3. Maintaining Investment Weights

In order to compute the profit distribution on a Mudarabah fund, you need to capture the risk associated with every investment that forms the Mudarabah fund.

This chapter contains the following sections:

- Section 3.1, "Maintaining Investment Weights"

- Section 3.2, "Profit Calculation Exclusion Batch"

- Section 3.3, "Profit Calculation Batch"

- Section 3.4, "Profit Distribution Batch"

- Section 3.4, "Profit Distribution Batch"

- Section 3.5, "Zakat Batch Process"

- Section 3.5, "Zakat Batch Process"

3.1 Maintaining Investment Weights

You can capture the risk or weight attached to every deposit investment in the ‘Weights Maintenance’ screen. This screen allows weights maintenance for different combinations of fund Id, product type, account class, effective date and currency. You can invoke the ‘Weights Maintenance’ screen by typing ‘ICDWTSMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can specify the following details:

Mudarabah Fund Id

You can specify the Mudarabah Fund Id for which you wish to maintain deposit weight details from the option list. The option list contains all Mudarabah fund Id that are active and authorized.

Currency

You can specify the currency to maintain deposit weight details from the option list. The option list will displays all the currency codes maintained in the system.

Effective Date

You can specify the date from which the weights should be considered for profit calculation and distribution. You can also maintain a back-valued effective date but not a future date.

Account Class

You can specify the account class for which you wish to maintain weight details from the option list. The option list displays all the account classes linked to the selected fund Id.

Bank Local Currency

The system defaults the bank local currency here and not the Branch currency. The entire profit calculation will be done in this currency.

Product Type

The system will default the product type based on the account class selected on saving the record:

- Savings

- Current

- Term Deposits

3.1.0.1 Broken Period

Weight (%)

You can specify a weight in percentage that should be for calculating the profit when term deposits are redeemed before their maturity dates.

If the utilization amount is not zero at the end of PDM calculation period then the system considers the broken weightage maintained along with other weightages for deposits in Mudarabah Sweep.

3.1.0.2 Mudarib Fee

Fee (%)

You can specify a fee in percentage that should be used as Mudarib fee for profit allocation calculation for the given pool code, account class and currency combination.

3.1.0.3 Value Category

Amount Slab

You can assign a weight to an amount slab. For all investment wherein the amount falls in the particular slab, the weight specified against the slab will be applicable.

Weight (%)

You can specify the weight for an investment falling under the specified slab.

3.1.0.4 Tenor Category

Units

You can specify the frequency of the term deposit. You can choose from the following option available in the drop-down list:

- Months

- Year

Tenor

You can specify the tenor of the term deposit.

TD Weight

You can specify the weights for Investment accounts having the particular profit distribution frequency.

Savings/Current Account

You can specify the weight for savings accounts falling under the chosen Mudarabah fund Id. This field is available only if the product type is specified as ‘Savings’.

3.1.0.5 PPO Category

Days

You can specify the profit distribution frequency in terms of days. You can specify any numerical value from 1 to 99.

Months

You can specify the profit distribution frequency in terms of months. You can specify any numerical value from 1 to 12.

Years

You can specify the profit distribution frequency in terms of number of years.

Weight (%)

You can specify the weights for investment accounts having the particular profit distribution frequency.

3.2 Profit Calculation Exclusion Batch

You can invoke the ‘Profit Calculation Exclusion Batch’ screen by typing ‘STDREXBT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details:

