4. Defining a Leasing Product

A product is a specific service that you offer your customers. For example, amongst other financial services, you may offer Financial Lease. Financial Lease can be of different types:

- Financial Lease provided for purchase of Agricultural Land

- Financial Lease provided for purchase of Non Agricultural Land

Financial Lease for purchase of Agricultural Land and Financial Lease provided for purchase of Non Agricultural Land are examples of specific services that you offer. All Financial Lease for purchase of Agricultural Land that you issue would involve the product, Financial Lease provided for purchase of Agricultural Land.

A product, helps classify the lease that you issue, according to broad groups (such as, for growing cash crops, non-cash crops etc.,) having some common features.

The other advantage of defining a product is that you can define certain general attributes for a product. These attributes will default to all contracts involving it.

In this chapter, we shall discuss the manner in which you can define attributes specific to a Leasing product.

You can create a leasing product in the ‘Product’ screen, invoked from the Application Browser. In this screen, you can enter basic information relating to a lease product such as the Product Code, the Description, etc.

This chapter contains the following sections:

- Section 4.1, "Setting up Product"

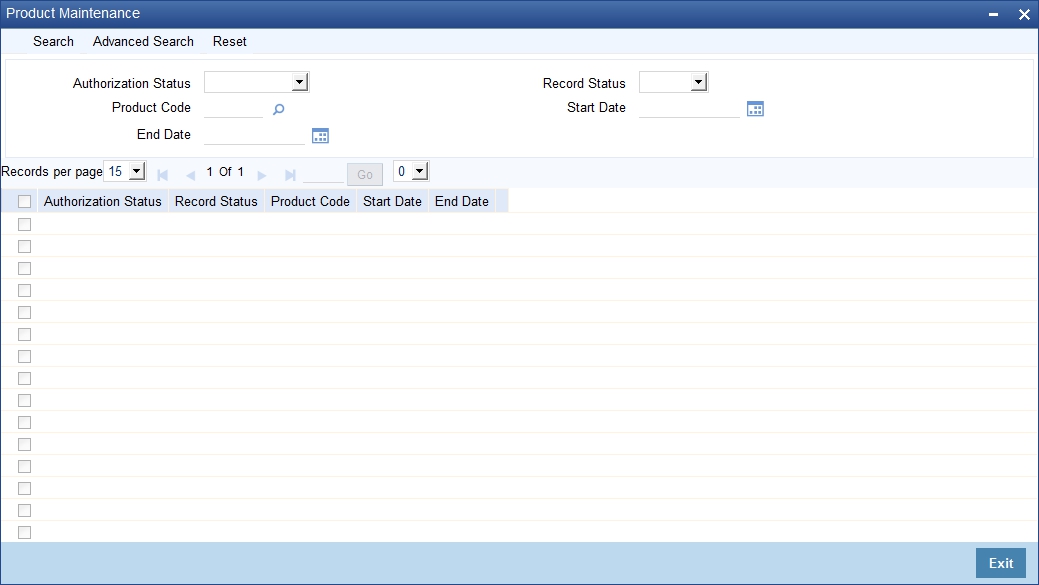

- Section 4.2, "Viewing Product Summary Details"

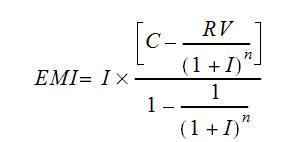

- Section 4.3, "Processing EMI on Lease"

4.1 Setting up Product

This section contains the following topics:

- Section 4.1.1, "Setting up a Product Details"

- Section 4.1.2, "Defining Other Attributes of the Product"

- Section 4.1.3, "Specifying User Data Elements"

- Section 4.1.4, "Specifying Product Preferences"

- Section 4.1.5, "Specifying Components"

- Section 4.1.6, "Specifying Notices and Statements"

- Section 4.1.7, "Mapping Accounting Role to Product"

- Section 4.1.8, "Specifying Account Status"

- Section 4.1.9, "Specifying Events"

- Section 4.1.10, "Maintaining Branch /Currency Restriction"

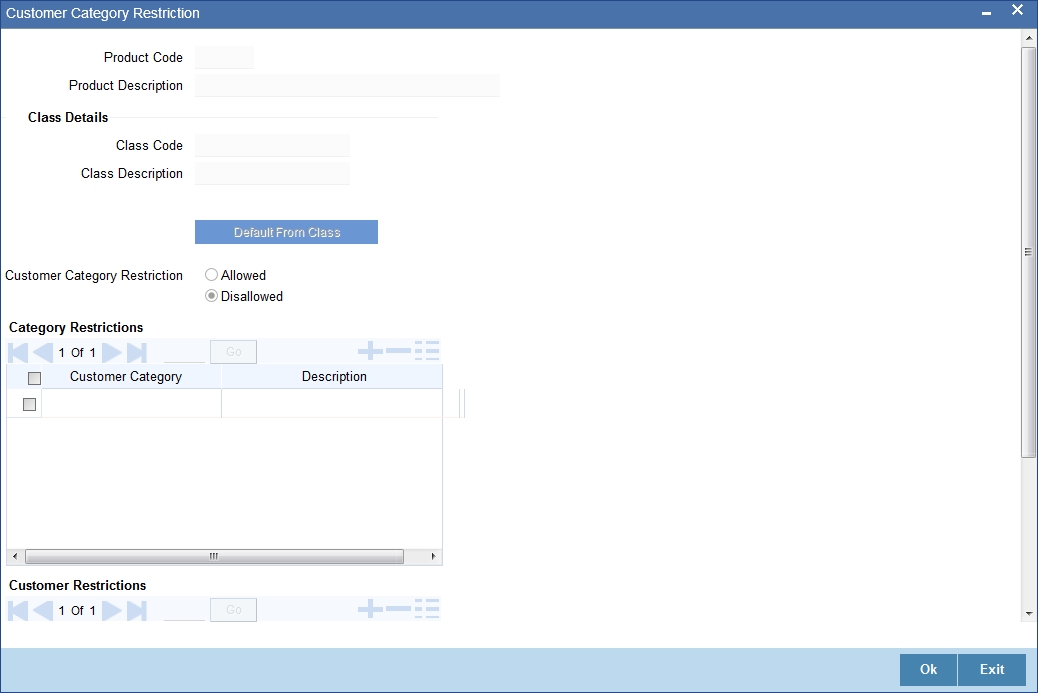

- Section 4.1.11, "Restricting Customer Category"

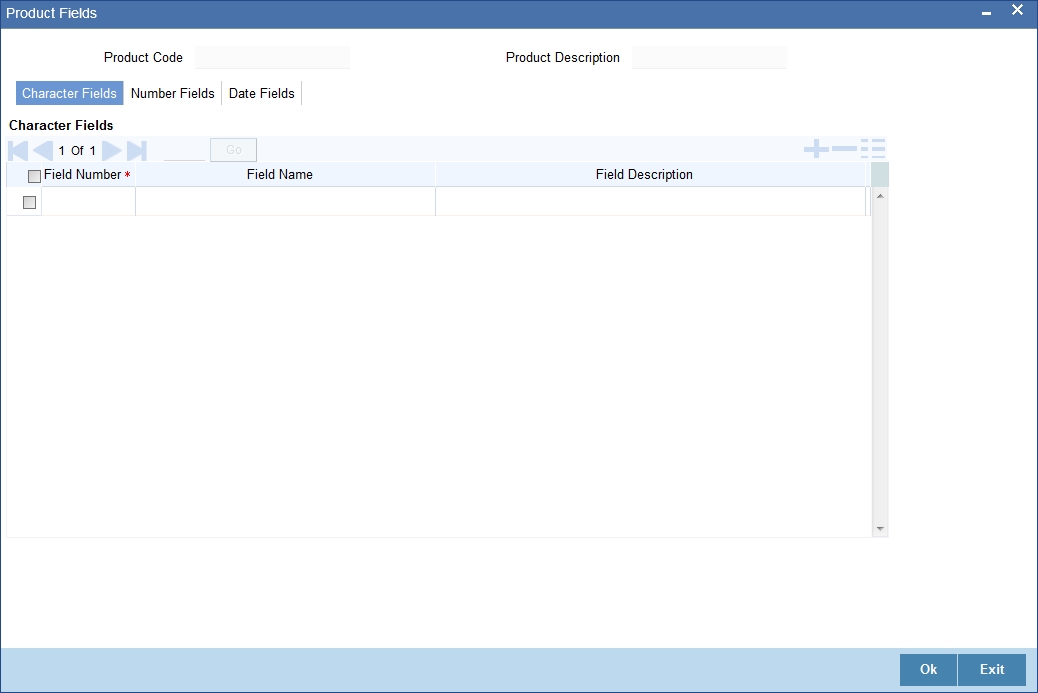

- Section 4.1.12, "Defining Product Fields"

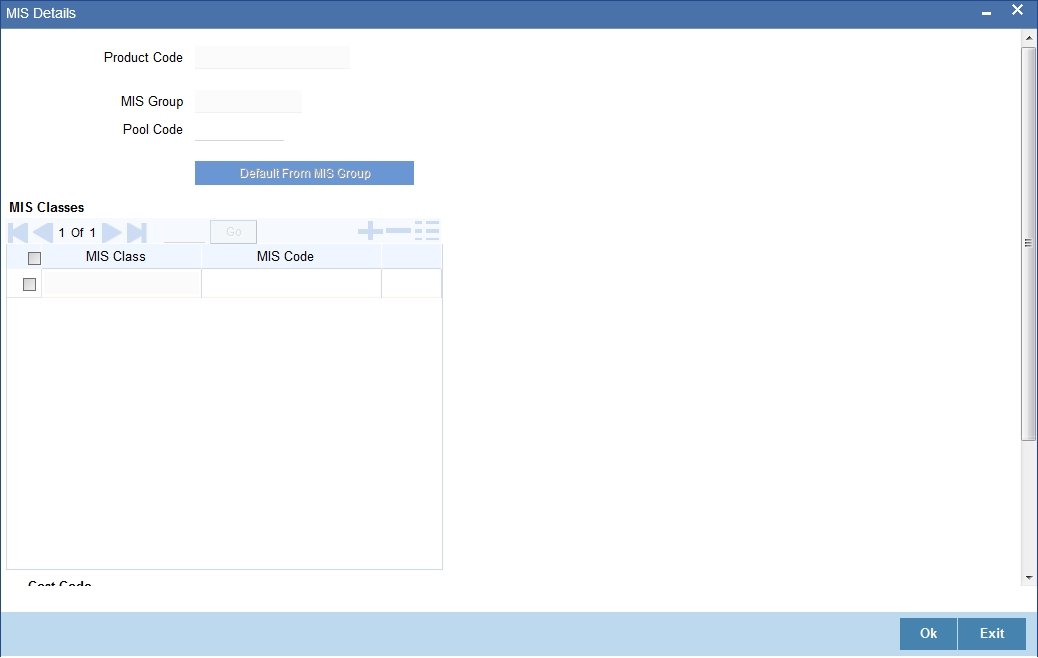

- Section 4.1.13, "Associating an MIS Group with the Product"

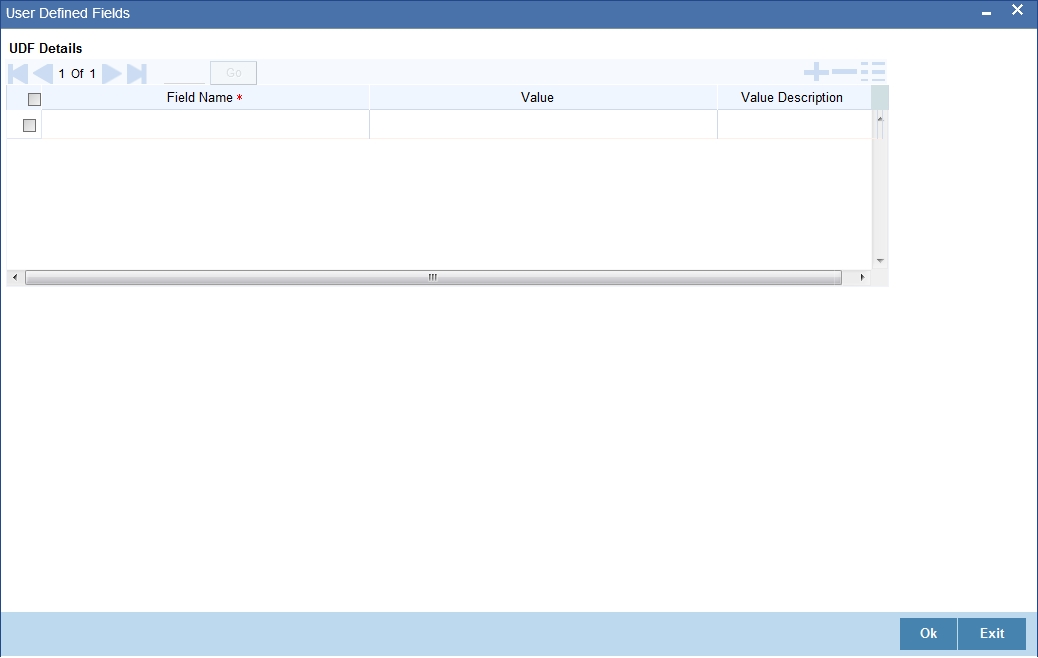

- Section 4.1.14, "Defining User Defined Fields"

4.1.1 Setting up a Product Details

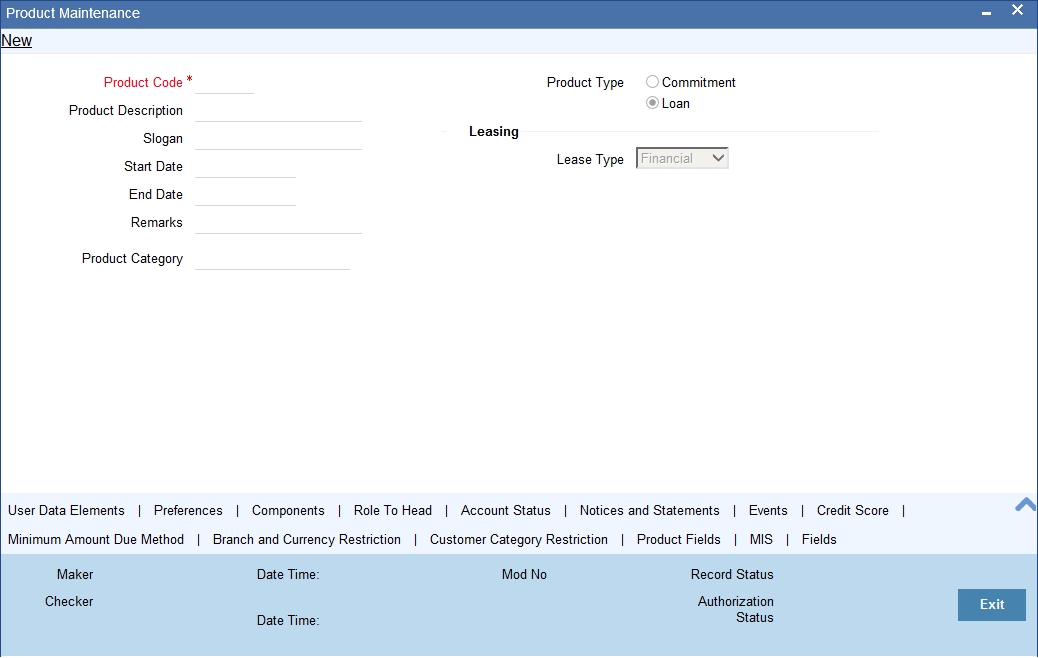

You can capture product details in the ‘Product’ screen. You can invoke the ‘Product’ screen by typing ‘LEDPRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

In this screen, you can enter basic information about a product such as the Product Code, the Description, etc. Information related to specific attributes of a product such as end date, preferences, components, events etc. have to be defined in the respective sub-screens.

Product Code

Specify the unique identifier for the leasing product in Oracle FLEXCUBE.

Product Description

Enter a brief description to identify the product code.

Slogan

You can enter marketing punch line for any product you create. This slogan will be printed on all advices that are sent to the customers who avail of the product.

For example, if you set up a borrowing product called Money Multiplier, you could enter the slogan ‘Watch your money grow with Money Multiplier.’

Product Category

The system displays the category of the product as ‘Leasing’.

Start Date and End Date

A product can be defined to be active over a specific period. When you create a product, you can specify a ‘Start Date’ and ‘End Date’ for it. The product can only be used within the specified period (i.e. within the Start Date and End Date).

If you do not specify the Start Date, the branch date will be displayed as the Start Date.

If you do not specify an End Date for a product, it can be used for an indefinite period.

The start and end dates of a product come in handy when you are defining a product that you would like to offer over a specific period.

