4. Defining Products for Loan Syndication

In this chapter, we shall discuss the manner in which you can define attributes specific to products that you could define, which are to be used to process Loan Syndication contracts, whether on the borrower side or the participant side.

This chapter contains the following sections:

- Section 4.1, "Introduction to Products for Loan Syndication"

- Section 4.2, "Products for Loan Syndication"

- Section 4.3, "Borrower Tranche / Draw down Product Details"

- Section 4.4, "Participant Products"

- Section 4.5, "Preferences for Participant Products"

- Section 4.6, "Borrower Facility products"

- Section 4.7, "Saving Loan Syndication Product"

4.1 Introduction to Products for Loan Syndication

A product is a specific service, scheme or utility that you make available to customers of your bank.

For instance, the facility of a syndication contract between your bank and other banks or financial institutions, for the purpose of pooling funds to disburse loans is a specific service you could offer. This service can be thought of as a product.

Similarly, the facility of availing loans through a draw down, from any of the tranches under the syndication contract, is another specific service that you offer to customers. This could also be thought of as a product.

This section contains the following topics:

4.1.1 Product Type

The first attribute of a product is the Product Type, which categorizes the product. It also indicates its nature and the kind of contracts that could be entered against the product. For instance, a borrowing line commitment contract would be entered against a borrowing line type of product.

4.1.2 Contracts

A contract is a specific agreement or transaction entered into between two or more entities. A customer who approaches your bank to avail of any of the services offered by your bank enters into a contract with your bank.

In the case of a borrower facility contract, the entities involved in a contract are the borrowing customer and the participants for any tranche of the agreement.

Similarly, any specific loans (draw downs) disbursed by your bank under a tranche in the borrower facility contract are also contracts.

In Oracle FLEXCUBE, a contract is entered into the system against a product. For instance, a draw down loan under a tranche in a borrower facility contract is entered into the system against a borrower leg draw down loan product.

When Oracle FLEXCUBE processes the contract, it will apply all the attributes and specifications made for the product against which the contract was entered. You can enter more than one contract against a product.

4.2 Products for Loan Syndication

Products for borrower side contracts

When you define products for the processing of borrower tranches and draw down loans under a borrower facility contract, you would need to do so at two levels:

- Products that contain attributes and preferences by which all commitments (and the resulting draw down loans) under borrower tranches of borrower facility contracts will be processed

- Product with attributes and preferences for processing the main level syndication agreement (facility) contracts with the borrowers

Products for Participant Contracts

You also need to define products containing attributes and preferences for processing participant facility, tranche or draw down (deposit) contracts that will be created under the related borrower facility, tranche or draw down (loan) contracts.

This section contains the following topics:

- Section 4.2.1, "Products for Borrower Tranche Contracts and Draw Down Loans"

- Section 4.2.2, "Borrower Facility Product for Main Borrower Facility Contract"

4.2.1 Products for Borrower Tranche Contracts and Draw Down Loans

At the second level, for the borrower tranche contracts under a main borrower facility contract, you will need to define a commitment type of product for the borrowing customer.

The commitment contract for the borrower at tranche level is processed in the same manner as a normal commitment contract in Oracle FLEXCUBE.

Also, for the actual borrower draw downs in a borrower tranche under a borrower facility contract, you would need to define a loan type of product for a loan advanced to the borrowing customer (draw down)

The loan contract at draw down level for the borrowing customer is processed in the same manner as normal loans in Oracle FLEXCUBE.

The process in which the loan is disbursed (or the borrowing customer avails the loan principal) under a borrower facility contract depends upon many factors. The most important factor is the nature of the requirement of the borrowing customer. The other factor is the identification of the participants who would share the load of funding the borrowing.

Under a syndication contract, the borrower may need to avail the loan principal in many tranches. Under each tranche, the borrower may avail the total tranche amount through a specified number of draw down loans.

The deployment of the total syndication amount in as many tranches is done according to the requirement of the borrower. Similarly, the deployment of the tranche amount, in a specified number of draw down loans is also decided by the requirement of the borrower. Each tranche amount as well as each draw down loan may have different processing attributes with regard to components such as interest, fees, tax applicable and so on, and these attributes would be arranged to suit the borrower’s requirement.

Accordingly, you will need to define borrower tranche products with specific attributes to process borrower tranche contracts with specific requirements. Similarly, you will need to define borrower draw down products with specific attributes to process borrower draw down loans with specific requirements. Consider the example given below:

4.2.2 Borrower Facility Product for Main Borrower Facility Contract

At the first level, you must define a borrower facility product for borrower facility contracts. The example given below will illustrate this.

For example, the bank has decided to make available the facility of entering into a Loan Syndication contract with customers. You can define a product for this facility. Let us assume that the product you define has been given the code SYN1. Now, any syndication facility contracts that are entered into by your bank with any borrowing customer can be processed against this product.

You can define more than one syndication facility product. For instance, you can define a general syndication product, and a special syndication product.

Suppose that you have entered into a syndication contract with one of your customers. After identifying the participants for a tranche under this contract, you want the participants in a tranche to fulfill their commitments five days in advance, before each draw down schedule under the tranche falls due. You could define a general syndication facility product to enter a contract of this nature, specifying the required number of notice days as five.

Your bank has also entered into an agreement with one of your corporate customers, Equinox Consultants. Let us suppose that, for this contract you do not need to notify the participants in advance of a schedule. You could define a special syndication facility product to enter agreements of this nature, with the number of notice days as zero.

4.3 Borrower Tranche / Draw down Product Details

This section contains the following topics:

- Section 4.3.1, "Creating Borrower Tranche / Draw down Product"

- Section 4.3.2, "Maintaining User Data Elements "

- Section 4.3.3, "Margin Component"

- Section 4.3.4, "Maintaining Preferences "

- Section 4.3.5, "Maintaining LS Preferences "

- Section 4.3.6, "Maintaining Components Details"

- Section 4.3.7, "Maintaining Notices and Statements "

- Section 4.3.8, "Maintaining Role to Head "

- Section 4.3.9, "Maintaining Events "

- Section 4.3.10, "Branch Currency Restriction"

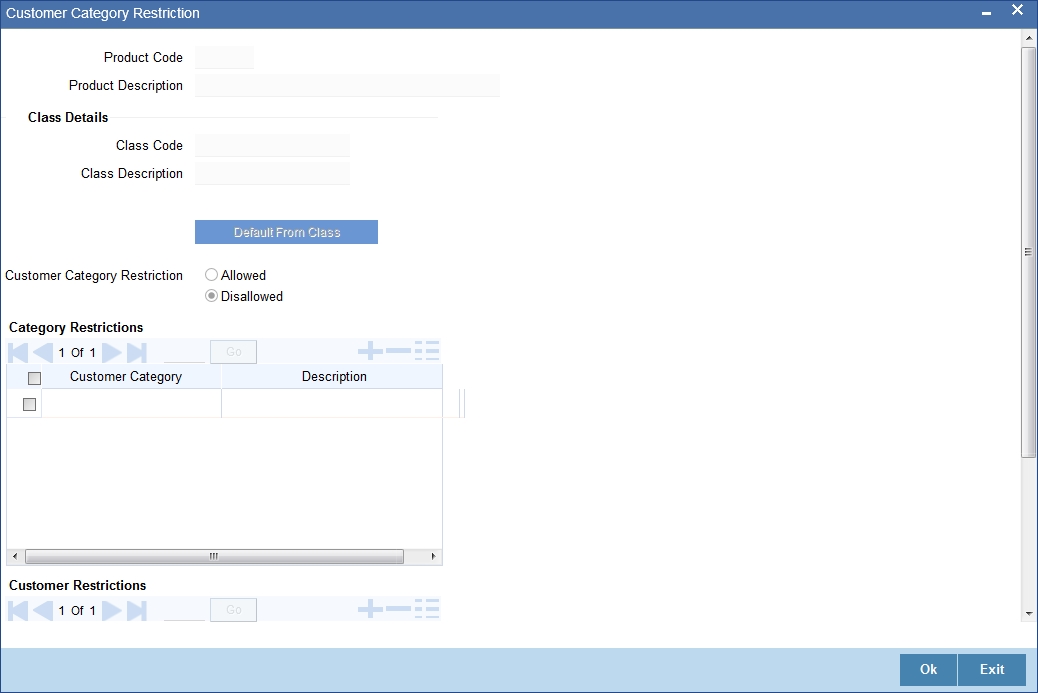

- Section 4.3.11, "Maintaining Customer Category Restriction Details"

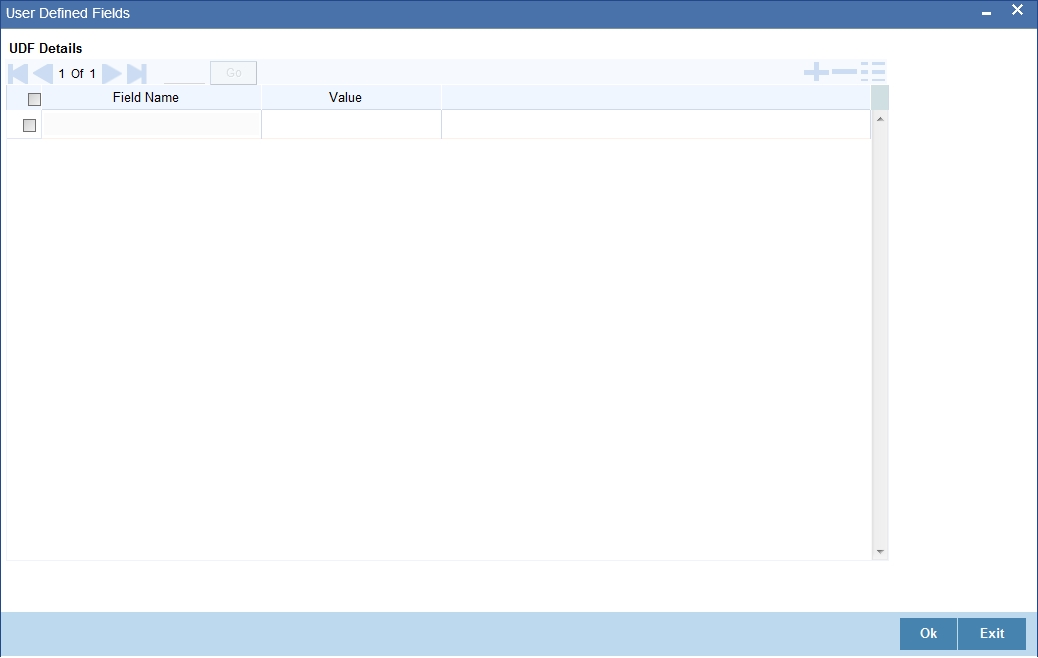

- Section 4.3.12, "Maintaining UDF"

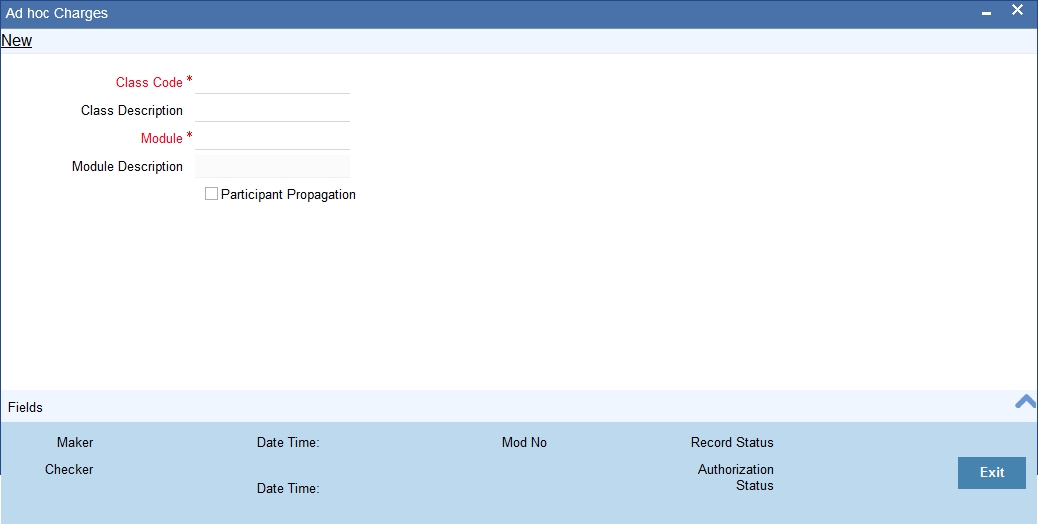

- Section 4.3.13, "Associating Ad-hoc fee Components "

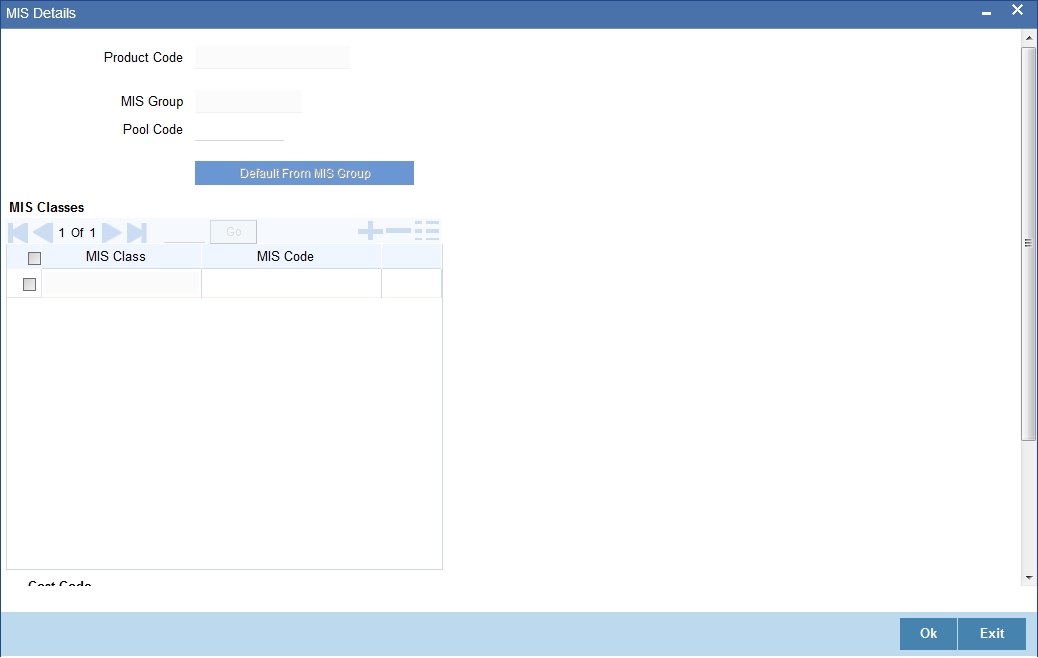

- Section 4.3.14, "Specifying MIS Details"

- Section 4.3.15, "Associating Parties"