- Period Code

- Financial Year

- Intraday Sequence Number

3.3 Profit Calculation Batch

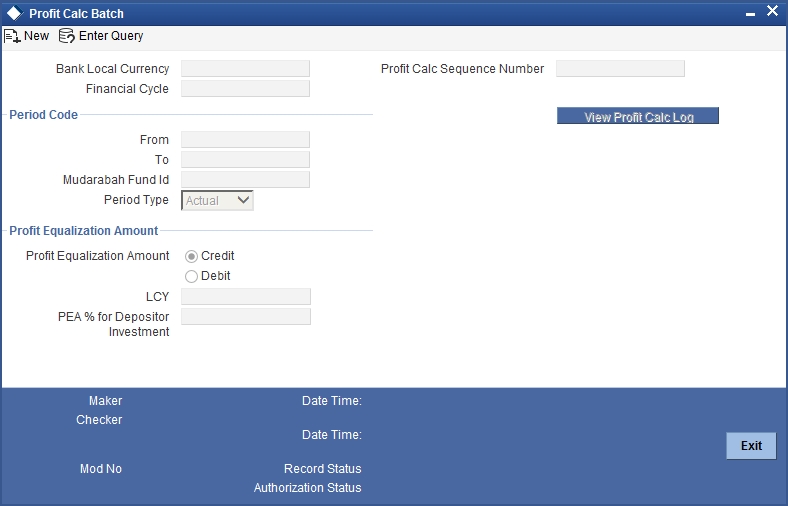

You can calculate the profit and as well as initiating distribution to depositors and shareholders for the Mudarabah fund using ‘Profit Calc Batch’ screen. You can invoke the ‘Profit Calc Batch’ screen by typing ‘ICDPRCBT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Bank Local Ccy

The system displays the local currency of the bank.

Financial Cycle

The system displays the previous month’s financial cycle.

3.3.0.1 Period Code

From

You can specify the period code from which the profit needs to be shared. The option list displays all period codes maintained in the system. You can select the appropriate one.

To

You can specify the period code until which the profit needs to be shared. The option list displays all period codes maintained in the system. You can select the appropriate one.

Period Type

Specify the type of period for which the profit sharing needs to be done. You can choose any of the following options available in the drop-down list:

- Notional - If you select this option, you can do a simulation of the profit calculation using this option. If notional is selected, the system will do the investment and profit calculation and display the details on the screen, but actual updation to the account will not happen

- Actual - If you select this option, the system will update calculated rate on the accounts on authorization of profit distribution.

Mudarabah Fund ID

You can specify the fund id for which the profit calculation needs to be done. The option list displays all fund IDs for which the profit has to run for the period codes. However if the profit distribution is done already then the system will not display those fund IDs.

Profit Calc Sequence Number

When you click save icon, the system defaults the ‘Profit Calc Sequence Number’ in this field.

Profit Equalization Amount

You can indicate the following preferences.

Credit/Debit

Indicate whether the PEA amount should be deducted from or added to the depositor’s profit. Select one of the following options:

- Credit - Choose this to add the PEA amount to the depositor’s profit.

- Debit - Choose this to deduct the PEA amount from the depositor’s profit.

Lcy

Specify the PEA amount (in local currency) that should be deducted from the depositor’s profit before deduction of the Mudarib fee. If you have chosen ‘Credit’ as the PEA criterion, then indicate the amount that should be added to the depositor’s profit. Mudarib fee will not be deducted in this case. Alternatively, if you have specified the PEA % for depositor’s investment, the system will compute the PEA amount in local currency and display it here.

PEA% for DEP Investment

Specify the amount that should be considered for PEA deduction/addition, as a percentage of the depositor’s profit. The PEA amount in local currency will be computed based on this figure. Alternatively, if you have specified the PEA local currency amount, the system will display the same as a percentage of the depositor’s profit.

You can view details of the batch by clicking the ‘View Profit Calc Log’ button.

The batch needs to be authorised in order to be submitted.

While executing this batch, the system computes the balance of each account, based on the profit calculation balance basis maintained for the linked account class. The system computes the cash reserve amount for each account based on the cash reserve ratio (CRR) maintained for the currency in the linked account class. If the CRR value is not maintained for the currency, it will consider the CRR specified for the account class a whole. It deducts the computed cash reserve amount from the account balance before applying weights in profit distribution.

The system considers the account balance after deduction of cash reserve ratio for depositor’s investment in profit sharing.