Remarks

When creating a product, you can enter information about the product intended for your bank’s internal reference. This information will not be printed on any correspondence with the customer.

Leasing

Specify the following under leasing in the screen:

Lease Type

Select the type of lease from the adjoining drop-down list. This list displays the following values:

- Financial

- Operational

4.1.2 Defining Other Attributes of the Product

After specifying the basic details of a product, you can define finer attributes for the product in the appropriate buttons provided. Click on the button provided for this purpose. Each button is explained briefly in the table below:

| Button | Description | ||

|---|---|---|---|

| User Data Elements | To define the UDEs and Components relating to the product | ||

| Preferences | To indicate your preferences specific to the product | ||

| Components | To specify the component details, schedule definition and formulae for the product | ||

| Notices and Statements | To specify details of notices and account statements to be issued to customers. These have to be generated for different events in the life cycle of a lease. | ||

| Role to Head | To specify accounting roles and account heads for the product. (The concept of accounting roles and heads is explained later) | ||

| Account Status | To indicate the status preferences for the product | ||

| Events | To specify events | ||

| Branch/Currency Rest | To define the branch and currency restrictions for the product | ||

| Customer Category Restriction | To Define the Customer Category Restrictions and Customer Access Restrictions for the Product | ||

| Fields | To associate User Define Fields(UDFs) i.e. Character Fields, Number Fields and Date Fields, with the product | ||

| MIS | To associate MIS details with a product. | ||

| Product Fields | To define additional fields that are available for use depending on the bank’s requirement |

Note

There are some fields in the product screens, to which input is mandatory. If you try to save a product without entering details in these fields, the product will not be saved.

When you save a product that you have created, your user ID will be displayed in the ‘Input By’ field and the date and time at which you saved the product in the ‘Date/Time’ field. The Status of the product will be updated as ‘Unauthorized’. A product is available for use only after it has been authorized by another user.

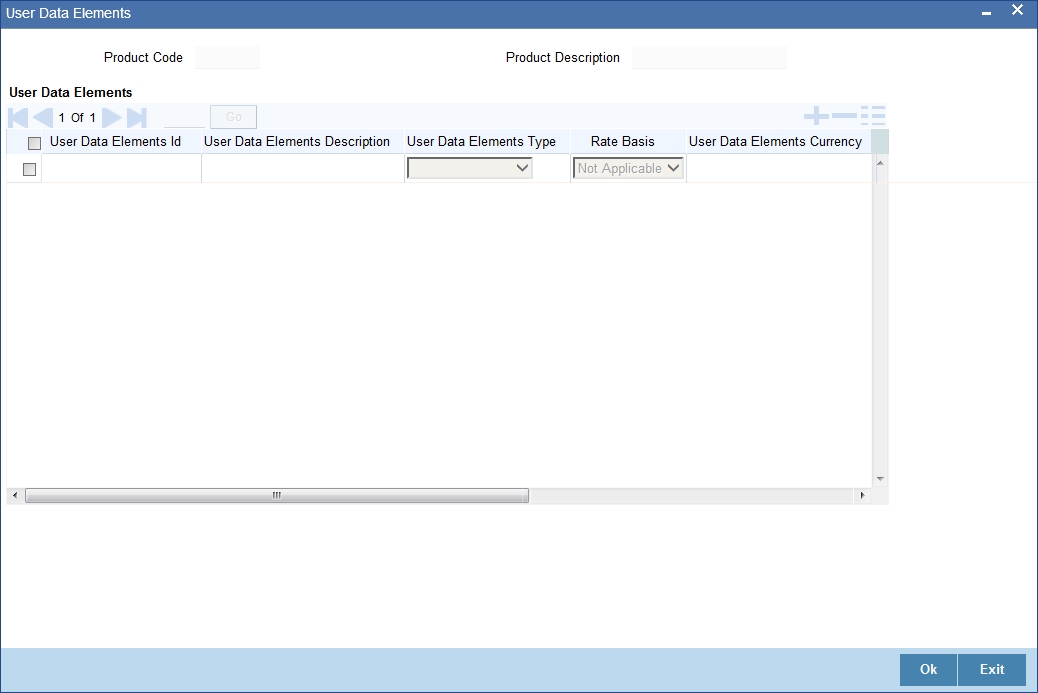

4.1.3 Specifying User Data Elements

You can define the User Data Elements in the ‘User Data Elements’ screen. Invoke this screen by clicking ‘User Data Elements’ button. The following screen displays:

To define a User Data Element (UDE), you have to specify the following details in the screen:

User Data Elements ID

Data elements like the rate at which interest has to be applied, the tier structure based on which interest needs to be computed etc. are called User Data Elements (UDEs). These are, in effect, elements for which you can capture the values. You have to specify a unique ID to identify the UDE in the system.

User Data Elements Description

You can also provide a brief description of the UDE being defined.

User Data Elements Type

UDE Type will describe the nature of the UDE. Select the type of UDE from the adjoining drop-down list. This list displays the following values:

- Amount

- Number

- Rate

- Rate Code

User Data Elements Currency

If the UDE type is ‘Amount’, you should specify the currency of the UDE. Specify a valid currency in which the UDE amount is counted. This adjoining option list displays all valid currencies maintained in the system. You can choose the appropriate one.

Minimum Value

Specify the floor limit for the UDE value. This means that the actual UDE value cannot be less than the rate specified here. Note that this amount has to be less than the maximum UDE value. The system will throw an error message if the minimum UDE value is greater than the maximum UDE value.

Maximum Value

Specify the ceiling limit for the UDE value. This means that the actual UDE value cannot be greater than the rate specified here. Note that this amount has to be greater than the minimum UDE value. The system will throw an error message if this value is less than the minimum UDE value.

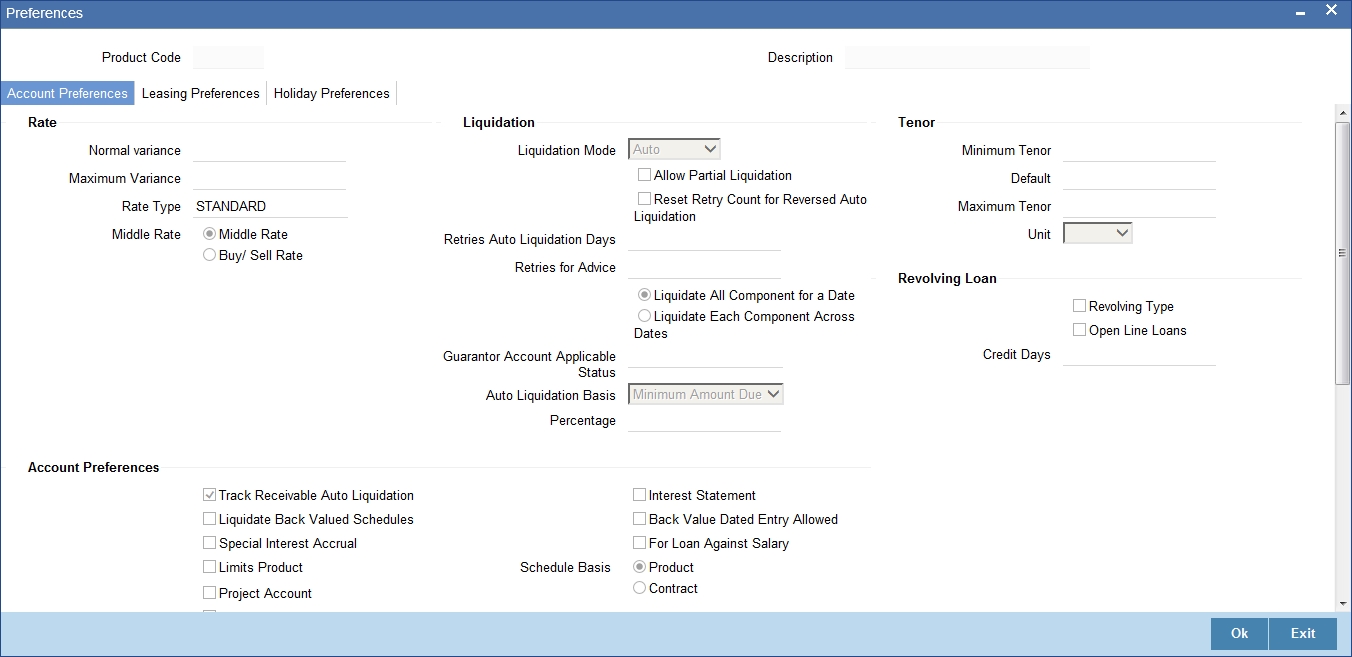

4.1.4 Specifying Product Preferences

Preferences are the options that are available to you for defining the attributes of a lease product. These could be:

- The manner in which the system should handle schedules falling due on holidays

- The tenor details for the lease

- Whether receivables should be tracked for the lease etc.

The options you choose, ultimately, shape the product. These details are used for lease processing.

Click ‘Preferences’ button in the ‘Product’ screen to move to this section of the screen.

You should maintain the following preferences for the loan product:

4.1.4.1 Account Preferences tab

Rate

The exchange rate preferences include the following:

Rate

Indicate the exchange rate applicable for the product you are maintaining. The available options are:

- Mid Rate

- Buy/Sell Rate

By default, the Buy/Sell Rate is used.

Rate Type

Specify a valid type of the rate that should be used for the product. This adjoining option list displays all valid types of rate maintained in the system. You can choose the appropriate one.

The ‘Rate’ and ‘Rate Type’ are used in combination to determine the actual rate applicable for currency conversion.

The default value for Rate Type is ‘STANDARD’. This means that, if you choose ‘Mid Rate’, the mid rate maintained for the STANDARD code is used for the loans created under the product.

Maximum Variance

Specify the maximum limit for rate variance. This is expressed in percentage. The variance between the exchange rate (specified for the product) and the rate captured for a loan (at the account level) should not be greater than the value specified here. If the exchange rate exceeds the maximum variance that you have defined for the product, the system will not allow you to save the loan. The transaction is rejected.

This value should be greater the value for ‘Normal Variance’.

Normal Variance

Specify the minimum/normal variance allowed for the rate. If the exchange rate variance between the exchange rate (specified for the product) and the rate captured for a loan exceeds the value specified here, the system will display an override message before proceeding to apply the exchange rate. The normal variance should be less than the maximum variance.

For back valued transactions, the system applies the rate on the basis of the exchange rate history. The variance will be based on the rate prevailing at that time.

Account Preferences

As part of specifying the account preferences, you can indicate the following:

Track receivable Auto Liquation

Check this box to indicate that the receivables should be tracked during auto liquidation.

Liquidate Back Valued Schedules

Check this box to indicate that the schedules with a due date less than the system date should be liquidated on the initiation of back valued lease account.

Special Interest Accrual

Check this box to indicate that the accrual computation should be based on formula specified for a component. Otherwise, interest accrual will be done based on the number of days in the schedule.

Back Period Entry Allowed

Check this box to indicate that the lease account should be allowed to process transactions with a value date less than the current system date.

Interest Statement

Check this box to indicate that the interest statement should be generated for the account.

Product for Limits

Check this box to indicate that the product is for limits. If you check this option, the product will be available for limits linkage during line creation.

Partial Block Release

Check this box to indicate whether the partial release of term deposit should be done as part of loan repayment.

Schedule Basis

You should also specify the schedule basis for the rolled over lease. The new lease can inherit the schedules from the lease product or you can apply the schedules maintained for the original loan itself.

Liquidation

Liquidation preferences include the following:

Liquidation Mode

Indicate the mode of liquidation that you are maintaining. You can select one of the following options:

- Manual

- Auto

- Component

The default value for liquidation mode is ‘Manual’. At the end of the day, liquidation will be done according to the specified mode.

Allow Partial Liquidation

In case of insufficient funds, check this box to indicate that the partial liquidation should be done automatically to the extent of funds available in the account you are maintaining. However, if this check box is not selected, the schedule amount due will not be liquidated if sufficient funds are not available in the account.

Reset Retry Count for Reversed Auto Liquidation

If you have maintained a limit on the number of retries for auto liquidation, this option will reset the retries count to zero during reversal of auto liquidation. This will be applicable from the date of reversal of payment. Hence, the system will once again attempt auto liquidation till the number of retries allowed. The system will update the status of the reversed payment to ‘Unprocessed’ after which it again attempts auto liquidation.

Retries Auto Liquidation Days

Capture the number of working days for which the system should attempt auto liquidation. The number of retries per day will depend on the configuration maintained for the ‘Liquidation Batch Process’ - during BOD, EOD or both. For instance, if the batch is configured for both EOD and BOD, and the number of retry days is ‘1’, then, auto liquidation is attempted twice on the same day i.e. once during BOD and another retry at EOD.

Retries for Advice

Specify number of times you want to retry generation of advice. The number of retries should be less than ‘Retries Auto Liquidation Days’. When auto liquidation fails and advice retry count is reached, the system generates a failure advice and sends it to the customer to initiate an appropriate action for the successful execution of the advice.

Tenor

Specify the following under Tenor in the screen:

Minimum Tenor

Specify the minimum amount of time that the customer can take to decide on the ‘rate plan’ and intimate the bank about the decision.

Maximum Tenor

Specify the maximum amount of time that the customer can take to decide on the ‘rate plan’ and intimate the bank about the decision.

Unit

Select the unit for the rate plan tenor from the drop-down list. The following options are available for selection:

- Monthly

- Yearly

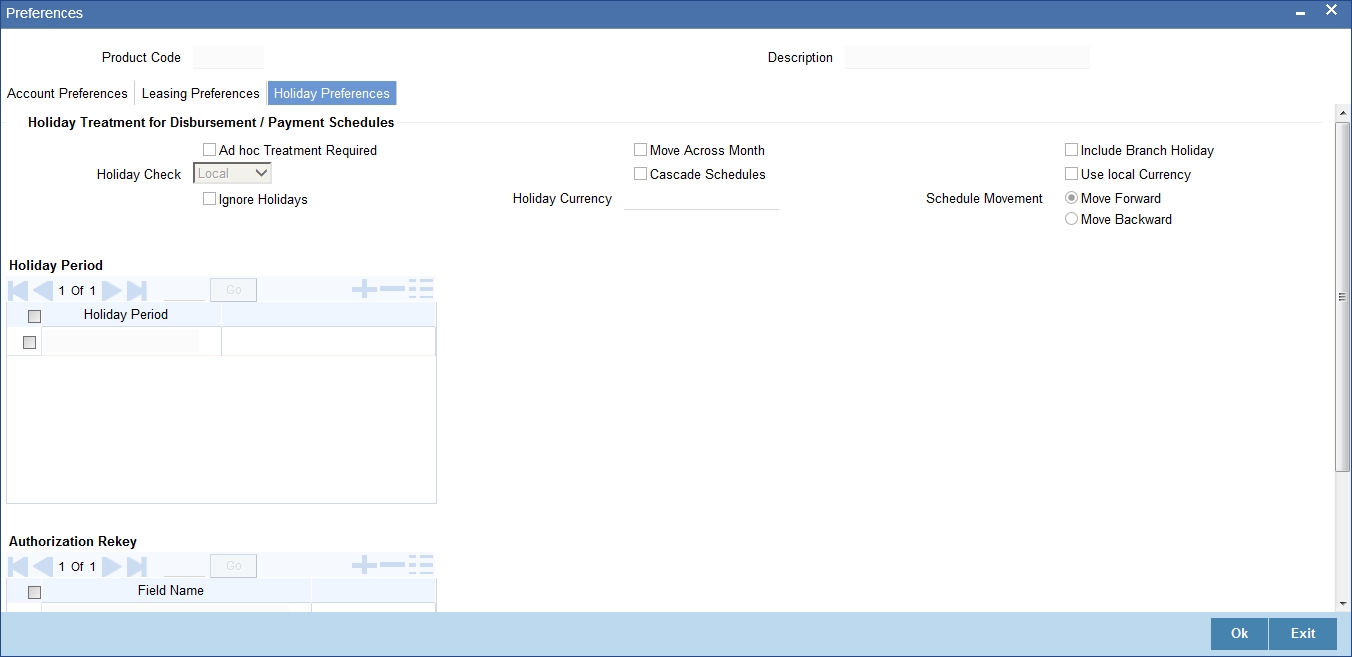

4.1.4.2 Holiday Preferences Tab

The value date/maturity date of a contract might fall on a holiday defined for branch or on a holiday specified for the currency involved in the contract.

You need to specify the following holiday parameters, which has to be considered for holiday handling:

Holiday Treatment for All Schedules

The schedule date of a contract might fall on a local holiday defined for your branch or on a holiday specified for the currency involved in the contract.

You need to specify the following holiday parameters, which has to be considered for holiday handling:

Adhoc Treatment Required

Check this option to allow the movement of due dates of the schedules that fall on the newly declared holidays. This option is enabled only if the options, Ignore Holidays parameter and the Cascade Schedules parameter are not checked at the product level.

