5. Loan Syndication Contracts

A contract is a specific agreement or transaction entered into between two or more entities. A customer who approaches your bank to avail of any of the services offered by your bank enters into a contract with your bank.

In the case of a syndication facility contract, the entities involved in a contract are the borrowing customer and the participants for any tranche of the agreement.

Similarly, any specific loans (draw downs) disbursed by your bank under a tranche in the facility contract are also contracts.

This chapter contains the following sections:

- Section 5.1, "Borrower Facility Contract"

- Section 5.2, "Products for Loan Syndication Contracts"

- Section 5.3, "Borrower Facility Contract Details"

- Section 5.4, "Loan Syndication Contracts Details"

- Section 5.5, "Borrower Tranche Contracts Details"

- Section 5.6, "Drawdown Loan Contracts Details"

- Section 5.7, "Participant Contracts Details"

- Section 5.8, "Specifying Interest Margins for Customers"

- Section 5.9, "Amending Participant Details For Borrower Tranche or Draw Down Contracts"

- Section 5.10, "Specifying Diary Events for Borrower Syndication Contract"

- Section 5.11, "Processing Participant Contracts"

- Section 5.12, "Free Format Messages for Loan Syndication Contracts"

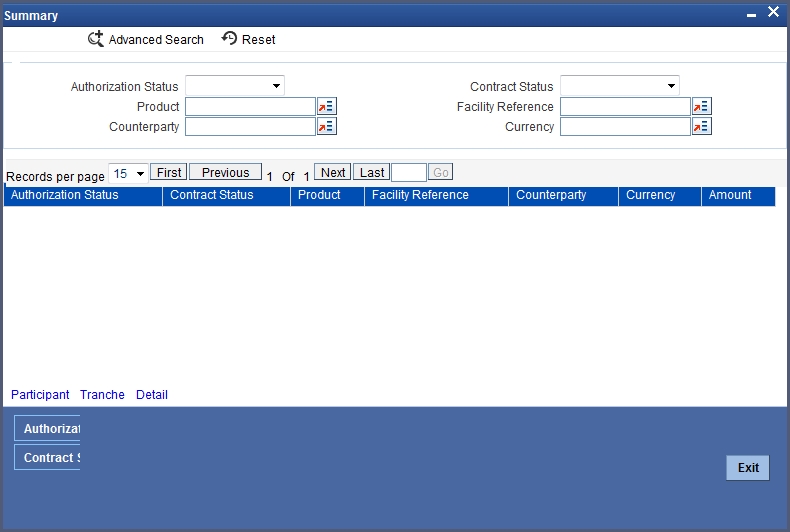

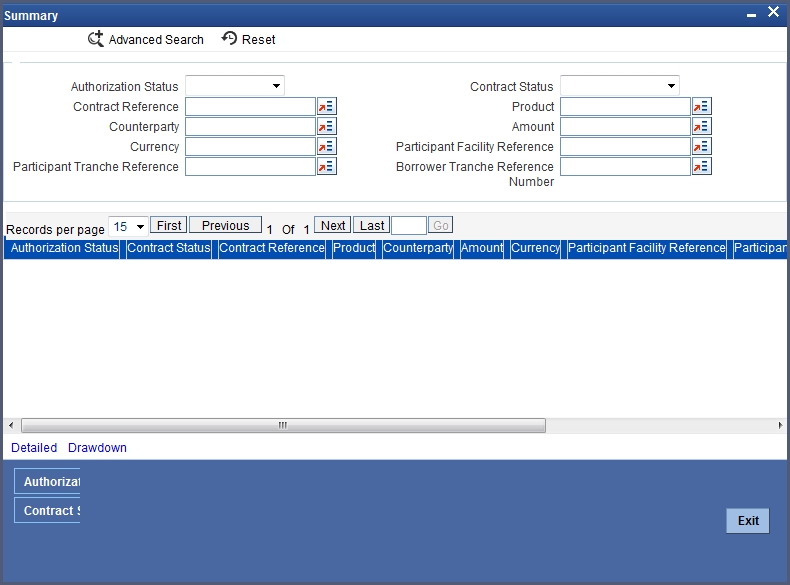

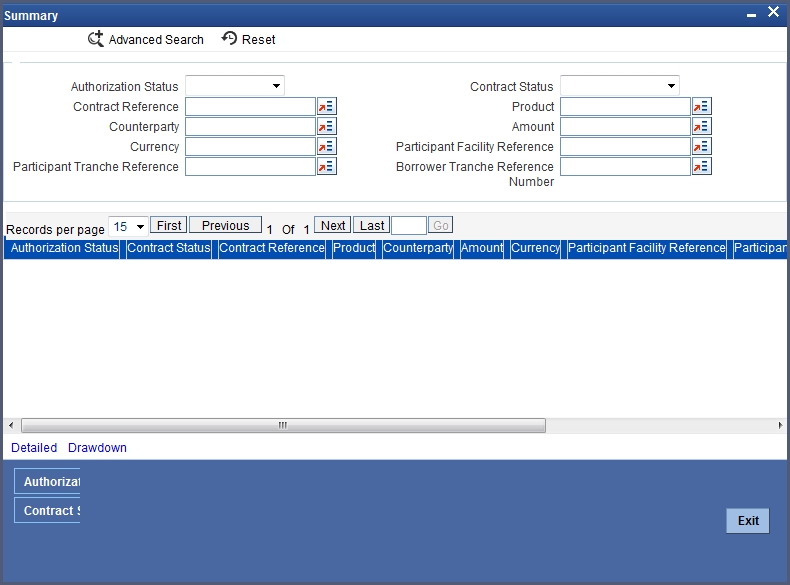

- Section 5.13, "Viewing Syndication Contracts"

5.1 Borrower Facility Contract

A facility contract is reached between a borrowing customer and a bank (or financial institution), which arranges or provides facility for the syndication. The lead bank identifies one or more participants who pool funds to meet the borrowing requirements. The lead bank disburses the loan, after receiving the contributions of the other participants. The participants share the interest and other income accruing from the loan, in the ratio that was agreed upon at the time of entering the agreement.

The syndication agreement with the borrowing customer is known as a borrower facility contract.

In a borrower facility contract, the borrowing customers receive loans from any of the arms or tranches. Each of the arms would have a set of participants, who would pool in their contributions toward the borrowing requirement in a mutually agreed ratio. The borrowing customer could receive loans towards the borrowing requirement as ‘draw downs’ from a tranche. Therefore, a single tranche would have a specified number of draw downs.

Each of the players in a tranche (i.e., the borrowing customer and the participants) enters into a tranche contract. The individual loans (draw downs) under each tranche are loan contracts.

Therefore, a borrower facility contract under a syndication agreement involves the following contracts:

- The main borrower facility contract between the borrowing customers and the facilitating bank. The contract officialises the agreement and makes the terms binding by law on all borrowers and participants entering into it. (For the main borrower facility contract, contracts are drawn up for each of the participants to mirror the borrower facility contract)

- The tranche contracts at the level of a tranche opened under the main borrower facility contract, for each of the borrower and the participants.

- The actual loans disbursed to the borrowing customer as draw downs under a tranche of the main borrower facility contract

The example given below illustrates the concept of syndication and the contracts involved.

This example will be referred throughout this chapter as a reference contract to illustrate the concept of the contracts.

The main syndication facility contract

One of your customers, Mr. Robert Carr, has approached you for a loan of 100000 USD on 1st January 2000. You enter into a syndicated contract with him on the same date, with a view to meeting his funding requirement by identifying other banks or institutions that can share the load of funding. The agreement is booked on 1st January 2000, and the end date, by which all components of the borrowed amount will be repaid, to be 1st January 2001.

The main borrower facility contract is the one under which all subsequent tranche / draw down contracts will be processed. When you enter this contract (with Mr. Robert Carr) into the system, it saves the contract and generates a unique identifier for it, known as the Facility Contract Reference Number. (i.e., the Contract Reference Number of the main borrower facility contract). Let us suppose the Facility Contract Reference Number assigned to this contract is 000SNEW000010001. Whenever you enter a tranche or draw down contract against this main borrower facility contract, you will have to specify this number as reference information.

Getting back to Mr. Robert Carr’s borrowing requirement, let us suppose that he wants to avail of the total loan principal in the following manner:

Total syndicated loan principal: 100000 USD, in two tranches, with a total tenor of six months.

Tranche contracts

Mr. Robert Carr’s total syndicated loan principal is therefore required to be disbursed in two different sets of tranches, as seen above.

The tranche involves a ‘tranche’ from Mr. Robert Carr as the borrowing customer, as well as a tranche from your bank, as the lead bank in the contract, to disburse the loan after pooling together resources from any willing participants. Each of the participants enters into a tranche contract, committing to provide the funds as agreed.

For the first tranche, wherein a principal of 50000 USD is to be disbursed, your bank has now identified Brinsley Bank and Dayton Commercial Bank as potential sources from whom funding may be obtained, to meet Mr. Carr’s borrowing requirement. The funding load is proposed to be shared in the following pattern, which is known as the ratio of participation:

Your bank (Participant) : 10000 USD

Brinsley Bank (Participant) : 20000 USD

Dayton Commercial Bank (Participant) : 20000 USD

When you open the tranche in the system, you input a borrower tranche for Mr. Robert Carr. When the BOOK event is triggered for the borrower tranche contract, the system creates tranche contracts for your bank and for Brinsley Bank and Dayton Commercial Bank, based on the borrower tranche contract.

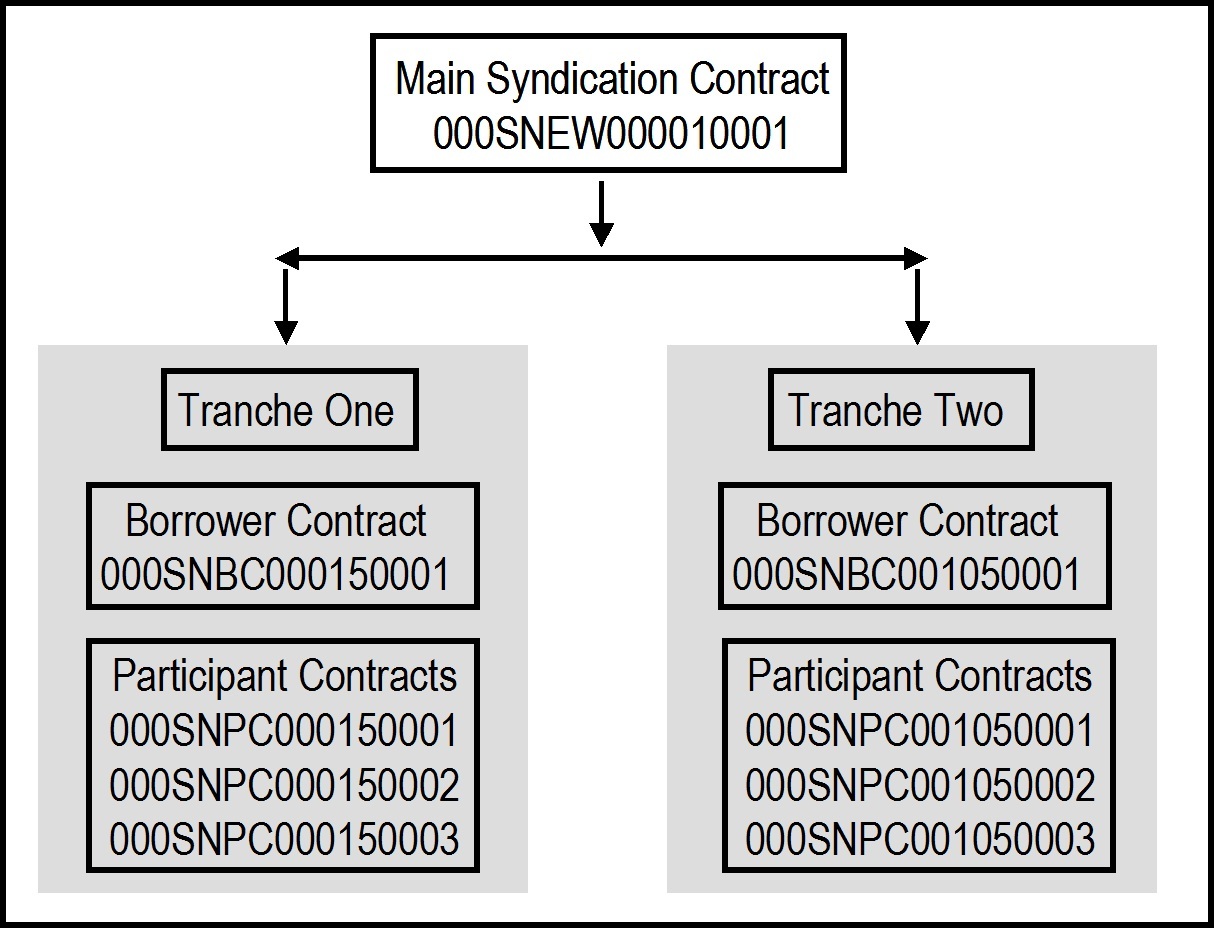

Let us suppose that the first tranche is booked on 15th January. Let us suppose that the following Contract Reference Numbers are generated by the system for the contracts:

- Borrower (Mr Carr) Tranche : 000SNBC000150001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main facility contract against which the first tranche is being opened, which is 000SNEW000010001.

- Participant (Your Bank) Tranche : 000SNPC000150001. This contract is created by the system when you the BOOK event is triggered for the borrower tranche contract 000SNBC000150001.

- Participant (Brinsley Bank) Tranche : 000SNPC000150001. This contract is created by the system when the BOOK event is triggered for the borrower tranche contract 000SNBC000150001.

- Participant (Dayton Commercial Bank) Tranche: 000SNPC000150002. This contract is created by the system when the BOOK event is triggered for the borrower tranche contract 000SNBC000150001.

For the second tranche, wherein a principal of 50000 USD is to be disbursed, your bank has identified South American Overseas Bank and Banco Milan as funding partners. The ratio of participation is finalized as follows:

Your bank 10000 USD

South American Overseas Bank 25000 USD

Banco Milan 15000 USD

When you open the tranche in the system, you input a borrower tranche for Mr. Robert Carr. When the BOOK event is triggered for the borrower tranche contract, the system then creates tranche contracts for your bank and for South American Overseas Bank and Banco Milan based on the borrower tranche contract.

Let us suppose that the second tranche is booked on 15th April. Let us suppose that the following Contract Reference Numbers are generated by the system for the contracts:

- Borrower (Mr Carr) Tranche : 000SNBC001050001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main facility contract against which the first tranche is being opened, which is 000SNEW000010001.

- Participant (Your Bank) Tranche : 000SNPC001050001. This contract is created by the system when the BOOK event is triggered for the borrower tranche contract 000SNBC001050001.

- Participant (South American Overseas Bank) Tranche : 000SNPC001050002. This contract is created by the system when the BOOK event is triggered for the borrower tranche contract 000SNBC001050001.

- Participant (Banco Milan) Tranche: 000SNPC001050003. This contract is created by the system when the BOOK event is triggered for the borrower tranche contract 000SNBC001050001.

Since the principal amount in each tranche is scheduled to be made available during a fixed period - between 1st January and 31st March for the first tranche, and between 1st April and 30th June for the second, the participants are reminded to fulfil their tranches just before each schedule is due.

This would mean that the approved contributions from each participant would be credited into a common syndication pool before each schedule is due. The schedule dates, according to the agreement, are 30th January, 29th February and 31st March for the first tranche, and 30th April, 31st May and 30th June for the second.

Therefore, the relationship of the tranche contracts under a main facility contract can be seen below, using our example:

Draw Down Contracts

On any date including and following the 31st of January, Mr. Robert Carr can avail of his first draw down loan of 20000 USD, under the first tranche. Similarly, on any date including and following the 30th of April, Mr. Robert Carr can avail of his first draw down loan of 20000 USD, under the second tranche.

You can enter each of Mr. Carr’s draw down loans into the system. The system defaults the details like as the start date of the draw down, the maturity date, currency, interest rate and amount. You can modify these details. The system saves the loan contract with a unique reference number. When the BOOK event for each of the loans is triggered, the system initiates deposit contracts for the participants of the tranche, based on the draw down loan reference number.