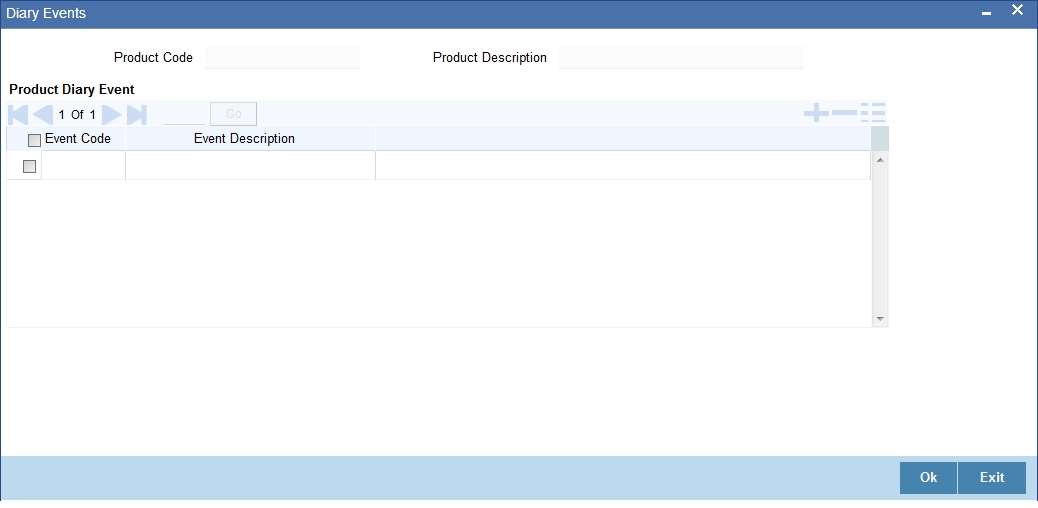

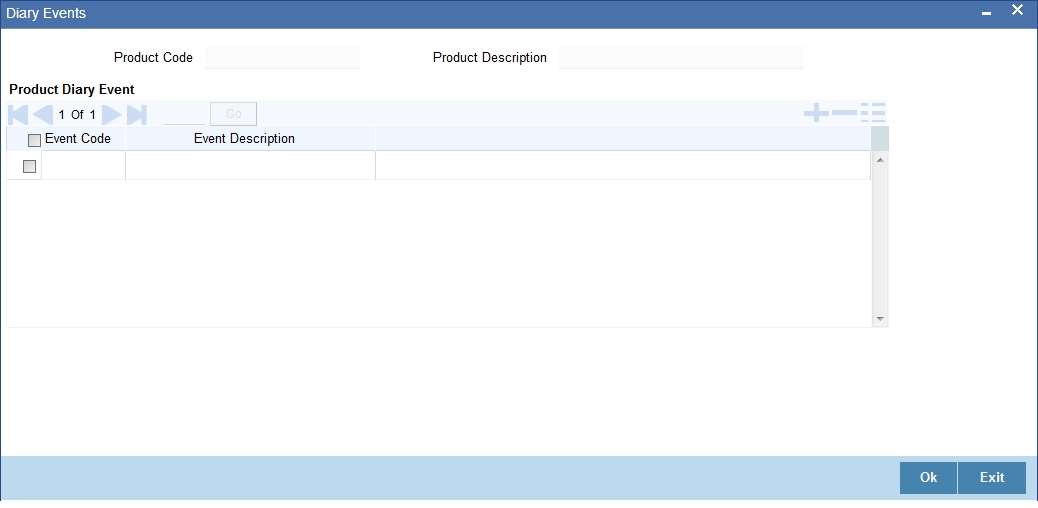

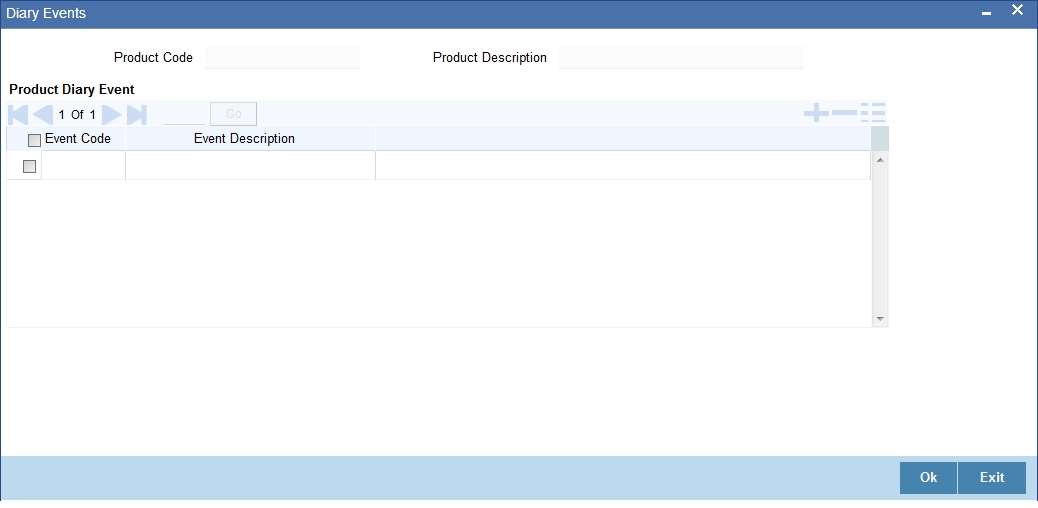

- Section 4.3.16, "Associating Diary Events"

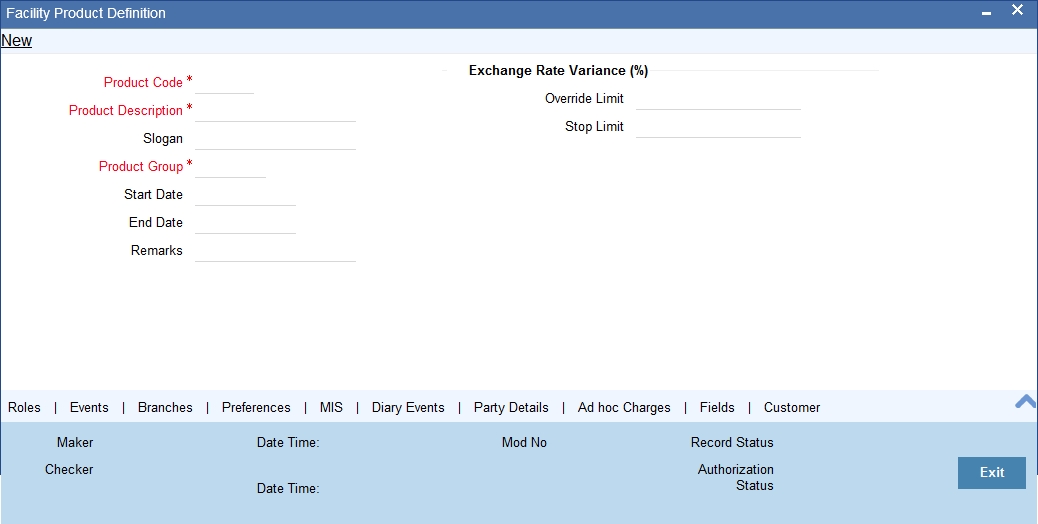

4.3.1 Creating Borrower Tranche / Draw down Product

When you define a borrower facility product, you must specify the corresponding borrower tranche and draw down products to be used for borrower tranche or draw down contracts that will be processed under the parent borrower facility contract that uses the borrower facility product.

Therefore, it becomes necessary for you to create borrower tranche and draw down products before creating borrower facility products.

In this section, the creation of borrower products at tranche level and draw down level is explained.

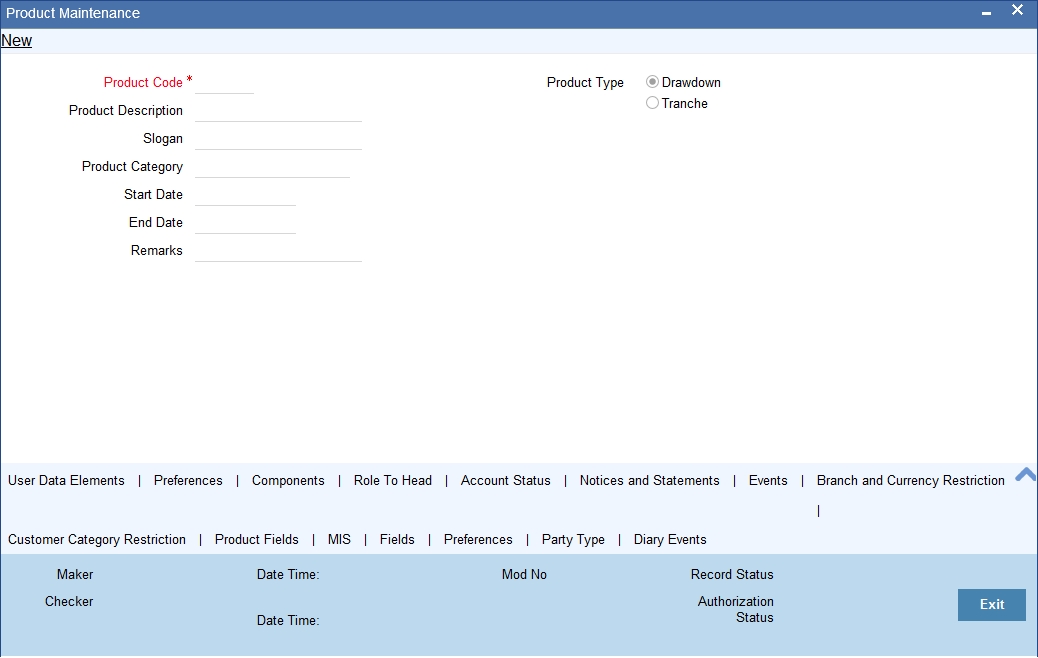

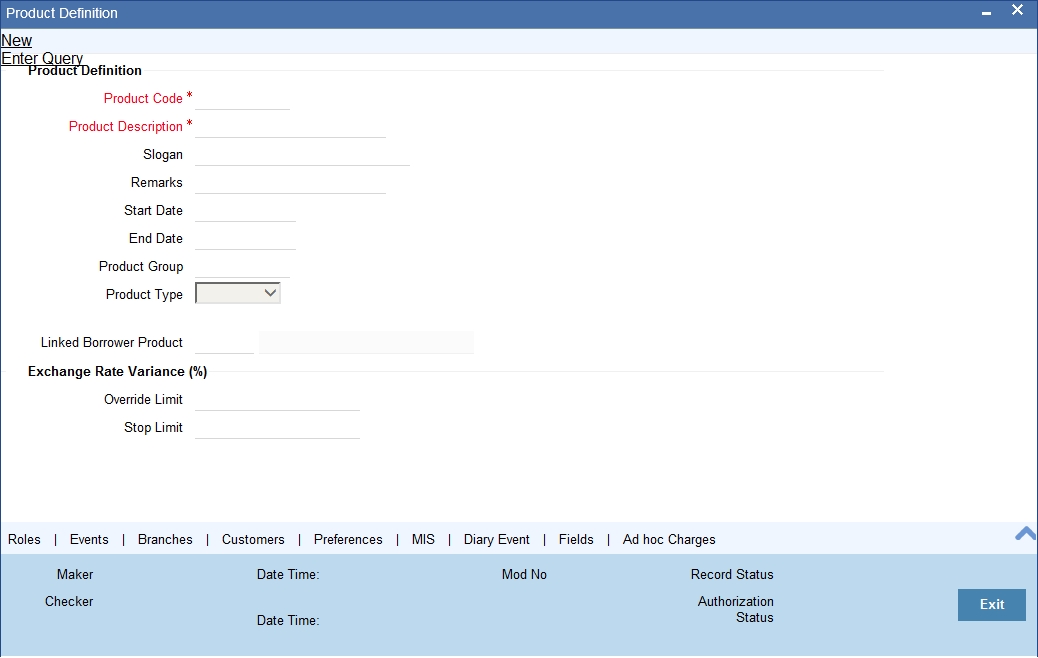

To create a borrower tranche or draw down product you can specify the basic details such as the Product Code, Group, Description, and so on in the Tranche/Drawdown – Product Definition screen.

You can invoke this screen by typing ‘LSDPRMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

For any product you create in Oracle FLEXCUBE, you can define generic attributes, such as branch, currency, and customer restrictions, interest details, etc., by clicking on the appropriate icon in the horizontal array of icons in this screen. For a borrower tranche/drawdown product, in addition to these generic attributes, you can specifically define other attributes. These attributes are discussed in detail in this section.

You can define the attributes specific to a borrower tranche / draw down product in the ‘Loan Syndication – Borrower Product Definition’ screen, the ‘LS Product Preferences’ screen.

The code you enter for a product identifies it throughout the module. You can follow your own conventions for devising the code. However, it must have a minimum of four characters.

When defining a new product, you should enter a code. This code is unique across the CL modules of Oracle FLEXCUBE. For instance, if you have used VA01 for a product in this module, you cannot use it as a product code in any other module.

You should also enter a brief description of the product. This description will be associated with the product for information retrieval.

The product type is the first attribute that you specify for a borrower tranche or draw down product. It indicates the category under which the product can be placed, and the type of contract that will be processed against the product.

Each borrower tranche level or draw down level product that you define could be placed under any of the following categories:

- Drawdown – Select this option to define a borrower draw down in a borrower tranche under a borrower facility contract.

- Tranche – Select this option to define a tranche under a facility contract. Product Category

Products can be categorized into groups, based on the common elements that they share. For example Vehicle Loans, Personal Loans, Home Loans, and so on. You must associate a product with a category to facilitate retrieval of information for a specific category.

The categories defined through the ‘Product Category Maintenance’ are available in the option-list provided.

Product End Date

A product can be defined to be active for a specific period. When you create a product, you specify an End Date for it. The product can only be used within the specified period i.e. within the Start Date (the date on which the product is created) and End Date. If you do not specify an end date for a product, it can be used for an indefinite period and the product becomes open-ended in nature.

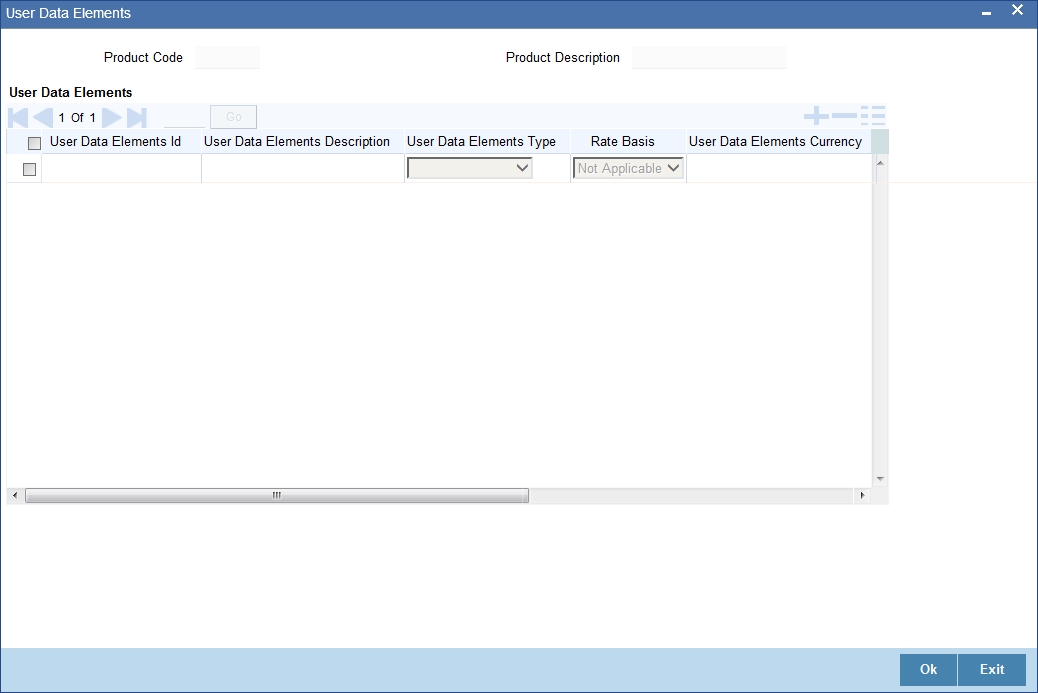

4.3.2 Maintaining User Data Elements

The main details are defined in the ‘User Data Elements’ screen which you can invoke the screen by clicking ‘User Data Elements’ button. The header section of the screen is used to define the basis details of a product.

The main details include the definition of ‘User Data Elements.

To define a User Data Element (UDE), you have to specify the following details:

UDE ID and Description

Data elements like the rate at which interest has to applied, the tier structure based on which interest needs to be computed etc. are called User Data Elements (UDEs). These are, in effect, elements for which you can capture the values. You have to specify a unique ID to identify the UDE in the system. The UDE maintained here will be available for defining product rules.

You can also provide a brief description of the UDE being defined.

UDE Type

UDE Type will describe the nature of the UDE. An UDE can fall into one the following types:

- Amount

- Number

- Rate

- Rate Code

UDE Currency

If the UDE type is ‘Amount’, you should specify the currency of the UDE. The currencies maintained in the ‘Currency Definition’ screen are available in the option-list provided. You can select a currency from this list.

The UDE names alone are captured here. To capture the values for the UDEs defined for a product, you have to use the ‘UDE Values’ screen.

Refer to the section titled ‘Providing UDE Values’ in the ‘Maintenances and Operations’ chapter of this User Manual for more details.

4.3.3 Margin Component

In addition to normal interest rate, borrower can be charged a margin to accommodate the bank's mark up. For margin, the calculation type will be "Margin", and will have only revision schedules. The component does not have any formula, and uses "MARGIN_RATE" ude for "rate to use". This UDE is added to the regular MAIN_INT component's book formul with the INTEREST RATE UDE. Formula used is @SIMPLE(PRINCIPAL_EXPECTED,INTEREST_RATE + MARGIN_RATE ,DAYS,YEAR,COMPOUND_VALUE)

Note

This component is applicable only to the drawdown.