Move Across Month

Check this box to indicate that the schedule date falling on a holiday should be allowed to cross over into next/previous month.

If you have specified to move the schedule date of a lease falling due on a holiday, either to the next or previous working day and the movement crosses over into a different month, then this option will determine whether the movement should be allowed or not.

Ignore Holidays

Check this box to indicate that the holidays should be ignored while fixing schedule date. In such a case, if a schedule date falls on a holiday, the automatic processing of such a schedule is determined by your holiday handling specifications for automatic processes, as defined in the ‘Branch Parameters’ screen.

Cascade Schedules

Check this box to indicate that the schedule should be cascaded to all the other schedules fall on holidays. Hence, when you move a cascaded schedule which falls due on a holiday to the next or previous working day (based on the ‘Branch Parameters’), the movement happens to other schedules too.

If not selected, only the affected schedule will be moved to the previous or next working day, as the case may be, and other schedules will remain unaffected.

However, when you cascade schedules, the last schedule (at maturity) will be liquidated on the original date itself and will not be changed like the interim schedules. Hence, for this particular schedule, the interest days may vary from that of the previous schedules.

Include Branch Holiday

Check this box to indicate that the branch holiday should be considered for schedule date.

Indicate the type of movement of the schedule that you are maintaining. You can select one of the following options:

- Move Forward: Indicates that the schedule date falling due on a holiday will be moved forward to the next working day.

- Move Backward: Indicates that the schedule date falling due on a holiday will be moved backward to the previous working day.

However, if you opt to ignore the holidays and do not select the ‘Move Across Months’ option, the system Ignores the holidays and the due will be scheduled on the holiday itself.

Holiday Check

Select the type of holiday to be considered for schedule date from the adjoining drop-down list. This list displays the following values:

- Currency

- Local

- Both

Holiday Currency

Specify the currency based on which holiday check needs to be done for leases under this product. Input to this field will be mandatory if you have indicated ‘Currency’ in the ‘Holiday Check’ field. The adjoining option list displays all valid currency codes maintained in the system. You can select the appropriate one.

Auth Re-key Fields

As a cross-checking mechanism to ensure that you are invoking the right lease for authorization, you can specify that the values of certain fields should be entered, before the other details are displayed. The complete details of the lease will be displayed only after the values to these fields are entered. This is called the re-key option. The fields for which the values have to be given are called the re-key fields.

You can specify the values of a lease that the authorizer is supposed to key-in before authorizing the same.

You can select the fields from the option list provided. If no re-key fields have been defined, the details of the loan will be displayed immediately once the authorizer calls the loan for authorization.

The re-key option also serves as a means of ensuring the accuracy of the data captured.

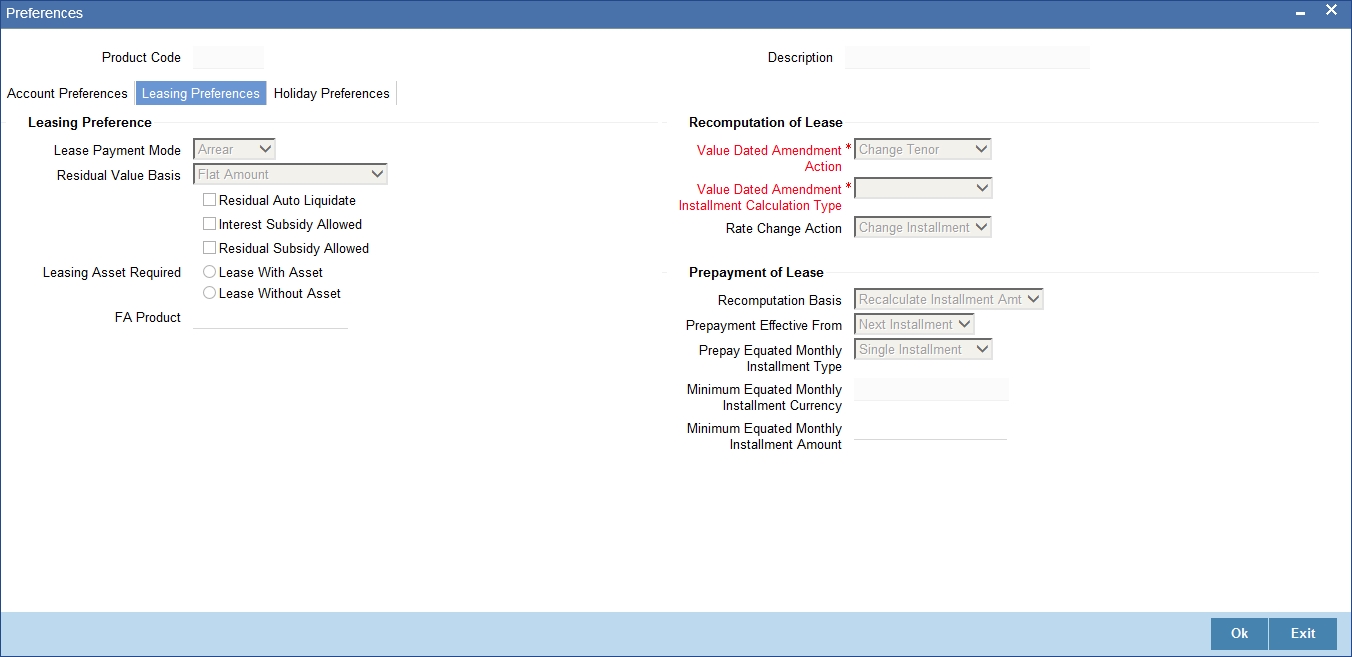

4.1.4.3 Leasing Preferences Tab

The leasing preferences include the following:

Lease Payment Mode

Select the mode of payment of the lease from the adjoining drop-down list. This list displays the following values:

- Advance: The payment is made in the beginning of the schedule.

- Arrears: The payment is made in the end of the schedule.

Residual Value Basis

Residual amount is the price at which a lessee can buy the asset at the end of the lease. Select the basis of residual amount from the adjoining drop-down list. This list displays the following values:

- Percentage of asset amount

- Flat amount

- Percentage of lease amount

Using the aforementioned basis the system calculates the residual amount during the processing of contract. The value computed by the system can be altered while account booking.

Residual Auto Liquidate

Check this box to indicate that the residual amount is liquidated automatically.

Interest Subsidy Allowed

Check this box to indicate that the subsidy is allowed for interest rate. The system will process the EMI computation based on the subsidized rate.

Note

If this option is selected at the product level, then there must be at least one more interest component with ‘Include in EMI’ checked at the Product - Component level. Interest rate subsidy, is not applicable for operational lease

Residual Subsidy Allowed

Check this box to indicate that the subsidized residual amount will be used while liquidating the residual value. You can specify the subsidized residual amount at the account level.

Lease Asset Required

Indicate the preference of customer while booking a lease. You can select one of the following options:

- Lease with Asset: In this lease the asset will be associated with the lease account.

- Lease without Asset: In this lease the asset will not be associated with the lease account. But for financial leasing, you can buy the asset with the residual value as asset value at the end of the lease.

Note

At the time of closure of lease account through ‘Close’ operation, you can choose a different FA product other than the one already linked at product level.

Fixed Asset Product Code

Specify a valid FA product code that should be created when a lease account which has no asset associated with it, is closed. This adjoining option list displays all valid FA products maintained in the system. You can choose the appropriate one.

Prepayment of Lease

The following are the preferences based on which prepayment of amortized loan should be processed:

Recomputation Basis

Select the basis of re-computation of lease for the prepayment of the lease from the adjoining drop-down list. This list displays the following values:

- Recalculate Instalment Amount: In this case the tenor remains constant.

- Change Tenor: Here, the tenor is recomputed while the instalment remains constant.

Prepayment Effective From

Select the start of lease prepayment from the adjoining drop-down list. This list displays the following values:

- Next Instalment

The default value of lease prepayment is ‘Next Instalment’.

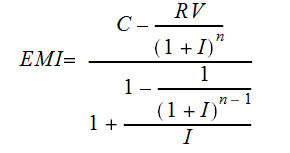

Prepayment Equated Monthly Installment Type

Select the type of Equated Monthly Installment (EMI) prepayment from the adjoining drop-down list. This list displays the following values:

- Single Instalment: A single instalment is computed using the future rates.

- Multiple Instalment: Multiple EMIs are defined if a future rate change is known upfront.

Minimum Equated Monthly Installment Amount

Specify the minimum amount that has to be paid after recomputing the Equated Monthly Installment (EMI). The recalculated EMI after prepayment should be equal to or greater than this amount.

Equated Monthly Installment Currency

Specify the currency in which the minimum Equated Monthly Installment (EMI) amount should be paid.

Disbursement Mode

Indicate the mode of principal disbursement that you are maintaining. You can select one of the following options:

- Manual: You can manually disburse the lease using ‘Disbursement’ screen. Here, disbursement happens on demand.

- Auto: The system automatically disburses the lease during a batch process according to the schedules maintained. In this case, disbursement happens based on the disbursement schedule maintained for the product. This is defined in the ‘Components’ tab. By default, the system does an auto disbursal.

Note

This disbursement mode is only applicable for Financial Leasing.

For details, refer the ‘Making Manual Disbursements’ chapter of this User Manual.

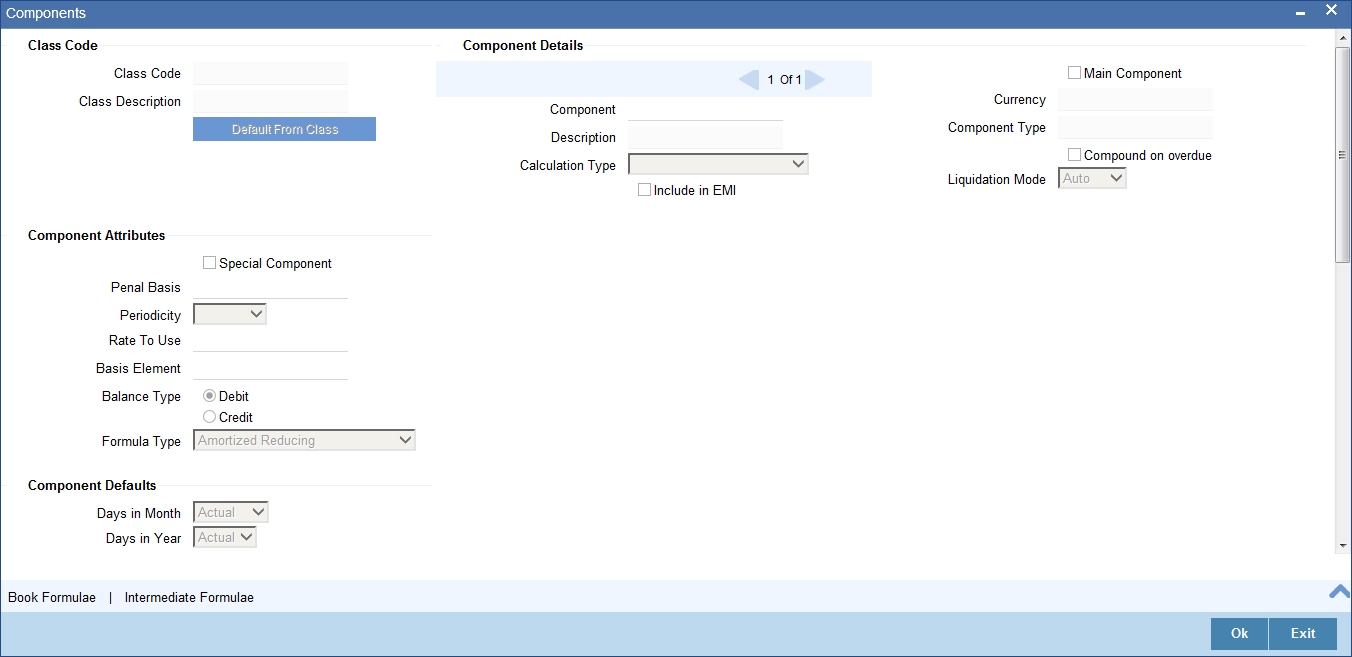

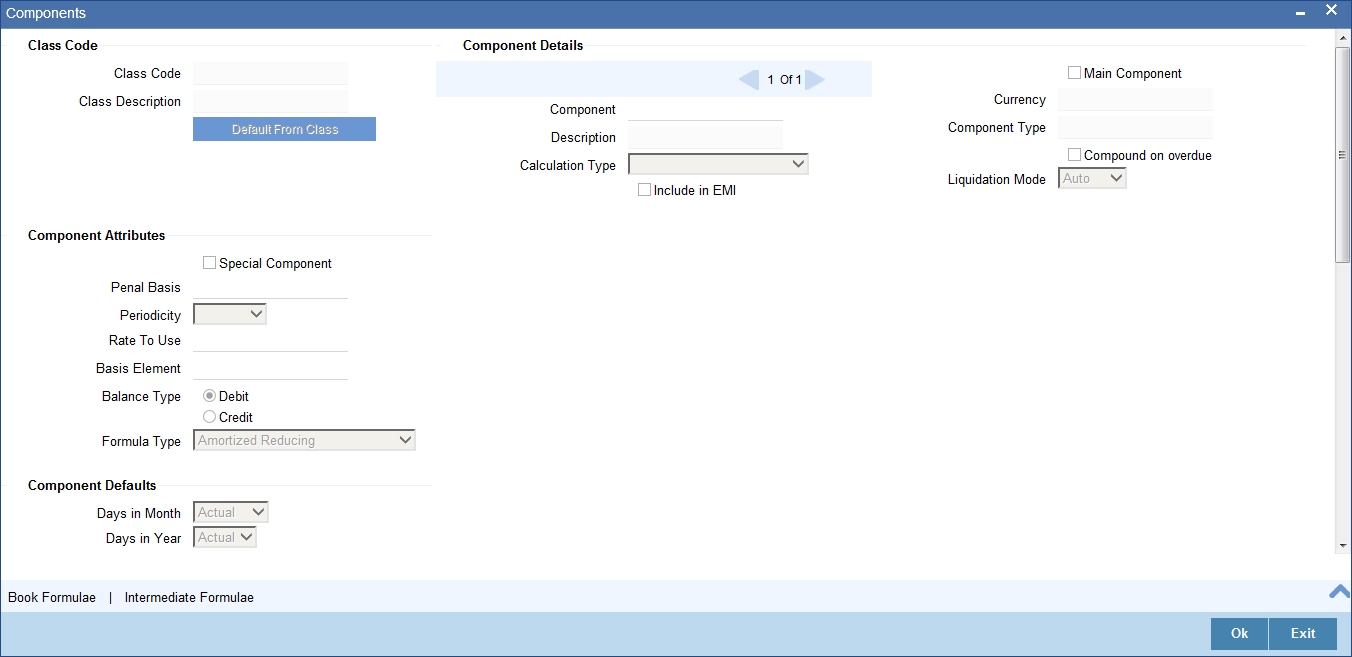

4.1.5 Specifying Components

You have already maintained the components of the product in the ‘Main’ tab of the ‘Product’ screen. The features of the components are defined in the ‘Components’ tab of the screen.

Note that the components defined in the ‘Main’ tab are displayed in the form of a list in the screen above. From the component list, highlight a component and then go on to define the features for the selected component.

Component Details

The basic information for a component is specified here. This includes the following:

Component

The Components which are defined in Main Tab are available in Component list.

The Component which is selected in the list appears in Component field. For e.g. ‘INSURANCE’, ‘MAIN_INT’, ‘PRINCIPAL’ etc. Subsequently, you have to define the parameters for these components in the ’Component’ tab of the screen.

Description

The system displays the description of the selected component, which is specified in the ‘Main’ tab.

Currency

Specify a valid currency that should be associated to the component. This adjoining option list displays all valid currencies maintained in the system. You can choose the appropriate one.

Calculation Type

This value is displayed based on the preference maintained in the ‘Main’ tab. However, you can change it. Select the method of the calculation which is to be associated with the component from the adjoining drop-down list. The list displays the following values:

- Formula with schedule (Component Type - Interest)

- Formula without schedule (Charge)

- Penal Interest

- Prepayment Penalty

- Discount

- Schedule without formula (Principal)

- No schedule No formula (Ad Hoc Charges)

- Penalty Charges

Note

‘Penalty Charges’ are calculated only once for a ‘Penal Basis’ schedule.

Include in EMI

Check this box to indicate that the selected component should be included in EMI calculation.

Main Component

Check this box to designate a component as the ‘Main’ Interest component. If you enable the ‘Main Component’ option for a particular component, the system treats this component as the main component and also uses this component for calculating EMI.

The default value of main component is ‘MAIN_INT’.

Component Type

Specify a valid type of the component. This adjoining option list displays all valid types maintained in the system. You can choose the appropriate one.