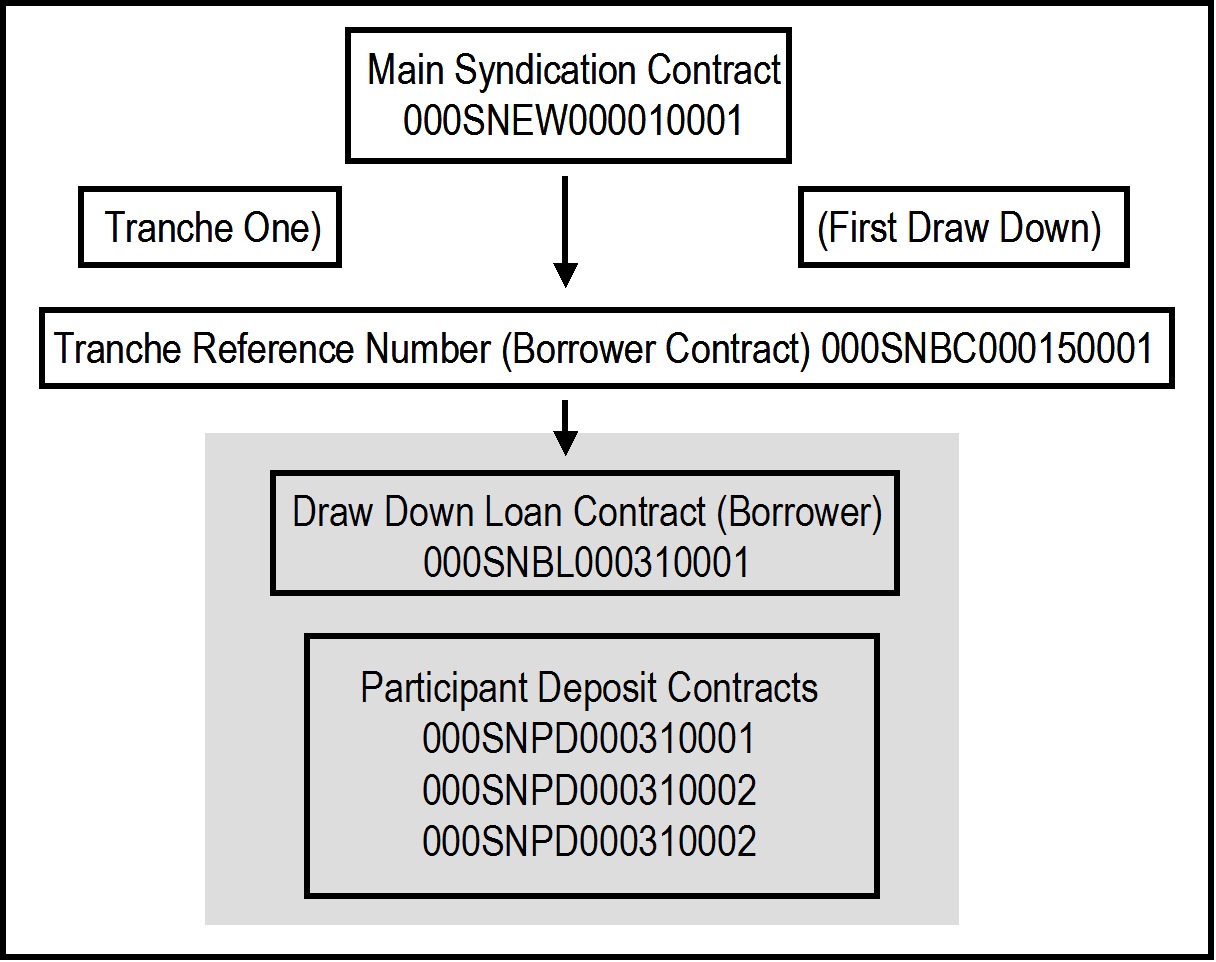

Let us suppose that the following Contract Reference Numbers are generated for the loans and the contracts for the participants:

Tranche One, Draw Down Loan

- Borrower (Mr Carr) Draw Down Loan : 000SNBL000310001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main borrower facility contract against which the tranche was being opened, which is 000SNEW000010001, as well as the Contract Reference Number of the borrower tranche contract against which the draw down loan is being entered, which is 000SNBC000150001.

- Participant (Your Bank) Deposit : 000SNPD000310001. This contract is created by the system when the BOOK event is triggered for the draw down loan contract 000SNBL000310001.

- Participant (Brinsley Bank) Deposit : 000SNPD000310002. This contract is created by the system when when the BOOK event is triggered for the draw down loan contract 000SNBL000310001.

- Participant (Dayton Commercial Bank) Deposit: 000SNPD000310003. This contract is created by the system when when the BOOK event is triggered for the draw down loan contract 000SNBL000310001.

Therefore, the relationship of the draw down contracts under the first tranche can be seen below, using our example:

The relationship of the draw down contracts in each draw down would be similar to the structure depicted above, with the appropriate tranche reference numbers and the draw down contract numbers.

Tranche One, Second Draw Down Loan (28th February)

- Borrower (Mr Carr) Draw Down Loan : 000SNBL000590001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main facility contract against which the tranche was being opened, which is 000SNEW000010001, as well as the Contract Reference Number of the borrower tranche contract against which the draw down loan is being entered, which is 000SNBC000150001.

- Participant (Your Bank) Deposit : 000SNPD000590001. This contract is created by the system when the BOOK event is triggered for the draw down loan contract 000SNBL000590001.

- Participant (Brinsley Bank) Deposit : 000SNPD000590002. This contract is created by the system when the BOOK event is triggered for the draw down loan contract 000SNBL000590001.

- Participant (Dayton Commercial Bank) Deposit: 000SNPD000590003. This contract is created by the system when the BOOK event is triggered for the draw down loan contract 000SNBL000590001.

Tranche One, Last Draw Down Loan (31st March)

- Borrower (Mr Carr) Draw Down Loan : 000SNBL000900001 (As explained earlier)

- Participant (Your Bank) Deposit : 000SNPD000900001. (As explained earlier).

- Participant (Brinsley Bank) Deposit : 000SNPD000900002. (As explained earlier)

- Participant (Dayton Commercial Bank) Deposit: 000SNPD000900003. (As explained earlier)

Tranche Two, First Draw Down Loan (30th April)

- Borrower (Mr Carr) Draw Down Loan : 000SNBL001200001 (As explained earlier for tranche two)

- Participant (Your Bank) Deposit : 000SNPD001200001. (As explained earlier).

- Participant (South American Overseas Bank) Deposit : 000SNPD001200002. (As explained earlier)

- Participant (Banco Milan) Deposit: 000SNPD001200003. (As explained earlier)

Tranche Two, Second Draw Down Loan (31st May)

- Borrower (Mr Carr) Draw Down Loan : 000SNBL001510001 (As explained earlier for tranche two)

- Participant (Your Bank) Deposit : 000SNPD001510001. (As explained earlier).

- Participant (South American Overseas Bank) Deposit : 000SNPD001510002. (As explained earlier)

- Participant (Banco Milan) Deposit: 000SNPD001510003. (As explained earlier)

Tranche Two, Last Draw Down Loan (30th June)

- Borrower (Mr Carr) Draw Down Loan : 000SNBL001810001 (As explained earlier for tranche two)

- Participant (Your Bank) Deposit: 000SNPD001810001. (As explained earlier).

- Participant (South American Overseas Bank) Deposit : 000SNPD001810002. (As explained earlier)

- Participant (Banco Milan) Deposit: 000SNPD001810003. (As explained earlier)

5.2 Products for Loan Syndication Contracts

A product is a specific service, scheme or facility that you make available to customers.

For instance, the facility of a syndication agreement between your bank and other banks or financial institutions, for the purpose of pooling funds to disburse loans is a specific service you could offer. This service can be thought of as a product.

Similarly, the facility of availing loans through a draw down, from any of the tranches under the borrower facility contract, is another specific service that you offer to customers. This could also be thought of as a product.

In Oracle FLEXCUBE, a contract is entered into the system against a product, and is specific to a customer. For instance, a draw down loan for a borrowing customer under a tranche of a borrower facility contract is entered into the system against a borrower leg draw down loan product.

Defining a product simplifies the process of entering a contract, since you can define certain attributes for a product that will be applied to all contracts entered against the product automatically, saving your effort to specify them afresh each time you input a contract. When Oracle FLEXCUBE processes the contract, it will apply all the attributes and specifications made for the product against which the contract was entered.

You can enter more than one contract against a product.

Before you enter any contracts for a facility contract, whether the main contracts or the tranches or loan contracts, you should have already defined the following products:

- A borrower facility product for borrower facility contracts. Also, participant facility products for the resultant participant facility contracts.

- Tranche-level tranche type of products for borrowing customers, and participants

- Loan products for the borrowing customers for draw downs under a tranche, as well as deposit products for the participants.

The definition of these products is explained in detail in the chapter Defining Products for Loan Syndication in this user manual.

5.3 Borrower Facility Contract Details

This section contains the following topics:

- Section 5.3.1, "Capturing Details for Borrower Facility Contract"

- Section 5.3.2, "Features of Loan Syndication - Contract Input Screen"

- Section 5.3.3, "Contract Tab"

- Section 5.3.4, "Holiday Preferences Tab"

- Section 5.3.5, "Specifying Currency Details"

- Section 5.3.6, "Specifying Borrower Details"

- Section 5.3.7, "Specifying Participant Details"

- Section 5.3.8, "Specifying Party Type Details"

- Section 5.3.9, "Specifying Settlement Instructions"

- Section 5.3.10, "Specifying MIS Details"

- Section 5.3.11, "Specifying Adhoc Charges"

- Section 5.3.12, "Viewing Diary Events"

- Section 5.3.13, "Viewing Events"

- Section 5.3.14, "Capturing User Defined Fields"

5.3.1 Capturing Details for Borrower Facility Contract

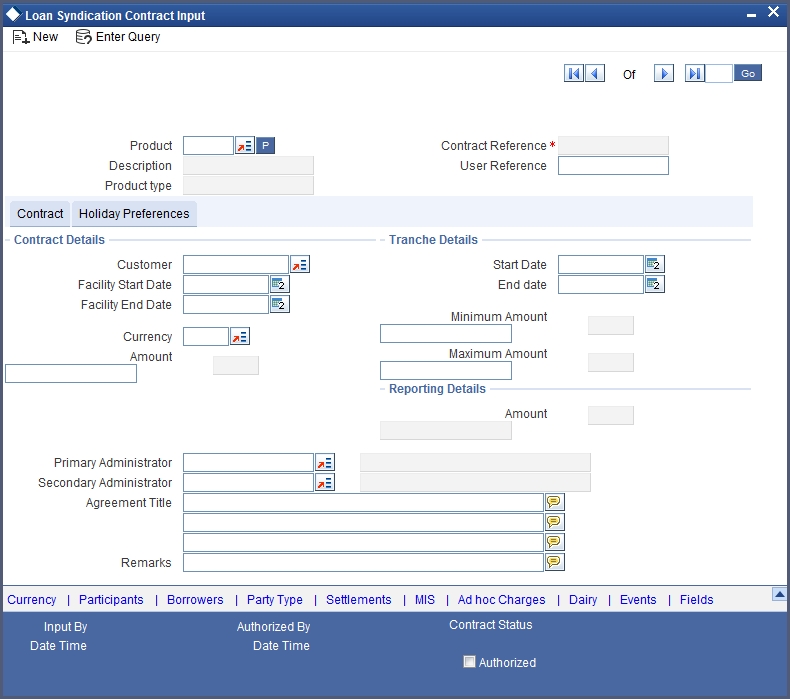

You can capture details for a borrower facility contract in the Loan Syndication Contract Input screen. You can access this screen from the Application Browser. You can also invoke this screen by typing ‘LNDCONON’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Throughout our discussion of how borrower facility contracts are entered, in this chapter, we will be referring to the example given at the beginning of the chapter.

5.3.2 Features of Loan Syndication - Contract Input Screen

In the Loan Syndication Contract Input screen, you capture the following details to input the borrower facility contract:

- The main borrower facility product against which the contract is being entered

- The counterparty (customer) with whom the borrower facility contract has been finalized.

- The currency associated with the customer

- The date of value of the contract

- The date on which the contract matures

- The amount being transacted in the contract

- Earliest possible value date for Tranches under the Facility

- Latest possible maturity date for Tranches under the Facility

- The minimum amount that would be allowed for Tranches created under the Facility

- The maximum amount that would be allowed for Tranches created under the Facility

- The purpose for the borrower facility contract

- Any narrative regarding the contract (remarks)

5.3.3 Contract Tab

You can specify the details regarding the facility contract in the ‘Contract’ Tab.

The Contract Reference Number

The Contract Reference Number uniquely identifies the borrower facility contract in the system. It is generated by the system automatically for every borrower facility contract.

The system combines the following elements to form the Contract Reference Number:

- The branch code (3-digit code)

- The product code (4-digit code)

- The value date of the borrower facility contract (in 5-digit Julian format)

- A running serial number for the booking date (4-digits)

For instance, if you are entering the facility contract with Mr. Robert Carr, as in our previous example, the Contract Reference Number generated by the system was 000SNEW000010001.

The first three digits are the code of the branch of your bank where the contract was entered into the system.

SNEW is the code of the borrower facility product that you have set up against which you are entering your facility contract with Mr. Robert Carr.

00001 refers to January 1, 2000 (in Julian format) when the contract was booked. (see example given below to understand how the Julian date is interpreted)

0001 is a running serial number, incremented by 1 for each contract entered on the booking date for the product code and the booking date combination.

The Julian date is expressed in the following format - YYDDD

Here, YY represents the last two numerals of the year, and DDD, the number of elapsed days in the year.

For instance, 00059, in Julian format, would mean the 28th of February 2000. Here, 00 stands for the year 2000, and 059 would stand for number of elapsed days in the year 2000. The number of elapsed days in January would be 31, followed by 59-31 days in February, which computes to 28.

The User Reference Number

The reference number is the identification that you specify for the borrower facility contract. You can specify any identification number. In addition to the Contract Reference Number generated by the system for the contract, this number will also be used to retrieve information about the contract.

By default, the Contract Reference Number generated by the system is considered to be the User Reference Number for the contract.

You can use the User Reference Number to uniquely identify as well as classify the borrower facility contract for the internal purposes of the bank. For instance, you may want to identify all facility contracts entered into with all customers (borrowers) of a certain net worth; or all customers in a particular nationality, or a particular industry, and so on. In such a case, you can supply a unique prefix to the user reference number to identify and classify the contract.

Specifying the Product Code

The syndication contract facility is a service you offer to customers, which you have defined as a product. When you are inputting a borrower facility contract in this screen, you must specify the facility product that it involves.

For instance, taking the example of your bank’s facility contract with Mr. Robert Carr, let us suppose that you have set up the facility product SNEW to process all facility contracts with customers. You can select SNEW from the option list.

Contract Details

In the Contract Details section, you must specify the following:

Specifying the Customer

You must specify the customer with whom the facility contract has been finalized. This, typically, is the borrowing customer.

The customers allowed to be counterparty to a facility contract are defined for the facility product. Select the code of a customer with whom the contract has been entered into, from a list of these.

Note

A primary entity must be defined for every customer who is allowed to be a borrower of the facility contract, in the Borrower Details screen.

When you are entering a borrower facility contract that we saw in the first example, with Mr. Robert Carr, you can select the code assigned to Mr. Carr, in the system, from the option list.

You must also designate a Primary Entity to whom advices and notices related to the contract would be sent.

Specifying the tenor of the contract

To indicate the tenor of the contract, you must specify the Facility Start Date and the Facility End Date of the contract.

Facility Start Date

This is the date on which the contract is effective in the system. On any date following this, the tranche-level tranche contracts and the individual draw down loans can be inputted into the system.

You can enter any date as the value date. It could be any of the following dates:

- A past date

- The application date

- A future date

The facility start date must be later than the Start Date defined for the product involving the borrower facility contract, and earlier than the End Date of the same product.

All tranche contracts and draw down loan contracts must be value dated later than the Facility Start Date specified for the borrower facility contract.

For instance, when you enter the borrower facility contract with Mr. Robert Carr, you must enter 1st January 2000 as the Value Date.

The application date on the day you enter the contract could be earlier, later or the same as this value date. For instance, Mr. Robert Carr could approach you on 15th January 2000 and enter into a contract with your bank, wishing that the contract to come into effect on 1st January. The value date in this case is 1st January 2000, and the contract would be backdated.

For backdated contracts, you can enter backdated tranches and draw downs.

Alternatively, Mr. Robert Carr could approach you on 15th December 1999, and enter into a contract with your bank, wishing that the contract must come into effect on 1st January 2000. This is the value date, and the contract would be future dated.

For future dated contracts, you cannot enter tranches before the contract actually comes into effect (i.e., before the value date).

Facility End Date

This is the date on or before which all tranches and draw downs under the borrower facility contract mature.