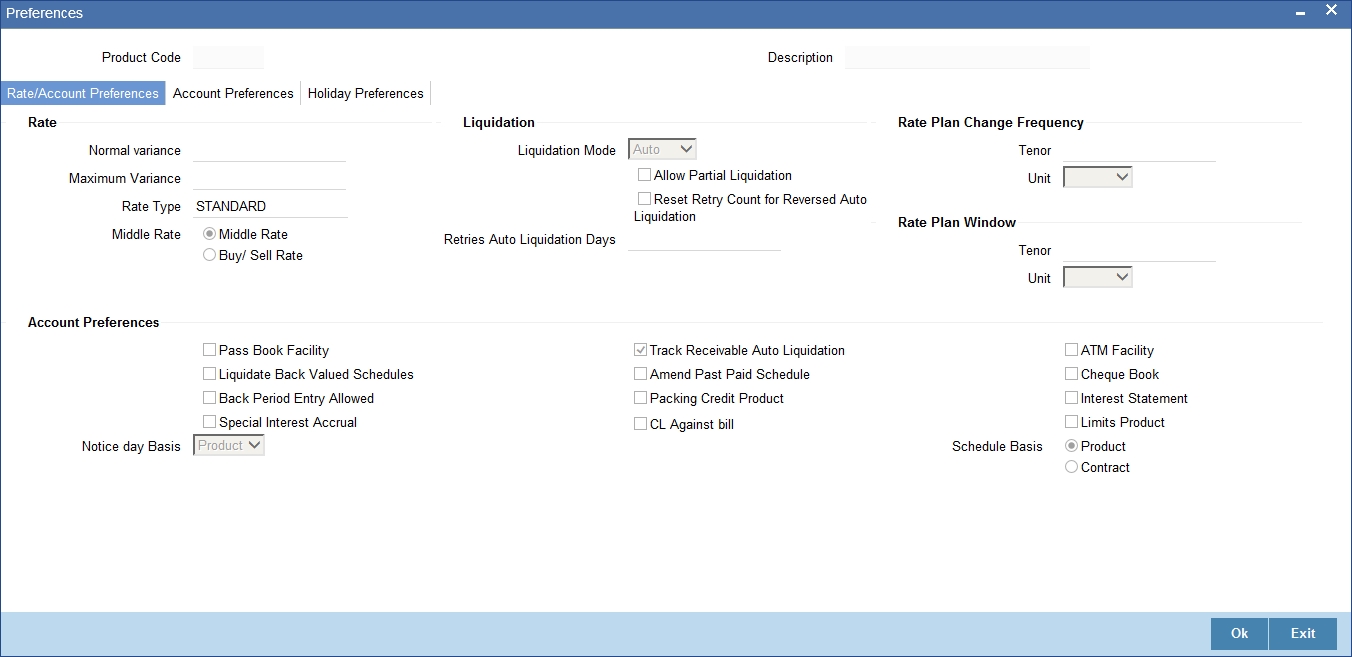

4.3.4 Maintaining Preferences

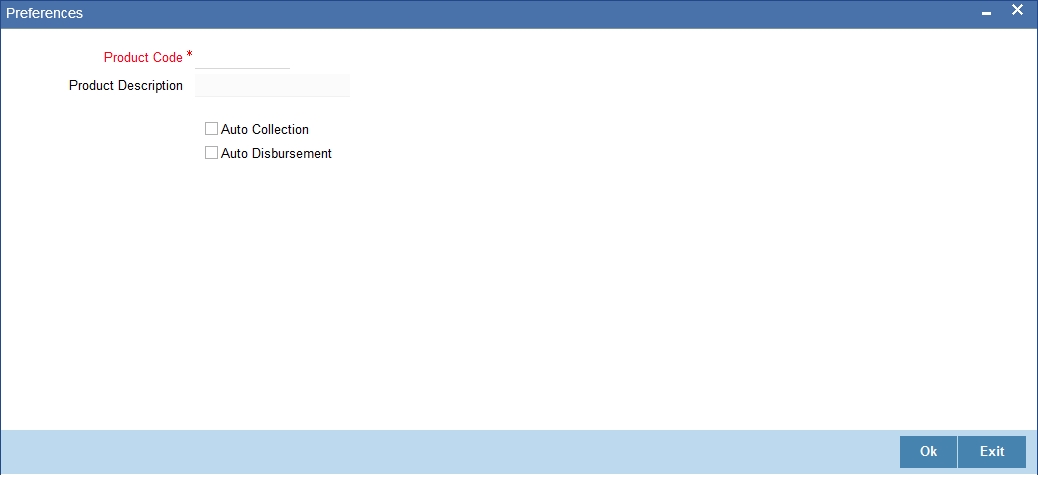

Preferences are options that you can use to define specific attributes for a product, which will be applied automatically to contracts that are entered and processed against the product.

You set up preferences for a borrower tranche/draw down product in the LS Product Preferences screen. Click ’Preferences’ button in the ‘Loan Syndication Product’ screen.

You set up the general preferences for a borrower tranche or draw down product in the LS Product – Preferences screen in the same manner as you would for a normal commitment product or loans, depending upon the product type you have specified in the ‘Loan Syndication – Borrower Product Definition’ screen.

Refer to the Retail Lending User Manual for a detailed description. In this section we will discuss only those preferences that are specifically used by borrower tranche or drawdown products.

4.3.4.1 Rate Preferences

The exchange rate preferences include the following:

Normal Variance

You also need to specify the minimum/normal variance allowed for the rate. If the exchange rate variance between the exchange rate (specified for the product) and the rate captured for a loan exceeds the value specified here, the system will display an override message before proceeding to apply the exchange rate. The normal variance should be less than the maximum variance.

For back valued transactions, the system applies the rate on the basis of the exchange rate history. The variance will be based on the rate prevailing at that time.

Maximum Variance

When creating a product, you can capture the maximum limit for rate variance. This is expressed in percentage. The variance between the exchange rate (specified for the product) and the rate captured for a loan (at the account level) should not be greater than the value specified here. If the exchange rate exceeds the maximum variance that you have defined for the product, the system will not allow you to save the loan. The transaction is rejected.

This value should be greater the value for ‘Normal Variance’.

Rate Type

You have to select the code that should be used for the product from the option list provided. The ‘Rate’ and ‘Rate Type’ are used in combination to determine the actual rate applicable for currency conversion.

The default value for Rate Code is ‘STANDARD’. This means that, if you choose ‘Mid Rate’, the mid rate maintained for the STANDARD code is used for the loans created under the product.

Rate

You have to indicate the exchange rate applicable for the product you are maintaining. The available options are:

- Mid Rate

- Buy/Sell Rate

By default, the Buy/Sell Rate is used.

4.3.4.2 Liquidation Preferences

Liquidation preferences include the following:

Liquidation Mode

You can specify the mode of liquidation to be either Auto Liquidation or Manual Liquidation.

Allow Partial Liquidation

In case of insufficient funds in the account, you can instruct the system to perform partial auto liquidation to the extent of funds available in the account. However, if this option is not selected, the schedule amount due will not be liquidated if sufficient funds are not available in the account.

Retry Count for Reversed Auto Liquidation

If you have maintained a limit on the number of retries for auto liquidation, this option will reset the retries count to zero during reversal of auto liquidation. This will be applicable from the date of reversal of payment. Hence, the system will once again attempt auto liquidation till the number of retries allowed. The system will update the status of the reversed payment to ‘Unprocessed’ after which it again attempts auto liquidation.

Retries Auto Liq Days

Capture the number of working days for which the system should attempt auto liquidation. The number of retries per day will depend on the configuration maintained for the ‘Liquidation Batch Process’ - during BOD, EOD or both. For instance, if the batch is configured for both EOD and BOD, and the number of retry days is ‘1’, then, auto liquidation is attempted twice on the same day i.e. once during BOD and another retry at EOD.

4.3.4.3 Holiday Treatment Preferences for Schedules

The value date, schedule date, revision date or the maturity date of a contract might fall on a local holiday defined for your branch or on a holiday specified for the currency involved in the contract.

You need to specify the following holiday parameters, which has to be considered for holiday handling:

Ignore Holidays

If you check this option, the schedule dates will be fixed without taking the holidays into account. In such a case, if a schedule date falls on a holiday, the automatic processing of such a schedule is determined by your holiday handling specifications for automatic processes, as defined in the ‘Branch Parameters’ screen.

Move Across Month

If you have chosen to move the schedule date of a loan falling due on a holiday, either to the next or previous working day and the movement crosses over into a different month, then this option will determine whether the movement should be allowed or not.

Cascade Schedules

If you check this option, when a particular schedule falls due on a holiday and hence is moved to the next or previous working day (based on the ‘Branch Parameters’), the movement cascades to other schedules too. If not selected, only the affected schedule will be moved to the previous or next working day, as the case may be, and other schedules will remain unaffected.

However, when you cascade schedules, the last schedule (at maturity) will be liquidated on the original date itself and will not be changed like the interim schedules. Hence, for this particular schedule, the interest days may vary from that of the previous schedules.

Adhoc Treatment Required

Check this option to allow the movement of due dates of the schedules that fall on the newly declared holidays. This option is enabled only if the options, Ignore Holidays parameter and the Cascade Schedules parameter are not checked at the product level.

Move across Month – Forward /Backward

If you opt to move the schedule date falling due on a holiday across months, you need to specify whether the schedule date should move forward to the next working day in the following month or move backward to the previous working day of the current schedule month itself.

However, if you opt to ignore the holidays and do not select the ‘Move Across Months’ option, the system Ignores the holidays and the due will be scheduled on the holiday itself.

4.3.4.4 Account Preferences

As part of specifying the account preferences, you can indicate the following:

Amend Past Paid Schedule

This option, if checked, allows you to perform value dated amendments to interest rate, installment amount etc with effective date beyond the last paid schedule. In such a case, the increase/decrease in the interest amount, as a result of the amendment, will be adjusted against the next available schedule after the current system date (date on which the amendment was performed) even if unpaid (overdue) schedules are present for the loan.

Liquidate Back Valued Schedules

If you select this option, on initiation of a back value dated loan, all the schedules with a due date less than the system date will be liquidated.

Back Period Entry Allowed

This option facilitates back valued transactions. If you select this option, you will be allowed to process transactions with a value date less than the current system date.

Specifying the notice days basis

You can indicate whether the notice days applicable for borrower draw down contracts using the product must be defaulted from the product preferences, or from the parent tranche or facility contract.

The notice days refers to the number of days before a schedule payment date, a payment notice is to be sent to the borrowing customer, for the borrower draw down contract. This would apply to ad-hoc fee, interest and principal schedules, defined for the contract.

4.3.4.5 Readjustment Entry Preferences

You have to specify the manner in which adjustment entries passed due to back dated adjustments should be handled. The options are:

- Settlement: This means that the adjustment is settled directly.

- Adjust: In this case, the entries are tracked as a receivable (Cr) or a payable (Dr), to be settled later.

4.3.4.6 Specifying Rollover Details

Allow Rollover

Select ‘Yes’ to indicate that the loan can be rolled over. This preference is defaulted at the account level and can be overridden. Other rollover preferences can be maintained only if this option is checked.

If you select ‘No’ validation is done during save, to disallow setup of ROLL event.

4.3.4.7 Tenor Preferences

You can set the minimum and maximum tenor limits for a product. You can also specify a standard or a default tenor.

Minimum Tenor

You can fix the minimum tenor of a product. The tenor of the loan account that involves the product should be greater than or equal to the Minimum tenor that you specify.

Maximum Tenor

Likewise, you can also specify the maximum tenor for a product. The tenor of the loan accounts that involve the product should be less than or equal to the Maximum tenor that you specify.

Default Tenor

The ‘default tenor’ is the tenor that is associated with a loan account involving this product. The value captured here should be greater than the minimum tenor and less than the maximum tenor. You can change the default tenor applied on a loan account during loan processing. However, the new tenor should be within the minimum and maximum tenors maintained for the product.

Unit

The tenor details that you specify for a product can be expressed in one of the following units:

- Days

- Months

- Year

4.3.4.8 Recomputation of Amortization Loan at Amendments

You have to indicate whether the tenor of the loan should be reduced or the installment should be recalculated whenever a maturity date, principal change or a rate change is made against an amortized loan.

Recomputation basis for amendments

The possible amendments and the recomputation basis are given below:

- For amendment of maturity date of an amortized loan: You can opt to change the tenor, keeping the installment constant or change the Installment keeping tenor constant.

- For amendment of principal amount: You can affect it either as a Balloon additional amount in the last schedule or apportion it across the installments.

- For interest rate change: You can change the tenor keeping the installment constant or vary the EMI and keep the tenor same.

VAMI Installment Calculation Type

For amendments, if the recomputation basis is ‘Change Installment’, then the Installment calculation can be:

- Single Installment

- Multiple Installment based on multiple future rates

4.3.4.9 Account Opening Installment Calculation Type

The Account Opening Installment Calculation Type based on future rates can be:

- Single Installment: A single installment is computed using the future rates.

- Multiple Installments: Multiple EMIs are defined as per the future rates.

4.3.4.10 Accrual Preferences

If IRR computation is applicable for the product that you are defining, you need to specify the accrual preference for the same. You can do this through the Accrual Preference part of the preferences screen.

Here you can specify the following details:

Accrual Frequency

Specify the frequency at which IRR accrual should be performed. This can be either Daily or Monthly. Choose the appropriate option from the adjoining drop-down list.

Handling of Foreclosure

Specify how foreclosures in respect of the loan contracts under the product, must be handled. You can opt for complete accruals or refund. Choose the appropriate option from the adjoining drop-down list.

Note

In case of pre-closure of the loan (prepayment of the total outstanding amount), the fund interest will also get liquidated and thus the accrual entries will get reversed.

Acquisition Type

Specify the acquisition type for the product. You can specify any of the following options:

- Par

- Par/Discount

- Par/Premium

- Par/Discount/Premium

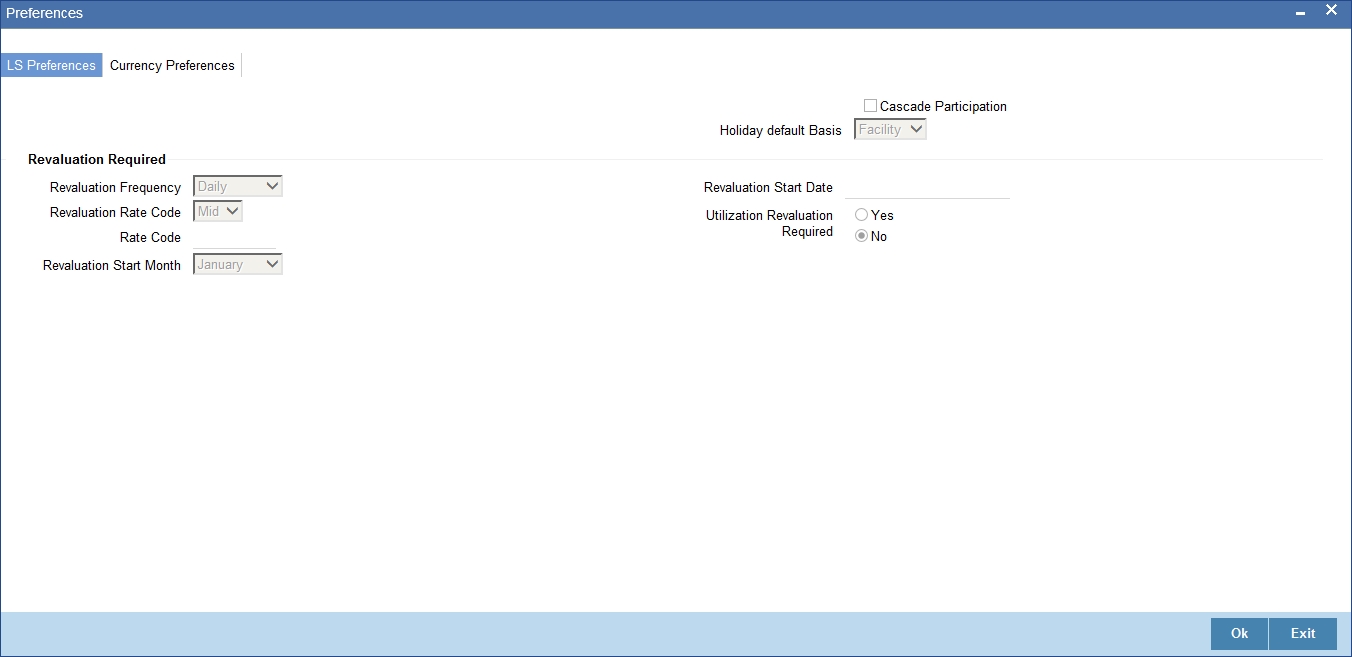

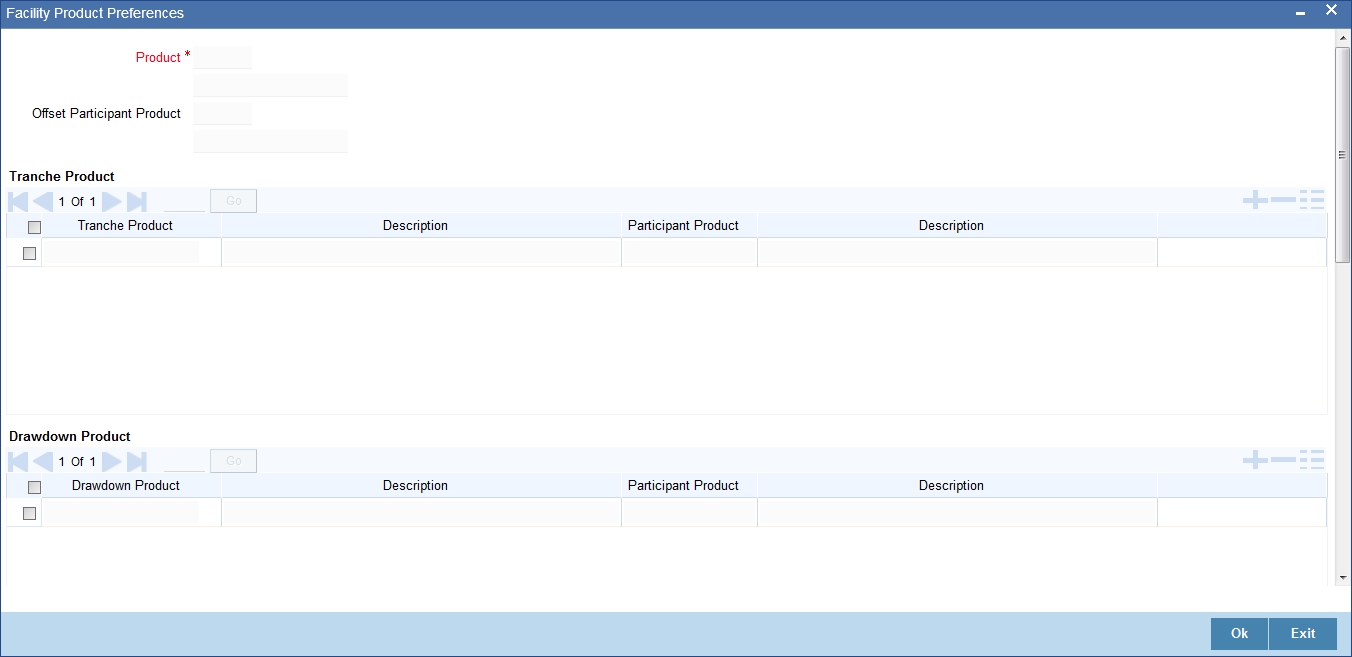

4.3.5 Maintaining LS Preferences

You can specify the following additional details regarding syndication, for borrower tranche or draw down products, in the Loan Syndication Preferences screen. Click ‘Preferences’ button in the ‘Loan Syndication Product’ screen.

Product for resultant participant contracts

For a borrower tranche/drawdown product, the corresponding participant product to be used for participant borrowing line contracts that will be created under the borrower tranche/drawdown contracts that use the product.

Cascading Participation

For a borrower tranche product, you can indicate whether any changes to participant details in respect of a borrower tranche contract that uses the product, must be propagated to all related and active draw down contracts.

You cannot change the participants or their ratios in respect of borrower draw down contracts that you define for a borrower tranche contract using a product for which the ‘Cascade Participation’ preference has been set.

Specifying the holiday default basis

For a borrower product, you can indicate whether the holiday treatment (for schedule dates and maturity date) applicable to tranche or draw down contracts using the product must be defaulted from the parent borrower facility product; or from the borrower tranche or draw down product.

In the Holiday Default Basis field, select “Facility” to indicate that the holiday treatment specified in the borrower facility product is applicable, or select “Product” to indicate that the holiday treatment from the borrower tranche or draw down product is applicable.

Specifying exchange rate fixing details

For borrower tranche products, you can specify the number of days before the draw down date (defined in the draw down schedule), the exchange rate must be fixed, for contracts wherein the draw down currency is different from tranche currency. The Exchange Rate Fixing Date will be generated as a part of the online process based on this parameter.

You must also specify the currency for which the exchange rate fixing days you have specified would be applicable.

You can specify the applicable number of days for each required currency.

Indicating interest rate fixing details

For borrower tranche products, you can specify the number of days before the draw down date (defined in the draw down schedule), the interest rate must be fixed. The Interest Rate Fixing Date will be generated as a part of online process based on this parameter.

You can specify the applicable number of days for each required currency.

4.3.5.1 Revaluation Preferences for Tranche Amount Utilization

For borrower tranche products, you can indicate whether tranche amount utilization must be revalued, for tranche contracts using the product for which the draw down currency is different from the tranche currency.

Revaluation Frequency

If you have indicated revaluation of tranche amount utilization, you must specify the frequency of revaluation. The options available are Daily, Monthly, Half-yearly, Quarterly and Yearly.

For frequencies other than ‘Daily’, you must also specify the month and the date for commencing the revaluation.

Revaluation Rate type

You must also specify the type of exchange rate that must be used to convert the draw down amount from draw down currency to tranche currency. The options are Buy, Mid and Sell.

Note

Specifying revaluation details for tranche utilization amount is not applicable for borrower draw down products.

Reval Start Month and Date

Specify the month and the date for commencing the revaluation process, for the frequency selected.

Utilization Reval Reqd

Select whether tranche utilization should be revalued or not, when drawdown currency is different from tranche currency. The options available are:

- Yes

- No

Note

This is applicable only for tranche products.

Revaluation Rate Code

If you have indicated revaluation of tranche amount utilization, you must specify the code for the exchange rate that must be used to convert the draw down amount from draw down currency to tranche currency.

4.3.6 Maintaining Components Details

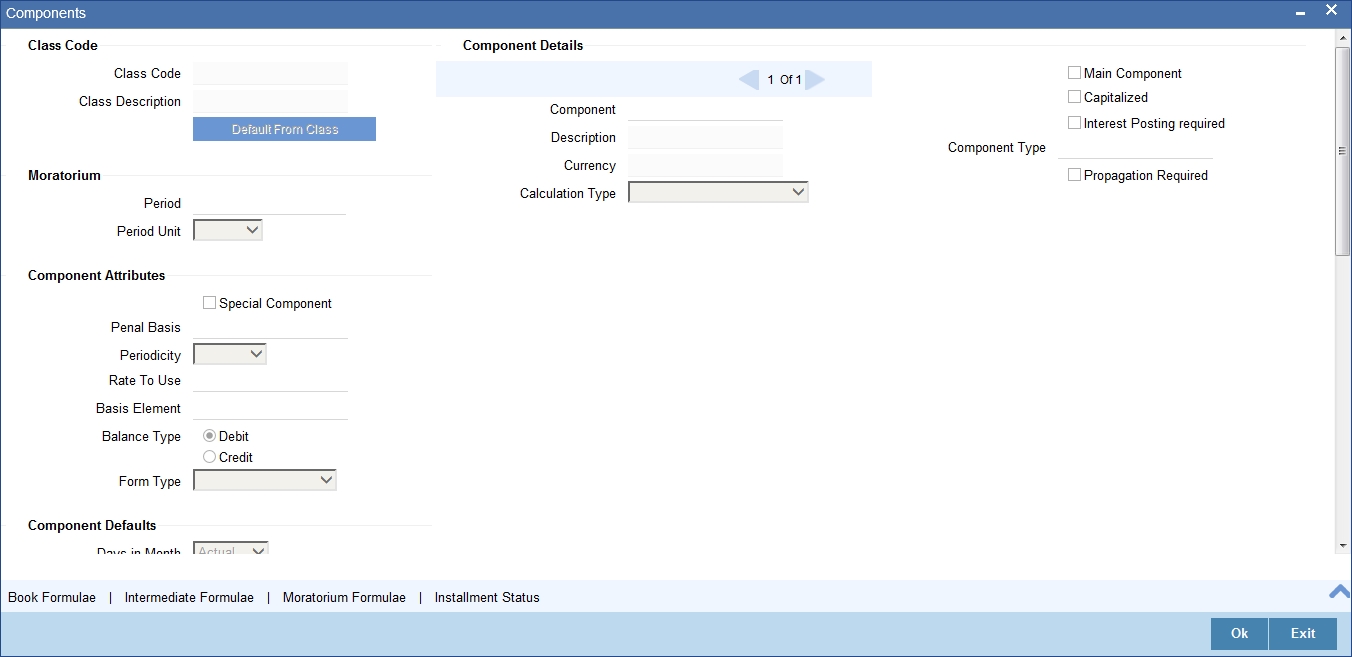

The component details for the Borrower tranche/drawdown product that you are defining are captured in the Components screen. Click ‘Components’ button in the ‘Loan Syndication Product’ screen.

Note that the components defined in the ‘Main’ tab are displayed in multiple pages with one component in each page in the ‘Components’ screen.. From the component list, highlight a component and then go on to define the features for the selected component e.g, highlighting the ‘Fund Interest’ component will treat the component as ‘Funding Interest component’.

Note

The relevant accounting entries will be maintained for MLIQ/ALIQ events.

4.3.6.1 Component Definition Parameters

The basic information for a component is specified here. This includes the following:

Component

The Components which are defined in Main Tab are available in Component list.

The Component which is selected in the list appears in Component field. For e.g. ‘PRINCIPAL’, ‘INTEREST’, ‘PENALTY’ etc. Subsequently, you have to define the parameters for these components in the Components Tab of the screen.

For Commitment products, the MAIN_INT component is used for defining periodic fees on the unutilized commitment amount.

Description

The Description of the component which is defined in Main tab for the component will appear in this field once you select the component in component list.

Currency

Associate the component with a currency. The component is expressed in the currency selected here. You can select the currency of your choice from the option list provided.

Calculation Type

Specify the manner in which the component should be calculated and liquidated. You can choose one of the following options (the applicable ‘Component Type’ is also provided):

- Formula with schedule (Component Type - Interest)

- Formula without schedule (Charge)

- Penal Interest

- Prepayment Penalty

- Discount

- Schedule without formula (Principal)

- No schedule No formula (Ad Hoc Charges)

- Penalty Charges

Note

‘Penalty Charges’ are calculated only once for a ‘Penal Basis’ schedule. ‘Penal Basis’ is explained later in this user manual.

Main Component

This option is used to designate a component as the ‘Main’ Interest component. If you enable the ‘Main Component’ option for a particular component, the system treats this component as the main component. Also, you are allowed to define the amortization schedules only for this component.

‘Principal’ is an implicit component that is automatically created for the product.

Capitalized

You can indicate whether capitalization is required for all the schedules for various component of the loan. At anytime, the outstanding interest will be capitalized on the schedule date at the rate prevalent on that day. You can opt for capitalization at the component level or opt for capitalization/non-capitalization for a particular schedule at the ‘Schedule’ level.

You could have more than one type of schedules applicable on a product. In such a case, you can designate one as the capitalized and the other as un-capitalized schedule.

Interest Posting Req

Check this box if interest posting is required for the component.

Component Type

Indicate the nature of the component. This is also known as the ‘Reporting Type’. It defines the manner in which the component should be classified for reporting/accounting purposes. A component can be of one of the following types:

- Reimbursement: these are components which have both Dr and Cr mapped to settlement accounts.

- Off-Balance Sheet (OBS): An OBS Component will have balances but these need not be zero when an account is closed.

- Fund Interest: This indicates the funding component.

- Ad hoc Charges

- Charge

- Tax

- Insurance

- Interest

- Provisioning

- Deposit

Note

The fund interest component gets liquidated on schedule even if the customer does not pay the other components.

Propagation Reqd

Check this option to indicate that the interest amount collected from the borrower should be passed on to participants.

When you collect the Interest/Charges/Fees from the borrower, you can choose to pass these to the participants of the facility, tranche or drawdown contract. In the product Components Tab, when you are associating the interest components for the borrower tranche or draw down product, you can choose a class for which the propagation to participants option has been indicated in the class definition, if required. If so, the Propagation Reqd box will be checked. You can change this specification and uncheck the Propagation Reqd box, if you wish to indicate that component propagation to participants is not applicable. Alternatively, if you have chosen a component for which propagation to participants has not been indicated, you can check the Propagation Reqd box to indicate propagation of component to participants, if required.

4.3.6.2 Component Attributes

The component attributes include the following:

Special Component

You can define a component as a ‘Special Interest Component’. You can override such components at the account level. You may need to apply a special interest component as a result of customer negotiations. A special interest component is specified as an amount.

Penal Basis

You may want to allot the penalty to the recovery of certain components. Once a component is overdue, an appropriate penalty is applied. Therefore, you need to identify the component, which on becoming overdue will trigger the penalty computation. However, the system will calculate the penalty on the component you select in the ‘Basis Element’ field.

Note

For commitment products ‘PRINCIPAL’ is not used for penal basis and for basis amount.

Periodicity

The periodicity of the component can be either:

- Daily

- Periodic

If you choose the periodicity as ‘Daily’, any changes to UDE and SDE values will result in recalculation of the component. The recalculation happens as and when a change in value occurs. If maintained as ‘Periodic’, the values and calculations of the elements will be refreshed on the last day of the period.

Formula Type

You can specify the type of formula to be used for calculating the component. This formula is applied for the component across all its’ schedules. It can be one of the following:

- User Defined: This can also include a combination of standard formulae for different schedules of the component or can have a completely user defined formula.

- Standard

- Simple

- Amortized Rule of 78

- Discounted

- Amortized Reducing

- True Discounted

- Rate Only

Note

- This is not applicable for the ‘PRINCIPAL’ component.

- For a commitment product, the formula type cannot be ‘Amortized’, ‘Discounted’ or ‘Simple’.

Rate to Use

Here, you need to select the UDE which will define the rate to be used for computing the component. The value of the selected UDE is picked up as per the maintenance in the ‘UDE Values’ screen.

This is applicable only for components defined with ‘Standard’ Formula Type.

Basis Element

If you select the ‘Standard’ formula type, you have to specify the component upon which calculation should be performed. The component is denoted by an SDE (e.g. PRICIPAL_EXPECTED) and you can select it from the option-list provided. For an overdue/penalty component, this is the element on which penalty is applied.

This is not applicable if ‘Formula Type’ is ‘User Defined’.

Note

The ‘Basis Element’ for computing fund interest will always be ‘Principal Outstanding’ and the ‘Formula Type’ will be ‘Simple’, independent of the main interest component. The liquidation mode for funding component will always be ‘Auto’, independent of the Product / Account Liquidation mode.

Balance Type

Identify the nature of the balance that the component would hold. This can be represented through this field. For instance, for a loan product, the ‘Principal’ component is expected to have a ‘Debit’ balance.

4.3.6.3 Interest Computation Methods

For computing interest, you have to specify the following:

Days in Month

Here, you have to specify the number of days to be considered in a month for component computation. The options available are:

- Actual: This implies that the actual number of days is considered for calculation. For instance, 31 days in January, 28 days in February (for a non-leap year), 29 days in February (for a leap year) and so on.

- 30 (EURO): In this case, 30 days is considered for all months including February, irrespective of leap or non-leap year.

- 30 (US): This means that only 30 days is to be considered for interest calculation for all months except February where the actual number of days is considered i.e. 28 or 29 depending on leap or non-leap year.

The value selected here corresponds to the Numerator part of the Interest method.

Days in Year

You can specify the number of days to be considered for a year during computation of a particular component. This could be:

- 360: This means that only 360 days will be considered irrespective of the actual number of calendar days.

- 365: In this case, leap and non leap year will be 365

- Actual: In this case, leap year will be 366 and non leap year will be 365.

This value corresponds to the denominator part of the interest method.