A component can be of one of the following types:

- Charge

- Tax

- Insurance

- Interest

Note

You can not associate ‘PRINCIPAL’ component with a particular type.

Liquidation Mode

You can specify the mode of liquidation of the component from the drop-down list. The following options are available for selection:

- Auto

- Manual

Note

This is applicable only if ‘Liquidation mode’ is selected as ‘Component’ at the product preference level.

Component Attributes

The component attributes include the following:

Special Component

Check this box to indicate the component as a ‘Special Component’. You can specify the special amount for the special component at the lease account level.

In Operational leasing, for the main interest component, the default value of ‘Special Component’ field is ‘checked’.

Penal Basis

Specify the basis component on which the penalty is computed.

Periodicity

Select the periodicity of the component from the adjoining drop-down list. The list displays the following values:

- Daily

- Periodic

If you choose the periodicity as ‘Daily’, any changes to UDE and SDE values will result in recalculation of the component. The recalculation happens as and when a change in value occurs. If maintained as ‘Periodic’, the values and calculations of the elements will be refreshed on the last day of the period.

Formula Type

Select the type of the formula to be used for calculating the component from the adjoining drop-down list. The list displays the following values:

- User Defined: This can also include a combination of standard formulae for different schedules of the component or can have a completely user defined formula.

- Standard

- Simple

- Amort-Payment in Advance

- Amort –Payment in Arrears

- Amortized Operational

Note

For a financial lease, the default value of the formula type is ‘Amort-Payment in Arrears’. If the payment mode is changed to advance, then you have to select the formula type ‘Amort-Payment in Advance’.

Rate to Use

Specify a valid UDE rate that should be used in computing the standard formula. This adjoining option list displays all valid UDE rates maintained in the system. You can choose the appropriate one.

Basis Element

Specify a valid component that should be used in computing the standard formula. This adjoining option list displays all valid components maintained in the system. You can choose the appropriate one.

For interest and charges, this is applicable if ‘Formula Type’ is ‘Standard’ and this is not applicable if ‘Formula Type’ is ‘User Defined’. For ‘Principal’ component, this is not applicable.

Balance Type

Indicate the type of balance that you are maintaining. You can select one of the following options:

- Debit

- Credit

Component Defaults

The following are the component defaults:

Days in Month

Select the number of days in a month for interest computation from the adjoining drop-down list. This list displays the following values:

- 30 (Euro): In this case, 30 days is considered for all months including February, irrespective of leap or non-leap year

- 30 (US): This means that only 30 days is to be considered for interest calculation for all months except February where the actual number of days is considered i.e. 28 or 29 depending on leap or non-leap year.

- Actual: This implies that the actual number of days is considered for calculation. For instance, 31 days in January, 28 days in February (for a non-leap year), 29 days in February (for a leap year) and so on

Days in Year

Select the number of days in a year for interest computation from the adjoining drop-down list. This list displays the following values:

- 360: This means that only 360 days will be considered irrespective of the actual number of calendar days.

- 365: In this case, leap and non leap year will be 365 .

- Actual: In this case, leap year will be 366 and non leap year will be 365.

Note

For EMI computation, the number of days in month/year is always 30/360.

Grace Days

Specify the number of days available without penalty after the due date. You have to repay the lease within the grace days to avoid the penalty.

Verify Funds

Check this box to indicate that the availability of funds in the customer account should be verified during liquidation.

Interest Method

Check this box to indicate that the interest method should be used for the selected component.

IRR Applicable

Check this box to indicate that the selected component should be considered for Internal Rate of Return (IRR) calculation. This option is applicable to interest, charge and insurance components.

If a charge component is to be considered for IRR, the charge will be accrued using the FACR (Upfront Fee Accrual) batch.

The following components cannot be considered for IRR calculation:

- Off-balance sheet component

- Provision component

If you check this option, then you have to check the ‘Accrual Required’ option.

For bearing type of component formula, you can check this option only if the ‘Accrual Required’ option is checked.

For discounted or true discounted types of component formula, this option will be enabled irrespective of the whether the ‘Accrual Required’ option is checked or not. If this option is checked and ‘Accrual Required’ is not, the discounted component will be considered as a part of the total discount to be accrued for Net Present Value (NPV) computation. If both ‘Accrual Required’ and ‘IRR Applicable’ are checked, then discounted interest will be considered for IRR computation.

Accruals/Provisioning/Interest Payback

To perform accrual of the components, you have to capture the following details:

Required

Check this box to indicate that the component should be accrued.

Required check box should be checked for interest payback component.

Frequency

Select the frequency of accrual from the adjoining drop-down list. This list displays the following values:

- Daily

- Monthly

- Quarterly

- Half Yearly

- Yearly

The frequency for interest payback component should not be selected as daily.

Start Month

Select the starting month of accrual from the adjoining drop-down list. This list displays the following values:

- January

- February

- March

- April

- May

- June

- July

- August

- September

- October

- November

- December

If you set the accrual frequency as quarterly, half yearly or yearly, you have to specify the month in which the first accrual has to begin, besides the date.

Start Date

Specify the starting date of accrual.

Start month and start date are not applicable for interest payback component if the component type is Interest Payback.

Prepayment Threshold

This includes the threshold amount and currency, explained below:

Amount

Specify the minimum limit for allowing prepayment of schedules. If the residual amount after prepayment against a schedule is less than the threshold amount you specify here, the system will disallow the prepayment.

Currency

Specify a valid currency in which the threshold amount should be expressed. This adjoining option list displays all valid currencies maintained in the system. You can choose the appropriate one.

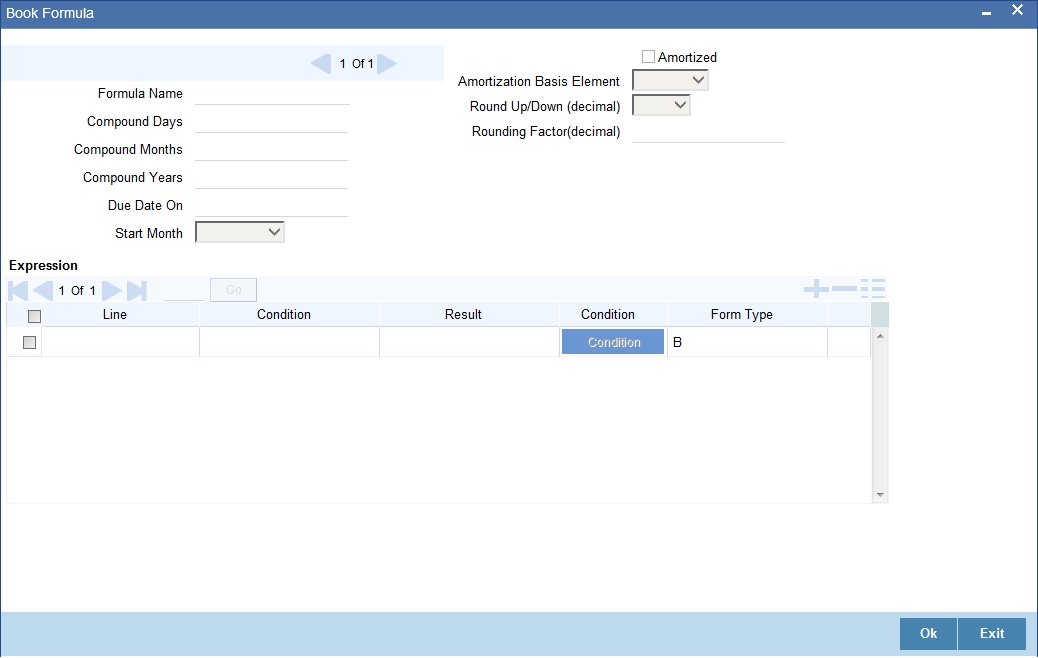

4.1.5.1 Defining Formula

To compute component value for a particular schedule, you have to define a formula. You can define any one of the two types of formulae:

- Book

- Intermediate

Book

Booked Formula refers to the formula used to compute a component value for a particular schedule. You can use intermediate formulae to create a ‘Booked’ formula. To create the formula, click ‘Book’ in the ‘Component’ tab of the screen. The following screen is displayed:

The SDEs available will be shown in the Condition Builder. The Booked formula so created will be linked to a schedule.

These are some of the examples of the formulae generated by the system on its own by choosing the formula type and the basis elements.

- Simple - @SIMPLE(PRINCIPAL_EXPECTED,(INTEREST_RATE),DAYS,YEAR,COMPOUND_VALUE)

- Amortized Reducing - @AMORT_RED(PRINCIPAL_EXPECTED,(INTEREST_RATE),DAYS,YEAR)

- Discounting - @DISCOUNTED(PRINCIPAL_EXPECTED,(INTEREST_RATE),DAYS,YEAR)

- Amortised Rule 78 - @AMORT_78(PRINCIPAL_EXPECTED,(INTEREST_RATE),DAYS,YEAR)

- True Discounted - @TRUE_DISC(PRINCIPAL_EXPECTED,(INTEREST_RATE),DAYS,YEAR)

- Amort-Payment in Adavance - @AMORT_ADV(CAPITAL_AMOUNT,(INTEREST_RATE),DAYS,YEAR,RESIDUAL_AMOUNT)

- Amort payment in Arrears - @AMORT_ARR(CAPITAL_AMOUNT,(INTEREST_RATE),DAYS,YEAR,RESIDUAL_AMOUNT)

- Amoritzed Operational @AMORT_OPR(CAPITAL_AMOUNT,RESIDUAL_AMOUNT,NO_OF_PERIODS)

The parameters required to create a ‘Booked’ formula is similar to the ones explained for an Intermediate formula.

Amortized

Check this box to indicate that the schedules of the component should be amortized.

Amort Basis Element

If you opt to Amortize the schedules of the component, you have to identify the element based on which the component is amortized. For example, if it is deposit interest, the amortization basis would be ‘Principal’. The components are available in the option list provided.

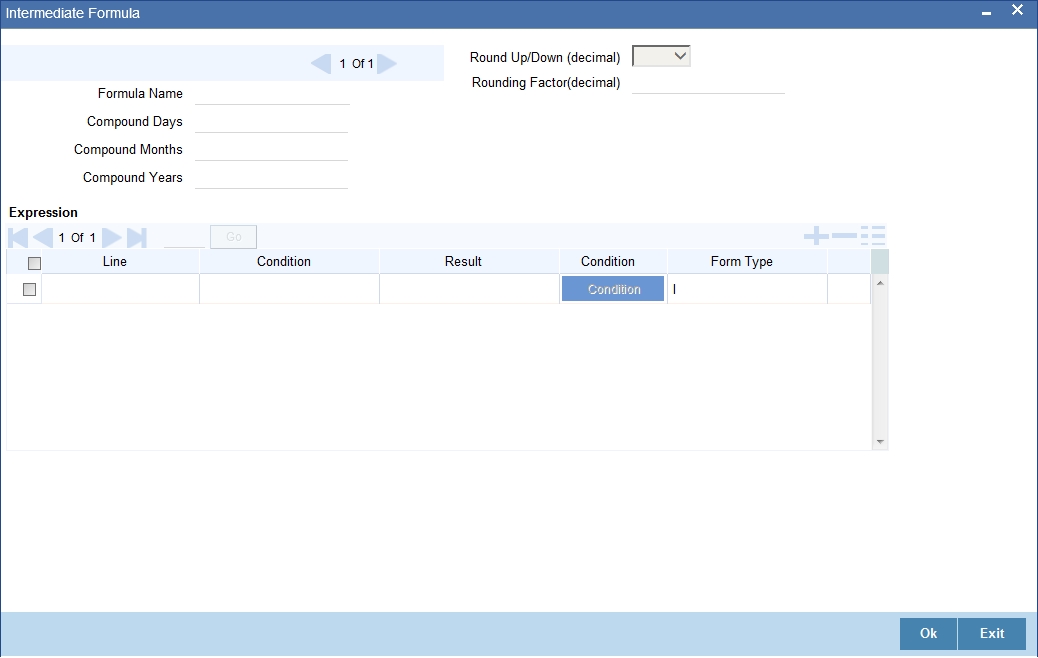

Intermediate

Intermediate Formulae are used as building blocks for more complex formulae. An intermediate formula is used to create a Book formula as an intermediate step. It will not be associated directly to any schedule.

To define an intermediate formula, click ‘Intermediate’ in the ’Components’ tab of the screen. The ‘Intermediate Formula - Expression Builder’ screen is displayed.

Formula Name

Specify a suitable name to identify the formula that you are defining. After you specify the name you can define the characteristics of the formula in the subsequent fields. You have to use the name captured here to associate a formula with a schedule. The name can comprise of a maximum of 27 alphanumeric characters.

Round Up/Down (Decimal)

If you want to round off the results of an intermediate formula, you can indicate whether the result should be rounded up or rounded down by choosing one of the following values from the drop-down list:

- Up

- Down

Compound Days/Months/Years

If you want to compound the result obtained for the intermediate formula, you have to specify the frequency for compounding the calculated interest.

The frequency can be in terms of:

- Days

- Months

- Years

If you do not specify the compound days, months or years, it means that compounding is not applicable

Rounding Factor

Specify the precision value if the number is to be rounded

It is mandatory for you to specify the precision value if you have maintained the rounding parameter.

Compound Days

If you want to compound the result obtained for the intermediate formula, you have to specify the frequency for compounding the calculated interest. The frequency can be in terms of days.

Compound Months

If you want to compound the result obtained for an intermediate formula, you have to specify the frequency for compounding the calculated interest. The frequency can be in terms of months.

Compound Years

If you want to compound the result obtained for an intermediate formula, you have to specify the frequency for compounding the calculated interest. The frequency can be in terms of years.