3.4 Profit Distribution Batch

This section contains the following topics:Section 3.4.1, "Invoking Profit Distribution Batch Screen"

- Section 3.4.1, "Invoking Profit Distribution Batch Screen"

- Section 3.4.2, "Profit Calculation Details Tab"

- Section 3.4.3, "Account Class Wise Profit Details Tab"

- Section 3.4.4, "Viewing Profit Distribution Batch Details"

3.4.1 Invoking Profit Distribution Batch Screen

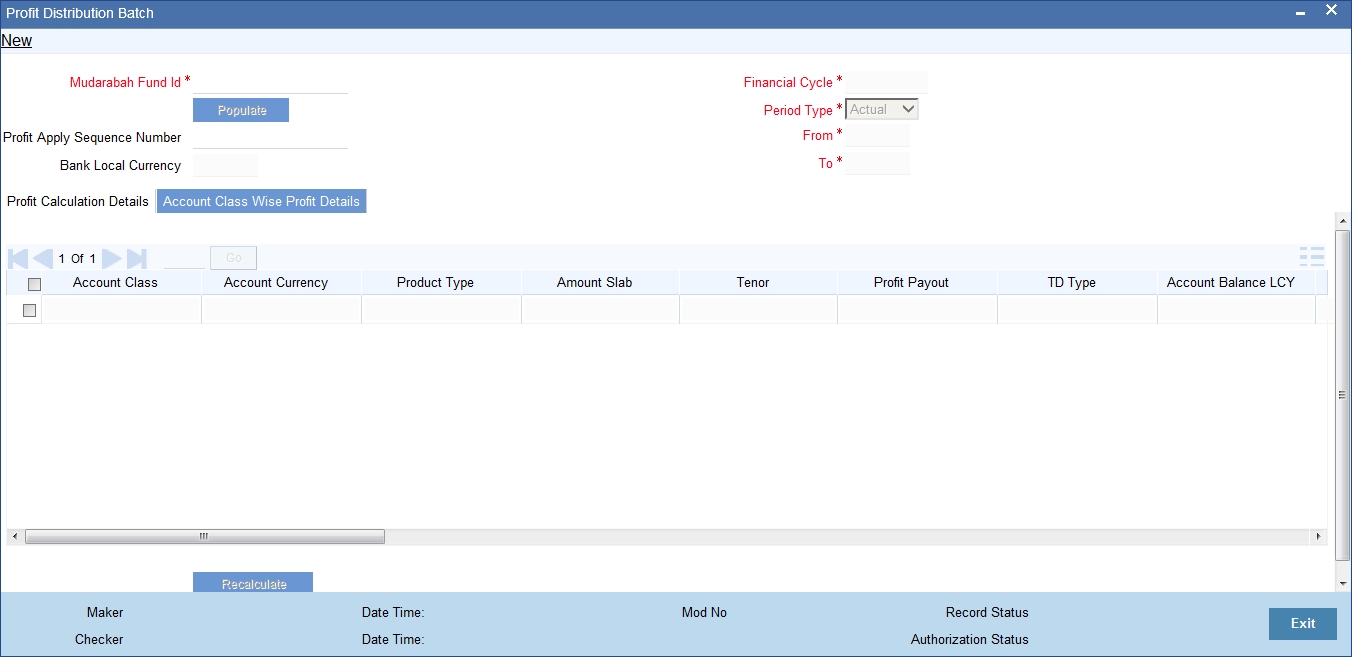

Profit sharing for a Mudarabah fund is primarily driven by the weights ratio between depositors and shareholders in the fund. As mentioned before, the weights for deposits are maintained in the ‘Weights Maintenance’ screen. You can capture the weight for shareholders and also compute the profit for depositors and shareholders in the ‘Profit Distribution Batch’ screen. You can invoke the ‘Profit Distribution Batch’ screen by typing ‘ICDPRABT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can capture the following details in this screen:

Mudarabah Fund ID

Specify the fund id for which the profit calculation to be done. Alternatively, you can select the fund ID from the option list. The list displays all fund Ids for which the profit has to run for the period codes.

If the profit distribution is done already then the system will not display those fund Ids.

Click ‘Populate’ button, to view the calculated profit.

Profit Apply Sequence Number

The system displays the sequence number. You can amend this value.