Verify Funds

You can indicate whether the system should verify the availability of sufficient funds in the customer account before doing auto liquidation of the component.

Interest Method

You also have the option to use the interest method defined for the currency of the component. In this case, the interest method defined in the ‘Currency Definition’ screen (for the component currency) will become applicable to the loan. By default, this option is checked.

IRR Applicable

Check this option to indicate that the chosen component needs to be considered for Internal Rate of Return (IRR) calculation. This option is applicable to interest, charge, ad hoc charge, prepayment penalty, penalty and upfront fee components.

Note

This option should not be checked for Commitment products.

If a charge component is to be considered for IRR, the charge will be accrued using the FACR (Upfront Fee Accrual) batch.

The following components cannot be considered for IRR calculation:

- Off-balance sheet component

- Provision component

If you check this option, then you have to check the ‘Accrual Required’ option.

For bearing type of component formula, you can check this option only if the ‘Accrual Required’ option is checked.

For discounted or true discounted types of component formula, this option will be enabled irrespective of the whether the ‘Accrual Required’ option is checked or not. If this option is checked and ‘Accrual Required’ is not, the discounted component will be considered as a part of the total discount to be accrued for Net Present Value (NPV) computation. If both ‘Accrual Required’ and ‘IRR Applicable’ are checked, then discounted interest will be considered for IRR computation.

4.3.6.4 Moratorium Preferences

The following parameters have to be specified:

Moratorium Period and Period Units

If you wish to provide a moratorium on a loan, you need to mention the moratorium period and moratorium unit for each component. This refers to a repayment holiday at the beginning of the loan. When you input a loan in Oracle FLEXCUBE, the repayment start date of each component will be defaulted based on your specifications here. The moratorium unit should be in terms of:

- Days

- Months

- Years

4.3.6.5 Prepayment Threshold Preferences

This includes the threshold amount and currency, explained below:

Amount

Here, you can maintain the minimum limit for allowing prepayment of schedules. If the residual amount after prepayment against a schedule is less than the threshold amount you specify here, the system will disallow the prepayment.

Currency

If you specify the threshold amount, you also have to indicate the currency in which the amount should be expressed. You can select the currency from the option-list provided.

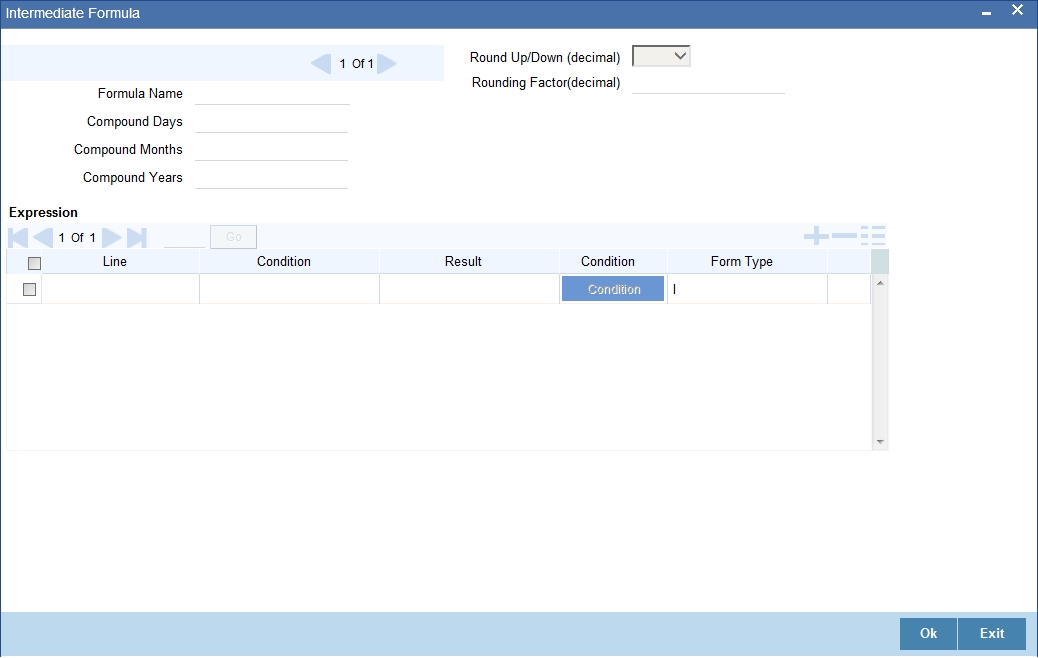

4.3.6.6 Intermediate Formula

Intermediate Formulae are used as building blocks for more complex formulae. An intermediate formula is used to create a Booked/Moratorium formula as an intermediate step. It will not be associated directly to any schedule.

To define an intermediate formula, click the Intermediate button in the Components screen. The ‘Intermediate Formula - Expression Builder’ screen is displayed.

You can specify the following details here:

Formula Name

Specify a suitable name to identify the formula that you are defining. After you specify the name you can define the characteristics of the formula in the subsequent fields. You have to use the name captured here to associate a formula with a schedule. The name can comprise of a maximum of 27 alphanumeric characters.

Round Up/Down (Decimal)

If you want to round off the results of an intermediate formula, you can indicate the number of digits upto which the results should be rounded-off to. Compound Days/Months/Years

If you want to compound the result obtained for the intermediate formula, you have to specify the frequency for compounding the calculated interest.

The frequency can be in terms of:

- Days

- Months

- Years

If you do not specify the compound days, months or years, it means that compounding is not applicable.

Rounding Factor (Decimal)

Specify the precision value if the number is to be rounded. It is mandatory for you to specify the precision value if you have maintained the rounding parameter.

Compound Days

If you want to compound the result obtained for the intermediate formula, you have to specify the frequency for compounding the calculated interest. The frequency can be in terms of days.

Compound Months

If you want to compound the result obtained for an intermediate formula, you have to specify the frequency for compounding the calculated interest. The frequency can be in terms of months.

Compound Years

If you want to compound the result obtained for an intermediate formula, you have to specify the frequency for compounding the calculated interest. The frequency can be in terms of years.

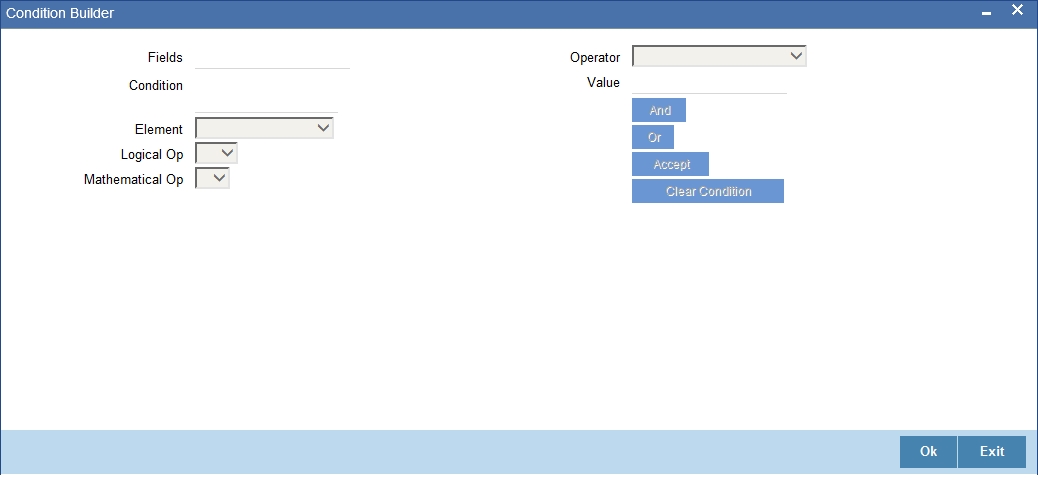

Condition and Result

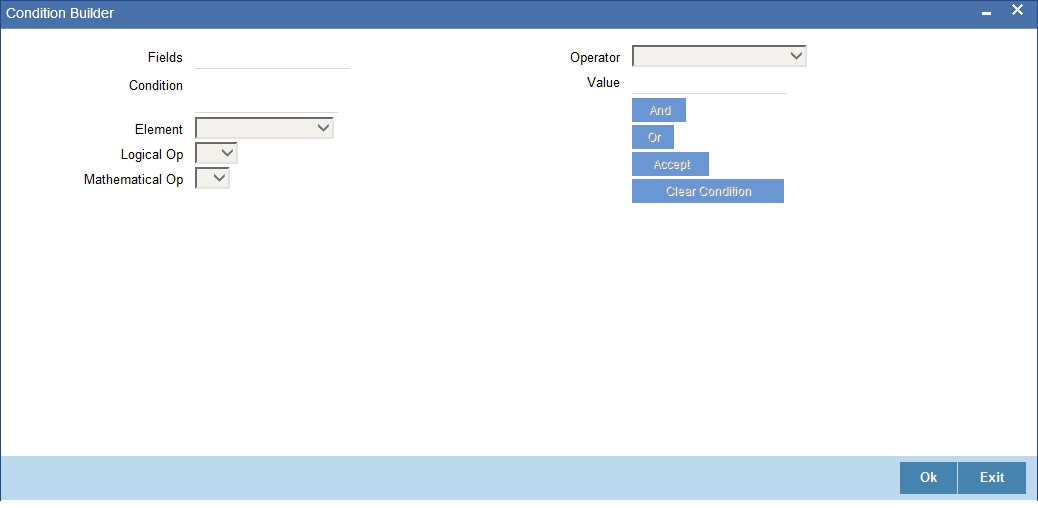

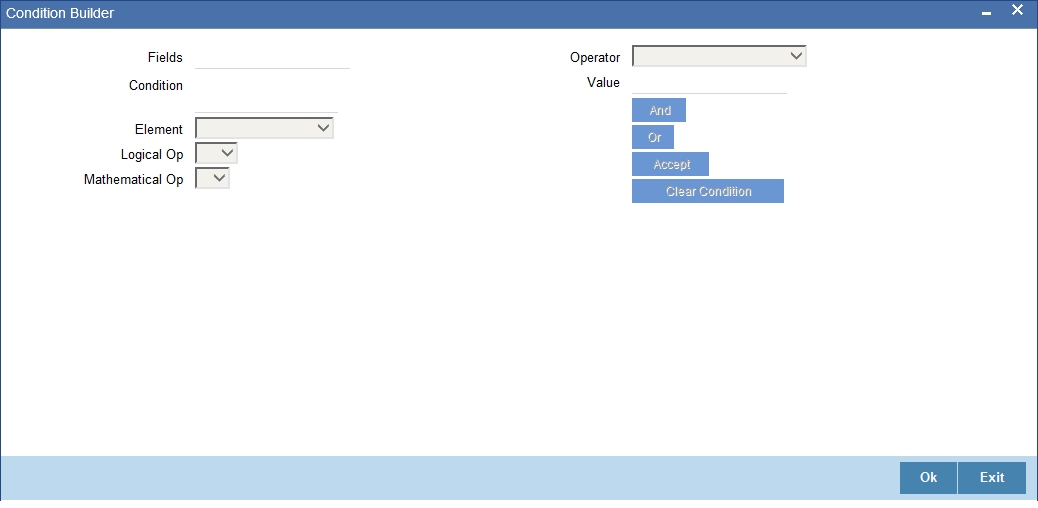

A formula or calcualtion logic is built in the form of expressions where each expression consists of a ‘Condition’ (optional) and a ‘Result’. There is no limit to the number of expressions in a formula. For each condition, assign a unique sequence number/formula number. The conditions are evaluated based on this number. To define a condition, click on the ‘Condition’ button in the screen above. The following screen is displayed:

In this screen, you can use the elements, operators, and logical operators to build a condition.

Although you can define multiple expressions for a component, if a given condition is satisfied, subsequent conditions are not evaluated. Thus, depending on the condition of the expression that is satisfied, the corresponding formula result is picked up for component value computation. Therefore, you have the flexibility to define computation logic for each component of the product.

The result of the formula may be used as an intermediate step in other formulae.

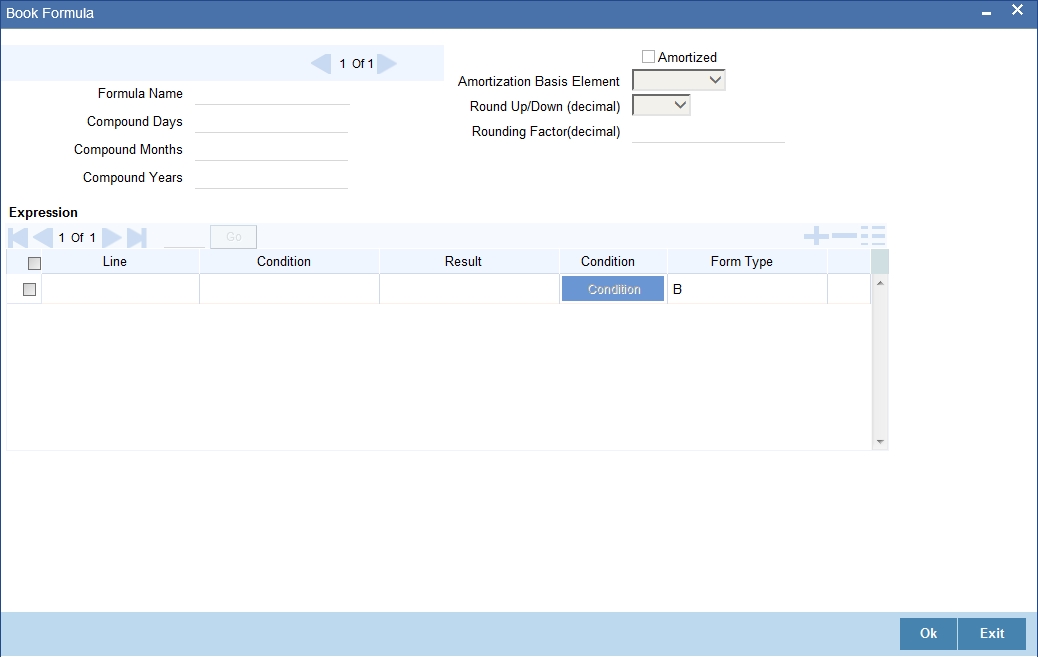

4.3.6.7 Book Formula

Book Formula refers to the formula used to compute a component value for a particular schedule. You can use intermediate formulae to create a ‘Book’ formula. To create the formula, click the ‘Book Formulae’ button in the ‘Component’ of the screen. The following screen is displayed:

The SDEs available will be shown in the Condition Builder. The Booked formula so created will be linked to a schedule.

The parameters required to create a ‘Booked’ formula is similar to the ones explained for an Intermediate formula.

Amortized

Select this option to specify that the schedules of the component should be amortized.

Note

For Commitment products do not select this option

Amortization Basis

If you opt to Amortize the schedules of the component, you have to identify the element based on which the component is amortized. For example, if it is deposit interest, the amortization basis would be ‘Principal’. The components are available in the option list provided.

4.3.6.8 Moratorium Formula

Moratorium refers to the repayment holiday given during the period between the value date of the loan and the first repayment date. While no repayment will happen during this period, computation will continue. The Moratorium formula is used for the computation of interest for the moratorium period.