Condition and Result

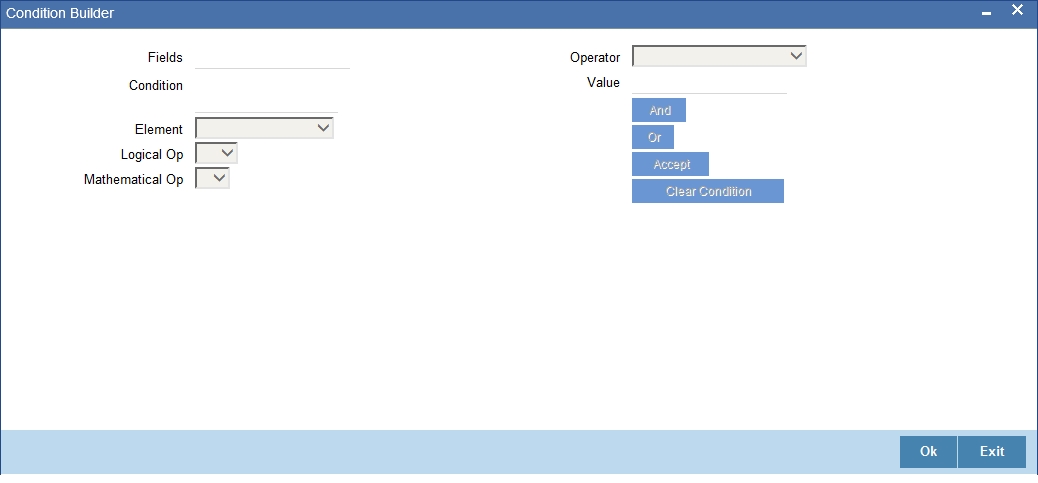

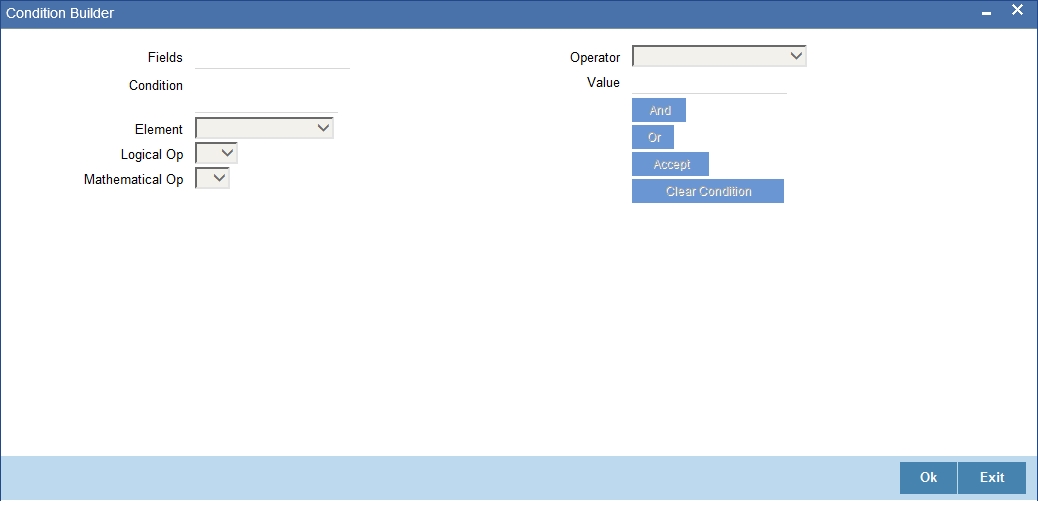

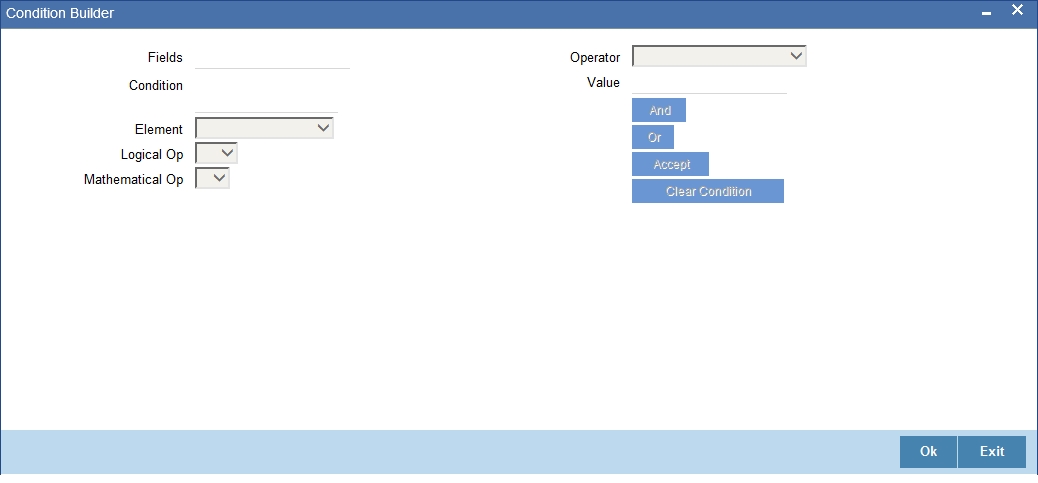

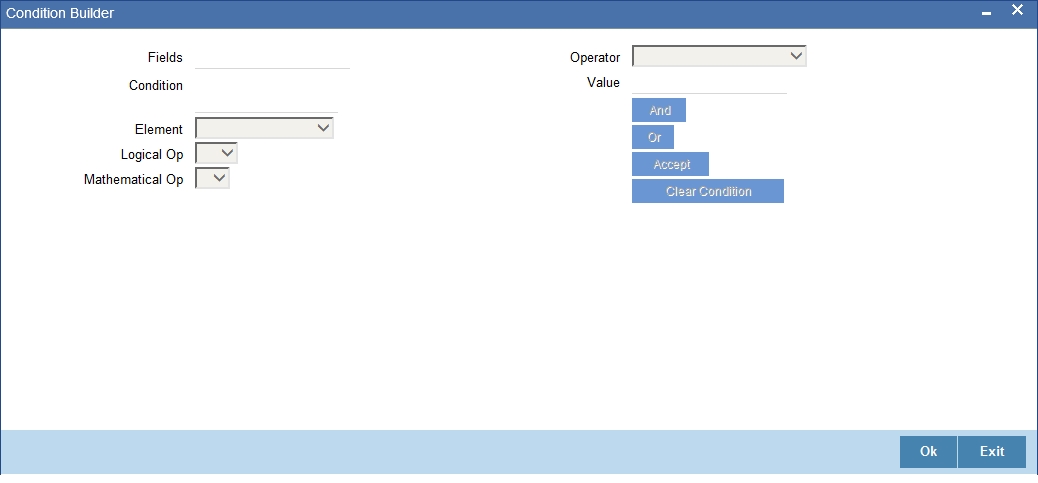

A formula or calculation logic is built in the form of expressions where each expression consists of a ‘Condition’ (optional) and a ‘Result’. There is no limit to the number of expressions in a formula. For each condition, assign a unique sequence number/formula number. The conditions are evaluated based on this number. To define a condition, click on ‘Condition’ in the screen above. The following screen is displayed:

In this screen, you can use the elements, operators, and logical operators to build a condition.

Although you can define multiple expressions for a component, if a given condition is satisfied, subsequent conditions are not evaluated. Thus, depending on the condition of the expression that is satisfied, the corresponding formula result is picked up for component value computation. Therefore, you have the flexibility to define computation logic for each component of the product.

The result of the formula may be used as an intermediate step in other formulae.

Schedule

In the ‘Component’ section of the screen, you need to maintain the applicable schedule details for each component:

Sequence Number

Specify the sequence number to determine the order in which the individual schedule should be applied on a component. You can define more than one schedule to a component.

Type

Select the type of schedule from the adjoining drop-down list. This list displays the following values:

- Payment: This type of schedule is used for the components Principal, Interest, Charge and Insurance.

- Disbursement: This type of schedule is only used for Principal component under financial leasing.

- Rate Revision schedules: This will capture the schedule at which the rates applicable to the component should be revised. This type of schedule is used for the interest, charge and insurance components.

Start Reference

Select the reference to arrive at the due date of the schedule from the adjoining drop-down list. This list displays the following values:

- Calendar: If you select this option, you should also specify the ‘Start Date’ for the schedule. For example, if an account is created on 15th Sept with a ‘Monthly’ schedule frequency and the Start Date is 1st, then the schedule due dates would be 1st Oct, 1st Nov and so on.

- Value Date: If you select value date, the schedule due dates will be based on the Value Date of the account. Here, the value date and start date is the same. For instance, if an account is created on 15th Sept and the schedule frequency is ‘Monthly’, then the schedule due date would be 15th October, 15th Nov and so on.

For a component, you can define schedules based on both value date and calendar date.

Frequency Unit

Select the unit of the schedule from the adjoining drop-down list. This list displays the following values:

- Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

If the schedule unit is ‘Weekly’, you should also capture the ‘Start Day’. Similarly, for units ‘Quarterly’, ‘Half Yearly’ and ‘Yearly’, you should also specify the ‘Start Month’.

Frequency

Specify the multiplier that should be multiplied with the frequency unit to derive the non-standard frequency unit. This is used in combination with ‘Unit’ explained above, to define non-standard frequencies. For instance, a ‘Monthly’ unit and frequency 2 implies that the schedule is bi-monthly (occurring every two months).

Start Day

Select the starting day of the schedule from the adjoining drop-down list, if the schedule unit is ‘Weekly’. This list displays the following values:

- Sunday

- Monday

- Tuesday

- Wednesday

- Thursday

- Friday

- Saturday

Start Month

Select the starting month of the schedule from the adjoining drop-down list, if the schedule unit is one of the following:

- Quarterly

- Half Yearly

- Yearly

The drop-down box lists the months in a year.

Start Date

Specify a value between 1 and 31. This is applicable if the schedule unit is ‘Monthly’

Formula

Specify a valid formula that should be used for calculating the component value. This adjoining option list displays all valid formulae maintained in the system. You can choose the appropriate one.

Number of schedules

Specify the number of times a schedule frequency should recur. For example, a 12 monthly schedule would have a ‘Monthly’ unit and number of schedules as 12.

4.1.6 Specifying Notices and Statements

Just as you define components that should become a part of the product, so also you can associate Notices and account statement with a product.

The actual communication/correspondence, however, is handled by the Messaging Module of Oracle FLEXCUBE. Click ‘Notices and Statements’ button in the ‘Product’ screen.

In this screen, you need to maintain the preferences for Billing Notices, Delinquency Notices, Rate Revision Notice, Direct Debit Notice and Statements. Also, you can associate multiple formats for the generation of notices and statements. The selection of a particular format is based on the condition.

Rule Number

You can assign a unique number for each rule/condition that is being maintained for notice and statement generation.

Condition

Define the conditions/rules for notice and statement generation. The system will evaluate the conditions and based on the one that is satisfied, the corresponding advice format is selected for notice/statement generation.

To maintain a condition, click ‘Condition’ button in the screen above. The ‘Condition Builder’ is displayed.

For details on building a condition using the options available in the screen, refer the section titled ‘Defining UDE Rules’ in the ‘Maintenances and Operations’ chapter of this User Manual.

Number of Days

The Number of days indicates the period before the due date, when the system starts sending the Billing/Delinquency notices to customers.

This period is defined as a specific number of days and will begin before the date the repayment becomes due.

Format

For the condition defined, select the format in which the advice should be generated. The system will select the specific format of the message type when the condition maintained evaluates favorably. Frequency Days

Specify the frequency (in days) for generation of Delinquency Notices. The first notice is sent on the basis of the ‘Num Days’ maintained. For instance, if the ‘Num Days’ is four and the payment due date is 4th April 2004, the first notice will be sent on 31st March ’04 (4 days before due date). Subsequent generation of the same notice is based on the frequency days maintained. If the ‘Frequency Days’ is ‘2’, the second notice will be sent on 2nd April ’04 i.e. the notice is sent once in two days only.

Message Type

For the condition defined, select the format in which the advice should be generated. The system will select the specific format of the message type when the condition maintained evaluates favorably.

Liquidation Frequency Days

Specify the frequency (in days) for generation of Delinquency Notices. The first notice is sent on the basis of the ‘Num Days’ maintained. For instance, if the ‘Num Days’ is four and the payment due date is 4th April 2004, the first notice will be sent on 31st March ’04 (4 days before due date). Subsequent generation of the same notice is based on the frequency days maintained. If the ‘Frequency Days’ is ‘2’, the second notice will be sent on 2nd April ’04 i.e. the notice is sent once in two days only.

The following information is applicable to Statement generation:

Frequency

Indicate the frequency in which the Statements have to be generated. The available options:

- Daily

- Monthly

- Quarterly

- Half Yearly

- Yearly

Frequency Days

The frequency captured here is used to get the next date for statement generation subsequent to the first statement. This will be used in combination with the ‘Frequency’ explained above.

Start Date

The date entered here is used as a reference to start generation of the statement

Message Type

Specify the type of Statement that should be generated. Statements are of the following types:

- Interest Statements

- Loan Statements

Generic Notice

You can maintain the following details to generate a notice.

Notice ID

Select the notice type of the rate plan from the list of options.

Rule Number

Specify the unique number for the rule maintained for notice.

Condition

Specify the condition for notice generation. The system will evaluate the conditions and based on the one that is satisfied, the corresponding advice format is selected for notice.

Click ‘Condition’ button to maintain a condition in ‘Product’ screen. The ‘Condition Builder’ is displayed.

Format

Specify the format of the advice to be generated.

Tenor

Specify the tenor at which the notice has to be generated.

Number of Days

Specify the number of days required to intimate the customer in advance about the UDE rate change period.

Frequency

Specify the frequency in which the notice has to be generated.

Transaction Code

Specify the identifier code of the transaction.

Interest Rate Revision within the Rate Revision Period

The Rate Revision Notice section allows you to maintain the number of days for the generation of the advice, prior to the scheduled date of rate revision. During End of Day if the notification date is less than or equal to schedule date, a Rate Revision Advice is generated.

The four different conditions for the rate revision will be handled in Oracle FLEXCUBE as follows:

- Condition 1: Once the interest revision date is reached, the system continues to use the same interest rate code, till the next revision date.

- Condition2: If the request for change in interest rate is received a few days before the scheduled revision date, the interest rate code of the lease account is changed by value dated amendment, with the effective date as the scheduled interest revision date. On the effective date, the system changes the rate code and picks up the new interest rate

- Condition 3: If the request is for a future dated prepayment of the

lease account there is no change in the interest rate, the principal

is changed depending on the prepaid amount and once the payment is available

in the settlement account, you can liquidate the lease manually with

the requested effective date.

An outstanding component breakup of prepayment penalty charges if applicable is sent to the customer. - Condition4: If the request for interest rate revision is made much before the scheduled revision date, you can change the interest rate code of the lease account by value dated amendment with effective date as requested.

The rate revision will be applicable on the total principal outstanding amount.

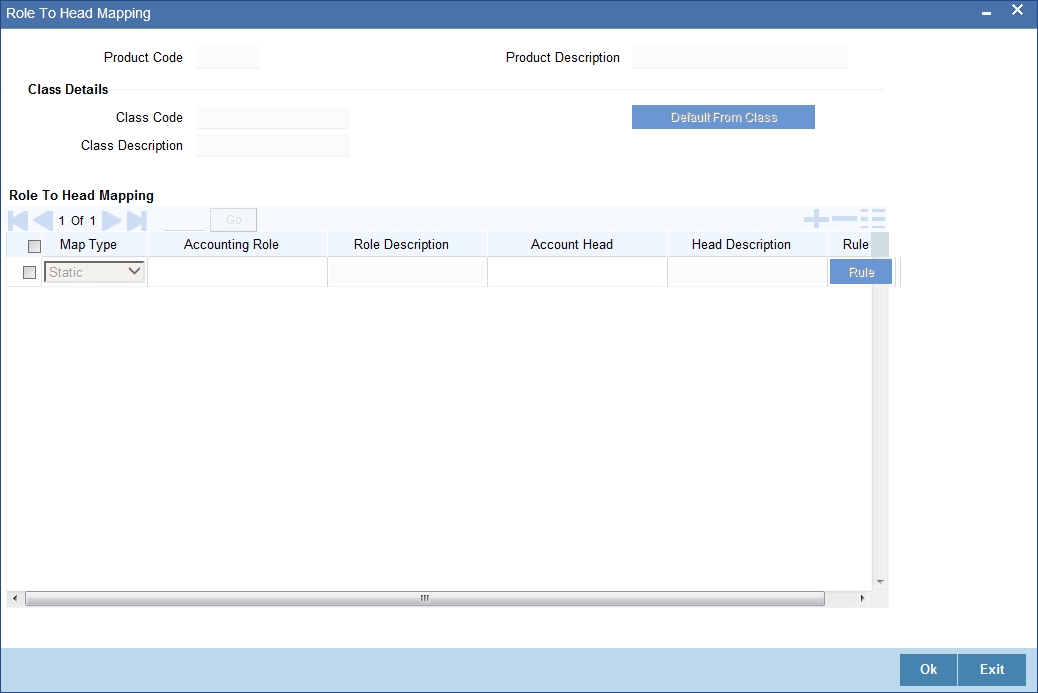

4.1.7 Mapping Accounting Role to Product

You can define the accounting roles for a product in the ‘Role to Head’ button of the ‘Consumer Lending Product’ screen. A list of accounting roles that are applicable to the product being maintained is provided. This list also includes the accounting roles that you have maintained for the module using the ‘Accounting Role and Head Maintenance’ screen.

The following details are captured in this screen:

Class Code

Select a class code from the adjoining option list. The option list displays all the valid classes maintained in the system.

Click ‘Default from Class’ button to default the role to head mapping details for the selected class. You can select and modify the required role to head mapping details to suit the product you are defining. You can also define new role to head mapping by clicking add icon.

Map Type

The mapping between an accounting role and account head can be of the following types:

- Static: If the map type is static, you can link an accounting role to only one accounting/GL head (one to one mapping).

- User Defined: For a user defined map type, you can maintain multiple linkages under different conditions using a case-result rule structure (one to many accounting).

Accounting Role and Description

Accounting role is used to denote the accounting function of a GL or Account. To map an accounting role to an account head, select a valid accounting role from the option list provided. This list will display the roles available for the module.

Once you choose the accounting role, the description maintained for the role is also displayed in the adjacent field.

If you do not want to select a role from the option list, you can also create an accounting role for a product and specify a brief description for the same.

Note

The GLs (Account Heads) for the Dr/Cr Settlement Bridge Role will default as per your selection in the ‘Branch Parameters’ screen.

Account Head and Description

The account head identifies the GL or Account to which the accounting entries would be posted. Based on the type of accounting role you select (Asset, Liability etc.), the list of Account Heads (General Ledger heads) that are of the same type as that of the accounting role, becomes available in the option list provided. You can select an accounting head from this list and thus, create a role to head mapping. On selection of the Account Head, the description is also displayed in the adjacent field.

Click Add icon to create subsequent mappings for the product. If you would like to delete a role to head mapping, click Delete icon.