Bank Local Currency

The system displays the local currency code of the bank.

Financial Cycle

The system displays the financial cycle for which the profit is calculated.

Period Type

The system displays one of the following type of period for which the profit sharing needs to be done:

- Notional

- Actual

From

The system displays the previous month’s period code from which the profit needs to be shared.

To

The system displays the previous month’s period code until which the profit needs to be shared.

3.4.2 Profit Calculation Details Tab

Click ‘Profit Calculation Details’ tab to view the various investment details.

You can specify the following details:

Share Holders Investment Details

Share Holders

On selecting the Mudarabah fund ID, the system displays the total investment of the fund as contributed by the shareholders.

This amount is computed on the basis of all the liability GLs that are linked to the particular Mudarabah fund ID.

Share Holders ADJ

Specify the adjustment amount posted to the shareholders’ contribution.

Weights in %

The system displays the weight (as a percentage of the total shareholders’ investment) that should be used to compute the profit for shareholders. The system shows a default value of ‘100%’. You can amend this value.

Depositors' Investment Details

Depositors

For the selected Mudarabah fund ID, the system displays the total investment of the fund as contributed by the depositors.

The system arrives at this amount based on the preference set in the ‘Profit Contribution Balance Basis’ field in the ‘Account Class Maintenance’ screen for the account class to which the particular Mudarabah fund ID is linked.

Effective Depositors Investment

The system displays the investment details of the depositors.

Profit Equalization

Credit/Debit

Indicate whether the profit amount should be deducted from or added to the depositor’s profit. Select one of the following options:

- Credit - Select this option to add the profit amount to the depositor’s profit.

- Debit - Select this to deduct the ptofit amount from the depositor’s profit.

LCY

Specify the PEA as a fixed amount in the bank’s local currency.

PEA % for Depositor Investment

Specify the profit equalization amount to distribute to the depositors

If your bank makes more-than-expected profit, you can set aside some profit as ‘Profit Equalization Amount’. You can use this amount to distribute to the depositors in the months of losses.

Investment Risk Ratio

Credit/Debit

Indicate whether the IRR amount should be deducted from or added to the depositor’s profit. Select one of the following options:

- Credit - Select this option to add the IRR amount to the depositor’s profit.

- Debit - Select this to deduct the IRR amount from the depositor’s profit.

LCY

Specify the IRR amount that should be deducted from the depositor’s profit after allocation of PEA and deduction of the Mudarib fee. Alternatively, if you have specified the IRR% for depositor’s investment, then the system will compute the IRR amount in local currency and display it here upon clicking the Save button.

IRR

Specify the amount that should be considered for IRR deduction/addition, as a percentage of the depositor’s profit. The IRR amount in local currency will be computed based on this figure. Alternatively, if you have specified the IRR local currency amount, the system will keep this field blank. After specifying the IRR local currency, even if you specify a value here, the system will make it blank upon clicking the Save button.

IRR will be deducted after PEA and Mudarib fee,

PEA/IRR

PEA GL

The system displays the balance of the PEA GL for the Mudarabah fund. This amount is computed on the basis of the liability GL (specified as PEA) that is linked to the particular Mudarabah fund ID.

PEA GL ADJ

Specify the adjustment amount posted to the PEA GL contribution.

IRR GL

The system displays the balance of IRR liability GL. This balance is computed based on the ‘Profit Contribution Balance Basis’ specified in the ‘Islamic Profit Calculation GL Maintenance’ screen.

Total Investment

Total

The system displays the total investment of the fund.

Total Adjusted

The system displays the sum of the Shareholder, Depositor and PEA contribution after adjustment.

Effective Weight %

Share Holders Effective Weights

The system displays the effective weight of the shareholders as a percentage of the total shareholders’ investment.

Depositors Effective Weights

The system displays the effective weight of the depositors as a percentage of the total depositor’s investment.

Total Profit

Total

The system displays the total profit for the Mudarabah fund.

Profit Adjusted

Specify the total profit adjustment amount.

Profit After ADJ

The system displays the total amount less the profit adjustment.

