6. Processing Repayments

When you disburse loans to a borrowing customer through a draw down loan contract against a tranche under a borrower facility contract, you also define the terms according to which the loan components will be repaid. You can define your own repayment schedules. For instance, you could choose to have the principal repaid at maturity, with the interest component being repaid monthly. You could also define the repayment terms to suit your customer.

In Oracle FLEXCUBE, you can define the repayment schedules when you define a product. They will be applied to any contracts involving the product. If you need to change the schedule for a specific contract, you could do so.

Repayments, in the context of a syndication contract, involve liquidation of the following components:

For tranche contracts

- Interest /Charge applicable

- Ad-hoc fees

For draw down contracts

- Loan Principal

- Interest /Charge applicable

- Ad-hoc fees

This chapter contains the following sections:

6.1 Defining Schedules for Product

You can define the following attributes for repayment schedules, when you define them for a draw down loan product:

- The mode of liquidation (automatic or manual)

- Liquidation of schedules due before the date on which a loan is initiated

- The type of schedule – capitalized or normal

You define these attributes in the Product Preferences screen that you invoke by clicking the Preferences’ Tab in the ‘Loans Syndication Borrower Product Definition’ main screen.

If the mode of liquidation specified for a schedule is automatic, it will be liquidated by the Automatic Contract Update function. If the mode is specified as manual, you must manually liquidate them through the Contract Schedule Payments function.

After specifying the attributes for repayment schedules, you can specify the repayment details for each component of a draw down loan, such as the reference date, the frequency and the month and date, in the ‘Components’ Tab of the ‘Loans Syndication Borrower Product Definition’ screen.

These are the attributes for repayment schedules that would apply to all draw down loan contracts involving the draw down loan product for which they have been specified.

The manner in which you specify the attributes for the repayment schedules for a draw down borrower or participant product is much the same as for a normal loan product.

6.2 Defining Schedules for Contract

The repayment schedules that you define for a draw down loan product will apply to all draw down contracts involving the product. When you are entering a draw down loan in the Contract Online screen, the schedules defined for the product involving the contract will be displayed in the Schedules tab of the screen.

You can change some of the attributes of the schedule for an individual draw down loan contract that it inherits from the draw down loan product that it involves. If you do so, any schedules that are due on the system application date and on any past date will be erased, and you can specify new schedules.