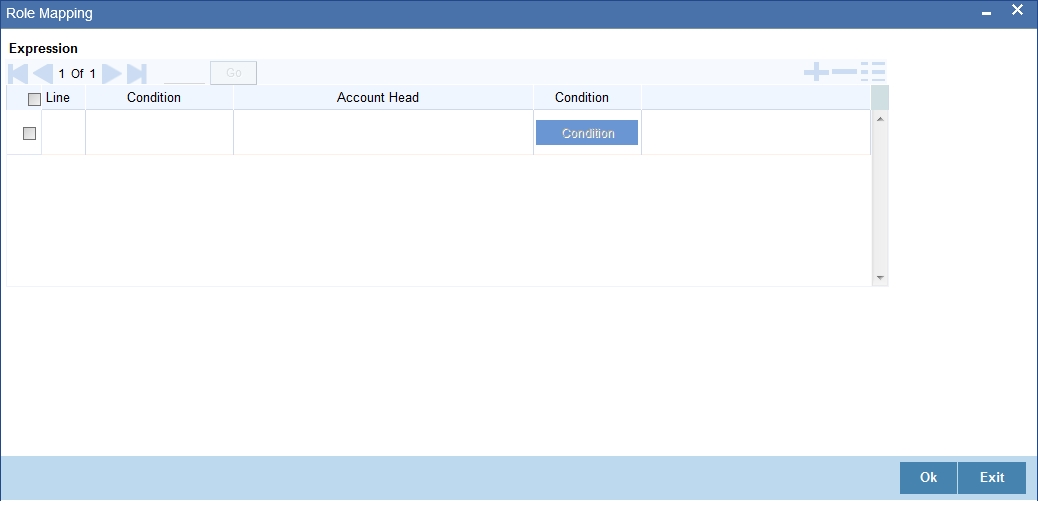

Rule

If the ‘Map Type’ is ‘User Defined’, you can create a case-result rule structure based on which the entries are posted to the appropriate account head. To create a rule, click ‘Rule’ in the ‘Role to Head’ tab of the product screen.

You can define multiple conditions and for each condition you can specify the resultant ‘Account Head’. This way you can maintain one to many mappings between an accounting role and an account head. Depending on the condition that is evaluated favorably, the corresponding account head is used for posting the entries.

To build a condition, click on ‘Condition’ in the screen above. The ‘Condition Builder’ is displayed.

You can build the conditions using the elements (SDEs), operators and logical operators available in the screen above.

For details on building a condition using the options available in the screen, refer the section titled ‘Defining UDE Rules’ in the ‘Maintenances and Operations’ chapter of this User Manual.

Note

The system ensures that all accounting roles that are applicable for the Product and which have been used in the definition of the accounting entries are necessarily linked to an account head. If the mapping is not complete, an error message is displayed when you attempt to save the product.

4.1.7.1 Dynamic creation of accounting roles for a component

For each component you define for a product in the ‘Main’ tab, six accounting roles are dynamically created by the system. For example, if you have defined a component ‘MAIN_INT’, the following accounting roles are created:

- MAIN_INTINC - Component Income

- MAIN_INTEXP - Component Expense

- MAIN_INTRIA - Component Received in Advance

- MAIN_INTPAY - Component Payable

- MAIN_INTREC - Component Receivable

- MAIN_INTPIA - Component Paid in Advance

For a detailed list of Events, Advices, Accounting Roles and Amount Tags, refer ‘Annexure 1’ of this User Manual.

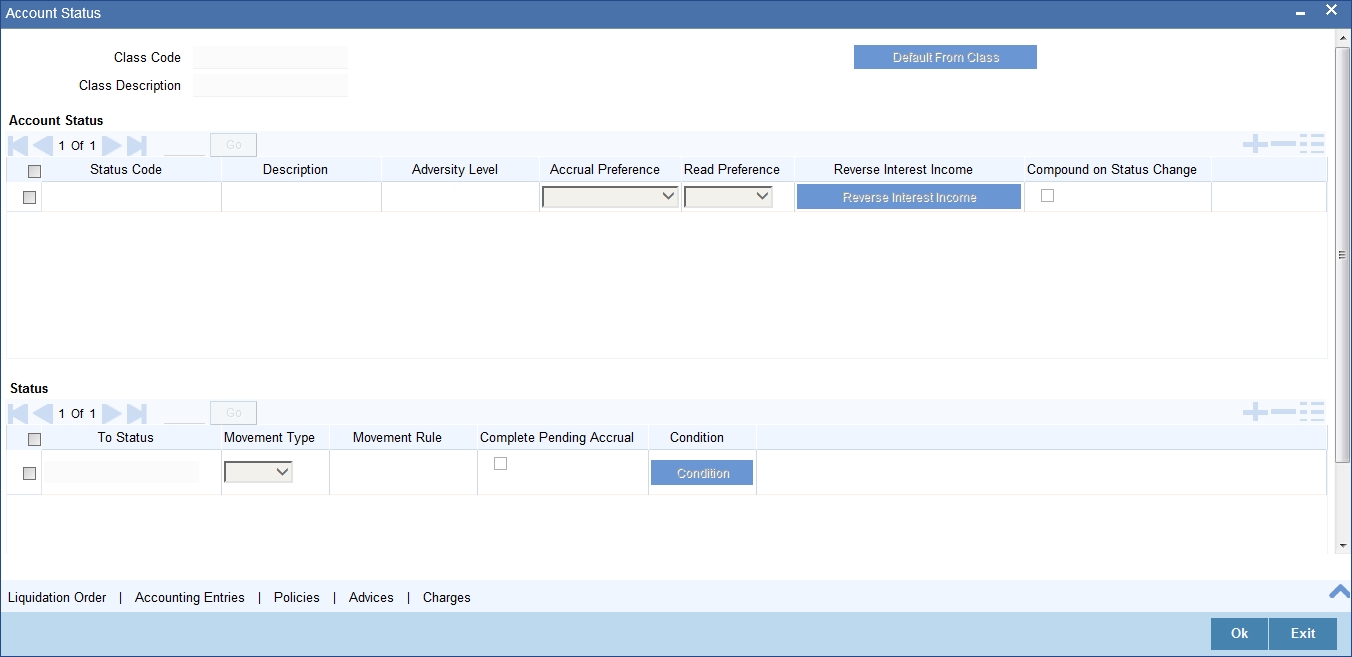

4.1.8 Specifying Account Status

Ideally, when setting up a product, you should identify all possible status that lease involving the product would move into.

A status can apply either to a lease installment or the entire lease account. Installment level status change preferences are maintained in the ‘Component’ tab of the screen.

For more details, refer the section titled ‘Component Details’ in this chapter

You can maintain account level status movement preferences the ‘Account Status’ button of the screen.

In this screen, you can specify the following:

Class Code

Select a class code from the adjoining option list. The option list displays all the valid classes maintained in the system.

Click ‘Default from Class’ button to default the account status details for the selected class. You can select and modify the required details to suit the product you are defining. You can also define new account status by clicking the ‘+’ button.

- Define a status derivation rule to resolve a status

- Define accounting entries, advices etc. which need to be fired for a status

- Specify the liquidation order for a status

- Associate charges, if applicable, for a status

- Policies to be triggered for a status change

Status

When setting up a product, you should identify all possible statuses that lease involving the product would move into. By default, the ‘NORM’ (Normal) status is defined for the product. You can select the relevant status codes from the option list provided. The status codes defined through the ‘Status Codes Maintenance’ screen with ‘Status Type’ as ‘Account’ is available in this list.

When you select a status, the associated description is also displayed in the adjacent field.

Adversity Level

This signifies the adversity level of the status. The Status ‘NORM’ has an adversity level of ‘1’ and is the most favorable. This is the default status for a lease.

Accrual Preference

For a status, you have to indicate the manner in which accounting entries should be posted when the lease moves to the status. The options are:

- Stop Accrual – accruals are frozen

- Reverse Accrual – accruals till date are reversed by transferring them to an expense GL

- Continue Accrual – accruals continue as in the previous status as per the Role to Head maintained for the status and as per the accounting entries defined

After you specify the status codes applicable for the product, you need to specify the manner in which the status movement should occur.

From Status and To Status

When you highlight a status from the list of status codes maintained for the product, the selected status becomes the ‘From Status’

In the option list provided for the ‘To Status’, the status codes applicable for the product is displayed. Select the relevant status into which a loan should move from the ‘From Status’.

Movement Type

You have to indicate the type of movement of a lease from the current status (From Status) to the next status (To Status). The movement can be:

- Automatic

- Manual

- Both

Movement Rule

You have to define the status derivation rule which will determine the movement of a lease from one status to the other. This is the condition based on which the status movement occurs. If a lease satisfies all the rules defined due to which it can move to several statuses at a time, it will identify the most adverse status and move to that status.

To define a derivation rule, click ‘Condition’ button in the screen above. The ‘Condition Builder’ is displayed.

You can build the conditions using the elements (SDEs), operators and logical operators provided in the screen above.

For details on building a condition using the options available in the screen, refer the section titled ‘Defining UDE Rules’ in the ‘Maintenances and Operations’ chapter of this User Manual.

Complete Pending Accruals

Check this box to indicate if the pending interest accruals need to be completed before the Account status changes. This is applicable only if Accrual Frequency is any one of the following:

- Monthly

- Quarterly

- Half yearly

- Yearly

This check box will not be enabled if Accrual Frequency in the ‘Consumer Lending Product’ screen is ‘Daily’.

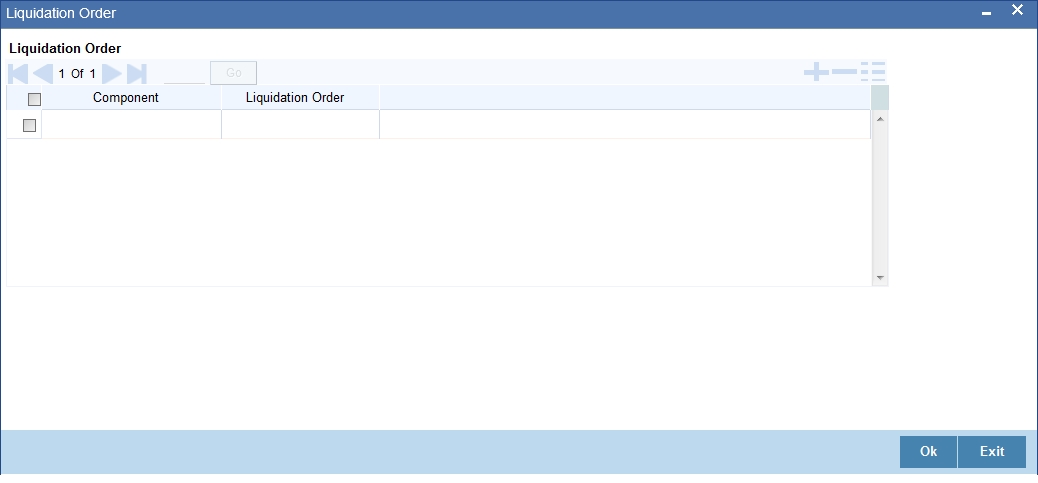

4.1.8.1 Specifying Liquidation Order

You can prioritize the liquidation of the various lease components at a status level. To maintain liquidation order of components, click ‘Liquidation Order’ button in the ‘Account Status’ screen – the following screen is displayed.

When a loan attains an adverse status, you may want to allot priority to the recovery of certain components. For example, you may want to recover the Principal first and then the Interest type of components.

The components maintained for the product are available in the option list provided. Select a component and then specify the order of liquidation for the component.

Click on Add icon to maintain the liquidation order for the next component

4.1.8.2 Specifying Accounting Preferences

You can specify accounting preferences at a status level. You may have a GL structure under which loans in ‘Normal’ status should report. You can maintain a different structure for lease in other status. To do this, click ‘Accounting Entries’ in the ’Account Status’ tab – the following screen is displayed:

Also, for a status, you may not want to change accounting roles but change only the accounts/GLs. The accounting roles will be the same. To achieve this, you can create a rule based ‘Role to Head’ mapping. The SDEs like ’Account Status’ can be used to create the rule and if a lease satisfies the rule i.e. moves to the status maintained in the rule, the Account Head selected for the rule is used for posting the entries.

Refer the section titled ‘Role to Head Tab for details on creating a ‘Role to Head’ mapping.

4.1.8.3 Specifying Advices

You can also specify the advices that should be generated when a status change occurs. For instance, when a lease moves from an ‘ACTIVE’ status to an ‘OVERDUE’ status, you can choose to send an advice to inform the customer of the status change and request for payment.

The advices can be maintained in the ‘Product Event Advices Maintenance’ screen - click ‘Advices’ in the ‘Account Status’ tab to invoke it.

You can associate advices at an event level also.

For more details on maintaining advice preferences, refer the ‘Maintaining Event details’ section of this User Manual.

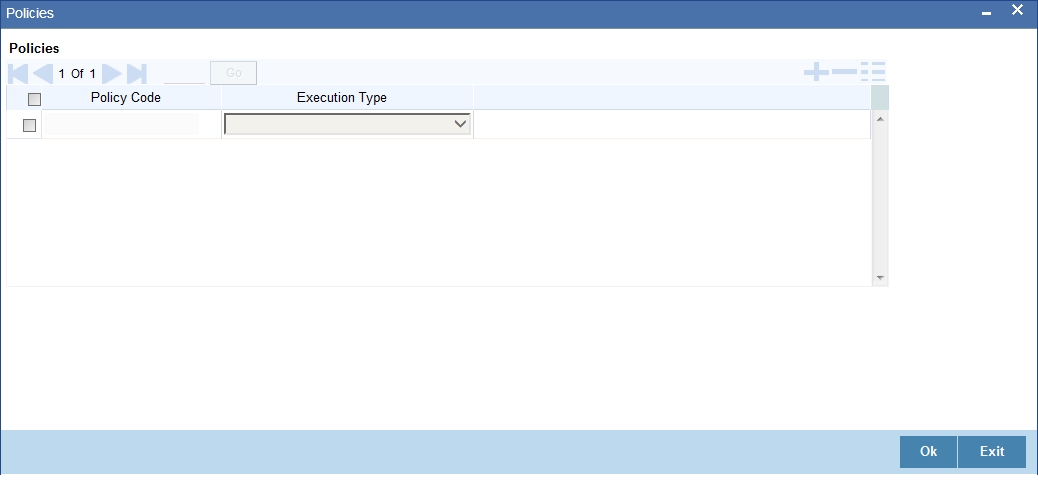

4.1.8.4 Specifying Policy Preferences

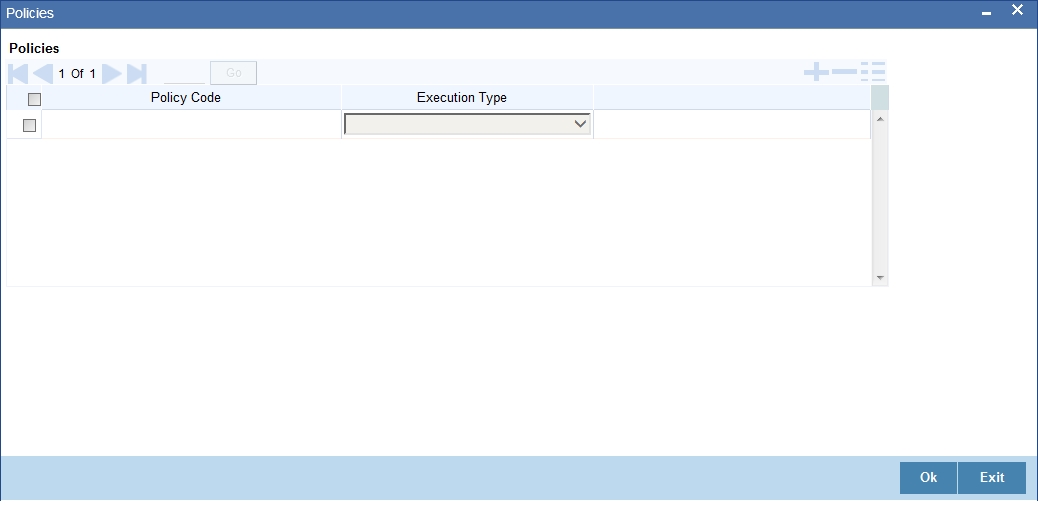

Just as you associate policies at an installment level, you can also associate policies for a lease account status. To do this, click ‘Policies’ in the ‘Account Status’ tab of the product screen – the following screen is displayed:

Specify the following in this screen:

Policy Code

The policies defined in the ‘User Policy’ screen are available in the option list provided. Policies are used to handle special validations and operations on a loan.