Share Holders

The system displays the total profit for shareholders based on the effective investment ratio calculated earlier.

Depositors

The system displays the profit share for depositors based on the effective investment ratio.

Total PEA ADJ Amount

The system displays the total PEA adjustment amount made for the depositor.

Depositors Profit After PEA

The system displays the depositors’ share of profit after PEA.

Total Mudarib Fee Amount

The system displays the Mudarib fee amount that is deducted from the depositors’ share of profit.

Depositors Profit After Fee

The system displays the depositor’s fee amount that is deducted from the depositors’ share of profit.

Depositors Profit After IRR

The system displays the depositors profit after deducting the Investment Risk Reserve (IRR) amount.

Total Ad hoc Adjustment Amount

The system displays the sum of the adjustment amounts made for the depositors.

Final Depositor Profit

The system displays the final profit of the depositor.

Click ‘Get Details’ button, to recalculate the profit.

Click ‘View Profit Apply Log’ button to view the profit details.

3.4.3 Account Class Wise Profit Details Tab

Click ‘Account Class wise Profit Details’ tab to view the profit details. You can do adjustments to PEA, Mudarib fee and give Adhoc adjustment amount.

Clicking ‘Get Details’ button, the system will recalculate the profit in this tab.

You can view the following details:

- Account Class

- Account Currency

- Product Type

- Amount Slab

- Tenor

- Profit Payout

- TD Type

- Account Balance LCY

- Weights

- Effective Depositor Investment

- Profit Amount

- PEA %

- PEA LCY

- PEA Adjustment LCY

- Profit After Adjustment of PEA

- Annualized Rate after PEA ADJ

- Mudarib Fee Percentage

- Mudarib Fee LCY

- Adj.Mudarabah Fee LCY

- Profit After Mudarib Fee Adjustment

- Annualized Rate After Mudarib Fee ADJ

- IRR Amount

- Profit After IRR

- Adhoc Adjustment Amount

- Profit After Adhoc ADJ

- Annualized Rate After Adhoc ADJ

- Adjusted Annualized Rate in %

Click ‘Recalculate’ button to recalculate the profit based on the adjustments done.

After recalculating, if you click ‘Get Details’ button in ‘Profit Calculation Details’ tab the, system will re-populate the account class wise profit details. You need to specify the adjustment entries again.

The system will validate if the difference between the final adjusted annualized rate and annualized rate after adhoc adjustment is within the limit maintained in bank parameter level. If not, the system will display a configurable override message.

The system will also display a separate error message for each record for which the validation fails.

The system will calculate the final profit after doing adjustments as follows:

Column |

Fields |

Description |

a |

Total Profit |

Derived from GL linkages to Fund Id |

b |

Profit Adjustment (editable) |

Editable adjustment field |

c |

Profit after adjustment |

a – b |

d |

Shareholders profit (derived field) |

= c x Shareholders effective Weights % |

e |

Depositors profit (derived field) |

= c x (depositors effective weight %) |

f |

PEA Amount |

Derived from the final PEA amount column of profit screen grid |

g |

PEA % for Depositor Investment |

User provides the % , upon get details system will derive the PEA amount. |

h |

Depositors profit after deducting PEA |

e-f |

i |

Mudarib Fee Amount |

Derived from the final (sum) Mudarib fee column of Account class wise profit screen grid. |

j |

Depositors profit after fee |

g – h |

k |

Depositors profit after IRR |

I (+/- Dr/Cr) IRR LCY amoun |

l |

Adhoc Adjustment Amount |

Derived from the (sum) Adhoc adjustment column of Account class wise profit screen grid |

m |

Final Depositor Profit |

K+J |

The system will update new rate to all the accounts which are opened between the PDM start date and the date on which the distribution batch is authorized.