You can enter any future date as the facility end date. It must be later than the Start Date defined for the product involving the borrower facility contract, and earlier than the End Date of the same product.

The Facility End Date must be later than the Facility Start Date defined for the borrower facility contract.

For instance, when you enter the borrower facility contract with Mr. Robert Carr, the customer indicates that the tenor of the contract must be a year, i.e., the maturity date of the facility contract must be 1st January 2001. This means that all tranches and draw downs entered must mature on or before that date.

Specifying the Currency

Specify the currency of the borrower facility contract. This is the currency in which the contract amount is expressed.

Specifying the contract amount

You must specify the total principal that is to be lent to the borrowing customer through the facility contract. The value you enter here is taken to be in the currency specified for the facility contract. You can specify T or M to signify thousand or million, respectively. For instance, 10T would mean ten thousand and 5M, five million.

The total principal that you specify here must be greater than or equal to the sum of all the amounts proposed to be disbursed through draw downs in all tranches of the contract.

For instance, when you enter your bank’s facility contract with Mr. Robert Carr, specify 100000 USD as the total principal in the Contract Amount field.

When you specify the contract amount, the system computes and displays the facility amount in reporting currency using the exchange rate maintained between the two currencies for the branch.

Specifying the Primary and Secondary Administrator

You can indicate the officer assigned to be the primary and the secondary administrator for the borrower facility contract.

Specifying the Agreement Title

A borrowing customer may avail a syndicated loan arrangement for a specific purpose, such as beginning a new venture, or a personal business project. You can capture this information as part of the facility contract.

Adding remarks

You can specify information about the facility contract that will be used for reference, within your bank. It will not be printed on any correspondence with customers, but will be displayed when the details of the contract are displayed or printed.

Tranche Details

The following tranche details are maintained here:

Start Date

Select the date from which the tranche becomes effective.

End Date

Select the date till which the tranche is available.

Minimum Amount

Specify the maximum amount that can be availed from that tranche.

Maximum Amount

Specify the minimum amount that can be availed from that tranche.

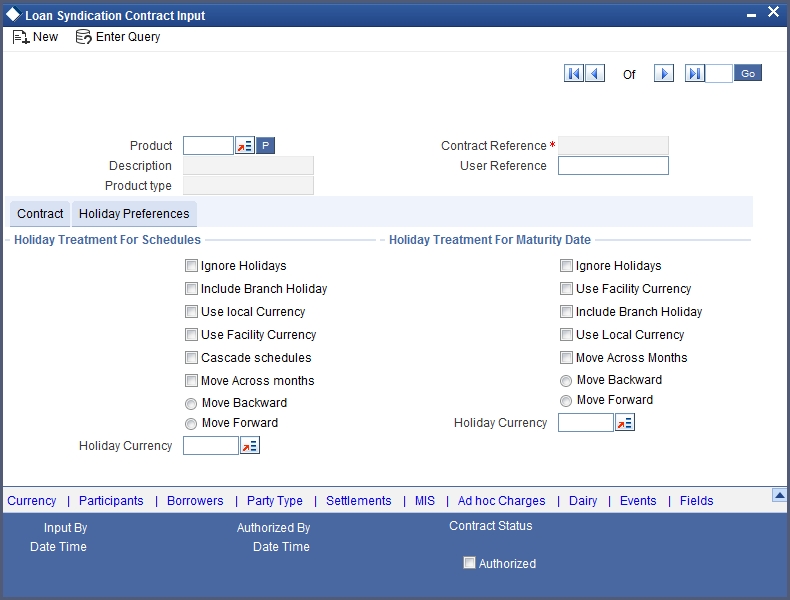

5.3.4 Holiday Preferences Tab

You can maintain holiday preferences for schedule dates and maturity dates in the ‘Holiday Preferences’ Tab.

Holiday Treatment For Schedules

Schedule dates for a contract could fall on holidays defined for your branch or on holidays defined for the currency of the contract. In the Product Preferences the borrower facility contract, the specification as to whether the system should check for schedule dates falling on holidays, and how such schedule dates must be handled, would have been defined. These specifications would default to any borrower facility contract using the product, and also to underlying borrower tranche or draw down contracts that are opened under the facility contract.

You can make changes to the specifications defaulted from the borrower facility product and specify that:

- Holidays must be ignored, OR,

- Checks must be made for schedule dates falling on holidays

If you specify that checks must be made, you can also specify the corresponding treatment for schedule dates falling on holidays.

The system checks the holiday table for the currencies you have specified. If it encounters a contract using any of the specified currencies, with a schedule date falling on a holiday for any of the currencies, the holiday is handled according to the holiday-handling preferences you specify.

Currency

Select the type of currency you want to use. The options are:

- Facility Currency

- Local Currency

- Holiday Currency

If you have specified that the system check for schedule dates falling on holidays, you must also specify the treatment for schedule dates encountered by the system that do fall on holidays. The following preferences can be set:

Moving the schedule date backward or forward

You can indicate whether the schedule date falling on a holiday must be moved forward to the next working day, or backward to the previous one.

Moving across months

If you have indicated either forward or backward movement, and the moved schedule date crosses over into a different month, you can indicate whether such movement is allowable; it will be allowable only if you indicate so in the Move Across Months field.

Cascading schedules

If one schedule has been moved backward or forward in view of a holiday, cascading schedules would mean that the other schedules are accordingly shifted. If you do not want to cascade schedules, then only the schedule falling on a holiday is shifted, as specified, and the others remain as they were.

Holiday Treatment For Maturity Date

The maturity date for a contract could fall on holidays defined for your branch. In the Product Preferences, the specification as to whether the system should check for maturity dates falling on holidays, and how such dates must be handled, would have been defined. These specifications would default to any borrower facility contract using the product, and also to underlying borrower tranche or draw down contracts that are opened under the facility contract.

You can make changes to the specifications defaulted from the borrower facility product and specify that:

- Holidays must be ignored, OR,

- The maturity date falling on a holiday must be moved according to the holiday-handling preferences that you specify

You can indicate that the maturity date falling on a branch holiday be moved either backward or forward, as required, and if it is allowed to move across months. These preferences are explained under the previous (schedule dates) section.

5.3.5 Specifying Currency Details

You can specify the different currencies that are allowable for the borrower facility contract, for tranches and draw downs created under it.

When you enter a tranche or a draw down under the facility contract, the allowable currencies are those defined in this list.

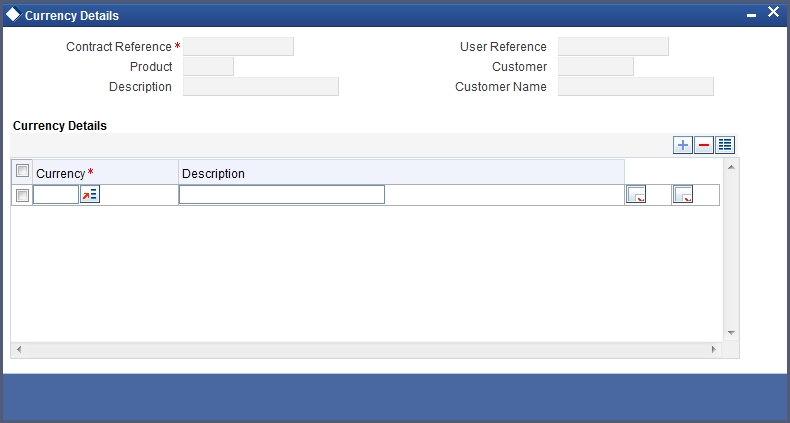

To specify the allowable currencies, click the ‘Currency’ button in the Loans Syndication Contract Input screen. The ‘Currency Details’ screen is opened, where you can specify the required currency list.

The following information gets defaulted here:

- Contract Reference Number

- User Reference Number

- Product Code and Description

- Customer and Customer Name

The following details need to be captured here:

Currency

Select the currency that can be allowed for the borrower facility contract, for tranches and draw downs created under it. The adjoining option list will have all the currencies maintained in the system.

Description

The description for the selected currency is defaulted here.

5.3.6 Specifying Borrower Details

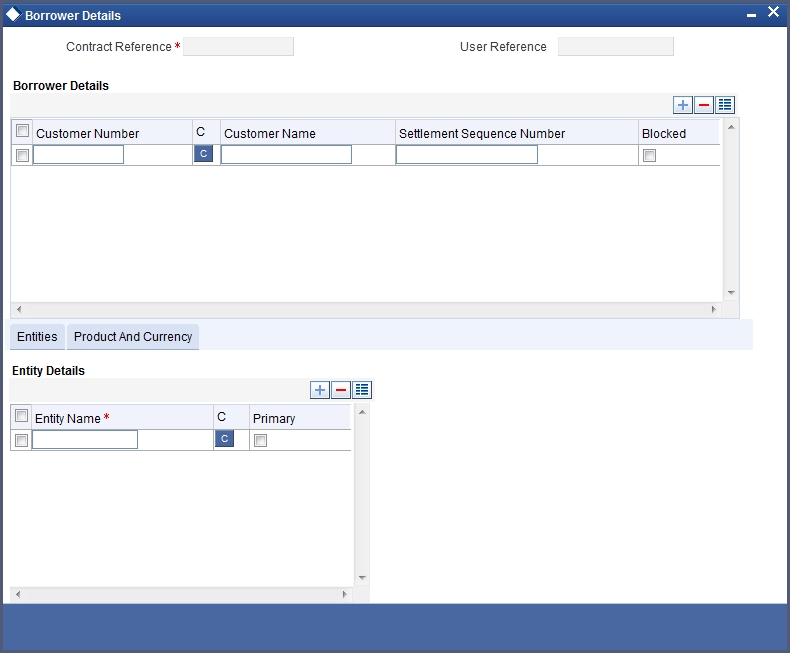

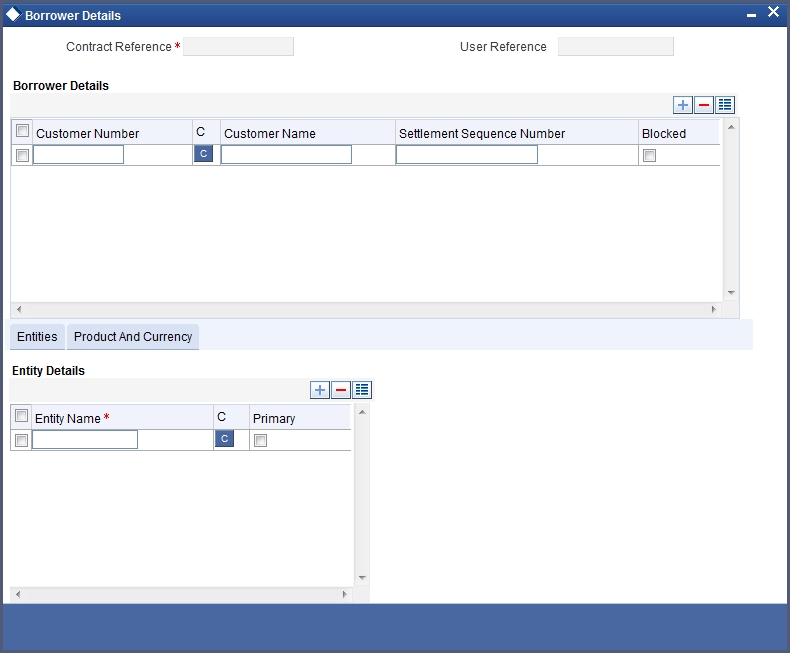

You must specify the borrowers for the facility contract, who will actually be availing the draw down loans under the facility contract. Click the ‘Borrowers’ button in the Loans Syndication Contract Input screen to invoke the Borrower Details screen, where you can specify the borrowers.

You can specify more than one borrower. The following details are defaulted:

Contract Reference

The contract reference number is defaulted here.

User Reference

The user reference number of the contract is defaulted here.

Borrower Details

You can specify the following details related to the borrower:

Customer Number

Select the customer number from the option list. The adjoining option list contains all the customer codes/numbers maintained in the system.

Customer Name

Depending on the customer number chosen the name of the customer is displayed here.

Settlement Sequence Number

For each borrower, you must specify a settlement sequence number that will enable the system to obtain the settlement details for the selected borrower, for the contract.

Blocked

This indicates whether a borrower is available during Tranche/Drawdown.

5.3.6.1 Product and Currency Tab

Note

Borrower Product Restriction is not applicable to Facility contracts. This applies only to Tranche contracts. At the facility contract level, this tab appears disabled.

5.3.6.2 Entity Tab

You can specify the following entity related details of the borrower:

Entity

You can also specify the entities for the borrowers that you specify, with a single primary entity, to be the recipient of notices and messages for the borrower.

Primary

A primary entity must be designated for every customer who is allowed to be a borrower of the facility contract.

5.3.7 Specifying Participant Details

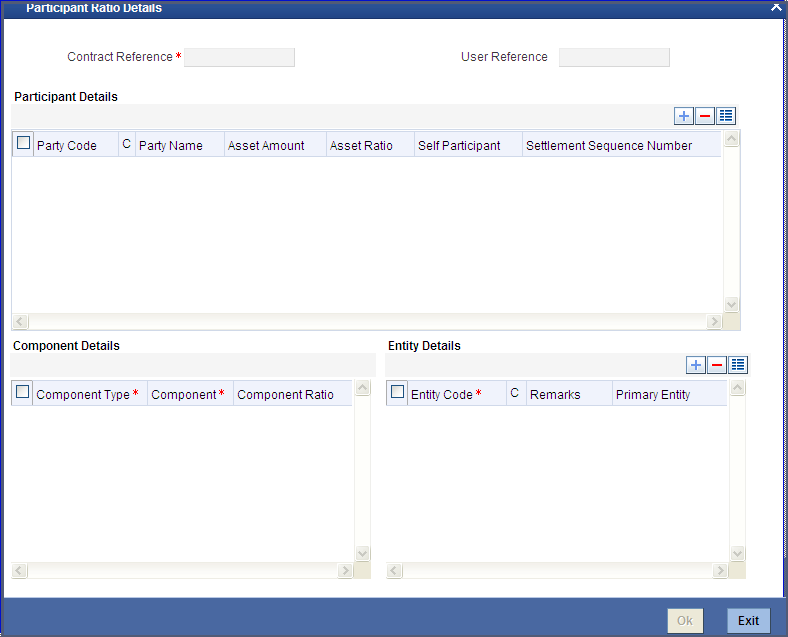

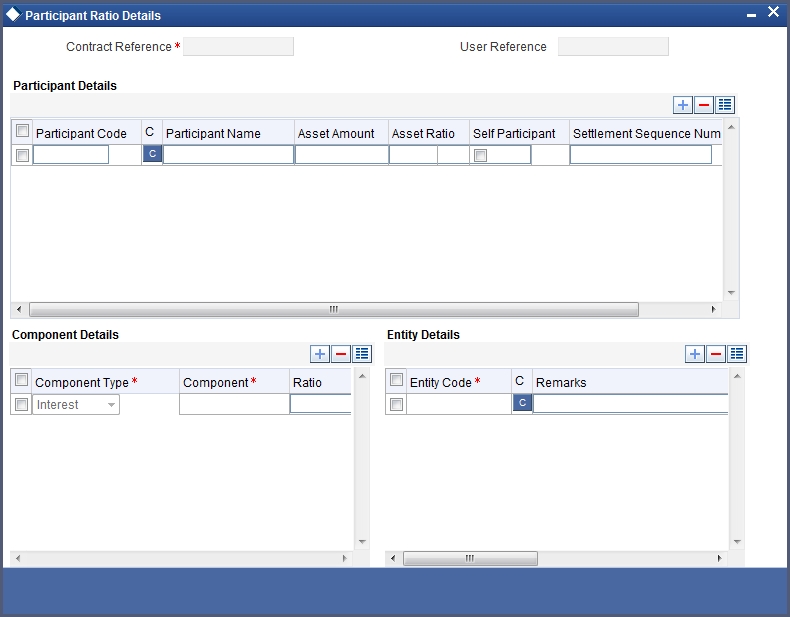

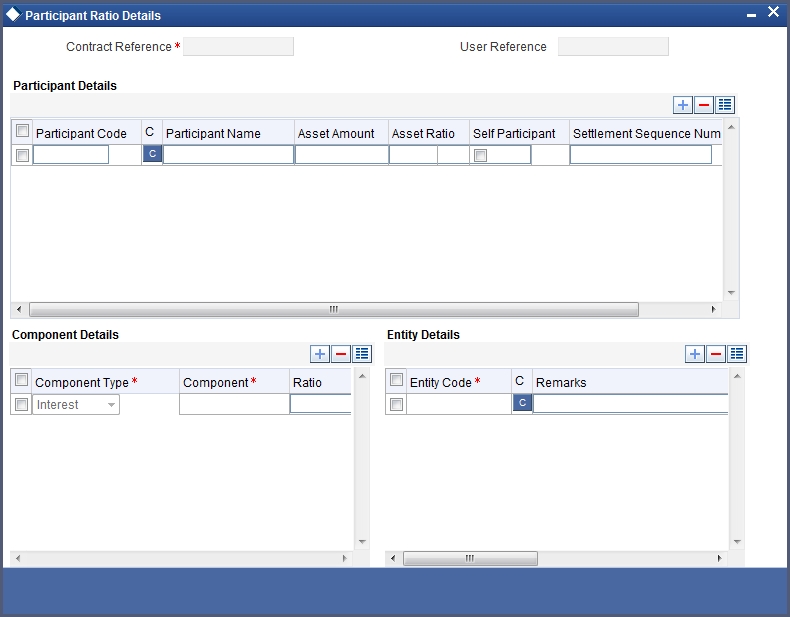

You must also identify the participants who contribute to the syndication agreement for the borrower facility contract. To do this, use the Participant Ratio Details screen, which you can invoke by clicking the ‘Participants’ button in the Loans Syndication Contract Input screen.