Execution Type

You can associate a policy at one of the following points in time in a lease-event lifecycle:

- Before Event

- After Event

- Both

The policy gets executed appropriately

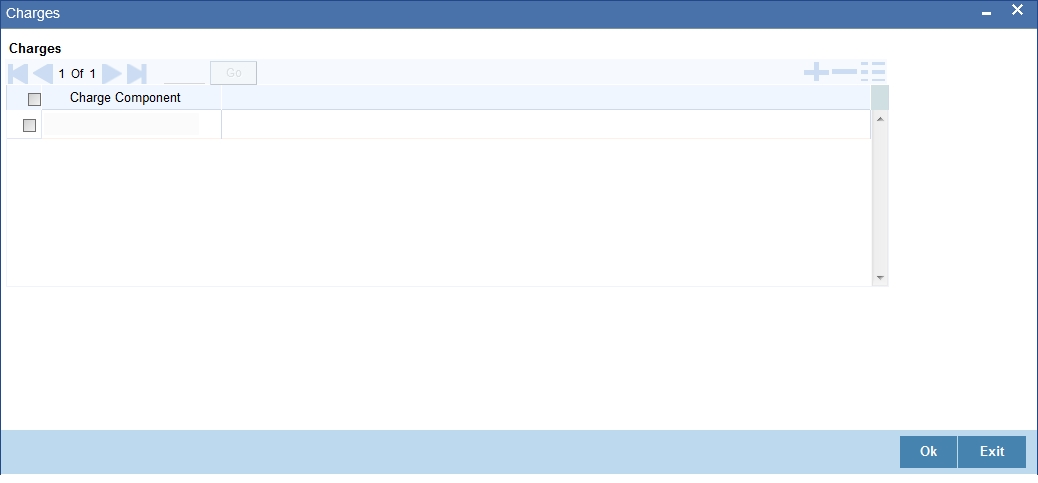

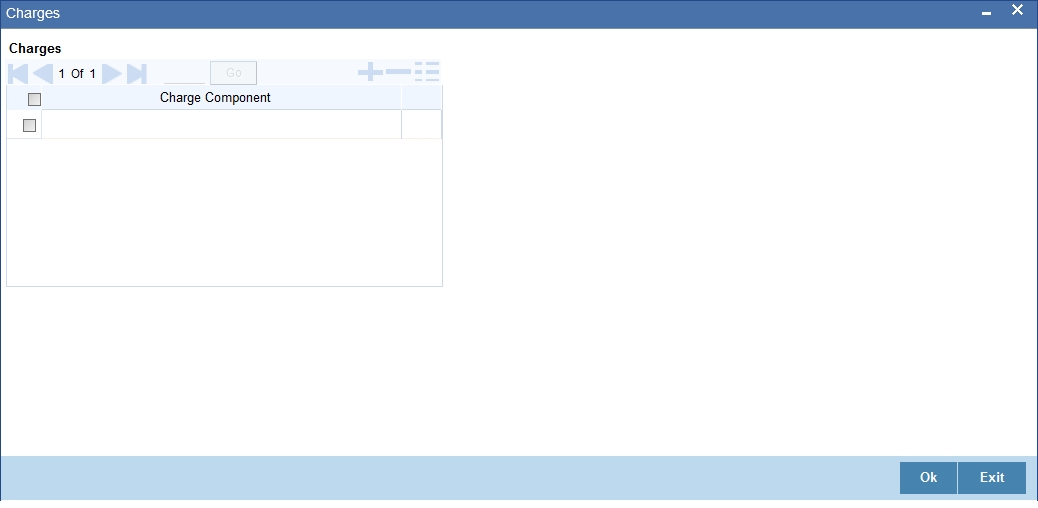

4.1.8.5 Associating Charges

Whenever a lease undergoes a status change, you can apply charge on the lease. You need to associate charge components at a status level. To do this, click ‘Charges’ in the ‘Account Status’ tab of the screen – the following screen is displayed:

The charge type of components defined for the product (in the ‘Components’ tab of the screen) are displayed in the option list. Select the component you wish to associate with the lease. The charge is applied when the lease moves to the status and is debited to the customer account.

4.1.8.6 Processing at Account Level

At the account level, when there is a change in the status, Oracle FLEXCUBE will first check if accrual is required for the components. When the accrual frequency for a component is not ‘Daily’, Oracle FLEXCUBE will validate if the installment status or the account status changes before accrual execution date. If it changes, Oracle FLEXCUBE will trigger catchup accrual for the component till the installment status and the account status change date. Subsequent to this, Oracle FLEXCUBE will process the installment status change and account status change.

- An installment status change will not change the next execution date of unprocessed ACCR events

- A status change is applicable for both manual and automatic account status

- If you delete an account level status change, it will delete the catch up accrual accounting entries also

- If you reverse an account level status change, it will reverse the catch up accrual accounting entries as well

4.1.8.7 Maintaining Ad Hoc Charge Components

A component of the type Ad hoc can be set up using ‘Components’ tab in the ‘Consumer Lending Product’ screen since ad hoc charges cannot be computed upfront or scheduled. Select the option in ‘Calculation Type’ as ‘No Schedule No Formula’.

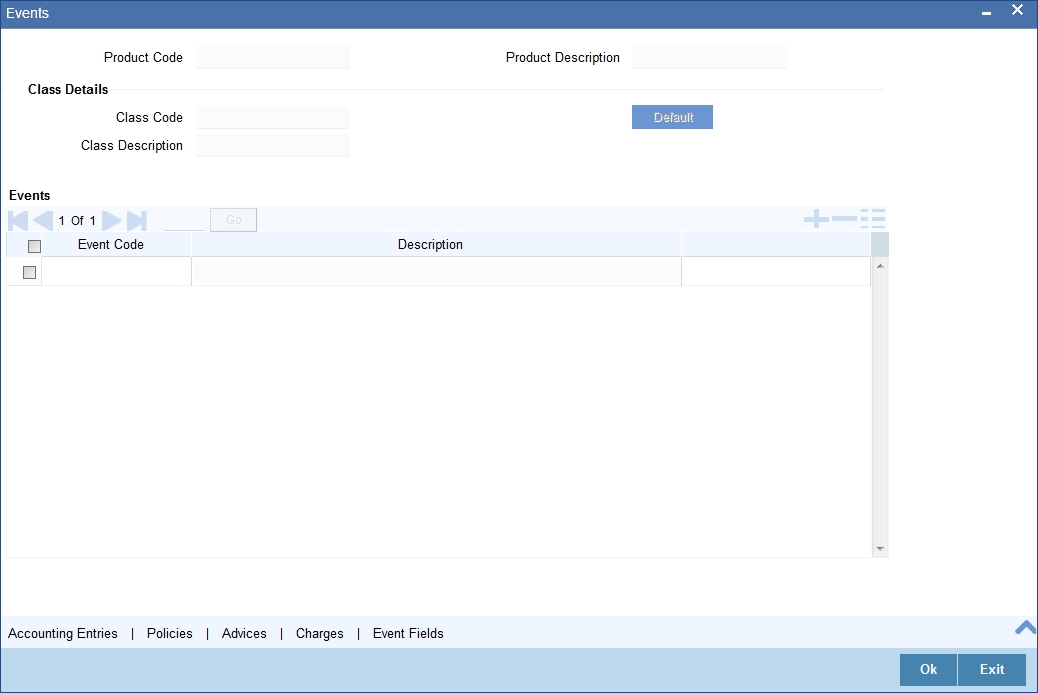

4.1.9 Specifying Events

A contract goes through different stages in its life cycle. In Oracle FLEXCUBE, the different stages a contract passes through in its life cycle are referred to as ’Events‘.

At an event, typically, you would want to post the accounting entries to the appropriate account heads and generate the required advices. When setting up a product, you can define the accounting entries that have to be posted and the advices that have to be generated at the various events in the life cycle of accounts involving the product.

Therefore, for the required events you have to specify the Accounting entries, Charges, Policies and Advices. To do this, click ’Events’ button in the ‘Product’ screen – the following screen is displayed.

You can specify the following details:

Class Code

Select the class code from the adjoining option list. The list displays all the class codes maintained in the system.

Click ‘Default’ button to default the events maintained for the selected class. You can select the required events for the product you are defining. You can also define new events apart from the defaulted events.

Event Code and Description

These are the events for which the accounting entries, advices, policies and charges will be maintained, individually. The event codes applicable for the module are available in the option list provided. This list also includes user defined events set up for the module. Select the relevant events for the product from this list.

The description for the event chosen is also displayed

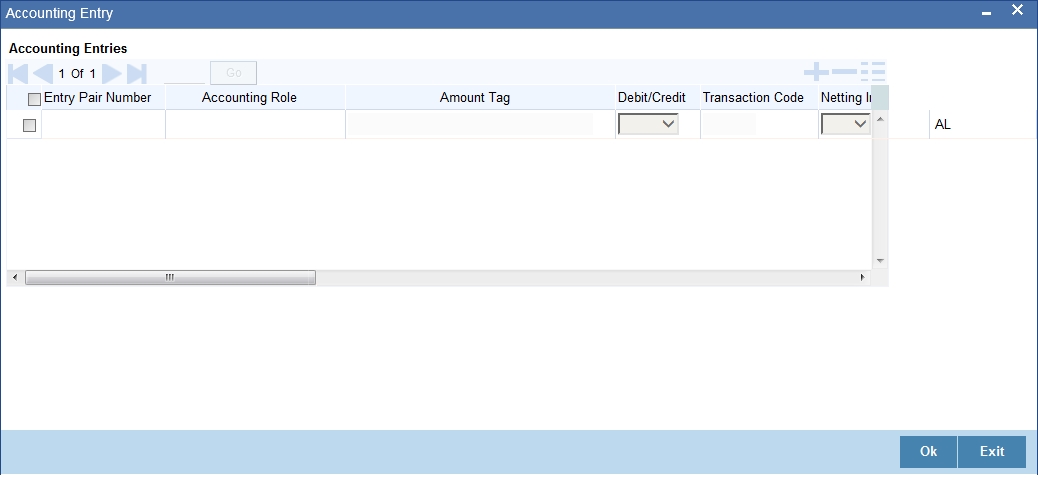

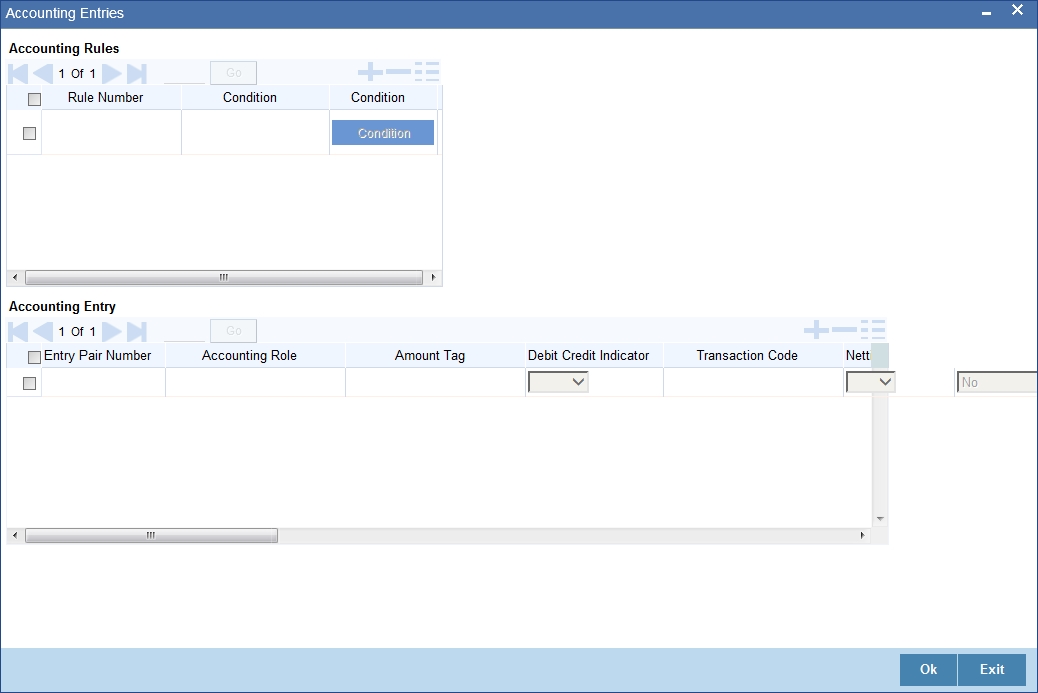

4.1.9.1 Defining Accounting Entries

To define accounting entries for an event, click ‘Accounting Entries’ in the ‘Events’ screen – the ’Accounting Entries’ screen is displayed.

With the Rule definition builder, you can maintain different set of accounting entries for different conditions.

Rule Number

Every rule/condition you define for a product should be assigned a unique number. The rule number can consist of a maximum of 5 digits

Case

You can use the ‘Condition Builder’ to define a rule. Click on ‘Condition’ in the above screen to invoke it.

You can define a rule using the SDEs like Tenor, Customer Risk Category and other UDEs.

If you do no specify a rule/condition, the accounting entries become applicable to all conditions.

Accounting Role

Select the accounting role that should be used at the event. The option list displays all the accounting roles specified for the product in the ‘Role To Head’ tab of the ‘Consumer Lending Product’ screen. Select the role appropriate for the event.

Amount Tag

Specify the amount tag applicable for the Accounting Role. An amount tag identifies the amount/value that is actually due for a component. Depending on the components defined for the product, the system dynamically creates a set of amount tags. For instance, if the component is ‘MAIN_INT’, the following amount tags are automatically created:

- MAIN_INT _RESD - Component Amount Residual

- MAIN_INT_ADJ - Component Amount Adjustment

- MAIN_INT_LIQD - Component Amount Liquidated

- MAIN_INT_CAP - Component Amount Capitalized

- MAIN_INT_ACCR - Component Amount Accrued

- MAIN_INT_DLIQ - Component Amount Paid against Due Schedules/future not-due schedules

- MAIN_INT_OLIQ - Component Amount Paid against Overdue Schedules

The ‘_DLIQ’ and ‘_OLIQ’ tags will be generated only for the events LIQD and ROLL.

Select the appropriate amount tag from this list

Debit or Credit

Here, you have to specify the type of accounting entry to be posted – the entry can be a debit entry or a credit entry.

Transaction Code

Every accounting entry in Oracle FLEXCUBE is associated with a Transaction Code that describes the nature of the entry. Specify the transaction code that should be used to post the accounting entry to the account head. You can group all similar transactions under a common transaction code. The transaction codes maintained in the ‘Transaction Code Maintenance’ screen are available in the option list provided.

Netting

Specify whether accounting entries should be netted at an event. You can net the accounting entries that are generated at an event by selecting ‘Yes’ from the drop down list. The system will then net the entries and show the resultant value in account statements. If you do not net, the entries will be shown separately in the statements.

MIS Head

An MIS Head indicates the manner in which the type of entry should be considered for profitability reporting purposes. This classification indicates the method in which the accounting entry will be reported in the profitability report. It could be one of the following:

- Balance

- Contingent Balance

- Income

- Expense

You can also link a product to an MIS Group if you do not want to define individual entities for the product.

Refer the section titled ‘Associating an MIS Group with the product’ in this chapter for more details.

Revaluation Required

Online Revaluation refers to revaluation done on transaction amounts during transaction posting, and not as part of an end-of-day process. The Revaluation profit /loss are booked to the Online ‘Profit GL’ or Online ‘Loss GL’ that you maintain for the GL being revalued.

You can opt for online revaluation by selecting the ‘Reval Reqd’ option.

Profit GL and Loss GL

If you have opted for online revaluation and the result of revaluation is a profit, the profit amount is credited to the Profit GL you select here. Similarly, if the result of revaluation is a loss, the loss amount is credited to the Loss GL you specify here.

Reval Txn Code

If you opt for online revaluation, you need to associate the transaction code to be used for booking revaluation entries. The system will use this transaction code to track the revaluation entries.

Holiday Treatment

Specify whether holiday treatment is applicable for processing accounting entries falling due on holidays. Select one of the following:

- Yes

- No

GAAP

Indicate the GAAP indicators for which the accounting entry is required for reporting under multi GAAP accounting. The adjoining option list shows all the GAAP indicators maintained in the system. Choose the appropriate one.

The system will then post entries into the specified books (GAAP indicators) during the different events that occur in the lifecycle of the lease. You can retrieve the balance for a certain component in an account in a specific status, for a given GAAP indicator, in a certain branch, reporting to a certain GL. The system will show the real and contingent balances accordingly.

Split Balance

Specify whether you need the balances to be split or not. If you check this option, the system will store the balance break-up for the specified GAAP indicators. You can then retrieve the balances separately for the different GAAP indicators to which accounting entries are posted for the lease.

If you need to move the balances from multiple/Single GLs, where the balances are currently lying, check this box. In such case the credit leg will be governed by the GLs from where component balances need to move, and not the GL maintained at the product level for the event.

Balance Check in Batch

Indicate whether the balance check is required for the batch operations/online processing.

The options available are:

- Reject – The transaction is rejected if there is insufficient fund to process the transaction.

- Delinquency Tracking – The transaction is processed. If you have specified delinquency tracking for the accounting entries, the tracking is done according to the parameters you have defined for the Delinquency Product.

- Force Debit – The transaction is processed. However, no delinquency tracking is done even if the account goes into overdraft.

- Partial Liquidation – The transaction is processed. If you have specified partial delinquency, the system liquidates upto the available amount and the delinquency tracking is done on the remaining amount only.