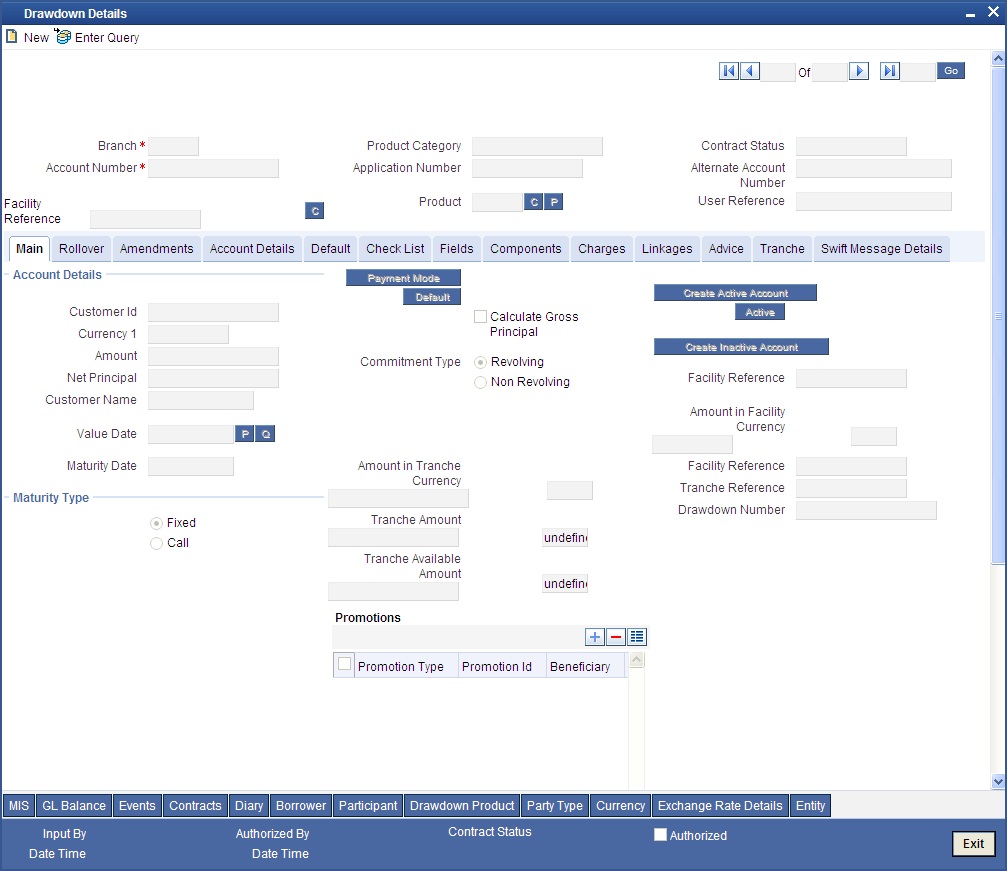

You can invoke the ‘Drawdown Details’ screen by typing ‘LSDDDONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Click ‘Components’ tab to define schedule details.

The schedule payment type that is defined for a draw down loan product (capitalized or normal) is inherited by all draw down loan contracts involving it. This attribute cannot be changed when you enter a draw down loan contract.

The manner in which you specify the attributes for repayment schedules for a draw down loan contract is the same as for a normal loan contract.

For a detailed description, refer to the chapter Operations in the Retail Lending user manual.

Only those aspects of specifying attributes for repayment schedules that are specific to borrower tranche or draw down contracts are explained in this chapter.

This section contains the following topics:

- Section 6.2.1, "Specifying how schedules falling on holidays must be handled"

- Section 6.2.2, "Specifying how maturity dates falling on holidays must be handled"

- Section 6.2.3, "Specifying how Rate Revision Schedules "

- Section 6.2.4, "Specifying revision schedules for fixed rate interest components"

- Section 6.2.5, "Specifying revision schedules for interest margin components"

- Section 6.2.6, "Processing Repayments Manually"

- Section 6.2.7, "Processing Prepayments"

- Section 6.2.8, "Specifying rate revision for fixed rate interest components"

6.2.1 Specifying how schedules falling on holidays must be handled

Schedule dates for a contract could fall on holidays defined for your branch or on holidays defined for the currency of the contract.

In the Product Preferences for the borrower facility product, you can specify whether the system should check for schedule dates falling on holidays, and how such schedule dates must be handled. These specifications would default to any borrower facility contract using the product, and also to underlying borrower tranche or draw down contracts that are opened under the facility contract.

You can specify either of the following:

- Holidays must be ignored

- Checks must be made for schedule dates falling on holidays

If you specify that checks must be made, you can also specify the corresponding treatment for schedule dates falling on holidays.

6.2.1.1 Holiday Treatment Type

The Holiday Treatment Type is the parameter that defines how the system checks for schedule dates falling on holidays. You can specify one of the following options:

Local

Select this option to indicate that you want the system to check whether a schedule date falls on a local holiday defined for the branch. You will not be able to specify a check for currency holidays, if you choose this option.

The system checks the holiday table for your branch. If it encounters a contract entered in your branch, with a schedule date falling on a branch holiday, the holiday is handled according to the holiday-handling preferences you specify.

Currency

Select this option to indicate that the system must check whether the schedule date falls on a holiday defined for the currency of the contract. You must specify the code of the holiday currency, if you select this option. Further, you have the following options to specify the specific currency for which the check must be done:

- Facility currency : If you choose this option, the system checks whether the schedule date falls on a holiday defined for the currency of the facility (borrower) contract, if this currency is different from the holiday currency you have indicated.

- Contract currency : If you choose this option, the system checks whether the schedule date falls on a holiday defined for the currency of the draw down contract, if this currency is different from both the holiday currency and the facility currency (if any) you have indicated.

- Local currency : If you choose this option, the system checks whether the schedule date falls on a holiday defined for the local currency, if this currency is different from the holiday currency, facility currency and contract currency you have indicated.

The system checks the holiday table for the currencies you have specified. If it encounters a contract using any of the specified currencies, with a schedule date falling on a holiday for any of the currencies, the holiday is handled according to the holiday-handling preferences you specify.