When you open this screen, the reference number of the borrower facility contract for which you are specifying the participant details is displayed in the Contract Reference Number field.

You must specify the following details for each participant:

- The ID and Name of the participant

- Settlement sequence number of the participant, which the system will use to obtain the settlement details for the participant

- Whether the lead bank is also a participant in the syndication (self participant)

- Interest, charge and ad-hoc fee components levied on the contract, the receivables from which are due to the participant (you can only specify those components marked for propagation to participants in the product preferences of the borrower facility product used by the contract)

- Proportion of income from the interest, charge and ad-hoc fee components, which is due to the participant. This can be specified either as a ratio or an amount.

- Location IDs for the participant where notices and advices related to the contract will be sent. A primary location must be designated.

Note

The Asset Amount/ Ratio is not allowed to be input at Facility Contract level. This however is allowed at Tranche/ Drawdown Level.

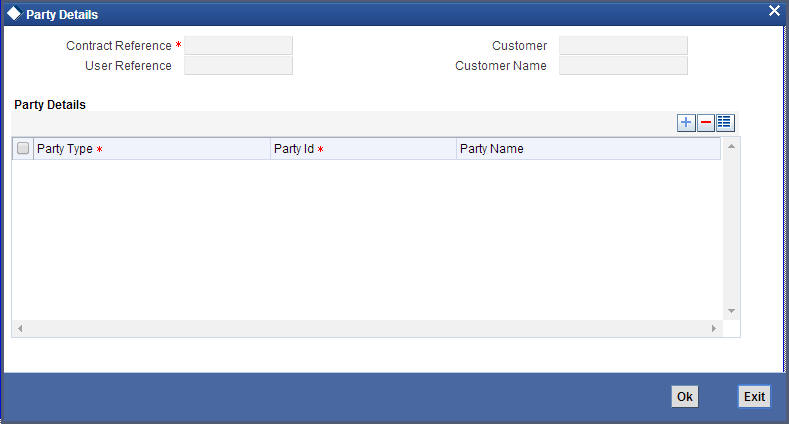

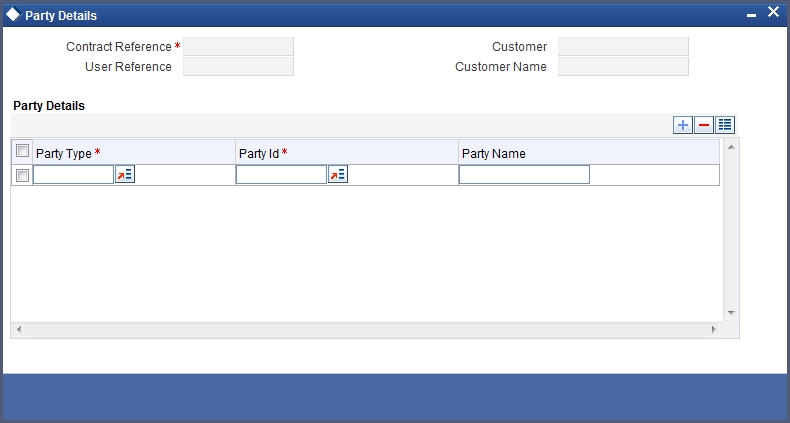

5.3.8 Specifying Party Type Details

You can also specify the different types of entities or parties that would be applicable for the borrower facility contract, as well as the applicable parties belonging to the selected type, in the Party Details screen. The party types associated with the borrower facility product used by the contract are defaulted; you can change them and specify the required types.

You can specify multiple parties for a selected type, if allowed as specified in the Party Association specification for the borrower facility product used by the contract. If multiple parties are not allowed, you can specify only one party for the selected type.

If any mandatory party types have been specified in the Party Association for the borrower facility product used by the contract, then you must specify at least one party for the party type.

Click the ‘Party Type’ button in the Loan Syndication Contract Input screen to invoke the ‘Party Details’ screen.

The following details are defaulted:

Contract Reference

The contract reference number is defaulted here.

User Reference

The user reference number of the contract is defaulted here.

Customer

The customer number gets defaulted here.

Customer Name

The customer name gets defaulted here.

Specifying Party Details

You need to maintain the following details here:

Party Type

Select the party type to be associated with the borrower facility contract. The party type associated to the product is defaulted here. However you can modify it.

Party Identification

Select a party belonging to the selected party type, to be associated with the borrower facility contract.

Party Name

The name of the selected party is displayed here.

5.3.9 Specifying Settlement Instructions

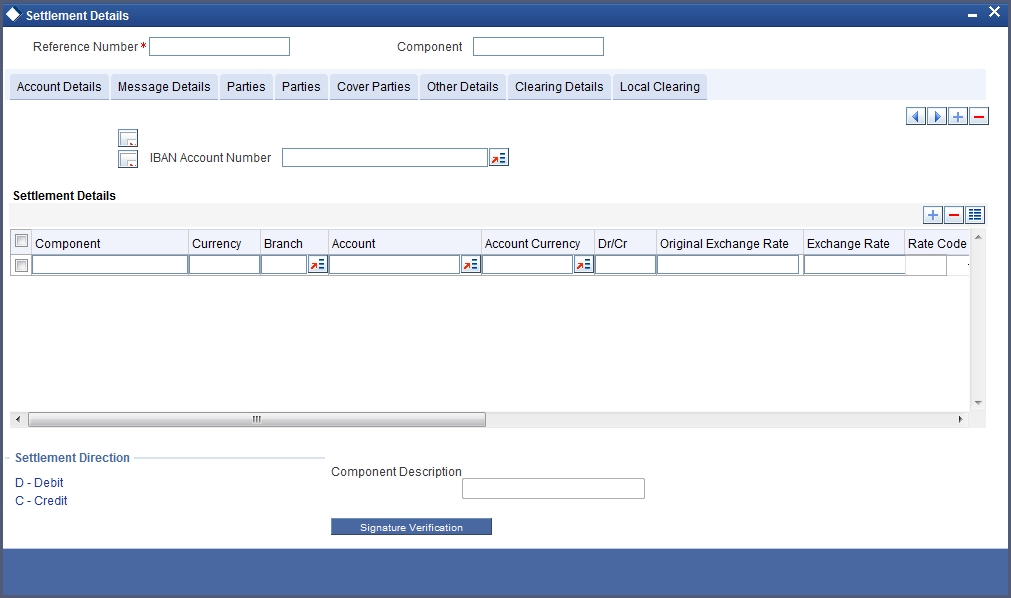

You must specify the settlement instructions to be used for the borrower of the contract. You can use the Settlement Message Details screen to do this. Based on the sequence number for each borrower, the system obtains the settlement details.

Click the ‘Settlements’ button in the ‘Loan Syndication Contract Input’ screen. The ‘Settlement Details’ screen is opened, where you can specify the settlement details.

For details about the Settlement Message Details screen, refer section ‘Processing Settlements’ in the ‘Settlements’ User Manual under Modularity.

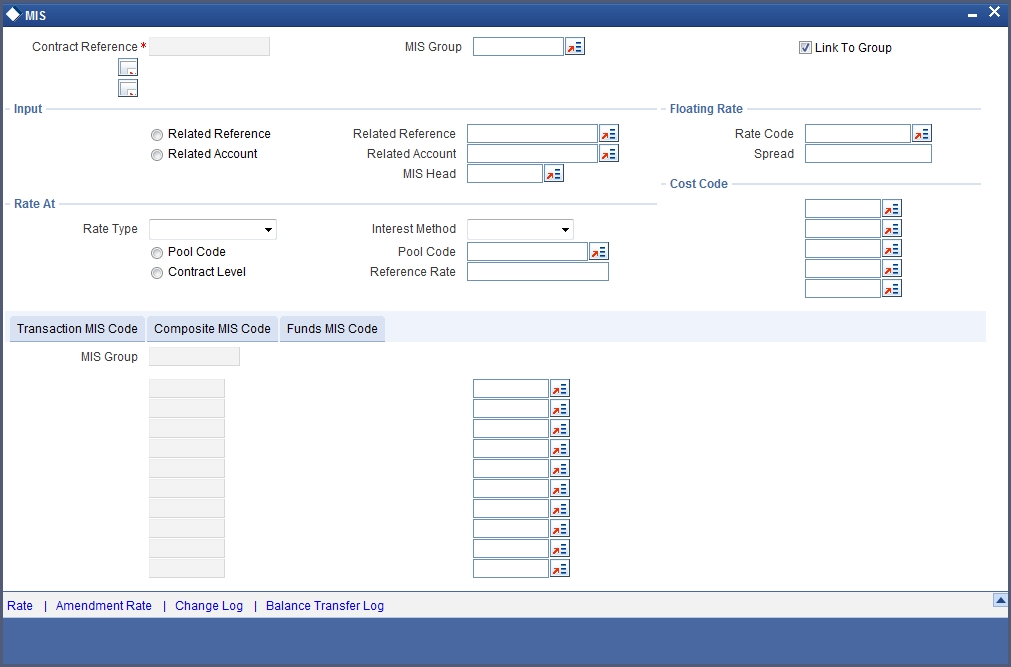

5.3.10 Specifying MIS Details

Click ‘MIS’ button in the ‘Loans Syndication Contract Input’ screen to invoke the ‘MIS’ screen. This is a view only screen, which provides a MIS details for a contract.

For more details on this screen refer section ‘Defining MIS details for an account or contract’ in the chapter ‘Defining MIS Details for a Customer, Account Class, Account, Product, and Contract’ in the ‘Management Information System’ User Manual.

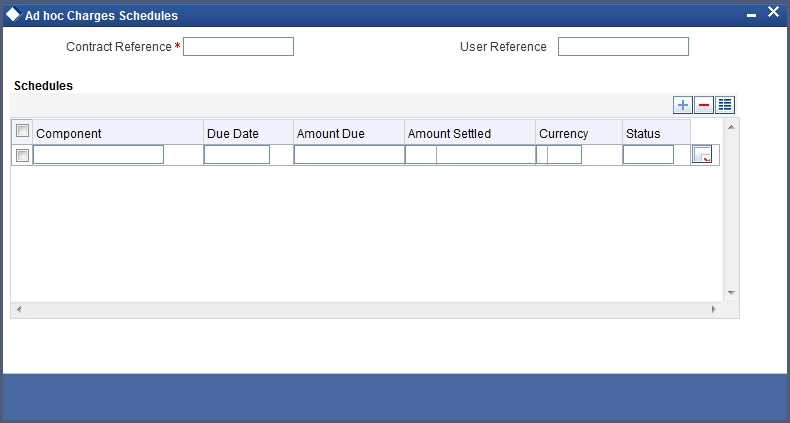

5.3.11 Specifying Adhoc Charges

Click ‘Adhoc Charges’ button in the ‘Loans Syndication Contract Input’ screen to invoke the ‘Adhoc Charges Schedule’ screen. This is a view only screen, which provides the Adhoc charge schedule details for a contract.

The following details are defaulted:

Contract Reference

The contract reference number is defaulted here.

User Reference

The user reference number of the contract is defaulted here.

Schedules

The following schedule related details are defaulted:

- Component

- Due Date

- Amount Due

- Amount Settled

- Currency

- Status

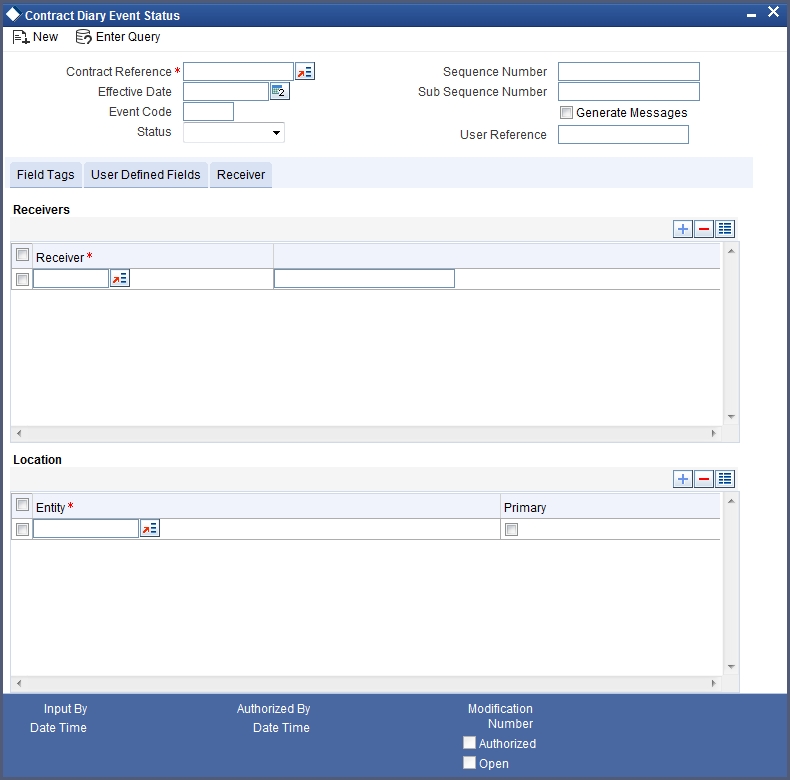

5.3.12 Viewing Diary Events

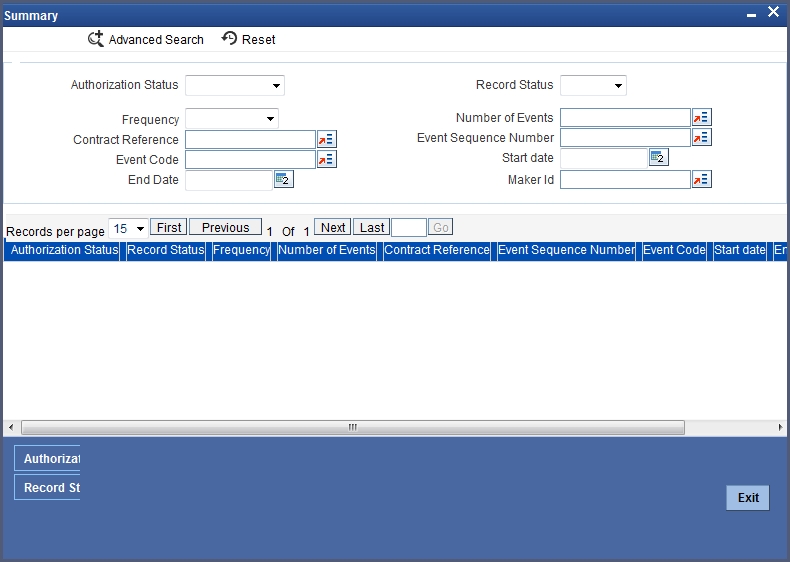

The diary events defined for the contract can be viewed in the ‘Contracts Diary Events Summary’ screen, which can be invoked by clicking the ‘Diary’ button in the Loan Syndication Contract Input screen.