Delinquency Product

In case you have specified delinquency tracking for balance check type, you need to specify the delinquency product under which the entry is tracked. The option list displays all the delinquency product codes maintained in the Oracle FLEXCUBE. Select the appropriate from the option list.

Settlement

This field used to settle the amount. If it set as yes, while doing settlement system uses the Account used during amount settlement. If it is no it will use default account, which is mapped in role to head.

If you have selected the ‘Accounting Role’ as DR_SETTL_BRIDGE or CR_SETTL_BRIDGE in and if ‘Settlement’ box is checked then system looks at the default settlement accounts maintained in the Debit settlement Mode and Credit settlement mode. If ‘Settlement’ box is not checked then the system tries to arrive at the GL through Role to Head Mapping.

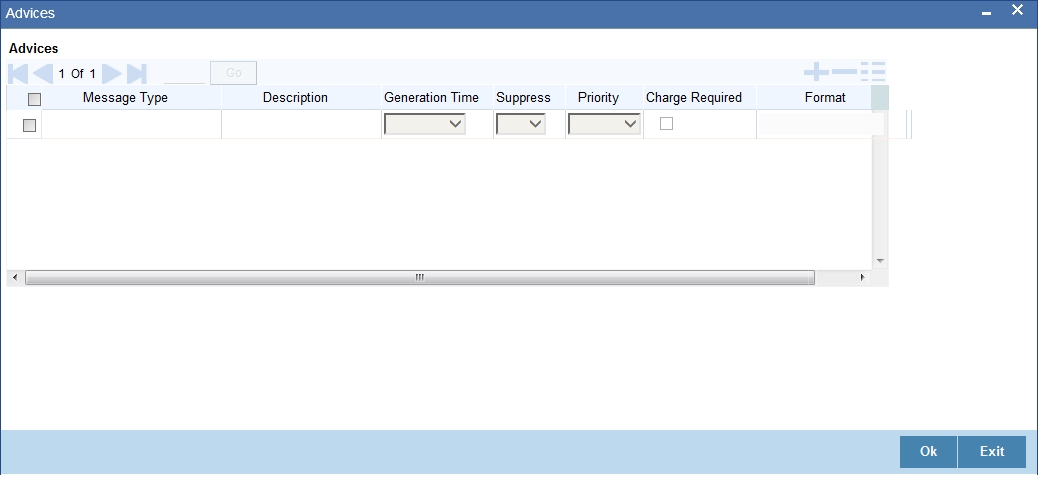

4.1.9.2 Specifying Advices for an Event

You can select the advices that should be triggered for various events. The selected advices are generated, once the product is authorized. These advices can be simple Debit /Credit advices when any payment or disbursement is made, Deal Slip advices, Rate Revision advices, Loan advices etc.

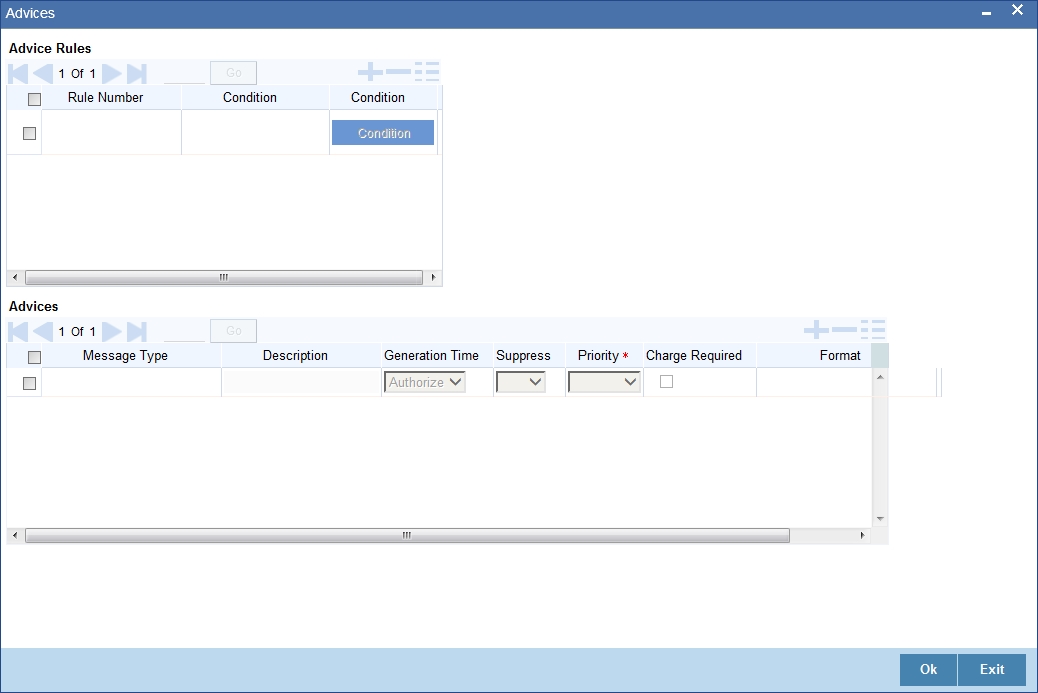

To specify the advices for an event, click ‘Advices’ button in the ‘Events’ screen of the ‘Product Maintenance’ screen – the following screen is displayed.

The following advice details have to be maintained in the screen:

Event Code

Code of the specified event is defaulted from the Event level.

Description

Description of the specified event is defaulted from the Event level.

Advices Details

The following advice details can be maintained here:

Advice Name

Specify a valid advice you want to trigger, from the adjoining option list. This option list displays advices applicable for the module.

Description

Description of the specified advice is defaulted here.

Generation Time

Authorization is defaulted as the generation time for all advices which need to be generated for a specified Event.

Suppress

Select ‘Y’ or ‘N’ from the adjoining drop-down list to either suppress or allow the generation of some advices.

Priority

Select the importance of the advice generation from the adjoining drop-down list. This list displays the following values:

- High

- Medium

- Low

Charges

Check this box if you want to collect charges for advice generation.

For a detailed list of Events, Advices, Accounting Roles and Amount Tags, refer ‘Annexure A’ of this User Manual.

4.1.9.3 Defining User Defined Policies

Policies are user defined validations that will be fired when any event is triggered. These can even be policies which govern the firing of an event under certain conditions.

For example, if an operation called payment is being done and the customer is paying an amount greater than his current overdue and one additional installment, you can associate a policy to disallow the payment. Therefore, you have to associate policies to an event.

Click on ‘Policies’ button in the ‘Events’ screen to define the policies that should be executed for an event.

You can select the appropriate policy from the option list provided. The policies defined in the ‘User Policy’ screen are available in this list. You should also specify the instance when the policy should be triggered for the event. The options are:

- Before Event

- After Event

- Both

4.1.9.4 Associating Charges

You can associate charges to an event. Linking a charge to an event implies calculating the value of the charge.

To associate charges, click ‘Charges’ button in the ‘Event’ screen.

The charge type of components defined for the product (in the ‘Components’ tab of the screen) are displayed in the option list. Select the component you wish to associate with the event.

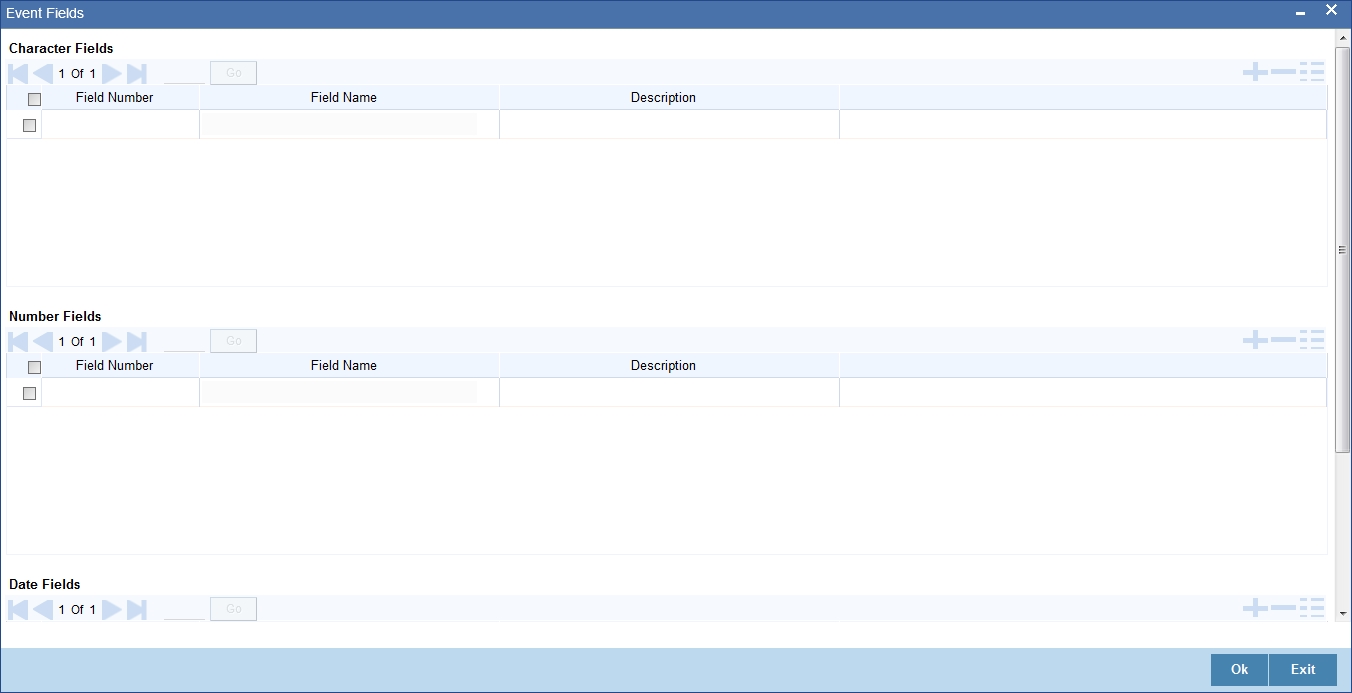

4.1.9.5 Defining Event Fields

You can invoke the ‘Event Fields’ screen by clicking on the ‘Event Fields’ button on the ‘Events’ screen.

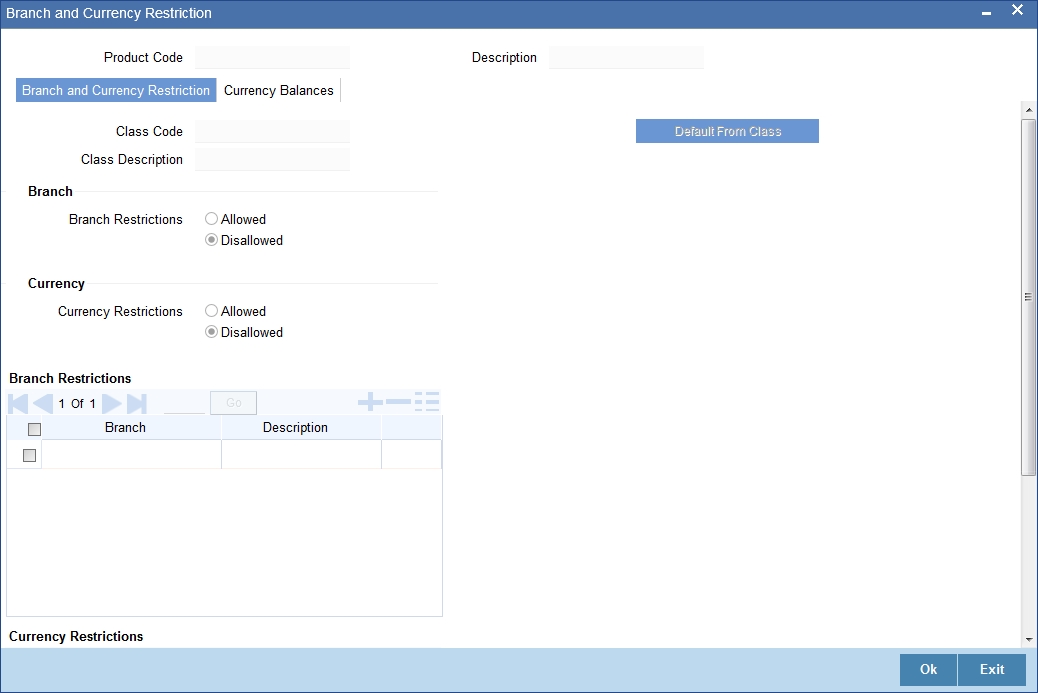

4.1.10 Maintaining Branch /Currency Restriction

The lease products created in the Head Office Bank (HOB) are available across all the branches subject to the branch restrictions maintained for the product. Likewise, you also restrict the products to select currencies. To achieve this, you can maintain a list of allowed/disallowed branches and currencies

Click on the ‘Branch /Currency Restriction’ button in the product screen.

The following details are captured here:

4.1.10.1 Branch /Currency Restriction tab

Under Branch and Currency Restrictions respectively, two columns are displayed.

- Allowed List

- Disallowed List

The allowed or disallowed column that is displayed would depend on the list type that you choose to maintain. For instance, if you choose to maintain an allowed list of branches, the column would display the branches that you can opt to allow.

In the Branch Restriction and Currency Restriction Section, click on the adjoining option list to invoke a list of bank codes and currencies codes respectively that you have maintained in your bank. Select an appropriate code.

Using the Add or Delete icons, you can add/delete a branch or currency from the corresponding allowed/disallowed column that you have maintained.

Note

When you create a product, it is, by default, available to all the branches of your bank, in all currencies, and for all customers unless restrictions are explicitly specified for the product.

Minimum Loan Amount

Specify the minimum amount for all the allowed currency maintained at the product level.

Maximum Loan Amount

Specify the maximum amount for all the allowed currency maintained at the product level.

Note

System checks the following:

- At the product level, if the minimum amount is less than the maximum amount

- At the Lease Contract screen, if the amount financed falls in the range of minimum and maximum amount derived from product for the currency same as the lease currency

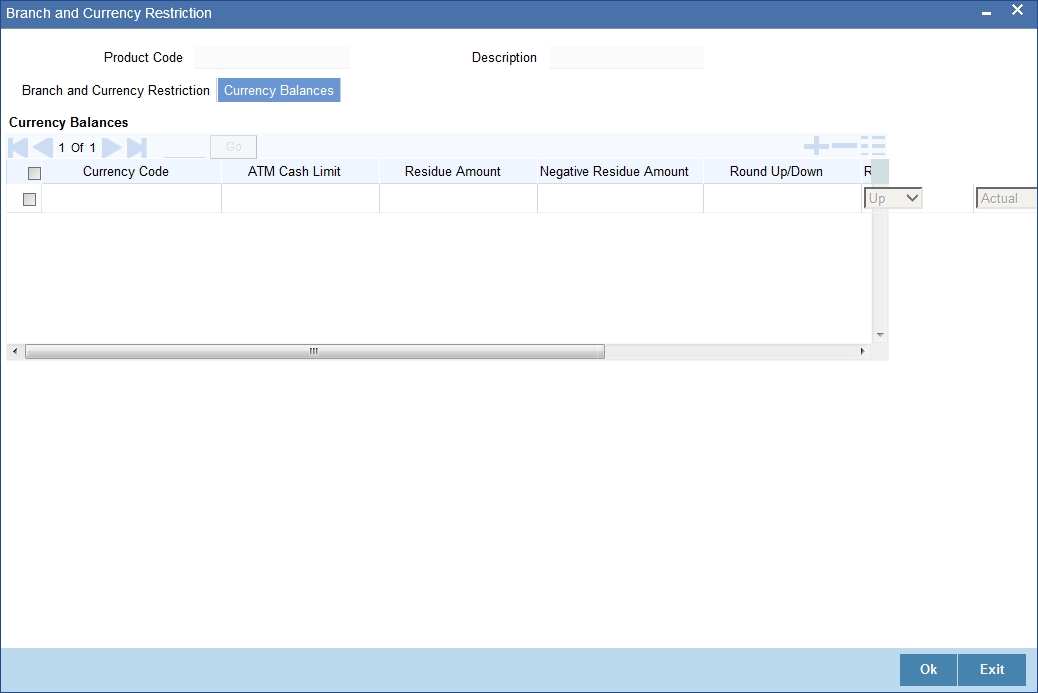

4.1.10.2 Currency Balance Restriction Tab

You can maintain the following currency balance details:

Currency Code

You can specify the transaction limit for a currency while defining currency restrictions for a product. Choose the currency code from the option list.

Residue Amount

Here, you have to capture the minimum amount by which, if a component of a schedule becomes overdue, the system will consider it as paid.

Negative Residue Amount

If the difference between the amount paid (COMPONENT_EXPECTED) and the amount due is less than the residue amount specified here, then the difference is treated as an income otherwise the transaction is rejected.