6.2.1.2 Holiday-handling preferences for schedule dates

If you have specified that the system check for schedule dates falling on holidays, you must also specify the treatment for schedule dates encountered by the system that do fall on holidays. The following preferences can be set:

Moving the schedule date backward or forward

You can indicate whether the schedule date falling on a holiday must be moved forward to the next working day, or backward to the previous one.

Moving across months

If you have indicated either forward or backward movement, and the moved schedule date crosses over into a different month, you can indicate whether such movement is allowable; it will be allowable only if you indicate so in the Move Across Months field.

Cascading schedules

If one schedule has been moved backward or forward in view of a holiday, cascading schedules would mean that the other schedules are accordingly shifted. If you do not want to cascade schedules, then only the schedule falling on a holiday is shifted, as specified, and the others remain as they were.

6.2.2 Specifying how maturity dates falling on holidays must be handled

The maturity date for a contract could fall on holidays defined for your branch. In the Product Preferences for the borrower facility product, you can specify whether the system should check for maturity dates falling on holidays, and how such dates must be handled. These specifications would default to any borrower facility contract using the borrower facility product, and also to underlying borrower tranche or draw down contracts that are opened under the facility contract.

You can specify that:

- Holidays must be ignored

- The maturity date falling on a holiday must be moved according to the holiday-handling preferences that you specify

6.2.2.1 Holiday-handling preferences for maturity date

You can indicate that the maturity date falling on a branch holiday be moved either backward or forward, as required, and if it is allowed to move across months.

Moving the Maturity Date backward or forward

You can indicate whether the maturity date falling on a holiday must be moved forward to the next working day, or backward to the previous one.

Moving across Months

If you have indicated either forward or backward movement of the maturity date such that the moved maturity date crosses over into a different month, you need to indicate whether such a movement is allowed. Check this option to indicate that it is allowed.

Holiday Currency

You need to specify the holiday currency the system must check against when applying the maturity date of the contract. Select a holiday currency code from the option list provided.

You also need to indicate the categories the system must check against, for applying the maturity date:

- Facility Currency: If you choose this option, the system checks whether the maturity date should be based on the holiday defined for the facility currency, in case the holiday currency maintained is different from the facility currency.

- Contract Currency: If you choose this option, the system checks whether the maturity date should be based on the holiday defined for the contract currency, in case the contract currency is different from both the holiday currency and the facility currency you have indicated.

- Local Currency: If you choose this option, the system checks whether the maturity date should be based on a holiday defined for the local currency, if the local currency is different from the holiday currency, facility currency and contract currency you have indicated.

The system checks the holiday table for the currencies you have specified. If it encounters a contract using any of the specified currencies, with a Maturity Date falling on a holiday for any of the currencies, the holiday is handled according to the holiday-handling preferences you specify here.

6.2.3 Specifying how Rate Revision Schedules

The Rate Revision Schedule for a contract could fall on holidays defined for your branch. You can specify whether the system should check for Rate Revision Schedules falling on holidays, and how such dates must be handled.

These specifications will default from the tranche to the underlying drawdown contract. However, you can modify them at the drawdown contract level if required. You can specify that:

- Holidays must be ignored

Or

- The Rate Revision Schedule falling on a holiday must be moved according to the holiday-handling preferences that you specify

6.2.3.1 Holiday handling preferences of Rate Revision Schedules

You can indicate whether the Rate Revision Schedules falling on a branch holiday should be moved either backward or forward depending on the requirement or if it can be moved across months.

Moving the Rate Revision Schedule backward or forward

You can indicate whether the Rate Revision Schedule falling on a holiday must be moved forward to the next working day or backward to the previous one.

Moving across months

If you have indicated either forward or backward movement of the Rate Revision Schedule such that the moved maturity date crosses over into a different month, you need to indicate whether such a movement is allowed. Check this option to indicate that it is allowed.

Holiday Currency

You need to specify the holiday currency the system must check against when applying the Rate Revision Schedule for the contract. Select a holiday currency code from the option list provided.

You also need to indicate the currency categories the system must check against, for applying the Rate Revision Schedule:

- Facility currency: If you choose this option, the system checks whether the Rate Revision Schedule should be based on the holiday defined for the facility currency, in case the holiday currency maintained is different from the facility currency.

