||

| Control | Debit | INR | 6000 | Gain on Assignment of positions | |||||

| Income | Credit | INR | 6000 |