5.3.13 Viewing Events

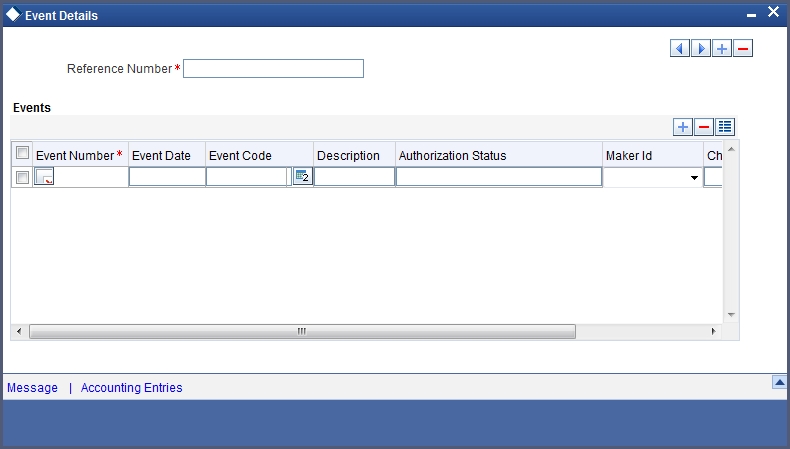

To view the events applicable for the contract, click the ‘Events’ button in the ‘Loans Syndication Contract Input’ screen. The ‘Event Details’ screen is opened, where the events defined for the contract are displayed and defaulted from the facility product used by the contract.

5.3.14 Capturing User Defined Fields

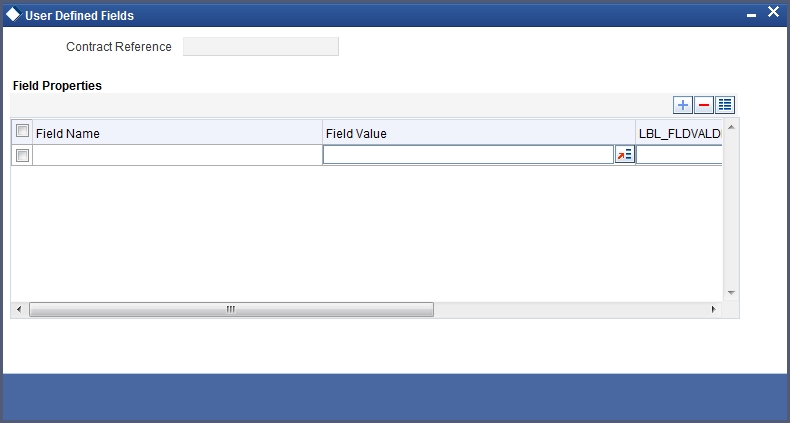

To view the user defined fields applicable for the contract, click the ‘Fields’ button in the Loans Syndication Contract Input screen. The ‘Fields’ screen is opened, where the UDFs defined for the contract are displayed and defaulted from the facility product used by the contract.

5.4 Loan Syndication Contracts Details

This section contains the following topics:

- Section 5.4.1, "Processing Loan Syndication Contracts"

- Section 5.4.2, "Tranche-level contracts"

- Section 5.4.3, "Draw Down Contracts"

- Section 5.4.4, "Participant Contracts"

- Section 5.4.5, "Entering Borrower Tranche or Draw Down Contracts"

5.4.1 Processing Loan Syndication Contracts

After you enter a borrower facility contract into Oracle FLEXCUBE, you need to:

- Open a tranche by creating a tranche contract for the borrower.

- Create a draw down loan contract for the borrower when a draw down is requested, and as soon as intimation is received from the participants, indicating that their tranche has been fulfilled and the funds have been credited to the nostro account of the lead bank (your bank).

A draw down loan can be entered for the borrowing customer on each of the schedule dates that are specified according to the borrower’s requirement. The lead bank typically checks to ensure that all the necessary formalities have been completed, and any necessary documents required to be furnished by the borrower have been received, before entering a draw down loan.

The participants make their contributions available in their vostro accounts, from where the funds are drawn into the common syndication pool, and then to the account of the borrower, when a draw down loan is entered.

The system therefore processes the borrower facility contract in two stages:

- Processing the tranche contracts

- Processing the draw down loan contracts

The system also processes two different types of contracts when it processes a borrower facility contract:

- Those related to the borrower. These include the main syndication agreement facility contract, the borrower tranche that you enter when you open a tranche, and any borrower draw down loan that you enter under a tranche. These contracts constitute the borrower leg of the borrower facility contract.

- Messages to the borrower are generated and transmitted through the borrower leg.

- Those related to the participants. These include the participant facility contracts, tranche tranches or draw down deposit contracts that are initiated by the system when the BOOK event for the corresponding borrower contract is triggered. These contracts constitute the participant leg of the facility contract.

5.4.2 Tranche-level contracts

After a borrower facility contract has been initiated, a number of arms or tranches can be opened under it, as specified under the contract. The processing of each tranche involves the creation of a simple tranche contract for the borrowing customer against the Reference Number of the borrower facility contract. This contract constitutes the borrower leg of the processing of the tranche.

When you create the borrower tranche (tranche) contract, you must also specify the following details:

- The participants involved in the tranche, such as the participants

- The ratio of participation

- The borrower details

The system generates a Reference Number for the borrower tranche contract.

After you have entered a borrower tranche contract, when the BOOK event of the contract is triggered, the system automatically initiates tranche contract for the participants. These contracts constitute the participant leg of the processing of the tranche.

The system also generates SWIFT messages to each participant according to the draw down schedule, intimating them to fulfil their tranche and disburse the funds to the nostro account of the lead bank.

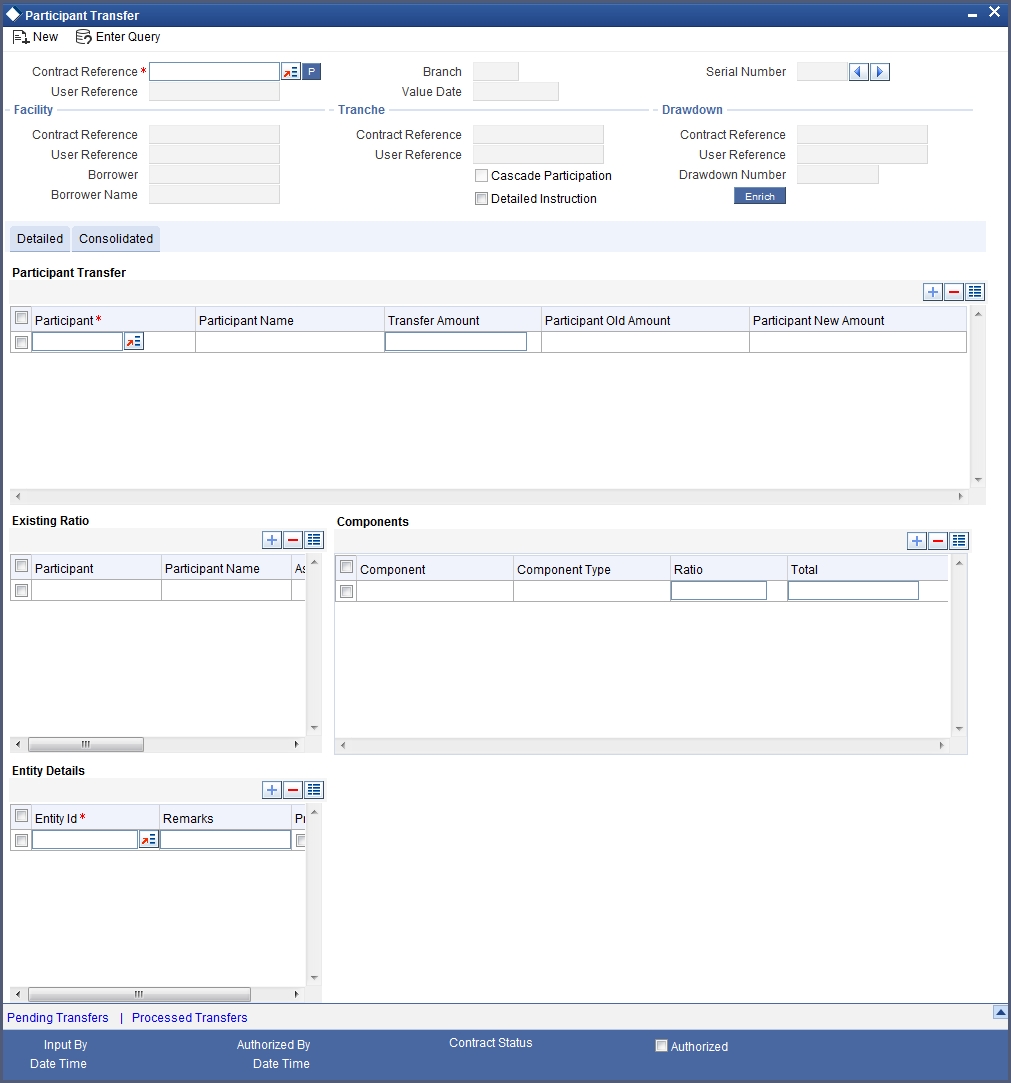

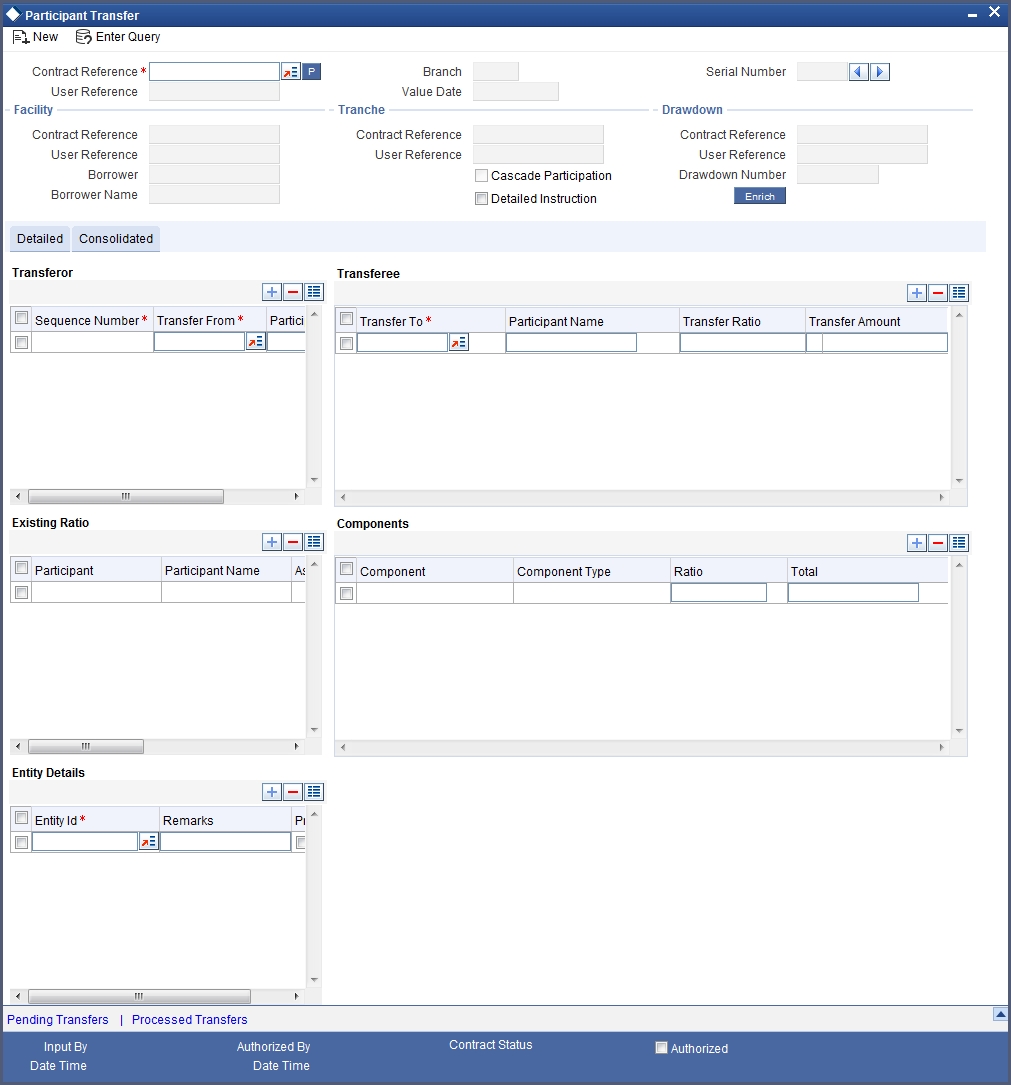

5.4.3 Draw Down Contracts

After the tranche contracts have been entered, the lead bank typically disburses the loans to the borrowing customer, against the Reference Number of the borrower tranche contract as well as the Reference Number of the main facility contract. The borrower loan contract constitutes the borrower leg of the processing for draw downs.

To disburse the draw down loan, you must enter the borrower loan contract and specify the following details for the participants:

- The participants involved in the draw down. You can change the participants if required, only if the Cascade Participation preference is set to ‘No’ for the borrower tranche contract under which the draw down has been entered.

- The ratio of participation. Again, the ratio specified for the participants defined in the borrower tranche contract will be defaulted to the draw down, and you can change it if required, only if the Cascade Participation preference has been set to ‘No’ for the borrower tranche under which the draw down has been entered.

- The borrower details

The system generates a Reference Number for the borrower loan contract.

After you have entered a borrower draw down contract, when the BOOK event of the contract is triggered, the system automatically initiates deposit contracts for the participants. These contracts constitute the participant leg of the processing of the draw down.They are linked to the respective tranche contracts created at the tranche level.

5.4.4 Participant Contracts

To recall, you open a tranche by entering a tranche contract for the borrower. When the BOOK event for the borrower tranche contract is triggered, the system creates tranche contracts for the participants, using the product specified for participant tranche contracts, in the product preferences for the borrower tranche product which the borrower tranche contract uses, and the participant details maintained for the borrower tranche contract.

Similarly, after you enter a draw down loan contract for the borrower under a tranche reference number, the system creates a deposit contracts for participants, using the product specified for participant draw down contracts, in the product preferences for the borrower draw down product which the borrower draw down contract uses, and the participant details maintained for the borrower tranche contract.

Participant contracts initiated by the system can be viewed and amended using the Participant Contract screen, which is discussed later in this chapter.

5.4.5 Entering Borrower Tranche or Draw Down Contracts

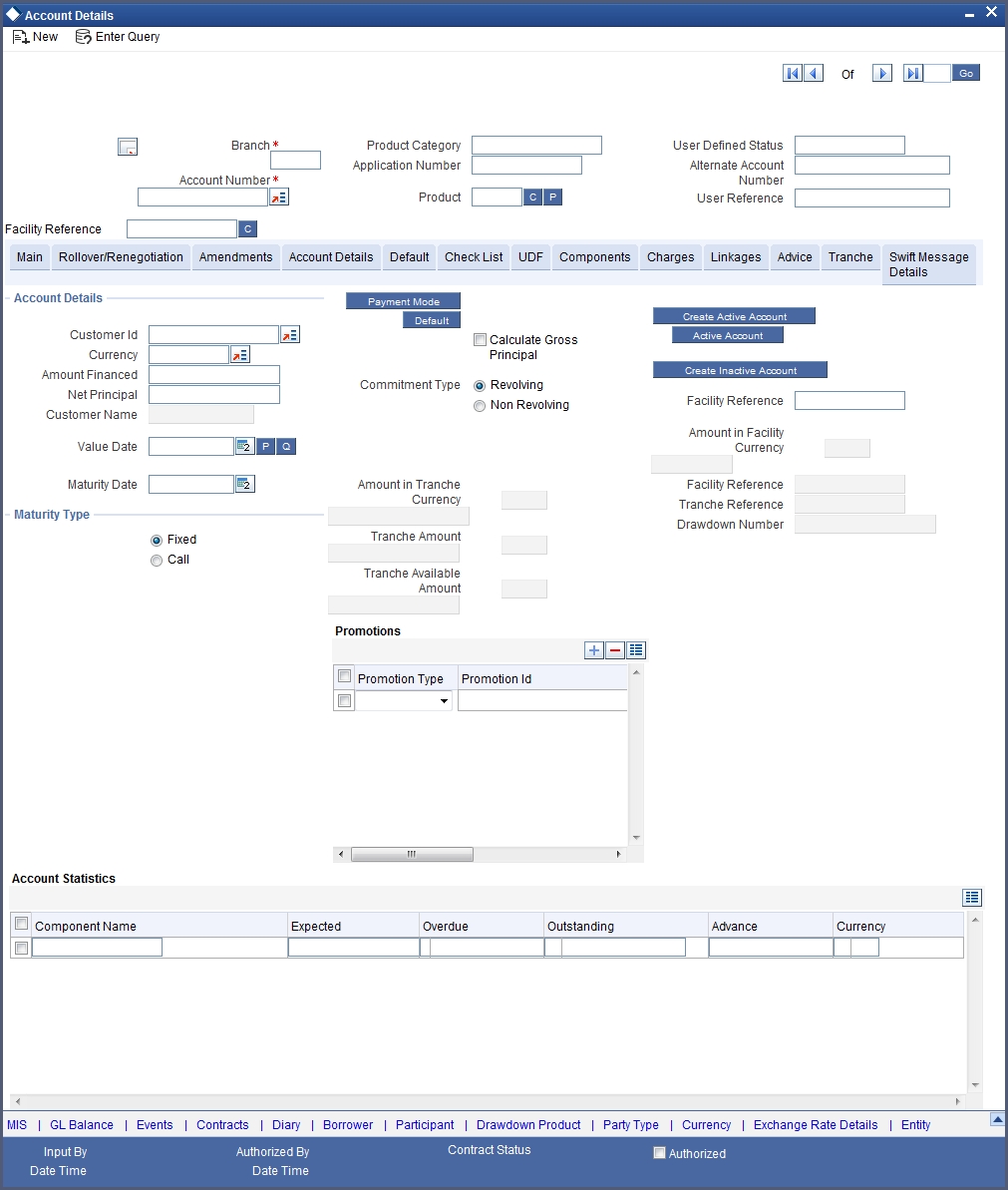

To enter borrower tranche or draw down contracts, you can use the Contract Online screen.