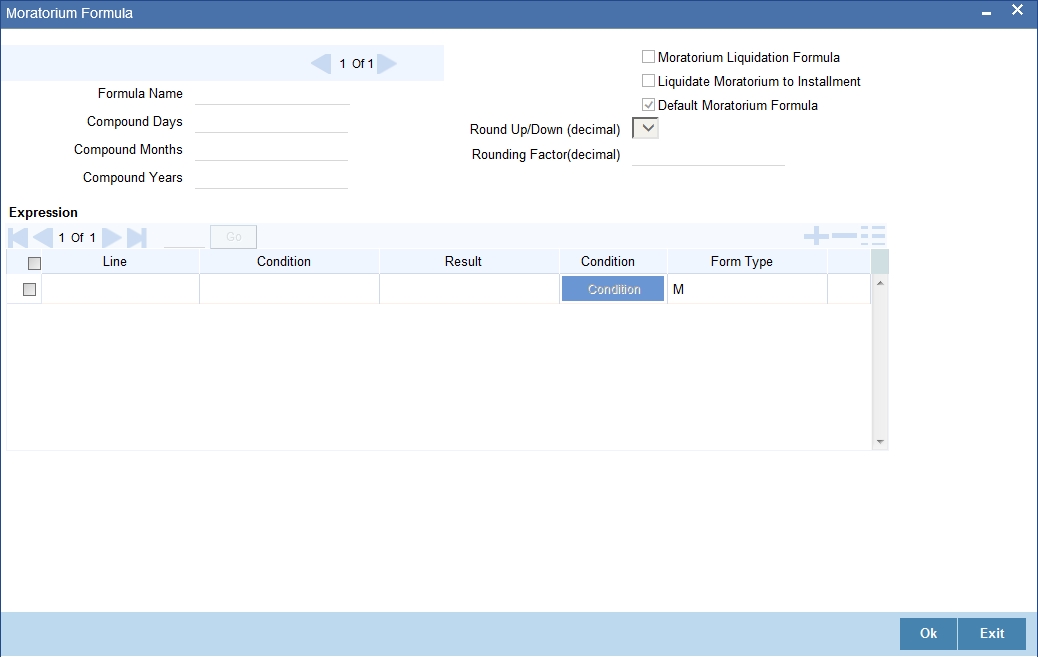

To define the formula, click the ‘Moratorium Formulae’ button in the Component screen. The ‘Moratorium Formula – Expression Builder’ screen is displayed:

The procedure is as explained for Intermediate and Booked formulae. The following additional fields are also applicable for a moratorium formula:

Formula Name

Here, you specify a suitable name to identify the formula that you are defining. After you specify the name, you can define the characteristics of the formula in the subsequent fields. You have to use the name captured here to associate a formula with a schedule. The name can comprise of a maximum of 27 alphanumeric characters.

Moratorium Liquidation Formula

The formula used for computation of interest for the moratorium period is called ‘Moratorium Formula’. The Interest calculated using the moratorium formula should be liquidated for the lifetime of the loan by apportioning it across all the installments. Therefore, you need to maintain a formula for liquidating the moratorium interest.

Check this option to indicate that the formula being maintained is for Moratorium liquidation.

Liquidate Moratorium to Installment

This option is applicable only if you are defining a ‘Moratorium Liquidation Formula’. If you check this option, the moratorium interest amount is added to the first installment amount and collected along with the schedule on the day the schedule falls due.

If you do not check this option, the moratorium amount is allocated from the Installment due. The principal component of the EMI is liquidated towards the moratorium. Therefore, Principal repayment does not begin until complete settlement of the moratorium amount.

Default Moratorium Formula

If you want to create a default moratorium formula, check this option. By default, the system will attach this formula to a moratorium schedule. You can, however, change it to a different moratorium formula.

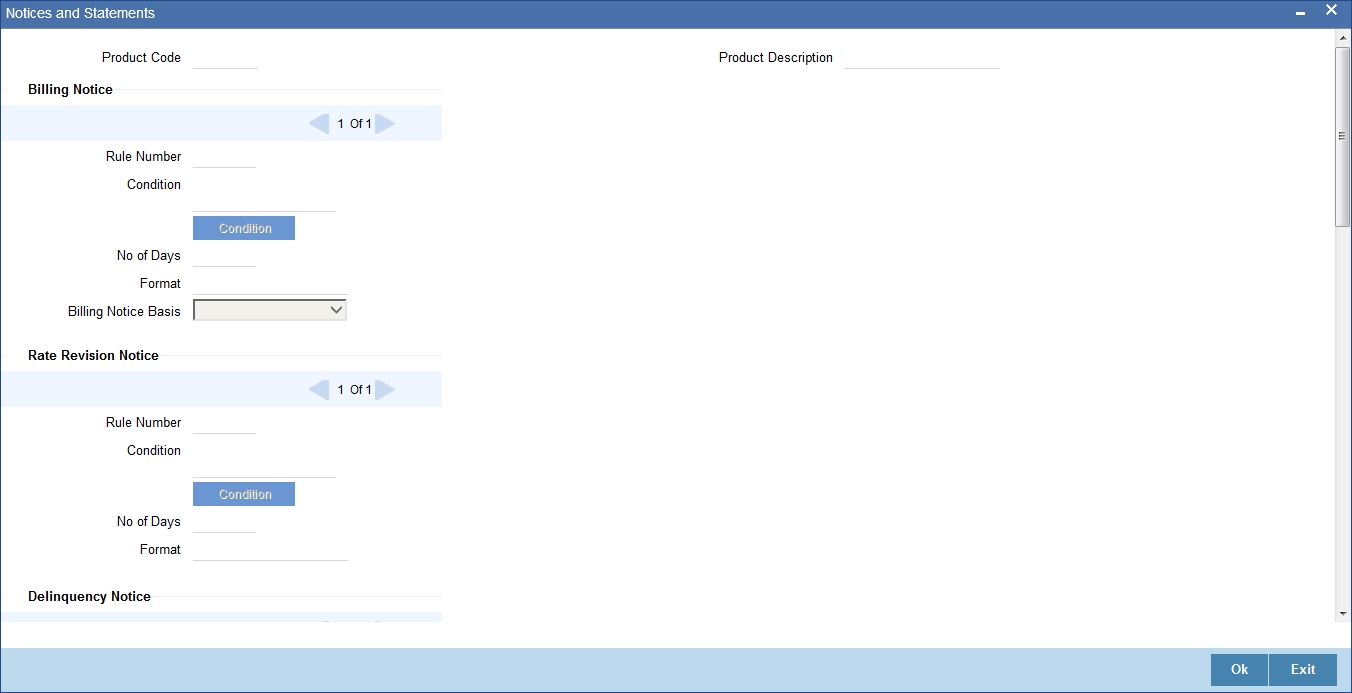

4.3.7 Maintaining Notices and Statements

Just as you define components that should become a part of the product, so also you can associate Notices and Statements with a product. The actual communication/correspondence, however, is handled by the Messaging Module of Oracle FLEXCUBE. Click the ‘Notices and Statements’ button in the ‘Loan Syndication Product’ screen. In this screen, you need to maintain the preferences for Billing Notices, Delinquency Notices, Rate Revision Notice, Direct Debit Notice and Statements. Also, you can associate multiple formats for the generation of notices and statements. The selection of a particular format is based on the condition.

Rule No/Condition No

You can assign a unique number for each rule/condition that is being maintained for notice and statement generation.

Condition

Define the conditions/rules for notice and statement generation. The system will evaluate the conditions and based on the one that is satisfied, the corresponding advice format is selected for notice/statement generation.

To maintain a condition; click the ‘Condition’ button in the screen above. The ‘Condition Builder’ is displayed.

For details on building a condition using the options available in the screen, refer the section titled ‘Defining UDE Rules’ in the ‘Maintenances and Operations’ chapter of this User Manual.

Number Days

The Number of days indicates the period before the due date, when the system starts sending the Billing/Delinquency notices to customers.

This period is defined as a specific number of days and will begin before the date the repayment becomes due.

Format

For the condition defined, select the format in which the advice should be generated. The system will select the specific format of the message type when the condition maintained evaluates favorably. Frequency Days

Specify the frequency (in days) for generation of Delinquency Notices. The first notice is sent on the basis of the ‘Num Days’ maintained. For instance, if the ‘Num Days’ is four and the payment due date is 4th April 2004, the first notice will be sent on 31st March ’04 (4 days before due date). Subsequent generation of the same notice is based on the frequency days maintained. If the ‘Frequency Days’ is ‘2’, the second notice will be sent on 2nd April ’04 i.e. the notice is sent once in two days only.

The following information is applicable to Statement generation:

Frequency

Indicate the frequency in which the Statements have to be generated. The available options:

- Daily

- Monthly

- Quarterly

- Half Yearly

- Yearly

Frequency Days

The frequency captured here is used to get the next date for statement generation subsequent to the first statement. This will be used in combination with the ‘Frequency’ explained above.

Start Date

The date entered here is used as a reference to start generation of the statement.

Message Type

Specify the type of Statement that should be generated. Statements are of the following types:

- Interest Statements

- Loan Statements

4.3.7.1 Interest Rate Revision within Rate Revision Period

The Rate Revision Notice section allows you to maintain the number of days for the generation of the advice, prior to the scheduled date of rate revision. During End of Day if the notification date is less than or equal to schedule date, a Rate Revision Advice is generated.

The four different conditions for the rate revision will be handled in Oracle FLEXCUBE as follows:

Condition 1:

Once the interest revision date is reached, the system continues to use the same interest rate code, till the next revision date.

Condition2

If the request for change in interest rate is received a few days before the scheduled revision date, the interest rate code of the loan account is changed by value dated amendment, with the effective date as the scheduled interest revision date. On the effective date, the system changes the rate code and picks up the new interest rate

Condition 3

If the request is for a future dated prepayment of the loan account there is no change in the interest rate the principal is changed depending on the prepaid amount and once the payment is available in the settlement account, you can liquidate the loan manually with the requested effective date.

An outstanding component breakup of prepayment penalty charges if applicable is sent to the customer.

Condition4

If the request for interest rate revision is made much before the scheduled revision date, you can change the interest rate code of the loan account by value dated amendment with effective date as requested.

The rate revision will be applicable on the total principal outstanding amount.

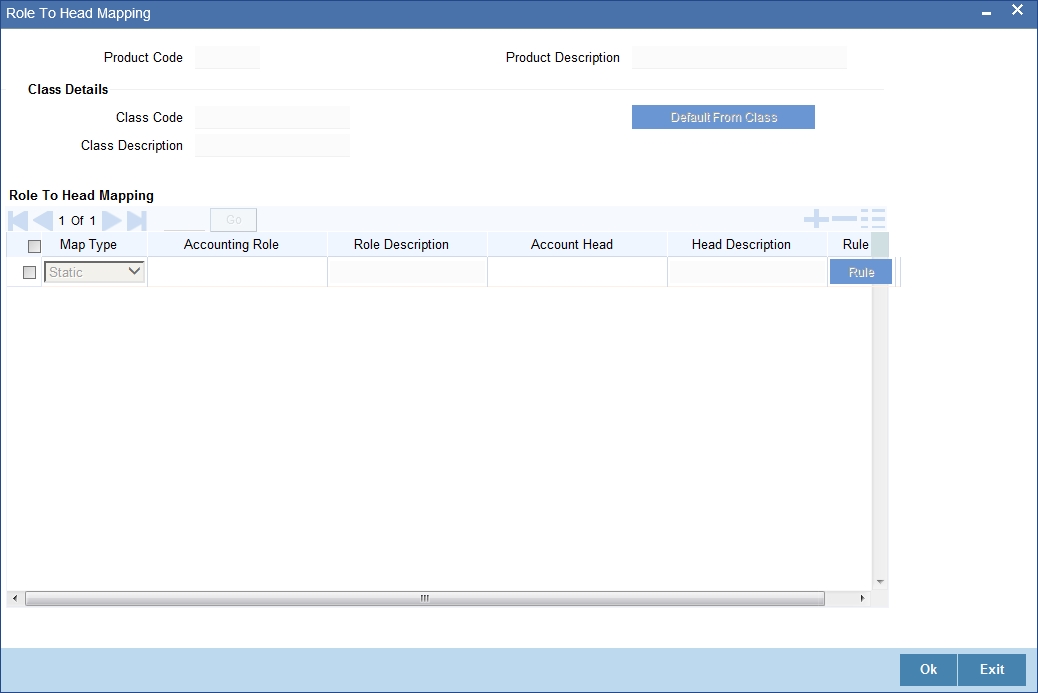

4.3.8 Maintaining Role to Head

You can define the accounting roles for a product by clicking ‘Role to Head’ button in the ‘Loan Syndication Product’ screen. A list of accounting roles that are applicable to the product being maintained is provided. This is a pre-defined list and you can add roles to it too.

The following details are captured in this screen:

Map Type

The mapping between an accounting role and account head can be of the following types:

- Static: If the map type is static, you can link an accounting role to only one accounting/GL head (one to one mapping).

- User Defined: For a user defined map type, you can maintain multiple linkages under different conditions using a case-result rule structure (one to many accounting).

Accounting Role and Description

Accounting role is used to denote the accounting function of a GL or Account. To map an accounting role to an account head, select a valid accounting role from the option list provided. This list will display the roles available for the product being maintained.

Once you choose the accounting role, the description maintained for the role is also displayed in the adjacent field.

If you do not want to select a role from the option list, you can also create an accounting role for a product and specify a brief description for the same.

Note

The GLs (Account Heads) for the Dr/Cr Settlement Bridge Role will default as per your selection in the ‘Branch Parameters’ screen.

Account Head and Description

The account head identifies the GL or Account to which the accounting entries would be posted. Based on the type of accounting role you select (Asset, Liability etc.), the list of Account Heads (General Ledger heads) that are of the same type as that of the accounting role, becomes available in the option list provided. You can select an accounting head from this list and thus, create a role to head mapping. On selection of the Account Head, the description is also displayed in the adjacent field.

Click the Add icon to create subsequent mappings for the product. If you would like to delete a role to head mapping, click the Delete icon button.

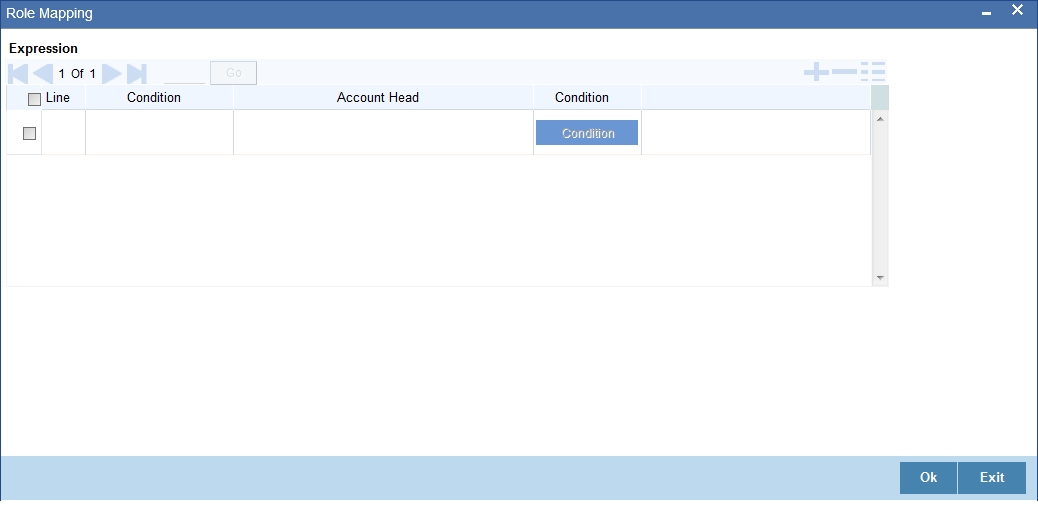

Rule

If the ‘Map Type’ is ‘User Defined’, you can create a case-result rule structure based on which the entries are posted to the appropriate account head. To create a rule, click the Rule button in the ‘Role to Head’ screen.

You can define multiple conditions and for each condition you can specify the resultant ‘Account Head’. This way you can maintain one to many mappings between an accounting role and an account head. Depending on the condition that is evaluated favorably, the corresponding account head is used for posting the entries.

To build a condition, click on the ‘Condition’ button in the screen above. The ‘Condition Builder’ is displayed.

You can build the conditions using the elements (SDEs), operators and logical operators available in the screen above.

For details on building a condition using the options available in the screen, refer the section titled ‘Defining UDE Rules’ in the ‘Maintenances and Operations’ chapter of this User Manual.

Note

The system ensures that all accounting roles that are applicable for the Product and which have been used in the definition of the accounting entries are necessarily linked to an account head. If the mapping is not complete, an error message is displayed when you attempt to save the product.

4.3.8.1 Dynamic creation of accounting roles for a component

For each component you define for a product in the ‘Main’ tab, six accounting roles are dynamically created by the system. For example, if you have defined a component ‘MAIN_INT’, the following accounting roles are created:

- MAIN_INTINC - Component Income

- MAIN_INTEXP - Component Expense

- MAIN_INTRIA - Component Received in Advance

- MAIN_INTPAY - Component Payable

- MAIN_INTREC - Component Receivable

- MAIN_INTPIA - Component Paid in Advance

For a detailed list of Events, Advices, Accounting Roles and Amount Tags, refer ‘Annexure 1’ of this User Manual.