- Contract currency: If you choose this option, the system checks whether the Rate Revision Schedule should be based on the holiday defined for the contract currency, in case the contract currency is different from both the holiday currency and the facility currency you have indicated.

- Local currency: If you choose this option, the system checks whether the Rate Revision Schedule should be based on a holiday defined for the local currency, if the local currency is different from the holiday currency, facility currency and contract currency you have indicated.

The system checks the holiday table for the currencies you have specified. If it encounters a contract using any of the specified currencies, with a Rate Revision Schedule falling on a holiday for any of the currencies, the holiday is handled according to the holiday-handling preferences you specify here.

Cascading schedules

If one schedule has been moved backward or forward in view of a holiday, cascading schedules would mean that the other schedules are accordingly shifted. If you do not want to cascade schedules, then only the schedules falling on a holiday are shifted, as specified, while the others remain as they are.

6.2.3.2 Validations for Rate Revision Schedules

When you specify rate revision schedules for the drawdown contract, the system will validate whether the Rate Revision Period matches with at least one of the allowed Rate Revision Periods specified at the tranche level (Schedules tab). If the validation fails, the system will give an override.

The system will also validate that the duration between Rate Revision Dates for any component does not exceed the maximum value specified at the tranche level. The system will give an error if this validation fails.

When you specify payment schedules for the drawdown contract, the system will validate to ensure that the interest period for any component does not exceed the maximum value specified at the tranche level (Schedules tab). The system will give an error if this validation fails.

Holiday validation and schedule movement for Maturity Date and Revision Schedules will be done based on the value of the respective holiday treatment fields.

6.2.4 Specifying revision schedules for fixed rate interest components

You can specify rate revision schedules for repayment of fixed rate interest components. Select ‘F’ in the Rev field, to indicate that the revision schedule is for repayment of fixed rate interest components.

6.2.5 Specifying revision schedules for interest margin components

You can specify rate revision schedules for interest margin components. Select ‘M’ in the Rev field, to indicate that the revision schedule is for interest margin components.

6.2.6 Processing Repayments Manually

The components of a draw down loan contract can be liquidated either manually or automatically, according to the definition you make for the product involving the contract, or at time of entering the contract. If you have defined automatic liquidation, the Automatic Contract Update function will perform the same on the schedule payment day.

If you have defined auto liquidation for the contract, you can manually liquidate the components before the liquidation schedule falls due. Also, if, for reasons of non-repayment, if the liquidation does not take place, you can manually liquidate the components when the repayment is made.