As mentioned earlier, when the BOOK event is triggered for the borrower tranche or draw down contract, the corresponding participant tranche or draw down contract is initiated by the system. Participant contracts initiated by the system can be viewed and amended using the Participant Contract screen, which is discussed later in this chapter.

A borrower drawdown contract under a tranche of a borrower facility contract is entered in the same manner as a normal tranche contract in the system.

For a detailed description of how tranches are entered, refer the chapter Account Creation in the Retail Lending user manual.

A borrower draw down loan contract under a tranche of borrower facility contract is entered in the same manner as a normal loan contract in the system. Only those aspects of tranche or loan processing that are specific to contracts for Loan Syndication are discussed here.

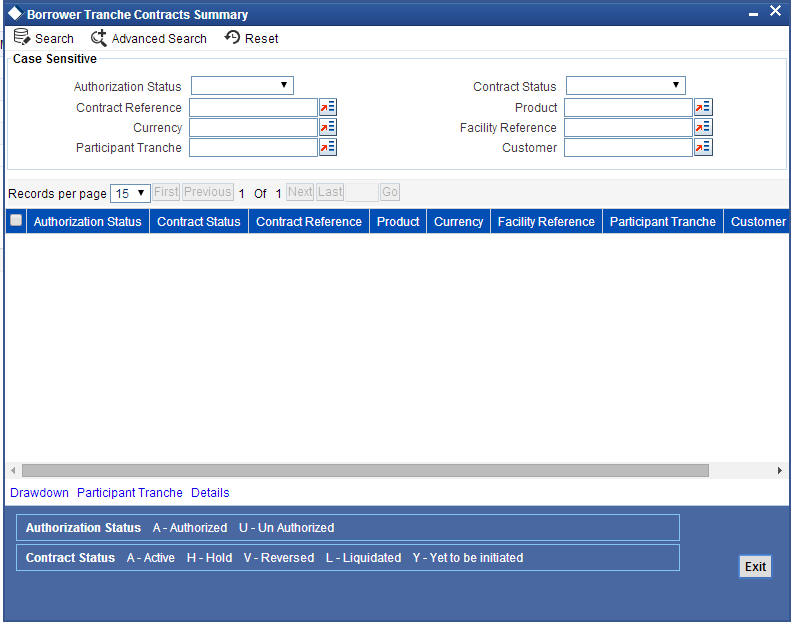

5.5 Borrower Tranche Contracts Details

This section contains the following topics:

- Section 5.5.1, "Capturing Details for Borrower Tranche Contracts"

- Section 5.5.2, "Participant Details for Borrower Tranche Contract"

- Section 5.5.3, "Borrower Details for Tranche Contract"

- Section 5.5.4, "Specifying Borrower Drawdown Products"

- Section 5.5.5, "Specifying Currency Details"

- Section 5.5.6, "Defining schedules for Non-revolving Tranches"

5.5.1 Capturing Details for Borrower Tranche Contracts

You capture the details for the borrower tranche contract in the ‘Tranche Details’ screen. You can invoke this screen by typing ‘LSDTRONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specifying Borrower Facility Contract Reference Number

Under each borrower facility contract, tranches are opened and draw down loans are disbursed against a tranche. When you are opening a borrower tranche by entering a borrower tranche contract in the ‘Tranche Details’ screen, you must specify the Contract Reference Number of the main borrower facility contract against which the tranche is being opened. You must also specify from the list of tranche products available under the main borrower facility contract, the tranche product which is going to be availed.

Details for Main Borrower Tranche Contract

In the ‘Tranche Details’ screen, you enter the borrower tranche contract, against the Contract Reference Number of the main borrower facility contract.

You need to select the borrower tranche product that you have defined in the preferences for the borrower facility product used by the borrower facility contract under which the tranche is being opened.

Specify the following details for the main borrower tranche contract:

- Counterparty or customer

- Currency of the tranche

- Amount. This is typically the amount being availed by the customer through the tranche.

- Settlement details

- Maturity Date (Fixed) of the tranche, depending upon the schedules

- Tenor of the tranche

- Type of the tranche, whether revolving or non-revolving

- Participant details

- Borrower details

- Facility reference number – The tranche contract is created for this facility number.

The amount for which you need to create the tranche contract in facility currency is displayed in the Amount Facility Currency field.

Any details of repayment schedules you have maintained for the tranche product will apply to the tranche contract. You can change these details if necessary, in the Contract Online Schedules screen.

Borrower Tranche Product

You need to select the code of the borrower tranche product, from the list of tranche products defined in the facility contract, being used for creation of the tranche.

Specifying Customer

When you enter a borrower tranche contract under a borrower facility contract, the system defaults the borrower customer of the facility contract, to the tranche. If you wish to change the borrower customer, you can select the required customer. The customer you select must be in the list of the borrowers identified for the parent borrower facility contract.

The customer you select will default to any borrower draw down loans you enter against the tranche.

Specifying Last Available Date

You must specify the date beyond which further draw downs under the tranche contract are not allowable. The system does not calculate any tranche fee beyond this date.

For tranche contracts, the last available date is defaulted to the maturity date of the tranche contract.

Specifying Agreement Title

Specify the agreement title here. If this field is not maintained, a configurable override will be displayed.

5.5.2 Participant Details for Borrower Tranche Contract

You must also identify the participants who contribute to the amount being committed for disbursement under the borrower tranche contract, and specify the contribution details. To do this; use the Participant Ratio Details screen.

You can invoke this screen by clicking the ‘Participant’ button in the ‘Tranche Details’ screen.

When you open this screen, the reference number of the borrower tranche contract for which you are specifying the participant details is displayed in the Tranche Reference Number field.

You can specify the following details for each participant:

- The ID of the participant

- Contribution of the participant to the tranche contract, known as the asset ratio or asset amount. You can specify the participant contributions either as an amount or a percentage. If specified as amounts, the sum of all contributions must not be greater than the tranche borrower tranche contract amount. If a percentage is specified, the sum of percentages for all participants must sum upto one hundred percent.

- Settlement sequence number of the participant, which the system will use to obtain the settlement details for the participant

- Whether the lead bank is also a participant in the syndication (self participant)

- Interest, charge and ad-hoc fee components levied on the contract, the receivables from which are due to the participant (you can only specify those components marked for propagation to participants in the product preferences of the borrower tranche product used by the contract)

- Proportion of income from the interest, charge and ad-hoc fee components, which is due to the participant. This can be specified either as a percentage.

5.5.3 Borrower Details for Tranche Contract

You must specify the borrowers for the borrower tranche contract, who will actually be availing the draw down loans under the tranche. The borrowers defined for the borrower facility contract under which the tranche is being entered, will be defaulted to the tranche, and you can change them if required. You will be allowed to add borrowers, provided the borrower is allowed for the facility. During amendment operations, you can add or delete a borrower. While deleting a borrower, the system will validate that there are no outstanding draw downs for the borrower. For each of the borrowers, you can maintain a Settlement Sequence Number. This will be defaulted to the drawdown. The borrower settlement details of the drawdown will be picked up based on this Sequence Number.

Click the ‘Borrower’ button in the ’Tranche Details’ screen to invoke the ‘Borrower Details’ screen, where you can specify the borrowers.

You can specify more than one borrower.

Entities for borrowers

You can also specify the entities for the borrowers that you specify, with a single primary entity, to be the recipient of notices and messages for the borrower.

Note

A primary entity must be designated for every customer who is allowed to be a borrower of the tranche contract.

Drawdown Product

You need to specify the drawdown products available to the borrower under the tranche contract.

Limit Amount

You need to specify the maximum amount that can be lent to a borrower for the selected drawdown product.

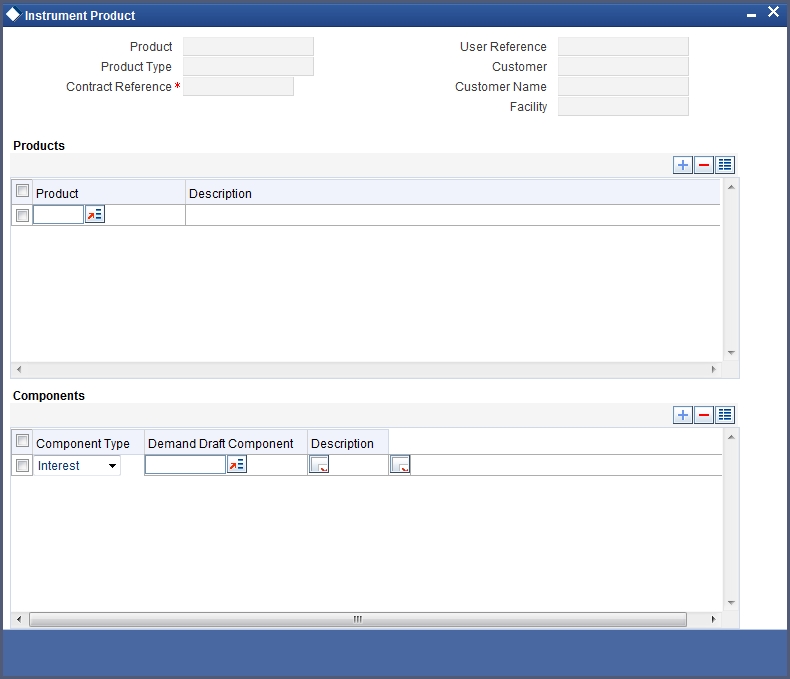

5.5.4 Specifying Borrower Drawdown Products

You can specify a list of allowed Borrower Drawdown Products under the Tranche contract through the ‘Instrument Product’ screen. You can invoke this screen by clicking the ‘DD Product’ button in the ’Tranche Details’ screen. The screen appears as shown below:

You can maintain the following details here:

Drawdown Product

You need to specify the drawdown products available under the tranche contract from the option list provided

Component

You need to specify the interest component for the selected drawdown product.

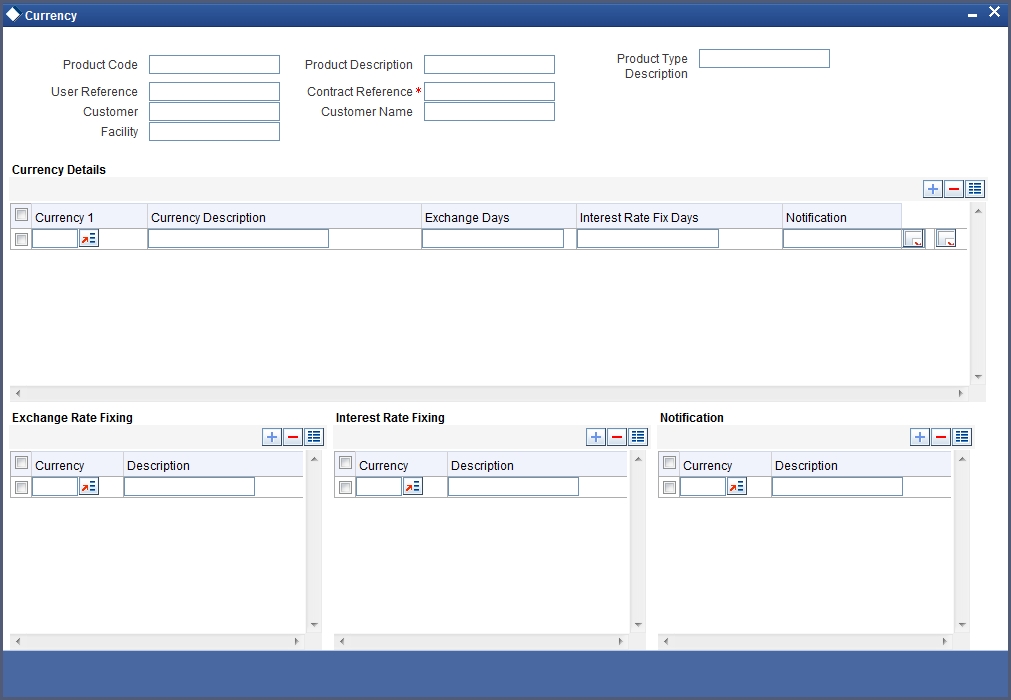

5.5.5 Specifying Currency Details

You can specify the different currencies that are allowed for drawdown products under the tranche contract. The list of currencies, Exchange Rate and Interest Rate Fixing days for each currency get defaulted from the tranche product, but can be changed here. The notification days currencies get defaulted from the facility product but can also be changed. The Exchange Rate Fixing Holiday Currencies and Interest Rate Fixing Holiday currencies get defaulted from the tranche product. The Notification Holiday currencies get defaulted from the facility product.

You cannot add any new currency if it is not already present at the tranche/facility product level.

To specify the Currency Details, click the ‘Currency’ button in ’Tranche Details’ screen. The screen appears as shown below:

You can maintain the following details here:

Currency

You need to specify the list of allowed currencies for drawdown products under the tranche contract.

Exchange Rate Fixing Days

You need to specify the number of working days before the drawdown date when the exchange rate should be fixed for the selected currency.

Interest Rate Fixing Days

You need to specify the number of working days before the drawdown date when the interest rate for the drawdown product should be fixed.

Notification Days

You need to specify the number of working days before the drawdown date when the notification for the drawdown should be sent to the customer.

Exchange Rate Fixing Holiday Currencies

You need to specify the list of currencies for which holiday validations must be done to arrive at the Exchange Rate Fixing Date.

Interest Rate Fixing Holiday Currencies

You need to specify the list of currencies for which holiday validations must be done to arrive at the Interest Rate Fixing Date.

Notification Holiday Currencies

You need to specify the list of currencies for which holiday validations must be done to arrive at the drawdown notice date.