3.4.4 Viewing Profit Distribution Batch Details

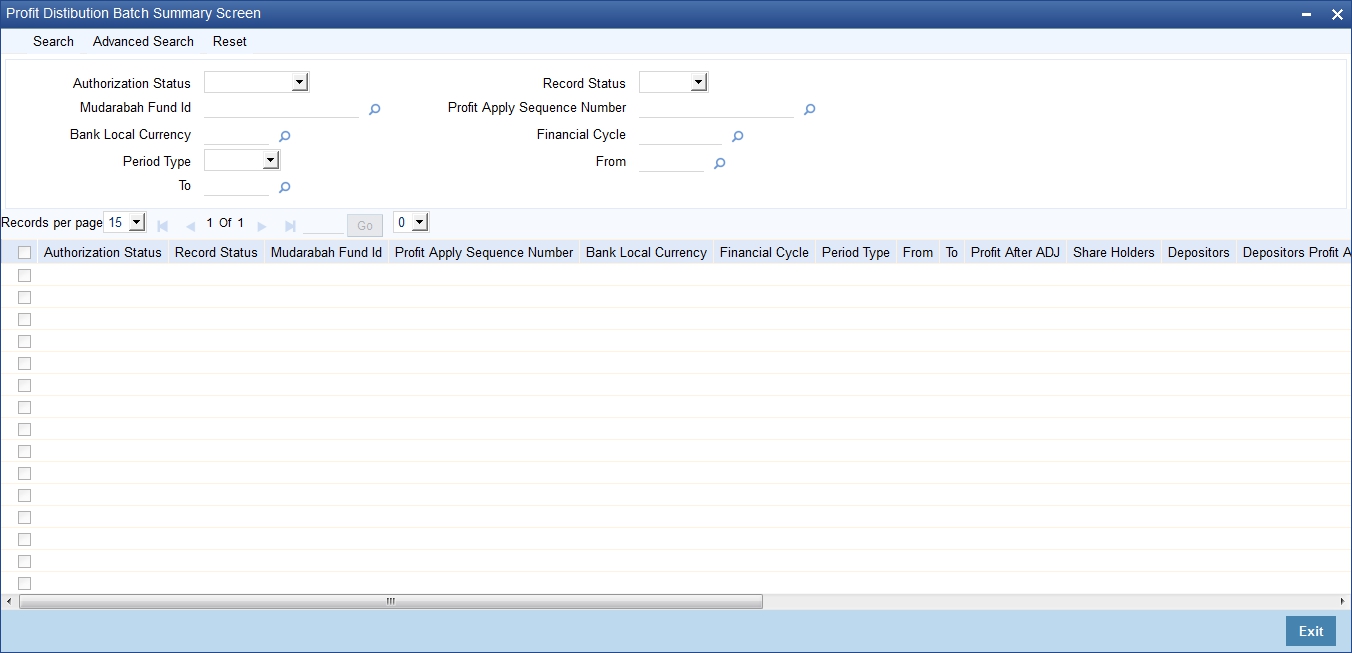

You can view profit distribution details using ‘Profit Distribution Batch Summary’ screen. You can invoke this screen by typing ‘ICSPRABT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

- Authorization Status

- Record Status

- Mudarabah Fund Id

- Bank Local Currency

- Period Type

- Profit Apply Sequence Number

- Financial Cycle

- From

- To

Select any or all of the above parameters for a query and click ‘Search’ button. The following records are displayed.:

- Authorization Status

- Record Status

- Mudarabah Fund Id

- Profit Apply Sequence Number

- Bank Local Currency

- Financial Cycle

- Period Type

- From

- To

- Profit After ADJ

- Share Holders

- Depositors

- Depositors Profit After PEA

- Total Mudarib Fee Amount

- Depositors Profit After Fee

- Depositors Profit After IRR

- Total Ad hoc Adjustment Amount

- Final Depositor Profit

3.5 Zakat Batch Process

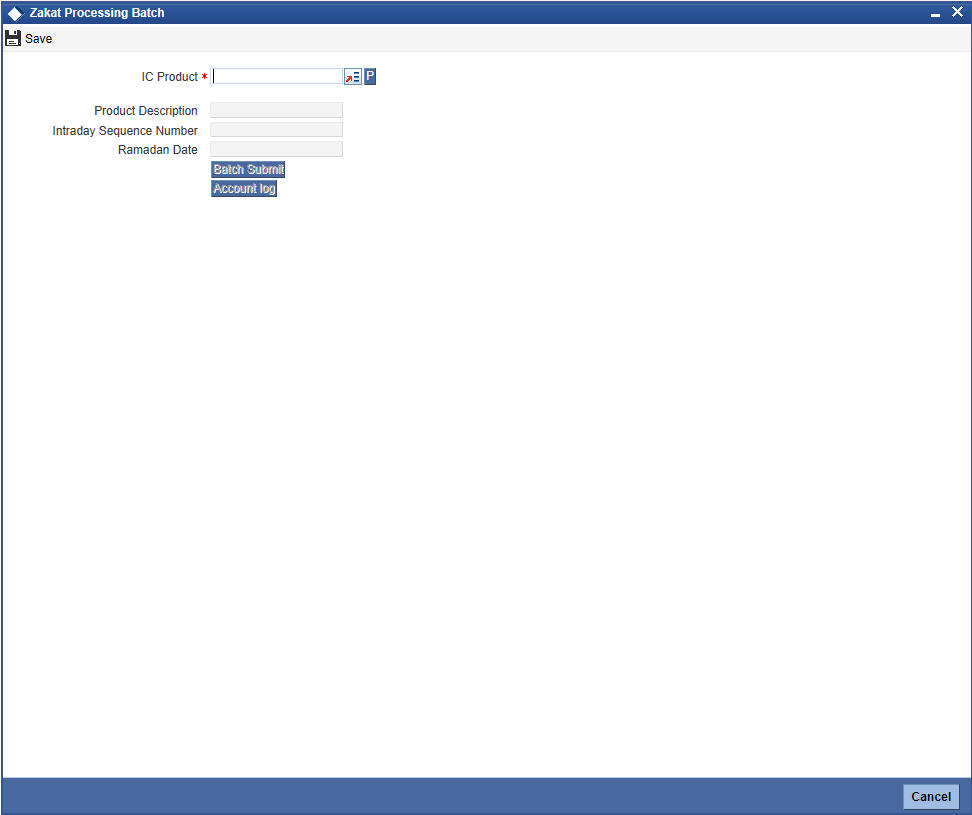

The Zakat processing batch needs to be run for all the savings accounts for which the ‘Zakat Exemption’ option is unchecked in the ‘Customer Accounts Maintenance’ screen. You can run this batch through the ‘Zakat Processing Batch’ screen. You can invoke this screen by typing ‘ICDZAKBT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here you can capture the following details:

IP Product

Specify an IP product maintained for Zakat computation. The adjoining option list displays all the IP products maintained in the system. You can select the appropriate one from there. Also, you can select ‘All’ and execute batch for all Zakat products.

You can run this batch on the First Day of Ramadan. On execution of this batch process, the Zakat will be automatically calculated and deducted from the accounts to which the chosen IP product is linked. If this batch is re-run on the same date, then the accounts where Zakat has already been liquidated will not be charged again.

If the batch is run after a day, the computation will take place on the Ramadan date.

3.5.1 Status Change Batch Processing (CSDSTBTC)

For the IA module the Status change batch will be run along with the customer/Group and apply worst status change for the customer. This batch will use the status change events.

You can trigger the batches to run before the Common Status Change

batch (CSDSTBTC).

The following given batches can be run in any order:

- LCEOD

- BCAUSTCH

- CLBATCH

- ICEOD

- CIDBATCH

- MODBATCH

- CASABAT

- IAAUTDLY

- CSDSTBTC

- ICEOD

- CLDPROV

- MODPROV

- CIDPROV

If ‘Status Processing’ is at Individual Contract Level, then system will trigger status change based on the Customer Credit rating for the customer of the Contract /Account booked. The other contracts of the customers in the same Group will not be impacted. However if the ‘Status Processing’ is at CIF/Group level individual module (LC,CL, CI, MO, CA, IA and BC) batches will be updating common storage with the derived status of each contract and CIF/Group level status will be triggered by the common status change batch. The common status change batch will call the individual module function for status change processing.