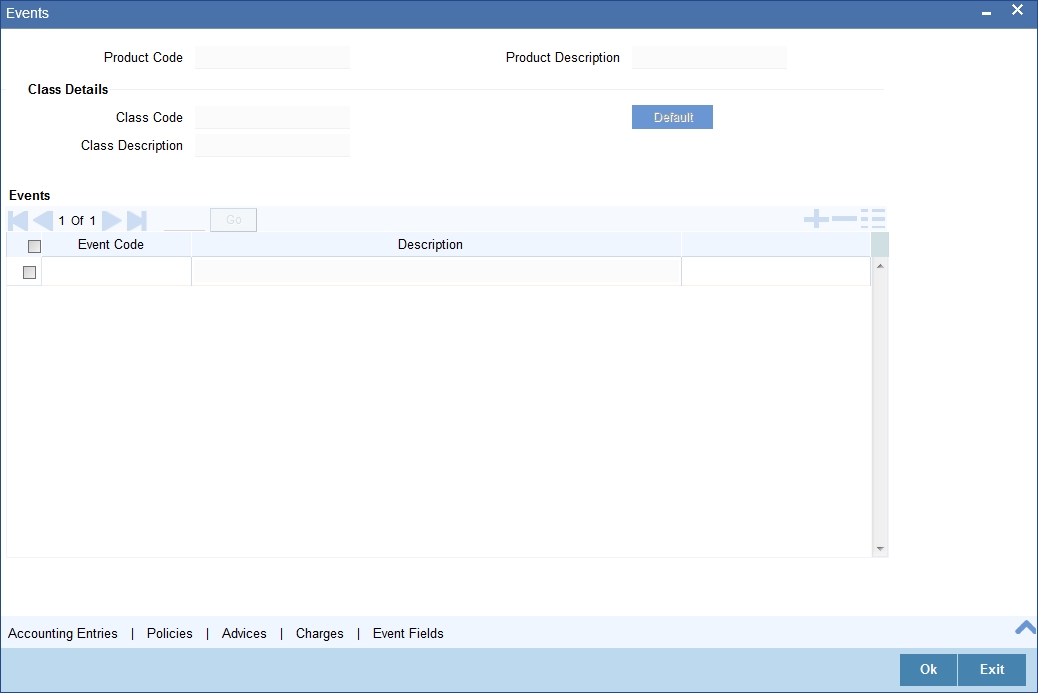

4.3.9 Maintaining Events

A contract goes through different stages in its life cycle. In Oracle FLEXCUBE, the different stages a contract passes through in its life cycle are referred to as ‘Events‘.

At an event, typically, you would want to post the accounting entries to the appropriate account heads and generate the required advices. When setting up a product, you can define the accounting entries that have to be posted and the advices that have to be generated at the various events in the life cycle of loans involving the product.

Therefore, for the required events you have to specify the Accounting entries, Charges, Policies and Advices. To do this, click the ‘Events’ button in the ‘Loan Syndication Product’ screen – the following screen is displayed.

Event Code and Event Description

These are the events for which the accounting entries, advices, policies and charges will be maintained, individually. The event codes applicable for the module are available in the option list provided. Select the relevant events for the product from this list.

The description for the event chosen is also displayed.

Note

For a commitment product the following events are used:

- LINK

- DLNK

- CLOC

The following events should not be maintained for a commitment product:

- BADJ

- CLOS

- REOP

- RNOG

- ROLL

- SROL

- YACR

- NOVA

- REVV

- REVL

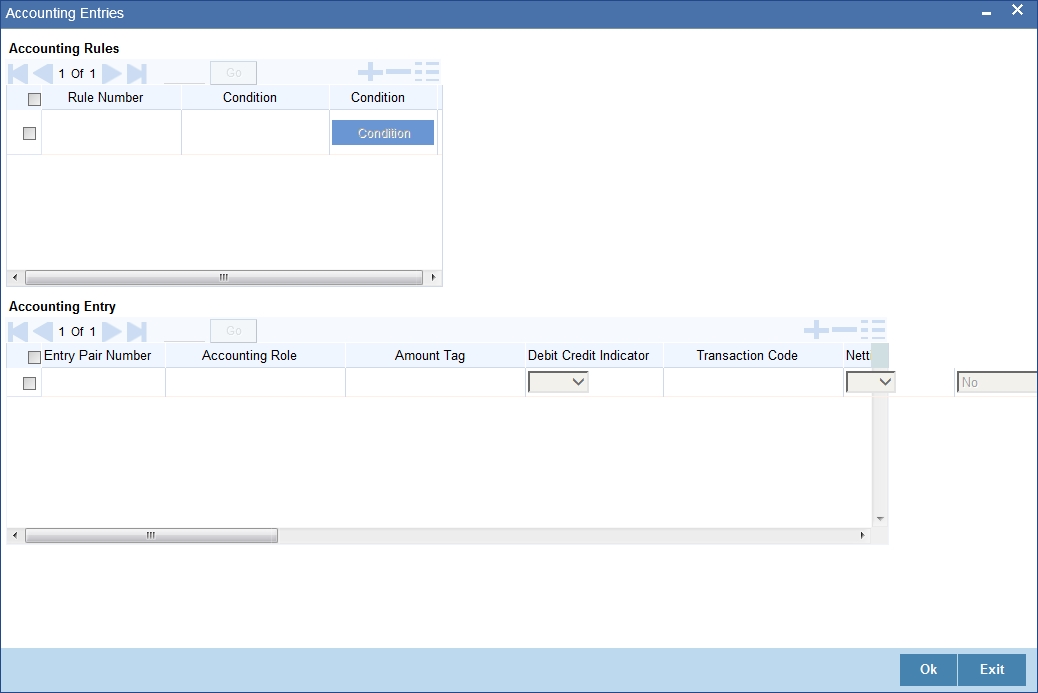

4.3.9.1 Accounting Entries

To define accounting entries for an event, click the ‘Accounting Entries’ button in the Events screen – the ’Product Event Rule Based Entries’ screen is displayed.

With the Rule definition builder, you can maintain different set of accounting entries for different conditions.

Rule Number

Every rule/condition you define for a product should be assigned a unique number. The rule number can consist of a maximum of 5 digits.

Case

You can use the ‘Condition Builder‘ to define a rule. Click on the ‘Condition’ button in the above screen to invoke it.

You can define a rule using the SDEs like Tenor, Customer Risk Category and other UDFs.

If you do no specify a rule/condition, the accounting entries become applicable to all conditions.

For details on building a condition using the options available in the screen, refer the section titled ‘Defining UDE Rules’ in the ‘Maintenances and Operations’ chapter of this User Manual.

Accounting Role

Specify the accounting role that should be used at the event. The option list displays all the accounting roles specified for the product in the ‘Role To Head’ tab of the ‘Consumer Lending Product’ screen. Select the role appropriate for the event.

Amount Tag

Specify the amount tag applicable for the Accounting Role. An amount tag identifies the amount/value that is actually due for a component. Depending on the components defined for the product, the system dynamically creates a set of amount tags. For instance, if the component is ‘MAIN_INT’, the following amount tags are automatically created:

- MAIN_INT _RESD - Component Amount Residual

- MAIN_INT_ADJ - Component Amount Adjustment

- MAIN_INT_LIQD - Component Amount Liquidated

- MAIN_INT_ROLL - Component Amount Rolled over

- MAIN_INT_CAP - Component Amount Capitalized

- MAIN_INT_ACCR - Component Amount Accrued

- MAIN_INT_DLIQ - Component Amount Paid against Due Schedules/future not-due schedules

- MAIN_INT_OLIQ - Component Amount Paid against Overdue Schedules

The ‘_DLIQ’ and ‘_OLIQ’ tags will be generated only for the events LIQD and ROLL.

Select the appropriate amount tag from this list.

D/C

Here, you have to specify the type of accounting entry to be posted – the entry can be a debit entry or a credit entry.

Transaction Code

Every accounting entry in Oracle FLEXCUBE is associated with a Transaction Code that describes the nature of the entry. Specify the transaction code that should be used to post the accounting entry to the account head. You can group all similar transactions under a common transaction code. The transaction codes maintained in the ‘Transaction Code Maintenance’ screen are available in the option list provided.

Netting Indicator

Specify whether accounting entries should be netted at an event. You can net the accounting entries that are generated at an event by selecting ‘Yes’ from the drop down list. The system will then net the entries and show the resultant value in account statements. If you do not net, the entries will be shown separately in the statements.

MIS Head

An MIS Head indicates the manner in which the type of entry should be considered for profitability reporting purposes. This classification indicates the method in which the accounting entry will be reported in the profitability report. It could be one of the following:

- Balance

- Contingent Balance

- Income

- Expense

You can also link a product to an MIS Group if you do not want to define individual entities for the product.

Refer the section titled ‘Associating an MIS Group with the product’ in this chapter for more details.

Revaluation Required

Online Revaluation refers to revaluation done on transaction amounts during transaction posting, and not as part of an end-of-day process. The Revaluation profit /loss are booked to the Online ‘Profit GL’ or Online ‘Loss GL’ that you maintain for the GL being revalued.

You can opt for online revaluation by selecting the ‘Reval Reqd’ option.

Profit GL and Loss GL

If you have opted for online revaluation and the result of revaluation is a profit, the profit amount is credited to the Profit GL you select here. Similarly, if the result of revaluation is a loss, the loss amount is credited to the Loss GL you specify here.

Reval Txn Code

If you opt for online revaluation, you need to associate the transaction code to be used for booking revaluation entries. The system will use this transaction code to track the revaluation entries.

Holiday Treatment

Specify whether holiday treatment is applicable for processing accounting entries falling due on holidays. Select one of the following:

- Yes

- No

GAAP

Indicate the GAAP indicators for which the accounting entry is required for reporting under multi GAAP accounting. The adjoining option list shows all the GAAP indicators maintained in the system. Choose the appropriate one.

The system will then post entries into the specified books (GAAP indicators) during the different events that occur in the lifecycle of the loan. You can retrieve the balance for a certain component in an account in a specific status, for a given GAAP indicator, in a certain branch, reporting to a certain GL. The system will show the real and contingent balances accordingly.

Split Balance

Specify whether you need the balances to be split or not. If you check this option, the system will store the balance break-up for the specified GAAP indicators. You can then retrieve the balances separately for the different GAAP indicators to which accounting entries are posted for the loan.

Balance Check in Batch

Indicate whether the balance check is required for the batch operations/online processing.

The options available are:

- Reject – The transaction is rejected if there is insufficient fund to process the transaction.

- Delinquency Tracking – The transaction is processed. If you have specified delinquency tracking for the accounting entries, the tracking is done according to the parameters you have defined for the Delinquency Product.

- Force Debit – The transaction is processed. However, no delinquency tracking is done even if the account goes into overdraft.

- Partial Liquidation – The transaction is processed. If you have specified partial delinquency, the system liquidates upto the available amount and the delinquency tracking is done on the remaining amount only.

Delinquency Product

In case you have specified delinquency tracking for balance check type, you need to specify the delinquency product under which the entry is tracked. The option list displays all the delinquency product codes maintained in the Oracle FLEXCUBE. Select the appropriate from the option list.

Settlement

This field is used to settle the amount. If it set as yes, while doing settlement system uses the Account during amount settlement. If it is no it will use default account, which is mapped in role to head.

4.3.9.2 Advices for Event

You can select the advices that should be triggered for various events. The selected advices are generated, once the product is authorized. These advices can be simple Debit /Credit advices when any payment or disbursement is made, Deal Slip advices, Rate Revision advices, Loan advices etc.

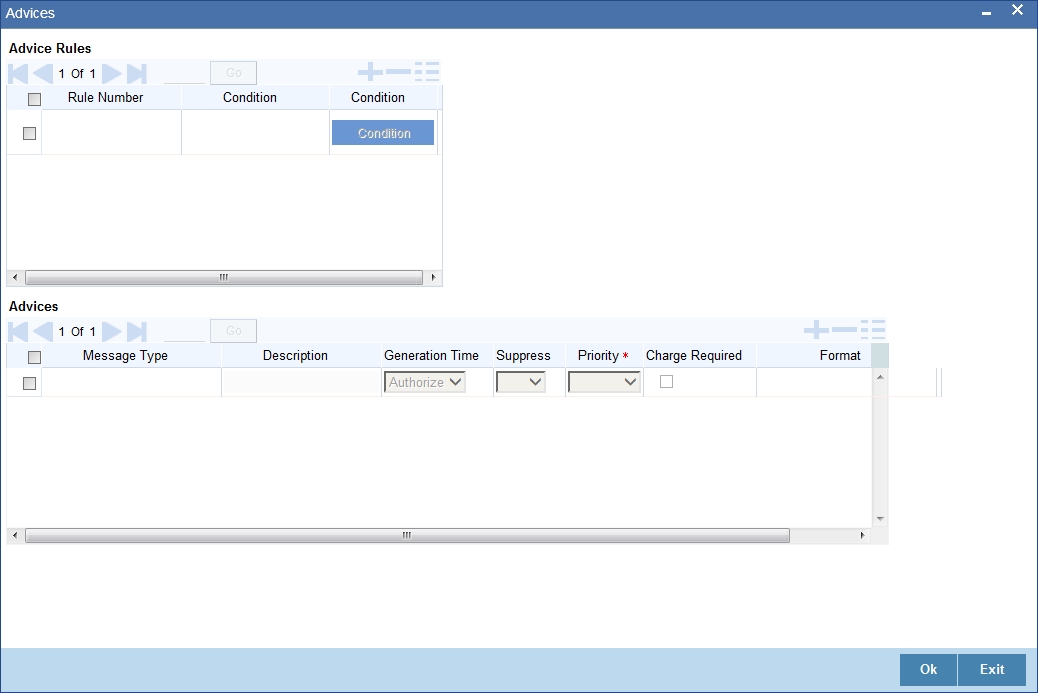

To specify the advices for an event, click the ‘Advices’ button in the Events screen of the ‘Loan Syndication Product’ screen – the following screen is displayed.

The following advice details have to be maintained in the screen:

Event Code

Code of the specified event is defaulted from the Event level.

Description

Description of the specified event is defaulted from the Event level.

Advices Details

The following advice details can be maintained here:

Advice Name

Specify a valid advice you want to trigger, from the adjoining option list. This option list displays advices applicable for the module.

Description

Description of the specified advice is defaulted here.

Generation Time

Authorization is defaulted as the generation time for all advices which need to be generated for a specified Event.

Suppress

Select ‘Y’ or ‘N’ from the adjoining drop-down list to either suppress or allow the generation of some advices.

Priority

Select the importance of the advice generation from the adjoining drop-down list. This list displays the following values:

- High

- Medium

- Low

Charges

Check this box if you want to collect charges for advice generation.

For a detailed list of Events, Advices, Accounting Roles and Amount Tags, refer ‘Annexure A’ of this User Manual.

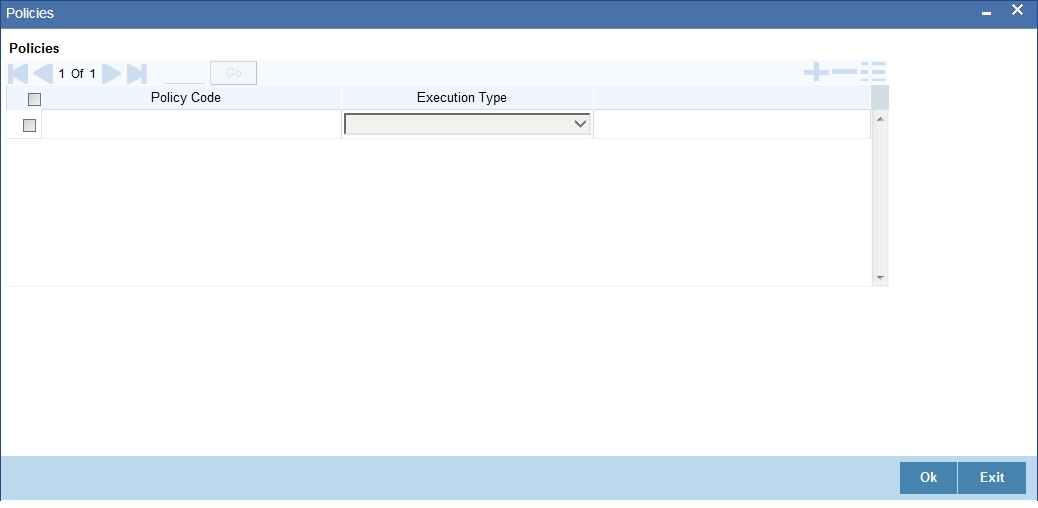

4.3.9.3 User Defined Policies

Policies are user defined validations that will be fired when any event is triggered. These can even be policies which govern the firing of an event under certain conditions.