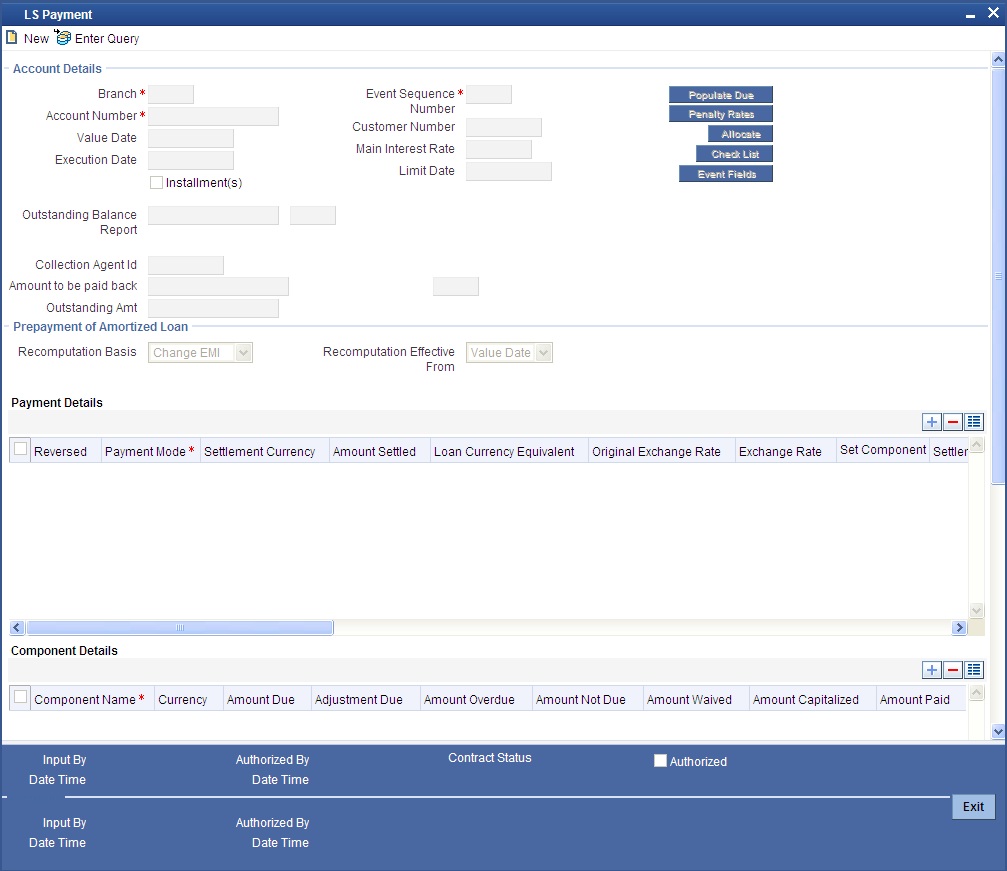

If you have defined manual liquidation for the contract, then you must manually liquidate the components a day before the schedule date. You perform manual liquidation through the Loan Syndication Schedule Payment screen.

You can invoke this screen by typing ‘LSDPMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The manner in which you perform manual liquidation for a draw down contract in the Schedule Payments screen is the same as for a normal loan contract.

The following details are displayed/captured here:

- Account Number

- Branch

- Value Date

- The outstanding balance on the borrower tranche or draw down contract, in reporting currency, as on the current date

For a detailed description of the rest of the fields, refer to the chapter Operations in the Retail Lending user manual.

6.2.7 Processing Prepayments

Prepayments are repayments of principal before it falls due to be repaid. Typically, a penalty is imposed on prepayments, since they are a violation of the contract.

When you define products for borrower leg contracts, you can choose to specify levying a penalty on prepayments, in the Product Preferences screen. You can also specify that the interest on any future schedules must be recomputed when a prepayment is made.

You specify the prepayment penalty as a percentage, in the Payment Schedules screen, when you enter the prepayment.

Interest is calculated on the prepaid portion of the principal, from the value date of the last liquidated schedule till the value date of the prepayment.The penal percentage is also applied on the prepaid principal, after adjusting the interest due.

The system uses the amount tag INTEREST_ADJ to post interest accounting entries due to prepayment.

6.2.8 Specifying rate revision for fixed rate interest components

You can enter the revised rate for a fixed rate interest component applicable to a syndication contract, before the rate revision schedule falls due. The revised rate is uploaded into the revision schedule for the contract as a rate revision amendment.

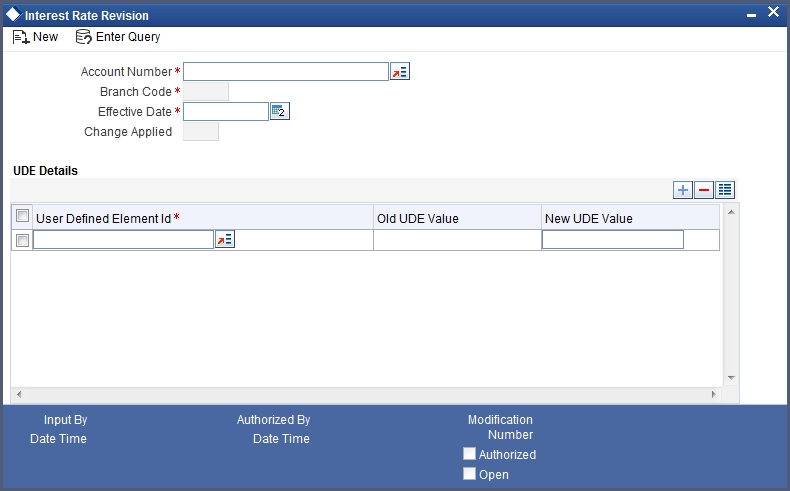

You can enter the revised rate in the ‘Fixed Interest Rate Revision’ screen. You can invoke this screen by typing ‘LSDFXRVN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can revise the rate of the interest component by adding the new UDE value against the old one. The modified schedules are displayed in the contract after the EOD batch.