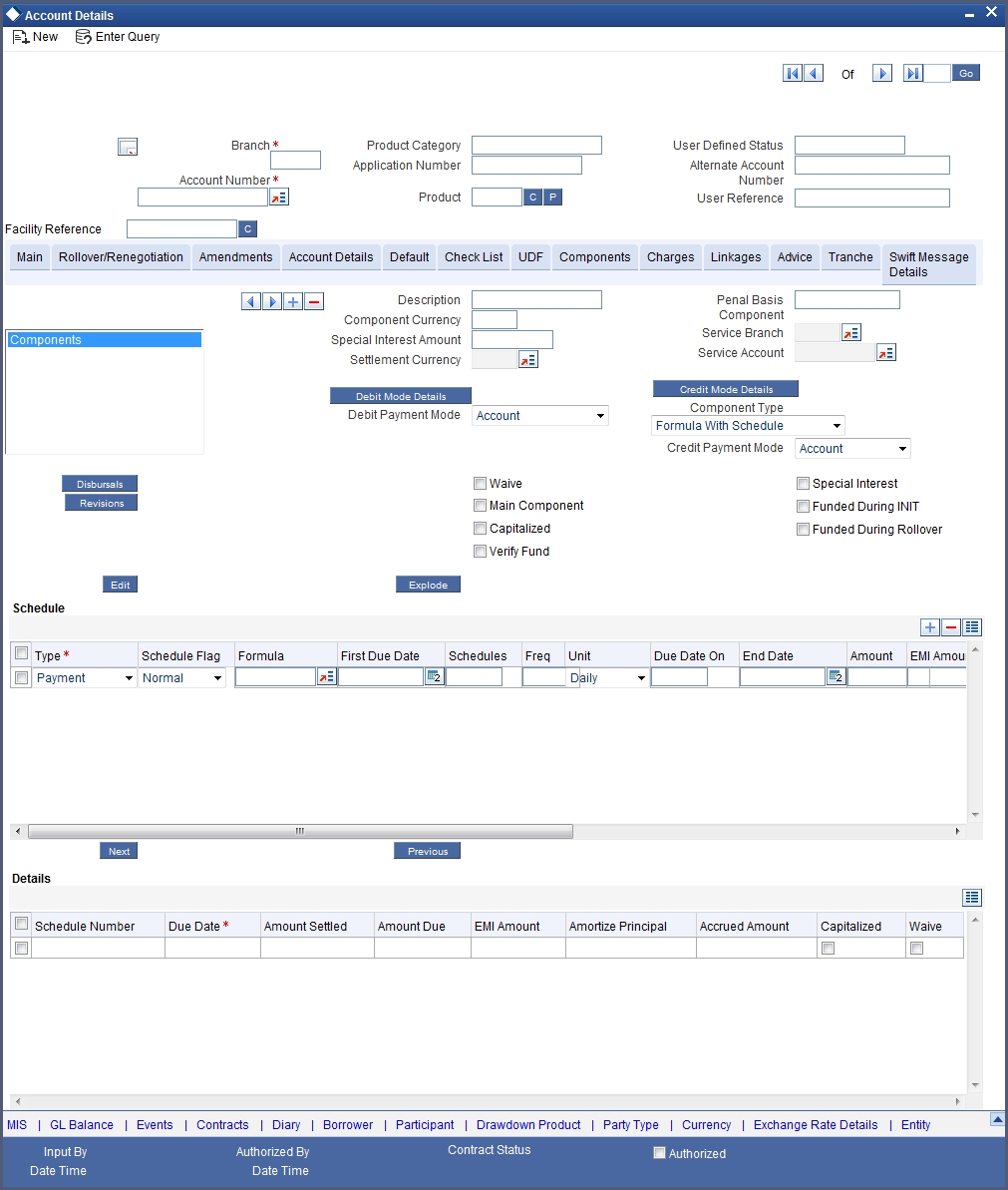

5.5.6 Defining schedules for Non-revolving Tranches

In the case of non-revolving tranches under a borrower facility contract, the cumulative outstanding draw down amounts would need to be reduced when prepayments are made. You can define schedules for this purpose, in the Components Tab of the ‘Tranche Details’ screen.

The following details are defaulted from the facility product used by the selected non-revolving tranche:

- Holiday handling details

- Prepayment method

You can change any of these details when you specify the repayment schedule.

Specifying the prepayment method

The prepayment method identifies the allocation of the prepaid amount, to the schedules defined for reduction of cumulative outstanding amounts in respect of non-revolving tranches. The specification made for the facility product is defaulted here, and you can change it if required.

You can specify that the prepaid amount must be allocated to immediate schedules, the last schedule, or forward schedules.

Specifying how schedules falling on holidays must be handled

The preferences made for the facility product used by the facility contract under which the non-revolving tranche was opened, are defaulted here. You can change them if required.

Refer the chapter Defining Products for Loan Syndication in this user manual for details about specifying the holiday preferences.

Specifying Schedule Details

You must specify the following details for reduction schedules for non-revolving tranches:

First Due Date

You must specify the date on which the first schedule would be processed for the non-revolving tranche.

Schedule No.

You can specify the number of schedules that are being defined for the non-revolving tranche.

Frequency

You can specify the frequency of non-revolving tranches for the selected contract. The options are Daily, Monthly, Quarterly, Half-yearly and Yearly.

Unit

Specify the units in which the specified frequency will be reckoned, that is, the factor by which the frequency must be multiplied to arrive at the final schedule frequency.

Amount

You can specify the amount that must be reduced from the cumulative outstanding draw down amount, when the non-revolving tranche schedule is liquidated.

Viewing Schedule Details

The system populates the following schedule details for the tranche based on the number of schedules you have indicated:

- Schedule No

- Due Date

- Amount Settled

- Amount Due

- EMI Amount

- Amort Prin

- Accrued Amount

- Capit

- Waive

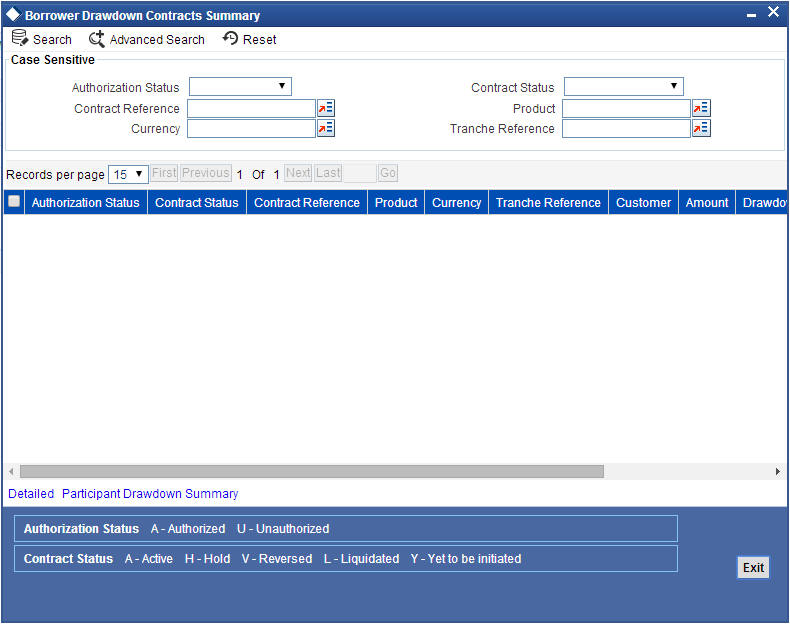

5.6 Drawdown Loan Contracts Details

This section contains the following topics:

- Section 5.6.1, "Capturing Details for Drawdown Loan Contracts"

- Section 5.6.2, "Viewing Participant Details for Borrower Draw Down Contract"

- Section 5.6.3, "Common Details for Borrower Tranche and Borrower Draw Down Contracts"

- Section 5.6.4, "Viewing Diary Events "

- Section 5.6.5, "Specifying Parties"

5.6.1 Capturing Details for Drawdown Loan Contracts

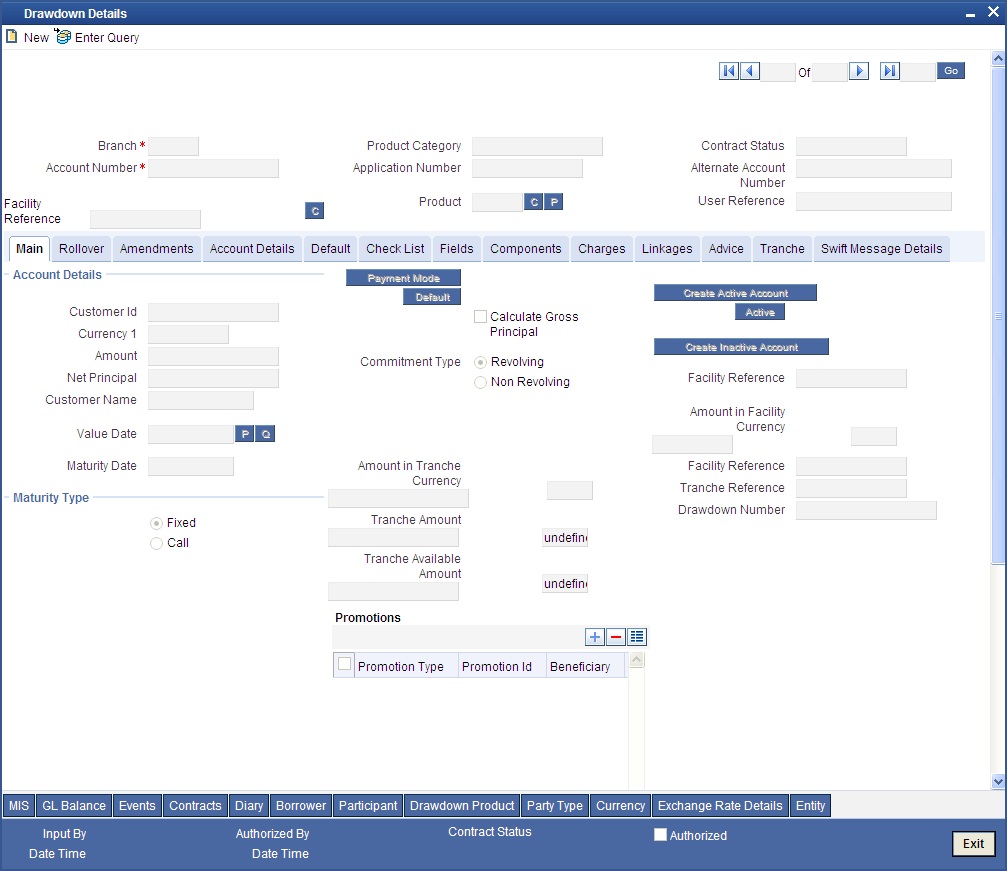

You capture the details for the actual loan disbursed to the borrowing customer as a draw down, in the ’Drawdown Details’ screen. You can invoke this screen by typing ‘LSDDDONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can maintain the following details here:

Tranche Ref No

When you are entering a draw down loan contract in the ’Drawdown Details’ screen, you must specify

- Tranche Contract Reference Number of the tranche borrower tranche contract against which the draw down loan is being entered.

The sequence number of the draw down loan is generated by the system. For instance, let us assume that you have scheduled 10 draw down loans under a tranche. Five disbursements have already been made. You are processing the sixth disbursement. The system displays 6 as the draw down number.

You can now proceed to enter the details of the borrower draw down contract.

Details for Main Borrower Draw Down Loan Contract

In the ‘Drawdown Details’ screen, you need to enter the draw down loan contract details for the borrower, against the following references:

- Contract Reference Number of the borrower tranche contract

- Contract Reference Number of the borrower facility contract

The borrower draw down products that you have defined in the borrower facility product used by the borrower facility contract under which, the draw down is being entered against a tranche, has to be picked from ‘Product Code’ pick list.

A loan contract inherits all the specifications made for the loan product it involves. Therefore, you need not specify all the details again. You do need only to specify the following details (these are not inherited from the product):

- Counterparty or customer details

- Loan Amount. This is typically the amount being availed by the customer through the draw down loan.

- Currency of the loan

- Repayment account for the loan

Any details of schedules you have maintained for the loan product will apply to the loan contract.

Note

Call and notice maturity types, and amortized schedules are not supported for borrower draw down loans.

Product Code

You need to select the code of the borrower drawdown product from the list of drawdown products defined in the facility contract being used for creation of the drawdown.

Account Details

The following details are captured here:

Customer id

When you enter a borrower drawdown contract under a borrower tranche contract, the system defaults the borrower customer of the tranche contract, to the drawdown. If you wish to change the borrower customer, you can select the required customer. The customer you select must be in the list of the borrowers identified for the parent borrower facility contract.

Reporting Details

The following reporting detail is maintained here:

Amount

Specify the amount here. Amount in reporting currency is displayed here.

5.6.2 Viewing Participant Details for Borrower Draw Down Contract

You can view the participant details in the ‘Participant Ratio Details’ screen, which you can invoke by clicking the ‘Participant’ button in the ’Drawdown Details’ screen.

When you open this screen, the reference number of the borrower drawdown contract is displayed in the Contract Reference Number field.

The following details would have been defined for each participant:

- The ID of the participant

- Contribution of the participant to the draw down contract, either in terms of a ratio or an amount (this is known as the asset ratio or asset amount)

- Settlement sequence number of the participant, which the system will use to obtain the settlement details for the participant

- Whether the lead bank is also a participant in the syndication (self participant)

- Interest, charge and ad-hoc fee components levied on the contract, the receivables from which are due to the participant

- Proportion of income from the interest, charge and ad-hoc fee components, which is due to the participant, specified either as a ratio or an amount.

- Locations for the participant where notices and advices related to the contract will be sent. A primary location would have been designated.

5.6.3 Common Details for Borrower Tranche and Borrower Draw Down Contracts

Contract Reference Number

The Contract Reference Number is a unique identification generated automatically by the system for each borrower tranche contract or borrower draw down loan contract.

The system combines the following elements to form the Contract Reference Number:

- The branch code (3-digit code)

- The product code (4-digit code)

- The value date of the borrower facility contract (in 5-digit Julian format)

- A running serial number for the booking date (4-digits)

The Julian date is expressed in the following format - YYDDD

Here, YY represents the last two numerals of the year, and DDD, the number of elapsed days in the year.

For instance, if you are entering the tranche contract with Mr. Robert Carr, as in our first example, the Contract Reference Number generated by the system for the borrower tranche (first tranche) was 000SNBC000150001.

- The first three digits are the code of the branch of your bank where the contract was entered into the system.

- SNBC is the code of the borrower tranche product that you have set up against which you are entering your tranche borrower contract for Mr. Robert Carr.

- 00015 refers to January 15, 2000 (in Julian format) when the contract was booked.

- 0001 is a running serial number, incremented by 1 for each contract entered on the booking date for the product code and the booking date combination.

Similarly, the reference number generated by the system for the first draw down loan under the first tranche was 000SNBL000310001, which can be interpreted in the same manner explained above.

User Reference Number

The reference number is the identification that you specify for the borrower tranche contract or borrower draw down loan contract. You can specify any identification number. In addition to the Contract Reference Number generated by the system for the contract, this number will also be used to retrieve information about the contract.

By default, the Contract Reference Number generated by the system is considered to be the User Reference Number for the contract.

Specifying Currency

Specify the currency of the borrower tranche contract or a borrower draw down loan contract. This is the currency in which the contract amount is expressed.

You can only select a currency that is in the list of currencies defined for the parent borrower facility contract.

Specifying Contract Amount

You must specify the total amount being disbursed under the tranche (for borrower tranche contracts) or the draw down loan (for borrower draw down loan contracts). The amount you enter must be

- Lesser than or equal to the total borrower facility contract amount, if no tranches have as yet been opened or borrower draw down loans disbursed as on today’s date.

- Lesser than or equal to the unused portion of the total borrower facility contract amount as on today’s date.

The value you enter here is taken to be in the currency specified for the tranche or loan contract. You can specify T or M to signify thousand or million, respectively. For instance, 10T would mean ten thousand and 5M, five million.

For instance, when you open the tranche under the main borrower facility contract 000SNEW000010001 with Mr. Robert Carr, you can specify 50000 USD as the total principal in the Contract Amount field, since that is the amount proposed to be disbursed through draw down loans under the first tranche.

Similarly, when you enter the first draw down loan under the first tranche, you can specify 20000 USD as the loan amount, since this is the amount Mr. Carr will be availing through the first draw down.

Contract amount in reporting currency

When you specify the contract amount, the system computes and displays the equivalent amount in reporting currency using the exchange rate maintained between the two currencies for the branch.

The outstanding amount in reporting currency is also computed and displayed.

Specifying Tenor

The tenor of a borrower tranche contract or a borrower draw down loan contract cannot be greater than that of the main borrower facility contract. However, each tranche or draw down loan may have a different tenor and independent life cycle.

Booking Date

This is the date on which the tranche or loan is entered into the system. It is taken to be today’s date by default. This date is only for information purposes and the actual accounting entries will be passed only as of the Value Date of the contract.

Value Date

This is the date on which the tranche or loan contract comes into effect. The tenor of the contract begins on this date, and accounting entries with respect to the contract are passed as of this date.

You can specify any date as the Value Date. However, it must be:

- Later than the Value Date of the main borrower facility contract

- Later than the Start Date of the tranche or loan product involving the contract

- Earlier than the Maturity Date of the tranche (Maturity date of the draw down can be later than that of the tranche) or draw down product involving the contract

- Earlier than the Maturity Date of the main borrower facility contract

An override would be displayed, if the specified Value Date falls on a holiday of the local currency.

For instance, when you open a tranche under the main borrower facility contract 000SNEW000010001 with Mr. Robert Carr, you can enter 15th January 2000 as the Value Date for the borrower tranche contract. If you do so, on any date including and following 15th January, a draw down loan can be entered for Mr. Robert Carr, if requested by him.

The application date on the day you enter the contract (which is the booking date) could be earlier, later or the same as this value date.

For backdated contracts, you can enter backdated tranche borrower contracts.

For future dated contracts, you cannot enter tranches before the contract actually comes into effect (i.e., before the value date).

Similarly, when you enter the first draw down loan under the first tranche, you would enter 31st January 2000 as the Value Date for the borrower loan contract, according to the draw down schedule requested by Mr. Carr.

Again, the application date on the day you enter the contract (which is the booking date) could be earlier, later or the same as this value date.