For example, if an operation called payment is being done and the customer is paying an amount greater than his current overdue and one additional installment, you can associate a policy to disallow the payment. Therefore, you have to associate policies to an event.

Click on the ‘Policies’ button in the ‘Events’ screen to define the policies that should be executed for an event.

You can select the appropriate policy from the option list provided. The policies defined in the ‘User Policy’ screen are available in this list. You should also specify the instance when the policy should be triggered for the event. The options are:

- Before Event

- After Event

- Both

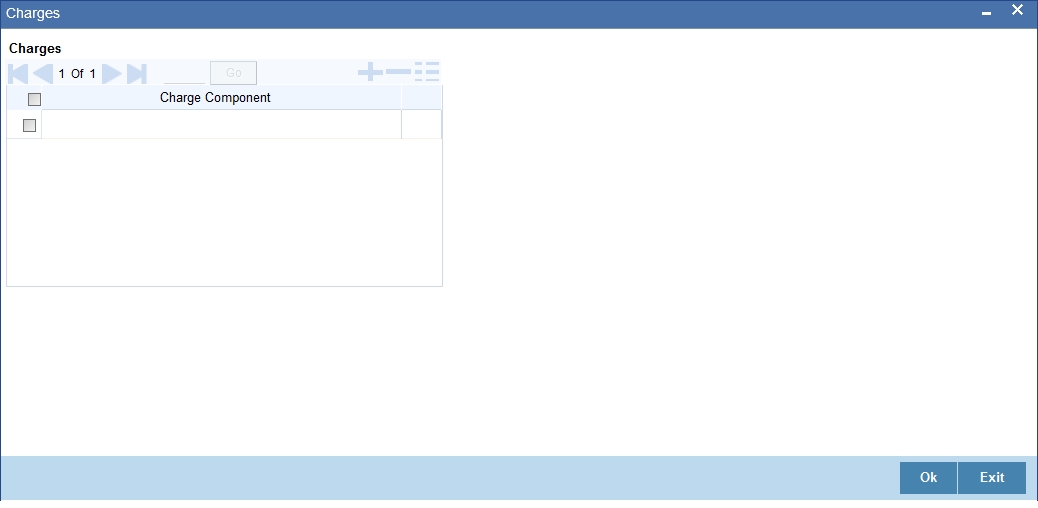

4.3.9.4 Charge

You can associate charges to an event. Linking a charge to an event implies calculating the value of the charge.

Click the ‘Charges’ button in the ‘Event’ screen, to associate charges.

The charge type of components defined for the product (in the ‘Components’ screen) are displayed in the option list. Select the component you wish to associate with the event.

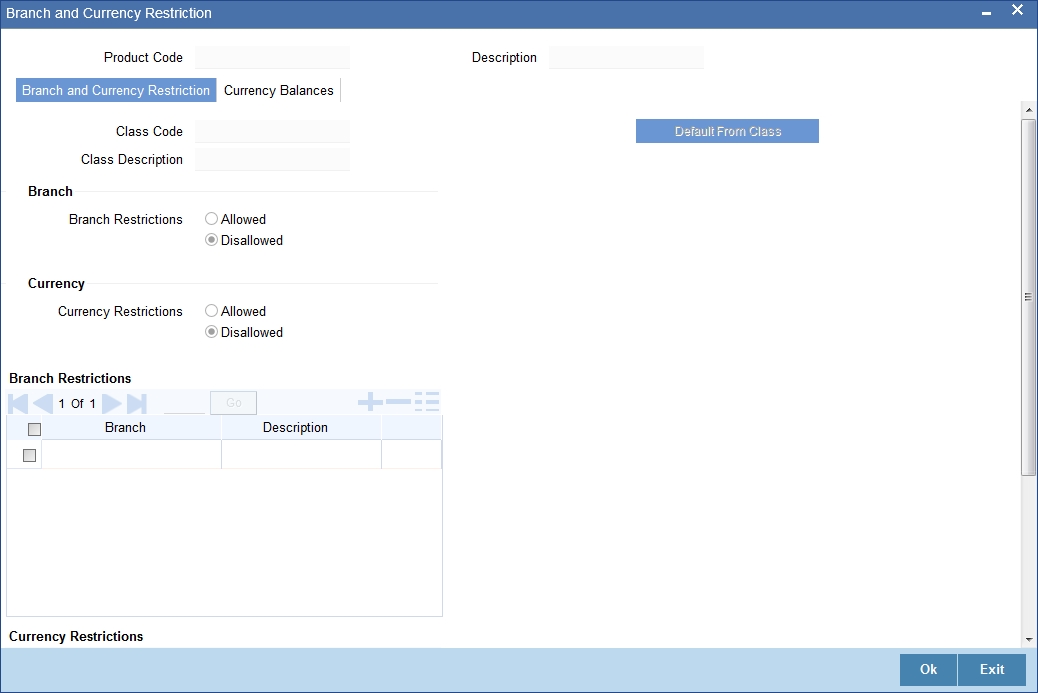

4.3.10 Branch Currency Restriction

The loan products created in the Head Office Bank (HOB) are available across all the branches subject to the branch restrictions maintained for the product. Likewise, you also restrict the products to select currencies.

To achieve this, you can maintain a list of allowed/disallowed branches and currencies.

Click on the ‘Branch/Currency Restriction’ button in the ‘Loans Syndication Product’ screen.

Moving a branch or currency to the Allowed/Disallowed column

Under Branch and Currency Restrictions respectively, two columns are displayed.

- Allowed List

- Disallowed List

The allowed or disallowed column that is displayed would depend on the list type that you choose to maintain. For instance, if you choose to maintain an allowed list of branches, the column would display the branches that you can opt to allow.

In the Branch Restriction and Currency Restriction Section, click on adjoining option list to invoke a list of bank codes and currencies codes respectively that you have maintained in your bank. Select an appropriate code.

Using the add icon or delete icon, you can add/delete a branch or currency from the corresponding allowed/disallowed column that you have maintained.

Note

When you create a product, it is, by default, available to all the branches of your bank, in all currencies, and for all customers unless restrictions are explicitly specified for the product.

4.3.10.1 Currency Balances Tab

You can maintain the following currency balance details:

Currency Code

You can specify the transaction limit for a currency while defining currency restrictions for a product. Choose the currency code from the option list.

Residue Amount

Here, you have to capture the minimum amount by which, if a component of a schedule becomes overdue, the system will consider it as paid.

Neg Residue Amount

If the difference between the amount paid (COMPONENT_EXPECTED) and the amount due is less than the residue amount specified here, then the difference is treated as an income otherwise the transaction is rejected.

In the case of an income, the installment schedule is marked as completely settled/paid and the income is posted to the residual suspense GL. This triggers the event called ‘RESD’ (Residual) and the following entries are passed:

| Accounting Role | Amount Tag | Dr/Cr | |||

|---|---|---|---|---|---|

| Loan Account | RESIDUAL_AMOUNT | Cr | |||

| Residual Suspense | RESIDUAL_AMOUNT | Dr |

ATM Cash Limit

Here, you can enter the maximum non- Cash transaction amount for the currency that you have defined. The ATM transaction amount cannot exceed the value given here.

Rounding Factor (EMI)

Specify the rounding factor if the EMI is to be rounded.

It is mandatory for you to specify the rounding factor if you have maintained the rounding parameter.

Round Up Down (EMI)

Indicate whether the EMI should be rounded up or down.

- Choose ‘UP’ in case you want to round the number to the next decimal value.

- Choose ‘DOWN’ if you want to truncate the number to the previous decimal value

The principal component of the EMI is adjusted based on the rounded EMI amount.

Numerator Method

Specify the day count method for the numerator for each currency applicable to the product. The following options are available in the drop-down list:

- Actual

- 30 Euro

- 30 US

Choose the appropriate one. This value will be used for calculation of the Net Present Value (NPV).

Denominator Method

Specify the day count method for the denominator for each currency applicable to the product. The following options are available in the drop-down list:

- 360

- 365

Choose the appropriate one. This value will be used for calculation of the Net Present Value (NPV).

4.3.11 Maintaining Customer Category Restriction Details

Just as you can maintain a list of allowed/disallowed branches and currencies for a product, you can maintain a list of allowed/disallowed customer categories.

You can maintain several restrictions for each customer category. Click on the ‘Customer Category Restriction’ button in the ‘Loan Syndication Product’ screen.

Customer Category Restriction

You can restrict customers from availing a product by maintaining an ‘allowed’ list or a ‘disallowed’ list of customer categories.

Only customer categories that are a part of an allowed list maintained for a product can avail the product. Likewise, customer categories that are part of a disallowed list cannot avail the product or service.

The allowed or disallowed column that you view depends on the list type that you choose to maintain. For instance, if you choose to maintain an allowed list, the column would display those customer categories that you choose to allow.

You can move a category to the allowed/disallowed column, using the add icon or delete icon.

4.3.11.1 Allowing Access to Special Customers

Depending on the customer restriction you specify – allowed or disallowed, you can further maintain a list of customers who are allowed (for a ‘Disallowed’ list) or specific customers who are not allowed to use the product (in the case of an ‘Allowed’ list).

For example, you may disallow the customer category ‘CORPORATES’ from availing a certain loan product. However, you may want to allow ‘Cavillieri and Barrett’ (belonging to the category ‘CORPORATES’) to avail the product.

Select the name of the customer from the option list provided. The ‘Customer Name’ is displayed after you select the customer id.

If the selected customer belongs to a category which is ‘Disallowed’ for the product but you want to allow the customer, check the ‘Allowed’ option. Similarly, if the customer belongs to a category that is ‘Allowed’ but you want to disallow the customer, do not check the ‘Allowed’ option.

4.3.12 Maintaining UDF

UDFs are additional fields that are available for use depending on the bank’s requirement. You can define UDFs in the ‘User Defined Fields’ screen by clicking on the ‘Fields’ button in the ‘Loan Syndication Product’ screen.

In the ‘UDF’ screen, you can associate these custom fields with the product.

The UDFs are segregated based on the ‘Field Type’, into the following:

- Character Fields

- Number Fields

- Date Fields

Field Name and Description

When you select an UDF from the option list, the description is also displayed in the adjacent field.

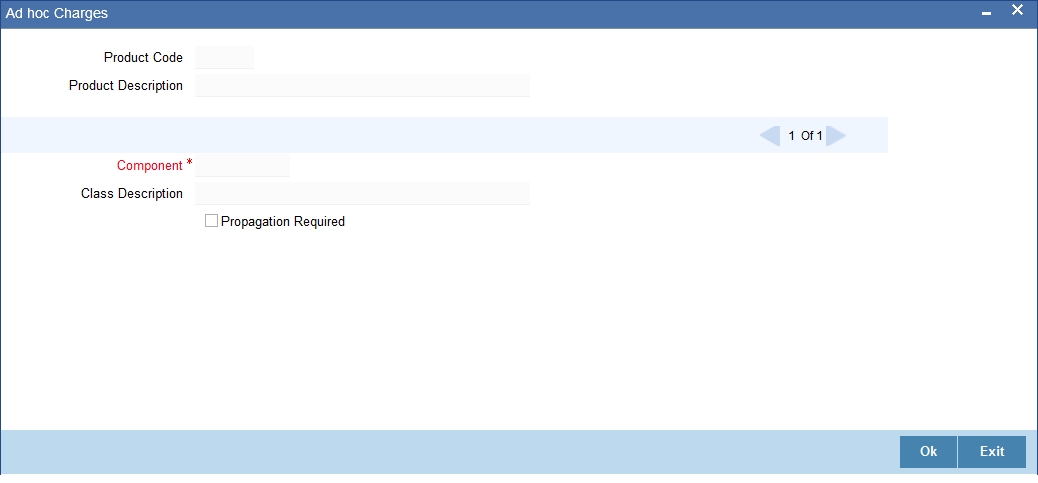

4.3.13 Associating Ad-hoc fee Components

Your bank may need to levy fees on borrower facility contracts on an ad-hoc basis. You can indicate the applicability of ad-hoc fees by associating the appropriate ad-hoc fee class that you have defined for borrower facility contracts. You can invoke this screen by typing ‘CFDXADFE’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can capture the following details here:

Class Code

Specify a class code for which you want to maintain ad hoc charges.

Description

Give a small description for the class code entered.

Module

Specify the module for which you want to maintain ad hoc charges.

Module Description

Give a small description for the module entered.

Participation Propagation

The ad-hoc fee component that you have associated will apply to all borrower contracts using the product, and the accounting entries relating to the fee will be propagated to all participant contracts arising from the borrower contract, if so specified in the Adhoc Fee Class Definition. If so, when you associate the class with the product in the Adhoc Fee Association screen, the Propagation Reqd check box will be selected.

4.3.14 Specifying MIS Details

To specify MIS details for the product you need to invoke the ‘MIS Details’ screen. To invoke this screen, click ‘MIS’ button on the ‘Loan Syndication Product Definition’ screen.

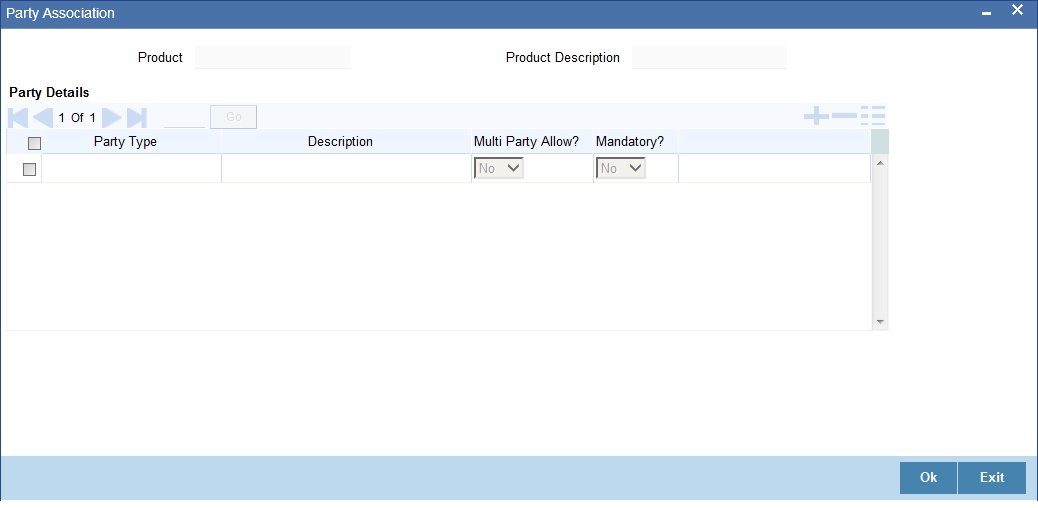

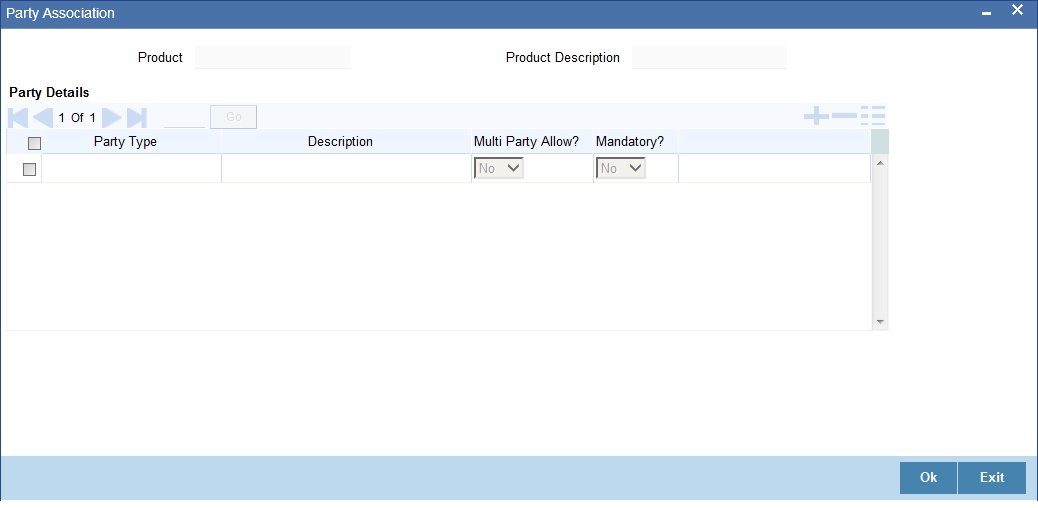

4.3.15 Associating Parties