Specifying Maturity Type

You can specify the maturity of a tranche or draw down loan contract as fixed, which means that the date of maturity is fixed. You can specify the date in the Contract Online main screen. Call and notice types of maturity are not applicable for tranche borrower contracts or draw down loans.

Maturity Date

If the maturity date is known at the time of disbursing the loan or creating the tranche, (fixed maturity) you can specify it in the Contract Online main screen. If the product has a standard tenor, the maturity date will be defaulted by the system based on the tenor and the From Date of the contract. You can change this defaulted date if necessary, by specifying an override.

Specifying Commitment Type

For tranche contracts, you must specify whether the tranche is of revolving or non-revolving type.

In the case of a revolving commitment, the amount available is restored when a loan linked to the commitment is paid out. In the case of a non-revolving commitment, the amount available is not restored.

A tranche contract can be of either type.

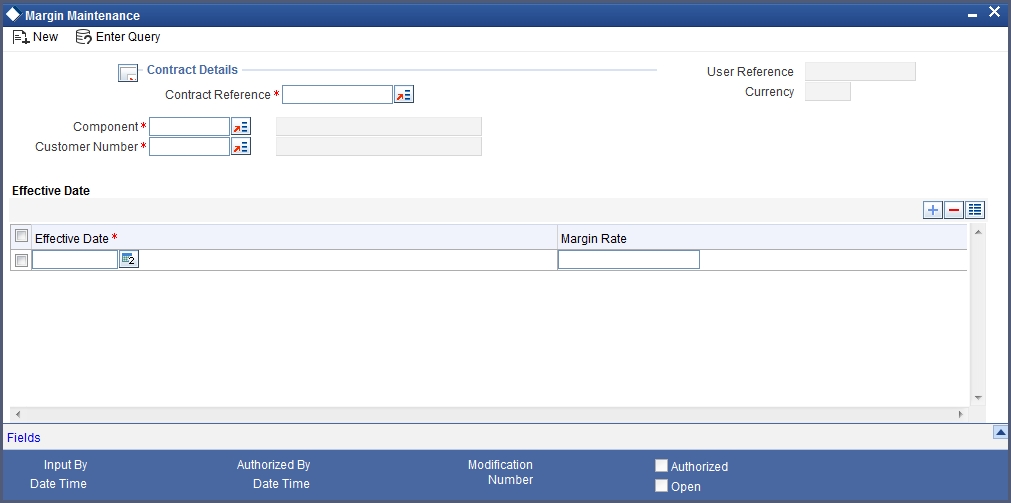

Specifying Margin

You can specify the margin applicable for interest components associated with the borrower tranche or draw down contract.

Specifying Margin Application

You need to specify the method of applying interest margin for the selected interest component, for contracts using the product. The available options are

- Periodic application

- Automatic application

- None

The net interest rate

For fixed rate components, the net interest rate is computed as the sum of the fixed interest rate and the specified margin. For floating rate components, it is computed as the sum of the base rate, spread and the specified margin.

Specifying Administrator

You can indicate the officer assigned to be the administrator for the borrower tranche or draw down contract.

Specifying Agreement Title

Specify the agreement title here. This defaults from the tranche contract but can be modified here if required.

5.6.4 Viewing Diary Events

The diary events defined for the borrower tranche or draw down contract can be viewed in the Diary Contracts Summary screen, which can be invoked by clicking the ‘Diary’ button in the Contract Online screen.

5.6.5 Specifying Parties

You can also specify the different types of entities or parties that would be applicable for the borrower tranche or draw down contract, as well as the applicable parties belonging to the selected type, in the ‘Party Details’ screen. The party types associated with the parent borrower facility contract are defaulted; you can change them and specify the required types.

You can specify multiple parties for a selected type, if allowed as specified in the Party Association specification for the borrower facility product used by the parent facility contract. If multiple parties are not allowed, you can specify only one party for the selected type.

If any mandatory party types have been specified in the Party Association for the borrower facility product used by the parent facility contract, then you must specify at least one party for the party type.

Click the ‘Party Type’ button in the ‘Drawdown Details’ screen to invoke the ‘Party Details’ screen. The screen appears as shown below:

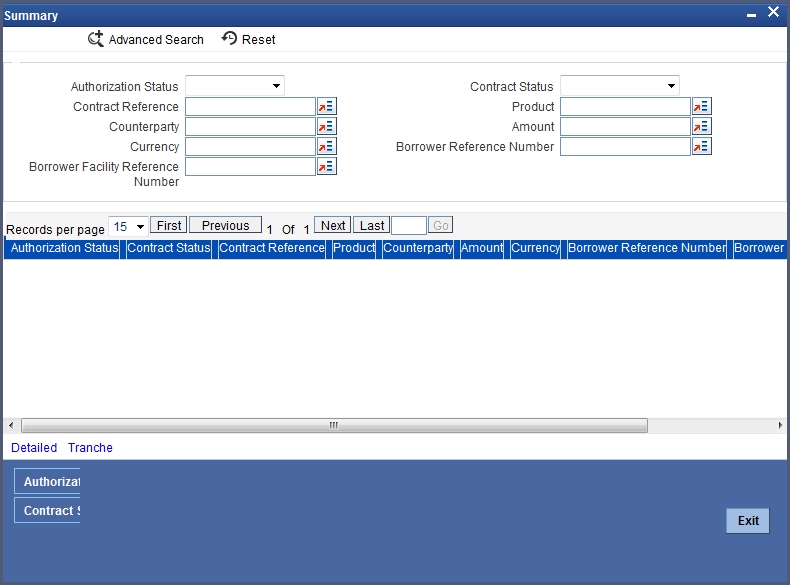

5.7 Participant Contracts Details

This section contains the following topics:

- Section 5.7.1, "Creating Participant Contracts"

- Section 5.7.2, "Details for Participant Contracts"

- Section 5.7.3, "Viewing and Amending Participant Contracts"

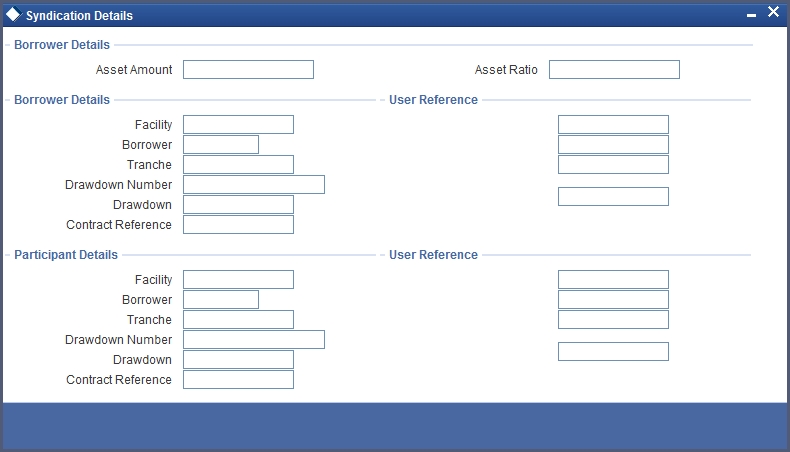

- Section 5.7.4, "Viewing Syndication Details"

5.7.1 Creating Participant Contracts

To recall, when the BOOK event for borrower facility, tranche or draw down contract is triggered, the system creates the related participant facility, tranche or draw down contracts.

5.7.2 Details for Participant Contracts

Contract reference numbers

When the participant contracts are initiated, the system generates reference numbers for them in the same manner as for normal borrower contracts.

For the purpose of tracking a borrower tranche, the reference numbers of the resultant participant tranche contracts are linked to the reference number of the parent borrower tranche contract.

For the purpose of tracking a borrower draw down loan, the reference numbers of the resultant participant draw down deposit contracts are linked to the reference number of the parent borrower draw down contract, as well as to its parent borrower tranche contract.

Product and contract details

During participant product definition, a borrower product is linked with each participant product. This is the product that would be used for the creation of the participant facility contract, along with the participant details specified in the borrower facility contract. Similarly, Tranche/drawdown products are used for creation of participant tranche/drawdown contracts along with the participant details specified in the borrower tranche/drawdown contract.

5.7.3 Viewing and Amending Participant Contracts

You can view the participant contracts created with respect of a borrower contract, in the Participant Contract screen. You can also amend the details, if required, in this screen.

The following details are displayed for the participant contract:

- Code of the product being used

- System generated reference number for the participant contract is displayed here.

- User reference number, which is defaulted to the contract reference number. You can change it if necessary, and specify the appropriate user reference number.

- System generated reference number for the borrower facility contract, under which the participant contract was created

- System generated reference number for the borrower tranche contract, under which the participant contract was created

- If it is a participant draw down contract, the serial number of the draw down under the tranche

- Customer of the contract

- Contract currency

- Contract amount in contract currency and reporting currency

- Contract booking date, value date and maturity date

- For participant tranche or draw down contracts, whether collection from the participant must be initiated automatically (auto collection). You can change this specification through amendment.

- Whether the amount repaid by the borrower must be disbursed automatically (auto disbursement). You can change this specification through amendment.

- Remarks

You can also view the following details:

- Events and accounting entries for the contract. Click the ‘Events’ button.

- Settlement details for the participant, defaulted from the settlement

sequence number for the participant in the borrower tranche contract.

Click on the

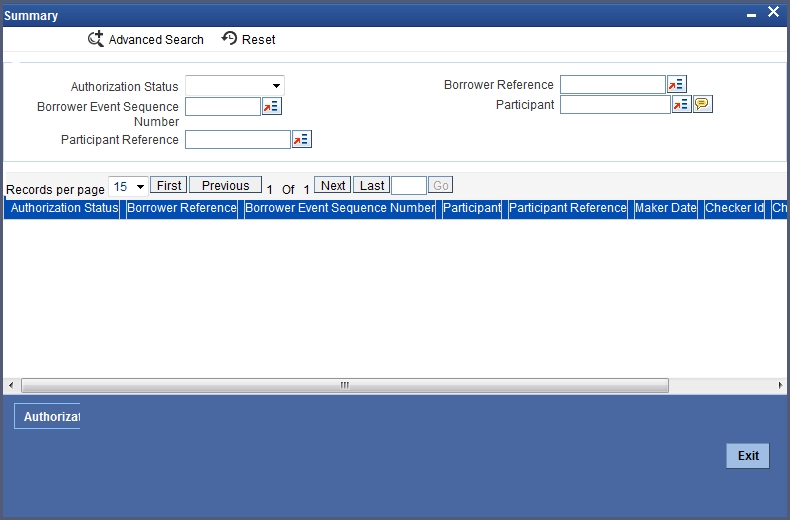

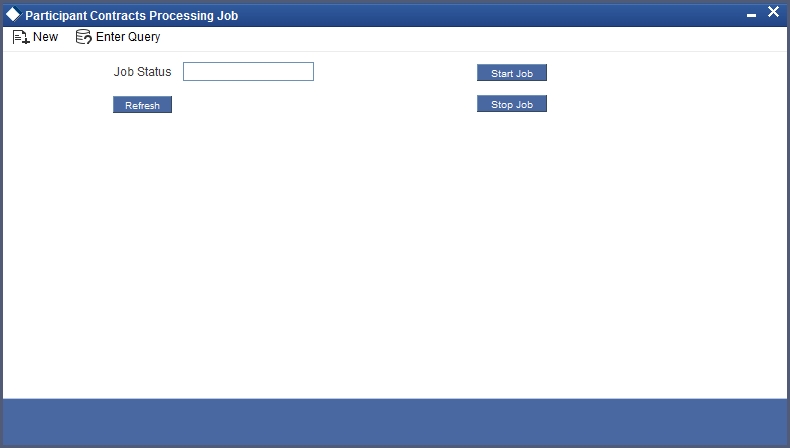

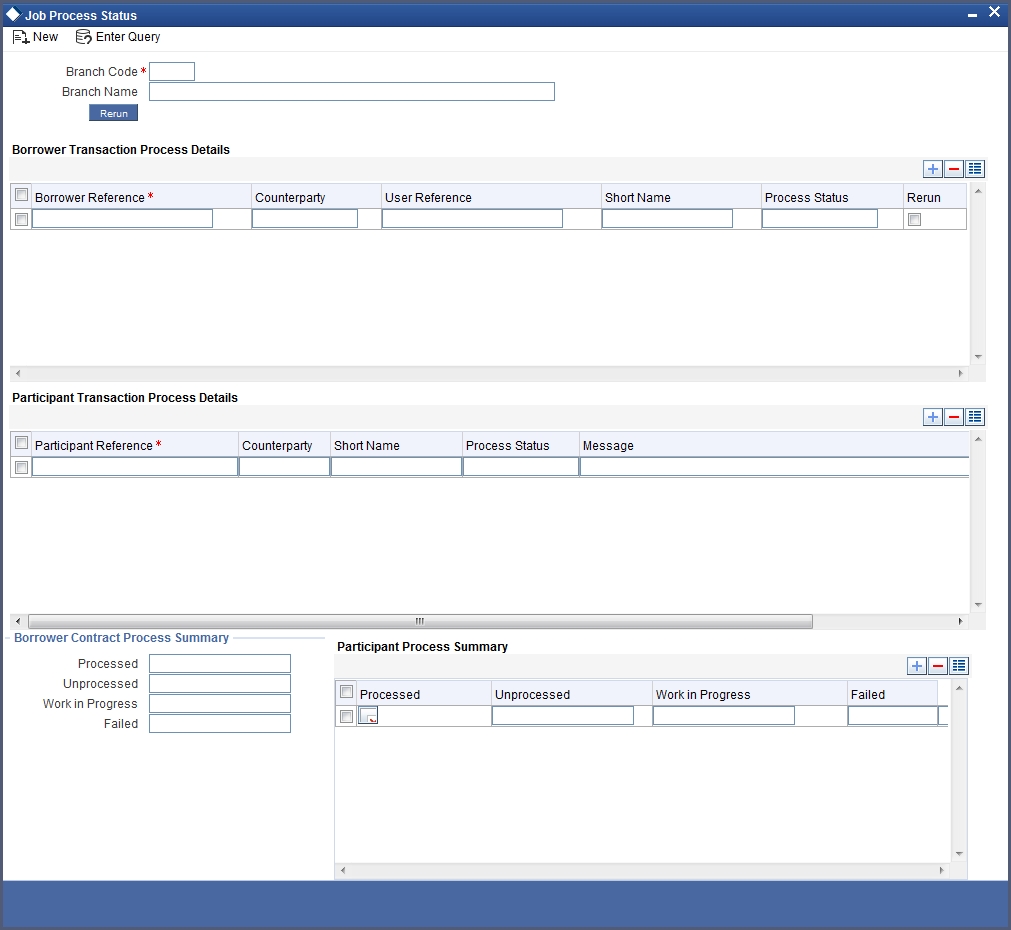

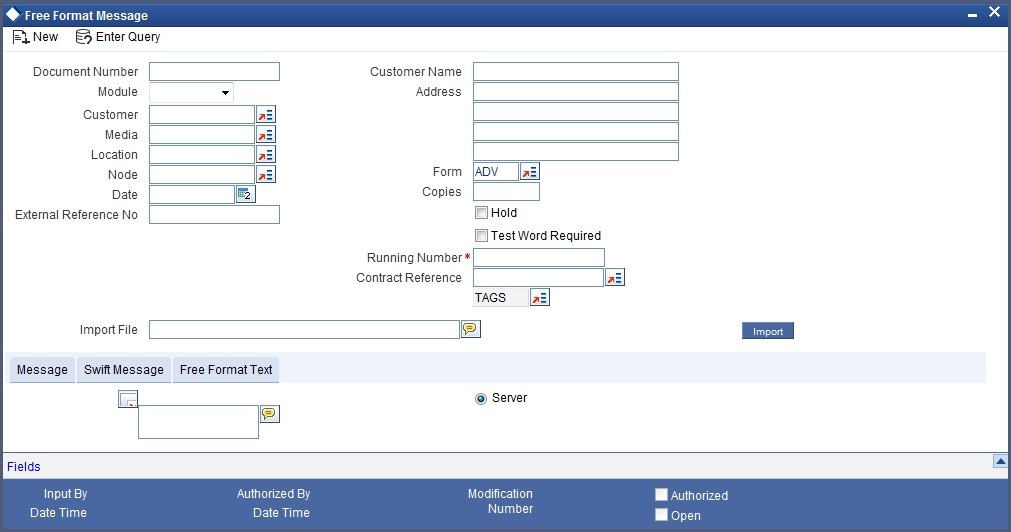

button to view the settlement details. You can also make changes to them through an amendment.